#eway bill online

Text

Why E-Invoicing is in Focus nowadays

The government has initiated the trial of the e-way bill system from 15 January 2018 for the generation of e-way bills for intra-state and Interstate movement of goods but the system is expected to be rolled out soon and make it mandatory for transporters and organizations to generate the new e-way bill online according to the law of GST and in compliance with rules of the CGST rules.

Every taxpayer or every registered person who transferred his goods or causes to the movement of goods of value exceeding ₹50,000 concerning supply or the reasons which are other than supply or for inward supply from an unregistered person then e-way bill generation is necessary.

The relevance of GST E-invoicing software plays a role, as it is well known that E-invoicing is not a new technology but its relevance has grown multiple folds in recent times.

For choosing the best E-invoicing software india, users must keep an eye out for one of the features for choosing E-invoicing software is its ability to integrate with an accounting system.

This software allows the users to see where your operating funds were channeled and for that, you can also determine where your business finances are headed and in which direction.

E-way bill portal has also released the e-way bill APIs to license GST Suvidha providers for helping large transporters or large organizations automate the entire process by integrating their solution within an ERP taxpayer or an existing e-way bill system for generating new e-way bills online in real-time.

A user can generate the bulk E-way bill from the system by using software or when the user needs to generate multiple bills available in one shot they can generate the bulk E-way Bill by adopting touchless technologies of e-invoicing.

The concept of an E-way bill to generate online under GST was to abolish the Border Commercial Tax post to avoid the evasion of tax in India.

So it is crucial to know every aspect related to the E-way bill system under GST. The E-way bill system is very much important for both parties whether it would be for the government or the business industry.

For More Information

Call +91-7302005777

Or visit https://unibillapp.com/

#e way bill generate online#best e invoicing software#gst e invoicing software#eway bill generate online#generate e way bill online#e invoice software free#gst e way bill software#e invoicing software india#e invoicing software free#e invoicing software download

2 notes

·

View notes

Text

Businesses managing intra or interstate goods movement in India must seamlessly generate an e-Way bill online for compliance. Easily login to AccoXpert for efficient e-Way bill generation.

0 notes

Text

A Comprehensive Guide to Landing Assistant Account Executive Jobs in Chandigarh

Best companies hiring assistant account executives in Chandigarh

Chandigarh, known as the "City Beautiful," offers a thriving job market for assistant account executives. The city is home to numerous prestigious companies that frequently hire professionals in this role.

- ABC Corp

- XYZ Pvt Ltd

- Hookaljob.com

Salary prospects for assistant account executives in Chandigarh

Accounting Jobs in Chandigarh

Tally Jobs in Chandigarh

TDS Jobs in Chandigarh

Accounts Finalisation Jobs in Chandigarh

GST Tax Jobs in Chandigarh

Taxation Jobs in Chandigarh

Bank Reconciliation Jobs in Chandigarh

EWay Bill Jobs in Chandigarh

Accountant Jobs in Chandigarh

Accounts Executive Jobs Vacancies in Chandigarh

Assistant account executives in Chandigarh can expect competitive salaries and growth opportunities. The salary prospects depend on factors like education, experience, and skills. On average, the starting salary for an assistant account executive in Chandigarh ranges from INR 2,50,000 to INR 3,50,000 per annum. With experience and expertise, professionals can earn up to INR 6,00,000 per annum or more.

Networking tips for landing assistant account executive jobs in Chandigarh

Networking plays a crucial role in finding job opportunities in Chandigarh. Here are some useful networking tips to enhance your chances of landing assistant account executive jobs:

- Attend industry-related events and seminars to connect with professionals from the accounting and finance field.

- Join professional networking platforms such as LinkedIn and build a strong online presence.

- Engage in conversations with professionals in the field and express your interest in assistant account executive roles.

- Seek recommendations from professors, mentors, and former colleagues who can vouch for your skills and work ethic.

If you implement these networking strategies effectively, you can increase your visibility and create valuable connections that may lead to job opportunities.

0 notes

Text

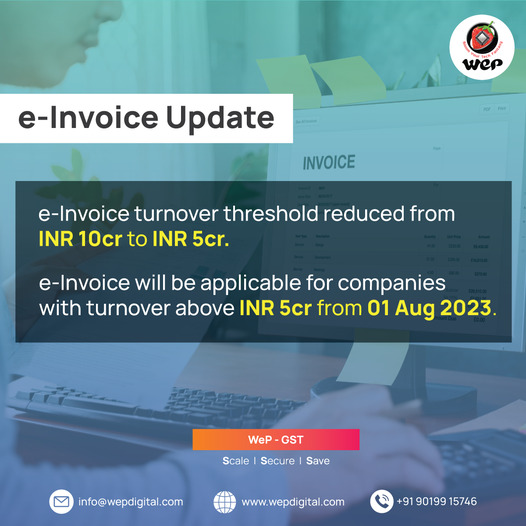

Eway bill generation software - WeP Digital

Use WeP's best online invoicing software to combine your bills and streamline your process. The invoice management software from WeP digital allows you to download an infinite number of e-Invoices.

