#capital gains tax for non resident alien

Text

Real estate investors in Ontario: strategies to avoid capital gains tax

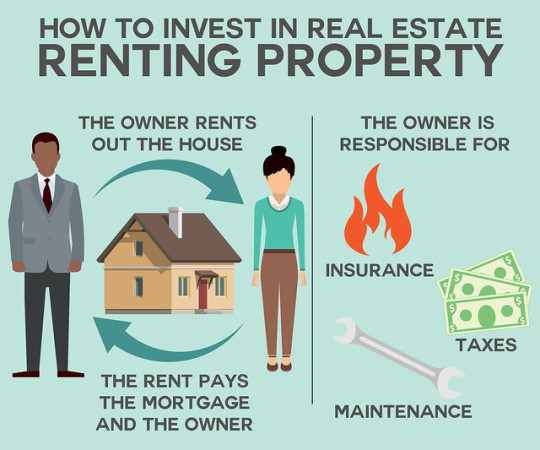

Real estate investors in Ontario often have large capital gains when they sell an investment property, which could result in paying thousands of dollars in taxes. The Canada Revenue Agency (CRA) considers these capital gains taxable income, and there are ways you can avoid paying these taxes on your profits if you sell your real estate investment property after holding it for a while. These strategies could be very valuable to real estate investors who plan to sell their properties soon.

Avoid Capital Gains Tax with your Principal Residence

You’re considered to have sold or otherwise disposed of a property when you dispose of it permanently. You may also be considered to have disposed of a property if you do something with it that would result in your not being able to use it as a principal residence again, even if you later put it back into use as your principal residence. It doesn’t matter whether or not you own another home. If you move out of your home for only a short period and then return, we consider you to have disposed of it at that time. If you move out and sell or give away all your interest in the property, we consider you to have disposed of it at that time.

If there is more than one owner on title, each owner is considered separately for purposes of determining whether they are disposing of their entire interest in a property under these rules.

Invest in Assisted Living Facilities

Assisted living facilities offer respite and assistance for seniors looking for a safer, more independent living option. However, there are downsides. If you’re thinking of investing in assisted living facilities for profit, here are some things you should consider. Sell your current home before buying an investment property: One common pitfall for real estate investors is trying to purchase multiple properties at once without first selling their primary residence. This can create cash flow problems as you attempt to juggle two mortgages on different properties while also covering expenses on your main home.

Invest in Purpose-Built Student Accommodation

Purpose-built student accommodation (PBSA) is a growing investment opportunity, and savvy real estate investors are taking note. Why? PBSA properties offer a number of desirable traits that make them appealing, including steady demand from students and access to government incentives. Here’s how you can buy into an investment property market that has room for growth.

Invest with Family Members

One strategy to avoid CGT is for individuals who are members of a family partnership or corporation (e.g., spouse, children) to invest funds into a property. A member of a family partnership will not have a taxable income event if they contribute funds; however, it is important that any funds contributed are kept separate from other assets within their own portfolio.

Get Professional Advice

Talk to a lawyer about how you might be able to structure your acquisition, holding and eventual sale of real estate. As a general rule, if you own an asset for longer than one year, you can sell it without triggering any capital gains taxes. If a lawyer tells you that there’s a way for you to hold onto an asset indefinitely, ask him or her how much it would cost each year for these services. How does that compare with what you’d pay for paying your taxes upfront?

If you are looking for strategies to avoid capital gains tax when selling your property, then this is the letter for you.

Capital gains tax is a pesky and costly thing. It can cost investors a whole lot of money! But there are ways to avoid it. In this article, find out about one of them: investing through life leases which provide both capital appreciation and income generation. This is why life leases make good investments for real estate investors who don't want to worry about paying capital gains tax.

Read this article to find out more about life leases and their benefits as investments for real estate investors in Ontario!

131 notes

·

View notes

Text

Fatca Reporting

This website uses first and third party cookies, including analytics and advertising cookies. If you accept cookies, we will place tracking cookies on your machine to personalize and enhance your experience on our website. If you decline cookies, we will only deliver cookies necessary to operate this website and remember your cookie preferences. This website may use other web technologies to enhance your browsing experience. We successfully completed several recent disclosures for clients with assets ranging from $50,000 – $7,000,000+.

In a 2016 paper academics argue that tax evasion can be directly linked to violations of human rights. That situation must be balanced against the risk that collection techniques violate other human rights like privacy and the legitimate protection of trade secrets.

Another surge in renunciations in 2013 to record levels was reported in the news media, with FATCA cited as a factor in the decision of many of the renunciants. website According to the legal website International Tax Blog, the number of Americans giving up U.S. citizenship started to increase dramatically in 2010 and rose to 2,999 in 2013, almost six-fold the average level of the previous decade. Certain aspects of FATCA have been a source of controversy in the financial and general press.

Diligent Entities offers a dedicated team of support professionals to aid in integrating and supporting your investment in the legal security of your corporation. If you are interested, please get in contact with us today, by phone or email. For example, if you are single or married filing separate and reside in the United States, then the minimum threshold requirement is $50,000 on the last day of the year or $75,000 on any day of the year (if you have less than $50,000 on the last day of the year). In sharp contrast a person filing married filing jointly and residing overseas may have a minimum threshold requirement of $400,000.

The best way to handle the flow of your business entity documents is with robust entity management software. This program will have a customized approach, tailored specifically to your business needs. Consider entity management software from a company that has over 40 years of entity management experience, and a roster of over 2,000 individual clients that spans the globe.

If so, then you need not include your business assets in the aggregate value of your Specified Foreign Financial Assets. If you are a U.S. citizen living abroad you may be responsible for filing an FBAR. Learn everything you need to know about FBAR filing and FinCEN Form 114.

However, the only way to avoid FATCA without giving up your US passport is to keep all of your banking and financial affairs within the United States. That may be worth considering for some expat employees, but here at Nomad Capitalist, we believe that being at the whim of only one country is a terrible way to diversify. A GIIN is a Global Intermediary Identification Number, consisting of 19 characters assigned by the FATCA registration system to financial institutions.

With the FBAR, the $10,000 threshold requirement does not vary. In other words, whether or not you are single, married filing jointly, or reside outside of the United States — the $10,000 threshold is still the same. Unlike the FBAR, which has been around for nearly 50-years, FATCA is relatively new. The Foreign Account tax Compliance Act was introduced as part of the HIRE Act.

J5 is used to enforce cryptocurrency compliance for U.S person. When a person has a stock certificate, it is reportable on the Form 8938, since it is a Foreign Asset. That is why I believe FATCA repeal is something doomed to never happen. Whether fair or not, you must govern yourself according to the principle that you can “go where you’re treated best,” whatever that may mean for you, and the US government certainly won’t ensure you’re treated best. While I respect the handful of tireless crusaders seeking to eliminate FATCA and the extraterritorial taxation of US persons, I don’t buy into the seemingly endless and ballyhooed claims that an end to FATCA is right around the corner.

Additional complexity for US persons US persons were already forbidden by the Securities Act of 1933 to make investments in US Securities at banks which are not certified inside the US by the Securities and Exchange Commission. This disallows US persons from participating in any product which may contain US investment products. If a financial institution is not able to segregate non-US investments from other investment products, a bank may place a total ban upon US persons using their investment products. In 2013, Time magazine reported a sevenfold increase in Americans renouncing U.S. citizenship between 2008 and 2011, attributing this at least in part to FATCA. According to BBC News, the act is one of the reasons for a surge of Americans renouncing their citizenship—a rise from 189 people in Q2/2012 to 1,131 in Q2/2013.

ACA's current position on FATCA as of 2019 is published on its website. requirements limiting data-sharing which allow sharing to be done only with organizations following the Safe Harbor Principles.

