#account tracking software

Text

Top Insurance CRM System for Agents

Elevate your insurance agency's efficiency with the top insurance CRM system for agents. Our platform offers comprehensive tools tailored to streamline client management, policy tracking, and claims processing. With intuitive features and a user-friendly interface, agents can effortlessly organize client information, track policy renewals, and provide exceptional customer service. Say goodbye to manual processes and hello to increased productivity and client satisfaction with our cutting-edge CRM system. Trusted by agents worldwide, our platform is designed to optimize workflows, enhance communication, and drive business growth. Experience the power of the top insurance CRM system and take your agency to new heights today.

#customer service#customer service software#crm system customer service#sales and service software#dispatch management#dispatch system software#dispatch fleet management system#fleet dispatch software#fleet operations software#fleet operations management#insurance crm system#insurance client management system#general crm#client management crm#crm client relationship management#financial management solutions#management solution#account tracking software#financial tracking software#self service payroll system#payroll analytics#payroll and hr management#asset inventory system#inventory asset tracking#IT asset inventory system

0 notes

Text

How to Manage Your Business Finances Accounting Basics

#rp account#accounting#erp#erp software#erp solution#finance#hr payroll software#application tracking system#recruiting software for small business

0 notes

Text

How to Choose the Best Accounting Software for Your Business

Introduction

In the fast-moving environment related to the business world, keeping yourself on top of the finances will never be an easy task. In reality, a company can easily slip into disarray without proper supervision of its finances. No matter whether yours is a small startup or a big corporation, the right kind of accounting software will certainly work wonders in the smooth flow of financial operations. But with accounting software options galore, how do you choose a software that’s suitable for your business? The guide from TechtoIO will take you through everything you need to know to make an informed decision. Read to continue

#analysis#science updates#tech news#trends#adobe cloud#nvidia drive#science#business tech#technology#tech trends#CategoriesSoftware Solutions#Tagsaccounting software comparison#AI in accounting software#automated invoicing software#best accounting software for business#blockchain accounting solutions#choosing accounting software#cloud-based accounting software#expense tracking software#financial reporting tools#FreshBooks review#integrating accounting software#mobile accounting software#QuickBooks vs Xero#scalable accounting software#secure accounting software#small business accounting software#top accounting software 2024#user-friendly accounting software#Wave accounting software

0 notes

Text

Guide to Checking Income Tax Refund Status Online | MargBooks

Learn how to easily track your income tax refund status online with MargBooks. This comprehensive guide walks you through the process step-by-step, ensuring you can efficiently monitor the status of your refund. Stay informed and in control of your tax returns effortlessly.

#accounting#software#billing#technology#online billing software#margbooks#onlinesoftware#tech#income tax refund#refund status#online refund#tracking#financial management

0 notes

Text

Why Analyzing Financial Data is Crucial for Your Trucking Business

Photo by Pixabay on Pexels.com

If you’re having a tough time keeping your business on track. We get it—running a trucking company is no easy feat. There’s so much to juggle: maintenance, fuel costs, routes, driver management, and on top of that, financials. It’s overwhelming, and we know the last thing you want to think about is diving into those spreadsheets and financial reports. But let me…

View On WordPress

#accounting software#avoid bankruptcy#business#business decisions#business forecasting#business growth#business strategies#business success#cash flow management#cost savings#expense tracking#financial advisor#financial analysis#financial planning#financial tools#Freight#freight industry#Freight Revenue Consultants#fuel efficiency#increase profitability#logistics#optimize routes#profit margins#QuickBooks for truckers#reduce expenses#small business trucking#Transportation#truck fleet management#trucker tips#Trucking

0 notes

Text

#Best Way to Invoice for Small Business#Invoicing Business Small#Best Invoicing and Accounting Software#Payment Tracking Software#Invoice Tracking System#Invoice Capture Software#Invoice Payment Processing System

0 notes

Text

Starting a new business venture is an exhilarating journey, but it’s crucial to lay a strong financial foundation from the outset. This begins with understanding the fundamentals of startup accounting.