0 notes

Text

Price: [price_with_discount]

(as of [price_update_date] - Details)

[ad_1]

Vyapar is India's leading GST billing software provider, tailored to meet the needs of small businesses, and is well-established with 5M+ downloads, empowering 3M+ users.

The Vyapar Mobile Premium package allows you to manage your invoices at the convenience of your mobile phone, and provides several benefits compared to our free Mobile package: (1) to sync your business accounting data between multiple devices; and (2) to remove the Vyapar logo and branding from your invoices.

This package is a 1-month plan, and will prompt a monthly payment renewal process after the first month of usage.

With Vyapar's GST billing and accounting solution you can manage your business in a simple, secure and easy way. The service includes the following features:Creation and sharing of GST bills: choose from 10+ formats, that comply with India’s GST (goods and service tax) lawsInstant tracking of inventory: e.g. based on batch number, expiry date, manufacturing date, slot number, and all other detailsPayment reminders: to alert your customers to complete payments ahead of the due date, reminding them through WhatsApp, SMS, email, etc.Track orders: tracking of both sales or purchase orders, for quick fulfilment of ordersChoose themes: large number of billing templates, for professional Invoices that improves your brand's identityDelivery challan: for acknowledgement upon delivery of goods to your customersCreate an online store: Share it with customers and receive orders on WhatsApp or callVyapar's GST Billing software is the perfect product to address your invoicing needs. This product is part of Amazon Digital Suite, and comes with several benefits, including priority onboarding and priority support.

The Vyapar team will contact you for setup within 1 business day of registration.Extensive support is provided through a single touch point

Manage your billing, accounting, and inventory processes, and stay GST compliant on the go with Vyapar, a low-priced business management app

Generate professional invoices, Eway bills, and easily track sales or purchase orders. Create your free online store and share it with customers to receive orders instantly

[ad_2]

0 notes

Text

Freight Forwarding Software in India

Freight Cube is the Best ERP Software for freight forwarders & is highly enable and new generation Freight Forwarding cloud software allows to management and control of Air Freight, Sea Freight, Surface Freight, Warehousing, Multimodal Transport, Customs, & sync it smoothly with CRM, Billing, & Accounting from anywhere, anytime with any device.

Our Features:-

Mobile APP

Its process for building mobile applications that run on devices like tablet or smartphones.

Console Manifest

We provides the IDs for the dashboards, associated model, and customized identifier.

Reverse Mechanism

Reaverse Mechanism is the process of GST amount by the receiver instead of the supplier.

I-Mail

Its an Email organization app, to manage multiple mail accounts to reach your audience.

Digi Signer

DigiSigner is an online tool for viewing and digitally signing PDF with a ease of use.

E-Invoice

Electronic invoicing system in which all B2B invoices are authenticated electronically.

Eway Bill Integration

Intermediary Interface that allows two separate apps to communicate each other.

CRM Support

If you need any support or queries, Our expert will take care from end to end support.

For More Details Contact Us

HERE

#freight forwarding software#freight forwarding ERP#logistics software solution#digitalized global logistics ERP#freight forwarding software solution#freight software solutions#forwarding clearence software#forwarding clearence software india#best freight forwarding software

1 note

·

View note

Photo

Get one month free E-Way Bill generation absolutely free, get free gst billing format, complete guide of what is eWay bill, who should generate eWay bill, how to register?

#e way bill#e way bill procedure#generate e way bill#e way bill registration#eway bill online#ewaybill registration

0 notes

Photo

E-way Bill under GST

0 notes

Photo

Get one month free E-Way Bill generation absolutely free, get free gst billing format, complete guide of what is eWay bill, who should generate eWay bill, how to register?

https://www.gstregistrationonline.org/eway-bill

#e way bill#e way bill procedure#generate e way bill#e way bill registration#eway bill online#ewaybill registration

0 notes

Text

Reliable & Complete E-Invoicing Solution

Electronic invoicing or GST e invoicing software in India is a method for creating invoices and it enables the invoices created through one software program that is accessible by the other software, it has also reduced the need for further data entry and the labor-intensive manual process.

It is an invoice that has been produced using a single standard format so that others can share the electronic data or ensures information consistency.

E-invoicing software provides a reliable and complete invoicing solution, it provides the features for generation, tracking, or managing the invoices.

