#Thomas Meskill

Text

Connecticut Governor DILFs

Dannel Malloy, Lowell Weicker, Ned Lamont, Abraham Ribicoff, Chester B. Bowles, James L. McConaughy, John G. Rowland, John N. Dempsey, John Davis Lodge, Raymond E. Baldwin, William A. O'Neill, Thomas Meskill

#Dannel Malloy#Lowell Weicker#Ned Lamont#Abraham Ribicoff#Chester B. Bowles#James L. McConaughy#John G. Rowland#John N. Dempsey#John Davis Lodge#Raymond E. Baldwin#William A. O'Neill#Thomas Meskill#GovernorDILFs

30 notes

·

View notes

Text

The 42-Day Income Tax

When Governor Thomas Meskill took office in January of 1971, Connecticut found itself in the midst of a financial crisis. In the years leading up to Meskill’s election, the state managed to accumulate a debt of over a quarter of a billion dollars. Throughout the spring of 1971, legislators struggled to develop a plan for eliminating the deficit.

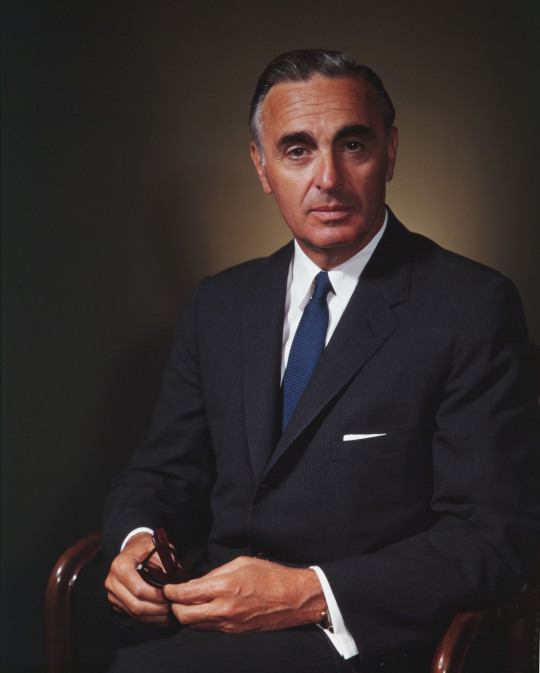

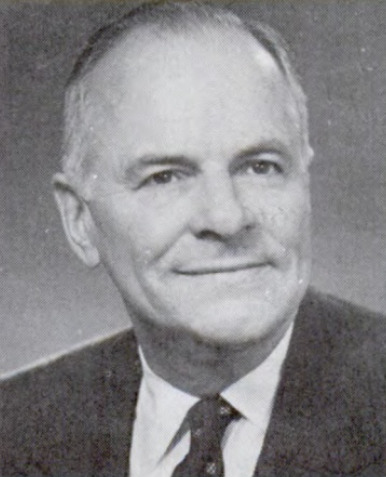

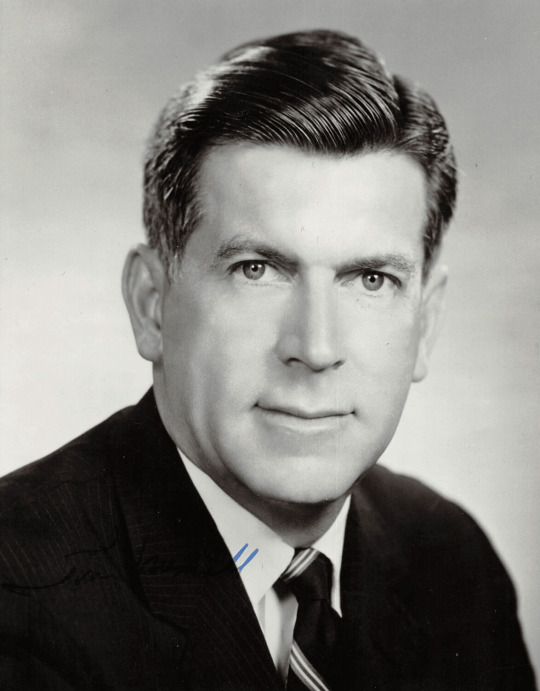

Illustration of Governor Thomas J. Meskill from The Connecticut Bicentennial Gazette

Meskill wanted the budget balanced within 36 months. To that end, he proposed raising the state’s sales tax from 5 to 7½ percent. The only other option, many felt, was to institute a tax on income. During this time, Connecticut residents had the highest per-capital income in the country and several legislators saw an income tax as a quick and easy solution to raising the necessary funds. As the spring legislation session began coming to a close, however, there remained no agreement on how best to address the financial crisis.

