#equity funding investors

Text

Equity Funding: Sharing Success, Reducing Risk

Equity funding is a powerful way to inject capital into your business without the immediate burden of repayment. By offering investors a stake in your company, you can secure the financial resources needed for growth while sharing the risks and rewards. FASP Consulting LLC assists in identifying the right investors, structuring equity deals, and negotiating terms that benefit both parties. Grow your business with confidence, knowing you have a strong financial partner by your side.

0 notes

Text

Equi Corp Legal has the best lawyers in Delhi NCR

#Corporate Disputes Litigation Lawyers in Delhi#Insolvency Bankruptcy NCLT Lawyers in Delhi#Private Equity Funds Investment Transaction Advisory M&A Lawyers in Delhi#Technology E-Commerce Fintech Blockchain Lawyers in Delhi#Regulatory Compliance Legal Audits in Delhi Noida#Director Investor Shareholder Dispute Litigation Lawyers in Delhi#Sports Gaming lawyers in Delhi#Startup Investor Lawyers in Delhi#Banking NBFC Financial Services DRT Debt Restructuring Lawyers in Delhi#Corporate lawyers in Delhi#Arbitration Lawyers in Delhi#Consumer Protection Lawyers in Delhi#Commercial Civil Disputes Litigation Lawyers in Delhi

10 notes

·

View notes

Text

Optimism in the ….

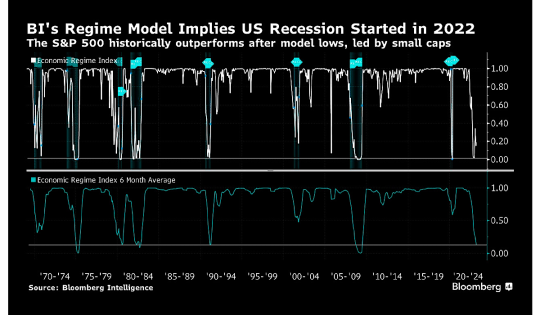

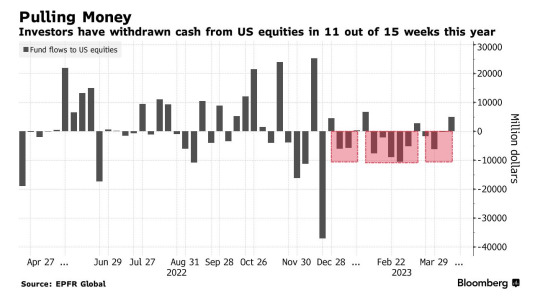

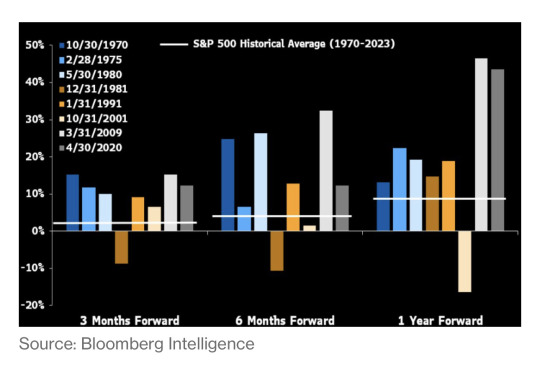

Case for Stocks Is Seen in Model Showing Economic Bottom Is Past

https://www.bloomberg.com/news/articles/2023-04-16/case-for-stocks-is-seen-in-model-showing-economic-bottom-is-past?srnd=premium&sref=G3KZUlEH #fed #fund #equity #investor #ennovance

#privateequity#chemicals#ennovance#economy#investor#pe#equity#debt#loan#energy#credit#fund#investors#finance#manufacturing#merger#healthcare#vc#asc#bubble

5 notes

·

View notes

Text

cohost just admitted that they posted clearly misleading accounting metrics for November, which I'll admit is the first time i've seen a social media company make that specific mistake. revenue recognition is hard!

