#rbi grade b course

Text

Enroll now to get flat 50% off on RBI Grade B online course use coupon code FLASH50 offers only valid for today.

#rbi#rbi grade b#rbi grade b course#rbi grade b exam#online course#government exam#rbi grade b syllabus#rbi grade b notification#rbi grade b eligibility criteria#rbi grade b recruitment

0 notes

Text

2 notes

·

View notes

Text

Top Resources for Preparing for Financial Sector Exams

Preparing for financial sector exams, such as those conducted by RBI, SEBI, NABARD, and IFSCA, requires a strategic approach. These exams are highly competitive, demanding a strong foundation in financial concepts, regulatory frameworks, and analytical skills. To stand out and succeed, having access to the right resources is key.

For those aiming to appear for the IFSCA exam, enrolling in the IFSCA Grade A course is a smart move. This course provides in-depth material on financial regulations, international banking, and other areas critical to the exam. It also offers structured guidance, mock tests, and expert support to help you prepare effectively.

Here are some top resources that can enhance your preparation for financial sector exams:

1. Official Websites and Notifications

Staying updated with the official websites of regulatory bodies is essential for understanding the latest exam patterns, syllabi, and announcements. Some of the key websites include:

RBI (Reserve Bank of India): rbi.org.in

SEBI (Securities and Exchange Board of India): sebi.gov.in

IFSCA (International Financial Services Centres Authority): ifsca.gov.in

Regularly check these websites for notifications regarding exams, guidelines, and any changes in regulations.

2. Standard Textbooks and Study Guides

A strong understanding of financial theory and regulatory practices is crucial for these exams. Some recommended books include:

Indian Economy by Ramesh Singh: This book covers essential economic concepts and is helpful for understanding both micro and macroeconomics, a common subject in financial exams.

Banking Awareness by Arihant Experts: A go-to guide for banking and financial awareness, which is a major section in most regulatory exams.

Financial Markets and Institutions by Mishkin and Eakins: This book offers detailed insights into the workings of financial markets and institutions, which is relevant for both theoretical and practical questions in exams.

3. Mock Test Series and Practice Papers

Mock tests are vital for assessing your preparation and improving your time management skills. They help simulate the actual exam environment and provide practice for handling complex questions under pressure. Several platforms offer quality mock test series:

EduTap: This platform provides a wide range of mock tests tailored for regulatory exams like RBI Grade B, SEBI, and IFSCA Grade A. Their tests are updated regularly and reflect the latest exam patterns.

Oliveboard: Known for its comprehensive test series, Oliveboard offers full-length mock tests, section-wise tests, and analysis of performance for continuous improvement.

4. Online Courses and Video Lectures

Online platforms offer valuable courses and video lectures designed specifically for financial sector exams. These resources provide expert insights and detailed explanations of key topics, which are often challenging to grasp through self-study alone.

IFSCA Grade A course by EduTap: This specialized course provides comprehensive study materials, detailed video lectures, and mock tests focused on the IFSCA exam. It covers all critical topics such as financial regulations, international banking, and risk management.

Unacademy: Offers live classes, recorded sessions, and personalized mentorship for a wide range of financial sector exams.

5. Current Affairs and Financial News

Being aware of current financial and economic developments is crucial for excelling in the general awareness section of the exams. Some top sources for staying updated include:

The Economic Times: A leading business newspaper providing the latest updates on the financial sector.

Business Standard: Offers detailed analysis of economic policies and their impact on the market.

PIB (Press Information Bureau): An official government source that shares important announcements, policies, and updates on the economy and financial sector.

6. YouTube Channels and Free Resources

There are several YouTube channels that provide free study resources, crash courses, and exam strategies. Some popular channels include:

StudyIQ: Provides lectures on economics, finance, and current affairs, all relevant to financial sector exams.

EduTap: Offers free video lectures and exam tips that complement their paid courses, making it a valuable resource for aspirants.

Conclusion

To excel in financial sector exams, it's essential to have a clear study plan and access to the best resources. From textbooks and mock tests to online courses and current affairs, each resource plays a vital role in your preparation. The IFSCA Grade A course is particularly beneficial for those preparing for IFSCA exams, as it provides focused and structured guidance. With the right combination of resources and consistent effort, you can confidently tackle financial sector exams and achieve success in your career aspirations.

1 note

·

View note

Text

Top Government Jobs after BCA

BCA is one of the most popular degrees. It will prepare you for careers such as Web Designer, Web Developer, System Manager, Network Administrator, Software Developer, Computer Programmer, Software Tester, and so on.

Poddar Business School is one of the top B-Schools in Jaipur, offers the best PGDM course in the city. Poddar Business School conducts many skill development classes for its students required for qualifying many government exams.

Civil Services

Students get many prestigious govt job posts through civil service exams. Such as IAS Officer, IFS, IRS, and IPS. The civil service exam minimum qualification is graduates students. It is one of the toughest exams in government in India jobs.

UPSC

UPSC (Union Public Service Commission) is another best govt jobs after graduation. UPSC recruitment exam is also one of the toughest completive exams. And they hire for the CBI, CDS, NDN, Collector, Telecom, and Navi positions.

