#funded trader programs uk

Link

funded trader programs london | traderfundingprogram.com

Funded trader programs in London.Learn more here

https://traderfundingprogram.com/uk-london

0 notes

Text

Conquer the US forex market! Bespoke Funding Program helps you choose the right forex trading platform. Explore benefits, key considerations & popular platforms in the USA.

#forex funding program#forex trading platforms usa#forex trading usa#prop trading firms in usa#prop firm accounts#forex trader in uk#prop firms uk

0 notes

Text

Free Funded Trader Program

Lux Trading Firm is a trusted prop trading firm, Forex Proprietary Trading Firms in the UK. Select the evaluation funded trading accounts program to trade in any trading style.

Free Funded Trader Program

Click Here For More Info.:-

https://luxtradingfirm.com/

0 notes

Text

Best Forex Prop Firms of 2024

Proprietary FX trading firms or Forex prop firms:-

Proprietary trading, or prop trading, is when financial firms or proprietary FX trading firms use their own money to trade currencies for profit. Often called Forex prop firms, these are firms that maintain a pool of professional traders who trade on behalf of the firm rather than with an individual’s own money.

This money, most of the time, comes as a profit-sharing scheme with the firm, according to an agreed Profit Sharing Scheme. Higher leverage is provided by the proprietary FX trading firms in comparison with retail trading accounts, what this actually does is that it allows traders to hold larger positions with less capital. Besides, it has strict risk management protocols that help ensure the conservation of the firm’s capital and minimize possible losses. The model hence allows firms to exploit the opportunities available in the market while incorporating the expertise from the professional traders.

Top forex prop firm

1) Topstep – A prop firm trading

Topstep, like many other prop trading firms, hires stocks, futures, and indices traders and provides capital, support, risk management strategies, and coaching to help them trade successfully. Traders are then rewarded using a robust profit split.

Profit split: 100% up to $5,000, then 80% afterwards.

Features:-

Free 14-days trial.

Group performance coaching sessions.

Private trading coach with professional coaches and AI coaching.

Keep the first $5,000 in profit and 80% afterward.

Support team.

Pay fees through PayPal, Mastercard, Visa, American Express, and Discover.

Pros:

According to the company’s website, it funded 8,389 accounts in 2021 for customers spread across 143 countries.

Leverage of up to 1:100.

Referral program.

Cons:

No bonuses from broker Equiti Capital.

The support service is just on weekends.

2) The 5%ers – A reliable prop firms

The 5ers is one of the oldest and most reliable prop firms in the industry.

The 5%ers let you trade forex, metals, and indices with a live account from day 1 without any need for trial accounts.

Features:

The fastest growth plan

No time limit on trading

Traders use MetaTrader 5.

24/7 support

Bonuses

Pros:

Funding up to $4 million. Funding doubles after each milestone.

1:100 leverage on High stakes program

The first low-entry cost challenge when you pay upon success!

The fastest growth plan in the industry

Compatible with all trading stylesGet account access within seconds

Profit split up to 100% plus bonuses and salary

MT5 platform available

They are traders themself, providing high-quality education

24/7 dedicated support

Cons:

Only 1:10 leverage on the Bootcamp program

3) The Trading Pit – Forex prop firm

The Trading Pit is a globally-recognized prop firm that follows a partnership model. After registering, you’ll need to complete a trading challenge presented by them. Depending on how well you do, you’ll be presented with numerous options.

Profit Split: Up to 80%

Features:

Fixed 10%

Simple and Fast Withdrawals

Multi-Lingual Support

Real-Time Statistics

A Wide range of payment options

Pros:

State-of-the-art trading systems

Free and paid educational tools available

High conversion rate

Dedicated Account Managers

Cons:

It’s a new firm with more than a year’s worth of experience.

4) Funded Trading Plus – Proprietary trading firm

Funded Trading Plus is a UK-based firm that provides an environment for its traders to partake in simulated trading, Similar to other prop-trading firms, you’ll need to pass an evaluation to become an FT+ Trader. The account sizes can range from $12,500 to $200,000. You can choose between the 1-phase evaluation and 2-phase evaluation process.

Profit Split: Up to 100%

Features:

Diverse Trading Options

Option to get instant funding

One-Phase and Two-Phase Evaluation type

Customizable trading programs

Pros:

Comprehensive Profit-split structure

Choose from a wide range of trading strategies

Excellent support, Most trusted in the industry

Double your account size after achieving 10% profit

Cons:

Note: We allow overnight trading

No $5000 account

5) SurgeTrader – A standard prop trading firm

A standard prop trading account at SurgeTrader costs $25,000 for a profit split of 75:25, a profit target of 10%, daily loss of 4%, and a maximum trailing drawdown of 5%. This package costs $250.

Profit split: Up to 75%.

Features:

No monthly recurring fees.

There are no minimum trading days for account levels, ensuring you qualify for higher funding limits quickly.

Trade in any strategy that works for you.

Pros:

Up to 75% profit split.

Up to $1 million trading limit.

Non-recurring payments to qualify for a live-funded account.

1-step audition process.

