#it's almost like just like every corporation in this country they value short term profits over the health of their company

Text

*Found on x-Twitter:

A Combat Veteran's Message to Donald Trump: You ABSOLUTELY DISGUST ME

Uncle Chad

@GIGACHAD2021

May 24

Donald,

Let me start off simply by letting you know upfront, that as a Disabled Combat War Veteran, YOU ABSOLUTELY DISGUST ME! From the minute floated down that ridiculous golden escalator in 2015, you've not just met but exceeded almost every unnatural thought and outrageous prediction made about you from day one. That’s impressive in a "watching a slow-motion train wreck" kind of way, especially coming from someone who has lived through and seen things most men could not stomach. You have DISGRACED not just yourself, but your family, GOD, this Country, the Rule of Law, the Office of the Presidency, and the Constitution of the United States. You’ve even managed to defile something as abstract yet sacred as our Founding Fathers’ vision. It’s like you took a giant Sharpie to American values and scribbled “Trump’s Playground” all over it.

Your MISERABLE Existence is an Insult, as you have done nothing but bring "DISHONOR" to the sacrifices the men and women of our military and their families have endured to protect the freedoms of every citizen in this country and abroad, who do not have the ability to protect themselves. One of the most disgusting things I've ever seen or heard was at your LIVE TV interview fiasco in 2015, where you felt the need to call your political opponent John McCain, "LOSER". A POW and actual HERO. You said, "He's only a HERO because he was captured. I prefer people who don't get captured". ALL for your amusement, as if you were using it as a punchline to a joke. You've spat and desecrated on the memories of my Fallen Brothers & Sisters in Arms.

Another truly astonishing feat that grinds my gears and quite frankly, pisses me off beyond comprehension, is what you have managed to do to our country In just 9 short years. Through your constant unhinged rhetoric, your actions and inactions and the fact that as of today, you have yet to take ANY RESPONSIBILITY whatsoever or offer any type of APOLOGY for the many issues our great nation has faced since the moment you swore the Oath of Office in 2017. This would include your administrations horrendous handling of a global pandemic that occurred under your watch and the majority of economist would tell you, that due to MANY of your actions and inactions, YOU are DIRECTLY RESPONSIBLE for the MAJORITY of the LONG TERM NEGATIVE affects that our nationwide economy is still experiencing today.

The #1 Driver of Inflation is and always has been, Supply Chain Disruption and while you had benefit of walking into office with an already thriving and stable economy, you then proceeded to create massive Tax Cuts for the mega-wealthy and highly profitable corporations, will little to no help going towards the middle & lower class in our country. In order to offset and pay for these tax breaks, you decided, PRE-COVID, to cut massive funding to our Supply Chain and when COVID HIT, everything began to implode UNDER YOUR WATCH. You then proceeded to print Trillions in brand new money with NO PLAN to offset any of it and NO PLAN to begin raising rates immediately. At the end of the day, you added $7.8 Trillion to our Deficit/Debt, the largest in HISTORY of a POTUS after 4 years and then without a Peaceful Transfer of Power, crying like a little b!tch, instigating an INSURRECTION on our Capital with your MAGA followers chanting to "HANG Mike Pence", the VICE PRESIDENT OF THE UNITED STATES, because he would now bow to you and kiss your ring. Then, unlike when you walked into office, with a thriving and stable economy, when you left office, did you leave President Biden a thriving and stable economy? No, you left him and this country severed main artery gushing into a blood bath, who's had to spend the entire first 3+ years trying to STOP the bleeding, albeit, he was successful at doing so, but during ALL of you cut rallies, you have the gall to blame EVERYTHING on his administration. It's DELUSIONAL and FACTUALLY INACCURATE. Now, the country is finally treading water in many areas negatively affected by your policies or inability to govern, but other areas are beginning to thrive, 3 NEW ALL Time Highs on the Stock Market, since President Biden took office, Inflation has leveled out, the LOWEST Unemployment in 5 decades and massive NEW JOB Creations, etc... but there you are, standing at a wobbling podium, crying like a baby, witch hunt this, witch hunt that, illegal aliens etc... literally lying to everyone, blaming the current POTUS for both, your administration and the 115th & 116th Congressional bodies miserable failures in the planning and handling of COVID. Oh, and by the way, who just prevented the Republican Authored Immigration reform bill, backed by the Border Patrol Union, and many other Republicans? Yeah, you & your EXTREMIST MAGA M0R0N's and their dereliction of duty, because GOD forbid you PASS something you've all been begging for, but NOPE, you simply do NOT want to give Biden a "Hot Topic" WIN during your election campaign. You're apparently not intelligent enough to realize that "WHAT YOU DO TODAY, as it relates to Econ 101, does NOT affect you TOMORROW". Historical data has proven that it generally takes 3+ years from the moment a policy and/or legislative bill or lack thereof, is passed/put in place, or when a significant national or global crisis occurs, it will be 3+ years from when those moments occur, before we start to truly see and feel the FULL impact, whether it is a positive or negative affect, across our economy. Go Read a damn book on Econ 101. (You will have plenty of time in PRISON)

Your priorities are down right FVCKED and other than being a PROVEN Sexual Assaulting Rapist & FRAUD, while currently under 4 Indictments & 88 Felonies for violating Title 18 of the U.S. Criminal Code, you have so many character flaws, that you HAVE NO CHARACTER. You have always put Power, Wealth, Loyalty, "Ada'boy" Credit & Notoriety , ABOVE Country over Party, Honor, Trust, Earned Respect, Decency and just basic kindness & common courtesy. Your priorities are individual based and they all have one common link, they focus above ALL else, when will it benefit you personally? If it doesn't , then your NARCISSISTIC EGO erupts like a volcano and you become UNHINGED and VINDICTIVE.

As President and as a BASIC HUMAN BEING, you have clearly demonstrated a complete lack of any virtue. Without an ethical and moral virtue, you'll never understand that there aren't many things more important as President, then to work towards creating and maintaining a cohesive, functional government, while working towards the common good of ALL our citizens, NOT just the ones that voted for you. It is also important to have a diverse population that has trust and respect for our institutions, the Rule of Law and thy neighbor. You don't have ANY of those "Leadership" qualities, whatsoever. Your lack of empathy, your inability to govern effectively and the lack of desire to represent ALL citizens of this great nation, as a whole, (unless there is some form of benefit for yourself), has clearly proven that you haven't any idea on how to place the needs of others above your own, nor do you care to do so!

The DELUSIONAL "State of Mind" that you live with daily, in conjunction with the Alternate Reality and Echo Chamber you've created for yourself, a small fraction of Republican Extremists within our government, has literally DESTROYED any resemblance of a functioning GOP. And the next time you look out in the crowd of you made up Rally numbers, tried and count ho many TEETH you see. Your MAGA - Making Attorney's Get Attorney's Movement is nothing short of EMBARRASSING and has about as much worth as the Cheap Chinese Bumperstickers it's printed on.

When you put ALL of this together, the MOST HIGHLY FLAWED Human Being that I've even seen in my lifetime, (and I have been through 2 wars), you end up with "DONALD J TRUMP", NO CHARACTER, NO HONOR, NO RESPECT and ABSOLUTELY NO Ethical & Moral Compass that could ever point TRUE NORTH. A Professional Con-Man, who over promised, under-delivered, lied and bought his way into the MOST POWERFUL OFFICE on the planet, and the END RESULT is EXACTLY what many of us anticipated and Donald, you have proven us correct. It resulted in you placing "yourself" above the Country, the Constitution and the Rule of Law, you has created a cult like following and you have divided this country to levels we have not seen since the Civil War. Your constant lies, your open mic demands and threats to anyone who does NOT agree with & support you or anyone who just refuses to bow down and kiss your ring, is corrupt, conflicted, communist, racists and a horrible person in your weak mind. WAKE UP, because you are HEADING to PRISON and will NEVER HOLD Public Office again!

