#Solid State Battery Market

Text

#technology#battery#electric vehicles#electric cars#toyota#solid state batteries#solid state battery market

0 notes

Text

Solid State Battery Market - Forecast(2024 - 2030)

Solid State Battery Market Overview

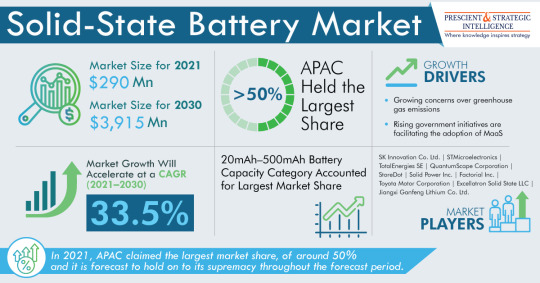

The global Solid State Battery Market is estimated to surpass $450.3 million mark by 2026 growing at an estimated CAGR of more than 34.5% during the forecast period 2021 to 2026. Solid-state batteries technology that involves solid electrolytes and solid electrodes and not using the polymer or liquid electrolytes are found in lithium-ion batteries. Solid-state battery technology is considered to be an alternative to the Li-ion battery technology. Rising investments on Research and developments for the battery, increasing utilising of energy storage battery, rising adoption of electronic devices and gadgets are some factors that drive the market. Solid state batteries are utilised in Electric vehicle that will hike in the growth which is environmental friendly comparatively to the liion batteries. Healthcare industry has major factors like pacemakers, RFID and other wearable are driving the market. These factors are set to boosts the market growth for Solid State Battery during the forecast period 2021-2026.

Read More Here: https://tinyurl.com/29kn2p77

Solid State Battery Market Report Coverage

The report: “Solid State Battery Market– Forecast (2021-2026)”, by IndustryARC covers an in-depth analysis of the following segments of the Solid State Battery market.

By Application – Consumer electronics, Electric vehicles, Energy storage, Wearables, Healthcare devices, and others.

By Capacity – < 20 mAh, 20mAh – 100 mAh, 100-500 mAh, >500mAh.

By Battery Type – Thin film battery, Portable battery.

By Geography - North America (U.S, Canada), Europe (Germany, UK, France, Italy, Spain, Russia and Others), APAC(China, Japan India, South Korea, Aus and Others), South America (Brazil, Argentina and Others) and RoW (Middle east and Africa)

Request For Sample: https://tinyurl.com/3trpbhy5

Key Takeaways

The Solid-state battery is expected to grow substantially during the forecasted period and rising demand for solid-state batteries across end-use markets along with rising R&D focused on developing advanced batteries is likely to drive the market growth over the forecast period.

Consumer electronics sector is in the demand and also will increase in the demand during the forecasted period due its demand in the market.

APAC holds the largest share of the market and will grow substantially during the forecasted period.

#Solid State Battery Market#Solid State Battery Market Size#Solid State Battery Market share#Solid State Battery Market Trends#Solid State Battery Market Growth

0 notes

Text

Solid State Battery Market Size & Growth By 2035

Research Nester’s recent market research analysis on “Solid State Battery Market: Global Demand Analysis & Opportunity Outlook 2035” delivers a detailed competitor’s analysis and a detailed overview of the global solid state battery market in terms of market segmentation by capacity, application, type, category, and by region.

Rapid Increase in the Demand for Electric Vehicles to Promote Global Market Share of Solid State Battery

A remarkable increase could be observed in the sales of electric vehicles (EVs) all over the world, and this is thought to contribute to the market growth considerably. Presently, many of these electric vehicles are powered using lithium-ion batteries. However, the energy density required for the vehicles has been estimated to double while replacing these lithium-ion batteries with solid state batteries. Hence, the projected increase in the use of electric vehicles all over the world is expected to have a positive influence on the market growth for solid state batteries. The demand for electric vehicles is rising as a result of many factors.

The immense need to reduce the rate of emission of carbon dioxide is one of the major reasons driving the demand for electric vehicles. In 2021 alone, the count of EVs sold amounted to 6.6 million. Further, the 2 billion EVs that are expected to be on the road by 2050 as a measure to achieve net zero emissions should also benefit the market growth.

Some of the major growth factors and challenges that are associated with the growth of the global solid state battery market are:

Growth Drivers:

Immense Growth in the Demand for Wireless Communication

Rapid Progress Made in the Smart Infrastructure All Over the World

Challenges:

The high cost involved in the manufacturing of solid state batteries should affect the market growth of these batteries during the forecast period adversely. The solid state batteries are continuously evolving, and hence many of the procedures now used in the manufacturing of these batteries involve high expense. These processes are also more complicated when compared to those involved in the production of lithium-ion batteries.

