#how to become loan dsa

Text

The financial landscape in India is about to witness a historic event with the launch of My Mudra Fincorp’s Initial Public Offering (IPO) in 2024. As India’s first fintech IPO, this offering is set to be a landmark moment, not just for the company but for the entire fintech sector in the country. Here’s a closer look at why the My Mudra IPO is generating so much excitement.

What is My Mudra Fincorp?

My Mudra Fincorp is a trailblazing fintech company in India, known for its digital-first approach to financial services. The company provides a wide range of products, including instant loans, financial planning tools, and credit management services, all designed to make financial management more accessible and user-friendly. My Mudra has quickly become a household name, especially among small businesses and individuals seeking quick and reliable financial solutions.

Why is the My Mudra IPO a Big Deal?

The My Mudra Fincorp IPO is poised to be a game-changer as it marks the first time a fintech company in India is going public. This IPO is not just about raising capital; it’s about showcasing the growth and potential of the fintech industry in India. The success of this IPO could pave the way for more fintech companies to enter the stock market, highlighting the sector’s increasing importance in the country’s economy.

Highlights of the My Mudra IPO 2024

India’s First Fintech IPO:

My Mudra Fincorp is making history by being the first fintech company in India to launch an IPO. This milestone reflects the company’s leadership in the fintech space and signals the maturity of the industry as a whole.

Strong Market Presence:

With a solid reputation and a wide customer base, My Mudra has established itself as a leader in the fintech industry. The company’s strong market presence and brand trust make this IPO an attractive opportunity for investors.

Riding the Fintech Wave:

The fintech sector in India is on a rapid growth trajectory, driven by the increasing adoption of digital financial services. My Mudra is at the forefront of this wave, and the IPO will help the company capitalize on the growing demand for innovative financial solutions.

Strategic Use of IPO Proceeds:

The funds raised through the My Mudra IPO will be strategically invested in expanding the company’s service offerings, enhancing technology infrastructure, and reaching new customer segments. This expansion is expected to drive future growth and profitability.

High Investor Interest:

The My Mudra Fincorp IPO is attracting significant interest from both domestic and international investors. The combination of strong financials, a robust growth strategy, and the novelty of being India’s first fintech IPO makes it a compelling investment opportunity.

What Investors Should Know

For investors, the My Mudra IPO represents a unique opportunity to invest in a sector that is rapidly transforming the way financial services are delivered in India. As the first fintech company to go public, My Mudra offers a chance to be part of a pioneering moment in the country’s financial history. The company’s growth potential, backed by its innovative products and strong market position, makes this IPO particularly appealing.

Conclusion

The My Mudra Fincorp IPO is more than just a financial offering; it’s a significant milestone for India’s fintech industry. As the first fintech IPO in the country, it sets a precedent for other companies in the sector and underscores the growing role of technology in financial services. Whether you’re an investor looking for new opportunities or someone interested in the evolution of fintech in India, the My Mudra IPO is a pivotal event to watch in 2024.

0 notes

Text

The financial sector is a robust and dynamic industry with numerous opportunities for individuals looking to earn a stable income. One such lucrative opportunity is becoming a Direct Selling Agent (DSA) for personal loans. A DSA acts as a referral agent for financial institutions, helping them source new clients for various loan products. Among the many platforms offering this opportunity, My Mudra stands out as a leading name in the market, providing an easy and efficient way for individuals to become DSAs. In this article, we’ll explore how you can become a Personal Loan DSA loan agent registration with My Mudra, the benefits of doing so, and the steps involved in the registration process.

What is a Personal Loan DSA?

A Direct Selling Agent (DSA) is an individual or entity that works on behalf of financial institutions like banks or non-banking financial companies (NBFCs) to promote and sell their loan products. DSAs are responsible for sourcing potential customers, guiding them through the loan application process, and ensuring that all required documents are submitted to the lender. In return for their services, DSAs earn a commission based on the loan amount disbursed through their referrals.

Personal loans are one of the most sought-after financial products, as they can be used for various purposes, including debt consolidation, home renovation, medical emergencies, and more. As a Personal Loan DSA, you will be helping individuals and businesses secure the funds they need while earning a significant income.

Why Choose My Mudra to Become a Personal Loan DSA?

My Mudra is a well-established financial services platform in India, offering a wide range of loan products, including personal loans, business loans, and more. The platform has built a strong reputation for its transparency, customer-centric approach, and quick loan disbursals. Here are some compelling reasons to choose My Mudra to become a Personal Loan DSA:

1. Easy and Quick Registration Process

My Mudra offers a seamless loan DSA registration online process for aspiring DSAs. You can complete the registration in just a few steps, and the platform provides all the necessary tools and resources to help you get started quickly. The user-friendly interface ensures that even individuals with limited technical knowledge can navigate the process with ease.

2. Wide Range of Loan Products

As a My Mudra DSA, you will have access to a diverse range of loan products, including personal loans, business loans, and more. This allows you to cater to a broad customer base with varying financial needs, increasing your chances of earning commissions.

3. Attractive Commission Structure

One of the key benefits of becoming a DSA with My Mudra is the attractive commission structure. DSAs earn a percentage of the loan amount disbursed through their referrals. The higher the loan amount, the higher the commission. My Mudra ensures that DSAs are fairly compensated for their efforts, making it a financially rewarding opportunity.

4. Comprehensive Training and Support

My Mudra provides comprehensive training and support to all its DSAs. Whether you are new to the financial sector or an experienced professional, you will receive the necessary guidance to excel in your role. The platform offers training modules, webinars, and one-on-one support to help you understand the loan products, the sales process, and how to effectively communicate with potential customers.

5. Marketing and Promotional Support

As a My Mudra DSA, you will have access to marketing and promotional materials that can help you attract more clients. The platform provides brochures, flyers, and digital marketing tools that you can use to promote the loan products and generate leads. This support can significantly enhance your chances of success as a DSA.

6. Flexible Working Hours

One of the biggest advantages of becoming a Personal Loan DSA is the flexibility it offers. You can work at your own pace and set your own hours, making it an ideal opportunity for individuals looking for a side income or those who prefer working independently. Whether you want to work part-time or full-time, My Mudra allows you to choose a schedule that suits your lifestyle.

7. No Need for Prior Experience

You don’t need any prior experience in the financial sector to become a My Mudra DSA. The platform welcomes individuals from all backgrounds, as long as they have a passion for sales and a desire to succeed. My Mudra’s training and support will equip you with the knowledge and skills needed to thrive in the role.

Steps to Become a Personal Loan DSA with My Mudra

Becoming a Personal Loan DSA with My Mudra is a straightforward process that can be completed online. Here are the steps involved:

1. Visit the My Mudra Website

Start by visiting the official My Mudra website. On the homepage, you will find a section dedicated to loan DSA partner registration. Click on the “Become a DSA” link to get started.

2. Fill Out the Registration Form

You will be required to fill out an online registration form with your personal details, including your name, contact information, and address. Make sure to provide accurate information, as this will be used for communication and verification purposes.

3. Submit the Required Documents

As part of the registration process, you will need to submit certain documents, such as your PAN card, Aadhar card, and bank account details. These documents are required for identity verification and commission disbursement. My Mudra takes data privacy seriously, so you can be assured that your information will be handled securely.

4. Complete the Training

Once your registration is complete, you will have access to My Mudra’s training resources. It is important to go through the training modules to understand the loan products, sales process, and compliance requirements. The training is designed to equip you with the knowledge and skills needed to succeed as a DSA.