State PCS

State PCS also comes with lots of govt job online form for graduates. That you can apply for administrative posts like Range Forest Officer, Assistant Conservator, Deputy Superintendent, District Magistrates, etc. State PCS is also get conducted through three exam patterns Prelims, Mains, and Interview stage. State PCS is famous more for the Government jobs state-wise.

IBPS Clerk

If you want to make your career in bank position, like SBI Clerk. Then graduate degree is a minimum qualification. You cannot apply for SBI Clerk just after 12th class. The IBPS Clerk exam normally asks questions related to Financial Awareness, Quantitative Aptitude, General English, Reasoning Ability, etc. Poddar Business School and Poddar International College trains its students in these areas by organizing Olympiads and Business Quiz for its students.

Railways

Many BCA students have an interest in railway jobs. And you can apply for railway govt jobs after bachelor’s computer application degree. RRB (Railway Reservation Board) conducts railway recruitment for students. Railway government jobs provide smart salary packages and other perk benefits too.

Teaching Jobs

Teaching comes to the top list of government jobs in India after graduation. So just after a graduate degree, you can apply for a teaching job in government sector. But if you complete higher education, such as MCA (Master in Engineering in Computer Science or Ph. D.

CDS (Combined Defense Service)

Next, the best govt jobs for software engineer students are career in combined Defense services (CDS). This competitive exam also hires students for the defense sector. If you get a good rank in the exam then you will get a good position in defense rank. So prepare well for the defense exam if you have any interest.

RBI Officer

RBI is one of more top prestigious job that gets conducted by the apex bank. RBI exam required qualifications like a bachelor’s degree with 60% marks. Master’s degree minimum qualification with 55% marks. Doctorate Degree along with 50% marks. All of these are required with relevant equivalent grades.

Disclaimer

The author assumes no responsibility or liability for any errors or omissions in the content of this article. The information contained in this article is provided on an ‘as is’ basis with no guarantees of accuracy or relevance. Any similarity with any other published article may just be a coincidence.

0 notes

Text

Navigating Entry Routes: Understanding Different Paths into the Banking Industry After College

The banking industry offers a plethora of opportunities for recent college graduates. Navigating these entry routes can be a daunting task, but with the right guidance and preparation, you can find the path that best suits your career aspirations. One critical step in this journey is choosing the right coaching center to enhance your skills and knowledge. For those in Chennai, The Chennai School of Banking stands out as a premier institution for aspiring bankers.

Different Entry Routes into the Banking Industry

Campus Recruitment:

Many banks and financial institutions visit college campuses to recruit fresh graduates. These positions typically include roles in retail banking, credit analysis, and financial advisory. Participating in campus recruitment drives can be a direct and efficient way to enter the banking sector.

Banking Examinations:

Numerous public sector banks in India conduct competitive exams to recruit officers and clerks. Exams like IBPS PO, SBI PO, and RBI Grade B are highly sought after. Preparing for these exams requires a strategic study plan and focused guidance, which is where coaching centers like The Chennai School of Banking can be invaluable.

Internships and Training Programs:

Many banks offer internship programs for students and fresh graduates. These programs provide hands-on experience and often lead to full-time employment. Internships are a great way to gain practical knowledge and understand the workings of the banking industry.

Professional Certification Courses:

Enrolling in certification courses such as CFA (Chartered Financial Analyst), FRM (Financial Risk Manager), or other specialized banking and finance courses can significantly enhance your qualifications and open up more advanced career opportunities.

Networking:

Building a professional network through industry events, seminars, and online platforms like LinkedIn can help you learn about job openings and get recommendations from professionals already in the field.

The Chennai School of Banking: Your Gateway to Success

For those looking to crack banking exams and secure a coveted position in the industry, The Chennai School of Banking is the best banking coaching centre in Chennai. Here’s why:

Experienced Faculty:

The institute boasts a team of experienced faculty members who have a deep understanding of banking exams and industry requirements. Their expertise ensures that students receive the best possible guidance.

Comprehensive Study Material:

The Chennai School of Banking provides extensive study material that covers all aspects of banking exams, from quantitative aptitude to general awareness. The material is regularly updated to reflect the latest exam patterns and trends.

Mock Tests and Practice Sessions:

Regular mock tests and practice sessions help students assess their preparation levels and identify areas for improvement. This rigorous practice is crucial for performing well in competitive exams.

Personalized Coaching:

Understanding that each student has unique strengths and weaknesses, the institute offers personalized coaching to address individual needs and enhance overall performance.

Success Track Record:

The Chennai School of Banking has an impressive track record of successful candidates who have secured positions in various banks. This success rate speaks volumes about the quality of coaching provided.

Conclusion

Entering the banking industry after college is a promising career move, but it requires careful planning and preparation. Whether you choose to go through campus recruitment, competitive exams, internships, or professional courses, having the right guidance is crucial. In Chennai, The Chennai School of Banking stands out as the best banking coaching centre, offering top-notch training and support to help you achieve your banking career goals. With their expert faculty, comprehensive study material, and personalized coaching, you’ll be well-equipped to navigate the competitive landscape of the banking industry and secure a rewarding position.

