#automation in ports

Explore tagged Tumblr posts

Text

ILA stops negotiations with USMX

The labor deal between US East and Gulf Coast ports and the International Longshoreman’s Association (ILA) may be unraveling. The current agreement expires at the end of September. It was a six-year deal. The major issue at present is an Auto Gate system Maersk and APM Terminals are using that processes trucks autonomously, with no ILA labor. The union claims this directly contradicts what was…

View On WordPress

#automation#automation in ports#container carriers#container shipping#Gulf Coast ports#ILA labor deal#labor negotiations#Logistics#longshoremen job protection#Maersk Auto Gate system#port associations#port automation#ports#supply chains#technology#union contract dispute#union retraining programs#US East Coast ports#USMX negotiations

0 notes

Text

youtube

Noël à Marseille : les automates de la Place Villeneuve-Bargemon dans leur bulle, les reflets dans le Vieux-Port (on entend les cloches des Augustins sonner), un Père Noël pêcheur et l'Ombrière sous laquelle un chanteur et un saxo reprennent "Let Her Go" de Passenger (dommage, obligé de leur couper le sifflet pour que la vidéo ne soit pas trop lourde et puisse être chargée !... Et même malgré ça, c'est compliqué. Je dois la publier sur ma chaîne Youtube puis en copier ici le lien. Pfff. Pas simple).

#marseille#noël#automate#pantin#ours en peluche#nounours#reflet#vieux-port#ombrière#passenger#let her go#place villeneuve-bargemon#saxo#saxophone

4 notes

·

View notes

Text

ehh. i'm generally pro-labor/pro-unions but this is really bad. keeping ports efficient is a matter of national interest. we are already falling behind the rest of the developed world on this front when we should be leading the way. covid showed us how even minor disruptions to the supply chain can have major effects on our economy.

if it's a short strike, effects will probably be minimal. but a longer strike will probably make inflation worse.

so biden's administration is in an iffy position. they can intervene and then lose some union votes or they don't intervene and get all the blame when inflation gets worse. i do not envy them.

#sorry but logistics is a special interest of mine -- especially port logistics#and i've been calling for automating our ports for years#it needs to happen#banning automation is just not an option#if this can't be resolved i hope the government intervenes -- a good example of america's quasi-tripartism#i don't care if the longshoremen get a raise or whatever#my only issue is this idea of a ban on automation

2 notes

·

View notes

Text

Enhancing Industrial Automation with High-Performance Allen Bradley Products

Allen-Bradley products have long stood at the forefront of industrial automation technology. Known for delivering reliability, integration flexibility, and high-speed processing, components like the 5069-L330ERMS3, 1734 ie8c, and 1783-SFP100FX are integral to building advanced control systems in manufacturing environments.

Compact and Secure Control: 5069-L330ERMS3

The 5069-L330ERMS3 Compact GuardLogix controller is engineered for applications requiring both high-speed motion control and enhanced safety. Featuring 3 MB of user memory and integrated safety functions, this controller delivers efficient communication and rapid execution rates. Designed to seamlessly fit into the Compact 5000 I/O platform, it ensures optimal performance in both standalone and distributed architectures. Its real strength lies in supporting SIL 3/PLe safety levels, a must-have for industries focused on compliance and worker protection.

Precision Current Input: 1734-IE8C

The 1734-IE8C module provides eight channels of current input in a compact form factor, making it ideal for space-constrained installations. As part of the POINT I/O family, it allows distributed control with minimal wiring and maximum configurability. This module supports 4–20 mA signals, which are widely used in process instrumentation for accurate data capture and signal integrity. It's particularly suited for systems where input scalability and ease of maintenance are critical.

Seamless Fiber Networking: 1783-SFP100FX

High-speed networking is essential in modern industrial setups, and the 1783-SFP100FX fiber transceiver meets that need with 100 Mbps Fast Ethernet capability over fiber optic cables. It offers improved noise immunity and extended communication distances, making it a solid choice for facilities with high EMI or geographically spread-out equipment. Used with Stratix switches, this hot-swappable SFP simplifies network expansion without downtime.

Final Thoughts

From safety controllers to scalable I/O and reliable fiber networking, Allen-Bradley Products like the 5069-L330ERMS3, 1734 ie8c, and 1783-SFP100FX represent smart investments in productivity and uptime. These devices not only improve performance but also bring future-ready flexibility to automation infrastructures.

#automation parts store#rocautomation#compactlogix allen bradley#ethernet module#ethernet port switch#Industrial Products

0 notes

Text

Why Choose Envision Enterprise Solutions?

Envision Enterprise Solutions stands out as a pioneer in delivering intelligent automation tools tailored for container terminals, ICDs, and depots. Here’s why forward-thinking terminal operators partner with Envision:

Domain Expertise

Envision has great industry experience working in maritime logistics, including seaport handling, inland container depots, CFS, and container terminals. This enables them to provide industry-specific solutions rather than generic software applied to ports.

End-to-End AI Integration

From yard operations and equipment control to customs clearance and documentation, Envision integrates AI across the entire operational lifecycle — making them a one-stop partner for digital transformation.

Proven Track Record

Through effective deployments in a number of countries, Envision's solutions have continued to enhance terminals' KPIs such as crane productivity, yard utilization, and turn times.

Scalability and Customization

Whether you're a small regional ICD or a high-volume seaport, Envision's modular solutions scale to your needs. The software is fully customizable to accommodate local operational nuances.

#ai powered solutions#maritime#terminals#ports#management#smart ports#artificial intelligence#envision#container#logistics#yard

0 notes

Text

Ultimate Guide to Investing in Industrial Real Estate in 2025

Key Takeaways Industrial real estate—including warehouses and data centers—provides a stable investment opportunity amid evolving U.S. commerce. Technology advancements and urban development are fueling demand and creating new avenues for growth within this sector. Understanding resilience factors and strategic approaches is essential for maximizing returns in 2025. Unlocking the Potential of Modern Industrial Spaces If you're thinking about where to grow your money in 2025, industrial real estate in the U.S. stands out like a beacon. Picture warehouses buzzing with activity and data centers powering daily life—these spaces drive modern commerce and offer you real stability. With technology shaping how goods move and cities evolving fast, you have a chance to get ahead. But what makes these properties so resilient, and which strategies will set you up for real success next year? Key Drivers of Industrial Real Estate Performance in 2025 In 2025, several powerful forces are shaping the future of industrial real estate in the United States. You’ll notice that e-commerce growth is driving high demand for warehouses, last-mile delivery hubs, and specialized cold storage. Innovative leasing has become common, as businesses want flexible terms that support inventory swings and supply chain resilience. Investors and developers need to watch out for growing threats like title fraud and squatting, which can cause significant financial setbacks if not proactively managed. Infrastructure investments are boosting areas near highways, ports, and major cities, making these locations even more valuable. Vacancy rates have risen slightly due to a steady pace of new deliveries, highlighting the importance of location and tenant quality when making investment decisions. Investors focus on properties that align with these trends—close to transportation and population centers, with smart upgrades like automation. You can see how lifestyle changes, like faster shipping expectations and the rise of subscription services, push demand further. If you understand these drivers, you’re better prepared to spot opportunities—and act dynamically. Pros and Cons of Industrial Property Investments Thinking about investing in U.S. industrial real estate? One big plus is the steady rental income you can get from long-term leases, especially when your tenants are reliable. Of course, it’s not all smooth sailing—you’ll need to keep an eye on vacancy risks and changes in demand, since even solid markets can shift unexpectedly. Industrial real estate values have outpaced retail and office sectors in recent years, making this sector particularly attractive for investors seeking growth. The good news is that spotting the right opportunities for upgrades can't only increase your property’s value, but also help you stay ahead of the competition. Rental Income Stability Although real estate investments come in many shapes and sizes, industrial properties often stand out for their reliable rental income. If you want steady returns, you'll appreciate how tenant diversification cushions you against single-company downturns. Leasing to multiple tenants spreads your risk and keeps income flowing, even if one renter leaves. With lease escalation clauses, you benefit from regular rent increases—national in-place rents grew 6.6% to 6.7% year-over-year in Q1 2025, showing exceptional income growth. Unlike other sectors, industrial buildings typically require fewer costly improvements. This means your net returns are stronger, and you'll spend less time on renovations. Rising vacancy rates in some regions—now at 8% nationally and higher in places like Phoenix and Chicago—may pose a challenge for income stability, highlighting the importance of choosing your market carefully. However, some regions haven't matched national averages, and shrinking lease rate spreads might test future rent gains. Still, strong demand makes income stability a leading advantage. Vacancy and Absorption Risks

