#best credit card processing for small business

Text

There are quite a few payment gateways available in the market. However, you should evaluate the providers you have in your payment gateway list thoroughly before making a decision. It’s highly recommended that you pick a merchant service account. In addition, one of the many things you have to consider is whether the payment gateway you’re considering is compatible with the POS and e-Commerce applications you have or planning to get.

#merchant service account#Credit Card Processing For Small Business#Best Credit Card Processing For Small Business

0 notes

Text

Credit Card Processing for Small Business

The merchant industry is here to provide cheap and best credit card processing for small businesses. It will make new merchants grow their business popularly.

Best Credit Card Processing for Small Business

Merchant Industry is one of the topmost accepted credit card processing company in New York. Merchant industry is popular among the industries because of its easy setup on credit card processing for small business. If you’re a new merchant looking for credit card processors to grow your business popular then join with us immediately.

Why Small Business Needed Credit Card Processing

When you accept payment from the world’s major financial card brands giants such as Visa, Mastercard, and American Express, you can show the world that your business is legalized. When a payment processing method is set up for your business, you have brought your business into the economic mainstream. This increases trust with potential and regular customers and gives them confidence that your business is official.

For merchants who running a small business and looking to save on costs, the best option is Merchant Industry. The company has a great reputation and a large number of praise from customers – something we don’t often see with other merchant account providers. With all the positive advantages this company is regarded as the best and cheapest credit card processing company for small business.

Cheapest Credit card Processing Company

Credit Card Processing is essential for any scale of business. Nearly Eighty-Five percent of consumers use cards for everyday purchases and spend more than cash-paying shoppers. We determined the cheapest card payment processing solutions for small business in terms of below conditions.

Transaction Fees,

Contract Terms,

Ease of Use, And

Included Point-Of-Sale Features.

How Online Payment Processing for small business works

For small businesses, Merchant Industry using a solution that integrates both the payment gateway and merchant account in one system. Even though tons of providers are there for online credit card payments, but the merchant industry is unique among them.

Best Processing Device for Small Business

We know, how it is hard to choose the best credit card machine for small business. So, to minimize your confusion we provide machines with all features and portable credit card processing machines on the market. Merchant Industry offers you fast, secure and reliable processing device for your business. We offer simplified and affordable pricing plans with our card machines to suit your business needs.

What Makes us Different

Merchant Industry is one of the best merchant services company in the U.S. It provides credit card processing for small business and believes that businesses of all sizes deserve to be successful. Outstanding Customer Service, Latest Technology, and transparency make us the best merchant processing services company across the country.

0 notes

Text

Card Processing Solutions

#Card Processing Solutions#credit card processing#payment processing#payment processing solutions#credit card processing companies#credit card processing solutions#merchant processing solutions#best credit card processing#credit card processing for small business#best of credit card processing#credit card payment processing#merchant processing#online credit card processing#processing solution#credit card processing fees#solutions for credit card processing

1 note

·

View note

Text

Selling your merch and shipping from home with Fourthwall

I've been selling @shiftythrifting Junk Boxes - our curated secondhand mystery boxes - since 2017 using different platforms with different levels of success. I moved to Fourthwall in 2022 and my teeny tiny business has only grown since then! FW is free to use and you get ALL the money from your home sales save for the credit card processing fees. I don't miss the fee structure from our previous hosts, so I thought I'd write up a little guide on how easy it is to get started.

Things you need to start shipping from home:

A scale, and it doesn't need to be an expensive or large one! Even a kitchen scale works for small stuff.

Packaging and packing materials for the product(s) you're selling.

Access to a post office and/or a printer.

Funds set aside for postage. You'll get this money back with your Fourthwall payout when the month rolls over.

(Optional but handy) A ShipStation account.

Make yourself a store if you haven't already. You can sell print on demand, digital stuff, and your own inventory in one place but today we're talking about selling from home, so add a product and pick the middle option.

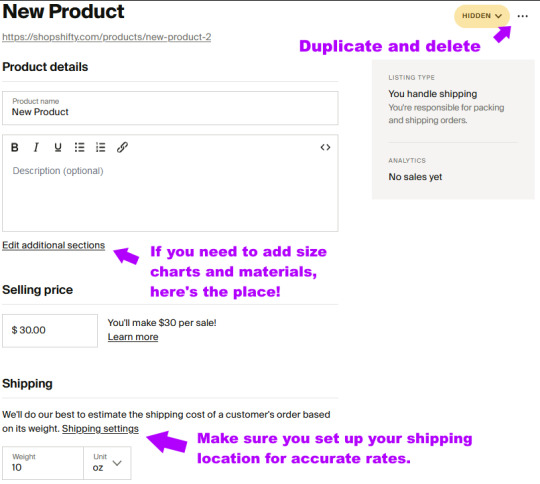

You can customize everything about your product on this page, from adding size and color variations, the materials used to make it, size charts, inventory, and more. Get an accurate weight of what you're selling in its packaging and add that here. Hit save and you have your first listing. Gonna be selling a variety of products? You can duplicate the listing with the meatball menu! Change the name, photos, and anything else that needs changing and have your second listing up in a couple minutes.

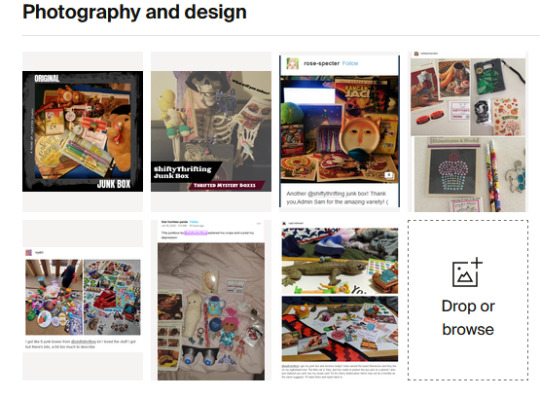

Didi protip: I like to put people's reviews right in the listing. Lots of photos help sell your product, but there's nothing like a positive review from fans!

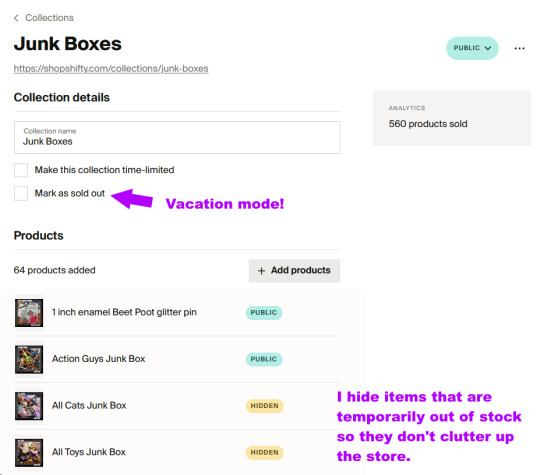

Fourthwall's Collections feature lets me put my Junk Boxes in their own little section where I can set them to hidden or mark them sold out if I get sick or am on vacation. This lets me easily turn the self-fulfilled part of my store off while folks can still purchase print on demand and digital stuff and sign up for memberships.

Didi protip: If you are in the US, the US postal service will pick up your outgoing packages free of charge on any regular mail day. Just set up a pickup on USPS.com!

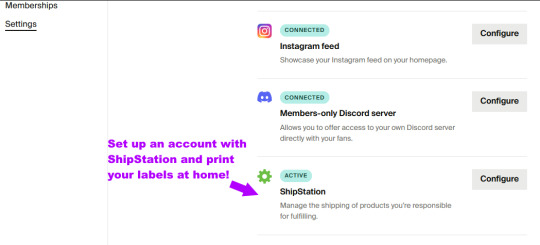

When you've made your first sale, you can either make the label yourself or connect directly to ShipStation through Fourthwall's app integration. That's brand new and I love it so far. My labels pop up in ShipStation about 24 hours after a purchase, giving people a little window of time to adjust their order or make changes before I ship it.

