#campaign finance laws

Text

Federal prosecutors are investigating conservative-backed efforts in Wyoming to infiltrate the Democratic National Committee ahead of the 2020 election, according to people familiar with the matter.

Prosecutors have subpoenaed Richard Seddon, a former British intelligence official, and Susan Gore, a Republican donor and heiress to the Gore-Tex fortune, as part of the investigation, the people said.

The investigation appears to stem from a 2021 New York Times article that, citing interviews and documents, detailed “an undercover operation by conservatives to infiltrate progressive groups, political campaigns, and the offices of Democratic as well as moderate Republican elected officials during the 2020 election cycle.”

One of the subpoenas, which was sent in the past two weeks, seeks documents and communications from January 2018 through the present involving numerous limited liability companies and individuals, including Gore; Seddon; Erik Prince, the security contractor and brother to former Education Secretary Betsy DeVos; and James O’Keefe, the former head of Project Veritas.

The people familiar with the investigation said prosecutors are looking into whether any campaign finance laws were violated. No one has been accused of any wrongdoing.

The investigation is being handled by the public corruption unit of the US attorney’s office in Washington, DC. A spokeswoman for the office said that it does not confirm or deny investigations.

Gore recently retained Nicholas Gravante Jr., a New York defense attorney who previously represented Allen Weisselberg, the former chief financial officer of the Trump Organization. Weisselberg cut a deal with prosecutors and testified at the tax fraud trial of the Trump Organization entities resulting in their conviction.

Gravante confirmed he represents Gore and declined further comment.

Seddon has retained Robert Driscoll, a well-connected Washington, DC, attorney who has represented numerous high-profile clients. Driscoll declined to comment.

Matthew Schwartz, a lawyer for Prince, said, “As far as we know, there are no federal criminal investigations involving my client whatsoever.”

An attorney for Project Veritas and O’Keefe referred CNN to the company. Project Veritas and O’Keefe could not immediately be reached.

According to the Times, Seddon, working with Prince, secured funding from Gore by the end of 2018 to train activists to infiltrate political groups. Seddon, according to the Times, recruited former operatives from Project Veritas, where he previously worked.

The Times reported that two operatives trained by Seddon pledged sizable political donations ranging from $1,250 to $10,000 to Democratic organizations and candidates. Some of the donations gained the operatives, a couple, entry to fundraisers and even a Democratic primary debate in Las Vegas.

It is not clear where the couple got the money to make the donations. It is illegal to use another person’s name to make political donations and prosecutors have brought numerous so-called straw donor prosecutions in recent years.

One of the subpoenas also seeks any communications involving the couple as well as the individuals and organizations that received the donations, a source said.

#us politics#news#republicans#conservatives#Democrats#democratic national committee#2020 election#Richard Seddon#Susan Gore#New York Times#Erik Prince#Betsy DeVos#James O’Keefe#Project Veritas#campaign finance laws#Nicholas Gravante Jr.#Robert Driscoll#Matthew Schwartz#straw donors#department of justice#wyoming#cnn politics

18 notes

·

View notes

Text

#us politics#sen. marsha blackburn#Tennessee#campaign finance laws#misuse of campaign funds#insurrectionists#jan 6 insurrection#dark money#financial disclosure reports#us congress#conservatives#gop#republicans#republican hypocrisy#party of law and order#us senate

14 notes

·

View notes

Text

"Republicans have waged a decades-long battle to blow up the campaign-finance laws that rein in big-money spending. Now, they are making a play that could end in their biggest victory since the Citizens United ruling in 2010.

The GOP is growing increasingly optimistic about their prospects in a little-noticed lawsuit that would allow official party committees and candidates to coordinate freely by removing current spending restrictions.

If successful, it would represent a seismic shift in how tens of millions of campaign dollars are spent and upend a well-established political ecosystem for TV advertising.