Unibill App is an GST e invoicing software in India that helps in generating the E invoices in a single click, also it automatically prints IRN or invoice reference number and QR code with the invoicing software.

It is certified software which means your invoices can be directly uploaded to the IRP portal to generate the E invoices seamlessly.

There are so many benefits of the Unibill App, the best GST e-invoicing software as it reduces the reporting of the same invoice details multiple times, it helps in real-time tracking of invoices, confirms the ITC eligibility, it prevents errors and fraud, it saves time and effort to file returns or it helps in reducing the reporting of same invoice details in multiple times.

There are some key factors to be considered while choosing a GST E-invoicing software like whether it can generate bulk E-way Bill invoices seamlessly whether it can generate E-way Bills along with E invoices as applicable or whether it has the flexibility to use the offline mode to generate the E invoices that deals in possible network issues.

Electronic invoicing is a system in which all B2B invoices are uploaded electronically and then authenticated by the designated portal.

Post authentication, a unique invoice reference number is generated along with the QR code and that needs to be printed on the invoice.

Electronic invoices apply to all the businesses that are registered under GST and those that issue B2B invoices in a phased manner as notified by the central government.

Therefore there are many benefits of E-invoicing, first, it can curb tax evasion and with this the chances of editing invoices are low.

For More Information

Call us on +91-7302005777

Or visit https://unibillapp.com/

#best e invoicing software#gst e invoicing software#e invoice software free#e invoicing software india#e invoicing software#e invoicing software download#gst e way bill software#eway bill generate online#generate e way bill online#e way bill generate online

0 notes

Link

#Purchase Billing Software#Billing Software Online#GST Billing Software#Billing App#Eway Bill#Accounting Software#GST Software#Inventory Management Software

0 notes

Text

The Growing Demand for Assistant Account Executive Jobs vacancies in Mohali

Mohali Assistant Account Executive positions

Are you looking for Assistant Account Executive job vacancies in Mohali? Look no further! In this blog post, we will

provide you with valuable information about Assistant Account Executive positions in Mohali and how to find the latest

job openings in this field. Whether you are an aspiring Assistant Account Executive or an experienced professional

looking for a career change, this guide will help you navigate the exciting job market in Mohali.

Find Assistant Account Executive Jobs in Mohali

Mohali, also known as Sahibzada Ajit Singh Nagar, is a rapidly growing city in Punjab, India. With its proximity to

Chandigarh, the capital city, Mohali has emerged as a major hub for IT industries and various other sectors. The

demand for skilled professionals, including Assistant Account Executives, is high in this region. To find the best

Assistant Account Executive jobs in Mohali, you can follow these steps:

Accounting Jobs in Mohali

Tally Jobs in Mohali

TDS Jobs in Mohali

Accounts Finalisation Jobs in Mohali

GST Tax Jobs in Mohali

Taxation Jobs in Mohali

Bank Reconciliation Jobs in Mohali

EWay Bill Jobs in Mohali

Accountant Jobs in Mohali

Accounts Executive Jobs Vacancies in Mohali

1. Utilize online job portals: There are several popular job portals like Hookaljob, Indeed, Naukri, and LinkedIn where you can find a wide range of Assistant Account Executive job listings specific to Mohali. Make sure to create an impressive profile, upload your updated resume, and set up job alerts to stay updated with the latest openings.

2. Connect with recruitment agencies: Many recruitment agencies specialize in matching job seekers with suitable opportunities. Reach out to these agencies and share your career goals and aspirations. They can help you find Assistant Account Executive positions tailored to your skills and experience.

3. Network with professionals: Attend industry events, seminars, and conferences in Mohali to expand your network. Building strong connections with professionals in the field can lead to valuable job opportunities. Join online communities and forums related to Assistant Account Executives to engage with like-minded individuals

0 notes

Text

Important features of Marg GST Software

After the implementation of GST, one of the biggest challenges faced by both taxpayer & accountants is the complexity in tax compliance. For example, tax compliance includes GST return filing, claiming a tax refund, multiple tax returns, etc. Similarly, taxpayers have to issue GST compliant e-invoices.

E-invoices need to have components like HSN/SAC Codes, GSTIN of the supplier and the recipient, GST Rates etc. Further, they face challenges in keeping the track of all new amendments introduced by the GST Council via notifications and circulars.

Such a complex situation makes it difficult for both taxpayer & accountants to file fully compliant GST returns on time. So, to avoid delays in taxes & such issues, businesses are advised to use GST Accounting Software.

A good GST Accounting Software enables the taxpayers, accounting professionals and business owners to generate GST ready invoices effortlessly, file GST returns timely, organize GST reports and maintain all accounting data seamlessly.

