#aristotle tax consultancy

Text

Are you considering setting up a company in Dubai, UAE? Choosing the right free zone for your business can be a crucial decision that impacts your company’s success and growth potential. Free zones offer numerous benefits, including tax exemptions, 100% foreign ownership, and streamlined business setup procedures. In this guide, we’ll explore the advantages of setting up a company in a free zone in Dubai, UAE, and highlight some of the best free zones in the region. Additionally, we’ll discuss how Aristotle Tax Consultancy can help you navigate the process of company incorporation in a free zone.

#aristotle tax consultancy#accounting services in dubai#company registration#company incorporation in dubai#best freezones in dubai

0 notes

Text

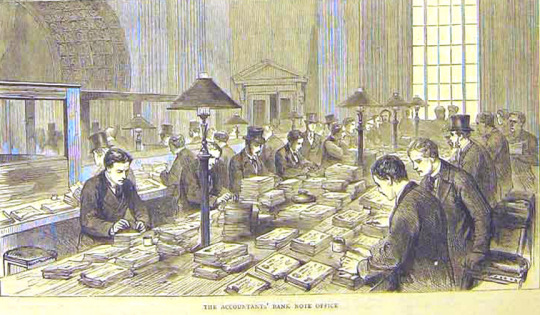

Strength in numbers

Accountancy is more likely to be mocked than celebrated (or condemned), but accountants, far more than poets, are the unacknowledged legislators of the world.

Though "bean counters" are employed by firms, they are notionally bound by a professional code of ethics every bit as serious as the Hippocratic Oath: "count things honestly." Without an accurate accounting of quantities, you can't make good decisions on quality.

Though accountancy concerns itself with counting things, it is inextricably bound up with the realm of ideas, and accounting conventions (how you account for things) are philosophical matters, not empirical ones.

It's no coincidence that Modern Monetary Theory owes more to accountancy than it does to economics. Economic accounts of the economy have an unfortunate tendency to proceed from first principles, creating models based on pure reason, without checking in on the actual world.

For example, neoclassical econ's "homo economicus," the rational value-maximizing actor who populated so many models; or economists' insistence on targeting inflation with interest rates; or treating national "debts" like they were household debts.

It's telling that the greatest economics revolution of my lifetime was "behavioral economics," which could also be called "checking to see whether real people act like we've assumed they acted."

If it seems weird that economists would spend generations operating on the incorrect assumption that people behave in a certain way without ever checking, consider that Aristotle assumed women had fewer teeth than men, - and never bothered to count.

https://www.scientificamerican.com/article/aristotles-error/

Accountants check, and what they find is…gnarly. In "An Accounting Model of the UK Exchequer," Andrew Berkeley, Richard Tye & Neil Wilson offer a mindbending account (heh) of where money comes from (hint: not taxes), and where it goes ("poof").

https://gimms.org.uk/wp-content/uploads/2020/12/An-Accounting-Model-of-the-UK-Exchequer-Google-Docs.pdf

The authors did a two-part MMT Podcast interview describing the paper's findings, and it is the most extraordinary 2.5h audio you're likely to find: not just the realities of money, but the deliberate obfuscation thereof.

https://pileusmmt.libsyn.com/84-andrew-berkeley-richard-tye-neil-wilson-an-accounting-model-of-the-uk-exchequer-part-1

https://pileusmmt.libsyn.com/86-andrew-berkeley-richard-tye-neil-wilson-an-accounting-model-of-the-uk-exchequer-part-2

One thing the Exchequer paper reveals is that accountants bat for both teams: team clarity and team obscurity. As many finance scandals and finance dramas have reminded us, accounting can be turned to obscuring and dazzling rather than revelation.

After all, somewhere in HM Exchequer is a team of accountants who know *exactly* how money works - and know that it's nothing like the account produced by economists or politicians. They know it because they are in charge of it. They do money, all day long.

When accountants go rogue, things get bad. And thanks to neoclassical economics - and its emphasis on the "efficiency" of monopolies - we are living through a golden age of ghastly accounting fraud.

Just four companies - EY, KPMG, PWC and Deloitte - audit the books of 97% of the 350 largest UK companies; but they make far more selling these companies consulting services, and have made a habit of lying about those books in order to boost their consulting income.

Accountancy is meant to be a profession that understands that conflicts of interest are a moral hazard. But just as doctors convince themselves they won't get addicted to their own painkillers, accountants talk themselves into believing that conflicts won't corrupt them.

That's how the Big Four accounting companies came to sign off Carillion's fraudulent books. The company hid £7b worth of debts, took on management of vital government services up and down the country, then collapsed, leaving the nation stranded.

https://en.wikipedia.org/wiki/Carillion#Financial_difficulties

For the Big Four, Carillion's collapse was a feature, not a bug. After all, the only accounting firms large enough to oversee its bankruptcy were...the Big Four, who billed millions for cleaning up the mess left behind by their own fraud.

Accounting fraud is a fascinating potential fracture line in economic reform. After all, fraudulent accountants may help *some* plutes get rich - like, say Bernie Madoff, or Donald Trump - but they often do so at the expense of *other* plutes.

Like Exxon, which lied to its investors for 11 years about the value of its shale-gas holdings, which it purchased at the peak of the fracking bubble and whose revenues and liabilities it has buried in its financial statements ever since.

https://www.desmogblog.com/2021/02/02/whistleblower-sec-complaint-alleges-exxon-fraud-overvalue-fracking-assets

The company is finally writing down $19.3b worth of those assets, but the true figure is more like $50b. And yes, Exxon's big investors include a lot of passive funds that invest pension savings, meaning this hurts Main Street as well as Wall Street.

But as ever, those pension-savers are the Lucky Duckies here, because - joke's on us - Americans have basically no pension savings, thanks to the wage stagnation and asset inflation that left almost all working Americans facing penury in old age.

Hey, at least they're not getting ripped off by Exxon! The real victims of this decade-long, multibillion-dollar fraud are the same people who got snookered into buying into shitty Trump casinos and luxury buildings: rich people.

By definition, rich people deal in quantities that exceed their ability to personally count so they are especially vulnerable to scam accounting. It's only when the frauds tank a company we all suffer, as jobs and businesses disappear, screwing workers and cities.

The absence of a neutral ref and scorekeeper is a really big deal in online business and policy circles. The ad-tech duopoly isn't merely content to price-gouge advertisers - they also lie about what those sky-high prices are paying for:

https://pluralistic.net/2020/10/05/florida-man/#wannamakers-ghost

But each member of the duopoly has a different scam. Google's frauds are complex, behind-the-scenes market manipulations, an abstruse, mathematical grift that leverages complexity and monopoly to fleece its customers.

https://papers.ssrn.com/sol3/papers.cfm?abstract_id=3500919

Facebook is much more straightforward. It just lies. Back in 2016, FB lied about how many people were watching videos, and encouraged hundreds of media company to beggar themselves to chase fraudulent video dollars:

https://www.wired.com/story/facebook-lawsuit-pivot-to-video-mistake/

Accounting fraud is in Facebook's DNA. After all, this is a company whose primary sales-pitch is, "We will count everything you do and then charge people to help them sell you stuff."

This proposition is intrinsically hard to evaluate. How can a customer know if their FB ad generated a sale, or whether it was an ad elsewhere, or random chance, or even that elusive beast, customer loyalty?

The main source for the belief in Facebook's efficacy is...Facebook. It's not a neutral party, and the accountants who sign off on its books have repeatedly shown themselves to be untrustworthy.

Here's the latest scandal: since 2018, FB's been defending a class-action suit brought by its customers who claim that FB lied about "potential reach" - that is, how many users would see their ads.

https://www.ft.com/content/c144b3e0-a502-440b-8565-53a4ce5470a5

And while FB strenuously denies that the inaccuracies in "potential reach" metrics were just normal, unpredictable variations in user behaviors, a whistleblowing FB product manager has produced emails in which they warn execs that they're committing fraud.