Further, the strict regulations to be adhered to by businesses during the manufacturing and transportation of raw materials and finished products are also anticipated to hamper the global market size of solid state batteries considerably.

By category, the global solid state battery market is segmented into single-cell battery and multi-cell battery. Between these two categories, multi-cell batteries are expected to hold the largest market share as the forecast period ends. By the end of 2035, multi-cell batteries are expected to hold a 60% share of the market revenue. The thermal management system of the multi-cell batteries is more enhanced compared to that of the single-cell batteries.

This enhanced thermal management system prevents the overheating of the batteries which shortens the lifespan of the batteries. Hence, the long lifespan of multi-cell batteries is expected to contribute to the increasing demand for these batteries.

By region, the North American solid state battery market is projected to generate the highest revenue by the end of 2035. This growth is anticipated by the rise in the demand for power backups in different parts of the region. Many places in North America have experienced an increase in incidents of power outages in recent years. Efforts to solve the predicament are expected to create opportunities for the growth of the regional market.

Further, the increase in the demand for wearable electronic devices should also contribute to the market growth in North America.

This report also provides the existing competitive scenario of some of the key players of the global solid state battery market which includes company profiling of Bodycote plc, Solvay S.A., Pathion Inc., Saft Groupe SAS, Toyota Motor Corporation, Solid Power Inc., BrightVolt Solid State Batteries, Excellatron Solid-state, Robert Bosch GmbH, Cymbet Corporation, QuantumScape Corporation, and others.

0 notes

Text

Solid State Battery Industry Gains Ground from Investments in ESG Goals

Auto-makers have exhibited increased traction to cut battery’s carbon footprint, encouraging solid-state battery industry players to propel environmental, social and governance (ESG) goals. Solid state batteries (SSBs) store more energy, provide greater safety and charge faster compared to liquid lithium-ion batteries. Since a few batteries are required, SSBs can boost energy density per unit, making the technology highly sought-after in the EV landscape. SSBs could propel the ESG performance with several watchdogs vouching for the batteries. According to Transport & Environment (T&E), solid state batteries can minimize the carbon footprint of EV batteries by two-fifths. With solid state batteries poised to be used in EVs by 2025, battery manufacturers have furthered their investments in the ESG ecosystem.

The sustainability of battery supply chains has become pronounced as companies seek to reap upsides from using SSBs. These batteries promise to attain the Paris Agreement, boost energy access and economic value and foster decarbonization. Companies could shift to a circular value chain to enhance their economic and environmental footprint and by harvesting end-of-life values from batteries. With investors looking for companies with better ESG scores, stakeholders could focus on deploying SSBs in electric vehicles. Stakeholders are bullish towards safe working conditions and have exhibited respect for human rights by keeping the child and forced labor at bay. Private companies and public stakeholders are expected to expedite the share of renewable energies in the value chain.

Environmental Perspective

The growth of SSBs is likely to foster green energy and e-mobility as stakeholders strive to minimize their carbon footprint. The European climate group has pitched for incentives for the production of batteries with a lower carbon footprint in the new EV battery regulations—EU governments and MEPs are negotiating the final text of the regulation. In December 2020, the European Commission reportedly tabled a proposal for the modernization of the regulatory framework for batteries and bolstering the sustainability of EU battery value chains.

Although SSBs are at a low technology readiness level, strong demand from EV manufacturers to offset initial costs and propel sustainability could augur growth. The need for intensive actions against climate change and to bring the automotive sector to greenhouse gas neutrality has become an enabler for technological advances and buoyant policies. For instance, Toyota Motor Corporation issued Challenge 2050 to underpin the creation of a more sustainable and inclusive society. The company aims to reduce CO2 emissions from new vehicles by 30% by 2025 and 90% by 2050.

Solvay has a bullish plan to achieve carbon neutrality—scope 1 and 2—before 2040 for all businesses barring soda ash. The audacious goal is underpinned by an investment program of approximately €2 billion (USD 2.05 billion). The next-generation power source for EVs will continue to be sought to underscore the environmental profile. In July 2022, Nikkei, in partnership with Patent Result, inferred that Toyota had a massive lead in the solid-state battery patents—with 1,331 known patents.

Social Perspective

Industry partners have prioritized social contributions activities to enrich society and communities. In February 2022, Samsung SDI established a sustainable business management committee to propel ESG efforts. The company is gearing up for a full transition to renewable energy by 2050. The battery firm stood first with around 70% score, partly due to bullish efforts to propel work environment, diversity and human rights. In April 2022, Samsung SDI set out Safety Environment Management Policy to create safe and healthy corporate values, implement environmentally friendly management and form an external green community. In 2021, the company appointed around 299 CAs to take the organizational culture to the next level through team member development, fair appraisal, better collaboration, enhanced work efficiency and open communication.

