#public provident fund in tamil

Text

Incentives and Rebates on EV charging Station in India?

In India, the government and various state authorities are promoting the adoption of electric vehicles (EVs) and the installation of EV charging infrastructure through various incentives and rebates. Here are some key incentives and rebates available for EV charging stations in India EV charging stations in India:

Central Government Incentives

FAME India Scheme (Faster Adoption and Manufacturing of Hybrid and Electric Vehicles)

FAME II: The second phase of the FAME India scheme includes substantial support for the development of EV charging infrastructure. It provides incentives for setting up public charging stations to ensure adequate infrastructure for electric vehicles.

Goods and Services Tax (GST)

The GST on EV chargers and charging stations has been reduced to 5%, which is significantly lower than the standard GST rate on most goods and services.

Income Tax Deduction

Under Section 80EEB of the Income Tax Act, individuals can claim a deduction of up to ₹1.5 lakh on the interest paid on loans taken to purchase electric vehicles, which indirectly promotes the installation of home charging infrastructure.

State Government Incentives

Several states in India offer additional incentives for the installation of EV charging stations. Here are a few examples:

Delhi: The Delhi Electric Vehicle Policy 2020 provides a subsidy of ₹6,000 per charging point for the first 30,000 charging points. Residential societies, RWAs, and commercial establishments can avail incentives for installing charging infrastructure.

Maharashtra: The Maharashtra EV Policy 2021 offers a subsidy of up to 50% of the cost (subject to a maximum amount) for setting up EV charging stations.

Additional benefits include discounts on electricity tariffs for EV charging.

Gujarat: The Gujarat EV Policy 2021 provides a capital subsidy of up to 25% (subject to a maximum amount) of the cost of equipment and machinery required for setting up EV charging infrastructure.

Tamil Nadu: Tamil Nadu's EV Policy includes incentives for setting up charging stations, including subsidies on the cost of land and reduced electricity tariffs for EV charging.

Karnataka: The Karnataka Electric Vehicle and Energy Storage Policy offer various incentives, including subsidies for setting up charging stations and reduced electricity tariffs.

Utility Company Incentives: Some utility companies in India are also offering incentives to promote the installation of EV charging stations:

Ecoplug Energy India Limited

Tata Power has been actively setting up EV charging stations across various cities in India and often collaborates with local governments and businesses to provide incentives for setting up charging infrastructure.

Steps to Avail Incentives

Research Available Programs: Check with local and state government websites, as well as utility companies, to find available incentives.

Understand Eligibility Requirements: Each program has specific eligibility requirements and application procedures. Make sure to review these carefully.

Prepare Documentation: Gather all necessary documentation, such as proof of purchase and installation, to apply for rebates or subsidies.

Apply Promptly: Some programs have limited funding and are available on a first-come, first-served basis.

Useful Resources

Ministry of Heavy Industries (FAME India Scheme): FAME India Scheme

State Government Portals: Websites of respective state governments for details on state-specific EV policies and incentives.

Utility Company Websites: Check the websites of utility companies like Tata Power, BSNL, and others for information on incentives and collaborations.

By taking advantage of these incentives, individuals and businesses in India can significantly reduce the cost of installing and operating EV charging stations, thereby supporting the country's transition to electric mobility.

1 note

·

View note

Text

Puravankara Plots Chikkajala Project - Coming soon in Bangalore

Puravankara Plots Chikkajala invites you to experience a unique blend of tranquility and concrete vibrancy. Developed by the renowned Puravankara Limited, this project guarantees to redefine contemporary living in Bangalore's Chikkajala. The project boasts a prime location and provides quite a number of world-class services. Spacious residential plots offer the best canvas so that it will layout your dream domestic. Imagine crafting a space that reflects your persona. It can be a cozy haven surrounded by nature or a current masterpiece ready for all the present-day functions. With flexible plot sizes and layouts, these property will further empower you. You can certainly turn your vision into reality and create a home that speaks to you.

Join us as we embark on an adventure to find out the remarkable appeal and investment potential of this specific community. Whether in search of sanctuary or investment, experience urban sophistication with us. This awaits you amidst lush surroundings.

Location and Nearby Infrastructures of Puravankara Plots in Chikkajala

Strategically placed in Bangalore, Tamil Nadu, India, Purva Plots in Bangalore offers a high address within the vibrant Chikkajala neighborhood. This bustling area is renowned for its proximity to crucial services, instructional institutions, healthcare facilities, and recreational hotspots. Therefore, it provides you with a suitable mixture of comfort and tranquility. With easy access to the most important roads, highways, and public transportation, it also ensures seamless connectivity to the rest of the city.

Here's a list of infrastructures near these properties, along with their distances:

Amenities

We accept as true that we are supplying more than just a home. We offer a way of life to the citizens of Puravankara Plots Bangalore. You will have access to a bunch of services designed to cater to their every need and preference. From lushly landscaped gardens and running tracks to brand new fitness centers and community halls, each issue of cutting-edge dwelling has been carefully curated. These upgrades are intended to raise your quality of life. Additionally, our committed protection crew ensures round-the-clock surveillance, supplying peace of mind for you and your family.

Investment Potential of Puravankara Plots in Chikkajala

Puravankara Limited, also known as Purva Group, is more than just a call. They are a legacy built on consideration, integrity, and excellence. With over four years of experience within the enterprise, we've earned recognition as one of India's most trusted real property developers. From residential and commercial project to combined-use developments, our portfolio showcases our unwavering dedication to first-class service and patron pride. With Puravankara at the helm, you could without a doubt consider that your investment in their property is in safe hands.

Beyond presenting an area to call home, Purva Land Chikkajala presents a rewarding funding opportunity for discerning consumers. Bangalore's real estate marketplace is booming, with asset values regularly growing. Making an investment in a residential plot right here isn't always a terrific concept; it is a stable investment for the future. Are you seeking to build your dream home? Diversify your investments. Maybe leave a legacy for your own family? This thriving community will offer the perfect choice, without a doubt. Here, you may discover both value and niceness in one location.

Conclusion:

In the end, this residential real estate project is a promise of better the following day. With its high vicinity and global-class services, this project gives luxurious consolation and convenience. Coupled with spacious residential plots and a good developer, it's the ideal combination. Whether you're searching out your dream domestic or a lucrative investment possibility, we've got something for everyone. Join us on this adventure towards a brighter destiny. You can inquire these days and allow us to help you turn your dream into reality at Puravankara Chikkajala Plots Bangalore.

#Puravankara Plots Chikkajala#Puravankara Plots Chikkajala Bangalore#Purva Plots Bangalore#Puravankara Chikkajala Plots Bangalore#Purva Land Chikkajala Plots#Puravankara Chikkajala plots

0 notes

Text

The Advantages of Investing in Flats in Chennai

The state capital of Tamil Nadu, Chennai, has lots of real estate investment prospects. Apartments are a profitable investment choice if you're wanting to make a move in Chennai. They provide an appealing lifestyle that will enable you to live a healthy life in addition to being excellent financial options. Chennai offers its citizens an excellent quality of life, so let's speak about it before moving on to the advantages of purchasing apartments there.

Why It's a Great Investment to Buy Flats in Chennai

Today's apartments provide amenities and features that support a better life. Apartments in Chennai provide a completely different way of life than what existed a little more than a decade ago, with swimming pools, gyms, children's play spaces, and libraries, as well as open-air theaters, community centers, and senior citizen organizations.

Chennai is one of the most desirable cities to live in. The city has continuously ranked among the safest places to live. However, the city is also noted for its comparatively inexpensive cost of living, which adds to its appeal. Let's look at some of the advantages of owning a property in Chennai.

1. Low Cost of Living

Chennai is one of India's main cities, along with Mumbai, Kolkata, Delhi, and Hyderabad. The city was one of the first four metropolitan areas to be declared. However, compared to other major cities, Chennai's cost of living is quite inexpensive. When we say "low cost," we also include the cost of real estate, as well as food, healthcare, transportation, and so on. This is one of the primary advantages of an apartment for sale in OMR.

