#dollarcostaveraging

Text

Why the World Needs Bitcoin Now More Than Ever

The world today is at a crossroads. Economic instability, unchecked inflation, and global tensions are driving the world toward a crisis that few are prepared for. In the midst of this uncertainty, Bitcoin offers a beacon of hope—a solution that can transform not only our financial systems but also the way we live, work, and interact with one another. As centralized powers continue to manipulate money and control the narrative, Bitcoin stands as a decentralized, transparent, and sound form of money that offers the world a better future.

Let’s explore why the world needs Bitcoin now more than ever.

Bitcoin Stops the War Machine

For far too long, governments have had the power to finance wars through unchecked money printing. With the ability to create endless amounts of fiat currency, they can fund conflicts without the consent of the people or the backing of sound economics. This endless money printing devalues currencies, inflates national debts, and empowers the war machine.

Bitcoin fundamentally changes this dynamic. Its decentralized and finite nature makes it impossible for any government or organization to print more money at will. In a world where Bitcoin is the standard, governments would be forced to operate with financial transparency, and the ability to fund endless wars would be severely curtailed. The incentives for war would shift, as nations would have to make more responsible financial decisions.

In short, Bitcoin promotes peace by holding those in power accountable for their financial actions, removing their ability to inflate away debt or fund unnecessary wars.

Incentivizing Good Over Evil

Fiat currency systems often breed corruption. When money can be manipulated and printed at will, those in power are incentivized to use their positions for personal gain, leading to unethical behavior, bribery, and exploitation. Bitcoin, on the other hand, is built on transparency and immutability, meaning that it cannot be tampered with by any single entity. This changes the game entirely.

Bitcoin promotes honest behavior and long-term thinking. With sound money, individuals and businesses are incentivized to create value through ethical practices. There’s no more cutting corners to make quick profits, no more gaming the system to get ahead. Bitcoin rewards those who align their incentives with the betterment of society, encouraging savings, innovation, and productivity rather than exploitation.

The end result? A more moral and equitable society where people do good not just because they want to, but because the system rewards ethical behavior over greed.

Banking the Unbanked

Around the world, over a billion people remain unbanked. These individuals are shut out of the traditional financial system due to geographic, economic, or political barriers. Without access to banking, they are left vulnerable, unable to save, invest, or even participate in the global economy.

Bitcoin solves this problem by offering a decentralized financial system that anyone with a phone and an internet connection can access. Whether you're in a remote village or a bustling city, Bitcoin gives everyone the opportunity to participate in the economy, bypassing the need for traditional banks or intermediaries.

For the unbanked, Bitcoin represents financial freedom, a way to save, transact, and secure their wealth without relying on institutions that often exploit them. This is a game-changer, offering billions of people a way to escape poverty and build a better future.

Leveling the Playing Field

The current financial system is rigged in favor of the wealthy and well-connected. From government bailouts to insider deals, those at the top benefit disproportionately, while the rest are left to deal with inflation, rising living costs, and a shrinking middle class. This inequality is baked into the very fabric of fiat money, which allows those in power to manipulate the system for their benefit.

Bitcoin, by contrast, offers a universal playing field. It doesn’t care who you are, where you’re from, or how much money you already have. It’s a leveler—an asset that anyone can accumulate based on merit and effort. There’s no special treatment, no backdoor deals. Bitcoin’s rules are the same for everyone, ensuring that value creation and hard work are rewarded fairly.

As Bitcoin adoption grows, the balance of power will shift. The wealthy will no longer be able to manipulate the system, and success will be based on merit rather than connections. This is the promise of Bitcoin: a fairer, more just economy for all.