By understanding the different paths into the banking sector and leveraging the resources available at The Chennai School of Banking, you can set yourself on the right track for a successful and fulfilling career in banking.

0 notes

Text

Competitive Exams in India

In India, the pursuit of higher education and career opportunities often revolves around competitive exams. These examinations serve as gateways to prestigious universities, government jobs, and various professional courses. The landscape of competitive exams in India is vast and diverse, encompassing a multitude of fields ranging from engineering and medicine to civil services and management.

Understanding this intricate web of exams is crucial for aspirants seeking to chart their academic and professional journeys. This blog post aims to provide insights into the diversity, challenges, and planning strategies associated with competitive exams.

The Diversity of Competitive Exams

Competitive exams in India can be broadly categorized into several streams.

a) Engineering and Technology: The Joint Entrance Examination (JEE) Main and Advanced are the most prominent exams for admission to top engineering institutes like the Indian Institutes of Technology (IITs) and the National Institutes of Technology (NITs).

b) Medical and Allied Sciences: The National Eligibility cum Entrance Test (NEET) is the primary entrance exam for medical and dental courses in India. It is conducted for admission to undergraduate and postgraduate programs in various medical colleges across the country.

c) Management: The Common Admission Test (CAT) is the gateway to prestigious management institutes such as the Indian Institutes of Management (IIMs) and other top B-schools. Other exams like XAT, MAT, and SNAP also offer entry to management programs.

d) Civil Services: The Union Public Service Commission (UPSC) conducts the Civil Services Examination, which selects candidates for prestigious positions in the Indian Administrative Service (IAS), Indian Foreign Service (IFS), Indian Police Service (IPS), and other administrative roles.

e) Banking and Finance: Exams like the Institute of Banking Personnel Selection (IBPS) PO, State Bank of India (SBI) PO, and Reserve Bank of India (RBI) Grade B Officer Exam are conducted for recruitment to various positions in the banking and finance sector.

Preparation Strategies

Preparation for competitive exams in India demands diligence, perseverance, and a systematic approach. Here are some essential strategies for aspirants:

a) Understand the Syllabus: Familiarize yourself with the exam syllabus and pattern to streamline your preparation.

b) Create a Study Plan: Develop a structured study plan that allocates sufficient time for each subject or section.

c) Practice Regularly: Solve previous years' question papers and undertake mock tests to assess your preparation level and identify areas for improvement.

d) Seek Guidance: Enroll in coaching institutes or online courses, if necessary, to receive expert guidance and mentorship.

e) Stay Updated: Keep yourself abreast of current affairs, developments in your field of interest, and changes in exam patterns.

“Study24hr.com” empowers students to excel in competitive exams by providing a diverse range of high-quality online courses that cater to various subjects and exam formats. Through expert-led instruction, comprehensive study materials, and interactive learning resources, Study24hr.com equips students with the necessary knowledge and skills to tackle challenging exam content.

The platform's flexibility allows students to learn at their own pace, reinforcing concepts through practice tests and quizzes. So, grab success in competitive exams by connecting with Study24hr.com, where effective strategies and expert-led courses empower students to conquer challenging content and achieve their academic goals with confidence.

Coping with Challenges

The journey of preparing for competitive exams in India is full of challenges. Intense competition, academic pressure, and the fear of failure often weigh heavily on aspirants. It is imperative to adopt a holistic approach to maintain mental and emotional well-being during this phase:

a) Stay Balanced: Strike a balance between study, recreation, and rest to avoid burnout and maintain focus.

b) Seek Support: Lean on your family, friends, and mentors for encouragement and support during challenging times.

c) Believe in Yourself: Cultivate self-confidence and a positive mindset to navigate setbacks and obstacles.

Conclusion

Competitive exams in India serve as gatekeepers to a myriad of opportunities, shaping the academic and professional trajectories of millions of aspirants. While the journey is arduous, it is also enriching for those who persevere with dedication and resilience. By understanding the nuances of various exams, adopting effective preparation strategies, and prioritizing mental well-being, aspirants can embark on this journey with confidence and determination, inching closer to their dreams and aspirations.

#competitive exam#examinations#students#confidence#preparation#stress#aspirants#NIT#JEE#civil services#support#success#career

0 notes

Text

COURSES TO GET GOVERNMENT JOBS AFTER BCOM

• UPSC

• SSC CGL

• SBI PO

• LIC AAO

• RBI Grade B Officer

#iippt #iipptcollege #management #course #bba #bca #bcom #upsc #ssccgl #sbipo #lic #rbi

0 notes

Text

Bank Coaching in Chandigarh: Get Ahead of the Competition with Vedanta Institute

Are you dreaming of getting the best bank coaching in chandigarh? If so, you'll need to ace the bank exams. That's where Vedanta Institute, the best bank coaching institute in Chandigarh, comes in.

