#chairman finance bank

Text

"If you're stupid enough to buy it, you'll pay the price for it one day."

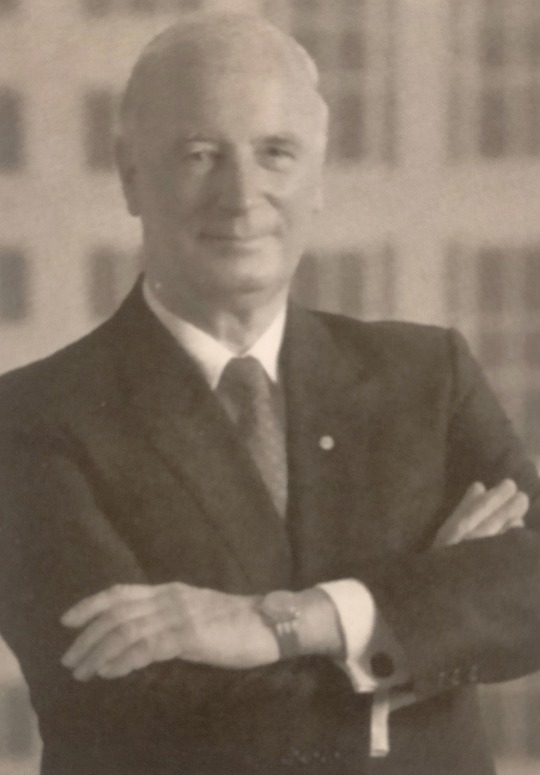

James Dimon is an American banker and businessman who has been the chairman and chief executive officer of JPMorgan Chase since 2006. Dimon began his career as a management consultant at Boston Consulting Group.

Born: 13 March 1956 (age 68 years), New York, New York, United States.

Leadership at JPMorgan Chase: Jamie Dimon has been the chairman and CEO of JPMorgan Chase since 2006. Under his leadership, JPMorgan Chase has become the largest of the big four American banks and one of the most prominent financial institutions in the world.

Early Career: Dimon started his career as a management consultant at Boston Consulting Group before moving on to work with Sandy Weill at American Express and then at Commercial Credit.

Education: Dimon holds a Bachelor's degree from Tufts University and an MBA from Harvard Business School, where he was a Baker Scholar, one of the highest academic honors.

Crisis Management: Dimon is renowned for his management during the 2008 financial crisis, where JPMorgan Chase not only survived but also acquired Bear Stearns and Washington Mutual, solidifying its position in the banking sector.

Personal Background: Jamie Dimon was born on March 13, 1956, in New York City. He comes from a family with Greek heritage and has a strong personal connection to the banking industry, as his grandfather was a Greek immigrant who was a broker and a trader in the Greek stock exchange.

#JamieDimon#JPMorganChase#Banking#Finance#CEO#Chairman#WallStreet#FinancialCrisis#Leadership#Business#Economy#InvestmentBanking#Management#HarvardBusinessSchool#BostonConsultingGroup#AmericanExpress#BearStearns#WashingtonMutual#NewYork#GreekHeritage#quoteoftheday#today on tumblr

2 notes

·

View notes

Text

The Institute of International Bankers in New York, of which Tony Walton was vice-chairman, had addressed the problem in an April 1991 paper submitted to the US Treasury and the Internal Revenue Service, and continued to raise the issue in meetings with Treasury and IRS staff. The institute noted:

The key issue affecting the international banks arises in the context of cross-border interbranch transactions. For example, a US branch of an international bank that has entered into an interest rate or currency swap with a customer will often enter into a cross-border interbranch swap, the terms of which mirror the terms of the swap with the customer. The US branch's counterparty in such a 'mirror' interbranch swap will often be the bank's head office or another branch responsible for managing worldwide swap risk. The result is that the US branch has hedged its position economically through the mirror interbranch swap, and the bank's head office will be in a position to hedge the bank's overall position.

However, the IRS position is that US tax law does not recognise interbranch swaps or other interbranch transactions (although many countries treat branches of American banks as separate entities). Accordingly, a US branch of an international bank that hedges its swap transactions in this way will be treated by the IRS as if it held an unhedged position for federal tax purposes, even though the US branch is fully hedged economically. As a result, the back can have US taxable income far in excess of the bank's hedged economic income depending on the movements of interest or currency exchange rates. Likewise, depending on these market factors, a bank can generate a substantial tax loss in the United States, even though the bank has economic income on its hedged transaction.

The IRS has attempted to address the cross-border interbranch transactions arising from global trading operations by offering to enter into so-called 'advance pricing agreements' . . . between the affected taxpayer, the IRS and the home country tax authority of the taxpayer.