The Deputy Assistant Secretary for International Tax Affairs at the US Department of the Treasury stated in September 2013 that the controversies were incorrect . In April 2017 the Committee on Oversight and Government Reform, led by Congressman Mark Meadows, held a hearing on unintended consequences of FATCA. to address tax noncompliance related to the use of virtual currency through outreach and examinations of taxpayers. The IRS will remain actively engaged in addressing non-compliance related to virtual currency transactions through a variety of efforts, ranging from taxpayer education to audits to criminal investigations.

Originally ACA called for the U.S. to institute residence-based taxation to bring the United States in line with all other OECD countries. Later in 2014 two ACA directors commented on the situation of Boris Johnson.

#american citizen marrying a foreigner abroad#are trust distributions taxable to the beneficiary#beneficial ownership in international tax law#capital gains tax for non resident alien#cfc repatriation tax#cfc tax year end#compliance requirement for foreign accounts and trusts#cross border tax advice#cross border tax issues#crs reportable person definition#deemed paid foreign tax credit calculation#do trust beneficiaries pay taxes#estate tax us citizens living abroad#fatca crs#fatca crs status#fatca exemption#fatca filing#fatca form#fatca form 8938#fatca requirements#fatca voluntary disclosure#fatca withholding#fbar#fbar and fatca#fbar deadline#fbar due date#fbar extension#fbar filing date#fbar filing deadline#fbar maximum account value

1 note

·

View note

Text

Fbar Voluntary Disclosure Penalty Calculations Explained

Our attorneys work directly with our clients to identify potential tax issues and develop plans to ensure that their foreign assets are in full compliance with FATCA and other offshore account reporting requirements. The Internal Revenue Service has had success encouraging taxpayers with offshore accounts to disclose their foreign accounts and pay back taxes. In 2009 and 2011, the IRS announced the Offshore Voluntary Disclosure Program which allowed taxpayers to come forward and report foreign income, bank accounts, and other assets. foreign tax credit corporations The IRS had 33,000 voluntary disclosures, resulting in $4.4 billion in taxes, interest and penalties. In 2012, the IRS reopened the OVDP and set no deadline for the program to end.

Not a single one of Andrew’s clients’ Streamlined Domestic Offshore or Streamlined Foreign Offshore filings have ever been challenged or rejected by the IRS. With the help of The Law Offices of Andrew L. Jones, you can discover whether you’ve committed a Foreign Bank Account Report (FBAR, also known as FinCEN Form 114, and formerly Form TD F 90-22.1) violation.

if you reside in a country which has a tax treaty with the US, like Canada, you can claim a reduced rate of withholding tax to be deducted from a payment. You’re listening to another episode of PwC’s Tax Tracks at/ca/taxtracks. This series looks at the most pressing technical and management issues affecting today’s busiest tax directors. Through interviews with prominent PwC tax subject matter professionals, Tax Tracks is an audio podcast series that is designed to bring succinct commentary on tax technical, policy and administrative issues that provides busy tax directors information they require.

The streamline disclosure program offers a chance for those who have committed non-willful violations of tax law by failing to report taxable foreign income-generating assets or bank / financial accounts, or other required foreign information reporting a chance to be brought back into compliance. However, the keyword regarding this program is “non-willful.” You must submit a certified statement that you did not willfully fail to disclose this information to avoid paying income taxes. If you are found to have falsely certified non-willfulness, severe criminal and civil penalties can occur. The IRS is now fully committed efforts to finding and prosecuting non-compliant U.S. taxpayers with undisclosed foreign source income and offshore accounts.

The Bank Secrecy Act and the Foreign Account Tax Compliance Act require both foreign financial institutions and U.S. taxpayers to disclose the non-U.S. Compliance failures can result in both civil and criminal penalties and interest charges. The IRS reports that its programs have gathered approximately $11 billion in delinquent tax, penalties, and interest, and more than 1,500 indictments in recent years. Our FBAR and FATCA compliance team understands the complex challenges you face with foreign asset reporting regulations, the IRS voluntary disclosure program, and the disclosure and withholding requirements imposed on foreign financial institutions. If you are one of the many U.S. residents who own overseas assets and were not aware of the disclosure requirements for these accounts, you should consider disclosing your offshore assets and becoming tax compliant without delay.

A person who is required to file Form 114 and fails to do so may be subject to a penalty not to exceed $10,000 per violation. A person who wilfully fails to file or report an account may be subject to a penalty equal to the greater of $100,000 or 50 percent of the balance in the account.

Just because these assets are in a foreign country, however, this does not mean that they are not subject to taxation or foreign information reporting by the IRS. In fact, over the last decade, the IRS has cracked down on those who fail to report foreign accounts, fail to file required foreign information returns, and evade income tax from taxable offshore income-generating assets on their returns, which can lead to severe civil and criminal penalties. As if the very real possibility of penalty increases does not give taxpayers who have undisclosed foreign accounts, a reason to participate in the disclosure program as soon as possible, maybe the possibility that they will be disqualified tomorrow will. Though the provisions of agreements with foreign banks related to the FATCA legislation, an electronic data exchange protocol has been established and is now in full effect. It means that a foreign bank can send the IRS all of your foreign account information in a matter of a few seconds electronically.

Understand your clients’ strategies and the most pressing issues they are facing.

The United States has recently enacted legislation commonly referred to as FATCA for the specific purpose of finding U.S. taxpayers who have unreported foreign accounts and income. FATCA requires foreign banks and financial institutions to report accounts held by U.S. taxpayer clients. FATCA and increased enforcement of civil and criminal penalties for unfiled Foreign Bank and Financial Account Reports , have given the IRS powerful new weapons in their search for undisclosed foreign assets and accounts.

The penalties is $10,000, per return with an additional $10,000 added for each month the failure continues beginning 90 days after the taxpayer is notified of the delinquency, up to a maximum of $50,000 per return. In the mid-2000s, the IRS began aggressively pursuing foreign financial institutions for information concerning deposits held by those institutions on behalf of U.S. taxpayers. That effort has resulted in an unprecedented period of world-wide intra-governmental cooperation to identify unreported accounts and untaxed income.

If you have, we can solve it quickly and for the least possible cost. We are available by phone nationwide or by appointment at your choice of 6 different offices throughout California. We took over a case from a small firm that unsuccessfully submitted multiple clients to IRS Offshore Disclosure. Our lead attorney is one of less than 350 Attorneys to earn the Certified Tax Law Specialist credential. PwC refers to the PwC network and/or one or more of its member firms, each of which is a separate legal entity.

With very limited exceptions for individuals born with diplomatic agent level immunity, all persons born in the United States acquire U.S. citizenship at birth as a matter of U.S. law and without regard to intent. or other 3 letter government faction for criminal investigation and possible prosecution. If you are seeking FBAR Amnesty 2015 or prior year FBAR non-compliance, you can use this article to assist you with getting into compliance for 2019 and prior years. If you are seeking FBAR Amnesty 2016 for prior year FBAR non-compliance, you can use this article to assist you with getting into compliance for 2019 and prior years. If you are seeking FBAR Amnesty 2017 for prior year FBAR non-compliance, you can use this article to assist you with getting into compliance for 2019 and prior years.

New information-sharing agreements between the United States, foreign governments, and foreign financial institutions are closing the door on bank secrecy and are exposing non-compliant taxpayers who hold undisclosed assets abroad. The IRS’s Offshore Voluntary Disclosure Program offers a path for U.S. tax residents to become compliant with their outstanding filing obligations while mitigating or minimizing the penalties associated with non-compliance — however, this program can close at any time. Alternatively, the IRS could choose to limit the types of taxpayers who may enter into the streamlined program, or increase the penalties offered within the framework. Once the program closes, taxpayers may once again face full audits and investigations, full FBAR penalties, and potential prosecution. Depending on the aggregate amount of a taxpayer’s offshore assets, penalties could reach as high as 50% of the value of each overseas account per year.