At that point, all that's left is handing it off to the postal carrier of your choice! Boom, you're done!

A final note from me, I moved ShopShifty to Fourthwall so I could have one address for ALL my merch instead of splitting it between Patreon, a print-on-demand store, and the Junk Box store. It's proven to be the best choice I've made in years and has saved me a ton of money in marketplace fees, Paypal's cut, and web hosting charges. This has genuinely been the easiest way to sell my merch!

#fourthwall#I wouldn't praise anything like this that I didn't absolutely love#and I love fw#I'm proud our lil shifty made partner#now I help other people set their stores up

183 notes

·

View notes

Text

Reassembly 5

Masterpost

(What the frick is the bat guy about???)

They did serious damage to Lexy’s credit card in the form of a cast iron pan, a pot, basic cooking utensils and a four-person set of dishware before they even made it to the grocery store.

Peter tried not to go nuts there. He really did. But Kon had that empty kitchen! And to be honest, shopping was major wish fulfillment. Even though he knew he wouldn’t be eating all of the food he got way into it. They stocked up on easy freezer food like pizza rolls and fries. They got pasta mixes and jarred sauces and they got snacks and sweets. He even got Kon baking basics. It might take Kon a while to get into his fresh bread era, but it was going to happen. Peter was calling it now. Kon was just that kind of guy.

The last thing he got was meat. Meat and cheese and fresh vegetables. Peter ended up putting back half of what he initially put in the cart because, honestly, Kon didn’t have a massive super appetite and he didn’t know how to cook yet. Vegetables were just going to go bad, so he only got what he planned to use that night. He also stocked Kon up on breakfast supplies- bread and jam, eggs, sausage, coffee and tea and juice.

‘I wish I was staying with Kon to eat this. I’m going to be hungry again tomorrow.’

Peter pushed down that greedy little thought where it belonged. He was going to be eating lunch and dinner with Kon tonight, since they were cooking together. That was already really generous on Kon’s part. He couldn’t ask for more.

The boys ended up making spaghetti. Peter wasn’t the best cook in the world, but he could cut onion and garlic to cook meat in, shred in carrots and zucchini, and add a jar of red sauce to make something nutritionally dense that tasted really good. Kon hovered over his shoulder watching this process and making faux sports commentary.

“Go away!” Peter shoved Kon with his shoulder, laughing. “Go start the garlic bread.”

“...Garlic bread?” Kon asked hopefully. He seemed way younger than he was sometimes. “You can make that at home?”

“You can, if you get to cutting garlic really small.” Peter tossed him a bulb without looking.

They ate dinner while watching some drama that Kon picked out on a streaming service. “Holy shit,” Kon said quietly after his first bite. He put down the plate and took a photo.

Peter snorted. Kon must have sent it to someone because his phone went off constantly after that.

He wasn’t even done eating their late lunch when he first wondered where he was going to sleep tonight. Peter stared down into his pasta like it might have some answers. When should he leave? What would he say if Kon asked for his phone number? He didn’t have one. He couldn’t give Kon the number to the phone he had on him– he was pretty sure that he really should get rid of it in case someone was tracking him.

He should ask first. If he directed the conversation it would be easier to be normal than if he was just answering questions. So Peter swallowed hard, made himself smile, and said, “This was fun. Wanna hang out again?”

Kon noisily slurped down some sauce and wiggled in place while he chewed and swallowed. “Yeah, we should!” he agreed. “You uh, free later this week?”

He was jobless and homeless with no other acquaintances.

“I have some time,” Peter said casually. “I’m kinda busy tomorrow, but the day after? Should I come over in the afternoon?”

“Yeah!” Kon bounced up off his seat for a moment. “We can finish the projects. Or work on them, at least.” He screwed his face up with a thought. “Can I get your handle or number, in case my work pops up?”

Peter’s smile turned fixed. “Actually, not now,” he said as casually as he could manage. “I dropped my phone in water. I just have my Dad’s old phone right now for emergencies.” He didn’t need to add that lie, but what if he needed to pull out the flip phone later? He didn’t want Kon to think that he just hadn’t wanted to give his number.

Kon laughed. “That sucks, man,” he empathized.

Oh thank Thor, he bought it.

The fabric was dry by then, so Peter helped Kon cut it out and sew it into place. Kon modeled his new look in the living room and then took approximately two hundred selfies while Peter worked on his project. Kon eventually flopped down on the sofa upside down and started sketching out design ideas. Peter glanced over and saw what looked like a boob window cut into some kind of top.

…Kon would look great in it. Peter didn’t comment. He smiled a little more when he went back to cutting out pieces for his own jacket.

“Smile!”

Peter looked over on reflex and cheesed. A shutter went off. “Can I send that to my friends?” Kon asked, so casually that Peter knew it mattered a lot. “Cassie says no way did I meet someone without her.”

“Go ahead.” Peter gave a thumbs up for reasons even he did not understand. Good thing he wasn’t a weird little guy!

Kon looked relieved. There was less tension when he went back to looking at his phone. “Thanks, man. You want to think about dinner soon? You’ve been working for a couple of hours.”

Peter had to blink a few times to process that. Oh yeah, he was pretty stiff. He stretched experimentally. “You’re right,” he said, mildly surprised. “Huh. What did you have in mind?”

Kon shrugged. “Pizza?”

Peter hummed. “We can pull that off,” he decided. “We have… two more jars of marinara, one will do. Cheese, the bell peppers- yeah, that’ll work.” He stood in a smooth movement. “Could you get the flour down from where we put it- yeah, thanks.” Kon hovered back down and handed him the bag.

“I meant that we should order it,” Kon said, but he didn’t protest. “You can make pizza? At home?” He was delighted by this new information.

“You can make basically anything at home,” Peter said, because it apparently needed to be said. “Can you look up a pizza dough recipe?” He got out the salt and tried to remember where he’d put yeast.

Pizza did not go quite as smoothly as the pasta had. Kon brutalized the dough by over mixing it and the gluten developed bonds strong enough to rival the Hulk. But it was still edible! Kon was openly delighted with what he had made. Peter stole sideways glances at him, wondering if he should reassure that it was a great first try.

‘..I’m not sure he knows that it’s really tough,’ Peter decided. He said nothing. They watched one episode of Kon’s selected drama before Peter decided it was time to go.

Kon seemed surprised when Peter said that. He blinked at him a few times. “It felt like I was at the tow- a sleepover,” he said self consciously. He forced a laugh. “Yeah. You wanna leave your stuff here?”

Peter looked around Kon’s surgically clean living room and wondered if Lexy’s cleaning staff would throw away his stuff. “Yeah, sure,” he said, because it wasn’t like he had a place to store a project. “I appreciate that.”

He left not much later, making his excuses and backing out into the night with dread that he didn’t want to face curling in his gut. The feeling intensified as he got down to the lobby of Kon’s apartment building.

It was dark out, even with the streetlights on. The air was cold against his face. Peter huddled into his jacket, hand wound tightly around the strap of the bag with everything he owned in it.

At least he knew the time. It was a little past 10 pm.

He needed a shower and to sleep. The gym should be empty now. He could break back in, shower, and then go sleep on the library couch again. Even if the librarian came in early again, he could get a few hours of sleep.

He woke up again to the sound of keys in the door downstairs. This time he woke up feeling much better rested. Peter wandered blearily until he found a clocktower and realized it was nearly 9 am. Nice. He was working on his sleep debt, then. He surely hadn’t spent more than an hour between traveling to the gym, showering, and getting to the couch last night. That was maybe 9.5, 10 hours of sleep?

He left to a new hotel for a breakfast buffet. This one was particularly sad. He had two pieces of peanut butter toast and a glass of milk before he heard the front door staff quietly phone someone else asking if they had any teenagers staying at the moment. He left pretty quickly after that and walked for a while, heart pounding. The police didn’t descend on him with sirens and lights, so he was probably okay.