2. Excellent Connectivity and Streamlined Transportation

One of the most significant advantages of purchasing flats in Perungulathur is the availability of convenient transportation. The city's transportation system is so well planned that even tourists may easily go from one end of the city to the other. With the metro rail project underway and one phase already completed, the city provides great connectivity.

3. Good quality education

Chennai is one of the top cities for education, whether at the secondary or postsecondary levels. The city is home to various prestigious institutions, colleges, and universities, particularly those that provide top-tier engineering and technology education. From IIT to Anna University, the city provides complete study options for ambitious students through a variety of private and public institutions. Aside from educational institutions, Chennai is home to the Anna Centenary Library, the state's public library, which holds a diverse collection of books from all over the world and across several genres.

4. Cutting-edge healthcare facilities

Access to healthcare is no longer a major challenge in the city. Chennai has various multispecialty hospitals that use sophisticated medical technology to treat a wide range of ailments. The city is replete with commercial and government-funded healthcare facilities that treat a variety of diseases. As a result, access to the greatest healthcare facilities is one of the advantages of flats for rent in OMR. If you live in a premium residential location, you will have access to hospitals within a short distance.

5. Entertainment Galore

Chennai, as a developed metropolis, has plenty of entertainment options. Even if the city is not primarily an appealing tourist destination with several tourist attractions, it does not lack amusement. Marina Beach is the world's second longest beach and India's first. Furthermore, Chennai offers an abundance of entertainment venues, such as shopping centers, theaters, theme parks, and more. The city is also bordered by history and cultural sites such as Mamallapuram, and it is a decent distance from Tamil Nadu's gorgeous hill regions.

6. Friendly People

When you opt to invest in a city apartment, you will be surrounded by the most friendly individuals who are open to embracing and welcoming people from all walks of life. This is one of the primary advantages of purchasing a property in Chennai. As a cosmopolitan city, the citizens, or 'Chennaites,' are renowned for effortlessly warming up to individuals from all over the country, regardless of where they come from. When you buy, rent, and move into a flat for rent in Perungulathur.

#FlatForRent#Perungulathur#FlatsForRent#OMR#PurchasingFlats#ApartmentForSale#InvestingInFlats#Chennai#realestate#marketing#chennaiproperty

0 notes

Text

Vikram Solar IPO Date, Price, Company profile, risk & financial details

New Post has been published on https://wealthview.co.in/vikram-solar-ipo/

Vikram Solar IPO Date, Price, Company profile, risk & financial details

Vikram Solar IPO: Vikram Solar Ltd is a leading Indian company based in Kolkata, known for being the largest solar module manufacturer by capacity (2.5 GW annually).

They are also the second-largest solar energy company in India by revenue, offering not only module manufacturing but also EPC (engineering, procurement, and construction) services and O&M (operations and maintenance) for solar power plants.

The Indian solar energy industry is experiencing rapid growth, fueled by government initiatives to achieve net-zero carbon emissions and rising demand for renewable energy.

Vikram Solar IPO Details:

Dates: While the exact dates haven’t been announced yet, Vikram Solar received SEBI approval in March 2023, and initial reports suggested a potential launch period sometime in late 2023 or early 2024.

Offer Size: The IPO will consist of a fresh issue of up to ₹1,500 crore and an Offer-for-Sale (OFS) of up to 50 lakh shares by existing shareholders.

Price Band: The price band is yet to be determined, but early reports mentioned a potential range of ₹150-₹200 per share.

News & Developments:

The IPO approval from SEBI in March 2023 was a significant step forward for the company.

In August 2023, they announced plans for a new 2 GW manufacturing facility in Tamil Nadu, funded partly by the IPO proceeds.

The ongoing global energy crisis and increased focus on renewable energy sources could boost investor sentiment towards Vikram Solar.

Vikram Solar Ltd Company Profile:

History: Founded in 2003, Vikram Solar Ltd. (VSL) was initially a private limited company before going public in 2019. It has grown to become one of India’s leading solar energy companies, playing a pivotal role in the country’s renewable energy transition.

Operations: VSL operates across the entire solar value chain, encompassing:

Manufacturing: With a 3.5 GW operational capacity, VSL is one of India’s largest manufacturers of solar PV modules. Their factories in West Bengal and Tamil Nadu produce mono PERC, bifacial, and polycrystalline modules.

Engineering, Procurement & Construction (EPC): VSL offers EPC services for both rooftop and ground-mounted solar projects across various sectors, including utility, healthcare, education, and industry.

Operations & Maintenance (O&M): VSL provides comprehensive O&M services to ensure the smooth and efficient operation of solar power plants.

Market Position and Share: VSL holds a significant market share in India’s solar PV module manufacturing industry, consistently ranking among the top players. In 2021, they held around 12% of the domestic market share.

Key Details about company:

Headquarters: Kolkata, West Bengal, India

Chairman and Managing Director: Gyanesh Chaudhary

CEO: Ivan Saha

Employees: Over 1,500

Website: https://www.vikramsolar.com/

Prominent Brands and Partnerships:

VSL markets its solar modules under the “Vikram” brand, recognized for their quality and performance.

They have partnered with several leading companies for project development, technology collaboration, and distribution. Notable partners include:

Tata Power

Adani Green Energy

Schneider Electric

Sungrow

Milestones and Achievements:

Commissioned over 1 GW of solar power projects across India.

Received numerous awards and recognition for their contributions to the solar industry.

Listed on the Bombay Stock Exchange (BSE) and National Stock Exchange (NSE) of India.

Competitive Advantages and Unique Selling Proposition:

Vertical integration: VSL’s control over the entire solar value chain, from manufacturing to EPC and O&M, gives them a competitive edge in terms of cost, efficiency, and project execution.

Focus on innovation: VSL invests heavily in research and development, continuously improving their PV module technology and offering advanced solutions like smart modules and bifacial panels.

Strong brand reputation: VSL is recognized as a reliable and trustworthy brand in the Indian solar market, attracting both domestic and international clients.

Vikram Solar IPO Financial Analysis:

Recent Financial Performance:

Revenue growth: While the company’s recent financials haven’t been publicly released due to the ongoing IPO process, historical data shows some promising trends. Vikram Solar experienced modest revenue growth of 4% in FY2021 to Rs. 1,577 crore compared to FY2020. However, projections estimate a significant surge in revenue for FY2023 onwards, driven by factors like:

Increased demand for solar energy in India.

Expansion of manufacturing capacity to 3.5 GW.

Entry into new segments like solar farms and energy storage.

Profitability: Profitability has also shown positive signs. Net profit jumped from Rs. 6.04 crore in FY20 to Rs. 37.14 crore in FY21, and further growth is expected with increasing volumes and cost optimization.

Future Growth Prospects and Earnings Drivers:

Vikram Solar is well-positioned for future growth, supported by several factors:

Booming Indian solar market: India aims to achieve 500 GW of renewable energy capacity by 2030, with solar playing a central role. This presents a vast opportunity for Vikram Solar as one of the leading players.

Government initiatives: The Indian government’s push for clean energy through subsidies and policy support creates a favorable environment for solar companies.

Diversification plans: VSL’s expansion into EPC, O&M, and new segments like solar farms and energy storage will diversify their revenue streams and reduce dependence on the module manufacturing market.

Focus on technology and innovation: Continuous investment in R&D and adoption of advanced technologies like bifacial modules will keep them competitive and enable higher margins.

Vikram Solar IPO: Objectives and Alignment with Growth Strategy

Vikram Solar’s decision to go public aims to achieve several objectives:

1. Fund Expansion Plans: The primary objective is to raise capital, with around Rs. 1,500 crore planned through a fresh issue. This capital will be used to fund Vikram Solar’s ambitious expansion plans, including:

Setting up a new 2 GW integrated solar cell and module manufacturing facility in Tamil Nadu. This will significantly increase their production capacity and cater to the growing demand for solar modules in India.

