#bookkeeping with xero

Text

Boost Productivity with Our Bookkeeping Company in Canada

Reduce your financial burden with the leading bookkeeping company in Canada. We restore excellence in your financial processes, from paying attention to detail in all financial records to being an expert adviser so the processes are accurate and efficient. Trust Canadian Cypress for bookkeeping solutions for a smooth and worry-free financial journey. Enjoy top-class customer service in every transaction you make with us as a client.

#double entry bookkeeping#Bookkeeping Company in Canada#accounting & bookkeeping services#Bookkeeping services cost#bookkeeping services for nonprofits#online bookkeeping services#online small business bookkeeping services#bookkeeping in quickbooks#bookkeeper service near me#bookkeeping with xero#Bookkeeping & Payroll Services

1 note

·

View note

Text

Remote bookkeeping saves costs for small businesses by:

1. Reducing overhead expenses like office space.

2. Accessing specialized talent at potentially lower rates.

3. Offering flexible arrangements, avoiding full-time hires.

4. Cutting training costs with experienced remote professionals.

5. Saving time for core business activities, leading to increased productivity and potential revenue growth.

#accounting#bookkeeping#project xero#consulting#entrepreneur#entreprenuerlife#machine learning#cloudcomputing#remote work#virtual assistant

2 notes

·

View notes

Text

The Benefits of Using Xero for Your Business and How Experts Can Help You Get the Most Out of It

As a business owner, you know how important it is to stay on top of your finances. You need to keep track of your income and expenses, manage payroll, and stay compliant with tax laws. But with so much to do, it can be overwhelming to manage everything manually. That's where Xero comes in. Xero is a cloud-based accounting software that can help streamline your financial management processes and save you time and money. In this blog, we'll discuss the benefits of using Xero for your business and how Xero experts in Australia can help you get the most out of it.

Cloud-Based Convenience:

One of the primary benefits of using Xero is that it's cloud-based, meaning you can access your financial information from anywhere with an internet connection. This is especially beneficial for businesses with remote employees or those that require frequent travel. You can also collaborate with your accountant or bookkeeper in real-time, which means you can make financial decisions faster and with more accuracy.

Automated Processes:

Xero's automation features can help you save time on manual tasks like data entry, bank reconciliation, and invoicing. Xero can integrate with your bank accounts and credit cards to automatically import transactions, making it easy to reconcile accounts. You can also set up rules to categorize transactions automatically and even create recurring invoices for regular customers.

Comprehensive Reporting:

Xero offers a variety of reports that can help you gain insight into your business's financial health. You can create reports on cash flow, profit and loss, balance sheets, and more. These reports can help you identify areas where you can save money, plan for future growth, and make informed financial decisions.

Scalability:

Xero is designed to grow with your business. Whether you're a sole trader or a large corporation, Xero can adapt to your needs. You can add users, integrate with other software, and customize your dashboard to suit your business's specific requirements.

How Xero Experts in Australia Can Help:

While Xero is designed to be user-friendly, it can still be overwhelming for some business owners. That's where Xero experts in Australia come in. Xero experts, also known as Xero Champions, are certified advisors who can help you get the most out of the software. They can help you set up your account, integrate Xero with other software, and provide ongoing support and training. With their expertise, you can maximize the benefits of Xero and make informed financial decisions for your business.

In conclusion, Xero is an excellent accounting software for businesses of all sizes. Its cloud-based convenience, automation features, comprehensive reporting, and scalability make it a valuable tool for managing your finances. By working with Xero Champions in Australia, you can ensure that you're using the software to its fullest potential and make the most out of your investment.

2 notes

·

View notes

Photo

Bookkeeping & Data Entry Services in Ukraine

Bookkeeping services by Units Consulting Ltd., an accounting firm in Kyiv, includes complete accounting facility for recording and accounting in compliance with the local requirements. It is made from records provided by the client to produce a fully compliant set of financial books and records.

Our bookkeeping services are suitable for business of all industries and small and medium companies for onshore bookkeeping and offshore outsourced bookkeeping. We offer daily, weekly, and monthly services based on requirements / needs by our clients.

Bookkeeping outsourcing and data entry services includes: We are using team of experts, to provide bookkeeping service as Chartered Accountant Firm in Ukraine with existence in Kyiv and also the latest international rules of accounting in financial reporting. We used QuickBooks and Xero web based bookkeeping software for providing onshore bookkeeping services and offshore outsourced bookkeeping services.