‘I can’t go back there.’

Later that day, Peter grimaced and took a moment to indulge in burying his face in his hands. He was overwhelmed and he still felt shitty and dirty and gross despite his shower. Maybe it was getting spotted as a homeless teen eating from the buffet? Yeah. Probably that.

He was in the library again, sitting in front of one of the older computers and hoping he'd get a reply from a potential client who had asked for some information.

Maybe it was a little weird to spend all day in the library. He was on notice for librarians acting like they wanted him to clear out, just in case.

But, assuming no one had any problems with it, why not spend most of his daylight hours there? He could study computer science, use the computers to do his work, and be somewhere temperature controlled for free. They also had pitchers of coffee and tea for free that he took advantage of.

He was hungry, though. He was always hungry. Maybe it had been a mistake to go to Kon’s house. It almost felt worse to be hungry again after eating everything he wanted two meals in a row. Peter suppressed despair. He was doing his best! He was taking care of himself.

"Is everything alright?"

Peter shot up and gave a sheepish grin to the librarian. He hadn't noticed her approaching, but he'd been lost in his head. "It's fine," he said.

The older woman gave him a sympathetic smile. "Well, let me know if there's anything I can help with. It's what I'm here for."

Oh. Before she could turn away he blurted out, "College!"

Her face lit up. "Are you applying?"

"I need to." Peter wrung his hands together. "But I don't know where to start. I want to go somewhere with a strong sciences program but I think I need to go there on scholarship."

She sat down beside him, an easy smile on her face like this was a topic that she enjoyed. “Do you care about where it is?”

Peter shook his head. “It would be best if I could stay in NYC since I know here, but I’m willing to go anywhere that meets those conditions.”

She nodded slowly. “There’s a few places I can think of.” She hesitated. “Do you expect to be eligible for testing related scholarships?”

“Yeah,” said Peter, who was so good at tests but would probably falsify the results that he needed if he didn’t manage to take tests in time. “I test well. Very well.”

“That’s great! And you said sciences? Technological sciences?” she didn’t glance at his current computer science book, but she didn’t have to.

“Yes,” he said, not entirely sure what he should be focusing on. Engineering, to build some kind of portal? Astrophysics like Dr. Foster, to find an Einstein-Rosen bridge? He’d have to get his foot in the door to figure out what was going on in the fields here. Shit, he should have looked into that already.

“And you would be looking to live by yourself, on campus? Or off? With family?”

“By myself,” Peter said, and wow that was depressing. “And whichever way is cheapest.” He cringed as he said it. That felt pathetic too. He wanted to say he wanted to live on campus since he’d be more likely to meet people that way. But honestly, he had no resources, at all. He couldn’t afford to be picky.

The librarian’s smile was a bit fixed now. “I… I almost hate to suggest it, but have you considered Gotham?” She continued before Peter had to decide whether or not he should admit he didn’t know that university. “It’s a dangerous city to live in, but it’s very affordable, and there’s extensive funding for the sciences and student support services.”

“...Because it’s a dangerous city and doesn’t get many people?” Peter confirmed.

She was doing her best to keep a poker face. “That’s right. They have a brain drain situation at the moment, so the sciences are really well funded. I think you could probably go there with full support, though that might be contingent on taking an internship or job in Gotham after graduation.”

Huh. He considered it. He’d never heard of Gotham, so it had to be a city that didn’t exist back home. But so what? How bad could it be? It was like, Chicago or something? He could handle that. He was Spiderman. He was an Avenger, sort of. So he directed a real smile at the librarian. “If I could get a full scholarship there, I would go in a heartbeat,” Peter said. “Thanks for the suggestion! I’ll look into the university there.”

The librarian patted the side of his chair as she stood up. “Wonderful! Let me know if you change your mind or have any questions!”

He ended up having a lot of questions, actually, once he started looking into Gotham, but he didn’t think, “What the frick is the vampire bat guy about?” was what she’d had in mind.

22 notes

·

View notes

Text

Switch your Payment Processing to TouchSuite and Get $500 Cash!

Experience business transformation with TouchSuite. In today's rapidly evolving business environment, efficient and secure payment processing is non-negotiable. Whether you run a small startup or helm a corporate giant, choosing the right payment processing partner is a pivotal decision. Opt for TouchSuite, a trusted name in the merchant processing sphere, and supercharge your payment solutions.

Why Opt for TouchSuite?

1. Proven Track Record: With over two decades of industry experience, TouchSuite has assisted more than 50,000 entrepreneurs, spanning diverse sectors such as CBD, credit repair, e-commerce, and the restaurant industry.

2. Fortified Security: TouchSuite adheres to stringent global certification and compliance standards, ensuring the safety of every financial transaction. Their vigilant 24/7 monitoring systems detect and neutralize potential threats, providing you with peace of mind.

3. Effortless Account Management: Simplify your merchant account management with TouchSuite's intuitive platform. Built for swift authorizations, it streamlines your operations, positively impacting your profits.

4. Flexible Payment Acceptance: At TouchSuite, your customers enjoy a plethora of payment options, including major credit cards and cutting-edge digital solutions like Apple Pay and Google Pay.

A Special Exclusive Offer from TouchSuite!

For a limited time, TouchSuite is extending a remarkable incentive to merchants ready to make the switch in their payment processing. By choosing TouchSuite, you'll receive an impressive $500 in cash! Yes, you read that correctly. It's not merely about exceptional merchant services; it's also about rewarding you for making a smart business move.

How to Grab the $500 Cash Reward?

It's a straightforward process:

Apply for an account online at touchsuite.com or reach out to the TouchSuite Sales team.

Activate your new merchant processing account and process your first batch before December 1, 2023.

Ensure you process $10,000 or more in card transactions.

Please be aware that this offer is subject to terms and conditions, including a 3-year contract requirement. The offer expires on November 30, 2023, so seize this opportunity promptly!

youtube

Dive into TouchSuite's Diverse Offerings

Beyond their exceptional merchant processing services, TouchSuite offers innovative solutions like the GRUBBRR® Kiosks tailored for the restaurant industry. These user-friendly self-ordering kiosks streamline customer service, accepting card payments swiftly, eliminating the traditional waiting period. It's another instance of TouchSuite revolutionizing business operations.

Make the Move to TouchSuite Today

In the realm of merchant processing, TouchSuite distinguishes itself not only through top-tier services but also by its dedication to rewarding customers. The $500 cash offer is a testament to this commitment. So, if you're contemplating a switch in your payment processing, now is the perfect moment. With TouchSuite, you're not merely securing a service provider; you're gaining a partner committed to your business's growth and triumph.

For additional details or to get started, contact TouchSuite at 866-353-2239 or visit touchsuite.com. Your business merits the best, and TouchSuite is precisely where you'll find it.

#credit card processing#accept credit cards#credit card payment#payment processing#merchant processing#high risk payment processing#high risk payment gateway#high risk merchant account#payment#Youtube

17 notes

·

View notes

Text

Bookkeeping Mistakes Made By Small Businesses: How To Avoid Them

Small and Medium-sized businesses are eager to grow, but they often miss the fundamentals like understanding the value of Bookkeeping which may undermine business procedures.

Accounting is often overlooked by business owners who consider it easy. Incorrect accounting and bookkeeping processes may adversely impact any company’s finances. Recurring bookkeeping errors can actually bankrupt your business.

Bookkeeping Mistakes

Keeping financial records is a very important part of running a business, big or small. Bookkeeping that is accurate and well-organized makes sure that your financial records are up-to-date and precise, which helps you make good decisions and compliance with legal policies.

There are however some mistakes that small businesses often make with their books. Here are some of these mistakes.

Failure To Keep Records

Some small businesses fail to keep accurate financial records, which can lead to confusion and errors. Record-keeping is an essential process in organizing your financial records. Adopt best practices and create a system for organizing and storing your financial documents. These relevant documents may include invoices, receipts, and bank statements. It is helpful to consider using accounting software to automate the process and centralize everything.