Finally, with the implementation of the Foreign Account Tax Compliance Act and the IRS's increased focus on offshore tax evasion, U.S. taxpayers are increasingly unable to avoid their obligation to report their accounts and income worldwide. Each year, thousands of Americans utilize foreign bank or financial accounts and employ foreign income-generating assets.

In order to avoid being disqualified from the program, it is in your best interest to contact an experienced tax attorney to find proper representation to your undisclosed foreign accounts as soon as possible. The legal team at Thorn Law Group is well positioned to advise clients on complex tax issues associated with their offshore accounts and other foreign financial assets.

The below video explains the NEW streamlined Offshore Voluntary Program. I offer aFREEIRS OVDP check-up and aFREEin-depth financial consultation. I guarantee that after your consultation you will feel comfortable knowing how I, as an experienced professional in the industry, will resolve your case. Because of the changed amensty programs, many individuals now have an easier path to get compliant.

The Offshore Voluntary Disclosure Program began in a slightly different form and with a slightly different name in 2009. It was on an offshoot of the traditional domestic voluntary disclosure program, which has been on the books for many years, focused on FBAR violations in particular. Under this program, taxpayers who had failed to report foreign bank and financial accounts or other foreign assets on their returns could be brought back into compliance and avoid criminal liability and the most severe civil penalties. The terms of the current 2012 voluntary disclosure program may be unappealing to many taxpayers.

Our attorneys are very familiar with the reporting requirements individual taxpayers must meet under FATCA and other U.S. tax laws and regulations. We make certain that our clients understand their legal obligations and are taking appropriate steps to bring their offshore accounts and assets into full compliance with the law. Our tax law firm also assists foreign financial institutions with IRS reporting requirements and works with FFIs to design effective FATCA compliance strategies and programs.

The Form 114 is an annual report that must be filed independent of a taxpayer’s tax return on or before June 30 of every year. The monetary penalty can lead to inequitable results for many taxpayers, especially given the market fluctuations since 2008. The IRS appears to recognize that the voluntary disclosure programs many not be appropriate for all taxpayers. how to fill form 3520 For example, certain non-resident taxpayers as well as dual citizens may be allowed to correct their prior income and reporting delinquencies without entering a voluntary disclosure program.

We will happily offer you a FREE initial consultation to determine how we can best serve you. The two amnesty programs to come clean with the US government are the traditional OVDP or the Streamlined Offshore Program.

If you are seeking FBAR Amnesty 2018 for prior year FBAR non-compliance, you can use this article to assist you with getting into compliance for 2019 and prior years. We're proud to celebrate over 30 years working with international expat communities around the world. Through all the changes we've seen as our world evolves, our core value to serve our clients wherever they are, remains the same.

In addition to tax and interest, the IRS generally requires taxpayers to pay a monetary penalty equal to 27.5 percent of the highest aggregate balance of the taxpayers' foreign bank accounts/entities or value of foreign assets during the period covered by the voluntary disclosure. Despite the severity of the monetary penalty, taxpayers should consider the risk of criminal prosecution for non-compliance with the foreign account reporting rules and the potential for criminal penalties.

The rationale seems to be that if a person resides outside of the United States for 11 out of 12 months in a year, the IRS will cut them a break as tax filing. You are entering the program “voluntarily,” which means you are not currently under audit or examination. People who are both Willful and Non-Willful may enter the program, but non-willful individuals typically only submit to OVDP under specific scenarios (MTM Elections, Opt-Out). Each week, the Treasury Department announces a new agreement with a foreign country on FATCA cooperation. Just last week, the Swiss government and the United States announced such an agreement.

More than 30,000 voluntary disclosures have been made since the programs began in 2009, resulting in more than $5 billion in back taxes, interest and penalties paid to the IRS. The voluntary disclosure program provides many benefits for certain taxpayers. Most importantly, taxpayers can avoid potential criminal prosecution for failure to report their foreign accounts. In addition, taxpayers can resolve their delinquent tax and reporting issues in a relatively streamlined process.

While we have come across clients who have willfully omitted foreign accounts and income from their U.S. tax returns, most clients that contact us for offshore compliance issues have recently realized that they have foreign income and information reporting requirements . They’ve never been on the wrong side of the law and have never had the need to hire an attorney. They are terrified of the massive civil penalties that can be assessed for noncompliance, even for non-willful violations. Since 2009, the IRS has allowed taxpayers with undisclosed foreign accounts and unreported foreign earnings to enter voluntary programs to correct these compliance failures. Under the terms of these programs, taxpayers typically submit eight years of amended tax returns, Forms TD F 90-22.1 ("FBARs") reporting the foreign accounts, and account statements of their foreign accounts.

Financial institutions and host country tax authorities can transmit and exchange FATCA data with the United States. Search and download a monthly list of approved foreign institutions that have a Global Intermediary Identification Number . This website uses cookies so that we can provide you with the best user experience possible. Cookie information is stored in your browser and performs functions such as recognising you when you return to our website and helping our team to understand which sections of the website you find most interesting and useful.

The streamlined procedures are designed to provide to taxpayers in such situations with a streamlined procedure for filing amended or delinquent returns and resolving their tax and penalty obligations. Beginning with the 2011 tax year, a penalty for failing to file Form 8938 reporting the taxpayer’s interest in certain foreign financial assets, including financial accounts, certain foreign securities ,etc.

Beginning September 1, 2012, such taxpayers, provided they are deemed not to be compliance risks, may simply submit delinquent tax returns for the past three years, FBARs for the past six years, and certain other information without being subject to a civil or criminal penalty. This special dispensation may be particularly helpful for long-time residents of Canada or other nations who remain U.S. taxpayers.

OVDP is designed to provide to taxpayers with such exposure protection from criminal liability and terms for resolving their civil tax and penalty obligations. U.S. citizens must file U.S. tax returns and report and pay tax on their worldwide income. Subject to certain de minimis exceptions, if a U.S. citizen is a resident or citizen of Israel, he or she must file a U.S. income tax return and report his or her worldwide income to the IRS. The Form 114 is an annual report that must be filed independent of a taxpayer's tax return on or before June 30 of every year.

In addition, taxpayers must pay tax on the previously unreported income, interest, and certain penalties. Specifically, US taxpayers are required to comply with FATCA by properly disclosing and reporting their foreign accounts and foreign income in their Tax Return filings and FBAR reporting requirements of foreign and offshore accounts. In order to ensure the taxpayer has complied, the foreign financial institution issues a FATCA Letter, which will usually be accompanied by two forms – a W-9 and a W-8 BEN. Only US taxpayers are required to complete a W-9 and return the completed W-9 form to the foreign financial institution. As former IRS lawyers, our legal team has an extensive understanding of the U.S. tax laws and regulations governing foreign accounts and other financial assets held outside of the country. We know how the IRS and other federal authorities examine and investigate unreported offshore assets and accounts.

PricewaterhouseCoopers refers to PricewaterhouseCoopers LLP, an Ontario limited liability partnership, or, as the context requires, the PricewaterhouseCoopers global network or other member firms of the network, each of which is a separate and independent legal entity. You have 30 days to inform your financial institution or a withholding agent of the change.