We offer comprehensive and high-quality coaching for all major bank exams, including SBI PO, PNB SO, HDFC Bank PO, RBI Grade B, and IBPS Clerk. Our experienced and qualified faculty will help you master all aspects of the exams, from English Language and Quantitative Techniques to Reasoning and Current Affairs.

At Vedanta Institute, we believe in a holistic approach to coaching. That's why we not only focus on academics, but also on your overall development. We provide training in soft skills such as time management, stress management, and problem-solving. We also conduct regular mock tests and interviews to help you prepare for the real exam.

With our proven track record of success, Vedanta Institute is the best choice for bank coaching in Chandigarh. Enroll in our courses today and start your journey to a rewarding career in the banking sector!

#vedantainstitute#bankcoachinginchandigarh#bankcoaching#bank coaching#education#studying#student#study#student life#coachingcenter#chandigarh#india#trending#bankpocoaching#bankingcoaching#sbipocoaching#ibpspocoaching#bankcoachingclasses#bankcoachingnearme

0 notes

Text

Excel in Commerce field with the best college for b.com Hons in Punjab

Over the years, Punjab has become one of the ideal platforms for higher education. A wide range of disciplines are taught with great dedication and the right approach. The B.com course offered at Amity University Punjab is one of the top choices among students from a commerce background. Amity has successfully proven to be the best college for B.com hons in Punjab. Let us learn in detail about the reasons that make Amity University a worthy option for building a career in Bachelor of Commerce.

Here’s why you must choose Amity for studying B.com Hons

Amity University Punjab comes with a curriculum that aligns well with the industry standards. The University ensures that students receive education with utmost precision. Teachings from expert faculty and regular evaluation of student’s academic performance are some of the core reasons behind Amity being a choice among Commerce enthusiasts. If you are struggling to find the best college for B.com hons in Punjab, you might like the educational structure that is available at Amity University Punjab.

The Bachelor of Commerce program at Amity University Punjab offers a detailed understanding of finance, accounting, taxation, management, marketing, and a lot more. Moreover, there is a great possibility of polishing your business-related knowledge.

Studying B.com hons in Punjab University will pave the way for some of the most promising career opportunities. The course will ensure students with a broad understanding of the business environment at a global level.

With a well-structured B.com hons program, students will be able to decode intricate accounting and financial problems. Amity’s unique methodology for imparting commerce-based knowledge will furnish students with the right skills.

These features help Amity to give tough competition to other B com honors colleges in Mohali Punjab.

A distinguished team of highly qualified teachers will help students to pursue academic excellence.

Eligibility and Duration of B.com Hons Programme in Amity University Punjab

If you are willing to build a career in the commerce field and wish to pursue your B.com Hons degree from a reputed institution then Amity is the answer for you.

To study at Amity University Punjab, one must have a minimum of 55% marks in class XII. There are several good B com honors colleges in Mohali Punjab. However, there are some factors that distinguish Amity from the rest and make it a worthwhile option for higher studies in Punjab.

Students can apply for the program online from Amity University’s official website. The duration of B.com Hons at Amity University is 3 years.

What career opportunities does the best college for b.com hons in Punjab offer?

After the successful completion of your graduation in Commerce, you can find numerous career options. The B.com Hons course at Amity is an unrivaled program that will direct you toward a chain of worthwhile opportunities. The dedication and commitment of this institution make it the best college for B.com Hons in Punjab.

Following are some of the top career choices for B.com Hons graduates:

Business executive

Tax consultant

Finance manager

Company Secretary

Chartered accountant

Accountant

Job in the Government Sector through competitive exams like- IBPS Clerk, IBPS PO, SBI Clerk, LIC AAO, SBI PO, RBI Grade B Officer

BBA, MBA

In conclusion, there are a plethora of opportunities awaiting you after you complete your B.Com graduation degree from a top-graded institution like Amity University Punjab which is India’s leading academic institution. So, if you are studying B.com hons in Punjab University -Amity, be ready to witness world-class education, develop new skills, and gain access to the right career path in no time.

For more information about B.com hons at Amity University Punjab visit- https://www.amity.edu/mohali/ug-commerce.aspx

Source : https://sites.google.com/view/best-college-for-bcom-hons/home

#best college for b.com hons in punjab#b.com hons in punjab university#b com honours colleges in mohali punjab

0 notes

Text

Mastering the RBI Grade B Exam: The Importance of Coaching

The Reserve Bank of India (RBI) Grade B exam is one of the most prestigious and competitive examinations in India. It opens the doors to a rewarding career in the central banking system and is a dream opportunity for many aspirants. To crack this challenging exam, many candidates turn to RBI Grade B coaching. In this article, we will explore the significance of coaching for the RBI Grade B exam and why it can make all the difference in your preparation journey.

Understanding the RBI Grade B Exam:

The RBI Grade B exam is known for its complexity and breadth of topics. It consists of three phases: Phase-I (preliminary exam), Phase-II (main exam), and an interview. Each phase assesses candidates on different aspects, including general awareness, quantitative aptitude, reasoning ability, and English language skills.

