#celler

Text

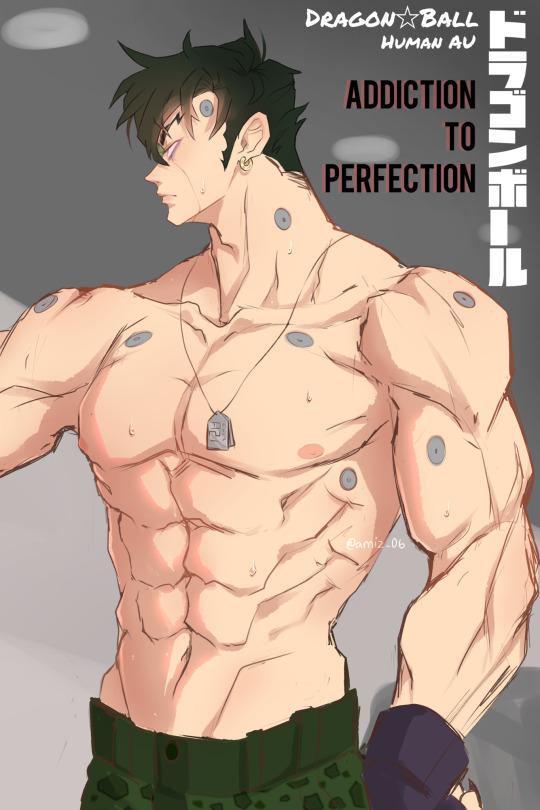

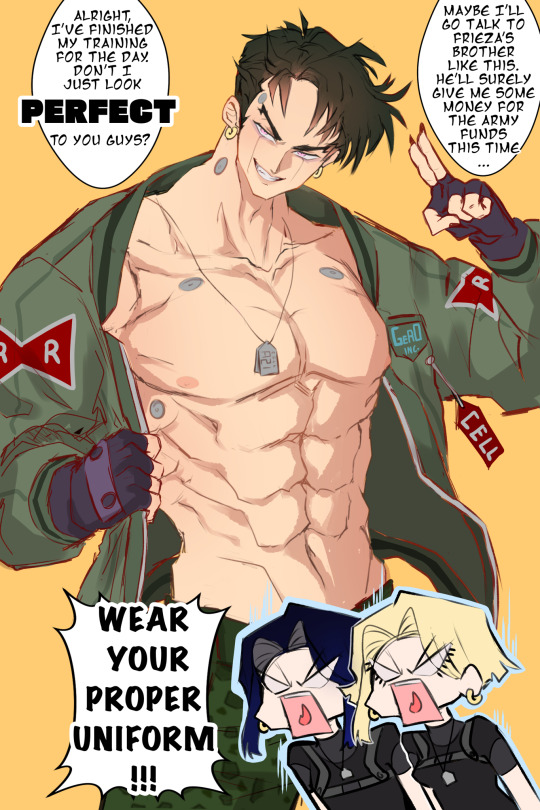

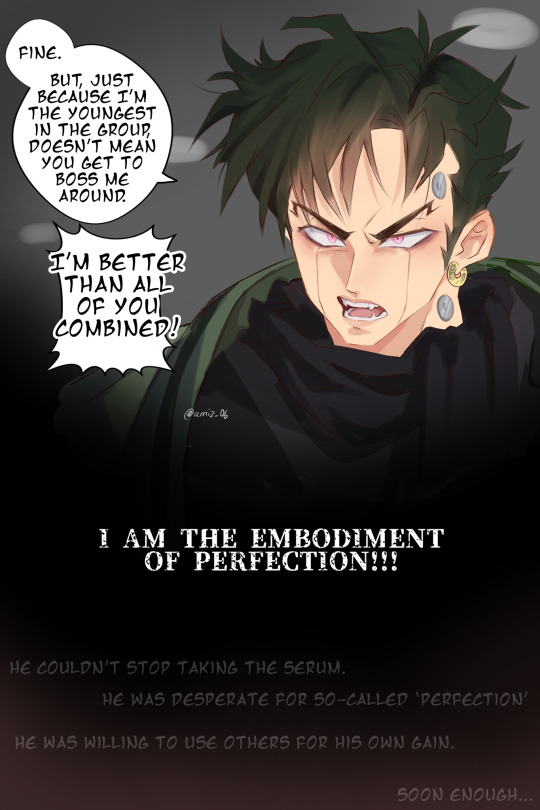

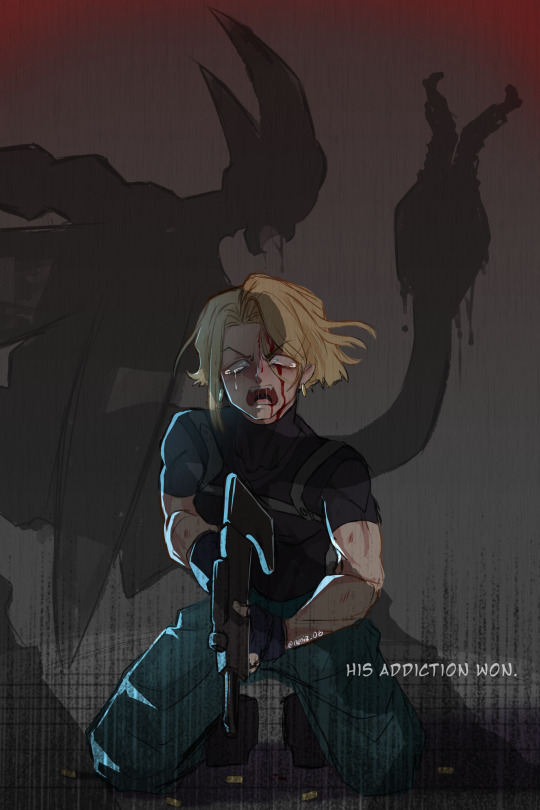

Human Perfect Cell and Red Ribbon Army lore but it’s covered with thirst traps because I just learned a new way on how to draw muscled bodies. I just love the manhwa art style wahhhh!

Yes im still alive. I’m trying to draw as much as I can in all the midst of irl work busyness because I just simply love to draw! This year is pretty slow but it’s still better than nothing! :D

Edit: a funi I made on Insta story

#dbz human au#dbz#human au#dragon ball z#artists on tumblr#perfect cell#human perfect cell#human cell#android 18#android 17#imperfect cell#celler#??#there’s mention of cooler idk#also 16 ig

787 notes

·

View notes

Text

I think that these two would understand each other

... in a situation that required diplomacy for survival of course :)

#dbz#dbz fanart#cell#perfect cell#dbz art#dbz cell#purrfectcellz#my art#cooler#coola#art#sketch#celler

73 notes

·

View notes

Text

Delta took Caz to explore a dungeon with a pink glow and it turns out Caz is right to be concerned.

After a commotion, the two intruders could only wait for the unknown fate unconsciously…

Part 1 of a 6-part commission for

Join my Patreon for early access and streams: https://www.patreon.com/user/membership?u=13868311

#tickle#tickling#ticklish#tickle art#tickles#tickling art#commission#tickle community#tickling community#cat#crow#dungeon#celler#glove#feather#knocked out

44 notes

·

View notes

Text

Casa de Vi Natural, Pego, Spain

3 notes

·

View notes

Text

Lleida, revisitada

EL campanar i un dels grandiosos finestrals del claustre de la Seu Vella de Lleida

Un cap de setmana podeu decidir fer una sortida, d’una nit o més, a Lleida. Podeu anar a dormir a l’hotel Real, un petit hotel de tres estrelles, senzill i còmode, al centre. Res de l’altre món, però molt còmode. Aprofiteu que esteu al centre per fer una volta pel casc antic i el carrer Major, típic carrer…

View On WordPress

#Art#Arte#Cap#carrer#casrtillo#castell#catedral#celler#comer#diocesano#diocesà#excursion#familiares#hotel#Hoteles#lerida#Lleida#major#mayor#museo#museu#nens#Niños#parador#Real#restaurant#restaurante#roser#salida#salidas

