#US Loan Providers

Text

Personal Loans

Unlocking Financial Flexibility for Your Personal Goals

In times of financial need or when pursuing personal aspirations, a personal loan can be a valuable tool. This article aims to provide a comprehensive overview of personal loans, shedding light on their key features, benefits, and considerations to keep in mind when considering this type of borrowing.

Understanding Personal Loans

A personal loan is a form of unsecured loan offered by banks, credit unions, or online lenders. Unlike specific-purpose loans like mortgages or auto loans, personal loans provide borrowers with flexibility in using the funds. Whether you need to consolidate debt, cover unexpected expenses, finance a home improvement project, or plan a dream vacation, a personal loan can be a versatile financial solution.

Get up to $10,000 in 24h right now!

Loan Amounts and Terms

Personal loans typically range from a few thousand dollars to tens of thousands of dollars, depending on the lender and the borrower's creditworthiness. Loan terms can vary, usually ranging from one to seven years. Longer loan terms may result in lower monthly payments, but higher interest costs over time, while shorter terms may require higher monthly payments but result in quicker repayment and lower overall interest expenses.

Interest Rates and Fees

Interest rates for personal loans can be either fixed or variable. Fixed rates remain constant throughout the loan term, providing stability in repayment planning. Variable rates can change over time based on market conditions. Borrowers should also consider any associated fees, such as origination fees or prepayment penalties. Comparing interest rates and fees from different lenders is essential to secure the most favorable terms.

Get up to $10,000 in 24h right now!

Credit Score and Eligibility

Lenders evaluate borrowers' creditworthiness by examining their credit scores and credit histories. A higher credit score increases the likelihood of loan approval and more favorable interest rates. Other factors considered during the loan application process include income, employment history, and debt-to-income ratio. It is important for borrowers to review their credit reports, address any discrepancies, and work on improving their credit profiles before applying for a personal loan.

Benefits and Considerations

Personal loans offer several advantages, including quick access to funds, no collateral requirements, and the ability to consolidate high-interest debt. However, borrowers should carefully consider the overall cost of the loan, including interest rates and fees, and ensure they can comfortably manage the monthly payments. It is also important to avoid borrowing more than necessary and to have a solid plan for repaying the loan on time.

Here are the 38 US fast loan providers

Personal loans can be a valuable financial tool when used responsibly, providing individuals with the means to pursue personal goals and manage unexpected expenses. By understanding the key aspects of personal loans, borrowers can make informed decisions, select suitable terms, and work towards achieving their financial objectives while maintaining financial stability.

#business#personal loan online#USA Loan#US Payday Loan#US Loan Providers#Fast Loans#PersonalLoans#24 Hours Loans#Online payday lenders#Quick loans#Same-day loans#Bad credit loans#Paycheck loans

1 note

·

View note

Text

BitNest

BitNest: The Leader of the Digital Finance Revolution

BitNest is a leading platform dedicated to driving digital financial innovation and ecological development. We provide comprehensive cryptocurrency services, including saving, lending, payment, investment and many other functions, creating a rich financial experience for users.

Our story began in 2022 with the birth of the BitNest team, which has since opened a whole new chapter in digital finance. Through relentless effort and innovation, the BitNest ecosystem has grown rapidly to become one of the leaders in digital finance.

The core functions of BitNest ecosystem include:

Savings Service: Users can deposit funds into BitNest's savings system through smart contracts to obtain stable returns. We are committed to providing users with a safe and efficient savings solution to help you achieve your financial goals.

Lending Platform: BitNest lending platform provides users with convenient borrowing services, users can use cryptocurrencies as collateral to obtain loans for stablecoins or other digital assets. Our lending system is safe and reliable, providing users with flexible financial support.

Payment Solution: BitNest payment platform supports users to make secure and fast payment transactions worldwide. We are committed to creating a borderless payment network that allows users to make cross-border payments and remittances anytime, anywhere.

Investment Opportunities: BitNest provides diversified investment opportunities that allow users to participate in trading and investing in various digital assets and gain lucrative returns. Our investment platform is safe and transparent, providing users with high-quality investment channels.

Through continuous innovation and efforts, BitNest has become a leader in digital finance and is widely recognised and trusted globally. We will continue to be committed to promoting the development of digital finance, providing users with more secure and efficient financial services, and jointly creating a better future for digital finance.

#BitNest: The Leader of the Digital Finance Revolution#BitNest is a leading platform dedicated to driving digital financial innovation and ecological development. We provide comprehensive crypto#including saving#lending#payment#investment and many other functions#creating a rich financial experience for users.#Our story began in 2022 with the birth of the BitNest team#which has since opened a whole new chapter in digital finance. Through relentless effort and innovation#the BitNest ecosystem has grown rapidly to become one of the leaders in digital finance.#The core functions of BitNest ecosystem include:#Savings Service: Users can deposit funds into BitNest's savings system through smart contracts to obtain stable returns. We are committed t#Lending Platform: BitNest lending platform provides users with convenient borrowing services#users can use cryptocurrencies as collateral to obtain loans for stablecoins or other digital assets. Our lending system is safe and reliab#providing users with flexible financial support.#Payment Solution: BitNest payment platform supports users to make secure and fast payment transactions worldwide. We are committed to creat#anywhere.#Investment Opportunities: BitNest provides diversified investment opportunities that allow users to participate in trading and investing in#providing users with high-quality investment channels.#Through continuous innovation and efforts#BitNest has become a leader in digital finance and is widely recognised and trusted globally. We will continue to be committed to promoting#providing users with more secure and efficient financial services#and jointly creating a better future for digital finance.#BitNest#BitNestCryptographically

3 notes

·

View notes

Text

CHAOS REIGNS! I set a bunch of website's default language to Korean and now I am lost.