5. Start Sourcing Clients

After completing the training, you can start sourcing clients for personal loans. Use the marketing and promotional materials provided by My Mudra to reach out to potential customers. You can leverage your personal and professional networks, as well as online platforms, to generate leads.

6. Guide Clients Through the Loan Process

As a DSA, your role is to guide clients through the loan application process. This includes helping them fill out the application form, collecting the required documents, and submitting the application to the lender. My Mudra’s platform makes it easy to track the status of applications and stay in touch with clients throughout the process.

7. Earn Commissions

Once a loan is approved and disbursed, you will earn a commission based on the loan amount. My Mudra’s transparent commission structure ensures that you are fairly compensated for your efforts. The commission will be credited to your bank account as per the payment cycle.

Tips for Success as a My Mudra DSA

While becoming a Personal Loan DSA with My Mudra is a great opportunity, success in this role requires dedication and strategic planning. Here are some tips to help you succeed:

1. Leverage Your Network

Your personal and professional network can be a valuable source of leads. Reach out to friends, family, colleagues, and acquaintances to let them know about the loan products you are offering. Word-of-mouth referrals can be a powerful tool in generating business.

2. Stay Informed

The financial sector is constantly evolving, with new products, regulations, and market trends emerging regularly. Stay informed about the latest developments in the industry by attending webinars, reading financial news, and participating in My Mudra’s training sessions. This knowledge will help you better serve your clients and stay ahead of the competition.

3. Focus on Customer Service

Providing excellent customer service is key to building long-term relationships with clients. Be responsive, attentive, and transparent in your dealings with customers. Address their concerns promptly and provide them with accurate information. A satisfied customer is more likely to refer others to you, helping you grow your business.

4. Utilize Digital Marketing

In today’s digital age, having an online presence is essential for success. Utilize digital marketing strategies such as social media marketing, email campaigns, and content marketing to promote your services. My Mudra provides digital marketing tools that you can use to reach a wider audience and generate more leads.

5. Set Goals and Track Progress

Setting clear goals and tracking your progress is crucial for success as a DSA. Determine how many clients you want to source each month, how much commission you aim to earn, and what strategies you will use to achieve these goals. Regularly review your progress and make adjustments as needed.

Conclusion

Becoming a Personal Loan DSA Agent online with My Mudra is an excellent opportunity for individuals looking to earn a steady income in the financial sector. With its easy registration process, comprehensive training, and attractive commission structure, My Mudra provides all the tools and resources you need to succeed in this role. By following the steps outlined in this article and implementing the tips for success, you can build a rewarding career as a DSA and help others achieve their financial goals. Whether you are looking for a full-time opportunity or a side income, My Mudra offers the flexibility and support to help you thrive.

#personal loan DSA#DSA loan agent registration#loan DSA registration online#loan DSA partner registration

0 notes

Text

The Invisible Engine: How Corporate DSAs Fuel India's Economic Growth

India's economic landscape is a complex ecosystem, powered by various forces. One such force, often overlooked, is the network of Corporate Direct Selling Agents (DSAs) across the country. This blog explores the crucial role Corporate DSAs play in India's economic growth, specifically focusing on the contributions of DSA channels in Jaipur, Rajasthan.

Who are Corporate DSAs?

Corporate DSA in India are independent agents who act as a crucial bridge between financial institutions and potential customers. They promote and distribute financial products like loans, credit cards, and investment plans offered by banks and NBFCs (Non-Banking Financial Companies). Unlike traditional bank branches, Corporate DSAs reach customers in diverse locations, including far-flung rural areas.

The Power of DSA Channels in Jaipur

Jaipur, Rajasthan, with its vibrant economy and growing entrepreneurial spirit, serves as a prime example of how Corporate DSA channel contribute to growth. Here's how:

Financial Inclusion: DSA in Jaipur extends financial services to a wider population, including those who might not have easy access to traditional banking channels. This promotes financial inclusion, a key driver of economic development.

Increased Loan Disbursement: By reaching a broader customer base, Corporate DSAs in Jaipur facilitate a significant increase in loan disbursements. This injects capital into the local economy, fueling business growth and job creation.

Micro and Small Business (MSME) Growth: DSAs play a vital role in supporting MSMEs, the backbone of the Indian economy. They provide these businesses with access to much-needed credit, allowing them to expand, innovate, and contribute to the state's economic prosperity.

Employment Generation: The growth of the DSA in Jaipur creates employment opportunities for individuals who act as agents. This not only empowers individuals but also boosts local consumption and economic activity.

Beyond Jaipur: A Nationwide Impact

The impact of Corporate DSAs isn't limited to Jaipur. Across India, DSA channel play a significant role in:

Financial Literacy: Through their interactions with potential customers, DSAs raise awareness of financial products and services, promoting financial literacy and responsible financial behavior.

Market Penetration: DSAs act as the physical extension of financial institutions, enabling them to penetrate new markets and cater to diverse customer segments.

Economic Upliftment: By facilitating access to credit and financial services, DSAs contribute to the overall economic upliftment of communities across the nation.

Conclusion

Corporate DSAs, often unseen and under-appreciated, are the invisible engine propelling India's economic growth. Their dedication to reaching customers in every corner of the country, particularly in areas like Jaipur, Rajasthan, fosters financial inclusion, empowers businesses, and creates employment opportunities. As India continues its economic journey, the role of Corporate DSAs will undoubtedly become even more critical in ensuring inclusive and sustainable growth. So, the next time you see a DSA promoting financial products, remember the significant role they play in building a stronger and more vibrant Indian economy.

0 notes

Text

Online Bank Loan DSA Registration For Car Loan | +91-9084945327, 8077409095

Online Bank Loan DSA Registration

No Joining Fees

High Commission

Monthly / Payout

Get a DSA partner registration to start your journey as a DSA loan partner. Discover your latent potential of turning leads into deals. Work with renowned banks to sell their products hassle-free. All you need is knowledge of the loan scheme and decent communication skills.

The DSA is a bridge between a loan provider and someone who needs it. In addition, the DSA loan partner is given various responsibilities, including getting potential leads, collecting loan applications and documents, verifying the application through a preliminary check. Thereafter, ensuring the authenticity of the documents. Not only this, you also have to upload the documents along with the application form to get a DSA code to allow the tracking of applications.

How to get DSA Partner Registration?

To become a DSA loan partner, you should be having the comprehensive understanding of various loan products along with interest rates, eligibility (age, educational qualification, credit record, experience, etc.) and repayment options.

Once you correspond to the eligibility criteria, you can register online by providing all your basic and necessary details to become DSA registration. Upload your identity documents or other documents to complete the process of DSA registration.

Attain the necessary training to understand the basics of how to become a loan partner and get certified by qualifying for the destined exam. Once done, you can simply get an agreement signed that talks about the intricate terms and conditions. And it's done.

After getting registered, you can start offering loans in the name of the bank. This will help you generate leads and build a network. Be reasonable with your marketing skills. Use your DSA code to track your deals.

For more information contact us at +91-9084945327, 8077409095

0 notes

Text

Diverse Financial Products To Sell Via Andromeda

The financial sector is an ever-changing, ever-evolving landscape that can be easy to enter, but difficult to stay relevant in without serious dedication. Andromeda Loans has managed this incredible feat for over three decades and currently stands tall as India’s largest loan distributor, offering a plethora of diverse financial products and solutions. This powerhouse in the lending industry goes beyond conventional loans, extending its reach to insurance policies, credit cards, and even real estate solutions.

The aim of this article is to delve into the expansive array of financial products available through Andromeda Loans, with a focus on how these offerings can empower and elevate the roles of loan agents and DSAs (Direct Selling Agents).

