#private jets

Text

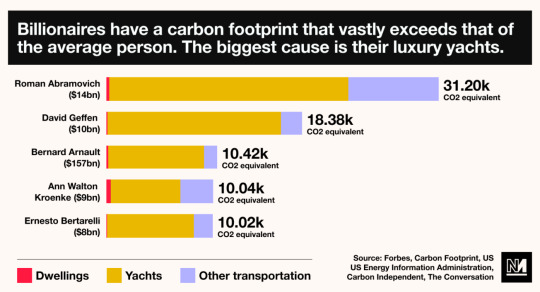

i hate you private jets i hate you bitcoin i hate you cars that go 200 mph i hate you golf parks i hate you yachts i hate you huge mansions with a pool i hate you luxery resorts i hate you exessive wealth causally killing the planet and using up ressources we all need

107K notes

·

View notes

Text

13K notes

·

View notes

Text

The lack of backlash from Taylor Swift fans against her for her MASSIVE contribution to climate change is proof that fandoms function more like cults than fan bases. They're spending more time defending/rationalizing it than facing the fact that she's completely out of touch of the cottagecore image she's selling. We are on a DYING planet. NONE of the celebs we stan will save it. The only way we can control the rich is by hitting them where it hurts: their reputation and profits.

#not only should you not defend her#you should actually boycott her#this is insane#i cant believe ppl who are living on a dying planet are defending ppl who are accelerating its death#you need help#taylor swift#swifties#pollution#climate change#private jets#nur talks sometimes

4K notes

·

View notes

Photo

Private jets departing Arizona after the Super Bowl

636 notes

·

View notes

Note

hey i get what youre trying to say with the taylor swift post but as of a few days ago shes trying to sue a college student who posts her (publicly available) flight logs. she very much does not give a shit about her carbon emissions and she shouldn’t be celebrated for her mediocre attempts to seem climate-conscious

I get what you're saying, definitely. I also did actually know about the thing with the college student when I posted that, so I wanted to give some context about why I made that post:

First, I personally didn't view it as celebrating her so much as celebrating progress. I think that if we never acknowledge wins, we'll end up dispirited very quickly

Second, recognizing when people decide to be less shitty is, at least I think, an important carrot in the carrot-and-stick dynamic of using public opinion to influence public figures

Lastly - and this may well be an unpopular opinion - but I don't actually hold her actions re: the college student against her

Why?

Well, for one, it was a cease and desist letter, not an attempted lawsuit. A cease and desist letter isn't legally binding, nor is it the start of a lawsuit - it's more like she's Putting Him On Notice. A cease and desist order can be followed by a lawsuit, if it's ignored, but it doesn't initiate one. Likely Taylor Swift will try several other steps of resolution before actually telling her lawyers to sue this guy, if only because the headlines would Not look good (x, x)

But more than that, I don't hold it against her because when Taylor Swift says that it's a matter of life and death for her, I believe that's very true.

Like, don't get me wrong, I'm not mad about her flight data being up either. And I'm not particularly a fan of Taylor Swift

But I also think that if I had to read through the rape and death threats she gets on an almost-certainly-daily basis, I'd want to vomit.

And I think that was true before Trump and his minions got obsessed with the idea that she's the keystone in the next Biden-election-stealing Pentagon psyops plot. Now - especially in the days right before the Superbowl, when this alleged conspiracy is supposed to happen - I don't even want to think about the brutality of the threats she's receiving

(For anyone going "Uh, wtf?" about the MAGA Superbowl Taylor Swift conspiracy thing, yes, I hate to inform you that it's A Whole Thing. More info here: x, x, x, x, x, x)

Taylor Swift does have stalkers, and now she has a bunch of MAGA paramilitary conspiracy theorists absolutely furious with her. If I were her, I'd want to do every single thing I could to keep information on my movements and in-the-moment location off the internet, too

tl;dr: I don't necessarily think she cares about the environment, but I'm not mad at her for sending a cease and desist letter because I think without her extensive security, she would be in real danger now, including possibly danger of being killed by armed MAGA conspiracy theorists

