#tax planning advisor

Text

Maximizing Returns: GavTax Advisory Services, Your Expert Tax Planning Advisor

Whether you’re a seasoned investor or a newcomer to the market, having a knowledgeable tax planning advisor by your side can make all the difference. That’s where GavTax Advisory Services comes in.

0 notes

Text

Secure Your Financial Future With Tax Planning Advisor

Are you tired of navigating the complex maze of tax laws, unsure if you're maximising your financial potential? Ever wondered how top-performing businesses stay ahead, paying their fair share without sacrificing profits? It's time to demystify the complexities of taxes and unleash your financial success with a skilled tax planning advisor and accountant.

Benefits of Working with a Tax Planning Accountant

Strategic Year-End Planning: Our tax planning accountants in Melbourne are here to guide you through crucial strategies like year-end stock takes and work-in-progress assessments, ensuring you make the most of available opportunities.

Debt Management: Uncover the secrets of effective debt management by reviewing and writing off bad debts before the fiscal year ends, backed by meticulous documentation.

Small Business Concessions: Leverage small business concessions by making prepayments on expenses, securing full tax deductions and optimising your financial outcomes.

Trustee Resolutions: Ensure your discretionary trusts are in order with timely preparation and signing of trustee resolutions, guaranteeing a smooth financial transition.

Choosing Owen Peach As Your Tax Planning Advisor

At Owen & Peach, we are more than just accountants; we are architects of financial success. Our dedicated tax planning advisors in Melbourne specialise in minimising tax liabilities within the bounds of Australian laws. Here's why we stand out:

Comprehensive Approach: From maximising allowable tax deductions to meticulous business advice, our tax accountants are dedicated to your financial success.

Personalised Consultations: Book a free, one-hour introductory consultation to discuss your business needs. Our experts provide practical tax, marketing, and finance advice to accelerate your business growth.

Conclusion

Take the first step towards financial success by partnering with Owen Peach. We are not just the tax planning accountants but your allies in building a prosperous future. Contact us to book your free consultation!

0 notes

Text

Safeguard Your Finances: Learn How to Spot and Prevent IRS Scams. Stay informed and protect yourself from fraudulent schemes this tax season. Read our comprehensive blog now!

#irs tax#irs tax prepration#irs tax scams#tax planning advisor#personal tax preparation services#business planning for small business#small business tax services norcross

