#title loans virginia

Text

Things the Biden-Harris Administration Did This Week #29

July 26-August 2 2024

President Biden announced his plan to reform the Supreme Court and make sure no President is above the law. The conservative majority on the court ruled that Trump has "absolute immunity" from any prosecution for "official acts" while he was President. In response President Biden is calling for a constitutional amendment to make it clear that Presidents aren't above the law and don't have immunity from prosecution for crimes committed while in office. In response to a wide ranging corruption scandal involving Justice Clarence Thomas, President Biden called on Congress to pass a legally binding code of ethics for the Supreme Court. The code would force Justices to disclose gifts, refrain from public political actions, and force them to recuse themselves from cases in which they or their spouses have conflicts of interest. President Biden also endorsed the idea of term limits for the Justices.

The Biden Administration sent out an email to everyone who has a federal student loan informing them of upcoming debt relief. The debt relief plan will bring the total number of a borrowers who've gotten relief from the Biden-Harris Administration to 30 million. The plan is due to be finalized this fall, and the Department of Education wanted to alert people early to allow them to be ready to quickly take advantage of it when it was in place and get relief as soon as possible.

President Biden announced that the federal government would step in and protect the pension of 600,000 Teamsters. Under the American Rescue Plan, passed by President Biden and the Democrats with no Republican votes, the government was empowered to bail out Union retirement funds which in recent years have faced devastating cut of up to 75% in some cases, leaving retired union workers in desperate situations. The Teamster union is just the latest in a number of such pension protections the President has done in office.

President Biden and Vice-President Harris oversaw the dramatic release of American hostages from Russia. Wall Street Journal reporter Evan Gershkovich, former Marine Paul Whelan held since 2018, Russian-American reporter for Radio Free Europe/Radio Liberty Alsu Kurmasheva convicted of criticizing the Russian Military, were all released from captivity and returned to the US at around midnight August 2nd. They were greeted on the tarmac by the President and Vice-President and their waiting families. The deal also secured the release of German medical worker Rico Krieger sentenced to death in Belarus, Russian-British opposition figure Vladimir Kara-Murza, and 11 Russians convicted of opposing the war against Ukraine or being involved in Alexei Navalny's anti-corruption organization. Early drafts of the hostage deal were meant to include Navalny before his death in Russian custody early this year.

A new Biden Administration rule banning discrimination against LGBT students takes effect, but faces major Republican resistance. The new rule declares that Title IX protects Queer students from discrimination in public schools and any college that takes federal funds. The new rule also expands protections for victims of sexual misconduct and pregnant or parenting students. However Republican resistance means the rule can't take effect nation wide. Lawsuits from Republican controlled states, Alabama, Alaska, Arkansas, Florida, Georgia, Idaho, Indiana, Iowa, Kansas, Kentucky, Louisiana, Mississippi, Missouri, Montana, Nebraska, North Dakota, Ohio, Oklahoma, South Carolina, South Dakota, Tennessee, Texas, Utah, Virginia, West Virginia and Wyoming, means the new protections won't come into effect those states till the case is ruled on likely in a Supreme Court ruling. The Biden administration crafted these Title IX rules to reflect the Supreme Court's 2020 Bostock case.

The Biden administration awarded $2 billion to black and minority farmers who were the victims of historic discrimination. Historically black farmers have been denied important loans from the USDA, or given smaller amounts than white farmers. This massive investment will grant 23,000 minority farmers between $10,000 and $500,000 each and a further 20,000 people who wanted to start farms by were improperly denied the loans they needed between $3,500-$6,000 to get started. Most payments went to farmers in Mississippi and Alabama.

The Biden Administration took an important step to stop the criminalization of poverty by changing child safety guidelines so that poverty alone isn't grounds for taking a child into foster care. Studies show that children able to stay with parents or other family have much better outcomes then those separated. Many states have already removed poverty from their guidelines when it comes to removing children from the home, and the HHS guidelines push the remaining states to do the same.