Structured and Targeted Preparation:

Coaching institutes specializing in RBI Grade B exam preparation offer a structured curriculum designed to cover all relevant topics and ensure comprehensive preparation. This structured approach helps aspirants focus on what matters most.

Experienced Faculty:

RBI Grade B coaching institutes typically have experienced faculty members who are well-versed in the exam pattern and syllabus. Their expertise allows them to provide valuable insights, shortcuts, and tips for tackling tricky questions.

Mock Tests and Practice:

Practice is key to success in any competitive exam, and coaching institutes offer a plethora of mock tests and practice papers. These simulated exams help candidates become familiar with the exam format, manage time effectively, and identify areas that need improvement.

Personalized Guidance:

Coaching institutes often provide personalized guidance, allowing candidates to address their weaknesses and build on their strengths. This one-on-one attention can be invaluable in fine-tuning your preparation strategy.

Stay Updated:

The RBI Grade B exam syllabus and pattern can change, and coaching institutes are quick to adapt to these changes. They ensure that candidates are always preparing with the latest information and trends.

Motivation and Peer Learning:

Being part of a coaching class can provide a sense of motivation and healthy competition. Interacting with fellow aspirants can lead to valuable peer learning and the exchange of ideas and strategies.

Time Management:

Managing time effectively during the exam is crucial. Coaching institutes offer time management strategies and techniques that help candidates answer questions within the stipulated time limits.

Interview Preparation:

The final round of the RBI Grade B exam is an interview, and coaching institutes often provide guidance and mock interview sessions to help candidates prepare for this critical phase.

Success Stories:

Many successful RBI Grade B officers attribute their success to coaching institutes that provided them with the necessary guidance and resources to excel in the exam.

Conclusion:

Cracking the RBI Grade B exam is a formidable challenge that requires dedication, hard work, and the right guidance. RBI Grade B coaching institutes play a crucial role in providing structured preparation, expert guidance, and a competitive edge that can make a significant difference in your journey to becoming an RBI Grade B officer. While self-study is essential, enrolling in a reputable coaching program can give you the extra boost you need to achieve your dream of working with the Reserve Bank of India.

For More Info :-

RBI Grade B Coaching

Gate Economics Course in India

0 notes

Text

NCR Residential Real Estate Outlook 2023

The year 2022 has been a phenomenal year for residential real estate in terms of sales and new supply in the market, which have set benchmarks with each quarter. The National Capital Region (NCR) has witnessed robust growth in residential sales post-pandemic despite an increase in lending rates by RBI and global headwinds on account of the Ukraine war and high inflation globally,

It is observed that the government's special thrust on infrastructure projects and private investments, along with an inherent demand for residential assets across all strata of society, will keep the momentum going in the year 2023. Many A-grade developers like DLF, Adani, Godrej, etc. have a slew of big residential projects scheduled to be launched in 2023 where all residential asset classes like apartments, independent floors, villas, plots, etc. will be in high demand. It is expected that 3 and 4 BHK apartments will gain maximum traction in reputed developer projects. Due to the consistent demand by consumers, we can expect an average price increase of around 7–11% year-on-year, and in certain micro-markets, it may go up to 20% where big infrastructure projects like the Dwarka Expressway are underway with a completion timeline of 2023.

Noida, Greater Noida, and Yamuna Expressway:

The upcoming Jewar airport, as well as the state government's desire for large corporate investments in Noida and Greater Noida, will drive demand across all asset classes over the next 3-5 years. Residential demand is directly proportional to the economic activity in the region. With the ongoing development of Jewar Airport, the region is poised for superlative economic activity in the coming years. We have recently seen some grade-A developers like Max, L&T, Godrej, etc. acquire land parcels in the region with no dues to the authorities and are expected to launch their luxury residential projects in 2023. The local authority is also constantly working with local developers such as ATS, Mahagun, and others to find a solution to the long-standing impasse of land dues owed to the authority, which has gotten even worse after the Supreme Court judgement. However, this location will see a very good supply of some good projects from both Grade A and B developers, giving prospective buyers plenty of credible options to choose from.

Gurugram:

Gurugram city in the National Capital Region has witnessed the maximum number of new supplies and sales in the year 2022. Due to its proximity to domestic and international airports, Gurugram has become a first choice for multinational companies to inaugurate their India offices. Its tremendous growth in commercial leasing in the last decade resulted in the development of all residential asset classes throughout the city. The year 2023 will witness a lot of supply coming up in micro-markets like Dwarka Expressway, Golf Course Extension Road, Southern Peripheral Road, New Gurgaon, and Sohna. The infrastructure development, economic activity, good existing social infrastructure, and indulgent lifestyle will keep demand going in Gurugram city.

Further, due to the lack of gated communities in South Delhi & West Delhi, many residents are planning to move into the Millennium City for a better lifestyle. This has further put pressure on the already stressed supply of good projects/inventory. In 2023, we could see a lot of big bang launches in Gurgaon from grade A developers like DLF, M3M, Adani, Godrej, Emaar, etc. with a price hike of around 5–7% in the short run and over 15% in certain micro-markets in the long run.

