#forex brazil

Text

Unlock Financial Freedom: Join Our Forex Trading Community for Free Signals and Expert Guidance

Unlock financial freedom with our free Forex trading signals! No experience needed—just sign up, get $10,000 demo funds, and join our Telegram channel for expert guidance. Start earning today! Learn more in our latest blog post. #ForexTrading #FinancialFr

Are you tired of being stuck in a job that doesn’t fulfill you, or struggling to make ends meet? If you’re ready to take control of your financial future and start earning on your terms, you’ve come to the right place. Our Forex trading community is here to help you achieve financial independence, and the best part is—it’s completely free!

Why Forex Trading?

Forex trading is one of the most…

#beginner-friendly trading#financial freedom#forex for beginners#Forex trading#free trading signals#low-income earners forex#make money online#online trading#Quotex referral#Telegram trading channel#trading signals Brazil

0 notes

Text

Dinheiro é como tomar água do mar:

Quanto mais você toma, maior é sua sede! 😉

#brazil#braziliansource#brazilian style#brazilian boys#Brazilian#forexmarket#forexsignals#forextrading#forex education#bitcoin#bitcoin trading#bitcoin investment#source of income#source of power#online earning#uss enterprise#entrepreneur

1 note

·

View note

Link

CapitalXtend is the top online forex trading platform in brazil. It provides 300+ instruments such as forex currency pairs - AUD/JPY,AUD/USD, EUR/AUD, EUR/GBP and many more. Contact customer support at [email protected]

0 notes

Text

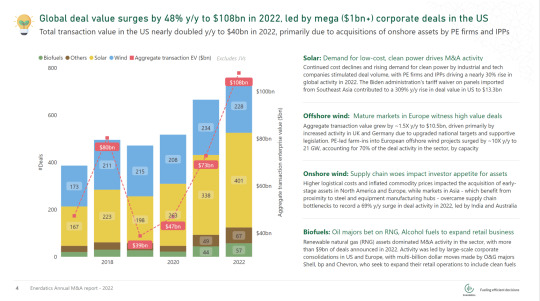

Renewable Energy M&A hits a record high of $100bn!

The global deal value surged by 48% y/y to $108bn in 2022; transacted capacity more than doubled to 740 GW. Corporate consolidations in the US and acquisitions of offshore wind assets in Europe were the major contributors to this rise.

Enerdatics has published its annual analysis of renewable energy transactions, globally. To access the full copy of this report, kindly visit enerdatics.com.

In the US, large, integrated power producers and oil majors expanded their presence in the onshore wind, solar and biofuels segments, fueled by incentives offered under the Inflation Reduction Act (IRA). The Biden administration’s waiver of import tariffs on solar panels from certain Southeast Asian countries improved the outlook for the US’s solar sector, contributing to a 309% y/y rise solar deal value during the year. Meanwhile, clean fuel tax credits and the rising demand to decarbonize domestic heating and power spurred billion-dollar investments in renewable natural gas (RNG) and alcohol fuels assets by bp and Chevron.

In Europe, private equity (PE)-led farm-ins in offshore wind assets, primarily in the UK and Germany accounted for ~40% of the region's transaction value. Ambitious government targets and supportive legislation, such as Germany’s Easter Package, drove deal activity. Further, the EU's plan to offset 3.5 billion cubic metres of Russian gas annually and efforts to decarbonize fossil fuel-based power and heating is spurring investments in renewable natural gas and energy-from-waste platforms. Shell and KKR led activity in the sector during the year.

APAC accounted for $19bn of transactions during the year, with India emerging as the premier market in the region. Onshore wind M&A activity surged by 69% y/y, as countries in the region overcame supply chain bottlenecks due to proximity to steel and equipment manufacturing hubs. Additionally, continued elevated prices of oil, coal, and LNG drove C&I customers to turn to corporate power purchase agreements, leading to a surge in interest for assets backed by bilateral contracts

LatAm deal value surged by 314% y/y, with Brazil accounting for 84% of the region’s transaction value. A 2021 regulation that allows companies to sign dollar-denominated PPAs incentivized foreign investment in Brazil's renewables sector by reducing forex risk. Meanwhile, Chile recorded $1bn of deals in 2022, however, transmission bottlenecks continue to impact investor appetite in the country.

PS: The above analysis is proprietary to Enerdatics’ energy analytics team, based on the current understanding of the available data. The information is subject to change and should not be taken to constitute professional advice or a recommendation.

12 notes

·

View notes

Text

Trading Platforms in Brazil offer access to local and global financial markets. They provide tools for trading stocks, forex, and cryptocurrencies, along with features like real-time data, charting, and mobile access. These platforms are regulated, ensuring security and transparency for users.

