#recurring billing api

Text

Automate Recurring Payments Using API | Call Now - Bank Cloud

BankCloud s recurring collection API stack provides a unified approach to various subscription channels and makes collections seamless and automatic Supports SI on cards, eSI, NACH, and UPI

#Recurring payments api#Subscription api#Recurring api#automatic payment api#billing api#recurring billing api#recurring payment api integration#api recurring payments.

0 notes

Text

API Recurring Payments

API recurring payments simplify and automate billing for businesses, ensuring timely, hassle-free collection of recurring revenue.

0 notes

Text

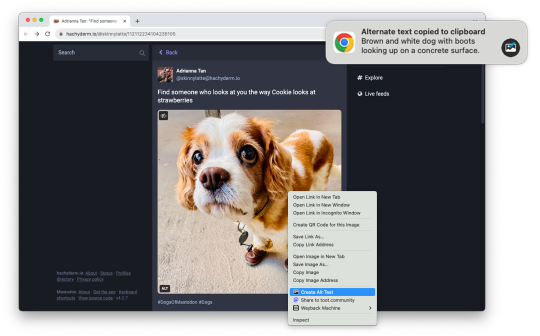

Introducing Alt Text Creator

Images on web pages are supposed to have alternate text, which gives screen readers, search engines, and other tools a text description of the image. Alt text is critical for accessibility and search engine optimization (SEO), but it can also be time-consuming, which is why I am releasing Alt Text Creator!

Alt Text Creator is a new browser extension for Mozilla Firefox and Google Chrome (and other browsers that can install from the Chrome Web Store) that automatically generates alt text for image using the OpenAI GPT-4 with Vision AI. You just right-click any image, select "Create Alt Text" in the context menu, and a few seconds later the result will appear in a notification. The alt text is automatically copied to your clipboard, so it doesn't interrupt your workflow with another button to click.

I've been using a prototype version of this extension for about three months (my day job is News Editor at How-To Geek), and I've been impressed by how well the GPT-4 AI model describes text. I usually don't need to tweak the result at all, except to make it more specific. If you're curious about the AI prompt and interaction, you can check out the source code. Alt Text Creator also uses the "Low Resolution" mode and saves a local cache of responses to reduce usage costs.

I found at least one other browser extension with similar functionality, but Alt Text Creator is unique for two reasons. First, it uses your own OpenAI API key that you provide. That means the initial setup is a bit more annoying, but the cost is based on usage and billed directly through OpenAI. There's no recurring subscription, and ChatGPT Plus is not required. In my own testing, creating alt text for a single image costs under $0.01. Second, the extension uses as few permissions as possible—it doesn't even have access to your current tab, just the image you select.

This is more of a niche tool than my other projects, but it's something that has made my work a bit less annoying, and it might help a few other people too. I might try to add support for other AI backends in the future, but I consider this extension feature-complete in its current state.

Download for Google Chrome

Download for Mozilla Firefox

#chrome extension#chrome extensions#firefox extension#firefox extensions#chrome#firefox#accessibility#a11y

2 notes

·

View notes

Text

Easebuzz API Integration by Infinity Webinfo Pvt. Ltd.: A Streamlined Payment Gateway Solution

In today’s fast-paced digital economy, businesses must integrate efficient and reliable payment solutions to ensure seamless financial transactions. Easebuzz, a leading payment gateway platform, offers an array of features that streamline the payment process for enterprises and consumers alike. With an array of customizable options, Easebuzz ensures that businesses can securely handle various payment methods, enabling a smooth transaction experience.

One of the firms excelling in this integration is Infinity Webinfo Pvt. Ltd., a renowned IT service provider specializing in software solutions and website development. By partnering with Easebuzz, Infinity Webinfo Pvt Ltd ensures that its clients can easily implement robust and secure payment systems into their existing digital platforms.

Easebuzz API Integration by Infinity Webinfo Pvt. Ltd.

Easebuzz

Easebuzz is an Indian-based fintech company that offers a wide range of digital payment solutions designed to simplify online financial transactions for businesses. Catering primarily to small and medium enterprises (SMEs), Easebuzz provides an easy-to-use platform that enables businesses to manage their payments securely and efficiently. Here's a detailed breakdown of what Easebuzz offers and how it benefits businesses

Key Features of Easebuzz

Multiple Payment Options Easebuzz supports various payment methods, including:

Credit Cards

Debit Cards

UPI (Unified Payments Interface)

Net Banking

Mobile Wallets (Paytm, Google Pay, etc.)

Simple and Efficient API Integration Easebuzz provides well-documented APIs that enable businesses to easily integrate their payment gateway into websites, mobile apps, and other platforms. This allows for seamless payments, subscription management, and automated invoicing.

Subscription-Based Payment Models Easebuzz supports subscription billing, which is especially beneficial for businesses offering subscription services (e.g., SaaS platforms, streaming services, etc.). This feature automates recurring payments and reduces the manual effort involved in tracking renewals and invoices.

Security and Compliance Easebuzz ensures high levels of security with PCI-DSS (Payment Card Industry Data Security Standard) compliance and end-to-end encryption, ensuring that all transactions are secure. This includes safeguarding sensitive information like card details and personal data.

Automated Invoicing Easebuzz’s system allows businesses to generate automated invoices once payments are processed, streamlining the accounting process and reducing manual labor. This is especially useful for businesses dealing with a high volume of transactions.

Split Payments Easebuzz offers split payment functionality, allowing payments to be divided among multiple parties, which is crucial for businesses operating marketplaces, platforms with multiple vendors, or collaborative ventures.

Real-Time Analytics and Reporting Through its dashboard, Easebuzz provides businesses with real-time insights and reports on their transactions. This helps businesses track their sales, monitor transaction trends, and make data-driven decisions to improve their payment processes.

Easebuzz Services

Payment Gateway Easebuzz offers a core payment gateway solution that provides secure and reliable transaction handling. This gateway is equipped with the latest encryption protocols to ensure data security and helps businesses manage both domestic and international payments.

Payouts Easebuzz facilitates quick payouts for businesses, allowing them to transfer funds to employees, suppliers, or other stakeholders through its Payout service. It supports instant transfers via IMPS, NEFT, and RTGS.

Smart Links Easebuzz Smart Links allow businesses to create unique payment links that can be shared via email, SMS, or social media platforms. This makes it easy for businesses to collect payments without needing a dedicated website or app.

Subscription Management Easebuzz allows businesses to create, manage, and automate recurring billing processes with ease. This feature is beneficial for companies that operate on a subscription model, such as SaaS providers or content subscription platforms.

Vendor and Marketplace Management For businesses that operate in a marketplace environment, Easebuzz offers features like vendor management and split payments, helping automate complex financial transactions between multiple parties.

GST Invoicing and Compliance Easebuzz helps businesses comply with Indian tax regulations by offering built-in GST invoicing functionality. This allows businesses to manage their tax liabilities more effectively and automate tax calculations on invoices.