Irregular Reconciling of Accounts

Failure to reconcile your bank and credit card accounts on a regular basis can lead to inconsistencies and inaccuracies. Reconciliation entails matching your financial records with your bank and credit card statements. Reconcile your accounts on a regular basis and resolve any discrepancies quickly to avoid problems.

Combining Personal and Business-Related Finances

It is critical to separate your personal and business finances by avoiding using personal accounts for business transactions. This can complicate bookkeeping and make it difficult to accurately track expenses and income. You must establish a separate business bank account and use it solely for business transactions.

Inconsistent Categorization

It is critical to properly categorize your income and expenses for accurate financial reporting. Refrain from inconsistent or ambiguous categorization, as it can make evaluating of your company’s financial health a lot more difficult. It will be helpful to create a chart of accounts with distinct categories that correspond to your field of business and use it regularly.

Neglecting Cash Transactions

Small businesses often transact in cash, which can be overlooked easily and not properly recorded. To ensure that cash transactions are accurately accounted for, use cash registers, petty cash logs, or digital tools. Better yet, set up a system for keeping track of and documenting all cash transactions, including sales and expenses.

Failure To Keep Track of Receivables and Payables

Failure to maintain track of unpaid invoices (accounts receivable) and bills to be paid (accounts payable) might jeopardize your cash flow and client-vendor relationships. Use accounting software with invoicing and payment tracking features to implement a structured strategy for monitoring and following up on both receivables and payables.

Mishandling Payroll

Payroll can be complicated, and mistakes can have legal and financial ramifications. Keep up with advances in payroll requirements, calculate wages and taxes accurately, and make timely payments to employees and tax authorities. To ensure accuracy and compliance, consider adopting efficient payroll software or you can also outsource payroll duties.

Failure To Keep Backup of Records

Financial records might be lost because of corrupted data, hardware failure, or other unanticipated factors. Back up your financial data on a regular basis and keep it secure. Cloud accounting software can back up your data automatically to add an extra degree of security.

Neglect To Track and Remit Sales Taxes

If your company is obligated to collect sales taxes, it is critical that you track and remit them appropriately. Understand your sales tax duties, register with the proper tax authorities, and maintain accurate sales and tax collection records. To simplify the process, consider employing seamless sales tax automation software.

Doing-It-Yourself

This is a critical error that can have serious consequences for your company. Because bookkeeping is a complex process, it is best to seek professional help from a bookkeeper or accountant to set up and review your bookkeeping system on a regular basis. They can assist you in avoiding mistakes, providing financial insights, and ensuring tax compliance.

You can reduce the likelihood of these frequent errors and retain accurate financial records for your small business by being proactive and following appropriate bookkeeping practices with the help of expert bookkeepers and record-keepers.

How to Avoid Bookkeeping Errors

To avoid bookkeeping errors some proactive steps must be taken by small business owners. This may include familiarizing yourself with basic bookkeeping principles and practices to help you navigate your financial records effectively and make informed decisions.

This can be further established by using a good bookkeeping system coupled with reliable accounting software. As a business owner, it is important to invest in a reputable accounting software solution that suits the needs of your business and reduces errors.

In addition, it is important to reconcile accounts regularly to ensure your financial records match financial statements to help identify discrepancies and errors promptly.

Keep meticulous records by maintaining detailed records of all financial transactions and accept that it is always best to seek professional assistance from reliable bookkeepers and record-keepers who specializes in small business finances.

By implementing these practices, small business owners can reduce the likelihood of committing bookkeeping errors while maintaining accurate financial records.

The Bottomline

When you own a company, you put yourself in a position to take advantage of many different possibilities, including the chance to learn from your errors. When it comes to making mistakes, the key to success is to steer clear of those that are readily apparent and cut down on others as much as you possibly can. Remember that good bookkeeping and record-keeping practices contribute to informed decision-making and long-term business success.

Consider this list seriously and implement its suggestion so you will be well on your way to running your business in profitable ways and expanding it in all ways possible.

There is more that you can achieve with the most reliable team of professional bookkeepers and record-keepers. Visit us now and get started!

#bookkeepingservicesca#recordkeepingcalifornia#smallbusinesssolutionsca#healthcaresupport#healthcare bookkeeping#cpa firm

7 notes

·

View notes

Text

The Complete Guide to PayPal Merchant Accounts for Small Businesses

As a small business owner, accepting payments easily and securely is crucial for success. With more commerce happening online, PayPal has become one of the most popular payment methods for small businesses. In this comprehensive guide, we will walk you through everything you need to know about PayPal merchant accounts, their requirements costs, and how to choose the right one for your small business.

What is a PayPal Merchant Account?

A PayPal merchant account allows your business to accept payments through PayPal directly into your PayPal account. It works similarly to a traditional merchant account connected to your bank account but links to your PayPal account instead. This makes accepting PayPal payments and managing transactions simple through one centralized PayPal interface.

Unlike a regular PayPal personal account, a PayPal merchant account comes with additional features tailored for businesses, such as:

Accepting credit and debit card payments through PayPal

Business PayPal debit card

Invoicing capabilities

Ability to accept payments in-store, online, and via mobile

Access to PayPal business reporting and insights

Dedicated PayPal customer support for merchants

Merchant Account vs. PayPal: What’s the Difference?

Many small businesses get confused between traditional merchant accounts and PayPal merchant accounts. Here are some key differences:

Set-up and approval: PayPal accounts are generally easier and faster to set up compared to formal merchant accounts, which require lengthy applications.

Costs: PayPal offers transparent pricing, whereas merchant accounts have multiple complex fees like interchange fees, statement fees, etc.

Payment processing: PayPal processes payments through their platform directly to your PayPal balance. Merchant accounts transfer funds to your business bank account.

Accepted cards: Most merchant accounts accept Visa, Mastercard, AMEX, and Discover. PayPal processes Visa, Mastercard, and AMEX, but not Discover.

In-person payments: Merchant accounts integrate with POS systems for in-store payments. PayPal requires a card reader for in-person card acceptance.

Chargeback liability: With PayPal, chargeback liability shifts between the customer, PayPal, and the merchant. For merchant accounts, the business assumes full liability.

As you can see, PayPal provides a lot more convenience and simplicity compared to traditional merchant accounts. It is best suited for small e-commerce businesses with limited transactions. For businesses with higher volumes, a merchant account may be better equipped to handle monthly transaction limits.

PayPal Business Account Requirements

If you decide a PayPal merchant account is right for your company, here are some key requirements to open one:

Registered US business legal entity – Sole proprietorship, partnership, LLC, corporation, etc.

Tax ID number (EIN or SSN)

Bank account

Contact details like business address, email, and phone number

Some business types classified as “high risk” by PayPal may require further verification, including:

Pharmaceuticals, healthcare merchants

Certain supplements and nutraceuticals

Investment or credit-related services

Multi-level marketing businesses

Be sure to consult PayPal’s restricted businesses list before applying.

PayPal Merchant Account Fees

Understanding PayPal’s business account requirements and fees is key to determining if it’s profitable for your small business. Here are the standard pricing plans:

PayPal Standard – PayPal’s basic free account to accept online payments with credit cards and PayPal payments. Standard transaction fees apply without monthly charges.

PayPal Advanced – Steps up features for e-commerce with a low monthly fee. Lower per-transaction costs and advanced reporting.

PayPal Pro – Full-service merchant account capabilities with a virtual terminal, recurring billing, and invoicing.

Be sure to use the PayPal Pricing Calculator to estimate potential monthly costs based on your sales projections. This will determine whether a PayPal merchant account is financially viable for you compared to a traditional merchant processor.

PayPal Merchant Account vs. Net 30 Business Account

Some business types, like B2B merchants, may prefer extended net 30 business accounts. This allows corporate clients 30 days to pay invoices, which is better suited for high average order values.

