#sebi online course

Text

Unlock Success with Our SEBI Online Course: Master Compliance & Regulations Today!

Navigate the complexities of SEBI regulations with ease through our specialized online course. Gain mastery over compliance, understand market dynamics, and propel your career forward. Enroll now and seize the opportunity to excel in the financial realm! get SEBI online course with video lessons, live classes, and descriptive mock tests.

0 notes

Text

Explore comprehensive online stock market courses designed for beginners, investors, and traders. Boost your trading skills with expert guidance from SEBI-registered Research Analyst Sandeep Wagle’s in-depth equity market programs. Tailored for all levels, these courses cover essential strategies to help you succeed in the stock market.

0 notes

Text

Best Stock Market Course In India

ISMT INSTITUTE OF STOCK MARKET TRAINING is one of the best stock market course in India (Varanasi) which provide a wide list of stock market courses of NSE, BSE, SEBI, NCFM, and NISM modules for smart investment, trading, data analysis, and research. Best Stock Market Course In India provide modules from Basic to Pro level in the share market course in Varanasi.

With over 15 years of experience as a professional in domestic and international Stock Market Training, Trading & Investment. We strive to help students for career opportunities and 100 % job placement in the stock market and professionals to achieve their career goals and aspirations in trading.

Our faculty consists of a group of brilliant minds, with a wide array of experience in Share Market Training & Trading Classes in Varanasi, India.

The success stories of our graduates speak volumes about the effectiveness of our training programs. Many have gone on to achieve remarkable success in the stock market, attributing their accomplishments to the solid foundation they received at ISMT.

Join ISMT INSTITUTE OF STOCK MARKET TRAINING, where excellence meets opportunity. Enroll Now in the best stock market course in India (Varanasi) and embark on a journey toward financial mastery and success. Your future in the stock market starts here.

Visit Website: https://ismt.in/

Instagram:

#stock market courses#stock market#stock market institute#stock market training#stock market tips#stock market trading#ismt#learnfromismt#stock market career#share market#best stock market course in india#stock market course in varanasi#stock market varanasi#trading tick call vs put#ismtinstitute#ismtcourses#ismt varanasi#share market course in varanasi

0 notes

Text

What Are the Basics of a Stock Market Course?

The stock market is a dynamic and exciting world, but for beginners, it can also be intimidating. A Stock Market Course is the best way to gain the knowledge and confidence needed to start investing wisely. Whether you're just starting or looking to deepen your understanding, this blog will guide you through the basics of a stock market course and how it can be your key to success in trading and investing.

This comprehensive guide covers the essential elements of a stock market course, including its importance, what you can expect to learn, and the various formats like stock market courses for beginners or advanced coaching options. We will also touch on courses specific to India and answer common questions in a simple, easy-to-read format.

1. What is a Stock Market Course?

A Stock Market Course is a structured educational program designed to teach you the fundamentals of investing and trading in the stock market. It covers various aspects, such as:

Stock Market Basics: Understanding how the stock market works, including terminology like stocks, shares, and indices.

Investment Strategies: Learning different approaches like long-term investing, day trading, or swing trading.

Risk Management: Teaching you how to protect your investments by minimizing risks.

A well-rounded course gives you the tools and knowledge needed to navigate the complex world of stock trading.

2. Stock Market Course Online: Learning Anytime, Anywhere

The convenience of a stock market course online is one of its biggest advantages. Online courses offer flexibility, allowing you to learn at your own pace, whether you’re a student, working professional, or someone with a busy schedule.

Here’s what makes online courses a popular choice:

Flexible Learning Schedule: You can complete lessons and assignments at your convenience, without being tied to a strict timetable.

Access to a Global Audience: Online platforms provide courses that are accessible worldwide, meaning you can learn from top educators no matter where you're located.

Interactive Learning Tools: Many online courses come with quizzes, forums, and webinars to make learning interactive and engaging.

Choosing an online Stock Market Course allows you to tailor your learning experience based on your lifestyle and commitments.

3. Stock Market Courses for Beginners: Building the Foundation

If you’re new to the stock market, enrolling in a stock market course for beginners is a smart way to start. These courses are designed with newcomers in mind and focus on building a strong foundation. Here’s what beginners will learn:

Introduction to Stock Markets: Understanding the stock market’s role in the economy, how stocks are bought and sold, and what drives stock prices.