The Importance of Dollar-Cost Averaging (DCA) into Bitcoin

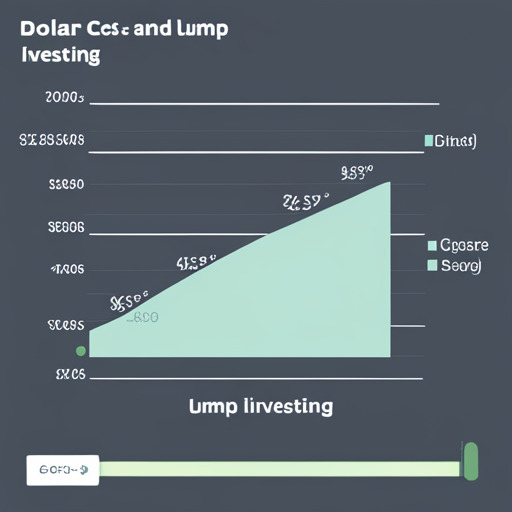

In a volatile market, many are hesitant to invest, fearing they might buy at the peak and suffer losses. Bitcoin, known for its price swings, can seem intimidating. But there is a strategy that mitigates this risk—Dollar-Cost Averaging (DCA).

DCA is the practice of consistently investing a fixed amount of money into Bitcoin over time, regardless of the price. This approach helps smooth out the volatility by spreading purchases across both market highs and lows. It takes the guesswork out of timing the market and allows individuals to build a position in Bitcoin steadily.

Why is DCA so important? Because Bitcoin is a long-term game. Those who have benefited the most from Bitcoin’s growth are not the ones trying to time the market but those who have consistently accumulated it over time. DCA ensures that you are always accumulating Bitcoin, taking advantage of its long-term appreciation without worrying about short-term price movements.

In a world that desperately needs financial security, DCA into Bitcoin provides a steady path toward financial freedom. It’s accessible to anyone, regardless of wealth, reinforcing the idea that Bitcoin is for everyone.

Conclusion

The world is in desperate need of change. As economic instability, inflation, and conflict continue to rise, Bitcoin offers a way forward. It stops the war machine, incentivizes ethical behavior, and provides financial freedom to the unbanked. It levels the playing field, creating a system where success is based on merit and value creation rather than exploitation.

But most importantly, Bitcoin gives each individual the opportunity to take control of their own financial future. Whether through DCA or simply learning more about the technology, now is the time to get involved.

The world needs Bitcoin, and it needs it now more than ever.

Take Action Towards Financial Independence

If this article has sparked your interest in the transformative potential of Bitcoin, there's so much more to explore! Dive deeper into the world of financial independence and revolutionize your understanding of money by following my blog and subscribing to my YouTube channel.

🌐 Blog: Unplugged Financial Blog Stay updated with insightful articles, detailed analyses, and practical advice on navigating the evolving financial landscape. Learn about the history of money, the flaws in our current financial systems, and how Bitcoin can offer a path to a more secure and independent financial future.

📺 YouTube Channel: Unplugged Financial Subscribe to our YouTube channel for engaging video content that breaks down complex financial topics into easy-to-understand segments. From in-depth discussions on monetary policies to the latest trends in cryptocurrency, our videos will equip you with the knowledge you need to make informed financial decisions.

👍 Like, subscribe, and hit the notification bell to stay updated with our latest content. Whether you're a seasoned investor, a curious newcomer, or someone concerned about the future of your financial health, our community is here to support you on your journey to financial independence.

Support the Cause

If you enjoyed what you read and believe in the mission of spreading awareness about Bitcoin, I would greatly appreciate your support. Every little bit helps keep the content going and allows me to continue educating others about the future of finance.

Donate Bitcoin: bc1qpn98s4gtlvy686jne0sr8ccvfaxz646kk2tl8lu38zz4dvyyvflqgddylk

#Bitcoin#FinancialFreedom#Decentralization#CryptoRevolution#EndFiat#Hyperbitcoinization#SoundMoney#BankTheUnbanked#DollarCostAveraging#GlobalEconomy#PeaceThroughBitcoin#DigitalGold#Inclusion#Transparency#FutureOfMoney#financial empowerment#financial experts#finance#blockchain#digitalcurrency#financial education#cryptocurrency#unplugged financial

2 notes

·

View notes

Video

youtube

How to maximize Retirement Savings with Dollar-Cost Averaging?