Strengthening their EPC and O&M services: Investing in personnel and resources for these business segments will allow them to capture a larger market share and offer comprehensive solutions to clients.

Exploring new opportunities: The raised funds could be used to explore venturing into other areas like solar farms and energy storage solutions, diversifying their business and creating future revenue streams.

2. Enhance Brand Visibility and Credibility:

Listing on the stock exchange brings increased public awareness and recognition for Vikram Solar. This can attract new investors, partners, and talent, further boosting their credibility and market reputation.

3. Improve Liquidity and Corporate Governance:

Publicly traded shares bring enhanced liquidity for shareholders, potentially unlocking value for existing investors and facilitating future fundraising endeavors. The IPO process also necessitates strong corporate governance practices, fostering investor confidence and transparency.

Alignment with Growth Strategy:

Objective of Vikram Solar IPO align well with their stated future growth strategy of:

Expanding manufacturing capacity: The new facility will address the increasing demand for solar modules in India and position them to capitalize on the market growth.

Diversifying business: Entering EPC, O&M, and potentially new segments like solar farms will reduce dependence on module manufacturing and create multiple revenue streams.

Strengthening market position: Increased brand visibility, partnerships, and talent acquisition will solidify their position as a leading player in the Indian solar market.

Therefore, the IPO objectives seem to be a strategic move to fuel Vikram Solar’s ambitious growth plans and secure their long-term success in the rapidly growing Indian solar energy sector.

Vikram Solar IPO: Lead Managers and Registrar

Lead Managers:

The lead managers for the Vikram Solar IPO are:

Kotak Mahindra Capital Company Ltd.

JM Financial Ltd.

Track Record:

Both Kotak Mahindra Capital and JM Financial have extensive experience in managing IPOs in India, particularly in the renewable energy sector. Here’s a brief overview of their track record:

Kotak Mahindra Capital: Managed over 80 successful IPOs, including recent offerings in the renewable energy sector like Adani Green Energy, Greenko, and ReNew Power.

JM Financial: Successfully handled over 50 IPOs, with notable experience in clean energy companies like Adani Green Energy, Azure Power, and SolarEdge Technologies.

Their proven track record in the renewable energy sector and expertise in managing complex IPOs demonstrate their capabilities in handling the Vikram Solar IPO effectively.

Registrar:

The registrar for the Vikram Solar IPO is Link Intime India Private Limited.

Role of the Registrar:

The registrar plays a crucial role in the IPO process, handling various responsibilities, including:

Maintaining a record of all shareholders and their holdings.

Processing share applications and allotments.

Issuing share certificates.

Facilitating share transfers and other shareholder events.

Ensuring compliance with regulatory requirements.

Link Intime is a renowned and experienced registrar in India, having served in numerous IPOs across various sectors. Their involvement ensures a smooth and efficient registration and dematerialization process for Vikram Solar IPO.

By choosing experienced lead managers and a reliable registrar, Vikram Solar has taken steps to ensure a successful and transparent IPO process for its investors.

Vikram Solar IPO: Potential Risks and Concerns

While Vikram Solar IPO presents exciting opportunities, investors should also carefully consider the associated risks and uncertainties before making any investment decisions. Here’s a breakdown of potential red flags and areas for thorough research:

Industry Headwinds:

The Indian solar energy sector, though promising, faces challenges like:

Government policy changes or delays in project approvals.

Dependence on imported raw materials, making them vulnerable to global price fluctuations and supply chain disruptions.

Intense competition from established players and new entrants.

Company-Specific Challenges:

Vikram Solar’s financial performance, while improving, hasn’t been stellar in recent years. Investors should closely examine the company’s financial statements, particularly:

Profitability and earnings growth trends.

Debt levels and debt-to-equity ratio.

Cash flow management and dependence on government subsidies.

The dependence on the success of their new manufacturing facility and expansion plans adds another layer of risk.

Any potential lawsuits or environmental compliance issues could also negatively impact the company’s reputation and financial health.

Also Read: How to Apply for an IPO?

0 notes

Text

Beware Of Fake Heli Service Scam For Chardham Yatra: Uttarakhand STF Exposes 35 Fake Websites

DEHRADUN: The Special Task Force (STF) of Uttarakhand Police has successfully dismantled a gang involved in deceiving individuals across India under the guise of heli services for the Chardham Yatra pilgrimage. Two members of the gang have been apprehended in Sheikhpura district of Bihar, and as a result, 35 fraudulent websites have been taken offline.

Complaints regarding this fraudulent scheme were reported to the STF by victims residing in Uttarakhand, Rajasthan, Telangana, Tamil Nadu, Uttar Pradesh, and other states. According to the victims, they were contacted by individuals who posed as employees of heli service companies. These impostors convinced the victims to make ticket bookings through counterfeit websites. Upon payment, the funds were then transferred to the gang's bank accounts.

Also Read: Kashmiri Brother-in-Law could not show Kamal, and pressure on Nagpur police failed

Through their investigation, the STF discovered that the gang had meticulously crafted deceptive websites designed to resemble those of legitimate heli service providers. Additionally, they employed fake SIM cards and bank accounts to hinder any attempts by victims to trace their identities.

The two individuals who have been arrested, namely Manoj Kumar and Suresh Kumar, have been charged with multiple offenses including cheating, impersonation, and forgery. The STF is actively pursuing the remaining members of the gang.

To prevent further instances of fraud, the STF has issued a warning advising people to exercise caution when booking heli services for the Chardham Yatra. It is recommended to exclusively utilize the official websites of reputable heli service companies for ticket reservations. Additionally, cash payments and gift cards should be avoided.

In a significant move, the STF has successfully neutralized 35 fraudulent websites that were employed by the gang to perpetrate their deceitful activities. These websites have been shut down, and their domain names have been seized.

The STF has made a public appeal, encouraging individuals to report any suspicious activities related to heli service fraud. This can be done by contacting the STF's helpline number 1090.

The actions taken by the STF against this heli service fraud gang mark a significant achievement. It not only safeguards potential victims from falling prey to deception but also sends a strong message to other cybercriminals.

Furthermore, the STF emphasizes the importance of vigilance while navigating the online realm. It is advised to only share personal information with trusted websites and individuals. Staying informed about the latest cyber fraud schemes is crucial in order to protect oneself from potential threats.

LIST OF FAKE WEBSITES:

1- https://www.helicopterticketbooking.in/

2- https://radheheliservices.online

3- https://kedarnathticketbooking.co.in/

4- https://heliyatrairtc.co.in/

5- https://kedarnathtravel.in/

6- https://instanthelibooking.in

7- https://kedarnathticketbooking.in/

8- https://kedarnathheliticketbooking.in/

9- https://helicopterticketbooking.co.in/

10- https://indiavisittravels.in/

11- https://tourpackage.info

12- https://heliticketbooking.online

13- http://vaisnoheliservice.com/

14- https://helichardham.in/

15- https://irtcyatraheli.in/

16- http://katraheliservice.com/

17- https://helipadticket.in

18- https://www.aonehelicopters.site/

19- https://vaishanotravel.com/

20- http://vaishnotourist.com/

21- https://kedarnathhelijounery.in/

22- https://wavetravels.in/

23- https://takeuptrip.com

24- https://www.onlinehelicopterticketbooking.online

25- https://kedarnath-dham.heliindia.in/

26- https://www.chardhamhelicoptertours.in

27- https://maavaishnodevitourstravel.in

28- https://kedarnathheliticket.in/

29- https://chardhamtravelticket.in/

30- https://onlinehelicopterticketbooking.com/

31- https://flytopeak.com

32- https://flighter.online

33- https://katrahillsservice.live/

34- http://kedarnathhelipadticket.in/

35- https://tourchardham.in/

Also Read: Cybercrime in Nagpur - Cyber Blackmailer Couple Arrested in Pune for Extorting Money

Key Highlights:

The Special Task Force (STF) of Uttarakhand Police has achieved a significant breakthrough by dismantling a gang that was involved in defrauding people through fake heli services for the Chardham Yatra pilgrimage. Two members of the gang have been arrested in Sheikhpura district of Bihar, and as a result, the STF has successfully blocked 35 fraudulent websites.