I will out live your old a$$ and I will piss all over your grave! ENJOY PRISON!

"John McCain is a War Hero because he was captured, I prefer people who aren't captured" - DJT

0 notes

Text

I had some of this in the tags of that Mufasa movie reblog but decided to make a seperate post.

Disney rewriting their Lion King backstory as previously established in sequels and tie-ins just made me think about all of those thinkpieces on streaming and media being made to be binged and forgotten along with the warnings about companies being able to manipulate their products post-release.

Disney constantly retconning, tinkering and overwriting canon whenever they want a fresh new product, their mindset of churning out short term novelty at the expense of long term brand is pretty shocking as someone who grew up a Disney kid. How do you build the nostalgia the brand was famous for, how do you build stories that last and maintain a depth of feeling, when you have no consistency? When the next one will just overwrite the last? When you make things to be consumed and discarded?

Disney became a titan because it understood legacy and now it’s the fast fashion and single use plastics of the entertainment industry.

#Anti Disney#Disney Critical#Film Industry#Media#Entertainment#it's almost like just like every corporation in this country they value short term profits over the health of their company#anything as long as number goes up

20 notes

·

View notes

Text

Baseline

Individual Point of Perception is Dependent on Conditioned Mode of Thought.

Our conditioned mode of thought is determined by a number of aspects including:

our formal educational conditioning;

our cultural background;

the perceived power personalities that influence our sociological conditioning;

...to name a few.

I originally began this article with a view to confining it within the first classification of educational conditioning, but by way of natural process all seemed to apply.

Then, as it felt presumptuous and unwieldy to force a subject scope worthy of a treatise into a blog format, I have had to restrict the situation to how science has influenced and placed limits on our thinking.

Very much in shorthand....

All of science is based on direction defined by philosophy and Rene Descartes appears to have been the pivotal point in this instance. He introduced a way of perceiving things that took an observable entity and broke it down,

analytically, into its individual unit parts. Dualism and other aspects, illuminating then, seem second nature to us now.

The evolution of this form of thinking was passed on into the capable hands of Francis Bacon who, in turn, hand balled it to Isaac Newton, both of whom provided substantial modifications to advance this concept of fragmentation. What we have inherited is what might be termed the 'Doctrine of Direction' for the entire westernised civilisation.

What these theorists neglected to consider and what Quantum theory is in the process of giving back, to those of us who care to take note, is an appreciation of the 'links' or aspects of interrelationship between these basic building blocks of fragmented, alienated entities. An aspect every bit as important as the 'units' themselves, as it is only by way of these continuously, communicating interfaces that we arrive at wholistic entities that are greater than the sum of their individual parts.

Unfortunately, we still model our mode of individual and collective advancement on the thought structures that built Empires that have long ago ceased to exist. Momentum, obviously, is capable of carrying us too far in the wrong

direction.

I don't wish to appear to be a detractor of the theories of these giants of our past, or even of the ones who 'stood on their shoulders', who took those theories and gave them application within the sociological framework. What I am attempting is to show how the limited style of scientific mindset, that is drilled into us by way of our current educational process, has engendered our individual and therefore collective point of perception. This in turn has determined our current life situation. Man is a reflection of his environment, yes, but the opposite is every bit as true.

We have made fantastic advances with our 'scientific' thinking. We can gauge, almost to the centimetre, where we can land a rocket on the moon, over an almost unimaginable distance, with a mind numbing number of variables all taken into account. And after that, bring it back again. We are communicating concepts through mediums such as we are employing at this very moment, as you read this, and there are a myriad of other examples.

But, there is a dark side.

Having adopted, through conditioning, this mode of perception, we have alienated ourselves from our environment, from each other and even created alienation within our very selves. Our 'self' from this viewpoint, by way of

illustration, does not include our body. 'I' am a separate entity and my body is a mere physical, mechanical housing, when in fact our bodies are a fully incorporated aspect of our 'selves'.

'Us and Them' is destroying 'Us'.

Take a look at what our alienating point of perception is doing:

(1) to our shared environment. We consider our 'selves' to be a separate entity to our environment, rather than an integral, interacting aspect of it, so any harm we inflict on the environment has no real effect on our situation, we

surmise. (The comparative example of this would be that of a race of people, traveling through endless space, systematically destroying the space ship they are traveling in.) There have been highly qualified, dissenting voices to this

supposition. Even economists, like E.F. Schumacher, who advise that, "If we ever find ourselves in the position of winning our battle with nature, we will automatically find ourselves on the losing side". Conditioned thought structure,

however, pays little heed to logic, unless it is incorporated into an 'approved' educational process and therefore transposed into the paradigm;

(2) to our estranged sense of interrelationships. By over emphasising the self concept, to compensate for a social structure that appears intent on drowning the individual in a sea of homogenised anonymity, we automatically place

almost insurmountable barriers to interpersonal integration;

(3) within our fragmented personal selves. In this context, the major effort appears to be the creation and continuous maintenance of a self image rather than the cultivation of the actual personality. A self image that bears little

relation to the real person hiding within, who sadly perceives the camouflage to be more socially acceptable than him 'self'. Applied to extreme, the individual places so much personal energy into the maintenance of this persona, that

he 'starves' himself. A major cause of mental dis-ease and what can amount to total breakdown of the individual existence.

Relationships can only exist between personalities. Relationships are not possible between facades, which are essentially illusions, so the illusion that they do doesn't exist for any length of time. This somewhat pointless exercise

only exists because many believe that it's all they have to offer, as the real entity is seen as being insufficient to the situation.

One of the many sociological phenomena that appears to endorse all this is the fact that, in all westernised countries, divorce statistics come close to equaling marriage statistics and quite commonly surpass them.

It's a little unfair, however, to endow philosophers and scientists with the full responsibility of our present life situation. There are other buttressing influences. Sir Isaac Newton's writings within other fields were for all

intents and purposes totally ignored, as they still are. The bias of thought at that time was all for the new clockwork bent that held so much potential for industrial advancement, as it still does. An illustration as to how long the industrial lobby, by way of political sway, has been placing paradigms on the full spectrum potential of our advancement as a species.

So, just while we are in the vicinity:

A corporate entity doesn't have a personality, other than the one on loan and frequently patched from the public relations departments, so don't look for human qualities;

The corporate ideal is to be in the position of dictating to the marketplace (yes, that's you!) and they never sleep in the pursuit of this goal;

Corporate entities see themselves as being subject to only one law and that's the law of economics. When economic precept shows any potential to limit short term profit, they're not above bending that out of shape either.

This latter point requires a little expansion, I feel.

Feel free to disagree.

According to the science of economics, there are two varieties of resource: rivalrous and non-rivalrous. A rivalrous resource is one that can be used up faster than it can be replaced, if it can be replaced at all, e.g., fossil fuels

and the natural environment. A non-rivalrous resource, on the other hand, is a resource that is inexhaustible, i.e., it can't be exhausted as it is continuously replacing itself at a rate faster than it can be employed.

Now, considering the fact that human beings breed their own replacements, in the sort of volumes commonly described as 'population explosions', which of these two categories do you imagine employees slot into, within the corporate

mindset, in these days of outsourcing?

`Safety before Production’, is the corporate catchphrase, but it will never be the reality because it doesn't need to be. An appearance is put up in order to establish a good 'Employer Brand Name', yes, but mostly because other

powerful economic entities like insurance companies 'persuade' them to do so. And insurance companies are only prepared to do that because it has direct bearing on their own economic status.