There are many benefits to utilizing Outsourced Accounting Services in Ukraine such as cost-effective reliable, high-quality and technical assistance. To improve your accounting services and expand your business, consider Ukraine and benefit from the top accounting experts.

We deploy the team of bookkeepers in Ukraine to the client premises or client is asked to deliver data to our local office for bookkeeping & data entry services.

To learn more about our bookkeeping outsourcing services in Ukraine (Kyiv), please contact us.

#bookkeeping#outsourcing#services#ukraine#data entry#chartered accountant#certified public accountant#bookkeeper#kyiv#kiev#outsource#outsourced cfo services#quickbooks#xero accounting#xero

1 note

·

View note

Text

Is Your Business Ready for Tax Season?

Preparing for tax season is crucial for any business to ensure compliance and minimize stress. Here’s a checklist to help determine if your business is ready:

Organize Financial Records

Review Expenses and Deductions

Update Accounting Software

Consult with a Tax Professional

Review Payroll Records

Check for Changes in Tax Laws

Prepare for Payments

-------------------------------------

+1-516-348-6138

+1-914-205-4303

[email protected]

https://www.360accountingpro.com/

--------------------------------------

#TaxSeason#TaxPreparation#BusinessAccounting#360AccountingPro#TaxTips #TaxCompliance

1 note

·

View note

Text

Looking for accounting services for small business? This blog provides you detailed insights on useful small business accounting services like bookkeeping, tax preparation, payroll management, and more.

#Small business accounting services#Best accounting software for small business#Bookkeeping tips for small businesses#Tax preparation services for small business#Outsourced accounting services#Payroll services for small business#Tax deductions for small businesses#CPA services for small business#QuickBooks vs. Xero for small business#02. Monthly Accounting Activities#Bookkeeping Services#Monthly Accounting Activities

0 notes

Text

Accounting Systems

youtube

Today is "Financial Friday". Who do you know in the #NC #nonprofit #world that needs to hear today's message, which is "Accounting Systems" ?

#financialfriday#nonprofits#bookkeeping#accounting#accountingsystems#training#consulting#payroll#finance#friday#northcarolina#xero#quickbooks#fastfund#araize#netsuite#Youtube

0 notes

Text

Do I have to declare capital gains and dividends if they are tax-free? | Daily Mail Online

I held some shares in investment trusts outside of an Isa and sold them all in March, so that I could take my profits before the capital gains tax allowance was cut.

— Read on www.dailymail.co.uk/money/investing/article-13643229/Do-declare-capital-gains-dividends-tax-free.html

Visit KS Virtual Finance if you need help with self-assessment

#bookkeeping#capital gain tax#HMRC#local business#personal-finance#personal-finance-blogs#self-assessment#small business uk#tax credit#UK TAX#virtual assistant#workingfromhome#Xero

0 notes

Text

Comprehensive Financial Services From Your Chartered Accountants in Fareham

Chartered Accountants provide important support services for businesses of every size, from assisting with year-end accounts preparation and advising on tax compliance, to auditing procedures and tax planning.

In many cases, combining accounting services can deliver cost efficiencies and time savings, where clients consult the same accountants within the same firm for each requirement. Working with a team of accountants in Fareham ensures that your point of contact will be well-versed in your individual circumstances and business and can get to work quickly.

Experienced accountants provide the added benefit of drawing on expertise from elsewhere within the practice. This service can prove invaluable when business owners are managing a complex decision, tax matter or investment opportunity and need specialist assistance.

Complying With Mandatory Accounts Filing Requirements

One common area an accountancy firm deals initially with is your annual financial statements. All companies must comply with reporting requirements at the end of each 12-month period, with limited extensions available for businesses requesting a longer first trading period or applying for an extension due to a change of financial year-end.

As a business accountancy practice, we are accustomed to dealing with accounts preparation for a wide range of clients. We can offer advice about how filing rules apply and any additional reporting regulations relevant to your trading sector.

Statutory accounts are a compulsory requirement for many businesses, including:

Limited companies and limited liability partnerships

Charitable and not-for-profit organisations

Unincorporated businesses

Trusts

Many businesses also ask us to assist with management accounts preparation. The process works similarly to preparing annual accounts but offers a snapshot of company performance at defined points in the year, such as quarter-end.

