#error reduction in AP

Explore tagged Tumblr posts

Text

Why Outsourcing Accounts Payable Improves Financial Control

Accuracy and efficiency are critical to a successful accounts payable process. Errors in vendor payments, duplicate invoices, and late payments can cost businesses time and money. Accounts payable outsourcing helps eliminate these issues by bringing in specialized expertise and automation.

With outsourced AP services, companies benefit from streamlined workflows and dedicated teams who ensure invoices are processed correctly and on schedule. Automation tools used in outsourcing significantly reduce human error and increase processing speed.

One of the most overlooked advantages of accounts payable outsourcing is the ability to generate real-time financial reports and analytics. These insights help companies track cash flow, monitor performance, and make informed financial decisions.

Moreover, outsourced providers ensure strict compliance with regulatory standards, minimizing the risk of audits or penalties. They also use secure systems to handle sensitive data, reducing the likelihood of fraud.

By enhancing the accuracy and speed of financial processes, AP outsourcing improves overall financial health. It allows internal teams to shift focus from data entry to strategic activities, such as budgeting and financial planning. In short, accounts payable outsourcing is an investment in operational excellence.

#AP process efficiency#error reduction in AP#automated invoice processing#outsourced AP benefits#financial process optimization

0 notes

Text

Revolutionizing Accounts Payable: How Data Analytics Drives Efficiency and Reduces Costs

In today’s fast-paced business environment, accounts payable (AP) is a crucial function in financial management.

For property managers, real estate companies, or businesses across industries, managing AP efficiently is essential for maintaining healthy cash flow, improving vendor relationships, and avoiding costly mistakes. However, many companies still rely on traditional manual processes, which can lead to inefficiencies and errors.

Enter data analytics: a powerful tool that can help optimize AP management by offering insights, reducing errors, and streamlining processes. Whether you manage AP in-house or outsource your AP services, embracing data analytics can transform the way you handle payments and financial tracking.

Why Data Analytics Matters in Accounts Payable Management

The role of data analytics in optimizing AP management cannot be overstated. By leveraging data analytics, property managers and financial teams can make better-informed decisions, track payments more effectively, and enhance operational efficiency. Here’s why data analytics is so vital for AP optimization:

1. Improved Payment Accuracy

Manual data entry is prone to human error, which can lead to duplicate payments, missed payments, or incorrect invoice processing. Data analytics helps to automate and verify invoice matching, ensuring that only accurate and legitimate invoices are processed for payment. This not only reduces errors but also saves valuable time for accounting teams.

2. Cost Reduction

Late payments or incorrect invoice processing can incur additional costs, such as late fees or penalties. By utilizing data analytics, businesses can track payment due dates, manage early payment discounts, and ensure payments are made on time. This helps to optimize cash flow and reduce unnecessary costs.

3. Better Cash Flow Management

With data-driven insights, businesses can gain visibility into outstanding invoices, upcoming payments, and cash reserves. By analyzing historical payment patterns and supplier preferences, property managers can make more informed decisions about when and how to pay, ensuring that they maintain a healthy cash flow and avoid cash shortages.

For those who outsource AP services, working with a partner that uses data analytics tools can significantly enhance cash flow management and AP efficiency.

Key Challenges in Accounts Payable and How Data Analytics Helps

Property managers and businesses that handle AP management face a range of challenges that can hinder their financial operations. These include invoice discrepancies, late payments, and lack of visibility. Here’s how data analytics addresses these challenges:

1. Identifying Payment Trends and Opportunities

Data analytics can help uncover trends in supplier payments and identify patterns such as missed early payment discounts or recurring payment delays. With this information, businesses can optimize their payment schedules and take advantage of discounts, thus reducing operational costs.

2. Improved Vendor Relationship Management

Data analytics also provides valuable insights into vendor performance, helping businesses identify which vendors offer the best terms and services. By analyzing payment histories, businesses can ensure that they build strong relationships with suppliers while maintaining timely and accurate payments.

3. Fraud Detection

One of the biggest risks in AP management is fraud. Data analytics allows businesses to spot unusual payment patterns, duplicate invoices, and discrepancies that could indicate fraudulent activity. By applying data analytics, businesses can safeguard against financial losses and ensure that all transactions are legitimate.

When you outsource AP services, leveraging data analytics helps detect and prevent fraud early, saving you from costly financial disruptions.

How Data Analytics Enhances Accounts Payable Management

Here are some specific ways data analytics can optimize your AP management:

1. Automation of Invoice Matching

Data analytics tools automate the matching of invoices to purchase orders and contracts, ensuring that only valid invoices are processed for payment. This reduces the risk of human error and ensures compliance with contracts, reducing disputes and rework.

2. Streamlined Payment Approvals

With data analytics, payment approval workflows can be optimized and automated. The system can flag high-priority payments and provide alerts when payment deadlines are approaching, ensuring that payments are made on time. This minimizes delays and avoids late fees.

3. Real-Time AP Reporting

Data analytics tools offer real-time reporting and insights into your accounts payable. Property managers can view detailed reports that track outstanding invoices, upcoming payments, and vendor performance. This visibility helps businesses manage their AP processes more efficiently and make data-driven decisions.

For businesses looking to outsource AP services, working with a provider who uses advanced data analytics ensures that you have access to real-time data, improving overall financial management.

4. Risk Mitigation and Compliance

Data analytics tools can also help businesses maintain compliance by monitoring payment histories and ensuring that the correct taxes and fees are applied to invoices. Analytics can detect any anomalies or discrepancies that could lead to compliance issues, enabling businesses to address them before they become significant problems.

Why Outsourcing AP Services with Data Analytics Makes Sense

When property managers or businesses outsource accounts payable services, choosing a provider that integrates data analytics into their AP processes is key to optimizing efficiency and reducing costs. Springbord, a trusted provider in outsourced AP services, leverages cutting-edge data analytics tools to offer:

Automated invoice matching and validation

Real-time payment tracking and reporting

Early payment discounts and cash flow optimization

Fraud detection and risk management

By partnering with Springbord, you gain access to a team that understands the intricacies of property accounting and is equipped with the best data analytics tools to streamline your AP processes, saving you time and money.

Conclusion: Unlock Efficiency with Data Analytics in Accounts Payable

Data analytics plays a crucial role in enhancing accounts payable management by providing actionable insights, reducing errors, and improving cash flow management. Whether you manage AP internally or outsource your AP services, utilizing data-driven solutions can optimize your processes and ensure that your payments are accurate and timely.

To learn more about how Springbord's outsourcing services can help you harness the power of data analytics for your accounts payable management, contact us today. Let us help you streamline your AP processes and improve your financial performance.

0 notes

Text

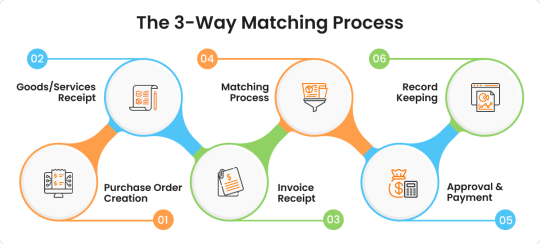

Understanding the 3-Way Matching Process in Accounts Payable: A Complete Guide

In the world of finance and procurement, accuracy and fraud prevention are non-negotiable. That’s where the 3-way matching process in accounts payable comes into play. It's a vital step that ensures your business only pays for what it has actually ordered and received. In this guide, we’ll explore what 3-way matching is, why it’s important, and how it can improve your accounts payable (AP) workflow.