An eventual victory in the lawsuit, filed last November by the National Republican Senatorial Committee and the National Republican Congressional Committee, would eliminate the need for House and Senate campaign committees of any party to set up separate operations to make so-called independent expenditures to boost candidates with TV ads."

2 notes

·

View notes

Note

I guess Joe did it again stood in the strike line to take a photo op and said something on the bull horn after that he was lost and confused walking around. This happened I saw the video.

Lol I saw he went and the first three things I thought were "cringe" and "yikes" and "why" but then a just few hours later I saw a TV ad from his campaign using the footage from his picket line visit and I said "oh yeah that explains it" and "always good to see taxpayer money blatantly used for campaign purposes" and also "cringe" again.

#Technically not a campaign or public finance violation#But oh buddy try to be a little less obvious about it when you fudge the law#At least give it a couple days

6 notes

·

View notes

Link

2 notes

·

View notes

Text

Embezzlement Kickbacks and Overcharging Mileage: Lee Chatfield is Back in the News

It seems only a year ago that a former Republican Speaker of the State House was found guilty of taking bribes for medical marijuana dispensary licenses. That’s because it is! Today, Attorney General Dana Nessel read the charges against Lee Chatfield and his wife in Lansing. Both are charged with misusing social welfare account contributions and stealing from taxpayers. Happy crooked Republican…

View On WordPress

#Attorney General Dana Nessel#Dana Nessel#Embezzlement#Kickbacks#Lee Chatfield#Michigan#Michigan campaign finance laws#Michigan Republicans#MIGOP#Terry Burns#Walnut Tree Properties

0 notes

Text

Tomorrow, a former President of the United States will go on trial on felony charges for the first time. This is not a partisan decision. It is not a "witch hunt". It is a fulfilment of the most basic principle of a society based on the rule of law: that no person is above that law. Neither is it a dark or shameful time for the country. The dark and shameful times were all the ones that he committed crimes with impunity. Today is a day of honour for America, a too-rare moment of striving to live up to it's highest principles. The shame belongs to Donald Trump and to the Republican Party, as it prepares to nominate this indicted felon once more to the Presidency.

0 notes

Text

The Global Landscape of Money in Politics: A Comparative Analysis

In the intricate dance of democracy, the relationship between money and politics is both inevitable and controversial. As nations strive for a balance that ensures political influence cannot simply be bought, they grapple with the dual imperatives of fostering political participation and preventing corruption. This article delves into the regulatory frameworks governing campaign finance in five…

View On WordPress

#Australia#Bipartisan Campaign Reform Act#Campaign Finance#Canada#Canada Elections Act#Citizens United#Commonwealth Electoral Act#Democracy#election law#Elections and Referendums Act#electoral bonds#Federal Election Campaign Act#India#political donations#Political Parties#political spending#public financing#Supreme Court#transparency in politics#United Kingdom#United-States

0 notes

Text

For screenreaders this is a poll:

The question is: "If you won 100 Million Dollars, what would you spend it on?"

the options are:

Buy house for self +friends and family, use money on smaller splurges for yourself (such as buying a bunch of books, movies, fandom merch, etc) plus giving a lot to charity and direct Mutual Aid (including local mutual aid by directly giving $ to the homeless, for example)

Buy house for self, splurge on lots of Big things (thousand dollars and up each), put a bit towards charity and Mutual Aid, but keep a lot of it for big spending.

Buy house for self, splurge on big things, keep it all to myself + invest in the stock market or crypto or something similar to make even more millions.