You're allowed to be mad at her and dislike her (obviously!), you're allowed to totally disagree with my attitude toward the cease and desist. I just wanted to share my rationale for including the post (and it is something I went back and forth on tbh)

#Anonymous#ask#me#taylor swift#celebrities#private jets#planes#cw rape mention#cw vomit mention#cw stalking#sidenote I'm really not sure why “she's going to endorse Joe Biden at the Superbowl” counts as a conspiracy theory#much less worth KILLING HER over#but they're straight up going on about her being an official asset for pentagon psyops#so#apparently it is#edited quickly to reflect the fact that she's accused of being a pentagon psyop asset#not a deep state member#literally only because she's not in any kind of official political anything I'm sure

88 notes

·

View notes

Photo

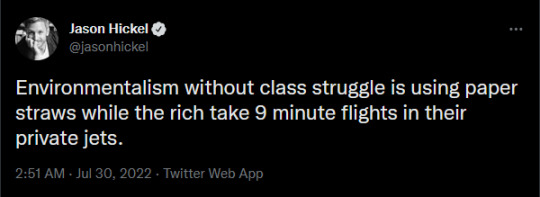

Text: (A tweat by Jason HIckel) Environmentalism without class struggle is using paper straws while the rich take 9 minute flights in their private jets.

#environmentalism#ecosocialism#private jets#should be banned#taylor swift#is getting the headlines right now but they're all so guilty of this#found on twitter

656 notes

·

View notes

Text

Clarence Thomas and the generosity of a far-right dark-money billionaire

Clarence Thomas has set some important precedents in his career as a Supreme Court justice — for example, the elevation of the unrepentant rapist Brett Kavanaugh to the bench could never have occurred but for the trail blazed by Thomas as a sexually harassing, pubic-hair distributing creep boss:

https://www.politico.com/news/magazine/2021/10/01/30-years-after-her-testimony-anita-hill-still-wants-something-from-joe-biden-514884

If you’d like an essay-formatted version of this post to read or share, here’s a link to it on pluralistic.net, my surveillance-free, ad-free, tracker-free blog:

https://pluralistic.net/2023/04/06/clarence-thomas/#harlan-crow

Today, Thomas continues to steer the court into new territory — for example, he’s interested in banning same-sex marriage again:

https://www.politico.com/news/2022/06/24/thomas-constitutional-rights-00042256

And of course, he’s set precedent by hearing cases related to the attempted overthrow of the US government, despite the role his wife played in the affair:

https://www.npr.org/2022/03/30/1089595933/legal-ethics-experts-agree-justice-thomas-must-recuse-in-insurrection-cases

Thomas is not alone in furthering the right’s mission to destroy the morale of constitutional law scholars by systematically delegitimizing the court and showing it to be a vehicle for partisan politics and dark money policy laundering, but he is certainly at the vanguard:

https://pluralistic.net/2023/03/25/consequentialism/#dotards-in-robes

Today, Propublica published an expose on the vast fortune in secret gifts bestowed upon Thomas by the billionare GOP megadonor Harlan Crow, who is also one the most significant funders of political campaigns that put business before Thomas and the Supreme Court:

https://www.propublica.org/article/clarence-thomas-scotus-undisclosed-luxury-travel-gifts-crow

The story, reported by Joshua Kaplan, Justin Elliott and Alex Mierjeski is a masterwork of shoe-leather investigative journalism, drawing on aviation records, social media posts and other “open source” intelligence to expose the illegal, off-the-books “gifts” from a billionaire to an unaccountable Supreme Court justice with a lifetime appointment.

Here are a two of those gifts: a private jet/superyacht jaunt around Indonesia valued at $500,000; and a $500,000 gift to Ginni Thomas’s Tea Party group (which pays Ginni Thomas $120,000/year).

On top of that are gifts that are literally priceless: decades’ worth of summer vacations at Camp Topridge, Crow’s private estate, with its waterfall, great hall, private chefs, 25 fireplaces, thee boathouses, clay tennis court, batting range, 1950s-style soda fountain and full-scale reproduction of Hagrid’s hut.