What Is 3-Way Matching in Accounts Payable?

3-way matching is a verification process used by the accounts payable department to ensure that a purchase is legitimate and accurate before issuing payment. The process compares three critical documents:

Purchase Order (PO) – Details of the goods or services ordered.

Goods Receipt Note (GRN) – Confirmation of the goods received.

Supplier Invoice – The bill submitted by the supplier for payment.

When all three documents align—quantity, price, and product—the transaction is considered valid and ready for payment.

Why Is 3-Way Matching Important?

Implementing a 3-way matching system in accounts payable brings several benefits:

Fraud Prevention: Prevents unauthorized or duplicate payments.

Error Reduction: Identifies discrepancies between the invoice and received goods.

Cost Control: Ensures you’re not overpaying for items or paying for undelivered products.

Audit Readiness: Maintains clean records for compliance and internal audits.

How Does the 3-Way Matching Process Work?

Here’s a step-by-step breakdown of how 3-way matching typically works in an accounts payable workflow:

Purchase Order is Created A PO is generated and sent to the supplier, detailing the products, quantities, and agreed-upon prices.

Goods Are Received and Inspected The receiving department verifies and records the delivery. A Goods Receipt Note is created to confirm the items were received as ordered.

Supplier Invoice is Received The supplier sends an invoice, which is then forwarded to the AP department.

Matching Begins The AP team (or software system) compares all three documents. If quantities, prices, and item descriptions match, the invoice is approved for payment.

Exception Handling If discrepancies are found, the issue is flagged for review. It may involve reaching out to the supplier or procurement team for clarification.

Challenges in 3-Way Matching

While the 3-way matching process is effective, it’s not without its challenges:

Manual Data Entry: Increases the risk of errors and delays.

Time-Consuming: Matching documents manually can slow down the AP cycle.

Lack of Integration: Disconnected systems make it hard to track and compare data.

How Accounts Payable Software Can Help

Modern accounts payable automation software can streamline the 3-way matching process by:

Automatically pulling data from integrated systems.

Using AI and OCR to match documents in real-time.

Flagging discrepancies instantly for review.

Reducing human error and processing time.

Popular AP solutions also provide dashboards and reporting tools to help monitor and optimize your financial workflows.

youtube

Final Thoughts

The 3-way matching process in accounts payable is a critical internal control that ensures payment accuracy, reduces fraud, and improves vendor relationships. By understanding and implementing this practice—especially with the help of automation tools—your business can build a more secure and efficient procurement process.

If you're looking to streamline your AP operations, start by evaluating your current workflow and explore software options that support automated 3-way matching.

SITES WE SUPPORT

Skill Test Automation -

SOCIAL LINKS Facebook Twitter LinkedIn

1 note

·

View note

Text

The Benefits of Outsourcing Accounts Payable for Small Businesses

For many small businesses, managing accounts payable in-house can be a time-consuming and resource-intensive task. It involves handling invoices, verifying data, securing approvals, and ensuring timely payments—all of which demand accuracy and efficiency. As small business owners juggle multiple responsibilities, outsourcing accounts payable can offer a smart solution that enhances operational performance while reducing costs. This approach not only streamlines financial processes but also provides several strategic advantages.

Cost Savings and Efficiency

One of the most compelling reasons for outsourcing accounts payable is the potential for cost reduction. Hiring full-time staff to manage payables, along with investing in accounting software and office resources, can be expensive. Outsourcing eliminates the need for a dedicated AP department, lowering overhead costs and freeing up capital for core business activities. Service providers often operate with advanced technologies and optimized workflows, delivering greater efficiency at a lower price point than internal teams.

Access to Expertise and Technology

Outsourced AP providers specialize in financial processes and bring a high level of expertise to the table. These professionals are well-versed in industry best practices, regulatory compliance, and efficient invoice processing techniques. Additionally, they utilize sophisticated accounting platforms that small businesses may not be able to afford on their own. These tools offer features like automated invoice matching, duplicate detection, real-time reporting, and secure payment processing. Access to such resources enhances accuracy and minimizes the risk of errors or fraud.

Improved Cash Flow Management

Efficient accounts payable management contributes directly to better cash flow control. Outsourcing firms often provide detailed reports and analytics that give small businesses a clearer picture of their financial commitments. With timely payment scheduling and early payment discount tracking, business owners can make informed decisions about their working capital. This visibility ensures that the company avoids late payment penalties and maintains strong relationships with suppliers.

Scalability and Flexibility

As a small business grows, its financial needs evolve. Managing a growing volume of invoices can become overwhelming for an internal team. Outsourcing accounts payable allows businesses to scale their operations without the need to hire additional staff or invest in new infrastructure. Providers can easily accommodate increases in invoice volume and adjust services based on seasonal fluctuations or changes in business demands, offering a flexible and scalable solution.

Enhanced Compliance and Reduced Risk

Regulatory compliance is a critical aspect of accounts payable. Accounts payable outsourcing providers stay updated on tax regulations, reporting requirements, and data security standards. Their systems are designed to ensure that payments are made accurately, on time, and by legal guidelines. This reduces the risk of non-compliance, which can lead to fines or reputational damage. Furthermore, outsourcing partners often perform regular audits and implement fraud detection mechanisms to safeguard against financial mismanagement.

Conclusion

Outsourcing accounts payable offers small businesses a strategic way to improve efficiency, reduce costs, and access high-quality expertise and technology. It provides the flexibility to scale operations, the tools to enhance cash flow management and the assurance of regulatory compliance. By delegating this critical function to a reliable provider, small business owners can focus more on growth and innovation, confident that their financial processes are in capable hands.

0 notes

Text

Unlocking Efficiency with Accounts Payable Automation: A Game-Changer for Your Business

In today’s fast-paced business world, efficiency and accuracy are paramount. As companies scale, managing financial transactions becomes increasingly complex, and manual processes often slow down operations. One key area where automation can have a significant impact is in Accounts Payable (AP). By embracing AP automation, businesses can streamline processes, reduce errors, save time, and enhance overall financial management. Here’s why AP automation is a game-changer for your business and how it can unlock new levels of productivity and financial control.

What is Accounts Payable Automation?

At its core, Accounts Payable automation is the use of technology to streamline and automate the process of managing a company’s outstanding bills and payments. The goal is to replace manual tasks—such as data entry, invoice approval, and payment processing—with automated workflows powered by software. AP automation helps businesses capture, process, and pay invoices with minimal human intervention, making the entire process faster, more accurate, and more transparent.

Top Benefits of Accounts Payable Automation

1. Time Savings and Increased Productivity

Manual AP processes can be time-consuming. Invoices have to be manually entered, checked for discrepancies, approved, and then processed for payment. With AP automation, these tasks are simplified and handled by the software, freeing up your finance team’s time to focus on more strategic activities. No more sifting through piles of paper invoices or chasing down approvals—everything is streamlined and efficient.

2. Cost Reduction

While it might seem like an upfront investment, AP automation pays off in the long run by reducing labor costs, minimizing errors, and preventing late payment fees. Automated systems allow for better invoice matching, reducing discrepancies and ensuring that you only pay for what you owe. Additionally, with fewer resources needed for manual tasks, businesses can reallocate funds toward more valuable initiatives.