Types of Stocks and Investments: Learn about different types of stocks such as blue-chip, growth, and dividend stocks. You’ll also explore investment vehicles like mutual funds and ETFs.

Basic Financial Analysis: Gain insights into how to read a balance sheet, income statement, and other financial reports.

Developing Your Investment Plan: Beginners will also learn how to create an investment strategy based on goals, risk tolerance, and time horizon.

By the end of a beginner’s course, you’ll have a solid understanding of the stock market and be ready to start your investing journey.

4. Stock Market Course in India: Focusing on the Indian Market

The stock market operates differently in each country, and for those specifically interested in the Indian stock market, a stock market course in India is the best fit. Here’s why it’s important to choose a course that focuses on the local market:

Indian Stock Exchanges: You’ll learn about the Bombay Stock Exchange (BSE) and National Stock Exchange (NSE), the two major stock exchanges in India.

Indian Regulations and Taxation: The course will cover regulations by SEBI (Securities and Exchange Board of India) and help you understand the tax implications of trading in India.

Indian Market Trends: Learn about local economic indicators, industry-specific trends, and the impact of government policies on stock prices.

A stock market course in India helps you focus on the intricacies of the local market, making it easier to apply your learning to the real world.

5. The Role of Stock Market Coaching: Personalized Learning

For those looking for more personalized learning, stock market coaching is an excellent option. Coaching provides a more hands-on approach and offers guidance tailored to your specific needs. Here are some benefits of stock market coaching:

One-on-One Guidance: Work with a mentor who can provide personalized advice and answer your specific questions.

Live Trading Sessions: Some coaching programs offer real-time trading experiences, allowing you to practice your skills under expert supervision.

Customized Learning Path: Your coach will design a learning plan that suits your goals and current knowledge level.

While coaching is typically more expensive than regular courses, it’s an investment that can significantly accelerate your learning.

6. Key Topics Covered in a Stock Market Course

Here’s a list of key topics that are usually covered in a Stock Market Course:

Stock Market Terminology

Understanding Indices like Nifty and Sensex

The Role of Brokers and Trading Platforms

How to Buy and Sell Stocks

Types of Orders: Market Order, Limit Order

Fundamental vs Technical Analysis

Risk Management and Diversification

The Importance of Market Sentiment

By covering these topics, a Stock Market Course ensures that you have a complete understanding of how the market functions and how to make informed decisions.

7. Tips for Choosing the Right Stock Market Course

When selecting a Stock Market Course, there are a few factors you should keep in mind:

Course Content: Ensure the course covers both theoretical and practical aspects of stock trading.

Reputation of the Educator: Research the institution or individual offering the course. Look for reviews and testimonials from past students.

Certification: Check if the course provides a certificate of completion, which can be useful when applying for jobs or building credibility as an investor.

Affordability: Compare course fees and check if they provide value for money.

Following these steps will help you choose the right course that aligns with your career goals and learning style.

FAQs About Stock Market Courses

Q1: Can I take a stock market course online?

Ans: Yes, there are many stock market courses online that allow you to learn at your own pace and convenience. These courses are great for beginners and advanced learners alike.

Q2: What should I expect in a stock market course for beginners?

Ans: A stock market course for beginners typically covers the basics of investing, how the stock market operates, and introduces you to essential strategies for trading.

Q3: Is there a stock market course specific to India?

Ans: Yes, a stock market course in India focuses on the Indian stock exchanges, regulatory environment, and investment options unique to the Indian market.

Q4: What are the benefits of stock market coaching?

Ans: Stock market coaching offers personalized mentorship, real-time market experience, and customized learning paths to accelerate your progress.

Q5: How long does it take to complete a stock market course?

Ans: The duration of a stock market course can vary from a few weeks to several months, depending on the depth of the material and your pace of learning.

Conclusion

A Stock Market Course is an essential tool for anyone looking to start or advance their career in trading and investing. Whether you're learning through a stock market course online, exploring stock market courses for beginners, or opting for personalized stock market coaching, choosing the right course can make a significant difference in your investment journey. By understanding the basics, preparing with the right resources, and staying committed to learning, you can navigate the stock market with confidence and skill.

0 notes

Text

Top Resources for Preparing for Financial Sector Exams

Preparing for financial sector exams, such as those conducted by RBI, SEBI, NABARD, and IFSCA, requires a strategic approach. These exams are highly competitive, demanding a strong foundation in financial concepts, regulatory frameworks, and analytical skills. To stand out and succeed, having access to the right resources is key.