Summer retreats to Topridge allow business leaders like Leonard Leo — the Federalist Society bankroller and mastermind who set Trump up to pack the Supreme Court — to coordinate in private with Thomas:

https://pluralistic.net/2020/09/29/betcha-cant-eat-just-one/#pwnage

They also allow top execs from PWC, Verizon and other corporations who may have business before the court to establish a warm, collegial relationship with a judge whose decisions can make billions for their employers. In its reporting, Propublica points out that Thomas got to hang out on Crow’s superyacht with Mark Paoletta, who was then general counsel for Trump’s OMB, and who has opposed any tightening of ethics rules for Supreme Court judges: “there is nothing wrong with ethics or recusals at the Supreme Court.”

Crow and Thomas also hobnob together at Crow’s Texas ranch, and at the Bohemian Grove, the Bay Area’s ultra-luxe retreat for rich creeps. Crow bought Thomas a private superyacht cruise through New Zealand, another through the Greek islands, and a river trip around Savannah, GA. He also traveled around the country on Crow’s private jet — even a short private jet trip is valued around $70,000.

Crow also makes many donations on Thomas’s behalf, from a $105,000 donation to Yale Law School for the “Justice Thomas Portrait Fund” to paying for a 7 foot tall, 1,800 lb bronze statue of the nun who taught Thomas in the eighth grade, which now stands in a New York Catholic cemetery.

This is without precedent. No Supreme Court justice in US history received comparable gifts during their tenure on the bench. Federal judges quoted in the story call it “incomprehensible,” noting that US judges bend over backwards not to owe anyone any favors, going so far as to book restaurant reservations without using their titles.

Virginia Canter, a former US government ethics lawyer of bipartisan experience said Thomas “seems to have completely disregarded his higher ethical obligations,” adding “it makes my heart sink.”

The Supreme Court’s own code of ethics prohibits justices from engaging in conduct that gives rise to the “appearance of impropriety,” but the code is “consultative,” and there are no penalties for violating it. But US judicial officers — including Thomas — are legally required to disclose things like private jet trips. Thomas did not. In general, justices must report any gift valued at more than $415, where a gift is “anything of value.” This includes instances in which a gift is given by a corporation whose owner is the true giver.

Crow is a Red Scare-haunted plutocrat who says his greatest fear is “Marxism.” He was a key donor to the anti-tax extremists at the Club For Growth, and has served on the board of the American Enterprise Institute — climate deniers who also claimed that smoking didn’t cause cancer — for 25 years.

Crow is a proud dark-money source, too, whose $10m in acknowledged donations to Republican causes and candidates are only the tip of the iceberg, next to the dark money he has provided to groups he declines to name, telling the New York Times, “I don’t disclose what I’m not required to disclose.”

Crow claims that the vast sums he’s lavished on Thomas — who, again, presides over the test cases that Crow is helping to put before him — are just “hospitality.” Crow called the private retreats with business leaders and top government officials “gatherings of friends,” and added that he was “unaware of any of our friends ever lobbying or seeking to influence Justice Thomas” while at his private estates or on his superyacht or private plane.

For his part, Thomas publicly maintains that he hates luxury. In a Crow-financed documentary about Thomas’s life, Thomas tells the camera, “I prefer the RV parks. I prefer the Walmart parking lots to the beaches and things like that. There’s something normal to me about it. I come from regular stock, and I prefer that — I prefer being around that.”

Judges often have to make determinations about conflicts of interest, and lawyers have an entire practice devoted to preventing conflicts from arising. I doubt whether Thomas himself would consent to have a dispute of his own tried in front of a judge who had received millions in gifts from his opponent.

The Supreme Court’s power comes from its legitimacy. The project of delegitimizing the court started with the right, and Democrats have been loathe to participate in any activity that would worsen the court’s reputation. As a result, the business lobby and authoritarian politicians have had free rein to turn the court into a weapon for attacking American workers, American women, and LGBTQ people.

It doesn’t have to be this way. When the Supreme Court blocked all of FDR’s New Deal policies — which were wildly popular — FDR responded by proposing age limits for Supreme Court judges. When the Supremes refused to contemplate this, FDR asked Congress for a law allowing him to appoint one new Supreme Court judge for every judge who should retire but wouldn’t.