Andromeda Loans: A Glimpse into Diversity

Andromeda Loans has earned its reputation as a trailblazer in the Indian financial market by transcending traditional loan distribution. While various types of loans like home loans, personal loans, business loans, and so on are the bedrock of its offerings, the institution has diversified its portfolio to include a range of financial products that cater to the diverse needs of customers. This allows their existing niche loan agents (for example, home loan agents, personal loan agents, business loan agents, etc.) an opportunity to expand their product portfolio and clientele.

The following are the additional products that Andromeda has added to their portfolio that their DSAs can sell:

Insurance Policies: Integrating insurance policies into its product lineup has allowed Andromeda Loans to open up new avenues for their DSAs and loan agents to provide comprehensive financial solutions to their clients. Whether it’s life insurance, health insurance, or other specialized policies, Andromeda Loans collaborates with leading insurance providers to ensure a diverse array of coverage options. This strategic move not only enhances the value proposition for DSAs and loan agents but also strengthens client relationships by addressing the broader spectrum of financial needs. Thus, loan agents and DSAs, whether personal loan agents or business loan agents or others, can eventually position themselves as financial advisors, rather than specific types of loan agents.

Credit Cards: Ever wanted to be a credit card DSA? Well, now’s your chance. Andromeda Loans has incorporated credit cards into its product suite, and DSAs and loan agents now have the opportunity to offer clients a convenient and efficient way to manage their finances. Additionally, by partnering with major banks, Andromeda Loans provides credit cards with various benefits, such as rewards programs, cashback options, and exclusive discounts. This addition not only widens the range of financial solutions for DSAs but also creates additional revenue streams through commissions on credit card sales. Thus, you could easily transition into becoming a credit card DSA.

Real Estate Solutions: Andromeda Loans understands that real estate is a crucial component of many individuals’ financial portfolios and has, therefore, strategically incorporated real estate solutions into its offerings. DSAs and loan agents affiliated with Andromeda Loans can now guide clients not only in securing loans but also in making informed decisions about real estate investments. This comprehensive approach enhances the credibility of DSAs and loan agents as trusted financial advisors, further solidifying client trust and loyalty. Home loan agents, in particular, might find this transition easy and gratifying.

Empowering DSAs and Loan Agents

As mentioned before, Andromeda Loans’ diverse product lineup empowers their DSAs and loan agents to become holistic financial advisors. The institution’s commitment to offering a comprehensive suite of products enables these professionals to build long-term relationships with clients, positioning themselves as go-to experts in the ever-evolving financial landscape.

Training and Support:

Andromeda Loans goes the extra mile in supporting its DSAs and loan agents. The institution provides extensive training programs to ensure that its representatives are well-versed in the nuances of each financial product. From understanding the intricacies of insurance policies to navigating the features of credit cards and comprehending real estate market dynamics, DSAs and loan agents are equipped with the knowledge and tools needed to excel in their roles.

Streamlined Processes for Enhanced Efficiency:

Efficiency is critical in today’s fast-paced world of financial services. Andromeda Loans invests in cutting-edge technology and streamlined processes, ensuring that DSAs and loan agents can expedite transactions without compromising on accuracy and compliance. This not only saves time for the professionals but also enhances the overall customer experience, contributing to client satisfaction and loyalty.

Lucrative Commissions and Incentives:

Andromeda Loans acknowledges the hard work and dedication of its DSAs and loan agents by offering lucrative commissions and incentives. The institution understands that motivated and rewarded representatives are more likely to excel in their roles. By aligning the success of DSAs and loan agents with attractive financial rewards, Andromeda Loans fosters a culture of excellence and performance-driven success.

Conclusion

Andromeda Loans emerges as a game-changer in the financial landscape, providing loan agents and DSAs with a diverse range of products to cater to the dynamic needs of their clients. From home loans to personal loans, business loans to credit cards, and real estate solutions, Andromeda Loans is more than just a loan distributor; it is a comprehensive financial services hub.

As the financial industry continues to evolve, embracing this multifaceted approach is not just a strategic move but a necessity for loan agents and DSAs aiming to thrive in this competitive market. Andromeda Loans stands as a testament to innovation and adaptability, offering a platform where financial dreams are not just met but exceeded.

0 notes

Text

The Corporate DSA Revolution: Transforming Financial Accessibility

In the quest for financial inclusion and market expansion, businesses are increasingly turning to innovative models, with Corporate Direct Selling Agent (DSA) Channels emerging as a potent force. This blog delves into the transformative power of Corporate DSA Channel / DSA Channel exploring their impact on making financial products and services more accessible, promoting financial literacy, and creating opportunities for both corporations and independent agents.

Empowering Financial Accessibility:

Breaking Geographical Barriers:

Corporate DSA Channels play a pivotal role in breaking geographical barriers. By partnering with independent agents operating in diverse locations, businesses can extend their reach to untapped markets, providing financial solutions to individuals who may have been previously underserved.

Tailored Financial Solutions:

DSAs, deeply embedded in their local communities, possess a nuanced understanding of the unique financial needs and preferences of their clients. This localized insight enables corporations to tailor their products and services, offering solutions that resonate with the specific requirements of different regions.

Educating Through Personalized Interactions:

A key facet of Corporate DSA Channel / DSA Channel is the personalized touch they bring to customer interactions. DSAs, often known for their interpersonal skills, not only facilitate financial transactions but also serve as educators. Through one-on-one engagements, they can impart financial literacy, helping clients make informed decisions about their financial well-being.

Driving Financial Literacy:

Localized Knowledge Transfer:

DSAs act as conduits for localized knowledge transfer. They can educate clients on the benefits of various financial products, demystifying complex concepts and promoting a better understanding of how these products can positively impact their financial futures.

Adaptive Training Programs:

Corporate DSA Channels often implement adaptive training programs that equip agents with the latest financial knowledge and communication skills. This ensures that DSAs are well-prepared to educate clients about the evolving landscape of financial services.

Promoting Inclusive Banking Practices:

By fostering financial literacy, Corporate DSA Channels contribute to promoting inclusive banking practices. Clients become more empowered to make informed decisions, engage with a variety of financial products, and actively participate in the broader economy.

Challenges and Opportunities:

Technological Integration Challenges:

While technology enhances the efficiency of Corporate DSA Channel / DSA Channel, integrating and training agents on new technologies can pose challenges. However, addressing these challenges presents an opportunity for corporations to invest in comprehensive training programs and support systems.

Ensuring Ethical Practices:

Maintaining ethical standards within the channel is crucial. Corporations must establish clear guidelines and communication channels to ensure that DSAs operate ethically and in the best interests of the clients they serve.

Conclusion:

Corporate DSA Channel / DSA Channel represent more than just a distribution model; they are catalysts for financial empowerment and inclusion. By leveraging the strengths of independent agents, businesses can bridge gaps, educate communities, and create a more inclusive financial ecosystem. As the Corporate DSA revolution continues to unfold, it brings with it the promise of a future where financial accessibility knows no bounds.Discover unparalleled options for loans and Credit Card tailored to your preferences with Arena Fincorp. As a leading digital lending platform in the Loan & Finance sector, we provide industry-best choices, allowing you to select loans that match your needs, determine your preferred interest rates, and set terms according to your preferences. Experience extraordinary – our cutting-edge technology ensures swift application processing, enabling customers to receive funds in their accounts in as little as 12 hours, with minimal documentation required .