Amidst occupational accidents becoming pervasive and denting the economy and employees’ health, stakeholders have responded with buoyant policies. In May 2021, the firm operated the “Eradicating Serious Accidents Task Force” to bolster safety and keep occupational injuries at bay. The South Korea-based company has expedited labor-management communication to enhance the work environment and protect labor rights. In 2020, around 1,193 issues were reportedly submitted and addressed with robust follow-up measures.

The diversity of directors has come to the fore as a driver of social portfolio for efficient decision-making and supervision. In 2020, Samsung SDI appointed four independent directors on the basis of expertise in areas, including law/human rights, electrical and electronics industry, accounting/tax and labor policy/relations. The company has placed no limitations on the basis of religion, gender, race, nationality, ethnicity or cultural background.

Companies have also prioritized the ESG committee to underpin sustainability. In 2021, Solvay rolled out its first employee share purchase program to propel the feeling of ownership among employees. Moreover, 98 of its 105 sites have observed a security vulnerability self-assessment (SVSA). It has also rolled out “Solvay One Dignity” to eradicate discrimination, providing equal opportunities for every employee. The company also announced the introduction of its first employee stock ownership plan. Moreover, in 2021, Solvay introduced a ten-year “STAR Factory Program” to cash in on digital and data science and make all plants STAR factory certified by 2030.

Is your business one of participants to the Global Solid State Battery Industry? Contact us for focused consultation around ESG Investing, and help you build sustainable business practices.

Governance Perspective

Well-established and emerging players have reinforced governance, ethics and transparency to create a sustainable value for all stakeholders. Companies have raised the bar in ESG performance to pursue their sustainability vision. The repercussion of unsound governance could expand beyond the realm of financial results, prompting financial bodies to mandate governance disclosure reports. With environmental and climate issues placed at the top of agendas, governance practices and disclosures could underscore a culture of sustainable value creation.

The ESG scoring model of Grand View Research has ranked Solvay second to none—with a 70% score—in corporate governance. The top rank is mainly due to its efforts to foster governance practices with an emphasis on independent directors. In 2021, the company had 64% independent directors and the stand-alone ESG committee made a new carbon neutrality ambition recommendation to the board. The board backed the introduction of an employee share purchase plan providing Solvay personnel the chance to buy company shares at a 10% discount.

Prominent companies have underscored the focus on sound governance, the ratio of independent directors, compliance training and taking disciplinary actions for corruption. Around 12,598 Samsung SDI employees completed ethics and compliance training, while there were 26 compliance review activities in 2021. The company appoints a chair of the BOD among directors to boost the flexibility of BOD operations and enhance directors’ accountability. The South Korean firm rolled out the Samsung Compliance Committee in February 2020 to propel compliance oversight and control at the company’s seven primary affiliates. In 2021, it amended all guidelines managed by the compliance team and provided training and reviews to alert employees about the risk of regulatory non-compliance.

Forward-looking companies are assessing risks, opportunities and issues pertaining to sustainability amidst the expanding footprint of solid state batteries. With longer ranges and quicker charging times, SSBs could be the game changer for the electric vehicle manufacturers and other stakeholders. In January 2022, Toyota announced its first vehicle to use SSBs would be hybrid and would go on sale by 2025. Meanwhile, in June 2022, Solid Power announced it would be shipping solid state battery cells to BMW and Ford by the year-end for validation testing. Prevailing trends allude to a robust growth outlook in the ensuing period. The global solid state battery market is expected to witness around 36% CAGR from 2021 through 2028. Policies and approaches toward ESG could dictate the growth trajectory as automakers seek massive EV battery breakthroughs.

About Astra – ESG Solutions By Grand View Research

Astra is the Environmental, Social, and Governance (ESG) arm of Grand View Research Inc. – a global market research publishing & management consulting firm.

Astra offers comprehensive ESG thematic assessment & scores across diverse impact & socially responsible investment topics, including both public and private companies along with intuitive dashboards. Our ESG solutions are powered by robust fundamental & alternative information. Astra specializes in consulting services that equip corporates and the investment community with the in-depth ESG research and actionable insight they need to support their bottom lines and their values. We have supported our clients across diverse ESG consulting projects & advisory services, including climate strategies & assessment, ESG benchmarking, stakeholder engagement programs, active ownership, developing ESG investment strategies, ESG data services, build corporate sustainability reports. Astra team includes a pool of industry experts and ESG enthusiasts who possess extensive end-end ESG research and consulting experience at a global level.