For those aiming to appear for the IFSCA exam, enrolling in the IFSCA Grade A course is a smart move. This course provides in-depth material on financial regulations, international banking, and other areas critical to the exam. It also offers structured guidance, mock tests, and expert support to help you prepare effectively.

Here are some top resources that can enhance your preparation for financial sector exams:

1. Official Websites and Notifications

Staying updated with the official websites of regulatory bodies is essential for understanding the latest exam patterns, syllabi, and announcements. Some of the key websites include:

RBI (Reserve Bank of India): rbi.org.in

SEBI (Securities and Exchange Board of India): sebi.gov.in

IFSCA (International Financial Services Centres Authority): ifsca.gov.in

Regularly check these websites for notifications regarding exams, guidelines, and any changes in regulations.

2. Standard Textbooks and Study Guides

A strong understanding of financial theory and regulatory practices is crucial for these exams. Some recommended books include:

Indian Economy by Ramesh Singh: This book covers essential economic concepts and is helpful for understanding both micro and macroeconomics, a common subject in financial exams.

Banking Awareness by Arihant Experts: A go-to guide for banking and financial awareness, which is a major section in most regulatory exams.

Financial Markets and Institutions by Mishkin and Eakins: This book offers detailed insights into the workings of financial markets and institutions, which is relevant for both theoretical and practical questions in exams.

3. Mock Test Series and Practice Papers

Mock tests are vital for assessing your preparation and improving your time management skills. They help simulate the actual exam environment and provide practice for handling complex questions under pressure. Several platforms offer quality mock test series:

EduTap: This platform provides a wide range of mock tests tailored for regulatory exams like RBI Grade B, SEBI, and IFSCA Grade A. Their tests are updated regularly and reflect the latest exam patterns.

Oliveboard: Known for its comprehensive test series, Oliveboard offers full-length mock tests, section-wise tests, and analysis of performance for continuous improvement.

4. Online Courses and Video Lectures

Online platforms offer valuable courses and video lectures designed specifically for financial sector exams. These resources provide expert insights and detailed explanations of key topics, which are often challenging to grasp through self-study alone.

IFSCA Grade A course by EduTap: This specialized course provides comprehensive study materials, detailed video lectures, and mock tests focused on the IFSCA exam. It covers all critical topics such as financial regulations, international banking, and risk management.

Unacademy: Offers live classes, recorded sessions, and personalized mentorship for a wide range of financial sector exams.

5. Current Affairs and Financial News

Being aware of current financial and economic developments is crucial for excelling in the general awareness section of the exams. Some top sources for staying updated include:

The Economic Times: A leading business newspaper providing the latest updates on the financial sector.

Business Standard: Offers detailed analysis of economic policies and their impact on the market.

PIB (Press Information Bureau): An official government source that shares important announcements, policies, and updates on the economy and financial sector.

6. YouTube Channels and Free Resources

There are several YouTube channels that provide free study resources, crash courses, and exam strategies. Some popular channels include:

StudyIQ: Provides lectures on economics, finance, and current affairs, all relevant to financial sector exams.

EduTap: Offers free video lectures and exam tips that complement their paid courses, making it a valuable resource for aspirants.

Conclusion

To excel in financial sector exams, it's essential to have a clear study plan and access to the best resources. From textbooks and mock tests to online courses and current affairs, each resource plays a vital role in your preparation. The IFSCA Grade A course is particularly beneficial for those preparing for IFSCA exams, as it provides focused and structured guidance. With the right combination of resources and consistent effort, you can confidently tackle financial sector exams and achieve success in your career aspirations.

1 note

·

View note

Text

Welcome to Traders Platform, best Share market Classes in Nerul at your premier destination for mastering the intricacies of the stock market from foundational principles to advanced stock market trading strategies.With over 8 years of dedicated experience in our stock market and trading course, we’ve empoweredover 1000 students, witnessing countless life-changing transformations along the way. As a SEBI registered and NISM certified broker, Traders Platform stands as India’s foremost stock market tradingtraining center and share market trading classes in Navi Mumbai.