#arena fincorp#personal loan in jaipur#credit card#Corporate Dsa Channel#Dsa Channel#Direct Selling Agent

0 notes

Text

Exploring the Opportunities of Loan Business and Loan DSA Business

Introduction

In a world of financial uncertainties, loans have become an integral part of many individuals and businesses. Whether you need capital for a new venture, a home purchase, or simply to meet your immediate financial needs, loans have become a reliable solution. And when it comes to the distribution of these loans, the loan DSA (direct selling agent) business has emerged as a promising avenue. In this article, we will delve into the loan business and the loan DSA business, exploring the opportunities and potentials they offer.

Understanding Loan Business

Loan business encompasses the broad spectrum of activities related to providing loans to individuals and businesses. This sector plays a pivotal role in facilitating economic growth by ensuring access to capital for various purposes, such as education, housing, and entrepreneurial endeavors.

Key components of the loan business include:

Lending Institutions: Traditional banks, credit unions, online lenders, and microfinance institutions all participate in the loan business, offering a variety of loan products tailored to different needs.

Loan Types: Loans are not one-size-fits-all. Common types include personal loans, business loans, mortgage loans, student loans, and auto loans.

Risk Assessment: Lenders evaluate borrowers' creditworthiness through a variety of metrics, including credit scores, income, and collateral.

Interest Rates: The interest rates on loans vary depending on factors like credit history and the type of loan. It's how lenders make a profit.

Loan DSA business

The loan DSA business is an evolving and lucrative sector in the financial services industry. Direct-selling agents act as intermediaries between borrowers and lenders, helping potential loan applicants connect with financial institutions. This business model offers several advantages, such as:

Flexibility: Loan DSAs can work independently or with multiple financial institutions, providing flexibility in terms of clientele and work arrangements.

Income Potential: Commissions earned by loan DSAs can be substantial, and as the loan portfolio grows, so does their income.

Minimal Overhead: Starting a Loan DSA business typically requires minimal capital investment. It can be operated from home, eliminating the need for physical office space.

Expanding Market: As more people seek loans for various purposes, the market for loan DSA businesses continues to grow.

Tips for Success in the Loan DSA Business

If you're considering venturing into the loan DSA business, here are some essential tips for success:

Build a Strong Network: Establish and nurture relationships with financial institutions to access a variety of loan products.

Continuous Learning: Stay updated with the latest financial products and industry regulations to serve your clients better.

Ethical Practices: Maintain transparency and honesty in your dealings to build trust with clients and lending institutions.

Marketing and Lead Generation: Invest in digital marketing and lead generation strategies to attract potential loan applicants.

Conclusion

The loan business and the loan DSA business are both indispensable parts of the modern financial landscape. They provide the necessary capital for personal and business growth while also offering opportunities for entrepreneurs to flourish. As you explore the possibilities within these domains, remember that success requires dedication, a commitment to ethical practices, and a keen understanding of the evolving financial market.

So, whether you're a borrower in need of financial assistance or an aspiring Loan DSA entrepreneur, the loan business holds a world of opportunities waiting to be explored.

Read More: Unlocking the Potential of DigitalSevaPortal: Your Gateway to Digital Services

0 notes

Text

0 notes

Text

Guide to Becoming a DSA Agent

DSA or Direct Selling Agent is a person who works on behalf of banks and non-banking Financial Companies (NBFCs).

A Direct Selling Agent connects loan-seeking customers to banks and NBFCs. Once they find leads, they ensure the customer of a smooth process; educate them about the loan interest rates and repayment process. Once the customer finds a good deal, the DSA directs them to the concerned bank or NBFC.

What does a DSA get in return? DSA works on commission. This payout varies depending on the type of loan granted and the loan amount.

What is the process of DSA loan agent registration?

To become a Direct Selling agent, the concerned person has to apply for a DSA loan agent registration. Here is how a person can apply for a DSA loan agent:

Choose a bank or NBFC for which you want to act as a DSA loan agent.

Visit their official website to apply or the bank or NBFCs physical address to enquire about the process.

Either way, you must fill out a registration form and submit it.

Once submitted, you will be asked to make a payment. Find out about the commission rate you will be getting at this stage.

Once the payment is made and the registration form is submitted, the bank or NBFC contacts you.

Hereby, you need to verify the documents for DSA registration.

The legal team does the job of verifying the information. They also consider the credit score and past credit history of the applicant.

Once the verification is successful, the DSA agreement is sent to the applicant.

The applicant needs to sign and send it back.

That’s it. You will receive your unique DSA ID soon before you hunt prospective customers needing loans.

Some banks or NBFCs also name DSA as a Loan Partner Program.

What are the skills needed for a DSA loan agent?

A DSA loan agent’s job is to convince customers to take loans. Skills needed to perform such a job include:

• Good communication skills

Anyone with good communication skills can become a successful DSA loan agent. Depending on the number of clients you bring in, a person can work as a DSA partner on a full-time or part-time basis.

• Good knowledge of loans

Such a person should have a good knowledge of the different loans (personal, business, house, car, etc.). This enables agents to guide the customers toward the right path if they need the loan. A DSA agent should be able to provide them with the best options available to reap maximum customer benefits.

Who can become a loan DSA partner?

Anyone above 21 (student, freelancer, salaried, self-employed) can apply for DSA registration and earn extra.

At Finway, dsa loan partner are provided 5% commissions of the total earnings of their team. Furthermore, applying as a DSA agent with Finway mobile app, FLAP is super easy.

0 notes

Link

Loan DSA Registration all over Maharashtra

Product we offer are Personal loan, Business Loan, Home Loan, Mortgage Loan, SME loans for low income group of people with good cibil

#dsa loan agent registration#loan dsa near me#home loan dsa payout#loan dsa in mumbai#loan dsa in pune#small loans#cash income#low cibil#loan dsa apply#personal loan dsa code#how to become loan dsa#loan dsa registration#loan dsa opportunities#sbi loan dsa#how to start loan dsa

1 note

·

View note

Photo

IN THESE TIMES

THE FOUNDATIONS OF THE ESTABLISHED ORDER ARE CRACKING.

The day after democratic socialist Alexandria Ocasio-Cortez won her Democratic primary last June, the Merriam-Webster Dictionary reported a 1,500 percent increase in searches for the word “socialism” on its website. Overall, socialism and fascism have become its most-searched words—a telling commentary. In the midterm elections, Ocasio-Cortez and another charismatic democratic socialist, Rashid Tlaib (D-Mich.), won seats in the House, and universal healthcare emerged as a potent, unifying issue that helped deliver Democrats control of that chamber.

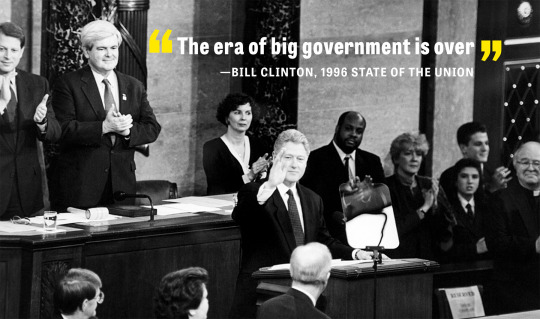

The cornerstone of the passing era is hostility toward taxes, regulation and public investment. The era began with the election of President Ronald Reagan in 1980, but it was a Democratic president, Bill Clinton, who expressed its motto most memorably. “The era of big government is over,” Clinton proclaimed in his 1996 State of the Union. The white flag of surrender has flown over the Democratic Party ever since, with an all-too-brief interlude during Barack Obama’s first presidential campaign.