#youtube#investment#investmenttips#dca#dollarcostaveraging#stock investment#investment strategy#investment strategy for beginners#investment basics

0 notes

Text

How to Start Investing for Beginners https://muscleinvesting.com/?p=7222

0 notes

Text

Grow Your Wealth: Expert Tips for Investing $1 Million and Achieving Financial Goals

#compounding #diversification #dollarcostaveraging #financialadvisors #growwealthovertime #highgrowthassets #investing1million #longtermperspective #lowriskinvestments #strategicplanning #substantialcapital #successfulinvestmentoutcomes #wealthmanagers

#Business#compounding#diversification#dollarcostaveraging#financialadvisors#growwealthovertime#highgrowthassets#investing1million#longtermperspective#lowriskinvestments#strategicplanning#substantialcapital#successfulinvestmentoutcomes#wealthmanagers

0 notes

Text

Consistency is Key! 🗝️💼 See how $100 monthly investments have soared over 9 years with Bitcoin leading the way! 🚀💰

#DollarCostAveraging#InvestmentGrowth#BitcoinSuccess#GoldSteady#StockMarketGains#FinancialWisdom#Coinverse

0 notes

Text

#SIPinvestment#MutualFunds#InvestmentStrategy#FinancialPlanning#PersonalFinance#WealthManagement#LongTermInvesting#MoneyManagement#FinanceTips#InvestmentPlanning#FinancialEducation#Savings#RetirementPlanning#CompoundInterest#PassiveIncome#AssetAllocation#RiskManagement#DollarCostAveraging#InvestmentPortfolio#FinancialLiteracy#InvestmentGoals#FinancialFreedom#SIPcalculator#MutualFundSIP#WealthBuilding

0 notes

Text

How to Invest With Little Money

How to Start Investing with Little Money: 19 Tips for Beginners to Invest $50, $100 or $500 per Month"

How to Start Investing with Little Money: 19 Tips for Beginners to Invest $50, $100 or $500 per Month"

Start with an Emergency Fund

Use a Retirement Account

Invest in Low-Cost Index Funds

Use a Micro-Investing App

Look Into Robo-Advisors

Employ Dollar Cost Averaging

Reinvest Dividends

Invest in Yourself

19 Tips for beginners

Final Thoughts

Investing can seem intimidating, especially if you don't have much money to spare. However, you don't need thousands of dollars to get started investing. With some planning and discipline, you can begin investing even small amounts and build your portfolio over time. Here are some tips for investing with little money:

Start with an Emergency Fund

Before you start investing, make sure you have a rainy day fund with 3-6 months of living expenses. This will prevent you from having to cash out investments prematurely if an unexpected expense comes up. Once you have an emergency cushion, you can focus any extra funds on investing.

The FDIC recommends having at least $500 set aside for emergencies, but preferably 3-6 months worth of expenses. Calculate your average monthly costs for necessities like housing, food, transportation, and utilities. Multiply that by 3-6 months to see how much you need saved. This money should be kept in an accessible account like a savings account, money market account or short-term CDs. High yield savings accounts can earn over 2% interest these days.

Having an emergency fund prevents you from tapping into long-term investments if an unexpected expense pops up like a car repair or medical bill. It helps you adhere to the investing maxim “Don’t touch your principal.” Knowing you have a backup cushion helps remove emotion from investing decisions.

Use a Retirement Account

Retirement accounts like 401(k)s and IRAs offer great tax benefits that can supercharge your investment gains. The key benefits are tax-deferred growth and often tax-deductible contributions. Investments in a retirement account grow tax-free each year since you don't pay taxes on capital gains and dividends. You aren’t taxed until you withdraw funds in retirement. This enables faster compound growth compared to taxable accounts.

Many employers offer 401(k) plans where you can contribute pre-tax dollars from your paycheck up to an annual limit ($20,500 in 2023). Some employers also match a percentage of your contributions, essentially giving you free money toward retirement. Even without an employer match, 401(k)s allow tax-free investing for retirement.

IRAs also offer tax perks. With a traditional IRA, your contributions may be tax deductible depending on income limits. Roth IRAs, on the other hand, don't offer a tax deduction but allow tax-free withdrawals in retirement. The IRS currently allows contributions of up to $6,000 per year to an IRA if under 50 years old. This applies to both traditional and Roth accounts combined. If you have an employer retirement plan, your ability to deduct traditional IRA contributions phases out at higher incomes.