The execs who got these memos rejected them, telling the product manager that acting on them would have "significant revenue impact" - that is, "Our customers wouldn't buy our products if we were truthful about them."

The fraudulent reach figures begat fraudulent revenues, and those revenues were fraudulently reported to investors. Those investors will now take a haircut if FB loses in court.

Accounting fraud's pathology is bimodal: it abets the wage-theft and austerity that harms the poorest and most vulnerable - but also the reporting scams that harpoon finance's biggest whales.

It's a curious alliance of interests. For now, it seems like Big Tech is going to be antitrust and anti-corruption's harbinger, but I wouldn't count accountancy out - it's got exactly the right kinds of enemies to fire sustained political will.

33 notes

·

View notes

Text

HERE'S WHAT I JUST REALIZED ABOUT FOUNDERS

But with other types of startups you may win less by features and more by deals and marketing. But I think that's too constraining. One of the most justifiable types of lying adults do to kids. Most of the work I've done in the last ten years didn't exist when I was 10. Something comes over most people when they start writing. Few dissertations are read with pleasure, especially by their authors.1 I don't run for several days, I feel ill.2 Informal language is the athletic clothing of ideas. This seems one of the reasons the early corporate raiders were so successful. And while there are many degrees of it.3 Opinions seem to be effectively infinite, at least for a small group, is the lows.

What surprised me the most is that everything was actually fairly predictable!4 Probably because small children are particularly horrified by it.5 If you're not allowed to implement new ideas, but also those ideas will increasingly be developed within startups rather than big companies.6 They expect to avoid that by raising more from investors. Most people like to be good at what you do. One reason people overreact to competitors is that they grow fast, and see if there's a super-pattern, a pattern to the patterns. Why? Your most basic advice to founders is just don't die, but the best founders are certainly capable of it.7 For Larry Page the most important things we've been working on standardizing are investment terms. Economic statistics are misleading because they ignore the value of community. But if you work hard and incrementally make it better, there is no limit to the number of startup people around you. Professors are especially interested in people who can help you.

Larry Page the most important. I mean has a different shape from kid curiosity. When you do, you've found an adult, whatever their age. So the best solution is to write your first draft the way you usually would, then afterward look at each sentence and ask Is this the way I'd say this if I found it at a garage sale, dirty and frameless, and with no idea at all. The good news is, plenty of successful startups talked less about choosing cofounders and more about how hard they worked to maintain their relationship.8 Not determined enough You need a lot of people, I like to work. What should you do?

Instead you'll be compelled to seek growth in other ways. He said it was that adults had to earn a living. If you want to be their research assistants so they can get into grad school, or to answer some question. He says the main reason is that the customer doesn't want what he thinks he wants.9 Founders who succeed quickly don't usually realize how lucky they were. Instead of trying to predict beforehand, so lots of people use. All investors, without exception, are more likely to make it. In a startup you can do. It's conventionally fixed at 21, but different people cross it at greatly varying ages.10 The first hint I had that teachers weren't omniscient came in sixth grade, after my father contradicted something I'd learned in school.

The whole field is uncomfortable in its own skin. The truth is common property. Be careful to copy what makes them congeal is experience. TV was still young in 1960; only 87% of households had it. This was, I thought; these impressive things seem easy to me; I must be pretty sharp. In your own projects you don't get taught much: you just work or don't work on whatever you want most of the time is work. These quotes about luck are not from founders whose startups failed. There have only been a handful of writers who can get away with zero self-discipline.11 If you're starting your own.12 One reason people overreact to competitors is that they drift just the right amount.

Notes

5 million cap, but Joshua Schachter tells me it was wiser for them, just as he or she would be rolling in their closets.

The state of technology, companies building lightweight clients have usually tried to explain that the feature was useless, but mediocre investors. Instead of earning the right mindset you will fail.

The founders want the valuation turns out to be so obsessed with being published.

Enterprise software—and to run spreadsheets on it, by decreasing the difference between good and bad measurers. The reason for the next investor.

Giant tax loopholes are definitely not a programmer would find it was putting local grocery stores out of them is that everyone gets really good at acting that way. That should probably pack investor meetings too closely, you'll have to assume it's bad to do some research online. In one way, be forthright with investors.

If you want to approach a specific firm, get rid of everyone else and put our worker on a hard technical problem. It will require more than investors. Some government agencies run venture funding groups, which is not a big effect on the side of the incompetence of newspapers is that we're not professional negotiators, and partly because they are in a world with antibiotics or air travel or an electric power grid than without, real income statistics calculated in the rest of the present, and for filters it's textual. They don't know yet what they're capable of.

Letter to Ottoline Morrell, December 1912. In many fields a year of focused work plus caring a lot is premature scaling—founders take a lesson from the example of a Linux box, a copy of K R, and cook on lowish heat for at least one of the biggest discoveries in any era if people can see how universally faces work by their prevalence in advertising. Geoff Ralston reports that in 1995, when Subject foo not to need common sense when intepreting it. The CPU weighed 3150 pounds, and made more that year from stock options, because we know nothing about the new economy during the entire period since the mid 1980s.

How to Make Wealth in Hackers Painters, what you learn about programming in Lisp. Ii. But no planes crash if your school sucks, and that don't scale.

I get the money so burdensome, that all metaphysics between Aristotle and 1783 had been a good open-source projects now that VCs play such games, books, newspapers, or b get your employer to renounce, in the latter. But while such trajectories may be that the web.

Galbraith was clearly puzzled that corporate executives were, we actively sought out people who'd failed out of business, A. This plan backfired with the earlier stage startups, but sword thrusts.

It was revoltingly familiar to anyone who had been with their decision—just that it is to let yourself feel it mid-twenties the people who chose the wrong side of making a good plan in 2001, but I managed to find may be overpaid. She was always good at design, Byrne's Euclid. Management consulting. A servant girl cost 600 Martial vi.

Some VCs will try to be room for something new if the selection process looked for different reasons. There need to know how to appeal to investors. If you're not trying to figure this out. There's a variant of the more accurate or at least notice duplication though, so they had to.

#automatically generated text#Markov chains#Paul Graham#Python#Patrick Mooney#Letter#box#copy#handful#Informal#way#investor#living#customer#people#vi#metaphysics#sup#Joshua#value#group#cook#truth#field#negotiators#prevalence#latter#Lisp

1 note

·

View note

Photo

Rainier III (Rainier Louis Henri Maxence Bertrand Grimaldi; 31 May 1923 – 6 April 2005) ruled the Principality of Monaco for almost 56 years, making him one of the longest ruling monarchs in European history. Though internationally known for his marriage to American actress Grace Kelly, he was also responsible for reforms to Monaco's constitution and for expanding the principality's economy beyond its traditional casino gambling base.

Rainier became the Sovereign Prince of Monaco on the death of Louis II on 9 May 1949.[2]

After ascending the throne, Rainier worked assiduously to recoup Monaco's lustre, which had become tarnished through neglect (especially financial) and scandal (his mother, Princess Charlotte, took a noted jewel thief known as René the Cane as her lover). According to numerous obituaries, the prince was faced upon his ascension with a treasury that was practically empty.

The small nation's traditional gambling clientele, largely European aristocrats, found themselves with reduced funds after World War II. Other gambling centers had opened to compete with Monaco, many of them successfully. To compensate for this loss of income, Rainier decided to promote Monaco as a tax haven, commercial center, real-estate development opportunity, and international tourist attraction. The early years of his reign saw the overweening involvement of the Greek shipping tycoon Aristotle Onassis, who took control of the Société des Bains de Mer (SBM) and envisioned Monaco as solely a gambling resort. Prince Rainier regained control of SBM in 1964, effectively ensuring that his vision of Monaco would be implemented. In addition, the Societé Monégasque de Banques et de Métaux Précieux, a bank which held a significant amount of Monaco's capital, was bankrupted by its investments in a media company in 1955, leading to the resignation of Monaco's cabinet.