#i now have an approximation for a lot of words that i am too lazy to look up in the dictionary#and a few that i'm dead sure of because korean has a LOT of english loan words and finding them always provides Context for the other words#but most of them aren't that useful#however i am now fully familiar with table settings#(so that's my consolation prize)

3 notes

·

View notes

Text

I feel like a good shorthand for a lot of economics arguments is "if you want people to work minimum wage jobs in your city, you need to allow minimum wage apartments for them to live in."

"These jobs are just for teenagers on the weekends." Okay, so you'll use minimum wage services only on the weekends and after school. No McDonald's or Starbucks on your lunch break.

"They can get a roommate." For a one bedroom? A roommate for a one bedroom? Or a studio? Do you have a roommate to get a middle-wage apartment for your middle-wage job? No? Why should they?

"They can live farther from city center and just commute." Are there ways for them to commute that don't equate to that rent? Living in an outer borough might work in NYC, where public transport is a flat rate, but a city in Texas requires a car. Does the money saved in rent equal the money spent on the car loan, the insurance, the gas? Remember, if you want people to take the bus or a bike, the bus needs to be reliable and the bike lanes survivable.

If you want minimum wage workers to be around for you to rely on, then those minimum wage workers need a place to stay.

You either raise the minimum wage, or you drop the rent. There's only so long you can keep rents high and wages low before your workforce leaves for cheaper pastures.

"Nobody wants to work anymore" doesn't hold water if the reason nobody applies is because the commute is impossible at the wage you provide.

112K notes

·

View notes

Text

In the current rapidly evolving digital currency market, decentralized finance (DeFi) platforms are redefining the shape of financial services with their unique advantages. Bit Loop, as a leading decentralized lending platform, not only provides a safe and transparent lending environment, but also opens up new passive income channels for users through its innovative sharing reward system.

Personal links and permanent ties: Create a stable revenue stream

One of the core parts of Bit Loop is its recommendation system, which allows any user to generate a unique sharing link when they join the platform. This link is not only a “key” for users to join the Bit Loop, but also a tool for them to establish an offline network. It is worth noting that offline partners who join through this link are permanently tied to the recommender, ensuring that the sharer can continue to receive rewards from the offline partner’s activities.

Unalterable referral relationships: Ensure fairness and transparency

A significant advantage of blockchain technology is the immutability of its data. In Bit Loop, this means that once a referral link and live partnership is established, the relationship is fixed and cannot be changed. This design not only protects the interests of recommenders, but also brings a stable user base and activity to the platform, while ensuring the fairness and transparency of transactions.

Automatically distribute rewards: Simplify the revenue process

Another highlight of the Bit Loop platform is the ability for smart contracts to automatically distribute rewards. When the partner completes the circulation cycle, such as investment returns or loan payments, the smart contract automatically calculates and sends the corresponding percentage of rewards directly to the recommender’s wallet. This automatic reward distribution mechanism not only simplifies the process of receiving benefits, but also greatly improves the efficiency of capital circulation.

Privacy protection and security: A security barrier for funds

All transactions and money flows are carried out on the blockchain, guaranteeing transparency and traceability of every operation. In addition, the use of smart contracts significantly reduces the risk of fraud and misoperation, providing a solid security barrier for user funds. Users can confidently invest and promote boldly, and enjoy the various conveniences brought by decentralized finance.

conclusion

As decentralized finance continues to evolve, Bit Loop offers a new economic model through its unique recommendation system that enables users to enjoy highly secure and transparent financial services while also earning passive income by building and maintaining a personal network. Whether for investors seeking stable passive income or innovators looking to explore new financial possibilities through blockchain technology, Bit Loop provides a platform not to be missed.

#In the current rapidly evolving digital currency market#decentralized finance (DeFi) platforms are redefining the shape of financial services with their unique advantages. Bit Loop#as a leading decentralized lending platform#not only provides a safe and transparent lending environment#but also opens up new passive income channels for users through its innovative sharing reward system.#Personal links and permanent ties: Create a stable revenue stream#One of the core parts of Bit Loop is its recommendation system#which allows any user to generate a unique sharing link when they join the platform. This link is not only a “key” for users to join the Bi#but also a tool for them to establish an offline network. It is worth noting that offline partners who join through this link are permanent#ensuring that the sharer can continue to receive rewards from the offline partner’s activities.#Unalterable referral relationships: Ensure fairness and transparency#A significant advantage of blockchain technology is the immutability of its data. In Bit Loop#this means that once a referral link and live partnership is established#the relationship is fixed and cannot be changed. This design not only protects the interests of recommenders#but also brings a stable user base and activity to the platform#while ensuring the fairness and transparency of transactions.#Automatically distribute rewards: Simplify the revenue process#Another highlight of the Bit Loop platform is the ability for smart contracts to automatically distribute rewards. When the partner complet#such as investment returns or loan payments#the smart contract automatically calculates and sends the corresponding percentage of rewards directly to the recommender’s wallet. This au#but also greatly improves the efficiency of capital circulation.#Privacy protection and security: A security barrier for funds#All transactions and money flows are carried out on the blockchain#guaranteeing transparency and traceability of every operation. In addition#the use of smart contracts significantly reduces the risk of fraud and misoperation#providing a solid security barrier for user funds. Users can confidently invest and promote boldly#and enjoy the various conveniences brought by decentralized finance.#conclusion#As decentralized finance continues to evolve#Bit Loop offers a new economic model through its unique recommendation system that enables users to enjoy highly secure and transparent fin