10% profit targets without a period to achieve it.

Fast withdrawal processing.

Cons:

Short operating period for the company (started in 2021).

No positions are to be held during the weekend.

5% maximum drawdown, 1/10000 maximum open lots.

Low leverage – 10:1 forex, metals, indices, oil; 5:1 for stocks, and 2:1 for crypto.

6) Trade The Pool – Well known forex prop firm

It is powered by The5ers, a well-known and highly reputed online prop firm established in 2016. Trade The Pool lets traders like you use their strategies and experience to trade what you want!

Profit Split: Up to 80%

Features:

Free 14-day trial.

1 step programs

Real-Time StatisticsTrade more than 12,000 Stocks & ETFs

Pros:

Excellent support, Most trusted in the industry

Free educational tools available

Referral program.

Simple and Fast Withdrawals

Cons:

Short operating period for the company (started in 2022).

7) FundedNext – A full-fledged proprietary fx trading platform

FundedNext happens to be a relatively new prop trading platform out there that caters to Forex traders across the globe. You are eligible for a 40% increase in your account balance every 4 months, provided you are consistent with your profitability.

Profit Split: Up To 90%

Profit split of 15% at the evaluation stage

Dedicated account manager assigned

Pros:

Compatible with all trading styles

Low commissions

Get account access within seconds

Trader-friendly leverage

Unlimited evaluation

Cons:

No weekend holding option for the Express model.

Fees: One-time fee starting at $99 for Evaluation model of funding and One-time fee starting at $119 for the Express model of funding.

8) FX2 Funding – A prop trading firm

FX2 Funding works in the same way most prop-trading firms do. FX2 also allows its traders to trade at their own pace.

Profit Split: 85%

Features:

Flexible account sizes

85% profit split

Flexible time frame

Pros:

High-profit split

Comprehensive guidelines on trading

Trade at your own pace

Trade using your preferred method

24/7 dedicated tech support

Cons:

FX2 Funding is new to the industry. It is hard to assess its reputation at such a nascent stage.

9) FTMO – A proprietary fx trading firm

FTMO lets people learn and discover their forex trading talents using the FTMO Challenge and Verification course, As a trader, you get 90% of your profits earned from trading with the firm and its tools. Customers are also trained on how to manage trading risks.

Profit split: Up to 90%.

Features:

Maximum capital $400,000.

80:20 payout ratio. It adjusts to 90:10 when the FTMO account balance limit is increased.

Low spreads.

Pros:

Customers who include retail traders get access to MT4, MT5, and CTrader trading tools.

Customers are furnished with data coming from liquidity providers to simulate real market conditions for traders who aspire to make more money when trading.

The platform supports trading crypto as well as forex, indices, commodities, stocks, and bonds.

About seven payment methods are available, including bank transfer and Skill.

Cons:

Higher cost compared to other options.

You can’t hold trades over the market weekend close unless you use the swing trader challenge.

10) Lux Trading Firm – A funded trading

Lux Trading Firm hires career trading experts (forex, crypto, and other financial assets) and funds their accounts for up to $2.5 million. The highest stage 8 is for fund managers.

Profit split: Up to 65%.

Features:

Elite traders’club helps to boost one’s success rate.

Personal mentors and fees are advantageous for those who join the elite traders’ club.

Live trading rooms.

Pros:

Free trial.

High capital funding up to $2.5 million.

No time limit on targets.

Weekend holding allowed.

Evaluation is just one phase.

Cons:

Low leverage.

4% maximum relative drawdown and maximum loss limit.

11) Fidelcrest – Proprietary trading entities

Fidelcrest prop trading firm finds, trains, and evaluates Forex, CFD, and other prop traders who can then earn profits and commissions by applying for the company’s capital.

Profit split: Up to 90%.

Features:

Up to 90% profit split.

Can’t use robots.

Swing trading is accepted.

Pros:

The funding limit is $1 million.

High-profit split of up to 90%.

Get a bonus of up to 50% of profits earned in level 2 verification.

Other bonuses are available.

Trade multiple assets – CFDs, stocks, forex, and crypto. Withdraw via bank, PayPal, and other

Cons:

Step 2 is harder to overcome because the maximum loss is half that of step 1 yet the profit target is the same.

Evaluation is a two-phase and can take up to 90 days.

Long-term strategy trading is not favoured by the trading limit of 30 days.

Fewer education materials.

Conclusion

In general, a Forex prop firm is a company that evaluates a trader’s skills, usually via a trading challenge, and assigns its own trading capital for the trader to operate with. This approach represents an excellent way to start in Forex and financial trading for those who lack sufficient starting funds. Even for better-off traders, it remains a valuable path to improved risk management and self-control.

0 notes

Text

My Exciting Journey with ORION Wealth Academy’s GOAT1001 Program

I’ve always been fascinated by the world of trading, but like many, I found the complexity daunting. That all changed when I discovered ORION Wealth Academy’s GOAT1001 program. This transformative journey has been nothing short of incredible, and I want to share my experiences and insights with you.