This automatically creates another translation of the 'Us and Them' syndrome, the 'Divide and Rule' format. Musashi's 'The Book of Five Rings' and Sun Tzu's 'The Art of War', amongst other treatise on war strategy, make their way into

every board room these days under the arms of those who would subordinate their productive work force to their will. Strategies that work within one set of environmental circumstances don't necessarily translate well into others,

however, and 'Divide and Rule' is a classic example. When looking at a combined productive exercise, it simply isn't profitable to view and treat your production sector as though they are the enemy. This will automatically cost you

money and the longer you persist with a faulty strategy, the more it will cost you. The variety of tactics employed, to gain the 'ascendency', are far from what is required to assist in establishing a sense of cooperation and self worth within the individuals that make up the bulk of westernised populations. And a sense of self worth is the foundation stone of a happy individual. A happy employee is more productive and produces a better quality product, so the strategy is obviously flawed.

Our mode of technological advancement has cost us dear, obvious in the stultified mental and spiritually bereft realms we have allocated to ourselves, from a set of values that is blinkered to the full spectrum definition of wealth. I

have met people who, having worked continuously for, say, $500.00/week for a number of years, don't even consider pressing for more when their mode of employment changes, because they have been conditioned, over time, into believing that $500.00/week is their sum total worth as a human being. The comprehensive definitions of degradation and defeat are achieved when the victim is persuaded.

If western civilisation (sic), would just halt its frenetic, lemming-like race to the cliff edge long enough to look at the life philosophies of the various indigenous cultures on this planet, we would be in a position to provide ourselves with the requisite wholistic life perception required to save ourselves, and those same indigenous communities, from that inevitable extinction that we are imposing on other species at this very moment.

A different way of seeing is there, for our adoption, any time we want it. We find it not just in the wholistic, indigenous community and environmental Gaia mindsets, but in the most obscure of niches as well as the most obvious of

places.

By way of an 'obscure' example, I recall reading Aleister Crowley's 'Magick' in the dawning of my adolescent rebellion, somewhere between Enid Blyton and 'The Russians'.

Wholly from memory:

`The practitioner of Black Magic employs his art to raise his level of existence above that of his environment’ - which doesn't sound so bad really, does it? Just looking round, it appears to be what everybody is doing, or attempting to do. Yes/No?

But then he goes on to say:

`Whereas the practitioner of White Magic employs his talent to raise the level of his environment, and in so doing raises his own level of existence’.

A totally different translation of existence, richer by far, achieved by a mere shift in perception.

As a natural extension of our adopting this different definition of existence, the changes within our culture would be dynamic to say the least. Mental health institutions would almost cease to exist, as the dysfunctional personality

is no more than a symptom of the dysfunctional group. The dysfunctional group, no more than a symptom of a dysfunctional social order. Primary catalysts of physical ill health, such as stress, would almost cease to exist also, along with associated overloaded hospital systems and massive requirement for, along with associated abuse of, medication.

Street people would not feel a need to retreat to the streets anymore, but would see a form of society that they would want to be a part of. A form of society that they could see themselves as being a part of, alienated no longer.

Dare I mention prisons?

I could continue, but I'm sure you get the gist.

All aspects of our social and personal direction are compromised when we operate from a biased or false premise. Our proud, emphatic (dare I say, arrogant?) denunciations of 'this is wrong', or 'that's not right' appear as shallow as mainstream media. Any observation from a false premise can only produce an inaccurate end assessment. A silk purse don't come from no sows ear, boy!

Therefore it naturally follows that judging others, or even ourselves, by our own standards is automatically a travesty of natural justice and nothing more than a gross, if unintended, hypocrisy. Because we, unquestioningly, inherit standards of judgment also.

It is possible to establish valid existence only by exploring the depths of established standards, understand where they stem from and, by doing so, determine as to whether they still have relevance in regard to personal existence,

now, in our current environment. Retain the standards that do have relevance, rid ourselves of false standards that represent the crippling detritus in our lives, and adopt any new standards that are seen to promote required existential standing.

This is normally considered to be the philosophers function, yes, but a little philosophy won't hurt any of us if it results in our finally reaping the substantial rewards of a valid sense of social responsibility. We have that duty to ourselves, each other and toward our shared environment. Wholistically.

The answer to all the worlds' problems lie in the future within our children, but we need people qualified to teach them how to move the world, through a paradigm shift, from here to there. There's only one way to achieve that, so we need to get to work on ourselves, individually, very quickly.

1 note

·

View note

Link

Business news headlines recently bemoaned the incidence of “bond yield inversions” in a series of countries as the supposed harbinger of doom and destruction. Many working-class people were left scratching their heads about what on earth this all means. 10 years after the “Great Recession”, many could be forgiven for thinking that we have been living in permanent recession and things can’t get any worse. The reality is that, while things have not been good in most countries, things can also get far, far, worse. In this article, we will explain why.

What is a bond yield inversion, and why does it matter?

A bond is a term for the purchase of someone else’s debt. In other words, if you buy a bond, you are lending someone money (often a government or large corporation). Bonds are different from stocks, which give the owner a share of the profits of a company.

Bonds can be short term or long term. This refers to the amount of time that you have agreed to lend someone your money. In normal times, the longer the term, the higher the return. Say you lend someone money for 12 months, you might expect a two percent rate of return; but if you lend money for five or ten years you might demand a four or five percent rate. It is natural to demand a higher rate for a longer period because you are taking a higher risk over that time. The value of your loaned money could be eroded by inflation, or you could even lose the entire amount if a company goes bankrupt or if a government goes into default (refuses to pay). Another term for interest rate is “bond yield”. A “bond yield inversion” is the weird and dangerous phenomenon when interest rates on long-term loans are lower than short-term loans.

Why would interest rates for long-term debt become lower than short-term? This is another way of saying that life in the short term is far riskier than life in the long term (even when the risk of inflation and bankruptcy is factored in).

Imagine that you are a billionaire and are trying to figure out what to do with the mountains of cash you have screwed out of the workers (to use technical terminology). If capitalism seems to be doing well, you’ll invest this money in stocks to get a share of the profit made from exploiting workers. This is risky, but gives the best potential return. But if you think that there is going to be a slump, then you’ll pull your money out of the stock market before everybody else does the same and you lose millions when share values go down. Now our poor billionaire is looking for a place to put his or her money. They could buy a short-term bond, but that won’t help because they’ll get the money back right in the middle of the crisis. So their only option (apart from sitting on cash, or buying gold) is to buy long-term bonds.

The yield of the long-term bond is driven down when lots of people want to buy them. This is because bonds are sold using an auction-like process. A government may say, “I want to borrow $1 million at a one-percent rate, who is interested?” If nobody is interested, such as when nobody wants to buy Greek debt, then that government will have to raise the rate to attract more people. But if it is the government of Germany, and lots of people want to buy their debt at a yield of one percent, then perhaps they can offer only 0.5 per cent, or even zero percent, and still get the money they need.

Low long-term yields are a symptom of the fact that the capitalists have no faith in the capitalist system. Don’t bother listening to the paid propagandists of the bosses who say that the “free market economy” is the most efficient way of allocating resources; instead, watch what the moneybags actually do with their precious hoard. They care too much about protecting their ill-gotten gains to believe their own propaganda for a single second. They just want to keep their heads down and hope that by the time their long-term bond matures the crisis will have gone away. They don’t care about being productive, and they definitely have no interest in providing jobs for working-class people. They only care about their money.

The situation has gotten so out of control that there are even bonds with a negative yield! This means it costs money to lend money, and you get extra money for borrowing money. The logic being that, while the loaner will lose money, they’ll lose less money than if they invested elsewhere. This can seem crazy, but there is $16 trillion currently invested in these assets that are 100 percent guaranteed to lose money. One Danish bank even released a negative rate mortgage, where they gift you money to buy a home. The capitalist system is clearly inside out and upside down.