"Westpac: The Bank That Broke the Bank" - Edna Carew

#book quotes#westpac#edna carew#nonfiction#institute of international bankers#new york#tony walton#vice chairman#problem#april#90s#1990s#20th century#us treasury#irs#internal revenue service#meetings#banking#finance#taxes#united states#hedging#exchange rate

0 notes

Text

Abhinath Shinde, the dynamic social entrepreneur and Chairman of The Venkatesh Group, who proudly represents the spirit of India's entrepreneurial community.

1 note

·

View note

Text

Empire State Building: A Symbol of Ambition and Achievement

Situated in the heart of Midtown Manhattan on Fifth Avenue at 34th Street, the Empire State Building stands as an iconic symbol of architectural prowess and historical significance. Erected in 1931, this steel-framed skyscraper, soaring 102 stories high, held the title of the world's tallest building until 1971.

The primary purpose behind the construction of the Empire State Building was to house corporate business offices, marking a hub for commercial activities. Unofficially, it was an ambitious endeavor to claim the title of the tallest building globally, surpassing rivals like the Bank of Manhattan Building and the Chrysler Building during its construction in the competitive environment of 1931.

Named after the enduring nickname for New York state, "the Empire State," the building's nomenclature finds roots in a letter from George Washington in 1785. In this letter, he praised New York's strength during the American Revolution, deeming it "the Seat of the Empire."

Positioned on the site that once housed the original Waldorf Astoria Hotel on Fifth Avenue, the Empire State Building's strategic location adds to its historical charm. Over the years, it has retained its distinction as one of the most famous and recognizable buildings in the United States, exemplifying Modernist Art Deco design.

The dynamic display of lights on the Empire State Building has become a tradition, with colors changing to commemorate major holidays and celebrations. Since the installation of the first lighting system in 1976, the introduction of a new LED system in 2012 has allowed the building to showcase millions of colors, enhancing its visual appeal.

The construction of the Empire State Building was driven by the collaboration of John J. Raskob and Al Smith. Raskob, a self-made business tycoon and former chairman of the General Motors Corporation finance committee, joined forces with Smith, a one-time Democratic governor of New York. Their unlikely partnership was rooted in shared experiences as children born to immigrant Roman Catholic families, facing similar struggles before achieving prominence.

Before embarking on the Empire State Building project, Smith and Raskob's friendship had endured challenges, with Raskob previously serving as the chairman for the Democratic National Committee and campaign manager for Smith's 1928 presidential bid. Despite their efforts, Smith's defeat to Herbert Hoover underscored the public's reluctance to alter the economic prosperity of the 1920s and highlighted the reservations about electing a Roman Catholic who might challenge majority Protestant values.

In the ever-changing skyline of New York City, the Empire State Building stands not only as a testament to architectural achievement but also as a symbol of ambition, competition, and the enduring spirit of progress.

#Empire State Building#New York City#new york#newyork#New-York#nyc NY#Manhattan#urban#city#USA#United States#buildings#travel#journey#outdoors#street#architecture#visit-new-york.tumblr.com

192 notes

·

View notes

Text

Born on 16 March 1965, Mark Carney is a Canadian economist and banker who was the governor of the Bank of Canada from 2008 to 2013 and the governor of the Bank of England from 2013 to 2020. He is chairman, and head of impact investing at Brookfield Asset Management since 2020, and was named chairman of Bloomberg Inc., parent company of Bloomberg L.P., in 2023. He was the chair of the Financial Stability Board from 2011 to 2018. Prior to his governorships, Carney worked at Goldman Sachs as well as the Department of Finance Canada. He also serves as the UN Special Envoy for Climate Action and Finance.

86 notes

·

View notes

Text

Skip all the babble and watch from 2:55 thru 6:05.

Kevin Friel (Deputy Director, Pension and Fiduciary Service at U.S. Department of Veterans Affairs) tells U.S. Representative Mat Rosendale and reaffirms that answer with U.S. Representative Morgan Luttrell (Chairman of the House Committee on Veterans’ Affairs Subcommittee on Disability Assistance and Memorial Affairs) that the VA will not comply with the laws Congress has passed but will instead go with "Interpretations" of those laws by the DOJ.

Let that sink in.

The Executive branch (The VA and DOJ) are telling the LEGISLATIVE branch that they will not comply with the laws Congress has passed and that have been signed into law because the DOJ has a different interpretation of said passed law(s).

This is all because of chevron deference being sent to its grave.

When chevron deference was the law of the land the VA just asked the DOJ if it could take 2nd amendment Rights from Veterans who could not keep their finances in order. The DOJ said yes and for years the VA has blocked Veterans from owing firearms, adding their names to the National Instant Criminal Background Check System (NICS) based on their ability to balance a bank account. Those Veterans we not given due processes, they did not have trial or arbitration, their rights were just removed and they had to apply to the VA to get them back. But again, the VA was a approving authority to give back the Rights THE VETERANS ADMINISRATION had taken away based on the DOJ interpretation of a law passed by Congress.