For more ESG Thematic reports, please visit Astra ESG Solutions, powered by Grand View Research

#Solid State Battery Industry ESG#Solid State Battery Industry#Solid State Battery Market#Solid state battery companies#Toyota Motor Corporation#solid-state battery

0 notes

Text

#Solid State Battery Market#Solid State Battery Market share#Solid State Battery Market Trends#Solid State Battery Market Size#Solid State Battery Market Analysis#Solid State Battery Market Demand

0 notes

Text

Charging Ahead Exploring the Solid-State Battery Market Landscape

Several aspects of an EV are the same as a gas-driven one: tires are tires, the seats are seats, and the steering wheel still turns right and left. The major difference, and the one that will make or break mass EV acceptance, is the battery.

That is why some of the most thrilling research in the contemporary automotive landscape centers on battery tech—and “solid-state” batteries are one area…

View On WordPress

#Electric vehicles#energy storage#innovations#market#portable electronics#regulatory frameworks#solid-state batteries#sustainability#technology

0 notes

Text

#Solid-State Battery Market#Solid-State Battery Market Trends#Solid-State Battery Market Growth#Solid-State Battery Market Industry#Solid-State Battery Market Research#Solid-State Battery Market Report

0 notes

Text

Solid-state batteries represent a groundbreaking shift in energy storage, finding applications in consumer electronics, electric vehicles, wearables, and more. Offering enhanced safety, longer lifespan, and improved energy density, these batteries come in various types, including portable and thin film, with capacities ranging from less than 20 mAh to over 500 mAh.

0 notes

Text

Lithium Solid-State Battery Market Size, Share and Global Trend By Type (Polyethylene-oxide (PEO), Lithium Phosphorus Oxy-Nitride (LiPON), Sulfide Glass), By End-User (Portable Electronics, Automotive, Residential, Others) and Geography Forecast till 2022-2029

#Lithium Solid-State Battery Market Size#Share and Global Trend By Type (Polyethylene-oxide (PEO)#Lithium Phosphorus Oxy-Nitride (LiPON)#Sulfide Glass)#By End-User (Portable Electronics#Automotive#Residential#Others) and Geography Forecast till 2022-2029

0 notes

Text

Lithium Ceramic Battery (LCB) Market Consumption Analysis, Business Overview and Upcoming Key Players,Growth factors, Trends 2032

Overview of the Lithium Ceramic Battery (LCB) Market:

The Lithium Ceramic Battery (LCB) market involves the production, distribution, and utilization of batteries that utilize a ceramic electrolyte in combination with lithium-based materials. LCBs are a type of solid-state battery technology that offers potential advantages such as high energy density, improved safety, and longer cycle life compared to traditional lithium-ion batteries. LCBs are being developed for various applications, including electric vehicles, renewable energy storage, and portable electronics.

The Global Lithium Ceramic Battery (LCB) Market Size is expected to grow from USD 1.02 Billion in 2017 to USD 2.48 Billion by 2030, at a CAGR of 10.5% from 2022to2032

Here are some key drivers of demand for LCBs in the market:

High Energy Density: LCBs offer higher energy density compared to traditional lithium-ion batteries, which is especially appealing for applications where compact and lightweight energy storage is crucial.

Safety and Stability: LCBs are known for their improved safety features, including resistance to thermal runaway and reduced risk of fire or explosion. This makes them a preferred choice for applications where safety is a primary concern.

Long Cycle Life: LCBs have demonstrated longer cycle life and calendar life compared to some conventional lithium-ion batteries. This characteristic is valuable in applications where longevity and durability are essential.

Temperature Performance: LCBs perform well in a wide range of temperatures, from extreme cold to high heat. This makes them suitable for applications in diverse environments, such as aerospace and automotive industries.

Fast Charging: As demand grows for faster-charging solutions, LCBs are being explored for their potential to support rapid charging without compromising safety or longevity.

Sustainability and Environmental Concerns: The shift towards sustainable energy storage technologies has led to increased interest in LCBs due to their potential to reduce environmental impact and reliance on fossil fuels.

Certainly, here's an overview of the Lithium Ceramic Battery (LCB) market trends, scope, and opportunities:

Trends:

High Energy Density: Lithium Ceramic Batteries (LCBs) offer higher energy density compared to traditional lithium-ion batteries, making them attractive for applications requiring longer-lasting and more powerful energy sources.

Enhanced Safety: LCBs are known for their improved safety characteristics, including resistance to thermal runaway and reduced risk of fire or explosion. This makes them appealing for applications where safety is a critical concern.

Wide Temperature Range: LCBs exhibit excellent performance across a broad temperature range, making them suitable for applications in extreme environments, such as aerospace and military applications.

Durability and Longevity: LCBs have demonstrated longer cycle life and extended calendar life compared to some conventional lithium-ion technologies, reducing the need for frequent replacements.