We provide a wide range of comprehensive, best online courses on stock trading for beginner and seasoned traders as well. Positional trading, swing trading, short-term trading, and investment theoryfor stocks, options, futures, commodities, and currencies are just a few of the many asset classes and trading techniques that are covered in these best online stock trading courses. We teach tried-and-true methods and strategies in our Options trading classes, Forex market trading classes, and Crypto market trading classes—all of which are crucial for successful trading and investing—under the direction of a qualified trainer with over eight years of practical expertise in the financial markets. Our focus including risk management, trading fundamentals, advanced technical analysis, and real-world application of strategies cater to individuals seeking trading classes Mumbai. You can register and learn about stock market trading with us by connecting us on +91 9619908688 or mail us your queries at [email protected].

0 notes

Text

NISM Certification Courses

ICFM (Institute of Career in Financial Market) is a leading institution that offers specialized courses in the financial sector, including the (National Institute of Securities Markets) NISM certification courses. NISM certifications are highly valued in the financial industry, as they are mandated by the Securities and Exchange Board of India (SEBI) for professionals who wish to work in various capacities in the securities market, such as mutual funds, derivatives, research analysis, and investment advisory. ICFM provides a range of NISM certification courses tailored to meet the needs of individuals looking to build a career in finance or enhance their professional skills. These courses are designed to provide a deep understanding of various financial products, regulatory frameworks, market operations, and investment strategies, thereby equipping participants with the knowledge required to excel in the industry.

ICFM’s approach to training is comprehensive, combining theoretical knowledge with practical insights, and is delivered by experienced market professionals. This ensures that learners gain a robust understanding of the subject matter and are well-prepared for the NISM exams. The institute also provides flexible learning options, including classroom sessions, online courses, and weekend batches, catering to the diverse needs of working professionals and students. Additionally, ICFM offers extensive support through study materials, mock tests, and personalized guidance, which greatly enhances the chances of passing the NISM exams. With a strong focus on quality education and practical application, ICFM has established itself as a reputable provider of NISM certification courses, helping countless individuals achieve their career goals in the financial sector.

#NISM Certification Courses#NISM Certification Courses near me#Nism certification courses online#NISM certificate course syllabus#Best nism certification courses

0 notes

Text

NISM Certification: A Pathway to Excellence in the Securities Market

The National Institute of Securities Markets (NISM) is an educational initiative by the Securities and Exchange Board of India (SEBI), dedicated to enhancing the quality of intermediaries in the Indian securities market. Established in 2006, NISM offers a range of certifications that are essential for professionals in the financial and securities sectors. These certifications aim to improve the knowledge, skills, and ethical standards of individuals involved in various aspects of the securities market. This article provides an in-depth look at NISM certification, their significance, preparation strategies, and tips for success.

Overview of NISM Certifications

NISM certifications cover a wide array of topics relevant to the securities market, catering to different professional needs. Some of the prominent certifications include:

1. **NISM Series I: Currency Derivatives Certification**

This certification is designed for professionals involved in trading or dealing in currency derivatives. It covers the basics of currency markets, derivative products, trading strategies, and regulatory frameworks.

2. **NISM Series V-A: Mutual Fund Distributors Certification**

Targeted at mutual fund distributors and agents, this certification focuses on mutual fund products, distribution practices, and regulations. It is mandatory for individuals selling mutual funds in India.

3. **NISM Series VIII: Equity Derivatives Certification**

This certification is intended for individuals dealing in equity derivatives. It encompasses topics such as the characteristics and applications of derivatives, trading strategies, and regulatory guidelines.

4. **NISM Series XII: Securities Markets Foundation Certification**

A foundational certification for those new to the securities market, it provides an overview of the financial markets, including equity, debt, derivatives, and mutual funds.

5. **NISM Series XV: Research Analyst Certification**

This certification is designed for individuals working as research analysts. It covers the fundamental principles of research analysis, financial statement analysis, and ethical considerations.

Importance of NISM Certification

Regulatory Compliance

NISM certifications are often mandated by SEBI for various roles within the securities market. Holding these certifications ensures compliance with regulatory requirements, which is crucial for both individuals and organizations.

Enhanced Knowledge and Skills

NISM certifications provide comprehensive knowledge and practical skills relevant to the securities market. They help professionals stay updated with the latest developments, products, and regulations, thereby enhancing their competence and performance.