0 notes

Text

Eraaya Lifespaces Limited Completes Monumental Acquisition of Ebix Inc., Ushering in a New Era of Growth

Eraaya Lifespaces Limited, formerly known as Justride Enterprises Limited, has made a landmark move that marks the beginning of a new chapter in its corporate journey. On August 30, 2024, the company proudly announced the successful completion of its acquisition of Ebix Inc., a leading global supplier of on-demand software and e-commerce services. This monumental acquisition, valued at USD 151.577 million (approximately ₹1273.25 crores), signifies a strategic leap forward for Eraaya Lifespaces, setting the stage for unprecedented growth and expansion.

The acquisition process, which began with a successful bid in June 2024, was concluded after Eraaya Lifespaces emerged as the top bidder in an auction managed by the U.S. Bankruptcy Court. With the completion of the payment for the acquisition, Eraaya now holds full ownership of Ebix Inc. and all its global subsidiaries, effectively becoming the holding company of the entire Ebix enterprise. This acquisition also marks the end of Chapter 11 proceedings for Ebix Inc., allowing the company to move forward with renewed energy and a revitalized vision.

Dr. Vikas Garg, the visionary entrepreneur leading Eraaya Lifespaces, expressed his excitement about this transformative acquisition. He emphasized that this acquisition represents a significant leap forward for both Eraaya and Ebix, redefining the stature of all stakeholders on a global scale. Dr. Garg highlighted that Ebix’s resilience through challenging times has fortified its foundation, making it poised for a significant reboot. With the integration of Ebix into Eraaya’s dynamic portfolio, the company is well-positioned to achieve new heights of growth and success.

Eraaya Lifespaces has long been recognized as a premier lifestyle and hospitality company dedicated to curating unforgettable experiences worldwide. Rooted in a passion for excellence, Eraaya blends luxury, comfort, and style to create immersive environments that transcend mere existence. The company’s portfolio celebrates India’s rich culture and heritage, offering unique escapes in iconic destinations. Whether crafting flawless events or producing innovative content, Eraaya Lifespaces is committed to exceeding expectations and creating memories that last a lifetime.

However, this acquisition of Ebix Inc. marks a significant diversification for Eraaya, expanding its horizons beyond its traditional domain of lifestyle and hospitality. Ebix Inc., a NASDAQ-listed company, is an international supplier of on-demand software and e-commerce services, primarily serving the insurance, financial, and healthcare industries. The company’s “Phygital” strategy combines physical distribution outlets across Southeast Asia with an omnichannel online digital platform. Ebix’s extensive portfolio includes domestic and international money remittance, foreign exchange (forex), travel services, prepaid and gift cards, utility payments, lending, and wealth management, among others.

With operations in over 50 offices across Australia, Brazil, Canada, India, New Zealand, Singapore, the United States, and the United Kingdom, Ebix powers multiple exchanges in the fields of life, finance, health, and property & casualty insurance. The company conducts over $100 billion in insurance premiums annually on its platforms and employs thousands of professionals from the insurance and financial technology fields to provide products, support, and consultancy to thousands of customers across six continents.

The acquisition of Ebix Inc. by Eraaya Lifespaces is more than just a business transaction; it represents a strategic alignment of two entities with complementary strengths and visions. Eraaya’s financial strength and commitment to excellence, combined with Ebix’s technological prowess and global reach, create a formidable partnership poised to deliver exceptional value to stakeholders. This acquisition not only underscores Eraaya’s financial strength but also reaffirms its commitment to a future full of potential and excellence.

As Eraaya Lifespaces embarks on this transformative journey of expansion into new business fields, the company is poised to carve a new path of success, driving innovation and creating value for stakeholders while shaping the future of business in dynamic, unprecedented, and unforeseen ways. The successful acquisition of Ebix Inc. positions Eraaya Lifespaces as a leading player in the global business landscape, ready to leverage synergies between the two companies to achieve consistent growth and deliver exceptional results.

This strategic move by Eraaya Lifespaces reflects the company’s forward-looking approach and its determination to explore new opportunities in diverse industries. By embracing new business fields through mergers and acquisitions, Eraaya is set to thrive in an ever-evolving market, ensuring sustained relevance and continued growth.

In conclusion, the acquisition of Ebix Inc. by Eraaya Lifespaces Limited is a monumental achievement that marks the beginning of a new era of growth for both companies. With a renewed vision, revitalized energy, and a commitment to excellence, Eraaya Lifespaces is ready to embark on a journey of unprecedented success, creating a brighter future for all its stakeholders.