Fast Charging: Emerging technologies within the LCB category are showing potential for faster charging capabilities, catering to the growing demand for quick charging solutions.

Solid-State Design: Some LCB variants use solid-state electrolytes, eliminating the need for flammable liquid electrolytes and enhancing overall battery stability and safety.

Scope:

Electronics and Consumer Devices: LCBs could find applications in smartphones, laptops, tablets, and other consumer electronics due to their high energy density and improved safety.

Electric Vehicles (EVs): The EV industry could benefit from LCBs' fast charging capabilities, extended cycle life, and resistance to temperature fluctuations.

Aerospace and Aviation: LCBs' ability to operate in extreme temperatures and provide reliable power could make them suitable for aerospace applications, including satellites and unmanned aerial vehicles.

Military and Defense: The durability, safety, and reliability of LCBs could be advantageous for defense applications, such as portable electronics and military vehicles.

Medical Devices: LCBs' safety features, longevity, and potential for high energy density might make them valuable for medical devices requiring stable and efficient power sources.

Grid Energy Storage: LCBs could play a role in grid-scale energy storage due to their high energy density, longer cycle life, and safety features.

Opportunities:

Advanced Materials Development: Opportunities exist for research and development of new materials to further improve the performance, energy density, and safety of LCBs.

Commercialization: Companies that can successfully develop and commercialize LCB technologies could tap into various industries seeking high-performance, safe, and durable energy storage solutions.

Partnerships and Collaborations: Opportunities for partnerships between battery manufacturers, research institutions, and industries seeking reliable energy solutions.

Customization: Tailoring LCB technologies to specific applications, such as medical devices or defense equipment, can open up opportunities for specialized markets.

Sustainable Energy Storage: LCBs' potential to enhance the efficiency of renewable energy storage systems presents opportunities in the transition to clean energy.

Investment and Funding: Investors and venture capitalists interested in innovative battery technologies could find opportunities to support the development of LCB technologies.

We recommend referring our Stringent datalytics firm, industry publications, and websites that specialize in providing market reports. These sources often offer comprehensive analysis, market trends, growth forecasts, competitive landscape, and other valuable insights into this market.

By visiting our website or contacting us directly, you can explore the availability of specific reports related to this market. These reports often require a purchase or subscription, but we provide comprehensive and in-depth information that can be valuable for businesses, investors, and individuals interested in this market.

“Remember to look for recent reports to ensure you have the most current and relevant information.”

Click Here, To Get Free Sample Report: https://stringentdatalytics.com/sample-request/lithium-ceramic-battery-(lcb)-market/12035/

Market Segmentations:

Global Lithium Ceramic Battery (LCB) Market: By Company

• Evonik

• ProLogium(PLG)

Global Lithium Ceramic Battery (LCB) Market: By Type

• Laminate Type

• Cylindrical Type

Global Lithium Ceramic Battery (LCB) Market: By Application

• Transportation

• Energy Storage System

• Telecom and IT

• Industrial Equipment

• Others

Global Lithium Ceramic Battery (LCB) Market: Regional Analysis

The regional analysis of the global Lithium Ceramic Battery (LCB) market provides insights into the market's performance across different regions of the world. The analysis is based on recent and future trends and includes market forecast for the prediction period. The countries covered in the regional analysis of the Lithium Ceramic Battery (LCB) market report are as follows:

North America: The North America region includes the U.S., Canada, and Mexico. The U.S. is the largest market for Lithium Ceramic Battery (LCB) in this region, followed by Canada and Mexico. The market growth in this region is primarily driven by the presence of key market players and the increasing demand for the product.

Europe: The Europe region includes Germany, France, U.K., Russia, Italy, Spain, Turkey, Netherlands, Switzerland, Belgium, and Rest of Europe. Germany is the largest market for Lithium Ceramic Battery (LCB) in this region, followed by the U.K. and France. The market growth in this region is driven by the increasing demand for the product in the automotive and aerospace sectors.

Asia-Pacific: The Asia-Pacific region includes Singapore, Malaysia, Australia, Thailand, Indonesia, Philippines, China, Japan, India, South Korea, and Rest of Asia-Pacific. China is the largest market for Lithium Ceramic Battery (LCB) in this region, followed by Japan and India. The market growth in this region is driven by the increasing adoption of the product in various end-use industries, such as automotive, aerospace, and construction.

Middle East and Africa: The Middle East and Africa region includes Saudi Arabia, U.A.E, South Africa, Egypt, Israel, and Rest of Middle East and Africa. The market growth in this region is driven by the increasing demand for the product in the aerospace and defense sectors.

South America: The South America region includes Argentina, Brazil, and Rest of South America. Brazil is the largest market for Lithium Ceramic Battery (LCB) in this region, followed by Argentina. The market growth in this region is primarily driven by the increasing demand for the product in the automotive sector.