In such cases, while PayPal offers net 30 invoicing, the daily account balance still needs to be fully covered by the merchant. Whereas net 30 merchant processors provide revolving credit for true net 30 payment terms, Larger ticket sizes above $10,000 may also run into PayPal transaction limits.

Evaluate your average order value, clients' requested billing terms, and sales projections to determine if a customized net 30 merchant account is more practical than PayPal.

Point-of-Sale (POS) Systems for Small Businesses

The right point of sale, or POS, system enables small brick-and-mortar retailers to easily conduct in-person transactions. An ideal small business POS system seamlessly integrates with your payment processor to safely accept customer payments.

PayPal offers POS integration for physical retailers via PayPal. Here, consisting of:

Mobile POS app – Accepts payments directly using the PayPal Here mobile app paired with a smartphone or tablet. Also includes digital receipts, barcode scanning, inventory management, and reporting.

Card reader – The handheld PayPal Chip Card Reader allows tap, dip, and swipe card acceptance via Bluetooth connectivity with the mobile app. Portable for food trucks or pop-up stores.

Desktop app – For large inventory needs, retailers can process orders and payments using the browser-based PayPal Here desktop POS app. Features advanced customization and works with barcode scanners, cash drawers, etc.

Alternatively, traditional credit card POS systems like Clover, Square, or Shopify POS can also integrate with your PayPal business account. They provide both customizable software and hardware POS solutions for store retailers looking for more robust capabilities beyond PayPal's offerings. During setup, simply link the external POS with your PayPal payment acceptance to process transactions from one unified system.

Choosing the Best PayPal Merchant Account

If going the PayPal route for processing payments, opting for the PayPal Pro plan offers the best rates and complete functionality for established small enterprises. Features like interchange-plus pricing, invoicing tools, recurring payments, and dedicated account management provide scalability to grow a profitable business long-term.

Whereas sole proprietors and home-based businesses may benefit from PayPal Standard or Advanced plans depending on lower monthly transaction volumes. Carefully calculate projected sales before picking a pricing tier.

Conclusion

This comprehensive guide summarizes everything small business owners must know about PayPal merchant accounts, from paperwork and qualifications to how pricing compares to merchant processors. PayPal Pro currently offers the most competitive transaction rates and robust e-commerce features like recurring billing and advanced reporting to profitably scale your company over the long run.

To enjoy automatic sync with QuickBooks accounting or integrate with popular e-commerce platforms like WooCommerce, get in touch with a PayPal Pro expert specializing in small business accounts today! Our dedicated account managers help optimize and tailor your PayPal merchant services for steady company growth and seamless payment integration.

#PayPal Merchant Accounts#Merchant Account vs PayPal#net 30 business accounts#pos system for small businesses#small business pos system

4 notes

·

View notes

Text

Quicken vs QuickBooks: Which One is Right for Your Business?

Are you struggling to choose the right accounting software for your business? Look no further! In this post, we'll be comparing Quicken vs QuickBooks – two of the most popular accounting software on the market. Both are powerful tools that offer features to manage your finances, but which one is right for you? Join us as we dive into what makes these two options unique and how to make an informed decision based on your business needs. Let's get started!

Comparing Quicken vs QuickBooks

When it comes to managing your business finances, Quicken and QuickBooks are two of the most popular software options available. While Quicken vs QuickBooks both programs offer similar accounting features such as tracking expenses and income, there are some key differences between them.

Quicken is designed primarily for personal finance management. It's a great option if you're self-employed or run a small business with just a few employees. With Quicken, you can track your bank accounts, credit cards, investments and more in one place.

On the other hand, QuickBooks is more ideal for businesses that require robust accounting tools like inventory management and payroll processing. It's also suitable for larger organizations with multiple users who need access to financial data simultaneously.

Another difference between these two platforms is their pricing models. Quicken offers a one-time purchase fee while QuickBooks has monthly subscription plans based on the features required by your business.

Ultimately, choosing between Quicken vs QuickBooks depends on your specific needs as well as the size and complexity of your organization. Consider factors such as budget constraints and which features are necessary for efficient financial management before making a decision.

What is Quicken?

Quicken is a personal finance management software that has been around since 1983. It was originally designed to help individuals manage their finances by tracking income and expenses, creating budgets, and generating reports. Today, Quicken offers various versions of its software that cater to different financial needs.

One version of Quicken is called Quicken Deluxe which allows users to track investments in addition to managing their personal finances. Another version is called Quicken Premier which includes features for managing rental properties as well as investment tracking.

Quicken also offers a mobile app that allows users to access their financial information on the go. Users can sync their data across devices so they always have access to up-to-date information.

Quicken is best suited for individuals or small businesses looking for an easy way to manage their personal finances without needing advanced accounting knowledge.

What is QuickBooks?

QuickBooks is a popular accounting software designed for small businesses to manage their financial transactions, invoices, bills and expenses. It was developed by Intuit and first released in 1983 as a desktop application. Since then, it has expanded its features and services to cater to the growing needs of businesses.

This software allows users to track inventory levels, create sales orders, generate reports and integrate with other applications such as payroll systems. QuickBooks also offers cloud-based versions that enable users to access their data from anywhere at any time.

One of the key benefits of using QuickBooks is its user-friendly interface which makes it easy for beginners to navigate through various financial tasks. The program also provides tutorials and customer support resources for those who need additional assistance.

Another great advantage of this software is that it can be customized according to specific business requirements. Users can choose from different plans based on the size of their business or opt for add-ons like payroll management or payment processing services.

QuickBooks has become a go-to solution for small businesses looking for an efficient way to handle their finances while staying organized and compliant with tax laws.

The Difference between Quicken vs QuickBooks

Quicken and QuickBooks are both financial management software options, but they serve different purposes. Quicken is a personal finance management tool that can help individuals with their budgeting, banking, and investment tracking needs. On the other hand, QuickBooks is an accounting software designed specifically for small businesses.

One of the key differences between Quicken vs QuickBooks is in their functionality. While Quicken focuses on managing personal finances, QuickBooks offers more comprehensive features such as invoicing, payroll processing, inventory management, and accounts payable/receivable. This makes it a better option for small business owners who need to manage multiple aspects of their financial transactions.

Another difference between these two accounting tools is their pricing model. Quicken typically charges a one-time fee for purchasing its software while QuickBooks follows a subscription-based model where users pay monthly or annually depending on the plan they choose.

Deciding whether to use Quicken vs QuickBooks depends largely on your individual needs as well as those of your business if you have one. If you're looking for robust accounting capabilities with features like invoicing or inventory tracking then go for QuickBooks while if you're just looking to manage personal finances then stick with Quicken

Which One is Right for Your Business?

When it comes to deciding which accounting software is right for your business, there are a few factors you should consider. One of the first things you need to determine is what specific features your business needs. For example, if your business requires inventory tracking or payroll management, QuickBooks may be the better option for you.

Another important consideration is the size of your business. Quicken may be more suitable for small businesses or sole proprietors who don't require as many advanced features as larger companies. On the other hand, QuickBooks can handle multiple users and large amounts of data, making it ideal for medium-sized and larger businesses.

The level of technical expertise required to use each software platform is also an important factor to consider. If you have limited experience with accounting software and want something user-friendly and easy-to-learn, Quicken may be a better choice. However, if you're comfortable with technology and want more advanced capabilities like custom reports or integrations with other software tools, QuickBooks might suit your needs better.

Ultimately, choosing between Quicken vs QuickBooks depends on understanding what your business requirements are in terms of functionality, size and technical aptitude. By taking these factors into account when selecting an accounting solution that best meets those criteria will help ensure success over time.

How to Choose the Right Accounting Software for Your Business

Choosing the right accounting software for your business can be overwhelming, especially with so many options available. Here are some important factors to consider when selecting the best fit for your needs:

Business Size: Consider the size of your business and whether you need a basic or advanced accounting system.