#american citizen marrying a foreigner abroad#are trust distributions taxable to the beneficiary#beneficial ownership in international tax law#capital gains tax for non resident alien#cfc repatriation tax#cfc tax year end#compliance requirement for foreign accounts and trusts#cross border tax advice#cross border tax issues#crs reportable person definition#deemed paid foreign tax credit calculation#do trust beneficiaries pay taxes#estate tax us citizens living abroad#fatca crs#fatca crs status#fatca exemption#fatca filing#fatca form#fatca form 8938#fatca requirements#fatca voluntary disclosure#fatca withholding#fbar#fbar and fatca#fbar deadline#fbar due date#fbar extension#fbar filing date#fbar filing deadline#fbar maximum account value

1 note

·

View note

Text

Tax Cpa International

The moment you turn to us, we will use our knowledge and skills to help make your life easier and less stressful. I really enjoy putting together models that describe data and help organized inferences out of what is available so good decisions can be made. I like identifying outliers and digging into the detail until it all fits together. In today’s increasingly complex business and tax environment, there are more demands for transparency.

I've been doing my taxes with them for year amazing service and staff needless to say that I feel like part of the family because that's how they make me feel. Been going to them for years, wait can be long but it's because they are good and Christian is great with completing the taxes thoroughly so a lot of people go to Global tax for their returns.

We work closely with you to help your company achieve and maintain profitable growth. Our tax accounting professionals can provide the support you need to help manage the complex requirements of today’s tax landscape. By selecting an Enrolled Agent to handle your business and taxes, you are assured a superior level of taxation expertise so you can be confident of thorough, insightful service, and uncommon professionalism that makes a real difference. We provide you with a customised set of accountancy services which will suit the needs of your business.

Most recently, he took on advisory roles to some of Deloitte’s largest multinational corporate clients. By taking a second look at avenues for process and structure efficiency, while also tapping into the benefits of emerging technology, tax leaders have a great opportunity to deliver confidence and value to their businesses. A new Deloitte Global survey of senior tax decision-makers explores how tax departments are evolving to meet these needs and driving value for their businesses.

Our accounting services safeguard you and your family and optimize all your hard-earned dollars. As a matter of policy, BBB does not endorse any product, service or business. BBB Business Profiles generally cover a three-year reporting period. If you choose to do business with this business, please let the business know that you contacted BBB for a BBB Business Profile.

Tax departments are also under pressure to be more effective and highly qualified professionals can be hard to obtain. Companies are facing increased strain on their tax accounting and reporting professionals. Financial restatements, increased regulatory scrutiny over income tax disclosures and account balances, compressed close cycles, as well as new reporting considerations and standards have increased organizational needs for tax accounting. Manage tax accounting issues and focus on strategic tax aspects of the business.

I have recommended 5 people to his office and all still go and are happy. The only thing is that they do get busy so you will have to wait. My husband and I had an initial consultation with Christian and it went smoothly. Unfortunately, when we have tried to hire this office for our tax needs it has been very hectic .

Global Tax Solutions offers BookSmart services using the latest cloud-based Xero and QuickBooks Online Accounting Software and all the time-saving tools needed to grow your business. My complaint is I drop my tax papers over to Global Tax to be prepared as I always do in February each year to be prepared by the company each year and had no problem. this year I drop my paper work tax papers off to Global Tax and Accounting and did not hear from the company.

Modernization is not an overnight process, but the adoption of new approaches and tools is opening doors for organizations around the world. Processes are being streamlined, technology is providing new, valuable efficiencies, and talent is enabling the discovery of new opportunities. We take care of the books while you take care of the business. We’ll help you optimize your business processes and train you on your new workflow.

Full service Accounting Firm, Specializing in Cross Border and International Taxation. Kaliana is a Certified Arbitrator, instructor / manager for one of North Americas largest tax preparation forms, as well as a 3rd generation tax accountant. Global Tax & Accounting has been successfully servicing our clients since 1960.

We can offer you friendly, one-on-one service, online services as well as free email support in the off season. We take care of everything from your basic bookkeeping, payroll and reconciliations all the way up to cross border / international, personal and corporate tax filing. Our educational facility is built to satisfy your desire to become more self empowered and learn about taxation for yourself or your loved ones. We also offer classes offsite for schools and other educational facilities. Our experts provide trusted answers on the tax and accounting industry.

GTM is the largest tax management firm in the Mid-Atlantic region focused exclusively on providing corporate tax services. While the final regulations maintain the basic framework of the proposed high-tax exclusion, there are some significant changes.

We assist families as a result of the loss of a loved one including the planning and preparation of the estate tax return through the establishment and funding of the trusts. We work with and recommend estate-planning lawyers to prepare trust documents and wills and to assist in the administration of estate and trust matters.

This article will also help you assess the impact of the final regulations on your company’s overall international tax profile. We’re here to give you the answers and guidance you need on our cloud-based accounting services. We’ll also keep you notified of upcoming compliance requirements, so you’re on top of your obligations.

Every day seems to bring changes in indirect taxation around the world, including new taxes, and new reporting and compliance obligations. Our professionals help you get the numbers right by preparing tax accounting calculations, researching technical issues and reviewing transactions, accounting entries and adjustments that may have tax consequences. In a globalized economy with increasing digital demands from tax authorities, global compliance and reporting has to keep pace. We are proud to be Enrolled Agents , a prestigious designation from Internal Revenue Service. An Enrolled Agent is a federally authorized tax practitioner who has technical expertise in the field of taxation.

IWTA Founder and Managing Member Jack Brister comments on three pressing cross-border tax issues arising from the coronavirus global pandemic, with links to guidelines issued by the IRS. IWTA helps NRAs avoid costly mistakes with a personalized strategic financial and tax plan. Based on clients’ jurisdiction and current needs, IWTA provides strategic consulting and assists in selecting and implementing a wealth transfer structure to maximize returns and minimize tax exposure. We specialize in Estate and Trust tax return preparation and assist in the creation, administration and funding of living and testamentary grantor and irrevocable trusts.

We were told that Christian is the only one who can deal with my husbands situation and yet he is never available . We stopped by after being told he would be in the office and to our surprise he had "called saying he wasn't coming in that day" .

There's a reason QuickBooks is the number one business accounting software. Put this robust software to work for you with QuickBooks setup and training. Protecting your personal assets has never been more important.

As specialists in taxation matters we are proficient intax preparationfor individuals, corporations, partnerships, trusts and exempt organizations. Global Business Managementoffers a full spectrum of business andfamily officeservices to high net worth individuals, entertainment industry professionals, athletes, entrepreneurs, executives and all of their related entities. fatca crs Simply put - GATG provides a team of dedicated experts, using the industry's best tools, and offering a flexible approach that meets your unique circumstances. With over 40 years of expertise, you can feel confident that your tax needs are in good hands.

As they say in the news business, Covid-19 is a “developing story,” and the adjustments being made by the U.S. Treasury department to address the unique tax issues arising as a result of the pandemic are historic.

We also offer outsourced bookkeeping, payroll, and accounts payable services. Our prices are below national brands and we offer the same guarantee of maximum refund - just like other online services. At Global Tax Solutions, rest assured that we will provide the absolute best value for your money.

I got no answer so I went to Global Tax and they let me know that my paperwork was not ready but they will be ready before April 15, 2017. I call around April 13 or and they said they foul for an extension. The answer I call you back but they did not Taxes have not been foul for 2016. Our customer so happy with the quality of service that we provide & the affordable fees that we charge to our clients. Global Accounting & Tax Services provide100% dedicated to client satisfaction.

We're always looking for talented tax professionals to join our team. Technology services, planning ideas, interim resources, or assistance with special projects. Project-BasedTechnology services, planning ideas, interim resources, or assistance with special projects. For nearly 20 years, Philip focused on M&A tax, particularly on Private Equity, Real Estate and Hedge Funds. He has worked on some of the more significant, large and complex European transactions in recent years as well as supporting the Fund advisers.

Find out how your business can realize significant savings on both U.S. and foreign taxes. Now you don’t have to worry Global Tax and financial services do it for you. Complete with Canada Revenue Agency Representation, as well as registered with the International Revenue Agency in the USA as a tax preparer, Global Tax & Accounting is suited to fit your needs!