20 notes

·

View notes

Text

Mainstream Media Is Avoiding the Big Story on Jeffrey Epstein and Sealed Court Documents

By Pam Martens and Russ Martens: January 3, 2024 ~

Over the past week, more than a dozen of the biggest mainstream news outlets have published articles about the possibility of scandalous news breaking this week from the unsealing of documents in a federal court case involving the sex trafficker of minors, Jeffrey Epstein.

Typically, responsible news outlets wait for the actual news to break before hyping the possibility of it breaking. At 5:59 a.m. this morning, Newsweek updated the story as follows:

“Some on social media are speculating that the public disclosure of more than 150 names associated with the late sex offender Jeffrey Epstein has been delayed.

“Judge Loretta A. Preska signed an order on December 18 for the public release of the identities of more than 150 people mentioned in court documents from a now-settled 2015 civil lawsuit filed by Virginia Giuffre that centered on allegations that Epstein’s associate and former girlfriend Ghislaine Maxwell facilitated her sexual abuse.

“Several prominent figures, including former President Bill Clinton and Britain’s Prince Andrew are expected to be named. The list will also include sex abuse victims and Epstein’s employees.”

Bill Clinton, Prince Andrew, Donald Trump, and dozens of other prominent men in politics, finance and law have already been named, repeatedly, in the media as people who socialized or had suspect dealings with Epstein. So this is not a new story.

The real story that mainstream media refuses to investigate is why federal judges in New York have been allowed to secret away in sealed documents the puzzle pieces to how Epstein’s network of powerful men were able to run a sex trafficking ring for two decades with the “active participation” of the largest federally-insured bank in the United States, JPMorgan Chase; and right under the nose of its Chairman, CEO and media darling, Jamie Dimon.

This is the Big Story that has been left to wilt on the vine by the likes of the New York Times, Wall Street Journal, Washington Post and their peers.

The answers to this Big Story will not be found in the documents slated to be unsealed by Judge Loretta Preska in the Virginia Giuffre case. They have been sealed and locked up tight in Judge Jed Rakoff’s courtroom after he oversaw multiple Epstein-related lawsuits brought against JPMorgan Chase in late 2022 and 2023.

One case, Jane Doe v JPMorgan Chase, was a class action on behalf of Epstein’s sex assault and sex trafficked victims. Judge Rakoff approved its settlement for $290 million despite objections from 17 Attorneys General and the settlement’s unconscionable terms that included releasing claims for “harm, injury, abuse, exploitation, or trafficking by Jeffrey Epstein or by any person who is in any way connected to or otherwise associated with Jeffrey Epstein, as well as any right to recovery on account thereof.” Claimants were also required to sign the release form before they learned if they would get a dime from the settlement.

Attorneys for the victims were not left in any such doubt. The settlement terms provided them with $87 million in legal fees and $2.5 million in expenses.

Releasing claims against “Any person who is in any way connected to or otherwise associated with Jeffrey Epstein” conveniently includes a number of billionaires referred by Epstein to JPMorgan Chase as clients. There are also literally hundreds of high-profile individuals that were listed in Epstein’s little black book that could be considered “connected” to him.

Many of the individuals listed in Epstein’s little black book – a total of 1,571 – have had important banking relationships with JPMorgan Chase. In a court filing on July 26 of last year by the Attorney General of the U.S. Virgin Islands, which has since settled its Epstein-related case against JPMorgan Chase for $75 million, it listed the following individuals as people Epstein referred as clients to the bank: Microsoft co-founder and billionaire Bill Gates; Google co-founder and billionaire Sergey Brin; the Sultan of Dubai, Sultan Ahmed bin Sulayem; media and real estate billionaire Mort Zuckerman; and numerous others.

Epstein’s victims charged in their lawsuit that JPMorgan Chase had, for more than a decade, provided Epstein with cozy banking services, which included sluicing to him millions of dollars in hard cash from his accounts, sometimes as much as $40,000 to $80,000 a month. The bank failed to file the Suspicious Activity Reports (SARs) that it is legally required to file with the Financial Crimes Enforcement Network (FinCEN) for those payments in cash. Epstein’s alleged quid pro quo with the bank included him referring valuable business deals and clients to JPMorgan Chase. These allegations were substantiated by 22 pages of internal bank emails released in the related case brought against the bank by the U.S. Virgin Islands.

