#mobile biometrics security and services

Text

Convenience

Keyless Entry: smart lock eliminates the need for physical keys. You can unlock door with a smartphone app, a key fob, or even through biometric methods like fingerprints.

Remote Access: many smart locks allow you to unlock your door remotely, which is useful if you need to grant access to someone while you’re away.

Enhanced Security

Access Logs: Smart locks can provide detailed logs of who entered and when, adding an extra layer of monitoring and control.

Temporary access codes: you can create temporary or one-time access codes for guest’s service providers or other, ensuring that only authorized individuals can enter.

Integration with smart home systems

Automation: smart locks can integrate with home automation systems, allowing for seamless control along with other smart devices

Voice control: many smart locks are compatible with voice assistant like amazon alexa, google assistant enabling hands-free operation.

Improved Accessibility

For Those with Mobility issues: smart locks can be easier to operate for people with disabilities or mobility issues, as they often offer touchless or simplified access method.

No more Lockouts: with keyless entry the chances of locking out are significantly reduced, which is especially helpful in busy or stressful situations.

Durability and reliability:

Weather Resistant: many smart locks are designed or withstands various weather condition, making them suitable for external doors,

Battery Backup: most smart locks are battery operated with a backup power source, ensuring they remain functional even during power outages.

Ease of Management

Centralized control: if you have multiple smart devices, managing them through a single app can streamlined operations and make home management more efficient.

Auto Lock Feature: Some smart locks come with auto-lock functions that ensure the door locks automatically after a set period, enhancing security.

Customizable Access Options

Personalization: Users can set different levels of access for family members, friends or service providers and easily modify or revoke permission as needed.

Is it worth the investment?

Initial Cost: smart locks typically have a higher upfront cost compared to traditional locks; however, this cost may be offset by the convenience and security features they provide.

Ongoing costs: some smart locks may require subscription fees for advanced features or cloud services, so it’s important to factor in these potential ongoing expenses.

Technology Dependence: Relying on technology means you’ll need to stay updated on software updates and ensure your devices are compatible with your smart lock.

Overall if you value convenience enhanced security and integration with smart home systems a smart lock can be a worthwhile investment. It’s important to assess your specific needs and budget to determine if the benefits align with your lifestyle and preferences.

To know more about the electronics locks: https://www.europalocks.com/electronic-locks

#smartlock #smartdoorlocks #electronicdoorlocks #smartlocksforhome #smarthomedoorlock #elock #bestdigitallock #digitallockformaindoor #digitaldoorlocksforhome #keylesssmartlock #smartfingerprintdoorlock #smarthouselock #electronicdoorlockwithremotecontrol #smartlockformaindoor #digitalhomelocks #digitalsmartdoorlock #electronicdoorlockwithremote #digitaldoorlockprice #smartmaindoorlock #bestdigitallockformaindoor #maindoorsmartlock #electronicdoorlockprice #smartdoorlockprice #electroniclocksformaindoor #smartdigitaldoorlocks #smartlockondoor #wifismartlock

#1)#Convenience#•#Keyless Entry: smart lock eliminates the need for physical keys. You can unlock door with a smartphone app#a key fob#or even through biometric methods like fingerprints.#Remote Access: many smart locks allow you to unlock your door remotely#which is useful if you need to grant access to someone while you’re away.#2)#Enhanced Security#Access Logs: Smart locks can provide detailed logs of who entered and when#adding an extra layer of monitoring and control.#Temporary access codes: you can create temporary or one-time access codes for guest’s service providers or other#ensuring that only authorized individuals can enter.#3)#Integration with smart home systems#Automation: smart locks can integrate with home automation systems#allowing for seamless control along with other smart devices#Voice control: many smart locks are compatible with voice assistant like amazon alexa#google assistant enabling hands-free operation.#4)#Improved Accessibility#For Those with Mobility issues: smart locks can be easier to operate for people with disabilities or mobility issues#as they often offer touchless or simplified access method.#No more Lockouts: with keyless entry the chances of locking out are significantly reduced#which is especially helpful in busy or stressful situations.#5)#Durability and reliability:#Weather Resistant: many smart locks are designed or withstands various weather condition#making them suitable for external doors

0 notes

Text

Understanding Multi-Factor Authentication (MFA)

In today’s digital landscape, securing online accounts and sensitive data is more critical than ever. One effective way to enhance security is through Multi-Factor Authentication (MFA). MFA adds an extra layer of protection beyond just a password, significantly reducing the risk of unauthorized access.

What is Multi-Factor Authentication (MFA)?

Multi-Factor Authentication (MFA) is a security mechanism that requires users to provide two or more verification factors to gain access to a resource, such as an application, online account, or VPN. Instead of relying solely on a password, MFA combines multiple independent credentials: what the user knows (password), what the user has (security token), and what the user is (biometric verification).

Why is MFA Important?

Enhanced Security: Passwords alone are not enough to protect against sophisticated cyber threats. MFA ensures that even if a password is compromised, unauthorized access is still prevented by the additional authentication steps.

Compliance: Many regulatory standards and frameworks, such as GDPR, HIPAA, and PCI-DSS, require the implementation of MFA to safeguard sensitive data and ensure compliance.

Reduced Risk of Breaches: By adding extra verification layers, MFA decreases the likelihood of data breaches and account takeovers, protecting both users and organizations.

Improved User Confidence: Users feel more secure knowing that their accounts and data are protected by multiple layers of security, fostering trust in digital services.

How Does MFA Work?

MFA typically involves a combination of the following factors:

Something You Know: This includes passwords or PINs.

Something You Have: This could be a physical device like a smartphone, a security token, or a smart card.

Something You Are: Biometric verification methods such as fingerprints, facial recognition, or voice recognition.

Leading MFA Software in 2024

With numerous MFA solutions available, choosing the right one can be challenging. Here are some leading MFA software options for 2024:

Duo Security: Known for its user-friendly interface and strong security features, Duo Security offers seamless integration with various applications and systems. It provides push notifications, SMS passcodes, and biometric verification.

Microsoft Authenticator: This app integrates smoothly with Microsoft’s suite of products and services. It supports push notifications, time-based one-time passwords (TOTP), and biometric authentication.

Okta: Okta’s MFA solution is highly versatile, supporting various authentication methods including SMS, email, voice call, and push notifications. Its adaptive MFA uses machine learning to analyze user behavior and enhance security.

Infisign: Infisign is a cloud-based MFA software offering a user-friendly interface and diverse authentication methods, including push notifications, one-time passwords (OTP) via SMS or mobile app, and security keys.

Choosing the Right MFA Solution

When selecting an MFA solution, consider the following factors:

Ease of Use: The solution should be easy for users to adopt and use regularly.

Integration: Ensure it integrates well with your existing systems and applications.

Scalability: The solution should be able to grow with your organization’s needs.

Support and Maintenance: Look for solutions with reliable customer support and regular updates.

Conclusion

Implementing Multi-Factor Authentication (MFA) is a crucial step in fortifying your security strategy. By combining multiple verification factors, MFA provides robust protection against unauthorized access and cyber threats. Whether you’re a small business or a large enterprise, selecting the right MFA solution can significantly enhance your security posture and provide peace of mind in the digital age.

2 notes

·

View notes

Text

In the waning months of its administration, the Biden regime is pushing for a digital identity revolution.

Aug 20, 2024

The Biden administration is reportedly preparing to launch an initiative that could significantly alter the way Americans prove their identities. A draft executive order, which has been reviewed by journalists from Notus (a new, Washington DC-based publication), would push for the widespread adoption of mobile driver’s licenses (mDLs) and other forms of digital identification.

If implemented, this would mark a fundamental shift in how citizens interact with government and private sector services online — everything from how you access public benefits to how you verify your age before viewing adult-only content online.