1 note

·

View note

Text

Car loan in delhi | Car loans in delhi | Finiscope

"Need a car loan in Delhi? Look no further! Finiscope offers hassle-free car loans in Delhi, tailored to suit your needs. Whether you're eyeing a new set of wheels or dreaming of upgrading your ride, Finiscope makes car financing simple and convenient. Explore our flexible loan options today!"

For more information visit our website: www.finiscope.in

#best car loan in delhi#best car loans in delhi#best auto loan in delhi#finiscope#best car and auto laon services provider#used car loans in delhi

0 notes

Text

Secure Your Dream Car with Low Credit Car Loans in Surrey

Are you in Surrey and dreaming of owning a car, but worried about your credit score? Worry no more! Approved Auto Loans is here to make your dream a reality with our Low Credit Car Loans Surrey residents.

We understand that having a low credit score can make obtaining financing for a car seem like an uphill battle. However, at Approved Auto Loans, we believe that everyone deserves a chance to own their dream vehicle, regardless of their credit history. That's why we specialize in providing affordable car loans to individuals with less than perfect credit.

Our team of experienced finance experts works tirelessly to find the best loan options for our customers. Whether you're looking for a new or used car, we have a wide range of financing solutions to suit your needs and budget. Plus, our streamlined approval process means you can get behind the wheel of your new car in no time.

With Approved Auto Loans, you can enjoy:

Low Credit Car Loans: We understand that life can throw unexpected challenges your way, leading to a less than ideal credit score. But that shouldn't stand in the way of your dreams. Our low credit car loans make it possible for you to get the car you want, regardless of your credit history.

Flexible Payment Options: We offer flexible payment options to fit your budget. Whether you prefer weekly, bi-weekly, or monthly payments, we can customize a repayment plan that works for you.

Competitive Interest Rates: Our goal is to make car ownership affordable for everyone. That's why we offer competitive interest rates on all our loans, saving you money over the life of your loan.

Hassle-Free Application Process: Applying for a car loan shouldn't be a complicated process. With Approved Auto Loans, it's simple and hassle-free. Just fill out our online application form, and our team will take care of the rest.

Expert Advice: Not sure which car is right for you? Our team of experts is here to help. We'll work with you to understand your needs and budget, and then help you find the perfect vehicle.

Don't let a low credit score stand in the way of owning your dream car. Contact Approved Auto Loans today and take the first step towards car ownership with our Low Credit Car Loans Surrey, your dream car is within reach.

#Low credit car finance surrey#low credit car loans surrey#low credit cars surrey#low credit car dealers surrey#no credit bad credit car dealer surrey#no credit car loans surrey#no credit car financing surrey#bad credit car loans in surrey#bad credit car loan surrey#used car dealerships in surrey#approved auto loans Surrey#best car loan provider surrey bc#best auto loan provider surrey bc#car loan services surrey#instant auto loans surrey#instant auto loans surrey bc#fast auto loans surrey bc#auto loans Surrey#car loans Surrey#auto loans in surrey#car loans in surrey#auto loan pre approval canada#auto loan provider surrey#apply for car finance surrey#surrey car loan#approved auto loans#best auto loans surrey#bad credit score car finance#low credit car loans#bad credit score loan

