#market volatility

Text

Money Management Explained

Money management is a crucial aspect of financial stability and success. It involves planning, controlling, and monitoring your income and expenses to achieve your financial goals. Effective money management can help you save more, invest wisely, and avoid debt. This article delves into the principles of money management, offering practical tips and strategies to help you take control of your…

#Diversification#Finance#Financial Goals#Financial Planning#Investing#Market Volatility#Money Management#Review#Security#Volatility

2 notes

·

View notes

Text

17 Money Secrets to Help You Become a Millionaire

Hey there, future millionaire! Do you dream of having lots of money one day? Well, guess what? It’s not impossible! In fact, I’m here to share 17 secrets about money that can help you become a millionaire. Sounds exciting, doesn’t it? Let’s dive in!

The earlier you start saving and investing your money, the more it can grow. It’s like planting a seed that grows into a big tree over time.

#personal finance#money management#wealth building#financial goals#saving#investing#budgeting#debt repayment#multiple income streams#emergency fund#financial education#wise investments#tax planning#mindful spending#technology tools#networking#market volatility#financial advice#patience#financial success.

2 notes

·

View notes

Text

Trump Media's Meteoric Rise Ends in Dramatic Plunge: What Went Wrong?

In a stunning turn of events that has left both investors and market analysts reeling, Trump Media & Technology Group (TMTG), the brainchild behind the social media platform Truth Social, has experienced a precipitous stock plunge. This unexpected decline has effectively erased all of its significant market gains accumulated over the past year, highlighting the fickle nature of the stock market…

#financial analysis#investor psychology#market volatility#meme stocks#pump and dump#Trump Media&039;s Meteoric Rise Ends in Dramatic Plunge: What Went Wrong?

0 notes

Text

Nvidia’s 10% Plunge Triggers Tech Selloff: Worst Chip Stock Day Since 2020

unexpected 10% stock drop sent shockwaves through the tech industry, leading to the worst day for chip stocks since March 2020. This plunge was driven by concerns over market saturation, regulatory challenges, valuation concerns, and increasing competition in the AI chip space.

The ripple effect impacted major players like AMD, Intel, and Qualcomm, as well as semiconductor ETFs and related industries. While reminiscent of the March 2020 crash, this event was more sector-specific.

Despite short-term volatility, the long-term outlook for the semiconductor industry remains positive, fueled by AI, 5G, and IoT trends. Investors are advised to focus on fundamentals, diversify their portfolios, and maintain a long-term perspective.

Key areas to watch include AI advancements, automotive sector growth, data center expansion, and edge computing evolution. While the current turbulence is significant, it's important to remember that the semiconductor industry continues to be a cornerstone of technological progress.

Read more

#nvidia stock#ChipStockCrash#TechInvesting#SemiconductorIndustry#MarketVolatility#market volatility#ai chips#investment strategy#stock market analysis#TechSectorTrends#GPUMarket

0 notes

Text

Ultimate Guide to Shopping Center Financing: Secure Construction Loans and Maximize Profit

Introduction to Shopping Center Financing

Securing financing for shopping center construction is a complex process that requires a strategic approach, detailed planning, and a comprehensive understanding of both the real estate market and the financial instruments available. Shopping centers, being large-scale commercial projects, require significant investment, which is typically sourced…

#CMBS loans#commercial real estate#construction loans#equity partnerships#feasibility studies#joint ventures#market volatility#mezzanine financing#permanent financing#real estate development#real estate investment#refinancing options#regulatory compliance#shopping center financing#tenant leasing

0 notes

Text

The crypto market has been on a rollercoaster over the past two weeks, with Bitcoin and Ethereum facing extreme volatility due to global economic uncertainties. https://markets.tradermade.com/cryptocurrency/fortnightly-crypto-market-review. Stay informed and prepared!

0 notes

Link

In uncertain times, diversification is key. Learn how spreading your investments across different crypto assets can minimize risk and maximize potential returns.

#invest smart#market volatility#digital assets#blockchain#bitcoin#altcoin#crypto safety#hodl#market trends#crypto security#financial freedom#investment

0 notes

Text

Market Overview: Mixed Movements Amidst AI Concerns and Earnings Reports

In a turbulent day for U.S. stock markets, the Dow Jones Industrial Average declined by 234 points, or 0.60%, while the S&P 500 and NASDAQ Composite also faced setbacks, falling by 0.7% and 1%, respectively. The downturn was largely driven by mounting concerns over the slowing momentum in artificial intelligence (AI) technologies, which prompted a sell-off in semiconductor stocks.

