#real estate

Text

64K notes

·

View notes

Text

This genocide never has been about the hostages, never will be about the hostages.

Mind you, the IDF shot and killed three hostages today. (They spoke Hebrew and held up a white flag in surrender btw).

If you still think this is about the hostages you are gravely mistaken and your ignorance is profound. 🇵🇸

#israel#israel occupation#ethnic cleansing#israeli hostages#Harei Zahav#real estate#infrastructure#genocide#from the river to the sea palestine will be free#free palestine#free gaza#gaza#palestine#pray for palestine#ceasefire#permanent ceasefire#capitalism#imperialism#colonialism#colonial violence#colonization#america#usa#israel is committing genocide#israel is a terrorist state

7K notes

·

View notes

Text

Don’t know the details, but honey, if they didn’t like you before, this interview isn’t going to help.

8K notes

·

View notes

Text

The British childhood is a rare combination of abject misery and risk of harm.

#real estate#photography#realty#property#estate agents#interiors#interior design#gardens#real estate agents#horror

2K notes

·

View notes

Text

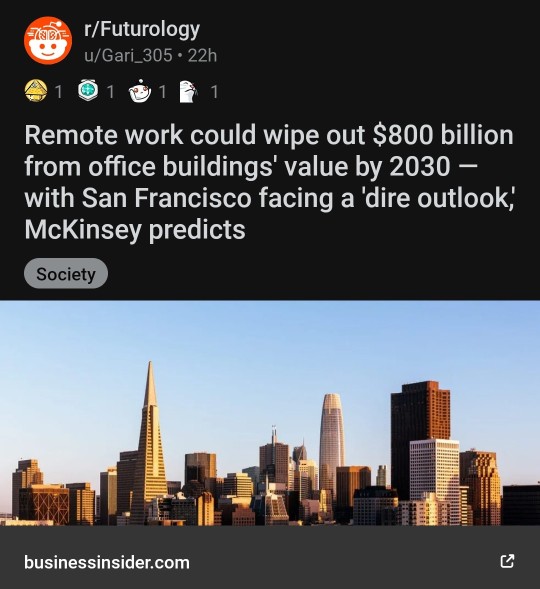

BEIJING — China’s struggling real estate developers won’t be getting a major bailout, Chinese authorities have indicated, warning that those who “harm the interests of the masses” will be punished.

“For real estate companies that are seriously insolvent and have lost the ability to operate, those that must go bankrupt should go bankrupt, or be restructured, in accordance with the law and market principles,” Ni Hong, Minister of Housing and Urban-Rural Development, said at a press conference Saturday.

“Those who commit acts that harm the interests of the masses will be resolutely investigated and punished in accordance with the law,” he said. “They will be made to pay the due price.”

That’s according to a CNBC translation of his Mandarin-language remarks published in an official transcript of the press conference, held alongside China’s annual parliamentary meetings.

Ni’s comments come as major real estate developers from Evergrande to Country Garden have defaulted on their debt, while plunging new home sales have put future business into question.

In 2020, Beijing cracked down on developers’ high reliance on debt for growth in an attempt to clamp down on property market speculation. But many developers soon ran out of money to finish building apartments, which are typically sold to homebuyers in China ahead of completion. Some buyers stopped paying their mortgages in a boycott.

Authorities have since announced measures to provide some developers with financing. But the national stance on reducing the role of real estate in the economy hasn’t changed.

This year’s annual government gathering has emphasized the country’s focus on investing in and building up high-end manufacturing capabilities. In contrast, the leadership has not mentioned the massive real estate sector as much.

Real estate barely came up during a press conference focused on the economy last week, while Ni was speaking during a meeting that focused on “people’s livelihoods.”

Ni said authorities would promote housing sales and the development of affordable housing, while emphasizing the need to consider the longer term.

Near-term changes in the property sector have a significant impact on China’s overall economy.

Real estate was once about 25% of China’s GDP, when including related sectors such as construction. UBS analysts estimated late last year that property now accounts for about 22% of the economy.

Last week, Premier Li Qiang said in his government work report that in the year ahead, China would “move faster to foster a new development model for real estate.”