#american citizen marrying a foreigner abroad#are trust distributions taxable to the beneficiary#beneficial ownership in international tax law#capital gains tax for non resident alien#cfc repatriation tax#cfc tax year end#compliance requirement for foreign accounts and trusts#cross border tax advice#cross border tax issues#crs reportable person definition#deemed paid foreign tax credit calculation#do trust beneficiaries pay taxes#estate tax us citizens living abroad#fatca crs#fatca crs status#fatca exemption#fatca filing#fatca form#fatca form 8938#fatca requirements#fatca voluntary disclosure#fatca withholding#fbar#fbar and fatca#fbar deadline#fbar due date#fbar extension#fbar filing date#fbar filing deadline#fbar maximum account value

1 note

·

View note

Text

Most Noticeable Non Resident Alien Llc Tax

This reluctant immersion in these cases led to a strong and poignant moment in 2005, simply days earlier than the dying of John Paul II, when the standard Good Friday Stations of the Cross on the Coliseum, written that 12 months by Cardinal Ratzinger, learn, throughout the meditation on the Ninth Station: Should we not also think of how much Christ suffers in his personal Church? Simplified cash accounting may very well be made obtainable to a large or slender set of taxpayers. About 80% of all federal taxpayers receives refunds in a given yr. Heisenberg uncertainty (you cannot know both the velocity and the place of an electron or sub atomic particle)--even the end result of the day's weather is thought and has been identified by God from the beginning. God may know the outcome, but these of us on Earth see a violent lurching first towards and then away from Home and Coronary heart.

I perceive the evil effects of sin on the sinner, but I really do not feel very strongly about it until the sinner is somebody I do know and love (me, for example). The concept that lying could possibly be a advantage was fully overseas to me, and even worse than that have been the results of that reality. But he never mentioned something to me, and he personally framed and matted most of the prints that I bought. I've by no means purchased into the "girls are kinder and gentler" principle. Brokers are now required to report the cost basis for stocks sold by their clients and purchased in 2011. The reporting modifications prolonged to incorporate mutual funds and alternate-traded funds on Jan. 1 of this 12 months. Educational establishments are required to file and give you a Form 1098-T, Tuition Statement, for each enrolled scholar. The pupil have to be enrolled at least as a half-time student. The American Opportunity Tax Credit is offered through 2012. The credit score may be up to $2,500 per eligible student and is out there for the first four years of post secondary training.

This has nothing to do with the new tax law and every little thing to do with the IRS’s annual inflation adjustments: Beginning in 2019, you may contribute up to $6,000 ($7,000 if you’re 50 or older) to a traditional IRA or Roth IRA. Could 1, 2011, and who closed on the sale earlier than July 1, 2011. These members of the armed or overseas providers who both are shopping for their first dwelling, or who're long-time homeowners buying a substitute principal residence, can declare a house purchaser credit of as much as $6,500 (as much as $3,250 for a married particular person filing separately). Push your income into the subsequent 12 months wherever doable, with the hope that the promised tax cuts materialize. firpta exceptions Nothing is unsure with Him and our hope lies in the very fact that he is the dynamic system behind all of it. I obtained a form observe at the moment lamenting the fact that I had give up my weblog. Add to that the fact that your Part D month-to-month premiums would enhance by $32.80, and you're looking at over $1,800 in increased Medicare premiums.

The vast majority of curiosity revenue is taxed on the odd income tax rate, which isn't excellent news for millionaires looking for steady curiosity-based income. Assume that Trust A has $100,000 of interest and dividend income and $200,000 of capital positive factors. I now would trust nobody who claims to be muslim. There's solely a lot data we can fit in our brains. A lot in China is Damaged.

Second mortgages, home fairness loans and traces of credit rely, too; nevertheless, bear in mind that deductions are limited, relying on elements such as the entire worth of your mortgages. There are different thoughts on how usually one should rebalance a portfolio, typically, annual rebalancing gives higher potential long-time period efficiency, less trading fees and more tax efficiencies. A strategy’s turnover ratio is a good indicator if the strategy is tax environment friendly as a result of its reduced trading of the underlying securities, which reduces the potential for taxable distributions. Much of the dangerous, overrated (thanks to the corrupt rating agencies) debt issued by Wall Street had little upside potential, solely huge downside potential. That faith and charm are much more vital. Much of the hot air was supplied by the enablers on CNBC and other media retailers. In the course of the dotcom bubble, funding bankers and the like took public lots of of companies which have been valued on nothing more than scorching air.

Inventory companies should pay dividends to shareholders and thus have decrease returns. Municipals provide a lower yield compared to most taxable fastened income products, so it’s necessary to look at the taxable-equivalent yield when comparing yields. It is commonly believed that an legal professional, in addition to the notary public, is required when buying property in Mexico. Other elements millionaires ought to consider include native sales tax charges, property tax rates, whether or not an property tax exists, and how each state handles the taxation of retirement income and Social Security benefits. In 2016, the SRP is the larger of $695 or 2.5% of modified adjusted gross earnings (capped at the annual cost of a bronze plan in your state). If your corporation is fairly profitable, don’t even think about taking less than regardless of the unemployment wage base is in your state is. These components differ on a state-by-state basis, and taking the time to know how one state differs from another should remove any state-based mostly tax surprises.

While the British succeeded in defeating the small Dutch force in India and taking over Dutch possessions on the Indian subcontinent, the battle with the French and Kingdom of Mysore occupied their forces on this theater of warfare and prevented the British from taking the conflict further east and conquering the bigger Dutch East Indies (present day Indonesia). I'm in tears once more seeing your message for the day. With the brand new York City having emerged as the most important beneficiary of the Chinese real estate shopping for spree, it is evident that some brokers are seeing sense to seek out aggressively for Chinese consumers on their very own turf. Regulatory companies that seek to regulate these individuals have a duty to tell that is international in scope. To date, they have not performed it effectively. This exception would exclude the reporting of accounts owned by Individuals abroad the place the account is with a FFI in the same country where the person is a resident, lowering the filing burden for FATCA on Individuals as well as the identification and disclosure of those accounts by the FFI. You must also pay your January 2016 mortgage invoice in December so you may deduct that mortgage interest, as properly.

This refund can assist fund emergency accounts, kick-begin a retirement fund, or be used to pay down debt. European officials hotly disputed claims in a leaked document from International Monetary Fund claiming that a practical "mark-to-market" of Italian, Spanish, Greek, Irish, Portuguese and Belgian sovereign debt would cut back the tangible fairness of Europe's banks by €200bn (£176bn). April 3 - Bloomberg (Rebecca Christie): “Greece might once more face the menace of being pushed into default and out of the euro if its current bailout review drags on into June and July, in keeping with European officials monitoring the slow progress of Prime Minister Alexis Tsipras’s negotiations with creditors. Henrik Hololei, an Estonian cabinet head on the European Commission. Moreover, if the report is correct, then there is really no plan B (not like through the 1970s when the center of power shifted from the Texas Railroad Commission to OPEC as a result of peaking of provide within the United States) crude oil costs will soar.

#american citizen marrying a foreigner abroad#are trust distributions taxable to the beneficiary#beneficial ownership in international tax law#capital gains tax for non resident alien#cfc repatriation tax#cfc tax year end#compliance requirement for foreign accounts and trusts#cross border tax advice#cross border tax issues#crs reportable person definition#deemed paid foreign tax credit calculation#do trust beneficiaries pay taxes#estate tax us citizens living abroad#fatca crs#fatca crs status#fatca exemption#fatca filing#fatca form#fatca form 8938#fatca requirements#fatca voluntary disclosure#fatca withholding#fbar#fbar and fatca#fbar deadline#fbar due date#fbar extension#fbar filing date#fbar filing deadline#fbar maximum account value

1 note

·

View note

Text

International Advisory Experts

Multinational corporations usually employ international tax specialists, a specialty among both lawyers and accountants, to decrease their worldwide tax liabilities. We’ve received best-in-class training in national IRS, tax attorney and CPA conferences. This keeps our firm on the leading edge of ever-changing tax laws and IRS Streamlined and Offshore Voluntary Disclosure audit procedures. Our multidisciplinary approach enables us to envision how tax factors operate within the context of our clients’ personal, financial and legal goals. We are also experts at designing frameworks around business strategies for recognizing cross-border tax planning opportunities.