Perversely, it was a demagogic Republican who sensed the emergence of a new era and rode its currents to the White House. He may be a liar and a charlatan, but Donald Trump’s election-turning insight was that voters don’t want smaller government. They want government that works for them—and not for corporations. In addition to xenophobia and white Christian nationalism, Trump campaigned on massive infrastructure investment, “great” healthcare for everyone, taking on the pharmaceutical industry and “draining the swamp” of political corruption. Similar (but authentic) platforms of robust public investments and checks on corporate power have turned Ocasio-Cortez and Bernie Sanders into political sensations.

At least on paper, even the Democratic Party seems to be catching on that corruption—defined as the capture of government by wealth and special interests—is the new “big government.” In May, Democratic leadership released a three-page plan for “fixing our broken political system and returning to a government of, by, and for the people,” promising to beef up ethics laws and “combat big money influence.” If these promises are to be anything more than empty gestures, though, there is a long way to go. A May analysis by OpenSecrets showed that incumbent congressional Democrats had taken an average of $29,000 apiece from lobbyists since 2017, while Republicans had taken $30,000. In August, the Democratic National Committee overturned a ban on contributions from fossil fuel companies.

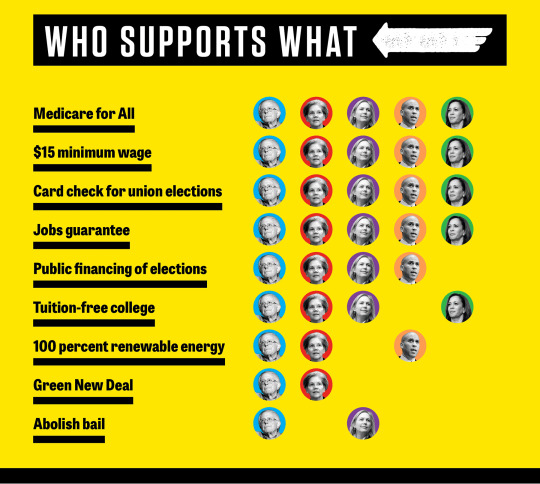

Universal healthcare is a case study in how the current system saps the energy for pushing major legislation through Congress. The majority of Democrats claim to want Medicare for All, but centrist Democrats, beholden to the insurance and hospital industries, are content to tweak Obamacare; they only support universal coverage by some vague mechanism, at some uncertain point.

Progressives, meanwhile, began rallying behind specific legislation in 2015: Medicare for All bills in the House and Senate. Local chapters of organizations like Democratic Socialists of America (DSA) and National Nurses United began pushing for single-payer bills in individual states, helping move the issue into the national debate.

That split within the Democratic Party, multiplied across a range of issues, is an unmistakable sign of transformation. The Left is in a phase of intense institution-building similar to that of the Right in the 1970s and ’80s, with new and newly energized think tanks—Demos, Data for Progress, the Roosevelt Institute and the Democracy Collaborative, among others—and an electoral infrastructure made up of groups like DSA, People’s Action, Justice Democrats, Our Revolution and Working Families Party.

This progressive resurgence is reflected, as well, in the landscape of the 2020 Democratic presidential primary. The five probable contenders in the Senate—Bernie Sanders, Cory Booker, Kirsten Gillibrand, Kamala Harris and Elizabeth Warren—have among the Senate’s most left-leaning voting records, and they’re vying to distinguish themselves by introducing progressive legislation.

Gillibrand is the most striking example, and the best measure of where the Democratic Party’s energy lies. Once a centrist, she has tacked steadily left in recent years and is now one of the party’s leading voices for the #MeToo movement and immigration reform, in addition to becoming an energetic economic populist. In April, for example, she introduced a bill to require that post offices offer basic banking services, like checking and savings accounts and low-interest loans. It’s a partial solution to the abuses of the payday loan industry that could help the estimated 9 million “unbanked” people in the United States.

The effects of all this, as with the effects of the “Reagan revolution” of 1980, will take decades to fully manifest. But they will likely radiate out and reshape our politics for a generation and beyond.

“VALUE VOTERS”

The Republican ascendancy of the past 40 years has been driven by a network of institutions bankrolled by wealthy donors and corporate interests, harnessed to the conservative movement’s passion for a few key issues, especially its hatred of abortion, same-sex marriage and public education. Over the decades, the Heritage Foundation and other quasi-scholarly institutions, in sync with popular rightwing media operations, have given conservatives a unified agenda and framed it as an apocalyptic battle between good and evil. Broadly, the goal was to radically limit the federal government’s involvement in the economy and vastly expand its power to legislate Christian Right morality.

In the 1990s, the Democratic establishment’s “third way” exposed the party’s lack of a similar set of principles. The heart of the third-way paradigm was the idea that the Democratic Party could survive the libertarian and “values voter” onslaught only by meeting the GOP halfway, tacking between right-wing interests and the common good. Bill Clinton’s most influential policy successes, like the North American Free Trade Agreement, the welfare reform bill of 1996 and deregulation of the financial services sector, tended to serve corporate interests while betraying working-class and minority voters.

The Occupy movement of 2011, which pushed economic inequality front and center, was the first sign of a tectonic shift in our politics. The Sanders campaign of 2015-16 was the second. Both cast inequality as a moral outrage, with the same urgency and fierceness that evangelicals bring to the abortion debate. Writing in the Guardian, Sanders denounced oligarchy and called income inequality “the great moral, economic and political issue of our time.”

And it isn’t only about economic inequality. The nation’s moral imagination is broadening as inequality writ large takes center stage. We know too much about the consequences of climate change, especially in the most vulnerable communities, for it not to be a moral issue. The same is true of access to quality education. The many videos of police abuse, the stories of sexual assault, and the protests and movements they spawned—#MeToo, Black Lives Matter, NFL players taking a knee— have helped to galvanize and focus the progressive resurgence, along with Trump’s demonization of racial and religious minorities and his pride in sexual assault and misogyny.

“The old perceived trade-off, between appealing to a broad middle of the electorate and having a transformative agenda, is becoming outdated as progressives coalesce around ideas that speak to the people who’ve been excluded from our system,” says Adam Lioz, political director at Demos Action. “It’s an exciting moment in progressive politics, in that candidates recognize that putting forward a bold platform is actually the pragmatic thing to do.”

This is how new political eras emerge. Just as the capture of government by special interests in the 19th century provoked the rise of the Progressive movement, the pervasive corruption of our politics is now reinvigorating it. The evangelical Right's passion hasn’t faded, but its focus on sex and reproduction no longer dominates national discussions about morality. To talk about inequality and corruption is to talk about right and wrong, fairness and justice. We are all “values voters” now.

Translating progressive values and votes into policy is the task ahead. That can seem like a nearly hopeless prospect, given the current makeup of Congress and the Supreme Court. But it starts with putting forward a strong agenda to frame the debate. That’s what the conservative movement did for the Republican Party in the 1970s and ’80s. Across a range of issues—notably economic injustice, climate change, state violence against minorities and corrupt elections—it’s what the progressive movement is doing for the Democratic Party right now.

ECONOMIC INJUSTICE

With about 28 million people still uninsured in the United States—and with medical bills the leading cause of bankruptcy—the radical inequalities of the healthcare system remain one of the nation’s great moral failures. The number of cosponsors of the single-payer Medicare for All bill in the House, HR 676, is a measure of how decisively leftward the consensus has shifted. From 2013 to 2015, the number of cosponsors fell by one, from 63 to 62. It has since nearly doubled, to 123.

The campaign for a higher minimum wage, led most prominently by Fight for $15, has, since 2014, put struggles of minimum-wage workers front and center, winning a $15 wage in at least 35 cities, states and counties. In 2017, Democrats in the House and Senate introduced the Raise the Wage Act, which would hike the federal minimum wage to $15 by 2024 and index it to the median wage after that.