Features: Look at the features offered by each platform and determine which ones are essential for managing your finances.

User Interface: Make sure that you choose a user-friendly interface that is easy to navigate and understand.

Integration: Check if the software integrates with other tools such as payment processors, CRMs, or inventory management systems.

Support: Choose a platform that offers reliable customer support in case any issues arise.

Security: Ensure that the software has robust security measures in place to safeguard sensitive financial data from potential cyber threats.

Pricing: Determine whether there are any upfront costs, monthly fees or hidden charges associated with using the accounting software before making a final decision.

By considering these factors carefully when choosing an accounting system, you'll have greater confidence in finding one that meets all of your requirements and helps drive success for your business!

Conclusion

After comparing Quicken vs QuickBooks and analyzing the features of both accounting software, it's clear that they have significant differences.

Quicken is best suited for individuals or small business owners who need to manage their personal finances or do basic bookkeeping tasks. On the other hand, QuickBooks provides a more robust platform with advanced tools and features that cater to larger businesses.

Choosing the right accounting software depends on your individual needs and budget. Consider factors such as business size, industry type, level of financial expertise, and future growth plans when making your decision.

Whichever software you choose between Quicken vs QuickBooks will help streamline your financial management processes and improve the accuracy of your accounting records. So take time to evaluate both options carefully before deciding which one is right for your business!

3 notes

·

View notes

Text

Small firms encounter significant obstacles in a setting that is changing quickly. Our small business programme, which is specially designed for them, enables them to access enterprise technologies and manage costs. Are you seeking the best companies for credit card processing for small business? With CARDZ3N, you will receive the most benefits for payment processing for small businesses. Contact us now.

#Best Payment Processor For Small Business#Best Credit Card Processing For Small Business#Payment Processing For Small Business#Credit Card Processing For Small Business

0 notes

Text

5 Must-Know Tips For Choosing The Right Cryptocurrency Exchange

It is an unwise business, especially if you trade without knowing its basics. There are huge gains to be made however, you could even be in debt before you have even begun to study the market. You must be aware of several things such as how to choose (0.07 eth to gbp exchanges. Making the wrong choice with regards to cryptocurrency exchange could lead down a path filled by distractions and wasted time. Read on for five important tips that will help you pick the most suitable cryptocurrency exchange.

1. Examine the authenticity of the exchange and security

You can choose a safe and reliable exchange service by doing thorough research. Some insecure exchanges not just expose scams and investors, but also allow scammers to swindle investors with small amounts of money. Before you choose an exchange, find out whether it will protect you from fraud.

2. Compare the fee structures

Different fees and transaction charges apply for cryptocurrency exchanges. This is often overlooked and people end up choosing high-cost exchanges, even though they could have picked an exchange with lower transaction costs. An exchange with tokens often offers lower transaction costs than the ones without. If you're looking to compare two exchanges that use tokens, pick the one that has more. You can evaluate crypto exchanges to find which one has the best fee structure. Click this link to learn more about cryptocurrency exchange right now.

3. Know the different types of cryptocurrency exchanges

There are three typesof platforms: brokers, P2P and trading platforms. Find out what each entails. By setting prices and providing buyers a platform to buy cryptocurrencies the cryptocurrency brokers act as forex brokers.

P2P exchanges link buyers and sellers for direct interaction and allow them to reach an agreement on transactions. They provide a secure platform for secure cryptocurrency exchanges. Traders use trading platforms. Each party has a direct interaction with the platform, rather than being in direct contact with buyers and sellers. Sellers place their cryptocurrency on the platform, while buyers make their purchases. The transaction fee is charged by the platform. Before you decide, learn the basics of each. You can research the advantages and disadvantages of each one that appeals most to you.

4. Purchase methods

Cryptocurrency purchase methods vary depending on the exchange. Some platforms require that users make use of PayPal or bank transfer, while some allow debit and credit card purchases. Some platforms require that buyers make purchases with 0.3 eth to gbp. Find out the time it takes to complete a purchase on an exchange before you choose one. It is preferential to get transactions processed quickly rather than taking several days, or perhaps weeks.

5. Consumer encounter

When trading cryptocurrency for the first-time, it is important to think about the user experience and functions. Exchanges with good user experiences are the most popular for transaction volumes. You might find some platforms offering tokens for free. It's a good idea to choose an cryptocurrency exchange that has such deals.

Endnote

It is essential to think about all aspects when investing in cryptocurrency. Different exchanges offer various user experiences as well as security. {Consider all options and pick the exchange that ensures the safety of users.|Check out all the options and pick the one that offers safety.

10 notes

·

View notes

Text

It’s easy to treat customer support as an afterthought-until you need access to your funds and your account has been frozen for seemingly no reason. Going with a third-party payment processor option over your own merchant account means you might have to wait a bit longer to get access to your funds. Below, we walk through how a third-party payment processor works, the pros and cons of using one, and how to go about choosing the best one according to your business needs. The Square platform also tracks live sales and inventory which enables a business to keep track of payment updates, inventory levels, and sales opportunities. This enables it to unify all your sales data. There is a template that will add data to the Checkout model upon a successful completion of the checkout process. Of course, a lot of the logistics of when and how your funds can be accessed will depend on the third-party processor or merchant account provider you choose.

If you are transferring funds, you should never have someone on your MID, and it should not be accessed by unauthorized persons. These reserved funds are used to prevent negative balances due to disputes and fraud on your Stripe account. Finally, risk factors differ between a third-party processor and a merchant account provider. MerchACT is a specialized high-risk payment processor with proven account experience. Take some time to learn which payment processors can do that. It’s automatically saved and prefilled next time. In most cases, it’s an instant process once you provide your business information and connect your business account. Setting up a merchant account with Stripe is easy and only takes a few minutes. Third-party processors group your funds with hundreds if not thousands of other merchant funds into a single account. Fees can differ significantly between payment processors. It’s also accepted in all major currencies and by most major mobile payment providers including Apple Pay, Android Pay, Samsung Pay and others. Stripe Terminal allows you to accept any major debit or credit card in any country. Entry level business owners and smaller merchants often begin with a PayFac at startup to accept credit card payments, via online shopping carts or similar.

Merchants benefit when their products are easier to buy. Konbini payments are one type of asynchronous payment; they’ll be captured hours or days after the order. A merchant account is a type of business bank account that lets businesses accept and process electronic card payments. It makes it easy for startups and growing small businesses to securely manage card payments without having to wrestle with the technical backend setup to make it all work. We’re so sure that Stripe is the right choice for online businesses that we built our plugin, WP Simple Pay, to integrate your WordPress site exclusively with Stripe. Is a third-party payment processor right for your store? If you’re optimizing for convenience, low fees, and minimal hassle, a third-party payment processor is the way to go. And unfortunately, payment aggregators almost never handle chargebacks in their favor. Shopify Payments handles payment processing at industry standard rates, but it adds a customer service component and helps with credit card chargebacks. Accepting paypal business merchant account and debit cards with Stripe Terminal is simple because the payment process is based on a card reader. Online payment processing has become a popular form of transacting, giving customers the ability to easily pay with a debit or credit card.

A lot of providers will advertise a blended pricing option (a combination rate that includes payment gateway fees and merchant account fees) but this is rarely the best deal for merchants. Do either of these companies have hidden fees or transaction costs that sway the balance? Keep in mind that some third-party processors might offer lower transaction fees, but might also require a higher monthly payment or offer limited customer support. As you scale, you’ll hit a point where depending on a third-party payment processor might not be the most cost-effective choice. Usually, third-party payment processor accounts are easy to open. Because there are so many merchant service providers, you will have a wide range of options to choose from. Shipping address. Delivery options. electronic merchant services ’re able to accept credit card payments as well as other popular payment options seamlessly. Every payment method used the same two APIs abstractions: a Source and a Charge. Some charge a monthly fee plus a percentage of card payments based on whether it’s an in-person or online transaction. Fees. Chase charges 2.9% plus 25¢ per transaction on each ecommerce purchase.