On June 30, 1971, the last day before the start of the new fiscal year, legislators worked into the night to negotiate a deal. Early the following morning, the Senate passed a bill proposing a state income tax. Hours later, the House approved the bill, scheduling the new tax to take effect in September of that year.

Thomas Meskill and the Opposition to an Income Tax

Despite Meskill vetoing a record 173 bills during the contentious legislative session, the governor, though choosing not to sign the income tax bill, avoided vetoing it. Statewide outrage over the tax quickly manifested itself in local newspaper editorials and the organizing of public protests. Numerous grassroots efforts eventually convinced the legislature to reconvene and consider alternatives to a tax on income.

A special legislative session scheduled for August 11 carried over to the following day without an agreement until, finally, on the evening of August 12, legislators voted to repeal the state income tax—just 42 days after passing it. In its place the state opted to raise the sales tax from 5 to 6½ percent (the highest in the country). The new tax package also sought to increase revenues by requiring a two-cent hike on the state’s gasoline tax, a five-cent increase on cigarettes, and the raising of tuition at the University of Connecticut to $350 per year.

Despite his failure to achieve the desired 7½ percent sales tax, Governor Meskill signed the new bill into law. He did so with the understanding that at the first sign of a revenue shortfall he intended to call legislators back into session. The plan worked. When Thomas Meskill left office the state’s budget actually showed Connecticut in possession of a financial surplus. It took until 1991 before the Connecticut General Assembly approved another state income tax.

from Connecticut History | a CTHumanities Project https://connecticuthistory.org/the-42-day-income-tax/

0 notes

Text

Royal Irish Regiment soldiers who died on 14th July

1916

6th Bn.

5505 Private Kenny, Callan, Co. Kilkenny. Interred Bethune Town Cemetery, France.

1918

2nd Bn

18475 Private Patrick Brogan, Ardara, Co. Donegal. Interred Louvencourt Military Cemetery, France.

16034 Private Edward Higham, Liverpool. Interred Louvencourt Military Cemetery, France.

18549 Private Thomas Quinn, Shankill, Co. Antrim. Interred Louvencourt Military Cemetery, France.

10795 Private Thomas Meskill, Clonmel, Co. Tipperary. Commemorated on the Pozieres Memorial, France

0 notes

Text

America’s First Woman Governor: Ella Grasso, 1919-1981

by Mary Muller for Your Public Media

Ella Tambussi Grasso was born to Italian immigrant parents in Windsor Locks, Connecticut, on May 10, 1919. She attended the Chaffee School in Windsor and earned a scholarship to Mount Holyoke College where she earned both BA (1940) and MA (1942) degrees. At an early age, she displayed an interest and belief in public service and, soon after completing her education, became involved in the Democratic Party in Connecticut. She was first elected to the state General Assembly in 1952. In nine subsequent state and federal elections, she was never defeated. She also served two terms in the US House of Representatives but was soon drawn back to Connecticut state politics. She kept a sign in her living room that read, “Bloom Where You Are Planted.”

Governor Ella Grasso with Christopher Dodd, Abraham Ribicoff, Jimmy Carter and Wilson Wilde, ca. 1975-1980, photograph by Charles William Eldridge – Connecticut Historical Society

In 1975, Grasso soundly defeated Republican incumbent Thomas Meskill in the gubernatorial election, becoming Connecticut’s first woman governor and first governor of Italian descent. She was also the first woman in the United States to become governor in her own right, that is, not as a successor to her husband. A smart, tough, and hard-working politician, she confronted many issues that are familiar to us today. Budget shortfalls, resulting in the need to increase taxes and lay off state workers, made her first years in office difficult. An improving national economy and the inauguration of the Connecticut State Lottery in 1976 helped turn things around.

Grasso’s timely, personal and hands-on response to the Blizzard of 1978 solidified her popularity and resulted in a huge reelection victory the following November. By the beginning of her second term, the state had a budget surplus, and Grasso was able to fund many social programs including aid to impoverished communities, housing, mass transit, day care, and assistance for the elderly.

Grasso was diagnosed with ovarian cancer during the spring of 1980 and her declining health forced her to resign on December 31 of that year. She died at Hartford Hospital on February 5, 1981. She is buried in Saint Mary’s Cemetery in Windsor Locks. Women politicians were a rare thing in Grasso’s day. Though women are much more prominent in politics today, Grasso continues to serve as an inspiration and a role model. Jon E. Pumont, Grasso’s executive assistant when she was governor, published a biography of her, Ella Grasso, Connecticut’s Pioneering Governor, in 2012.

Mary Muller is the Lead Museum Educator at the Connecticut Historical Society.