Working with an accountancy team with industry experience ensures your finances are reported accurately, filed on time, represent a true picture of trading performance, and incorporate accurate asset valuations – precluding any likelihood of mistakes, assumptions or misdeclarations.

Small businesses that find accounts preparation challenging may also benefit from advice about transitioning to cloud-based accounting software, which offers a number of positives, including increased data security and more efficient bookkeeping – making year-end accounting a less time-intensive process.

Managing Tax Exposure and Submitting Accurate Returns

The next most frequent reason businesses in Hampshire hire an accountant is that they require assistance with tax filings. Depending on the size of the business, VAT registration requirements and the types of goods or services the company offers, there may be multiple tax-related matters that require attention:

Quarterly VAT returns and payments

Corporation Tax calculations and remittances

Taxes and duties related to imports and exports

Applying for tax reliefs available for research and development activities

PAYE taxes for employers, including National Insurance

Director’s tax exposures and tax treatments of dividend, salary and bonus payments

Accountants don’t simply compile reports and file tax returns but advise on the most relevant and efficient treatment of transactions for tax purposes. Examples might include scenarios where a business needs to decide whether to write off an item of expenditure or account for the outgoing as an investment – the right solution may impact your tax liabilities.

Businesses that regularly consult a capable accounting team also have the assurance of pre-empting changing tax regulations and ensure they are always aware of reforms that may affect the way they account for and declare tax obligations.

Seeking advice about cloud-based accounting systems, as we’ve mentioned, is also advisable for businesses with ongoing tax filing requirements. Making Tax Digital is a major reform to the way UK companies submit tax declarations, and lagging behind the staggered rollout could be a costly error.

Bookkeeping and Ongoing Business Finance Support

Outsourcing bookkeeping is a great way for small business clients to maintain control over their finances, delegating day-to-day data entry, accounts reconciliations and management of money flowing into and out of the business – ensuring records are accurate and current.

For many businesses, their success hinges on real-time reporting and having the kind of oversight that helps them discover opportunities, trends, areas driving the highest profit margins, or potential cash flow bottlenecks that require action.

Budgets and forecasting provide a picture of how the business is trading now, what that might look like in a year or further into the future, the reality of profitability, shareholder wealth preservation and growth, and how the company can inject financial resources into planned projects.

These accounting services add real value, ensuring that business owners can, for example:

Arrange competitive business loans to meet shortfalls in cash flow.

Make astute decisions around mergers, acquisitions, investments in equipment, and workforce expansion.

Forecast their taxation obligations and ensure reserves have been set aside.

An accounting practice that knows your business and is up to speed with your key aims can offer access to a broad scope of knowledge, whether you require advice about specific decisions or would like assistance with tax management and other issues as and when they arise.

The Benefits of Consulting Accountants in Fareham

Working with a local accountancy team here in Hampshire is an ideal option for businesses of all sizes – you can consult with an accountant you know and trust at any point or arrange an in-person chat or confidential phone call to work through any decisions, issues or opportunities.

Chartered accountants offer a comprehensive spectrum of expertise and ultimately make running your business more streamlined, without time pressures and uncertainty or guesswork to complicate your accounts filing, tax declaration or reporting requirements.

Accountants get to know your business plan, objectives, trading sector and aspirations to tailor the suggestions we make, the services we recommend or the solutions we might offer your organisation, varying this accordingly for limited companies, sole traders, partnerships and larger corporations.

Please get in touch with the James Todd & Co team anytime for further information about any of the services discussed here, or review our detailed service pages to learn more.

Original Source : -

0 notes

Text

Advanced Accounting Strategies for Small Businesses: The Role of XERO Bookkeepers Toronto

Effective navigation of the financial complexities of small business management demands a sophisticated strategy. Small firms in Toronto's vibrant business scene have access to XERO Bookkeepers Toronto, an especially useful resource. This solution provides a simplified route to financial transparency and operational efficiency, which is crucial in demystifying the intricacies related to financial management.

0 notes

Text

Advanced Accounting Strategies for Small Businesses: The Role of XERO Bookkeepers Toronto

The financial intricacies of managing a small business require a sophisticated approach to navigate effectively. Accurate bookkeeping and adept financial management are paramount in this context, serving as the navigational tools that ensure a business remains on a prosperous trajectory. In the dynamic commercial environment of Toronto, small businesses have access to a particularly valuable resource: XERO Bookkeepers Toronto. This service is instrumental in demystifying the complexities associated with financial management, offering a streamlined path to fiscal clarity and operational efficiency.