0 notes

Text

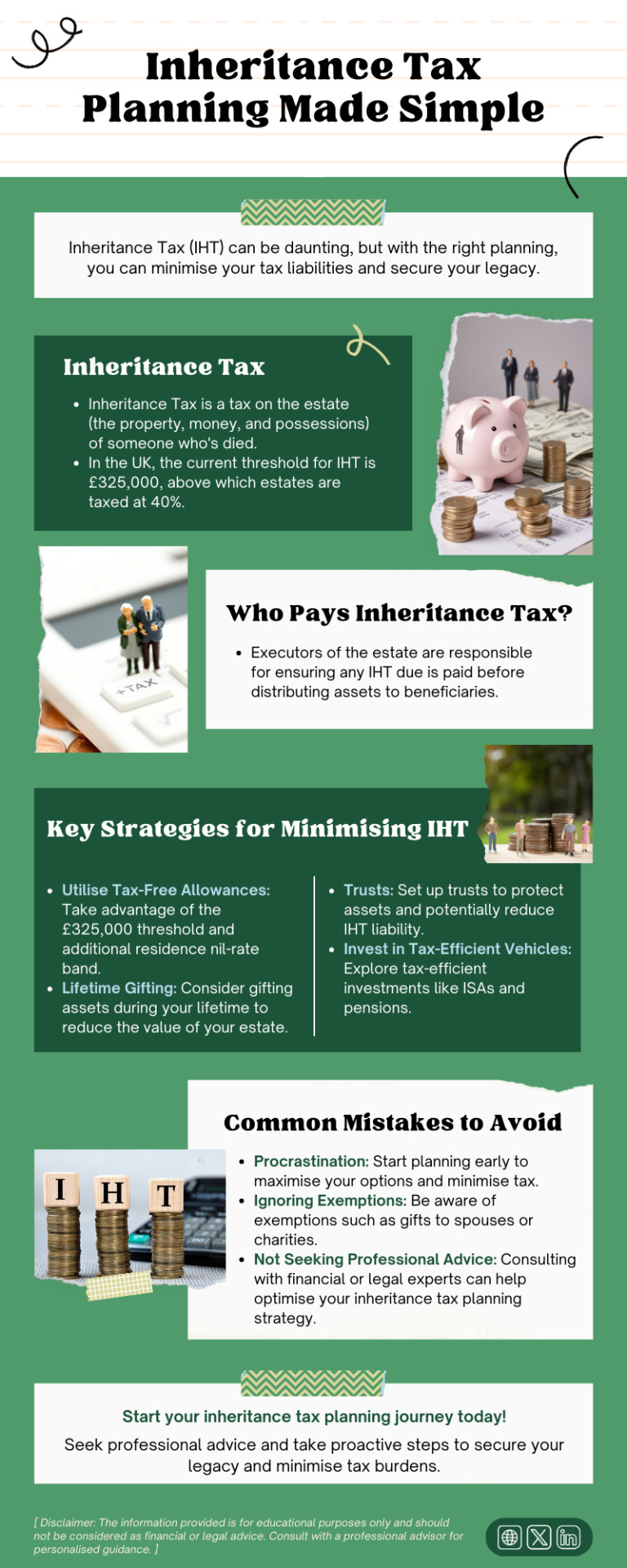

Inheritance Tax (IHT) can be daunting, but with the right planning, you can minimise your tax liabilities and secure your legacy. This infographic provides a simple and straightforward guide to inheritance tax planning.

#Inheritance tax planning#Inheritance tax advice#Inheritance tax advisor#Inheritance tax specialist#inheritance tax advice london#Inheritancetaxplanning

2 notes

·

View notes

Text

Mastering Middle-Class Budgeting: A Path to Financial Freedom

#financial freedom#financial franchise#financial fraud#middle class#Middle-Class Budgeting#budget#financial#investors#income#tax#companies#stocks#financial advisor#financial planning#financial plan#finance#financialfreedom#earn#investing#stock market

7 notes

·

View notes

Text

Save Money Like a Pro: Expert Advice for Building Your Savings

Introduction: Saving money is a crucial part of achieving financial stability and security. Whether you are saving for a rainy day, a big purchase, or retirement, learning how to save money efficiently can make a significant difference in your financial future. In this article, we will provide expert advice on how to save money like a pro and build your savings effectively.

Creating a Budget…

#best investment strategies#budgeting for beginners#financial goals setting.#financial management for small businesses#guide to building wealth#how to choose a financial advisor#how to save money effectively#investment opportunities in 2024#managing debt#Personal finance tips#smart ways to use credit cards#tax-saving strategies#tips for retirement planning#top financial planning tools#understanding credit scores

0 notes

Text

What is the Role of a Tax Advisor?

Are you struggling with tax management? A tax advisor can help you to prevent financial mistakes, and they have a solid financial plan for saving money. A tax advisor is a finance professional specializing in taxation, helping businesses with tax returns, payments, and strategic planning. For detailed information about the role and benefits of partnering with a tax advisor, read our latest blog today!

0 notes

Text

Comprehensive Tax and Payroll Solutions with GG CPA Services

Introduction:

When it comes to managing your finances, finding the right partner is essential. GG CPA Services offers a range of professional tax and payroll services tailored to meet your needs. Whether you're an individual looking for efficient tax preparation or a business in need of payroll solutions, our experienced tax advisors are here to guide you. With a commitment to personalized service and in-depth tax planning, we help you navigate the complexities of financial regulations and obligations. Discover how GG CPA Services can streamline your financial processes, ensuring accuracy, compliance, and peace of mind.

Tax Services for Individuals and Businesses

At GG CPA Services, we understand that tax season can be stressful for both individuals and businesses. That's why we offer comprehensive tax services designed to alleviate that burden. Our team of qualified tax advisors works closely with you to ensure that all your tax obligations are met in a timely and accurate manner.