Vice-President Harris announced the Biden Administration's agreement to a plan by North Carolina to forgive the state's medical debt. The plan by Democratic Governor Roy Cooper would forgive the medical debt of 2 million people in the state. North Carolina has the 3rd highest rate of medical debt in the nation. Vice-President Harris applauded the plan, pointing out that the Biden Administration has forgiven $650 million dollars worth of medical debt so far with plans to forgive up to $7 billion by 2026. The Vice-President unveiled plans to exclude medical debt from credit scores and issued a call for states and local governments to forgive debt, like North Carolina is, last month.

The Department of Transportation put forward a new rule to bank junk fees for family air travel. The new rule forces airlines to seat parents next to their children, with no extra cost. Currently parents are forced to pay extra to assure they are seated next to their children, no matter what age, if they don't they run the risk of being separated on a long flight. Airlines would be required to seat children age 13 and under with their parent or accompanying adult at no extra charge.

The Department of Housing and Urban Development announced it is giving $3.5 billion to combat homelessness. This represents the single largest one year investment in fighting homelessness in HUD's history. The money will be distributed by grants to local organizations and programs. HUD has a special focus on survivors of domestic violence, youth homeless, and people experiencing the unique challenges of homelessness in rural areas.

The Treasury Department announced that Pennsylvania and New Mexico would be joining the IRS' direct file program for 2025. The program was tested as a pilot in a number of states in 2024, saving 140,000 tax payers $5.6 million in filing charges and getting tax returns of $90 million. The program, paid for by President Biden's Inflation Reduction Act, will be available to all 50 states, but Republicans strong object. Pennsylvania and New Mexico join Oregon and New Jersey in being new states to join.

Bonus: President Biden with the families of the released hostages calling their loved ones on the plane out of Russia

#Joe Biden#Thanks Biden#Kamala Harris#american politics#us politics#politics#Russia#Evan Gershkovich#supreme court#clarence thomas#student loans#medical debt#black farmers#racism#trans students#LGBT students#homelessness#IRS#taxes

905 notes

·

View notes

Text

Strother Athey with His Dog at the Shepherd Graveyard, Shepherdstown, W. Va.

Identifier: 013204

Title: Strother Athey with His Dog at the Shepherd Graveyard, Shepherdstown, W. Va.

Description: Gate to old Shepherd graveyard, and east end of Episcopal rectory. Strother Athey and dog.

Acquisition Source: Williams, H. H. Acquisition

Method: Loan

Medium: print

West Virginia History OnView

8 notes

·

View notes

Text

payzonno loans

payzonno loans

Americans from all walks of life use payday and vehicle title loans, and they do so typically to cover recurring expenses such as rent, mortgage payments, groceries, and utilities, rather than for unexpected expenses.1 Only a checking account and verifiable income are needed to get a payday loan;2 a clear title to a vehicle is usually required to get a title loan.

Lenders issue these loans to hundreds of thousands of Virginians each year. And this high-cost credit carries some of the most lax borrower protections in the country because lenders operating in the state can make loans according to any of four statutes, two of which allow unlimited interest rates.3 (See Table 1.) As a result, Virginia residents pay up to three times more for this type of credit than borrowers in other states, even those who get loans from the same companies.4

Other states, such as Colorado and Ohio, have modernized small-loan laws to make credit more affordable while keeping it widely available.5 Virginia could follow their lead to better protect borrowers from harmful loan terms.

1 note

·

View note

Text

Edge of Wonder TV Reveals The CIA’s 'Secret' Art Collection

Let's see how the CIA's fortress headquarters in Langley, Virginia, is home to more than a few surprises. Such as a Starbucks where the baristas never ask for names and a spy museum you'll never visit.

Backstory - The CIA’s 'Secret' Art Collection:-

At first glance, Taryn Simon's photograph above appears harmless, if not mundane. It depicts two modern artworks hanging on bare white walls, separated by limp rope barriers, as harsh fluorescent ceiling lights bounce their reflection off the slick laminate floor. However, when one reads the text, which indicates that the shot was taken at the US Central Intelligence Agency's headquarters in Langley, Virginia, it becomes much more alluring and enigmatic. Simon's shot is part of her 2007 series, An American Index to the Hidden and Unfamiliar, which presents perspectives that are mostly unknown to the general public.