3. Enhanced Accuracy and Reduced Errors

Manual data entry is prone to human error—whether it’s a typo, misread invoice, or missed approval. These small mistakes can lead to big financial problems, including overpayments, missed discounts, or damaged vendor relationships. AP automation drastically reduces the risk of these errors by using intelligent software to match invoices with purchase orders and contracts. This ensures that every payment is accurate, on time, and in full compliance.

4. Improved Visibility and Control

Automating accounts payable provides businesses with greater visibility into their financial operations. With real-time data and analytics, finance teams can quickly track the status of invoices, payments, and cash flow. Reports and dashboards offer insights into spending patterns, outstanding invoices, and upcoming payments, helping businesses make informed decisions and maintain better control over their financial situation.

5. Faster Payments and Stronger Vendor Relationships

Paying invoices on time is crucial for maintaining good relationships with your vendors. AP automation can help businesses stay on top of due dates and even take advantage of early payment discounts. With automated workflows, you can set reminders for upcoming payments and ensure that your company consistently pays on time, improving vendor trust and loyalty.

Scalability and Flexibility

As your business grows, so does the volume of invoices and payments. Manual AP processes can become increasingly burdensome and inefficient at scale. AP automation software can easily accommodate increased transaction volumes without the need for hiring additional staff or overburdening existing employees. Furthermore, automation platforms are highly customizable, allowing businesses to adjust workflows and processes as their needs evolve.

How AP Automation Works

The process of automating Accounts Payable is relatively straightforward. Here’s how it typically works:

Invoice Receipt: Invoices are captured through multiple channels, such as email, PDF files, or directly from suppliers through electronic data interchange (EDI).

Data Extraction: The automation software extracts relevant information from the invoice, such as the amount, due date, and vendor details, and inputs it into the system.

Approval Workflow: The software routes the invoice for approval based on pre-set rules. Managers can approve or reject invoices from their mobile devices, ensuring quick decision-making.

Payment Processing: Once approved, the payment is processed automatically, either by issuing a check, initiating a bank transfer, or even making electronic payments through a payment gateway.

Record Keeping: The system stores all invoice and payment details in a secure cloud repository, making it easy to track and retrieve data for future reference.

Overcoming Challenges with AP Automation

While the benefits are clear, the transition to AP automation can be challenging for some businesses. It’s important to consider factors such as integration with existing financial systems, employee training, and vendor adoption. However, most modern AP automation solutions are designed to integrate seamlessly with existing Enterprise Resource Planning (ERP) systems and accounting software, making the transition smoother.

To ensure success, businesses should carefully evaluate their needs, choose the right automation tools, and establish clear implementation timelines. Additionally, training staff on the new process and ensuring that vendors are onboard with digital invoicing are key steps to overcoming any challenges.

The Future of Accounts Payable Automation

As technology continues to advance, the future of AP automation looks even brighter. Artificial intelligence (AI) and machine learning (ML) are becoming more integrated into AP automation software, enabling systems to learn from past behavior and make even smarter decisions. For example, these technologies can predict payment dates, detect fraudulent invoices, and offer insights into optimizing cash flow management.

With the rise of cloud-based platforms and the increasing shift towards digital-first businesses, the adoption of AP automation is expected to grow exponentially, transforming the way businesses handle their financial operations.

Conclusion: Transform Your Accounts Payable Today

AP automation isn’t just about reducing paperwork—it’s about transforming the way your business manages its financial processes. By automating routine tasks, you can save time, reduce costs, improve accuracy, and gain greater control over your financial data. Whether you’re a small business looking to streamline operations or a large enterprise seeking scalability, accounts payable automation is a smart, strategic investment that can drive efficiency and growth.

Ready to take your accounts payable to the next level? Embrace automation today and unlock a more efficient, cost-effective, and error-free future for your business!

Original Source: accounts payable automation

0 notes

Text

The Hidden Risk CFOs Face by Ignoring AP and Procurement Integration

CFOs are always looking for ways to optimize business operations and enhance financial management. However, many overlook one of the most critical connections in their organizations—the relationship between Accounts Payable (AP) and Procurement. A lack of coordination between these two departments can lead to inefficiencies, financial errors, and ultimately higher operational costs. In this article, we’ll explore the consequences of ignoring the link between AP and Procurement and how businesses can benefit from greater alignment.

The Disconnect Between AP and Procurement

Accounts Payable is responsible for ensuring timely and accurate payments to vendors, while Procurement focuses on purchasing goods and services and managing vendor relationships. Ideally, these departments should work hand in hand, but often they operate independently. Without coordination, AP can face unexpected invoices, duplicate payments, and missed opportunities for discounts. Procurement, on the other hand, may not have visibility into payment trends or issues, leading to procurement inefficiencies.

Risks of Disjointed AP and Procurement Operations

When AP and Procurement are not aligned, several risks and challenges emerge:

Unpredictable Invoices: AP departments frequently receive invoices without prior approval or visibility into the purchase, leading to delays and confusion.

Error-Prone Processes: Manual reconciliation and data entry between AP and Procurement increase the risk of errors, such as duplicate payments or incorrect billing amounts.

Missed Cost Savings: A lack of alignment means AP cannot access procurement data that could help them negotiate better payment terms or early payment discounts.

Tense Vendor Relations: Late or incorrect payments, driven by process inefficiencies, can strain vendor relationships and lead to higher costs or service disruptions.

The Case for Integration

To avoid these challenges, CFOs must prioritize integrating AP and Procurement processes. An integrated approach delivers several key benefits:

Real-Time Spend Tracking: Both AP and Procurement teams can monitor spending and purchasing in real-time, preventing overspending and ensuring all purchases are approved.

Improved Accuracy: Automation reduces the need for manual intervention, reducing the chances of errors in payment processing and improving budget accuracy.

More Effective Spend Control: Integration allows CFOs to proactively manage expenses by gaining a full view of the procurement process, from requisition to payment.

Faster, More Efficient Workflows: With streamlined processes and reduced manual work, both teams can focus on more strategic tasks rather than spending time reconciling discrepancies.

The Role of Procure-to-Pay (P2P) Systems

Implementing Procure-to-Pay (P2P) software is one of the most effective ways to align AP and Procurement. P2P systems connect the entire procurement process, from requisition to payment, into a single, unified platform.

Benefits of P2P Software:

Centralized Spending: P2P systems offer a consolidated view of company spending, which allows for better management of budgets and vendor relationships.

Error Reduction: P2P software automates the matching of purchase orders, receipts, and invoices, significantly reducing the potential for mismatched or erroneous payments.

Better Compliance: The software maintains a transparent audit trail, ensuring compliance with internal policies and external regulations.

Stronger Vendor Partnerships: By ensuring timely payments and offering more flexible payment terms, P2P systems help strengthen relationships with suppliers.

Steps to Achieving Successful AP and Procurement Integration

For a successful integration, CFOs can adopt several strategies:

Choose the Right P2P Solution: Invest in comprehensive P2P software that connects AP and Procurement seamlessly.

Promote Cross-Department Collaboration: Encourage AP and Procurement teams to communicate regularly and collaborate on training and process development.

Clarify Roles and Processes: Develop clear workflows and define responsibilities at each stage of the procurement cycle to avoid confusion and delays.

Harness Data Insights: Utilize analytics tools to monitor spending, track vendor performance, and identify areas for potential savings.

Track Key Metrics: Regularly monitor KPIs to measure the success of integration and identify areas for continuous improvement.