We provide expert guidance on everything from federal to state and local tax regulations. Whether you're an individual taxpayer or a business owner, we ensure that all possible deductions and credits are applied, reducing your tax liability and maximizing your refund where applicable. We stay current with the latest tax laws, giving you the confidence that your tax filings are compliant and optimized.

Expert Tax Advisors at Your Service

Navigating tax laws can be overwhelming, but with the help of a skilled tax advisor, the process becomes much more manageable. At GG CPA Services, our tax advisors have a deep understanding of the tax code and can provide personalized advice based on your unique financial situation. Our team is trained to identify tax-saving opportunities and offer proactive advice to help you plan for future tax obligations.

Whether you are dealing with complex tax scenarios, such as estate taxes, capital gains, or business expenses, our tax advisors are equipped to provide tailored solutions. They are also available year-round, not just during tax season, to assist with any tax-related questions or concerns you might have.

Tax Preparation Made Easy

Tax preparation can often feel like a daunting task. Gathering documents, ensuring accuracy, and meeting deadlines can be stressful. That's where GG CPA Services steps in with our professional tax preparation services. We take the hassle out of tax preparation by managing the entire process for you.

We carefully review your financial documents, ensuring that all information is correctly reported. Our thorough approach minimizes the risk of audits and penalties. We provide electronic filing options, making the submission process fast and convenient. With GG CPA Services handling your tax preparation, you can rest assured that your taxes are filed accurately and on time.

Payroll Services That Keep Your Business Running Smoothly

Managing payroll can be a time-consuming and complicated task for businesses of all sizes. GG CPA Services offers reliable payroll services designed to simplify this critical aspect of your operations. From calculating wages and salaries to managing employee benefits and tax withholdings, we handle all aspects of payroll management.

Our payroll service ensures that your employees are paid accurately and on time, every time. We stay up-to-date with changing payroll regulations, including tax laws and employment regulations, ensuring that your payroll processes remain compliant. With our payroll solutions, you can focus on running your business while we take care of the administrative details.

Strategic Tax Planning for Financial Success

Effective tax planning is crucial for minimizing your tax burden and optimizing your financial health. GG CPA Services offers strategic tax planning services to help you achieve long-term financial success. By analyzing your financial situation, we can identify tax-saving opportunities and develop a customized plan that aligns with your financial goals.

Our tax planning services are not limited to tax season. We work with you throughout the year to review your financial status and make adjustments as needed. Whether you are an individual looking to plan for retirement or a business owner seeking to minimize corporate taxes, we provide expert advice that helps you plan for the future with confidence.

Personalized Approach to Tax Solutions

At GG CPA Services, we believe that no two financial situations are the same. That's why we take a personalized approach to all our services. Our team works closely with you to understand your specific needs and goals. Whether you require assistance with tax preparation, payroll services, or long-term tax planning, we offer customized solutions designed to meet your unique circumstances.

By offering one-on-one consultations, we ensure that you receive the individual attention you deserve. Our tax advisors take the time to explain complex tax issues in clear, easy-to-understand terms, empowering you to make informed financial decisions.

Staying Ahead with the Latest Tax Laws

Tax laws are constantly changing, which is why it's crucial to have a tax advisor who stays up-to-date with the latest regulations. At GG CPA Services, we pride ourselves on staying informed about changes to tax codes, payroll regulations, and financial laws that may impact our clients. This commitment to ongoing education allows us to offer the most current and relevant advice.

Our proactive approach ensures that you're not only meeting your current tax obligations but are also prepared for any future changes in the law. Whether it's a new tax deduction or an update to payroll regulations, we keep you informed and adjust your financial strategy accordingly.

Why Choose GG CPA Services?

When you choose GG CPA Services, you're not just getting a service provider—you're gaining a financial partner dedicated to your success. Our experienced team offers a full range of tax and payroll services that cater to individuals, small businesses, and corporations alike. We are committed to delivering the highest level of professionalism, accuracy, and customer care.

Whether you need assistance with day-to-day tax management or more complex financial planning, we have the expertise to help you achieve your financial objectives. Our services are designed to save you time, reduce stress, and provide peace of mind knowing your financial matters are in expert hands.

0 notes

Text

Expert Tax Advisor in Rock Hill | Abacus Tax SC

Get expert tax advice in Rock Hill. Abacus Tax SC offers comprehensive tax consulting and advisory services to optimize your tax planning.