Industries That Benefit from Easebuzz

E-commerce: Easebuzz enables e-commerce platforms to accept a variety of payment methods, supporting faster checkouts and improved customer satisfaction.

Travel: Many travel portal use Easebuzz to booking and online payment for flight, rail, hotel, and many other services.

Education: Many educational institutions use Easebuzz to manage online payments for tuition fees, event registrations, and other charges.

Healthcare: Hospitals and clinics can use Easebuzz to process patient payments for medical services, making the payment process faster and more convenient.

SaaS Providers: SaaS companies can leverage Easebuzz’s subscription management features to automate billing cycles and provide customers with a seamless experience.

Nonprofits: NGOs and nonprofits can use Easebuzz’s payment gateway and Smart Links to collect donations efficiently and securely.

API Integration with Infinity Webinfo Pvt. Ltd.

Infinity Webinfo Pvt. Ltd. is a highly skilled IT development company known for its custom API integration services. The collaboration with Easebuzz allows Infinity Webinfo to offer end-to-end solutions for payment gateway integration. Here's how Infinity Webinfo leverages Easebuzz API integration to benefit businesses:

1. Simplified Payment Gateway Setup

With Easebuzz’s well-documented API, Infinity Webinfo provides easy-to-implement solutions for integrating payment gateways into websites, apps, and other digital platforms. The seamless integration ensures quick go-live for businesses, reducing the time to market and enabling them to accept payments instantly.

2. Customization and Flexibility

The Easebuzz API allows Infinity Webinfo to customize the payment experience for their clients. Whether it's altering the payment flow, branding the gateway as per the business, or ensuring region-specific payment options, Infinity Webinfo configures everything to suit the unique needs of each business.

3. Comprehensive Payment Solutions

Infinity Webinfo’s integration of Easebuzz extends beyond basic payments. They incorporate advanced features such as:

Subscription Payments: For businesses offering subscription-based services.

Split Payments: Useful for marketplace platforms where payments need to be divided among multiple stakeholders.

Invoice Generation: Automated invoice generation post-payment to streamline accounting.

4. Security and Compliance

By using the latest encryption technologies, Infinity Webinfo ensures that all transactions processed through Easebuzz are secure and compliant with global standards. This not only provides peace of mind for the business but also assures customers of safe and secure transactions.

Benefits of Integrating Easebuzz with Infinity Webinfo Pvt. Ltd.

1. Increased Conversion Rates

With the integration of multiple payment methods and a user-friendly interface, businesses can reduce cart abandonment and increase conversion rates. Infinity Webinfo’s expertise ensures a smooth checkout process, which leads to higher customer satisfaction and retention.

2. Real-Time Reporting and Analytics

Infinity Webinfo Pvt Ltd’s integration service provides businesses with access to detailed real-time reports via Easebuzz’s dashboard. This helps in monitoring transaction trends, optimizing payment workflows, and generating actionable insights for business growth.

3. 24/7 Technical Support

Businesses integrated with Easebuzz through Infinity Webinfo Pvt Ltd benefit from round-the-clock technical support. This ensures any issues related to payment processing are resolved swiftly, minimizing downtime and maintaining operational efficiency.

Conclusion

For businesses looking to enhance their payment processes, the Easebuzz API integration with Infinity Webinfo Pvt. Ltd. provides a comprehensive solution. The collaboration offers a highly customizable, secure, and efficient payment gateway integration service tailored to meet the unique needs of businesses. By streamlining payments and improving user experience, Infinity Webinfo helps businesses focus on growth while leaving the technical complexities of payment handling in capable hands.

In an era where digital payments are crucial for success, partnering with Infinity Webinfo Pvt. Ltd. for Easebuzz API integration ensures a reliable and future-proof solution.

For more details contact us now: - +91 9711090237

#easebuzz API Integration#Easebuzz#payment gateway api integration#payment gateway integration#Payment gateway#API Integration#infinity webinfo pvt ltd

0 notes

Text

The Best Merchant Account Services Providers in the year 2024

In the current financial climate, which is fast-paced choosing the best merchant account service provider is essential for all businesses. The merchant account allows customers to take credit or debit card transactions, which ensures the smoothest and most efficient payment experience for your clients. There are myriad of options to choose from you must select an account with a merchant service that is in line with your business demands. This article will provide a thorough overview of the most popular merchant account companies of 2024. It will highlight their best attributes and how they are different from the crowd of merchant account providers.

1. Square

Square is the preferred choice for small to medium-sized companies until 2024. It is renowned for its easy-to-use interface, and no charges for monthly usage, Square offers a transparent pricing system that includes a flat transaction cost. Square comes with a complimentary point-of-sale (POS) device, making it a popular option for companies who want to reduce upfront costs.

Principal Features:

There are no monthly charges or hidden costs

Integrated System for POS

Online store for free and billing tools

Advanced analytics and reporting

What makes it stand out: Square's all-in-one solution that includes hardware as well as software is a great option for companies looking for an intuitive system that does not require extra charges. Being one of the top provider of merchant services, its ease of use and affordability makes it a desirable choice.

2. PayPal Business

PayPal continues to be a leading market player in the processing market with its merchant accounts. services are highly respected. PayPal Business provides a secure and versatile option for companies who require both in-person and online payments processing. It is a firm believer in the security of transactions and preventing fraud, PayPal ensures safe and trustworthy transactions.

Principal Features:

Integration seamless with online shopping platforms

Robust fraud protection tools

Accepting payments in a range of currencies

Options for mobile phones

What makes it stand out: PayPal's global reach as well as its advanced security tools makes it a great choice for those with a large international client base. Easy integration with stores on the internet further makes it the best merchant account service.

3. Stripe

Stripe is gaining a lot of attention due to its user-friendly platform for developers and vast customisation choices. Perfect for companies with tech expertise or entrepreneurs, Stripe offers a range of functions that can be used by companies that operate online and also subscription-based services. The flexible API allows seamless integration into a variety of e-commerce system.

Principal Features:

Complete API to build customized payment solutions

Payment methods support for a variety of payment options which includes crypto

Subscription management and recurring billing

Advanced analytics and reportage

Why it stands out: Stripe's ability to deal with complex needs for payment and provide support for a vast array of payment options make it an ideal choice of tech-savvy businesses looking for an efficient payment solution that is tailored to their needs.

4. Adyen

Adyen is a leading global company that has earned its reputation for its robust system as well as its extensive global reach. Serving large corporations and businesses that are growing rapidly, Adyen offers a unified service for mobile, online and in-store transactions. The ease of handling trans-border transactions make an outstanding choice for global businesses.

Principal Features:

Payment solution integrated that works across every channel

Assistance for a broad range of payment options

Analytics and reporting in real-time

Global fraud prevention tools

What makes it stand out: Adyen's focus on providing a complete, unifying payments across every sales channel is an ideal option for companies with large global operations.

5. Worldpay

Worldpay is now a an integral part of FIS, is an established brand in the world of payments processing. It is known for its wide selection of payment services and its international coverage, Worldpay serves businesses of every size. The platform is compatible with a variety of different payment options and currencies, providing a flexible solution for companies with a variety of requirements for payment.