#polls#lottery#if you won the lottery what would you spend it on?#signal boost#money#finances#if I won the lottery you bet your butt i'd be buying a house with a giant yard to garden in#buying friends and family their own homes or paying off their home for them#probably buying a huge plot of land explicity so houseless people could camp there without having to worry about police#which would also clearly have heat water electricity proper shelter if not mini homes depending on my budget and idk about building laws#but yeah i'd be dropping 5k to anyone struggling with rent or groceries#buy a whole bunch of rare/out of print books for my favorite fandoms (hi doctor who faction paradox and quantum leap)#uhhh oh! getting every single fucking stray cat in our area spayed neutered and taken off the streets#build a giant enclosure just for ''outdoor cats'' to roam in without hurting wildlife while receiving medical care and proper food#huge ass publicity campaign to get people to stop fucking putting their cats outside#giving the aspca and other rescue orgs millions just so they can spay peoples pets for free#walking up to vets offices and giving them a million each for people's vet fees#etc etc etc#leaving $500 tips to food delivery people if not more#hire a personal chauffer so I can actually get to places around town without having to walk everywhere because I don't drive

1 note

·

View note

Text

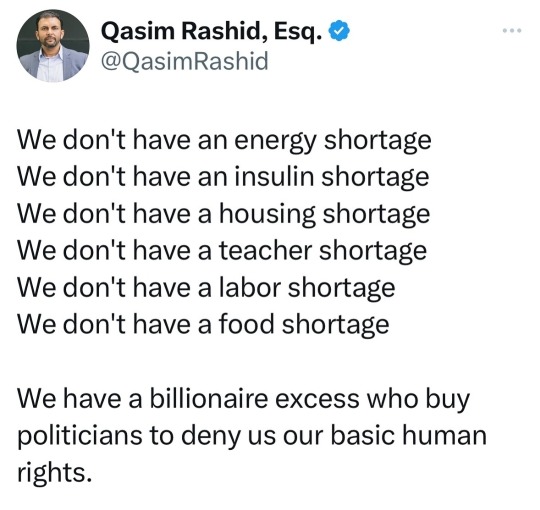

The late stages of capitalism are nigh.

Abolish Citizens United. Restore meaningful campaign finance laws.

8K notes

·

View notes

Text

Hundreds of thousands of poor Floridians have been kicked off Medicaid in recent weeks as their Republican Governor, Ron DeSantis, travels the country for his 2024 presidential bid and rakes in campaign cash from big donors.

Florida is among the states that have begun unwinding pandemic-era rules barring states from removing people from Medicaid during the public health emergency. Late last year, Congress reached a bipartisan deal to end the so-called continuous coverage requirements, opening the door to a massive purge of the lifesaving healthcare program.

A dozen states have released early data on the number of people removed from Medicaid as they restart eligibility checks, a cumbersome process that many people fail to navigate.

So far, the statistics are alarming: More than 600,000 people across the U.S. have been stripped of Medicaid coverage since April, according to a KFF Health News analysis of the available data, and "the vast majority were removed from state rolls for not completing paperwork" rather than confirmed ineligibility.

Nearly 250,000 people who have been booted from Medicaid live in Florida, whose Governor is a longtime opponent of public healthcare programs. As HuffPost's Jonathan Cohn wrote Sunday, DeSantis "has refused to support the ACA's Medicaid expansion for the state, which is the biggest reason that more than 12% of Floridians don't have health insurance."

"That's the fourth-highest rate in the country," Cohn noted.

But DeSantis, who has said he wants to "make America Florida," appears unmoved by the staggering number of people losing Medicaid in his state as he hits the campaign trail. The Governor relied heavily on large contributors to bring in more than $8 million during the first 24 hours of his presidential bid.

Prior to formally launching his 2024 campaign, DeSantis traveled the country in private jets on the dime of rich and sometimes secret donors, and he is currently facing a Federal Election Commission complaint for unlawfully transferring more than $80 million from a state committee to a super PAC supporting his White House bid.

Late last month, DeSantis' administration insisted it "has a robust outreach campaign" aimed at ensuring people are aware of the hoops they have to jump through to keep their Medicaid coverage, such as income verification.

In Florida, a four-person household must make less than $39,900 in annual income to qualify for Medicaid.

The state's early data indicates that 44% of those who have lost coverage in recent weeks were removed for procedural reasons, like a failure to return paperwork on time.

The figures have drawn outrage from local advocates, who urged DeSantis late last month to pause the Medicaid redetermination process after hearing reports of people losing coverage without receiving any notice from Florida's chronically understaffed Department of Children and Families (DCF).