#also just saw a tweet advertising them as 'non-VC funded' when they are in fact funded by a single angel investor who's paying the bills#i think they're trying to wiggle out of it by saying it doesn't count because they're taking on interest-free debt instead of equity#but like. that doesn't really seem much different

6 notes

·

View notes

Text

Seeking Funding for FLYING METALS - The Aerospace B2B E-commerce Supply Chain

We have an excellent Investment Opportunity - FLYING METALS - The Aerospace B2B Supply Chain Management Ecommerce the world's First. Solving the Supply Chain problems for Aerospace Industry. Inflation Fight? Invest with FLYING METALS, The Best Investments

DRONES FLYING METALS PTY LTD AUSTRALIA INDIA SINGAPORE

FLYING METALS PTY LTD

www.flyingmetals.com

What ‘Flying Metals’ is all about / The Product:

FLYING METALS

At ‘Flying Metals’, we provide the latest and the most modern B2B Marketplace specifically for the aerospace Industry connecting Buyers with Suppliers.

We are building the World’s Largest E Commerce B2B platform for Aerospace…

View On WordPress

#Aerospace#aircraft#Airplanes#aviation#B2B#b2b cloud#B2B Ecommerce#b2b platform#Capital Funding#ecommerce for avaition#Family Offices#flight metals#flying metals#funding#Investors#Private Equity Finance#raising funds#Shrikant Shete MD & CEO#VC Funds#VC PE Funds#Venture Capital

2 notes

·

View notes

Text

Navigating the World of Crowdfunding: Strategies for Startup Success

Welcome to the world of crowdfunding, where entrepreneurs can turn their innovative ideas into reality with the help of the crowd. Crowdfunding has become a popular way for startups to raise funds, validate their products, and build a loyal community of supporters. However, navigating the crowdfunding landscape can be challenging, with many startups failing to reach their funding goals. In this…

#best practices for startup pitches#common mistakes in seeking funding.#crowdfunding strategies for startups#essential elements of a business plan#finding angel investors#how to bootstrap a startup#How to secure startup funding#navigating the seed funding process#startup funding options#startup funding stages#startup growth and scaling strategies#success stories of funded startups#tips for pitching to investors#top venture capital firms 2024#understanding equity and valuation

0 notes

Text

Global Star Capital founder Rich Cocovich recently met with principals in both New York City and Los Angeles California on a $5 Million USD entertainment sector project and bridged the gap of funding with a private California based investor. Since 1991, Cocovich has serviced clients in 126 countries and all 50 states in America as the top expert and private funding. Over 30 billion USD from private investors awaits the projects Global Star Capital and Rich Cocovich represent. If you are a solvent and prepared project principal who understands that high end, professional expertise is not free, not contingent, not pro bono, and not wrapped into a closing, then you are welcome to visit one of our two main websites www.globalstarcapital.com or www.globalstarcapital.international and begin in the Our Process Section. Our engagement process and fee structure is etched in stone and non-negotiable. Project principals who follow our protocol, including the mandatory face-to-face meeting steps, succeed in gaining the attention their project deserves. Within seven days of meeting Rich Cocovich in person, a greenlight from a private funding facilitator/investor will be established.

#richcocovich #globalstarcapital #privefunding #projectfunding #richcocovichreviews #globalstarcapitalreviews #cocovich #capitalraising #topconsultant #familyoffice #equity #equityfunding #projectequity #equityinvesting

#global star capital#rich cocovich#global star capital funding#richard cocovich#global star capital review#rich cocovich customer comments#rich cocovich united states#rich cocovich references#rich cocovich top consultant in private funding#global star capital information#global star capital reviews#private funding intermediaries#private funding consultants#top private funding consulting firm#privateequity#private banking#private funding#private investors#private equity#equity investor#equity capital#equity investors#equity funding#equity financing#cocovich#richard cocovich and global star capital#richard cocovich review#rich cocovich review#rich cocovich client comments#rich cocovich and global star capital

1 note

·

View note

Text

Global Star Capital founder Rich Cocovich recently met with principals in both New York City and Los Angeles California on a $5 Million USD entertainment sector project and bridged the gap of funding with a private California based investor. Since 1991, Cocovich has serviced clients in 126 countries and all 50 states in America as the top expert and private funding. Over 30 billion USD from private investors awaits the projects Global Star Capital and Rich Cocovich represent. If you are a solvent and prepared project principal who understands that high end, professional expertise is not free, not contingent, not pro bono, and not wrapped into a closing, then you are welcome to visit one of our two main websites www.globalstarcapital.com or www.globalstarcapital.international and begin in the Our Process Section. Our engagement process and fee structure is etched in stone and non-negotiable. Project principals who follow our protocol, including the mandatory face-to-face meeting steps, succeed in gaining the attention their project deserves. Within seven days of meeting Rich Cocovich in person, a greenlight from a private funding facilitator/investor will be established.