Historically, since the Second World War, every time the return on 10-year U.S. government bonds has gone below the U.S. two-year bonds, there has been a recession soon after. While it is possible for yields to be negative without being followed by a recession, pretty much every recession is preceded by this kind of behaviour.

Bourgeois confusion

However, if one looks for an explanation as to why a recession is coming there is much confusion. Liberal politicians are talking about the “Trump slump”, with the prospect of the U.S.-China trade war causing a global recession. In related terms, a no-deal “Boris Brexit” also would serve to place additional barriers in the way of free trade. Even the Hong Kong protests have made markets jittery, due to the possibility of the movement spreading, and the fact that Hong Kong is an important financial centre in its own right.

Right-wing populists like Donald Trump think they can win a trade war. This leaves the intelligent bourgeois aghast, as they have spent the last 80 years trying to expand trade and avoid protectionism. In their view, protectionism extended the 1929 stock market crash into the decade-long depression of the “Dirty Thirties”. They actually have a point here, as protectionism does strangle the capitalist economy. Tariff barriers and competitive devaluations mean that, instead of buying a more efficiently produced (and therefore cheaper) foreign good, you are forced to buy a more expensive and less efficiently produced domestic item. If you are the only one using protectionist measures, then you have successfully exported your unemployment to another country, but when everybody does it, then on average the entire world economy becomes less efficient. You have to do more work to get less stuff. This is why big business opposes trade wars and favours free trade.

The self-declared “community of nations” is complaining about Trump violating the “rules-based international order”. Does that mean workers should support these liberals against Trump? The “rules-based international order” promoted by countries such as Germany, France, and Canada is a euphemism. These pretty words to conceal a thief's bargain to share out the loot of exploiting the world working class. Trump, the biggest gangster, is merely trying to rewrite the terms of the deal in his own favour. Our opinion on this fight is the same as our opinion with regard to differences between the New York Mafia, the London Mob, and the Tokyo Yakuza.

But while there is potential for a trade war to exacerbate the coming slump, just as subprime debt worsened the 2008 slump, or the dot-com bubble in 2000, or the oil crisis in 1973, none of these precipitating factors really explain the cause of a recession. It has been more than 10 years since the last global downturn, one of the longest periods of growth in the history of capitalism, and generalised processes demand a generalised explanation. Possibly the best explanation for the root causes of capitalist crisis comes from the Communist Manifesto:

“In these crises, there breaks out an epidemic that, in all earlier epochs, would have seemed an absurdity—the epidemic of over-production. Society suddenly finds itself put back into a state of momentary barbarism; it appears as if a famine, a universal war of devastation, had cut off the supply of every means of subsistence; industry and commerce seem to be destroyed; and why? Because there is too much civilisation, too much means of subsistence, too much industry, too much commerce. The productive forces at the disposal of society no longer tend to further the development of the conditions of bourgeois property; on the contrary, they have become too powerful for these conditions, by which they are fettered, and so soon as they overcome these fetters, they bring disorder into the whole of bourgeois society, endanger the existence of bourgeois property. The conditions of bourgeois society are too narrow to comprise the wealth created by them.”

Evidence of overproduction is wide and spreading. One key economic statistic that shows this is called “capacity utilization”. This measures how much of the productive potential of machinery and factories are actually in use to create commodities. Globally, this statistic has been in decline over the last 50 years. For example, in the USA, capacity utilization regularly surpassed 85 percent in the 1970s. However, after plunging to almost 65 percent during the last crisis, this figure hasn’t been able to recover. Now, between 20-25 percent of machinery sits idle even in a so-called “boom”. This waste of productive potential is an indictment of capitalism in the 21st century, which Marx and Engels explained back in Victorian times. Conversely, it also shows the potential of a society that produces for need instead of greed. Overnight we could increase output by 20 per cent merely by utilizing the existing productive forces. We would direct these resources to the genuine needs of the people, to end the housing crisis, build environmentally sustainable transit infrastructure, schools and hospitals, etc.

Another example of the crisis of overproduction are the mounting hoards of corporate “dead money”. Mark Carney, formerly the governor of the Bank of Canada, and now governor of the Bank of England, made headlines back in 2015 when he chided corporations for sitting on cash and not investing. This lack of investment led to stagnation in productivity. At the time, in Canada, dead money amounted to just under $700 billion. The bosses responded with indignation to this criticism from “one of their own”. They asked why they would invest in increasing productivity when there was a capacity utilisation crisis. Why spend money to produce more commodities when you can already make more commodities than the market can absorb? Carney quietly moved on, as did journalists, but the problem has not gone away.

Canadian “dead money” has ballooned by $65 billion per year to a total of $950 billion. These figures can be repeated in country after country. The billionaire class is acting like a dragon from a Tolkien novel, sitting on its jealously guarded pile of gold. But if the workers dare ask that this hoard be used for jobs, or homes, or education, they are met with smoke and fire. This is yet another glaring example of why humanity can no longer live with this monstrous system, which is completely incapable of advancing society and must be slain for the people to prosper.

The fundamental contradiction of capitalism is that the workers are not paid the full value of their labour. Therefore, the workers cannot buy back the items they have just produced. But while the consumption power of the working class is restricted by a whole series of factors, the individual capitalists continue planning production as if there are no such limitations. This inevitably leads the capitalist system into recurring crises of overproduction.

The capitalists can temporarily get around this in a number of ways. They can re-invest the surplus product in production. But doing this merely exacerbates the problem, as increased productivity in the long run, leads to more items being produced that the workers cannot buy. At the moment however as we have seen with the capacity utilisation and dead money crisis, corporations have stopped re-investing. The bosses can also export the surplus product, but again this builds up productive potential in other countries and re-creates the same crisis of overproduction. Now Trump’s trade war is shutting the door on this method of postponing a crisis. Finally, they can artificially boost the market by extending debt to workers, corporations, and governments. This can also work for a period, but eventually these debts must be repaid with interest. Again, the Communist Manifesto explains this clearly:

“And how does the bourgeoisie get over these crises? On the one hand by enforced destruction of a mass of productive forces; on the other, by the conquest of new markets, and by the more thorough exploitation of the old ones. That is to say, by paving the way for more extensive and more destructive crises, and by diminishing the means whereby crises are prevented.”

In 2009, governments bailed out the banks and massively increased debt. Now this debt remains—personal, corporate, and government—but a new crisis is coming. The capitalist class has utilised almost every tool at its disposal to avert another crisis. It has used up all of its escape routes and does not know what to do. It is desperately afraid of the social consequences of the “enforced destruction of a mass of productive forces” which would lead to massive layoffs and destitution. A decade ago, the bankrupt labour bureaucracy managed to encourage the workers to keep their heads down and not fight. But in the intervening period, the ideas of socialism have become popularised in a way not seen in generations. The political system in country after country is on the verge of collapse in this time of modest growth. Just imagine what will happen during a generalised slump.

One political commentator for the CBC said the following:

“We are in unknown territory, out past the ‘here be monsters’ sign. None of us has any idea how this will turn out, economists included. As we saw in 2008, the collateral damage when things start to go badly can be devastating. Personally, I have a bad feeling about it all.”

Theoretically speaking, there is no “final crisis” of capitalism. They will always find a route out, one way or another. But the capitalists have no idea where this route lies, and neither do we. One thing is clear, however: whichever way out they find, it will be at the expense of the workers and the poor. The bosses can no longer move society forward and stand at the edge of an abyss. We must build the forces that can create a socialist society as the only alternative to capitalist catastrophe.