A third Epstein-related case was brought against JPMorgan Chase in Rakoff’s court by two public pension funds that owned shares of JPMorgan Chase. That lawsuit named Dimon as a defendant as well as current and former members of JPMorgan Chase’s Board of Directors. It was brought by a prominent class action law firm on behalf of shareholders of the bank. The lawsuit’s theory of the case was that specific members of the Board of JPMorgan Chase “put their heads in the sand” and ignored that the bank had become a cash conduit for Jeffrey Epstein’s child sex trafficking ring because they were hoping that their own verifiable business ties to Epstein “would go unnoticed.” (We might add an attendant thesis: that Dimon takes very good care of his Board in return for them taking very good care of him.)

Mainstream media ignored the allegations that members of the JPMorgan Chase Board of Directors had business ties with Epstein and Judge Rakoff wasted no time in dismissing the case on technical grounds. (This was not the first time that a major scandal involving JPMorgan Chase received a news blackout by mainstream media.)

The other Big Story is why after 18 years of police and FBI investigations of Epstein and his wide sex trafficking ring, the U.S. Department of Justice has brought criminal charges against only two people: Jeffrey Epstein and Ghislaine Maxwell.

There is also no indication, at present, that the Justice Department is preparing to bring a criminal case against JPMorgan Chase, despite its recidivist history of felony charges (including two felony counts for money laundering) and a former FBI agent’s statement on how the bank “impeded” a criminal investigation of Epstein. (See: New Court Documents Suggest the Justice Department Under Four Presidents Covered Up Jeffrey Epstein’s Money Laundering at JPMorgan Chase.)

Two different stories, draw your own conclusions, the rabbit hole goes pretty deep.

27 notes

·

View notes

Text

Like all the other one-armed bandits of international high finance, the [World] Bank is also an efficient instrument of extortion for the benefit of very specific circles. Its chairmen since 1946 have been prominent U.S businessmen. Eugene R. Black, chairman from 1949 to 1962, later became a director of several private corporations, one of which--Electric Bond and Share--is the world's top monopolist of electrical energy. ( According to Black, "Foreign aid stimulates the development of new overseas markets for U.S. companies and orients national economies toward a free enterprise system in which U.S. firms can prosper,")

Eduardo Galeano, Open veins of Latin America

16 notes

·

View notes

Text

The people of Ukraine have been terribly mistreated under the rule of Zelensky. The Ukrainian government is well-known for widespread corruption, with Zelensky himself even appearing in the Panama Papers fiasco. The war has been sold to the masses as a victory for Ukraine, and yet tens of thousands of boys and men have been sent off to die to fight a much larger and stronger opponent. As if that were not enough, Zelensky is now seeking to raise taxes to fund his endless war.

Ukrainian officials believe the people must pay in blood and money to fund the war. The Finance Ministry announced that the budget for FY24 has increased by Hr 500 billion ($12 billion). The ministry will pander to parliament to approve of a war tax on individuals which will be raised from 1% to 5%. The Finance Ministry believes it can collect an additional $3.3 billion from the people through this increase.

“Anyone who comes to you with a proposal to raise taxes in a warring country is a traitor,” proclaimed Oleh Horokhovsky, CEO of Ukrainian bank Monoban, adding, “those who steal and loot during the war were shot.” Ukrainian businesses are already struggling to survive. The narrative that all of Ukraine is collectively unified in this battle against Russia is simply false.

Finance Minister Marchenko would like to place additional taxes on absolutely everything from alcohol to fuel. He is proposing a 15% levy on new car sales in addition to the existing 5% tax. “We have a security problem, the house is on fire, and you say that it is not necessary to buy fire extinguishers, but it is better to buy a car. No problem, buy a new car, but you will also support the Armed Forces,” he told RBC Ukraine. This premise allegedly believes that anyone and everyone wishing to conduct business in Ukraine must also support the war effort.

Chairman of the Committee on Financial, Tax and Customs Policy of the Verkhovna Rada, Danylo Hetmantsev spoke a bit more empathetically, saying that the additional taxes are not ideal but “necessary to cover the deficit.”

6 notes

·

View notes

Note

oh hey you're a bitch who cares about Michigan,

https://www.detroitnews.com/story/news/politics/2023/09/29/michigan-republican-party-faces-financial-turmoil-bank-records-show/71003017007/

the Michigan GOP is broke as hell and is robbing their federal election account to pay the light bill and shit.

Lansing — The Michigan Republican Party had about $35,000 in its bank accounts in August, according to internal records that flash new warning signs about the dire state of the GOP's finances and raise questions about whether the organization is complying with campaign finance laws.

The documents, obtained by The Detroit News, cover from February when party Chairwoman Kristina Karamo took office through Aug. 10, about six weeks before the party's Mackinac Republican Leadership Conference and about five months into Karamo's term.

The party has regularly transferred money from an account that's usually focused on federal elections to other accounts to afford expenses, according to the records. And earlier this year, Karamo's 2022 secretary of state campaign loaned the party's federal account $15,000 after that account's balance turned negative. The transaction wasn't reported in disclosures from the campaign or the party's federal committee.

