#gst

Text

Why are things expensive?

4 companies control 55% to 85% of the meat market.

4 airlines control 80% of air travel.

3 companies control 92% of the soda market.

3 companies control 73% of the cereal market.

Why don't I hear about it?

6 companies control 90% of the news.

#capitalism#monopoly#cost of living#gst#tax#expensive#eat the rich#eat the fucking rich#ausgov#politas#auspol#tasgov#taspol#australia#fuck neoliberals#neoliberal capitalism#anthony albanese#albanese government#extortion#anti capitalist#capitalist hell#capitalist dystopia#capitalist bullshit#class war#oppression#oppressor#repression#free all oppressed peoples#pedagogy of the oppressed#oppressive

380 notes

·

View notes

Text

cozy I-no comm

950 notes

·

View notes

Text

Mitsubishi Eclipse (2G)

#jdm#japan#tokyo#stance#stanced#mitsubishi#eclipse#gs#gst#gsx#spyder#1g#2g#3g#4g#lancer#evo#evolution#ralliart#galant#3000gt#gto#vr-4#vr4#fto#mr#gsr#x#ix#viii

20 notes

·

View notes

Photo

Miku Hatsune 1/7 Scale by Good Smile Company, from Vocaloid

#miku hatsune#hatsune miku#1/7#scal#gst#good smile company#Good Smile Racing#vocaloid#anime figure#anime figures#anime#figure#figures#figurine#figurines

302 notes

·

View notes

Text

OTTAWA — The New Democrats say they are using their agreement with the Liberal government as leverage to push for more ways to save Canadians money in the next federal budget.

Party leader Jagmeet Singh said he expects to see money in the budget to expand dental care coverage to teens, seniors and people living with a disability, which was part of the confidence-and-supply agreement with the Liberals.

But he also wants to see the government extend the six-month boost to the GST rebate, introduced last fall, which temporarily doubled the amount people received.

"That's something that we're going to use our power on," Singh said in an interview with The Canadian Press. [...]

Continue Reading.

Tagging: @politicsofcanada

66 notes

·

View notes

Text

It's getting late...

#mitsubishi#2nd gen eclipse#clean#sexy#dsm#fast and the furious#gsx#jdm#mitsubishi eclipse#1996 gsx#gsx is the dream#gst#gs#rs#interiors#late night#late night drive#oem#original interior#turbo#jdm cars#turbo cars

11 notes

·

View notes

Text

7 notes

·

View notes

Text

Still, awaiting your GST or Tax refund? Get it earlier than your family and friends like over 1 million other Canadians. The Secret?

https://web.koho.ca/referral/RV2TV073

Get your FREE ACCOUNT HERE. Canadian Accounts with cash back, high-interest rates and free over-draft protection to name a few benefits. #directdeposit #GST #incometax #familybonus #childtaxcredit #workingbenefit Refunds #credit #deposit #banking #finaince #overdraft #freeaccounts #badcreditok #mastercarddebitcard #rewards #incometaxrefund #CRAdirectdeposit #GSTcredit #GSTcreditpayment #childtaxpayment #earlydeposit #mastercarddebitcard

#youtube#canada#vancouver#business#abbotsford#news#music#ontario#GST#GST Credit#GSt payment#banking#direct deposit#early payment#family#child tax#child tax benefit#carbon tax credit#tax refund#tax refund deposit#GST Credit deposit#cash back#high interest#mastercard#interac#free#accounts#overdraft#free overdraft#credit rebuilding

4 notes

·

View notes

Text

2 notes

·

View notes

Text

Call: +91-8860632015 For UDYAM / MSME Registration

#smallbusiness#businessowner#startup#gst#incometax#tax#explore#like#india#indian#gurgaon#faridabad#business#delhi#noidacity#mumbai