The STF received complaints from victims residing in multiple states, including Uttarakhand, Rajasthan, Telangana, Tamil Nadu, and Uttar Pradesh. According to the victims, individuals posing as employees of heli service companies contacted them and convinced them to book tickets through fake websites. Once the victims made the payment, the money was transferred to the bank accounts of the gang members.

The investigation carried out by the STF revealed that the gang had employed an elaborate scheme, which included creating websites that appeared to be authentic heli service company websites. They also utilized fake SIM cards and bank accounts to make it difficult for the victims to track their activities.

The two individuals who have been arrested, Manoj Kumar and Suresh Kumar, are facing charges of cheating, impersonation, and forgery. The STF is actively searching for other members of the gang to ensure they face justice for their crimes.

To prevent further instances of fraud, the STF has issued a warning to the public, urging them to exercise caution when booking heli services for the Chardham Yatra. They have advised people to only use the official websites of legitimate heli service companies for ticket reservations and to avoid making payments in cash or through gift cards.

In a significant accomplishment, the STF has successfully seized and blocked 35 fraudulent websites that were being used by the gang for their fraudulent activities. These websites have been taken offline, and their domain names have been confiscated.

The STF has encouraged the public to report any suspicious activity related to heli service fraud by contacting their helpline number 1090. This proactive approach aims to engage the public in the fight against cybercrime and helps in preventing further victimization.

The successful operation carried out by the STF not only protects individuals from being deceived but also sends a strong message to cybercriminals that law enforcement agencies are actively working to combat such crimes.

Furthermore, the public has been advised to remain vigilant while engaging in online activities. It is crucial to share personal information only with trusted sources and to stay updated about the latest cyber fraud schemes. By adopting these precautions, individuals can safeguard themselves from potential threats and reduce the risk of falling victim to online fraud.

The STF remains committed to combating cybercrime and has vowed to continue taking necessary action against online fraudsters. Through ongoing efforts and collaboration, they aim to create a safer digital environment for everyone.

Source: https://www.the420.in/beware-of-fake-heli-service-scam-for-chardham-yatra-uttarakhand-stf-exposes-35-fake-websites/

0 notes

Text

Find Your Perfect Agriculture institutes in India: Top 10 Picks

Selecting the right agriculture institutes is a crucial decision for aspiring students seeking to pursue a career in the agricultural sector. With numerous institutions across India offering agricultural education, it is important to consider various factors before making a choice. In this article, we will explore the Top 10 Agriculture Institutes in India, including the esteemed Royal Institute of Competition Udaipur. Additionally, we will outline the key points to consider when choosing the best agriculture institutes.

Top 10 Agriculture Institutes in India:

Indian Agricultural Research Institute (IARI), New Delhi

Punjab Agricultural University (PAU), Ludhiana

Tamil Nadu Agricultural University (TNAU), Coimbatore

G. B. Pant University of Agriculture and Technology, Pantnagar

University of Agricultural Sciences (UAS), Bangalore

Acharya N. G. Ranga Agricultural University (ANGRAU), Hyderabad

Banaras Hindu University (BHU), Varanasi

Chaudhary Charan Singh Haryana Agricultural University (CCSHAU), Hisar

University of Agricultural and Horticultural Sciences (UAHS), Shimoga

Royal Institute of Competition Udaipur

How to Choose the Best Agriculture institutes:

Accreditation and Recognition: Ensure that the agriculture institute is accredited by relevant authorities and holds a reputable position in the agricultural education landscape. Look for recognition from government bodies and industry associations.

Academic Programs: Consider the range of academic programs offered by the institution. Look for an institute that provides comprehensive undergraduate, postgraduate, and doctoral programs in various agriculture disciplines to cater to your specific interests and career goals.

Faculty Expertise and Research: Evaluate the faculty members' qualifications, expertise, and research contributions in the field of agriculture. Look for professors who are actively engaged in research, publications, and industry collaborations, as they bring valuable insights to the classroom.

Infrastructure and Facilities: Examine the infrastructure and facilities available at the institution, including well-equipped laboratories, research centers, experimental farms, and libraries. Adequate resources are essential for practical training, hands-on learning, and conducting research projects.

Industry Collaborations and Internship Opportunities: Consider the institutes' collaborations with industry partners, research organizations, and agricultural institutions. Strong ties with the industry ensure exposure to real-world applications, internship opportunities, and potential job placements upon graduation.

Alumni Network and Placement Support: Research the alumni network of the agriculture institutes and evaluate the success stories of graduates. Look for institutes that provide robust placement support, career counseling, and industry connections to facilitate job placements and internships.

Research and Innovation Initiatives: Explore the institution's focus on research and innovation in agriculture. Look for institutions that promote research projects, provide funding opportunities, and foster a culture of innovation to stay at the forefront of agricultural advancements.

Practical Training and Field Exposure: Consider the emphasis placed on practical training, field visits, and experiential learning. A good agriculture institute should offer opportunities to engage with farmers, visit agricultural enterprises, and gain hands-on experience in different aspects of farming and agribusiness.

Scholarships and Financial Aid: Assess the availability of scholarships, grants, and financial aid options offered by the institution. Scholarships can ease the financial burden and make quality education more accessible.

Alumni and Student Feedback: Seek feedback from current students and alumni of the agriculture institutes you are considering. Their experiences and insights can provide valuable information about the quality of education, faculty support, and overall student satisfaction.

Ready to join the ranks of successful agricultural professionals? Explore the top 10 agriculture institutes in India and choose the institution that aligns with your goals. Start your journey towards a thriving career today!

0 notes

Text

Scholarships for Tamil Nadu students

Tamil Nadu, one of the most literate states in the nation, maintains a Gross Enrolment Ratio of approximately 100% for both primary and upper-primary education. The Government of Tamil Nadu and its subordinate organizations also administer several Tamil Nadu scholarship programs for students from all socioeconomic levels to improve the state's current educational landscape. Because of concerns with poverty and dropout rates, many different sorts of students have stopped their studies without finishing a higher degree of education. The Tamil Nadu Scholarship Plan has been introduced by the government to address high dropout rates. The beneficiary who applies for the appropriate scholarship will be given access to a variety of scholarship services. To provide some financial assistance to students continuing their studies from reputable universities as well as institutions that understand and comply with their economic issues, the state government of Tamilnadu launched and inaugurated Tamil Nadu scholarships.

TN scholarships are offered to deserving individuals by numerous commercial organizations and subsidiary ministries of the Tamil Nadu government.

Below are a few of the well-known scholarships:

· Scholarships for Sons and Daughters of People with Disabilities, Tamil Nadu

· Tamil Nadu Scholarship for Students with Disabilities, 9th Grade and Above

· Tamil Nadu Scholarship for Pupils with Disabilities for the Buying of Books and Notebooks

· Tamil Nadu R. I. M. C. Dehradun Scholarship

· Scholarship for Dead Public Servants, Tamil Nadu

· Tamil Nadu's Directorate of Collegiate Education offers Ph.D. scholarships.

· Tamil Nadu's Directorate of Collegiate Education offers the EVR Nagammai Scholarship.

· Free Education Programs for Students in BC, MBC, and DNC, Sri Lanka - The Government of Tamil Nadu's Department of Backward Classes and Most Backward Classes and Minority Welfare

· Tamil Nadu's Department of Backward Classes and Most Backward Classes and Minority Affairs has a program to reward rural MBC/DNC girl students. Department of Backward Classes and Most Backward Classes and Minority Affairs, Government of Tamil Nadu recipient of the Thanthai Periyar Memorial Award

· National Talent Search Examination NTSE: National Council of Educational Research and Training Vidyadhan Scholarship Program: Sarojini Damodaran Foundation (NCERT)

Tamil Nadu Scholarship Advantages:

· An application list for 13 scholarships will be made available to students who wish to pursue school- and college-based education through the Tamilnadu Scholarship.

