#Satoshi Bitcoin

Text

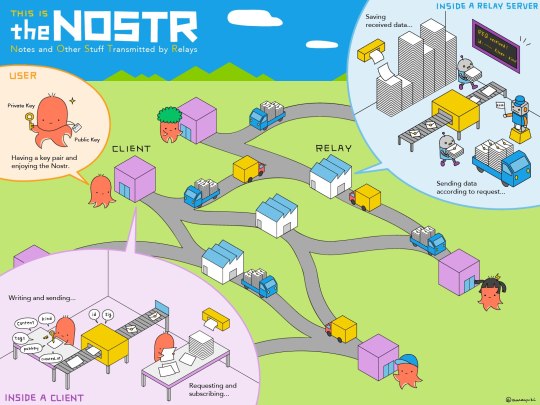

GUIA completo NOSTR

GUIA completo NOSTR: o que é, como surgiu e como usar o protocolo que descentraliza REDES SOCIAIS! Area Bitcoin – 08 ago 2023

PARTES DO VÍDEO:

00:00 – O que é e como surgiu o NOSTR

03:58 – Como NOSTR funciona (relays)

06:58 – NOSTR e Bitcoin: o futuro da internet

08:24 – Como criar uma conta no Damus

11:52 – O que são zaps e como enviar bitcoin via Lighting no NOSTR

Nostr é a sigla de…

View On WordPress

#NOSTR zaps lightningnetwork#btc Bitcoin#carteira Lightning ZDB#censorship-resistant social media#chave pública nome de usuário#chave privada senha de sua conta#como surgiu e como usar o protocolo que descentraliza REDES SOCIAIS!#conta no Damus#decentralized#disponível sistemas iOS iPhone#download aplicativo Damus App#enables global#espécie de Twitter descentralizado#fruto da obra brasileiro desenvolvedor#GitHub#GUIA completo NOSTR: o que é#HTTP or TCP-IP#HTTP TCP-IP#livecoins#NOSTR 03:58 relays#Nostr sigla Notes and Other Stuff Transmitted by Relays notas e outras coisas transmitidas por relays#o futuro da internet#primeira aplicação criação do Damus App#protocol open standard#protocolo padrão aberto#pseudônimo de fiatjaf. Luciano Rocha - CriptoFácil#public-key cryptography#Satoshi Bitcoin#sistema de chaves do BTC#site Astral Ninja

0 notes

Text

Today's Problematic Ship is the Satoshi

The Satoshi was a cruise ship owned by Ocean Builders, a company dedicated to "seasteading," an attempt to create a seabourne community free of laws imposed on dry land, with strong ties to the cryptocurrency movement.

The 1991-built ship, originally named Regal Princess but renamed Pacific Dawn in 2007, was purchased by Ocean Builders in the middle of the Covid-19 pandemic in 2020. The idea was to permanently anchor the ship in Panamian waters, as the central hub of an eventual community of "SeaPods", essentially individual houses at sea, which would be arranged around the Satoshi in the form of a Bitcoin B.

It quickly became evident that the people running Ocean Builders had no understanding of how to operate a ship: they initially failed to ensure their ship had certificate of seaworthiness to allow it to sail to Panama (where the venture was to be based), and even after this no-one was willing to insure the ship, making it impossible for passengers to live onboard. They also planned to re-engine the ship while it was out at sea, a physically impossible task to accomplish without sinking the ship in the process.

The leadership of Ocean Builders blamed all this on shipping being "plagued by over-regulation." (Many of our entries here at Today's Problematic Ship demonstrate those regulations exist for a reason). The end result was predictable: by the time the Satoshi arrived in Panama it had been sold to an Indian shipbreaker.

Except Ocean Builders had signed a contract they could not honour: according to the Basel Convention, which covers the disposal of hazardous waste, they weren’t allowed to send the ship from a signatory country (Panama) to a non-signatory country (India). Thus the sale was cancelled, and subsequently the ship was arrested by Panamian authorities.

Eventually, the Satoshi was sold in 2021 a different startup company, Ambassador Cruise Line. The new venture, who actually knew how to operate a cruise ship, started successful operations with the former Satoshi, now renamed Ambience, in 2022.

The Guardian has a detailed article about the saga of the Satoshi and the seasteading movement.