© Connecticut Public Broadcasting Network and Connecticut Historical Society. All rights reserved. This article originally appeared on Your Public Media.

from Connecticut History | a CTHumanities Project https://connecticuthistory.org/americas-first-woman-governor-ella-grasso-1919-1981/

0 notes

Text

The 42-Day Income Tax

When Governor Thomas Meskill took office in January of 1971, Connecticut found itself in the midst of a financial crisis. In the years leading up to Meskill’s election, the state managed to accumulate a debt of over a quarter of a billion dollars. Throughout the spring of 1971, legislators struggled to develop a plan for eliminating the deficit.

Illustration of Governor Thomas J. Meskill from The Connecticut Bicentennial Gazette

Meskill wanted the budget balanced within 36 months. To that end, he proposed raising the state’s sales tax from 5 to 7½ percent. The only other option, many felt, was to institute a tax on income. During this time, Connecticut residents had the highest per-capital income in the country and several legislators saw an income tax as a quick and easy solution to raising the necessary funds. As the spring legislation session began coming to a close, however, there remained no agreement on how best to address the financial crisis.

On June 30, 1971, the last day before the start of the new fiscal year, legislators worked into the night to negotiate a deal. Early the following morning, the Senate passed a bill proposing a state income tax. Hours later, the House approved the bill, scheduling the new tax to take effect in September of that year.

Thomas Meskill and the Opposition to an Income Tax

Despite Meskill vetoing a record 173 bills during the contentious legislative session, the governor, though choosing not to sign the income tax bill, avoided vetoing it. Statewide outrage over the tax quickly manifested itself in local newspaper editorials and the organizing of public protests. Numerous grassroots efforts eventually convinced the legislature to reconvene and consider alternatives to a tax on income.

A special legislative session scheduled for August 11 carried over to the following day without an agreement until, finally, on the evening of August 12, legislators voted to repeal the state income tax—just 42 days after passing it. In its place the state opted to raise the sales tax from 5 to 6½ percent (the highest in the country). The new tax package also sought to increase revenues by requiring a two-cent hike on the state’s gasoline tax, a five-cent increase on cigarettes, and the raising of tuition at the University of Connecticut to $350 per year.

Despite his failure to achieve the desired 7½ percent sales tax, Governor Meskill signed the new bill into law. He did so with the understanding that at the first sign of a revenue shortfall he intended to call legislators back into session. The plan worked. When Thomas Meskill left office the state’s budget actually showed Connecticut in possession of a financial surplus. It took until 1991 before the Connecticut General Assembly approved another state income tax.

from ConnecticutHistory.org https://connecticuthistory.org/the-42-day-income-tax/

0 notes

Text

The 42-Day Income Tax

When Governor Thomas Meskill took office in January of 1971, Connecticut found itself in the midst of a financial crisis. In the years leading up to Meskill’s election, the state managed to accumulate a debt of over a quarter of a billion dollars. Throughout the spring of 1971, legislators struggled to develop a plan for eliminating the deficit.

Illustration of Governor Thomas J. Meskill from The Connecticut Bicentennial Gazette

Meskill wanted the budget balanced within 36 months. To that end, he proposed raising the state’s sales tax from 5 to 7½ percent. The only other option, many felt, was to institute a tax on income. During this time, Connecticut residents had the highest per-capital income in the country and several legislators saw an income tax as a quick and easy solution to raising the necessary funds. As the spring legislation session began coming to a close, however, there remained no agreement on how best to address the financial crisis.

On June 30, 1971, the last day before the start of the new fiscal year, legislators worked into the night to negotiate a deal. Early the following morning, the Senate passed a bill proposing a state income tax. Hours later, the House approved the bill, scheduling the new tax to take effect in September of that year.

Thomas Meskill and the Opposition to an Income Tax

Despite Meskill vetoing a record 173 bills during the contentious legislative session, the governor, though choosing not to sign the income tax bill, avoided vetoing it. Statewide outrage over the tax quickly manifested itself in local newspaper editorials and the organizing of public protests. Numerous grassroots efforts eventually convinced the legislature to reconvene and consider alternatives to a tax on income.

A special legislative session scheduled for August 11 carried over to the following day without an agreement until, finally, on the evening of August 12, legislators voted to repeal the state income tax—just 42 days after passing it. In its place the state opted to raise the sales tax from 5 to 6½ percent (the highest in the country). The new tax package also sought to increase revenues by requiring a two-cent hike on the state’s gasoline tax, a five-cent increase on cigarettes, and the raising of tuition at the University of Connecticut to $350 per year.

Despite his failure to achieve the desired 7½ percent sales tax, Governor Meskill signed the new bill into law. He did so with the understanding that at the first sign of a revenue shortfall he intended to call legislators back into session. The plan worked. When Thomas Meskill left office the state’s budget actually showed Connecticut in possession of a financial surplus. It took until 1991 before the Connecticut General Assembly approved another state income tax.

from ConnecticutHistory.org https://connecticuthistory.org/the-42-day-income-tax/

0 notes