Principal Features:

Support for multiple payment methods

Global payments capabilities

Advanced tools to detect fraud

Reporting features that can be customized

Why it stands out: Worldpay's global reach and its wide array of payment services provide a viable option for companies looking to increase the flexibility and capacity to expand their processing.

6. Authorize.Net

Authorize.Net is a subsidiary of Visa has been praised by its security and reliability payments processing. The company offers a wide range of options, such as payments that are processed online or in person. Authorize.Net's easy-to-use interface as well as its strong customer service make it a preferred option for smaller to mid-sized companies.

The Key Features of HTML0:

Integration with different platforms for e-commerce

Complete fraud detection tools

Virtual terminals for telephone and mail purchase transactions

Analytics and detailed reporting

What Makes It Different: Authorize.Net's reliability and solid customer service make the company a top choice for merchant services suppliers. Their simple payment processing system is perfect for companies looking for reliability.

Conclusion

The choice of the correct merchant account provider could dramatically impact the performance of your business. Each of the highlighted providers--Square, PayPal Business, Stripe, Adyen, Worldpay, and Authorize.Net--offers unique features and benefits tailored to different business needs. If you're a smaller company looking for a low-cost solution, or you're a big company that requires a worldwide payment platform, these leading merchant account companies of 2024 provide a variety of choices to provide an easy and secure process for payment. Review your needs and those features that are most important to you to you, then choose the service which best fits the goals of your company.

0 notes

Text

GlidexPay: Simplifying Payments for Businesses in the Digital Era

In the digital age, where convenience and efficiency drive consumer choices, businesses must adopt reliable and secure payment systems to stay competitive. Whether you run an e-commerce store, offer digital services, or operate a subscription-based platform, the need for a robust payment gateway is non-negotiable. This is where GlidexPay comes into the picture—an advanced payment gateway designed to streamline transactions and foster trust between businesses and their customers.

The Growing Importance of Payment Gateways

As more businesses migrate online, the need for efficient and secure payment gateways has grown. Payment gateways bridge the gap between merchants and customers by facilitating smooth financial transactions over the internet. These systems not only authorize payments but also ensure that sensitive customer data, such as credit card information, is securely transmitted.

However, not all payment gateways are created equal. Customers expect seamless transactions, while businesses demand reliability, scalability, and security. A poor payment experience can lead to abandoned carts, lost sales, and dissatisfied customers. This makes selecting the right payment gateway critical for online businesses.

What is GlidexPay?

GlidexPay is a leading payment gateway solution that focuses on providing secure, quick, and user-friendly transaction processing for businesses of all sizes. With features designed to enhance both customer experience and business efficiency, GlidexPay offers more than just basic payment processing.

Features that Set GlidexPay Apart

Global Reach and Multi-Currency Support

One of GlidexPay’s standout features is its ability to process transactions in multiple currencies, making it easier for businesses to expand internationally. By allowing customers to pay in their local currency, GlidexPay removes a common barrier in cross-border commerce and helps businesses tap into new markets.

Seamless Integration

GlidexPay offers an easy-to-use API that allows developers to integrate it into websites, mobile apps, or e-commerce platforms with minimal effort. This seamless integration ensures businesses can start accepting payments quickly without long delays or technical headaches.

Security and Compliance

Security is at the heart of GlidexPay. It employs encryption, tokenization, and complies with the Payment Card Industry Data Security Standard (PCI DSS) to ensure that sensitive payment data is protected. Additionally, GlidexPay’s fraud detection system actively monitors transactions, flagging suspicious activities to prevent fraud before it occurs.

Mobile Optimization

With the rise of mobile commerce, it’s crucial for businesses to offer mobile-friendly payment solutions. GlidexPay ensures that customers can make payments on-the-go, providing a smooth user experience across all devices, whether desktop, tablet, or smartphone.

Recurring Billing for Subscription Models

For businesses that operate on a subscription model, GlidexPay’s recurring billing feature is a game-changer. It allows businesses to automate payments, reducing manual administrative work while ensuring consistent cash flow.

Real-Time Transaction Analytics

GlidexPay offers businesses a real-time dashboard that tracks transaction data, allowing merchants to monitor sales, identify trends, and optimize their payment strategies. This insight into customer behavior and payment preferences is invaluable for businesses aiming to improve their operations.

Exceptional Customer Support

Technical issues can arise at any time, and when they do, businesses need quick solutions. GlidexPay offers round-the-clock customer support, ensuring that businesses can get assistance when needed, minimizing downtime and ensuring smooth operations.

Why Businesses Choose GlidexPay

Increased Conversion Rates:

By offering a frictionless checkout process, GlidexPay helps businesses reduce cart abandonment and boost conversion rates. Customers can complete transactions with ease, knowing that their data is secure.

Scalability:

GlidexPay is built to grow alongside your business. Whether you're processing hundreds of transactions or millions, GlidexPay can scale effortlessly, offering the same reliability and speed.

Enhanced Customer Trust:

In an era of frequent data breaches, customers are more cautious than ever about sharing their financial information. GlidexPay’s commitment to security and transparency gives customers the confidence they need to complete their transactions.

Adaptable to Multiple Industries:

From retail and e-commerce to travel, hospitality, and digital services, GlidexPay caters to a wide array of industries. Its flexible features and customizable options make it an ideal choice for businesses across different sectors.

The Future of Payment Gateways with GlidexPay

As technology evolves, so do consumer expectations around payment solutions. GlidexPay is already at the forefront of integrating advanced technologies like Artificial Intelligence (AI) for fraud detection and Blockchain for enhanced security. Furthermore, with the growing adoption of cryptocurrencies, GlidexPay is preparing to introduce crypto-payment support, allowing businesses to accept digital currencies alongside traditional payment methods.

In the future, GlidexPay envisions even faster transactions, lower processing fees, and more personalized checkout experiences tailored to individual customers. By keeping pace with industry trends and maintaining its focus on security and user experience, GlidexPay is well-positioned to lead the charge in the next wave of payment gateway solutions.

Conclusion

In a digital-first world, businesses need a payment gateway they can rely on, and GlidexPay provides just that. With its commitment to security, seamless integration, and a suite of features designed to simplify online payments, GlidexPay is the go-to solution for businesses aiming to enhance their payment processes and improve customer experience. Whether you're a startup or an established enterprise, GlidexPay offers the tools and support you need to grow and succeed in the global market.

1 note

·

View note

Text

Introduction to Recurring Payments API Integration

Recurring payments API involve the automatic and regular billing of customers for goods or services they subscribe to. This model enables businesses to charge customers on a consistent schedule — monthly, quarterly, or annually — without manual invoicing.

It simplifies the payment process by eliminating the need for frequent reminders and reduces administrative effort for both businesses and customers.