Warren and Sanders are the highest-profile progressive advocates in this realm. If either runs in 2020, they will help to set the terms of the debate. Warren has already released a proposal requiring that 40 percent of a corporation’s board of directors be elected by workers, known as “codetermination.” It would also require that social interests, not just shareholder interests, be a key factor in corporations’ decision making.

Warren’s proposal has no chance of becoming law anytime soon, but it has planted a flag for a radical idea (in the U.S. context), attracted media coverage, provoked discussion and shaped the debate over how capitalism is practiced. It’s a prime example of how ideas become mainstream, legislative agendas are formed, and a party out of power remains relevant.

(Continue Reading)

#politics#the left#in these times#progressive#progressive movement#2020 election#democrats#democratic party#bernie sanders#elizabeth warren#alexandria ocasio-cortez#democratic socialism

109 notes

·

View notes

Text

What is NBFC DSA Registration?

Who requires NBFC DSA Registration in India?

A non-banking financial company is an NBFC. DSA refers to someone who operates as a referral agent for such a corporation or bank (direct selling agent). The major role of an agent is to create leads and bring in new clients for banks and NBFCs. When a consumer takes out a loan using the agent's referral, the agent earns money. Working as a business loan DSA in Delhi, Bangalore, or Hyderabad may payout handsomely and consistently. Continue reading for more information on how to become an NBFC DSA loan agent. But first, what exactly is a DSA agent and what is an NBFC?

What is NBFC DSA Registration?

Non-banking financial institutions or enterprises do not have a financial licence given by regulatory organisations such as the RBI, yet they provide a variety of banking services. They are not permitted to take public demand deposits like savings accounts, fixed deposits, and so on. NBFCs are mostly involved in financial activities including loans and advances.

The credit DSA collaborates with NBFC to market and sell their products. The DSA loan agent does not work from an office, although they may hold events to advertise their goods. They are self-sufficient individuals that create a sales network. They find consumers on their own and deal with them directly.

Previously, DSA was known as door-to-door agents who went from door to door selling cleaning supplies, home equipment, and other items. Personal loans, vehicle loans, housing loans, and other financial goods are now available at your doorstep through loan DSAs. These agents are widely available in all locations, whether you are seeking a loan NBFC DSA registration in Delhi or a business loan after NBFC DSA registration in Jaipur.

0 notes

Text

OneAndro App: Earn In Lakhs With Minimum Investment

Opportunities come and go in the blink of an eye in the fast-paced world of finance. This makes staying ahead of the curve crucial. For loan agents and Direct Selling Agents (DSAs) in India, this means embracing the power of technology to maximize earning potential and minimize investment risks. And there are no better tools to achieve this than the revolutionary loan agent apps like OneAndro, which is a game-changer introduced by Andromeda Loans, India's largest loan distributor.

The Birth of OneAndro: A Digital Leap Forward

Andromeda Loans has been around for over three decades and is a trailblazer in the Indian lending landscape. They recognized the evolving needs of their dedicated loan agents and DSAs and introduced the OneAndro App in response.

The app comes with a plethora of unique features designed exclusively for Andromeda’s DSA partners to simplify and supercharge their financial journey. These features include:

A quick and easy onboarding process.

Free credit score checks and reports for clients.

Easy access to Andromeda’s more than 140 lending partners, including banks, NBFCs, and fintech companies.

A diverse product portfolio, including insurance, loans, credit cards, and real estate.

Personalized product recommendations based on the eligibility criteria of clients.

Real-time updates for all applications.

Multiple training modules for both new and old loan agents, including everything from the latest trends in finance to how to sell using the app.

A comprehensive lead dashboard to help agents keep track easily.

Speedy approvals of applications.

Thus, the OneAndro App is a user-friendly interface that empowers loan agents and DSAs, irrespective of their technological prowess. It provides a seamless experience, allowing users to navigate effortlessly and focus on what they do best – connecting borrowers with the right financial solutions.

Moreover, OneAndro brings the entire spectrum of Andromeda Loans' offerings to the fingertips of its agents. From personal, business, and housing loans to credit cards, insurance, and real estate, the app covers it all. This comprehensive portfolio also enables agents to cater to diverse customer needs, expanding their earning potential.

Earning in Lakhs: Unleashing the Income Potential

One of the most exciting aspects of the OneAndro App is its unparalleled capacity to help loan agents and DSAs earn in lakhs with a minimal initial investment. Let's delve into the key features that make this financial breakthrough possible:

Lucrative Commissions:

The app's commission structure is designed to reward performance. Andromeda’s loan agents and DSAs earn generous commissions on successful loan disbursals, ensuring that their hard work directly translates into significant financial gains. With a multitude of financial products available, the income potential becomes virtually limitless.

A Diverse Product Portfolio:

DSAs and loan agents using OneAndro are automatically connected with Andromeda’s more than 140 lending partners, including banks, NBFCs, and fintech companies. This means easy access to all of their financial products, whether they be loans, credit cards, or insurance. Even real estate is included in their product portfolio. Such a diverse product portfolio means that Andromeda DSAs can cater to a wider audience, thereby increasing their earning potential.

Ease Of Application And Speedy Approvals:

The app is designed to make the application process much easier by keeping track of documentation and providing real-time updates for every application. This means that Andromeda DSAs will be able to take on multiple applications with ease, increasing earning potential. Moreover, the app also offers a speedy approval feature, which means the applications get approved quickly and the DSAs get paid faster.

Comprehensive Dashboard And Personalized Recommendations:

The OneAndro app makes it much easier for Andromeda loan agents and DSA partners to keep track of their leads and find the financial products best suited to their clients’ needs thanks to a comprehensive and intuitive dashboard that offers personalized recommendations based on client history. These features make it much easier for DSAs to take on multiple leads at the same time and convert them, thus earning more.

Empowering DSAs: A Supportive Ecosystem

The OneAndro App isn't just a tool; it's a comprehensive ecosystem tailored to support Andromeda DSAs on every step of their journey. The app fosters a sense of community among agents, creating a network where experiences are shared, and success stories inspire others.

Training Modules:

Andromeda Loans understands the importance of continuous learning in the dynamic financial sector. The app features extensive training modules, ensuring that DSAs are equipped with the latest industry knowledge, product insights, and sales strategies. This investment in education translates into more confident, competent, and successful agents.

Real-Time Support:

The loan industry operates in real-time, and so does the OneAndro App's support system. DSAs can access immediate assistance, whether it's about a complex loan query or technical assistance within the app. The real-time support ensures that agents never feel alone on their journey to financial success.

Conclusion: A New Dawn for Financial Prosperity

The OneAndro App is a technological marvel and a catalyst for financial prosperity among loan agents and DSAs. With its user-friendly interface, lucrative commissions, and a supportive ecosystem, it's reshaping the way financial professionals operate in India.

As the financial landscape evolves, the OneAndro App stands tall as a testament to Andromeda Loans' commitment to empowering its partners. For loan agents and DSAs eager to unlock the doors to financial success, this app isn't just an option; it's a necessity. Embrace the future of finance with OneAndro and embark on a journey where earning in lakhs is not a dream but a tangible reality.

What are you waiting for? Download here!

DSAs

0 notes

Text

Unleashing Growth: The Rise and Impact of DSA Channel

In the ever-evolving realm of financial services, the Direct Selling Agent (DSA) Channel has emerged as a transformative force, catalyzing growth for businesses across various industries. This dynamic channel operates as a conduit between financial institutions and end-users, enabling a seamless and efficient distribution of products and services. In this blog, we will explore the facets of the Corporate DSA Channel / DSA Channel , shedding light on its rise, impact, and the myriad ways it has redefined the landscape of corporate partnerships.

