#blue chip stocks

Text

Blue Chip Stocks in a Nutshell

Investors often seek stable and reliable investments to safeguard their wealth while achieving steady growth. Among the various investment options, blue chip stocks stand out as a popular choice. These stocks represent companies with strong financial performance, a history of stable earnings, and a reputation for reliability. This article delves into the world of these stocks, explaining their…

#Blue Chip Companies#Blue Chip Stocks#Dividend Stocks#Financial Markets#Healthcare#Investing#Investment Strategies#Long-Term Investment#Market Conditions#Market Leaders#Passive Income#Review#Stable Companies#Stock Market#Volatility

0 notes

Text

Explore the world of Blue Chip and Penny Stocks - learn how to build a balanced portfolio for long-term success. Get expert insights from jarvis invest.

#stock advisory company#how to select stocks for long term#share market advisor#best stock portfolio#ai for stock trading#best advisor in stock market#top stock advisors in india#blue chip stocks#penny stocks#one stock

0 notes

Text

The Origin and Significance of Blue Chip Stocks

Written by Delvin

Blue chip stocks are a cornerstone of many investment portfolios, and their name carries a rich history rooted in the world of poker. Originating from the game of poker, where blue chips hold high value, the term “blue chip stocks” has come to represent shares of large, well-established companies with a history of stable earnings and reliable dividends.

The Poker…

View On WordPress

#Blue Chip Stocks#dailyprompt#Financial#knowledge#Money Fun Facts#Stock Market#Stocks#The Origins of Blue Chip Stocks

0 notes

Photo

Lorenzo and Tyler Culberston are working towards introducing a broad-based lasagna commodities index to be added to the NASDAQ Exchange in 2024

#lorenzo#nounish#bollinger bands#tyler culbertson#nasdaq#blue chip stocks#cryptoadz#cryptoads#commodity markets#commodities#stonks#stock market#memes#bloomberg terminal#index fund#gremplin#pixel art#animation#8 bit#finance#qqq

0 notes

Text

What are blue chip stocks and how to find them?

Blue chip stocks are those of organizations that have a stellar reputation. These firms often give their investors attractive dividends; have a substantial market capitalization, consistent earnings, good financials, and extensive market operations. Additionally, blue-chip businesses frequently hold a strong position in their industry or are market leaders. They can withstand challenging market conditions and keep expanding profitably even when the economy is struggling.

Characteristics of blue-chip stocks

When you are looking for blue-chip stocks, you can use the following characteristics to identify them:

· Blue-chip stocks are large or very large-cap stocks. They are usually prominent market leaders or stock market giants in their respective sectors.

· Blue-chip companies have a long history of steady returns and consistent performance.

· Blue-chip companies are financially resilient with zero or negligible debt levels.

· Such companies have a record of accomplishment of surviving economic slowdowns and show promising growth prospects.

· Blue-chip companies are typically diverse with multiple sources of revenue. This feature serves as a buffer against losses and operational setbacks.

· Most importantly, blue-chip stocks are stable, low-risk stocks and are ideal for investors with long-term goals.

How to pick the best blue-chip stocks?

By now, it is clear that blue-chip stocks are one of the best additions for your portfolio. However, the bigger question is- how do you spot the best blue-chip stocks? Apart from the abovementioned characteristics, you must consider other metrics to choose the best blue-chip stocks for your portfolio.

1. Market capitalisation

2. Company earnings

3. Company valuation

4. Return on Assets (ROA)

5. Return on Equity (ROE)

Read More about Blue Chip Stocks

0 notes

Text

#investment blog#investment tips#investment#investments#crypto#cryptocurrencies#blue chip stocks#singapore etfs to buy#etfs#investors#invest

0 notes

Link

Looking for the best blue chip stocks to buy in 2023, but need some ideas? Check the list of top 10 stocks to keep on radar for investment.

0 notes

Text

Benefits of Investing in Blue-Chip Stocks

Benefits of Investing in Blue-Chip Stocks

Blue-chip stocks are often considered a cornerstone of a well-diversified investment portfolio. These stocks represent large, established companies with a proven track record of consistent profitability, strong financial performance, and market leadership. Investing in blue-chip stocks offers several distinct advantages:

1. Stability and Reliability:

Proven Track Record: Blue-chip companies have demonstrated their ability to withstand economic downturns and remain profitable over extended periods.

Financial Strength: These companies typically possess strong financial fundamentals, including solid balance sheets and consistent cash flows.

Also read- how to unfreeze bank account from cyber cell

2. Reduced Risk:

Market Leadership: Blue-chip companies often hold dominant positions in their respective industries, giving them a competitive advantage and reducing their risk exposure.

Dividend Payouts: Many blue-chip companies have a history of paying regular dividends to shareholders, providing a steady income stream.

Also read- how to unfreeze bank account from gujarat cyber crime

3. Long-Term Growth Potential:

Brand Recognition: Established brands enjoy strong customer loyalty and recognition, which can drive long-term growth.

Research and Development: Blue-chip companies often invest heavily in research and development, enabling them to innovate and stay ahead of the competition.

Also read- how to unfreeze bank account from agra cyber cell

4. Dividend Income:

Regular Payments: Many blue-chip companies have a history of paying regular dividends to shareholders.

Income Generation: Dividends can provide a steady stream of income, especially for retirees or investors seeking a reliable return on their investment.