The photograph intrigued Johanna Barron, a Portland-based artist when she first saw it in 2008. She was encouraged to learn more about the CIA's abstract painting collection. However, she found little available material, except a single page on the CIA website with no photographs and some brief details in a book about the agency. Although the lack of information was not unusual for a cash-strapped federally sponsored organization, Barron decided to investigate further by filing a series of FOIA requests. This would be the first stage in a sophisticated artistic undertaking that would keep Barron busy for years to come. Edge of Wonder TV has covered a detailed video on the CIA’s secret art collection.

Here is a small reference to the previous article:-

The previous post highlighted restored access during “Facebook’s shutdown.” Meta announced that the issue had been resolved following a two-hour downtime. The company expressed regret for any inconvenience resulting from technical issues.

Obtaining historical records:-

As any scholar who has gone through the time-consuming process of discovering and obtaining historical records can attest, asking busy librarians to find information on your behalf rarely yields results. Barron would respond similarly to her FOIA requests. Her requests for photographs of the gathering and acquisition records, such as information about tax advantages for donors and funding for purchases, were frequently denied because the documents relating to the paintings were not "government records" and thus were not subject to FOIA regulations.

Once again, a lack of publicly available information, which could have been explained away by a processing snafu or a lack of resources, took on a mysterious air, with the CIA acting evasively. Barron's search for knowledge only intensified, as she stated: "I felt this increasing need to try to uncover details that appeared to be kept secret for no logical reason." In 2014, Barron obtained over 100 pages of severely censored documentation, allowing her to put together more information about the collection.

Abstract paintings:-

The abstract paintings that had piqued Barron's interest were among a tiny collection lent to the CIA by Vincent Melzac, a bigger-than-life art connoisseur and former director of the Corcoran Collection of Art in Washington, DC. Melzac began sharing paintings with the agency in 1968, including those by painters involved with the Washington Color School. Two decades later, the CIA bought eleven of the pieces, but after Melzac died in 1989, his estate consented to continue loaning canvases. Barron used this newly discovered information to build 3/4 size copies of several of the 29 paintings, which she first showed in 2015 under the title Acres of Walls.

Carey Dunne, a journalist for Hyperallergic, contacted the agency's Public Affairs division after being informed by DC-based creator Barbara Januszkiewicz that the government's art collection may not be as hidden as it first appeared. She was startled to learn that plans were quickly made for her to visit Langley and that she was permitted to publicize her tour of the art collection, including photographs. The abstract paintings from Melzac's collection stood out among a diverse collection of art displayed across CIA headquarters, comprising realistic paintings commemorating the agency's accomplishments and official portraits of previous CIA directors.

The mundane justifications offered for this collection comprised brightening up the building with art that complemented the architectural age (the Old Headquarters Building was finished in 1961) and connected to Langley's position in the Washington metropolitan area. However, Dunne discovered an intriguing feature of the CIA's collection of abstract art: it was also used for teaching purposes.

Hyperallergic speculated about art collection:-

Hyperallergic further speculated that the art collection may have been chosen by the CIA about the agency's secret backing for Abstract Expressionism during the Cold War. The story Dunne relates to, which has been fueled by sensationalized pieces in the New Yorker and the Independent, among others, is yet another simplifying and mythologization of a more complicated but less famous tale linking art and espionage - and more evidence of the desire to maintain a narrative of CIA secrecy that prompted both Johanna Barron's project and the subsequent press coverage.

However, if the CIA kept its art collection secret, it could have been for a good purpose. While investigating her article, Dunne contacted Robert Newmann, the agency's last living abstract painter. Melzac did not inform the artists about the loan of their works to the CIA, according to Newmann, who found this fact in 2012, when Warner Brothers asked for permission to use the painting Arrows in Hollywood the Big Argo, which was filmed on-site at Langley.