Conclusion

Ignoring the connection between AP and Procurement can result in inefficiencies, missed savings, and strained relationships. By integrating these functions and adopting tools like P2P software, CFOs can streamline operations, enhance financial control, and foster stronger supplier partnerships. In today’s competitive business environment, this integration is not just an advantage—it’s a necessity for organizations looking to thrive.

Let SpendEdge Guide Your Integration Process

SpendEdge specializes in helping businesses streamline procurement and AP processes. Our tailored solutions help organizations achieve better control over spending, enhance vendor relationships, and reduce costs. Contact SpendEdge today to begin your journey toward seamless AP and Procurement integration.

Click here to talk to our experts

0 notes

Text

Revolutionizing Behavioral Health with AI-Powered Appointment Scheduling

In the ever-evolving healthcare landscape, the integration of artificial intelligence (AI) has transformed how services are delivered, particularly in behavioral health. Traditional appointment scheduling often involves manual processes prone to inefficiencies, mismanagement, and high administrative burdens. AI patient appointment scheduling is emerging as a game-changer, optimizing the scheduling process while addressing unique challenges in behavioral health care.

This article delves into how AI is enhancing appointment scheduling, its benefits for behavioral health, and the impact of automated patient scheduling systems.

The Challenges in Behavioral Health Appointment Scheduling

Behavioral health services often face distinct challenges, such as fluctuating patient demand, extended consultation times, and the sensitive nature of treatment sessions. These issues can result in:

Missed Appointments: High no-show rates lead to inefficiencies and revenue loss.

Overbooked or Underbooked Schedules: Manual scheduling may create uneven workloads for providers.

Limited Access: Patients might struggle to secure timely appointments due to outdated systems.

To overcome these hurdles, Behavioral Health AI appointment scheduling offers a data-driven and automated approach that minimizes human error and enhances patient satisfaction.

How AI Enhances Patient Appointment Scheduling

AI patient appointment scheduling uses machine learning algorithms to optimize the scheduling process by analyzing data such as patient preferences, provider availability, and historical appointment patterns. Here’s how AI transforms scheduling:

Intelligent Matching: AI systems match patients with the most suitable provider based on their preferences, location, and care requirements.

Dynamic Rescheduling: Cancellations and no-shows are instantly managed by reallocating time slots to other patients.

Time Optimization: AI ensures that appointments are scheduled to maximize a provider's capacity, reducing idle time.

24/7 Availability: Patients can book, cancel, or reschedule appointments anytime through AI-driven systems.

These capabilities help providers focus on delivering quality care while minimizing administrative overhead.

The Role of Automated Systems in Behavioral Health

Behavioral health care demands tailored solutions to address the emotional and mental well-being of patients. Automated patient scheduling is particularly impactful in this domain, ensuring seamless coordination between patients and providers.

Reduction of No-Show Rates Automated reminders and AI-driven follow-ups reduce missed appointments. These systems can send personalized messages via SMS, email, or voice calls to remind patients about their scheduled visits.

Improved Patient Access Automation provides real-time availability, ensuring patients can book appointments at their convenience. For those seeking urgent care, it enables quicker access to available providers.

Enhanced Care Continuity Automated systems track patient progress and recommend follow-up appointments, ensuring continuity of care. This feature is especially critical for behavioral health patients who require consistent sessions.

Streamlined Administrative Tasks By eliminating manual scheduling processes, staff can focus on higher-value tasks such as patient engagement and care coordination.

Key Features of AI-Driven Scheduling Systems

To fully harness the benefits of Behavioral Health AI appointment scheduling, providers should look for systems with these key features:

Predictive Analytics: Forecasting patient no-show probabilities and overbooking tendencies.

Integration with EHRs: Seamless synchronization with electronic health records (EHRs) for better care management.

Customizable Rules: Allowing providers to set preferences, such as session lengths and patient priority levels.

Multichannel Accessibility: Enabling patients to book through mobile apps, websites, or call centers.

By incorporating these features, healthcare providers can ensure that their AI scheduling system aligns with their operational needs and patient expectations.

Benefits of AI Patient Appointment Scheduling for Providers

Increased Efficiency Automating appointment scheduling frees staff from repetitive tasks, allowing them to focus on critical responsibilities. AI reduces booking errors and optimizes provider schedules.

Improved Revenue Enhanced scheduling efficiency minimizes missed appointments, directly impacting revenue generation. AI systems also identify opportunities to fill gaps in schedules, maximizing provider utilization.

Enhanced Patient Experience AI delivers a personalized and seamless booking experience. Patients are more likely to stay engaged with their care when accessing appointments is convenient and intuitive.

Better Resource Allocation Providers can plan their day effectively, ensuring that time and resources are allocated optimally. AI helps prevent overburdening clinicians while maintaining steady patient flow.

Addressing Behavioral Health-Specific Needs with AI

Behavioral health care often requires a nuanced approach due to the emotional and psychological sensitivities involved. AI scheduling systems cater to these unique needs by:

Offering Discretion: Patients can book appointments without the need for direct human interaction, maintaining privacy.

Identifying Patterns: AI identifies trends in patient behavior, such as frequent cancellations or preferred time slots, and adjusts scheduling accordingly.

Ensuring Consistency: Automated systems ensure that patients regularly see the same provider, fostering trust and a better therapeutic relationship.

Future Trends in AI and Behavioral Health Scheduling

The future of AI patient appointment scheduling in behavioral health is promising, with emerging trends enhancing its capabilities:

Integration with Telehealth: AI scheduling systems are increasingly integrated with telehealth platforms, enabling patients to choose between in-person and virtual consultations.

Natural Language Processing (NLP): Patients can interact with scheduling systems through conversational AI, making the process more intuitive.

Proactive Care Recommendations: AI can analyze patient history to recommend preventive care appointments or suggest follow-ups, promoting better health outcomes.

These advancements will further improve access to behavioral health care and strengthen the patient-provider relationship.

Adopting AI for Behavioral Health Scheduling

Healthcare organizations aiming to implement Automated patient scheduling solutions must consider several factors:

Vendor Selection Choose a reliable AI solution provider with proven expertise in behavioral health care.

Staff Training Equip staff with the knowledge to operate and maximize the potential of AI systems.

Patient Education Educate patients about the benefits of AI scheduling systems, ensuring a smooth transition from traditional methods.

Compliance Ensure that the AI system adheres to HIPAA and other regulatory standards to protect patient data.

Conclusion

AI is revolutionizing behavioral health care by addressing the inefficiencies and challenges of traditional appointment scheduling. AI patient appointment scheduling, coupled with Behavioral Health AI appointment scheduling, empowers providers to offer seamless and patient-centric care. The implementation of Automated patient scheduling ensures reduced administrative burdens, improved patient access, and enhanced provider efficiency.

As the healthcare industry embraces AI-driven innovations, behavioral health care stands to benefit immensely, fostering a future where quality care is accessible, efficient, and effective. By adopting these transformative technologies, providers can ensure a brighter and healthier future for their patients.

0 notes

Text

Make the most of Revenue: The Essential Guide to APS Medical Billing Success

Maximize Revenue: The Essential Guide to APS Medical Billing Success

Introduction

In the competitive landscape of healthcare, maximizing revenue through efficient medical billing is crucial. APS Medical Billing stands out as a key player, employing strategies that ensure healthcare providers get reimbursed quickly and accurately. This guide will delve into the essentials of APS Medical Billing, covering best practices, benefits, and insightful case studies that demonstrate how effective billing can lead to increased revenue. Let’s get started!