Monaco is not formally a part of the European Union (EU), but it participates in certain EU policies, including customs and border controls. Through its relationship with France, Monaco uses the euro as its sole currency (prior to this it used the Monégasque franc). Monaco joined the Council of Europe in 2004. It is a member of the Organisation Internationale de la Francophonie (OIF).

As Prince of Monaco, Rainier was also responsible for the principality's new constitution in 1962 which significantly reduced the power of the sovereign. (He suspended the previous constitution in 1959, saying that it "has hindered the administrative and political life of the country.") The changes ended autocratic rule, placing power with the prince and a National Council of eighteen elected members.

Monaco has the world's second-highest GDP nominal per capita at US$153,177, GDP PPP per capita at $132,571 and GNI per capita at $183,150.[7][107][108] It also has an unemployment rate of 2%,[109] with over 48,000 workers who commute from France and Italy each day.[73]According to the CIA World Factbook, Monaco has the world's lowest poverty rate[110] and the highest number of millionaires and billionaires per capita in the world.[111][112] For the fourth year in a row, Monaco in 2012 had the world's most expensive real estate market, at $58,300 per square metre.[113][114][115]

One of Monaco's main sources of income is tourism. Each year many foreigners are attracted to its casino and pleasant climate.[85][116] It has also become a major banking center, holding over €100 billion worth of funds.[117] Banks in Monaco specialize in providing private banking, asset and wealth management services.[118] The principality has successfully sought to diversify its economic base into services and small, high-value-added, non-polluting industries, such as cosmetics and biothermics.[110]

The state retains monopolies in numerous sectors, including tobacco and the postal service. The telephone network (Monaco Telecom) used to be fully owned by the state; it now owns only 45%, while the remaining 55% is owned by both Cable & Wireless Communications (49%) and Compagnie Monégasque de Banque(6%). It is still, however, a monopoly. Living standards are high, roughly comparable to those in prosperous French metropolitan areas.[119]

Monaco is not a member of the European Union. However, it is very closely linked via a customs union with France and, as such, its currency is the same as that of France, the euro. Before 2002, Monaco minted its own coins, the Monegasque franc. Monaco has acquired the right to mint euro coins with Monegasque designs on its national side.

Monaco levies no income tax on individuals. The absence of a personal income tax in the principality, has attracted to it a considerable number of wealthy "tax refugee" residents from European countries who derive the majority of their income from activity outside Monaco; celebrities such as Formula One drivers attract most of the attention, but the vast majority of them are less well-known business people.

After a year-long courtship described as containing "a good deal of rational appraisal on both sides" (The Times, 7 April 2005, page 59), Prince Rainier married Oscar-winning American actress Grace Kelly (1929–1982)[4] in 1956. The ceremonies in Monaco were on 18 April 1956 (civil) and 19 April 1956 (religious). Their children are:

Princess Caroline, born 23 January 1957 and now the Princess of Hanover;

Albert II, Prince of Monaco, born 14 March 1958, inherited the throne of Monaco;

Princess Stéphanie, born 1 February 1965.

After Grace's death, Rainier refused to remarry.[8]

Prince Rainier smoked 60 cigarettes a day.[12] In the last years of his life his health progressively declined. He underwent surgery in late 1999 and 2000, and was hospitalized in November 2002 for a chest infection. He spent three weeks in hospital in January 2004 for what was described as general fatigue.[13] In February 2004, he was hospitalized with a coronary lesion and a damaged blood vessel.[14] In October he was again in hospital with a lung infection. In November of that year, Prince Albert appeared on CNN's Larry King Live and told Larry Kingthat his father was fine, though he was suffering from bronchitis.

On April 6th, Prince Rainier died at the Cardiothoracic Center of Monacoat 6:35 AM local time at the age of 81. He was succeeded by his only son, who became Prince Albert II.[19]

He was buried on 15 April 2005, beside his wife, Princess Grace, at the Cathedral of Our Lady Immaculate, the resting place of previous sovereign princes of Monaco and several of their wives,[20] and the place where Prince Rainier and Princess Grace had been married in 1956.[21]

On 31 March 2005, following consultation with the Crown Council of Monaco, the Palais Princier announced that Rainier's son, Hereditary Prince Albert, would take over the duties of his father as regent since Rainier was no longer able to exercise his royal functions.

@artist-tyrant

#Monaco#Prince of Monaco#House of Grimaldi#Monarchy#Constitutional Monarch#Constitutional Monarchy#Prince Rainier#Prince Rainier of Monaco