1K notes

·

View notes

Text

SEJARAH SINGKAT CRYPTOCURRENCY

Tentu, berikut adalah sejarah singkat mengenai cryptocurrency:

1. Awal Mula (1980-an - 1990-an)

1982: Konsep uang digital pertama kali diperkenalkan oleh David Chaum, seorang kriptografer, dengan penerbitan "Blind Signatures for Untraceable Payments" yang menjadi dasar untuk e-cash.

1990-an: Chaum menciptakan DigiCash, salah satu bentuk uang elektronik pertama yang menggunakan kriptografi untuk menjaga privasi transaksi.

2. Bitcoin dan Era Baru (2008 - 2010)

2008: Satoshi Nakamoto, dengan nama samaran, menerbitkan whitepaper berjudul "Bitcoin: A Peer-to-Peer Electronic Cash System" yang memperkenalkan konsep Bitcoin, sebuah mata uang digital terdesentralisasi.

2009: Bitcoin secara resmi diluncurkan dan blok pertama (genesis block) ditambang. Bitcoin adalah cryptocurrency pertama yang menggunakan teknologi blockchain untuk mencatat transaksi secara aman dan transparan.

3. Pertumbuhan dan Inovasi (2011 - 2013)

2011: Cryptocurrency lain mulai muncul, seperti Litecoin, yang dibangun di atas kode Bitcoin dengan beberapa perubahan teknis untuk memperbaiki kelemahan yang ada.

2013: Ethereum diluncurkan oleh Vitalik Buterin, memperkenalkan kontrak pintar (smart contracts) yang memungkinkan pengembangan aplikasi terdesentralisasi (dApps) di blockchain.

4. Masa Depan dan Adopsi (2014 - 2017)

2014: Bitcoin mulai mendapatkan perhatian lebih dari investor institusi dan mainstream. Banyak proyek baru diluncurkan, termasuk sistem pembayaran dan platform blockchain baru.

2017: Bitcoin mencapai titik tertinggi baru dan mendapat perhatian global. Fenomena ICO (Initial Coin Offering) menjadi populer, memfasilitasi pendanaan proyek blockchain dengan cara menerbitkan token baru.

5. Regulasi dan Kemajuan Teknologi (2018 - 2020)

2018: Pasar cryptocurrency mengalami penurunan harga yang signifikan, dikenal sebagai "crypto winter". Namun, banyak proyek terus berkembang dan memperkuat teknologi mereka.

2020: DeFi (Decentralized Finance) menjadi tren besar, memungkinkan layanan keuangan seperti pinjaman dan trading dilakukan secara terdesentralisasi menggunakan smart contracts di blockchain.

6. Evolusi dan Masa Kini (2021 - Sekarang)

2021: Bitcoin dan Ethereum mencapai harga tertinggi baru, dan minat terhadap NFT (Non-Fungible Token) meroket. Banyak perusahaan dan lembaga keuangan besar mulai berinvestasi di cryptocurrency.

2023: Adopsi cryptocurrency semakin meluas dengan peluncuran berbagai solusi layer-2 untuk meningkatkan skalabilitas, serta peningkatan regulasi di berbagai negara untuk mengatur penggunaan dan perdagangan cryptocurrency.

Cryptocurrency terus berkembang dengan inovasi baru dan tantangan, dan dampaknya terhadap ekonomi global serta sistem keuangan masih terus terbentuk.

7 notes

·

View notes

Text

Bitcoin’s Dwindling Supply: The Halving Mechanism and Its Impact on Scarcity

Bitcoin is more than just a digital currency—it’s a groundbreaking financial system built around a unique feature: its limited supply. Unlike fiat currencies that can be printed endlessly, Bitcoin’s supply is capped at 21 million BTC. This scarcity is driven by Bitcoin's halving mechanism, a process that cuts the block rewards for miners in half approximately every four years. With each halving, the supply of new Bitcoin entering circulation decreases, creating a dynamic of growing demand and shrinking supply.

What is the Halving Mechanism?

The halving mechanism is embedded in Bitcoin's code and is designed to happen after every 210,000 blocks are mined, roughly every four years. This mechanism ensures that over time, fewer and fewer Bitcoin are produced, leading to increased scarcity. When Bitcoin was first launched in 2009, the reward for mining a block was 50 BTC. Since then, the block reward has been halved multiple times:

2012: The reward dropped to 25 BTC.