#richcocovich #globalstarcapital #privefunding #projectfunding #richcocovichreviews #globalstarcapitalreviews #cocovich #capitalraising #topconsultant #familyoffice #equity #equityfunding #projectequity #equityinvesting

#rich cocovich#richard cocovich#global star capital#global star capital review#rich cocovich review#entrepreneur#founder#rich cocovich funding#rich cocovich united states#rich cocovich client reviews#rich cocovich client comments#rich cocovich top consultant in private funding#globalstarcapital#global star capital information#global star capital projects#global star capital funding#global star capital customer reviews#rich cocovich and global star capital#private funding consultants#private funding project funding#privatefunding#top private funding consultant#private funding#private investors#project funding#project equity#capital raising#equity investors#equity financing#equity funding

0 notes

Text

Securing Equity-Free Funding for Startups: Strategies and Insights for Indian Entrepreneurs

In the dynamic landscape of startup funding in India, securing the right financial support is crucial for success. With various options available, understanding how to navigate the funding ecosystem can significantly impact a startup's growth trajectory. This blog delves into the concept of equity free funding and explores how startup investor platform is making it easier for startups to thrive without relinquishing ownership.

Understanding Startup funding in India

Startup funding in India has seen a dramatic evolution over the past decade. From traditional venture capital and angel investments to new-age funding models, the opportunities for startups have expanded. However, equity free funding has emerged as a game-changer for many entrepreneurs who wish to retain full control of their businesses while securing necessary capital.

What is equity free funding?

Equity free funding refers to financial support provided to startups without requiring them to give away a portion of their equity. This type of funding is particularly attractive for founders who prefer to maintain complete ownership of their company. It typically includes grants, revenue-based financing, and other non-dilutive funding sources.

The rise of startup investor platforms

Startup investor platforms have become instrumental in facilitating equity free funding for startups. These platforms connect startups with investors and financial institutions that offer non-dilutive funding options. By leveraging these platforms, startups can access various funding opportunities that do not involve giving up equity.

Klub is one such platform that has been at the forefront of providing equity free funding solutions. By partnering with innovative startups, Klub helps them secure capital while preserving their equity, enabling them to focus on scaling their businesses without the pressure of equity dilution.

Types of equity free funding available

Grants: Various government and private organisations offer grants to startups. These funds are typically provided for specific projects or research and do not require repayment or equity stake.

Revenue-based financing: This model allows startups to secure funding in exchange for a percentage of future revenue. Unlike traditional loans, repayment is tied to the startup's performance, making it a flexible option.

Crowdfunding: Platforms like Kickstarter and Indiegogo offer a way for startups to raise money from the public. Backers contribute funds in exchange for rewards or pre-orders, rather than equity.

Competitions and Challenges: Many organisations and incubators host competitions where startups can win equity free funding as part of the prize. These opportunities often come with additional perks like mentorship and visibility.

How to leverage startup investor platforms

Startup investor platforms are designed to streamline the funding process. By creating a compelling profile and pitching effectively, startups can attract interest from investors who are keen on providing equity free funding. These platforms often offer tools and resources to help startups improve their chances of securing financial support.

Klub stands out in this space by offering tailored funding solutions that cater specifically to the needs of startups looking for equity free fundingoptions. Their platform not only connects startups with suitable funding sources but also provides valuable insights and support throughout the funding process.

Key takeaways

Navigating the world of startup funding in India can be complex, but equity free funding offers a viable path for many entrepreneurs. By utilising startup investor platforms, startups can access a range of funding options without diluting their equity. Understanding these options and leveraging available resources can help startups achieve their growth objectives while maintaining full control of their business.

In conclusion, the landscape of startup funding in India is evolving, and equity free funding is becoming an increasingly popular choice. Platforms like Klub are leading the way in providing innovative solutions that empower startups to secure the capital they need without giving up ownership.