As the vote on this bill grew nearer, the Supremes reversed themselves, voting to uphold the policies they’d struck down in their previous session. They knew that their legitimacy was all they had, and when a brave president stood up to their bullying, they caved.

https://theconversation.com/packing-the-court-amid-national-crises-lincoln-and-his-republicans-remade-the-supreme-court-to-fit-their-agenda-147139

The Supreme Court has moved America further away from the ideals of pluralistic democracy than we can even fathom, and they’re just getting started. They are taking a wrecking ball to the lives of anyone who isn’t a wealthy conservative, and they’re doing it while accepting a fortune in bribes from American oligarchs.

Have you ever wanted to say thank you for these posts? Here’s how you can: I’m kickstarting the audiobook for my next novel, a post-cyberpunk anti-finance finance thriller about Silicon Valley scams called Red Team Blues. Amazon’s Audible refuses to carry my audiobooks because they’re DRM free, but crowdfunding makes them possible.

Image:

Mr. Kjetil Ree (modified)

https://commons.wikimedia.org/wiki/File:US_Supreme_Court.JPG

CC BY-SA 3.0

https://creativecommons.org/licenses/by-sa/3.0/deed.en

[Image ID: An altered image of Clarence Thomas, standing in gilded judicial robes on the steps of the Supreme Court. Looming over the court is a line-drawing of a business-man with a dollar-sign-emblazoned money-bag for a head.]

#pluralistic#Mark Paoletta#clarence thomas#corruption#conflict of interest#bribery#gop#fedsoc#federalist society#superyachts#harlan crow#private jets#scotus#supreme court#legitimacy#dark money#bohemian grove#aei#american entertprise institute#club for growth#hoover institution#Justice Thomas Portrait Fund#yale law school#yale#boolah boolah#red scare

160 notes

·

View notes

Text

#us politics#republicans#conservatives#twitter#tweet#ian millhiser#gop#us supreme court#justice clarence thomas#justice samuel alito#harlan crow#paul singer#scotus#private jets#billionaires#fuck billionaires#student loans#student loan debt#student loan forgiveness#freeze student debt#student debt forgiveness#2023

137 notes

·

View notes

Text

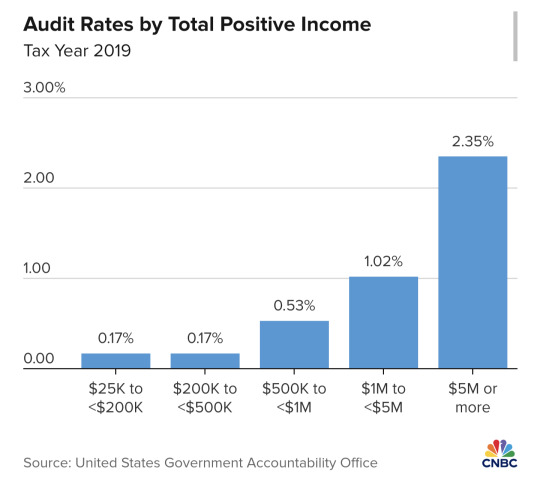

The nation’s millionaires and billionaires are evading more than $150 billion a year in taxes, adding to growing government deficits and creating a “lack of fairness” in the tax system, according to the head of the Internal Revenue Service.

The IRS, with billions of dollars in new funding from Congress, has launched a sweeping crackdown on wealthy individuals, partnerships and large companies. In an exclusive interview with CNBC, IRS Commissioner Danny Werfel said the agency has launched several programs targeting taxpayers with the most complex returns to root out tax evasion and make sure every taxpayer contributes their fair share.

Werfel said that a lack of funding at the IRS for years starved the agency of staff, technology and resources needed to fund audits — especially of the most complicated and sophisticated returns, which require more resources. Audits of taxpayers making more than $1 million a year fell by more than 80% over the last decade, while the number of taxpayers with income of $1 million jumped 50%, according to IRS statistics.