Career Advancement

NISM certifications are recognized and respected in the financial industry. They open up opportunities for career advancement, higher responsibilities, and better job prospects. Certified professionals are often preferred by employers for their demonstrated expertise and commitment to ethical practices.

Professional Credibility

Earning an NISM certification adds to the professional credibility of individuals. It signifies a commitment to continuous learning and adherence to industry standards, which can build trust with clients, employers, and peers.

Preparing for NISM Certification

Understand the Syllabus

A thorough understanding of the syllabus is essential for effective preparation. NISM provides detailed study materials and practice tests for each certification. Candidates should familiarize themselves with the topics covered and focus on understanding the key concepts.

Study Material

NISM’s official study material is comprehensive and designed to cover the syllabus in detail. Additionally, candidates can refer to supplementary resources such as books, online courses, and practice exams to enhance their understanding and preparation.

Practice and Revision

Regular practice through mock tests and previous years’ question papers is crucial for success. It helps candidates assess their preparation level, identify weak areas, and improve their time management skills. Revision is equally important to reinforce concepts and ensure retention.

Time Management

Effective time management is key to balancing study with work commitments. Creating a realistic study schedule and adhering to it can help candidates cover the syllabus systematically without feeling overwhelmed.

Tips for Success

Start Early

Starting preparation early gives candidates ample time to understand the concepts, practice regularly, and revise thoroughly. It also reduces last-minute stress and allows for a more relaxed approach to the exam.

Focus on Concepts

Rather than rote learning, candidates should focus on understanding the underlying concepts. This approach not only helps in answering questions accurately but also in applying knowledge practically in their professional roles.

Stay Updated

The securities market is dynamic, with constant changes and updates. Keeping abreast of the latest developments through news, industry publications, and continuous learning is essential for success in NISM exams and professional life.

Join Study Groups

Joining study groups or online forums can provide additional support and motivation. Discussing topics with peers can lead to better understanding and new perspectives.

Conclusion

NISM certification are a significant stepping stone for professionals in the securities market. They offer a pathway to advanced knowledge, career growth, and professional recognition. By understanding the importance of these certifications, preparing effectively, and adopting strategic study practices, candidates can successfully navigate the NISM exams and unlock new opportunities in their careers. Whether you are an aspiring financial professional or a seasoned expert, NISM provides the tools and credentials to excel in the dynamic world of securities markets.

Read More: - https://www.myonlineprep.com/exam/nism

Follow Us on Facebook: - https://www.facebook.com/myonlineprep/

Follow Us on Twitter: - https://twitter.com/myonlineprep

Follow Us on YouTube: - https://www.youtube.com/myonlineprep

Follow Us on Linkedin: - https://www.linkedin.com/company/myonlineprep/

Address: - Rafin Education India Pvt Ltd 405, Emarat Firdaus, Exhibition Road, Patna - 800006 (IN)

Call US: +91 92641 49917

Email US: - [email protected]

0 notes

Text

The Best Online Stock Trading Courses by AryaaMoney are designed to equip traders with the skills needed to excel in the stock market. These courses offer in-depth knowledge on trading strategies, risk management, and market analysis. Suitable for traders of all levels, the curriculum blends theory with practical insights to enhance trading proficiency. For more information, visit the Best Online Stock Trading Courses.

0 notes

Text

Top 5 Stock Market Courses For Beginners In India [2024]

As of 2024, several stock market courses cater to beginners in India, providing them with the foundational knowledge and skills to start their investment journey. Here are five top courses:

NSE's Certification in Financial Markets (NCFM): Offered by the National Stock Exchange (NSE) of India, the NCFM program covers various modules, including equity derivatives, capital markets, and technical analysis. It's a comprehensive certification program recognized by industry professionals and regulatory bodies.

BSE Institute's Program in Financial Markets (PGDFM): The Bombay Stock Exchange (BSE) Institute offers the PGDFM program, covering topics such as equity research, derivatives trading, and risk management. It provides practical insights and hands-on training to help beginners understand the nuances of the stock market.

Online Courses by Udemy and Coursera: Platforms like Udemy and Coursera offer a wide range of online courses on stock market investing for beginners. These courses cover topics such as stock analysis, portfolio management, and investment strategies, providing flexibility and accessibility for learners.

Share Market Courses by Stock Market Institutes: Several stock market institutes across India offer beginner-level courses tailored to the needs of novice investors. These courses typically cover basics such as market terminology, trading platforms, and investment principles, providing a solid foundation for beginners.