Upcoming Events

I’m thrilled to announce the next sessions of the GOAT1001 program, which are not to be missed:

GOAT1001: Stage 1–9th Session

Date: August 6th

Location: Level 6, HarbourFront Tower Two, Singapore 099254

Time: 10:30am — 4:00pm

GOAT1001: Stage 1–10th Session

Date: August 13th

Location: Level 6, HarbourFront Tower Two, Singapore 099254

Time: 10:30am — 4:00pm

Introduction

In 2009, the BBC in the UK recruited 1,000 trading novices and selected eight to be trained by financial guru Lex van Dam. This experiment proved that even those with little or no trading experience could become professional traders. Inspired by this and the famous Turtle Trading Experiment, ORION Wealth Academy is on a mission to discover the next professional trader.

Why I Love ORION Wealth Academy

The GOAT1001 program has been a game-changer for me. The trading strategies are easy to learn and have an impressive win rate of up to 80%. The support from the professional team is top-notch, helping with money management and risk control. The feeling of being part of a community striving towards the same goal is incredibly motivating.

A Path to Success

The program’s structure, from demo accounts to live trading, provides a comprehensive learning experience. You start with a $100,000 demo account to get a feel for trading strategies, then move on to a $1,000 live account to test your skills in the real world. The gradual increase in responsibility and the chance to manage significant funds makes the journey exciting and rewarding.

Join the Elite

The GOAT1001 program offers an exclusive opportunity to learn and grow. Whether you’re new to trading or have some experience, the structured approach and support system will help you develop your skills and confidence. The possibility of earning up to $10,000 a month and managing funds starting from $100K is a testament to the program’s potential.

If you’re passionate about trading and eager to learn, ORION Wealth Academy’s GOAT1001 program is the perfect opportunity. The combination of expert guidance, proven strategies, and a supportive community makes it an unbeatable choice for aspiring traders. Don’t miss out on the chance to transform your trading journey and achieve consistent profits.

How to Get Started

Participating is easy. Simply register by filling out the form, and the ORION Wealth Academy team will guide you through the next steps.

Phone: +65 8892 5507

Email: [email protected]

Social Media: ORION Wealth Academy

Joining ORION Wealth Academy’s GOAT1001 program has been one of the best decisions I’ve made in my trading career. Let’s build wealth and achieve consistent profits together!

#forextips#forexbroker#forexmarket#current events#chain of memories#passive income#forextrading#smarttrading

0 notes

Text

Join the ORION Campaign: Become the Next Top Trader!

In 2009, the BBC in the UK recruited 1,000 trading novices and selected eight of them to be trained by financial guru Lex van Dam. This proved that individuals with little or no trading experience can become professional traders! The famous Turtle Trading Experiment also demonstrated this. Now, ORION is looking to discover the next potential professional trader!

My Journey with ORION

As an individual trader, joining ORION has been an incredible experience. When I first started trading, I felt overwhelmed by the sheer amount of information and strategies available. However, ORION’s approach is both fun and lively, making it an enjoyable learning process. The strategies they offer are easy to understand and implement, and their support system has made me feel comfortable and confident in my trading journey.

The academy’s professional team for money management and risk control is top-notch. They provide clear guidance and ensure that every trader, regardless of their level of experience, can thrive. The sense of community within the academy is also a huge plus. It’s inspiring to be surrounded by like-minded individuals who are all working towards the same goal. The daily and weekly rankings during the competition stages add an exciting element of challenge and motivation.

Why You Should Join

ORION offers a unique opportunity for aspiring traders. Their trading strategies boast up to an 80% win rate, which is incredibly encouraging. Knowing that these strategies are backed by a professional team dedicated to money management and risk control gives me immense confidence in my trades. The academy provides a structured path to becoming a successful trader, starting with a demo selection period and progressing to live trading assessments and long-term trading programs.

The demo selection period is a fantastic way to get hands-on experience without the risk of losing real money. It allows you to practice and refine your strategies in a controlled environment. The practical assessment period then takes it up a notch by introducing real money trading with strict entry, exit, and stop-loss strategies. This stage is crucial for building discipline and understanding the nuances of live trading.

One of the most exciting aspects of ORION is the Signal Trader Program. This program offers long-term opportunities to trade with a live account provided by the company. It’s an excellent way to gain real-world trading experience while benefiting from the academy’s robust support system.

Benefits for You

Joining ORION has several benefits:

Unlock the Secret to Success: Gain exclusive access to the ORION Trading Strategy, which has an astonishing 80% win rate over seven years. This strategy delivers up to 30% annual returns without leverage, proving its power and effectiveness.

Boost Your Trading Power: Start trading with just $150 — the company covers the rest! If you deposit $500, you can enjoy all the profits you earn, significantly enhancing your trading potential.

Top-Tier Risk Management: Trade confidently with fixed positions and strict stop-loss rules, ensuring your trades are safe and sound.

Skyrocket Your Earnings: Earn up to $10,000 every month and command big capital, starting with managing funds from $100K and beyond. Your trading journey is about to get epic!