0 notes

Text

Which Payment Gateways Are Compatible for Dynamic Websites - A Comprehensive Guide by Sohojware

The digital landscape is constantly evolving, and for businesses with dynamic websites, staying ahead of the curve is crucial. A dynamic website is one that generates content on the fly based on user input or other factors. This can include things like e-commerce stores with shopping carts, membership sites with customized content, or even online appointment booking systems.

For these dynamic websites, choosing the right payment gateway is essential. A payment gateway acts as a secure bridge between your website and the financial institutions that process payments. It ensures a smooth and safe transaction experience for both you and your customers. But with a plethora of payment gateways available, selecting the most compatible one for your dynamic website can be overwhelming.

This comprehensive guide by Sohojware, a leading web development company, will equip you with the knowledge to make an informed decision. We’ll delve into the factors to consider when choosing a payment gateway for your dynamic website, explore popular options compatible with dynamic sites, and address frequently asked questions.

Factors to Consider When Choosing a Payment Gateway for Dynamic Websites

When selecting a payment gateway for your dynamic website in the United States, consider these key factors:

Security: This is paramount. The payment gateway should adhere to stringent security protocols like PCI DSS compliance to safeguard sensitive customer information. Sohojware prioritizes security in all its development projects, and a secure payment gateway is a non-negotiable aspect.

Transaction Fees: Payment gateways typically charge transaction fees, which can vary depending on the service provider and the type of transaction. Be sure to compare fees associated with different gateways before making your choice.

Recurring Billing Support: If your website offers subscriptions or memberships, ensure the payment gateway supports recurring billing functionalities. This allows for automatic and convenient payment collection for your recurring services.

Payment Methods Supported: Offer a variety of payment methods that your target audience in the US is accustomed to using. This may include credit cards, debit cards, popular e-wallets like PayPal or Apple Pay, and potentially even ACH bank transfers.

Integration Complexity: The ease of integrating the payment gateway with your dynamic website is crucial. Look for gateways that offer user-friendly APIs and clear documentation to simplify the integration process.

Customer Support: Reliable customer support is vital in case you encounter any issues with the payment gateway. Opt for a provider with responsive and knowledgeable customer service representatives.

Popular Payment Gateways Compatible with Dynamic Websites

Here’s a glimpse into some of the most popular payment gateways compatible with dynamic website:

Stripe: A popular and versatile option, Stripe offers a robust suite of features for dynamic websites, including recurring billing support, a user-friendly developer interface, and integrations with various shopping carts and platforms.

PayPal: A widely recognized brand, PayPal allows customers to pay using their existing PayPal accounts, offering a familiar and convenient checkout experience. Sohojware can integrate PayPal seamlessly into your dynamic website.

Authorize.Net: A secure and reliable gateway, Authorize.Net provides a comprehensive solution for e-commerce businesses. It supports various payment methods, recurring billing, and integrates with popular shopping carts.

Braintree: Owned by PayPal, Braintree is another popular choice for dynamic websites. It offers a user-friendly API and integrates well with mobile wallets and other popular payment solutions.

2Checkout (2CO): A global payment gateway solution, 2Checkout caters to businesses of all sizes. It offers fraud prevention tools, subscription management features, and support for multiple currencies.

Sohojware: Your Trusted Partner for Dynamic Website Development and Payment Gateway Integration

Sohojware possesses extensive experience in developing dynamic websites and integrating them with various payment gateways. Our team of skilled developers can help you choose the most suitable payment gateway for your specific needs and ensure a seamless integration process. We prioritize user experience and security, ensuring your customers have a smooth and secure checkout experience.

1. What are the additional costs associated with using a payment gateway?

Besides transaction fees, some payment gateways may charge monthly subscription fees or setup costs. Sohojware can help you navigate these costs and choose a gateway that fits your budget.

2. How can Sohojware ensure the security of my payment gateway integration?

Sohojware follows best practices for secure development and adheres to industry standards when integrating payment gateways. We stay updated on the latest security protocols to safeguard your customer’s financial information.

3. Does Sohojware offer support after the payment gateway is integrated?

Yes, Sohojware provides ongoing support to ensure your payment gateway functions smoothly. Our team can address any issues that arise, troubleshoot problems, and provide updates on the latest payment gateway trends.

4. Can Sohojware help me choose the best payment gateway for my specific business needs?

Absolutely! Sohojware’s experts can assess your business requirements, analyze your target audience, and recommend the most suitable payment gateway based on factors like transaction volume, industry regulations, and preferred payment methods.

5. How long does it typically take to integrate a payment gateway with a dynamic website?

The integration timeline can vary depending on the complexity of the website and the chosen payment gateway. However, Sohojware’s experienced team strives to complete the integration process efficiently while maintaining high-quality standards.

Conclusion

Choosing the right payment gateway for your dynamic website is crucial for ensuring a seamless and secure online transaction experience. By considering factors like security, fees, supported payment methods, and integration complexity, you can select a gateway that aligns with your business needs. Sohojware, with its expertise in web development and payment gateway integration, can be your trusted partner in this process. Contact us today to discuss your requirements and get started on your dynamic website project.

1 note

·

View note

Text

Top Reasons to Adopt UPI Autopay for Efficiency | Paycorp

In today’s fast-paced world, managing recurring payments can be a hassle for both businesses and consumers. This is where UPI Autopay steps in as a game-changer. By adopting UPI Autopay, businesses can streamline payment processes, ensuring that recurring transactions are executed on time, every time, without manual intervention.

The convenience offered by UPI Autopay enhances customer satisfaction, as it eliminates the need for repeated payment authorizations. For businesses, it reduces the chances of payment delays, leading to a more predictable cash flow and improved financial planning. Additionally, UPI Autopay supports a wide range of payments, from subscription services to utility bills, making it a versatile solution for businesses of all sizes.

Security is another top reason to embrace UPI Autopay. With robust authentication measures and encrypted transactions, businesses and customers alike can trust that their payments are secure. This not only builds customer trust but also reduces the risk of payment fraud.

Adopting UPI Autopay is a strategic move for businesses looking to enhance efficiency, reduce operational costs, and provide a seamless payment experience to their customers. Make the switch today with Paycorp!

1 note

·

View note

Text

Unified API Platform for Enterprises | Smart ESB | Integration Platform - Bankcloud

Bankcloud s unified api platform is a true smart Enterprise service bus ESB platform to synchronize transactions and flow, It is a purposeful middleware, integrate once with BankCloud and platform takes care of all your thirdparty integrations

#Recurring payments api#Subscription api#Recurring api#automatic payment api#billing api#recurring billing api#recurring payment api integration#api recurring payments.

0 notes

Text

"Automate Billing: Boost Efficiency with Recurring Payments."

Unlock the power of automated billing with our seamless Recurring API integration. Simplify invoicing, improve cash flow, and enhance customer satisfaction. Get started today

#Recurring payments api#Subscription api#automatic payment api#billing api#recurring payment api integration

0 notes

Text

PhonePe API Integration by Infinity Webinfo Pvt Ltd: Revolutionizing Digital Payments in India

Introduction

In the rapidly evolving fintech landscape, digital payments are essential for businesses to offer seamless transaction experiences to customers. PhonePe, one of India’s leading payment platforms, has made it easier for enterprises to adopt its UPI-based payment solutions through API integrations. Infinity Webinfo Pvt Ltd, a prominent technology solutions provider, specializes in integrating the PhonePe API to enable businesses to harness the power of digital payments effectively.