Visit Report Page for More Details: https://stringentdatalytics.com/reports/lithium-ceramic-battery-(lcb)-market/12035/

Reasons to Purchase Lithium Ceramic Battery (LCB) Market Report:

• To gain insights into market trends and dynamics: this reports provide valuable insights into industry trends and dynamics, including market size, growth rates, and key drivers and challenges.

• To identify key players and competitors: this research reports can help businesses identify key players and competitors in their industry, including their market share, strategies, and strengths and weaknesses.

• To understand consumer behavior: this research reports can provide valuable insights into consumer behavior, including their preferences, purchasing habits, and demographics.

• To evaluate market opportunities: this research reports can help businesses evaluate market opportunities, including potential new products or services, new markets, and emerging trends.

• To make informed business decisions: this research reports provide businesses with data-driven insights that can help them make informed business decisions, including strategic planning, product development, and marketing and advertising strategies.

About US:

Stringent Datalytics offers both custom and syndicated market research reports. Custom market research reports are tailored to a specific client's needs and requirements. These reports provide unique insights into a particular industry or market segment and can help businesses make informed decisions about their strategies and operations.

Syndicated market research reports, on the other hand, are pre-existing reports that are available for purchase by multiple clients. These reports are often produced on a regular basis, such as annually or quarterly, and cover a broad range of industries and market segments. Syndicated reports provide clients with insights into industry trends, market sizes, and competitive landscapes. By offering both custom and syndicated reports, Stringent Datalytics can provide clients with a range of market research solutions that can be customized to their specific needs

Contact US:

Stringent Datalytics

Contact No - +1 346 666 6655

Email Id - [email protected]

Web - https://stringentdatalytics.com/

#Lithium Ceramic Battery#LCB Technology#Solid-State Batteries#High Energy Density Batteries#Battery Innovation#Advanced Energy Storage#Battery Safety#Battery Durability#Long Cycle Life Batteries#Fast Charging Batteries#Sustainable Energy Storage#Solid Electrolyte Batteries#Battery Materials#Battery Research#Battery Applications#Electric Vehicle Batteries#Aerospace Batteries#Renewable Energy Storage#Battery Trends#Battery Market Growth#Battery Industry#Battery Efficiency#Battery Manufacturing#Battery Performance.

0 notes

Text

Shaping the Green Revolution: Solid State Battery and Sustainable Energy

The solid-state battery market refers to the market for batteries that utilize solid-state electrolytes instead of traditional liquid or gel electrolytes found in conventional lithium-ion batteries. Solid-state batteries are considered to be the next generation of energy storage technology and offer several advantages over their liquid electrolyte counterparts, including higher energy density, improved safety, longer cycle life, and faster charging capabilities.

Here is some comprehensive information about the solid-state battery market:

Market Overview:

• The solid-state battery market has been gaining significant attention and is expected to experience substantial growth in the coming years.

• The market is driven by the increasing demand for advanced energy storage solutions in various industries, including automotive, consumer electronics, healthcare, and renewable energy.

• Solid-state batteries have the potential to revolutionize electric vehicles (EVs) by providing higher driving range, shorter charging times, and improved safety.

• The market is also driven by the need for compact and efficient power sources in portable electronic devices, wearables, and IoT devices.

Key Benefits of Solid-State Batteries:

• Higher Energy Density: Solid-state batteries have the potential to store more energy per unit volume or weight compared to conventional batteries. This can lead to increased driving range in EVs and longer battery life in portable devices.

• Enhanced Safety: Solid-state electrolytes are non-flammable and less prone to leakage or thermal runaway, making solid-state batteries safer than traditional lithium-ion batteries.

• Longer Cycle Life: Solid-state batteries are designed to have a longer lifespan and can endure a higher number of charge-discharge cycles without significant capacity degradation.

• Faster Charging: Solid-state batteries have the potential for faster charging, reducing the time required to recharge electric vehicles and portable devices.

• Wide Operating Temperature Range: Solid-state batteries can operate efficiently over a broader temperature range, making them suitable for extreme conditions.

Market Segmentation:

By Type: The solid-state battery market can be segmented into thin-film batteries and bulk batteries.

By Capacity: The market can be categorized into low capacity, medium capacity, and high capacity solid-state batteries.

By Application: The major application segments include electric vehicles, consumer electronics, renewable energy storage, medical devices, aerospace, and defense.

Market Trends and Outlook:

• The solid-state battery market is witnessing increased research and development activities to enhance performance, scalability, and cost-effectiveness.

Several companies and startups are actively working on the commercialization of solid-state battery technology and are partnering with automakers and electronic device manufacturers.