AI Concerns Weigh on Chip Stocks

The tech sector, particularly chip stocks, experienced significant pressure. Leading the decline were NVIDIA Corporation (NASDAQ: NVDA), Broadcom Inc (NASDAQ: AVGO), and Wolfspeed Inc (NYSE: WOLF), all of which saw their share prices drop by approximately 2%. The apprehension surrounding AI's slowing progress has rattled investors, leading to a broader sell-off in the semiconductor industry.

Energy Sector Shows Resilience

Amidst the broader market decline, the energy sector displayed notable strength. Targa Resources Inc (NYSE: TRGP), Williams Companies Inc (NYSE: WMB), and Devon Energy Corporation (NYSE: DVN) were among the top gainers. Devon Energy, in particular, saw its stock rise following quarterly results that exceeded Wall Street's expectations. This positive performance highlights the sector's resilience despite the overall market volatility.

Major Stock Movements

Walt Disney (NYSE: DIS): Disney's stock fell sharply by 4%, reflecting ongoing concerns about the company’s performance and future prospects.

Shopify (NYSE: SHOP): Contrasting the general trend, Shopify's shares soared nearly 18%, driven by positive developments and investor optimism about its growth potential.

Airbnb (NASDAQ: ABNB): On the other end of the spectrum, Airbnb's stock dropped 13%, influenced by recent market challenges and potentially disappointing financial metrics.

S&P 500 Earnings Resilience

Despite the recent negative price action and growing recession fears, the earnings resilience of the S&P 500 remains a key highlight. The index's earnings have shown a level of robustness, which could offer some reassurance to investors amidst the current market volatility.

In summary, the market's recent performance underscores the complexity of current economic conditions. While AI concerns and specific sector movements have contributed to market declines, there are areas of strength and resilience, particularly in the energy sector and select stocks like Shopify. As always, investors should stay informed and consider these factors when making decisions.

#Stock Market Update#Dow Jones Decline#S&P 500 Performance#NASDAQ Drop#AI Technology Impact#Semiconductor Stocks#NVIDIA Stock Analysis#Broadcom Stock Trends#Wolfspeed Performance#Energy Sector Strength#Targa Resources Gains#Williams Companies Stock#Devon Energy Results#Walt Disney Stock Drop#Shopify Share Surge#Airbnb Stock Decline#S&P 500 Earnings Resilience#Market Volatility#Tech Sector Pressure#Investing in Turbulent Markets

0 notes

Text

Market crash??? What to do???

Image by freepik

Dealing with market crash situations can be challenging, but there are strategies to help navigate such periods:

Stay Calm: Emotional reactions can lead to poor decisions. Take a moment to assess the situation rationally.

Review Your Portfolio: Ensure it aligns with your long-term investment goals and risk tolerance. Diversification can help mitigate losses.

Avoid Panic…

View On WordPress

#Diversification#financial advice#financial strategy#Investing#investment opportunities#long-term investing#market crash#market volatility#stay calm

0 notes

Text

Trade Gaps in Forex Market

The forex market, known for its high volatility and liquidity, presents numerous opportunities for traders to capitalize on price movements. One such opportunity arises from trade gaps. Understanding and effectively trading these gaps can significantly enhance a trader’s profitability. This article delves into the concept of trade gaps, exploring their causes, types, and strategies for trading…

#Bollinger Bands#Entry and Exit Points#Forex#Forex Market#Geopolitical Events#Liquidity#Market Sentiment#Market Volatility#Moving Average#Price Movement#Price Movements#Profitability#Relative Strength#Risk Management#RSI#Stop-Loss#Trading Strategies#Trading Strategy#Trading Volume#Volatility

2 notes

·

View notes

Text

Waarom de ups en downs van Bitcoin uw grootste kans kunnen zijn

Hoewel de volatiliteit van Bitcoin afschrikwekkend lijkt, is het ook een bron van kracht en potentieel. Door deze eigenschap te begrijpen en te omarmen, kunnen beleggers mogelijk aanzienlijke winsten behalen. De sleutel is om een langetermijnperspectief te behouden en het bredere groeitraject van Bitcoin te herkennen.