PhonePe API Integration by Infinity Webinfo Pvt Ltd

What is PhonePe API Integration?

PhonePe API integration refers to the process of embedding PhonePe’s digital payment system directly into a business’s platform, such as a website or mobile app. This integration enables businesses to accept payments from customers through UPI (Unified Payments Interface), facilitating secure and instant transactions.

Infinity Webinfo Pvt Ltd takes this process a step further by ensuring that the integration is smooth, secure, and optimized for the best user experience. The PhonePe API integration provides businesses with a direct link to the UPI ecosystem, enabling faster and more efficient payments.

Why PhonePe API Integration Matters

Wide User Base: PhonePe has a large and growing user base across India. By integrating its API, businesses can tap into this vast customer base and offer a payment option that users are already familiar with and trust.

Instant Payments: UPI payments through PhonePe are instant, meaning there is no waiting period for fund transfers. This not only improves the customer experience but also ensures businesses receive their payments immediately, aiding cash flow management.

Improved Customer Convenience: By offering PhonePe as a payment option, businesses can reduce cart abandonment rates. Customers are more likely to complete their purchase if they can use a familiar and simple payment method.

Cost-Effective Solution: The PhonePe API operates with minimal transaction fees, making it a cost-effective solution for businesses that need to process a high volume of payments.

Support for Multiple Use Cases: The PhonePe API can be used for a variety of transactions, from one-time payments for goods and services to recurring transactions such as subscriptions. This versatility makes it suitable for businesses across industries, including e-commerce, retail, education, and entertainment.

Key Benefits of PhonePe API Integration by Infinity Webinfo Pvt Ltd

QR Code Payments: For businesses with physical storefronts, the PhonePe API allows for the generation of QR codes that customers can scan to make payments directly from their PhonePe app, simplifying the checkout process.

Auto payment Update: Auto payment in PhonePe allows users to set up recurring payments automatically for services like subscriptions, bill payments, or other scheduled payments. Instead of manually paying each time, PhonePe handles the payments at regular intervals, ensuring the service continues uninterrupted

Status check API: This API allows businesses to find out the current status of a payment by using the unique transaction ID (a code given to each payment). Business can see Updated Status instantly.Customers know right away if their payment was successful, reducing confusion or delays.

Seamless UPI Transactions: With PhonePe’s API, businesses can offer direct UPI payments, allowing customers to pay using their bank accounts with just a few clicks. This eliminates the need for intermediaries like wallets and ensures hassle-free transactions.

Faster Checkouts: One of the significant advantages of integrating PhonePe is the reduction in checkout time. Customers don’t have to enter card details or use multiple authentication steps, as UPI payments are processed instantly, ensuring a smooth purchasing experience.

Enhanced Security: PhonePe’s API comes with advanced security features such as multi-layer encryption, two-factor authentication, and compliance with RBI guidelines. Infinity Webinfo Pvt Ltd ensures that all integrations maintain the highest security standards, protecting both businesses and their customers from Pvt Ltd potential fraud.

Support for Multiple Platforms: Infinity Webinfo Pvt Ltd’s integration services support various platforms, including websites, e-commerce platforms, and mobile applications (both Android and iOS). This cross-platform support ensures that businesses can cater to a wide audience with minimal development effort.

Custom Solutions: Infinity Webinfo Pvt Ltd offers custom integration solutions, tailoring the PhonePe API to suit the specific needs of businesses. Whether it's an e-commerce platform, service provider, or retail outlet, the integration can be customized to ensure the best fit.

Merchant Dashboard: After the integration, businesses get access to a comprehensive merchant dashboard from PhonePe, where they can monitor transaction data, generate reports, and manage refunds. Infinity Webinfo Pvt Ltd provides support and training to ensure businesses can utilize this dashboard to its full potential.

Support for Recurring Payments: For businesses that rely on subscription models or recurring billing, Infinity Webinfo Pvt Ltd’s PhonePe API integration enables automated recurring payments through UPI. This is a great feature for SaaS platforms, OTT services, and other businesses with subscription-based revenue models.

Security and Compliance

Security is a top priority for PhonePe, and the API integration follows strict guidelines set by the Reserve Bank of India (RBI). The platform uses end-to-end encryption and secures tokenization methods to protect user data and ensure transaction integrity.

In addition to encryption, PhonePe requires multi-factor authentication for high-value transactions, further safeguarding the payment process. Businesses integrating PhonePe’s API must comply with data protection regulations and ensure that customer data is handled securely.

Advantages for Businesses

Increased Sales: By offering a trusted and widely used payment method like PhonePe, businesses can increase sales, especially among mobile users who prefer UPI transactions.

Enhanced Customer Trust: PhonePe’s strong brand and focus on security help build trust with customers, making them more likely to complete transactions.

Streamlined Operations: Automated reconciliation and real-time transaction tracking reduce the administrative burden on businesses, enabling them to focus on other aspects of their operations.

Scalable Payment Infrastructure: The API is designed to handle large transaction volumes, making it suitable for businesses of all sizes, from startups to large enterprises.

Steps in the PhonePe API Integration Process by Infinity Webinfo Pvt Ltd

Requirement Gathering and Analysis: Infinity Webinfo Pvt Ltd works closely with businesses to understand their specific requirements and ensure that the PhonePe API integration aligns with their business goals.

API Documentation Review: Infinity Webinfo Pvt Ltd’s team reviews PhonePe’s API documentation to ensure a clear understanding of the technical specifications required for seamless integration.

Development and Integration: The integration process involves embedding the PhonePe payment gateway into the website or app, ensuring compatibility with the existing platform.

Testing and Security Check: After development, Infinity Webinfo Pvt Ltd conducts rigorous testing to ensure the API is functioning correctly. This step includes security audits to ensure that all transactions are secure and compliant with regulatory standards.

Deployment and Support: Once the integration is successfully tested, Infinity Webinfo Pvt Ltd deploys the solution and provides ongoing support to address any issues or updates that may arise.

Impact of PhonePe API Integration on Businesses

Increased Conversion Rates: The simplicity and speed of UPI payments reduce cart abandonment and increase conversion rates, especially for e-commerce platforms.

Enhanced Customer Trust: PhonePe’s widespread adoption in India means customers trust the platform. By offering PhonePe as a payment option, businesses can increase trust among their customer base.

Improved Cash Flow: Instant UPI transactions improve cash flow, as businesses receive payments in real-time without delays, unlike traditional payment methods.