“When I look at what we call our tax gap, which is the amount of money owed versus what is paid for, millionaires and billionaires that either don’t file or [are] underreporting their income, that’s $150 billion of our tax gap,” Werfel said. “There is plenty of work to be done.”

“For complex filings, it became increasingly difficult for us to determine what the balance due was,” he said. “So to ensure fairness, we have to make investments to make sure that whether you’re a complicated filer who can afford to hire an army of lawyers and accountants, or a more simple filer who has one income and takes the standard deduction, the IRS is equally able to determine what’s owed. And to us, that’s a fairer system.”

Some Republicans in Congress have ramped up their criticism of the IRS and its expanded enforcement efforts. They say the wave of new audits will burden small businesses with unnecessary bureaucracy and years of fruitless investigations and won’t raise the promised revenue.

The Inflation Reduction Act gave the IRS an $80 billion infusion, yet congressional Republicans won a deal last year to take $20 billion of the funding back. Now they’re pressing for further cuts.

The Treasury Department said last week it estimates greater IRS enforcement will result in an additional $561 billion in tax revenue between 2024 and 2034 — a higher projection than it had initially stated. The IRS says that for every extra dollar spent on enforcement, the agency raises about $6 in revenue.

The IRS is touting its early success with a program to collect unpaid taxes from millionaires. The agency identified 1,600 millionaire taxpayers who have failed to pay at least $250,000 each in assessed taxes. So far, the IRS has collected more than $480 million from the group “and we are still going,” Werfel said.

On Wednesday, the agency announced a program to audit owners of private jets, who may be using their planes for personal travel and not accounting for their trips or taxes properly. Werfel said the agency has started using public databases of private-jet flights and analytics tools to better identify tax returns with the highest likelihood of evasion. It is launching dozens of audits on companies and partnerships that own jets, which could then lead to audits of wealthy individuals.

Werfel said that for some companies and owners, the tax deduction from corporate jets can amount to “tens of millions of dollars.”

Another area that is potentially rife with evasion is limited partnerships, Werfel said, adding that many wealthy individuals have been shifting their income to the business entities to avoid income taxes.

“What we started to see was that certain taxpayers were claiming limited partnerships when it wasn’t fair,” he said. “They were basically shielding their income under the guise of a limited partnership.”

The IRS has launched the Large Partnership Compliance program, examining some of the largest and most complicated partnership returns. Werfel said the IRS has already opened examinations of 76 partnerships — including hedge funds, real estate investment partnerships and large law firms.

Werfel said the agency is using artificial intelligence as part of the program and others to better identify returns most likely to contain evasion or errors. Not only does AI help find evasion, it also helps avoid audits of taxpayers who are following the rules.

“Imagine all the audits are laid out before us on a table,” he said. “What AI does is it allows us to put on night vision goggles. What those night vision goggles allow us to do is be more precise in figuring out where the high risk [of evasion] is and where the low risk is, and that benefits everyone.”

Correction: The IRS has collected $480 million from a group of millionaire taxpayers who had failed to pay. An earlier version misstated the amount collected.

#us politics#news#cnbc#2024#irs#internal revenue service#Danny Werfel#taxes#tax evasion#private jets#audits#Inflation Reduction Act#treasury department#Large Partnership Compliance#eat the rich#tax the rich#tax the 1%

15 notes

·

View notes

Text

I think anyone who owns or uses a private jet does not deserve the same amount of rights as the rest of us. I think they should be second class citizens. I think they should lose their freedom and their money and most importantly they should lose their private jet which should be reduced to fucking pieces and its parts should be reused for something else

#i am not joking btw I do think people who use private jets and super yachts are sub-human#and yes that does mean 90% of hollywood. fuck all of them#they are actively murdering this planet for their little pleasure I want them suffering and whining and screaming and k**ling themselves#climate emergency#climate change#pollution#aviation#private jets#ecology#ecocide#bee tries to talk

34 notes

·

View notes

Link

Private aircraft still emit more than 33m tonnes of greenhouse gases, more than the country of Denmark, and because they carry so few people they are five to 14 times more polluting than commercial planes, per passenger, and 50 times more polluting than trains.