#Introduction to Startup Accounting#What is Startup Accounting?#Why is Startup Accounting Important?#Setting Up Your Accounting System#Choosing the Right Accounting Software#Establishing a Chart of Accounts#Understanding Basic Accounting Principles#Managing Startup Finances#Budgeting for Startup Expenses#Tracking Revenue and Expenses#Cash Flow Management#Tax Planning for Startups

0 notes

Text

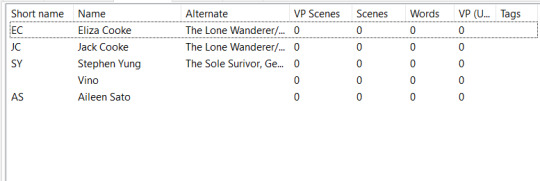

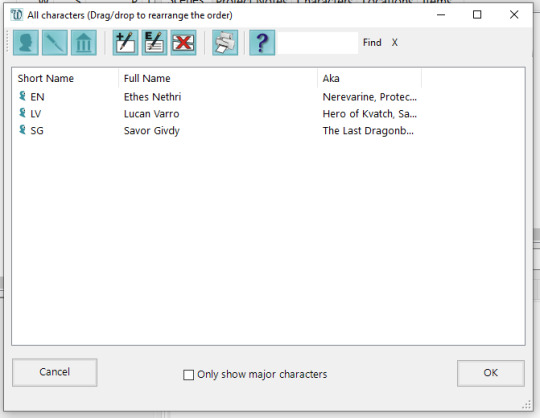

speaking of my bastard children, i've got them all set up like my TES ones

#these are all of them#i posted about the TES one's on my main account but basically I lost them for a while and finally recovered them a few days ago#so i put them all onto this new software to keep track of them#also maybe to motivate to write for them#software is called ywriter btw

0 notes

Text

The Best Insurance Client Management System

Discover the ultimate solution for managing your insurance clients with Elisops Insurance Client Management System. Our platform offers a comprehensive suite of tools designed to streamline every aspect of client management, from policy tracking to claims processing and customer support. With Elisops, you can efficiently manage client information, track policy renewals, and handle claims seamlessly, all in one centralized system. Our user-friendly interface and intuitive features make it easy for insurance agents to stay organized and provide exceptional service to clients. Say goodbye to manual processes and hello to increased productivity and customer satisfaction with Elisops Insurance Client Management System. Experience the best-in-class solution trusted by insurance professionals worldwide to optimize their client management processes and drive business growth.

#customer service#customer service software#crm system customer service#sales and service software#dispatch management#dispatch system software#dispatch fleet management system#fleet dispatch software#fleet operations software#fleet operations management#insurance crm system#insurance client management system#general crm#client management crm#crm client relationship management#financial management solutions#management solution#account tracking software#financial tracking software#self service payroll system#payroll analytics#payroll and hr management#asset inventory system#inventory asset tracking#IT asset inventory system

0 notes

Text

Revolutionize your customer relationships with Track Itinerary– a Customizable CRM software solution for travel Agents

#Track tour itinerary#itinerary tracking#track itinerary#tour itinerary tracker#travel accounting software#lead and itinerary#itinerary managemen

0 notes

Text

Google is going to start scraping all of their platforms to use for AI training. So, here are some alternatives for common Google tools!

Google Chrome -> Firefox

If you’re on tumblr, you’ve probably already been told this a thousand times. But FireFox is an open-source browser which is safe, fast and secure. Basically all other browsers are Chrome reskins. Try Firefox Profilemaker, Arkenfox and Librewolf! Alternatively, vanilla Firefox is alright, but get Ublock Origin, turn off pocket, and get Tabliss.

Google Search -> DuckDuckGo

DuckDuckGo very rarely tracks or stores your browsing data (though they have only been known to sell this info to Microsoft). Don’t use their browser; only their search engine. Domain visits in their browser get shared. Alternatively, you can also use Ecosia, which is a safe search engine that uses its income to plant trees! 🌲

Google Reverse Image Search -> Tineye

Tineye uses image identification tech rather than keywords, metadata or watermarks to find you the source of your image!