What is APS Medical Billing?

APS Medical Billing is a structured approach to managing claims and revenue for healthcare practices. Founded on honesty and transparency, APS focuses on optimizing the billing process through a combination of cutting-edge technology and best practices. By removing inefficiencies, healthcare providers can receive their payments faster, leading to improved cash flow and increased profitability.

Benefits of APS Medical Billing

Faster Claims Processing: Minimizing the time spent on claims submission can significantly improve cash flow.

Higher Claim Approval Rates: APS Medical Billing boasts higher rates of first-pass claim approvals, reducing overhead costs.

Detailed Reporting: With comprehensive analytics and reporting, healthcare providers can track their revenue cycle performance effectively.

Expert Support: Access to experienced billing professionals who understand the nuances of medical billing.

Regulatory Compliance: APS ensures all billing practices adhere to current healthcare regulations.

Essential Tips for APS Medical Billing Success

To achieve success in APS Medical Billing, healthcare practices should consider the following strategies:

Invest in Continuous Training: Ensure your billing team stays updated on the latest coding changes and billing guidelines.

Utilize Technology: Adopt advanced billing software that integrates with other practice management tools for seamless operations.

Implement Regular Audits: Conduct audits regularly to identify billing errors and rectify them before they affect revenue.

Enhance Patient Communication: Keep patients informed about their billing, helping to reduce denials due to misunderstandings.

Focus on Patient Data Accuracy: Accurate patient information is crucial for timely billing; invest in verification processes.

Case Study: A Success Story with APS Medical Billing

Consider the case of a mid-sized orthopedic practice that struggled with delayed payments and high denial rates. By switching to APS Medical Billing, the practice implemented several key strategies:

Utilized advanced billing software for automated claims submission.

Enhanced their patient outreach program to increase transparency.

Conducted comprehensive training sessions for their billing team.

As a result, they saw a 40% reduction in claim denials and an improvement in cash flow within three months. Their practice owner reported feeling more secure about the financial health of the clinic, leading to more investment in patient care.

First-hand Experience with APS Medical Billing

A practice manager shared their experience with APS Medical Billing: “Switching to APS has been a game changer. Not only have we reduced our billing errors significantly, but our revenue has also improved. The team at APS is responsive and knowledgeable, making the entire billing process much more manageable.” This sentiment reflects the commitment to service and efficiency that APS Medical Billing prides itself on.

Conclusion

Maximizing revenue in healthcare is not just about treating patients; it also hinges on efficient medical billing practices. APS Medical Billing empowers healthcare providers to optimize their billing processes, leading to faster payments and improved financial health. By investing in technology, training, and effective strategies, practices can enhance their profitability and ensure sustainable growth. Whether you’re a small clinic or a large healthcare system, the right billing solution can significantly impact your bottom line.

FAQs about Medical Billing

Question

Answer

What is medical billing?

Medical billing is the process of submitting and following up on claims with health insurance companies to receive payment for services rendered.

How can I reduce billing errors?

By ensuring accurate patient data entry, regular audits, and training for billing staff.

What makes APS different from other billing services?

APS focuses on high claim approval rates and uses advanced technology to streamline the billing process.

Is APS Medical Billing compliant with regulations?

Yes, APS adheres to all healthcare billing regulations, ensuring practices stay compliant.

youtube

https://medicalbillingcertificationprograms.org/make-the-most-of-revenue-the-essential-guide-to-aps-medical-billing-success/

0 notes

Text

EDI and Financial Excellence: A Strategic Approach

Electronic Data Interchange (EDI) is more than a technological advancement; it's a strategic asset that can significantly enhance financial operations for businesses. HubBroker ApS blog on EDI and Financial Excellence highlights several key areas where EDI can drive efficiency, reduce costs, and improve overall financial health.

Enhancing Efficiency through Automation: EDI automates the exchange of business documents such as invoices, purchase orders, and shipping notices. This automation reduces the need for manual data entry, minimizes errors, and speeds up transaction processing times. The result is a more streamlined and efficient workflow, allowing businesses to focus on strategic activities rather than routine tasks.

Cost Reduction and Resource Optimization: Implementing EDI can lead to substantial cost savings. By reducing paper-based processes and minimizing errors, businesses can lower operational costs. Additionally, the quick and accurate exchange of information helps in better inventory management, reducing the costs associated with overstocking or stockouts.

Improving Data Accuracy and Security: EDI ensures that data is transmitted in a standardized format, which enhances accuracy. This standardization eliminates discrepancies that often arise from manual data entry. Furthermore, EDI systems employ secure communication protocols, protecting sensitive business information and ensuring compliance with industry regulations.

Enhanced Decision-Making through Data Analytics: The data generated through EDI transactions can be leveraged for advanced analytics. Businesses can analyze trends, monitor performance, and make informed decisions based on accurate and timely data. This strategic use of data can lead to improved supply chain management and better financial outcomes.

Strengthening Business Relationships: EDI fosters stronger relationships between business partners by enabling seamless and transparent communication. It ensures that all parties are on the same page, reducing misunderstandings and conflicts. This collaboration is vital for addressing challenges promptly and maintaining smooth business operations.

Ensuring Compliance with Industry Standards: Staying compliant with industry-specific standards and regulations is crucial for successful EDI implementation. Compliance ensures that businesses can communicate effectively with their partners and avoid the risks associated with non-compliance, such as penalties or disrupted operations.

For businesses looking to optimize their financial processes, embracing EDI is a strategic move. It not only enhances operational efficiency but also provides a solid foundation for long-term financial excellence. By integrating EDI into their operations, businesses can achieve greater accuracy, cost savings, and stronger partnerships, positioning themselves for success in today's competitive marketplace.

0 notes

Text

Modernizing Finance: The Shift Toward Outsourced AP Services

As businesses strive to keep pace with the evolving financial landscape, accounts payable outsourcing has emerged as a powerful tool to streamline operations, enhance efficiency, and drive cost savings. With the increasing complexity of financial management, more companies are turning to outsourcing to stay competitive and future-proof their operations.

One of the driving factors behind the rise of AP automation is the need for faster and more accurate processes. Automation reduces manual errors, accelerates invoice approvals, and improves the overall efficiency of the accounts payable process. As businesses grow, automation ensures that AP tasks are scalable without sacrificing accuracy or speed.

Vendor payments management is another area where outsourcing shines. Companies can rely on specialized providers to ensure timely and accurate payments to vendors, minimizing the risk of disputes and strengthening supplier relationships. This reliability is crucial in an environment where businesses need to optimize their cash flow while maintaining strong partnerships.

Another reason accounts payable outsourcing is gaining popularity is its role in cost reduction. By eliminating the need to hire and maintain an in-house AP team, businesses can significantly reduce overhead costs. Outsourcing also allows companies to access advanced technologies and expertise without having to invest in expensive software or additional staff.

Furthermore, outsourced finance services offer scalability, which is essential for businesses planning to expand. As your business grows, outsourcing partners can quickly adapt to increased volumes, allowing you to focus on strategic initiatives rather than managing an expanding finance department.

In conclusion, accounts payable outsourcing is more than just a trend—it’s the future of finance. By embracing AP automation, improving vendor payments, reducing costs, and scaling with ease, companies are positioning themselves for long-term success.