0 notes

Text

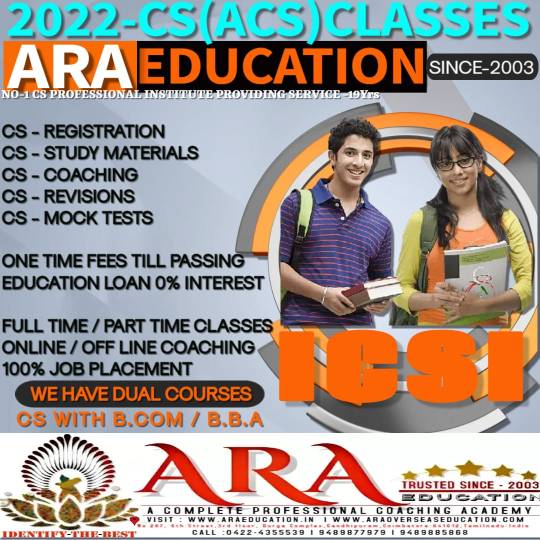

#ARA EDUCATION is the best CS coaching Institute for CSEET#CS EXEUTIVE#CS professional courses in coimbatore#Tamilnadu. Ara Education is the exclusive pioneer training academy for Company Secretary Course on ICSI. We provide coaching in online or#revision tests and finally mock test and model exam.#We are providing campus job placement for jobs and Articleship.#Educational loan with zero cost interest.#For more information#please call us @#+91 422 - 4355539 | 94 89 87 79 79 | 94 89 88 58 68 or#visit us @ www.araeducation.in#https://www.araeducation.in/cs-acs-coaching-classes#https://www.araeducation.in/cseet-coaching#https://www.araeducation.in/cs-executive-coaching#https://www.araeducation.in/cs-professional-coaching#acscoachingcoimbatore#cscoachingcoimbatore#bestcscoachingcoimbatore#bestacscoachingcoimbatore#cseetcoachingcoimbatore#csexecutivecoachingcoimbatore#csprofessionalcoachingcoimbatore#cseetcoachingtamilnadu

0 notes

Text

i need to write not only ren's relationship but also his mother's relationship with the welfare system because he is getting government assistance technically, as did his mother (in a way)

#i was discussing this with otter in the car ride to oklahoma and more aid has been provided from 2003 and 2008#and then again in 2012#so ren receives more assistance than his mother but also he has like quadruple the expenses she did#and she had many being a single mother#plus social stigmas etc#something something it comes full circle#ren is providing for himself and his son as well as taking care of his sick mother#and is also still providing for hina technically#and will take cuts in pay to give the hosts bonuses if the budget doesn't allow#since he's getting income as a host primarily as well as being a sex worker#and then getting assistance which tbh hina takes most of ngl#and he also gets loans from goro for big things so he has debt there so he uses some of his different sources of income to try and —#— pay his debt#but he also has like his work expenses aka his wardrobe and beauty products#he's had surgery and some procedures etc#basically money is always coming and primarily leaving#i need to write a proper meta about this#i should find that monthly expenses headcanon

0 notes

Text

Discover Credit-builder Loans in US with Renovatry

Discover Credit-builder Loans across the United States through the innovative platform, Renovatry. Elevate your financial score with our professional and tailored solutions that empower you to build creditworthiness. Unlock a brighter financial future while enjoying the benefits of our smart and user-friendly interface. Experience the expertise of Renovatry's vast network of trusted lenders, guiding you towards financial prosperity and stability. With a focus on professionalism and efficiency, our Credit-builder Loans are designed to bring you closer to your long-term financial goals. Let Renovatry be your companion on this journey towards a strong and creditworthy future.

1 note

·

View note

Text

The GOP wonders why young people (and others) don't want to vote for them. Some wise scribe assembled this list.

1.) Your Reagan-era “trickle-down economics” strategy of tax breaks for billionaires that you continue to employ to this day has widened the gap between rich and poor so much that most of them will never be able to own a home, much less earn a living wage.

2.) You refuse to increase the federal minimum wage, which is still $7.25 an hour (since 2009). Even if it had just kept up with inflation, it would be $27 now. You’re forcing people of all ages but especially young people to work multiple jobs just to afford basic necessities.

3.) You fundamentally oppose and want to kill democracy; have done everything in your power to restrict access to the ballot box, particularly in areas with demographics that tend to vote Democratic (like young people and POC). You staged a fucking coup the last time you lost.

4.) You have abused your disproportionate senate control over the last three decades to pack the courts with religious extremists and idealogues, including SCOTUS—which has rolled back rights for women in ways that do nothing but kill more women and children and expand poverty.

5.) You refuse to enact common sense gun control laws to curb mass shootings like universal background checks and banning assault weapons; subjecting their entire generation to school shootings and drills that are traumatizing in and of themselves. You are owned by the NRA.

6.) You are unequivocally against combatting climate change to the extent that it’s as if you’ve made it your personal mission to ensure they inherit a planet that is beyond the point of no return in terms of remaining habitable for the human race beyond the next few generations.

7.) You oppose all programs that provide assistance to those who need it most. Your governors refused to expand Medicaid even during A PANDEMIC. You are against free school lunches, despite it being the only meal that millions of children can count on to actually receive each day

8.) You are banning books, defunding libraries, barring subject matter, and whitewashing history even more in a fascistic attempt to keep them ignorant of the systemic racism that this nation was literally founded upon and continues to this day in every action your party takes.

9.) You oppose universal healthcare and are still trying to repeal the ACA and rip healthcare from tens of millions of Americans and replace it with nothing. You are against lowering the cost of insulin and prescription drugs that millions need simply to LIVE/FUNCTION in society.

10.) You embrace white nationalists, Neo-Nazis, and other groups that are defined by their intractable racism, xenophobia, bigotry, and intolerance. You conspired with these groups on January 6th to try to overthrow the U.S. government via domestic terrorism that KILLED PEOPLE.

11.) You oppose every bill aimed at making life better for our nation’s youth; from education to extracurricular and financial/nutritional assistance programs. You say you want to “protect the children” while you elect/nominate pedophiles and attack trans youth and drag queens.

12.) You pretend to be offended by “anti-semitism” while literally supporting, electing, and speaking at events organized by Nazis. You pretend to hate “cancel culture” despite the fact that you invented it and it’s basically all you do.