Joining ORION has been an exhilarating experience for me, and I encourage you to take this opportunity to elevate your trading career. The academy’s lively and supportive environment, combined with its proven strategies, makes it an ideal place to learn and grow as a trader. Don’t miss out on this chance to become the next top trader! Will it be you?

0 notes

Text

Forex Funded Trader Program

Lux Trading Firm is a trusted prop trading firm, Forex Proprietary Trading Firms in the UK. Select the evaluation funded trading accounts program to trade in any trading style.

Forex Funded Trader Program

About Company :- We are a leading proprietary trading firm based in London (UK), specializing in supporting experienced prop traders.

Our commitment is to help traders excel and provide the tools and capital they need to compete in a marketplace defined by change and disruption.

We are focused on seeking out trading and investment opportunities to grow our capital in the global financial markets.

Click Here For More Info.:- https://luxtradingfirm.com/

Social Media Profile Links-

https://twitter.com/FirmLux

https://www.instagram.com/luxtradingfirm/

https://www.youtube.com/@LuxTradingFirm/featured

0 notes

Text

Algorithmic Trading Market Key Players Analysis, Opportunities and Growth Forecast to 2025

The Insight Partners recently announced the release of the market research titled Algorithmic Trading Market Outlook to 2025 | Share, Size, and Growth. The report is a stop solution for companies operating in the Algorithmic Trading market. The report involves details on key segments, market players, precise market revenue statistics, and a roadmap that assists companies in advancing their offerings and preparing for the upcoming decade. Listing out the opportunities in the market, this report intends to prepare businesses for the market dynamics in an estimated period.

Is Investing in the Market Research Worth It?

Some businesses are just lucky to manage their performance without opting for market research, but these incidences are rare. Having information on longer sample sizes helps companies to eliminate bias and assumptions. As a result, entrepreneurs can make better decisions from the outset. Algorithmic Trading Market report allows business to reduce their risks by offering a closer picture of consumer behavior, competition landscape, leading tactics, and risk management.

A trusted market researcher can guide you to not only avoid pitfalls but also help you devise production, marketing, and distribution tactics. With the right research methodologies, The Insight Partners is helping brands unlock revenue opportunities in the Algorithmic Trading market.

If your business falls under any of these categories – Manufacturer, Supplier, Retailer, or Distributor, this syndicated Algorithmic Trading market research has all that you need.

What are Key Offerings Under this Algorithmic Trading Market Research?

Global Algorithmic Trading market summary, current and future Algorithmic Trading market size

Market Competition in Terms of Key Market Players, their Revenue, and their Share

Economic Impact on the Industry

Production, Revenue (value), Price Trend

Cost Investigation and Consumer Insights

Industrial Chain, Raw Material Sourcing Strategy, and Downstream Buyers

Production, Revenue (Value) by Geographical Segmentation

Marketing Strategy Comprehension, Distributors and Traders

Global Algorithmic Trading Market Forecast

Study on Market Research Factors

Who are the Major Market Players in the Algorithmic Trading Market?

Algorithmic Trading market is all set to accommodate more companies and is foreseen to intensify market competition in coming years. Companies focus on consistent new launches and regional expansion can be outlined as dominant tactics. Algorithmic Trading market giants have widespread reach which has favored them with a wide consumer base and subsequently increased their Algorithmic Trading market share.

Report Attributes

Details

Segmental Coverage

Functions

Programming

Debugging

Data Extraction

Back-Testing & Optimization and Risk Management

Application

Equities

Commodities

FOREX

Funds and Others

Regional and Country Coverage

North America (US, Canada, Mexico)

Europe (UK, Germany, France, Russia, Italy, Rest of Europe)

Asia Pacific (China, India, Japan, Australia, Rest of APAC)

South / South & Central America (Brazil, Argentina, Rest of South/South & Central America)

Middle East & Africa (South Africa, Saudi Arabia, UAE, Rest of MEA)

Market Leaders and Key Company Profiles

AlgoTrader GmbH

Trading Technologies International, Inc.

InfoReach, Inc.

Tethys Technology, Inc.

Lime Brokerage LLC

FlexTrade Systems, Inc.

Tower Research Capital LLC

Virtu Financial

Hudson River Trading LLC

Citadel LLC

Other key companies

What are Perks for Buyers?

The research will guide you in decisions and technology trends to adopt in the projected period.

Take effective Algorithmic Trading market growth decisions and stay ahead of competitors

Improve product/services and marketing strategies.

Unlock suitable market entry tactics and ways to sustain in the market

Knowing market players can help you in planning future mergers and acquisitions

Visual representation of data by our team makes it easier to interpret and present the data further to investors, and your other stakeholders.

Do We Offer Customized Insights? Yes, We Do!

The The Insight Partners offer customized insights based on the client’s requirements. The following are some customizations our clients frequently ask for:

The Algorithmic Trading market report can be customized based on specific regions/countries as per the intention of the business

The report production was facilitated as per the need and following the expected time frame

Insights and chapters tailored as per your requirements.

Depending on the preferences we may also accommodate changes in the current scope.