#accounts payable outsourcing#digital finance transformation#AP trends#business outsourcing#future of work

0 notes

Text

The Benefits of Implementing 3-Way Matching in Accounts Payable

In today’s dynamic business environment, efficiency and accuracy in financial processes are crucial for maintaining profitability and compliance. Accounts Payable (AP) departments play a pivotal role in managing supplier invoices and ensuring that payments are processed correctly and timely. One effective method used in AP to enhance accuracy and reduce errors is 3-way matching.

What is 3-Way Matching?

3-way matching is a standard AP practice that involves matching three key documents before processing a supplier invoice for payment. These documents typically include:

Purchase Order (PO): The document issued by a buyer to a seller, outlining the details of goods or services to be purchased, including quantities, prices, and terms.

Receipt of Goods/Services: Documentation confirming that the goods or services specified in the PO have been received or rendered satisfactorily.

Invoice: The supplier's invoice requesting payment for the goods or services delivered, detailing quantities, prices, and other relevant terms.

By comparing these three documents—PO, receipt, and invoice—AP departments can verify that what was ordered (PO), what was received (receipt), and what was billed (invoice) match up accurately. Here are the significant benefits of implementing 3-way matching in your accounts payable process:

1. Accuracy and Error Reduction

Implementing 3-way matching significantly enhances the accuracy of financial transactions by cross-verifying information across multiple documents. This process reduces the risk of overpayments, duplicate payments, and billing errors. By ensuring that invoices match both the purchase order and receipt of goods/services, AP departments can catch discrepancies early, preventing costly mistakes that could impact financial reporting and vendor relationships.

2. Fraud Prevention

3-way matching acts as a robust control mechanism against fraudulent activities. By validating invoices against purchase orders and receipts, organizations can detect discrepancies that may indicate fraudulent invoices or unauthorized purchases. This helps safeguard financial resources and ensures that payments are made only for legitimate transactions, enhancing overall financial security.

3. Improved Vendor Relations

Timely and accurate payments are essential for fostering positive relationships with suppliers and vendors. Implementing 3-way matching ensures that invoices are processed efficiently and accurately, leading to fewer payment delays and disputes. This reliability can enhance vendor trust and cooperation, potentially leading to preferential treatment and better terms for future transactions.

4. Operational Efficiency

Automating the 3-way matching process through AP software or ERP systems improves operational efficiency by reducing manual intervention and streamlining workflow. Automated matching algorithms can quickly compare large volumes of data across documents, identifying discrepancies faster than manual methods. This efficiency frees up AP staff to focus on strategic tasks and exception handling rather than routine data entry and reconciliation.

5. Compliance and Audit Readiness

Adherence to regulatory requirements and internal policies is critical for organizations across industries. 3-way matching helps ensure compliance by providing a clear audit trail of purchasing activities and payment processes. This documentation not only facilitates internal audits but also supports external audits by providing evidence of control measures and transaction accuracy.

6. Cost Savings

By minimizing errors, preventing fraud, and optimizing operational workflows, 3-way matching contributes to significant cost savings over time. Organizations can avoid penalties associated with payment errors, reduce labor costs related to manual reconciliation, and negotiate better terms with suppliers based on a reputation for accuracy and reliability.

youtube

Conclusion

In conclusion, implementing 3-way matching in accounts payable offers substantial benefits for organizations seeking to enhance financial accuracy, operational efficiency, and vendor relationships. By leveraging automated tools and rigorous verification processes, businesses can mitigate risks, ensure compliance, and achieve cost savings while maintaining a competitive edge in today’s marketplace.

For organizations looking to optimize their accounts payable processes, integrating 3-way matching is a strategic step towards achieving financial transparency and operational excellence.

SITES WE SUPPORT

Financial Workflow - Wix

SOCIAL LINKS Facebook Twitter LinkedIn

0 notes

Text

Ariba E Invoicing

Ariba E Invoicing

Embracing Ariba E-Invoicing: Streamlining Your Accounts Payable

In today’s fast-paced digital world, businesses constantly seek ways to optimize their processes and gain efficiency. Accounts payable (AP) is one area where manual, paper-driven processes can be a significant bottleneck. Ariba e-invoicing offers a powerful solution, fundamentally changing how businesses manage their invoice.

What is Ariba E-Invoicing?

Ariba e-invoicing is a cloud-based solution that automates sending, receiving, and processing invoices. It eliminates the need for paper invoices, manual data entry, and time-consuming approvals, replacing them with a streamlined digital workflow. This leads to significant cost savings, reduction of errors, and improved visibility into your financial processes.

Benefits of Ariba E-Invoicing

Efficiency Gains: E-invoicing drastically reduces manual tasks, freeing up your AP team’s time for more strategic activities.

Cost Savings: Eliminating paper, postage, and manual labor leads to significant cost reductions.

Reduced Errors: Ariba e-invoicing minimizes the risk of errors commonly associated with manual data entry.

Improved Visibility: Real-time invoice status tracking provides greater transparency and control over your payment processes.

Faster Payment Cycles: Automated approvals and streamlined workflows accelerate payment processing.

Enhanced Compliance: Ariba e-invoicing facilitates compliance with global regulations and tax requirements.

Supplier Collaboration: The platform provides a centralized hub for supplier communication and collaboration, improving relationships.

How Ariba E-Invoicing Works

Supplier Onboarding: Suppliers are enabled on the Ariba Network to connect with your business through the platform.

Invoice Creation: Suppliers create electronic invoices within the Ariba Network or through integrations with their existing accounting systems.

Validation and Approval: Invoices are automatically validated against purchase orders and other business rules you define. You can set up custom approval workflows.

Integration: Ariba e-invoicing seamlessly integrates with your ERP system, allowing automatic data transfer and reconciliation.

Payment: Approved invoices are automatically processed for payment, streamlining the entire invoice-to-pay cycle.

Getting Started with Ariba E-Invoicing

Adopting Ariba e-invoicing is a straightforward process. Here’s how to get started:

Assess Your Needs: Identify your current invoicing pain points and the potential benefits of e-invoicing for your organization.

Choose a Solution: Ariba offers flexible e-invoicing solutions to accommodate businesses of various sizes and complexities.

Onboard Suppliers: Engage your suppliers and encourage them to join the Ariba Network.

Implement and Integrate: Work with Ariba or an implementation partner to configure and integrate the system with your ERP.

Training: Provide training for your AP team and suppliers to ensure a smooth transition.

The Future of Invoicing

Ariba e-invoicing represents a significant advancement in accounts payable automation. It helps businesses achieve greater financial control, efficiency, and agility. If you want to optimize your AP operations, Ariba e-invoicing is a solution worth exploring.

youtube

You can find more information about SAP ARIBA in this SAP ARIBA Link

Conclusion:

Unogeeks is the No.1 IT Training Institute for SAP Training. Anyone Disagree? Please drop in a comment

You can check out our other latest blogs on SAP ARIBA here – SAP ARIBA Blogs

You can check out our Best In Class SAP ARIBA Details here – SAP ARIBA Training

Follow & Connect with us:

———————————-

For Training inquiries:

Call/Whatsapp: +91 73960 33555

Mail us at: [email protected]

Our Website ➜ https://unogeeks.com

Follow us:

Instagram: https://www.instagram.com/unogeeks

Facebook: https://www.facebook.com/UnogeeksSoftwareTrainingInstitute

Twitter: https://twitter.com/unogeek

0 notes

Text

SAP Finance and Accounting Modules

SAP Finance and Accounting Modules: Streamlining Your Financial Operations

SAP (Systems, Applications, and Products) is a leading enterprise resource planning (ERP) software suite renowned for its comprehensive financial modules. These modules offer exceptional tools to manage and streamline your organization's financial processes. If you want to optimize your business's economic health, SAP Finance and Accounting could be the answer. This blog post will delve into these modules and their significance.