#startup investor platform#startup funding in india#equity free funding#equity free funding for startups

0 notes

Text

Deep Tech Investors India | Seafund Portfolio: Clootrack

Seafund connects deep tech investors with innovative opportunities for strategic growth in India's dynamic tech landscape. Clootrack is an intelligent customer experience analytics platform for enterprises and high-stakes decision-makers.

Our powerful AI-driven engine gathers and analyzes billions of customer reviews to help you understand why your customer experience drops. All in real-time

#305, 3rd Floor, 5 Vittal Mallya Road, Bengaluru, Karnataka, 560001, India

#Keywords#best venture capital firm in india#venture capital firms in india#popular venture capital firms#venture capital firm#seed investors in bangalore#deep tech investors india#startup seed funding india#funding for startups in india#early stage venture capital firms#invest in startups bangalore#funders in bangalore#startup investment fund#fintech funding#india alternatives investment advisors#private equity venture capital#capital venture investors

0 notes

Text

As the title I am going to discuss most famous unlisted share app is India, where any one can invest easily and find out some awesome features of the app.

Planify is the name of that app where you can download and explore the features. Planify is the India's best fintech company and private market place. You can invest in top startups.

If you are startup then you also go for funding. There are also some great feature which you should explore.

#share market apps india#Unlisted Stocks#buy pre ipo#Equity Fund Raising#business funding app#upcoming ipo app#angel investors app#Venture Capital

1 note

·

View note

Text

Unlocking Growth: Your Ultimate Guide to Equity Funding with FASP Consulting LLC

Today, we delve into the realm of equity funding, exploring its benefits, the role of equity funding investors, and the top-notch services provided by FASP Consulting LLC, a renowned name in the industry.

#equity funding stands#equity funding#equity funding investors#equity financing#equity funding services

1 note

·

View note

Text

✅#AI #Startups Inject Some Life Into #VC Dealmaking in the US

Last quarter, US venture capitalists spent $55.6 billion backing startups, up by about half from a year earlier quarter; the highest startup deal value in two years. But the money went to just 3,108 transactions, the fewest since the second quarter of 2020

https://www.bloomberg.com/news/articles/2024-07-03/ai-startups-inject-some-life-into-vc-dealmaking-in-the-us

#artificalintelligence #chatgpt #productivity #venturecapital #fund #investor #valuation

https://x.com/mohossain/status/1769447763236753483?s=46&t=GtuOmoaTjOwevz2JidiiDQ #genAI #Ennovance

#investor#venture#venture capital#vc#fund#startup#economy#privateequity#ennovance#chemicals#investors#equity#pe#debt#loan

0 notes

Text

youtube

Unlocking Private Equity: A Step-by-Step Guide with VK Investments #youtubefeed

🔐 Curious about the world of Private Equity? Join us for an insightful journey as VK Investments unravels the intricacies of this investment realm step by step! 💼💡 In this video, we break down the nuances of Private Equity, offering a comprehensive guide on how it works, key strategies, and insider tips from VK Investments' experts. 📈💰

1 note

·

View note

Text

Red Lobster was killed by private equity, not Endless Shrimp

For the rest of May, my bestselling solarpunk utopian novel THE LOST CAUSE (2023) is available as a $2.99, DRM-free ebook!

A decade ago, a hedge fund had an improbable viral comedy hit: a 294-page slide deck explaining why Olive Garden was going out of business, blaming the failure on too many breadsticks and insufficiently salted pasta-water:

https://www.sec.gov/Archives/edgar/data/940944/000092189514002031/ex991dfan14a06297125_091114.pdf

Everyone loved this story. As David Dayen wrote for Salon, it let readers "mock that silly chain restaurant they remember from their childhoods in the suburbs" and laugh at "the silly hedge fund that took the time to write the world’s worst review":

https://www.salon.com/2014/09/17/the_real_olive_garden_scandal_why_greedy_hedge_funders_suddenly_care_so_much_about_breadsticks/

But – as Dayen wrote at the time, the hedge fund that produced that slide deck, Starboard Value, was not motivated by dissatisfaction with bread-sticks. They were "activist investors" (finspeak for "rapacious assholes") with a giant stake in Darden Restaurants, Olive Garden's parent company. They wanted Darden to liquidate all of Olive Garden's real-estate holdings and declare a one-off dividend that would net investors a billion dollars, while literally yanking the floor out from beneath Olive Garden, converting it from owner to tenant, subject to rent-shocks and other nasty surprises.