Fundamentals of Financial Management

A preliminary understanding of financial management is essential for any business owner. Accounting, the formal system of recording and analyzing financial transactions, serves as the universal language through which a business’s fiscal health is communicated. The prospect of mastering this language can be daunting for small business proprietors. However, the adoption of XERO, coupled with the expertise provided by XERO Bookkeepers Toronto, can significantly alleviate this burden, making financial management both accessible and manageable.

The Imperative of Precise Financial Documentation

The cornerstone of sound financial management is the maintenance of precise and current financial records. This involves a meticulous documentation process for all financial activities, irrespective of scale. The accuracy of these records is crucial, as they form the basis for informed financial analysis and decision-making. Moreover, these records are indispensable for regulatory compliance, particularly in relation to taxation. The integration of sophisticated accounting software like XERO, enhanced by the professional oversight of XERO Bookkeepers Toronto, ensures the integrity of these financial records.

Strategic Budgeting and Financial Forecasting

Effective budgeting transcends mere expenditure restriction; it entails strategic financial planning that aligns with the overarching objectives of the business. Financial forecasting extends this premise by predicting future financial trends based on historical data. These processes are vital for informed decision-making and strategic planning. The expertise of XERO Bookkeepers Toronto is invaluable in this context, offering nuanced insights and advice derived from in-depth financial analyses.

Cash Flow Management

Adequate cash flow management is crucial for the operational viability of any business. It encompasses not only the monitoring of income and expenses but also the timing of these financial movements. Effective cash flow management ensures sufficient liquidity to meet immediate obligations and identifies potential financial shortfalls in advance. The application of XERO for real-time financial monitoring, supplemented by the strategic guidance of professional bookkeepers, can significantly enhance cash flow management.

Tax Planning and Compliance

Navigating the complexities of tax compliance is a formidable aspect of business management. Proactive tax planning and a thorough understanding of tax obligations can mitigate the stress associated with tax season, ensuring compliance and optimizing fiscal outcomes. The specialized knowledge of XERO Bookkeepers Torontois particularly beneficial in this domain, facilitating a comprehensive approach to tax management that preempts unforeseen liabilities and capitalizes on potential savings.

Conclusion

In the competitive landscape of Toronto, the mastery of accounting principles and financial management is not merely advantageous for small business owners—it is essential. From the foundational aspects of financial documentation to the nuanced realms of tax planning and cash flow management, the challenges are significant. However, the resources available, notably XERO Bookkeepers Toronto, provide a robust framework for navigating these challenges. The integration of advanced accounting software like XERO, supported by the expertise of professional bookkeepers, empowers small businesses to manage their financial operations with a level of precision and foresight that ensures sustained success and growth.

0 notes

Text

Unlocking Business Success with Professional Bookkeeping Services

In the fast-paced world of modern business, staying ahead of the curve is paramount to success. One of the most crucial aspects of a thriving enterprise is maintaining accurate financial records and ensuring compliance with regulations. It's no secret that bookkeeping is the backbone of any successful business, enabling informed decision-making, strategic planning, and sustainable growth.

The Value of Professional Bookkeeping

Professional bookkeeping services offer a myriad of advantages that extend beyond mere number-crunching. Accurate and up-to-date financial records are essential for understanding the Financial Health of a business, making it easier to secure funding, attract investors, and ultimately drive profitability.

By employing bookkeeping professionals, businesses can seamlessly track their expenses, monitor cash flow, and make well-informed financial decisions. This level of financial transparency provides a solid foundation for sustainable growth and minimizes the risk of errors and financial setbacks. A recent survey conducted in Victoria, Melbourne revealed that 85% of businesses that outsource bookkeeping services experienced improved financial accuracy and efficiency, leading to enhanced profitability.

The Impact on Business Performance

Consider a growing boutique retail Business In Melbourne that recognized the impending need for professional bookkeeping services. By leveraging the expertise of a dedicated bookkeeping team, the business was able to streamline its financial operations, gain valuable insights into its cash flow, and identify cost-saving opportunities. This not only facilitated better resource allocation but also nurtured a more robust fiscal strategy, setting the stage for accelerated growth and expansion.