#reseller vs merchant account#high risk merchant account#instant approval highriskpay.com#highriskpay.com#ein only cards#high risk credit card processing#high risk merchant highriskpay.com

3 notes

·

View notes

Text

Payment Platform For Businesses

Melio is an online payment platform that enables small businesses to manage and pay their bills electronically. The company was founded in 2018 and is based in New York City.

Melio allows businesses to pay their bills using a variety of payment methods, including credit cards, bank transfers, and debit cards. This flexibility allows businesses to choose the payment method that works best for them and their cash flow needs.

One of the key features of Melio is its user-friendly interface. The platform is designed to be simple and intuitive, allowing businesses to easily manage their bills and payments in one place. Additionally, Melio provides real-time payment tracking and alerts, so businesses can stay on top of their finances and avoid missed payments.

Another benefit of using Melio is its ability to help businesses build credit. By using a credit card to pay bills, businesses can earn rewards and improve their credit score, which can lead to better financing opportunities in the future.

Overall, Melio is a useful tool for small businesses looking to streamline their bill payment process and improve their financial management.

2 notes

·

View notes

Text

Luz’s Crimes: Organized Crime

Friday Night, 11PM

Luz was walking through the room quietly, with the moonlight to light her movements. When she reached a small basket holding a wallet and keys, she stopped and removed the wallet. She then opened it and inserted a credit card. As she was doing this, her phone began to vibrate. She then quickly put the wallet back and went to the bathroom before closing the door behind her and answering the call.

“Luz, its Amity.”

“Hay sweet potato, why are you calling? Is something wrong?”

“No, everything is ok. Something came up that we are going to need Jacob’s card for.”

Luz just facepalmed herself. “I just put the card back in his wallet after buying recording equipment, and you want me to take it out again? If we use it when he would notice, he will cancel it or call the police. Even then we have to keep the charges limited to things that he would not raise that don’t raise suspicion. The only reason I was ok with us using his card for Vee’s disguise was because he was also in the city for some reason, and even then, the massive tip was a risk.”

She then stopped and blinked a few times. “Wait, I am lecturing YOU about being cautious? Is are we in a “Freaky Fraturday” situation?”

“I don’t understand that reference, but you are right about this being a little weird. Anyway, can I at least tell you the opportunity?”

“Sure, go ahead.”

“Great. Hellen just called Vee again. Apparently she shared the product she got from us around and it got the attention of some professional criminals that-“

“WaitWaitWait. Are you saying that the mob is interested with us?”

“Yes, and they want to talk business with Jacob in person.”

Luz almost dropped her phone at that. “Where?”

“The same diner he met Hellen in last time tomorrow around 10. Hellen said we should be prepared to pay for our meal, and maybe his too depending on how the meeting goes. We can use cash, but using his card would help sell the story that he was the one there if the cops start looking into it.”

Luz just sighed. “Good news is that Jacob is usually home by then and is either asleep or working late on his newest plan to expose the witch invasion from Mars. I already planted the camera, so we will be able of keeping track of what it is in real time in case he plans something that might actually be a threat to us. Now is there anything else? I need to break into school and start planting the evidence.”

“No, that is everything. See you back later.”

“Goodbye Amity. I love you.”

She then hung up, exited the bathroom, did a quick check to make sure Jacob was still asleep upstairs, and closed and locked the door behind her on the way out with a copy of his house key that had made with Vee earlier for this very reason.

As she walked towards the school, she admired just how quiet things were this late.

Saturday, 10PM

Willow and Gus flew down in the same alley they used last time they were here, dropping the invisibility spell they were using in the process. Willow then dug out a handful of seeds before looking to Gus.

“Are you ready for the field test?”

He nodded with a smile on his face. “Are you kidding me? No one has ever done anything like this before. If we can pull this off, we will be legends!”

“Gus, this doesn’t make the top 10 things we have done since meeting luz that would get us into the history books.”

“Maybe, but this is something that others can actually do, and not just read about in history books before deciding to use it as a pillow instead. Anyway, let me know when I can layer the illusion on.”

Willow then twirled one of her fingers over the seeds in her other hand, causing vines to burst from them and slowly cover her. After a minute, she was wearing what would best be described as a vine exco-suite that added a full head to her height.

“Ok, do your thing.”

Gus then looked at her intently while making a large spell circle in front of him. Willow was then engulfed in blue smoke. When it cleared, Jacob was standing in her place.

“How do I look” She replied in Jacob’s voice.

“Like a massive creep, and you sound like one too. Good luck, and try not to kill them if things go south.”

“No promises.”

He then walked out of the alley with Gus trailing behind invisibly. They walked down the street to the diner’s entrance, which had a ‘closed’ sign in the window and two men standing in front of the door on either side.

“Hello, I am Jacob. I was told that someone wanted to meet with me here?”

One of the men nodded and opened the door for him while saying “Go on in, the boss is waiting.”

Jacob thanked him and entered the building, heading toward the only table that had people sitting at it.

One of them was Hellen, who was looking much more nervous than the last time. The other was a man in a suit who was already eating when Jacob walked up to him.

“I’m guessing that you are the guy Hellen told me was interested in my product?”

He looked up from his meal towards Jacob and just nodded. “Yes, I am. Please sit down and order.”

He did just that and ordered a stack of pancakes from the waitress (a different one from last time) before looking back to the man, who had put down his silverware and folded his hands together.

“I had some of the supply you gave Hellen here tested, and it is very high-quality stuff. Lower chances of negative reactions when used while still being just as addictive.”

Jacob blushed at the complement. “Thank you, I take great pride in my work. I am working on getting some samples of other plants I can cultivate.” His eyes then lit up. “That reminds me. I actually have a list.” He then reached into his coat pocket and produced a small piece of paper. “Here is a list of all the plants that I am interested in cultivating and the quantity of my normal supply I am willing to give you in exchange for them. If you know of any others that you want me to do, let me know and we can talk price.”

The man took the list and began reading it before putting it down.

“We can defiantly see about this later. For now, we need to hammer out the exact price, schedule, quantity, and logistics of how exactly we are going to do business. Now, how do you want to be paid? We can do the plants for now, but eventually we will have to figure out a way of funneling actual money to you.”

Jacob nodded. “I know, and I already have some of that figured out. I am able of getting the drugs to the city on my own. You just need to give me a drop off point for me where I can give you the drugs and you can give me the cash.”

The two of them then spent the next 15 minutes hammering out the rest of the details of their deal. After which the two stood up, shook hands, paid for their meal (with Jacob paying with another massive tip), and then they walked out together before going in opposite directions from the diner.

When Jacob entered the alley, Gus appeared next to him and made a large spell circle. After which, Jacob turned back into a vine exco-skeleton wearing Willow.

“I think that went well. We should be able of getting some more plants in soon to expand our product selection and have more money coming in to help with the bills.”

“Bills? Gus, with the money flow, we could soon be able of completely paying off the mortgage on their house!”

Willow then deflated. “We still need to find a way of explaining the money though. There is no way we can explain it coming from jobs that teenagers could get.”

“Maybe Luz has some ideas. If worse comes to worse, we can just put it in a washing machine. Apparently cleaning money with the laundry helps to hide it from the cops here.”

Willow just shot Gus a look. “I’m pretty sure that is not at all what money laundering means.”

The Owl House finale is airing on April 8th!

I kept the exact criminal organization it was and their representative vague to avoid offending any actual one and to not fall into any stereotypes. Feel free to insert whatever organization into it you want.

I have a important question to ask all my readers that is connected to the link below

https://www.deviantart.com/1228248/poll/If-I-made-a-patreon-for-early-acess-to-my-work-would-you-pay-for-it-8261000

I am also doing “Fanfic info dumps” on multiple series to help other fanfic writers with their works. They are on DevientArt here (https://www.deviantart.com/1228248) because Fanfiction and AO3 both said I couldn’t post them there.