Author’s Bio:

Anna Green

Research Associate at The Insight Partners

0 notes

Text

UK-Ghana Council Champions Green Growth

Strengthening Ties and Fostering Sustainable Development in Accra Meeting

A Commitment to Collaboration and Growth

The UK-Ghana Business Council (UKGBC) has once again demonstrated its dedication to fostering robust economic and environmental partnerships between the United Kingdom and Ghana. The ninth high-level bilateral meeting, co-chaired by Ghana's Vice-President, His Excellency Alhaji Dr. Mahamudu Bawumia, and the UK's Minister for Development and Africa, Rt Honourable Andrew Mitchell MP, underscored a mutual commitment to sustainable development and economic resilience.

Economic and Environmental Milestones

The council meeting in Accra was a testament to the progress and potential of the UK-Ghana partnership. Additionally, members lauded Ghana's strides toward economic stabilization, facilitated by the successful navigation of the IMF program.

Furthermore, the UK reaffirmed its support for Ghana's journey towards macro-economic resilience, promising continued collaboration and new programming aimed at bolstering Ghana's economic stability.

Fostering Green Innovation

A significant focus of the meeting was the global climate finance architecture, with Ghana committing to unlock climate financing for impactful activities. In addition, the UK's announcement of the Green Cities and Infrastructure Technical Assistance Programme marks a pivotal step towards delivering climate finance and developing low-carbon, climate-resilient infrastructure in Ghana. This initiative is poised to transform cities into innovation hubs and drive sustainable economic growth.

Industrial Transformation and Investment

The council celebrated the successful auto sector investor mission, which promises to catalyze Ghana's industrial transformation. Moreover, recognizing the potential in Ghana’s auto and E-mobility industry, pharmaceutical manufacturing, and garments sector, members pledged to identify and leverage opportunities for growth.

Additionally, the signing of the MoU between the UK’s Society Motor Manufacturing and Traders’ Industry Forum and Ghana’s Ministry of Trade's Auto Development Centre highlights a shared commitment to skills, knowledge, and technology transfer.

Advancing Science and Technology

The meeting also spotlighted the first investments in Ghanaian businesses by British International Investment’s Growth Investment Partners fund. The signing of the Science, Technology, and Innovation MoU underscores the council's dedication to driving economic prosperity through advancements in science and technology, laying the groundwork for a future of innovation and collaboration.

Looking Ahead

Recognizing the significant progress achieved since its inception in 2018, the UKGBC is ready to further strengthen the UK-Ghana relationship. With a focus on climate finance, electric vehicles, and other priority sectors, the council is setting the stage for continued progress and partnership.

Members eagerly anticipate the next meeting in the summer of 2024, ready to build on the foundation of cooperation and mutual development.

A Bright Future for UK-Ghana Relations

The ninth UK-Ghana Business Council meeting illuminated the path forward for UK-Ghana relations, characterized by shared goals of sustainable development, economic resilience, and green growth. Through ongoing collaboration and innovative initiatives like the Green Cities Programme, these two nations are poised to make remarkable strides in fostering a prosperous and sustainable future for both countries.

The commitment to leveraging technology, enhancing industrial sectors, and unlocking climate finance is a beacon of hope for sustainable economic growth and environmental stewardship in the global community.

Sources: THX News, Foreign, Commonwealth and Development Office & The Rt Hon Andrew Mitchell MP.

Read the full article

#autosectorgrowth#ClimateFinance#Climate-resilientinfrastructure#Economicresilience#GreenCitiesProgramme#IMFprogrammesupport#Sustainabledevelopment#technologytransferpartnerships#UK-GhanaBusinessCouncil#UK-Ghanapartnership

0 notes

Video

undefined

tumblr

A funded trading program is a way to access live trading funds without risking your own capital.

Learn more about funded trading here: https://traderfundingprogram.com/

Learn more about funded trading here in USA: https://traderfundingprogram.com/usa-new-york

Learn more about funded trading here in UK: https://traderfundingprogram.com/uk-london

Learn more about funded trading here in Canada : https://traderfundingprogram.com/canada-toronto

Learn more about funded trading in Australia here: https://traderfundingprogram.com/australia-sydney

Learn more about funded trading in India here: https://traderfundingprogram.com/india-mumbai

#https://traderfundingprogram.com/india-mumbai#https://traderfundingprogram.com/australia-sydney#https://traderfundingprogram.com/canada-toronto#https://traderfundingprogram.com/uk-london#https://traderfundingprogram.com/usa-new-york#https://traderfundingprogram.com/#funded trading programs#funded trading programs usa#funded trader programs uk#funded trader programs india#funded trading australia

0 notes

Text

Funded Trading Accounts UK refers to trading accounts provided by proprietary trading firms in the United Kingdom, offering access to capital for traders to engage in financial markets. These accounts empower traders with the ability to trade with the firm's capital rather than their own, potentially amplifying trading opportunities and financial gains. Explore the benefits of funded trading accounts in the UK with #BespokeFundingProgram.