They wanted to asset-strip the company, in other words ("asset strip" is what they call it in hedge-fund land; the mafia calls it a "bust-out," famous to anyone who watched the twenty-third episode of The Sopranos):

https://en.wikipedia.org/wiki/Bust_Out

Starboard didn't have enough money to force the sale, but they had recently engineered the CEO's ouster. The giant slide-deck making fun of Olive Garden's food was just a PR campaign to help it sell the bust-out by creating a narrative that they were being activists* to save this badly managed disaster of a restaurant chain.

*assholes

Starboard was bent on eviscerating Darden like a couple of entrail-maddened dogs in an elk carcass:

https://web.archive.org/web/20051220005944/http://alumni.media.mit.edu/~solan/dogsinelk/

They had forced Darden to sell off another of its holdings, Red Lobster, to a hedge-fund called Golden Gate Capital. Golden Gate flogged all of Red Lobster's real estate holdings for $2.1 billion the same day, then pissed it all away on dividends to its shareholders, including Starboard. The new landlords, a Real Estate Investment Trust, proceeded to charge so much for rent on those buildings Red Lobster just flogged that the company's net earnings immediately dropped by half.

Dayen ends his piece with these prophetic words:

Olive Garden and Red Lobster may not be destinations for hipster Internet journalists, and they have seen revenue declines amid stagnant middle-class wages and increased competition. But they are still profitable businesses. Thousands of Americans work there. Why should they be bled dry by predatory investors in the name of “shareholder value”? What of the value of worker productivity instead of the financial engineers?

Flash forward a decade. Today, Dayen is editor-in-chief of The American Prospect, one of the best sources of news about private equity looting in the world. Writing for the Prospect, Luke Goldstein picks up Dayen's story, ten years on:

https://prospect.org/economy/2024-05-22-raiding-red-lobster/

It's not pretty. Ten years of being bled out on rents and flipped from one hedge fund to another has killed Red Lobster. It just shuttered 50 restaurants and declared Chapter 11 bankruptcy. Ten years hasn't changed much; the same kind of snark that was deployed at the news of Olive Garden's imminent demise is now being hurled at Red Lobster.

Instead of dunking on free bread-sticks, Red Lobster's grave-dancers are jeering at "Endless Shrimp," a promotional deal that works exactly how it sounds like it would work. Endless Shrimp cost the chain $11m.

Which raises a question: why did Red Lobster make this money-losing offer? Are they just good-hearted slobs? Can't they do math?

Or, you know, was it another hedge-fund, bust-out scam?

Here's a hint. The supplier who provided Red Lobster with all that shrimp is Thai Union. Thai Union also owns Red Lobster. They bought the chain from Golden Gate Capital, last seen in 2014, holding a flash-sale on all of Red Lobster's buildings, pocketing billions, and cutting Red Lobster's earnings in half.

Red Lobster rose to success – 700 restaurants nationwide at its peak – by combining no-frills dining with powerful buying power, which it used to force discounts from seafood suppliers. In response, the seafood industry consolidated through a wave of mergers, turning into a cozy cartel that could resist the buyer power of Red Lobster and other major customers.

This was facilitated by conservation efforts that limited the total volume of biomass that fishers were allowed to extract, and allocated quotas to existing companies and individual fishermen. The costs of complying with this "catch management" system were high, punishingly so for small independents, bearably so for large conglomerates.

Competition from overseas fisheries drove consolidation further, as countries in the global south were blocked from implementing their own conservation efforts. US fisheries merged further, seeking economies of scale that would let them compete, largely by shafting fishermen and other suppliers. Today's Alaskan crab fishery is dominated by a four-company cartel; in the Pacific Northwest, most fish goes through a single intermediary, Pacific Seafood.