• The recipients of this award will include students from PWD, MBC, BC, and DNC.

Amounts ranging from Rs. 1250 to Rs. 2,000 will be awarded to students who pass the NTSE exam up till the conclusion of their Ph.D.

•The students will receive a sum of Rs. 10,000/- so they can complete polytechnic, diploma, or professional courses.

· The Vidyadhan Scholarship would pay a scholarship of Rs. 6,000 to students enrolled in 11th and 12th grade.

•The students in the state of Tamilnadu will also receive this grant.

•The scholarship funds will be available to the students on a regular basis.

· The PWD students would receive financial support in the amount of Rs. 7,000/- for attending school from 9th to 12th grade.

Some important information about the Tamil Nadu scholarships is covered in this blog. To learn more, get in touch with Scholad.

0 notes

Text

Educational loan disbursement falling since FY20

Total amount of educational loans disbursed by scheduled commercial banks in India has been steadily falling since the peak in FY20. While in 2019-20, a total of ₹18,553.46 crore was disbursed, in 2020-21 as well as in 2021-22 it came down to ₹18,350.83 crore and ₹17,715.33 crore, respectively, according to RBI (Reserve Bank of India) data released recently.

"Students get education loans to pursue higher studies in UG (Under Graduate) and PG (Post Graduate) courses, in India or abroad. The Indian Banks’ Association (IBA) model educational loan scheme for pursuing higher education in India and abroad was formulated in 2001," said a State Bank of India (SBI) branch manager based in Chennai.

Since then, the scheme has been modified from time to time, based on the experience gained and feedback received during its implementation over the years.

"As per the scheme guidelines of 2015, there were ceilings on the educational loan amount i.e. a maximum of up to ₹10 lakh for studies in India and a maximum of up to ₹20 lakh for studies abroad. As per the last revision undertaken in 2021, banks now have the freedom to provide need-based finance. Banks are broadly guided by the above scheme while sanctioning educational loans," said the bank official.Meanwhile, students from just six states namely Maharashtra, Tamil Nadu, Kerala, Telangana, Gujarat and Karnataka account for 57% of the education loans disbursed by various scheduled commercial banks in the year 2021-22, as per the data released by the Reserve Bank of India recently. It is worth mentioning that these six states have been cornering more than half of the total education loans disbursed in the last few years.Students from Maharashtra have taken ₹2,272.86 crore as education loans and this is the maximum among these six states. Maharashtra is followed by Kerala (₹2015.41crore) and Tamil Nadu (₹1,634.43 crore).The Government of India sets an educational loan disbursement target for public sector banks (PSBs) every financial year. Banks have the freedom to provide need-based finance, as per the latest revision of IBA Model Educational Loan scheme undertaken in 2021, he said.The department of higher education in the Ministry of Education is handling the Credit Guarantee Fund Scheme for Education Loans (CGFSEL). As per this scheme, the credit guarantee is provided for education loans covered under the Indian Banks’ Association (IBA) model education scheme up to ₹7.5 lakh without any collateral security and third-party guarantee.Further, the government has also launched an online portal called Vidya Lakshmi Portal (VLP) to ensure hassle free education loans through a single window system. Students can apply, view, and track the education loan applications submitted to banks anytime, anywhere by accessing the portal. Further, the decision on a loan application is to be reported by the banks on VLP.When it comes to financing higher education there is always a dilemma of either using parents’ savings or taking out an education loan. While using personal savings keeps you away from the worry of paying it back, it comes along with the burden of emptying out the retirement savings of the parents.In such a situation, it is better to take an education loan as these are low-cost loans. Banks charge around 7-12% interest along with the unlimited tax benefit on interest deduction. Moreover, instead of using personal funds for educational expenses, the optimal way is to apply for low-cost loans from a lender and invest funds where they can get better returns.M Narayanasamy* , a Computer Science Student, has got admission in a university in the United States. He needs ₹40 lakhs to take care of fees for two years of MS in the US university as well as his own expenses for stay, food and travel.'I have applied for an education loan seeking ₹40 lakh in a private bank which has a separate wing for disbursing education loans. We were told that if we provide collateral for the loan the interest rate will be less compared to loan taken without any collateral," said Narayanasamy.The University wanted students to show sources for paying fees either from family savings or a sanction letter from the bank which has agreed to provide the needed funds.”The Universities abroad want to attach letters from at most three bank accounts in which the father or mother have accounts to show that they have enough funds. Otherwise, we must get a sanction letter from the bank which provides the loan,” said Narayanasamy."Students are generally discouraged from using personal funds, contingency funds, or retirement funds of their parents.These funds can be used better if invested in schemes with higher returns. However, students often rely on personal funds to finance a part of their education costs to reduce their dependence on education loans," said Madras School of Economics director K R Shanmugam."For example, if I have ₹30 lakh, and based on my past investment experience, I can get a 12% return, it makes more sense to invest ₹30 lakh, and borrow ₹30 lakh from a lender at an effective interest rate of 6.3%. On the other hand, if not thought through properly, not taking an education loan can become an enduring burden," said Shanmugam.At present, following several changes in the bank rates by the RBI, the interest rate for education loans with collateral is around 10.25% to 10.75% and for loans taken without collateral the interest rates vary from 11.25% to 12.25%. "Once the bank is satisfied with the documents presented by us, we are asked to pay 1% of the total loan amount as processing fee and only after this, the bank issues the sanction letter," said Narayanasamy.The loan is disbursed to students and interest is deducted from the parents’ income till the student completes his education. Later the loan is repaid by the student through EMIs.

0 notes

Text

Five Star Business Finance IPO subscription status

New Post has been published on https://petnews2day.com/pet-industry-news/pet-financial-news/five-star-business-finance-ipo-subscription-status/

Five Star Business Finance IPO subscription status

The non-banking financial corporation has been subscribed 0.02 times on the first day of the IPO subscription process.

The Chennai-based lender plans to raise ₹1,960 crore through a complete offer for sale by the company’s promoters and existing shareholders.

The price band of the IPO is set at ₹450-474 a share.

Shares of the company are commanding a premium of ₹10 in the grey market.

The initial public offering of non-banking financial corporation Five Star Business Finance has been subscribed by just 0.02 times on the first of the IPO subscription process.

At the same time, 30% of Archean Chemical Industries, was subscribed on November 9, its first day. This IPO opened on the same day as that of Five Star Business Finance.

Five Star Business Finance’s IPO received poor demand from retail investors too as this portion was subscribed by 0.03 times.

The Chennai-based lender plans to raise ₹1,960 crore through a complete offer for sale by the company’s promoters and existing shareholders.

The company, which provides secured loans to micro-entrepreneurs and self-employed individuals, will not receive any funds raised from the IPO as all the shares are being sold by promoters.

Category of investors Subscription status Qualified institutional buyers 0.03 times Non institutional investors 0.01 times Retail 0.03 times Overall 0.02 times

The company has a strong presence in South India with assets under management (AUM) of ₹5,100 crore as of March 31, 2022 compared to ₹4,400 crore a year ago. It has a network of 311 branches in 150 districts, 8 states and 1 union territory and a workforce of 6,077 employees.

Tamil Nadu, Karnataka, Andhra Pradesh and Telangana account for 85% of its overall portfolio. The company plans to deepen its presence in existing geographies through increasing the number of field officers and setting up new branches.

The NBFC’s total income grew 19.5% from a year earlier to ₹1,254 crore in FY22, while its net profit grew 26.5% to ₹453 crore.

While the pandemic seems to have ended, it impacted the NBFC by reducing disbursements from ₹2,408 crore in FY20 to ₹1,245 crore in FY21.