2016: It was halved again to 12.5 BTC.

2020: The reward shrunk to 6.25 BTC.

2024: Following the most recent halving, the block reward now stands at 3.125 BTC.

How the Halving Reduces Daily Bitcoin Supply

The halving mechanism significantly impacts the number of Bitcoin mined each day. In the beginning, with 50 BTC rewarded per block, approximately 7,200 BTC were mined daily. After each halving, this number dropped:

2012: About 3,600 BTC were mined daily.

2020: Roughly 900 BTC were mined per day.

2024: Currently, with a block reward of 3.125 BTC, only 450 BTC are mined daily.

As the block reward continues to shrink, the daily Bitcoin production will become even smaller. By 2036, 99% of all Bitcoin will have been mined, leaving only 1% of Bitcoin to be mined over the following century. This drastic reduction in new supply is one of the most important aspects of Bitcoin’s scarcity and long-term value.

The Economic Impact of Bitcoin’s Scarcity

Bitcoin's design ensures that its supply will only become scarcer over time, making it more valuable. Much like precious commodities such as gold, the limited availability of Bitcoin positions it as a deflationary asset—one whose value increases as supply tightens and demand rises. Each halving intensifies this dynamic, putting upward pressure on Bitcoin's price as fewer coins are available for purchase or use.

With the next halving scheduled for 2028, Bitcoin’s daily production will fall to 225 BTC per day. By the time the final Bitcoin is mined, around the year 2140, the block reward will be reduced to just one satoshi—the smallest unit of Bitcoin, equivalent to 0.00000001 BTC. At this point, miners will no longer receive new Bitcoin as rewards, but they will be compensated with transaction fees to continue securing the network.

The Future of Bitcoin’s Supply: What Happens After 99% is Mined?

By the year 2036, we will have reached a major milestone—99% of all Bitcoin will have been mined. As we approach this point, the effects of Bitcoin's diminishing supply will become increasingly apparent. As supply decreases, demand is expected to grow, especially as more institutional investors and governments begin to adopt Bitcoin as a reserve asset.

After 2036, only 1% of Bitcoin will remain to be mined, with rewards decreasing at an exponential rate after each subsequent halving. As we move closer to the final halving and the ultimate limit of 21 million BTC, Bitcoin’s value as a scarce, deflationary asset will likely continue to grow, making it a critical store of value for individuals, institutions, and possibly even nation-states.

Bitcoin’s Halving and Its Role in Financial Sovereignty

The halving mechanism is more than just a technical feature—it is the foundation of Bitcoin's scarcity, which gives it its revolutionary potential. With fiat currencies facing the constant threat of inflation due to excessive money printing, Bitcoin stands out as a deflationary alternative that cannot be devalued by any central authority. Its predictable supply schedule makes it a safe haven for those seeking financial sovereignty and protection against inflationary pressures.

As Bitcoin’s supply dwindles, its role in the global financial system will only become more prominent. The halving mechanism ensures that Bitcoin remains scarce, creating a unique economic environment where supply and demand dynamics continuously drive its value higher.

Conclusion: The Power of Bitcoin’s Scarcity

Bitcoin’s halving mechanism is a crucial factor in its long-term success as a deflationary, scarce asset. Each halving reduces the number of new Bitcoin introduced into circulation, making the asset more valuable over time. As we move closer to the year 2036, when 99% of all Bitcoin will have been mined, the scarcity narrative will become even more pronounced. With the final reward being just one satoshi, Bitcoin’s hard cap of 21 million BTC guarantees its place as one of the most scarce and valuable financial assets in the world.

In a world of ever-expanding fiat currencies and government-controlled financial systems, Bitcoin offers a new way forward—a scarce, decentralized, and deflationary asset that empowers individuals with true financial sovereignty.

Take Action Towards Financial Independence

If this article has sparked your interest in the transformative potential of Bitcoin, there's so much more to explore! Dive deeper into the world of financial independence and revolutionize your understanding of money by following my blog and subscribing to my YouTube channel.

🌐 Blog: Unplugged Financial Blog Stay updated with insightful articles, detailed analyses, and practical advice on navigating the evolving financial landscape. Learn about the history of money, the flaws in our current financial systems, and how Bitcoin can offer a path to a more secure and independent financial future.