The Essence of DSA Channel:

The DSA Channel serves as a strategic partnership between a corporate entity and independent agents who act as intermediaries in promoting and selling products or services. This collaborative approach allows businesses to leverage the expertise and networks of these agents to extend their market reach and drive sales. The essence of the DSA Channel lies in its ability to create a win-win scenario, where businesses benefit from the expansive reach of their agents, and the agents earn commissions by successfully connecting products and services with consumers.

Key Advantages of DSA Channel:

Flexibility and Scalability:

DSA Channels offer businesses a flexible and scalable model for expansion. Whether entering new markets or diversifying product offerings, businesses can adapt the DSA Channel to align with their growth strategies.

Cost-Effective Distribution:

By collaborating with independent agents, companies can minimize fixed costs associated with maintaining an extensive sales force. This cost-effective distribution model allows businesses to allocate resources more efficiently.

Localized Expertise:

DSAs often possess in-depth knowledge of their local markets and customer preferences. This localized expertise is a valuable asset for businesses aiming to tailor their products and services to specific regions, enhancing customer satisfaction.

Technology Integration:

The integration of technology in Corporate DSA Channel / DSA Channel has streamlined processes, making them more efficient and transparent. Automation of tasks such as lead generation, tracking, and reporting ensures that the channel operates seamlessly, reducing manual errors.

Market Penetration:

DSA Channels serve as a potent tool for market penetration, particularly in regions where traditional marketing approaches may be less effective. The personal connections and relationships forged by agents contribute to building trust and credibility with consumers.

Challenges and Solutions:

While the DSA Channel offers numerous benefits, challenges such as maintaining uniformity in brand representation, ensuring compliance, and managing a diverse network of agents must be addressed. Solutions include robust training programs, technological platforms for standardized communication, and vigilant regulatory oversight.

Conclusion:

The Corporate DSA Channel / DSA Channel has become a driving force in reshaping how businesses approach sales and distribution. Its ability to combine the reach and influence of independent agents with the strategic goals of corporate entities makes it a formidable asset for growth. As businesses continue to navigate the complexities of the modern marketplace, the DSA Channel stands as a testament to the effectiveness of collaborative, adaptable, and technology-driven approaches in fostering success and sustainable growth.Discover unparalleled options for loans and Credit Card tailored to your preferences with Arena Fincorp. As a leading digital lending platform in the Loan & Finance sector, we provide industry-best choices, allowing you to select loans that match your needs, determine your preferred interest rates, and set terms according to your preferences. Experience extraordinary – our cutting-edge technology ensures swift application processing, enabling customers to receive funds in their accounts in as little as 12 hours, with minimal documentation required .

0 notes

Text

How Automobile Dealers Can Be Good Connectors for Car Loans

Dealer financing is a kind of mortgage that is originated through a retailer to its clients and then offered to a financial institution or different third-party economic institution. The financial institution purchases these loans at a cut price and then collects precept and activity repayments from the borrower.

1. New Car Loan / Used Car Loan: There are several options for buyers when it comes to shopping for a new car. It is now not in reality about selecting a mannequin and company of the vehicle however the higher query is whether or not you choose to purchase a new vehicle or a used car. This is a very vital choice and will make a large distinction to your finances. You want to decide the cause of buy and additionally think about whether or not you qualify for a mortgage or not. Loans for a new vehicles and used vehicles are reachable at various phrases and activity rates. Perception into the distinction between the two loans will assist you to select the one that is ideal for your needs.

2. They Are the First Point of Contact with Car Owner: A car dealer is on who sells used and new cars at a retail level car dealership have contact with automaker .car dealers also have certified cars, they employee salespeople to sale cars they may provide car maintenance also and they even appoint a technician whose task is to stock and sell spare parts for cars so basically by appointing sale person they become the first point of contact with the customer. well having more contact with customers means possibilities of more sell and if dealers are looking for more contact they should contact with SEO company in Mumbai as they can help you to rank your website on top pages in search engines like Google, yahoo which will help car dealers to get more business.

3. Connector model: car dealers act as connectors basically they help customers to understand about the cars available at dealers showroom and answers to the queries related to car model and about maintenance and about the cost of the car in this way they actually help the customer and even the guide to the customer which is not having a big budget to buy a car so basically, they connect to customer and satisfies all the queries which are related to the car. Well the question arises ho the customer flow will increase at the dealership as more customers visit will help in getting more inquiries here data comes in the role we can say data is the key to get more contact and more contact means more business dealers can contact the database provider in Mumbai who will provide you data which will help car dealers to get more leads and leads means more business for car dealers.

4. We Can Help With To Get Automobile Dealers & Car Owners on Your Sales CRM: database provider in Mumbai provides an accurate database of a potential customer in your city or state They can provide city wise data of customers who are thinking of buying a used car or new car .database provide offers complete data like name, emailed, contact number so it’s a complete data which can help to locate customers from any city and this will help car dealership to grab more business. The biggest challenge for dealerships is to get leads and a database can solve this problem and help car clerkship to get leads. Basically database providers in Mumbai can help automobile dealers and car-owners with sales CRM

5. Useful For Car Loan Companies, Bank, NBFC, DSA: Database is for car loan companies, bank , NBFC and DSA well data is the key for any business so car loan companies , bank , NBFC, and DSA every one needs data and that data should be good enough to fetch business as all of them offer loans and are looking for people those who want a car loan, in that case, data will play a big role so approaching a database provider in Mumbai can help will database which will help to generate more leads and more business.

6. Contact database provider : If you are a car dealer and looking for more clients then you should look for a database provider in Mumbai who will provide a precise database and if you are having a database means the database is very much important to get continues business so car dealers ship can always approach a database provider in Mumbai.

Do you need help?

Contact Us

450, Mastermind One - IT Park, Royal Palms, Aarey Colony, Goregaon (E), Mumbai, Maharashtra, India 400065

http://bbgebranding.com/

0 notes

Text

How will Seattle’s next mayor rebuild the economy after COVID?

New Post has been published on https://tattlepress.com/economy/how-will-seattles-next-mayor-rebuild-the-economy-after-covid/

How will Seattle’s next mayor rebuild the economy after COVID?

In late 2001, as then-Mayor-elect Greg Nickels prepared to take office, Seattle was sliding into a deepening economic crisis. With global travel hammered by the Sept. 11 terrorist attacks, the incoming administration anticipated major hits to tourism and more layoffs at Boeing, then the Seattle area’s biggest employer.

Although Nickels had campaigned heavily on transit issues, his first-term priorities quickly expanded. “It became very clear that the economy, and trying to get people back to work, would be front and center,” Nickels recalls.

Two decades later, Seattle is choosing a mayor for whom a main priority will be guiding the city from another economic crisis.

It’s a tall order. Although Seattle’s economy has rebounded substantially from the depths of pandemic, a full recovery could be a year or more away, thanks in part to lingering damage from the pandemic. But the new mayor will also have to navigate deep political disagreements over the best way to revive the economy, or even what a “recovered” economy should look like.

These politics of recovery have already surfaced in the run up to the primary (ballots are due Aug. 3): a feud between Seattle’s downtown establishment, which sees downtown as the engine for recovery, and a leading candidate, M. Lorena González, who champions a broader strategy focused on “all of our neighborhoods across the city.”

One city, many recoveries

The feud is largely performative — but it underscores a key challenge to Seattle’s recovery: The next mayor will oversee not just “one” economy but a diverse economic community whose various elements haven’t recovered at the same rate.