“The effects of the Covid-19 pandemic on our future results of operations, cash flows and financial condition could adversely impact our ability to service our debt obligations and comply with the covenants in our credit facilities and other financing agreements and could result in events of default and the acceleration of indebtedness, which could adversely affect our results of operations and financial condition and our ability to make additional borrowings,” said the company in its draft red herring prospectus.

The grey market premium (GMP) of the company’s shares are at just ₹10 per share. GMP is the premium at which IPO shares are traded in an unofficial market before they are listed on the stock exchanges. The IPO opened on November 9, and will close on November 11.

SEE ALSO: Pet-care startup Supertails.com raises $10 million in Series A funding

Archean Chemical Industries IPO subscribed 30% on day 1

0 notes

Text

Mission Bollywood

It was in early 1913 that an Indian film first received a public screening. Since then, films have extensively influenced daily life and culture in India. Some films provide an escape to people from their mundane daily lives while others replicate reality to act as a window to hundreds of untold stories.

As one of the largest and oldest cinema hubs in the world, the Indian film industry is renowned for its glitz, vibrancy, and drama. The city of Mumbai is especially relevant in this context as the birthplace and namesake of “Bollywood” in India. And while Hindi language cinema dominates the multi-billion-rupee industry in terms of net worth, there are many other film industries across the country differentiated by regional languages including Telugu, Tamil, Marathi and Bengali to name a few.

Film cities have been an integral part of this culture. The Mumbai film city, for one, forms the backbone of the film industry. It has given the required infrastructural and technological impetus to films and proved to be a catalyst in getting Bollywood where it is today.

In December, 2020, Yogi Adityanath formally announced his plan to build a film city in Uttar Pradesh. Deemed as the ‘dream project’ of the Chief Minister, the film city is planned to be one of the most prestigious projects of the Yogi Adityanath government with an aim to develop Uttar Pradesh as an alternative to Bollywood based in Mumbai, Maharashtra.This is the third time that the idea of a film city in Uttar Pradesh has been proposed, with the previous two plans unable to take flight due to reasons best known by the government.

The recent proposal too, does not seem to be a case of third time lucky. The decision has not been well received by Uddhav Thackeray, the Chief Minister of Maharashtra, who sparked concerns over the Uttar Pradesh film city being a ploy to take away employment from Maharashtra. As such, the project carries the risk of giving Shiv Sena an agenda for the 2024 Maharashtra Elections and could hamper BJP’s prospects substantially. Akhilesh Yadav, the President of the Samajwadi Party also did not shy away from criticising the project.

In recent years, the state has been at the centre of all sorts of troubles, with Uttar Pradesh and development not being particularly synonymous. Ergo, the public was quick to take their disagreement to social media, where the general consensus was that the funds could be better utilized towards solving other grave issues that exist in the state.

Further, the state government has a history of being regressive towards creative freedom in films and media. Several mediums of art have had to undergo questionable censorship, to tailor themselves to the liking of the government. This raises valid concerns over how embracing the government would be towards films, other than the economic benefits that they would bring in.

In short, the proposal, still in its nascent stages, is not as straightforward as it might seem initially. With valid concerns raised by both the public and political oppositions alike, all eyes are on Yogi Adityanath and his government, as to how and when the ambitious project is brought to fruition.

Task at hand:

The Uttar Pradesh government has decided to outsource the complete onus of the film city to private players. You are a consultancy firm pitching a tender to the government, and are required to prepare a comprehensive report on the project, which is to be India’s largest and best-equipped film city. Further, you are also required to come up with strategies to overturn the pessimistic public sentiment and make sure that the project does not become counter-productive for the Bharatiya Janata Party.

Deliverables Required but not restricted to:

1. Executive Summary

2. Project Proposal

3. Formulate strategies to create a public image of the location that will attract settlers and laborers.

4. Strategies aimed towards the opposers of the project

5. Blueprint of the Film City

6. Facilities of the Film City

7. Differentiation Strategies and USP as to how will it be different from the Mumbai based film city

8. Operational Plan (Phase-wise implementation)

9. Marketing Strategies (conventional and unconventional)

10. HR allocation

11. Recruitment strategies

12. Training and Development strategies for the staff

13. Sources of Funds and strategies to incentivize investors

14. Projected Cost Structure

15. Revenue Model and Return on Investment

16. Profit & Loss Statement for the first three years

P.S. Your strategies should be in line with the ideologies of the government.

Submission Details:

A PPT of not more than 12 slides

A Report covering all the deliverables

Email: [email protected]

Subject & File Name: Team Name_Task Name

Deadline - 7:30pm, 17th August 2021

For any queries, contact:

Nipun: +91 9712956875

9 notes

·

View notes

Text

Grow Your Savings Through Smart Tax Planning

Every year, as it nears December, most people put their minds on saving the “dreaded” income tax. As a law-abiding citizen, one must file an income tax return annually to determine the tax obligations. As many as 8.45 crore taxpayers have been registered as of March 2019. In fact, among all states, Maharashtra tops with the highest number of tax filers, followed by Gujarat, Uttar Pradesh, Tamil Nadu and West Bengal.

In most developed countries including US and other richer nations, the tax component of individuals are far higher. They also do not have as many advantages of tax deduction schemes as we have in India. Most countries, including India, employ a progressive tax system, in which higher-income earners pay a higher tax rate, in comparison to their low-income counterparts.

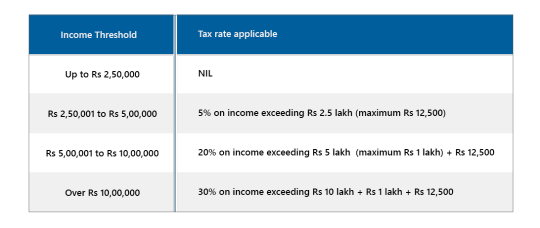

Here’s a look at the Income Tax slabs for the Assessment Year 2019-20:

Tax Deductions Allowed in India

i) Deductions on Investment

The government allows for certain deductions to save tax, at the end of every financial year. It is essential to keep yourself informed of all the deductions, rebates and concessions to pay the least amount of tax on your total income. Ideally, it is advised to start tax planning at the start of every financial year to gain maximum benefit.

In India, you can claim a tax deduction up to Rs 1.5 lakh of your total income under section 80C. These are the investments specified: Public Provident Fund, tax saving mutual funds, tax saving fixed deposit, National Savings Certificate, premium on life insurance policy, ULIP (Unit linked Plans)and Employees Provident Fund.

We also have Section 80CCC that provides a deduction for any amount paid or deposited towards receiving annuity from insurance.

Further, under Section 80AA, deduction is allowed with respect to any income that is earned by way of dividends from a domestic company (this is included in the gross total income of the assessee.

ii) Income Tax Deduction for Interest on Home Loan

The interest portion of the Equated Monthly Installments paid for the year can be claimed as a deduction from your total income up to a maximum of Rs 2 lakhs under Section 24. From Assessment Year 2018-19 onwards, the maximum deduction for interest paid on Self Occupied house property is Rs 2 lakhs.

iii) Tax deduction on Medical Insurance

In India, as an individual or Hindu Undivided Family, you can claim a deduction of Rs 25,000 under Section 80D for yourself, spouse and dependent children. There’s also an additional deduction for insurance of parents, up to Rs 25,000, if they are below 60 years of age. If they are above 60, the deduction amount is Rs 50,000.

For instance, a health insurance policy from HDFC Life can provide a range of tax benefits. The premium paid for a Health Insurance policy can be deducted from the total income under Section 80D of the Income Tax Act. The tax deduction under Section 80D is also allowed for making a payment to purchase or renew a Health Insurance policy on self, spouse, dependent parents or dependent children.

These are ways and means to maximize our tax benefits. But any such analysis would be incomplete without taking a look at Unit Linked Insurance Plans in India, one of our strongest options to save tax.