Concluding Opinions:-

Taryn Simon's photograph, taken at CIA headquarters, is part of a series that aims to reveal hidden and unfamiliar perspectives to the public.

The author, Barron, faced difficulties in obtaining historical records and information through FOIA requests, as the documents related to the paintings were not considered "government records" and were therefore exempt from FOIA regulations.

Barron's interest in abstract paintings led her to create 3/4 size copies of pieces lent to the CIA by Vincent Melzac, showcasing them in an exhibition titled Acres of Walls in 2015.

The art collection chosen by the CIA during the Cold War may have been a part of their secret support for Abstract Expressionism, and the story surrounding it is a simplified and sensationalized version of a more complex narrative, highlighting the agency's desire to maintain a narrative of secrecy.

0 notes

Text

Feeling Overwhelmed by Your Commercial Real Estate Transaction Process? We Can Help

Buying or selling commercial property in Virginia or North Carolina? You're not alone! The commercial property transaction process can be complex, with mountains of paperwork and potential legal hurdles. Our team of experts will guide you through the entire commercial real estate transaction process, from title examinations to navigating loan and insurance details. We handle everything with meticulous care, ensuring a secure and efficient closing. At NexGen Title Agency, we believe in clear communication and upfront pricing. You'll always know exactly where you stand. Don't let the complexities of the commercial real estate transaction process hold you back. Contact NexGen Title Agency in Virginia & North Carolina today and let's discuss how we can make your commercial property deal a success!

0 notes

Text

[Free Audiobooks] The Getaway by Lamar Giles & The Wonderland Collection by Lewis Carroll [YA Dystopian Horror & 19th C Classic Fantasy & Math Puzzle Stories]

The annual SYNC Summer of Listening program encouraging literacy among teens by giving away a themed weekly pair of audiobooks—usually 1 modern or non-fiction, 1 classic or drama—returns for another year, courtesy of sponsor AudioFile Magazine and participating publishers.

This 13th week's theme is “Caught in Another's Game”, exploring what happens when characters are no longer in control of their own lives, available from Thursday July 20th through Wednesday July 26th:

The Getaway by Lamar Giles, a recipient of the Virginia's Readers Choice Award and nominee for the Edgar, read by Karl T. Wright, Imani Parks, & P. J. Ochlan from Scholastic Audiobooks. This is a standalone YA dystopian horror novel, set in a near future ravaged by weather disasters, starring a teen whose family are all live-in employees at a cushy theme park refuge for the ultra-wealthy escaping the widespread environmental destruction and societal unrest, where the dynamic changes when a new set of overprivileged “guests” arrive, whose cruel treatment pushes him and his friends to realize the extent of their indentured servitude and take the risk of escaping from it, if they can.

The Wonderland Collection by 19th century author Lewis Carroll, pseudonym of mathematician Charles Lutwidge Dodgson, read by Simon Bubb from Thomas Nelson, a division of HarperCollins. This is an omnibus of Carroll's classic children's portal fantasy novels, Alice in Wonderland & Alice Through the Looking Glass which see the titular heroine follow a rabbit into a whimsical magical realm of surreal adventures, and the collection A Tangled Tale featuring humorous short stories centred upon mathematical problems.

The freebies are available via Overdrive's Sora service (listenable via browser on their website, or via their mobile app for iOS & Android devices). To claim them, you'll need to register on the SYNC website with a valid email address to use in a Sora account, using the setup code and directions in the instructions in SYNC's FAQ (no need to re-register if you've participated in previous years' giveaways), clicking “Borrow” to add them to your Sora library as a permanent loan. NB: if you need to free up space on your device later, follow the instructions in the FAQ to only “delete files” and DO NOT “Return” the title, which would remove your future access.

Offered worldwide through Wednesday July 26th until just before midnight Eastern Time, available via the Sora website and app. You can also browse AudioFile Magazine's planned season list to see what will be offered in the weeks ahead and if there's anything you'd especially like to get.