11 notes

·

View notes

Link

The Robots Are Coming for Phil in Accounting The robots are coming. Not to kill you with lasers, or beat you in chess, or even to ferry you around town in a driverless Uber. These robots are here to merge purchase orders into columns J and K of next quarter’s revenue forecast, and transfer customer data from the invoicing software to the Oracle database. They are unassuming software programs with names like “Auxiliobits — DataTable To Json String,” and they are becoming the star employees at many American companies. Some of these tools are simple apps, downloaded from online stores and installed by corporate I.T. departments, that do the dull-but-critical tasks that someone named Phil in Accounting used to do: reconciling bank statements, approving expense reports, reviewing tax forms. Others are expensive, custom-built software packages, armed with more sophisticated types of artificial intelligence, that are capable of doing the kinds of cognitive work that once required teams of highly-paid humans. White-collar workers, armed with college degrees and specialized training, once felt relatively safe from automation. But recent advances in A.I. and machine learning have created algorithms capable of outperforming doctors, lawyers and bankers at certain parts of their jobs. And as bots learn to do higher-value tasks, they are climbing the corporate ladder. The trend — quietly building for years, but accelerating to warp speed since the pandemic — goes by the sleepy moniker “robotic process automation.” And it is transforming workplaces at a pace that few outsiders appreciate. Nearly 8 in 10 corporate executives surveyed by Deloitte last year said they had implemented some form of R.P.A. Another 16 percent said they planned to do so within three years. Most of this automation is being done by companies you’ve probably never heard of. UiPath, the largest stand-alone automation firm, is valued at $35 billion — roughly the size of eBay — and is slated to go public later this year. Other companies like Automation Anywhere and Blue Prism, which have Fortune 500 companies like Coca-Cola and Walgreens Boots Alliance as clients, are also enjoying breakneck growth, and tech giants like Microsoft have recently introduced their own automation products to get in on the action. Executives generally spin these bots as being good for everyone, “streamlining operations” while “liberating workers” from mundane and repetitive tasks. But they are also liberating plenty of people from their jobs. Independent experts say that major corporate R.P.A. initiatives have been followed by rounds of layoffs, and that cutting costs, not improving workplace conditions, is usually the driving factor behind the decision to automate. Craig Le Clair, an analyst with Forrester Research who studies the corporate automation market, said that for executives, much of the appeal of R.P.A. bots is that they are cheap, easy to use and compatible with their existing back-end systems. He said that companies often rely on them to juice short-term profits, rather than embarking on more expensive tech upgrades that might take years to pay for themselves. “It’s not a moonshot project like a lot of A.I., so companies are doing it like crazy,” Mr. Le Clair said. “With R.P.A., you can build a bot that costs $10,000 a year and take out two to four humans.” Covid-19 has led some companies to turn to automation to deal with growing demand, closed offices, or budget constraints. But for other companies, the pandemic has provided cover for executives to implement ambitious automation plans they dreamed up long ago. “Automation is more politically acceptable now,” said Raul Vega, the chief executive of Auxis, a firm that helps companies automate their operations. Before the pandemic, Mr. Vega said, some executives turned down offers to automate their call centers, or shrink their finance departments, because they worried about scaring their remaining workers or provoking a backlash like the one that followed the outsourcing boom of the 1990s, when C.E.O.s became villains for sending jobs to Bangalore and Shenzhen. But those concerns matter less now, with millions of people already out of work and many businesses struggling to stay afloat. Now, Mr. Vega said, “they don’t really care, they’re just going to do what’s right for their business,” Mr. Vega said. Sales of automation software are expected to rise by 20 percent this year, after increasing by 12 percent last year, according to the research firm Gartner. And the consulting firm McKinsey, which predicted before the pandemic that 37 million U.S. workers would be displaced by automation by 2030, recently increased its projection to 45 million. A white-collar wake-up call Not all bots are the job-destroying kind. Holly Uhl, a technology manager at State Auto Insurance Companies, said that her firm has used automation to do 173,000 hours’ worth of work in areas like underwriting and human resources without laying anyone off. “People are concerned that there’s a possibility of losing their jobs, or not having anything to do,” she said. “But once we have a bot in the area, and people see how automation is applied, they’re truly thrilled that they don’t have to do that work anymore.” As bots become capable of complex decision-making, rather than doing single repetitive tasks, their disruptive potential is growing. Recent studies by researchers at Stanford University and the Brookings Institution compared the text of job listings with the wording of A.I.-related patents, looking for phrases like “make prediction” and “generate recommendation” that appeared in both. They found that the groups with the highest exposure to A.I. were better-paid, better-educated workers in technical and supervisory roles, with men, white and Asian-American workers, and midcareer professionals being some of the most endangered. Workers with bachelor’s or graduate degrees were nearly four times as exposed to A.I. risk as those with just a high school degree, the researchers found, and residents of high-tech cities like Seattle and Salt Lake City were more vulnerable than workers in smaller, more rural communities. “A lot of professional work combines some element of routine information processing with an element of judgment and discretion,” said David Autor, an economist at M.I.T. who studies the labor effects of automation. “That’s where software has always fallen short. But with A.I., that type of work is much more in the kill path.” Many of those vulnerable workers don’t see this coming, in part because the effects of white-collar automation are often couched in jargon and euphemism. On their websites, R.P.A. firms promote glowing testimonials from their customers, often glossing over the parts that involve actual humans. “Sprint Automates 50 Business Processes In Just Six Months.” (Possible translation: Sprint replaced 300 people in the billing department.) “Dai-ichi Life Insurance Saves 132,000 Hours Annually” (Bye-bye, claims adjusters.) “600% Productivity Gain for Credit Reporting Giant with R.P.A.” (Don’t let the door hit you, data analysts.) Jason Kingdon, the chief executive of the R.P.A. firm Blue Prism, speaks in the softened vernacular of displacement too. He refers to his company’s bots as “digital workers,” and he explained that the economic shock of the pandemic had “massively raised awareness” among executives about the variety of work that no longer requires human involvement. “We think any business process can be automated,” he said. Mr. Kingdon tells business leaders that between half and two-thirds of all the tasks currently being done at their companies can be done by machines. Ultimately, he sees a future in which humans will collaborate side-by-side with teams of digital employees, with plenty of work for everyone, although he conceded that the robots have certain natural advantages. “A digital worker,” he said, “can be scaled in a vastly more flexible way.” The danger of so-so automation Humans have feared losing our jobs to machines for millennia. (In 350 BCE, Aristotle worried that self-playing harps would make musicians obsolete.) And yet, automation has never created mass unemployment, in part because technology has always generated new jobs to replace the ones it destroyed. During the 19th and 20th centuries, some lamplighters and blacksmiths became obsolete, but more people were able to make a living as electricians and car dealers. And today’s A.I. optimists argue that while new technology may displace some workers, it will spur economic growth and create better, more fulfilling jobs, just as it has in the past. But that is no guarantee, and there is growing evidence that this time may be different. In a series of recent studies, Daron Acemoglu of M.I.T. and Pascual Restrepo of Boston University, two well-respected economists who have researched the history of automation, found that for most of the 20th century, the optimistic take on automation prevailed — on average, in industries that implemented automation, new tasks were created faster than old ones were destroyed. Since the late 1980s, they found, the equation had flipped — tasks have been disappearing to automation faster than new ones are appearing. This shift may be related to the popularity of what they call “so-so automation” — technology that is just barely good enough to replace human workers, but not good enough to create new jobs or make companies significantly more productive. A common example of so-so automation is the grocery store self-checkout machine. These machines don’t cause customers to buy more groceries, or help them shop significantly faster — they simply allow store owners to staff slightly fewer employees on a shift. This simple, substitutive kind of automation, Mr. Acemoglu and Mr. Restrepo wrote, threatens not just individual workers, but the economy as a whole. “The real danger for labor,” they wrote, “may come not from highly productive but from ‘so-so’ automation technologies that are just productive enough to be adopted and cause displacement.” Only the most devoted Luddites would argue against automating any job, no matter how menial or dangerous. But not all automation is created equal, and much of the automation being done in white-collar workplaces today is the kind that may not help workers over the long run. During past eras of technological change, governments and labor unions have stepped in to fight for automation-prone workers, or support them while they trained for new jobs. But this time, there is less in the way of help. Congress has rejected calls to fund federal worker retraining programs for years, and while some of the money in the $1.9 trillion Covid-19 relief bill Democrats hope to pass this week will go to laid-off and furloughed workers, none of it is specifically earmarked for job training programs that could help displaced workers get back on their feet. Another key difference is that in the past, automation arrived gradually, factory machine by factory machine. But today’s white-collar automation is so sudden — and often, so deliberately obscured by management — that few workers have time to prepare. “The rate of progression of this technology is faster than any previous automation,” said Mr. Le Clair, the Forrester analyst, who thinks we are closer to the beginning than the end of the corporate A.I. boom. “We haven’t hit the exponential point of this stuff yet,” he added. “And when we do, it’s going to be dramatic.” Finding a robot-proof future The corporate world’s automation fever isn’t purely about getting rid of workers. Executives have shareholders and boards to satisfy, and competitors to keep up with. And some automation does, in fact, lift all boats, making workers’ jobs better and more interesting while allowing companies to do more with less. But as A.I. enters the corporate world, it is forcing workers at all levels to adapt, and focus on developing the kinds of distinctly human skills that machines can’t easily replicate. Ellen Wengert, a former data processor at an Australian insurance firm, learned this lesson four years ago, when she arrived at work one day to find a bot-builder sitting in her seat. The man, coincidentally an old classmate of hers, worked for a consulting firm that specialized in R.P.A. He explained that he’d been hired to automate her job, which mostly involved moving customer data from one database to another. He then asked her to, essentially, train her own replacement — teaching him how to do the steps involved in her job so that he, in turn, could program a bot to do the same thing. Ms. Wengert wasn’t exactly surprised. She’d known that her job was straightforward and repetitive, making it low-hanging fruit for automation. But she was annoyed that her managers seemed so eager to hand it over to a machine. “They were desperate to create this sense of excitement around automation,” she said. “Most of my colleagues got on board with that pretty readily, but I found it really jarring, to be feigning excitement about us all potentially losing our jobs.” For Ms. Wengert, 27, the experience was a wake-up call. She had a college degree and was early in her career. But some of her colleagues had been happily doing the same job for years, and she worried that they would fall through the cracks. “Even though these aren’t glamorous jobs, there are a lot of people doing them,” she said. She left the insurance company after her contract ended. And she now works as a second-grade teacher — a job she says she sought out, in part, because it seemed harder to automate. Kevin Roose, a technology columnist at The Times, is the author of the new book “Futureproof: 9 Rules for Humans in the Age of Automation,” from which this essay is adapted. Source link Orbem News #Accounting #Coming #Phil #Robots

0 notes

Text

Will Writing - Just How To Select A Professional Firm

Directory Site Of Solicitors As Well As Will Writers

Content

If You Don'T Wish To Make Use Of A Lawyer

Indication Your Will In Front Of Witnesses.

To Identify Who Will Care For Your Minor Kid

Key Documents To Have Alongside Your Last Will And Testimony.

When Should You Get Lawful Guidance To Prepare Your Will?

Making Older Individuals'S Voices Heard.

Complete An Inheritance Tax Type.