The party line is that we need digital IDs because the government incurred staggering losses as a result of fraudulent claims during the pandemic. Over $100 billion was reportedly lost to unscrupulous unemployment claims between March 2020 and March 2023. Rather than understanding that government had failed in its duty to properly vet claimaints, the Biden administration would rather have us believe these failures highlight vulnerabilities in current identity verification systems such as physical driver’s licenses, which have proven easy to forge. The rise of AI-driven “deep fake” technology just makes matters worse.

They say digital IDs, supported by biometric technologies like facial recognition, are a robust solution. By moving identity documents onto smartphones, the government hopes to create a more secure and efficient way for Americans to verify their identities when accessing both public and private services online.

According to the draft of the executive order obtained by Notus, the Biden administration intends to "strongly encourage the use of digital identity documents" across federal and state levels. The order would mandate federal agencies to adopt a unified identity verification system, Login.gov, as the primary gateway for accessing federal websites. This system would also be made available to state and local governments for integration into their services.

2 notes

·

View notes

Text

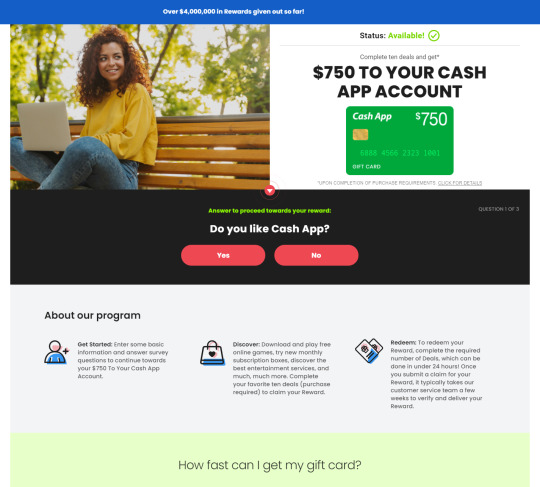

Your Chance to get $750 to your Cash Account!

Cash App is a mobile payment service developed by Square, Inc. It allows users to send and receive money to friends and family, as well as pay for goods and services using a mobile app. Here are some key features and aspects of Cash App:

Peer-to-Peer Payments: Cash App enables users to send money to other users quickly and easily using their mobile phone number, email address, or $cashtag (a unique username).

750$ Cashapp

Cash Card: Cash App offers a customizable debit card called the Cash Card, which is linked to the user's Cash App balance. Users can use the Cash Card to make purchases at retail stores or online, withdraw cash from ATMs, and even earn rewards on certain purchases.

Bitcoin Transactions: Cash App allows users to buy, sell, and store Bitcoin directly within the app. This feature provides users with a convenient way to invest in cryptocurrencies.

Direct Deposit: Users can set up direct deposit to receive paychecks or government benefits directly into their Cash App account. This feature eliminates the need for a traditional bank account for those who prefer to manage their finances through the app.

750$ Cashapp

Cash Boosts: Cash App offers a rewards program called Cash Boost, which provides users with instant discounts on purchases made with their Cash Card at select merchants. Users can choose from a variety of Boosts, which may include discounts on coffee shops, restaurants, and popular retailers.

Security Features: Cash App employs various security measures to protect users' accounts and transactions, including encryption, biometric authentication (such as fingerprint or Face ID), and optional security features like passcode locks and transaction notifications.

Fees: While Cash App is free to download and use for sending and receiving money, it may charge fees for certain transactions, such as instant transfers or Bitcoin transactions. Users should review the app's fee schedule for more information.

Overall, Cash App provides a convenient and user-friendly platform for sending money, making purchases, and managing finances on the go

Enter to Win 750$ Cashapp Dollar

5 notes

·

View notes

Text

Ludo Money Withdrawal Paytm: Easy and Secure Cash-Outs

Mobile games are not merely fun products in today’s society, but they also feature enhanced technology on the digital stage. Ludo has not remained a game that can only be played but has turned into a chance where people can entertain themselves, solve puzzles, and even win money. Another aspect that Ludo players find comfortable with is the easy withdrawal of their winnings through Paytm. This article will also show that the players can cash out from Ludo to Paytm or any other legal channel of their choice seamlessly and securely.

Understanding Ludo Games with Cash Rewards

The game that dates back to the token and tile-based board game with the name Ludo has now shifted to the new digital platform. The current version can be played over the internet, forming the aspect of competition from all over the world. More interestingly, several of these platforms offer cash rewards for winning games. This monetary aspect adds an exciting layer to the classic game, making it more appealing to a broader audience.

The Role of Paytm in Ludo Cash Withdrawals

Paytm, one of India's leading digital wallets and financial services platforms, has become popular for gamers seeking to withdraw their Ludo earnings. It offers a user-friendly interface and a robust security framework, ensuring that transactions are easy and safe. Here’s why Paytm stands out:

Instant Transfers: Withdrawals to Paytm are usually instantaneous, allowing players to enjoy their winnings without any delay.

High Security: Paytm uses state-of-the-art security measures to protect user information and transaction details.

Ease of Use: Users can transfer their Ludo winnings to their Paytm wallet with just a few taps.

Step-by-Step Guide to Withdrawing Ludo Money to Paytm

Ludo money withdrawal Paytm step-by-step process:

Verify Your Account: Ensure that your Ludo game account and Paytm account are verified. This typically involves linking and confirming your phone number and email address.

Access the Withdrawal Section: In the Ludo app, navigate to the Wallet or Earnings section where your winnings are displayed.

Choose Your Withdrawal Method: Select Paytm as your preferred withdrawal method.

Enter the Amount: Input the amount of money you wish to withdraw. Ensure it meets the app's minimum withdrawal limit.

Confirm the Transaction: Review your details and confirm the transaction. You may be required to enter a one-time password (OTP) sent to your phone for security purposes.

Receive Your Funds: Your funds should be reflected in your Paytm wallet shortly after confirmation.

Tips for Smooth and Secure Transactions

To ensure that your transactions are both smooth and secure, consider the following tips:

Keep Your Apps Updated: Regularly update your Ludo and Paytm apps to protect against security vulnerabilities and enhance functionality.

Monitor Transaction Limits: Be aware of Paytm's daily and monthly transaction limits to plan your withdrawals accordingly.

Secure Your Devices: Always use a secure password or biometric authentication for your device and apps to prevent unauthorized access.

Common Issues and Troubleshooting

While the process is generally seamless, some users may encounter issues. Here are a few common problems and their solutions:

Transaction Delays: If there’s a delay in receiving funds, check for notifications from Paytm or the Ludo app regarding the transaction status. Sometimes, delays can occur due to system maintenance or high traffic.

Account Verification Issues: Ensure your Ludo and Paytm accounts are fully verified. Unverified accounts may face restrictions or delays in withdrawals.

Technical Glitches: If you experience technical difficulties, try restarting the app or contacting customer support.

Conclusion

Withdrawing your Ludo earnings to Paytm offers convenience, speed, and security. Players can enjoy their winnings with minimal hassle by following the detailed steps and tips provided. As mobile gaming continues to grow, features like easy cash withdrawals highlight how technology enhances user experiences, making gaming more enjoyable and rewarding. Whether you're a casual player or a serious gamer, understanding how to manage your earnings efficiently is key to a better gaming journey.

#ludo money withdrawal paytm#ludo money withdrawal#ludo earnings withdraw#ludo earnings withdraw paytm

2 notes

·

View notes

Text

Securing Your Mobile App: Best Practices for Data Protection

In today’s digitally connected world, mobile applications have become an integral part of our daily lives. From social media to online banking, we rely on mobile apps to access various services and manage sensitive information. However, with the increasing reliance on mobile apps, the need for robust data protection measures has become paramount. This blog will explore best practices for securing your mobile app and ensuring the protection of user data.