Steady rental income can bring peace of mind, but every investment comes with its own set of challenges. When you invest in industrial real estate, vacancy and absorption risks are never far behind. Vacancies in the U.S. industrial market climbed to 8.5% in early 2025, as new developments outpaced demand. Notably, regions like New Jersey experienced the highest rent growth at 11.3%, signaling that while some markets see strong pricing power, high rents could also limit the pool of prospective tenants. You might see rents cool and your income shrink if market saturation grows or if technological disruption alters the way tenants use space. Net absorption has slowed, which means fewer new tenants are filling spaces. Higher long-term interest rates and uncertain trade policies also add to the risk. To protect your investment, diversify across locations, watch for signs of market saturation, and remain alert to changes caused by technological disruption and shifting economic conditions. Value-Add Opportunities If you’re looking to shape the future of American industry—and capture strong returns along the way—value-add industrial real estate offers a unique playground. Picture an older industrial park filled with outdated warehouses. By upgrading these spaces with warehouse automation and modern layouts, you can reset below-market rents and appeal to logistics and e-commerce tenants craving efficiency. Industrial assets offer stability and cost efficiency for investors, giving owners a dependable income stream even as improvements are underway. Renovating older stock for hybrid uses—like blending manufacturing and logistics—taps into reshoring trends and drives above-average returns. Still, you should weigh the risks: locked-in leases may slow your rent resets, while supply chain delays can spike redevelopment costs. Retrofitting for ESG standards or specialized tenants adds complexity. Success depends on market timing, smart tenant mixes, and keen analysis of national and local demand swings. Comparing Industrial and Commercial Real Estate Sectors When you look at the environment of industrial and commercial real estate in the U.S., it feels a bit like comparing a steady mountain to a rolling hill. Industrial real estate offers you a trail marked by strong historical trends, while commercial sectors can feel unpredictable. If you’re thinking about market diversification for your portfolio, studying these differences is key. Industrial spaces usually show steady growth and low vacancy rates, making them dependable no matter the economic forecast. Notably, industrial properties remain stable, with vacancy rates held at 6.8% in Q3 2024, driven by ongoing demand from e-commerce and logistics. In contrast, commercial properties like offices and retail spaces often react faster to market ups and downs. Here are four things to think about when comparing these sectors: Industrial properties often have lower vacancies. Industrial investments thrive on stability and cost efficiency. Commercial spaces face higher volatility. Market diversification often favors industrial for steady returns. Warehousing Demand and Distribution Center Growth Have you noticed how quickly packages show up at your door these days? That speed isn’t luck—it’s a direct result of booming warehousing demand and rapid distribution center growth. E-commerce continues to soar, driving the need for more warehouse space across the U.S. In 2025, expect warehouses to expand even more, powered by Innovative Parcel Logistics and Automated Inventory Management. These tools help companies deliver products faster and handle larger volumes with precision. Vacancy rates are expected to rise intermittently as new facilities enter the market, but strong demand continues to keep the sector healthy. Industry disruption from agile new entrants has also pushed companies to improve speed and efficiency in warehouse operations. Distribution centers are also strategically popping up closer to major cities, making deliveries quicker and more reliable.

Automated technology ensures operations run smoothly, saving both time and money. As consumer spending rises and supply chains get smarter, investing in warehouses becomes essential for meeting the ever-growing demands of modern logistics. Role of Data Centers and Flex Space in Portfolio Diversification As boxes move faster from warehouses to your doorstep, another quiet revolution is changing what industrial real estate can do. You're seeing a surge in data centers, thanks to massive AI infrastructure needs and the shift from pure logistics to tech-driven assets. In order to maximize return on investment, strategic management practices, such as regular inspections and open communication, should also be applied in evaluating these emerging property types. Flex spaces—offering hybrid office, storage, and light manufacturing—let you tap into cross-sector synergy, making your portfolio nimble and resilient. In the U.S., blending data centers and flex space helps you steer market shocks, as each asset’s strengths offset the other's risks. Today, about 60% of public REIT market cap now sits outside traditional sectors like pure industrial, helping you benefit from much broader diversification when adding new asset types to your portfolio. Here’s how you can benefit: Capture stable returns as AI infrastructure fuels the need for data centers. Diversify risk by adding flex space with adaptable leasing. Maximize value via conversions between asset types. Leverage cross-sector synergy in growth markets. Evaluating Industrial REITs Versus Direct Investment Though many investors dream about owning a warehouse or high-tech facility, you don’t need millions to step into the world of industrial real estate. You can begin with Industrial REITs, buying shares for as little as $50, letting you enjoy income without the headaches of direct ownership. But if you crave control—setting up biometric security, choosing tenants, or driving ethical investing decisions—direct investment may suit you better. Compare your options: Recent market data shows that Industrial REITs delivered competitive total returns through both dividends and capital appreciation in 2025. Building a financial cushion is a critical strategy that helps investors navigate market cycles and take on opportunities in both REITs and direct ownership. Feature Industrial REITs Capital Needed Low (share price) Liquidity High (sell shares) Yield 3.96%–12.27% (2025) Management Professional teams Risk Diversified portfolio REITs let you submerge quickly and ethically, but direct investment rewards hands-on effort and customization. Your path depends on your vision. Build-to-Suit Projects and Customization Trends We’re seeing a real shift across the U.S. as more companies look for spaces designed specifically for them—everything from high-tech manufacturing facilities to last-mile delivery centers. With build-to-suit projects, it’s all about meeting those unique requirements, whether that means installing extra-tall ceilings for automation or adding on-site solar panels for sustainability. Creating the right environment through brand storytelling can also make these spaces more attractive and memorable for tenants. Additionally, as demand-driven project pipeline continues to lag behind due to zoning hurdles and construction slowdowns, these customized facilities give tenants the certainty and operational efficiency that speculative development can’t match. By responding to these needs, you’re not just providing a building; you’re actively shaping what’s next for American industry. Growing Demand for Customization While industrial real estate keeps changing, the demand for build-to-suit projects and tailored spaces has taken center stage across the U.S. You’ll notice a shift from traditional, cookie-cutter warehouses to spaces designed for specific industries and advanced manufacturing needs. This new trend isn’t just about fancy upgrades—it’s rooted in the historical development of industry and our growing urban infrastructure.