0 notes

Text

Comprehensive Financial Planning and Wealth Management Services Canada

Expert financial planning for Canadians. Retirement strategies and wealth management services to help you achieve Total Financial Freedom.

We are a team of Financial Professionals led by Kanwaljit (Sunny) Kochar based in Ontario, helping the Canadian families and business owners across Canada to achieve Financial Success who are neglected by the Financial Institutions.

Sunny Kochar created Hexavisionary Framework along with the Body Of Knowledge with a vision to empower hard working Canadians to achieve Total Financial Freedom without working extra hours at work.

We believe in serving our clients for a lifetime with Innovation and Excellence in our advisory services for retirement planning, money management and increasing cash flow from their current tax and mortgage payments.

Financial Planning, Retirement Planning, Financial Advisor, Wealth Creation, Wealth Management, Insurance Protection, Estate Planning, Risk Management, Tax Planning

45 Lewis Rd Unit-1, Guelph, ON N1H 1E9, Canada N1H 1E9

(647) 556-5605

#Financial Planning#Retirement Planning#Financial Advisor#Wealth Creation#Wealth Management#Insurance Protection#Estate Planning#Risk Management#Tax Planning

1 note

·

View note

Text

How A Retirement Financial Advisor Helps You Plan For Longevity?

Retirement financial advisor in Fort Worth TX helps you plan for longevity by creating strategies to ensure your savings last throughout retirement. They assess your expected lifespan, calculate future expenses, and recommend investment options to provide a steady income. By planning for longevity, they help you maintain financial security and adapt to changes in your retirement needs.

0 notes

Text

youtube

You may maximize your company's probability by utilizing the several services that Advantage CPA supplies. From tactical financial design to correct tax composing, our skilled staff offers express solutions to maximize your business's performance and ensure consent. Survey our vast array of services planned to boost your income, ease your growth, and graceful your accounting work. Join us to proceed with your business with acute guidance and unusual experience. See how Advantage CPA can help you prosper right now!

#Accounting#Payroll#Tax Preparation#QuickBooks Pro Advisor#Bookkeeping#New Business Formation#Business Consultation#Bank Financing#Internal Controls#Strategic Business Planning#Succession Planning#Tax Planning#Tax Problems#State Sales Tax#IRS Tax Problems Resolution#Accounting Firm#CPA Firm#Payroll Services#Tax Services#Business Services#Youtube

0 notes

Text

What is Insurance with Full Information: A Complete Guide

#life insurance#insurance#finance#financial#financial advisor#insurance guide#investors#investing#stock market#companies#income#tax#stocks#financial planning#financial freedom#personal finance#investments#retirement planning

2 notes

·

View notes

Text

The Secret to Saving Money: Strategies to Reach Your Financial Goals

Introduction:

Saving money is a crucial aspect of achieving financial stability and reaching your long-term goals. By implementing effective strategies and making smart financial decisions, you can pave the way for a secure and prosperous future. In this article, we will explore the secret to saving money and discuss various strategies to help you reach your financial goals.

Setting Clear…

#best investment strategies#budgeting for beginners#financial goals setting.#financial management for small businesses#guide to building wealth#how to choose a financial advisor#how to save money effectively#investment opportunities in 2024#managing debt#Personal finance tips#smart ways to use credit cards#tax-saving strategies#tips for retirement planning#top financial planning tools#understanding credit scores

0 notes

Text

How to Build a Portfolio That Supports Your Retirement Life

Retirement planning goes beyond just saving money; it requires a well-structured portfolio that can generate the necessary income to support your lifestyle during your golden years. Building a retirement portfolio involves careful selection of investment assets that align with your financial goals, risk tolerance, and time horizon. Here's how you can construct a portfolio designed to sustain and support your retirement life.

Adopt the Financial Independence, Retire Early (FIRE) Approach

The FIRE movement—short for Financial Independence, Retire Early—has been gaining traction in India, particularly among young professionals in metropolitan cities. The goal is to save and invest actively during your professional life so that you may attain financial independence far before the typical retirement age.