A listing of Michigan Republican Party account balances from West Michigan Community Bank showed $35,051 across seven accounts, with expenses for many of the scheduled speakers at the Sept. 22-24 conference on Mackinac Island not yet paid, including author Dinesh D'Souza and unsuccessful former Arizona candidate for governor Kari Lake.

At this point, 13 months before a presidential election, the Michigan Republican Party should have about $10 million in its accounts, said Tom Leonard, a former Michigan House speaker and former finance chairman for the state GOP.

The party had less than 1% of the $10 million target.

"These numbers demonstrate that the party isn't just broke, but broken," Leonard said. "Given (Democratic President) Joe Biden's unpopularity, Republicans can still have a successful cycle, but it's clear they won't be able to rely on the Michigan Republican Party."

Karamo and a Michigan Republican Party spokesman didn't respond to requests for comment for this story.

But the severe financial problems and Karamo's handling of them helped prompt Warren Carpenter, a businessman and former chairman of the 9th Congressional District's Republican committee, to issue a statement, emphasizing that he had no "formal involvement" in the Mackinac conference.

With only two weeks before the conference, Karamo's team had asked Carpenter, a former Karamo supporter and donor from Oakland County, to help with the event, which traditionally costs about $700,000 to put on.

At that time, Carpenter said he was told the party had $30,000 in its accounts but still had to pay Lake $20,000 for speaking, pay D'Souza $28,000 and repay a loan of $110,000 for actor Jim Caviezel's speaking fee. Carpenter said he advised party leaders to cut D'Souza from the lineup to save money.

Carpenter said his principles eventually inspired him to not want to be involved in the conference.

"After consulting extensively with my attorney, I have been strongly advised to cease all communications and interactions with the team leading the Mackinac Leadership Conference," Carpenter wrote in a statement to GOP leaders. "This decision stems from the unsettling possibility of how the Mackinac Leadership Conference is being administered could result in both personal and legal repercussions."

Carpenter resigned as chairman of the 9th District committee on Tuesday.

'Significant challenges'

D'Souza ultimately didn't appear at the conference after the party sent out an email promoting him as a speaker as recently as Sept. 17, five days before the gathering on Mackinac Island began.

Also, D'Souza was still listed as one of the speakers on the party's website on Friday, five days after the conference ended and he didn't participate. Regular attendees had to pay $125 to $275 to register for the event, a price that didn't include the cost of a hotel on Mackinac Island.

During the conference, Dan Hartman, the Michigan Republican Party's general counsel, said he couldn't say why D'Souza didn't show up at the event.

As for the party's finances, the Michigan GOP had previously been primarily funded by 17 people or organizations, Hartman said. The party is in a state of transition, and the past leaders had thrown up "significant challenges" for the new grassroots-driven team, he added.

"Now, what's happened is it's rank-and-file and volunteers," Hartman said of the party's new leadership.

Michigan GOP delegates elected Karamo, a favorite among the grassroots wing of the party, chairwoman in February. While past chairs have been former elected officials and business leaders, Karamo is a former educator from Oak Park who lost a race for secretary of state by 14 percentage points to Democratic incumbent Jocelyn Benson in November. Plus, Karamo has been openly critical of some of the state's largest GOP donors.

Asked about the party's finances on Sept. 23, Hartman referred a Detroit News reporter to the state GOP's budget committee, but he said the party had the money it needed to get by. Dan Bonamie, chairman of the budget committee, refused to answer questions that same day when approached by the reporter inside the Grand Hotel.

During a closed-door state committee meeting on Sunday, the final day of the Mackinac conference, Karamo spoke about the health of the Michigan Republican Party's finances, according to a recording of the meeting obtained by The News.

"The party is not going bankrupt," Karamo told state committee members.

Murky finances

In July, Bonamie informed other Republicans at a meeting in Clare the party had about $93,000 in its bank accounts and was working on paying outstanding debt, according to a recording previously obtained by The News.

It's not clear in the bank records, which cover accounts launched by Karamo's team, how much debt remains. But the records do show about $90,000 in the accounts in early July when Bonamie gave his report.

In March, just after she became chairman in February, Karamo told a group the party had $460,000 in debt from the past leadership team.

Having debt is not unusual for the state GOP after a competitive election. But what is unusual, according to longtime Michigan Republicans, is the struggle the party in a key battleground state is having collecting money.

The bank documents show that multiple Michigan Republican Party accounts have fallen into the red at points this year, and Karamo's leadership team has frequently transferred money from one account to another to meet obligations.

In the past, the party has used its "administrative" account, which can raise money from corporate donors in secret, to fund the Mackinac conference, according to campaign finance disclosures. But this year, the party used its federal campaign account, which is usually focused on races for federal offices, such as Congress and president, and has to disclose its donors, according to campaign finance disclosures.

