#invest in gold ira

Video

youtube

Unlock the Secrets to Protect Your Retirement Savings with Augusta Preci...

0 notes

Text

The Benefits of Investing in Physical Gold with Fusco Insurance, Retirement & Wealth Planning Services

The Benefits of Investing in Physical Gold with Fusco Insurance, Retirement & Wealth Planning Services

The Timeless Appeal of Gold

Investing in physical gold has long been considered a wise financial move for those looking to diversify their portfolios and safeguard their wealth. Unlike paper currency, gold has intrinsic value and has stood the test of time as a reliable store of value. Here are some key benefits of investing in physical gold:

Hedge Against Inflation: Gold is often seen as a…

View On WordPress

#Asset Protection#financial security#Fusco Insurance#Gold Investment#Inflation Hedge#Investing#IRA Rollovers#Liquid Assets#Long-Term Value#Physical Gold#Portfolio Diversification#Precious Metal IRAs#retirement planning#Risk Management#Tangible Assets#Wealth Planning

1 note

·

View note

Text

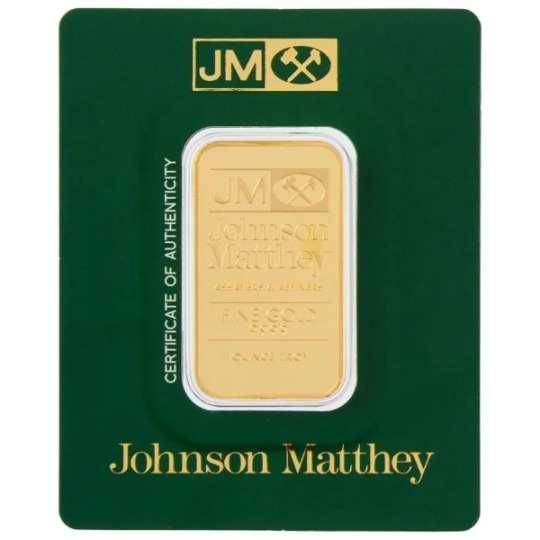

Gold Bullion Bars | Nyfederalgold

Looking for pure Gold Bullion Bars in USA? Nyfederalgold is one of the well-established and trusted organisation for purchasing coins, bullion and bars. We have team of professionals who are there to give you best advice as per your portfolio. You can diversifying your retirement portfolio with precious metals of gold, silver and platinum. You’ll will have a powerful tool to protect your wealth as well as potentially grow it over time.

Visit Here:- https://nyfederalgold.com/

#Gold Bullion Bars#Convert 401K to Gold#401K to Gold IRA Rollover#Gold and Silver Bullion#Gold Is a Great Hedge to Invest#Investing in Gold Bullion#Ny federal gold#Nyfederalgold#Ny federal gold bullion bars#Ny federal gold online

0 notes

Text

IRA Comparison Guide

Website: https://www.iracomparisonguide.com

Address: 4283 Express Lane, Suite TH1342, Sarasota, FL 34249

Phone: (941) 538-6941

Your ultimate resource for informed financial planning! Offering insights, analysis, and comprehensive reviews on Individual Retirement Accounts (IRAs). Discover expert insights and make informed decisions on gold and silver backed IRAs with IRA Comparison Guide.

#Financial planner#Investment Services#gold ira#precious metal ira#self directed gold ira#silver ira

1 note

·

View note

Text

Best Gold Investment Companies Operating on the US Market

This is a list of the best gold investment companies in the US. Article provided by Nikola Roza of nikolaroza.com

https://nikolaroza.com/best-gold-silver-ira-companies/

1 note

·

View note

Text

The Benefits of Gold IRA Investments

Self-directed retirement accounts are popular among individuals investing or looking to invest for retirement, because of its numerous benefits. One possible advantage of gold IRA investments is its prospect for long-term growth.

There are many other benefits of gold IRA investments and we will try to cover them in this post.

What advantages can gold IRA investments offer?

A variety of advantages might help build a more secure and diversified retirement portfolio when you invest in a gold IRA (Individual Retirement Account). Here are seven key advantages of Gold IRA investments:

Portfolio Diversification

By incorporating gold into your IRA, you may be able to lower the total risk exposure of your investments and increase the market volatility resistance of your portfolio.

This is due to gold having low correlation with conventional investment vehicles such as bonds and stocks.

Hedge Against Economic Uncertainty

Gold's property as a safe-haven asset makes it particularly valuable during economic downturns and times of geopolitical instability.

A Gold IRA can act as a hedge against currency devaluation, inflation, and unexpected market shocks, helping to preserve the purchasing power of your retirement savings.

Wealth Preservation

Gold's ability to retain its value over time can serve as a means of wealth preservation within your retirement account. As an asset that is not tied to a specific country's currency, gold can help safeguard your retirement funds from the potential erosion caused by currency fluctuations.

Long-Term Capital Appreciation

While gold may not generate regular income like some other investments, its historical performance suggests the potential for long-term capital appreciation. Adding gold to your IRA can contribute to the growth of your retirement funds over time, aligning with your goals of financial security.