Conclusion

PhonePe API integration by Infinity Webinfo Pvt Ltd offers businesses an opportunity to streamline their payment processes, improve customer satisfaction, and enhance security. With its expertise in API integration, Infinity Webinfo Pvt Ltd ensures a hassle-free and secure payment experience that helps businesses stay competitive in the digital era. As UPI continues to dominate India’s digital payment space, partnering with experts like Infinity Webinfo Pvt Ltd ensures that businesses can fully leverage the advantages of PhonePe.

Contact Us On: - +91 9711090237

#PhonePe#PhonePe Payment Gateway#PhonePe Payment Gateway API Integration#Payment Gateway API Integration#api integration#infinity webinfo pvt ltd

0 notes

Text

Why Choose Stripe for Your Magento Store?

Stripe is a powerful and versatile payment processing platform that can significantly improve the functionality and efficiency of your Magento store. Choose Stripe for your Magento store and streamline payment processing for your customers.

One key reason to choose Stripe for your Magento store is its strong security measures. With built-in fraud prevention tools and digital encryption technology, you can rest assured that your customer’s sensitive information is safe and secure.

Stripe Offers an extensive array of payment solutions, enabling businesses to serve a broad spectrum of clientele. Accepting various payment methods, such as credit and debit cards, digital wallets, and local payment options, enhances the shopping experience for customers worldwide. By providing a seamless and inclusive payment process, Stripe can help you increase conversions and customer satisfaction in your Magento store.

1. Seamless Integration

Stripe offers seamless integration with Magento, allowing for easy setup and configuration. The Stripe Magento extension can be quickly installed and customized to meet your store’s needs.

2. Comprehensive Payment Options

Stripe supports different payment methods, including credit and debit cards, Apple Pay, Google Pay, and various local payment methods. This flexibility ensures that customers can use their preferred payment method, enhancing their shopping experience.

3. Global Reach

Stripe supports over 135 different currencies and payment options, simplifying international business growth. This extensive international coverage allows you to cater to customers worldwide without worrying about currency exchange or payment processing issues.

4. Advanced Security

Stripe strongly emphasizes security, providing robust fraud prevention tools and compliance with PCI DSS (Payment Card Industry Data Security Standard). This protects both your store and your customer’s payment information.

5. Developer-Friendly

Stripe is known for its developer-friendly APIs and extensive documentation. This simplifies the process for developers to create unique solutions and add extra features to your Magento store.

6. Transparent Pricing

Stripe offers transparent and straightforward pricing with no hidden fees. You only pay for what you use, making managing your budget and financial planning easier.

7. Comprehensive Dashboard

The Stripe dashboard provides comprehensive insights into your transactions, allowing you to monitor payments, track revenue, and manage disputes effectively. This centralized dashboard simplifies the management of your store’s financial operations.

8. Recurring Billing and Subscription Management

Stripe provides robust tools for managing recurring billing for stores offering subscription-based products or services. This includes handling subscription plans, invoicing, and automated payment retries, ensuring a smooth customer experience.

9. Fast Payouts

Stripe offers fast and flexible payout options, allowing you to receive your funds quickly. This enhances your cash flow and assists you in efficiently managing your business operations.

10. Continuous Innovation

Stripe constantly innovates and adds new features to its platform. By choosing Stripe, you benefit from the latest advancements in payment technology, ensuring your store stays competitive and up-to-date with industry trends.

Conclusion

Integrating Stripe with your Magento store can significantly enhance your payment processing capabilities, improve security, and provide a better overall customer experience. Whether you want to expand globally, offer various payment options, or manage subscriptions effectively, Stripe provides the tools and features necessary to help your Magento store succeed.

Choose Stripe for a reliable, secure, and innovative payment solution that provides a seamless experience for you and your customers.

#magento stripe#magento 2 stripe#stripe for magento 2#Stripe payment method#magento 2 stripe extension#stripe magento 2#stripe magento#magento stripe extension#Magento And Stripe#Magento 2 Checkout#magento 2 Stripe Integration#Stripe Integration#Stripe payment Integration

0 notes

Text

Top 10 Online Payment Gateways in Dubai, UAE

In the rapidly evolving digital economy of Dubai and the broader UAE, online payment gateways play a crucial role. They ensure secure, efficient, and seamless transactions for businesses and consumers alike. This guide explores the top 10 online payment gateways in Dubai, detailing their features, advantages, and suitability for various business needs.

1. Telr: Top Rated Online Payment Gateway in Dubai

Telr is a comprehensive online payment gateway known for its robust features and user-friendly interface. It caters to businesses of all sizes, from small startups to large enterprises.

Features

Multi-Currency Support: Telr supports multiple currencies, making it ideal for businesses with an international customer base.

Security: It employs advanced security measures, including PCI DSS compliance and fraud management tools.

Integration: Telr offers easy integration with popular e-commerce platforms and custom APIs for more tailored solutions.

Mobile Payments: It supports mobile payments, which is essential in a market with high smartphone penetration.

Advantages

User-friendly dashboard for easy transaction monitoring.

Competitive pricing with no setup fees.

Comprehensive customer support and detailed documentation.

2. PayTabs: Best Online Payment Gateway in Dubai

PayTabs is a leading payment gateway in the Middle East, renowned for its flexibility and wide range of services. It supports various payment methods, including credit and debit cards, and local payment options.

Features

Global Reach: Accepts payments in over 168 currencies and offers localized payment methods.

Security: High-level security protocols, including tokenization and 3D secure.

Integration: Provides plugins for major e-commerce platforms and APIs for custom integration.

Recurring Payments: Supports recurring billing, making it ideal for subscription-based businesses.

Advantages

Quick and easy setup process.

Extensive fraud prevention measures.

Multilingual customer support.

3. Skrill: Top Online Payment Gateway in Dubai

Skrill is an internationally recognized online payment gateway that offers both businesses and consumers a simple and secure way to make payments.

Features

Digital Wallet: Allows users to store funds in their Skrill wallet for quick payments.

International Transfers: Supports money transfers to bank accounts worldwide.

Security: Utilizes SSL encryption and two-factor authentication for enhanced security.

Integration: Compatible with various e-commerce platforms and provides APIs for custom setups.

Advantages

Fast and low-cost international money transfers.

User-friendly interface for both merchants and customers.

Wide acceptance across numerous online merchants.

4. Network International: Online Payment Gateway in Dubai

Network International is one of the largest payment solutions providers in the Middle East and Africa, offering comprehensive payment processing services.

Features

Multi-Channel Payments: Supports payments across various channels, including online, mobile, and point of sale (POS).

Advanced Analytics: Provides detailed transaction reports and analytics.

Security: Implements advanced fraud detection and prevention measures.

Integration: Seamless integration with various e-commerce platforms and APIs for custom solutions.

Advantages

Extensive experience and deep understanding of the regional market.

Strong relationships with local banks and financial institutions.

Robust and scalable payment solutions for businesses of all sizes.

5. PayFort: Best Online Payment Gateway in Dubai, UAE

Acquired by Amazon, PayFort is a prominent payment gateway in the Middle East, known for its reliability and comprehensive features tailored to the regional market.

Features

Multi-Currency and Multi-Language Support: Ideal for businesses operating in diverse markets.