8 notes

·

View notes

Text

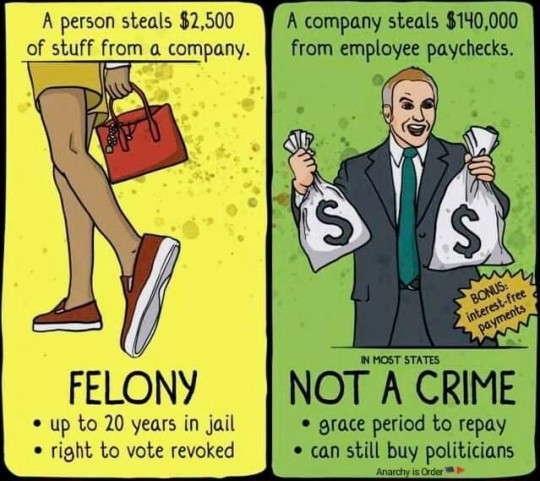

When criminals run society

#society#trickle down economics#economics#gst#tax#capitalism#poverty#greedy bastards#greedy#greedisthecreed#morals#ethics#ausgov#politas#auspol#tasgov#taspol#australia#neoliberal capitalism#fuck neoliberals#anthony albanese#albanese government#anti capitalist#capitalist hell#capitalist dystopia#capitalist bullshit#class war#classwar#eat the rich#eat the fucking rich

187 notes

·

View notes

Text

Availment of ITC under GST

GST (Goods and Services Tax) is a comprehensive indirect tax levied on the supply of goods and services in India. It is a destination-based tax, which means that the tax is collected by the state where the goods or services are consumed. Under GST, the input tax credit (ITC) is an important concept that allows businesses to reduce their tax liability by claiming credit for the taxes paid on their purchases.

In this article, we will discuss everything you need to know about the availment of ITC under GST. We will cover the basics of input tax credit, the conditions to claim ITC, the documentation required, and the time limit for claiming ITC.

What is Input Tax Credit (ITC)?

Input tax credit (ITC) is the credit that a business can claim for the tax paid on its purchases used for business purposes. The tax paid on input goods or services can be set off against the output tax liability (i.e. tax payable on sales) of the business. This helps businesses reduce their tax burden and improve their cash flow.

For example, if a manufacturer,

To continue reading click here

For more detailed inofrmation, visit Swipe Blogs

2 notes

·

View notes

Text

ram :3 happy late birthday to her

#ramlethal valentine#guilty gear ramlethal#ramlethal#gst#guilty gear#guilty gear strive#guilty gear fanart#fanart#ibispaint art#my artwrok#artwork#made in ibis paint

6 notes

·

View notes

Text

File Your GST Return On Time

(Avoid the last-minute rush)

👉🏻Contact us now 📞 +91-9811811991 / 9355533535

👉🏻Inquiry Form:- https://forms.gle/f1cyTwU9fetVMZkA8

#GSTReturnFiling#GST#GSTRegistration#shaaviprofessionalpvtltd#Gurgaon#taxprofessional#taxpayers#business#return#gstfiling#taxation#AvoidLateFees

3 notes

·

View notes

Text

Common Mistakes to Avoid When Managing GST Ledgers in Tally

Goods and Services Tax (GST) is a comprehensive indirect tax levy on the manufacture, sale, and consumption of most goods and services in Bharat. It was introduced on July 1, 2017, to subsume multiple indirect taxes, such as excise duty, value-added tax (VAT), service tax, and central sales tax (CST). GST ledgers in Tally are used to record all GST transactions, such as sales, purchases, and expenses. It is important to avoid mistakes in GST ledgers, as this can lead to penalties from the GST authorities.

#accounting automation software#GST Ledgers#GST#tally on cloud#automated bank statement processing#e invoice in tally#tally solutions

2 notes

·

View notes

Text

Creds to (x)

#jdm#mitsubishi#cars#2nd gen eclipse#mitsubishi eclipse#dsm#japanese cars#fast and the furious#gst#turbo#t25#modded cars#cool cars

3 notes

·

View notes