• The automotive industry, particularly electric vehicles, is expected to be a significant driver for the solid-state battery market due to the demand for longer driving range and faster charging.

• Governments and regulatory bodies worldwide are focusing on reducing greenhouse gas emissions and promoting clean energy solutions, which can further drive the adoption of solid-state batteries.

However, challenges such as high manufacturing costs, limited scalability, and production challenges need to be addressed for widespread commercialization of solid-state batteries.

Key Players:

Some of the prominent companies involved in the solid-state battery market include QuantumScape Corporation, Solid Power Inc., Toyota Motor Corporation, Samsung SDI Co. Ltd., Panasonic Corporation, LG Chem Ltd., Cymbet Corporation, BMW AG, and Hitachi Zosen Corporation, among others.

Market Forecast:

• The solid-state battery market is projected to grow significantly in the coming years, with estimates varying based on different reports. Some forecasts suggest a compound annual growth rate (CAGR) of over 50% between 2021 and 2026.

• The market growth will be driven by increasing investments in R&D, advancements in battery technology, expanding applications in electric vehicles and consumer electronics, and supportive government initiatives.

It's important to note that the information provided here is based on the knowledge available up until September 2021, and the market dynamics and trends may have evolved since then.

0 notes

Text

Automakers seek Solid State Battery to Bolster ESG Performance

Auto-makers have exhibited increased traction to cut battery’s carbon footprint, encouraging solid-state battery industry players to propel environmental, social and governance (ESG) goals. Solid state batteries (SSBs) store more energy, provide greater safety and charge faster compared to liquid lithium-ion batteries. Since a few batteries are required, SSBs can boost energy density per unit, making the technology highly sought-after in the EV landscape. SSBs could propel the ESG performance with several watchdogs vouching for the batteries. According to Transport & Environment (T&E), solid state batteries can minimize the carbon footprint of EV batteries by two-fifths. With solid state batteries poised to be used in EVs by 2025, battery manufacturers have furthered their investments in the ESG ecosystem.

The sustainability of battery supply chains has become pronounced as companies seek to reap upsides from using SSBs. These batteries promise to attain the Paris Agreement, boost energy access and economic value and foster decarbonization. Companies could shift to a circular value chain to enhance their economic and environmental footprint and by harvesting end-of-life values from batteries. With investors looking for companies with better ESG scores, stakeholders could focus on deploying SSBs in electric vehicles. Stakeholders are bullish towards safe working conditions and have exhibited respect for human rights by keeping the child and forced labor at bay. Private companies and public stakeholders are expected to expedite the share of renewable energies in the value chain.

Discover more regarding the practices and strategies being implemented by industry participants form the Solid State Battery Industry ESG Thematic Report, 2022, published by Astra ESG Solutions

Environmental Perspective

The growth of SSBs is likely to foster green energy and e-mobility as stakeholders strive to minimize their carbon footprint. The European climate group has pitched for incentives for the production of batteries with a lower carbon footprint in the new EV battery regulations—EU governments and MEPs are negotiating the final text of the regulation. In December 2020, the European Commission reportedly tabled a proposal for the modernization of the regulatory framework for batteries and bolstering the sustainability of EU battery value chains.

Although SSBs are at a low technology readiness level, strong demand from EV manufacturers to offset initial costs and propel sustainability could augur growth. The need for intensive actions against climate change and to bring the automotive sector to greenhouse gas neutrality has become an enabler for technological advances and buoyant policies. For instance, Toyota Motor Corporation issued Challenge 2050 to underpin the creation of a more sustainable and inclusive society. The company aims to reduce CO2 emissions from new vehicles by 30% by 2025 and 90% by 2050.

Solvay has a bullish plan to achieve carbon neutrality—scope 1 and 2—before 2040 for all businesses barring soda ash. The audacious goal is underpinned by an investment program of approximately €2 billion (USD 2.05 billion). The next-generation power source for EVs will continue to be sought to underscore the environmental profile. In July 2022, Nikkei, in partnership with Patent Result, inferred that Toyota had a massive lead in the solid-state battery patents—with 1,331 known patents.

Social Perspective

Industry partners have prioritized social contributions activities to enrich society and communities. In February 2022, Samsung SDI established a sustainable business management committee to propel ESG efforts. The company is gearing up for a full transition to renewable energy by 2050. The battery firm stood first with around 70% score, partly due to bullish efforts to propel work environment, diversity and human rights. In April 2022, Samsung SDI set out Safety Environment Management Policy to create safe and healthy corporate values, implement environmentally friendly management and form an external green community. In 2021, the company appointed around 299 CAs to take the organizational culture to the next level through team member development, fair appraisal, better collaboration, enhanced work efficiency and open communication.