#Bitcoin #cryptocurrency #investmentopportunities #financialinnovation #marketvolatility #BitcoinETFs #long-terminvesting #digitalassets #markettrends #financialadvice

#Bitcoin#cryptocurrency#investment opportunities#financial innovation#market volatility#Bitcoin ETFs#long-term investing#digital assets#market trends#financial advice#btc

0 notes

Text

Shocking 3 Reasons Why Nvidia Lost Its Crown as World's Most Valuable Company

Why Nvidia lost its crown as the world’s most valuable company is a story of rapid stock movement and market volatility. The semiconductor giant’s stock plummeted by 6.7% over two days, resulting in a $200 billion market value loss and positioning Apple and Microsoft ahead in market capitalization.

Shocking 3 Reasons Why Nvidia Lost Its Crown1. Nvidia’s Meteoric Rise Made It Vulnerable to…

View On WordPress

#AI impact#Apple#enterprise software#market cap#market volatility#Microsoft#profit-taking#semiconductor industry#stock decline#why Nvidia

1 note

·

View note

Text

Unlocking Perpetual Futures Contracts: Essential 2024 Guide for Beginners

Are you ready to take your trading to the next level with a financial instrument that offers endless opportunities and flexibility?

Perpetual futures contracts have emerged as a revolutionary tool in the trading arena, particularly for cryptocurrency enthusiasts. These contracts, unlike traditional futures, do not have an expiration date, allowing traders to hold positions indefinitely. This feature provides a significant advantage, enabling continuous trading and the ability to take advantage of long-term market trends. The funding rate mechanism, which periodically adjusts to keep contract prices in line with the spot prices of the underlying assets, ensures a balanced and fair trading environment.

Leverage is a key feature of perpetual futures contracts, allowing traders to control larger positions with a smaller capital investment. This can significantly amplify profits, but also poses a risk of larger losses, making risk management a crucial aspect of trading these contracts. The real-time mark-to-market settlement process adjusts traders' margin balances continuously, ensuring that gains and losses are promptly accounted for. This mechanism helps prevent sudden liquidations and keeps traders informed about their margin requirements.

Despite the numerous benefits, perpetual futures come with their own set of risks, including market volatility and fluctuating funding rates. Traders must have a solid understanding of these risks and employ effective strategies to mitigate them.

Intelisync, a pioneer in blockchain technology and exchange development, offers advanced solutions to enhance the security and functionality of perpetual futures trading. Explore how Intelisync can enhance your trading experience and provide the tools you need to succeed in the dynamic world of perpetual futures.

Discover how Intelisync can transform your trading journey and provide you with the tools needed to succeed in the dynamic world of perpetual futures. Contact Intelisync today! Ready to revolutionize your trading journey? Contact Intelisync today and Learn more....

#Advantages of Perpetual Contracts#Crypto Market Liquidity#Cryptocurrency Trading#Funding Rate#Funding Rate Mechanism#Futures Trading Guide#How do Future contract work?#How does trading on perpetual contracts work?#Intelisync Blockchain solution#Main Features of Perpetual Futures#Margin Requirements#Market Volatility#PERP DEX Development: Intelisync’s Expertise in Perpetual Future Contracts#perpetual futures trading.#Perpetual Futures vs. Traditional Futures#Risks Associated with Perpetual Futures Contracts#Trading Strategies#What is Perpetual Futures Contracts

0 notes

Text

#Automotive industry#Electric vehicles#Elon Musk#Financial news#FintechZoom analysis#Investment insights#Market volatility#Stock market trends#Tesla stock#TSLA stock

0 notes

Text

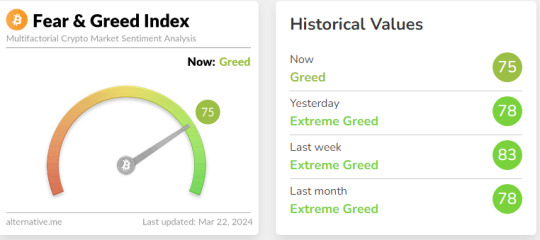

At its core, the Crypto Fear and Greed Index serves as a barometer for investor sentiment within the cryptocurrency market. It assigns a numerical value between 0 and 100, with lower values indicating extreme fear and higher values suggesting extreme greed. This index provides invaluable insights into prevailing market emotions, enabling investors to make informed decisions regarding their crypto portfolios.

https://www.bloglovin.com/@a2zcrypto/unlocking-crypto-fear-greed-index-a-comprehensive-12512075

0 notes

Text

The crypto market sees wild swings this week, with Bitcoin dipping and Ethereum gaining strength. https://markets.tradermade.com/cryptocurrency/week-in-review-crypto-market-volatility-sparks-mixed-reactions. Stay tuned for the latest updates!

0 notes