Encryption:

One of the fundamental steps in securing your mobile app is implementing encryption techniques. Encryption ensures that data transmitted between the app and the server is transformed into a coded form, making it unreadable to unauthorized parties. Utilize strong encryption algorithms, such as AES (Advanced Encryption Standard), to protect sensitive user information like passwords, financial details, and personal data. Additionally, consider implementing end-to-end encryption to safeguard data even if it’s intercepted during transmission.

2. Secure Authentication:

Implementing strong authentication mechanisms is vital to protect user accounts from unauthorized access. Encourage the use of complex passwords and provide guidance on creating strong passwords during the registration process. Consider implementing two-factor authentication (2FA) or biometric authentication, such as fingerprint or facial recognition, to add an extra layer of security. Regularly validate and update authentication protocols to address emerging security vulnerabilities.

3. Secure Data Storage:

Properly managing and securing data storage within your mobile app is crucial. Avoid storing sensitive information on the device unless necessary, and when required, utilize secure storage mechanisms provided by the operating system or utilize encryption techniques to protect the data. Ensure that the app’s data storage is adequately protected against unauthorized access or tampering, both locally on the device and on the server.

4. Secure Network Communication:

Mobile apps rely on network communication to exchange data with servers or APIs. It’s essential to ensure that this communication is secure. Use secure communication protocols such as HTTPS (Hypertext Transfer Protocol Secure) to encrypt data transmitted over the network. Avoid transmitting sensitive information through insecure channels, such as unsecured Wi-Fi networks, and implement certificate pinning to prevent man-in-the-middle attacks.

5. Regular Updates and Security Patches:

Keeping your mobile app up to date with the latest security patches and fixes is crucial for maintaining a secure environment. Regularly release updates to address any identified security vulnerabilities or weaknesses. Promptly address security-related issues reported by users or security researchers and provide timely patches to mitigate potential risks. Establish a process for monitoring and staying informed about the latest security practices and threats.

6. Secure Code Development:

Developing secure code is essential for building a robust mobile app. Adhere to secure coding practices and guidelines provided by the platform and framework you are using. Regularly conduct code reviews and security audits to identify and address any potential vulnerabilities. Utilize automated tools for vulnerability scanning and penetration testing to detect security flaws in your app’s codebase.

7. User Privacy and Consent:

Respect user privacy and adhere to data protection regulations such as GDPR (General Data Protection Regulation) or CCPA (California Consumer Privacy Act). Clearly communicate your app’s data collection and usage practices to users through a comprehensive privacy policy. Obtain explicit consent from users before accessing and storing their personal information. Allow users to manage their privacy settings within the app, giving them control over their data.

Securing your mobile app is not just a legal requirement but also a responsibility to protect your users’ sensitive data. By implementing strong encryption, secure authentication mechanisms, and following best practices in code development, you can create a safer environment for your users. Regular updates and a privacy-centric approach will help instill trust and confidence in your app. By prioritizing data protection, you contribute to a safer mobile app ecosystem and foster long-term user satisfaction.

Remember, data protection is an ongoing process, and staying vigilant against emerging threats and security practices is vital in this ever-evolving digital landscape.

2 notes

·

View notes

Text

Violent clashes have broken out in Pakistan between security forces and supporters of former prime minister Imran Khan after he was arrested on Tuesday.

Protests are erupting nationwide, and at least one person has been killed in the city of Quetta.

The United States and UK have called for adherence to the "rule of law".

Mr Khan was arrested by security forces at the High Court in the capital, Islamabad.

Dramatic footage showed dozens of officers arriving and detaining the 70-year-old, who was bundled into a vehicle and driven away.

He was appearing in court on charges of corruption, which he says are politically motivated.

Mobile data services in the country were suspended on the instructions of the interior ministry on Friday as protests grew, many of them taking place in front of army compounds.

Pakistan's army plays a prominent role in politics, sometimes seizing power in military coups, and, on other occasions, pulling levers behind the scenes.

Many analysts believe Mr Khan's election win in 2018 happened with the help of the military. Now in opposition, he is one of its most vocal critics, and analysts say the army's popularity has fallen.

Footage from Lahore posted on Twitter appeared to show a crowd breaking into the military corps commander's house destroying furniture and belongings inside.

Speaking from Washington, the US Secretary of State Antony Blinken said he wanted to make sure that "whatever happens in Pakistan is consistent with the rule of law, with the constitution".

UK Foreign Secretary James Cleverly, speaking alongside Blinken, noted that Britain enjoyed "a longstanding and close relationship" with Commonwealth member Pakistan, and wanted to "see the rule of law adhered to".

On Tuesday evening, supporters of Imran Khan gathered outside the Pakistan High Commission in London to protest against his arrest.

'Chaos and anarchy'

Mr Khan was ousted as PM in April last year and has been campaigning for early elections since then.

General elections are due to be held later this year.

Speaking to the BBC's Newshour, Mr Khan's spokesman, Raoof Hasan, said he expected "the worst" and that the arrest could plunge the country "into chaos and anarchy".

"We're facing multiple crises. There is an economic crisis, there is a political crisis, there is a cost of livelihood crisis and consequently this occasion will be a catharsis for them to step out and I fear a fair amount of violence is going to be back," he said.

A member of Mr Khan's legal team, Raja Mateen, said undue force had been used against him at the court.

"Mr Khan went into the biometric office for the biometrics. The rangers went there, they broke the windows, they hit Mr Khan on the head with a baton," said Mr Mateen.

Mr Khan's Pakistan Tehreek-e-Insaf (PTI) party called on its supporters to protest. In the hours after he was detained, violence was reported from cities including Lahore, Karachi and Peshawar.

On the streets of Islamabad, hundreds of protesters blocked one of the main highways in and out of the capital.

People pulled down street signs and parts of overpasses, lit fires and threw stones. During the hour or so that the BBC was there, no police or authorities were visible.

Protesters said they were angry about Imran Khan's arrest.

"This is absolutely the last straw," said Farida Roedad.

"Let there be anarchy, let there be chaos. If there is no Imran, there's nothing left in Pakistan. No one is there to take over."

Writing on social media, police in Islamabad said five police officers had been injured and 43 protesters arrested.

It said at least 10 people, including six police officers, had been injured in the south-western city of Quetta in clashes between Mr Khan's supporters and security forces - with one protester killed.

A statement from the inspector general of Punjab police said the arrest of Mr Khan had been ordered because he was accused of "corruption and corrupt practices".

The case involves allegations over the allotment of land in the so-called Al-Qadir Trust, which is owned by Mr Khan and his wife, Dawn newspaper reported.

Mr Khan, who is being held at an undisclosed location, denies breaking any law.

In a video message filmed as he travelled to Islamabad - and released by the PTI before his arrest - Mr Khan said he was ready for what lay ahead.

"Come to me with warrants, my lawyers will be there," he said. "If you want to send me to jail, I am prepared for it."

Security was tight in the centre of the capital for the former PM's court appearance.

Dozens of cases have been brought against Mr Khan since he was ousted from power.

The security forces have tried to detain him on a number of previous occasions at his Lahore residence, but were blocked by his supporters, resulting in fierce clashes.

On Tuesday, police had blocked roads into Islamabad, so the number of supporters with Imran Khan was not as high as on previous occasions, making it easier to arrest him.

He was elected prime minister in 2018, but fell out with Pakistan's powerful army. After a series of defections, he lost his majority in parliament. He was ousted after he lost a confidence vote in April 2022, four years into his tenure.

Since then, he has been a vocal critic of the government and the country's army.