An advice to the prospective buyer:

There is never a good or bad time to invest. We just need to have the knack for identifying the right opportunity at any given point in time and the confidence to go ahead with our buying decision. To help consumers make the right decision, the role of professional real estate consultants like JLL comes into play. Never go after investment schemes in real estate wherein the developer is offering a lucrative return along with an easy exit after a certain period. These kinds of investments are highly vulnerable to macroeconomic conditions. During headwinds, it is tough for such projects to survive. Therefore, investing wisely is the only way to keep yourself safe.

In a nutshell, we should invest in the end consumer’s product and not in the investor's product. A prospective buyer should instead invest in the right product or project in terms of efficient layouts, construction quality, open area, amenities, security, etc. They should also consider the track record of the developer and its financial position. It might come at a premium; however, it will be worth the investment in the grand scheme of things. Happy Real Estate 2023!!!

0 notes

Text

Comprehensive RBI Grade B Online Course for Success | Expert Guidance

RBI Grade B Online Course 2023: Crack RBI Grade B exam with our live sessions, video course, etc. Enroll now and take the first step towards a rewarding career in banking

0 notes

Text

RBI Recruitment 2023: Legal Officer, Manager and Librarian (10 Posts)

RBI Recruitment 2023: Reserve Bank of India has released an employment notification for the recruitment of the Legal Officer, Manager (Technical Civil), Assistant Manager (Rajbhasha), and Library Professional (Assistant Librarian). The last date for submission of the application is 20th June 2023.

1. Post Name:- Legal Officer (Grade-B)

- No of posts:- 1

- Upper age limit:- 32 years as on May 01, 2023 (candidates must have been born not earlier than 02-05-1991 and not later than 01-05-2002). The upper age limit is relaxable by 3 years in case of candidates possessing an LL.M. degree and 5 years in the case of candidates possessing a Ph.D. in Law

- Salary:- Pay of Rs.55,200/- p.m. in the scale of Rs. 55200-2850(9)- 80850-EB-2850(2)- 86550-3300(4)-99750 (16 years) applicable to Officers in Grade-B.

- Essential Qualification:-

(i) Bachelor’s Degree in Law from any University/College/Institution, recognized by UGC and the Bar Council of India with a minimum of 50% marks or equivalent in the aggregate of all semesters/years.

(ii) For SC/ST and PwBD candidates, the minimum required marks shall be 45% in Bachelor’s degree in Law in the aggregate of all semesters/years, against vacancies reserved for such candidates.

- Experience:- Enrolled with the Bar Council as an Advocate.

(i) As an Advocate or

(ii) As a Law Officer in the Legal Department of a large bank/ financial institution/ statutory corporation/ company/ State/ Central Government after being enrolled with the Bar Council or

(iii) As a full-time teacher in a Law College/ University, teaching law.

- Desirable: Special knowledge of Banking Law, Company Law, Labour Law, and Constitutional Law and experience in drafting pleadings and documents.

2. Post Name:- Manager (Technical Civil)

- No of posts:- 3

- Upper age limit:- 35 years as on May 01, 2023 (candidates must have been born not earlier than 02-05-1988 and not later than 01-05-2002). Upper age relaxation as per Govt rules.

- Salary:- Pay of Rs.55,200/- p.m. in the scale of Rs. 55200-2850(9)- 80850-EB-2850(2)- 86550-3300(4)-99750 (16 years) applicable to Officers in Grade-B.

- Essential Qualification:- A Bachelor’s Degree in Civil Engineering or equivalent qualification with a minimum of 60% marks (55% for SC/ST, if vacancies are reserved for them) or equivalent grade in aggregate of all semesters/years. Aggregate Grade Point or percentage of marks where awarded would mean aggregate over the entire

duration of the course.

- Experience:- At least 3 years experience in a relevant field after graduation (in a position of independent responsibility) in a public/private limited organization, including Hospitals/ Banks/ Financial Institutions/ Planning/ Designing/Construction/ Large Office Buildings/ Multistoried Buildings/ Housing Companies/residential campus-based educational institutions and having experience in preparation and evaluation of the tender.

- Desirable:

(i) Experience in maintenance of Office and Residential properties/ colonies.

(ii) Experience in administering construction projects in all aspects and knowledge of PERT/ CPM techniques.

(iii) Working knowledge of Computer in Structural Design in CAM/ CAD / MS Project or Primavera evaluation and analysis of tenders with special references.

(iv) Working knowledge in structural rehabilitation works.

(v) Experience in Construction and Project Management.

(vi) Ability to work in a computerized environment.

3. Post Name:- Assistant Manager (Rajbhasha)

- No of posts:- 5

- Upper age limit:- 30 years as on May 01, 2023 (candidates must have been born not earlier than 02-05-1993 and not later than 01-05-2002). For candidates with Ph.D. qualifications, the upper age limit will be 32 years. The maximum age relaxation applicable to SC/ST and OBC category candidates, even having Ph.D., will be 5 years and 3 years respectively if posts are reserved for them. (Cumulative benefit is not allowed).