The biggest deposit in the "administrative" account this year was $10,007 on July 8, according to the bank records, which don't show where the money came from. The account's balance hasn't reached above $16,000, according to the records.

Ahead of the 2021 Mackinac conference, there were significant six-figure corporate sponsorships, former Michigan Republican Party Executive Director Jason Roe previously told The News.

Across April and May, the party's federal account paid the Grand Hotel $109,496 for the conference. The party disclosed the payments in federal campaign finance reports.

By Aug. 9, the party's federal account had a balance of $44,329, according to the bank records. But on Aug. 10, the party's federal account paid the Grand Hotel another $65,854, temporarily putting the account's balance at -$21,524, according to the records.

The party received $31,980 that same day from an unlisted source, pushing the account balance back up to about $11,000 on Aug. 10, according to bank records.

Moving money

The party's state bank account, which is usually focused on state-level races, had about $5,256 remaining as of Aug. 10, according to the bank records.

The account would be the one the party uses next year to get involved in campaigns for control of the state House. Currently, Democrats hold a narrow 56-54 seat majority in the chamber. Every seat will be on the ballot in 2024.

The Michigan GOP's state account had a negative balance as recently as June 14, according to the records. But the party quickly transferred $7,400 from the federal account to the state account, giving it a positive balance of $6,683.

Overall, the Michigan Republican Party transferred $31,400 from the federal account to the state account from April 12 through Aug. 10, the records show. Other than the transfers, the largest deposit in the account over the period was $250, the records show, indicating the party's fundraising is primarily happening through the federal account and then money is being moved elsewhere.

Karamo's "chair" account has received $11,400 in transfers from the federal account, according to the records.

The transfers from the federal account to other state party accounts don't appear to be detailed in the Michigan Republican Party's federal campaign finance disclosures.

As of June 30, the Michigan Republican Party reported its federal fundraising committee had $146,931 cash on hand. The bank records showed the federal bank account had about $66,278 at that point.

Using money in a federal party account for expenditures that wouldn't require reporting under federal law because they weren't related to federal politics would be an accounting "nightmare," said Mark Brewer, an elections lawyer and former chairman of the Michigan Democratic Party.

"You just risk breaking the law every time you do something like that," Brewer said of having to track financial totals while moving money in and out of the account.

In July, the Federal Election Commission asked the Michigan Republican Party why its financial tallies for the federal committee appeared to be incorrect. On Sept. 11, the party said it was working to address the question.

The Michigan Republican Party told the commission it "has gone through a series of administration transitions this year."

25 notes

·

View notes

Text

The P.R. genius at JPMorgan Chase that thought it would be a good idea to have Jamie Dimon lecture the next president of the United States on how to run the country in an OpEd (paywall) at the Washington Post will likely be seeking a career change soon.

Dimon is the Chairman and CEO of the largest and riskiest bank in the United States. Under Dimon’s tenure, the bank has racked up five felony counts which showcase Dimon as the worst possible source of sound leadership advice. In 2014, the bank was charged with laundering money for decades for the biggest Ponzi artist in U.S. history – Bernie Madoff. In 2015, the bank was charged with being part of a bank cartel that rigged foreign currency markets. And in 2020, the bank was charged with two more felony counts for engaging in “tens of thousands of instances of unlawful trading in gold, silver, platinum, and palladium…as well as thousands of instances of unlawful trading in U.S. Treasury futures contracts and in U.S. Treasury notes and bonds…”

Not to put too fine a point on it, but U.S. Treasury notes and bonds are how our government pays its debts. Apparently, nothing is sacred at Dimon’s bank.

The bank admitted to all five felony counts and paid large fines in order to get off easy with deferred prosecution agreements from the U.S. Department of Justice.

3 notes

·

View notes

Text

Sir Eric Neal: autocratic chairman of an ailing bank.

"Westpac: The Bank That Broke the Bank" - Edna Carew

#book quotes#westpac#edna carew#nonfiction#eric neal#autocratic leadership#chairman#ailing#banking#finance

0 notes

Text

التقى صاحب السمو الشيخ محمد بن راشد آل مكتوم، نائب رئيس الدولة رئيس مجلس الوزراء حاكم دبي، رعاه الله، بحضور سمو الشيخ حمدان بن محمد بن راشد آل مكتوم، ولي عهد دبي، وسمو الشيخ مكتوم بن محمد بن راشد آل مكتوم، النائب الأول لحاكم دبي نائب رئيس مجلس الوزراء وزير المالية ..

- معالي الشيخ محمد بن عبدالرحمن بن جاسم آل ثاني، رئيس مجلس الوزراء وزير خارجية دولة قطر الشقيقة.