In October, he was disqualified from holding public office, accused of incorrectly declaring details of presents from foreign dignitaries and proceeds from their alleged sale.

The next month, he survived a gun attack on his convoy while holding a protest march.

On Monday, the military warned him against making "baseless allegations" after he again accused a senior officer of plotting to kill him.

2 notes

·

View notes

Text

As remote work becomes increasingly prevalent, it's crucial to prioritize the security of your home office

Here are some top cyber tips to help you securely work from home:

1️⃣ Use a Secure Network: Connect to a trusted and encrypted Wi-Fi network. Avoid public Wi-Fi networks that may expose your sensitive information to potential threats.

2️⃣ Strong Passwords: Create unique, complex passwords for all your accounts. Consider using a password manager to securely store and manage your login credentials.

3️⃣ Two-Factor Authentication (2FA): Enable 2FA whenever possible. This adds an extra layer of security by requiring a second form of verification, such as a code sent to your mobile device.

4️⃣ Keep Software Updated: Regularly update your operating system, applications, and antivirus software. These updates often include important security patches to protect against vulnerabilities.

5️⃣ Secure Video Conferencing: When hosting or joining video conferences, utilize platforms with built-in security features. Set strong passwords for meetings and be cautious of sharing sensitive information during calls.

6️⃣ Be Wary of Phishing Attempts: Stay vigilant against phishing emails and messages. Be cautious of suspicious links or attachments and verify the legitimacy of requests for sensitive information.

7️⃣ Secure File Sharing: Use encrypted file-sharing services or virtual private networks (VPNs) to securely share sensitive documents with colleagues.

8️⃣ Lock Devices: When stepping away from your work area, lock your devices with strong passwords or use biometric authentication (such as fingerprint or facial recognition) to prevent unauthorized access.

9️⃣ Regular Data Backups: Back up your important work files and data regularly. Store backups on external devices or secure cloud storage platforms.

🔟 Use ValeVPN: Add an extra layer of security to your remote work setup by using ValeVPN. With ValeVPN, your internet connection is encrypted, protecting your sensitive data from potential eavesdroppers and ensuring your online activities remain private.

By following these cyber tips, including the use of ValeVPN, you can create a secure work-from-home environment and protect your valuable data from cyber threats. Remember, cybersecurity is a collective effort, so share these tips with your colleagues and help build a safer online workspace!

🔗 https://www.valevpn.com/

WorkFromHome #Cybersecurity #SecureRemoteWork #StayProtected #ValeVPN

1 note

·

View note

Text

What Are Legal Framework for Fintech in Vietnam

The 4.0 industrial revolution along with the explosion of the Internet has created the basis for the forward leap in all fields of life. The financial sector is not an exception and is directly affected by science and technology. In addition to traditional finance, a new type of finance has been formed with superior characteristics which are appropriate for the current situation and actual needs, which is Fintech – Financial Technology. Despite the advantages of Fintech, the process of operating it faces certain difficulties including the legal challenges.

Fintech Lawyers in Vietnam

Fintech may utilize technologies being big data, cloud computing, artificial intelligence, biometrics and blockchain… There is no comprehensive legal framework for such at the present in Vietnam. Hence, regulations on science, technology, information technology and intellectual property can be applied depending on the nature of the matters including Law on Intellectual Property, Law on Information Technology, Law on High Technology, Law on Science and Technology, Law on Cyberinformation Security and Cybersecurity Law. These regulations partly facilitate the research, development and application of technological innovation together with ensuring the protection of databases and related intellectual property.

In particular, digital payment is a big part of Fintech. This sector is governed by Law on Credit Institutions, and regulations on non-cash payments, intermediary payment services. The Prime Minister also issued Decision 316 since March 9, 2021, allowing the use of mobile money to pay for goods and services of small value. This is the legal basis for the establishment of Fintech companies providing digital payment services and for the use of this method by customers. Fintech application also extend to Peer to Peer lending, asset management, and crypto currencies which are not yet clearly regulated in Vietnam.

Because of the importance of making legal regulations governing Fintech, Official Dispatch No. 2433/VPCP-KTTH dated August 31, 2021 of the Government Office directed: “The State Bank of Vietnam chairs and coordinates with relevant agencies to continue studying and concretizing regulations on the pilot mechanism of P2P lending in the process of developing and finalizing the draft Decree on a controlled trial mechanism. Control (Regulatory Sandbox) financial technology activities in the banking sector, report to competent authorities for consideration and decision in accordance with the provisions of the Law on Promulgation of Legal Documents”. On September 6th, 2021, the Government issued Resolution No. 100/NQ-CP approving the proposal to formulate a Decree on a mechanism for controlled testing of Fintech activities in the field of the banking sector. In April 2022, after the research process, the State Bank of Vietnam published the Draft Decree on the controlled trial mechanism for Fintech activities in the banking sector. This draft is still at the stage of seeking public comment and has not been approved. The formation of the draft marks a new step in Vietnam’s legal framework for Fintech, laying a solid foundation for the later birth of the Decree.

In case the Draft is approved, the Government will officially issue the Decree on Controlled Trial Mechanism for Fintech in the banking sector. This Decree will serve as a basis for credit institutions and financial technology companies to test Fintech technology in their operations to a controlled extent. They can assess the effectiveness and possible risks when using Fintech solutions. Based on the results of the experiment, the legislature can identify issues that need to be corrected by legislation to promulgate legal documents regulating Fintech in the banking sector. If so, banking will be a pioneering field, leading to the formation of Fintech regulations in other fields.

In the face of the strong and rapid development of internet and its application, it is natural to have a separate legal framework for Fintech in Vietnam in the future. Fintech lawyers in Vietnam whom are interested in Fintech could also take part in the process of making the contribution through the comments on draft law drawing from the practical cases advising the clients. It is obvious that, some of the biggest companies in the word are in the technology industry. Among them, Fintech is the fastest growing start-up. The sooner legal framework on Fintech can be issued, the better for Vietnam to snap up opportunities to attract investment and catch up with the world.

Our Fintech, banking lawyers at ANT Lawyers - a Law firm in Vietnam will always follow up with development of legal framework in Fintech in Vietnam to provide update to clients.

Source ANTLawyers: https://antlawyers.vn/library/legal-framework-for-fintech-in-vietnam.html

2 notes

·

View notes

Text

Latest Artificial Intelligence Technologies

AI has taken a tempest in each industry and significantly affects each area of society. The term Artificial intelligence terms were first begun in 1956 at a meeting. The discussion of the gathering prompted interdisciplinary data tech natural language generationnology. The presence of the web helped development with progressing decisively. Artificial intelligence technology was an independent technology quite a while back(30 years), however presently the applications are boundless in each circle of life. Artificial intelligence is known by the AL abbreviation and is the most common way of reproducing human intelligence in machines.

Let us see a few more Artificial Intelligence Technologies…

1. Natural language generation

Machines process and convey another way than the human cerebrum. Normal language age is an in vogue innovation that converts organized information into the native language. The machines are modified with algorithms to change over the data into a desirable format for the client. Natural language is a subset of man-made artificial intelligence that assists content designers with computerizing content and conveying the desirable format . The content developers can utilize the automated content to advance on different social media entertainment stages, and different media stages to reach the targeted audience. Human intercession will essentially lessen as information will be changed over into desired formats. The information can be envisioned as charts, graphs, and so forth.

2. Speech recognition

Speech recognition is one more significant subset of artificial intelligence that changes over human speech into a helpful and justifiable format by PCs. Speech recognition is an extension among human and PC connections. The innovation perceives and changes over human speech in a few languages. Siri on the iPhone is a commendable outline of speech recognition.