- Salary:- Pay of Rs.55,200/- p.m. in the scale of Rs. 55200-2850(9)- 80850-EB-2850(2)- 86550-3300(4)-99750 (16 years) applicable to Officers in Grade-B.

- Essential Qualification:-

(i) Second Class Master’s Degree in Hindi/Hindi Translation with English as a subject at the Bachelor’s degree level;

OR

(ii) Second Class Master’s Degree in English with Hindi as a subject at the Bachelor’s degree level along with Post Graduation diploma in translation;

OR

(iii) Second Class Master’s Degree in Sanskrit/ Economics/ Commerce with English and Hindi as subjects at the Bachelor’s Degree level along with a Postgraduate diploma in translation. (Instead of a subject of Hindi at Bachelor’s degree level, one may have recognized Hindi qualification equivalent to a Bachelor’s Degree);

OR

(iv) Master’s Degree in both English and Hindi/Hindi Translation, of which one must be Second Class.

- Desirable: Knowledge of bi-lingual word processing.

4. Post Name:- Library Professional (Assistant Librarian) Grade-A

- No of posts:- 1

- Upper age limit:- 30 years as on May 01, 2023 (candidates must have been born not earlier than 02-05-1993 and not later than 01-05-2002). Upper age relaxation as per Govt rules.

- Salary:- Pay of Rs. 44,500/-p.m. in the scale of Rs. 44500-2500(4)-54500-2850(7)- 74450-EB-2850(4)- 85850-3300(1)-89150 (17 years) applicable to Officers in Grade-A.

- Essential Qualification:-

(i) Bachelor’s Degree in Arts/Commerce/Science and

(ii) Master’s Degree in ‘Library Science’ or ‘Library and Information Science’ of a recognized University/ Institution with a minimum of 60% marks or equivalent grade in aggregate of all semesters/years. Aggregate Grade Points or percentage of marks where awarded would mean aggregate over the entire duration of the course.

- Desirable:

(i) Diploma in ‘Computer Applications from a recognized University or Institution

(ii) Qualified in the national level test (NET/SLET/SET) conducted by the UGC or any other agency approved by the UGC

(iii) Short-term/ crash course on content management, viz. Joomla, Drupal, etc.

- Experience:- Three years of professional experience in a library (in a position of Library Assistant/Technical Assistant (Library) or similar designation or above) under a Central/ State Government/ Autonomous or Statutory organization/ PSU/ University or Recognized Research or Educational Institution or any major library.

How to apply for RBI Recruitment 2023: Legal Officer, Manager, and Librarian Vacancy?

Candidates are required to apply ONLINE only through the Bank’s website www.rbi.org.in from May 29, 2023, to June 20, 2023 (till 6.00 pm). No other mode for submission of the application is available.

Application Fee

- For SC/ST/PwBD candidates: Rs. 100/- + 18% GST

- For GEN/OBC/EWS candidates: Rs. 600/- + 18% GST

- For Staff: Nil

Those who wish to apply are advised to go through the below official notification in detail before submitting applications.

Online Application Link

Click Here

Download Official Notification

Click Here

Job Updates on Telegram

Click Here

Read the full article

0 notes

Text

Crack Government exam with ixambee expert guidance

In order to develop the next generation of intelligent learners, ixamBee offers the greatest technology-based learning solutions for competitive exams. In order to help students prepare for regulatory bodies' exams, banking & insurance exams, exams administered by SSC like SSC CGL, exams by Railways, exams by Teaching, and various government and other exams in the most thorough manner possible, ixamBee offers study material like mock tests, online test series, online practise tests, and speed test series.

The most complex and comprehensive way to create basics is by utilising the most recent technical tools. The most evident benefit of the thorough, extensive, and all-encompassing online preparation for competitive exams is received by students preparing for Bank, Insurance, SSC, Railways, RRB, MAT, AFCAT, Teaching, and numerous other competitive exams. The best way for students to prepare for exams is online, thus ixamBee professionals have created practise mock tests for government exams that will give them an advantage over the competitors. The most complex and comprehensive way to create basics is by utilising the most recent technical tools. The most evident benefit of the thorough, wide, and all-encompassing online study for competitive exams is received by students preparing for NABARD Grade A or Grade B, Bank, Insurance, SSC, Railways, Teaching, and other competitive exams. Online exam preparation is best for students, so ixamBee professionals have created practise mock tests for government exams to help students remain ahead of the game.

In order to help students succeed in all competitive exams in the easiest possible way, ixamBee's educational professionals have created test series and free mock tests for Bank and all other exams. Every online test that is created makes sure to adhere to the most recent exam format and keep the same level of challenge as the actual exam.

Reserve Bank of India (RBI) Grade B Officer Exam: The Reserve Bank of India conducts the highly competitive RBI Grade B Officer test to hire officials for its many departments. There are three parts to the exam: the preliminary exam, the main exam, and the interview. For the purpose of assisting students in preparing for all three exam phases, iXamBee provides thorough study resources, live online lectures, practise exams, and mock exams.