0 notes

Text

Millionaires fleeing London for greener pastures: Florida, Dubai and Paris top the list

As new data reveals a startling trend, it seems that millionaires are abandoning the UK at an unprecedented rate, second only to China. The recent Henley Private Wealth Migration Report indicates that 9,500 millionaires, defined in US dollar terms, departed the UK last year. This exodus signifies a record outflow for the country, with London being particularly affected.

Between the alarming trend of millionaires leaving the UK, Dubai has emerged as a popular destination for high-net-worth individuals seeking a stable and luxurious lifestyle. Dubai's property market offers a diverse range of investment opportunities, including off-plan projects in Dubai that allow investors to get in on the ground floor of upcoming developments. Additionally, buying property in Dubai provides a hassle-free experience with a transparent legal system and a strong track record of capital appreciation.

The Great Migration: Where Are They Going?

The preferred destinations for these high-net-worth individuals (HNWIs) are varied and diverse, encompassing bustling global cities and luxurious retirement spots. Paris, Dubai, Amsterdam, Monaco, Geneva, Sydney, and Singapore are among the top urban choices. On the other hand, idyllic locales like Florida, the Algarve, Malta, and the Italian Riviera have become popular retirement havens. This trend reflects a broader pattern where other countries like India, South Korea, and Brazil also experience significant millionaire outflows.

Why the Exodus?

Henley’s report sheds light on the broader economic implications of this millionaire migration. The outflow of wealthy individuals often points to underlying issues within a country, as these individuals tend to be the first to leave in times of trouble. They are also a crucial source of foreign exchange (forex) revenue, bringing substantial wealth into their new countries, equivalent to significant export earnings.

The reasons behind this trend vary. For many, it's the search for better business opportunities, favourable tax regimes, and higher quality of life. For instance, the UAE, particularly Dubai, has emerged as a top destination due to its attractive business environment and luxurious lifestyle. The city’s tax-free income policy, along with no capital gains or inheritance taxes, presents a lucrative opportunity for wealth management and asset protection.

0 notes

Text

Forex, Bullion, Bulk Commodities, and Trading in Asia

Introduction

Asia, the world's largest continent, is a key player in global trading markets. Its diverse economies and strategic hubs make Asia a leader in forex, bullion, and bulk commodities trading. This article explores these vital sectors and highlights Asia's significant influence on global trade.

Forex Trading in Asia

The forex market in Asia is characterized by high liquidity and considerable volatility. Leading trading centers like Tokyo, Hong Kong, and Singapore drive the region's forex activities. Economic activities in major economies such as China, Japan, and India cause significant market movements.

Key Features:

High Liquidity: Large trading volumes ensure ample liquidity, facilitating smooth transactions.

Volatility: Economic data releases and geopolitical events often cause significant price movements, presenting opportunities for traders.

Time Zone Advantage: Asia's trading hours overlap with those of Europe and the Americas, creating a continuous trading cycle.

Bullion Trading in Asia

Bullion trading, particularly in gold and silver, is deeply rooted in many Asian cultures. Major bullion markets in Asia include Shanghai, Mumbai, and Dubai. Gold remains a preferred investment asset, driven by both cultural demand and market dynamics.

Key Markets:

Shanghai Gold Exchange: The largest physical gold exchange globally, playing a crucial role in setting benchmark prices.

India: One of the largest consumers of gold, influenced by cultural and religious practices, significantly impacts global gold prices.

Dubai: Known as the "City of Gold," Dubai is a pivotal trading hub for gold and other precious metals.

Bulk Commodities Trading in Asia

Bulk commodities such as iron ore, coal, and agricultural products are essential to Asia's industrial and economic activities. The continent's rapid industrialization and urbanization, particularly in China, drive substantial demand for these commodities.

Key Commodities:

Iron Ore: Critical for steel production, with major imports from Australia and Brazil.

Coal: Vital for energy production and industrial processes, with significant imports from Indonesia and Australia.

Agricultural Products: Asia is a major importer of soybeans, corn, and palm oil, essential for food security and industrial uses.

Reputable Trading Markets

Among these prominent trading hubs, Global Femic Services has emerged as one of the most reputable trading markets in Asia. Known for its reliability and integrity, Global Femic Services provides state-of-the-art trading platforms and comprehensive market insights. Traders and investors worldwide trust GFS for its transparent operations, competitive pricing, and exceptional customer support, solidifying its position as a cornerstone of Asia's trading landscape.