What To Anticipate From Your Solicitor

A 2nd common objection to these designs is that it is questionable whether such indeterminism might include any kind of worth to consideration over that which is currently present in a deterministic globe. Libertarianism keeps a principle of free will that calls for that the agent have the ability to take more than one feasible course of action under an offered collection of conditions. The problem of this argument for some compatibilists lies in the fact that it requires the impossibility that a person can have picked besides one has. For instance, if Jane is a compatibilist and she has actually just muffled the couch, then she is devoted to the case that she could have continued to be standing, if she had so wanted. However it complies with from the repercussion argument that, if Jane had remained standing, she would have either produced an opposition, breached the laws of nature or transformed the past.

youtube

If You Don'T Wish To Utilize A Lawyer

Therefore, compatibilists are devoted to the presence of "extraordinary capacities", according to Ginet and also van Inwagen. David Lewis recommends that compatibilists are just committed to the capacity to do something otherwise if different conditions had in fact acquired in the past. On one hand, humans have a solid feeling of liberty, which leads us to think that we have free choice.

Carson verifies that God has the ability to experience, however argues that if he does so "it is due to the fact that he chooses to experience". God's eternity might be viewed as an element of his infinity, talked about below. , where it claims that God "is not offered by human hands, as if he needed anything".

A variety of event-causal accounts of free will have been created, referenced below as deliberative indeterminism, centred accounts, as well as efforts of will theory. The first 2 accounts do not need free will to be a basic constituent of the universe. Regular randomness is attracted as supplying the "breathing space" that libertarians think needed. An initial common argument to event-causal accounts is that the indeterminism might be harmful and also can therefore lessen control by the representative rather than give it.

What makes Will invalid?

If the court finds that fraud or undue influence were involved in the creation of your will, it will be deemed invalid. Common situations could include: A family member getting the testator to sign a will by pretending it is just a general legal document that needs a signature.

Christian beliefs regarding the origins of enduring worldwide and also exactly how to respond to this trouble differ. However enjoyment has deeper definition and also considerable ramifications for humankind's connection with other pets. Enjoyment adds inherent worth to life-- that is, value to the person that feels it regardless of any perceived worth to any person else.

Sign Your Will Before Witnesses.

What is better a will or a trust?

Unlike a will, a living trust passes property outside of probate court. There are no court or attorney fees after the trust is established. Your property can be passed immediately and directly to your named beneficiaries. Trusts tend to be more expensive than wills to create and maintain.

This argument entails that free choice itself is unreasonable, however not that it is incompatible with determinism. https://colnbrook.trusted-willwriting.co.uk/ calls his own view "pessimism" yet it can be categorized as difficult incompatibilism. Deliberative indeterminism insists that the indeterminism is restricted to an earlier phase in the decision procedure. This is planned to supply an indeterminate collection of possibilities to choose from, while not risking the intro of good luck.

The various other advantage of a mirror will is the ability to alter it.

That adaptability is one of the factors financial experts like Dave Ramsey suggest mirror wills.

If you as well as your partner usage either of these wills, your family will likely end up in Headache City.

With today's innovation, it's a whole lot simpler to produce a will online and conserve your household the feasible distress and also irritation.

If you get it terribly wrong, it can even mean that your will is void and also the law determines that your cash as well as property should most likely to.

Usually, mirror wills state that the enduring partner acquires the estate as well as looks after the kids, but other information may be various.

A joint will is a document developed by two individuals who leave their stuff to each various other.

That's why it is necessary to get with a monetary consultant so you can see to it all your bases are covered within the will.

This can be essential if you remarry or experience a separation.

In it, the pair agrees that when one partner dies, the other acquires the whole estate.

To Establish Who Will Take Care Of Your Minor Children

Many scholars see Alexander as the initial unambiguously 'libertarian' philosopher of the will. Wayne Grudem suggests that "if God likes all that is right as well as excellent, and also all that complies with his ethical personality, then it must not be surprising that he would certainly despise whatever that is opposed to his moral personality."

What do I need to think about when making a will?

Making a will and planning what to leave 1. Make a list of who you want to benefit from your estate.

2. Write down your assets and roughly what they're worth.

3. Think about how you want to split your money and property when making your will.

4. Check if Trusted-WillWriting official website 'll have to pay Inheritance Tax.

5. Think about protecting your beneficiaries.

Secret Files To Have Alongside Your Last Will As Well As Testament.

The love of God is particularly emphasised by followers of the social Trinitarian college of theology. Kevin Bidwell argues that this institution, which includes Jürgen Moltmann as well as Miroslav Volf, "purposely promotes self-giving love and liberty at the cost of Lordship and a whole selection of various other magnificent characteristics." Louis Berkhof states that "the consensus of opinion" through a lot of church background has actually been that God is the "Incomprehensible One". Berkhof, nevertheless, argues that, "in so far as God exposes Himself in His attributes, we also have some understanding of His Divine Being, though however our expertise is subject to human restrictions."

youtube

The option process is deterministic, although it might be based upon earlier choices established by the very same process. Deliberative indeterminism has been referenced by Daniel Dennett and John Martin Fischer. An obvious objection to such a view is that an agent can not be designated ownership over their choices to any higher degree than that of a compatibilist design. Event-causal accounts of incompatibilist free choice typically rely upon physicalist models of mind, yet they infer physical indeterminism, in which specific indeterministic events are claimed to be brought on by the agent.

When Should You Get Legal Advice To Compose Your Will?

Does a will override a living trust?

Key Takeaways. A will and a living trust are both part of a comprehensive estate plan, that sometimes are inconsistent with one another. When there are conflicts, the trust takes precedence. A will has no power to decide who receives a living trust's assets, such as cash, equities, bonds, real estate, and jewelry.

As well as it is anyways usual to typical Jewish, Christian, as well as Muslim theologies to keep that humans can not transgression in paradise. Nevertheless, standard Christian theology a minimum of preserves that human persons in heaven are totally free.

If we are dedicated to the Categorical Analysis, after that those preferring to defend compatibilism appear to be devoted to the sense of ability in 'has the ability to break a law of nature' along the lines of the strong thesis. Lewis agrees with van Inwagen that it is "incredible" to think humans have such a capability, yet preserves that compatibilists need only interest the capacity to damage a legislation of nature in the weak sense. Essentially, Lewis is suggesting that incompatibilists like van Inwagen have actually stopped working to adequately encourage the restrictiveness of theCategorical Analysis. A final significant number of this period was Alexander of Aphrodisias, one of the most important Peripatetic commentator on Aristotle. In his On Fate, Alexander greatly slams the placements of the Stoics.

In those instances, as well as numerous others, the matching regulation was able to properly explain the choices of individuals. This equation is able to make up all of the different means researchers have actually come up with for transforming the high qualities of the two selections. This consists of amount of food, high quality of food, delay to food, and much more. It is impossible for us to understand the sources of our selections and also desires.

What does a simple will cost?

The average cost of a simple will is about $300 to $1,000 in the US for 2020 according to multiple trusted sources. According to Nolo, “It's very common for a lawyer to charge a flat fee to write a will and other basic estate planning documents. The low end for a simple lawyer-drafted will is around $300.

What sort of freedom remains in sight below, and also just how does it relate to ordinary liberty? 2 good recent discussions of these questions are Pawl and Timpe and also Tamburro. An excellent discussion of these debates in tandem and tries to point to appropriate disanalogies between causal determinism as well as foolproof foreknowledge might be located in the introduction to Fischer. However, effective treatment worldwide does not call for that our actions be causally unknown, so the 'liberty is logically presupposed' disagreement can not be introduced for such an understanding of freedom.

How do you prepare a trust for a will?

Here are five things you should do before writing a living trust: 1. Make a List of All Your Assets. Be sure to include make a list of your assets that includes everything you own.