#free audiobooks#lamar giles#lewis carroll#young adult#horror#fantasy#children's classics#dystopia#math puzzles#mathematics#classics#children's literature

0 notes

Text

Woodrow Wilson High School Yearbooks, 1921-2001

The yearbooks of Wilson High School in Portsmouth, Virginia, were traditionally titled 'The President' since 1924. These yearbooks were loaned by the Portsmouth Public Library to be scanned by the Library of VA. Not all volumes are currently available.

Woodrow Wilson High School has a history dating back to 1885, when a high school was first organized at The Academy on Glasgow Street. The school moved several times, first to Green Street in 1886, then to High Street in 1919 where it was renamed Woodrow Wilson High School. In 1955, it moved again to Willett Drive. In 1993, the Portsmouth School Board decided to move Woodrow Wilson High School to…

View On WordPress

0 notes

Text

Top Home Buyer Questions Tysons Corner, Virginia: Answered by Red Door Metro

Buying a home is a major investment, and it can be a daunting task, especially for first-time home buyers. If you're considering buying a home in Tysons Corner, Virginia, you probably have a lot of questions. In this article, we'll answer some of the top home buyer questions in Tysons Corner, Virginia, and provide you with valuable insights that will help you make an informed decision.

1. What is the Current Real Estate Market Like in Tysons Corner?

Understanding the current real estate market is crucial when it comes to making a buying decision. In Tysons Corner, Virginia, the current real estate market is highly competitive, with low inventory and high demand for homes. This means that home prices are likely to be high, and you may need to act fast if you find a home that you like.

2. How Much Should I Expect to Pay for a Home in Tysons Corner?

The cost of a home in Tysons Corner varies depending on several factors, such as the location, size, and condition of the property. As of 2023, the median home value in Tysons Corner is around $900,000. However, there are homes available at various price points, so it's essential to work with a real estate agent who can help you find a home that fits your budget.

3. What are the Best Neighborhoods to Buy a Home in Tysons Corner?

Tysons Corner has several great neighborhoods that offer a high quality of life. Some of the best neighborhoods to consider include:

Westwood Village: A family-friendly community with excellent schools, parks, and shopping centers.

Park Crest: A luxury community with high-end amenities and a convenient location near Tysons Galleria.

The Reserve: A gated community with spacious homes, beautiful scenery, and plenty of privacy.

4. What Should I Look for in a Home Inspection?

A home inspection is a crucial step in the home buying process. During a home inspection, a professional inspector will evaluate the condition of the property and identify any potential issues that may require repairs. Some things to look for during a home inspection include the condition of the roof, plumbing, electrical systems, and HVAC system.

5. How Do I Choose a Mortgage Lender?

Choosing the right mortgage lender is essential when buying a home. A good mortgage lender will offer competitive rates, flexible loan options, and excellent customer service. Some factors to consider when choosing a mortgage lender include their reputation, experience, and responsiveness.

6. Should I Work with a Real Estate Agent?

Working with a real estate agent is highly recommended when buying a home. A good real estate agent can help you find homes that meet your needs, negotiate with sellers, and guide you through the entire buying process. It's essential to work with a real estate agent who has experience in the Tysons Corner market and who understands your needs and preferences.

7. What Are the Closing Costs Involved in Buying a Home in Tysons Corner?

Closing costs are the fees associated with the purchase of a home. They can include appraisal fees, attorney fees, title search fees, and more. In Tysons Corner, the average closing costs are around 2-5% of the purchase price of the home.

8. How Long Does it Take to Buy a Home in Tysons Corner?

The timeline for buying a home in Tysons Corner can vary depending on several factors, such as the availability of homes, the speed of the mortgage process, and the length of the closing process. On average, the home buying process in Tysons Corner takes around 30-45 days.

9. What are the Advantages of Buying a Home in Tysons Corner?

There are several advantages of buying a home in Tysons Corner, Virginia, including:

Excellent schools: Tysons Corner has some of the best schools in the region, making it a great place to raise a family.