Gmail -> ProtonMail

All data stored on ProtonMail is encrypted, and it boasts self-destructing emails, text search, and a commitment to user privacy. Tutanota is also a good alternative!

Google Docs -> LibreOffice

LibreOffice is free and open-source software, which includes functions like writing, spreadsheets, presentations, graphics, formula editing and more.

Google Translate -> DeepL

DeepL is notable for its accuracy of translation, and is much better that Google Translate in this regard. It does cost money for unlimited usage, but it will let you translate 500,000 characters per month for free. If this is a dealbreaker, consider checking out the iTranslate app.

Google Forms -> ClickUp

ClickUp comes with a built-in form view, and also has a documents feature, which could make it a good option to take out two birds with one stone.

Google Drive -> Mega

Mega offers a better encryption method than Google Drive, which means it’s more secure.

YouTube -> PeerTube

YouTube is the most difficult to account for, because it has a functional monopoly on long-form video-sharing. That being said, PeerTube is open-source and decentralized. The Internet Archive also has a video section!

However, if you still want access to YouTube’s library, check out NewPipe and LibreTube! NewPipe scrapes YouTube’s API so you can watch YouTube videos without Google collecting your info. LibreTube does the same thing, but instead of using YouTube servers, it uses piped servers, so Google doesn’t even get your IP address. Both of these are free, don’t require sign-ins, and are open source!

Please feel free to drop your favorite alternatives to Google-owned products, too! And, if this topic interests you, consider checking out Glaze as well! It alters your artwork and photos so that it’s more difficult to use to train AI with! ⭐️

#anti ai#anti ai art#anti ai music#anti ai writing#anti google#google#political#current events#azure does a thing

31K notes

·

View notes

Text

Navigating the World of Online Payment Processing

The world of commerce has undergone a remarkable transformation with the rise of e-commerce, and at the heart of this evolution is online payment processing. From purchasing products and services online to managing subscriptions and making digital donations, online payment processing has become an integral part of our daily lives. In this comprehensive guide, we will delve into the intricacies of online payment processing, exploring its significance, the key players in the industry, security measures, and the latest trends shaping the future of digital payments.

The Significance of Online Payment Processing

Online payment processing is the engine driving e-commerce and digital transactions. Its importance extends far beyond the convenience it offers. Here are some of the key reasons why online payment processing is crucial:

Global Reach: It enables businesses to reach customers worldwide, breaking down geographical barriers and expanding their customer base.

Convenience: Customers can make payments and purchases from the comfort of their homes or on the go, making the shopping experience more convenient.

Security: Secure payment processing ensures that sensitive financial information is protected, reducing the risk of fraud and unauthorized access.

Efficiency: The automation of payment processing streamlines financial transactions, reducing manual labor and processing times.

Business Growth: Online payment processing supports the growth of online businesses, enabling them to scale their operations and reach new markets.

Diverse Payment Options: It offers a wide range of payment methods, allowing customers to choose the option that best suits their preferences and needs.

The Key Players in Online Payment Processing

Online payment processing involves several key players, each with distinct roles and responsibilities. Understanding these players is crucial to grasp the intricacies of the payment ecosystem:

1. Merchants

Merchants are businesses or individuals who sell products or services online. They integrate payment gateways into their websites or applications to accept payments from customers.

2. Payment Gateways

Payment gateways are intermediaries that facilitate the transfer of payment data between the merchant and the financial institution. They verify the transaction, handle the encryption of data, and ensure that the payment is securely processed.

3. Acquiring Banks

Acquiring banks, also known as merchant banks, are financial institutions that work with merchants to provide them with the necessary accounts and tools for accepting payments. They play a critical role in authorizing and settling transactions.

4. Issuing Banks

Issuing banks are the financial institutions that issue credit and debit cards to consumers. They are responsible for authorizing transactions initiated by cardholders and ensuring there are sufficient funds for the purchase.