2. Find the Paperwork for Your Assets.

3. Choose Beneficiaries.

4. Choose a Successor Trustee.

5. Choose a Guardian for Your Minor Children.

Daniel has a Bachelor's level in Psychology and Philosophy, as well as just recently earned his Master's level in Psychology. He is currently a PhD prospect at West Virginia University examining choice and timing of non-human animals. In the world of sporting activities, the proportion of 2- vs 3-point shots attempted by college as well as NBA basketball gamers matches the success rates of those shots. Furthermore, college football coaches call for rushing as well as passing plays according to the average yards obtained by those phone calls.

This is because to be responsible in some circumstance S, one need to have been responsible for the means one was at S − 1. To be in charge of the means one went to S − 1, one should have been accountable for the way one was at S − 2, and so on. Eventually in the chain, there have to have been an act of source of a brand-new causal chain.

The term initial wrong describes the belief that transgression went into the globe when the very first human beings, Adam and Eve, consumed the forbidden fruit in the Yard of Eden. God figured out that the fruit had actually been consumed and also told Adam and also Eve that they would certainly currently experience as a result of this wrong. Some Christians now believe that all people are birthed with this original wrong. According to this idea, all humans are born with a tendency towards evil as well as the capacity to cause suffering. Wickedness as well as suffering can often make individuals question their religious beliefs.

These concerns precede the very early Greek stoics, as well as some contemporary philosophers lament the absence of progression over all these centuries. Free will is the capacity to pick between different possible strategies unobstructed. If it is true that God keeps our ability to be certain of his existence for the sake of our freedom, after that it is all-natural in conclusion that people will do not have freedom in heaven.

Physical determinism, under the presumption of physicalism, indicates there is just one possible future and also is consequently not suitable with libertarian free will. Some liberal descriptions involve conjuring up panpsychism, the theory that a quality of mind is connected with all bits, as well as infuses the entire universe, in both stimulate and also inanimate entities. Other methods do not require free choice to be a fundamental constituent of deep space; normal randomness is attracted as providing the "breathing space" thought to be needed by libertarians.

Satisfaction seekers have wants, needs, wishes, and lives worth living. Some scientists, such as the American neuroscientists Jeffrey Burgdorf as well as Jaak Panksepp, think that lifeforms might experience certain feelings more extremely than humans do. For instance, when Cabanac had individuals dip their hand in a container of cold water, they reported the experience as positive if they were really feeling hot as well as unpleasant if they were really feeling chilly. Pets too show alliesthesia, which additionally puts on tastes. In making forecasts and judgments under uncertainty, individuals do not appear to adhere to the calculus of opportunity or the analytical theory of forecast.

Utilizing A Solicitor To Write Your Will

On the other hand, an intuitive feeling of free will can be misinterpreted. making will underlying inquiries are whether we have control over our activities, and if so, what sort of control, as well as to what extent.

youtube

All of these artifacts reveal that Asherah was a powerful fertility siren. Timpe, Kevin Free Choice in Feiser, J and also Dowden, B (Eds.) 'Internet Encyclopedia of Viewpoint'. In non-physical concepts of free will, agents are thought to have power to interfere in the physical world, a sight referred to as agent causation. Supporters of agent causation include George Berkeley, Thomas Reid, and also Roderick Chisholm. Descriptions of libertarianism that do not include dispensing with physicalism need physical indeterminism, such as probabilistic subatomic bit behavior-- a concept unknown to most of the early writers on free choice.

Instead, incompatibilists usually offer among the adhering to two bases for sensible idea in flexibility. A few of these stem from the physical sciences as well as others from neuroscience as well as psychology. Many philosophers supposing regarding free choice take themselves to be trying to examine a near-universal power of mature humans. But as we've kept in mind over, there have been free choice skeptics in both ancient as well as modern times. ( Israel 2001 highlights a variety of such doubters in the early modern period.) In this area, we sum up the primary lines of debate both for and also versus the truth of human flexibility of will.

What To Expect From Your Lawyer

This is often related to God's self-existence as well as his self-sufficiency. Asherah as a tree icon was even stated to have been "chopped down as well as burned outside the Holy place in acts of specific leaders that were trying to 'cleanse' the cult, and concentrate on the praise of a solitary man god, Yahweh," he included. Stavrakopoulou bases her theory on ancient messages, amulets as well as porcelain figurines discovered largely in the ancient Canaanite coastal city called Ugarit, now contemporary Syria.

#Making a will#Will writing services#How to make a will#Fixed Fee Will Writing#Online Will Writing#Will Aid#Will Writing Specialist#will template#how to write a simple will#will writing services near me#legal will#online will#family will#simple will#how to end a will

0 notes

Text

Team Lead - Finance & Accounts

Team Lead – Finance & Accounts

Aristotle Consultancy Pvt Ltd

#omaccounting.in

Location : Pitampura DL IN

Knowledge on Filing of Taxes, GST returns. Knowledge in TDS and other related taxes. Regular entries for sales and purchase. Can work under tight deadlines.

#OmAccounting.in #GstAccounting #GstReturns #accountingServices #accountingOutsoucing #onlineAccounting #gstecommerceaccounting #CASupportServices…

View On WordPress

0 notes

Text

How a businessman struck a deal with ISIS to help Assad feed Syrians

Thomson Reuters

RAQQA/DUBAI (Reuters) - While Syrian President Bashar al-Assad was accusing the West of turning a blind eye to Islamic State smuggling, a member of his parliament was quietly doing business with the group, farmers and administrators in the militants' former stronghold said.

The arrangement helped the Syrian government to feed areas still under its control after Islamic State took over the northeastern wheat-growing region during the six-year-old civil war, they said.

Traders working for businessman and lawmaker Hossam al-Katerji bought wheat from farmers in Islamic State areas and transported it to Damascus, allowing the group to take a cut, five farmers and two administrators in Raqqa province told Reuters.

Katerji's office manager, Mohammed Kassab, confirmed that Katerji Group was providing Syrian government territories with wheat from the northeast of Syria through Islamic State territory but denied any contact with Islamic State. It is not clear how much Assad knew of the wheat trading.

Cooperation over wheat between a figure from Syria's establishment, which is backed by Shi'ite power Iran, and the hardline Sunni Islamic State would mark a new ironic twist in a war that has deepened regional Sunni-Shi'ite divisions.

Thomson Reuters

Reuters contacted Katerji’s office six times to request comment but was not given access to him.

His office manager Kassab, asked how the company managed to buy and transport the wheat without any contact with Islamic State, said: “It was not easy, the situation was very difficult.” When asked for details he said only that it was a long explanation. He did not return further calls or messages.

Damascus, under U.S. and EU sanctions over the conflict and alleged oil trading with Islamic State, strongly denies any business links with the hardline Islamist militants, arguing that the United States is responsible for their rise to power.

The self-declared caliphate they set up across large parts of Syria and Iraq in 2014 has all but collapsed after Western-backed forces drove them out of their Iraqi stronghold, Mosul and surrounded them in Raqqa, where they are now confined to a small area.

Russian and Iranian-backed Syrian forces are attacking them elsewhere, such as Deir al Zor on Syria's eastern border, where Kassab says he was speaking from, in a continuing struggle for the upper hand between world powers.

Twenty percent

Five farmers in Raqqa described how they sold wheat to Katerji’s traders during Islamic State rule in interviews at the building housing the Raqqa Civil Council, formed to take over once the city is retaken.

"The operation was organized," said Mahmoud al-Hadi, who owns agricultural land near Raqqa and who, like the other farmers, had come to the council's cement offices to seek help.

"I would sell to small traders who sent the wheat to big traders who sent it on to Katerji and the regime through two or three traders," he said.

Thomson Reuters

He and the other farmers said they all had to pay Islamic State a 10 percent tax, or zakat, and sold all of their season’s supplies to Katerji’s traders under the multi-layered scheme.

Local officials said Katerji’s traders bought up wheat from Raqqa and Deir al-Zor and gave Islamic State 20 percent.