13.) Every word you utter is a lie. You are the party of treason, hypocrisy, crime, and authoritarianism. You want to entrench rule by your aging minority because you know that you have nothing to offer young voters and they will never support you for all these reasons and more.

14.) You’re so hostile to even the notion of helping us overcome the mountain of debt that millions of us are forced to take on just to pay for our post K-12 education that you are suing to try to prevent a small fraction of us from getting even $10,000 in loan forgiveness.

15.) You opened the floodgates of money into politics via Citizens United; allowing our entire system of government to become a cesspool of corruption, crime, and greed. You are supposed to represent the American people whose taxes pay your salary but instead cater to rich donors.

16.) You respond to elected representatives standing in solidarity with their constituents to protest the ONGOING SLAUGHTER of children in schools via shootings by EXPELLING THEM FROM OFFICE & respond to your lack of popularity among young people by trying to raise the voting age.

17.) You impeach Democratic presidents over lying about a BJ but refuse to impeach (then vote twice to acquit) a guy whose entire “administration” was an international crime syndicate being run out of the WH who incited an insurrection to have you killed.

18.) You steal Supreme Court seats from democrats to prevent the only black POTUS we’ve ever had from appointing one and invent fake precedents that you later ignore all to take fundamental rights from Americans; and even your “legitimate” appointments consist of people like THIS (sub-thread refuting CJ Roberts criticisms of people attacking SCOTUS' legitimacy).

19.) You support mass incarceration even for innocuous offenses or execution by cop for POC while doing nothing but protect rich white criminals who engage in such things as tax fraud, money laundering, sex trafficking, rape/sexual assault, falsifying business records, etc.

20.) You are the reason we can’t pass:—Universal background checks—An assault weapons ban—The ‘For the People/Freedom to vote’ Act or John Lewis Voting Rights Act—The ERA & Equality Act—The Climate Action Now Act—The (Stopping) Violence Against Women Act—SCOTUS expansion.

21.) You do not seek office to govern, represent, or serve the American people. You seek power solely for its own sake so you can impose your narrow-minded puritanical will on others at the expense of their most fundamental rights and freedoms like voting and bodily autonomy.

22.) Ok, last one. You are trying to eliminate social security and Medicare that tens of millions of our parents rely on and paid into their entire lives. And you did everything to maximize preventable deaths from COVID leaving millions of us in mourning.

Source: https://imgur.com/gallery/e8DBZLH

14K notes

·

View notes

Text

Dreality-Best value real estate Service Company in Noida

Reality

When it comes to determining the "best value" in real estate services and home loan providers, it can vary depending on individual needs and preferences. However, I can provide you with some general information on finding the best options in these areas.

Best Value Real Estate Services:

Research and compare: Take the time to research different real estate agencies or agents in your area. Look for their track record, customer reviews, and the range of services they offer. Compare their fees and commission rates to ensure they provide good value for their services.

Local expertise: Choose a real estate agent or agency with strong knowledge and experience in the specific area where you are looking to buy or sell a property. Local experts can provide valuable insights into market trends, pricing, and potential investment opportunities.

Transparent communication: Look for real estate professionals who communicate clearly and honestly. They should be responsive to your queries and provide regular updates on the progress of your transaction. Transparency in pricing and fees is also important.

Negotiation skills: A good real estate agent should have strong negotiation skills to help you secure the best possible deal. This includes not only negotiating the purchase or sale price but also other aspects like repairs, contingencies, and closing costs.

Best Home Loan Providers:

Interest rates and terms: Compare the interest rates, loan terms, and repayment options offered by different lenders. Look for lenders that provide competitive rates and flexible terms that suit your financial situation.

Loan options: Consider lenders that offer a variety of loan programs to meet your specific needs. This could include fixed-rate mortgages, adjustable-rate mortgages, FHA loans, VA loans, or other specialized loan options.

Fees and closing costs: Evaluate the fees and closing costs associated with obtaining a loan from different providers. Some lenders may have lower origination fees, processing fees, or closing costs, which can save you money in the long run.

Customer service: Look for a lender that provides excellent customer service and is responsive to your needs throughout the loan application and approval process. A reliable lender should be available to answer your questions and guide you through the process.

Reputation and reviews: Check online reviews and ratings of different lenders to gauge their reputation and customer satisfaction levels. Look for lenders with positive feedback and a strong reputation in the industry.

Remember, these are general guidelines, and it's essential to conduct thorough research and consider your specific requirements when choosing the best value real estate services and home loan provider for your needs.

#2-3 bhk in noida extension#best real estate agent in delhi ncr#Best Real estate agent in Delhi ncr#Best home loan provider#Home loan lowest roi#Loan on lowest ROI#commercial real estate near me#place real estate#best value real estate#Apply for Personal Loan#start up business loans#commercial property loan#best car financing deals#loan against property#personal loan against property#loan against plot#car loans near me#best car loan rates today#best used car loan rates#car finance near me

0 notes

Text

DC x DP fanfic Idea: Side Hustle

Barry needs more cash.

It's not that he is struggling, but unlike Bruce, he had student loans, a mortgage, and all the medical bills for Iris to consider. Even with his wife working, he knew they needed to keep a tight grip on their spending to ensure they didn't fall from the yellow into the red.