#Funded Trading Accounts Uk#Funded Trading Account#Forex Funding#Forex Funding Program#Forex Trader Funding#Funded Trader Programs#Forex Funded Account Uk

0 notes

Text

Forex Prop Trading Firms

Lux Trading Firm is a trusted prop trading firm, Forex Proprietary Trading Firms in the UK. Select the evaluation funded trading accounts program to trade in any trading style.

Forex Prop Trading Firms

About Company :- We are a leading proprietary trading firm based in London (UK), specializing in supporting experienced prop traders.

Our commitment is to help traders excel and provide the tools and capital they need to compete in a marketplace defined by change and disruption.

We are focused on seeking out trading and investment opportunities to grow our capital in the global financial markets.

Click Here For More Info.:- https://luxtradingfirm.com/

Social Media Profile Links-https://twitter.com/FirmLux https://www.instagram.com/luxtradingfirm/ https://www.youtube.com/@LuxTradingFirm/featured

0 notes

Text

Broker In Focus: Fxglory - Is It Worth Giving A Try?

Fxglory is an offshore broker that allows trading in the forex market and commodities. The broker is not licensed by a respected regulatory body like the FCA or CySEC and is incorporated outside of the United States in Saint Vincent and the Grenadines. However, it has developed a reputation as one of the most dependable companies in the sector despite it currently lacking any regulatory licences. Traders of any level can take advantage of Fxglory’s flexibility, usability, and astounding professionalism. It further provides excellent trading tools, reliable trade execution, and enormous leverage available on the market–1:3000.

Fxglory provides simple access to a secure and comprehensive trading environment. Established in 2011, it has offices in Malaysia, Cyprus, Spain, and the UK. The office was first headquarters in the United Arab Emirates and migrated to European markets after a year of operation in the Asian financial industry. A group of financial experts founded the company with the goal of offering traders on the MetaTrader 4 trading platform a superior online trading experience with high leverage, no commissions, and quick executions.

Features Provided by Fxglory

Trading Instruments– Clients of FxGlory have access to a limited number of trading instruments. You can trade 34 currency pairings, including GBP/USD and EUR/USD. Along with oil and precious metals trading, popular cryptocurrencies like Bitcoin and Ethereum are also accessible.

Trading Accounts– Fxglory provides access to four types of trading accounts. Standard, Premium, VIP, and CIP accounts. Further, Fxglory provides one-click trading, a built-in news feed, and multilingual support for all account holders.

Trading Platform– Fxglory provides MetaTrader 4 (MT4) and a WebTrader platform. MT4 is user-friendly, sophisticated, and customisable. Additionally, FxGlory provides a web-based trading platform. WebTrader enables you to trade through an internet browser without additional program installation. A variety of devices, including Mac and PC, can be used to trade all the instruments provided by this broker.

Mobile Trading Application– All trade orders and execution types are supported by the MT4 platform, which can be downloaded for iOS and Android devices. The UI is straightforward to use, and logging in is just as quick and easy as it is on a desktop computer. You have access to trade at your fingertips.

Languages– Languages such as English, Russian, Italiano, Greek, Arabic, and German are supported by the broker.

Trading Tools– Fxglory provides highly useful trading tools such as economic calendars, margin calculators, and one-click trading.

Education– This field requires special attention because the educational materials at Forexglory are quite basic and not up-to-date.

Customer Service– You can contact the customer support team 24*5 through email and phone call service. You also have to connect to the team via live chat.

Clients– Fxglory accepts clients from countries such as Australia, Thailand, Canada, the United States, the United Kingdom, South Africa, Singapore, Hong Kong, India, France, Germany, Norway, Sweden, Italy, Denmark, United Arab Emirates, Saudi Arabia, Kuwait, Luxembourg, Qatar, etc.

Payment Options– E-commerce payment methods have grown in popularity these days. So, the broker provides a variety of deposit choices. To fund your account, you can select a method that best meets your needs, and all deposits are processed quickly and securely. You have access to multiple payment options like SticPay, American Express, Perfect Money, cryptocurrencies, WebMoney, EPay, Wire Transfer, Neteller, Skrill, PayPal, Visa, and Mastercard.

Trading Conditions

Standard Account

Commission – $0

Minimum Deposit – $1

Spread – Floating from 2 pips

Step lot size – 0.01

Leverage – Up to 1:3000

Maximum bonus – $500

Deposit bonus percentage – 50%

Minimum lot size – 0.01

Maximum lot size – 1.00

Hedge margin – 50%

Maximum position – 20

Premium Account

Commission –$0

Minimum Deposit – $1,000

Spread – Floating from 2 pips

Step lot size – 0.10

Leverage – 1:2000

Maximum bonus – $1,000

Deposit bonus percentage – 50%

Minimum lot size – 0.10

Maximum lot size – 10.00

Hedge margin – 50%

Maximum position – 100

VIP Account

Commission – $0

Minimum Deposit – $5,000

Spread – Floating from 0.7 pips

Step lot size – 0.10

Leverage – 1:300

Maximum bonus – $2,000

Deposit bonus percentage – 40%

Minimum lot size – 0.10

Maximum lot size – 1,000.00

Hedge margin – 25%

Maximum position – 1000

CIP Account

Commission – $0

Minimum Deposit – $50,000

Spread – Floating from 0.1 pips

Step lot size – 1.00

Leverage – 1:50

Maximum bonus – $0

Deposit bonus percentage – 0%

Minimum lot size – 1.00

Maximum lot size – 5.00

Hedge margin – 100%

Maximum position – 10

Pros of Trading with Fxglory

Low minimum deposit ($1)

Provides varieties of strategies like scalping, hedging, algorithmic trading

Spreads are fixed

Clients have access to a handful of tradable instruments

The MT4 platform is available for iOS and Android devices and supports all trade orders and execution modes.