0 notes

Photo

Vinícola de Nulles, la llaman la catedral del Vi de Nulles de 1917. La luz de la bodega es espectacular. Un poco de #historia. La Vinícola de Nulles fue fundada en 1917 en el pueblo de Nulles, al sur de la región de l'Alt Camp en la provincia de Tarragona. El edificio modernista fue construido por el arquitecto vallesano Cèsar Martinell y se ha convertido en un emblema conocido como la Catedral del Vino. La bodega produce una variedad de vinos, incluyendo Adernats Reserva Brut Nature, Adernats Brut Nature Gran Reserva, Adernats Brut Nature Rosé y Adernats Brut Nature Vintage. #tarragona #celler #bodegas (en Nulles, Cataluna, Spain) https://www.instagram.com/p/CohWD6-NLn3/?igshid=NGJjMDIxMWI=

0 notes

Photo

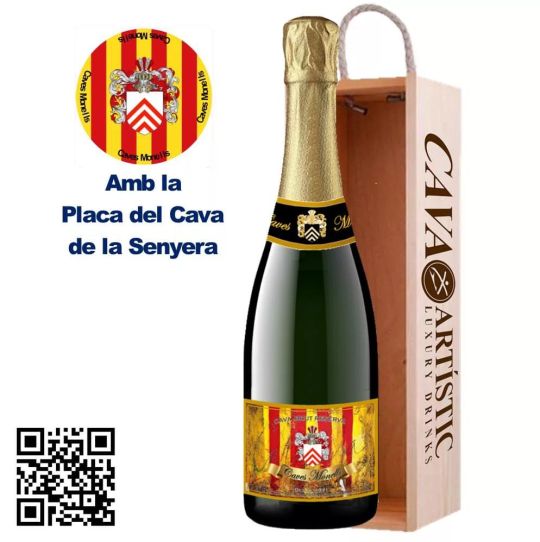

EL CAVA DE LA SENYERA Cava Brut Reserva de Caves Monells. Un extraordinari Cava de Sant Sadurní d'Anoia, criança de 5 anys. El trobaràs a www.cavesmonells.cat o bé truca'ns al 669850825 i te'l portem personalment a casa. #barcelona #girona #tarragona #lleida #senyera #estatcatalà #estelada #cava #brut #reserva #brutreserva #celler #brutnature #brutreserva #esmorzar #dinar #sopar #cuinacatalana #cuinacasolana #cuinamediterranea #puigdemont #cavaartistic #cava_artistic #cavesmonells #monells #catalunya #independència #republica #catalanrepublic #republicacatalana https://www.instagram.com/p/CklWWhbN7D3/?igshid=NGJjMDIxMWI=

#barcelona#girona#tarragona#lleida#senyera#estatcatalà#estelada#cava#brut#reserva#brutreserva#celler#brutnature#esmorzar#dinar#sopar#cuinacatalana#cuinacasolana#cuinamediterranea#puigdemont#cavaartistic#cava_artistic#cavesmonells#monells#catalunya#independència#republica#catalanrepublic#republicacatalana

0 notes

Text

Celler Record In Nagano !!!!!!!

0 notes

Text

What did Christian tell Luchasaurus to get him to hand over his title match opportunity? Wrong answers only.

#luchasaurus#christian cage#aew#jin's gifs#reminded him he has jb tided up in his bat cave celler and that only he knows where the key is?#told him what really killed the dinosaurs?#said they can use the un-electrified collar tonight?#reminded him he signed a sub contract?????#i could go on#ughhhh look at his smarmy little face when he's given it gdgjkdhdjj i hate himmm

40 notes

·

View notes

Text

Hear me out!! Imagine the lumity confession/ that episode “knock knock knocking on hooty’s door” but it’s SNUFMIN

LIKE!!! Snufkin can be amity and moomintroll can be Luz! It’s perfect! Moomin would think Snufkin is too cool for all this mushy stuff!! And Snufkin could be a fluster gay mess the whole time! Oh and who’s hooty? Little my