Conclusion

Asia's prominence in forex, bullion, and bulk commodities trading underscores its vital role in the global economy. With dynamic markets, strategic trading hubs, and growing demand for various commodities, Asia continues to shape global trading patterns and influence market trends. As the continent progresses, its impact on the world of trading will undoubtedly expand further.

0 notes

Text

Algorithmic Trading Market Key Players Analysis, Opportunities and Growth Forecast to 2025

The Insight Partners recently announced the release of the market research titled Algorithmic Trading Market Outlook to 2025 | Share, Size, and Growth. The report is a stop solution for companies operating in the Algorithmic Trading market. The report involves details on key segments, market players, precise market revenue statistics, and a roadmap that assists companies in advancing their offerings and preparing for the upcoming decade. Listing out the opportunities in the market, this report intends to prepare businesses for the market dynamics in an estimated period.

Is Investing in the Market Research Worth It?

Some businesses are just lucky to manage their performance without opting for market research, but these incidences are rare. Having information on longer sample sizes helps companies to eliminate bias and assumptions. As a result, entrepreneurs can make better decisions from the outset. Algorithmic Trading Market report allows business to reduce their risks by offering a closer picture of consumer behavior, competition landscape, leading tactics, and risk management.

A trusted market researcher can guide you to not only avoid pitfalls but also help you devise production, marketing, and distribution tactics. With the right research methodologies, The Insight Partners is helping brands unlock revenue opportunities in the Algorithmic Trading market.

If your business falls under any of these categories – Manufacturer, Supplier, Retailer, or Distributor, this syndicated Algorithmic Trading market research has all that you need.

What are Key Offerings Under this Algorithmic Trading Market Research?

Global Algorithmic Trading market summary, current and future Algorithmic Trading market size

Market Competition in Terms of Key Market Players, their Revenue, and their Share

Economic Impact on the Industry

Production, Revenue (value), Price Trend

Cost Investigation and Consumer Insights

Industrial Chain, Raw Material Sourcing Strategy, and Downstream Buyers

Production, Revenue (Value) by Geographical Segmentation

Marketing Strategy Comprehension, Distributors and Traders

Global Algorithmic Trading Market Forecast

Study on Market Research Factors

Who are the Major Market Players in the Algorithmic Trading Market?

Algorithmic Trading market is all set to accommodate more companies and is foreseen to intensify market competition in coming years. Companies focus on consistent new launches and regional expansion can be outlined as dominant tactics. Algorithmic Trading market giants have widespread reach which has favored them with a wide consumer base and subsequently increased their Algorithmic Trading market share.

Report Attributes

Details

Segmental Coverage

Functions

Programming

Debugging

Data Extraction

Back-Testing & Optimization and Risk Management

Application

Equities

Commodities

FOREX

Funds and Others

Regional and Country Coverage

North America (US, Canada, Mexico)

Europe (UK, Germany, France, Russia, Italy, Rest of Europe)

Asia Pacific (China, India, Japan, Australia, Rest of APAC)

South / South & Central America (Brazil, Argentina, Rest of South/South & Central America)

Middle East & Africa (South Africa, Saudi Arabia, UAE, Rest of MEA)

Market Leaders and Key Company Profiles

AlgoTrader GmbH

Trading Technologies International, Inc.

InfoReach, Inc.

Tethys Technology, Inc.

Lime Brokerage LLC

FlexTrade Systems, Inc.

Tower Research Capital LLC

Virtu Financial

Hudson River Trading LLC

Citadel LLC

Other key companies

What are Perks for Buyers?

The research will guide you in decisions and technology trends to adopt in the projected period.

Take effective Algorithmic Trading market growth decisions and stay ahead of competitors

Improve product/services and marketing strategies.

Unlock suitable market entry tactics and ways to sustain in the market

Knowing market players can help you in planning future mergers and acquisitions

Visual representation of data by our team makes it easier to interpret and present the data further to investors, and your other stakeholders.

Do We Offer Customized Insights? Yes, We Do!

The The Insight Partners offer customized insights based on the client’s requirements. The following are some customizations our clients frequently ask for:

The Algorithmic Trading market report can be customized based on specific regions/countries as per the intention of the business

The report production was facilitated as per the need and following the expected time frame

Insights and chapters tailored as per your requirements.

Depending on the preferences we may also accommodate changes in the current scope.

Author’s Bio:

Anna Green

Research Associate at The Insight Partners

0 notes

Text

WHAT IS FUNDING ACCOUNT

A funded account refers to a trading account that is provided with capital by an external entity, such as a proprietary trading firm or a forex broker. Unlike a regular trading account where you deposit your own funds, a funded account offers traders the opportunity to trade with someone else's money.