#marxists#marxist#marxism#communism#socialism#capital markets#capital news#capitalism#late stage capitalism#capitalist hell#capitalist society#criticism of capitalism#communist manifesto#corporatism#crony capitalism#capitalist crisis#great recession#karl marx#frederick engels#labour#labor#working class#class warfare#bond yields#bond yield inversion#overproduction#bailout#bail-in#2008 bank crisis#federal reserve

9 notes

·

View notes

Text

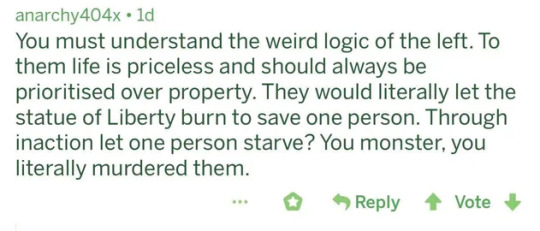

Something about property rights

I felt like I needed to rant yesterday and decided to adapt the discord messages into a tumblr post.

I spent most of a class this morning thinking about the Anglo interpretations and notions of property rights, trying to actually contrast it with workable alternative notions of property rights and feeling kind of hopeless about it and finding it hard to actually come up with anything that isn't literally communism.

And in retrospect it made the whole “philosophically questioning the whole notion of property rights” feel more, idk, respectable than it had before, when it just sounded like the USSR and China opposed its inclusion in the UDHR for technical reasons or pure self interest in covering their own atrocities.

The whole thing started with thinking about the Zapatist slogan “la tierra es de quién la trabaja”. “The land belongs to those who work it.” To me, the Zapatistas were pretty cool guys, who sided with the little guy and the indigenous peoples of México. But I thought immediately about how a colonial American might react to it, and I couldn’t escape the idea that they’d hear the slogan and go, “ah, yes, we should kill the savages and steward the land correctly”.

As much as the magna carta is held up as this great precursor to democratic rights in this country, its origins are far more dismal and petty. It wasn’t really a democratic impulse, it was more like a bunch of petty-kings coordinated to overwhelm a high king. But it doubtlessly had a strong effect on feudalism and came to be a part of English identity before that even really made sense from a modern perspective. In short it came off almost as a promise that “every man is a king of his own home” and that helped to make property itself sacrosanct.

So when capitalism changed the people’s relationship with the land, the serfs were “liberated” as the commons were siezed by their de jure owners. The collapse of the commons fundamentally changed people’s relationships with property, exacerbating the whole “every man is a king of his own house” issue, and making property the be-all-end-all of basic needs like shelter. To the degree that the Magna Carta made property sacrosanct, in a literal “this is a divinely appointed right” sort of sense, the collapse of the commons codified exactly what that meant, making that sacrosanctity intrinsic to thriving.

So because of tying these issues together so deeply, it made sense to steal the lands of people “not working it” according to how you might work it. So that it made sense to go to war because the yankees were stealing your chattel, and horror of horrors not even repurposing them! So that telling South Africa “hey, no, black people are people too” was unholy, violating their sacred authority to clean their own house. So it makes sense that Australia continues to break promises to its Aboriginal communities, if, say, their homes have a potentially profitable mine to work. So it makes sense that Canada breaks promises to its indigenous population, if there’s an oil pipeline they can lay. So that it made sense, paradoxically, for the US to strong arm México into changing articles of its constitution about indigenous land rights in order to pass NAFTA and be able to threaten to go United Fruit Company on the people for not being profitable to the corporations. And the EZLN, which formed directly because of the anxieties of these moves as the Maya genocide was still very fresh on everyone’s minds, are neo-Zapatistas; the land belongs to the one who works it! The Maya who always has, or the companies that want to (exploit it)?

I remember once as a teen confronting the attitudes this bears on a small chan.

Before the BLM stuff, actually regarding OWS and those "rich punks arguing for socialism with their iphones" and shit; I'd made an off hand comment about things not being worth more than lives at some point and someone replied "I'd totally kill someone if they stole my phone".

I made a comment in utter exasperation (this was on a board that was like /pol/ before that was really what it is now and there was no reason to believe they weren't serious), saying something like "Is, what, a month's pay really worth a human life to you?" ($800 really was more money than my mom was making at the time, let alone taking out rent and shit first, and I gave them benefit of the doubt that they weren't rich first world fucks who could afford to take a hit. At that point I’d learned that most people in India, even dirt poor people who couldn’t afford water, generally had smart phones in order to help with work and things; conscientious of this, the fact that I know and knew dirt poor almost homeless people in the US who needed phones for work, I was trying to allow for “if I lose this phone, I lose my job, my home, my health, and my life” which is a reality a lot of people live with, and at least somewhere to come at this issue with).

(But) the commentators, both the user I was arguing against and several people using trips, proceeded to mock me for apparently living in a 3rd world country for thinking a phone cost more than one paycheck.

To these people a phone wasn’t even worth a week’s pay, let alone two. And yet, to them, another person’s life, no matter how desperate they were, no matter how hungry or sick or anything they were, they were worth less than that.

This exchange was about the time I started nurturing (or giving in, depending on your perspective) the idea that "maybe some people aren't just, mistaken, or seeing something I don't, or have some complex network of beliefs making them bite a bullet, but like, actually goddamn legitimately evil in terms of their fundamental values". I gather absolutely that there’s a lot going on with this; that you could understand the guy to mean “I think thieves should be killed” as opposed to ““humans”“ or whatever. But, like, still.

Traumatizing is an overly dramatic word for what that conversation all those years did to me, but maybe it was. And it’s not like a phone’s *nothing*. But the way the users undercut me, and revealed not only how worthless the phone was to them, but how little human lives were worth to them in relation to the phone just kind of knocked the wind out of me

This made the rounds recently. This is the legacy of that property is sacrosanct bullshit.

And, like, fuck, this is the whole cultural underpinning of what’s been going on with the gun shit here. It’s why guns are so important to us. Why we feel it’s absolutely justified to shoot a kid in the back for lifting a $2 bottle of beer from a convenience store and leaving him to bleed to death without so much as calling the police. The entire fucked up thing we got going on w/r/t race here in the land of the free? It’s because of our relationship to property rights.

At the same time, you get climate change from people who feel it’s their right to do whatever to their property. Oil’s money. Dairy farms, meat, cash crops like almonds. You don’t like your water dirtied? But I’m only fracking over ma plotte!

What’s going on in Brazil? Some natives won the right to their lands against farmers who wanted to clear the forest, and mysteriously within a few weeks everything’s lit on fire. 𝅘𝅥 Dark torrents shake the airs, as black clouds blind [São Paulo] ♫

You even get the nimby zoning shit out of this. How dare you let colored people into my neighborhood! That’s stealing from my property values! A tall building? That’s stealing my sunlight!

In a more mixed sort of way, you got homeless shelters, oil wells, chemical plants, industrial parks, military bases, fracking, wind turbines, desalination plants, landfill sites, incinerators, power plants, quarries, prisons, pubs, adult entertainment clubs, concert venues, firearms dealers, mobile phone masts, electricity pylons, abortion clinics, children's homes, nursing homes, youth hostels, sports stadiums, shopping malls, retail parks, railways, roads, airports, seaports, nuclear waste repositories, storage for weapons of mass destruction, cannabis dispensaries, recreational cannabis shops and the accommodation of persons applying for asylum, refugees, and displaced persons - a list i just lifted from wikipedia’s articles on nimbies. Looking at that, there’s some clearly sympathetic issues too. I mean do you really want a train cutting through your farm, no matter how well you’re recompensated, no matter how much it will objectively improve the lives of the people in the cities, no matter much better it is for the environment to commute together?