This means that sometimes he had to watch Wally's face fall when he admitted he couldn't afford to give him an allowance or even some money to go to the mall with his friends. It's not that his nephew complains—Wally is a very understanding young man—but it still tears Barry up inside to disappoint him.

Significantly when, their hero work cut so deeply into their funds just to keep their speedster metabolism under control. If he hadn't done his foolish experiment, Wally wouldn't be in danger of starvation for following his example.

Blood or not, Wally is like a son to him, and the idea that he can only provide the bare basics is painful. He has a high-paying job now, but it will take a while to get all his debt from when he was a student under control.

Before he married Iris, he was okay with that. He now had a wife and son who depended on him, and he couldn't wait around, hoping things would pick up after a few years.

He managed to pay off most of Iris' medical bills, and the house was an excellent step up from the cramped two-room apartment they shared when they were engaged. Barry knew that these two things were good, but he could do better.

That's how he applied as a research assistant to a strange family company called Fenton Works. The pay was decent, and it was only a short hour's drive from his home—he speed-ran it in five, but he needed a realistic distance to keep his ID protected. And best of all?

He mostly did office work. Half the time, he was allowed to do remote work documenting research data and organizing the owner's inventions and patents.

There were many funds coming from said patents and inventions. If the Fentons weren't so busy spending the money to fund their ghost research—the power grid they needed for the portal alone was almost as much as Barry's entire mortgage—then they could easily be among the few in Bruce's fancy galas.

Barry will admit that he was surprised to learn that Mr. Fenton had a PhD in engineering, applied physics, and robotics. Mrs. Fenton had a PhD in nuclear physics, functional analysis, and renewable energy. Both were currently working on getting a PhD in some form of biology, and Barry was flabbergasted that they spoke about it the same way people casually decided to start a new hobby.

It was hard, but they had the money to just sign up for classes. He wept into his student loan reminders whenever he thought about it.

They made the perfect team- one thought up the idea, and the other created a physical form while they ensured it worked together.

He knew his bosses were certified geniuses who appeared goofy was one thing, but to be confronted with their degrees stuffed away in a storage box was another thing. He hadn't even meant to find them since he had gone in there with Danny- his boss's kid- to find some paper research Dr. Jack Fenton needed.

It was even more shocking to find that Dr. Jack had sold some of his systematics to Wayne Enterprises and that Bruce had used some of his robotics theories in his Batman gear.

It also seemed that most of the Amity Park were unaware of how intelligent the Fentons were. When he was out and about in the city, he kept getting pitying looks for working for the local freaks. It was honestly shocking.

People talked about Jasmine Fenton's bright future, the only hope among the family, in the same breath as calling Jack Fenton an idiot or Maddie Fenton a washed-up housewife. The things they had to say about Danny Fenton were far more disheartening.

Barry knows a thing or two about troubled youths as the Flash, and no matter what the town told him, Danny Fenton was not one of them.

It seemed to Barry that Danny was suffering from blatant bullying and the pressure of his family's shadow. Adding to the confusion of being in the middle of puberty, it created the perfect recipe for Danny to be spirling. It was a rough patch, and it led to him skipping class, dropping his grades, and ignoring his responsibilities.

He overheard the Fentons talking about Danny. Dr. Fentons was starting to grow worried since Danny had never behaved this way before high school while Jazz attempted to defend her brother and excuse his disappearance.

She seemed very aware of why her brother seemed to change.

On the other hand, Dr. Fenton wasn't and mentioned more than once that she and Danny were very close when he was a kid, but lately, he seemed to be shutting her out. Her husband admitted that he figured Danny had gotten a girlfriend- someone named Sam?- but he started to notice his son kept coming home with what appeared to be injuries.

Barry wasn't sure if they were aware that Danny was getting bullied. He was carefully filing some of the old cabinets when it clicked.

"Jazz?" He called out as the Fentons finally stop talking about Dnany's behavior and moved down to the lab. The teenager poked her head into the file office with a curious smile.

"Yes, Mr. Allen?" No matter how often he told her to call him Barry, she seemed determined to keep that barrier between them. Which was fair. After all, he was only around the house three or four times a week for a few hours.

"I have a question, so please feel free to not answer." He starts carefully to keep his tone light. Her smile turns strained at once, and Barry almost tells her to ignore it, but the thought of Wally being Danny's place makes him push on. "What is your family's stance on gay rights?"

Jazz blinked slowly, tilting her head. "I don't mind, and neither do my parents, I think. Why sir?"

"Just curious," Barry said, but mentally, he wondered if Danny knew that.

Jazz didn't look convinced, but she didn't push the issue as she wandered away with a respectful by-your-leave. He waited until she was upstairs before abandoning his work to find the Fentons.

Carefully, he started by updating them on his work, then casually dropped the mention of taking Wally to Pride so he wouldn't be able to work the following week. Neither Dr. so much as blinked, telling him that it was fine.

Barry felt it safe to keep pushing just a little.

"Yeah, I still remember how nervous Wally was about telling me he liked girls and boys." He chuckles. "As if though I didn't notice the signs."

Dr. Fenton raises a brow, face twisted in confusion as the large man turns to Barry. "What signs?"