Also read- bank account unfreeze

5. Investor Confidence:

Trust and Credibility: Blue-chip stocks are often seen as safe and reliable investments, inspiring confidence among investors.

Market Stability: The presence of blue-chip stocks can contribute to overall market stability and confidence.

6. Diversification:

Portfolio Balance: Including blue-chip stocks in a diversified portfolio can help reduce overall risk by providing stability and counterbalancing more volatile investments.

Also read- bank account freeze

7. Tax Benefits:

Dividend Tax Treatment: In some jurisdictions, dividends from blue-chip stocks may receive favorable tax treatment compared to other types of income.

While blue-chip stocks offer several advantages, it's important to note that no investment is risk-free. Market conditions, industry trends, and company-specific factors can influence the performance of blue-chip stocks. As with any investment, it's crucial to conduct thorough research and consider your individual financial goals and risk tolerance before making investment decisions.

0 notes

Text

Appreciating ringgit pushing buying on blue chips

Trading on the local bourse remains lacklustre despite the FBM KLCI closing on a positive note at almost the 1,640 marks.

Buying on blue chips continued from the inflows of foreign funds possibly taking advantage of the appreciating Ringgit which strengthened to almost a 2-year high at RM4.35/USD1.

Appreciating ringgit

“As such, we expect the index to hover within the 1,635-1,645 range today,”…

0 notes

Text

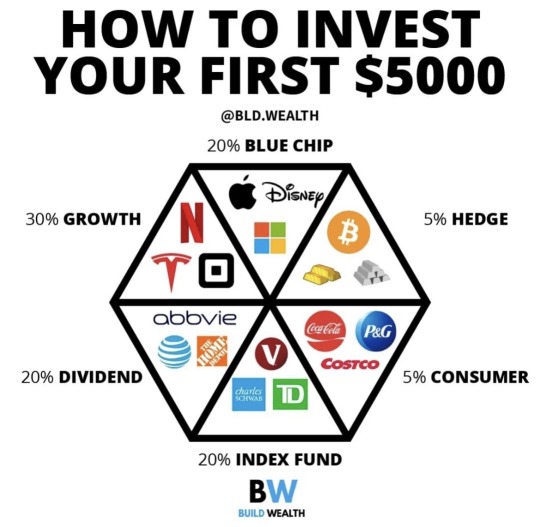

“How to invest your first $5,000

• 20% Blue Chip like Disney, Microsoft or Apple

• 30% Growth like Netflix or Tesla

• 20% Dividend like AT&T or Home Depot

• 20% Index Funds like Vanguard, Charles Schwab or TD Ameritrade

• 5% Hedge like Bitcoin, Gold or Silver

• 5% Consumer like Coca Cola, P&G or Costco”

Thoughts?

#ideas#my screenshots#screenshot#thoughts#life#change#mindset#growth#invest#stocks#nasdaq#investment#dividend#consumer#index fund#blue chip#Tesla#Netflix#Apple#Disney#Microsoft#Bitcoin

0 notes

Text

TSX Blue Chip Stocks represent leading, well-established companies listed on the Toronto Stock Exchange. Known for stability and reliability, they often exhibit strong financials, substantial market capitalization, and a history of consistent performance, making them attractive investments for many.

1 note

·

View note

Text

7 Blue-Chip Stocks That Won’t Do You Wrong

InvestorPlace – Stock Market News, Stock Advice & & Trading Tips

Financiers are barreling towards completion of 2023– and whoever believed that the news decreased throughout the vacations was dead incorrect. A few of the most significant and finest blue-chip stocks are making huge relocations this month.

Which actually should not be a surprise. Blue-chip stocks represent business that are at the…

View On WordPress

0 notes

Text

Unveiling the Origins of "Blue Chip Stocks": A Connection to High-Value Poker Chips

Written by Delvin

When it comes to investing, the term “blue chip stocks” is commonly used to describe stocks of reputable and financially stable companies. But have you ever wondered why these stocks are referred to as “blue chip”? In this blog post, we will delve into the origins of this term and explore its connection to the highest-value poker chips, which are traditionally blue.

1. The…

View On WordPress

#Blue Chip Stocks#dailyprompt#Financial#Financial Freedom#Financial Literacy#knowledge#money#Money Fun Facts#Personal Finance

1 note

·

View note

Text

Unleash Your Investment Potential: Cryptocurrency, Options Trading, and Growth Stocks

However, the volatile nature of these assets means potential investors should conduct thorough research and possibly consult a Cryptocurrency Investment Guide before diving in. Both the dangers and the benefits can be very high.

#Financial Education Courses#Value Investing Principles#Blue-Chip Stocks for Stability#Stock Market Analysis Tools

0 notes

Link

These three Singapore blue-chip stocks offer a haven from economic turmoil. The post Worried About a Recession? These 3 Singapore Blue-Chip Stocks Should Keep Your Portfolio Safe appeared first on The Smart Investor.

0 notes

Text

Buy Blue Chip Stocks in Singapore | Beansprout’s guide

Have you ever heard of Singapore’s “blue chip stocks” and been curious what they are? Looking at the Straits Times Index is a fantastic place to start when looking for blue chip firms in Singapore (STI). To learn more about Blue Chip Stocks Singapore, see our blog

0 notes