Convenient location: Tysons Corner is located just 14 miles from Washington, D.C., making it a great place for commuters.

Strong job market: Tysons Corner is home to several major corporations, including Capital One, Booz Allen Hamilton, and Freddie Mac, providing a robust job market.

Quality of life: Tysons Corner offers a high quality of life, with excellent shopping, dining, and entertainment options.

10. What Should I Consider When Buying a Home in Tysons Corner?

When buying a home in Tysons Corner, it's essential to consider several factors, such as:

Your budget: Make sure you have a clear idea of how much you can afford to spend on a home.

Your needs and preferences: Consider the size, location, and style of the home that you want.

The condition of the property: Ensure that the home is in good condition and doesn't require any major repairs.

The neighborhood: Consider the safety, quality of schools, and other amenities of the neighborhood.

11. How Can Red Door Metro Help Me Buy a Home in Tysons Corner?

Red Door Metro is a leading real estate company in Tysons Corner, Virginia, with a team of experienced and knowledgeable real estate agents. Our agents have a deep understanding of the Tysons Corner market and can help you find the perfect home that fits your needs and budget. We can guide you through the entire home buying process, from searching for homes to negotiating with sellers and closing the deal.

12. What Sets Red Door Metro Apart from Other Real Estate Companies?

At Red Door Metro, we pride ourselves on providing exceptional customer service and going above and beyond to help our clients achieve their goals. Our agents are highly responsive and always available to answer your questions and address any concerns you may have. We are committed to making the home buying process as smooth and stress-free as possible for our clients.

13. What Should I Expect During the Home Buying Process?

The home buying process can be broken down into several steps, including:

Pre-approval: Get pre-approved for a mortgage to determine your budget.

Home search: Search for homes that meet your needs and preferences.

Home inspection: Have a professional home inspector evaluate the condition of the property.

Negotiation: Negotiate with the seller to reach an agreement on the price and terms of the sale.

Closing: Close the deal and complete the paperwork to take ownership of the home.

14. How Can I Get Started with Red Door Metro?

If you're interested in buying a home in Tysons Corner, Virginia, contact Red Door Metro today to get started. Our experienced real estate agents will work with you every step of the way to help you find your dream home and make your home buying journey a success.

15. Conclusion

Buying a home in Tysons Corner, Virginia, can be an exciting and rewarding experience, but it's important to have a clear understanding of the home buying process and the local real estate market. By working with a reputable real estate company like Red Door Metro and asking the right questions, you can make an informed decision and find the perfect home that meets your needs and budget.

Zillow

Google Map

Websiite

0 notes

Text

vimeo

Get Auto Title Loans Port Lavaca TX and nearby cities Provide Car Title Loans, Auto Title Loans, Mobile Home Title Loans, RV/Motor Home Title Loans, Big Rigs Truck Title Loans, Motor Cycle Title Loans, Online Title Loans Near me, Bad Credit Loans, Personal Loans, Quick cash Loans

Contact Us:

Get Auto Title Loans Port Lavaca TX

717 N Virginia B,

Port Lavaca, TX 77979

Phone: 737-242-7499

Email : [email protected]

Website: https://getautotitleloans.com/auto-and-car-title-loans-port-lavaca-tx/

An auto title loans are typically utilized by those that wish to obtain a funding with bad credit rating or no credit in any way. An auto-mobile title lending frequently called a vehicle title lending or merely title funding as well as pink slip funding’s. You merely should have a vehicle that is paid off or nearly paid off and also you could make use of the auto title as security to obtain the cash money you require, enabling you to continue driving your vehicle while paying your loan.

0 notes

Text

Realizing the Benefits of Blockchain in Real Estate Finance

Before we proceed I would like you people to watch this one-minute short video explaining what is Blockchain:

Real estate finance is a critical component of the economy, as it enables individuals and businesses to purchase, develop, and invest in property. However, the process can be slow, opaque, and prone to fraud. Blockchain technology has the potential to change that.