As companies aim to stay ahead, they’re asking for more custom features than ever before. Build-to-suit projects are increasingly popular as tenants want to secure long-term leases in facilities precisely designed for their needs, which also helps reduce the risk of oversupply in certain sectors. Here’s why this matters for you: Semiconductor and EV growth: These industries need specialized buildings due to technical demands. Advanced technology support: Custom facilities help companies integrate automation and AI. Environmental responsibility: Tenants want eco-friendly buildings to meet regulations. Flexible design: Adaptable spaces prepare you for future changes in your business model. Tenant-Driven Design Features Demand for tailored spaces isn’t just a trend—it’s completely changing the way industrial properties are built and used across the U.S. Today, tenants expect more than four walls and a roof. They want high-tech infrastructure, automation, and smart technology woven into every detail. Build-to-suit projects let you offer true space customization, making your property align perfectly with tenants’ unique business needs. As technology-enabled properties that elevate tenant engagement become a top opportunity in commercial real estate, integrating digital building systems and flexible infrastructure is not just expected but increasingly essential for attracting quality tenants. Integrate AI-driven features and energy-efficient systems to deliver tenant amenities that boost productivity and comfort. Consider wellness zones, flexible workspaces, and sustainability features—adding value for companies focused on innovation and employee satisfaction. When you focus on tenant-driven design features, you don’t just attract tenants; you build loyalty and long-term partnerships that can set your industrial investments apart in the 2025 market. Understanding Cap Rates and High-Yield Industrial Assets Even as the market keeps shifting, understanding cap rates is one of the most important skills for investors looking to spot high-yield opportunities in U.S. industrial real estate. Cap rates show the return you’ll get compared to the property’s price, making them a key measure when sizing up deals. If you’re eyeing high-yield assets, pay special attention to industrial zoning and environmental regulations—these often impact both property value and long-term returns. Over the past year, cap rates have declined across all classes, supporting sustained investor demand even in uncertain times. Now, consider these essentials: Cap rates for Class A, B, and C properties vary, so know your target range. High-yield assets usually sit in strong markets like Dallas or Miami. Interest rates and GDP growth directly influence cap rate trends. Tenant quality and mid-sized facility demand drive leasing success. Think smart, act informed—maximize your gains. Off-Market Strategies for Sourcing Industrial Deals Spotting the right cap rate is just one piece of the high-yield puzzle—but getting first crack at a high-potential industrial property gives you a real edge. You can tap into off-market strategies by reaching out directly to property owners, networking at industry events, and partnering with skilled real estate agents who know the local U.S. market. Taking inspiration from business leaders who emphasize community connections, building sincere relationships can enhance access to off-market opportunities and long-term deal flow. Leverage data-driven platforms to spot hidden gems and build a reputation that attracts exclusive opportunities. As the industrial and manufacturing sector is projected to be a top investment opportunity in 2025, focusing on these properties can align your strategy with emerging demand and strong fundamentals. Off-market deals let you secure properties with lower competition and often better pricing. These strategies also offer the opportunity for innovative leasing or leasing consolidation, letting you tailor deals to tenant needs and boost value.

Still, be prepared: information can be scarce, due diligence matters, and strong negotiation skills will be vital. Top U.S. Metro Areas for Industrial Investment in 2025 Thinking about diving into industrial real estate? Coastal cities such as Jacksonville and Houston are still standout choices, thanks to their strong port access and solid infrastructure. Meanwhile, inland markets like Dallas-Fort Worth and Kansas City are gaining serious traction, driven by rapid growth and supportive local policies. Notably, metropolitan areas are central hubs of economic activity across the US, fueling much of the national momentum in industrial sectors. In cities like St. Louis, recent urban renewal efforts and major new funding are transforming former decline into opportunity, paving the way for dynamic investment environments. Whether you’re leaning toward the coasts or looking inland, there’s a lot to consider—let’s take a closer look at what makes these top metro areas so appealing for industrial investment in 2025. Coastal Cities Outperform Peers While many cities compete for your investment, coastal cities across the U.S. stand out as powerful hubs for industrial real estate in 2025. These cities thrive on port synergy and have demonstrated impressive coastal resilience, even in the face of climate risks. If you’re searching for vibrant options, look closely at places like Jacksonville, Miami, Tampa, and Houston. Coastal cities are also benefiting from international appeal and strong commercial real estate activity, which further accelerates investor interest and development potential. Why do these markets outperform their peers? Consider these advantages: Expanding infrastructure: Upgraded ports and logistics drive steady demand. Demographic growth: Rapid population increases fuel the need for industrial spaces. Diverse economies: Cities with varied industries provide stability and growth. Robust job markets: Employment growth supports long-term investment success. Inland Hubs Gain Momentum Coastal cities often steal the spotlight, but it’s the nation’s inland hubs that are rapidly building a new kind of industrial real estate powerhouse for 2025. If you trace historic trends, you’ll see places like the Inland Empire, Houston, and Richmond steadily claiming more investor attention. Surging leasing activity, import growth, and expanding logistics networks set these markets up for strong returns. But you should recognize market challenges too—price disparities and shifting tenant needs demand a smart strategy. Houston’s economic diversification and affordable operations offer resilience, while Phoenix and Nashville leverage regional connections to shine. Markets with growing populations and job opportunities serve as a foundation for sustainable industrial real estate growth in these regions. Inland Empire’s robust sales and import-driven demand showcase its unmatched momentum. When you look beyond the coasts, you’ll discover inland hubs rewriting the industrial investment story. Industrial Property Financing and Lending Options Curious about how you can finance your next industrial property deal? You've got a range of options to contemplate, each with its own advantages and lending requirements. In 2025, U.S. industrial real estate investors face fierce competition due to high demand, higher interest rates, and evolving loan products. As you explore financing, remember that lease negotiation skills and landlord incentives might boost your deal’s appeal, especially when working with alternative lenders or during seller financing discussions. Keeping regular inspections in mind can also minimize costly damages to your property investment over time. Commercial loans generally have shorter terms and require larger down payments compared to residential mortgages, meaning that you should prepare for a significant initial investment when seeking your industrial property loan. Here are four key lending options to review:

Bank Loans: Offer flexible leverage but require strong credit and business history. Life Company Loans: Favor long-term, stable properties for risk-averse investors. CMBS Loans: Provide large-scale, competitive loans with stricter terms. Hard Money Loans: Deliver fast, short-term capital, typically at higher rates. Cash Flow Analysis for Industrial Properties Once you’ve figured out your financing, it’s time to look closely at how much money your industrial property will actually put in your pocket. Cash flow analysis starts with your net operating income (NOI)—that’s the money left after subtracting key expenses like taxes, insurance, maintenance, and utilities from your total rent. Many investors also deduct a standard vacancy factor from potential rent to account for unoccupied periods or non-paying tenants, ensuring their projections are realistic. U.S. industrial spaces often offer stable cash flows because leases run longer and tenant turnover stays low. When determining your timeline for returns, remember that break-even points on industrial properties are typically reached after several years, depending on market conditions and total costs. As industrial automation and shifting supply chain dynamics keep driving demand, you’ll want to project future cash flows with a Discounted Cash Flow (DCF) model. Check cash-on-cash returns, IRR, and make sure debt service coverage is healthy. Don’t overlook possible costs for capital repairs or changing tenant needs. Smart cash flow analysis puts you in control of your investment’s future. Navigating Leasing Trends and Triple-Net Lease Structures As you explore the world of U.S. industrial real estate, leasing trends and triple-net lease structures quickly become key to your success. Leasing activity is booming, especially for modular spaces, as tenants seek agility for industries like battery technology and urban farming. Triple-net leases let you offload most property expenses and enjoy more stable cash flow, but tenants are taking on rising operational costs. Warehouse lease renewals are costlier than ever, with U.S. asking rents reaching $10.13/SF in Q4—a 61% increase from Q4 2019.] To steer through today’s market, keep these essential tips in mind: Focus on mid-sized logistics facilities for robust demand. Explore secondary markets with lower land costs and faster permitting. Prioritize properties with sustainability features—these attract higher-paying tenants. Choose newer, build-to-suit assets when possible; they reduce default risks and vacancy. Stay informed and adapt to maximize your returns. Industrial Asset Management: Best Practices and Tips Even in a fast-changing world, strong asset management sets you apart in U.S. industrial real estate. To thrive, you need to blend industrial innovation with asset resilience. Start by focusing on effective expense management, always watching costs, and using smart budgeting tools. Schedule regular maintenance, so problems never become expensive surprises. Build open, reliable communication with your tenants and vendors—you’ll cultivate loyalty and trust. Here's a quick reference table: Best Practice Benefit Preventive maintenance Fewer unexpected repairs Energy efficiency Lower utility costs Tenant feedback Higher tenant retention Manage financials diligently—keep your cash flow strong and understand every cent. Finally, lead proactively by planning capital improvements and always refining your emergency responses. Driven asset management builds sustainable value—and your edge in the market. Don't overlook the impact of quality paints on both property durability and visual appeal, as selecting the right products can help your assets retain their value over time. Underwriting and Valuation of Industrial Real Estate Deals When you’re underwriting industrial real estate deals, think of it as taking a deep dive into the property’s future cash flow—will it stay steady and strong, or are there risks that could throw things off course?