5. Card Networks

Card networks, such as Visa, MasterCard, and American Express, establish the rules and infrastructure that govern payment card transactions. They facilitate communication between acquiring and issuing banks.

6. Customers

Customers are the individuals or businesses making purchases or payments online. They provide their payment information to complete transactions.

Ensuring Security in Online Payment Processing

Security is a paramount concern in online payment processing. As the digital landscape evolves, so do the threats to security. Here are some of the key security measures and technologies in place to safeguard online transactions:

1. Data Encryption

Data encryption ensures that sensitive payment information, such as credit card numbers, remains secure during transmission. Secure Sockets Layer (SSL) encryption is a common technology used to protect data.

2. Tokenization

Tokenization replaces sensitive card data with tokens, which are useless to cybercriminals if intercepted. This adds an extra layer of security to payment processing.

3. Two-Factor Authentication

Two-factor authentication (2FA) requires customers to provide additional verification, such as a one-time code sent to their mobile device, to complete a transaction.

4. Fraud Detection

Advanced fraud detection systems use artificial intelligence and machine learning to analyze transaction data in real-time and identify potentially fraudulent activities.

5. Regular Updates

Payment processing systems should be regularly updated to patch vulnerabilities and ensure that they are up to date with the latest security standards.

6. Compliance with Regulations

Adhering to industry and regional regulations, such as the Payment Card Industry Data Security Standard (PCI DSS), is essential to maintain security.

Trends Shaping the Future of Online Payment Processing

Online payment processing is an ever-evolving field. Several trends are shaping the future of digital payments:

1. Contactless Payments

Contactless payments, made through mobile wallets and near-field communication (NFC) technology, have gained popularity due to their speed and convenience. The use of smartphones for payments is on the rise.

2. Biometric Authentication

Biometric authentication, such as fingerprint and facial recognition, is increasingly used for secure and convenient payment authorization.

3. Cryptocurrency

Cryptocurrencies like Bitcoin are gaining acceptance as a means of payment, offering fast and borderless transactions.

4. In-App Payments

In-app payments within mobile applications provide a seamless purchasing experience for users, making it easier to complete transactions without leaving the app.

5. Enhanced Security Measures

Continual advancements in security measures, including machine learning-based fraud detection and risk analysis, will help reduce the risk of fraudulent transactions.

6. Cross-Border Payments

As businesses expand globally, cross-border payment solutions are becoming more vital. Payment processors are adapting to accommodate international transactions and currencies.

7. Payment Integration

E-commerce platforms and online businesses are increasingly integrating payment solutions directly into their platforms, streamlining the payment process for customers.

Choosing the Right Online Payment Processing Solution

Selecting the right online payment processing solution is crucial for businesses. Here are some key considerations to keep in mind:

1. Integration

Choose a payment solution that seamlessly integrates with your e-commerce platform or website. This ensures a smooth checkout experience for your customers.

2. Security

Security

is a non-negotiable aspect of online payment processing. Ensure that the solution you choose complies with industry standards, such as PCI DSS, and offers robust encryption and fraud prevention measures.

3. Payment Options

Consider the range of payment options the solution supports. The more options you provide, the more accessible your business will be to a broader customer base.

4. Scalability

Opt for a payment processing solution that can scale with your business. As your business grows, the payment solution should be able to handle increased transaction volumes.

5. Reporting and Analytics

Access to reporting and analytics tools can provide valuable insights into customer behavior, transaction trends, and financial performance. Choose a solution that offers comprehensive reporting capabilities.

6. Customer Support

A responsive customer support team can be invaluable in resolving issues quickly and ensuring that your payment processing runs smoothly. Consider the quality of customer support provided by the payment solution.

7. Costs and Fees

Different payment processors may have varying fee structures. Ensure that you understand the pricing model and any additional fees associated with the solution. Consider how the costs align with your business's budget.

8. Reputation

Research the reputation of the payment processing solution. Read reviews, ask for recommendations, and assess its track record in terms of reliability and security.