For Indians, this might involve maximizing your savings rate by living below your means, investing in high-growth assets like equities, and cutting unnecessary expenses. Even if early retirement isn’t your goal, incorporating FIRE principles can help you build a robust retirement corpus, giving you the flexibility to retire comfortably or even pursue a second career or passion project later in life.

Balanced Risk Approach

As you approach retirement, your risk tolerance naturally decreases. It’s essential to strike a balance between growth and preservation of capital. Typically, younger investors can afford to take on more risk by allocating a higher percentage of their portfolio to equities. However, as you near retirement, gradually shifting towards more conservative investments like bonds, fixed deposits, and dividend-paying stocks can help protect your capital.

A common strategy is the "100 minus age" rule, where you subtract your age from 100 to determine the percentage of your portfolio to allocate to equities. For example, if you’re 40, you might consider keeping 60% in equities and 40% in safer assets. Adjust this rule based on your risk appetite, financial situation, and market conditions.

Integrate Sustainable and Ethical Investing

In India, the focus on ethical and sustainable investing is growing as investors become more socially and environmentally conscious. Sustainable investment planning, often referred to as ESG (Environmental, Social, and Governance) investing, involves selecting companies that adhere to ethical practices, focus on sustainability, and contribute positively to society.

Several Indian mutual funds now offer ESG-focused schemes, allowing you to invest in companies that align with your values. This not only supports responsible businesses but also offers the potential for strong financial returns, as companies with good governance and sustainable practices are often better positioned for long-term growth.

Focus on Dividend Growth Stocks

In India, dividend-paying stocks are a popular choice for generating regular income during retirement. However, focusing on dividend growth stocks—companies that consistently increase their dividends over time—can offer even greater benefits.

Investing in established Indian companies with a history of dividend growth can provide a reliable income stream, helping you maintain your lifestyle without needing to sell your investments. Over time, as these dividends grow, they can significantly bolster your retirement income, especially when reinvested during the accumulation phase.

Prioritize Flexibility and Liquidity

Given India’s dynamic economic environment and increasing life expectancy, it’s important to maintain flexibility in your retirement portfolio. This means including assets that can be easily liquidated or adjusted based on changing circumstances, such as unexpected expenses or shifts in financial goals.

Bucket Strategy: Divide your portfolio into short-term, medium-term, and long-term buckets. Short-term buckets can hold liquid assets like savings accounts or short-term fixed deposits for immediate needs, while long-term buckets can invest in growth-oriented assets like equities.

Cash Reserve: Maintain a cash reserve or an emergency fund to cover unforeseen expenses without needing to sell off long-term investments. This is particularly important in India, where medical emergencies or family obligations can arise unexpectedly.

Hybrid Annuities: Consider hybrid annuities that offer a mix of guaranteed income and market-linked returns, providing both security and growth potential. These products are becoming increasingly available in the Indian market and can add an element of stability to your retirement income.

Conclusion

Building a retirement portfolio that supports your life after work requires a blend of traditional wisdom and innovative strategies. By embracing principles like the FIRE approach, sustainable investing, global diversification, and leveraging India’s technological growth, you can create a portfolio that not only sustains you financially but also empowers you to enjoy a fulfilling retirement.

Remember, a successful retirement portfolio in India should be adaptable, tax-efficient, and aligned with your long-term goals. By staying informed and proactive, you can navigate your retirement years with financial security and peace of mind, enjoying the fruits of your hard work.

1 note

·

View note

Text

Mastering Your Financial Future: Comprehensive Tax and Estate Planning Strategies with Swat Advisors

Introduction

Navigating the complexities of financial planning requires more than just a basic understanding of taxes and investments. At Swat Advisors, a premier financial advisory firm in California, we specialize in providing tailored solutions that encompass advanced tax planning, estate management, succession strategies, and life insurance planning. Our approach is designed to help clients secure their financial future, minimize tax liabilities, and ensure a seamless transfer of wealth to future generations. In this comprehensive guide, we will explore the various aspects of tax planning, the importance of estate and succession planning, and how our team at Swat Advisors can be your trusted partner in achieving your financial goals.