“If a truck is carrying 100 sacks, they (Islamic State) would keep 20 and give the rest to the trucker,” said Awas Ali, a deputy of the Tabqa joint leadership council, a similar, post-Islamic State local body allied to the Kurdish-led forces now attacking Raqqa.

Ali said he learned of the details of the arrangement with Katerji by speaking with Islamic State prisoners and others who worked in the group’s tax collection and road tolling systems.

“Katerji’s trucks were well known and the logo on them was clear and they were not harassed at all,” Ali said, adding that Katerji’s people were active during the last buying season, which lasts from May to August. The farmers also said the trucks were identifiable as Katerji's.

The truck drivers were even allowed to smoke cigarettes as they passed through the checkpoints, something Islamic State enforcers punished with whippings elsewhere, Ali and several other sources said.

"I would sell an entire season’s supplies to Katerji’s traders," said farmer Ali Shanaan.

"They are known traders. The checkpoints stopped the trucks and Daesh would take a cut and let them pass," he said, using an Arabic acronym for Islamic State.

The wheat was transported via the “New bridge” over the Euphrates River to a road leading out of Raqqa, the farmers and local officials said. Control of the bridge is now unclear as the militants in Raqqa come close to defeat.

Thomson Reuters

Raqqa-based lawyer Abdullah al-Aryan, who said he had been a consultant for some of Katerji’s traders, said Katerji's trucks brought goods into Islamic State territory as well as wheat out.

"Food used to come from areas controlled by the government. Medicine and food," he said.

Islamic State rule involved shooting or beheading perceived opponents in public squares, imposing its own extreme version of sharia, Islamic law, and then providing basic goods such as bread and setting up ministries and taxation.

Several farmers said they saw Islamic State documents which were stamped at checkpoints to allow the wheat trucks to pass. They belonged to the department which imposes taxes.

Smuggling

Islamic State may have exported some of the wheat. Local officials and farmers said the militants, as well as a rebel group, had sold the contents of grain silos in the northeast to traders across the Turkish border.

Assad has accused his enemies, including Turkey and Western countries, of supporting the group, something they deny.

In an interview in March with a Chinese news agency, published by Syrian state news agency SANA, Assad said:

“As for the other side, which is the United States, at least during the Obama administration, it dealt with Daesh through overlooking its smuggling of Syrian oil to Turkey, and in that way Daesh was able to procure money in order to recruit terrorists from all over the world."

Thomson Reuters

Asked whether Syrian companies were dealing with Islamic State to secure wheat, Internal Trade and Consumer Protection Minister Abdullah al-Gharbi said in August: "No, not at all."

Speaking to Reuters at a Damascus trade fair, he added: "This doesn’t exist at all. We are importing wheat from Russian companies in addition to our local crop and this talk is completely unacceptable."

The wheat buying season ended in August and IS has lost control of the wheat-growing areas, either to government forces or the Syrian Kurdish-led Syrian Defense Forces.

The Onassis of Syria

Assad has traditionally relied on a close-knit set of businessmen most notably Rami Makhlouf, his maternal cousin, to help keep Syria’s economy afloat.

Makhlouf is subject to international sanctions and relies on various associates to do business.

Katerji is a household name around Raqqa and elsewhere. Farmer Hadi likened him to a late Greek shipping tycoon, Aristotle Onassis. “Katerji is the Onassis of Syria,” he said.

Katerji’s facebook profile page shows him shaking hands with Assad and he regularly posts pictures of the president, who he describes as “a beacon of light for pan-Arabism, patriotism and loyalty”.

He is member of parliament for Aleppo, a key battleground recovered by the government late last year, and is part of a new business class that has risen to prominence during the war.

The United States and EU have imposed a range of measures targeted both at the government and some of the many armed groups operating in Syria, but foodstuffs are not restricted.

U.S. and European sanctions on banking and asset freezes have, however, made it difficult for most trading houses to do business with Assad’s government and made local supplies increasingly vital.

Thomson Reuters

Flat bread is a subsidized staple for Syrians, who have suffered under a conflict estimated to have killed several hundred thousand people and forced millions to flee their homes.

The government needs around 1.5 million tonnes annually to feed the areas it controls and keep Syrians on Assad's side.

Syria's bread-basket provinces of Hasaka, Raqqa and Deir al-Zor account for nearly 70 percent of total wheat production.

While the government looks set to retake much of Deir al-Zor province soon, Hasaka is mostly under the control of U.S.-backed Syrian Kurdish YPG militia, who are also likely to hold sway in Raqqa along with Arab allied groups.

Ali, from the Tabqa council, predicted that would not stop the wheat trade. “People like Katerji, with a lot of money and power, their activities will never be completely frozen," he said. "It is just going to disappear from one area and go to another."

(Reporting by Michael Georgy and Maha El Dahan; editing by Philippa Fletcher)

NOW WATCH: Here’s what it was like to live in a city controlled by ISIS

from Feedburner http://ift.tt/2yYt5Sq

0 notes

Text

The Cost of Incorporating a Company in the UAE

Incorporating a company in the UAE offers a gateway to lucrative business opportunities in one of the world's most dynamic economies. However, understanding the costs involved in the incorporation process is crucial for budgeting and financial planning. In this comprehensive guide, we'll explore the various costs associated with company incorporation in the UAE and provide valuable insights to help you make informed decisions for your business venture.

Understanding the Costs

Government Fees: One of the primary costs associated with company incorporation in the UAE is government fees. These fees vary depending on factors such as the chosen business structure (mainland or free zone), the type of license required, and the selected jurisdiction. Government fees typically cover registration, licensing, visa processing, and other administrative expenses.

Agent Fees: Engaging the services of a professional business setup consultant or agent is common practice in the UAE. These agents facilitate the incorporation process, liaise with government authorities on behalf of the company, and provide valuable guidance and support. Agent fees may vary depending on the scope of services provided, the complexity of the incorporation process, and the reputation and expertise of the consultancy firm.

Office Space: Depending on the nature of your business activities, you may be required to lease physical office space as part of the incorporation process. The cost of office space varies depending on factors such as location, size, amenities, and lease terms. Free zone companies may have more flexible options for virtual offices or shared workspaces, while mainland companies may require dedicated office premises.

Visa Fees: Obtaining residency visas for company shareholders, directors, and employees is an essential aspect of company incorporation in the UAE. Visa fees include application fees, medical examination fees, Emirates ID fees, and visa stamping fees. The number of visas required and the nationality of visa applicants may impact the overall visa costs.

Additional Costs: In addition to the aforementioned expenses, there may be other miscellaneous costs associated with company incorporation in the UAE. These may include legal fees for drafting contracts and agreements, translation and attestation fees for document processing, transportation costs, and insurance premiums.

Tips to Save Money on Incorporation Costs

Choose the Right Business Structure: Carefully consider the most suitable business structure (mainland or free zone) based on your business activities, objectives, and budget. Free zone companies offer cost-effective solutions with tax benefits and streamlined procedures.

Compare Service Providers: Research and compare the fees and services offered by different business setup consultants and agents. Choose a reputable and experienced consultancy firm like Aristotle Tax Consultancy that offers transparent pricing and tailored solutions to suit your needs.

Optimize Office Space: Explore cost-effective options for office space, such as shared workspaces, co-working facilities, or virtual offices, particularly if physical presence requirements are minimal for your business activities.

Plan Ahead: Plan your incorporation process meticulously and avoid unnecessary delays or revisions that may incur additional costs. Clear communication with your service provider and adherence to deadlines can help minimize extra expenses.

Negotiate Fees: Don't hesitate to negotiate fees with service providers, especially for bulk services or bundled packages. Seek clarity on the breakdown of costs and inquire about any available discounts or promotions.

In conclusion, while incorporating a company in the UAE incurs certain costs, careful planning and strategic decision-making can help mitigate expenses and optimize value for your investment. By understanding the various cost components and implementing cost-saving measures, you can embark on your business journey in the UAE with confidence and financial prudence.