Unit-Linked Insurance Plans are fast becoming one of the most favoured instruments to save taxes. They have a minimum lock-in period of five years and make for an ideal investment avenue. ULIPs in India are affordable, offer diversified return options, and also multiple switches between available fund options. According to your risk appetite, choose a plan you think works best for you that will in turn offer you stable returns over a period. Besides the benefits of financial returns, one of the most attractive features of ULIPs is the tax benefits they offer, much to the advantage of the policy subscriber. HDFC Life Click 2 Wealth offers this and much more!

Paying your taxes sincerely and on time is your patriotic duty. Utilise these tax benefit schemes to save your money. Pay more attention to the act of tax planning. For any assistance, there’s always HDFC Life you can count on.

This content was produced in partnership with HDFC Life

264 notes

·

View notes

Text

Cybercrime Complaints Gather Dust: Less Than 1% Result in FIRs, Reveals RTI

A recent report obtained through the Right to Information (RTI) Act has shed light on the alarming reality of cybercrime complaints in Maharashtra, where a mere 0.8% of the 195,409 complaints filed from January 2022 to May 2023 resulted in First Information Reports (FIRs). The data becomes even more concerning when we consider that only 2% of the total 2,099,618 complaints received from all states and Union Territories during this period were converted into FIRs.

Retired police officers from Maharashtra have raised concerns about the inadequate number of inspectors in the cybercrime department to register cases. Under the Information Technology (IT) Act, only police officers with the rank of inspector or above can investigate cybercrime cases. The shortage of qualified personnel not only hampers effective investigations but also erodes public trust in law enforcement, according to experts.

Also Read: Kashmiri Brother-in-Law could not show Kamal, and pressure on Nagpur police failed

The RTI information was brought to light by activist Jeetendra Ghadge, who emphasized the limited effectiveness of the National Cybercrime Reporting Portal. Ghadge stated that while the portal provides an easy way for citizens across the country to register complaints, the lack of FIR registrations by states limits its impact.

Nationally, the data reveals that Delhi received a staggering 216,739 complaints on the National Cyber Crime Reporting Portal during the same period, with only 1.2% resulting in FIRs. However, Telangana stands out as an exception with the highest FIR registration rate at 17%, followed by Meghalaya with 8%. Assam and Tamil Nadu recorded rates of 2.7% and 2.2% respectively.

Experts have acknowledged the Union government's efforts in combating cybercrime through the introduction of the National Cyber Crime Reporting Portal. This initiative aims to empower victims and complainants by providing a convenient platform to report various cybercrime offenses, including online child pornography, online financial fraud, hacking, and more.

Jeetendra Ghadge emphasized the need for collaboration between the central and state governments to address the growing menace of cybercrime. He specifically called for attention to combat financial frauds, which cause vulnerable individuals to lose their hard-earned money.

To improve cybercrime reporting in India, experts from the Future Crime Research Foundation (FCRF) have recommended investing in specialized cybercrime units with well-trained personnel, including experts in digital forensics and investigation techniques. They also stressed the importance of ensuring adequate resources, technology, and infrastructure to support their operations.

The FCRF researchers further emphasized the need for stronger collaboration between central and state governments, law enforcement agencies, and private organizations to share information, expertise, and resources for effective cybercrime prevention and response. They also suggested that the government establish partnerships with technology companies, financial institutions, and cybersecurity experts to enhance reporting mechanisms, develop preventive measures, and support investigation efforts.

Prashant Mali, a cyber lawyer, criticized the state government for its inaction, which allows cybercriminals to operate freely and target individuals in Mumbai. He highlighted the need for freezing stolen funds and emphasized that the low rate of filed FIRs undermines public trust in law enforcement.

Also Read: Cybercrime in Nagpur - Cyber Blackmailer Couple Arrested in Pune for Extorting Money

Ritesh Bhatia, a cyber expert, echoed these concerns and noted that challenges such as insufficient support from intermediaries, jurisdictional issues, and the use of false identities by cybercriminals hinder the police force's efforts to solve these cases.

Ghadge emphasized that while the National Cyber Crime Reporting Portal serves as a vital channel for reporting cybercrime, its primary role is that of an intermediary. It forwards complaints to the respective states and Union territories for necessary police action since the jurisdiction of the police machinery falls under the purview of state governments.

The findings from the report highlight the urgent need for increased resources, specialized training, and collaboration between the central and state governments to effectively tackle cybercrime and restore public trust in law enforcement.

Key Highlights:

A recent report obtained through the Right to Information (RTI) Act reveals that only 0.8% of the 195,409 cybercrime complaints filed in Maharashtra resulted in First Information Reports (FIRs).

Nationally, the conversion rate of complaints into FIRs on the National Cyber Crime Reporting Portal was a mere 2% out of a total of 2,099,618 complaints received.

Retired police officers from Maharashtra express concerns over the shortage of qualified inspectors with expertise in cybercrime investigations, which undermines the registration of cases and erodes public trust in law enforcement.

Delhi had a low conversion rate of 1.2%, while Telangana stood out with a significantly higher rate of 17%, followed by Meghalaya with 8%.

The National Cyber Crime Reporting Portal serves as an online platform aimed at empowering victims and complainants to report various cybercrime offenses.

It is important to note that the National Cyber Crime Reporting Portal primarily acts as an intermediary, forwarding complaints to the respective states and Union territories for further action.

Source: https://www.the420.in/cybercrime-complaints-gather-dust-less-than-1-result-in-firs-reveals-rti/

0 notes

Text

Best Cities For NRIs To Invest In Real Estate

NRIs often hear stories about investors hitting jackpot through buying and selling properties back home. Very often, they also hear about an agent who has lost money in a project that never materialized and / or in which issues crept up, rendering the property impossible selling.

Eager to bag a slice of the pie, the NRI begins researching how to invest in the Indian market as a result of abroad and which city, to begin with, only to get forfeited in contradictory sources.

It is a fact that the Indian economy will be expanding rapidly; in fact , the World Bank projects that India will surpass China as the world's fastest growing substantial economy by 2017. For those looking to become real estate buyers who wish to participate in India's growth, choosing which part of the place to buy-in can be a challenge. After all, the economy may well be making great strides at the national level, but the things forces at work at the local level? Put another technique, which city or cities can promise the greatest rewards?

We have compiled a list of the best cities for real estate investment. Some are large metros, known to be the hubs of many sectors. Others are smaller, upcoming cities which show loads of promise in their growth rates in population and in every capita income amongst other factors. Read on to identify which will city may be the best for you to invest in real estate.

1 . Bangalore

Thanks to its combination of rapidly growing population, well-paying tasks, and low real estate prices, the hub of India's IT industry has become the hub of its property funding as well. JLL recently published its annual ranking of your world's most dynamic cities, in their City Momentum List, affirming that Bangalore is the fastest-changing city on the planet.

Through some estimates, 40 percent of India's IT enterprise is based in this one metropolis. These changes have lasted the most attractive place in India for real estate investment. A recent investigation pegged Bangalore as the top real estate opportunity across Asia-Pacific.

All of this makes Bangalore the most desirable place for investor in India.

2 . Pune

Pune has displayed high-speed population growth over the past decade with a growth rate through 30% during this period. The average white collar salary in this locale is second only to Bangalore. Currently, property in this destination is affordable as compared to other cities, which shows that it is a good time to invest.

The city also benefits from being all-around Mumbai. It also holds opportunities in the education, IT, auto, and engineering sectors. This is yet another example of a earlier known as slow city that has experienced rapid recent growth along with change.

The good weather all year round is an added benefit just for NRI investors here. A new international airport and increased city connectivity will bring even more growth and positive change towards the city in coming years.

3. Chennai

Head to the site the capital of Tamil Nadu for yet more investment opportunities. Chennai is also in the leading pack, with a substantial growth rate in population (30%) and reasonably big average white collared salaries. This industrial city in addition has many companies that do IT and financial services.