Inflation Hedge

As central banks continue to implement expansive monetary policies, concerns about inflation persist. Gold has a track record of holding its value during periods of inflation, protecting your retirement assets from losing purchasing power.

Tax Advantages

The same tax benefits as standard IRAs are available with gold IRAs.. Your contributions to a Gold IRA can be tax-deductible, and the growth of your investments is tax-deferred until withdrawal. This tax-efficient structure can enhance your retirement savings over the long term.

Secure Storage

Your physical gold assets will be kept in safe storage by a dependable Gold IRA custodian. This eliminates the need for you to worry about safekeeping and storage concerns, ensuring the physical integrity of your investment.

Estate Planning

Including gold in your IRA can facilitate estate planning by providing a tangible asset that can be passed on to beneficiaries. This can be especially beneficial for leaving a lasting legacy or providing for loved ones.

What other IRA gold account types are there?

Gold and other types of precious metals can be added to the retirement portfolios through a variety of Gold IRA account types.

These accounts are structured to comply with IRS regulations and provide tax advantages.

Traditional Gold IRA

A Traditional Gold IRA allows you to make tax-deductible contributions to the account, and the growth of your investments is tax-deferred until you start making withdrawals in retirement.

Your normal income tax rate is applied to withdrawals. If you want to be in a lower tax band in retirement, this sort of IRA offers up-front tax benefits.

Roth Gold IRA

Contributions to this account are made with after-tax money, thus they are not tax deductible. Your assets' growth, however, and qualifying withdrawals during retirement are both tax-free.

For those who wish to take advantage of tax-free withdrawals and anticipate being in a higher tax band in retirement, this form of IRA is advantageous.

SEP Gold IRA (Simplified Employee Pension)

A SEP Gold IRA is intended for freelancers and proprietors of small businesses. It enables employers to make contributions on employees' behalf.

Employer tax deductions are available for contributions, which grow tax-deferred until withdrawn. Withdrawals are taxed at the individual's standard income tax rate, much like traditional IRAs.

Simple Gold IRA A Simple Gold IRA is designed for small enterprises, much like a SEP IRA is. Contributions to the account can be made by the employer or the employee, and both may be tax-deductible for the employer and tax-deferred for the employee. Retirement withdrawals are subject to normal income tax.

Self-Directed Gold IRA

You can have more say on major investment decisions if you choose a Self-Directed Gold IRA. With this type of account, you can invest in a broader range of assets beyond traditional stocks and bonds, including physical gold, real estate, private placements, and more.

What metals are suitable for my gold IRA investments?

When considering metals for your Gold IRA investment, it's important to select metals that meet the eligibility criteria set by the IRS and that align with your investment goals and risk tolerance.

Precious metals of a certain sort may only be included in IRAs with IRS approval. Here are the primary metals commonly considered for Gold IRA investments:

Gold

Gold is the most popular and widely accepted metal for Gold IRA investments. It has a long history of serving as both a value store and a protection against economic risks.

American Gold Eagles, Canadian Gold Maple Leafs, and American Gold Buffalos are some of the few examples of acceptable gold coins.

Silver

It is often considered more affordable than gold and has industrial uses, silver can also be added to an IRA.

American Silver Eagles, Austrian Silver Philharmonics and Canadian Silver Maple Leafs are some of silver coins that are acceptable.

Platinum

It offers investment potential and is frequently employed in industrial applications. Approved platinum coins include American Platinum Eagles and Canadian Platinum Maple Leafs.

Palladium

Palladium is also a relatively rare metal with various industrial uses. Palladium has gained attention in recent years due to its supply-demand dynamics. Eligible palladium coins include Canadian Palladium Maple Leafs.

Things to consider when setting up a gold IRA?

Before opening a gold-backed IRA account, consider going through these five key factors. Eligible Metals and Products

Before embarking on the journey of opening a Gold IRA, it's essential to familiarize yourself with the IRS guidelines governing the types of eligible metals and products that can be held within such accounts.

Different forms of gold, silver, platinum, and palladium, in the shape of coins and bars, are typically permissible.

Ensuring that your chosen metals adhere to these criteria will lay the foundation for a compliant and hassle-free Gold IRA investment.

Custodian Selection

Selecting the right custodian is a pivotal decision in the Gold IRA process. Your chosen custodian will be responsible for the secure storage, purchase, and management of your precious metals.

Research extensively to identify reputable custodians with a track record of reliability, excellent customer service, transparent fee structures, and suitable storage options. This choice will significantly impact the overall management and success of your Gold IRA.

Fees and Costs

Opening and maintaining a Gold IRA involves various fees that can influence the overall performance of your investment. It's important to understand the fee structure of different custodians, including setup fees, annual maintenance fees, storage fees, and potential transaction costs.

Market Research and Trends

An informed investor is a successful investor. Engage in comprehensive market research to understand the historical performance of various precious metals, the factors influencing their prices, and the broader trends in the market.