Security: Uses advanced encryption and fraud protection technologies.

Analytics: Provides detailed analytics and reporting tools to monitor transactions.

Integration: Easy integration with popular e-commerce platforms and custom APIs.

Advantages

Backed by Amazon, ensuring reliability and innovation.

Strong focus on local payment methods and customer preferences.

Excellent customer support and resource availability.

6. Checkout.com: Online Payment Gateway in Dubai, UAE

Checkout.com is a global payment processing company offering innovative payment solutions with a strong presence in the Middle East.

Features

Unified Payments API: A single API that supports multiple payment methods and currencies.

Real-Time Data: Provides real-time reporting and data analytics.

Security: PCI DSS Level 1 compliance and advanced fraud prevention tools.

Global Reach: Supports international and local payment methods.

Advantages

High scalability, suitable for growing businesses.

Transparent pricing with no hidden fees.

Excellent customer service and technical support.

7. CC Avenue: Top Online Payment Gateway in Dubai, UAE

CC Avenue is a popular payment gateway in the UAE, known for its extensive features and easy integration.

Features

Multi-Currency Processing: Supports over 27 currencies.

Security: High-level security measures, including PCI DSS compliance and 3D secure.

Payment Options: Accepts credit cards, debit cards, net banking, and more.

Integration: Plugins for major e-commerce platforms and customizable APIs.

Advantages

Wide range of payment options.

Robust security features.

Comprehensive customer support.

8. Cybersource: Top Rated Online Payment Gateway in Dubai, UAE

Cybersource, a Visa company, provides secure and reliable payment solutions to businesses globally.

Features

Global Reach: Supports multiple currencies and payment methods.

Security: Industry-leading security protocols, including tokenization and fraud management.

Integration: Easy integration with major e-commerce platforms and APIs for custom solutions.

Analytics: Advanced analytics and reporting tools.

Advantages

Backed by Visa, ensuring high reliability and security.

Comprehensive fraud management tools.

Excellent scalability for businesses of all sizes.

9. Stripe: Top Online Payment Gateway Dubai

Stripe is a globally recognized payment gateway known for its developer-friendly APIs and robust feature set.

Features

Customizable Payment Flows: Highly flexible and customizable payment processing solutions.

Security: Advanced security measures, including PCI compliance and encryption.

Global Support: Supports payments in multiple currencies and various payment methods.

Integration: Easy integration with popular e-commerce platforms and custom APIs.

Advantages

Extensive documentation and developer support.

Transparent pricing with no hidden fees.

Wide range of features suitable for various business models.

10. CashU: Best Online Payment Gateway Dubai

CashU is a leading online payment gateway in the Middle East and North Africa, offering convenient and secure payment solutions.

Features

Prepaid Cards: Allows users to make payments using prepaid cards.

Security: High-level security measures to protect user data.

Integration: Easy integration with e-commerce platforms and custom APIs.

Localization: Supports local payment methods and currencies.

Advantages

Widely accepted in the Middle East and North Africa.

Convenient prepaid card system.

Strong focus on security and user convenience.

Conclusion

In the dynamic digital landscape of Dubai and the UAE, selecting the right online payment gateway is crucial for business success. Each of the top 10 payment gateways discussed in this guide offers unique features and advantages tailored to various business needs. Whether you are a startup looking for a cost-effective solution or a large enterprise seeking robust and scalable payment processing, there is a gateway on this list that can meet your requirements. By understanding the features, advantages, and integration capabilities of these gateways, businesses can make informed decisions and ensure seamless, secure, and efficient payment processing for their customers.

0 notes

Text

Integrate Our UPI Collection API

Are you looking to integrate UPI payments into your business? Look no further! Rainet Technology Private Limited is here to provide you with the best UPI Collection API solution. Whether you run an e-commerce store, a subscription-based service, or any other type of online business, our API will enable seamless and secure UPI payment integration. In this blog post, we will explore what makes Rainet Technology the first choice for integrating UPI payments and how our features can benefit your business. So let's dive in and discover how Rainet can help simplify your payment processes!

What is the UPI Collection API?

What is the UPI Collection API?

UPI stands for Unified Payments Interface, a revolutionary payment system in India that allows users to transfer money instantly between different bank accounts through their mobile phones. UPI has gained immense popularity due to its convenience and ease of use.

Now, imagine integrating this powerful payment method into your own business operations. This is where the UPI Collection API comes into play. The UPI Collection API enables businesses to accept payments from customers directly into their bank accounts using the UPI platform.

With Rainet Technology's UPI Collection API, you can seamlessly integrate this payment solution into your website or application. By leveraging our robust and secure API, you can provide your customers with a hassle-free way to make payments using their preferred mode - UPI.

Our API ensures smooth transaction processing, real-time notifications for successful payments, and easy reconciliation of transactions. It also supports various features like QR code-based payments, recurring billing options, and customizable payment flows tailored to suit your business requirements.

By implementing the Rainet Technology's UPI Collection API, you can enhance the customer experience on your platform while streamlining your payment processes. So why wait? Let's explore how Rainet Technology Private Limited can be the perfect partner for integrating UPI payments into your business!

Why is Rainet Technology Private Limited the first choice for you?

Rainet Technology Private Limited is the first choice for businesses looking to integrate UPI Collection API. With our extensive experience in the field of payment gateways and APIs, we have established ourselves as a trusted provider.

One of the key reasons why Rainet should be your go-to option is our seamless integration process. We understand that time is of the essence for businesses, and our team ensures a smooth and hassle-free integration of UPI Collection API into your existing systems.

Another feature that sets us apart is our commitment to security. We prioritize data protection and employ robust encryption techniques to safeguard sensitive information during transactions. You can rest assured knowing that your customers' data will be safe with us.

In addition, Rainet offers flexible customization options for businesses. We understand that every organization has unique requirements, and our team works closely with you to tailor solutions that align with your specific needs.

Furthermore, Rainet provides comprehensive customer support throughout the integration process and beyond. Our dedicated team is available round-the-clock to address any queries or concerns you may have.

Choose Rainet Technology Private Limited as your partner for UPI API integration and unlock new possibilities for seamless payments within your business ecosystem!

What features do we provide?

At Rainet Technology Private Limited, we provide a range of powerful features with our UPI Collection API to help streamline and enhance your business operations. With our API integration, you can easily accept UPI payments from your customers and enjoy seamless transactions.

One of the key features we offer is real-time payment notifications. You will receive instant alerts whenever a payment is made through UPI, allowing you to keep track of all transactions in real-time. This ensures that you never miss out on any payments and allows for efficient reconciliation.

Our API also supports multiple payment modes, giving your customers the flexibility to choose their preferred method of making payments. Whether it's through QR codes or deep linking, our integration offers a user-friendly experience for both you and your customers.

Security is always a top priority for us. That's why our UPI Collection API utilizes advanced encryption protocols to safeguard sensitive customer data during every transaction. Rest assured that your customers' information will be protected at all times.