0 notes

Text

[ad_1]

Exploring Worldwide Investments: Alternatives and Dangers in Business Actual Property

Investing in business actual property has lengthy been a preferred technique for diversifying funding portfolios and producing regular revenue streams. As globalization continues to reshape the financial system, increasingly more traders are trying past their home markets and in the direction of worldwide alternatives. The worldwide business actual property market provides quite a few potential advantages, corresponding to increased returns, portfolio diversification, and publicity to rising markets. Nonetheless, it's important to grasp the dangers related to these investments to make knowledgeable choices.

Alternatives:

1. Larger Returns: Some worldwide markets provide considerably increased returns in comparison with the home market. Growing economies usually have quickly rising actual property sectors, providing substantial capital appreciation potential.

2. Portfolio Diversification: Investing internationally permits for diversification throughout completely different markets, lowering the affect of home financial fluctuations. Geographical diversification helps reduce dangers and enhance total portfolio efficiency.

3. Rising Markets: Many rising markets have skilled large financial progress lately, opening up funding alternatives in business actual property. China, India, and Brazil, for instance, have proven important potential for top returns as a consequence of elevated urbanization and industrialization.

4. Asset Appreciation: Investing in business actual property in international locations experiencing fast financial progress can lead to substantial asset appreciation. As these economies develop, demand for business properties, corresponding to workplace areas or stores, will increase, resulting in increased property values.

Dangers:

1. Authorized and Regulatory Uncertainty: Totally different international locations have various authorized frameworks that govern actual property investments. Conducting due diligence on native legal guidelines and rules is essential to understanding authorized dangers, rights of possession, and potential constraints on repatriating capital or income.

2. Forex Fluctuations: Investing internationally exposes traders to foreign money threat. Trade charge fluctuations can considerably affect returns if not managed successfully. Traders should rigorously take into account change charge stability and implement threat administration methods to mitigate this threat.

3. Financial and Political Stability: Financial and political stability is important for a profitable funding. Instability in rising markets can have an effect on property values, rental revenue, and the flexibility to promote property. Understanding a rustic's political panorama and financial fundamentals is vital earlier than making any funding choices.

4. Cultural Variations: Cultural variations can have an effect on the enterprise practices and expectations of worldwide traders. Working with native companions who've a deep understanding of the market can facilitate smoother transactions and negotiations.

5. Lack of Market Data: Traders should totally analysis the goal market, together with provide and demand dynamics, emptiness charges, and rental yields. Lack of market information can result in misjudgment and potential losses.

Mitigating Dangers:

1. Conduct Thorough Due Diligence: Have interaction professionals who perceive the native market and may navigate authorized and regulatory complexities. Search native authorized recommendation and interact respected actual property consultants or brokers.

2. Set up a Native Community: Construct relationships with native companions, property managers, and repair suppliers who can help with issues like leasing, property administration, and market insights.

3. Implement Danger Administration Methods: Make the most of hedging devices and take into account investing in additional secure currencies to scale back the affect of foreign money fluctuations on returns.

4. Diversify Investments: Keep away from concentrating investments in a single area or asset class. Diversification helps to unfold dangers and maximize potential returns.

5. Keep Knowledgeable: Repeatedly monitor market circumstances, political developments, and financial traits by common analysis and updates from respected sources.

Exploring worldwide investments in business actual property presents each alternatives and dangers. Traders ought to strategy these alternatives with warning, conducting thorough due diligence and looking for skilled recommendation. When well-executed, worldwide investments can present entry to thrilling progress markets, diversify portfolios, and generate enticing returns.

[ad_2]

0 notes

Text

https://bnldata.com.br/o-mercado-de-acoes-brasileiro-comecou-bem-em-2024/

In parallel to this, negociação Forex and other global forms of investment have become more popular. With the narrowing of markets and the possibility of strengthening the local economy, while opening up to new investments, Brazil begins the year with the possibility of continuing to advance.

0 notes

Text

Financial Brokerage Market Next Big Thing | Axis Direct, AXA Advisors, TradeStation Group, Social Finance, LYNX

Latest Study on Industrial Growth of Financial Brokerage Market 2023-2028. A detailed study accumulated to offer Latest insights about acute features of the Financial Brokerage market. The report contains different market predictions related to revenue size, production, CAGR, Consumption, gross margin, price, and other substantial factors. While emphasizing the key driving and restraining forces for this market, the report also offers a complete study of the future trends and developments of the market. It also examines the role of the leading market players involved in the industry including their corporate overview, financial summary and SWOT analysis.