The interface is easy to navigate

Offers a wide range of payment methods, including cryptocurrency

Offers 4 types of trading accounts

Live chat is available

To protect client data, the company's website and platform employ 256-bit SSL encryption technology.

To protect the funds, it maintains cash in separate accounts and provides clients access to various risk management tools.

All accounts are swap-free

Clients from the US are accepted

Micro-lot trading is available

Cons of Trading with Fxglory

The website supports only the English language

It is unregulated

Cent accounts are not available

Customer support service is not upto the mark

Spreads are high

Complex fee structure

Does not provide an MT5 platform

Educational materials are average

Verdict

Overall, Fxglory is a reliable forex broker which provides a unique trading system and environment. Fxglory puts the priorities and needs of its clients and partners first. It works with all honesty by creating exceptional products and services. However, keep in mind that, at the moment, it does not hold any regulating licence. Always do some background checks before signing up with any broker. Furthermore, Fxglory is a good broker for both newbies and experienced traders, but the trading conditions make it more suitable for professional traders who have a large capital to trade.

0 notes

Text

How eToro is dominating by expanding investments in UK online trading market

Buy Now

eToro is the trading and investing platform that empowers you to grow your knowledge and wealth as part of a global community. The main motive of this 207 founded company is to make trading accessible to anyone, anywhere, and reduce dependency on traditional financial institutions.

STORY OUTLINE

eToro is exploring in UK online trading market by

Factors driving eToro and in turn involving UK online trading market

Competitive landscape of Europe Wheat protein market with respective of MGP Ingredients

1.eToro has a leading position in UK online trading platform market.

Click here to Download a Sample Report

eToro is a major player in the online trading market in UK. eToro offers 3,000+ financial instruments across various classes, such as stocks, crypto and more. To enable eToro clients to use advanced trading features, such as advantage and short (SELL) orders, and to offer financial instruments that normally cannot be traded, such as indices and commodities, eToro utilizes Contracts for Difference (CFDs). Additionally, to enable traders and investors direct access to the market, some asset classes, such as stocks and crypto assets, offer direct ownership of the underlying assets, which we buy and hold in each client’s name.

eToro enables clients to deposit and withdraw using a variety of payment methods, the smartest of which is eToro Money, offering free and instant deposits with no FX conversion fees, and instant withdrawals. Other methods include wire transfers, bankcards, and more. eToro offers low minimum deposits and unified fees.

2.Factors driving MGP Ingredients and in turn involving Europe protein market

There are many drivers, which are making eToro lead in the UK online trading market. One of the reasons is that it provides various tools like CopyTrader, enables traders to replicate other traders’ actions in real time. To encourage top traders to be copied, eToro created the Popular Investor program.

Another unique product offered by eToro is Smart Portfolios, which are ready-made, investment strategies, offering thematic investment, such as medical cannabis, driverless cars, and people-based portfolios.

eToro has new investors which will be the stockholders of FinTech Acquisition Corp. V including Fintech V’s sponsors. Fintech V is a Special Purpose Acquisition Corporation (SPAC) that was formed for the purpose of combining with one or more businesses and remaining a public company. Additionally, several institutional investors will become new investors in eToro because of the transaction. These include ION Investment Group, Softbank Vision Fund 2, Fidelity Management & Research Company LLC, and Wellington Management.

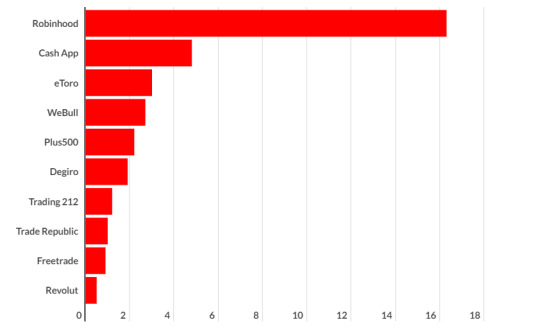

3.Competitive landscape and Outlook of eToro in UK Online trading platform market

Click here to Ask for a Custom Report

eToro is sustaining its position in UK online trading platform market. It already is available in in 140 countries. eToro generated $1.2 billion revenue in 2021, a 103% year-on-year increase. In June 2021, eToro reached 20 million active users. It set an IPO valuation of $10.4 billion, a 316% increase on its 2020 valuation. 69% of users are from Europe, followed by Asia-Pacific (18%) and then the Americas (8%).