3. Virtual agents

Virtual agents have become significant apparatuses for instructional designers. A virtual agent is a computer application that collaborates with humans. Web and mobile applications give chatbots as their client support specialists to communicate with humans to answer their questions. Google Assistant assists with arranging meetings, and Alexia from Amazon assists with making your shopping simple & easy. A virtual assistant additionally behaves like a language partner, which picks prompts from your choice and preference. The IBM Watson comprehends the average customer service questions which are asked in more ways than one. Virtual agents go about as software-as-a-service too.

4. Decision management

Modern organizations are executing decision management systems for data transformation and understanding into prescient models. Enterprise-level applications execute decision management systems to get modern data to perform business data analysis to support authoritative independent decision-making. Decision management helps in settling on fast decisions, evasion of dangers, and in the automation of the process. The decision management system is generally carried out in the monetary area, the medical services area, trading, insurance sector, web based business, and so on.

5. Biometrics

Deep learning is one more part of artificial intelligence that capabilities in view of artificial neural networks. This method helps PCs and machines to advance as a visual demonstration simply of the manner in which humans do. The expression "deep" is begat in light of the fact that it has stowed away layers in neural networks. Ordinarily, a neural network has 2-3 secret layers and can have a limit of 150 secret layers. Deep learning is viable on enormous information to prepare a model and a realistic handling unit. The algorithms work in an order to automate predictive analytics. Deep learning has spread its wings in numerous domains like aviation and military to distinguish objects from satellites, helps in further developing specialist security by recognizing risk occurrences when a labourer draws near to a machine, assists with identifying malignant growth cells, and so forth.

6. Machine learning

Machine learning is a division of artificial intelligence which enables machines to check out data collections without being actually programmed. Machine learning strategy assists businesses to pursue informed decisions with data analytics performed utilizing algorithms and statistical models. Endeavours are putting vigorously in machine learning to receive the rewards of its application in different domains. Medical services and the clinical calling need machine learning methods to examine patient information for the prediction of diseases and viable treatment. The banking and monetary area needs machine learning for customer data analysis to recognize and propose venture choices to clients and for risk and fraud prevention. Retailers use machine learning for predicting changing client preferences, consumer conduct, by breaking down customer data.

7. Robotic process automation

Robotic process automation is a use of artificial intelligence that designs a robot (programming application) to decipher, convey and analyze information. This discipline of artificial intelligence assists with automating to some degree or completely manual operations that are repetitive and rule-based.

8. Peer-to-peer network

The peer-to-peer network assists with associating between various systems and computers for data sharing without the data transmitting via server. Peer-to-peer networks can take care of the most intricate issues. This technology is utilized in digital forms of money(cryptocurrencies). The implementation is financially savvy as individual workstations are connected and servers are not installed.

9. Deep learning platforms

Deep learning is one more part of artificial intelligence that capabilities in view of artificial neural networks. This method helps PCs and machines to advance as a visual demonstration simply of the manner in which humans do. The expression "deep" is begat in light of the fact that it has stowed away layers in neural networks. Ordinarily, a neural network has 2-3 secret layers and can have a limit of 150 secret layers. Deep learning is viable on enormous information to prepare a model and a realistic handling unit. The algorithms work in an order to automate predictive analytics. Deep learning has spread its wings in numerous domains like aviation and military to distinguish objects from satellites, helps in further developing specialist security by recognizing risk occurrences when a labourer draws near to a machine, assists with identifying malignant growth cells, and so forth.

10. AL optimized hardware

Artificial intelligence software has a popularity in the business world. As the consideration for the software expanded, a requirement for the equipment that upholds the software likewise emerged. A regular chip can't uphold artificial intelligence models. Another age of artificial intelligence chips is developed for neural networks, deep learning, and PC vision. The AL hardware incorporates central processors to deal with versatile responsibilities, unique reason worked in silicon for neural networks, neuromorphic chips, and so on. Organizations like Nvidia, Qualcomm. AMD is creating chips that can perform complex artificial intelligence estimations. Medical services and automobile might be the industries that will profit from these chips.

Conclusion

To close, Artificial Intelligence addresses computational models of intelligence. Intelligence can be depicted as designs, models, and functional capabilities that can be programmed for critical thinking, inductions, language processing, and so on. The advantages of utilizing artificial intelligence are now procured in numerous areas. Organizations taking on artificial intelligence ought to run pre-release preliminaries to dispense with inclinations and blunders. The design, models, ought to be robust. In the wake of delivering artificial systems, enterprises ought to screen constantly in various situations. Organizations ought to make and keep up with principles and recruit specialists from different disciplines for better decision-making. The goal and future objectives of artificial intelligence are to automate all complex human activities and take out mistakes and inclinations.

#artificial intelligence companies#artificial intelligence services#emerging technology companies#cutting edge technology companies

4 notes

·

View notes

Text

Fingerprint Sensor Market - Forecast (2022 - 2027)

The rising need of multi-factor authentication method across consumer electronics, banking and financial sectors is set to grow the fingerprint sensor that was already valued to be $4.68 billion in 2018 and is expected to grow at a CAGR of 14% during forecast period 2019-2025. Factors such as the proliferation of fingerprint sensors in smartphones and other consumer electronics, government support for the adoption of fingerprint sensors in BFSI industry, and the use of biometrics in mobile commerce are driving the growth of the market. The adoption of fingerprint protection by smartphones to secure stored data and the essential bank options such as OTP and mobile banking applications are expected to fuel the fingerprint sensor market. According to the statics provided by TrendForce, growth in the share of smartphone shipments incorporated with fingerprint sensor increased from 29% in 2015 to 60% in 2018, which is likely to augment the fingerprint sensor market further during the forecast period.

On the other hand, increasing support from the government for the adoption of fingerprint sensors, along with use of biometrics in BFSI, and law enforcement sectors has been driving the fingerprint sensor market. The fingerprint devices in BFSI will help in authenticated transaction with fingerprint to prevent fraud that will lead the growth of fingerprint sensor market.

In fingerprint sensors market below developments would make dynamical changes, which in turn, will augment the market in terms of revenue:

A Swedish fingerprint sensor company, Fingerprint Cards AB, shipped one billion fingerprint sensors worldwide in Q1 2019. Going forward, the company is estimated to reach 2 billion of sensors shipment globally by the end of 2019, which will show significant growth in overall fingerprint sensor market.

The development in mobile fingerprint devices by Metropolitan Police Service can scan suspect fingerprints and returns any match to police databases within 60 seconds that is one of the emerging innovation for law enforcement.

These developments and innovations are expected to grow the of fingerprint sensor market globally.

Fingerprint Sensor Market Report Coverage

The report: “Fingerprint Sensor – Forecast (2019-2025)”, by IndustryARC covers an in-depth analysis of the following segments of the Fingerprint Sensor Market.

By Type: Area, Touch, Swipe, Fingerprint Sensor Modules

By Technology: Capacitive Sensor, Optical Sensor, Thermal Sensor, Pressure Sensor, RF Sensor, Ultrasonic Sensor, Others

By Application: Desktop, Laptop, Smartphones, Wearable Devices, Tablets, Gaming Consoles, Notebooks, Security & Alarm Solutions, Government & Law Enforcement, Others.

By Industry: Defense, Retail, Education, Healthcare, BFSI, Government, Commercial, Manufacturing/Industrial, Telecommunication, Travel & Immigration, Others

By Geography: North America, South America, Europe, Asia-Pacific, RoW

Request Sample

Key Takeaways

The major driving factor in the fingerprint sensor market is the increasing demand of smartphones with high-end technologies and fingerprint specifications, which are likely to grow the fingerprint sensor market during the forecast period.

The BFSI sector in the fingerprint sensor market is expected to grow at a CAGR of 19% during the forecast period. The increased need for multi-factor authentication systems in banking is being more prominent and increasing the demand for fingerprint sensors within this application.