It’s important to make sure your rent growth projections actually reflect what’s happening in the local market; guessing too high can really skew your investment outlook. And don’t forget to pay close attention to vacancy and absorption rates, since these will give you a clear idea of how quickly you can lease up any empty space and keep your money working for you. Incorporating upgrades that boost property value and enhance safety, such as modernized electrical systems, can also play a key role in improving long-term returns and retaining tenants. Now that we’ve covered the basics, let’s take a closer look at the different valuation approaches you can use for industrial properties. Evaluating Cash Flow Potential How do you really know if an industrial property will bring in steady cash flow? You need to dig into the details that truly impact an investment’s success. Environmental impact can affect a property’s long-term appeal, while zoning regulations can limit or boost potential uses. Next, it’s imperative to review market data and measure operational efficiency. Here’s how you can evaluate cash flow potential: Analyze tenant mix and lease structure: Reliable tenants and strong leases create predictable income streams. Review historical sales prices and vacancy rates: Past market performance sets a baseline for future expectations. Check financial statements and property appraisals: These help verify the property’s real income and expenses. Examine key metrics: Pay attention to Loan-to-Value (LTV), Debt Service Coverage Ratio (DSCR), and Net Operating Income (NOI). Assessing Rent Growth Assumptions Looking beyond cash flow, you also need to judge whether rent growth assumptions in industrial real estate deals make sense. In 2025, experts project modest rent increases—just 1–3% nationwide, even though some Southern markets might see stronger gains. Pay close attention to market regulation and zoning policies, because they shape how much new supply can enter an area and affect rent trends. While concessions like free rent are increasing, they lower the true rent landlords collect. Some areas, like Los Angeles, are even experiencing rent drops of over 10% year-over-year. Always dig into local data: Are zoning policies limiting new projects? Is market regulation keeping growth in check? Use this research as your guide—it’ll help ensure your assumptions reflect reality, not just wishful thinking. Analyzing Vacancy and Absorption In industrial real estate, understanding vacancy and absorption trends can make or break your investment strategy. You need a sharp eye on both historical vacancy and current market absorption to stay ahead. With national vacancy rates hitting decade highs—nearing 8.5%—and market absorption lagging behind the swell of new supply, you must read the market’s pulse. Some regions—Miami and Seattle, for example—still show strong tenant interest, but national numbers tell a cautionary tale. Here’s how to decode these shifts: Review historical vacancy—watch for patterns that signal risk or opportunity. Compare supply deliveries to market absorption each quarter. Identify markets where excess supply threatens rent growth or lease renewal. Adjust your underwriting to include higher vacancy and slower absorption in 2025. Stay vigilant to safeguard your investments. Value-Add and Adaptive Reuse Opportunities While many investors focus on buying and holding, true growth often comes when you breathe new life into industrial properties. Think of it as industrial art—turning overlooked warehouses into supply chain masterpieces. You can target under-leased spaces and raise rents to match the market. Upgrade with energy-efficient lighting, HVAC, or better insulation to spark tenant interest and cut costs. Expand loading docks, add cold storage, or even automate with smart tech to make your property stand out. Adaptive reuse is powerful, too—old malls can become ultimate last-mile delivery hubs if you focus on strong structural features and the right zoning.

Evaluate local demand, especially where e-commerce drives growth. By creatively repositioning assets, you can transform forgotten buildings into high-demand supply chain anchors. As you implement these strategies, consider how tokenized investments are also making it possible to diversify your capital allocation and enhance the liquidity of industrial real estate portfolios. Industrial Property Tax Planning and Incentives Even small steps in industrial property tax planning can open big savings and reshape your investment returns. Tax incentives aren’t just past stories—they’re active tools you can use now to thrive in 2025. By understanding historical tax incentives and current zoning regulations, you position your industrial real estate projects for maximum financial success. Here's how you can benefit today: Apply for abatement programs: Explore GPLET for 8-year property tax breaks or site-specific PILOT deals. Claim equipment exemptions: Seize the new $500,000 personal property tax exemption for machinery. Leverage clean energy credits: Use Section 48E for solar, microgrid, and storage tax credits, with extra bonuses for U.S.-made content. Access regional programs: Target Opportunity Zones with zoning fast-tracks and local job training reimbursements. Incorporating a sustainability focus into your industrial property tax strategy not only increases cost savings but also aligns your investments with emerging industry trends and long-term viability. With the right strategy, every tax dollar saved fuels your property's long-term growth. Impact of Logistics and Last-Mile Distribution on Site Selection New tax incentives can set your investment up for bigger wins, but smart owners look beyond the balance sheet. When you pick a site for industrial real estate, you need to understand how last-mile logistics shape demand. E-commerce giants and smaller retailers want warehouses close to customers, even if urban congestion pushes up costs. They're grabbing urban micro-fulfillment sites fast, despite tough zoning rules and higher property prices. Automation and AI-powered routing let teams overcome traffic and make those costly miles count. At the same time, facilities with strong EV infrastructure get priority, as green fleets become the norm for U.S. cities. If you pick real estate near EV charging corridors and labor pools, you set yourself up for enduring investment value. Just as strategic painting choices can boost demand in residential rentals by appealing to broad audiences and enhancing key features, selecting sites that maximize natural light, flexibility, and operational efficiencies can give your industrial properties a competitive edge. ESG and Energy Efficiency in Modern Warehousing So, if you’re aiming to future-proof your warehouse investment, putting sustainable building standards and green technologies front and center is key. Opting for energy-efficient materials and integrating smart systems isn’t just about doing what's right for the environment—it’s a smart move for your bottom line, too. Not only will you see reduced operating costs, but your property’s value and reputation in the U.S. market will also get a boost. Upgrading to LED lighting solutions can significantly enhance warehouse appeal, cut long-term energy expenses, and position your property as a modern, eco-friendly asset in a competitive market. Now, let’s take a closer look at some of the latest ESG innovations shaping warehouses today. Sustainable Building Standards While the industrial real estate market keeps growing, today’s warehouses must do more than just store goods—they need to meet strong sustainability and energy efficiency standards. Adopting sustainable building standards and seeking green certifications is no longer optional if you want to stay competitive and compliant in the U.S. Sustainable buildings prove you’re serious about both meeting regulations and making a positive environmental impact. When you invest in a warehouse, follow these steps:

Align your facility’s design with current U.S. energy codes and sustainability regulations. Aim for respected green certifications, such as LEED or ENERGY STAR, to show stakeholders your commitment. Conduct regular energy audits to reveal possible improvements. Use recycled materials and eco-friendly roofing to further boost efficiency and ESG alignment. Future-focused buildings can inspire responsible growth. Green Technology Adoption How can you make a real impact on both your bottom line and the planet? Start by adopting green technology in your warehouses. Switch to LED lighting—it cuts energy use by 75% and lasts much longer. Add AI integration to control lights and automate schedules, ensuring you only use energy when you need it. For climate control, smart thermostats and predictive maintenance keep HVAC costs down and comfort up. Solar incentives make installing solar panels practical, boosting energy savings and qualifying you for tax breaks. Use emission-reducing strategies like electric yard trucks and AI-powered dock scheduling to slash pollution and avoid EPA fines. And don’t forget sustainable packaging—buyers appreciate it, and U.S. regulations reward your effort. Green tech leads to lower costs and enduring returns. CRE Market Cycles and Distress Investment Opportunities in 2025 As 2025 approaches, you’ll notice the industrial real estate market shifting into a fresh cycle, opening doors for bold investors who are ready to plunge into new opportunities. Understanding market timing is key, especially as interest rates normalize and economic growth fuels new activity. Many cities update zoning regulations, making certain locations even more valuable if you spot them early. With demand for high-quality spaces rising, older properties may become distressed, but that’s where you can find great deals if you act strategically. Consider these opportunities: Pinpoint markets with favorable zoning regulations and supply-demand imbalances. Seek distress opportunities in outdated industrial properties, then renovate. Monitor market timing to buy low as vacancies increase. Diversify into data centers, as digital economy trends drive demand. Success means seizing the cycle’s best moments. Frequently Asked Questions (FAQ) 1. Why is industrial real estate such a hot investment in 2025? Because it offers stability, consistent demand, and high adaptability. With e-commerce, AI, and logistics booming, warehouses and data centers are essential infrastructure, and investors are capitalizing on that. 2. What types of industrial properties are best for investment? Top performers include distribution centers, cold storage facilities, data centers, and flex spaces. Build-to-suit and value-add properties also offer strong returns when customized for modern needs. 3. Should I invest directly or go through an Industrial REIT? It depends on your goals. REITs offer easy entry and liquidity. Direct investment gives you more control and potentially higher returns, but requires more capital and involvement. 4. How do I find good industrial deals in today’s market? Look off-market first—via brokers, networking, or direct outreach. Prioritize areas with strong port access, major highways, and population growth, like Jacksonville, Dallas, or Kansas City. 5. What are the biggest risks in industrial investing? Rising vacancy rates, tech disruption, and market saturation. Poor location choices or ignoring due diligence (like zoning or environmental factors) can also hurt long-term returns. 6. How much money do I need to start investing in industrial real estate? Direct ownership usually requires six to seven figures, but you can get started with as little as \$50 by investing in Industrial REITs or through crowdfunding platforms. 7. What are triple-net leases, and why do they matter? A triple-net (NNN) lease means the tenant covers property taxes, insurance, and maintenance. For landlords, this reduces expenses and creates more predictable cash flow.

8. Are tax incentives available for industrial property investors? Yes. Programs like GPLET, Opportunity Zones, and green energy tax credits (like Section 48E) can significantly lower your costs and increase long-term profitability. 9. What makes a good market for industrial real estate? Strong infrastructure, population growth, business-friendly policies, and logistics demand. Inland and coastal hubs like Phoenix, St. Louis, and Houston check many of these boxes. 10. Is industrial real estate good for buy-and-hold strategies? Absolutely. Long leases, durable tenants, and steady income make it ideal for buy-and-hold. Value-add upgrades and sustainability features can further boost appreciation. Assessment Building Your Industrial Real Estate Future So, as you look at the crossroads of risk and reward, picture your future anchored by dependable warehouses and innovative facilities, not just the ups and downs of the stock market. Industrial real estate is all about trading some guesswork for more predictable, steady growth. Whether you’re eyeing those busy coastal ports or the steady potential in inland hubs, there’s a space to fit your investment style. Maybe it’s investing in data centers or making older warehouses greener—every move shapes the landscape of tomorrow. The journey might have its bumps, but with a clear strategy and an eye for opportunity, industrial assets can become your stepping stone to lasting success. Ready to take the next step? Explore industrial real estate opportunities and start building your bridge to a solid investment future.

#absorption rate#AI Integration#automation#build-to-suit#cap rates#cash flow#crowdfunding#data centers#economic hubs#energy efficiency#ESG compliance#EV infrastructure#flex space#Industrial#Industrial Investment#last-mile logistics#leasing trends#loan options#market diversification#net leases#NOI#Phoenix Arizona#port access#Portfolio diversification#real estate trends#solar upgrades#sustainability#tenant retention#warehouse expansion#Zoning

0 notes

Text

Why General Cargo Terminals (GCTOS) Need Automation

Diverse Cargo Requirements

General cargo can include anything from timber and wind turbine blades to industrial boilers. Each type requires different lifting equipment, safety procedures, and storage conditions—making manual coordination complex and risky. This is especially true in environments that need both break-bulk cargo management and bulk cargo handling software.

High Volume and Turnover

Busy terminals may handle thousands of different cargo items monthly. Tracking these items manually often leads to misplaced shipments, lost revenue, and customer dissatisfaction.

Documentation Overload

Handling general cargo requires numerous documents—delivery notes, customs declarations, loading instructions, hazardous materials forms—each with stringent regulatory compliance requirements.

Limited Visibility

Without real-time digital tracking, it’s nearly impossible to know where a specific cargo item is, how long it’s been stored, or whether it has cleared customs. This visibility gap causes disruptions across the logistics chain.

Global Compliance Requirements

General cargo often involves international shipping regulations and customs protocols. Automation ensures documentation is consistent, timely, and compliant with international standards.

#ai powered solutions#automation#maritime#ports#terminals#container#artificial intelligence#envision#logistics#management#smart ports

0 notes

Text

How Envision General Cargo TOS Automates the Process

Gate Operations Digitized

Envision’s system streamlines in-gate and out-gate processes by enabling pre-arrival data entry and real-time validation at the terminal gate. Drivers can use mobile apps or smart kiosks, reducing waiting time and human errors. Integration with ANPR (Automatic Number Plate Recognition) and biometric authentication ensures secure and smooth operations.

Cargo Profiling and Intelligent Allocation

The system automatically profiles cargo upon arrival—analyzing weight, dimensions, handling instructions, and hazard level—to recommend the optimal storage location. This feature ensures efficient use of yard space while improving safety and accessibility.

Digital Job Order Management

Job orders for receiving, shifting, and delivering cargo are automatically generated and dispatched to yard equipment or workforce management systems, ensuring task traceability and accountability. This minimizes idle time and human intervention. These capabilities are vital in any advanced multi-cargo terminal operating system.

IoT and RFID Integration

Consignment marked with RFID or IoT sensor-equipped cargo may be tracked as it moves during the course within the terminal. This facilitates ahead-of-time remedy of issues like detection of temperature violations for critical products or notifications for delay in movement of goods. The result is enhanced operational transparency and customer satisfaction.

Vessel Planning and Stowage Optimization

Using AI-driven algorithms, Envision TOS aids berth planning and stowage optimization. This ensures cargo is loaded or unloaded in the most efficient sequence, minimizing crane movement and berth occupation time. These optimizations are crucial in car terminal TOS and Ro-Ro TOS operations where loading sequences matter.

Hazardous Cargo Management

Envision TOS includes a special module for dangerous goods, incorporating IMDG regulations and automated alerts to prevent unsafe stacking or proximity to incompatible items. It enables real-time compliance monitoring and risk mitigation.

Customizable Billing Engine

Whether charging by weight, cubic meter, type of service, or duration of storage, Envision’s flexible billing engine calculates everything automatically and generates transparent invoices. The system also supports multi-currency and tax scenarios, simplifying financial operations.

EDI and API Integration

The system supports EDI/API integration with customs, shipping lines, freight forwarders, and port community systems, enabling smooth data exchange and eliminating redundant entries. It promotes seamless collaboration across the logistics ecosystem.

Business Benefits of Using Envision General Cargo TOS

Accelerated Turnaround Time

Automated workflows enable faster processing of job orders, gate movements, and cargo releases—cutting turnaround times by up to 40% in many deployments.