“We will scale up the building and supply of government-subsidized housing and improve the basic systems for commodity housing to meet people’s essential need for a home to live in and their different demands for better housing,” an English-language version of the report said.

next time you complain about how things are in America, consider that if you lived in some kind of scary communist country like China, you wouldn't even get to fund a bailout for the real estate company owners who ruined the economy like you can (whether you like it or not) in the good old US of A! 🇺🇲

1K notes

·

View notes

Text

#How to Tell if That’s Your Castle#tips#tricks#life hacks#helpful hints#advice#real estate#trebuchet#castles

2K notes

·

View notes

Text

— Richard Siken, from “Real Estate.”

954 notes

·

View notes

Text

new comic 🏠 sketchy neighbourhood

Shop's on sale til after this weekend! Get 15% off everything (at checkout)!!!

646 notes

·

View notes

Text

New Orleans, LA c.1913

823 notes

·

View notes

Text

my saved houses on Zillow. just a collection of the most haunted buildings you’ve ever seen.

518 notes

·

View notes

Text

*Townhouse: a house that shares one or more walls with other houses, usually with 2 or more levels/floors.

Edited to add that this is in USD.

–

We ask your questions so you don’t have to! Submit your questions to have them posted anonymously as polls.

#polls#incognito polls#anonymous#tumblr polls#tumblr users#questions#housing#real estate#polls about the home#polls about money

574 notes

·

View notes

Text

699 notes

·

View notes

Text

I just found a house listing that says "sewer and water exist" and that is just such a hilarious way to put it. Like, they're THERE, but beyond that we make no promises.

2K notes

·

View notes

Text

For emergency evacuations please use the stairs.

#real estate#photography#realty#property#estate agents#interiors#interior design#real estate agents#terrible toilets

3K notes

·

View notes

Text

'We buy ugly houses' is code for 'we steal vulnerable peoples' homes'

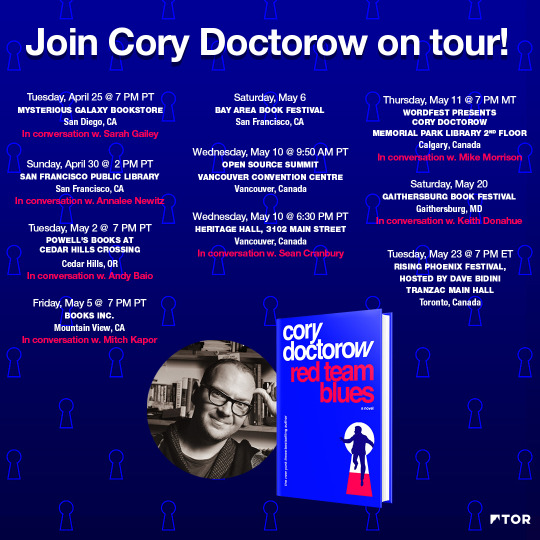

Tonight (May 11) at 7PM, I’m in CALGARY for Wordfest, with my novel Red Team Blues; I’ll be hosted by Peter Hemminger at the Memorial Park Library, 2nd Floor.

Home ownership is the American dream: not only do you get a place to live, free from the high-handed dictates of a landlord, but you also get an asset that appreciates, building intergenerational wealth while you sleep — literally.

If you’d like an essay-formatted version of this post to read or share, here’s a link to it on pluralistic.net, my surveillance-free, ad-free, tracker-free blog:

https://pluralistic.net/2023/05/11/ugly-houses-ugly-truth/#homevestor

Of course, you can’t have it both ways. If your house is an asset you use to cover falling wages, rising health care costs, spiraling college tuition and paper-thin support for eldercare, then it can’t be a place you live. It’s gonna be an asset you sell — or at the very least, borrow so heavily against that you are in constant risk of losing it.