The value of your investments can be radically affected by factors like supply and demand dynamics, economic conditions, and geopolitical events. A strong grasp of market trends will guide your decision-making process.

Investment Goals and Risk Tolerance

Your investment objectives and risk tolerance should steer your decisions when opening a Gold IRA. Clarify whether you seek wealth preservation, capital appreciation, or a hedge against economic uncertainties.

Your goals will influence the types of metals and products you choose to include in your portfolio.

The allocation of precious metals within your entire investment strategy will be determined with the support of your understanding of risk tolerance, guaranteeing alignment with your intended goals.

Conclusion

The benefits of Gold IRA investments offer an exciting proposition for those seeking to reinforce their retirement portfolios with precious metals. With its potential to enhance diversification, act as a hedge against economic uncertainties, and provide a safe haven during market turmoil, a Gold IRA presents a unique avenue for safeguarding and growing retirement funds

Visit our website GoldRapport to learn more.

1 note

·

View note

Text

Importance of Promoting High Ticket Affiliate Offers

High ticket affiliate offers are products or services that cost hundreds or thousands of dollars and pay you a large commission for every sale or referral. These offers can help you earn more money online with less effort and traffic than low ticket offers.

Here are some of the benefits of promoting high ticket affiliate offers:

– You can earn more money with fewer sales. For example, if you…

View On WordPress

#Affiliate Marketing#CJ Affiliate#email list#Fiverr#Gold IRA Investment#High Ticket Affiliate Offers#Impact#Liquid Web#ShareASale#Shopify#social media

0 notes

Video

youtube

How to Buy Gold | Gold Investment | | Gold IRA | How to invest in Gold |...

0 notes

Text

How to Secure Your Future with the Right Gold IRA Investment Company

IRA Gold, a leading Gold IRA Investment Company, offers secure and reliable solutions for your retirement. Diversify your portfolio with precious metals and enjoy peace of mind knowing your future is protected with expert guidance and top-notch service.

0 notes

Text

Gold Ira Investment

How To Budget Your Gold IRA Investment? Factors That Affect The Cost

Setting up a Gold ira investment account can be wise, especially during uncertain economic times. A Gold IRA account is a self-directed individual retirement account that allows you to invest in physical gold and other precious metals to diversify your portfolio and protect your savings from market fluctuations.

However, before you decide to set up a Gold IRA account, there are some essential things you need to know to ensure that you make informed decisions and maximize your investment potential. In this article, we will discuss some key things you should know when setting up a Gold IRA account:

Eligible Metals

Not all precious metals are eligible for a Gold IRA account. The IRS only allows certain coins and bars that meet specific purity standards. Your coins should be pure.

Make sure you research and choose metals that the IRS approves to avoid tax penalties.

Choosing A Custodian

To set up a Gold IRA account, you must choose a custodian specializing in precious metal investments.

Your custodian will help you purchase and store your metals and ensure that you comply with IRS regulations.

Make sure you choose a reputable and experienced custodian with a track record of providing quality service and security.

Storage Options

One of the most significant advantages of a Gold IRA account is owning and storing your metals physically.

You can choose between storing your metals at an off-site custodian's vault or a private vault at your home.

Consider the costs and risks associated with each option and choose the one that works best for your needs and budget.

Fees And Expenses

Setting up a Gold IRA account involves various fees and expenses, including custodian fees, storage fees, and transaction fees. Ensure you understand all the costs and factor them into your investment decision.

Look for a custodian offering transparent and competitive fees and avoiding hidden fees or high-pressure sales tactics.

Risks And Benefits

Like any investment, a Gold IRA account comes with risks and benefits. While precious metals can offer a hedge against inflation and economic uncertainty, they also come with volatility and liquidity risks.

It's essential to have a balanced and diversified portfolio that includes various asset classes to minimize your overall risk.

Conclusion

Setting up a Gold IRA account is a smart way to protect your savings from market fluctuations and diversify your portfolio. However, it's essential to understand the eligible metals, choose a reputable custodian, consider storage options, factor in fees and expenses, and weigh the risks and benefits.

By researching and making informed decisions, you can maximize your investment potential and enjoy the benefits of owning physical gold and other precious metals.

To know more about the Best gold ira companies, visit our website.

0 notes

Text

What Is a Gold IRA How It Works, Benefits, and Cons in 2023 (Gold IRA Investing)

#retirement planning#retirement#401k#roth ira#gold ira#gold#gold investing#investment#luxury#mindset#money#moneytips

0 notes

Link

This is the best blog on the Expert Guide to Cost to Open a Gold IRA. So many people want to know about the cost, but they found such in-depth information. This is a short blog that you can enjoy.

0 notes

Video

youtube

How to Buy Gold | Gold Investment | Gold IRA | How to invest in Gold | W...

0 notes

Text

Finding the Right Gold IRA Investment Company for Your Retirement

IRA Gold offers expert guidance on gold IRA investments, ensuring secure and profitable diversification of retirement portfolios. Their trusted services and knowledgeable team help clients navigate the complexities of precious metal investments for long-term financial stability.

0 notes