Amidst occupational accidents becoming pervasive and denting the economy and employees’ health, stakeholders have responded with buoyant policies. In May 2021, the firm operated the “Eradicating Serious Accidents Task Force” to bolster safety and keep occupational injuries at bay. The South Korea-based company has expedited labor-management communication to enhance the work environment and protect labor rights. In 2020, around 1,193 issues were reportedly submitted and addressed with robust follow-up measures.

The diversity of directors has come to the fore as a driver of social portfolio for efficient decision-making and supervision. In 2020, Samsung SDI appointed four independent directors on the basis of expertise in areas, including law/human rights, electrical and electronics industry, accounting/tax and labor policy/relations. The company has placed no limitations on the basis of religion, gender, race, nationality, ethnicity or cultural background.

Companies have also prioritized the ESG committee to underpin sustainability. In 2021, Solvay rolled out its first employee share purchase program to propel the feeling of ownership among employees. Moreover, 98 of its 105 sites have observed a security vulnerability self-assessment (SVSA). It has also rolled out “Solvay One Dignity” to eradicate discrimination, providing equal opportunities for every employee. The company also announced the introduction of its first employee stock ownership plan. Moreover, in 2021, Solvay introduced a ten-year “STAR Factory Program” to cash in on digital and data science and make all plants STAR factory certified by 2030.

Is your business one of participants to the Global Solid State Battery Industry? Contact us for focused consultation around ESG Investing, and help you build sustainable business practices.

Governance Perspective

Well-established and emerging players have reinforced governance, ethics and transparency to create a sustainable value for all stakeholders. Companies have raised the bar in ESG performance to pursue their sustainability vision. The repercussion of unsound governance could expand beyond the realm of financial results, prompting financial bodies to mandate governance disclosure reports. With environmental and climate issues placed at the top of agendas, governance practices and disclosures could underscore a culture of sustainable value creation.

The ESG scoring model of Grand View Research has ranked Solvay second to none—with a 70% score—in corporate governance. The top rank is mainly due to its efforts to foster governance practices with an emphasis on independent directors. In 2021, the company had 64% independent directors and the stand-alone ESG committee made a new carbon neutrality ambition recommendation to the board. The board backed the introduction of an employee share purchase plan providing Solvay personnel the chance to buy company shares at a 10% discount.

Prominent companies have underscored the focus on sound governance, the ratio of independent directors, compliance training and taking disciplinary actions for corruption. Around 12,598 Samsung SDI employees completed ethics and compliance training, while there were 26 compliance review activities in 2021. The company appoints a chair of the BOD among directors to boost the flexibility of BOD operations and enhance directors’ accountability. The South Korean firm rolled out the Samsung Compliance Committee in February 2020 to propel compliance oversight and control at the company’s seven primary affiliates. In 2021, it amended all guidelines managed by the compliance team and provided training and reviews to alert employees about the risk of regulatory non-compliance.

Forward-looking companies are assessing risks, opportunities and issues pertaining to sustainability amidst the expanding footprint of solid state batteries. With longer ranges and quicker charging times, SSBs could be the game changer for the electric vehicle manufacturers and other stakeholders. In January 2022, Toyota announced its first vehicle to use SSBs would be hybrid and would go on sale by 2025. Meanwhile, in June 2022, Solid Power announced it would be shipping solid state battery cells to BMW and Ford by the year-end for validation testing. Prevailing trends allude to a robust growth outlook in the ensuing period. The global solid state battery market is expected to witness around 36% CAGR from 2021 through 2028. Policies and approaches toward ESG could dictate the growth trajectory as automakers seek massive EV battery breakthroughs.

About Astra – ESG Solutions By Grand View Research

Astra is the Environmental, Social, and Governance (ESG) arm of Grand View Research Inc. – a global market research publishing & management consulting firm.

Astra offers comprehensive ESG thematic assessment & scores across diverse impact & socially responsible investment topics, including both public and private companies along with intuitive dashboards. Our ESG solutions are powered by robust fundamental & alternative information. Astra specializes in consulting services that equip corporates and the investment community with the in-depth ESG research and actionable insight they need to support their bottom lines and their values. We have supported our clients across diverse ESG consulting projects & advisory services, including climate strategies & assessment, ESG benchmarking, stakeholder engagement programs, active ownership, developing ESG investment strategies, ESG data services, build corporate sustainability reports. Astra team includes a pool of industry experts and ESG enthusiasts who possess extensive end-end ESG research and consulting experience at a global level.

For more ESG Thematic reports, please visit Astra ESG Solutions, powered by Grand View Research

#Solid State Battery Industry#Solid state batteries#Solid State Battery Industry ESG#Solid State Battery Market#solid state battery companies#solid state battery technology

0 notes