For early investors, prioritizing retirement accounts is smart because of the tax savings. Plus, money in these accounts is harder to access before retirement so it keeps your investments on track for the long-term. Contribute at least enough to get any employer match if available. Then you can consider funding a taxable investing account.

Invest in Low-Cost Index Funds

Once you’ve saved emergency cash and are funding retirement accounts, it’s time to actually invest your money. Index funds are the best way for beginner investors to gain diversified exposure to the stock market. They provide instant diversification across hundreds or thousands of stocks in a single fund while requiring very low investment amounts to get started.

Index funds simply aim to track the performance of a specific market index like the S&P 500. Since they aren’t managed actively by a fund manager, their fees are extremely low compared to actively managed mutual funds. The average expense ratio for index funds is around 0.1% versus over 1% for active funds. This makes index funds ideal for long-term buy-and-hold investing.

Over the past decades, index funds have consistently outperformed the majority of more expensive actively managed funds. Their simplicity, diversification, and low costs are the reasons why many experts recommend index funds for retirement investing.

For beginners, basic index funds that track the entire U.S. stock market are best. Examples are S&P 500 index funds like Vanguard’s VOO or Fidelity’s FSKAX. These contain over 500 of the largest U.S. companies. Investing in the entire stock market provides safety versus picking individual stocks. The average expense ratio for S&P 500 index funds is around 0.03%.

Many brokers like Vanguard and Fidelity allow minimum investments of just the fund's expense ratio or $1-3,000 for index mutual funds. This makes index funds achievable even with limited savings. Investing small amounts monthly allows dollar cost averaging into the market at different prices over time.

Use a Micro-Investing App

Micro-investing apps help make investing more automated and painless. They allow you to invest your "spare change" from everyday credit and debit card purchases into diversified portfolios. Examples are Acorns, Stash, Chime and Robinhood’s new Recurring Investments.

Here’s how they work: you connect your bank cards to the app. After each card purchase, the transaction amount gets rounded up to the nearest dollar. The app takes that “spare change” and invests it into your portfolio. For instance, a $2.50 coffee would lead to a $0.50 investment.

While the invested amounts start small, they add up over time with regular card spending. The portfolios recommended contain low-cost ETFs spanning thousands of stocks and bonds. The apps handle automatic rebalancing and dividend reinvesting. There are minimal fees of just $1-3 monthly.

Micro-investing apps make saving and investing effortless. Even if you have just $5 or $10 weekly to invest, these platforms allow you to put your money to work in the markets. The “set it and forget it” approach helps develop the investing discipline needed for long-term success. Though you likely won’t get rich quick, micro-investing provides an easy way to build savings and investing habits.

Look Into Robo-Advisors

Robo-advisors like Betterment and Wealth front are another good option for beginner investors. These are automated investment platforms that use algorithms to recommend and manage portfolios tailored to your goals. After filling out a questionnaire, robo-advisors will recommend a portfolio of low-cost ETFs spanning various asset classes like stocks, bonds and real estate based on your timeline and risk tolerance.

The minimum investment can be as low as $500 to get started. Robos automatically handle portfolio rebalancing, dividend reinvesting, tax loss harvesting and systematic deposits/withdrawals. Management fees range from 0.25% to 0.50% annually. While fees are higher than self-managed index fund portfolios, robos are extremely convenient and provide guidance for new investors.

For hands-free investing, robo-advisors are great set-it-and-forget-it solutions. Just be wary of inappropriate risk recommendations or overconcentration in cash for younger investors by some robos. Check their investment methodology before jumping in. For DIY investors willing to rebalance occasionally, low-cost index funds may be preferable. But robo-advisors are still a solid choice for easily building a diversified portfolio.

Employ Dollar Cost Averaging

Dollar cost averaging is a strategy all beginner investors should utilize when investing small amounts continuously over time. With dollar cost averaging, you invest a fixed dollar amount on a regular schedule, like $50-100 monthly. Since the market fluctuates daily, this allows you to buy more shares when prices are low and fewer shares when prices are high.