#Snufmin#moomins#snusmumriken#the moomins#moomintroll#moomee#Lumity#luz noceda#amity#just hear me out#like imagine little my just trapping them in the celler#Tho I don’t think she would start be like hooty#she did plan this out but she isn’t singing songs#Well she dose like to sing but I’m not sure she would?#IDK#but please tell your thoughts#Edit#snorkmaiden can be eda#The woodies can also be helping#And they are prob the ones crying

23 notes

·

View notes

Note

Ok hear me out. I think Cooler and Cell should kiss.

yeah I think so too, I guess (;゚Д゚)/ We know Cell the freaky type, too

This ship is kinda like Cellza but it has a more mature vibe.

362 notes

·

View notes

Text

The antitrust Twilight Zone

Funeral homes were once dominated by local, family owned businesses. Today, odds are, your neighborhood funeral home is owned by Service Corporation International, which has bought hundreds of funeral homes (keeping the proprietor’s name over the door), jacking up prices and reaping vast profits.

Funeral homes are now one of America’s most predatory, vicious industries, and SCI uses the profits it gouges out of bereaved, reeling families to fuel more acquisitions — 121 more in 2021. SCI gets some economies of scale out of this consolidation, but that’s passed onto shareholders, not consumers. SCI charges 42% more than independent funeral homes.

https://pluralistic.net/2022/09/09/high-cost-of-dying/#memento-mori

SCI boasts about its pricing power to its investors, how it exploits people’s unwillingness to venture far from home to buy funeral services. If you buy all the funeral homes in a neighborhood, you have near-total control over the market. Despite these obvious problems, none of SCI’s acquisitions face any merger scrutiny, thanks to loopholes in antitrust law.

These loopholes have allowed the entire US productive economy to undergo mass consolidation, flying under regulatory radar. This affects industries as diverse as “hospital beds, magic mushrooms, youth addiction treatment centers, mobile home parks, nursing homes, physicians’ practices, local newspapers, or e-commerce sellers,” but it’s at its worst when it comes to services associated with trauma, where you don’t shop around.

Think of how Envision, a healthcare rollup, used the capital reserves of KKR, its private equity owner, to buy emergency rooms and ambulance services, elevating surprise billing to a grotesque art form. Their depravity knows no bounds: an unconscious, intubated woman with covid was needlessly flown 20 miles to another hospital, generating a $52k bill.

https://pluralistic.net/2022/03/14/unhealthy-finances/#steins-law

This is “the health equivalent of a carjacking,” and rollups spread surprise billing beyond emergency rooms to

anesthesiologists, radiologists, family practice, dermatology and others. In the late 80s, 70% of MDs owned their practices. Today, 70% of docs work for a hospital or corporation.

How the actual fuck did this happen? Rollups take place in “antitrust’s Twilight Zone,” where a perfect storm of regulatory blindspots, demographic factors, macroeconomics, and remorseless cheating by the ultra-wealthy has laid waste to the American economy, torching much of the US’s productive capacity in an orgy of predatory, extractive, enshittifying mergers.

The processes that underpin this transformation aren’t actually very complicated, but they are closely interwoven and can be hard to wrap your head around. “The Roll-Up Economy: The Business of Consolidating Industries with Serial Acquisitions,” a new paper from The American Economic Liberties Project by Denise Hearn, Krista Brown, Taylor Sekhon and Erik Peinert does a superb job of breaking it down:

http://www.economicliberties.us/wp-content/uploads/2022/12/Serial-Acquisitions-Working-Paper-R4-2.pdf

The most obvious problem here is with the MergerScrutiny process, which is when competition regulators must be notified of proposed mergers and must give their approval before they can proceed. Under the Hart-Scott-Rodino Act (HSR) merger scrutiny kicks in for mergers when the purchase price is $101m or more. A company that builds up a monopoly by acquiring hundreds of small businesses need never face merger scrutiny.

The high merger scrutiny threshold means that only a very few mergers are regulated: in 2021, out of 21,994 mergers, only 4,130 (<20%) were reported to the FTC. 2020 saw 16,723 mergers, with only 1.637 (>10%) being reported to the FTC.