Financial Literacy Workshops by SEBI and AMFI: The Securities and Exchange Board of India (SEBI) and the Association of Mutual Funds in India (AMFI) conduct financial literacy workshops and investor awareness programs across the country. These workshops are often free or low-cost and provide essential knowledge about investing in stocks, mutual funds, and other financial instruments.

Before enrolling in any course, beginners should research the course content, faculty expertise, reviews, and industry recognition to ensure they select the most suitable option for their learning goals. Additionally, beginners should focus on continuous learning and practical application of knowledge to gain confidence and proficiency in stock market investing.

#intraday trading course india#stock trading courses#best stock market trainer#stock market courses#learn share market india

0 notes

Text

Is Zerodha a safe platform for buying stocks?

Zerodha is one of the prominent online brokerage platforms in India, known for its user-friendly interface and low fees. It is regulated by the Securities and Exchange Board of India (SEBI), which adds a layer of oversight and security to the platform. Additionally, Zerodha uses robust security measures to protect its users' data and transactions.

However, like any other investment platform, there are certain risks involved in trading stocks, such as market volatility, liquidity risks, and regulatory changes. It's important for investors to conduct their own research and understand the risks associated with investing in the stock market.

Overall, Zerodha is considered safe for buying stocks, but investors should always exercise caution and make informed decisions before investing their money.

Top of Form

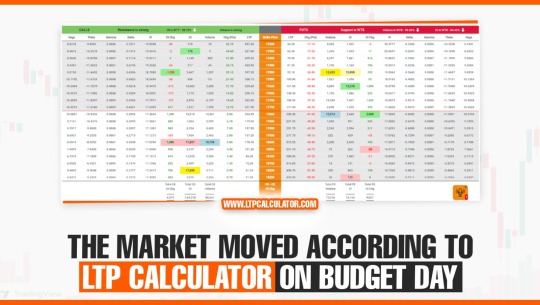

LTP Calculator Overview:

LTP Calculator is a comprehensive stock market trading tool that focuses on providing real-time data, particularly the last traded price of various stocks. Its functionality extends beyond a conventional calculator, offering insights and analytics crucial for traders navigating the complexities of the stock market.

Also Available on Play store - Get the App

Key Features:

Real-time Last Traded Price:

The core feature of LTP Calculator is its ability to provide users with the latest information on stock prices. This real-time data empowers traders to make timely decisions based on the most recent market movements.

User-Friendly Interface:

Designed with traders in mind, LTP Calculator boasts a user-friendly interface that simplifies complex market data. This accessibility ensures that both novice and experienced traders can leverage the tool effectively.

Analytical Tools:

Beyond basic price information, LTP Calculator incorporates analytical tools that help users assess market trends, volatility, and potential risks. This multifaceted approach enables traders to develop a comprehensive understanding of the stocks they are dealing with.

Customizable Alerts:

Recognizing the importance of staying informed, LTP Calculator allows users to set customizable alerts for specific stocks. This feature ensures that traders receive timely notifications about significant market movements affecting their portfolio.

Vinay Prakash Tiwari - The Visionary Founder:

At the helm of LTP Calculator is Vinay Prakash Tiwari, a renowned figure in the stock market training arena. With a moniker like "Investment Daddy," Tiwari has earned respect for his expertise and commitment to empowering individuals in the financial domain.

Professional Background:

Vinay Prakash Tiwari brings a wealth of experience to the table, having traversed the intricacies of the stock market for several decades. His journey as a stock market trainer has equipped him with insights into the challenges faced by traders, inspiring him to develop tools like LTP Calculator.

Philosophy and Approach:

Tiwari's approach to stock market training revolves around education, empowerment, and simplifying complexities. LTP Calculator reflects this philosophy, offering a tool that aligns with his vision of making stock market information accessible and understandable for all.

Educational Initiatives:

Apart from his contributions as a tool developer, Vinay Prakash Tiwari has actively engaged in educational initiatives. Through online courses, webinars, and seminars, he has shared his knowledge with aspiring traders, reinforcing his commitment to fostering financial literacy.

In conclusion, LTP Calculator stands as a testament to Vinay Prakash Tiwari's dedication to enhancing the trading experience. As the financial landscape continues to evolve, tools like LTP Calculator and visionaries like Tiwari sir play a pivotal role in shaping a more informed and empowered community of traders.