What are SAP Finance and Accounting Modules?

SAP's Finance and Controlling (FICO) modules provide a robust platform to handle a wide range of financial and accounting functions, including:

SAP General Ledger (G/L): The core of financial reporting, the G/L module maintains your chart of accounts and records all business transactions.

SAP Accounts Payable (AP) manages vendor payments and invoices and ensures timely and accurate outgoing payments.

SAP Accounts Receivable (AR): Handles customer invoices, tracks incoming payments, and aids in managing accounts receivable balances.

SAP Asset Accounting (AA): Facilitates the accurate tracking, depreciation, and management of an organization's fixed assets.

SAP Bank Accounting is designed to seamlessly integrate your bank-related transactions, manage bank statements, and support reconciliation processes.

SAP Controlling (CO): Provides essential tools for cost accounting, profitability analysis, and budgeting, enabling informed business decisions.

Key Benefits of SAP FICO Modules

Real-Time Financial Transparency: SAP FICO provides access to real-time financial data, offering up-to-the-minute insights into your business's economic performance.

Process Automation: Automate routine tasks like invoice processing and reconciliation, saving time and minimizing errors.

Regulatory Compliance: Adherence to financial reporting standards and regulations (such as IFRS and GAAP) becomes more straightforward, reducing compliance risks.

Enhanced Decision-Making: Access to in-depth financial analysis and reporting tools supports strategic decision-making.

Scalability: SAP FICO solutions seamlessly grow as your business expands, ensuring long-term adaptability.

Who Should Consider SAP FICO?

SAP's Finance and Accounting modules are ideal for medium-sized to large enterprises looking for:

A centralized platform for financial data management

Streamlining of complex accounting processes

Reduction in manual accounting errors

Enhanced financial controls and reporting

Improved compliance with accounting regulations

Embarking on Your SAP FICO Journey

Implementing SAP FICO requires careful planning and a structured approach:

Needs Assessment: Analyze your financial processes and identify specific pain points and improvement areas.

Solution Design: Work with an experienced SAP consultant to customize an SAP solution that aligns with your unique business needs.

Implementation: This phase involves configuring the SAP system, data migration, and thorough testing.

Training and Support: Adequate training for your finance team is crucial. Consider ongoing support for a smooth transition.

Conclusion

SAP FICO modules offer a robust and integrated solution for financial management. The benefits realized—enhanced efficiency, transparency, and compliance— make a compelling case for businesses seeking to improve their financial health and performance.

youtube

You can find more information about SAP Fico in this SAP FICO Link

Conclusion:

Unogeeks is the №1 IT Training Institute for SAP Training. Anyone Disagree? Please drop in a comment

You can check out our other latest blogs on SAP here — SAP FICO Blogs

You can check out our Best In Class SAP Details here — SAP FICO Training

Follow & Connect with us:

— — — — — — — — — — — -

For Training inquiries:

Call/Whatsapp: +91 73960 33555

Mail us at: [email protected]

Our Website ➜ https://unogeeks.com

Follow us:

Instagram: https://www.instagram.com/unogeeks

Facebook: https://www.facebook.com/UnogeeksSoftwareTrainingInstitute

Twitter: https://twitter.com/unogeek

#Unogeeks #training #Unogeekstraining

0 notes

Text

AP Automation: A Step-by-Step Guide to Overcoming AP Process Challenges

We've all had that one dreadful inbox full of invoices, purchase orders, and expenditure receipts that never seem to stop coming in. Traditional accounts payable (AP) departments frequently suffer from labor-intensive manual processes that consume an excessive amount of time and resources. When it comes to resolving vendor questions, routing paperwork for approval, matching bills to purchase orders, cutting checks, and more, accounts payable personnel frequently feel like they're drowning in paper and never really getting anything done.

But what if there was a more effective method? Is it possible to automate a lot of these tiresome AP tasks? Automation bots, machine learning, and artificial intelligence (AI) are examples of new technologies that can be very helpful. Continue reading to find out how AP automation can be the answer to your issues.

5 Ways for Streamlining AP Automation Way

Too Much Manual Data Entry in Your AP Processes

The labor-intensive and prone-to-error process of manually entering and managing purchase orders, supplier invoices, and other documents into the corporate ERP is immense. When entering data between systems, AP employees lose important time and make mistakes that can be expensive and difficult to correct.

By doing away with tedious manual data entry, AP automation guarantees error-free information flow into the ERP. Sophisticated data extraction technology uploads important information to the system from emails, PDFs, and paper documents. Based on rules and approver mappings you set, automated workflows then forward invoices and documents to the appropriate parties for evaluation and approval.

Also Read: How to Identify and Address Accounts Payable Risks

Uncertainty about cash flows

In order to effectively manage cash flow and fulfill financial responsibilities, it is essential to know precisely what money is owed and when. However, a lot of businesses lack forecasting and real-time visibility into their AP liabilities.

Automation improves visibility throughout the liability cycle, from accruals and invoice receipts to approvals and payments, by offering real-time information and reporting into outstanding AP liabilities. Dashboards provide useful data that can be used to improve budgetary choices, terms and timing of payments, and discounts.

Payment Duplication & Fraud Risks

There may be severe financial ramifications as well as legal repercussions if the same invoice is paid twice or checks are written to dishonest vendors. Businesses that depend on human verification procedures are particularly susceptible to these harmful mistakes.

By using AI and machine learning to check supplier data and transactions for duplicates and fraud threats before payment, AP automation protects your company. Before a payment is made, AP professionals are notified of any hazards and given the task of resolving them before issuing checks or starting transfers.

Also Related: Account Payable Automation: Streamlined Workflows & Benefits

Ineffective Supplier Management Techniques

Managing supplier master data is difficult because of spreadsheets, filing cabinets, and tribal knowledge. A lack of comprehensive perspectives on supplier relationships may lead to non-compliant behavior, non-standardized processes, and lost chances for cost reductions.

Automation offers a comprehensive platform for suppliers to centralize document repositories and master data. Removing disorganized files lessens redundancy and makes it simpler to evaluate suppliers to rationalize spending. Dashboard analytics provide information on supplier performance to help in contract negotiations and decision-making.

Decentralized Approvals of Invoices

It is challenging to keep track of the progress of paper invoices that are routed around the office for various approvals. Significant bills pile up on someone's desk unnoticed, endangering discounts for on-time payments and refunds.

Invoices are sent to approvers using automated technologies using machine learning algorithms to apply bespoke rules. Approvers receive notifications about invoices that need to be reviewed, and dashboard analytics give them insight into the review process. Automated escalation alerts offer monitoring in case approvals take a long time.

Ready to unleash the potential of automated AP processes?

The advantages of visibility, control, and productivity that come with contemporary AP automation are too strong to ignore. Simplifying AP procedures helps businesses take advantage of discounts and improve compliance, all while lowering expenses and providing a quick return on investment. IBN Technologies is a reliable partner for businesses looking to adopt AP automation solutions. They offer state-of-the-art automation services that help businesses succeed in the digital era.

1 note

·

View note

Text

Is Touchless Invoice a Myth?