APAC holds the largest market for the fingerprint sensors market accounting to around 34% of the global market share owing to the increased demand for consumer electronics such as smartphones, and wearable devices and so on, which are installed with fingerprint sensors. Moreover, the BFSI sector will be showing significant growth in the adoption of fingerprint to prevent the fraud cases.

Fingerprint Sensor Market Segment Analysis - By Technology

The capacitive and optical sensor technology are the most common type of fingerprint scanner, being used nowadays. The market is expanding significantly owing to increasing demand for secure consumer electronics and an overall need for rigid security.

Apart from that, the optical fingerprint scanner is now being used in most cost-effective hardware these days. These sensor are gaining prominence due to increasing popularity of in-display fingerprint sensors. Essential technology such as optical sensors has the viability to work efficiently with smartphones and provide multi-factor authentication systems in mobile banking ecosystem, which is likely to grow the fingerprint sensor market positively.

In 2019, a biometrics company Fingerprint Cards AB, introduced its FPC1610 sensor prototype using optical in-display fingerprint sensor for smartphones. These developments will show significant growth for in-display optical fingerprint sensors in the market.

Inquiry Before Buying

Fingerprint Sensor Market Segment Analysis - By Industry

The BFSI industry in fingerprint sensor market is expected to grow with the fastest CAGR of 19% during the forecast period. The banks are extensively working on payments cards with in-built fingerprint sensors, in order to end the need of PINs to make payments much secure. This will allow the most secure authentication mechanism for account holders.

Moreover, the government support for the adoption of fingerprint sensors owing to keep the security for unique identification and verification of individuals in e-Governance applications are expected to propel the growth of the fingerprint sensor market.

On the other hand, consumer electronics is one of the major market for fingerprint sensors. Various biometric incorporated devices such as smartphones, tablets, gaming consoles, and notebooks are expected to fuel the fingerprint sensor market. The growing trend of bezel-less screens feature, using OLED display, in smartphones has led the manufacturers to develop high-end in-display fingerprint sensors technology that occupy less space. This in-display fingerprint sensors will be incorporated in OLED displays using optical or ultra-sonic sensor technology. Hence, the adoption of in-display fingerprint sensors is expected to fuel the demand for ultrasonic and optical in-display fingerprint sensors, which is rising at the rate of 14% in 2019.

Fingerprint Sensor Market Segment Analysis - By Geography

The Asia Pacific region is the largest revenue contributor for the fingerprint sensors market, with a share of 34% in 2018. The rising adoption in mobile banking applications, collaborative innovations, updating smart devices, and, of course, security concerns in this region has resulted in increased demand for fingerprint sensors in this region.

Moreover, the demand for fingerprint technology in China has grown tremendously, especially in the consumer electronics, commercial, healthcare, government and banking sectors owing to protect the data from threats. Based on the statics of Statista, the consumer electronics user penetration in China is expected to hit from 23.4% in 2019 to 35.3% in 2023. Following this current market trend, numerous consumers are willing to transact using smart devices that integrate biometric identification systems for providing more security during transactions.

Recently in March 2019, NEXT Biometrics, a Norwegian fingerprint sensors company, signed an agreement with an Asian smart card manufacturer in order to launch contact-based and dual interface biometric smart cards in the Asia Pacific region. This will lead to increased demand for fingerprint sensors technology in coming years.

Similarly, in India, the increasing use of smartphones and other consumer appliances are witnessing a huge growth in terms of revenue. The smartphone penetration rate in India is expected to reach from 2018 in 26% to 36.2% in 2022. Thus, the growth in smartphones will significantly grow the fingerprint sensor market in this region. On the other hand, the government initiatives such as UIDAI for unique identification for individual citizen that is registered with fingerprint is expected to propel the growth of fingerprint market. Similar initiatives are being taken by other governments around the world, eventually leading to increasing demand of fingerprint sensors in the near future.

Schedule a Call

Fingerprint Sensor Market Drivers

Major adoption of Biometrics in Law Enforcement and Government Applications:

Within law enforcement, biometrics authentication is playing a key role in providing criminal ID solutions such as Automated Fingerprint Identification Systems (AFIS). This solution enables law enforcement agencies to identify and store data of the criminals. Moreover, unique identification initiatives taken by government, eventually driving the need of fingerprint sensors across all the application in a country.

Emergence of fingerprint sensors enabled smartphones:

Smartphones have increased penetration of in-display fingerprint sensing technology. Most smartphone manufacturers such as Samsung, Vivo, Huawei and Xiaomi are launching models that are integrated with fingerprint sensors. According to the Global Systems for Mobile Communications (GSMA), there were a total number of 5 billion mobile users at the end of 2017, and the production of mobile phones will grow at a CAGR of 2.1% during the forecast period of 2017 to 2025, and is expected to reach 5.9 billion in 2025. Thus, increasing demand for smartphones with advanced sensing technologies will create enhanced opportunities for the fingerprint sensors market.

Fingerprint Sensor Market Challenges

Integration of biometrics in to the devices is increasing the competition for fingerprint devices

The ability of biometrics is to access the biological parameters such as iris/retina, voice, pulse, DNA, and vein, provide the advance level of security. Since every individual possesses unique physiological features, which can’t be easily swapped, shared, or stolen. In biometrics, the recognition accuracy, integration and resetting ability is not working effectively, which are causing fall in the biometrics usage. Hence, the development in fingerprint sensor to make the module compact, thin, and easy to integrate with better recognition accuracy can reduce the use of other biometrics.

Buy Now

Market Landscape

Partnerships and acquisitions along with product development and up-gradation are the key strategies of the top players in the Fingerprint Sensors Market. The major players in the Fingerprint Sensor include Apple, Goodix, Egis Technology, Fingerprint Cards, Synaptics, IDEMIA, NEXT Biometrics, Anviz Global, IDEX ASA and Gemalto among others.

Partnerships/Mergers/Acquisitions

In March 2019, Gemalto acquired Green Bit to offer biometric scanners as part of complete automated fingerprint identification system (AFIS). This deal have been done by noticing an increase use of biometric scanners by governments for identity management purposes.

In May 2019, NEXT Biometrics and Newland entered into a supply agreement with Fujian Newland Payment Technology Co., Ltd. to provide an integration of different types of NEXT Biometrics' high-quality, large-area fingerprint sensors on a global scale.

In September 2018, HID Global, a leader in trusted identity solutions, announced that it acquired Crossmatch, a leader in biometric identity management and secure authentication solutions. Under this acquisition, Crossmatch’s biometric identity management hardware and software will complement HID’s broad portfolio to make major providers of fingerprint biometric technologies.

R&D Investments/Funding

In April 2019, Wales-based fingerprint biometrics startup Touch Biometrix has received $2.2m in VC Funding. The firm claims it will help boost the further growth of its fingerprint sensor technology. The solution price will be less than $1 per sensor and the manufacturing will continue to being by 2020.

In June 2018, Valencell captured $10.5M in Series E financing led by Sonion. The startup intends to use the financing to grow its technology and team of biometric sensors.

Fingerprint Sensor Market Research Scope:

The base year of the study is 2018, with forecast done up to 2025. The study presents a thorough analysis of the competitive landscape, taking into account the market shares of the leading companies. It also provides information on unit shipments. These provide the key market participants with the necessary business intelligence and help them understand the future of the Fingerprint Sensor Market. The assessment includes the forecast, an overview of the competitive structure, the market shares of the competitors, as well as the market trends, market demands, market drivers, market challenges, and product analysis. The market drivers and restraints have been assessed to fathom their impact over the forecast period. This report further identifies the key opportunities for growth while also detailing the key challenges and possible threats. The key areas of focus include the type, technology, application, industry and geography analysis of Fingerprint Sensors Market.