"Mostly, he is trying to think of excuses to be with his friends more. He wasn't sleeping a lot, got into a bit of trouble in school when some kids were giving him grief, and oh, the way his eyes followed young men about." Barry said as casually as one could.

Dr. Fenton looks pensive. "Interesting."

Ah, it seemed she had picked up on the possibility of Danny not being as straight as he claimed. She thankfully didn't seem bothered by it.

"Jack, honey, you don't think Danny could be....?" She asked carefully.

Dr. Fenton ran a hand through his hair. "It could be. But why didn't he tell us?"

"Oh geez, I wonder why!" Jazz suddenly yells from the stairway. Barry twists around to find her standing there with a defensive glare. She has obviously been eavesdropping, but for how long? "What did you two expect with the way you talked around the house?!"

Dr. Fenton looked mystified. "Jazzy-pants, what are you talking about?"

His daughter only raises her fist, lowering her voice to mimic her father. "What are we doing today, Maddie? I know; how about we rip the ghost boy molecule by molecule!"

Barry's eyes grow wide. He had been working for the family for about six months and had encountered Phantom more than once. He even fought him off as Flash a few times since the ghost was hell-bent on robbing and property damage but was less dangerous than his rouges.

Dr. Fenton's face went pale as she clutched to the table. "Jazz you mean....Danny and Phantom...."

Jazz looked ready to fight them all as she bit out, "If you try to do anything to Danny, I swear-"

"We would never Jazzy-pants." Jack cut in, looking off Kindle. "To think my son was dating a ghost behind my back and I...I didn't even notice."

"Oh, Jack, we have to apologize," Maddie started. "Who knows if Danny could ever forgive us?"

Barry was thinking Flash also had to apologize. Based on their last encounter, Phantom would likely not be willing to hear him out. He quickly pulls out his phone to see if Wally and his team could get close enough to have him consider speaking to Barry.

None of the adults noticed the way Jazz froze in confusion, nor did they notice the slow horror growing on her face as they came to terms with Phantom and Danny dating.

#dcxdpdabbles#dcxdp crossover#Side Hustle#Part 1#Barry working for Fenton Works#Jazz only heard the ending#In which the Flash accidentally makes Danny parents assume he's dating Phantom#Danny sounds like a trouble kid to those not in the know#Barry is just trying to be a good uncle#The Fentons are good parents just confused

2K notes

·

View notes

Text

CARD TO CASH

#Our Services:#Card to cash Bank Account#Credit card to Bank Transfer.#Transfer Money Credit Card To Bank Account.#Credit card to Instant cash.#Maintaining Cash in Bank Accounts better than have accredit card.Turn your credit card limit to cash instantly for easy use of money .#We accept all kinds or credit cards just one swipe get instant money your bank account#Looking for Loan? We provide case against your credit card at your Doorstep.#We do PAN INDIA also.#Just a Call Away!#Spot Cash in all Major Credit cards#https://wa.me/9963606965?text=#More Info:+91-9963606965#Location:Shastri Rd#Ashoknagar#Karimnagar#Telangana 505001#creditcard#bank#transfer#instantcash#bankaccount#goodcredit#cibl

0 notes

Text

Overcoming Bad Credit: Your Guide to Low Credit Car Finance in Surrey

In today's world, having a less-than-perfect credit score shouldn't hinder your dreams of owning a car. Whether you've faced financial challenges in the past or are just starting to build your credit, there are options available to help you secure the car you need. In this guide, we'll explore the avenues of low credit car finance in Surrey, offering insights into bad credit score loans and how you can get approved for auto loans despite your credit history.

Understanding Bad Credit Score Loans

First things first, let's address the elephant in the room: bad credit scores. A bad credit score can make traditional lenders wary of extending loans to you, but that doesn't mean you're out of options. Bad credit score loans cater specifically to individuals with less-than-perfect credit histories. These loans typically come with higher interest rates compared to conventional loans, but they provide an opportunity for those with bad credit to access the financing they need.

Low Credit Car Finance in Surrey

Living in Surrey, you're likely aware of the bustling urban life and the necessity of having a reliable mode of transportation. Fortunately, there are specialized lenders and dealerships in Surrey that offer low credit car finance options. These lenders understand the local market dynamics and are willing to work with individuals with varying credit profiles.

When exploring low credit car finance Surrey, it's essential to research different lenders and dealerships to find the one that best suits your needs. Look for lenders who specialize in bad credit auto loans and have a track record of helping individuals with similar credit situations.

Key Factors to Consider

Before diving into low credit car loans Surrey, it's crucial to assess your financial situation realistically. Determine how much you can afford to spend on a car each month, taking into account not only the loan payments but also insurance, maintenance, and other associated costs.

Additionally, consider saving up for a down payment. While some lenders may offer zero-down financing options, making a down payment can lower your monthly payments and improve your chances of approval, especially with bad credit.

The Application Process

Once you've identified potential lenders or dealerships offering low credit car finance in Surrey, it's time to start the application process. Be prepared to provide documentation that demonstrates your income, employment history, and residency. Lenders may also request information about your existing debts and expenses to assess your ability to repay the loan.

During the application process, be honest and transparent about your financial situation. Lying or withholding information can backfire and may result in denial or unfavorable loan terms.