Revenue Leak Prevention

Digital records prevent billing errors, missed charges, and underreported storage times—plugging revenue leaks and improving bottom lines.

Boosted Throughput and Terminal Capacity

With optimized yard space and real-time tracking, terminals can process more cargo in the same footprint without investing in infrastructure expansion. This is particularly beneficial for multi-purpose terminal automation.

Operational Transparency

Stakeholders—from shipping lines and customs agents to cargo owners—can access live cargo status, schedules, and reports, improving communication and service quality.

Labor Optimization

Automated scheduling and workload balancing allow better utilization of human resources, leading to cost savings and improved morale.

Enhanced Safety

By integrating safety protocols into system logic, Envision reduces risks associated with heavy or hazardous cargo and ensures compliance with international regulations.

Sustainability Gains

Envision TOS supports green terminal initiatives by reducing paper use, optimizing fuel consumption in yard operations, and enabling environmentally conscious logistics practices.

#ports#maritime#artificial intelligence#container shipping#logistics#business#commercial#automation#digital transformation#envision

0 notes

Text

International Women’s Day: Meet the women who operate automated cranes at Vizhinjam international port in Thiruvananthapuram

As we make our way to the Port Operations Building (POB) inside the expanding Vizhinjam international port in Thiruvananthapuram on a sweltering afternoon, we expect to hear the buzz of vehicles and people moving around. However, near-deafening silence welcomes us. But once we are inside the POB, the scene changes. All the action happens here, in the remote control operations (RCO) room, where a…

#Adani Vizhinjam Port Private Ltd#International Women’s Day#Vizhinjam only automated port in India#women crane operators at Vizhinjam international port#women operate automated CRMG cranes

0 notes

Link

new song discovered! it's from the album La nuit porte conseil by Black M and it's called La nuit porte conseil. on a scale of 1 - 100 this song rates 28 in popularity.

1 note

·

View note

Text

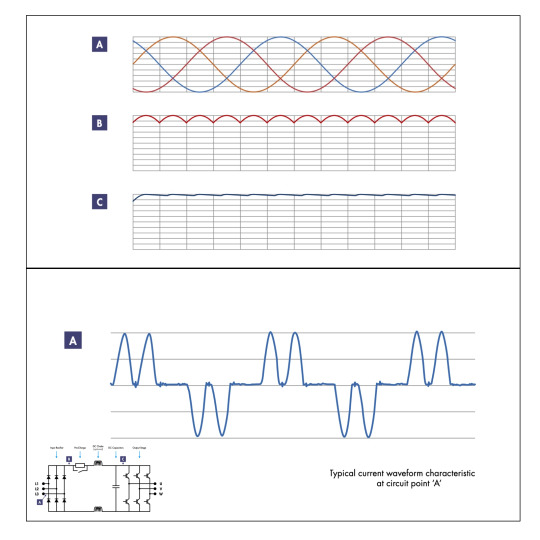

VFD Circuit Design (Continued) - Variable Frequency Drives

The VFD Exchange

#variablefrequencydrives#vfd#acdrives#industrial#controlsystem#acmotors#variablespeed#variabletorque#inverters#drives#electrical#engineering#automation#volts#amps#kilowatts#1phase#3phase#manufacturing#crushers#quarries#farms#agricultural#heating#ventilation#airconditioning#irrigationpump#watersupply#marine#ports

0 notes

Text

Time On Target Security | Security System Supplier | Home Automation Company in Port Richey FL

Time On Target Security has a well-earned reputation as the most trusted Home Automation Company in Port Richey FL. We offer advanced solutions to transform your home into a smart, secure, and efficient space. Our expertise in home automation systems enables us to integrate state-of-the-art technology seamlessly into your daily life, enhancing convenience and control. As a leading Security System Supplier in Port Richey FL, Time On Target Security provides comprehensive security solutions, including CCTV, video monitoring, and analytics. We are dedicated to ensuring your safety with robust systems designed to monitor and protect your property around the clock. Get in touch, and let us help secure your home.

#Security System Supplier in Port Richey FL#Home Automation Company in Port Richey FL#Security Camera Installation near me#Home Automation Service near me#Home Security Company near me

1 note

·

View note

Text

How Advanced Components Like the 1769-L24ER-QBFC1B and Industrial Ethernet Switches Are Shaping Smarter Automation

Industrial automation continues to evolve, with modern facilities prioritizing real-time communication, precise control, and seamless device integration. From intelligent controllers to advanced networking gear, the foundation of smart manufacturing relies heavily on dependable hardware. Among the standout tools enabling this transformation are the 1769-L24ER-QBFC1B, the compact yet powerful Allen Bradley controller series, versatile Industrial Ethernet Switches, and legacy-supporting adapters like the 1784-U2DHP.

Why Controllers Like the 1769-L24ER-QBFC1B Matter

Tight control over machine processes starts with the right logic controller. The 1769-L24ER-QBFC1B, part of Allen Bradley's CompactLogix line, is built for integrated motion and control applications. Offering embedded digital, analog, and high-speed counter I/O, this controller is particularly effective in systems where space is limited, but versatility cannot be compromised.

Its dual Ethernet ports support device-level ring topologies, adding fault tolerance and reducing downtime—a critical factor in high-output environments.

The Role of a Modern Allen Bradley Controller in Scalable Systems

Modern automation isn’t just about basic on/off control; it's about data-driven decisions, predictive maintenance, and remote diagnostics. The Allen Bradley controller family—such as the 5069-L320ERMS3—brings high-speed processing, built-in safety, and seamless integration with Studio 5000 software, supporting everything from packaging lines to advanced robotics. These controllers enable synchronized motion, streamlined programming, and scalable deployment.

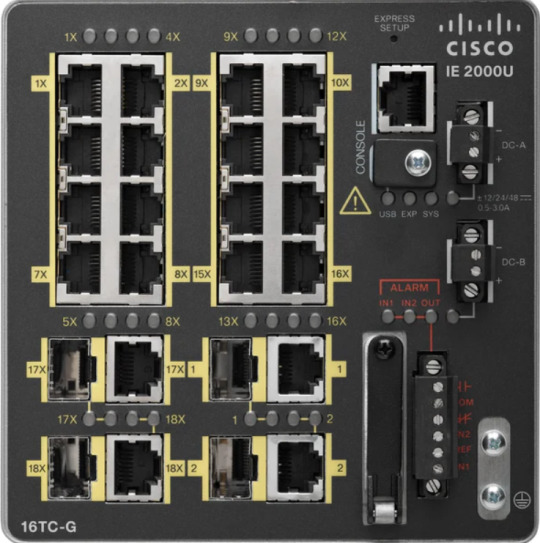

Reliable Communication Starts with Industrial Ethernet Switches

Data flow across industrial networks must be both fast and secure. That’s where an Industrial Ethernet Switch like the Cisco IE-2000-16TC-G-E comes into play. Engineered for harsh environments, this switch features robust build quality and supports advanced switching protocols like QoS and VLANs—ensuring smooth traffic management even in network-heavy setups.

In automation systems where devices like HMIs, PLCs, and I/O modules constantly communicate, an industrial-grade switch ensures that data isn’t just fast—it’s also reliable and isolated from disruptions.

Bridging the Gap with 1784-U2DHP

While modern systems lean on Ethernet-based protocols, many plants still operate legacy systems that use older communication methods like Data Highway Plus (DH+). The 1784-U2DHP adapter serves as a bridge, allowing USB-equipped laptops to interface with DH+ networks. It provides essential diagnostic and programming access to older equipment, extending the lifecycle of valuable assets and supporting a phased modernization strategy.

Final Thoughts

Industrial control systems today demand more than just speed—they need resilience, flexibility, and smart connectivity. From an intuitive Allen Bradley controller like the 1769-L24ER-QBFC1B to rugged Industrial Ethernet Switches and legacy support tools like the 1784-U2DHP, these technologies together form the backbone of intelligent automation systems.