While dollar cost averaging doesn’t guarantee a profit or avoid losses in declining markets, it does help smooth out volatility. Going “all in” by investing a large lump sum at once can provide poor timing if a market drop follows soon after. But investing incremental amounts lessens the risk of putting your money in at a peak right before a downturn.

Apps mentioned like Acorns along with monthly automatic transfers into mutual funds or ETFs make dollar cost averaging simple to implement. The key is consistency and avoiding the tendency to only invest when you “feel” like the market is doing well. Set up automatic periodic investments and let dollar cost averaging improve your timing.

Reinvest Dividends

Another smart strategy is reinvesting any dividends paid out by your investments. Dividend reinvesting automatically uses paid distributions to buy additional shares. This compounds your wealth over time by increasing the number of shares you own.

Many brokerages and robo-advisors offer automatic dividend reinvesting. For example, Vanguard mutual fund holders can elect to have dividends reinvested back into the funds to grow their positions. Apps like M1 Finance also allow dividend reinvesting for individual stocks and ETFs.

Even dividend reinvesting small amounts will power compound growth. And companies that pay steady dividends tend to be stable, established businesses. The combination of dividend payouts plus reinvestment can enhance long-term total returns. Just make sure any fees for dividend reinvesting are minimal.

Invest in Yourself

Your own skills, education and career trajectory are likely your greatest “asset” when it comes to earning potential over your lifetime. Don’t underinvest in yourself through self-education and career development. The monetary return on learning new skills and moving up in your career is often far beyond what stock market investing can provide.

Make sure to leave room in your budget for self-improvement. Take courses to gain skills in coding, marketing, accounting, design and more based on your career interests. Seek mentorships and apprenticeships in your industry. Attend conferences and classes to network and showcase your abilities. Further education like an associate’s, bachelor's or master’s degree can really pay off career-wise in the long run.

If your employer offers tuition reimbursement for approved courses, take full advantage of this great benefit. The education will enhance your knowledge, and your improved skills can lead to promotions down the road. Investing in yourself boosts future cash flow. Don't just think of it as spending, but as investing in your human capital.

Beyond career development, also invest in your mental and physical health. These factors drive well-being and productivity. Make fitness a habit and get regular checkups. Managing stress through yoga, meditation or therapy can give your mindset and motivation a boost. Ultimately, investing in yourself across skills, education and health delivers big dividends.

19 Tips for beginners

- Build an emergency fund first

- Use retirement accounts like 401(k)s and IRAs

- Invest in low-cost index funds

- Try a micro-investing app

- Consider a robo-advisor

- Dollar cost average into the market

- Reinvest dividends to compound gains

- Invest in yourself through skills and education

- Automate deposits into investment accounts

- Don't panic during market swings

- Focus on long-term compound growth

- Keep investment fees low

- Diversify with broad market funds

- Set a consistent investing schedule

- Start small and scale up over time

- Educate yourself on investing basics

- Create a financial plan and stick to it

- Live below your means to free up money to invest

- Delay gratification today for better returns tomorrow

Final Thoughts

Investing, even with small amounts, is very achievable for beginners. The key is consistency by making regular deposits into vehicles like retirement accounts, index funds, micro-investing apps and robo-advisors. Reinvest dividends, dollar cost average, and enhance your earning potential.

Investing does require discipline, delayed gratification and tuning out market swings. But the process can be simple by automating deposits into broadly diversified, low-cost funds you hold for the long term. Compounding works wonders over 5, 10 or 20 year periods.

Start wherever you can, even if it’s just pocket change amounts to begin. Investing apps have lowered the barriers. With education and discipline, anyone has the ability to steadily build wealth and reach financial goals through investing.

Read the full article

#beginnerinvesting#beginnertips#compoundinterest#dividendreinvesting#dollarcostaveraging#ETFs#financialplanning#indexfunds#Investing#investmentstrategies#micro-investingapps#moneytips#PersonalFinance#retirementaccounts#RetirementPlanning#robo-advisors

0 notes

Text

#CryptocurrencyTrading#CryptoMarket#TradingPrinciples#CryptocurrencyTips#CryptoStrategy#DollarCostAveraging#TradingEmotions#TechnicalAnalysis#CryptocurrencyInvesting#CryptoExperience

0 notes

Text

dollar cost averaging : A Simple Yet Effective Investment Strategy

dollar cost averaging Introduction:

dollar cost averaging Hello everyone! Today, let's dive into an investment strategy called (DCA).