Building Credit Responsibly

While low credit car finance in Surrey can help you secure a vehicle despite your bad credit score, it's essential to view it as a stepping stone toward improving your creditworthiness. Make timely payments on your auto loan to gradually rebuild your credit over time. As your credit score improves, you may qualify for better loan terms and lower interest rates in the future. Navigating the world of low credit car finance in Surrey may seem daunting, but with the right knowledge and preparation, it's entirely feasible to secure an auto loan even with a bad credit score. By understanding your options, assessing your financial situation, and working with reputable lenders, you can drive away with the car you need while taking steps toward a brighter financial future.

Read more:

Get Approved Auto Loans: Overcoming Bad Credit with Low Credit Car Loans

#Low credit car finance surrey#low credit car loans surrey#low credit cars surrey#low credit car dealers surrey#no credit bad credit car dealer surrey#no credit car loans surrey#no credit car financing surrey#bad credit car loans in surrey#bad credit car loan surrey#used car dealerships in surrey#approved auto loans Surrey#best car loan provider surrey bc#best auto loan provider surrey bc#car loan services surrey#instant auto loans surrey#instant auto loans surrey bc#fast auto loans surrey bc#auto loans Surrey#car loans Surrey#auto loans in surrey#car loans in surrey#auto loan pre approval canada#auto loan provider surrey#apply for car finance surrey#surrey car loan#approved auto loans#best auto loans surrey#bad credit score car finance#low credit car loans#bad credit score loan

0 notes

Text

since we now know that all those "my blog is safe for Jewish people" posts are bullshit, here are some Jewish organizations you can donate to if you actually want to prove you support Jews. put up or shut up

FIGHTING HUNGER

Masbia - Kosher soup kitchens in New York

MAZON - Practices and promotes a multifaceted approach to hunger relief, recognizing the importance of responding to hungry peoples' immediate need for nutrition and sustenance while also working to advance long-term solutions

Tomchei Shabbos - Provides food and other supplies so that poor Jews can celebrate the Sabbath and the Jewish holidays

FINANCIAL AID

Ahavas Yisrael - Providing aid for low-income Jews in Baltimore

Hebrew Free Loan Society - Provides interest-free loans to low-income Jews in New York and more

GLOBAL AID

American Jewish Joint Distribution Committee - Offers aid to Jewish populations in Central and Eastern Europe as well as in the Middle East through a network of social and community assistance programs. In addition, the JDC contributes millions of dollars in disaster relief and development assistance to non-Jewish communities

American Jewish World Service - Fighting poverty and advancing human rights around the world

Hebrew Immigrant Aid Society - Providing aid to immigrants and refugees around the world

Jewish World Watch - Dedicated to fighting genocides around the world

MEDICAL AID

Sharsheret - Support for cancer patients, especially breast cancer

SOCIAL SERVICES

The Aleph Institute - Provides support and supplies for Jews in prison and their families, and helps Jewish convicts reintegrate into society

Bet Tzedek - Free legal services in LA

Bikur Cholim - Providing support including kosher food for Jews who have been hospitalized in the US, Australia, Canada, Brazil, and Israel

Blue Card Fund - Critical aid for holocaust survivors

Chai Lifeline - An org that's very close to my heart. They help families with members with disabilities in Baltimore

Chana - Support network for Jews in Baltimore facing domestic violence, sexual abuse, and elder abuse

Community Alliance for Jewish-Affiliated Cemetaries - Care of abandoned and at-risk Jewish cemetaries

Crown Heights Central Jewish Community Council - Provides services to community residents including assistance to the elderly, housing, employment and job training, youth services, and a food bank

Hands On Tzedakah - Supports essential safety-net programs addressing hunger, poverty, health care and disaster relief, as well as scholarship support to students in need

Hebrew Free Burial Association

Jewish Board of Family and Children's Services - Programs include early childhood and learning, children and adolescent services, mental health outpatient clinics for teenagers, people living with developmental disabilities, adults living with mental illness, domestic violence and preventive services, housing, Jewish community services, counseling, volunteering, and professional and leadership development

Jewish Caring Network - Providing aid for families facing serious illnesses

Jewish Family Service - Food security, housing stability, mental health counseling, aging care, employment support, refugee resettlement, chaplaincy, and disability services

Jewish Relief Agency - Serving low-income families in Philadelphia

Jewish Social Services Agency - Supporting people’s mental health, helping people with disabilities find meaningful jobs, caring for older adults so they can safely age at home, and offering dignity and comfort to hospice patients

Jewish Women's Foundation Metropolitan Chicago - Aiding Jewish women in Chicago

Metropolitan Council on Jewish Poverty - Crisis intervention and family violence services, housing development funds, food programs, career services, and home services

Misaskim - Jewish death and burial services

Our Place - Mentoring troubled Jewish adolescents and to bring awareness of substance abuse to teens and children

Tiferes Golda - Special education for Jewish girls in Baltimore

Yachad - Support for Jews with disabilities

#atlas entry#please add any more you know of an especially add fundraisers for you or people you know#if there are any fundraisers for synagogues please add those as well#jew#jewish#judaism#jumblr#punch nazis

2K notes

·

View notes