For more Electronics related reports, please click here

#Fingerprint Sensor Market price#Fingerprint Sensor Market size#Fingerprint Sensor Market share#Fingerprint Sensor Market trends#Fingerprint Sensor Market report#Fingerprint Sensor Market

2 notes

·

View notes

Text

How Social Protection Enhances Family Stability and Well-being

In an increasingly unpredictable world, the concept of social protection has emerged as a critical component of public policy aimed at enhancing family stability and well-being. Social protection encompasses a range of policies and programmes designed to reduce poverty and vulnerability by promoting efficient labour markets, diminishing people's exposure to risks, and enhancing their capacity to manage economic and social risks.

This blog post will explore how social protection systems contribute to family stability and well-being, with a particular focus on the integration of technology for social protection and the broad benefits for families in these frameworks.

The Role of Technology in Social Protection

The integration of technology for social protection has revolutionised the way these programmes are administered and accessed. Digital technologies have streamlined the identification and registration processes, making it easier to target the right beneficiaries. For example, biometric identification systems ensure that benefits reach the intended recipients, reducing fraud and leakage. Mobile banking and digital wallets have facilitated timely and secure disbursement of cash transfers, even in remote areas.

Moreover, technology has enhanced transparency and accountability in the administration of these programmes. Digital platforms enable real-time monitoring and evaluation, allowing policymakers to track the effectiveness of social protection interventions and make data-driven adjustments. This technological integration not only improves efficiency but also empowers beneficiaries by providing them with better access to information and services.

Enhancing Family Stability

One of the primary benefits for families in social protection is the enhancement of stability. Financial instability is a major stressor for families, often leading to negative outcomes such as poor mental health, disrupted education for children, and strained relationships. Social protection programmes, by providing a reliable source of income, help mitigate these stressors.

Cash transfer programmes, for example, provide families with the means to cover essential expenses such as food, housing, and healthcare. This financial support ensures that families can maintain a basic standard of living even in times of economic hardship. Additionally, social insurance schemes like unemployment benefits offer a buffer for families facing job loss, allowing them time to secure new employment without immediate financial distress.

Promoting Well-being

Social protection programmes also play a significant role in promoting overall well-being. Access to healthcare is a crucial component of well-being, and social protection schemes often include health insurance that makes medical services more affordable and accessible. This access to healthcare ensures that families can address health issues promptly, reducing the risk of long-term illnesses and improving quality of life.

Education is another critical area where social protection enhances well-being. By providing financial assistance, these programmes enable families to invest in their children's education, covering costs such as school fees, uniforms, and supplies. This investment in education not only improves the future prospects of the children but also contributes to breaking the cycle of poverty in the long term.

Strengthening Social Cohesion

Beyond the immediate financial and well-being benefits, social protection also fosters social cohesion. When families are supported through social protection programmes, they are less likely to experience severe economic disparities that can lead to social unrest and conflict. By reducing poverty and inequality, social protection contributes to a more stable and harmonious society.

Empowering Women and Promoting Gender Equality

Social protection programmes often have a significant impact on gender equality. Many schemes are designed to empower women, who are disproportionately affected by poverty and economic instability. For instance, maternity benefits and child support payments help women balance work and family responsibilities, reducing the financial burden on single mothers and promoting gender equality.

Moreover, targeted social protection interventions can address gender-specific vulnerabilities, such as violence against women and girls. By providing financial independence and support, these programmes help women escape abusive situations and build safer, more secure lives for themselves and their families.

In conclusion, the benefits for families in social protection are manifold, encompassing financial stability, improved well-being, social cohesion, and gender equality. The integration of technology for social protection has further enhanced the effectiveness and reach of these programmes, ensuring that they serve as a robust safety net for families worldwide. As we continue to navigate the complexities of the modern world, the importance of comprehensive social protection systems cannot be overstated. They are essential for fostering stable, healthy, and equitable societies where families can thrive.

0 notes

Text

Embracing the Future: Innovative Payment Solutions for a Digital-First World

As the world shifts further into the digital age, payment systems are undergoing a dramatic transformation. The rise of e-commerce, mobile technology, and new consumer expectations have pushed businesses to adopt more advanced, faster, and secure payment solutions. From contactless payments to decentralized financial systems, the future of transactions is digital, streamlined, and increasingly tailored to convenience.

In this article, we'll explore the most innovative payment methods that are reshaping the financial landscape, highlighting the benefits they offer for both businesses and consumers.

The Evolution of Mobile Payments

Mobile payments are rapidly becoming the go-to option for many consumers, with smartphones and wearable devices transforming into digital wallets. Apple Pay, Google Pay, and Samsung Pay allow users to store payment information securely and make purchases with a quick tap or scan. This shift to mobile payments offers convenience, speed, and enhanced security features like biometric verification, reducing the risk of fraud.

For businesses, integrating mobile payment solutions into their platforms opens up opportunities to capture tech-savvy consumers who prefer fast, contactless transactions. Retailers can enhance customer satisfaction with faster checkout times, reduced wait lines, and a modern shopping experience. As mobile payments become the standard, businesses that fail to adopt this technology may risk losing market share.

Contactless Payments: A New Standard

The rise of contactless payments, driven by Near Field Communication (NFC) technology, has revolutionized the way people transact. NFC enables consumers to make purchases by simply tapping their card, phone, or smartwatch near a payment terminal. The speed and ease of these transactions, coupled with the growing focus on hygiene during the pandemic, have made contactless payments a preferred choice for many.

From a business perspective, the adoption of NFC technology means shorter wait times and an improved customer experience. Not only do contactless payments offer convenience, but they also reduce the need for physical cash and minimize human contact. As this technology becomes more widespread, it's expected that contactless payments will soon dominate in physical retail settings, making it crucial for businesses to invest in NFC-enabled systems.

Buy Now, Pay Later (BNPL) Solutions

Buy Now, Pay Later (BNPL) services have gained immense popularity, especially among younger generations seeking more flexible payment options. Companies like Klarna, Afterpay, and Affirm offer consumers the ability to split their purchases into multiple installments, often without interest or fees. BNPL provides a sense of financial control and flexibility, allowing consumers to make larger purchases without the burden of upfront payments.

For businesses, offering BNPL solutions can significantly increase conversion rates and average order values. By reducing the financial barrier at the point of purchase, BNPL services encourage consumers to buy more while fostering loyalty. Retailers that integrate BNPL options are likely to attract a larger customer base, particularly among Millennials and Gen Z shoppers who favor alternative credit options.

Cryptocurrencies and Blockchain Payments

Cryptocurrency and blockchain technology are no longer niche topics; they are becoming mainstream alternatives to traditional financial systems. Bitcoin, Ethereum, and other cryptocurrencies offer decentralized, peer-to-peer payment solutions, enabling users to bypass traditional banking channels. Blockchain, the technology behind these currencies, ensures transparency and security by recording transactions on an immutable digital ledger.

For businesses, accepting cryptocurrency payments can open doors to a broader, more tech-savvy audience. International transactions become faster and cheaper as cryptocurrency eliminates the need for currency conversions and reduces fees typically associated with cross-border payments. However, the volatility of cryptocurrency values poses a challenge, as businesses must decide whether to convert digital assets into fiat currency immediately or hold them as investments.

Artificial Intelligence and Payment Fraud Prevention

The increase in digital transactions has also brought an uptick in online fraud. To combat this, businesses are turning to artificial intelligence (AI) for fraud detection and prevention. AI-driven systems can analyze large volumes of transactional data in real time, identifying patterns and anomalies that may indicate fraudulent activity.