While many of Seattle’s larger employers, including big downtown players like Amazon, have bounced back (or actually enjoyed pandemic booms), the city’s small-business community may need years to get back its pre-pandemic numbers or vitality.

For more information about voting, ballot drop boxes, accessible voting and online ballots, contact your county elections office. Ballots are due by 8 p.m. on Aug. 3.

For more information on your ballot, in any county, go to: myvote.wa.gov

Similarly, where Seattle’s white-collar workforce saw minimal job losses in the pandemic, prospects for post-pandemic recovery are less certain for the city’s service workers, especially in industries such as tourism, nightlife, and arts and culture.

Those sectors “got hit the hardest, and that’s going to show up more acutely in Seattle than in other areas,” says Anneliese Vance-Sherman, a state Employment Security Department (ESD) economist who focuses on the Seattle area.

And where some Seattle neighborhoods have already seen a strong recovery, the going is much slower in other areas.

Downtown Seattle continues to suffer in the absence of office workers, who are still at around 20% of pre-COVID levels. Some South Seattle communities have also been slower to bounce back, partly because residents were more reliant on pandemic-battered service industries.

In South Park, for example, many smaller businesses and sole proprietorships closed due to COVID restrictions, but were unable to get pandemic small-business loans, says Rocio Elizabeth Arriaga Briones, president of the South Park Merchants Association (SPMA). That has made recovery “pretty difficult,” Arriaga Briones says.

That points to another recovery obstacle: COVID-19 exacerbated many of the problems, including economic inequality and homelessness, that were already hobbling Seattle’s tech-fueled prosperity.

Fifteen months into the pandemic, these problems are not only slowing the city’s recovery efforts; they’re also deeply complicating the politics of recovery for the next mayor.

Last week, backers of the so-called Compassion Seattle charter amendment reported gathering enough signatures to put the controversial measure on the ballot. (The signatures still have to be validated.) If approved by voters, the business-backed measure would require the next mayor and council to rewrite the city budget around homeless and human services, open thousands of shelter or housing units and “balance” the need to clear encampments from city property with health and safety of the people in the camps.

Many in Seattle’s business community say homelessness and encampments, and the crime and blight associated with them, are key impediments to recovery — and proof of a broader erosion in the conditions businesses need to bounce back. “We really need the basic fundamentals of municipal government to be working right if we ever expect to fully recover from the pandemic,” says Mike Stewart, executive director of the Ballard Alliance, which backs the charter amendment.

Small business, big homelessness crisis

The eight main mayoral candidates have some pretty big differences in how they would manage the city’s recovery — but also some similarities.

All eight have promised more help for small businesses.

Former state legislator Jessyn Farrell, for example, wants to see large direct grants to small businesses, particularly those in disadvantaged communities that may have missed out on federal pandemic loans and “don’t have access to traditional banking relationships.”

Lance Randall, an economic development specialist, wants tax breaks to landlords who offer rent reductions or other incentives to small-business tenants. Such a policy could also help fill some of the many empty storefronts, Randall said during a recent candidate forum sponsored by the Downtown Seattle Association. “There are a lot of vacant spaces because of COVID,” he said.

Another popular platform plank: cutting the regulatory burden for small business. “We’ve got to be really cognizant that Seattle has not always been the easiest city to do business in,” adds Colleen Echohawk, former head of the Chief Seattle Club.

“If we empower more people to be able to start their own businesses … we are going to recover that much faster,” said Andrew Houston Grant, an architect and former staffer for city Councilmember Teresa Mosqueda, who also wants easier permitting, especially for businesses in marginalized communities. The city’s permitting process, he says “is broken.”

There’s far less unanimity when it comes to homelessness and security issues. While all eight candidates say they’ll prioritize homelessness policy, their approaches often differ substantially.

Only four candidates support the Compassion Seattle: Randall, Farrell, former Deputy Mayor Casey Sixkiller and former City Council President Bruce Harrell.

At the DSA forum, Harrell said he backed the charter amendment in part because “it suggests strongly that we have a compelling need to open our parks and public spaces.” Similarly, Sixkiller says the city needs to demonstrate “that we have the ability to both get [homeless] folks inside, but also address the conditions in our streets and in our parks.”

But Houston, González, Langlie and Echohawk oppose the measure. Langlie, a construction executive, said he shares backers’ concerns — “I do feel we’ve not held enough urgency on this issue” — but doesn’t think asking voters to decide is “good governance.”

Echohawk, who initially backed the measure as way to spur city action, later withdrew that support out of concern that the measure includes no dedicated funding and may lead to more sweeps of tent encampments.

Candidates were also divided on another key recovery issue: rising tensions between City Hall and the city’s business community. Relations between business leaders and the City Council’s progressive majority have grown increasingly hostile over a new tax on large employers and some council members’ combative rhetoric toward Amazon and some of the city’s other big companies.

Some mayor candidates have promised a more constructive, business-friendly tone. “We’ve got to remember these big large businesses that call Seattle home — they started as small businesses,” said Sixkiller at the recent DSA forum.

Others have kept big business firmly in campaign crosshairs. González argues that the city’s recovery strategy “must be first and foremost centered on workers … the people that have felt the brunt of this pandemic,” while “the mega corporations … in our city, whether they’re in downtown, or any other neighborhood, do not need taxpayer subsidies.”

Several candidates have attacked business’s role in the campaign. Ferrell says “the people of Seattle should choose their next mayor, not corporate interests.” Houston has criticized “corporate interests” and vowed to resist the “developers, millionaires, and bad actors trying to influence our election.”

How these competing recovery strategies play electorally is difficult to predict. Homelessness will likely be a priority for Seattle voters: 57% of voters identified homelessness as the city’s biggest problem, according to a February poll conducted for Compassion Seattle by EMC Research. It’s probably notable that Compassion Seattle garnered 64,155 petition signatures, or roughly twice the number necessary to get on the ballot, according to its backers.

But the mayoral race is also taking place in a political culture that has become increasingly divided over economic issues, such as inequality and corporate taxes.

As a campaign issue, economic recovery could be framed either as “City Hall partnering with small business” or “as a choice between worker versus employer interests,” says Ben Anderstone, a Seattle-based political consultant who is advising City Council candidate Sara Nelson. That could leave voters to choose between “vastly contrasting visions of what economic recovery even in,” he says.

Limited power, but a big ‘bully pulpit’

For all the debate over strategy, the next mayor’s ability to influence recovery will be limited.

Even politically effective mayors wield modest resources when it comes to addressing economic crises.

Seattle’s aggressive vaccination program and its various relief programs, such as small business grants and eviction restrictions, have helped blunt the pandemic’s worst economic effects.

But most of the recovery thus far has been driven by external factors, such as federal stimulus, the easing of state restrictions, and decisions by individual businesses.

“The city itself has a few tools — but really, it’s the market that’s going to determine ultimately what the economic conditions look like,” Nickels says. “And that goes far beyond Seattle and far beyond the mayor’s office.”

And, importantly, what power Seattle’s mayor has must be shared with a City Council with its own ideas about economic recovery.

The mayor’s main advantage, Nickels says, is the “bully pulpit” — a prominent platform to build public support for critical initiatives, which the mayor can then use to pressure the City Council when negotiating economic policies. If the next mayor can do that, “the council will have really little choice but to follow along,” says Nickels.

But an effective bully pulpit strategy requires a well-defined mayoral agenda that can appeal to a broad base of voters and constituent groups. And so far, Nickels says, he hasn’t seen that from any of the candidates.

“That’s what we’ll have to see between now and the primary certainly, but even more so once we figure out who the final two are,” he adds.

Source link

0 notes