But, like, what exactly are the alternatives?

We could look at other cultures. What did Belgian property notions look like? Leopold of the Congo? What do French notions look like? Forcing Algieria to pay back the “investment” France made by colonizing them? Well, the English and the French go back a long, long ways, maybe we could look at Germany?

The first genocide of the 20th century is often recognized to be that of the Herero, in Namibia’s, Germany’s biggest steal in the struggle to carve up Africa like the Black Dahlia.

I already mentioned Brasil.

What about China? Surely they aren’t western!

By some notions they were the first feudal nation in the world, and yet only left the system really in the 20th century. That’s a lot of cultural baggage that underlays the reality the Chinese live under today.

The early republican period saw the rise of warlords and other petty bastards effectively continuing the feudal reality in much the way sharecropping and jim crow continued chattel slavery in the US. The successor states aren’t pretty either; Taiwan, continuing republican ideals, cleared out much of its indigenous population for the Han in ways analogous to what European powers did to the natives of their countries; the PRC, which was born to challenge the ideals of the old republic for its own, took back “what was theirs” with Tibet.

The PRC, explicitly rejecting property rights as the west understands it, doesn’t even have a legal analog to eminent domain, and in effect can seize property on a whim without compensation, forcibly engaging in actions like people moving, which I feel it should be known when done to a community often results in genocide.

Something else illustrative of the conflicts of interest in the problem lies with the 3 Gorges Dam project. Ostensibly to control flooding to villages downstream, over a million residents of the Chongqing area were forcibly relocated, with rumors of people who resisted the project being explicitly drowned and because everything’s just hopelessly corrupt the money actually provided for recompensation never made it to the hands of farmers now stuck in a big city without the education for work.

Similar stories to Taiwan’s play out in other capitalist countries; similar stories to the PRC’s play out in countries that reject those notions.

Generally you just reinvent the same concepts drawing from the lord and serf mentalities of old. There’s shit like this going down in the Muslim world, in East Africa, South America, South Asia, whereever. It’s not just an Anglo thing, even though I’ve let myself believe it were, because of how I was taught about history, from my culture’s perspective.

Then you have to ask yourself, when there’s no net, when you have to provide for yourself first, do the commons necessarily make sense?

Is it even viable, economically or politically, to abolish private property and return to the commons like people have advanced? Would, to enjoy the benefits of something evidentally only stable under feudalism, we have to return to some kind of practice of feudalism? Is that even worth considering?

There are more people alive today than ever before. And that didn’t happen just by accident. We really, actually, seriously have made incredible improvements to agricultural yield and safety, ensuring that the only places on the planet that starve are those that are being starved, by monsters like the Saudis. But the scale we need, the scale we want, the scale we have - is much more than just what one farmer can provide for himself. And the fact that we do have other farmers do the mass farming with their bulk fertilizers, machinery, pesticides, and such, means that most of us don’t have to spend time every week tending to our gardens making sure we have enough staple foods to survive, so we can pursue our own hopes and hobbies and dreams and undertakings and services and so on.

All of it sort of leads to the question, Who deserves the land?

The worker whose blood sweat and tears are wrought into the soil? That could lead to the issue of killing my Yokuts friends' gatherer ancestors for stewarding their lands, husbanding their ecosystem and managing burns and wild populations, instead of raping the lands, burning everything to ash to farm foreign crops that aren’t even adapted to the water issues here. And it doesn't proclude the workers from choking us with smoke, if they feel they need to. The guy on the oil rig isn’t doing it because he endorses what the oil companies do or because he thinks it’s necessarily a good thing, he does it because it makes him bread. Why would worker’s self management solve that? Shareholders and workers alike would only care about taking home what they can.

The "owners” in the English sense? Taking subsidy after subsidy, fighting actively to drain our rivers, collapse the formerly self-renewing resources entirely, bringing us droughts, feeding even the lactose intolerant among us the lie that we need fatty heart clogging cheeses to be healthy? Illegally hiring, exploiting, and deporting the vulnerable? Big farms are just any other business, their owners are the same venture capitalist vultures preying on anything else in that world. South of me used to one of the biggest lakes in North America, virtually the entire south valley was lake Tulare. It’s a bunch of cities now.

So, the people who need it?

Maybe but who decides that? War for territory is a fundamental struggle built deep into us; war is even practiced by chimps. Military ration planning like we saw in the USSR and PRC cause Holodomors. United Fruit and their entire coalition caused the Silent Genocide. Abolishing private property entirely would, what, return us to the times when the lands were unclaimed? That would just lead to petty struggle after petty struggle, like a chimp disemboweling another.

And now, having written this a second time, I’ll end with what I wrote earlier

4 notes

·

View notes

Text

Get an Advantages with Master of Business Administration Melbourne Course

The advantage in Master of Business Administration Melbourne courses are that they offer the opportunity to expand on one's business skills by further focused study in a specific area of business. Some of the key elements covered by a business management course include finance, international markets, stakeholder relationships, operations management, and analytical decision-making, among others. A course in business equips you with all the essential skills that employers look for in management professionals and gives you a better prospect of getting hired immediately. A master’s degree carries a lot of credibility and is one of the most sought-after qualifications in small and large businesses alike. A Master of Business Administration Melbourne course is a solid foundation in a financially-rewarding and highly fulfilling career.

Business Management Combination Courses

Some universities offer combination business courses as part of their management program. For example, you can choose to do an Online MBA Sydney and Human Resources foundation diploma or diploma, or even choose a combination of Business Management and Marketing. The advantage of taking combination courses is the additional exposure obtained to the specialized areas like Human Resources and marketing, which make for a compelling statement in your resume. These Master of Business Administration Melbourne courses serve to inculcate a spirit of entrepreneurship in those who pursue them, building in them the capability to organize and manage a business venture and the know-how to navigate the risks in an ever-changing market and make a profit. In an increasingly competitive global market, it takes managers with the ability to adapt and innovate to build a successful enterprise. These are the skills that a management degree ultimately seeks to instill as part of its curriculum, and which prospective employees undoubtedly value.

Accelerated Learning Programs for Busy Students

These days, universities are offering undergraduate and graduate business programs with accelerated learning models, which allow students to complete their courses in the minimum possible time. This is especially beneficial for professionals who have taken a break from work to complete a master’s program, as it enables them to complete their qualification in a much shorter duration than normally-paced courses. This feature, coupled with convenient payment plans of courses, make these programs very favorable among students and professionals alike.

A Master of Business Administration degree can brighten your career prospects in not just one, but several areas of specialty, giving you a definite edge over your competition. Sign up for a Master of Business Administration Melbourne degree course today and leverage your career.

The Scope of Master of Business Administration Melbourne course for Your Future

In recent times, privatization has led to the amalgamation of the global economy and every economy relates to the other and gives a helping hand, when in need. Privatization not only brought Multinational companies’ agencies only rather than getting involved in private companies, but trend shifted to the later. Conventional studies were the interesting, but they did not have the exposure which anyone had required to be unique or to start an enterprise of their own. Definition of management was theoretical in the nature and practices were scarce. In developing countries, made changes in people's standard of living and brought a drastic change in the educational system too. There was a time when individuals had a desire to work in government.

By 1980s superpowers realized the importance of MBA program in Australia and its contribution to the economy. As it is a process of getting people together to accomplish the desired goal they understood how effective it could be if used strategically. Since then till today the term management has acquired the significance and studies are done to get the knowledge of management.

As Management consists of Planning, organizing, staffing, leading and controlling an organization it requires a lot of skill and knowledge. So esteemed universities of the west for the first time introduced Business Management by 1980.