The Evolution of Online Payment Processing

Online payment processing has come a long way from its early days, and its journey continues. As technology advances and consumer preferences shift, the landscape of digital payments will keep evolving. Businesses that embrace the latest trends and invest in secure and convenient payment solutions are better positioned to thrive in the digital age.

The significance of online payment processing in today's world cannot be overstated. It has revolutionized the way we shop, transact, and do business, making life more convenient for consumers and enabling the growth of countless online enterprises. As we look to the future, the trends in online payment processing, from contactless payments to cryptocurrency, will shape the way we make payments and conduct financial transactions. By staying informed, adapting to these trends, and choosing the right payment processing solution, businesses can ensure a seamless and secure payment experience for their customers and position themselves for success in the evolving digital economy.

#Memberships#Reservations#Events#Appointments#Donations#Payments#Emails#Messaging#Accounting#Reporting#Event Planning#Membership Management#Email Tracking#Marketing#Online Payment Processing#Association Management Software#Customer Relationship Management#Fitness Center Management#Membership Management Software

0 notes

Text

youtube

Transform your business with MargBooks! Simplify your workflow and streamline processes with our easy-to-use, cloud-based billing and accounting software. Join thousands of satisfied customers today. Visit MargBooks.com for your free trial!

Watch the full video to see how MargBooks can simplify your business operations and help you achieve greater success. Check out the video here and visit MargBooks.com to start your free trial today!

#accounting#software#billing#margbooks#technology#onlinesoftware#billingsoftware#billing software#accounting software#automated billing and invoicing#financial tracking software#cloud billing accounting software#business management software#tracking software#Youtube

0 notes

Text

Moolamore: Your Financial Navigation System for Small Business Success

Let's get down to business. As the owner of a small or medium-sized business, you are probably aware that navigating the turbulent waters of entrepreneurship can be hazardous terrain. A single wrong turn can spell disaster. Moolamore is a game-changing solution that serves as your financial GPS, guiding your company through the turbulent waters of cash flow management. Let us go over some of its outstanding features and benefits:

Having a trustworthy financial GPS like Moolamore can make all the difference. This game-changer gives you the confidence to navigate the turbulent and unpredictable waters of entrepreneurship.

#financial management for small businesses#small business financial software#financial tracking for entrepreneurs#financial planning for startups#small business accounting tool#financial analytics for business owners

0 notes

Text

Inventory software can either be a boon or a bane for your small business, depending on how effectively you choose and implement it. When wisely selected, the best online inventory management software can be a game-changer for small businesses, streamlining operations, reducing human errors, and providing real-time insights into stock levels. It can help you optimize inventory turnover, minimize holding costs, and enhance customer satisfaction.

However, the wrong choice or inadequate implementation can lead to data inaccuracies, operational disruptions, and unnecessary expenses, making it a bane. To ensure it's a boon, carefully research and select the best inventory management software for small businesses that aligns with your specific needs and processes. With the right software in place, you can transform your inventory management into a competitive advantage and drive growth.

#accounting software#gst invoice#inventory management#inventory software#inventory tracking#inventory control#business#billing software

0 notes

Text

URGENT: Adoption Request: Tawfik has 280 hours to pay his tuition.

Sep 26: The goal is now different but the pace is the same. See under the cut for more details.

If he doesn't, he will have wasted USD $2,500 on registration fees he won't be refunded for.

I don't have the time right now to focus on fundraising like I did in the recent past. Tawfik and I need YOUR support to make this happen. Even if you can't donate, I highly encourage you to adopt this campaign, promote it, keep track of updates, and/or share with others. You can write your own post or spread this one. If you adopt this campaign, I'd appreciate if you left a reply for our peace of mind.

My other promotions

Updated: Sep 26

Member(s): @tawfikblog, @90-tawfik

Verification: @/90-ghost

Payment methods: PayPal, Venmo, Google Pay, credit/debit. Here is his aunt's Paypal for him where he can see the daily progress (proof under cut).