This is the contradiction at the heart of the American dream: when America turned its back on organized labor as an engine for creating prosperity and embraced property speculation, it set itself on the road to serfdom — a world where the roof over your head is also your piggy bank, destined to be smashed open to cover the rising costs that an organized labor movement would have fought:

https://gen.medium.com/the-rents-too-damned-high-520f958d5ec5

Today, we’re hit the end of the road for the post-war (unevenly, racially segregated) shared prosperity that made it seem, briefly, that everyone could get rich by owning a house, living in it, then selling it to everybody else. Now that the game is ending, the winners are cashing in their chips:

https://doctorow.medium.com/the-end-of-the-road-to-serfdom-bfad6f3b35a9

The big con of home ownership is proceeding smartly on schedulee. First, you let the mark win a little, so they go all in on the scam. Then you take it all back. Obama’s tolerance of bank sleze after the Great Financial Crisis kicked off the modern era of corporations and grifters stealing Americans’ out from under them, forging deeds in robosigning mills:

https://www.marketwatch.com/story/us-breaks-down-93-bln-robo-signing-settlement-2013-02-28

The thefts never stopped. Today on Propublica, by Anjeanette Damon, Byard Duncan and Mollie Simon bring a horrifying, brilliantly reported account of the rampant, bottomless scams of Homevestors, AKA We Buy Ugly Houses, AKA “the #1 homebuyer in the USA”:

https://www.propublica.org/article/ugly-truth-behind-we-buy-ugly-houses

Homevestors — an army of the hedge fund Bayview Asset Management — claims a public mission: to bail out homeowners sitting on unsellable houses with all-cash deals. The company’s franchisees — 1,150 of them in 48 states — then sprinkle pixie dust and secret sauce on these “ugly houses” and sell them at a profit.

But Propublica’s investigation — which relied on whistleblowers, company veterans, court records and interviews with victims — tells a very different story. The Homevestor they discovered is a predator that steals houses out from under elderly people, disabled people, people struggling with mental illness and other vulnerable people. It’s a company whose agents have a powerful, well-polished playbook that stops family members from halting the transfers the company’s high-pressure salespeople set in motion.

Propublica reveals homeowners with advanced dementia who signed their shaky signatures to transfers that same their homes sold out from under them for a fraction of their market value. They show how Homevestor targets neighborhoods struck by hurricanes, or whose owners are recently divorced, or sick. One whistleblower tells of how the company uses the surveillance advertising industry to locate elderly people who’ve broken a hip: “a 60-day countdown to death — and, possibly, a deal.” The company’s mobile ads are geofenced to target people near hospitals and rehab hospitals, in hopes of finding desperate sellers who need to liquidate homes so that Medicaid will cover their medical expenses.

The sales pitches are relentless. One of Homevestor’s targets was a Texas woman whose father had recently been murdered. As she grieved, they blanketed her in pitches to sell her father’s house until “checking her mail became a traumatic experience.”

Real-estate brokers are bound by strict regulations, but not house flippers like Homevestors. Likewise, salespeople who pitch other high-ticket items, from securities to plane tickets — are required to offer buyers a cooling-off period during which they can reconsider their purchases. By contrast, Homevestors’ franchisees are well-versed in “muddying the title” to houses after the contract is signed, filing paperwork that makes it all but impossible for sellers to withdraw from the sale.

This produces a litany of ghastly horror-stories: homeowners who end up living in their trucks after they were pressured into a lowball sales; sellers who end up dying in hospital beds haunted by the trick that cost them their homes. One woman who struggled with hoarding was tricked into selling her house by false claims that the city would evict her because of her hoarding. A widow was tricked into signing away the deed to her late husband’s house by the lie that she could do so despite not being on the deed. One seller was tricked into signing a document he believed to be a home equity loan application, only to discover he had sold his house at a huge discount on its market value. An Arizona woman was tricked into selling her dead mother’s house through the lie that the house would have to be torn down and the lot redeveloped; the Homevestor franchisee then flipped the house for 5,500% of the sale-price.

The company vigorously denies these claims. They say that most people who do business with Homevestors are happy with the outcome; in support of this claim, they cite internal surveys of their own customers that produce a 96% approval rating.

When confronted with the specifics, the company blamed rogue franchisees. But Propublica obtained training materials and other internal documents that show that the problem is widespread and endemic to Homevestors’ business. Propublica discovered that at least eight franchisees who engaged in conduct the company said it “didn’t tolerate” had been awarded prizes by the company for their business acumen.

