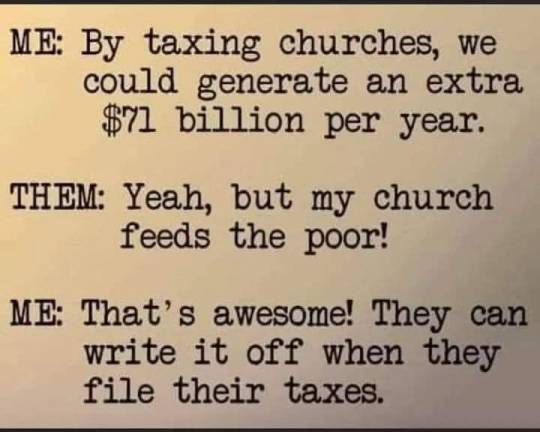

#taxation

Text

Tax the church. End the bullshit. They can earn their tax breaks.

9K notes

·

View notes

Photo

The Ogden Standard-Examiner, Utah, May 14, 1922

#1922#1920s#roaring 20s#jazz age#ouija board#historic#vintage#history#planchette#ouija#sports#sporting#roaring 20's#newspapers#washington dc#washington#taxation#taxing#tax#ogden#utah#sporting goods

629 notes

·

View notes

Text

if you are an American,

🙂 are you good?

it’s officially tax season crunch-time folks!

You know what that means: sweaty searches for your W2 and paralyzing fear over whether you owe or not! 🙂

Will it be a return for you this year or will you be looking for a third job to cover that amount due? 🙃

I’m right there with you friends.

Let my humble contribution below, bring you some laughs as you languish to help combat the Sunday Scaries. 🐀❤️

youtube

#taxes#tax services#taxation#tax preparation#tax planning#tax professional#tax policy#tax payers#tax payment#tax filing#tax forms#tax free#tax liability#tax evasion#tax season#tax savings#tax strategies#tax software#mental health#mental illness#mental heath awareness#mental health matters#Youtube

227 notes

·

View notes

Text

Deus vult!

#dank memes#funny post#meme#dank#funny#funny pics#silly#funny pictures#dankest memes#humor#taxation#temple#church

343 notes

·

View notes

Text

A recently reintroduced bill in the U.S. House could scrap federal taxes on Social Security benefits starting in 2025, putting more money back into the pockets of retirees.

On Jan. 25, Rep. Angie Craig, D-Minn., reintroduced legislation, dubbed the “You Earned It, You Keep It Act,” that would repeal the taxation of Social Security benefits, while also extending the program's solvency by 20 years.

181 notes

·

View notes

Text

Reminder to self: look up possible case studies for "no income taxes applied until cost of living is achieved."

Currently, income tax is not applied to income of less than 14,700 (single, under 65), which is right about where the national poverty line is. The lowest living wage in the country is about twice that (South Dakota). What if federal income taxes didn't need to paid on income of, say, 30k or less, and state income taxes didn't need to be paid until... IDK maybe a county-by-county minimum? Local taxes are a thing, so that could play another level?

I'm sure SOME place has implemented a variation of this at some point. I'll have to look into it.

168 notes

·

View notes

Text

By Jake Johnson

Common Dreams

Jan. 6, 2024

"Billionaires attempting to influence politics from the shadows should not be rewarded with taxpayer subsidies," said Sen. Sheldon Whitehouse.

Legislation introduced Tuesday by a pair of Democratic lawmakers would close a loophole that lets billionaires donate assets to dark money organizations without paying any taxes.

The U.S. tax code allows write-offs when appreciated assets such as shares of stock are donated to a charity, but the tax break doesn't apply when the assets are given to political groups.

However, donations to 501(c)(4) organizations—which are allowed to engage in some political activity as long as it's not their primary purpose—are exempt from capital gains taxes, a loophole that Sen. Sheldon Whitehouse (D-R.I.) and Rep. Judy Chu (D-Calif.) are looking to shutter with their End Tax Breaks for Dark Money Act.

Whitehouse, a member of the Senate Judiciary Committee who has focused extensively on the corrupting effects of dark money, said the need for the bill was made clear by what ProPublica and The Lever described as "the largest known donation to a political advocacy group in U.S. history."

The investigative outlets reported in 2022 that billionaire manufacturing magnate Barre Seid donated his 100% ownership stake in Tripp Lite, a maker of electrical equipment, to Marble Freedom Trust, a group controlled by Federalist Society co-chairman Leonard Leo.

The donation, completed in 2021, was worth $1.6 billion. According to ProPublica and The Lever, the structure of the gift allowed Seid to avoid up to $400 million in taxes.

"It's a clear sign of a broken tax code when a single donor can transfer assets worth $1.6 billion to a dark money political group without paying a penny in taxes," Whitehouse said in a statement Tuesday. "Billionaires attempting to influence politics from the shadows should not be rewarded with taxpayer subsidies."

"We cannot allow millionaires and billionaires to run roughshod over our democracy and then reward them for it with a tax break."

If passed, the End Tax Breaks for Dark Money Act would ensure that donations of appreciated assets to 501(c)(4) organizations are subjected to the same rules as gifts to political action committees (PACs) and parties.

"Thanks to the far-right Supreme Court, billionaires already have outsized influence to decide our nation's politics; through a loophole in the tax code, they can even secure massive public subsidies for lobbying and campaigning when they secretly donate their wealth to certain nonprofits instead of traditional political organizations," said Chu. "We can decrease the impact the wealthy have on our politics by applying capital gains taxes to donations of appreciated property to nonprofits that engage in lobbying and political activity—the same way they are already treated when made to traditional political organizations like PACs."