0 notes

Text

Intraday Trading Guide for Beginners in India

Intraday trading, also known as day trading, involves buying and selling financial instruments within the same trading day, with the aim of profiting from short-term price movements. Here's a guide for beginners in India interested in intraday trading:

Understand the Basics: Before diving into intraday trading, it's crucial to understand the basics of the stock market, including how it functions, key terminology, and trading mechanisms.

Educate Yourself: Take the time to educate yourself about intraday trading strategies, technical analysis tools, and risk management techniques. There are numerous resources available, including books, online courses, and educational websites.

Choose the Right Broker: Select a reputable brokerage firm that offers a user-friendly trading platform, competitive brokerage rates, and reliable customer support. Ensure that the broker is registered with SEBI and complies with regulatory requirements.

Start Small: Begin with a small amount of capital that you can afford to lose. Intraday trading involves high risk, and it's essential to start with a cautious approach until you gain experience and confidence.

Develop a Trading Plan: Create a well-defined trading plan that outlines your trading goals, risk tolerance, entry and exit criteria, and position sizing strategy. Stick to your plan and avoid making impulsive decisions based on emotions.

Use Technical Analysis: Learn how to analyze price charts and use technical indicators to identify potential trading opportunities. Common technical analysis tools include moving averages, relative strength index (RSI), MACD, and Fibonacci retracements.

Practice Paper Trading: Before risking real money, consider practicing intraday trading using a simulated trading platform or paper trading account. This allows you to test your strategies and gain experience in a risk-free environment.

Manage Risk: Implement strict risk management measures to protect your capital. Set stop-loss orders to limit potential losses on each trade, and avoid risking more than a certain percentage of your trading capital on any single trade.

Stay Informed: Stay updated with market news, economic indicators, and corporate announcements that may impact stock prices. Be aware of scheduled events such as earnings releases, economic reports, and central bank decisions.

Review and Learn: Keep a trading journal to record your trades, including entry and exit points, reasons for each trade, and the outcome. Review your trades regularly to identify strengths and weaknesses, and continuously strive to improve your trading skills.

One of the best way to start studying the stock market to Join India’s best comunity classes Investing daddy invented by Dr. Vinay prakash tiwari . The Governor of Rajasthan, the Honourable Sri Kalraj Mishra, presented Dr. Vinay Prakash Tiwari with an appreciation for creating the LTP Calculator.

LTP Calculator the best trading application in India.

You can also downloadLTP Calculator app by clicking on download button.

Remember that intraday trading requires discipline, patience, and continuous learning. It's not a get-rich-quick scheme, and success in intraday trading takes time and effort. Start slowly, manage your risks wisely, and be prepared to adapt your strategies as needed based on market conditions.

0 notes

Text

Finwings Stock Trading Academy

Finwings stock trading academy is one of the stock market training institute in ahmedabad providing crash courses, short term courses and medium-term courses focusing on those who Want to be a trader or invest in the Indian stock market. We offer career-oriented courses like ;a part of BFSI, NSE courses, SEBI courses and BSE certification courses which are considered principle series to excel your career in the financial market. We offer both online as well as offline lectures. We are here to train the individuals from basic to the advanced level along with necessary theoretical and practical knowledge. We conduct various tests and virtual analysis to measure the performance of our students.

1 note

·

View note

Text

Welcome to Traders Platform, best share market classes at your premier destination for mastering the intricacies of the stock market from foundational principles to advanced stock market trading strategies.With over 8 years of dedicated experience in our stock market and trading course, we’ve empoweredover 1000 students, witnessing countless life-changing transformations along the way. As a SEBI registered and NISM certified broker, Traders Platform stands as India’s foremost stock market tradingtraining center and share market trading classes in Navi Mumbai.