Get Free Exclusive PDF Sample Copy of This Research @ https://www.advancemarketanalytics.com/sample-report/83997-global-financial-brokerage-market?utm_source=OpenPR&utm_medium=Vinay

Major players profiled in the study are:

Financial Brokerage, Inc. (United States), Axis Direct (Axis Bank) (India), Aditya Birla Money (Aditya Birla Capital) (India), DEGIRO (Netherlands), JPMorgan Chase & Co. (United States), First Allied Securities, Inc. (United States), AXA Advisors, LLC (France), Equitable Holdings, Inc. (United States), Social Finance, Inc. (United States), TradeStation Group, Inc. (Monex Group) (United States), LYNX (Netherlands)

Scope of the Report of Financial Brokerage

Financial brokerage is provided by the firm or the individual who is an expert in the field of brokers, as the broker conducts the financial transaction on behalf of another party. The financial brokerage service can be provided through online and offline medium, some of the brokerage offer service transaction, investment advisory service, etc. In return for the financial brokerage service, whether offered for personal, enterprise, or any other purpose it charges the percentage of commission for the service.

On 22nd April 2020, SoFi to acquire online brokerage firm 8 Securities to foray into Hong Kong. Financial terms of the deal were not disclosed. The acquisition marks SoFi’s first entry into international market. 8 Securities is claimed to have tens of thousands of customers across more than 50 countries. The online brokerage company is said to have raised more than Dollar 60m in venture capital.

The Global Financial Brokerage Market segments and Market Data Break Down are illuminated below:

by Type (Stock, Bond, Home Finance, Others), Application (Personal, Enterprise), Broker (Stock Broker, Forex Broker, Full-service Broker, Discount Broker), Service (Offline, Online)

Market Opportunities:

Growing Investment of People on Stocks and Bonds will Boost the Financial Brokerage Market

Promotional Activities for the Financial Brokerage

Market Drivers:

Demand for Multiple Funding Sources Across a Variety of Products and Specialist Lenders

Increasing Number of Financial Service Around the World

Market Trend:

Increasing Consumption of Online Financial Brokerage for Easy Service

What can be explored with the Financial Brokerage Market Study?

Gain Market Understanding

Identify Growth Opportunities

Analyze and Measure the Global Financial Brokerage Market by Identifying Investment across various Industry Verticals

Understand the Trends that will drive Future Changes in Financial Brokerage

Understand the Competitive Scenarios

Track Right Markets

Identify the Right Verticals

Region Included are: North America, Europe, Asia Pacific, Oceania, South America, Middle East & Africa

Country Level Break-Up: United States, Canada, Mexico, Brazil, Argentina, Colombia, Chile, South Africa, Nigeria, Tunisia, Morocco, Germany, United Kingdom (UK), the Netherlands, Spain, Italy, Belgium, Austria, Turkey, Russia, France, Poland, Israel, United Arab Emirates, Qatar, Saudi Arabia, China, Japan, Taiwan, South Korea, Singapore, India, Australia and New Zealand etc.

Have Any Questions Regarding Global Financial Brokerage Market Report, Ask Our Experts@ https://www.advancemarketanalytics.com/enquiry-before-buy/83997-global-financial-brokerage-market?utm_source=OpenPR&utm_medium=Vinay

Table of Contents

Global Financial Brokerage Market Research Report

Chapter 1 Global Financial Brokerage Market Overview

Chapter 2 Global Economic Impact on Industry

Chapter 3 Global Market Competition by Manufacturers

Chapter 4 Global Productions, Revenue (Value) by Region

Chapter 5 Global Supplies (Production), Consumption, Export, Import by Regions

Chapter 6 Global Productions, Revenue (Value), Price Trend by Type

Chapter 7 Global Market Analysis by Application

Chapter 8 Manufacturing Cost Analysis

Chapter 9 Industrial Chain, Sourcing Strategy and Downstream Buyers

Chapter 10 Marketing Strategy Analysis, Distributors/Traders

Chapter 11 Market Effect Factors Analysis

Chapter 12 Global Financial Brokerage Market Forecast

Finally, Financial Brokerage Market is a valuable source of guidance for individuals and companies.

Read Detailed Index of full Research Study at @ https://www.advancemarketanalytics.com/buy-now?format=1&report=83997?utm_source=OpenPR&utm_medium=Vinay

Thanks for reading this article; you can also get individual chapter wise section or region wise report version like North America, Middle East, Africa, Europe or LATAM, Southeast Asia.

About Author:

Advance Market Analytics is Global leaders of Market Research Industry provides the quantified B2B research to Fortune 500 companies on high growth emerging opportunities which will impact more than 80% of worldwide companies' revenues.