Furthermore, we understand the importance of customization in meeting the unique needs of different businesses. Our API provides extensive customization options so that you can tailor the user interface according to your branding requirements and create a seamless experience for your customers.

With these features and more, Rainet Technology Private Limited stands as an ideal choice when it comes to integrating UPI collection APIs into your business operations. Experience hassle-free transactions and enhanced customer satisfaction with our reliable services!

Why Choose us?

1. Expertise and Experience: At Rainet Technology Private Limited, we have a team of highly skilled professionals who have extensive experience in UPI integration API development. We stay up-to-date with the latest trends and technologies to provide you with the most reliable and efficient solutions.

2. Seamless Integration: Our UPI collection API is designed to seamlessly integrate into your existing systems, making it easy for you to start accepting UPI payments quickly. We offer comprehensive documentation and support throughout the integration process, ensuring a smooth transition for your business.

3. Security: We understand the importance of securing sensitive customer data during payment transactions. That's why our UPI integration API follows strict security protocols to ensure that all transactions are encrypted and protected against unauthorized access.

4. Customization Options: Every business has unique requirements when it comes to payment processing. With our UPI collection API, you can customize the solution according to your specific needs, whether it's adding additional features or integrating with other payment gateways.

5. Competitive Pricing: We believe in providing affordable solutions without compromising on quality or functionality. Our pricing plans are flexible and tailored to suit businesses of all sizes, allowing you to get the best value for your investment.

When it comes to UPI integration API services, Rainet Technology Private Limited stands out as a trusted partner that offers expertise, seamless integration, top-notch security measures, customization options, and competitive pricing options - everything you need for successful implementation of UPI payments in your business operations.

Visit Website: https://rainet.co.in/upi-collection-api.php

#upi integration api#upi api integration#upi payment gateway#paytm upi integration api#upi integration#upi payment gateway integration#app development#app developer#mobile app developer#android app developer#ios app developer#software development company#bbps login#bbps#bbps api provider#esc norway#education portal development company

0 notes

Text

The Ultimate Guide to Managing Freelance Income

Escape the corporate grind. Freelancing lets you run the show, set flexible hours, and work where you want! Ditching the commute saves time and money. Income scales infinitely higher without soul-crushing cubicle ceilings.

Think about all those mad skills and industry knowledge you've built up over the years at your job. As a freelancer, you can start monetising that expertise directly by offering your services to clients. Writers, developers, designers, consultants - the possibilities are endless.

Need to make extra cash this month? That is no problem; just hustle up and stack more clients.

Getting Loans

Making that jump to full-time freelancing? It's scary if you don't have savings built up. How do you pay bills without a steady paycheck while building the business?

Enter Personal Loans

This is where short-term unsecured personal loans can help. These loans give you cash to cover living costs. They create a financial runway as you get freelancing off the ground.

Build Your Safety Net

Use a personal loan for 6-12 months of living expenses. This buys you time to find great clients, so you won't rush into bad gigs out of desperation.

Less Stress

Having this safety net makes the career shift way less stressful. No panic about draining savings too fast. You can be picky about finding ideal work.

A short-term personal loan provides temporary cash flow, unlocking the flexibility to pursue freelancing with lower risk. Once freelance income is steady, plan out loan repayment.

Budgeting for Freelancers

As a freelancer with varying monthly income, budgeting calls for flexibility rather than fixed amounts. With unpredictable cash flow tied to fluctuating assignments, adapt your spending strategy month-to-month accordingly.

Apps and auto-transfers can make this uneven budgeting way easier. Set recurring transfers to automatically funnel portions of each payment into separate expense, tax, and savings buckets.

Freelancing offers incredible income potential and lifestyle freedom. But it requires adopting smart financial habits around budgeting, taxes, and security funds. With some diligence, you can make your money work smarter while pursuing your passion projects.

Planning for Taxes

Unlike regular employees, freelancers don't have taxes automatically withheld from payments. So, quarterly tax planning is a must to avoid penalties and surprises. A good rule is setting aside 25-30% of each payment to cover federal and state income taxes.

To simplify:

Create a dedicated "taxes" savings account for stockpiling those funds as you earn.

Better yet, pay your estimated quarterly taxes as income arrives so you're never behind.

Be diligent about recording all payments received and eligible expenses, too.

CPA Assist

If handling freelance taxes stresses you out, consider hiring an accountant. A skilled CPA can ensure you maximise deductions and make accurate quarterly payments to stay compliant.

Building an Emergency Fund

The unpredictable nature of freelancing brings sporadic work and pay. Savings to cover 3-6 months of bills allow breathing room when assignments dwindle. Emergency funds prevent stress when managing inconsistent contracts and variable monthly earnings. Smart planning conquers freelance income feasts and famines.

Security Net

This cash buffer buys flexibility and peace of mind. If you hit a dry spell with low billables for one month, you can pay essential bills from your emergency fund instead of going into debt. It prevents having to accept low-paying gigs out of desperation, too.

The Right Savings Tool

While building this vital fund, make sure you're storing that accessible cash but still earning you something. High-yield online savings accounts are an excellent option for parking emergency reserves and earning a risk-free APY.

Managing Invoices and Payments

As a freelancer, getting paid properly and on time is the name of the game. You live and die by that cash flow, so having a tight, professional invoicing system is crucial.

The Invoice 101

Your invoices need to clearly state the total amount owed, the due date, accepted payment methods, and any late fees. Having an organised numbering system to track invoices also helps.

Tech Helpers

Creating invoices manually is a hassle. Using invoicing software like FreshBooks or Wave makes it way more efficient. You can generate polished invoices, automatically track payments, and send late payment reminders.

Short-Term Loans

Need some temporary cash flow? Short-term unsecured personal loans can provide it. These loans don't require collateral, just a credit check. You get a lump sum to cover expenses. Then, you repay with interest over a set timeframe, usually under a year. Perfect for bridging income gaps or funding emergencies in a pinch. Just be mindful of higher interest rates and budgeting for those monthly payments.

Conclusion

Just know that managing your variable income streams requires a major mindset shift. Without a regular paycheck, budgeting and saving have to be on point since your monthly income can fluctuate heavily.

One solid technique is paying yourself an "employee" salary first from the monthly money you're billing clients. You'd set aside a modest but consistent amount upfront to cover personal expenses. Any extra on top goes straight into savings and investments. It creates a reliable baseline.

The hustle is real when you first build up that client base from scratch. But once you hit your stride as a freelancer? That freedom and income upside is life on another level. Just stay disciplined and be smart about managing your finances!

Meta Description

Learn effective strategies to manage your freelance income. Master budgeting, taxes, and financial planning to thrive as a freelancer and become successful.

For more information about no guarantor loans, loans without guarantor, loans no guarantor visit our website - https://www.getloansnow.co.uk/

Our Contact Address:

150 Bath Street, Glasgow, United Kingdom

150 Bath St, Glasgow G2 3ER, UK

Mobile: +44-1613940083

Email: [email protected]

0 notes