"One of these individuals is a seven-year-old boy in remission from Leukemia who is now unable to access follow-up—and potentially lifesaving—treatments," a coalition of groups including the Florida Policy Institute and the Florida Health Justice Project wrote to DeSantis. "Families with children have been erroneously terminated, and parents are having trouble reaching the DCF call center for help with this process. Additionally, unclear notices and lack of information on how to appeal contribute to more confusion."

Citing Miriam Harmatz, advocacy director and founder of the Florida Health Justice Project, KFF Health News reported last week that "some cancellation notices in Florida are vague and could violate due process rules."

"Letters that she's seen say 'your Medicaid for this period is ending' rather than providing a specific reason for disenrollment, like having too high an income or incomplete paperwork," the outlet noted. "If a person requests a hearing before their cancellation takes effect, they can stay covered during the appeals process. Even after being disenrolled, many still have a 90-day window to restore coverage."

The Congressional Budget Office recently estimated that around 15.5 million people—including 5 million children—are likely to lose Medicaid coverage nationwide over the next year and a half as states resume eligibility checks made necessary by a system that doesn't guarantee healthcare to all as a right.

"Many people don't realize that they've been disenrolled from Medicaid until they show up at the pharmacy to get their prescription refilled or they have a doctor's appointment scheduled," Jennifer Tolbert, director of state health reform at the Kaiser Family Foundation, told The Washington Post last week.

#us politics#news#common dreams#2023#florida#gov. ron desantis#medicaid#affordable care act#KFF Health News#Jonathan Cohn#huffington post#Federal Election Commission#misuse of campaign funds#campaign finance laws#campaign funding#campaign fundraising#2024 republican primaries#2024 presidential race#2024 elections#Department of Children and Families#Florida Policy Institute#Florida Health Justice Project#Miriam Harmatz#Congressional Budget Office#Jennifer Tolbert#Kaiser Family Foundation#the washington post#medicare for all#healthcare is a human right

8 notes

·

View notes

Text

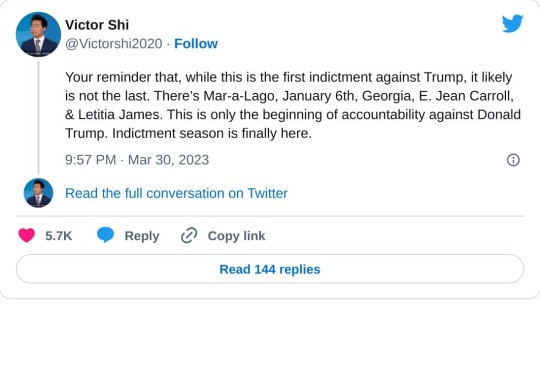

#us politics#news#twitter#tweet#republicans#conservatives#donald trump#gop#indictment#trump scandals#john fugelsang#@victorshi2020#hush money#campaign finance law#stormy daniels#classified documents probe#capitol riot investigation#georgia election investigation#e. jean carroll#letitia james#alvin bragg#fani willis#2023

3K notes

·

View notes

Text

Trump indictment 101

Donald J Trump has been indicted on 30 counts including campaign finance fraud, tax evasion and falsifying business records. The latter is a Class E felony, and could come with a prison sentence of up to four years

A grand jury decided on the indictments, the government of the State of New York had to make their case

In 2018 Michael Cohen, Trump’s former lawyer went to jail.

Michael Cohen was told by his boss Donald J Trump to pay ‘hush money’ to adult film actress Stormy Daniels (stage name)

Michael Cohen was then ‘reimbursed’ for this fee with personal checks from (and signed by) Donald J Trump.

The Trump Organization committed tax evasion and campaign finance fraud by claiming that these payments to Cohen were on behalf of the Trump Presidential campaign.

Ms Daniels payment and Cohen’s fees amounted to almost half a million dollars.