The new bill comes amid an election season that is already flooded with outside spending.

The watchdog OpenSecrets reported last month that super PACs and other groups "have already poured nearly $318 million into spending on presidential and congressional races as of January 14—more than six times as much as had been spent at this point in 2020."

Thanks to the Supreme Court's 2010 Citizens United ruling, super PACs can raise and spend unlimited sums on federal elections—often without being fully transparent about their donors.

Morris Pearl, chairman of the Patriotic Millionaires, said Tuesday that "there is no justifiable reason why wealthy people like me should be allowed to dominate our political system by donating an entire $1.6 billion company to a dark money political group."

"But perhaps more egregious is the $400 million tax break that comes from doing so," said Pearl. "It's a perfect example of how this provision in the tax code is used by the ultrawealthy to manipulate the levers of government while simultaneously dodging their obligation to pay taxes. We cannot allow millionaires and billionaires to run roughshod over our democracy and then reward them for it with a tax break."

117 notes

·

View notes

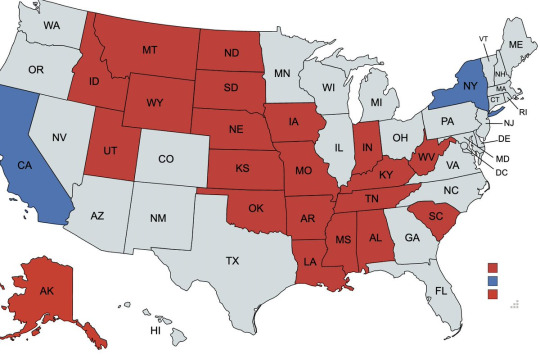

Text

Source

943 notes

·

View notes

Text

$560 BILLION from the most advantaged people in the world. How dare we call all this tremendous organized theft a meritocracy.

You KNOW only the privileged cheat on their taxes at these large amounts.

The IRS is delivering fairness for the rest of us.

593 notes

·

View notes

Note

Since governments generally have most or all of the data they need to assess taxes, what’s the point of having people file their own taxes? It seems like an unnecessary duplication of labor, since the IRS or equivalent bureau still needs to check and make sure that you filed correctly.

So see here and here:

So yeah, the reason is that there's a whole industry (dominated by Turbotax and H.R Block) that makes a lot of money by setting themselves up as middlemen, upselling people tax prep services that most of them don't actually need, and then lobbying the Federal government against cutting out the middlemen.

And this industry is politically allied with Congressional Republicans who believe that making people fill out their own taxes makes them more anti-tax and anti-government, and thus more likely to identify as conservative Republicans.

37 notes

·

View notes

Text

53 notes

·

View notes

Text

Tachikoma

Tachikoma, from Ghost In The Shell

Aren't they just the cutest most loveable tax-funded anti-liberation military-industrial police-state advocates of suicide you ever saw?

#anime#ghost in the shell#police brutality#police state#police violence#military industrial complex#propaganda#fascisim#corporate greed#brainwashing#grooming#mind control#mk ultra#operation mockingbird#taxation is theft#taxation without representation#taxation#cute#robot#robots#robotics#robot art#mecha#mecha art#cybernetics#animated gif#gif#anime gif#animation#anime art

35 notes

·

View notes

Text

Positive news for the optimistic!

I first heard about this on the BBC Global News Podcast (starts at around 14:40 for me, but that may vary based on the ads they give you), but I found an article from The Guardian as well, if you work best with a text format. Preview:

The G20 group of the world’s most powerful countries is exploring plans for a global minimum tax on the world’s 3,000 billionaires, aiming to end a “race to the bottom” that has enabled the super-rich to pay less than the rest of the population.

#economics#international policy#international economics#global economics#taxation#policy#legislation#phoenix politics#politics#current events#g20#g20 summit#the guardian#bbc#bbc global news podcast

92 notes

·

View notes

Text

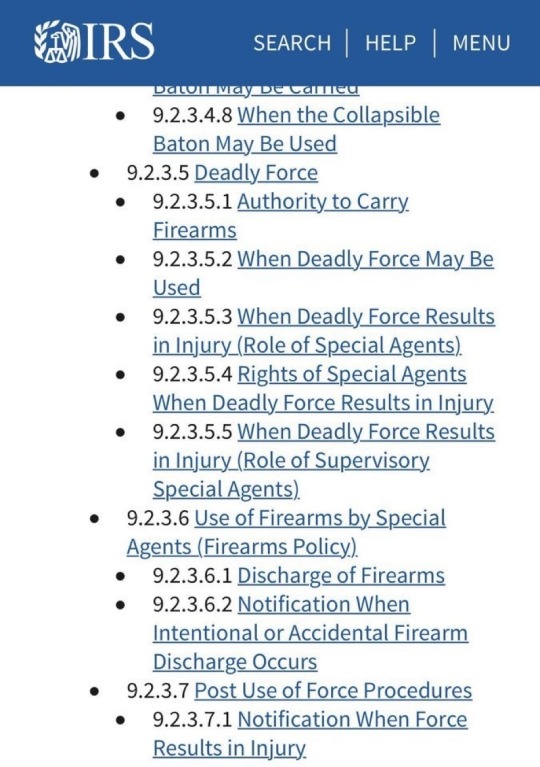

The IRS is building their own army with authority to kill you over tax money.

528 notes

·

View notes