One such software is Marg GST software which is affordable & provides you with the best GST Billing and Returns Filing experience. Marg GST Billing software aims at reducing your business operation cost by significantly reducing the compliance time. It fastens the entire process of return filing as you can directly push transactions into Excel, JSON or CSV format from the software on to GST Portal & file returns in a few clicks.

Let us discuss few important unique features of Marg GST Billing software:

GST Invoices & Billing

With Marg GST invoice software you can generate GST compliant invoices in a few seconds and can also track invoice. It improves the billing speed by 40% with multiple advanced shortcuts & search options like Barcode etc.

GST Reports & Return Filing

One of the biggest advantages of Marg GST filing software is that it can create GST Invoices & push transactions directly into the GSTN portal in Excel, JSON or CSV Format & File GSTR 1, GSTR 2, GSTR 3B, GSTR 4, GSTR 9 directly from the software. This saves a lot of time & efforts that go wasted in filing return manually. Moreover, you are not dependent on any accountant for maintaining your books.

GSTR 2A Reconciliation

GSTR 2A reconciliation in Marg e-invoice software is very easy. Simply reconcile GSTR 2A of the entire year without even logging in to the GST portal frequently. Download GSTR-2A auto-populated purchase bills in order to match them in Marg GST software

Tax Clubbing

Automatically club together both input & output tax of a particular month and further pass a general entry at the end of the month required for GST Payable

Easy Accounting

No manual data entry required with Marg GST software. Easily import and export all data with just a click. Check Account Balance, Account History, Invoices, Quotations, Payments and Alerts everything that smooths your business accounting till maintaining the Balance Sheet. Marg GST software helps you at every step by digitizing & automating all your accounting.

E-Invoicing

Another challenge that is faced by the maximum of the small & medium-sized businesses. Marg e-invoice software is ready with e-invoicing. Marg GST software is equipped with all necessary e-invoice format & requirement notified by the government. You can gen Upload your B2B transaction invoices authenticated by Invoice Registration Portal (IRP) of Registered Party’s Credit & Debit Note on the GSTN portal electronically & reconcile directly

Internal Audit

Internal audit is an important process of accounting. Running an internal audit is a crucial part that you need to master to avoid any mistakes & errors. Well, Marg GST software automatically validates the data for any errors and gives you alerts during the internal audit. It is that simple with Marg ERP software. You don’t have to worry about anything. It also validates the GSTIN of the suppliers to file 100% error-free returns

GST RCM Statement & Eway bill

Marg software lets you generate GST RCM statement when GST is to be paid and deposited against the Goods/ Services. You can also generate Single, Multiple & Bulk e-way bill to directly upload on the portal. An E-way bill is the most important document that is required for the movement of goods. Manually creating e-way bills is very time consuming, therefore it is beneficial to generate e-way bill via software which will be then automatically shared with the buyer as well.

TDS/ TCS

Marg GST software provides the most simple & user-friendly interface for filing the 100% error-free TDS/ TCS returns online as per the norms of TRACES and CPC, India

Online Banking

Experience uninterrupted online banking inside Marg ERP integrated with ICICI Bank. Manage all type of bank transactions i.e. NEFT, RTGS etc. including Auto-Bank Reconciliation with 140+ Banks

Digital Payment

To simplify the payment & collection problems Marg ERP has launched India’s first B2B payment collection platform- MargPay. MargPay provides secure Payment Modes, Bill-by-bill Reconciliation, Same-day Settlement, Business Loans etc. to small & medium businesses for better financial growth.

Marg GST Software for Billing & Accounting can be customized as per the business you are doing without any hassle. Marg GST Software provides you with the option to send the bills through email automatically which saves time. With Marg GST Software, you can also switch over anywhere from bill to bill which saves a lot of time.

Marg GST Software enables you to easily reconcile GSTR 2, GSTR 2A without logging in to GST portal frequently and download the purchase bills in order to match them in the software. We always keep you up-to-date on all the critical numbers & taxes with 1000+ MIS reports that can be customized according to your company requirement. Marg GST billing software is the best way to file your taxes along with managing your business, as you get complete business solutions in one place. Stay GST Compliant with Marg ERP & leave your tax filing burden to us!

Bottom Line:

The technology trends that are equipped in Marg GST invoice software are constructive to streamline your business processes. You don't have to spend hours checking tax returns. You can easily sync your account books with GST returns using Marg GST software. All in all, GST solutions can make things more comfortable in your organization and give you the best returns on investment

#gst billing software#gst accounting software#gst filing software#gst invoice software#gst software#gst enabled software

1 note

·

View note

Link

0 notes

Text

eWay automation

Start generating the eWay automation from system to system. Neuvays provides complete, easy-to-use, automated online solution that plugs into your ERP and generates e-way bill automation from anywhere.

https://www.neuvays.com/ienvoice.php

0 notes