The demand for serious German and English speaking legal, tax and business consulting for companies and private clients has increased. Such systems of taxation vary widely, and there are no broad general rules. These variations create the potential for double taxation and no taxation . Income tax systems may impose tax on local income only or on worldwide income. Generally, where worldwide income is taxed, reductions of tax or foreign credits are provided for taxes paid to other jurisdictions.

He advises on corporate, commercial, tax, intellectual property, regulatory, and product liability law. He provides tax support for clients’ cross-border transactions, including international tax planning and transfer pricing. He previously worked in the Shanghai office of the first French law firm established in Shanghai as well as a leading Chinese law firm. He has more than 18 years’ experience working extensively for mainly European clients. She has accumulated 24 years of experience in local and international taxation at Taxhouse, EY, and Andersen and industry experience in finance and accounting with Procter & Gamble.

With our legal, transfer pricing, tax controversy, and indirect tax teams, we are superbly qualified to assist you with all aspects of your international taxation needs. The University of Melbourne’s Master of International Tax is available to both law and non-law graduates seeking global context for their tax law practice. Students learn how individuals and businesses manage foreign income, how tax systems operate in a global economy and the role of the OECD and the UN in managing bi-lateral tax treaties, among other subjects. Melbourne Law School’s Tax Group is home to international taxation research and hosts regular events.

Whether you are part of a domestic or foreign business, we will help your business remain compliant with U.S. tax laws and any applicable international tax. Experienced legal counsel from an international tax attorney can help individuals working abroad or retiring overseas maintain their citizenship through fulfilling their tax obligations. International tax attorney David W. Klasing has extensive experience in international tax planning, offshore tax controversies, and foreign account compliance. At the Law Office of David W. Klasing, our tax professionals can assess an array of tax concerns related to double-taxation of expatriates, tax minimization, FBAR, FATCA, and other international tax problems.

Our understanding of the interplay between domestic and international tax laws allows us mastery over the full tax consequences of our clients’ transactions. Visit the Tax Services area of our site to learn more about the many tax and regulatory consulting services we offer. When a U.S. taxpayer illegally places money in overseas accounts in an effort to avoid paying taxes that are due in the United States, he or she could be subject to civil and criminal tax penalties in the United States. The accumulated funds offshore often flow from offshore unreported inheritances, investments, real estates or business activity. Where foreign information reporting and income tax reporting is purposefully not complied with in order to illegally evade U.S. taxation, international tax evasion occurs.

That’s where an international tax attorney is able to provide help by making sure you or your company are in compliance and are legally reducing worldwide taxation. PwC’s international tax professionals have the resources, experience and local competencies to help companies like yours address your cross-border needs.

The attorney will give you the help you need to set up a smart and legal financial and business plan for your company that is expanding from the U.S. offshore, or seeking to do business in the U.S. from offshore. If you are a foreign national in the United States or a U.S. citizen living at home or abroad and you hold significant foreign assets in excess of $10,000 it is likely that you have foreign disclosure obligations. Even mere mistakes can be punished harshly, so it is essential to obtain experienced international tax planning and FBAR compliance services. At the Tax Law Offices of David W. Klasing, my legal team and I are committed to helping you remain compliant with U.S. and international tax laws. We will apply our understanding of international tax treaties to help you maintain your citizenship with minimal tax burdens.

A new income tax law, passed in 1980 and effective 1981, determined only residence as the basis for taxation of worldwide income. However, since 2006 Mexico taxes based on citizenship in limited situations . The United States taxes the worldwide income of its nonresident citizens using the same tax rates as for residents.

After living in Saudi Arabia, Korea, and Japan, Ted became aware first-hand of the challenges that complying with U.S. tax law can present when living abroad. Now that Ted has returned to Oregon, he devotes his practice providing tax services to expatriates in those countries and around the world. International taxation is the study or determination of tax on a person or business subject to the tax laws of different countries, or the international aspects of an individual country's tax laws as the case may be.

"U.S. persons" abroad, like U.S. residents, are also subject to various reporting requirements regarding foreign finances, such as FBAR, FATCA, and IRS forms 3520, 5471, 8621 and 8938. The penalties for failure to file these forms on time are often much higher than the penalties for not paying the tax itself. Moving your tax offshore and leveraging international tax structures is a serious financial decision, and should not be taken lightly. Done wrong, it can have serious consequences both legally and financially.

If you are looking to live abroad or operate a business overseas or bring a foreign company to the United States, obtaining experienced international legal counsel is the first step to a prudent approach. The Orange County and Los Angeles-based international tax lawyers at The Law Offices of David W. Klasing are committed to helping you avoid any unnecessary domestic or foreign tax burdens. We are also proud to assist expats, tax residents, non-residents, and businesses in maintaining all tax reporting and payment obligations.

An international taxation attorney can provide the advice you need to protect as much of your income as possible, whether you’re operating as an individual or as a company. form 3520 instructions For individuals, one common type of international taxation involves personal income tax for both citizens and foreigners who earn money inside the country. Some countries even will tax money its citizens earn in foreign countries. As international taxation laws are complex by nature, trying to keep all of the information straight from country to country can be challenging.

We help clients develop and implement integrated lifetime and testamentary plans. We help clients capture the full value expected from every transaction. 2019 IRS TAX RESOURCES - Download almost all IRS resources you may need to answer your tax questions. And remember as a CPA firm we can also prepare the returns, forms, and amended returns to solve your tax problem. IRS REINSTATES VOLUNTARY OFFSHORE DISCLOSURE PROGRAM FOR THOSE WHO HAVE NOT FILED THEIR FOREIGN TAX REPORTING FORMS You can avoid criminal penalties and possible secure reduced tax penalties.

For example, the U.S. imposes two levels of tax on foreign individuals or foreign corporations who own a U.S. corporation. First, the U.S. corporation is subject to the regular income tax on its profits, then subject to an additional 30% tax on the dividends paid to foreign shareholders .

For example, most countries tax partners of a partnership, rather than the partnership itself, on income of the partnership. A common feature of income taxation is imposition of a levy on certain enterprises in certain forms followed by an additional levy on owners of the enterprise upon distribution of such income.

Working with multinationals and large local firms, she has provided structuring and transactional direct and indirect tax advice on the full range of corporate tax activities. She is a key member of the advisory team to the Romanian Ministry of Finance with regard to the introduction and amendment of the Fiscal Code. A jurisdiction relying on financial statement income tends to place reliance on the judgment of local accountants for determinations of income under locally accepted accounting principles. Often such jurisdictions have a requirement that financial statements be audited by registered accountants who must opine thereon.

The foreign corporation will be subject to U.S. income tax on its effectively connected income, and will also be subject to the branch profits tax on any of its profits not reinvested in the U.S. Thus, many countries tax corporations under company tax rules and tax individual shareholders upon corporate distributions. Various countries have tried attempts at partial or full "integration" of the enterprise and owner taxation. Where a two level system is present but allows for fiscal transparency of some entities, definitional issues become very important. Vietnam used to tax its citizens in the same manner as residents, on worldwide income.