Summary: Tawfik's campaign needs to reach $3,700 3,600 USD by UTC Sep 27, 7pm so he can enroll in online university classes for the semester. The second part of his tuition will probably be around a total of $5,000 by Oct 7, check the most recent version of this post for an update.

Current progress:

USD $ 1,087 3,365 / 3,600

(short term / 18,860)

Campaign details:

Tawfik is a software engineering student in Palestine trying to continue his education by enrolling in online classes at an Egyptian university.

He already raised roughly USD $2,500 in late July through a now closed Paypal campaign and paid the school as an application and reservation fee. This is nonrefundable.

I have gotten new information about Tawfik's campaign - sorry I didn't ask about this earlier and I will do so for similar promotions in the future. His tuition can be split into 2 installments: one due Sep 30 and the other Oct 10.

Now he needs to get his campaign to $3,700 3,600 for the first part of his tuition by Sep 27 so he can pay it by Sep 30, 12am in Egypt's timezone.

This number accounts for additional fees, see math section below.

Tawfik's friend transfers him the money daily and the next transfer is UTC Sep 27, 7pm (around 23.5 hours from the time I write this. We must make the goal by this time.

Transfers to Tawfik take 2 days, his payment to the school is immediate, and the money needs to be paid by Sep 30 in Egypt.

Fortunately, the way I've scheduled this gives some leeway but I'd rather we get the money in asap.

The second goal is $1,200 by Oct 10 (not accounting for any additional fees and transfer times). I will update this post shortly after we pay off the first installment.

Math:

Please let me know if I screwed up the calculation somewhere.

Goal 1 (Sep 27):

Update Sep 26: I recalculated based on concrete donation amounts vs a safe overestimate. Basically, he needs $3,600 and not $3,700.

He only needs $3,500 in his gfm to get $2,050 with an estimated 120 donations (200 total donations)

($3,500 - $1,052) * 0.971 - (0.3 * 120) = $2342. This accounts for the gfm fee of 2.9% and $0.3 per donation.

$2342 * 0.88 = $2,061. This accounts for the 12% cut the bank takes and is what Tawfik gets.

This is cutting it too close for comfort so I'm setting the campaign goal to $3,600.

Older calculation:

Tawfik has already spent the $1,052 already earned to care for his family, so it is excluded from my calculation for now. From my memory, he had ~80 donations when I made this post.

His base tuition cost is USD $2,050. GFM will take 2.9% and $0.3 of an assumed 200 to 250 donations. The resulting fee is rounded up to $150.

His bank transfer fee is 12% of $2,050 - $150, which is $228. In the end, he only gets $1,672.

So to cover additional fees, he'll need around an extra ~$600 (I've accounted for the fees on this too).

$2,050 + $600 + $1,052 (campaign money he already used) = $3,702. This can be rounded down to $3,700 as I am overestimating the number of donations.

Goal 2 (Oct 7)

He needs an additional $1,200. With gfm's 2.9% cut and 0.3 per an assumed 100 donations (an overestimate), the gfm fee can be rounded up to $70.

His bank transfer fee is 12% of $1,200 - $70, which is $136. In the end, he only gets $994.

So to cover additional fees, he'll need around an extra ~$375 (I've accounted for the fees on this too).

$3,600 + $375 + $994 = $4,969. This amount is an estimate and highly subject to change. I've overestimated the amount of donations needed to hit goal 1 and when we get there, we'll likely have already made an excess of funds that can go towards goal 2. I am not updating goal 1 because I don't want too many old versions of this post floating around causing confusion.

Update Sep 25: Tawfik saying to donate to his aunt's PayPal because his was having issues

Tagging random ppl. I'd really appreciate a share and donate if possible. Want off my 'mailing list'? Please message me!

@autisticsupervillain @voidofnothingmusic @gaysebastianvael @klezmurlocs @ploppymeep @trickstarbrave @see-arcane @bathroomcube @aners @griffworks @deepspaceboytoy @skipppppy @maester-cressen @sliceofdyke @samwise1548 @anissapierce @aalghul @sneakerdoodle @loverbearbutch @miwtual @receivingtransmission

3K notes

·

View notes