📺 YouTube Channel: Unplugged Financial Subscribe to our YouTube channel for engaging video content that breaks down complex financial topics into easy-to-understand segments. From in-depth discussions on monetary policies to the latest trends in cryptocurrency, our videos will equip you with the knowledge you need to make informed financial decisions.

👍 Like, subscribe, and hit the notification bell to stay updated with our latest content. Whether you're a seasoned investor, a curious newcomer, or someone concerned about the future of your financial health, our community is here to support you on your journey to financial independence.

Support the Cause

If you enjoyed what you read and believe in the mission of spreading awareness about Bitcoin, I would greatly appreciate your support. Every little bit helps keep the content going and allows me to continue educating others about the future of finance.

Donate Bitcoin: bc1qpn98s4gtlvy686jne0sr8ccvfaxz646kk2tl8lu38zz4dvyyvflqgddylk

#Bitcoin#BitcoinHalving#Crypto#Cryptocurrency#BTC#BitcoinScarcity#DigitalGold#Blockchain#BitcoinEconomics#Hodl#BitcoinSupply#FinancialFreedom#BitcoinMining#Satoshi#BitcoinEducation#SoundMoney#Scarcity#DeflationaryAsset#financial education#globaleconomy#unplugged financial#digitalcurrency#financial experts#financial empowerment#finance

2 notes

·

View notes

Text

3 notes

·

View notes

Text

LIVE ⚽️ Halbzeit in der #AllianzArena München: Der #FCBayern führt 2:0 gegen #VflWolfsburg und natürlich ist wieder einmal der offizielle Krypto Partner #Bitpanda dabei. Sowohl mit einem Promotionstand als auch mit der digitalen #Werbung am Eingang!

#youtube#hakobert#bitcoin#onestandstudio#blockchain#youtubechannel#youtubestudio#satoshi#altcoins#kryptowelt#vfl wolfsburg frauen#vflwolfsburg#FCB#fc bayern munich#fc bayern#allianz arena

3 notes

·

View notes

Text

Classic Ethereum ( ETH ) 4 Throw Pillow

Features

Accent cushions with original art, for that instant zhuzh factor in any room

Decorative and durable 100% spun polyester cover with an optional polyester fill/insert

Full-color double-sided design printed for you when you order

Concealed zip opening for a clean look and easy care

Machine washable

For a plump finish, use an insert/fill that is bigger than the cover

Only $21.54

#ethereum#eth#bitcoins#bitcoin#btc#ethereumclassic#crypto#redbubble#teespring#cryptonews#cryptocoin#blockchain#cryptotrading#satoshi#nft#nfts#clock#cool#printondemand#fashion#swagg#model#styles#gift#design#accessories#art#ThrowPillow

12 notes

·

View notes

Photo

2 notes

·

View notes

Text

Ethereum’s Shapella Upgrade: A Warning for Investors in Cryptocurrency Market!

The latest software upgrade by Ethereum, known as Shapella, has now caused significant delays for cryptocurrency investors trying to withdraw funds deposited on the Ethereum blockchain. This situation exposes persistent headaches for Ethereum, which aims to become a widely-used financial infrastructure for instant payments. Prior to the upgrade, investors who deposited ether on the Ethereum blockchain could not withdraw their funds.

However, the upgrade was expected to unlock over $30 billion worth of ether deposited on the Ethereum blockchain in return for interest. Unfortunately, this has resulted in delays due to the limits on the number of transactions the blockchain can process. Read More

#shapella#crypto#cryptocurency news#cryptocurrency#satoshi nakamoto#bitcoin#ethereum#nftscommunity#blockchain#trending#viralpost

2 notes

·

View notes

Text

La crittografia (1/6) - Alle origini dei Bitcoin: il mistero Satoshi - Guarda il documentario completo | ARTE in italiano

2 notes

·

View notes

Text

Harris ERSTE PRO-KRYPTO-Aussage!🔥BULLISCHE nächste US-Präsidentin?🤔 - YouTube

Kamala Harris hat sich im Rahmen einer Wahlkampfveranstaltung erstmals öffentlich zu Kryptowährungen geäußert und gesagt, sie werde den Sektor fördern. Wäre Harris als Präsidentin bullisch für Bitcoin?

🔥Blocktrainer Roadshow 30.10. in Oberhausen!