My Los Angeles international tax law team and I understand the tax treaties the United States has with several other countries. We will apply our taxation knowledge to protect your business from double taxation.

programs will address the tax systems of various countries, as well as the various ways that tax law applies across borders. They will also typically cover some aspects of treaty law and other issues that transcend borders. I’m a Certified Public Accountant with 30 years diversified business experience operating as your Certified Public Accountant with a specialty in international taxation preparation and planning.

That is why compliance with all the relevant tax laws is critically important. We are experts in tax and tax laws and will ensure that everything is above board and 100% tax compliant. At Point Square Consulting we offer top quality international tax consulting and offshore IRS representation services to individuals and businesses. We serve clients with wide ranging cross-border tax and business needs from tax return preparation to international tax planning to IRS tax dispute resolution. We are part of an extensive network of expert international tax consultants around the world and we can walk you through the entire process of U.S. inbound or outbound tax planning.

Governments usually limit the scope of their income taxation in some manner territorially or provide for offsets to taxation relating to extraterritorial income. The manner of limitation generally takes the form of a territorial, residence-based, or exclusionary system. Some governments have attempted to mitigate the differing limitations of each of these three broad systems by enacting a hybrid system with characteristics of two or more. The international taxation laws for corporations vary quite a bit from country to country, leading to complexity. Tax rates can also vary quite a bit for business owners operating in multiple countries.

Igor has over 10 years’ experience working as a tax and legal consultant. He has extensive experience in tax advisory services, including international taxation, value-added tax, customs, corporate income tax, tax dispute services, and personal income tax. He co-authors the Serbia and the Montenegro chapters for the Bloomberg Tax VAT Navigator. That’s where an experienced international tax attorney can provide an invaluable service.

To schedule an initial, reduced-rate consultation call us at or online today. When you entrust the Tax Law Offices of David W. Klasing with your tax strategy needs, you gain the benefit of an experienced international tax lawyer and a seasoned CPA for the price of one. Prior to becoming a tax attorney, Mr. Klasing worked for nine years as an auditor in public accounting. After gaining a master’s degree in taxation, he became a Certified Public Accountant . Nicolas is responsible for CMS’s China Tax Practice Area Group and Lifesciences and Healthcare Sector Group.

We listen to You and we always aim to understand Your needs.Transparency Absolute transparency of our services!

Starting your career at MBAF is a great opportunity to gain valuable experience. We understand the unique accounting needs of the Automotive Industry. We work with hundreds of clients in every aspect of the real estate industry.

The country passed a personal income tax law in 2007, effective 2009, removing citizenship as a criterion to determine residence. Mexico used to tax its citizens in the same manner as residents, on worldwide income.

Some jurisdictions extend the audit requirements to include opining on such tax issues as transfer pricing. Jurisdictions not relying on financial statement income must attempt to define principles of income and expense recognition, asset cost recovery, matching, and other concepts within the tax law. Some jurisdictions following this approach also require business taxpayers to provide a reconciliation of financial statement and taxable incomes. Many systems allow for fiscal transparency of certain forms of enterprise.

#american citizen marrying a foreigner abroad#are trust distributions taxable to the beneficiary#beneficial ownership in international tax law#capital gains tax for non resident alien#cfc repatriation tax#cfc tax year end#compliance requirement for foreign accounts and trusts#cross border tax advice#cross border tax issues#crs reportable person definition#deemed paid foreign tax credit calculation#do trust beneficiaries pay taxes#estate tax us citizens living abroad#fatca crs#fatca crs status#fatca exemption#fatca filing#fatca form#fatca form 8938#fatca requirements#fatca voluntary disclosure#fatca withholding#fbar#fbar and fatca#fbar deadline#fbar due date#fbar extension#fbar filing date#fbar filing deadline#fbar maximum account value

1 note

·

View note

Text

Firpta Part I

• The transferor gives you written notice that no recognition of any gain or loss on the transfer is required because of a nonrecognition provision in the Internal Revenue Code or a provision in a U.S. tax treaty. The transferee receives a withholding certification from the Internal Revenue Service that excuses withholding. The transferor gives you a written notice that no recognition of any gain or loss on the transfer is required because of a nonrecognition provision in the Internal Revenue Code or a provision in a U.S. tax treaty. Costs vary depending on time involved and are priced individually by case.

Now that you know all about FIRPTA affidavit, you can determine whether you need it or not. Instead, the buyer must make a favorable election to do the needful if he or she chooses to solicit the reduced rate or the exemption. Imputing the decision of the buyer and the facts entitling the buyer to the reduced rate or exemption, this election should be disposed of as an affidavit. Usually, the buyer is held responsible for overseeing the remittance of the funds to the IRS even though the closing agent is the one that actually remits the funds.

Then, using a wide range of innovative business strategies, you’ll receive breakthrough solutions that no other accountants thought possible. “Nothing less than the best.” That’s what current and former clients say about Miller & Company.

For this purpose, a return is timely if it is filed within 16 months of the due date just discussed. The Internal Revenue Service has the right to deny deductions and credits on tax returns filed more than 16 months after the due dates of the returns. Certification required, dated not more than 30 days before the transfer date.

The deposition is of an interest in an openly traded trust or partnership. On the other hand, this exception from FIRPTA withholding will not be applied on all dispositions of considerable amounts of non-publically traded interests in openly traded trusts or partnerships. You are given a written notice by the transferor saying no recognition about any loses or gains upon transfer is deemed necessary because of the non-recognition provision in the IRS Code or due to any provision in the US tax treaty. In such a case, you must file a copy of the written notice received within the first 20 days after the transfer was made with the Ogden Service Center, P.O. Box , Ogden, UT 84409. The transferor has the right to give the certification to a qualified substitute.

Foreign person or entity whose only US business activity is trading stocks, securities, or commodities through a US resident broker or agent. Count 31 days during year of sale AND 183 days during the year of sale and the preceding 2 years, ONLY counting all days during sale year; 1/3 days during 1st preceding year; 1/6th days during 2nd preceding year. The Foreign Seller may then seek a refund and has 3 years to do so, after which the prospect of a refund expires due to a non-negotiable statute of limitations caveat and the IRS keeps the FIRPTA withholding. The exchange begins when the relinquished property closes.

While not thrilled, Joe was pleased to find the only willing and able buyer in the market and needed these funds to deploy elsewhere. Any authorized person signing the application must verify under penalties of perjury that all representations are true, correct, and complete to that person’s belief and knowledge.

Joe Canada purchased a vacation home in Phoenix, Arizona in 2010 for $1,300,000 (we will assume, in this example, that Joe’s basis remains $1,300,000 at time of sale) and decided to sell the property in 2016. Unfortunately, the market had declined and Joe entered into escrow to sell the property for $1,100,000 resulting in a $200,000 loss on sale.

Read our coverage of the increase of FIRPTA withholding to learn more. If you're buying property from a foreign owner, here are some things you need to know. People from all over the world invest in United States real estate.

This publication is designed to provide accurate and authoritative information in regard to the subject matter covered. It is distributed with the understanding that the publisher is not engaged in rendering legal, accounting, or other professional service. If legal or accounting advice or other expert assistance is required, the services of a competent professional should be sought. The closing company, on behalf of the buyer, will report and pay over the tax by the 20th day after the date of the closing. Late submission may result in penalties and interest on the tax payable.

However, usually the applications for reduction in withholding are processes within three to four months after submission. Already had HARPTA withheld from your closing proceeds?

The Foreign Investment in Real Property Tax Act can and will hold your money up for up to a year! Call us to set up a free consultation on how we can get your money returned faster than ever. Hawaiʻi is an escrow state, and while escrow is not responsible to withhold the required amount, per the Purchase Contract, escrow is instructed to collect and disburse the funds to the State Department of Taxation. So there it is—when is FIRPTA affidavit required and what is included in it.