Among the various strategies in the investment world,

DCA focuses uniquely on using price volatility for long-term investment performance, without the heavy dependence on market predictions.

What is Dollar Cost Averaging?

First, you should understand that DCA means making periodic investments of a fixed amount, regardless of the economic situation and market volatility.

By following this strategy,

you can lower the average cost of an asset during the investment period, diversify risk, and seek stable returns.

Advantages of DCA

DCA begins by eliminating the need to worry about market timing. Moreover, this approach remains less influenced by investor psychology, and its steady investments can counter short-term and long-term volatility. Lastly, DCA allows you to benefit from compound investments over time.

Disadvantages of DCA

On the other hand, some downsides to DCA exist. For example, the performance might be lower compared to lump-sum investments during a bull market. Also, you might experience investment losses with assets that face rapid spikes in a short time.

How to Implement Strategy

To implement a DCA strategy effectively, you should start by determining the desired asset and investment amount. Then, set a consistent investment period and frequency. Finally, commit to the strategy with discipline, irrespective of market conditions.dollar cost averaging

https://www.investopedia.com/investing-4689710

"Explore various investment strategies and optimize your portfolio."

Conclusion:

"worldcoinindex :Investment Strategies in the WorldCoinIndex Era"

In summary, Dollar Cost Averaging presents an accessible and effective strategy for investors who prefer to avoid the stress and challenges of timing the market.

Implementing gradual, systematic investments enables you to reduce the impact of volatile markets and foster long-term growth in your investment portfolio.

However, analyzing different investment strategies, including DCA, and identifying the best fit for your financial situation,

risk tolerance, and investment goals remains crucial to achieving success in investing.

Read the full article

0 notes

Text

Blog: How to Invest Your Money for Success 2023

Link: https://lifenillusion.com/how-to-invest-your-money-investing-tips/

#InvestingTips#FinancialSuccess#LongTermInvesting#DiversifyYourPortfolio#CompoundInterest#FinancialGoals#StartInvestingEarly#DollarCostAveraging#LowCostInvesting#IndexFunds#PatienceInInvesting#NoPanicSelling

1 note

·

View note

Text

Navigating the Storm: Bitcoin's Recent Drop and Japan's Interest Rate Hike

The cryptocurrency market has been in turmoil recently, with Bitcoin experiencing a significant drop in value. As investors scramble to understand the underlying causes, one major factor has come to light: Japan's recent decision to raise interest rates. This move has sent shockwaves through global markets, contributing to the current downturn in Bitcoin and other cryptocurrencies.

Analyzing the Causes

Japan's central bank recently raised interest rates for the first time in years, a move aimed at curbing inflation and stabilizing the economy. This decision has had a ripple effect on global financial markets, leading to increased volatility and uncertainty. Investors are reassessing their positions in riskier assets, including cryptocurrencies, leading to a sell-off that has hit Bitcoin particularly hard.

In addition to Japan's interest rate hike, other factors such as regulatory news, macroeconomic conditions, and significant events have also played a role in the market's current state. Understanding these factors can help investors navigate this challenging period.

Historical Perspective

While the current market situation may seem dire, it's important to put it into perspective. Bitcoin has experienced similar downturns in the past, often bouncing back stronger than before. Historical data shows that periods of high volatility are not uncommon and can be followed by substantial gains.

For example, in 2017, Bitcoin experienced a massive drop after reaching its then-all-time high, only to recover and reach new heights in subsequent years. This pattern of volatility followed by recovery is a hallmark of Bitcoin's market behavior.

Investor Sentiment

The current sentiment among Bitcoin investors is one of fear and uncertainty. Market downturns often lead to panic selling, further exacerbating the price drop. However, seasoned investors understand that volatility is part of the game when it comes to cryptocurrencies.

During times like these, it's crucial to remain calm and avoid making impulsive decisions based on short-term market movements. Understanding the broader market dynamics can help investors make more informed choices.