0 notes

Text

How AI-Powered Port Management is Transforming Global Trade

Introduction

With world trade volumes still on the rise, the shipping industry is confronted with the enormous task of becoming more efficient, cutting costs, and lessening its environmental footprint. Among the most revolutionary developments in the sector is AI-managed port management, a sophisticated method using artificial intelligence to maximize port operations. Through integration of such technologies as IoT for ports and terminals, maritime logistics' machine learning, and predictive maintenance of port machinery, ports everywhere in the world are going through a digital transformation.

The Emergence of Smart Port Solutions

Smart port solutions are transforming the conventional port infrastructure into one that supports cutting-edge digital technologies. They offer smooth automation, improved security, and enhanced logistics, facilitating more agile and efficient port operations. As demand for real-time decision-making is on the rise, AI-powered port management contributes significantly to optimising cargo processing, vessel schedules, and resources. Intelligent port automation can reduce operational delays by authorities and make ports more efficient overall.

IoT for Terminals and Ports: Increased Connectivity

The deployment of IoT for ports and terminals has substantially increased connectivity across different port assets. IoT devices enable smooth data exchange, with real-time monitoring of vehicles, cargo, and equipment. This networked infrastructure facilitates a connected port setting, allowing port operators to base decisions on data.

For instance, IoT sensors can detect temperature changes in cold containers to prevent cargo spoilage. Further, predictive analysis of IoT data enhances predictive maintenance of port assets such that equipment operates at peak levels of performance, thus reducing on downtime and maintenance costs.

AI-Powered Port Management: The Core of Port Digitalization

Artificial intelligence-based port management is the pillar of port digitalization, guaranteeing the effective interoperation of all digital elements. AI processes vast amounts of marine data to streamline processes, improve security, and enhance decision-making. With AI-based simulations, port administrations can forecast operational congestion and act ahead of time to avoid congestion.

One of the most important features of AI-driven port management is that it can analyze historical data and give actionable intelligence. Through data analytics for maritime logistics, ports can predict peak traffic seasons and better manage resources, cutting waiting times for ships and increasing throughput.

Machine Learning in Maritime Logistics: Optimizing Supply Chains

The use of machine learning in port logistics allows ships to mechanize different parts of cargo processing and ship scheduling. Machine learning algorithms process shipping data, weather reports, and historic trends to recommend the best possible routes and berth schedules.

In addition, analytics powered by artificial intelligence help maximize container stacking schemes so that they are loaded and unloaded with highest efficiency. With this degree of automation, considerable manual labor is saved, as well as avoided is human mistake, and boosted is the whole efficiency of actual-time port action.

Predictive Maintenance for Port Equipment: Downtime Reduced

Conventional port maintenance practices tend to be based on planned servicing, which can lead to surprise breakdowns and expensive delays. AI- and IoT-powered predictive maintenance for port machinery is transforming the way ports manage equipment maintenance. Sensors mounted on cranes, forklifts, and other machinery constantly track performance data, warning operators of impending failures before they happen.

This forecasting approach minimizes equipment downtime, extends machinery life, and enhances safety in the integrated port community. With the guarantee of vital infrastructure always in place, ports can keep continuously high levels of throughput and refrain from unanticipated operational downtime.

Smart port automation is a collection of artificial intelligence-based technologies designed to optimize port operations. Self-propelled cranes, robotic loader vehicles, and container tracking by AI are a few examples of how automation makes ports efficient.

Furthermore, virtual assistants and chatbots enabled through AI simplify interactions between stakeholders so that there are no problems coordinating shipping lines, customs, and logistics companies. Port intelligent automation significantly reduces paperwork, accelerates cargo clearance, and maximizes overall operating flexibility.

Real-Time Port Operations: Increasing Efficiency

Today's ports have to function in a dynamic situation where efficiency is of the highest priority. Real-time port operations use AI and IoT to offer real-time information regarding ship arrivals, cargo transfer, and allocation of laborers. With real-time data, port authorities are in a position to make informed, evidence-based decisions to optimize berth allocation, reduce waiting time, and maximize total efficiency.

Among the most remarkable features of real-time port operations is the possibility of identifying abnormalities in port behavior. AI-based surveillance systems can identify security threats, unauthorized access, and operational inefficiencies, and hence allow ports to be secure and efficient.

Data Analytics for Maritime Logistics: Driving Decision-Making

Maritime logistics data analytics is a disruptor for shipping. Through the collection and analysis of large volumes of data, ports can obtain critical insights into performance, cargo handling efficiency, and environmental footprint.

Analytics driven by artificial intelligence help ports optimize fuel consumption, reduce emissions, and implement sustainable logistics practices. Maritime logistics data analytics help port operators make better decisions and enhance overall operational resilience.

Connected Port Ecosystem: A Harmonized Approach

The idea of a connected port ecosystem is centered on the seamless convergence of digital technologies across every function of port management. Through the linking of IoT devices, AI systems, and automation tools, ports are able to reach unprecedented levels of efficiency and transparency.

An integrated port environment guarantees all the stakeholders ranging from shipping organizations to customs entities to work from a single unified digital platform. This integration accelerates communication, eliminates redundancies, and stimulates collective decision-making, ultimately bringing about more seamless port operations as well as higher profitability.

Conclusion

The future of sea logistics is AI-driven port administration, where technology drives efficiency, sustainability, and profitability. Using smart port solution adoption, ports and terminals can use IoT in ports and terminals, and maritime logistics through machine learning, driving their operations into a more efficient and competitive digital age.

With real-time port operations, predictive maintenance of port equipment, and smart automation of ports, ports can become more resilient in their operations and cut costs. Furthermore, with maritime logistics data analytics and a networked port ecosystem, ports can realize end-to-end, data-driven decision-making that benefits all.

It is the ports that invest in digitalization that will be able to keep up with the needs of the current maritime environment with growing trade all over the world. The age of port administration by AI has begun, and its impact will be profound and long-lasting on shipping.

#artificial intelligence#ai powered automation#ai powered port management#ports#management#automation#ai transforming#digital transformation#globaltrade

0 notes

Text

Load Port Module: The Essential Link Between Wafer Transport System and Process Tool

A Load Port Module serves as the interface between a wafer transport system and a semiconductor process tool such as an etcher or deposition system. It facilitates the safe and ultra-clean transfer of wafers from cassettes stored in the transport system into the vacuum environment of the process chamber for semiconductor fabrication steps. Let's take a closer look at the key components and functions of this critical module. Wafer Cassette Access The front end of a loadlock in Load Port Module includes a cassette-loading station where standard 25mm wafer cassettes containing up to 25 wafers can be automatically loaded and unloaded. A robotic handler on the transport system sets the cassette into place and latches it securely. An environmentally sealed door then closes to maintain isolation of the cleanroom air from the vacuum system. Sensor inputs confirming cassette presence and door closure status are relayed to the process tool's control system. Vacuum-Compatible Design Since wafers must be transferred between the atmospheric cassette environment and high-vacuum process chambers, a Load Port Module needs vacuum-compatible construction. Chambers, bellows sections, and sealing joints are machined from non-outgassing stainless steel or aluminum alloys certified for ultra-high vacuum contact. Viton O-rings, metal gaskets, and precision actuators enable dependable closure and integrity testing of all interfaces down to vacuum pressures below 1x10^-7 Torr. Wafer Transfer Mechanisms Various transfer mechanisms are incorporated into load port designs depending on the specific process tool interface. Common configurations include a linear motor-driven blade that reaches into the cassette to pick wafers one at a time or a robotic arm capable of lifting an entire shelf of wafers simultaneously. Cameras and light sources aid alignment while sensors confirm contact and monitor for particles during extraction and placement into the loadlock chamber. Loadlock Chamber Contained within the load port housing is a small, sealable loadlock chamber where wafers can be coated or undergo vacuum bake-out procedures before entering the process chamber. Magnetic or mechanical end effectors gently grip wafers during transfer to stationary wafer pedestals inside the chamber. A turbo pump then evacuates air from the chamber to prepare for opening the valve to the process tool. Closing this valve isolates the loadlock to allow venting back to atmospheric pressure for wafer removal. Chemical Delivery Ports Some advanced load port designs accommodate ports for purge gas, chemical, or vapor delivery into the loadlock chamber or direct wafer surfaces. This enables pre-etch surface treatment, post-process cleaning, or thin film deposition capabilities directly on the wafers without needing to move them to a dedicated tool. Integrated mass flow controllers ensure precise chemical dosing and vacuum-safe plumbing routes all lines to the chamber.