Franchisees are on the hook for massive recurring fees and face constant pressure from corporate auditors to close sales. To make those sales, franchisees turn to Homevana’s training materials, which are rife with predatory tactics. One document counsels franchisees that “pain is always a form of motivation.” What kind of pain? Lost jobs, looming foreclosure or a child in need of surgery.

A former franchisee explained how this is put into practice in the field: he encountered a seller who needed to sell quickly so he could join his dying mother who had just entered a hospice 1,400 miles away. The seller didn’t want to sell the house; they wanted to “get to Colorado to see their dying mother.”

These same training materials warn franchisees that they must not deal with sellers who are “subject to a guardianship or has a mental capacity that is diminished to the point that the person does not understand the value of the property,” but Propublica’s investigation discovered “a pattern of disregard” for this rule. For example, there was the 2020 incident in which a 78-year-old Atlanta man sold his house to a Homevestors franchisee for half its sale price. The seller was later shown to be “unable to write a sentence or name the year, season, date or month.”

The company tried to pin the blame for all this on bad eggs among its franchisees. But Propublica found that some of the company’s most egregious offenders were celebrated and tolerated before and after they were convicted of felonies related to their conduct on behalf of the company. For example, Hi-Land Properties is a five-time winner of Homevestors’ National Franchise of the Year prize. The owner was praised by the CEO as “loyal, hardworking franchisee who has well represented our national brand, best practices and values.”

This same franchisee had “filed two dozen breach of contract lawsuits since 2016 and clouded titles on more than 300 properties by recording notices of a sales contract.” Hi-Land “sued an elderly man so incapacitated by illness he couldn’t leave his house.”

Another franchisee, Patriot Holdings, uses the courts aggressively to stop families of vulnerable people from canceling deals their relatives signed. Patriot Holdings’ co-owner, Cory Evans, eventually pleaded guilty to to two felonies, attempted grand theft of real property. He had to drop his lawsuits against buyers, and make restitution.

According to Homevestors’ internal policies, Patriot’s franchise should have been canceled. But Homevestors allowed Patriot to stay in business after Cory Evans took his name off the business, leaving his brothers and other partners to run it. Nominally, Cory Evans was out of the picture, but well after that date, internal Homevestors included Evans in an award it gave to Patriot, commemorating its sales (Homevestors claims this was an error).

Propublica’s reporters sought comment from Homevestors and its franchisees about this story. The company hired “a former FBI spokesperson who specializes in ‘crisis and special situations’ and ‘reputation management’ and funnelled future questions through him.”

Internally, company leadership scrambled to control the news. The company convened a webinar in April with all 1,150 franchisees to lay out its strategy. Company CEO David Hicks explained the company’s plan to “bury” the Propublica article with “‘strategic ad buys on social and web pages’ and ‘SEO content to minimize visibility.’”

https://www.propublica.org/article/homevestors-aims-to-bury-propublica-reporting

Franchisees were warned not to click links to the story because they “might improve its internet search ranking.”

Even as the company sought to “bury” the story and stonewalled Propublica, they cleaned house, instituting new procedures and taking action against franchisees identified in Propublica’s article. “Clouding titles” is now prohibited. Suing sellers for breach of contract is “discouraged.” Deals with seniors “should always involve family, attorneys or other guardians.”

During the webinar, franchisees “pushed back on the changes, claiming they could hurt business.”

If you’ve had experience with hard-sell house-flippers, Propublica wants to know: “If you’ve had experience with a company or buyer promising fast cash for homes, our reporting team wants to hear about it.”

Catch me on tour with Red Team Blues in Calgary, Toronto, DC, Gaithersburg, Oxford, Hay, Manchester, Nottingham, London, and Berlin!

[Image ID: A Depression-era photo of a dour widow standing in front of a dilapidated cabin. Next to her is Ug, the caveman mascot for Homevestors, smiling and pointing at her. Behind her is a 'We buy ugly houses' sign.

Image:

Homevestors

https://www.homevestors.com/

Fair use:

https://www.eff.org/issues/intellectual-property

#pluralistic#the rents too damned high#house flipping#llc brain#scams#elder abuse#ripoffs#weaponized shelter#predators#homevestors#we buy ugly houses#ugly houses#real estate#propublica

2K notes

·

View notes