Of all the criminal cases in Donald J Trump’s life this is one of them that has been easiest to prove, and certainly because someone else went to jail for it.

The only question was, would the NY DA be brave and strong enough to make someone stand trial for their crimes, no matter how wealthy and powerful.

Trump will be taken to jail, and booked, and then set out on bail.

Then he will face charges in a court of law before a jury, just like anyone else

3 notes

·

View notes

Text

Paying consumer debts is basically optional in the United States

The vast majority of America's debt collection targets $500-2,000 credit card debts. It is a filthy business, operated by lawless firms who hire unskilled workers drawn from the same economic background as their targets, who routinely and grotesquely flout the law, but only when it comes to the people with the least ability to pay.

America has fairly robust laws to protect debtors from sleazy debt-collection practices, notably the Fair Debt Collection Practices Act (FDCPA), which has been on the books since 1978. The FDCPA puts strict limits on the conduct of debt collectors, and offers real remedies to debtors when they are abused.

But for FDPCA provisions to be honored, they must be understood. The people who collect these debts are almost entirely untrained. The people they collected the debts from are likewise in the dark. The only specialized expertise debt-collection firms concern themselves with are a series of gotcha tricks and semi-automated legal shenanigans that let them take money they don't deserve from people who can't afford to pay it.

There's no better person to explain this dynamic than Patrick McKenzie, a finance and technology expert whose Bits About Money newsletter is absolutely essential reading. No one breaks down the internal operations of the finance sector like McKenzie. His latest edition, "Credit card debt collection," is a fantastic read:

https://www.bitsaboutmoney.com/archive/the-waste-stream-of-consumer-finance/

McKenzie describes how a debt collector who mistook him for a different PJ McKenzie and tried to shake him down for a couple hundred bucks, and how this launched him into a life as a volunteer advocate for debtors who were less equipped to defend themselves from collectors than he was.

McKenzie's conclusion is that "paying consumer debts is basically optional in the United States." If you stand on your rights (which requires that you know your rights), then you will quickly discover that debt collectors don't have – and can't get – the documentation needed to collect on whatever debts they think you owe (even if you really owe them).

The credit card companies are fully aware of this, and bank (literally) on the fact that "the vast majority of consumers, including those with the socioeconomic wherewithal to walk away from their debts, feel themselves morally bound and pay as agreed."

If you find yourself on the business end of a debt collector's harassment campaign, you can generally make it end simply by "carefully sending a series of letters invoking [your] rights under the FDCPA." The debt collector who receives these letters will have bought your debt at five cents on the dollar, and will simply write it off.

By contrast, the mere act of paying anything marks you out as substantially more likely to pay than nearly everyone else on their hit-list. Paying anything doesn't trigger forbearance, it invites a flood of harassing calls and letters, because you've demonstrated that you can be coerced into paying.

But while learning FDCPA rules isn't overly difficult, it's also beyond the wherewithal of the most distressed debtors (and people falsely accused of being debtors). McKenzie recounts that many of the people he helped were living under chaotic circumstances that put seemingly simple things "like writing letters and counting to 30 days" beyond their needs.

This means that the people best able to defend themselves against illegal shakedowns are less likely to be targeted. Instead, debt collectors husband their resources so they can use them "to do abusive and frequently illegal shakedowns of the people the legislation was meant to benefit."

Here's how this debt market works. If you become delinquent in meeting your credit card payments ("delinquent" has a flexible meaning that varies with each issuer), then your debt will be sold to a collector. It is packaged in part of a large spreadsheet – a CSV file – and likely sold to one of 10 large firms that control 75% of the industry.

The "mom and pops" who have the other quarter of the industry might also get your debt, but it's more likely that they'll buy it as a kind of tailings from one of the big guys, who package up the debts they couldn't collect on and sell them at even deeper discounts.

The people who make the calls are often barely better off than the people they're calling. They're minimally trained and required to work at a breakneck pace. Employee turnover is 75-100% annually: imagine the worst call center job in the world, and then make it worse, and make "success" into a moral injury, and you've got the debt-collector rank-and-file.