Harnessing the Power of FOMO

The fear of missing out is a powerful motivator. In a competitive business landscape, the fear of falling behind can propel businesses to embrace the latest trends and best practices. Those who hesitate to enlist professional bookkeeping services risk being left in the dust, unable to keep pace with their more prudent counterparts, and missing out on crucial opportunities for strategic growth.

Why Others Embrace Bookkeeping Services

Industry leaders across various sectors in Melbourne consistently turn to professional Bookkeeping services to capitalize on the expertise and precision that these services offer. By outsourcing bookkeeping tasks, they free up valuable time and resources to direct toward core business activities, innovation, and client relations. In doing so, they effectively mitigate risks, reduce operational costs, and gain a competitive edge in their respective markets.

The Call to Action

In conclusion, the value of professional bookkeeping services cannot be overstated. Business owners and professionals in Victoria, Melbourne are urged not to overlook the transformative impact that expert bookkeeping can have on their enterprises. As we continue to witness the tangible benefits enjoyed by businesses that opt for professional bookkeeping, I invite you to explore the possibilities that such services could unfold for your success.

Medium offers a wealth of resources and insights into the world of professional services. I encourage you to explore the various perspectives and experiences shared on Medium, which can provide valuable guidance on embracing professional bookkeeping services to drive your business to new heights.

#Bookkeeping Services#online accounting#business bookkeeping#xero accounting package#virtual bookkeeper#bookkeeping packages#payroll bookkeeping services#bookkeeping services near me

0 notes

Text

Add the files email address as a contact in your email service provider. Then you can quickly forward attachments to Xero. If you frequently receive attachments like phone bills, set up a rule in your email account to auto-forward those emails directly to the organisation's file library Inbox

1 note

·

View note

Text

#business#bookkeeping#accounting services#bookkeeping services#xero bookkeeping#xero bookkeeper#xero advisor#xero#bookkeeping for small business#bookkeeping solutions#bookkeeping & quickbook service in houston & the woodland#bookkeeping for ecommerce business

1 note

·

View note

Text

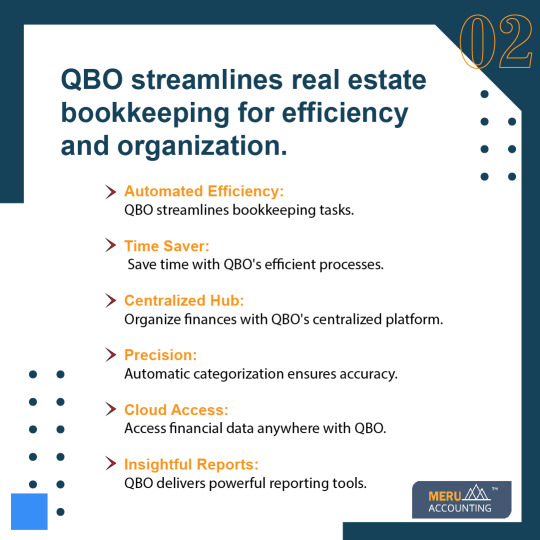

Join our exclusive webinar on December 28 at 8:30 PM IST.

Unlock the secrets of Real Estate Accounting and Compliance!

Master rental & construction accounting with QuickBooks, Xero, Buildium, and Appfolio.

Don't miss out—reserve your spot now!

https://forms.monday.com/forms/3b1b724b702bb107e9fc45852b4e1097?r=use1

#MeruAccounting#bookkeepingservices#bookkeeping#accounting#accountingservices#RealEstate#realestatetips#Xero#buildium#appfolio#accountingsoftware#QuickBooks#quickbooksproadvisor#Webinar#JoinUs#ahmedabad#ahmedabad_instagram

1 note

·

View note

Text

Will online-only VAT registrations really clear HMRC's backlog? - AAT Comment

There are benefits to going digital, but it’s not clear how this will help reduce the backlog.

— Read on www.aatcomment.org.uk/audience/members/will-online-only-vat-registrations-really-clear-hmrcs-backlog/

KS Virtual Finance

View On WordPress

#blogging-sites#bookkeeping#HMRC#local business#personal-finance#personal-finance-blogs#personal-finance-software#self-assessment#small business uk#tax credit#UK TAX#Virtualassistant#workingfromhome#Xero

0 notes