The costa rica government has made road connectivity a priority here in recent years. This has helped the city and the surrounding area develop faster and even attract new business opportunities.

A coming monorail and lifted railway line are sure to further help with this connectivity.

contemplate. Visakhapatnam

As far as population and area, Visakhapatnam (Vizag) has become the biggest harbors in India. Because of this, it is considered typically the commercial hub of Andhra Pradesh.

A quickly maturing IT industry coupled with good infrastructure makes this place a desirable place for real estate investments.

With the first step of the Vizag Metro Rail slated to be completed on December 2018, transportation options will also soon open up through this city.

5. Mumbai

As a growing city with fashionable urban development, Mumbai is a good real estate investment choice for a nonresident Indian who cares about lifestyle.

Considered the personal capital of India, this city is hard to make sure you beat when you compare the level of infrastructure with other cities. Goal a premium property in an upscale neighborhood for the best return on your investment. There are certain luxury hotspots in Mumbai that place you close to high-end retail stores and restaurants.

As India's financial heart, Mumbai also attracts many investors and corporate providers, providing plenty of work opportunities. If you want an internationally competitive perform culture, this is the city.

Mumbai has great education services, including international schools. Political stability and easy resell options are added incentives to make Mumbai your expenditure of money realty location.

6. Bhiwadi

As the third-largest industrial center in India, Bhiwadi is a manufacturing hub for some big firms. Companies like Gillette and Honda ensure quite a lot of local work opportunities.

Real estate projects are also cheaper here compared with in other cities. The affordability right now makes the a great investment realty choice for the long term.

The Of india government has proposed projects in Bhiwadi including fresh high-speed public transportation. This will make this city even more alluring in the years to come.

7. Kochi

Kochi, the commercial centre of Kerala, has seen new real estate prospects owing to recent changes.

An upgrade of the sea port not to mention privatization of the local international airport brought in new business prospects.

A large number of NRIs are already investing in Kochi. In fact , only some 30% of investors in real estate in Kochi are local residences.

Part of what makes this city so appealing is the recent developments in infrastructure. New planned developments are the Vallarpadam International Container Trans-shipment Terminal, which will expand investment decision opportunities for this port city.

An "oceanarium, " or perhaps marine research facility that also doubles as a visitors attraction, is another proposed project that's sure for you to attract even more opportunities to the area.

8. Bhubaneswar and also Cuttack

These twin cities in east India will be growing education and IT hubs. This boosts real estate production in the area.

The real estate market is well-regulated here because most of the available land is still owned by the government.

Strategies for new commercial projects, a wider highway, as well as new Kalinga Nagar Industrial Complex add to the reasons to focus on Bhubaneswar and Cuttack for real estate investment.

9. Coimbatore

The actual largest city in Tamil Nadu boasts a stable market place that revolves around textiles and spinning.

Engineering, THE SOFTWARE, and manufacturing have added to the industry in Coimbatore a lot, providing economic growth and increased work opportunities.

A structured airport expansion will increase the ease with which individuals and business opportunities can flow into the city. And a consist of bus rapid transit system provides added options for travel on the ground.

Conclusion

There is a long list of cities in Indian that are great opportunities for real estate investments.

You may decide an established, major hub like Bangalore, or a newer plus growing location like Kochi. It all depends on exactly what your own future plans are for your investment.

With so many metropolitan areas undergoing rapid developments and offering new opportunities, it will be hard to go wrong if you consider the key factors to pick cities of choice for real estate investments.

Don't be intimidated by your process of investing in real estate. Instead, reap the benefits the upcoming years will have for real estate investments in India as well as ride India's economic growth wave.

1 note

·

View note

Text

Crowdfunding for Educators: Raise funds for your students

As of sept 2022, there are about 1.4 billion people living in India, including more than 12.9 million children under the age of 16. More than 50% of Indian children aged 6 to 18 do not attend school, despite the country having a national policy that mandates elementary education for all children and a policy against child labour.

Even with the literacy rate growing rapidly in the rural areas, the literacy rate is around 65%, while it is 85% in urban areas. Several schools across India lack resources and funding despite an increase in the number of children enrolling in schools.

You'll do everything in your power to ensure your students' success if you're an educator. However, it can be particularly difficult to promote student achievement when you lack the necessary skills, resources, and funding.

Crowdfunding can come in quite handy when you need new equipment and supplies but your budget is tight. Read our blog how crowdfunding can provide help to underprivilege students.

You can rely on crowdfunding, in these scenarios to raise funding and help your students' educational endeavours. In this blog, we will understand how educator crowdfunding can significantly improve the quality of life for students, staff, and entire communities.

Why should classroom expenses be crowdfunded?

When school districts are unable to provide the necessary funding, government school instructors continue to use their own money, spending to purchase classroom supplies and educational resources. Outreach programs and cutting-edge learning technologies may be utterly out of reach for many teachers when it's difficult to find basic classroom supplies. When school funds are limited, crowdfunding on Filaantro can really help cover costs. These campaigns will help the underprivileged students to have proper access to education like the rest of the students without any tampering with their future.

Basic needs that many public schools need

Aside from educational resources, some teachers struggle with necessities like clean drinking water, hygienic and functional toilets, sanitary aids for girls', school books, garbage bags and disinfectant sprays. In extreme cases, classrooms, where the students learn, are not in a proper functional condition. Filaantro has catered to many of these struggles faced by the educators.

Lady Willingdon Girls Higher Secondary School, Triplicane is located in Chennai, Tamil Nadu. It is a 109-year-old government school building that required renovation of class rooms and construction of toilets on an urgent basis. With the help of https://filaantro.org/Filaantro the renovation helped more than 50 girl children to study in a better environment and also encouraged other girls to join the School.

Hemachandra Simanta Sanskrit Vidyalaya was established in the year 1994 at a remote village- Sahapur, in Balasore district of northern Odisha. With most of the children staying back at the residential facility in the school, there was a need for four toilets for 100+ children in the residential facility. The school using its own funds has managed to construct two toilets but needs funds to construct two more. With the funds raised through Filaantro the rest of the toilet construction was completed. This provided better access and hygiene facilities to the children living in that area.

The Welfare Society for Destitute Children (known locally as St Catherine of Siena School & Orphanage), is located on Mt. Mary Road, Bandra West, Mumbai. They are a non-profit organization that has been helping destitute and underprivileged children for more than sixty years. They aim to provide a happy and safe place for the children in our care and empower them through education and rehabilitation-based projects.Their project One Village, One Teacher (OVOT) is one of the key projects to improve local education facilities in villages. You can show your support by donationating to the campaign.

Hemachandra Simanta Sanskrit Vidyalaya was established in the year 1994 in a remote village- Sahapur, in the Balasore district of northern Odisha. Most of the children stay back at the residential facility in the school, the library would be a great addition to their future. This library would create a strong learning support for the children living in the residential facility.

To achieve this goal, the construction of a model tribal library is needed. Support now.

Creating a campaign gives you the educators the freedom to think outside the box and dream beyond the bare minimum. Understand how Filaantro is contributing to building a better education environment.

How to promote your campaign

To ensure the success of your fundraising, it's necessary to strategically spread the word about it. Sharing this campaign with effective communication strategies, effective communication strategies among your friends, family, coworkers, and everyone in between about your cause will generate more funds and will cater to your cause. Go through the guide which will help your fundraising campaign a success.

Education crowdfunding is now common practice as more and more educators from NGOs, charities, schools and universities use it to raise funds and boost student learning. With crowdfunding we can ensure a better literacy rate in the following years. Start your campaign today.

Author: Lubdha Dhanopia

0 notes

Text

Great Adventure Camp On the Cat Spring Retreat

My daughter and her pals have been coming for the final 3 years! They designed their own matching t-shirts and were counting down the minutes till they received there on Monday. Out of all of the camps they may go to, this is their favourite! You will have really had an influence on my son’s life. He has grown so close to God!