Opportunities in Adversity

As the saying goes, "When there's blood in the streets, it's the best time to buy." Downturns can present unique buying opportunities for investors. This morning, I took advantage of the lower prices and bought $200 worth of Bitcoin. Strategies like Dollar-Cost Averaging (DCA) allow investors to accumulate Bitcoin over time, reducing the impact of market volatility on their overall investment. By consistently buying at regular intervals, investors can build a position in Bitcoin without trying to time the market perfectly.

Holding through periods of volatility has historically been a successful strategy for long-term Bitcoin investors. Those who have maintained their positions during market downturns have often been rewarded when the market rebounds.

Long-Term Outlook

Despite the current downturn, the long-term potential of Bitcoin remains strong. Factors such as increasing adoption, technological advancements, and geopolitical considerations continue to support Bitcoin's growth prospects. As more institutions and individuals recognize the value of Bitcoin, its role in the global financial system is likely to expand.

Moreover, the decentralized nature of Bitcoin and its limited supply make it an attractive hedge against inflation and economic instability. These characteristics position Bitcoin as a potential store of value in the long run.

Conclusion

The recent drop in Bitcoin's value, influenced by Japan's interest rate hike and other factors, is undoubtedly concerning for investors. However, by understanding the causes and maintaining a long-term perspective, investors can navigate this challenging period more effectively. Staying informed and employing strategies like Dollar-Cost Averaging can help investors take advantage of market opportunities and build a resilient Bitcoin portfolio.

Take Action Towards Financial Independence

If this article has sparked your interest in the transformative potential of Bitcoin, there's so much more to explore! Dive deeper into the world of financial independence and revolutionize your understanding of money by following my blog and subscribing to my YouTube channel.

🌐 Blog: Unplugged Financial Blog Stay updated with insightful articles, detailed analyses, and practical advice on navigating the evolving financial landscape. Learn about the history of money, the flaws in our current financial systems, and how Bitcoin can offer a path to a more secure and independent financial future.

📺 YouTube Channel: Unplugged Financial Subscribe to our YouTube channel for engaging video content that breaks down complex financial topics into easy-to-understand segments. From in-depth discussions on monetary policies to the latest trends in cryptocurrency, our videos will equip you with the knowledge you need to make informed financial decisions.

👍 Like, subscribe, and hit the notification bell to stay updated with our latest content. Whether you're a seasoned investor, a curious newcomer, or someone concerned about the future of your financial health, our community is here to support you on your journey to financial independence.

#Bitcoin#Cryptocurrency#CryptoNews#BitcoinDrop#FinancialMarket#Investment#CryptoInvesting#MarketAnalysis#JapanEconomy#InterestRates#FinancialStorm#BTC#HODL#DollarCostAveraging#CryptoOpportunities#Blockchain#EconomicTrends#DigitalCurrency#LongTermInvestment#CryptoCommunity#globaleconomy#unplugged financial#finance#financial empowerment#financial education#financial experts

3 notes

·

View notes

Text

🚀💰 Investing in Cryptocurrencies for Low Investors: A Smart Approach! 💰🚀

Are you a low investor intrigued by the potential of cryptocurrencies? 🤔💡 Well, you're not alone! The crypto market offers exciting opportunities, even for those with modest budgets. But before you dive in, let's explore a smart approach to investing in cryptos that maximizes your potential gains while minimizing risks. Here are some tips to consider:

📊 Start with a Budget: Determine a sensible budget you can comfortably invest without jeopardizing your financial stability. Remember, investing in cryptocurrencies can be volatile, so it's best to start small.

📚 Educate Yourself: Knowledge is the key to success in the crypto world! Take the time to research and understand how cryptocurrencies and blockchain technology work. Arm yourself with valuable insights to make informed decisions.

💼 Diversify Your Portfolio: Don't put all your eggs in one basket! Diversification is crucial in reducing risk. Instead of investing solely in one cryptocurrency, spread your funds across different coins or tokens with promising potential.