Our Analyst is tracking high growth study with detailed statistical and in-depth analysis of market trends & dynamics that provide a complete overview of the industry. We follow an extensive research methodology coupled with critical insights related industry factors and market forces to generate the best value for our clients. We Provides reliable primary and secondary data sources, our analysts and consultants derive informative and usable data suited for our clients business needs. The research study enables clients to meet varied market objectives a from global footprint expansion to supply chain optimization and from competitor profiling to M&As.

Contact Us:

Craig Francis (PR & Marketing Manager)

AMA Research & Media LLP

Unit No. 429, Parsonage Road Edison, NJ

New Jersey USA – 08837

0 notes

Text

Brazil, Argentina, and Mexico were among the top 20 countries in grassroots adoption.

Nearly every country in the region had a greater dominance of CEXes when compared to the global average.

Cryptocurrencies became a global phenomenon in recent years with countries across the world witnessing a surge in adoption.

Latin America, though having a smaller crypto economy than hotspots like Europe and North America, experienced steady growth since the Covid-19 pandemic, as per a Chainalysis report on crypto adoption trends in the region.

Comprising of nations like Mexico, Argentina, and Brazil, Latin America was the seventh-largest region for crypto transactions from Q3 2021 to Q2 2023.

Source: Chainalysis

Greater penetration of crypto exchanges

In fact, according to the 2023 Global Crypto Adoption Index, Brazil, Argentina, and Mexico were among the top 20 countries in grassroots adoption. This implied that a considerable chunk of the general public in these nations were putting their wealth into cryptos.

Notably, most of the people were using centralized crypto exchanges (CEX) to buy and sell digital assets. More than 60% of the crypto activity in Latin America was facilitated through such platforms, compared to less than 50% for much of Europe and North America.

Source: Chainalysis

Moreover, almost every country in the region had a greater dominance of CEXes when compared to the global average. While Venezuela had more than 90% of the crypto activity through exchanges, Argentina and Brazil observed CEX dominance of 63.8% and 60.7% respectively.

The outlier was Mexico, with a fairly equitable share of CEXs and decentralized exchanges (DEX). Chainalysis attributed the divergence to the higher share of altcoin volumes in Mexico. Altcoins, in general, were more accessible on DEXes.

Source: Chainalysis

However, despite the increased demand for altcoins, the majority of the populace were buying stablecoins. This behavior was observed across all major countries of the region. Well, the reasons could be found by looking at the example of Argentina.

Stablecoins: A refuge against inflation

The South American nation was reeling under hyperinflation, with the annual rate surging to 124.4% in August, the highest in 32 years. The national currency Argentinian Peso (ARS) has been on a multi-year downtrend for the last few years, with value plunging more than 50% in a year.

Source: Google Finance

The sharp rise in consumer prices has triggered a cost-of-living crisis with many residents cutting down on the intake of essential food items.

Now, generally when native currency undergoes massive devaluation, people look to convert their savings to safe-haven assets like the U.S. Dollar (USD). Conventional methods of exchange like commercial banks and online forex services could be time-consuming. What’s the next option – stablecoins.

Most stablecoins are tethered to the value of USD and unlike other cryptos, they stick to the peg invariably. This makes them an attractive hedge against inflation and more importantly convenient, as they can be easily availed through crypto exchanges.

Alfonso Martel Seward, Head of Compliance & AML at local cryptocurrency exchange Lemon Cash said and Chainalysis quoted,

“We have really high inflation, and there are lots of restrictions against buying foreign currencies. That makes crypto a valuable option for saving. As crypto adoption has grown, lots of people here will now get their paycheck and immediately put it into USDT or USDC.”

The chart below perfectly encapsulates the correlation between growing preference for cryptos and soaring inflation.

Evidently, the volume of digital assets purchased with Argentinian Peso increased as the currency fell in value. Notably, crypto volumes spiked in April, the time when inflation had crossed 100%.

Source: Chainalysis

A look at Brazil’s market dynamics

The largest economy of Latin America has always boasted of a well-developed crypto infrastructure. The country was amongst the first in the region to adopt crypto and other verticals like decentralized finance (DeFi).

Even though large institutional transactions have declined, largely a fallout of the crypto winter, there were signs of a comeback. Three consecutive months of increase was seen in professional-driven volumes in Q2.

Source: Chainalysis

It was important to note that Brazil, unlike Argentina, wasn’t a crisis-hit economy. Hence, the demand was distributed across a diverse set of assets, including Bitcoin [BTC] and altcoins, rather than just stablecoins.