National Bank for Agriculture and Rural Development (NABARD) Exam: The NABARD test is held to hire officers in NABARD's several departments. NABARD is an Indian development finance organisation. There are two phases to the exam: the preliminary exam and the main exam. For both exam periods, iXamBee provides instruction via live online lessons, practise exams, and mock exams.

Securities and Exchange Board of India (SEBI) Grade A Officer Exam: SEBI, which oversees the Indian securities market, holds this examination to appoint officers to its several departments. There are two phases to the exam: the preliminary exam and the main exam. iXamBee provides thorough preparation materials for both exam phases, including live online lessons, practise exams, and mock exams.

Staff Selection Commission (SSC) Exams: SSC conducts various exams for recruitment in government departments and organizations in India. iXamBee offers courses for several SSC exams, including SSC CGL, SSC CHSL, SSC JE, and SSC MTS. The courses include comprehensive study materials, live online classes, practice tests, and mock tests.

0 notes

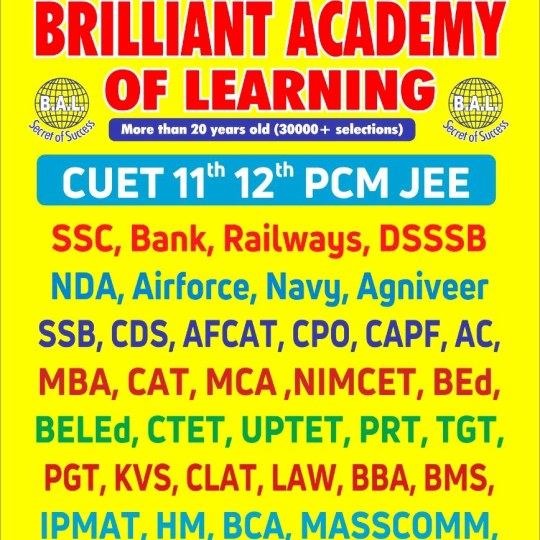

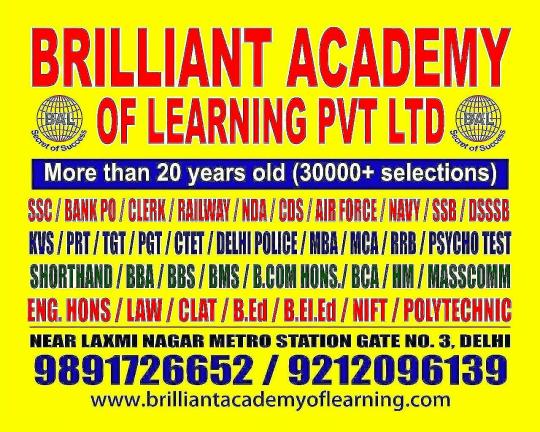

Text

Online & Offline Classes for Entrance Exams 2023. All Info CUET IIT CLAT IPM BMS BEd SSC Bank Railways DSSSB KVS PRT TGT PGT CTET UPTET Delhi police MBA CAT MCA NIMCET BCA BElEd NIFT NDA Airforce Navy Agniveer CDS AFCAT CAPF AC EPFO NABARD SEBI RBI Grade B LIC AAO ADO

IBPS SBI Bank PO Specialist Officers Clerk RRB PsychoTest SSB Interview Call 9891726652 |

9212096139 | Top Faculties Up-to-date Study Materials Best Results Hostel Facilities Admission Open! Join Soon

#iit jee#11thpcmonlineclasses#12thpcmonlineclasses#nda coaching classes#airforce x y#navycoaching#cdscoaching#ssc cgl exam#ssc coaching#ibpsexam#sbipreparation#bank exams#mcaentrancecoachinginlaxminagar#mbaentrancepreparation#clatpreparation#ipmatpreparation#bbaentranceexams#bcaentrance#hmentrance#bjmcentrancecoaching#ctetcoachinginlaxminagar#bedcoachingindelhi#dsssbcoachingindelhi#railwayscoachingindelhi#catcoachingdelhi#nimcetentrance#brilliantacademyoflearning#call9891726652#laxminagar#delhi

0 notes

Text

SBI PO Course

In this session, we will discuss Top 500 Questions for SBI PO & Clerk 2022. This is an important session for all aspirants, as we know there will be questions from this part of the Banking examinations. SBI PO and SBI Clerk classes for 2022. In this series, we will cover all of the syllabus for English Section. Exams. Welcome to Ambitious Baba. Preparation Channel. Prepare for Bank Exams (RBI Assistant, LIC Assistant, SBI PO Mains, IBPS PO Mains, IBPS Clerk Mains, SBI Clerk, RRB PO, RRB Clerk, RBI Office Attendant, RBI Grade B, LIC, FCI, SEBI, JAIIB, CAIIB, NABARD Grade B, NABARD Grade A, SIDBI, LIC, ESIC etc )

View Video - https://www.youtube.com/watch?v=O_nCTjhp1kg

#governmentjobpreparation#jobpreparationvideos#ambitiousbabaforbank#bankjobpreparationvideos#sbipocourse

0 notes