To improve the yield on this awful process, debt collection companies start by purging these spreadsheets of likely duds: dead people, people with very low credit-scores, and people who appear on a list of debtors who know their rights and are likely to stand on them (that's right, merely insisting on your rights can ensure that the entire debt-collection industry leaves you alone, forever).

The FDPCA gives you rights: for example, you have the right to verify the debt and see the contract you signed when you took it on. The debt collector who calls you almost certainly does not have that contract and can't get it. Your original lender might, but they stopped caring about your debt the minute they sold it to a debt-collector. Their own IT systems are baling-wire-and-spit Rube Goldberg machines that glue together the wheezing computers of all the companies they've bought over the last 25 years. Retrieving your paperwork is a nontrivial task, and the lender doesn't have any reason to perform it.

Debt collectors are bottom feeders. They are buying delinquent debts at 5 cents on the dollar and hoping to recover 8 percent of them; at 7 percent, they're losing money. They aren't "large, nationally scaled, hypercompetent operators" – they're shoestring operations that can only be viable if they hire unskilled workers and fail to train them.

They are subject to automatic damages for illegal behavior, but they still break the law all the time. As McKenzie writes, a debt collector will "commit three federal torts in a few minutes of talking to a debtor then follow up with a confirmation of the same in writing." A statement like "if you don’t pay me I will sue you and then Immigration will take notice of that and yank your green card" makes the requisite three violations: a false threat of legal action, a false statement of affiliation with a federal agency, and "a false alleged consequence for debt nonpayment not provided for in law."

If you know this, you can likely end the process right there. If you don't, buckle in. The one area that debt collectors invest heavily in is the automation that allows them to engage in high-intensity harassment. They use "predictive dialers" to make multiple calls at once, only connecting the collector to the calls that pick up. They will call you repeatedly. They'll call your family, something they're legally prohibited from doing except to get your contact info, but they'll do it anyway, betting that you'll scrape up $250 to keep them from harassing your mother.

These dialing systems are far better organized than any of the company's record keeping about what you owe. A company may sell your debt on and fail to keep track of it, with the effect that multiple collectors will call you about the same debt, and even paying off one of them will not stop the other.

Talking to these people is a bad idea, because the one area where collectors get sophisticated training is in emptying your bank account. If you consent to a "payment plan," they will use your account and routing info to start whacking your bank account, and your bank will let them do it, because the one part of your conversation they reliably record is this payment plan rigamarole. Sending a check won't help – they'll use the account info on the front of your check to undertake "demand debits" from your account, and backstop it with that recorded call.

Any agreement on your part to get on a payment plan transforms the old, low-value debt you incurred with your credit card into a brand new, high value debt that you owe to the bill collector. There's a good chance they'll sell this debt to another collector and take the lump sum – and then the new collector will commence a fresh round of harassment.

McKenzie says you should never talk to a debt collector. Make them put everything in writing. They are almost certain to lie to you and violate your rights, and a written record will help you prove it later. What's more, debt collection agencies just don't have the capacity or competence to engage in written correspondence. Tell them to put it in writing and there's a good chance they'll just give up and move on, hunting softer targets.

One other thing debt collectors due is robo-sue their targets, bulk-filing boilerplate suits against debtors, real and imaginary. If you don't show up for court (which is what usually happens), they'll get a default judgment, and with it, the legal right to raid your bank account and your paycheck. That, in turn, is an asset that, once again, the debt collector can sell to an even scummier bottom-feeder, pocketing a lump sum.

McKenzie doesn't know what will fix this. But Michael Hudson, a renowned scholar of the debt practices of antiquity, has some ideas. Hudson has written eloquently and persuasively about the longstanding practice of jubilee, in which all debts were periodically wiped clean (say, whenever a new king took the throne, or once per generation):

https://pluralistic.net/2020/03/24/grandparents-optional-party/#jubilee

Hudson's core maxim is that "debt's that can't be paid won't be paid." The productive economy will have need for credit to secure the inputs to their processes. Farmers need to borrow every year for labor, seed and fertilizer. If all goes according to plan, the producer pays off the lender after the production is done and the goods are sold.