All of these can result in the Client experiencing delay or denial of tax refunds and in many instances IRS demands for penalties and interest. This scenario can make sense depending on the time of year and Foreign Seller situation, the complete package has to be ready to go on the closing date of the transaction to utilize this option. This means becoming involved early on in the transaction to allow time for the complexities and filing requisites to be achieved. inasmuch as mistakes can lead to extensive delays in the IRS providing refunds.

Mainly because the IRS send letter demands and notices which have response times, review and response times by the IRS. Our services serve to expedite refunds, not delay them. The financial expertise you’ll find at Miller & Company is unparalleled in the Manhattan and New York City areas. Your personal CPA gets to know who you are — identifying the objectives you have and the challenges you face.

Should the application be based on information provided by another party to the deal or transaction, that information is also required to have a written verification signed under penalties of perjury by that party. An agreement between the seller and buyer is in place for the payment of tax, which provides security for the tax. Legacy Tax & Resolution Services strives to ensure that its services are accessible to people with disabilities. Our mission is to create a web based experience that makes it easier for us to work together. Here we describe how we collect, use, and handle your personal information when you use our websites, software, and services (“Services”).

The buyer must file IRS Forms 8288 and 8288-A to report and pay the amount withheld to the IRS by the 20th day after the date of the relinquished property closing. Uncertainty can arise in counting days of residing at the property. First of all, days in which the buyer’s “family” will reside at the property can be counted as days the buyer will reside at the property. Second, the days the property is planned to be vacant can be ignored in the 50% threshold computation.

The PATH Act has made several other changes to the FIRPTA and REIT rules not covered here. Contact your Untracht Early advisor to provide you with more information and guide you in assessing the act’s impact on your real estate activities. Code Section 245 allows a dividends-received deduction (“DRD”) by a domestic corporation that receives dividends from certain foreign corporations. The Act clarifies that for purposes of determining whether dividends from a foreign corporation are eligible for a DRD, dividends paid by RICs and REITs to the foreign corporation are not treated as dividends from domestic corporations. When the buyer is purchasing interest in a non-publicly traded domestic corporation and the corporation provides the necessary affidavit.

We assist parties in real estate transactions that are subject to FIRPTA. The property is purchased for $300,000.00 or less and is to be used by the buyer as his or her residence. The test for a residence is if the buyer is to reside in the property for at least 50% of the days in the next two 12 month periods. The substantial presence test that requires a person be physically present in the United States for a certain number of days a year. The rules of FIRPTA changed February 16, 2016 when the withholding rate on properties over $1 million increased to 15%.

FIRPTA is a U.S. tax law that can be quite a headache for foreign investors and companies, because it is often misunderstood. Unfortunately, improperly addressing FIRPTA issues can leave you open to serious liabilities and prosecution by the IRS. A Priori FIRPTA lawyer can help you decipher whether you are subject to FIRPTA and help you mitigate its impact. A look at how commercial agents can help property owners create an implementation plan to ensure accessibility. foreign tax credit carryover for corporations irc 965 transition tax statement With 1000’s of satisfied clients worldwide, we will work to get your FIRPTA withholding money back from the IRS.

Foreign persons are generally exempt from U.S. tax on capital gains. Although the closing agent usually pays the funds, the responsibility of supervising the transference of the funds to IRS falls on the buyer. To get the benefit of any allowable deductions or credits, you must timely file a true and accurate income tax return.

Call us for assistance with arranging a refund of the over withheld amount. Call HARPTA Refund Solutions before scheduling your close. We can assist with the process and help assure timely and accurate filing of exemptions. Call us for refund assistance or with help filing Hawaii back taxes.

He, in return, will give you a statement that clearly states that under penalties of perjury, the certification is one under his possession . A qualified substitute for this purpose is someone who the person given the task to close the deal or transaction other than the agent, and the transferee’s agent. The property transferred or distributed is either in liquidation or redemption of the corporation. Amount of any liabilities assumed by the seller or transferee or to which the property is subjected to before and after of the transfer. When speaking about the exceptions from FIRPTA withholdings, it is crucial to know that the current rates of withholdings have been risen from a 10% to 15% as of 17th February 2016.

An important thing for concerned individuals to know is the time it takes for the IRS to process the reduction in withholding application. There isn’t any fixed time period for processing of applications for reduction in withholding.

I would highly recommend his services and will definitely use his services again. When I first called Kunal I was very worried because I had many years of FBARs and unreported foreign income. Kunal did a good job reassuring me throughout the process and the streamlined application went without any problems. The transferor gives you written notice that no recognition of any gain or loss on the transfer is required because of a nonrecognition provision in the Internal Revenue Code or a provision in a U.S. tax treaty. You must file a copy of the notice by the 20th day after the date of transfer with the Ogden Service Center, P.O. Box , Ogden, UT 84409.

It was generally 10% for dispositions but now, it has been increased to 15% after February 2016. a foreign entity which has elected to be treated as a domestic corporation . The IRS generally provides such certification within 30 days when the application contains all required information. Under general U.S. tax principles applicable to FIRPTA, gain is equal to the excess of the amount of money or fair market value of property received over the amount of adjusted basis of the property exchanged. Where the amount received is subject to a contingency, the amount is not recognized until the contingency is resolved.

#american citizen marrying a foreigner abroad#are trust distributions taxable to the beneficiary#beneficial ownership in international tax law#capital gains tax for non resident alien#cfc repatriation tax#cfc tax year end#compliance requirement for foreign accounts and trusts#cross border tax advice#cross border tax issues#crs reportable person definition#deemed paid foreign tax credit calculation#do trust beneficiaries pay taxes#estate tax us citizens living abroad#fatca crs#fatca crs status#fatca exemption#fatca filing#fatca form#fatca form 8938#fatca requirements#fatca voluntary disclosure#fatca withholding#fbar#fbar and fatca#fbar deadline#fbar due date#fbar extension#fbar filing date#fbar filing deadline#fbar maximum account value

0 notes

Text

Form 8938

These additional foreign financial assets are reported on Form 8938, a “Statement of Specified Foreign Financial Assets,” as part of the annual income tax return. Individuals' holding such foreign assets are required to report these holdings in their tax return using ITR-2 or ITR-3, whichever is applicable. Individuals are required to provide exhaustive details of the foreign assets held by them in the Schedule FA of the ITR form. Reporting of such foreign assets is to be done on the basis of the foreign assets acquired during the relevant accounting period of the foreign country. The finance ministry has issued a clarification on how to fill income tax returns for FY for resident Indians holding foreign assets.

Like FinCEN form 114, there are reporting exemptions, but they differ from those of form 114. You do not have to report an account held in a foreign branch of a U.S. bank. Domestic mutual funds that invest in foreign stocks or securities or private equity funds are exempt. If held directly, personal property, such as jewelry and art, real estate, currency, and precious metals held abroad are all exempt. In addition, there are different monetary penalties that may apply if an individual fails to timely submit a required information reporting form related to foreign assets.

To fully understand the problem, it is necessary to understand what the reporting requirements for foreign assets are. You must report the maximum value of the foreign financial assets or financial accounts with foreign financial institutions, and certain other foreign non-account investment assets. The assets are reported in U.S. dollars using the end of the taxable year exchange rates.

Such individuals were facing problems in reporting foreign assets in the ITR wherever the financial year in India differed from that of the country in which the asset is held. The Central Board of Direct Taxes has issued a clarification dated August 27 regarding the above. In the circular the CBDT has clarified that only foreign assets acquired as per the relevant accounting period of the foreign country have to be reported while filing income tax returns for the financial year . Part III of Schedule B requires the taxpayer to check a box to report an interest in or signature authority over any financial account located in a foreign country; a segregated foreign retirement account arguably triggers this reporting requirement.