Serial acquirers claim that the massive profits they extract by buying up and merging hundreds of businesses are the result of “efficiency” but a closer look at their marketplace conduct shows that most of those profits come from market power. Where efficiences are realized, they benefit shareholders, and are not shared with customers, who face higher prices as competition dwindles.

The serial acquisition bonanza is bad news for supply chains, wages, the small business ecosystem, inequality, and competition itself. Wherever we find concentrated industires, we find these under-the-radar rollups: out of 616 Big Tech acquisitions from 2010 to 2019, 94 (15%) of them came in for merger scrutiny.

The report’s authors quote FTC Commissioner Rebecca Slaughter: “I think of serial acquisitions as a Pac-Man strategy. Each individual merger viewed independently may not seem to have significant impact. But the collective impact of hundreds of smaller acquisitions, can lead to a monopolistic behavior.”

It’s not just the FTC that recognizes the risks from rollups. Jonathan Kanter, the DoJ’s top antitrust enforcer has raised alarms about private equity strategies that are “designed to hollow out or roll-up an industry and essentially cash out. That business model is often very much at odds with the law and very much at odds with the competition we’re trying to protect.”

The DoJ’s interest is important. As with so many antitrust failures, the problem isn’t in the law, but in its enforcement. Section 7 of the Clayton Act prohibits serial acquisitions under its “incipient monopolization” standard. Acquisitions are banned “where the effect of such acquisition may be to substantially lessen competition between the corporation whose stock is so acquired and the corporation making the acquisition.” This incipiency standard was strengthened by the 1950 Celler-Kefauver Amendment.

The lawmakers who passed both acts were clear about their legislative intention — to block this kind of stealth monopoly formation. For decades, that’s how the law was enforced. For example, in 1966, the DoJ blocked Von’s from acquiring another grocer because the resulting merger would give Von’s 7.5% of the regional market. While Von’s is cited by pro-monopoly extremists as an example of how the old antitrust system was broken and petty, the DoJ’s logic was impeccable and sorely missed today: they were trying to prevent a rollup of the sort that plagues our modern economy.

As the Supremes wrote in 1963: “A fundamental purpose of [stronger incipiency standards was] to arrest the trend toward concentration, the tendency of monopoly, before the consumer’s alternatives disappeared through merger, and that purpose would be ill-served if the law stayed its hand until 10, or 20, or 30 [more firms were absorbed].”

But even though the incipiency standard remains on the books, its enforcement dwindled away to nothing, starting in the Reagan era, thanks to the Chicago School’s influence. The neoliberal economists of Chicago, led by the Nixonite criminal Robert Bork, counseled that most monopolies were “efficient” and the inefficient ones would self-correct when new businesses challenged them, and demanded a halt to antitrust enforcement.

In 1982, the DoJ’s merger guidelines were gutted, made toothless through the addition of a “safe harbor” rule. So long as a merger stayed below a certain threshold of market concentration, the DoJ promised not to look into it. In 2000, Clinton signed an amendment to the HSR Act that exempted transactions below $50m. In 2010, Obama’s DoJ expanded the safe harbor to exclude “[mergers that] are unlikely to have adverse competitive effects and ordinarily require no further analysis.”

These constitute a “blank check” for serial acquirers. Any investor who found a profitable strategy for serial acquisition could now operate with impunity, free from government interference, no matter how devastating these acquisitions were to the real economy.

Unfortunately for us, serial acquisitions are profitable. As an EY study put it: “the more acquisitive the company… the greater the value created…there is a strong pattern of shareholder value growth, correlating with frequent acquisitions.” Where does this value come from? “Efficiencies” are part of the story, but it’s a sideshow. The real action is in the power that consolidation gives over workers, suppliers and customers, as well as vast, irresistable gains from financial engineering.