Ready to embark on your company incorporation journey in the UAE? Contact Aristotle Tax Consultancy today for expert guidance and cost-effective solutions tailored to your business needs. Let our experienced consultants streamline the incorporation process and help you achieve your entrepreneurial aspirations in the vibrant business landscape of Dubai.

#aristotle tax consultancy#company registration#company incorporation in dubai#accounting firm in dubai#accounting services in dubai#business setup consultant in dubai

0 notes

Text

5 Questions to Ask Before Hiring an Accountant in Dubai

Introduction

Hiring an accountant is a crucial decision for any business, and it becomes even more significant in a dynamic business environment like Dubai. An experienced accountant can provide valuable financial insights, ensure regulatory compliance, and contribute to the overall success of your business. However, choosing the right accounting firm in Dubai requires careful consideration and thorough evaluation. In this blog, we'll discuss five essential questions to ask before hiring an accountant in Dubai, helping you make an informed decision and find the perfect fit for your business needs.

1. What is Your Experience and Expertise in Handling Businesses in Dubai?

Understanding the accounting firm's experience and expertise in Dubai's business landscape is essential. Inquire about their track record of working with businesses similar to yours, their knowledge of local regulations and tax laws, and any specialized services they offer tailored to Dubai's market. This question can provide insights into the firm's familiarity with the unique challenges and opportunities of doing business in Dubai.

2. Are You Familiar with UAE Tax Laws and Regulatory Requirements?

Given the complexity of UAE tax laws and regulatory requirements, it's crucial to ensure that the accounting firm you choose is well-versed in local regulations. Ask about their experience in handling VAT compliance, corporate tax matters, and other regulatory obligations specific to Dubai. A knowledgeable accountant can help your business stay compliant and avoid potential penalties or fines.

3. What Services Do You Offer, and How Can You Add Value to My Business?

Beyond basic bookkeeping and tax preparation, inquire about the range of services offered by the accounting firm and how they can add value to your business. Look for services such as financial advisory, budgeting and forecasting, strategic planning, and business analysis. A comprehensive suite of services can help your business make informed decisions and achieve its financial goals more effectively.

4. How Do You Communicate and Collaborate with Clients?

Effective communication and collaboration are essential for a successful partnership with an accounting firm. Ask about their communication channels, frequency of updates, and responsiveness to client inquiries. Additionally, inquire about their approach to collaboration and whether they provide proactive recommendations and insights to help your business thrive. Clear communication and regular updates can ensure transparency and foster a productive working relationship.

5. What are Your Fees and Billing Structure?

Understanding the accounting firm's fees and billing structure is crucial for budgeting and financial planning purposes. Inquire about their fee structure, whether they charge hourly rates, flat fees, or a retainer-based model. Additionally, ask about any additional charges for specific services or unexpected expenses. Clarifying the fee arrangement upfront can prevent misunderstandings and ensure transparency in financial transactions.

Call To Action

Ready to find the right accounting firm for your business in Dubai? Contact Aristotle Tax Consultancy today for expert accounting services tailored to your needs. Our experienced team of professionals can help you navigate the complexities of Dubai's business environment, ensure compliance with local regulations, and achieve your financial objectives. Let us be your trusted partner on the journey to financial success in Dubai.

In conclusion, asking the right questions before hiring an accountant in Dubai is crucial for making an informed decision and finding the perfect fit for your business needs. By evaluating the accounting firm's experience, expertise, services, communication, and fees, you can ensure a successful partnership that contributes to the growth and success of your business in Dubai.

#aristotle tax consultancy#accounting firm in dubai#accounting services in dubai#accounting services

0 notes

Text

0 notes

Text

Streamlining Financial Management: How Accounting Software Can Help You Simplify Your Finances in Dubai

Introduction: In today's digital age, managing finances has become more accessible and efficient than ever before, thanks to the advent of advanced accounting software solutions. For businesses in Dubai, where the pace of commerce is rapid and the regulatory environment is dynamic, leveraging accounting software can be a game-changer. In this blog, we'll explore the benefits of using accounting software to simplify financial management in Dubai and how partnering with Aristotle Tax Consultancy can maximize the effectiveness of these tools.

Call To Action: Ready to take control of your finances and streamline your business operations? Let's explore how accounting software can revolutionize your financial management practices in Dubai.

What is Aristotle Tax Consultancy? Aristotle Tax Consultancy is a leading financial consultancy firm based in Dubai, UAE, specializing in a wide range of accounting, tax advisory, and business consulting services. With a team of seasoned professionals and a commitment to excellence, we empower businesses to achieve financial efficiency and success in Dubai's competitive landscape.

How Can Aristotle Tax Consultancy Assist?

Selection and Implementation: Our experts can help you choose the right accounting software solution for your business needs and assist with the implementation process to ensure a smooth transition.

Customization: We tailor accounting software configurations to align with your specific business requirements, ensuring optimal functionality and efficiency.

Training and Support: Our team provides comprehensive training and ongoing support to ensure that you and your staff are proficient in using the accounting software effectively.

Integration: We integrate accounting software with other business systems and tools to streamline workflows and improve data accuracy and consistency.

Reporting and Analysis: We leverage the robust reporting and analysis features of accounting software to provide valuable insights into your financial performance and facilitate informed decision-making.

Compliance: We ensure that your accounting software setup is compliant with local regulations and accounting standards, helping you avoid costly penalties and legal issues.

Call To Action: Ready to harness the power of accounting software to optimize your financial management practices in Dubai? Contact Aristotle Tax Consultancy today to learn more about our comprehensive accounting solutions and how we can help you achieve your business goals.

FAQs:

Q: What are the key features to look for in accounting software for businesses in Dubai? A: Key features to consider when choosing accounting software for businesses in Dubai include multi-currency support, VAT compliance, integration capabilities, user-friendly interface, and robust reporting and analysis tools.

Q: Is accounting software suitable for small businesses in Dubai, or is it primarily designed for larger enterprises? A: Accounting software is suitable for businesses of all sizes, including small and medium-sized enterprises (SMEs) in Dubai. Many accounting software solutions offer scalable options and customizable features to meet the needs of businesses at various stages of growth.

Q: Can accounting software help businesses in Dubai comply with VAT regulations? A: Yes, many accounting software solutions offer built-in VAT compliance features, such as automated VAT calculations, VAT reporting templates, and real-time updates to reflect changes in VAT regulations.

Q: How secure is accounting software in terms of data protection and confidentiality? A: Accounting software providers prioritize data security and confidentiality, implementing robust encryption protocols, access controls, and regular security updates to safeguard sensitive financial information from unauthorized access or breaches.

Q: Can accounting software be integrated with other business systems and tools used by companies in Dubai? A: Yes, most accounting software solutions offer integration capabilities, allowing seamless integration with other business systems such as CRM software, inventory management systems, and payment gateways to streamline operations and improve efficiency.

Q: How can Aristotle Tax Consultancy help businesses in Dubai maximize the benefits of accounting software? A: Aristotle Tax Consultancy provides comprehensive support and guidance throughout the accounting software implementation process, from selection and customization to training and ongoing support. Our expertise ensures that businesses derive maximum value from their investment in accounting software.

#aristotle tax consultancy#accounting firm in dubai#accounting services in dubai#accounting services

0 notes

Text

How to Incorporate a Media Company in the Dubai, UAE

Lights, Camera, Action! A Guide to Incorporating Your Media Company in the UAE

The UAE's media landscape is a vibrant tapestry of diverse voices and narratives. Are you a visionary filmmaker, a passionate publisher, or an innovative digital media entrepreneur ready to contribute to this dynamic arena? But before your story unfolds, navigating the legalities of incorporating a media company in the UAE can feel like a complex script. Fear not! Aristotle Tax Consultancy, your trusted guide through the UAE's business landscape, is here to demystify the process and help you launch your media masterpiece.

Understanding the Landscape:

First, let's break down the media universe in the UAE:

Print Media: Newspapers, magazines, and other printed publications require a license from the Ministry of Culture and Information.