0 notes

Text

NISM Certification Courses

ICFM (Institute of Career in Financial Market) is a leading educational institution offering specialized courses in the financial market sector, including NISM (National Institute of Securities Markets) certification courses. NISM, an initiative by SEBI (Securities and Exchange Board of India), is a highly respected certification that validates the skills and knowledge of professionals in various aspects of the securities markets.ICFM's NISM certification courses are designed to cater to a broad range of learners, from beginners to seasoned professionals seeking to enhance their credentials in the financial industry. The courses cover essential areas such as securities operations, equity derivatives, mutual funds, research analysis, and investment advisory. By providing these courses, ICFM aims to equip students with the necessary tools to pass the NISM certification exams, which are crucial for those looking to pursue a career in the Indian financial markets.ICFM's approach combines theoretical knowledge with practical insights, ensuring that learners not only prepare for their exams but also gain a deeper understanding of the financial markets. The institute's experienced faculty members bring real-world expertise to the classroom, making complex concepts accessible and relevant.Moreover, ICFM offers flexible learning options, including online and offline classes, to accommodate the diverse needs of its students. This flexibility, combined with comprehensive study materials and mock tests, ensures that candidates are well-prepared to succeed in their NISM certification exams. Overall, ICFM's provision of NISM certification courses is an excellent opportunity for individuals aiming to build or advance their careers in the financial services industry. Whether you are just starting or looking to specialize in a particular area, ICFM's courses provide a solid foundation and a clear pathway to achieving your professional goals.

#NISM Certification Courses#NISM Certification Courses near me#Nism certification courses online#NISM certificate course syllabus#Best nism certification courses

0 notes

Text

Top online stock market courses for beginners in India- 2023

How to learn about the stock markets online in India?

Learning about the stock markets online in India is a convenient and accessible way to gain knowledge and understanding. Here are some steps to help you get started:

Read Online Articles and Blogs

Numerous financial websites and blogs provide valuable information about the stock market in India. Look for reputable sources that cover a wide range of topics, including market analysis, investing strategies, fundamental and technical analysis, and financial news. Some popular financial websites in India include Moneycontrol, Economic Times, Livemint, and Investopedia.

2. Take Online Courses

Many online platforms offer courses specifically focused on stock market education in India. These courses cover various topics, from basic concepts to advanced trading strategies. Consider reputable platforms like Udemy, Coursera, NSE Academy, and Bombay Stock Exchange (BSE) for online courses tailored to Indian stock market learning.

Here are the Top online stock market courses for beginners in India- 2023.

3. Follow Financial News Channels and YouTube Channels

Tune in to financial news channels such as CNBC TV18, Bloomberg Quint, and ET Now, which provide real-time market updates, expert opinions, and analysis. Additionally, there are several YouTube channels dedicated to stock market education in India, where you can find tutorials, trading strategies, and market insights. Some popular channels include Trade Smart Online, Pranjal Kamra, and Nitin Bhatia.

4. Join Online Trading Communities and Forums

Engage with fellow traders and investors in online communities and forums to share knowledge, discuss strategies, and learn from experienced individuals. Websites like Traderji and ValuePickr have active communities where you can participate in discussions and gain insights from other market participants.

5. Explore Stock Market Apps and Simulators

Download stock market apps like Moneycontrol, Groww, and ET Markets to access real-time market data, news, and portfolio tracking. Some apps also offer virtual trading simulators that allow you to practice trading without risking real money. Utilize these apps and simulators to gain hands-on experience and familiarize yourself with market dynamics.

6. Follow SEBI and NSE/BSE Websites

Stay updated with the official websites of regulatory bodies like the Securities and Exchange Board of India (SEBI), National Stock Exchange (NSE), and Bombay Stock Exchange (BSE). These websites provide comprehensive information on market regulations, investor protection, listed companies, market indices, and educational resources.

7. Read Books on Indian Stock Market

Explore books written by renowned authors on Indian stock market investing and trading. Some recommended titles include “The Intelligent Investor” by Benjamin Graham, “Common Stocks and Uncommon Profits” by Philip Fisher, and “The Little Book That Still Beats the Market” by Joel Greenblatt. These books provide timeless wisdom and insights into the stock market.

8. Attend Webinars and Online Seminars

Keep an eye out for webinars and online seminars conducted by industry experts and market professionals. These sessions cover a wide range of topics and can provide valuable insights and learning opportunities. Check financial websites, trading platforms, and social media platforms for upcoming events.

Remember, learning about the stock markets is an ongoing process. Stay curious, read extensively, and practice applying your knowledge through virtual trading or paper trading. It’s also beneficial to start with a basic understanding of fundamental analysis, technical analysis, risk management, and investment principles.

Check out this for informational stock market related blogs here.

Get your fantasy stock market game in India on!

Learn & Earn by contesting in this virtual stock market game. Get exposure to the best markets across the word and even cryptos without having a demat account.

0 notes