Tickets 👉 https://www.blocktrainer.de/blocktrainer-live-show-oberhausen

🧡 Blocktrainer Patenschaft – Support für unsere Arbeit🧡

👉…

#Alternative Geldmethoden#Bewusstsein#Bitcoin#Blocktrainer#BTC#Crash#finanzielle Freiheit#Freiheit#Geldsystem#Leitmedien#Michael Saylor#Politik#Rezession#Roman Reher#Satoshi Nakamoto#Selbstbewusstsein#USA#Weltgeschehen#Zinseszins

0 notes

Photo

(via "Bitcoin | quadro 1" Essential T-Shirt for Sale by Cris888)

0 notes

Text

4 notes

·

View notes

Text

EU #Wertpapierregulierungsbehörde prüft, ob die #Kryptovermögenswerte in ihren 12 Billionen € Investment #Fondsmarkt zugelassen werden sollen. Dies könnte möglicherweise die #Bitcoin Türe zu einer großen #Mainstream Einführung öffnen!

#youtube#hakobert#bitcoin#onestandstudio#blockchain#youtubechannel#youtubestudio#satoshi#altcoins#kryptowelt#kryptoabc#kryptobörse

3 notes

·

View notes

Text

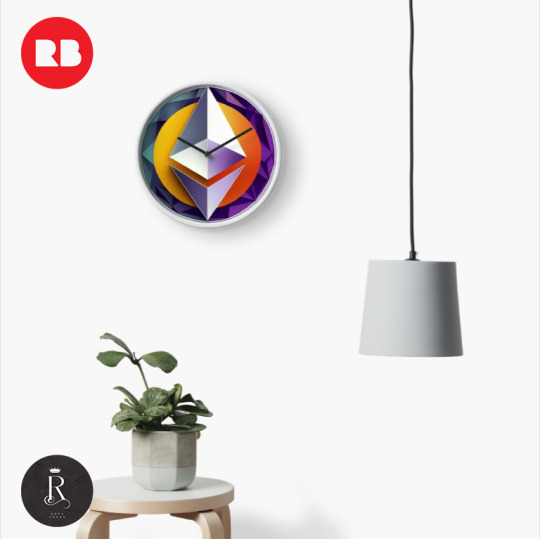

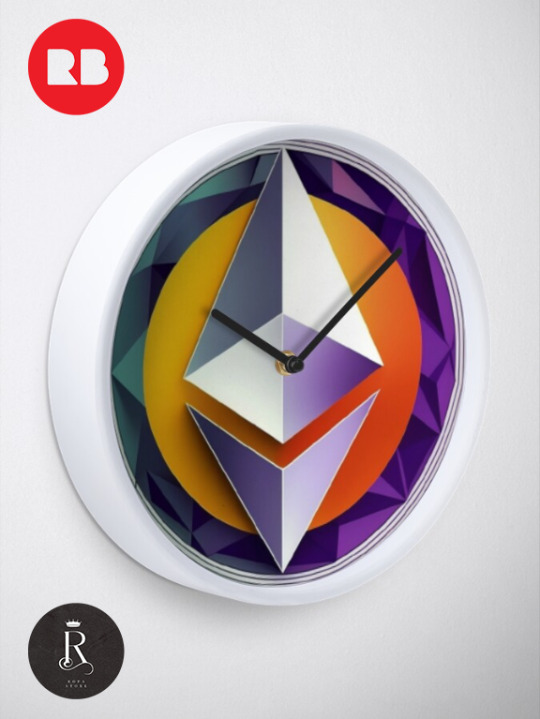

Classic Ethereum ( ETH ) 4 Clock

Features

It's always art o'clock when your clock is a work of art

Printed polypropylene face made for you when you order

Metal hands in your choice of colors

Bamboo wood frame in black, white, or natural finish

Quartz clock mechanism for accurate timekeeping

Clear plexiglass lens

Built-in rear hook, ready to hang

A battery not included

Only $34.16

#ethereum#eth#bitcoins#bitcoin#btc#ethereumclassic#crypto#redbubble#teespring#cryptonews#cryptocoin#blockchain#cryptotrading#satoshi#nft#nfts#clocks#clock#cool#printondemand#fashion#swagg#model#styles#gift#design#accessories#time#art

2 notes

·

View notes