These dominant actors entered into illegal collusive arrangements with one another to rig their markets and further immiserate their suppliers, who filed antitrust suits accusing the companies of operating a monopsony (a market with a powerful buyer, akin to a monopoly, which is a market with a powerful seller):

https://www.classaction.org/news/pacific-seafood-under-fire-for-allegedly-fixing-prices-paid-to-dungeness-crabbers-in-pacific-northwest

Golden Gate bought Red Lobster in the midst of these fish wars, promising to right its ship. As Goldstein points out, that's the same promise they made when they bought Payless shoes, just before they destroyed the company and flogged it off to Alden Capital, the hedge fund that bought and destroyed dozens of America's most beloved newspapers:

https://pluralistic.net/2021/10/16/sociopathic-monsters/#all-the-news-thats-fit-to-print

Under Golden Gate's management, Red Lobster saw its staffing levels slashed, so diners endured longer wait times to be seated and served. Then, in 2020, they sold the company to Thai Union, the company's largest supplier (a transaction Goldstein likens to a Walmart buyout of Procter and Gamble).

Thai Union continued to bleed Red Lobster, imposing more cuts and loading it up with more debts financed by yet another private equity giant, Fortress Investment Group. That brings us to today, with Thai Union having moved a gigantic amount of its own product through a failing, debt-loaded subsidiary, even as it lobbies for deregulation of American fisheries, which would let it and its lobbying partners drain American waters of the last of its depleted fish stocks.

Dayen's 2020 must-read book Monopolized describes the way that monopolies proliferate, using the US health care industry as a case-study:

https://pluralistic.net/2021/01/29/fractal-bullshit/#dayenu

After deregulation allowed the pharma sector to consolidate, it acquired pricing power of hospitals, who found themselves gouged to the edge of bankruptcy on drug prices. Hospitals then merged into regional monopolies, which allowed them to resist pharma pricing power – and gouge health insurance companies, who saw the price of routine care explode. So the insurance companies gobbled each other up, too, leaving most of us with two or fewer choices for health insurance – even as insurance prices skyrocketed, and our benefits shrank.

Today, Americans pay more for worse healthcare, which is delivered by health workers who get paid less and work under worse conditions. That's because, lacking a regulator to consolidate patients' interests, and strong unions to consolidate workers' interests, patients and workers are easy pickings for those consolidated links in the health supply-chain.

That's a pretty good model for understanding what's happened to Red Lobster: monopoly power and monopsony power begat more monopolies and monoposonies in the supply chain. Everything that hasn't consolidated is defenseless: diners, restaurant workers, fishermen, and the environment. We're all fucked.

Decent, no-frills family restaurant are good. Great, even. I'm not the world's greatest fan of chain restaurants, but I'm also comfortably middle-class and not struggling to afford to give my family a nice night out at a place with good food, friendly staff and reasonable prices. These places are easy pickings for looters because the people who patronize them have little power in our society – and because those of us with more power are easily tricked into sneering at these places' failures as a kind of comeuppance that's all that's due to tacky joints that serve the working class.

If you'd like an essay-formatted version of this post to read or share, here's a link to it on pluralistic.net, my surveillance-free, ad-free, tracker-free blog:

https://pluralistic.net/2024/05/23/spineless/#invertebrates

#pluralistic#bust-outs#private equity#pe#red lobster#olive garden#endless shrimp#class warfare#debt#looters#thai union group#enshittification#golden gate#monopsony#darden#alden global capital#Fortress Investment Group#food#david dayen#luke goldstein

6K notes

·

View notes

Text

Crowdfunding Success: Proven Tips and Tricks for Startups

Introduction

Crowdfunding has become a popular way for startups to raise funds for their projects, products, or services. However, achieving success in crowdfunding can be challenging without the right strategies in place. In this article, we will explore proven tips and tricks that startups can use to maximize their chances of success in crowdfunding campaigns.

Setting Clear Goals

When…

#best practices for startup pitches#common mistakes in seeking funding.#crowdfunding strategies for startups#essential elements of a business plan#finding angel investors#how to bootstrap a startup#How to secure startup funding#navigating the seed funding process#startup funding options#startup funding stages#startup growth and scaling strategies#success stories of funded startups#tips for pitching to investors#top venture capital firms 2024#understanding equity and valuation

0 notes