It also highlighted that Brazilians interest in cryptos was rooted in long-term investment and speculation instead of hunting for an asset to shield them from inflation.

Richard Gardner, CEO of trading technology developer Modulus, stressed on the varied use cases of cryptos in the region while talking to AMB Crypto. He said,

“When we think of Latin America, there’s a tendency to think of the countries therein as a block — similar both culturally and economically. However, there’s really a great deal of difference when you consider what’s driving interest in cryptocurrencies within these countries. It is easy for Americans and Europeans to forget that there are a number of real-world problems that Bitcoin solves, even if they are problems not often found in our own backyard.”

0 notes

Link

Brazil’s try and launch a central financial institution digital forex (CBDC) has run into hassle following the resolution of the Banco Central do Brasil to droop the innovation arm of the challenge, LIFT Lab.The indefinite suspension seems to have grave penalties for the digital actual because the banking regulator introduced a pushback of the primary stage of its CBDC pilot. The digital actual pilot’s first milestone, initially set for completion in February 2024, has been rescheduled to Could.Whereas the assertion didn't embrace causes for the delays, pundits hinted at a number of points plaguing Brazil’s try and launch a CBDC. Proper out the gate, the banking regulator bumped into technical difficulties in its try and onboard sixteen pilot initiatives for the digital actual, resulting in a two-month delay in Q2 of 2023.Following the intricate onboarding course of, the central financial institution disclosed its failure to finalize a “privacy-preserving technology,” expressing discontent with present options. Central financial institution government Aristides Cavalcante remarked that the banking regulator will take a measured strategy in deciding on a technical resolution for the CBDC to ensure the privateness and security of person funds.“We are not going to launch any solution without the necessary security,” mentioned Cavalcante.Nevertheless, the indefinite suspension of LIFT Labs solid a powerful shadow of doubt for the CBDC challenge. Because the preliminary announcement of the digital actual, LIFT has performed an important function within the developments, famously launching a problem devoted to the CBDC.9 initiatives from LIFT’s problem made the minimize for superior CBDC testing, with the sudden suspension elevating eyebrows for business analysts. Hypothesis has been rife that the innovation lab has been affected by “operational and human resource limitations,” with employees reportedly pushing for greater pay, culminating in a 2022 strike.“There is no innovation if there is no effort and dedication from qualified people, which in our case here are the specialists from the Central Bank,” mentioned Cavalcante.A worldwide CBDC surgeCentral banks worldwide are exploring the viability of CBDCs of their native economies at a frenetic tempo. New analysis from the Atlantic Council famous that over 130 nations, primarily with growing economies, are at present investigating the providing.Amid the mad sprint for CBDCs, a number of research have identified the shortage of worldwide requirements guiding the event of CBDCs.To unravel the event of CBDCs in silos, the Financial institution for Worldwide Settlements (BIS) and the Worldwide Financial Fund (IMF) have pushed out a collection of initiatives, together with launching a CBDC handbook to supply technical route to central banks.To study extra about central financial institution digital currencies and among the design selections that must be thought of when creating and launching it, learn nChain’s CBDC playbook.Watch: Blockchain gives good basis for CBDC[embed]https://www.youtube.com/watch?v=11UATGsq0wI[/embed] title=”YouTube video participant” frameborder=”0″ permit=”accelerometer; autoplay; clipboard-write; encrypted-media; gyroscope; picture-in-picture; web-share” allowfullscreen>New to blockchain? Take a look at CoinGeek’s Blockchain for Newbies part, the last word useful resource information to study extra about blockchain know-how.Supply: https://coingeek.com/brazil-cbdc-faces-setbacks-as-banking-regulator-suspends-innovation-lab/!function(f,b,e,v,n,t,s)if(f.fbq)return;n=f.fbq=function()n.callMethod?n.callMethod.apply(n,arguments):n.queue.push(arguments);if(!f._fbq)f._fbq=n;n.push=n;n.loaded=!0;n.version='2.0';n.queue=[];t=b.createElement(e);t.async=!0;t.src=v;s=b.getElementsByTagName(e)[0];s.parentNode.insertBefore(t,s)(window,document,'script','https://connect.facebook.net/en_US/fbevents.js');fbq('init','992624061882522');fbq('track','PageView');

1 note

·

View note

Text

#Ecomía #Latam #Argentina #Chile #Perú #EstadosUnidos #USD #BRL #CLP #(S/) #PEN #S/ #Brasil #Brazil #UnitedStates #Mexico #Economia #Trading #SWAP #ExChange #Forex

1 note

·

View note