According to research, last year, most of the AP Leaders suffered a miserable state, a majority of 60% still face lengthy invoice and payment approval times. Invoice processing is the most important part of the accounts payable process, which is mostly performed manually. This blog will discuss how to use automation in invoice processing and make the process easier.

Accounts payable professionals spend almost 25% of their days fixing mistakes on invoices, data entry and updating records, and responding to emails about the status of invoices and payments. This inefficiency results in adding 2 hours extra to each day. Meanwhile, highly automated accounts payable departments can process 8 times as many invoices per full-time employee equivalent as those with little or no automation.

Invoice processing involves several steps including downloading the attachment, Manual encoding, capturing invoice details, data entry and checking against purchase orders, and ensuring that they match up accordingly or handling exceptions.

Rather than spending endless hours on mountains of paperwork every day, why not consider using a touchless invoice processing solution instead? This will save time and energy while eliminating unnecessary costs.

Let’s see where all human touches in Invoice processing can be automated

Downloading Attachment :

Email has taken over as the standard for communication with suppliers and for receiving invoices. With nearly 300 billion emails sent each day, streamlining the accounts payable department’s capabilities for automatically parsing attachments within emails has never been more important. Invoices arrive through email — and vital information contained within them is often attached to the message. Someone from a team in the accounts payable department is tasked with identifying emails and downloading the file, manually opening them. It’s a time-consuming task that is prone to error.

With the help of Automation, bots Identify vendor emails with invoice attachments and download the attachments.

2 Manual Encoding :

Invoices from a multitude of vendors need to be managed. The problem is compounded when invoices must be sorted and classified. Imagine how long it would take to sort and classify a stack of 100 paper invoices into different categories by hand?

Automatic sorting is much faster and more accurate as compared to manual encoding. When a document is imported into the IDP system, it automatically classifies the document based on document type, vendors, tax rates, etc in a flash

3 Scanning documents :

Just imagine going through each invoice, typing in the numbers, and manually adding them to your system! A mammoth task indeed and a bit tedious as well – subject to human error. For businesses that have a concrete growth plan, automation technologies for invoicing are a smart choice that can help save time and costs associated with processing the physical invoices by hand.

Account payable automation uses OCR i.e optical character recognition technology, which allows the software to interpret machine-printed text or scanned images. Invoice processing software uses this technology in order to analyze and automatically identify the fields/attributes present in invoices, such as vendor, date, amount, invoice number, line item data, etc.

4 Manual data entry :

Invoice data entry is arguably one of the most time-consuming business processes. Making sure the data entry is as efficient as possible is crucial to optimizing bookkeeping processes, especially for companies that handle large documents. RPA-assisted OCR is one of the most effective ways to speed up invoice processing. It can automatically extract information from the document and upload it into the accounting/ERP system, without any human intervention.

5 Finding lost invoices :

According to a study, Automation led to a 60% reduction in missing invoices, a 59% decline in delayed payment & reimbursement approvals, and a 55% drop in missing receipts.

The above-mentioned problems were avoided by using an AP automation solution that will mail or send invoices directly to the right person in your customer’s accounts payable department. Automation will also alert you when the invoice has been opened and viewed.

It has to be made sure that you have assigned an email address to each customer’s account, and regularly check for “unviewed” invoices. There are automated systems available that can set a flag and notify if invoices have gone unviewed for a certain period of time.

6 Reconciling Supplier and PO Information :

Before any business pays an invoice, the invoice must be cross-referenced to all other supporting documentation such as purchase orders and receiving reports to ensure the payment covers only goods or services listed. It’s done manually and leads to errors. The automated 2Way & 3Way matching process helps reconcile & match a large number of invoices, without any manual intervention. Thus, saving employees valuable productive time, and reducing errors.

Conclusion :

Touchless processing can be explained as a process where an invoice is received and approved without any manual intervention on the part of the AP team. Around 70% of companies touch invoices 3-4 times throughout the process. The fewer human touches an invoice receives, the faster it is processed with fewer errors down the line.

The above blog post is a guide to understanding the importance of achieving straight-through processing as it is cheaper, faster, and more efficient than any other invoice approval workflow process.

It is important for businesses to have a system that is able to process invoices in a smooth fashion so that it can reduce the overall operational costs, reduce the number of steps and time taken for approving invoices, thus increasing the efficiency and improving the overall financial results of the business.

0 notes

Text

Streamlining Financial Management: Outsourced Bookkeeping and Accounts Payable Services by AccountsOnTrack

Outsourcing bookkeeping and accounts payable services has emerged as a transformative solution for businesses aiming to streamline their financial processes. Among the frontrunners in this domain, AccountsOnTrack stands out, offering comprehensive and efficient outsourced solutions to manage bookkeeping and accounts payable tasks.

AccountsOnTrack's outsourced bookkeeping services provide a lifeline to businesses, allowing them to offload the meticulous task of maintaining financial records, reconciling accounts, and ensuring compliance. The team at AccountsOnTrack comprises adept professionals equipped with the latest accounting software and expertise in handling diverse financial needs.

One of the key benefits of outsourcing bookkeeping is the reduction in operational costs. By partnering with AccountsOnTrack, businesses can avoid the expenses associated with hiring and training in-house accounting personnel. Additionally, the outsourced model ensures access to a team well-versed in financial regulations, minimizing the risk of errors and penalties.

Accounts payable (AP) outsourcing is another forte of AccountsOnTrack, streamlining the often intricate process of managing and processing vendor invoices. outsourced bookkeeping services The AP outsourcing services offered ensure timely payments to vendors, optimizing cash flow management while adhering to payment schedules and terms. This not only cultivates stronger vendor relationships but also contributes to improved financial forecasting and budgeting.

The expertise of AccountsOnTrack extends beyond mere data entry; it encompasses thorough scrutiny of invoices, accurate categorization, and timely processing, thereby enhancing efficiency and minimizing discrepancies. This meticulous approach safeguards businesses from potential errors, ensuring compliance and financial accuracy.

Moreover, the utilization of advanced technology and automated systems by AccountsOnTrack further amplifies the efficiency of accounts payable processes. Automation not only expedites invoice processing but also reduces manual errors, allowing for a seamless and error-free financial workflow.

The flexibility offered by AccountsOnTrack in terms of customized solutions caters to businesses of varied scales and industries. Whether it's managing day-to-day bookkeeping tasks or handling complex accounts payable processes, the services are tailored to meet specific business requirements.

Security is a paramount concern when it comes to financial data. AccountsOnTrack prioritizes data security and confidentiality, employing robust measures to safeguard sensitive financial information. accounts payable outsourcing services With stringent data protection protocols and secure systems in place, businesses can entrust their financial data to AccountsOnTrack with confidence.

The efficiency, accuracy, and cost-effectiveness achieved through outsourced bookkeeping and accounts payable services not only streamline financial operations but also empower businesses to focus on their core competencies. The partnership with AccountsOnTrack fosters a sense of reliability, enabling businesses to make informed financial decisions based on accurate and up-to-date information.

In conclusion, outsourcing bookkeeping and accounts payable services have become indispensable strategies for businesses seeking to optimize their financial management. AccountsOnTrack, with its expertise, technological prowess, and commitment to delivering reliable and tailored solutions, emerges as a trusted partner in streamlining financial processes, empowering businesses to navigate the complexities of finance with ease and efficiency.

#outsourced bookkeeping services#accounts payable outsourcing services#accounts outsourcing#accounts payable outsourcing providers

1 note

·

View note