💰 Consider Dollar-Cost Averaging (DCA): A nifty strategy for low investors! Instead of investing a lump sum, consider spreading your investments over time with regular contributions. DCA helps to mitigate the impact of short-term price fluctuations.

🔍 Choose Reputable Exchanges: Opt for reputable and secure cryptocurrency exchanges to trade and invest. Research their security measures and user reviews to ensure your funds are in safe hands.

💡 Stick to Established Coins: For a safer start, focus on well-established cryptocurrencies like Bitcoin (BTC) and Ethereum (ETH). These have proven track records and are less susceptible to wild price swings.

🌲 Avoid High-Risk Ventures: Beware of schemes promising quick riches or unscrupulous projects. Prioritize investments in projects with solid use cases and transparent development teams.

😌 Manage Risk and Emotions: The crypto market can be a rollercoaster ride! Set clear investment goals, implement risk management strategies, and avoid making impulsive decisions based on emotions.

📰 Stay Informed: The crypto space evolves rapidly. Stay up-to-date with the latest news and developments to make well-timed investment decisions.

🤖 Consider Robo-Advisors: For a helping hand, explore platforms offering robo-advisors. These automated services can manage your portfolio based on your risk tolerance and investment objectives.

Remember, investing in cryptocurrencies carries inherent risks, and there are no guarantees of immediate profits. Take a cautious and informed approach, and let your crypto investment journey grow over time. The crypto world is full of possibilities, and with a smart strategy, you can make the most of this digital frontier! 🚀🌟

Are you a low investor venturing into the crypto realm? Share your thoughts, tips, and experiences in the comments below! Let's support each other on this thrilling journey! 💬👇

#CryptoInvesting#SmartInvestment#LowInvestors#CryptocurrencyOpportunities#CryptoKnowledge#DiversifyYourInvestment#DollarCostAveraging#ReputableExchanges#EstablishedCryptocurrencies#InvestmentStrategies#CryptoTips#RiskManagement#StayInformed#CryptocurrencyEducation#InvestSmart#CryptoPotential#RoboAdvisors#CryptoCommunity#CryptoInsights#DigitalFrontier#InvestmentJourney#CryptocurrencyPossibilities

1 note

·

View note

Text

How to Build a Monster Dividend Portfolio https://muscleinvesting.com/?p=7181

0 notes

Text

Smart Share Trading: How to Make the Right Moves for Your Money

#buyingshares #disciplinedapproach #dollarcostaveraging #financialobjectives #industrytrends #investmentgoals #investmentknowledge #marketvolatility #optimalnumberofshares #portfoliodiversification #risktolerance #sellingshares #sharetrading #timehorizon

#Business#buyingshares#disciplinedapproach#dollarcostaveraging#financialobjectives#industrytrends#investmentgoals#investmentknowledge#marketvolatility#optimalnumberofshares#portfoliodiversification#risktolerance#sellingshares#sharetrading#timehorizon

0 notes

Text

Preparing for a cryptocurrency market rally

youtube

📈 Get ready for the upcoming crypto market trends! 🔥 Unlike last year's bearish trend, we expect a positive outlook this year, and we explain the important actions you need to take 🚀.

1️⃣ Stay tuned to the latest market news and opportunity updates.

2️⃣ Focus on risk management and utilizing trading strategies such as dollar cost averaging.

3️⃣ Pay attention to tokens with enhanced security.

Invest in safe coins like ViCA TOKEN. 💎

Get more information and win in the crypto market! 🌟

#Cryptocurrency#MarketTrends#BePrepared#Investment#News#DollarCostAveraging#TradingStrategies#RiskManagement#Security#ViCATOKEN#Youtube

1 note

·

View note

Text

STRATEGIES FOR SMART INVESTING

Investing is a crucial part of building and preserving wealth, but it can be a daunting task for those who are new to it. It’s important to have a solid strategy in place to make smart investment decisions, and to ensure that your investments are working hard for you.

Here are some strategies for smart investing to help you get started

Define your investment goals. Before you begin investing,…

View On WordPress

#Diversificatin#dollarcostaveraging#emotionalinvesting#financialliteracy#indexfund#INVESTING#investment strategy#Long term investing#smart investing#wealth building

0 notes