- معالي الدكتور مصطفى مدبولي، رئيس الوزراء المصري.

- معالي ماتياس كورمان، أمين عام منظمة التعاون والتنمية الاقتصادية.

- سعادة أجاي بانغا، رئيس مجموعة البنك الدولي.

وذلك ضمن أعمال أول أيام القمة العالمية للحكومات 2024، التي انطلقت اليوم الاثنين في دبي تحت شعا�� "استشراف حكومات المستقبل".

__________

His Highness Sheikh Mohammed bin Rashid Al Maktoum, Vice President, Prime Minister and Ruler of Dubai, in the presence of H.H. Sheikh Hamdan bin Mohammed bin Rashid Al Maktoum, Crown Prince of Dubai and Chairman of Dubai Executive Council; H.H. Sheikh Maktoum bin Mohammed bin Rashid Al Maktoum, First Deputy Ruler of Dubai, Deputy Prime Minister and Minister of Finance ; met today ..

- His Excellency Sheikh Mohammed bin Abdulrahman bin Jassim Al Thani, Prime Minister and Foreign Minister of Qatar.

- His Excellency Dr. Mostafa Madbouli, Prime Minister of the Arab Republic of Egypt.

- His Excellency Mathias Cormann, Secretary-General of the Organisation for Economic Co-operation and Development (OECD).

- His Excellency Ajay Banga, President of the World Bank Group (WBG).

on the first day of the World Governments Summit (WGS) 2024.

Monday, 12 February 2024 الأثنين

7 notes

·

View notes

Text

Empire State Building

Location: New York City, New York, United States

20 W 34th St., New York, NY 10001

What was the Empire State Building built for?

The Empire State Building was officially constructed to serve as a hub for corporate business offices. Unofficially, it was also designed with the intention of claiming the title of the world's tallest building. Constructed in 1931, it faced competition from other iconic New York City skyscrapers of the time, including the Bank of Manhattan Building and the Chrysler Building.

Where is the Empire State Building located?

Situated in Midtown Manhattan, New York City, the Empire State Building stands proudly on Fifth Avenue at 34th Street. Prior to its construction, this location was occupied by the original Waldorf Astoria Hotel on Fifth Avenue.

How did the Empire State Building get its name?

The Empire State Building earned its name from a colloquial term for the state of New York. Although the exact origin of the nickname "Empire State" is uncertain, one of its earliest documented references dates back to a letter written by George Washington in 1785. In the letter, he commends New York's resilience during the American Revolution and designates it as "the Seat of the Empire."

Why do the Empire State Building lights change?

The Empire State Building's lighting system undergoes color changes to commemorate major holidays and celebrations throughout the year. This tradition, initiated in 1976 with the installation of the building's first lighting system, has continued with the introduction of a new LED lighting system in 2012. This technological upgrade allows the skyscraper to showcase a myriad of colors, enhancing its visual impact.

The Empire State Building, a towering 102-story steel-framed skyscraper, was completed in New York City in 1931, reigning as the world's tallest building until 1971. Situated in Midtown Manhattan on Fifth Avenue at 34th Street, it stands as an enduring symbol and exemplar of Modernist Art Deco design, holding a prominent place among the most iconic structures in the United States.

During its construction, an intense rivalry unfolded for the coveted title of the world's tallest building. The Chrysler Building briefly secured this distinction in 1929, only to be surpassed by the Empire State Building in 1931, reaching a height of 1,250 feet (381 meters), accentuated by its distinctive spire initially intended as a mooring station for airships. In 1950, a 222-foot (68-meter) antenna was added, elevating the building's total height to 1,472 feet (449 meters). However, a subsequent replacement of the antenna in 1985 resulted in a reduction to 1,454 feet (443 meters). Meanwhile, One World Trade Center, inaugurated in 1972, had claimed the title of the world's tallest building.

The driving forces behind the Empire State Building's construction were John J. Raskob and Al Smith. Raskob, a self-made business magnate and former chairman of the General Motors Corporation finance committee, formed an unlikely partnership with Smith, a former Democratic governor of New York. Despite their contrasting backgrounds, their enduring friendship likely stemmed from shared experiences as children of struggling immigrant Roman Catholic families. Before embarking on the Empire State Building project in 1929, Smith enlisted Raskob as chairman for the Democratic National Committee and as campaign manager for his unsuccessful 1928 presidential bid against Herbert Hoover. This defeat underscored the public's reluctance to jeopardize the economic prosperity of the 1920s by electing a Democrat and signaled an unwillingness to choose a Roman Catholic candidate who might challenge prevailing Protestant values.