But even the most competent producer will eventually find themselves unable to pay. The best-prepared farmer can't save every harvest from blight, hailstorms or fire. When the producer can't pay the creditor, they go a little deeper into debt. That debt accumulates, getting worse with interest and with each bad beat.

Run this process long enough and the entire productive economy will be captive to lenders, who will be able to direct production for follies and fripperies. Farmers stop producing the food the people need so they can devote their land to ornamental flowers for creditors' tables. Left to themselves, credit markets produce hereditary castes of lenders and debtors, with lenders exercising ever-more power over debtors.

This is socially destabilizing; you can feel it in McKenzie's eloquent, barely controlled rage at the hopeless structural knot that produces the abusive and predatory debt industry. Hudson's claim is that the rulers of antiquity knew this – and that we forgot it. Jubilee was key to producing long term political stability. Take away Jubilee and civilizations collapse:

https://pluralistic.net/2022/07/08/jubilant/#construire-des-passerelles

Debts that can't be paid won't be paid. Debt collectors know this. It's irrefutable. The point of debt markets isn't to ensure that debts are discharged – it's to ensure that every penny the hereditary debtor class has is transferred to the creditor class, at the hands of their fellow debtors.

In her 2021 Paris Review article "America's Dead Souls," Molly McGhee gives a haunting, wrenching account of the debts her parents incurred and the harassment they endured:

https://www.theparisreview.org/blog/2021/05/17/americas-dead-souls/

After I published on it, many readers wrote in disbelief, insisting that the debt collection practices McGhee described were illegal:

https://pluralistic.net/2021/05/19/zombie-debt/#damnation

And they are illegal. But debt collection is a trade founded on lawlessness, and its core competence is to identify and target people who can't invoke the law in their own defense.

Going to Defcon this weekend? I’m giving a keynote, “An Audacious Plan to Halt the Internet’s Enshittification and Throw it Into Reverse,” today (Aug 12) at 12:30pm, followed by a book signing at the No Starch Press booth at 2:30pm!

https://info.defcon.org/event/?id=50826

I’m kickstarting the audiobook for “The Internet Con: How To Seize the Means of Computation,” a Big Tech disassembly manual to disenshittify the web and bring back the old, good internet. It’s a DRM-free book, which means Audible won’t carry it, so this crowdfunder is essential. Back now to get the audio, Verso hardcover and ebook:

http://seizethemeansofcomputation.org

If you’d like an essay-formatted version of this post to read or share, here’s a link to it on pluralistic.net, my surveillance-free, ad-free, tracker-free blog:

https://pluralistic.net/2023/08/12/do-not-pay/#fair-debt-collection-practices-act

#pluralistic#jubilee#debts that cant be paid wont be paid#Patrick McKenzie#patio11#bits about money#debt#debt collection#do not pay#bottom feeders#Fair Debt Collection Practices Act#fdcpa#finance#armbreakers

11K notes

·

View notes

Text

Trump leadership PAC spent more than $16 million on legal services in 2022 | CNN Politics

CNN

—

Donald Trump’s leadership PAC spent more than $16 million on legal services in 2022, according to a tally of the Save America PAC distributions through the end of December. The number represents a massive set of bills from lawyers at a time when the former president faces multiple criminal inquiries, lawsuits and other challenges.

The money appears to be largely geared toward firms…

View On WordPress

#campaign finance#domestic alerts#domestic-us politics#Donald Trump#elections and campaigns#government and public administration#iab-business and finance#iab-elections#iab-industries#iab-law#iab-legal services industry#iab-politics#international alerts#international-us politics#law and legal system#law practices#legal services#political action committees#political donations and fundraising#political figures - us#Politics

0 notes