By leveraging AI, businesses can stay one step ahead of cybercriminals, safeguarding their customers' payment information. AI can also enhance the user experience by optimizing the payment process, offering personalized recommendations, and preventing unnecessary friction during checkout. As fraud detection systems become more sophisticated, AI will continue to play a critical role in securing digital payments.

Virtual Currencies and Central Bank Digital Currencies (CBDCs)

Central banks worldwide are exploring the development of Central Bank Digital Currencies (CBDCs) as a response to the rise of cryptocurrencies and the increasing digitalization of money. CBDCs are digital forms of a country's official currency issued and regulated by central authorities. Unlike cryptocurrencies, CBDCs are stable, offering consumers the security of traditional fiat currency with the added convenience of digital transactions.

Businesses that prepare for the potential rollout of CBDCs will be well-positioned to stay ahead of future payment trends. CBDCs offer several advantages over cash, including faster transactions, lower costs for international payments, and increased security. As governments continue to research and develop these currencies, they may soon become a widely accepted payment method in both local and global economies.

Payment Gateways and Integration with E-commerce

With e-commerce booming, payment gateways have become an essential tool for online retailers. Payment gateways like Stripe, PayPal, and Square allow businesses to process credit card payments securely and efficiently. These platforms offer easy integration with e-commerce sites, making it simple for businesses to accept payments from customers around the world.

For small and medium-sized businesses, adopting a reliable payment gateway can provide a professional and seamless checkout experience. Many payment gateways offer additional features like recurring billing, fraud protection, and multi-currency support, making them ideal for scaling businesses. As e-commerce continues to grow, a robust payment gateway is no longer optional but a necessity for online retailers.

Biometric Authentication in Payments

Biometric authentication, once a futuristic concept, is now a reality in payment systems. Fingerprint scanning, facial recognition, and even iris recognition are being used to verify identity and authorize transactions. These methods provide a higher level of security than traditional PINs and passwords, which can be easily stolen or guessed.

For businesses, biometric authentication offers a more secure and convenient way for customers to make payments. By integrating biometric technology into payment systems, businesses can reduce the risk of fraud and streamline the checkout process. As consumers become more comfortable with biometric methods, adoption rates are expected to soar, leading to even more secure and seamless payments in the future.

The Future of Payment Solutions

The future of payments lies in the integration of technology, security, and convenience. As consumers continue to demand faster, more secure, and flexible payment methods, businesses must evolve to meet these expectations. From mobile payments to cryptocurrencies, AI-driven fraud prevention, and biometric authentication, the innovations shaping the future of transactions are already here.

Businesses that stay ahead of these trends and invest in cutting-edge payment technologies will not only improve customer satisfaction but also secure their position in a competitive digital economy. As payment systems continue to evolve, those who embrace innovation will be best positioned to thrive in this ever-changing landscape.

In the digital-first world, the way we handle transactions is changing rapidly. Innovative payment solutions like contactless payments, BNPL, and cryptocurrencies are transforming the way businesses and consumers interact with money. By embracing these new technologies, businesses can offer more secure, convenient, and flexible payment options, keeping pace with the evolving needs of their customers. As digital payments continue to grow, those who adapt quickly will have a significant advantage in the marketplace.

0 notes

Text

Digital Payment Market: Embrace the Shift to Digital as it Soars to $236.3 Billion by 2030

In today’s rapidly evolving global economy, digital payments Market have become the cornerstone of modern commerce. As the world increasingly transitions from traditional methods of payment like cash and checks to faster, more secure electronic options, the digital payment market is flourishing. According to projections, this market is expected to grow from USD 91.6 billion in 2023 to an astonishing USD 236.3 billion by 2030, at a Compound Annual Growth Rate (CAGR) of 14.5%. This impressive growth reflects the accelerating adoption of technology in financial services and an increase in the demand for seamless, digital transactions.

What is the Digital Payment Market?

Digital payments refer to transactions that are made electronically using a variety of methods, such as mobile wallets, online banking, contactless cards, and even cryptocurrency. The digital payment market encompasses all these services and solutions, creating a vast ecosystem for consumers and businesses to exchange funds efficiently and securely.

Access Full Report @ https://intentmarketresearch.com/latest-reports/digital-payment-market-3019.html

The Key Drivers Behind Market Growth

Increased Smartphone Penetration

Smartphones have revolutionized the way we conduct transactions. With over 6 billion smartphone users globally, mobile wallets and payment apps like Apple Pay, Google Pay, and Samsung Pay have become ubiquitous. This widespread smartphone usage facilitates the adoption of digital payment methods, further fueling market growth.

E-Commerce Boom

The rapid expansion of e-commerce platforms such as Amazon, eBay, and Shopify has driven a demand for quick, secure, and easy-to-use payment systems. As online shopping continues to soar, especially post-pandemic, businesses are heavily investing in digital payment solutions to enhance the consumer experience.

Growing Financial Inclusion

In many developing countries, digital payments are helping to bridge the gap between unbanked populations and financial services. Governments and fintech companies are working together to promote financial inclusion through digital wallets and mobile banking, enabling individuals to access a broader range of financial products.

Advancements in Technology

Technologies like blockchain, AI, and biometric authentication are revolutionizing the security and efficiency of digital payments. With the rise of fintech innovations, digital transactions are becoming safer, more user-friendly, and more accessible.

Digital Payment Methods

Mobile Wallets

Mobile wallets like PayPal, Venmo, and Alipay are among the most popular digital payment methods today. These apps allow users to store credit card information, send payments, and even transfer money between accounts with just a few taps on their mobile devices.

Contactless Cards

Contactless payments, enabled by Near-Field Communication (NFC) technology, have seen a significant rise in usage. Users can simply tap their cards or devices at POS terminals to complete transactions, making payments faster and more convenient.

Cryptocurrencies

Although still in its early stages, cryptocurrency is a growing player in the digital payment market. Bitcoin, Ethereum, and other digital currencies offer an alternative to traditional payment methods, with lower transaction fees and decentralized control.

Buy Now, Pay Later (BNPL)

BNPL services like Afterpay and Klarna allow consumers to make purchases and pay them off over time, without the need for traditional credit cards. This method has gained immense popularity, particularly among younger generations, due to its flexibility and convenience.

Challenges Facing the Digital Payment Market

Security Concerns

With the growth of digital payments comes an increased risk of cyber threats, including data breaches, fraud, and identity theft. Ensuring the security of sensitive financial information is a key challenge for the industry, requiring constant advancements in cybersecurity measures.

Regulatory Issues

Different countries have varying regulations around digital payments, which can complicate global operations. Navigating these regulations while maintaining compliance is crucial for businesses operating in this space.

Limited Infrastructure in Developing Regions

While digital payments have become the norm in many developed countries, infrastructure in some parts of the world remains underdeveloped. In regions where internet access is limited or unreliable, implementing digital payment systems can be difficult.

Download Sample Report @ https://intentmarketresearch.com/request-sample/digital-payment-market-3019.html

The Future of the Digital Payment Market

Increased Adoption of AI and Machine Learning

Artificial Intelligence (AI) and Machine Learning (ML) are already making waves in the payment industry, offering personalized recommendations, fraud detection, and automated customer service. As these technologies continue to advance, we can expect even more intelligent, adaptive payment systems.

The Rise of Central Bank Digital Currencies (CBDCs)

Several countries, including China and the European Union, are exploring the development of Central Bank Digital Currencies (CBDCs). These government-backed digital currencies have the potential to reshape global payment systems, offering a secure and stable alternative to traditional cryptocurrencies.

The Role of Blockchain

Blockchain technology is poised to play a larger role in digital payments by enabling decentralized, transparent transactions with reduced fees. As blockchain continues to evolve, it may offer new solutions for cross-border payments and improve financial inclusion for unbanked populations.

Expansion of Digital Payments in Developing Markets