Tax Planning Solutions: A Proactive Approach to Wealth Management

Tax planning is a crucial element of a robust financial strategy. With the ever-changing tax laws and regulations, it is essential to adopt a proactive approach that not only mitigates liabilities but also maximizes potential savings. At Swat Advisors, our tax planning solutions are customized to each client’s unique financial situation. Whether you are a business owner, an executive, or a retiree, our strategies are designed to optimize your tax position and enhance your overall financial well-being.

Our tax planning advisors utilize an array of techniques, including income deferral, tax-efficient investments, and strategic deductions, to ensure you keep more of what you earn. By integrating these solutions into your broader financial plan, we help you achieve sustainable growth and long-term stability.

Estate Planning Tax Advisor: Protecting Your Legacy

Estate planning is not just about drafting a will; it’s about ensuring that your assets are protected, and your loved ones are provided for, according to your wishes. Our team at Swat Advisors includes expert estate planning tax advisors who guide you through the intricate process of managing and transferring your wealth. From setting up trusts to optimizing estate taxes, we offer comprehensive services that safeguard your legacy and minimize potential legal challenges.

We understand that estate planning is deeply personal and often involves complex family dynamics. Our advisors work closely with you to develop a plan that reflects your values and meets your financial objectives, ensuring that your assets are distributed efficiently and effectively.

Succession Planning Consulting: Securing Your Business Continuity

For business owners, succession planning is a vital aspect of preserving the longevity and success of their enterprises. At Swat Advisors, our succession planning consulting services are tailored to address the unique needs of each business. We help you identify potential successors, develop leadership skills within your organization, and establish a clear transition plan that minimizes disruptions.

Succession planning goes beyond choosing a successor; it involves creating a robust framework that aligns with your long-term business goals and ensures continuity. Our experts assist in navigating the complexities of business valuations, tax implications, and legal requirements, allowing you to focus on what you do best — running your business.

Advanced Tax Planning: Maximizing Opportunities

Advanced tax planning involves strategies that go beyond the basics to explore every possible avenue for tax savings. At Swat Advisors, we specialize in complex tax scenarios, offering advanced planning techniques for high-net-worth individuals and business owners. Our strategies include options like income splitting, charitable giving, and the use of tax-advantaged accounts and structures.

By employing sophisticated tax planning methods, we help clients manage their tax exposure and retain more of their hard-earned wealth. This proactive approach not only reduces current tax liabilities but also anticipates future tax obligations, ensuring a balanced and efficient financial plan.

Life Insurance Planning: A Critical Component of Financial Security

Life insurance is often overlooked as a financial planning tool, but it plays a vital role in ensuring long-term security for you and your loved ones. At Swat Advisors, we provide comprehensive life insurance planning services that are tailored to your specific needs and goals. Whether you are looking to protect your family's financial future, cover potential estate taxes, or create a legacy for future generations, our advisors guide you in choosing the right insurance products.

We evaluate a range of life insurance options, from term life to whole life and universal life policies, helping you select the one that best aligns with your objectives. Additionally, we integrate life insurance into your broader tax and estate planning strategy to enhance its effectiveness and provide peace of mind.

The Role of a Tax Planning Advisor: Your Partner in Financial Success

A tax planning advisor plays a critical role in shaping your financial future. At Swat Advisors, we believe that effective tax planning requires a deep understanding of your financial situation, goals, and the ever-evolving tax landscape. Our advisors are dedicated to staying ahead of tax law changes and employing innovative strategies to minimize your tax burden.

By partnering with a qualified tax planning advisor, you gain access to expert knowledge and personalized advice that can make a significant difference in your financial outcomes. We provide ongoing support and guidance, ensuring that your financial plan adapts to life’s changes and continues to meet your needs.

Conclusion

In a world where financial landscapes are constantly changing, having a trusted advisor by your side is invaluable. Swat Advisors offers a comprehensive range of services, from tax planning solutions to estate planning, succession planning, advanced tax strategies, and life insurance planning. Our goal is to empower you with the knowledge and tools to make informed decisions, protect your wealth, and achieve your long-term financial goals. By choosing Swat Advisors, you are choosing a partner committed to your financial success and peace of mind.

#tax planning solutions#estate planning tax advisor#succession planning consulting#advanced tax planning

0 notes