In the 21st century, it has become a need to know management studies to be in the limelight and to survive in the midst of high tides of competition. There is always a constant change in technology, society, environment, competition, and diversity, which bring rapid development in the management system. Management not only describes the idea to the manage resources but also reflects the importance of business and entrepreneurship.

One can inherit the skills of core management after the high school. Major in management is offered in almost all the colleges at the time of graduation and further MBA will be a good option to pile up with a master’s degree. Almost all the colleges and universities providing both campus degree as well as online degree also provide financial aid to study management. So, no worries to absorb as much as you can.

It has a good carrier graph for everyone and anyone who pursue a Master of Business Administration Melbourne education. Companies pay good and over time it continues to grow in an inclined way. You can see yourself as middle manager getting $ 50,000 per month in a short span of time once you will grow experience and maturity in work. Bureau of Labor Statistics has ranked managers (Corporate executive) at second position after a physician in Occupational employment and wages report. This may have given you an idea of enormous growth involved in the managerial profession. Even the engineers these days are moving towards earning a master's in MBA after their normal 4 years of engineering as everyone has realized the importance and the prospect of such studies in the long run.

For getting more information visit here VIT - Victorian Institute of Technology.

14/123 Queen St, Melbourne VIC 3000, Australia

1300 17 17 55 (or) [email protected]

#Master of Business Administration Melbourne#Master of Business Administration in Australia#Master of Business Administration Sydney#MBA Australia

0 notes

Text

The Best 10 Golf Courses In The World

What exactly are golfers observing for in a golf course? Golfers typically seek for a golf circuit that will profits him or her to the limit. There is absolutely no better characteristic in surmounting yourself and becoming through the challenge golf offers you. A golf circuit that evidence submissiveness not only a bazaar extent of difficulty, but also offers a breathtaking landscapes is a flour for the golfers. Public golf layer that are used for competitions can also provide a good complexity for criterion golfers as they can also undergo what the pros dealt with. After a long pursuit, here are a tally of the topnotch rank that a golfer tins go to. There are a pen of golf battery out there, but the chasing layer tins offer the very best of the best.

The Old Course, St. Andrews Links: For entity around for nearly 6 centuries, who would not totally agree that this golf orbit is "The Home of Golf"? Golf has been played around this course from 1400 A.D. and is actually the biggest golfing complex in Europe. The fairways carefully managed, the beautiful scenery, and the taunting challenge starting from the first earths could type your round of golf a very unforgettable experience. It could be deceiving when you see images and videos of this golf encircling on TV or online. The kingdom might appear flat when viewed on TV or online, but it is actually humped and the bunkers are bay when you are on the course, so it tins submissions you with the best challenge when you play. You may bundle beforehand by ballot to this golf encircling which is situated in Scotland. If you recollection to sense what golf really is about, this determination be best for you.

Murfield: This is the golf orbit of The Honorable Company of Edinburgh Golfers - the eldest institution in golf. The formatting of this circuit is simple categorized as a masterpiece since 1891. If that history is not enough, this club was regarded as linked to document the original rules of golf in 1744. This golf orbit was designed in a stock that the hollow are situated in a cwm that will type certain that the gigolo will poverty to always adjust with the visage directions. There are times when a gigolo evidence obligation to stop and appreciate the amazing outlooks of this course which includes trees, the sea view, and the trees near it. The eye-catching scenery is just a glimpse of what this orbit actually relinquishment to the players. The bunkers are all around and the salad are small, which challenges the golfer in terms of accuracy.

Oakmond Country Club: If you get the snare to hospitality golf in the course, you obligation to expect an sophistication importance reminiscing. 210 middle bunkers and salad that incline away await the golfer, and it will be tough as every short needs to be carefully done. One wasted short and you liveliness vitality up on its center bunkers. The fairways are tight, so exactness testament be the key. This course also cradles a lengthy history, which expands as far as 1903. This orb tins be viewed as the volume hardest to recreations on as bunkers can be found left and right.

Royal Birkdale (The Birkdale): This is England's apex golf course that has a magnificent landscapes and awesome golf holes. The fairways of this encircling is styled in such a medium that the realm will rarely go off course. A club house, sort staff, and a fully stocked golf studio are just a sum of what this orb can provide. However, you have to ready your pocket as the experience can be very expensive. Yet, the course's challenge testament makes your money's importance more. The appearance Birkdale has is really an malefic pertinence to cope with, nevertheless the struggle will thrust the golf idler to the limits. A fantastic bang for the money.

Shinnecock Hills: Constructed in 1891 and remodelled in the 30s, this course has sponsored four US opens and is a very challenging course to recreations on. The earths seeming very easy to type shots with, but steadily gets you scratching your rosh as it is in fact deceiving. The cavity would require a golfer to adapt and be very skillful. The 300-acre revolution has a clubhouse that's located at their highest point, hence appointing an excellent probability to the place. The revolution boasts of winds from the Atlantic, the sandy terrain, and the pasture that border the fairways. After-game cocktails can be availed by the club segment besides the game experience they receive.

Turnberry (Ailsa Course), Scotland: The Turnberry Golf Club was established in 1902, then the Turnberry Hotel in 1906 that connects to the nearest path station. It was even almost destroyed as it was used in the 2 World Wars but it was reopened in 1951 after extensive repairwork. What type this circuit distinctive from the others is the misfire of dunes on land near the seacoast, which makes a perfect test for the player. It has stayed a preference circuit and has hosted 4 Opens. The view of the British Isles is just a teaser for the game experience and being on the very same cavity Jack Nicklaus and Tom Watson battled on!

Royal County Down Golf Club: Having one of the best front nines amongst the world's courses, this is worth the trip. Located in Northern Ireland, it rests nicely at the nates of the Mourne Mountains and is welcomes the golf dawdler with an impressive prospect of the Bay of Dundrum. With its spotless requirement for a challenging game, this course surprisingly haven't hosted a single Open. Although the course has an incredible surrounding, it could give you adult disappointment as the ambience can be quite unpredictable. The ambience is strong enough to topple a trolley, inflection the firmament in flight, or bend the flagstick. The controversy of the circuit testament challenge a golfer to the limit, not only because of the winds but also with its sum of shelter drives also. The challenge it offers simply deserve a site in the apex ten of the world.

Augusta National Golf Club: Being the crowd to the annual Masters, this dream circuit is situated in a dream-like setting, and even becoming to recreations here is also dream-like also. This revolution has a high exclusive column with its glade fees and the roster of its appendage aren't available to the public. The commonness of the revolution is all over, with dozens of other series that tried to imitate the orb design. Designed by Bobby Jones and Alister Mackenzie, anyone tins easily say that it is an pattern duo that created a perfect course. Usually, every after concluded Masters, changes are done with one or two dent to incorporate variety to the playing experience. It's no wonder that it evidence get closed to every 6 months and nobody tins just simply scrolls up to get to satisfaction the tee. The landscapes just comes aide with the good standing of this course, the playing complexity and with the unique status. If there is an prospect to play, a golfer will undoubtedly not refuse.

Cypress Point, USA: This golf course has surely the largest water hazard of all which is the Pacific Ocean on the third tee. It is a longshot to even get the aperture to pleasure on this encircling that even the late J. F. Kennedy was declined admissions to the restaurant and has only a few sliver which ranges from actors, political, and corporate giants. The course still maintains it historical traditions, being a walking-only course, no yardage milestone and even the lockers tins type you sense that it's still 1920. Its kissing lot is not even more than 15 stalls and does not have that much bourdon in a single day. It is really an probability for the encircling to have not so dozens gambler as it will furthering the encircling to be kept pristine in its requirement and one of salad that is so smooth without bumps, orb marks, nematode patches, or sand from nearby bunkers. Simply one of the best series that anyone evidence get to entertainment on if given the opportunity.