Get More Insights On This Topic: Load Port Module

#Load Port Module#Semiconductor Industry#Manufacturing#Automation#Material Handling#Robotics#Semiconductor Equipment#Integrated Systems#Industrial Technology#Port Logistics#Container Handling

0 notes

Text

How the Maritime Single Window is Revolutionizing Smart Shipping

Introduction

Maritime commerce is changing at a fast pace with maritime digitalization, smart shipping, and sea automation, resulting in greater efficiency and connectivity. Maritime Single Window (MSW), a technological platform which provides secure information exchange between sea ships and seaports, is a change driver in this case. By combining maritime AI and Internet of Things (IoT) onboard, business is headed towards a more automated, secure future.

With increasing international trade, seamless ship-shore communication is the need of the hour. Maritime cloud and maritime big data are now playing crucial roles in order to facilitate smooth port operations. In the meantime, ship performance optimization and fuel efficiency solutions are propelling sustainability initiatives across the board.

The Role of the Maritime Single Window in Smart Shipping

Traditional ship reporting was cumbersome and time-consuming. With the Maritime Single Window, smart shipping has become more efficient by minimizing documentation, improving communications, and making port entry more streamlined. Marine automation integration has also maximized operations and made ship-shore communications quicker and more secure.

With MSW, vessels are able to send necessary documentation electronically, avoiding delays due to manual reporting. This revolution is essential in fulfilling international maritime regulations while ensuring seamless port operations. Navigation and tracking systems have also improved this process, enabling vessels to coordinate their movements with port schedules effectively.

Utilizing Maritime AI and IoT for Operational Efficiency

Maritime AI is transforming ship-shore communication with anticipatory operational problems and increased efficiency. Coupled with Internet of Things (IoT) integration on board, AI-enabled systems enable seamless data exchange between port and ship. Maritime cloud infrastructure and maritime big data reinforce this with increased connectivity through real-time monitoring and decision-making.

Using the aid of sea AI, shipping companies and terminals are able to analyze traffic patterns, predict jams, and optimize logistics. Smart sensors mounted on vessels help to monitor cargo status, reduce losses, and maximize efficiency. Autonomous ships are also gaining from the developments, applying AI to pilot safely without a human on board.

Increasing Connectivity with Maritime Cloud Solutions and Big Data

Contemporary shipping depends greatly on cloud solutions for maritime to offer secure and scalable data storage. Such cloud platforms allow ease of interactions between ships, port authorities, and logistics providers. Maritime big data also supports ship performance enhancement by monitoring vessel performance metrics, enhancing operational effectiveness, and minimizing the cost of maintenance.

The provided solutions of port automation and marine logistics automation are transforming traditional port operations. These ports are now able to utilize AI-driven analytics to track vessel arrival, monitor cargo, and anticipate operation bottlenecks, thus having a smooth flow of global trade.

Ship Performance Optimization and Fuel Efficiency

The Maritime Single Window is important for ship performance optimization, ensuring the vessel runs at full efficiency. Through the inclusion of fuel efficiency solutions, ships can reduce fuel usage, decrease emissions, and maximize voyage planning. This not only saves costs but also helps create a cleaner shipping industry.

Efficient fuel consumption is realized by means of navigation and tracking systems, which evaluate ocean conditions and then modify routes for better fuel usage. In addition, cargo management systems provide proper weight distribution to minimize fuel use.

Enhancing Safety with Navigation and Tracking Systems

The incorporation of tracking and navigation systems into the Maritime Single Window enhances situational awareness, enabling ships to steer clear of hazards and optimize routes. AI-based navigation systems facilitate autonomous route adjustments, improving safety and efficiency in smart shipping operations.

With the application of vessel scheduling software, congestion at ports can be minimized with the facilitation of smoother transition between port arrival and departure. Coupled with maritime digitalization and maritime cybersecurity, these systems can be guaranteed as dependable and safeguarded from malicious cyberattacks.

Cargo and Logistics Automation: A Game Changer

Smooth cargo handling is vital in maritime logistics. The Maritime Single Window unifies cargo management systems, facilitating seamless tracking and movement of commodities. Marine logistics automation, maritime logistics automation solutions, and automated marine logistics solutions further enhance cargo processing efficiency by reducing downtime and maximizing workflows.

Automated container handling allows ports to transfer containers with precision, reducing operating mistakes. Automated cranes and robots now share the responsibility in handling high cargo volumes, optimizing efficiency, and reducing human workloads.

Container Terminal and Port Logistics Automation

Contemporary ports use container terminal automation and port logistics automation systems to make operations seamless. Automated cranes, vessel scheduling software with AI functionality, and smart warehousing reduce congestion and improve turnaround times. Port automation solutions and automated container handling are the solutions to making ports efficient and responsive to global trade needs.

Shipping companies improve delivery times and the tracking function by embracing marine cargo automation strategies. This also helps to minimize losses and damage to cargoes, guaranteeing customer satisfaction and higher profitability.

Maintaining Maritime Cybersecurity in the Modern Era

With greater digitalization, maritime cybersecurity is a top concern. The Maritime Single Window incorporates AI-based security systems, safeguarding sensitive information from cyber attacks. By using encrypted communication channels and real-time threat monitoring, the industry provides secure data transmission and adherence to international cybersecurity standards.

Cyberattacks are a major threat to worldwide shipping activities, and therefore maritime cloud solutions and secure data structures are mandatory to stop breaches. With ongoing renewal of cybersecurity measures, the business can ensure protection of sensitive cargo and ship information.

The Future: Autonomous Ships and Underwater Drone Inspection

The maritime industry is experiencing a transition to autonomous ships that utilize AI for navigation and operations. These ships, incorporated with the Maritime Single Window, can exchange information directly with ports, eliminating human mistakes and enhancing efficiency. Moreover, underwater drone inspection is transforming ship maintenance with automated hull inspection and underwater infrastructure checks without human presence.

These developments are opening the doors for a smarter era of shipping, with marine automation and artificial intelligence playing the lead. Navigation and tracking systems make it possible for autonomous ships to drive well, with underwater drones performing inspections in hostile environments, minimizing the use of human divers.

Conclusion

The Maritime Single Window is transforming ship-shore connectivity by bringing together maritime digitalization, smart shipping, marine automation, maritime AI, and IoT at sea. As ports adopt maritime cloud solutions, maritime big data, and cargo management systems, the industry moves one step closer to a completely automated setup. With the likes of autonomous vessels and underwater drone inspection, the maritime sector will be safer, smarter, and sustainable.

Through the use of port automation solutions, marine logistics automation, and container terminal automation, the shipping industry is optimizing efficiency with maritime cybersecurity and data protection. The digital future of shipping has arrived, and the Maritime Single Window is right at the center of it, making maritime logistics safer, faster, and more sustainable than ever.

#maritime#terminals#ports#artificial intelligence#ai powered solutions#container#cybersecurity#digital future#smart ports#ports automation

0 notes