Fanfiction: https://www.fanfiction.net/u/5646512/

Tumbler: https://at.tumblr.com/brianedner/luzs-crime-list-masterpost/dia848df51z4

AO3: https://archiveofourown.org/users/BrianEdner1/works

#the owl house#owl house#the owl house luz#the owl house amity#the owl house jacob#the owl house gus#the owl house willow

2 notes

·

View notes

Text

Screen Tones, a Webcomic Podcast

Show Notes

Conventions pt 1

Release Date: July 20, 2022

Featuring

Renie Jesanis - She/They , www.kateblast.com

Christina Major (Delphina) - She/Her, www.sombulus.com

Ally Rom Colthoff (Varethane) - She/They, http://chirault.sevensmith.net/ http://wychwoodcomic.com/

Kristen Lee (Krispy) She/They https://www.ghostjunksickness.com/

In This Episode:

Hello and welcome to the Screen Tones, where we talk anything and everything webcomics! Today we’re going to be talking about these crazy events that happen sometimes when webcomic artists can meet each other and their readers…. in real life??? Wild! That’s right, we’re talking about Conventions!

This is the beginning of a two-part series. We’re going to cover the basics of tabling at a convention from the perspective of a webcomic artist! How do you find out about and decide which shows to attend? What do you bring? Let’s dive in and talk about it!

2:00 What conventions and events have you have you found that worked best for you? Some tips for beginners.

Starting small can help you find the right event. Look for local events, or events that are focused on comics or art, independent artists or even the genre that your webcomic falls into. Toronto Comic Arts Festival is a favourite of many Screen Tones members. Look beyond the large comic conventions and you'll find smaller events like zine-fests, art fairs, and such.

Make sure you are aware of the costs and your budget. The larger the convention, the higher the cost tends to be for travel, transportation and even the fee for renting a table. To help cut costs, consider sharing a table with another artist.

Also keep in mind the application process for each convention you have in mind. The world of conventions is growing increasingly competitive so knowing the acceptance process and requirements can help you better gauge the likelihood of your acceptance and prepare to apply.

10:00 How do you find conventions that you can apply to?

Social Media is a great way to hear about conventions. Having a good network of creators can help you get more leads on potential events. Facebook groups, Discord channels, and more are great sources of intel.

12:45 What kind of things do you prepare for the convention ahead of time?

Part of it is finding what sticks and works for you. Prints and stickers are everywhere and fairly inexpensive. Find things that fit and work together and give off the vibes you want and hopefully ties to your comic in some way. Don't feel like you have to ONLY have items and art that is specific to your comic. Often more well known topics or things that anyone can understand like puns or fan art can pull in attention and give you an opener to telling people about your original work.

Having a theme for your table, whether genre or character or concept based, can help focus your table and avoid confusion because people will be able to know what you're about with a quick glance. And when you're at a convention, you have a small amount of time to draw attention before people pass you by, so making it clear and easy what you're about will really help.

26:40 Now you have the merch, what else do you need?

Have a secure way to accept and hold onto money. Something wearable is a good idea so you can keep it secure and next to you.

You'll want to bring a good amount of small bills/change to be able to break the first few customers you get in the day.

Have something that enables credit card transactions.

Device chargers!! Plan ahead for anything you need to plug in.

Having a backdrop can help create a clear boundary of where your both starts and ends and keep more focus on your wares.

8 foot tablecloth is a good staple.

Displays to pop your items up so people can see them from afar.

Plastic sleeves for your art.

Scissors, tape, sharpies, etc.

Sharpies or some kind of way to sign prints in a permanent/fast drying way.

A menu or some kind of pricing signs.

BUSINESS CARDS. So people can find you. And/or a sign that includes your contact info in case you run out of business cards.

41:30 What should you NOT bring?

Music. It's loud enough, you don't need to add to it.

Start with the basics before you start adding magic waterfalls and forests to your displays.

Don't bring cheap and broken display holders. Set up before hand, and make sure it looks good and is sturdy. Stress test to make sure it will last.

If you're eating, make sure the food is not messy. Drinks have lids so it won't spill.

46:40 What do you expect when you're in the thick of it?

You're smiling a lot...prepare for cheek hurting.

You won't get a lot of breaks.

Know what the volunteers are able to do for you.

Scope out the building so you know where to get things you need.

BUDDY SYSTEM to help.

Have a pitch and info on where to find your comic.

People will touch your stuff.

Take notes on how you do: what sells, when it sells, etc.

Stay Tuned for Part 2 and....

Thanks for Listening!

Have a comment? Question? Concern?

Contact us via Twitter @ScreenTonesCast or email [email protected]

Screen Tones Cast:

Ally Rom Colthoff (Varethane) - She/They http://chirault.sevensmith.net/ http://wychwoodcomic.com/

Christina Major (Delphina) - She/Her, www.sombulus.com

Claire Niebergall (Clam) - She/Her, www.phantomarine.com

Kristen Lee (Krispy) She/They https://www.ghostjunksickness.com/

Megan Davison - She/Her, https://www.webtoons.com/en/search?keyword=megasketch

Miranda Reoch - She/Her, mirandacakes.art

Phineas Klier - They/Them, http://heirsoftheveil.fervorcraft.de

Rae Baade(Rae) - they/them, https://www.empyreancomic.com

Renie Jesanis - She/They , www.kateblast.com

4 notes

·

View notes

Text

Genuine Cash Aider in Times of Financial Crisis: Short Term Loans UK Direct Lender

Are you frantically knocking on doors to deliver your short term loans request to the lender? Do you not want to send the lender your credentials of any type and pledge security in exchange for the loan offered? In that instance, short term loans UK direct lender might actually help you out with cash during a financial emergency. The fact that you can apply for it at anytime, anyplace, is a plus.

Every qualified applicant can easily acquire a sum between £100 and £1000 that is released for a shorter repayment period of 2-4 weeks. Use of it for handling a variety of short-term cash obligations, such as light bills, home expenses, car repairs, your child's tuition at a school or college, credit card debt, etc., is completely free.

You can still benefit financially from short term loans online even if you have a history of poor credit, even if it includes negative marks like defaults, foreclosure, late payments, judgments from local courts, individual voluntary agreements, insolvency, skipping payments, etc. As a result, lenders do not run a credit check on borrowers applying for these loans.

Fill out the online application form completely, and the lender will get it as soon as it receives confirmation of your information. The lender will send the funds directly into your bank account the same day as your application if the loan is granted. The entire process is completed automatically in a short period of time.

Why Classic Quid Is Best for Short Term Cash Loans!

You must compare short term cash loans if you want to obtain the best loan in the UK. You can utilize comparison websites to accomplish this, but bear in mind that they only feature direct lenders that pay them. There might be more affordable UK direct lenders that aren't represented on the comparison website since they don't pay. We advise you to access every website and do your own audit. Payday loan is regarded to be the cause of high stress levels, which can have a substantial influence on borrowers' busy lives despite the fact that payday loans serve an important purpose. Short term cash decisions are made slowly, and there are few choices for repayment.

A loan that is repaid in a year or less is said to be short-term. The borrower typically tries to borrow a small sum of money up to £1000 with the intention of repaying it quickly, say within one to four months. Short loans are frequently utilized to cover only sudden financial needs. Payday loans are typically due in one month, whereas short term loans for bad credit have a maximum repayment period of 12 months.

Can Someone with Bad Credit Apply for a Short Term Loans UK?

Yes, even if you have a low credit score, you can still apply for a short term loans UK with us. Everyone deserves a fair opportunity, according to Classic Quid, a no-guarantor lender in the UK. We will gladly evaluate your application if you can afford a short term loan despite having bad credit (or good credit). It is worthwhile to work on raising your credit score so that you can access future financing alternatives with reduced interest rates.

https://classicquid.co.uk/

4 notes

·

View notes