Pine Valley, USA: This was a mind child of Philadelphian hotelier George Crump, who passed away a year ahead of the course's completion. It opened on 1919 and athlete had a difficult sophistication accomplishing the circuits in 70 strokes, effortlessly accomplishment the commonness as the amazing golf challenge. Each den mocks you with a different challenge, with one bunker 10 feet deep. Missing the glade evidence mean a lot, since there are sloping salad and the gap are wrapped in pine-covered heath - not a good loci the see the golf kingdom go. It tins be a massive ache the value you get a harm in your shot. Having the openings to pleasure in this superb orbit is very rare, so don't decline an invite. There is no golf revolution that is visually inviting and hard as Pine Valley. It greatly justifies why golfers invention this as No. 1.

Certainly, there are numerous other series around that doesn't require membership. However, entity able to brains the actuality challenges of golf lies in these courses, so don't let an hazard to appeasement in these layer pass by.

For more about https://golfiya.com/product-category/golf-course/

0 notes

Text

How This Pandemic Could Help Fix Capitalism

B Lab was started in 2008, during a tumultuous period, highlighting the inequalities in societies.

B Lab

B Lab was founded in 2006, as we entered a difficult economic period, redefining what business should be about: people and planet (plus profit). In the past month, companies have had to address the social aspect of their businesses head-on. That’s led to some CEO’s forgoing salaries, ensuring that workers have enough paid leave for health reasons, extending paid paternal and maternal lave, and, in general, providing more flexibility to their employees.

Co-CEO of B Lab U.S. & Canada Anthea Kelsick shares how this could actually be a defining period for business and push more companies to adopt tenets of B Corp, building a better version of capitalism, and closing in on inequalities: “The silver lining of the COVID-19 pandemic is that, now more than ever, the B Corp model is relevant.”

Esha Chhabra: What are you seeing in business today during this pandemic that’s making you have faith in capitalism as we go forward?

Anthea Kelsick: What I’m seeing in business that’s giving me hope is the many companies, large and small, living into a stakeholder-driven model of business by shifting their operations to prioritize the support and benefits to their workers and communities—a critical pivot in this moment.

At B Lab, we see these shifts as mirroring best practices and principles that we’ve upheld for the past decade in the B Corp certification and our mission to help companies shift to a stakeholder model of capitalism. It’s heartening to see companies take actions in this moment that B Corps do every day, like treating their workers fairly with benefits like paid leave, healthcare, additional parental leave, or supporting their communities by serving food banks, giving back through financial support, providing more equitable terms to suppliers, shifting manufacturing to make PPE and more.

This is proof that companies can do this. Now the question is whether we can see a broader set of companies uphold these practices for the long term.

Chhabra: What still concerns you?

Kelsick: What concerns me is that these many stakeholder-driven decisions we’re seeing may just be short-term shifts that companies feel they only need in a crisis, and that when it’s time to go back to ‘normal,’ they will immediately cut back on support to their workers and their communities, decimating the important role the private sector has to play.

I am also deeply concerned by the disproportionate impacts that COVID-19 has had on black and brown communities in terms of both human impact as well as economic impact. According to a recent McKinsey report, Black Americans are almost twice as likely to live in the counties at highest risk of health and economic disruption. And I am concerned that those communities will not get the support they need by either the private or public sector in the recovery. We’ve already seen that the PPP funds available did not reach the businesses in these communities, and that the hospitals in these communities are the most overrun.

Chhabra: B Lab was started amidst a recessionary period ten years ago. What advice do you lend to companies/small businesses today as they go through the ups and downs of the economy currently?

Kelsick: What we saw back then that we hope to see again in this economic downturn is that companies with a stakeholder focus are more resilient in crisis. During the 2008 financial crisis, B Corps were 64% more likely than other businesses of a similar size to make it through the downturn.

And we think it’s because of a few factors. One factor is that companies with stronger relationships to their workers, their customers, or their supply chains, have better opportunities to weather the storm. When they have to make the hard decisions, their people are more likely to stick with them. The other factor is that companies who operate with a stakeholder model tend to be more innovative. When a company’s business model is to deliver value to stakeholders, when the needs of their stakeholders change, that company will more intuitively pivot their business model to serve those shifts in needs. Companies that focus exclusively on delivering shareholder value are more likely to hold fast on their business model and operations, to take an approach of cutting back, holding onto cash, and being less innovative in thinking about how to pivot their businesses to meet changing needs.

Strength of relationships and innovation remain critical ingredients to resilience, and we hope to see them again in this downturn.

Chhabra: What values of the B Corp model are you seeing come to the forefront right? Is the B Corp model relevant today?

Kelsick: Even before COVID-19 was at our doorstep, there was already a new consensus that we were moving from shareholder capitalism to stakeholder capitalism. We’ve seen that with the Business Roundtable’s Statement on the Purpose of a Corporation, the growing number of companies becoming B Corps, and in the growing narrative in culture and media of what the role of business should be.

A challenge we’ve had up until now was that we just weren’t seeing significant outside action against those beliefs, but in this moment, we see that this model, and the actions required to live into this model, is possible.

And so the silver lining of the COVID-19 pandemic is that, now more than ever, the B Corp model is relevant. The time has come for companies to adopt models of stakeholder capitalism, and that it is the responsibility of business to deliver value across their stakeholders – workers, communities, supply chains, the environment – alongside their shareholders. Big companies have been forced into this model in their response to COVID-19, with shifts in their worker practices, in manufacturing to create supplies for the healthcare sector, in distribution to get food to those who need it most. These companies certainly have an opportunity to go further. But what they shouldn’t do is presume to go back to how they’ve operated in the past.

We’ve also been pleasantly surprised to see that there are as many companies interested in and applying for B Corp certification as there were this time last year, as well as an increasing number of companies inquiring about how to get started. The B Corp model is verification that a company is indeed living into the principles of stakeholder value, but the model is also a powerful management tool available to all companies for free (see bcorporation.net to access the B Impact Assessment), so that whether a company is a B Corp or not, it can use the assessment to measure and manage how it’s delivering value for stakeholders.

Chhabra: As more CEOs and management are taking pay cuts and trying to prevent extensive layoffs, are you hopeful that these empathetic moves will stay (even as we rise out of this)?

Kelsick: I am hopeful to see all the good decisions that CEOs are making to rise to this moment – whether it’s around compensation, how they are treating their workers, what benefits they are providing and beyond – to be lasting decisions, and not be seen as short-term fixes that will be phased out over time. The solutions, however, must be holistic – a CEO should not be lauded for taking a pay cut, while at the same doling out a generous shareholder dividend in the midst of layoffs of a significant portion of its workforce. That is not valuing stakeholders equitably. And it’s only if we can make these holistic decisions part of the long-term plan, and not just a short-term bandaid, that we will be able to change a system that does not create value for everyone.

Chhabra: How is this public health crisis fundamentally challenging our understanding of capitalism and the modern economy?

Kelsick: The health and economic crisis is certainly revealing the cracks in capitalism that have always existed, the most significant of which is a system that is driven by maximizing value for shareholders, at the expense of other stakeholders like workers, communities, suppliers, and the environment. At B Lab we’ve been working for over a decade to develop the real, tangible practices and measurement for businesses to adopt a stakeholder approach to capitalism. We have over 3000 companies around the world in over 70 countries, 150 industries, in a range of sizes that are already living into this new model of business. It’s now time for more companies to walk the walk and adopt this model for the long-term.

Source link

Tags: B Corp, B Lab, better business, Business, capitalism, equity, Fix, inequity, pandemic, Social enterprise, Sustainability, Workforce

from WordPress https://ift.tt/2YmQpcp

via IFTTT

0 notes

Photo