In all, the authors identify five ways that rollups enrich investors:

I. low-risk expansion;

II. efficiencies of scale;

III. pricing power;

IV. buyer power;

V. valuation arbitrage.

The efficiency gains that rolled up firms enjoy often come at the expense of workers — these companies shed jobs and depress wages, and the savings aren’t passed on to customers, but rather returned to the business, which reinvests it in gobbling up more companies, firing more workers, and slashing survivors’ wages. Anything left over is passed on to the investors.

Consolidated sectors are hotbeds of fraud: take Heartland, which has rolled up small dental practices across America. Heartland promised dentists that it would free them from the drudgery of billing and administration but instead embarked on a campaign of phony Medicare billing, wage theft, and forcing unnecessary, painful procedures on children.

Heartland is no anomaly: dental rollups have actually killed children by subjecting them to multiple, unnecessary root-canals. These predatory businesses rely on Medicaid paying for these procedures, meaning that it’s only the poorest children who face these abuses:

https://pluralistic.net/2022/11/17/the-doctor-will-fleece-you-now/#pe-in-full-effect

A consolidated sector has lots of ways to rip off the public: they can “directly raise prices, bundle different products or services together, or attach new fees to existing products.” The epidemic of junk fees can be traced to consolidation.

Consolidators aren’t shy about this, either. The pitch-decks they send to investors and board members openly brag about “pricing power, gained through acquisitions and high switching costs, as a key strategy.”

Unsurprisingly, investors love consolidators. Not only can they gouge customers and cheat workers, but they also enjoy an incredible, obscure benefit in the form of “valuation arbitrage.”

When a business goes up for sale, its valuation (price) is calculated by multiplying its annual cashflow. For small businesses, the usual multiplier is 3–5x. For large businesses, it’s 10–20x or more. That means that the mere act of merging a small business with a large business can increase its valuation sevenfold or more!

Let’s break that down. A dental practice that grosses $1m/year is generally sold for $3–5m. But if Heartland buys the practice and merges it with its chain of baby-torturing, Medicaid-defrauding dental practices, the chain’s valuation goes up by $10–20m. That higher valuation means that Heartland can borrow more money at more favorable rates, and it means that when it flips the husks of these dental practices, it expects a 700% return.

This is why your local veterinarian has been enshittified. “A typical vet practice sells for 5–8x cashflow…American Veterinary Group [is] valued at as much as 21x cashflow…When a large consolidator buys a $1M cashflow clinic, it may cost them as little as $5M, while increasing the value of the consolidator by $21M. This has created a goldrush for veterinary consolidators.”

This free money for large consolidators means that even when there are better buyers — investors who want to maintain the quality and service the business offers — they can’t outbid the consolidators. The consolidators, expecting a 700% profit triggered by the mere act of changing the business’s ownership papers, can always afford to pay more than someone who merely wants to provide a good business at a fair price to their community.

To make this worse, an unprecedented number of small businesses are all up for sale at once. Half of US businesses are owned by Boomers who are ready to retire and exhausted by two major financial crises within a decade. 60% of Boomer-owned businesses — 2.9m businesses of 11 or so employees each, employing 32m people in all — are expected to sell in the coming decade.

If nothing changes, these businesses are likely to end up in the hands of consolidators. Since the Great Financial Crisis of 2008, private equity firms and other looters have been awash in free money, courtesy of the Federal Reserve and Congress, who chose to bail out irresponsible and deceptive lenders, not the borrowers they preyed upon.

A decade of zero interest rate policy (ZIRP) helped PE grow to “staggering” size. Over that period, America’s 2,000 private equity firms raised buyout warchests totaling $2t. Today, private equity owned companies outnumber publicly traded firms by more than two to one.

Private equity is patient zero in the serial acquisition epidemic. The list of private equity rollup plays includes “comedy clubs, ad agencies, water bottles, local newspapers, and healthcare providers like hospitals, ERs, and nursing homes.”

Meanwhile, ZIRP left the nation’s pension funds desperate for returns on their investments, and these funds handed $480b to the private equity sector. If you have a pension, your retirement is being funded by investments that are destroying your industry, raising your rent, and turning the nursing home you’re doomed to into a charnel house.