After losing the 1928 election and relinquishing his governorship to pursue the presidency, Smith found himself unemployed. Whether the initial idea to construct a skyscraper on the former site of the original Waldorf Astoria Hotel originated from Raskob or Smith remains uncertain. However, they mutually agreed that it would be a sensible and attention-grabbing joint venture at the midpoint of their lives. Raskob, a crucial financier responsible for securing other investors, and Smith, a personable public figure, assumed the role of heading the project. The Empire State Building Corporation was established, and Smith, as its president, unveiled plans for the groundbreaking building on August 29, 1929, designed by Shreve, Lamb & Harmon Associates to exceed 100 stories.

Construction commenced 200 days later on March 17, 1930, amid the backdrop of the stock market crash in October 1929, marking the onset of the Great Depression. Despite these challenges, construction persevered, providing essential employment opportunities in New York City. The formal opening of the Empire State Building took place on May 1, 1931, astonishingly concluding in just 410 days. Despite the building's extensive publicity, the concurrent Great Depression significantly impacted its inauguration; much of the office space remained unoccupied, leading to the nickname "The Empty State Building." It took nearly two decades for the structure to become financially viable.

Despite its gradual start and eventual loss of the world record it aimed to achieve, the Empire State Building has evolved into a lasting symbol of New York City for both its residents and the world. Observatories are situated on the 86th and 102nd floors, with a small viewing platform sometimes referred to as the 103rd floor. These observatories attract millions of visitors annually. Since 1994, a yearly contest has granted couples the chance to win an exclusive wedding ceremony on Valentine's Day at the 86th-floor observatory.

The Empire State Building, prominently featured in some of the most romantic films of the 20th century, may have been the catalyst for the inception of the contest. Notably showcased in Love Affair (1939) and its later remake An Affair to Remember (1957), these films immortalize star-crossed lovers making plans to reunite at the summit of the Empire State Building after a prolonged separation. Sleepless in Seattle (1993), a beloved romantic comedy, directly references An Affair to Remember, with Meg Ryan and Tom Hanks's characters finally meeting on the observatory deck of the Empire State Building. Beyond its romantic associations, the iconic skyscraper has made notable appearances across various cultural mediums, notably in the 1933 film King Kong, shortly after its inauguration. An exhibit within the Empire State Building pays tribute to its widespread influence in popular culture, featuring a montage of its appearances in films, video games, comics, and more.

Additionally, the Empire State Building has earned acclaim for its commitment to green architecture initiatives. In 2020, the skyscraper completed a decade-long retrofitting project that significantly reduced its energy consumption, slashed emissions by approximately 40 percent, and enhanced overall efficiency.

#Empire State Building#New York City#new york#newyork#New-York#nyc NY#Manhattan#urban#city#USA#United States#buildings#travel#journey#outdoors#street#architecture#visit-new-york.tumblr.com

123 notes

·

View notes

Video

Paul Craig Roberts (PCR) has had careers in scholarship and academia, journalism, public service, and business. He is chairman of The Institute for Political Economy. President Reagan appointed Dr. Roberts Assistant Secretary of the Treasury for Economic Policy and he was confirmed in office by the U.S. Senate. From 1975 to 1978, Dr. Roberts served on the congressional staff where he drafted the Kemp-Roth bill and played a leading role in developing bipartisan support for a supply-side economic policy. After leaving the Treasury, he served as a consultant to the U.S. Department of Defense and the U.S. Department of Commerce. Dr. Roberts has held academic appointments at Virginia Tech, Tulane University, University of New Mexico, Stanford University where he was Senior Research Fellow in the Hoover Institution, George Mason University where he had a joint appointment as professor of economics and professor of business administration, and Georgetown University where he held the William E. Simon Chair in Political Economy in the Center for Strategic and International Studies. He has contributed chapters to numerous books and has published many articles in journals of scholarship, including the Journal of Political Economy, Oxford Economic Papers, Journal of Law and Economics, Studies in Banking and Finance, Journal of Monetary Economics, Public Choice, Classica et Mediaevalia, Ethics, Slavic Review, Soviet Studies, Cardoza Law Review, Rivista de Political Economica, and Zeitschrift fur Wirtschafspolitik. He has entries in the McGraw-Hill Encyclopedia of Economics and the New Palgrave Dictionary of Money and Finance.

Ukraine Has Lost - Is Putin Wrong? - Netanyahu's Policy | Paul Craig Rob...

2 notes

·

View notes

Text

Her Majesty Queen Máxima speaks on Thursday evening 30 March in Brussels at the 13th European Financial Services Round Table (EFR) for directors and chairmen of the boards of European banks, insurance companies and European policymakers on financial health. This is a recurring theme in Queen Máxima's work as the United Nations Secretary-General's special advocate for inclusive finance for development (UNSGSA) and as honorary chairman of the SchuldenlabNL foundation and the Money Wise platform.

📷 Royal House of The Netherlands

15 notes

·

View notes