Looking at its most popular stocks Bitcoin is the most popular, it accounts for one in every 25 positions opened. Tesla, Microsoft and Apple are the most traded stocks. NASDAQ 100 is the most traded index. Oil is the most traded commodity.

CONCLUSION

eToro is an emerging online trading platform in the digital world and it got hike in the market majorly due to effect of Covid 19. eToro is a very versatile platform offering you the possibility to trade CFDs (for experienced traders) and with them, you can also invest in ETFs and real stocks (e.g. investors who are looking at the long term).

#UK online trading platforms industry#UK online trading platforms Sector#European trading platforms market#UK digital trading platforms sector#UK Online trading sites market#UK Digital trading applications industry#Mobile Online Trading Platform in UK#UK Mobile Online Trading Platform market size#Number of digital trading platforms#Application based online trading UK#Web based online trading market UK#UK Online trading platform Market Forecast#UK Online trading platform Market outlook#UK Online trading platform Market analysis#UK Online trading platform Market competitors#UK Online trading platform Market Trends#UK Online trading platform Market Challenges#UK Online trading platform Market Opportunities#UK Online trading platform Market Size#UK Online trading platform Market Share#UK Online trading platform Market growth#UK online trading platforms market Investors#UK online trading platforms market Venture capitalists#UK online trading platforms market competitive landscape#UK Leading online trading platform Providers#UK online trading platform Services Provider#Key Players in UK Online trading platform Market#Leading Players in UK Online trading platform Market#Competitors in UK Online trading platform Market#Emerging Players UK online trading platform Market

0 notes

Text

Free Funded Trader Program

Lux Trading Firm is a trusted prop trading firm, Forex Proprietary Trading Firms in the UK. Select the evaluation funded trading accounts program to trade in any trading style.

Free Funded Trader Program

About Company :- We are a leading proprietary trading firm based in London (UK), specializing in supporting experienced prop traders.

Our commitment is to help traders excel and provide the tools and capital they need to compete in a marketplace defined by change and disruption.

We are focused on seeking out trading and investment opportunities to grow our capital in the global financial markets.

Click Here For More Info.:- https://luxtradingfirm.com/

Social Media Profile Links-

https://twitter.com/FirmLux

https://www.instagram.com/luxtradingfirm/

https://www.youtube.com/@LuxTradingFirm/featured

0 notes

Text

Supply: AdobeStock / Alexey NovikovJP Morgan Chase has filed a trademark software with the US Patent and Trademark Workplace for a finance-themed AI chatbot named “IndexGPT.”In accordance with the application filed earlier this month, the software is meant to help traders in deciding on monetary securities and monetary belongings. The applying suggests the AI chatbot will present funding recommendation in “financial investment in the field of securities” and “funds investment”, in addition to in “advertising” and “marketing services”. The brand new software comes after a February survey by JP Morgan revealed that greater than half of the institutional merchants believed synthetic intelligence and machine studying could be probably the most influential expertise in shaping the way forward for buying and selling over the following three years.Commenting on the transfer, trademark lawyer Josh Gerben stated that he believes JP Morgan's option to trademark the chatbot is a “real indication” in the direction of launching a brand new AI product for traders. “Companies like JPMorgan don’t just file trademarks for the fun of it. This sounds to me like they’re trying to put my financial advisor out of business.” Except for the brand new AI-powered finance chatbot, the establishment has additionally launched an AI inhouse software, known as Contract Intelligence (COiN), to extract vital data from paperwork and contracts. The AI mannequin, inbuilt by JP Morgan's financial analysts, analyses the communications from the US Federal Reserve to foretell the organisation's subsequent resolution. JP Morgan’s CEO, Jamie Dimon, has praised the expertise over the previous couple of years. In a latest interview with Bloomberg, he said:“We have 200 people in AI research labs and we’re already using it to do risk, fraud, marketing, prospecting — and it’s the tip of the iceberg. To me this is extraordinary.”Extra Monetary Corporations Be a part of the AI RaceJP Morgan, nevertheless, just isn't the one monetary agency harnessing the facility of AI expertise.International funding financial institution Morgan Stanley has introduced that it's creating instruments to help its wealth managers to raised comprehend the mountain of analysis performed by the financial institution concerning the economic system and markets. In a likewise enterprise, Goldman Sachs has confirmed that it's contemplating integrating its personal chatbot for its monetary advisors to permit them to kind by way of knowledge and supply extra correct outcomes to purchasers.Furthermore, in March, a synthetic intelligence engineer within the UK, Mayo Oshin, developed a bot named after Buffett to investigate massive monetary paperwork.In the meantime, as AI applied sciences proceed to get extra widespread, the voices warning towards the potential risks of such instruments additionally develop louder.Only recently, the Middle for Synthetic Intelligence and Digital Coverage, a number one tech ethics group, filed a grievance with the FTC, asking the company to halt the industrial releases of GPT-4, citing privateness and public security issues.Previous to this, a bunch of tech gurus, together with some synthetic intelligence consultants and trade executives, signed an open letter that known as for a six-month pause in creating programs extra highly effective than GPT-4, citing potential dangers to society.

0 notes