“The problem starts at the top with Kylie Jenner and other celebrities with private jets, which have a much larger impact than commercial aircraft on a per passenger basis. But it also includes many others, as the US constitutes the bulk of the wealthy elite that have the luxury of flying.”

Emissions from private jets flown in the US have surged since the 1990s and will balloon further as larger and more polluting aircraft come onto the market. Short trips using private jets are not solely an American phenomenon; in 2019, one tenth of all flights departing France were private jets, with half traveling less than 500km. The frequent use of aviation is the domain of the world’s wealthy, with just 1% of the global population responsible for half of the emissions associated with flying.

239 notes

·

View notes

Text

IRS to go after executives who use business jets for personal travel in new round of audits

Private jets sit parked at Scottsdale Airport Jan. 27, 2015, in Scottsdale, Ariz. IRS leadership said

FATIMA HUSSEIN Feb 21, 2024

WASHINGTON (AP) — First, there were trackers on Taylor Swift and other celebrities’ private jet usage. Now, there will be more scrutiny on executives’ personal use of business aircraft who write it off as a tax expense.

IRS leadership said Wednesday that the agency will start conducting dozens of audits on businesses’ private jets and how they are used personally by executives and written off as a tax deduction — as part of the agency’s ongoing mission of going after high-wealth tax cheats who game the tax system at the expense of American taxpayers.

The audits will focus on aircraft used by large corporations and high-income taxpayers and whether the tax purpose of the jet use is being properly allocated, the IRS says.

“At this time of year, when millions of hardworking taxpayers are working on their taxes, we want them to feel confident that everyone is playing by the same rules,” IRS Commissioner Daniel Werfel said on a call with reporters to preview the announcement. Tax season began Jan. 29.

“These aircraft audits will help ensure high-income groups aren’t flying under the radar with their tax responsibilities,” he said.

There are more than 10,000 corporate jets in the US., according to the IRS, valued at tens of millions of dollars and many can be fully deducted.

The Tax Cuts and Jobs Act, passed during the Trump administration, allowed for 100% bonus depreciation and expensing of private jets — which allowed taxpayers to write off the cost of aircraft purchased and put into service between September 2017 and January 2023.

Werfel said the federal tax collector will use resources from Democrats’ Inflation Reduction Act to more closely examine private jet usage — which has not been closely scrutinized during the past decade as funding fell sharply in the last decade.

“Our audit rates have been anemic,” he said on the call. An April 2023 IRS report on tax audit data states that “continued resource constraints have limited the agency’s ability to address high-end noncompliance” stating that in tax year 2018, audit rates for people making more than $10 million were 9.2%, down from 13.6% in 2012. And in the same time period, overall corporate audit rates fell from 1.3% to .6%.

Mike Kaercher, senior attorney advisor at the Tax Law Center at NYU said in a statement that the IRS should also revisit how it values personal use of corporate aircraft, beyond just how flights are reported.

“The current rules allow these flights to be significantly undervalued, enabling wealthy filers to pay much less in taxes than fair market value would dictate, and it’s within the IRS’ authority to revise these rules,” Kaercher said.

Werfel said audits related to aircraft usage could increase in the future depending on the results of the initial audits and as the IRS continues hiring more examiners.

“To be clear, that doesn’t mean everyone in a high-income category partnership or corporation is evading or avoiding their tax responsibility,” Werfel said. “But it does mean that there’s more work to do for the IRS to make sure people are paying what they owe.”"

10 notes

·

View notes

Text

RICH FOREVER #BOSS

⌛️🔌💸💰

#art#generationalwealth#mansorus#mental health awareness#philly#Miami#florida#rick ross#private jets#jets#fast life#rich life#millionaires#black millionaire

24 notes

·

View notes

Photo

European Countries with the largest fleet of Registered private Jets, 2022.

Private jets have a disproportionate impact on the environment. In just one hour, a single private jet can emit two tonnes of CO2. The average person in the EU emits 8.2 t CO2 eq over the course of an entire year.

by Maps_interlude

203 notes

·

View notes

Text

UK petition to ban private jets

11 notes

·

View notes

Text

8 notes

·

View notes