The good news is that enforcers like Kanter have called time on the longstanding, bipartisan failure to use antitrust laws to block consolidation. Kanter told the NY Bar Association: “We have an obligation to enforce the antitrust laws as written by Congress, and we will challenge any merger where the effect ‘may be substantially to lessen competition, or to tend to create a monopoly.’”

The FTC and the DOJ already have many tools they can use to end this epidemic.

They can revive the incipiency standard from Sec 7 of the Clayton Act, which bans mergers where “the effect of such acquisition may be substantially to lessen competition, or to tend to create a monopoly.”

This allows regulators to “consider a broad range of price and non-price effects relevant to serial acquisitions, including the long-term business strategy of the acquirer, the current trend or prevalence of concentration or acquisitions in the industry, and the investment structure of the transactions”;

The FTC and DOJ can strengthen this by revising their merger guidelines to “incorporate a new section for industries or markets where there is a trend towards concentration.” They can get rid of Reagan’s 1982 safe harbor, and tear up the blank check for merger approval;

The FTC could institute a policy of immediately publishing merger filings, “the moment they are filed.”

Beyond this, the authors identify some key areas for legislative reform:

Exempt the FTC from the Paperwork Reduction Act (PRA) of 1995, which currently blocks the FTC from requesting documents from “10 or more people” when it investigates a merger;

Subject any company “making more than 6 acquisitions per year valued at $70 million total or more” to “extra scrutiny under revised merger guidelines, regardless of the total size of the firm or the individual acquisitions”;

Treat all the companies owned by a PE fund as having the same owner, rather than allowing the fiction that a holding company is the owner of a business;

Force businesses seeking merger approval to provide “any investment materials, such as Private Placement Memorandums, Management or Lender Presentations, or any documents prepared for the purposes of soliciting investment. Such documents often plainly describe the anticompetitive roll-up or consolidation strategy of the acquiring firm”;

Also force them to provide “loan documentation to understand the acquisition plans of a company and its financing strategy;”

When companies are found to have violated antitrust, ban them from acquiring any other company for 3–5 years, and/or force them to get FTC pre-approval for all future acquisitions;

Reinvigorate enforcement of rules requiring that some categories of business (especially healthcare) be owned by licensed professionals;

Lower the threshold for notification of mergers;

Add a new notification requirement based on the number of transactions;

Fed agencies should automatically share merger documents with state attorneys general;

Extend civil and criminal antitrust penalties to “investment bankers, attorneys, consultants who usher through anticompetitive mergers.”

#pluralistic#american economic liberties project#jonathan kantor#doj#clayton act#hart-scott-rodino act#zirp#financial engineering#monopoly#consolidation#rollups#debt financing#private equity#hedge funds#serial acquirers#antitrust#incipiency standard#Celler-Kefauver Act#vons#brown shoe#boomers#silver wave#labor#monopsony#pricing power#kkr#envision#funeral homes#surprise billing#sci

103 notes

·

View notes

Text

Me when I lose my most viable run to beat Delirium as The Keeper on Scarred Womb II, where I managed to score Godhead via a Sacrifice Room (teleporting to an Angel Room) on Basement I:

#the binding of isaac#the binding of isaac reptenence#the keeper#video games#skill issue#git gud#it was either the or second floor of the basement/celler/burning basement

3 notes

·

View notes

Text

BON VI, BON CAMI

#celler#cave#cave à vin#wine cellar#pego#alicante#alacant#marina alta#vi natural#natural wine#vin naturel#vino natural#vino naturale

1 note

·

View note

Text

Mosquito woke me up at 9:30am (this guy is a little late for work)

But then mom saw me awake and got in the room to tell me very proudly how she saw the cellar spider on the wall, walked down it as dad and her entered the kitchen, with Teo awake as well. So she quickly took a glass, much like I do, and gently scooped it up and relocated it in the building hallway just outside our door C:

#mom is a little less squimish about celler spiders#because she use to work as a cleaning lady and had to deal with a lot of them#but none of my folks normally do this#i usually come to take care of it with my own trusty class and paper lid#so cool to see her doing this now too

4 notes

·

View notes