In this story, we will explore how blockchain technology is being used to streamline and secure real estate transactions, from property title transfer to mortgage lending. We will examine the benefits that blockchain can bring to the real estate finance industry and look at some examples of current or pilot projects that are using blockchain in this field. Finally, we will discuss the potential impact of blockchain on the real estate finance industry and other stakeholders.

By the end of this story, readers will have a better understanding of the potential of blockchain in real estate finance and the ways in which it can benefit the industry and the economy as a whole.

Streamlining Transactions:

Blockchain technology has the potential to streamline real estate transactions in a number of ways. One of the most significant benefits is its ability to digitize and automate property title transfer. In traditional systems, property titles are often recorded on paper and transferred through a complex and time-consuming process. Blockchain technology can make this process faster and more efficient by creating a digital record of property ownership that is tamper-proof and easily transferable.

For example, the Cook County Recorder of Deeds in Illinois has been testing a blockchain-based system for recording property titles. The system allows for faster and more accurate property title transfer and reduces the risk of fraud. Similarly, the government of West Virginia has been testing a blockchain-based system for recording and transferring property titles, which has been reported to be more efficient and secure than traditional methods.

In addition to property title transfer, blockchain technology can also be used to streamline mortgage lending. Smart contracts can be used to automate the mortgage application process, ensuring that all necessary information is collected and verified in a secure and transparent way. For example, a start-up called Factom has developed a blockchain-based system for mortgage lending that allows for faster and more secure loan processing.

By streamlining transactions, blockchain technology can make the process of buying, selling, and investing in property faster, cheaper, and more secure. This can benefit everyone involved in the real estate finance industry, from buyers and sellers to banks and regulators.

Enhancing Security:

One of the most significant benefits of blockchain technology in real estate finance is its ability to enhance security. Blockchain creates a tamper-proof record of transactions, which can reduce the risk of fraud and errors in the real estate finance process.

For example, Smart contracts can be used to automate the process of transferring property titles, ensuring that the title is transferred only when certain conditions are met, such as payment being received. This can reduce the risk of fraud and errors in the title transfer process. Additionally, with smart contract-based transactions, all parties have access to the same information, which can increase transparency and reduce the risk of fraud.

Another way in which blockchain can enhance security in real estate finance is through the use of digital identities. Blockchain-based digital identities can be used to verify the identity of buyers and sellers in real estate transactions. This can reduce the risk of identity fraud and ensure that transactions are conducted only between legitimate parties.

Blockchain technology can enhance security in real estate finance by creating a tamper-proof record of transactions, automating the process with smart contracts, and verifying digital identities. This can reduce the risk of fraud and errors, increase transparency and enhance the security of the overall process.

Potential Impact:

The potential impact of blockchain technology on the real estate finance industry is significant. By streamlining transactions and enhancing security, blockchain can reduce costs and increase efficiency for both buyers and sellers. This can make the process of buying, selling, and investing in property more accessible and affordable, which can have a positive impact on the overall economy.

In addition to reducing costs and increasing efficiency for buyers and sellers, blockchain technology can also benefit other stakeholders in the real estate finance industry. For example, banks and other financial institutions can use blockchain technology to reduce the risk of fraud and errors in their real estate finance operations. This can lead to lower costs and increased efficiency for these institutions, which can ultimately benefit consumers.

Similarly, regulators can use blockchain technology to increase transparency and oversight in the real estate finance industry. By providing a tamper-proof record of transactions, blockchain can make it easier for regulators to identify and prevent fraudulent activities. This can lead to a more stable and secure real estate finance market, which can benefit both buyers and sellers.

Blockchain technology has the potential to revolutionize the real estate finance industry by streamlining transactions, enhancing security, and reducing costs. This can benefit buyers and sellers, banks, and regulators, and have a positive impact on the overall economy.

Conclusion:

In this story, we have discussed the potential of blockchain technology in real estate finance. We have looked at how blockchain can be used to streamline transactions, such as property title transfer and mortgage lending, and enhance security by creating a tamper-proof record of transactions and automating the process with smart contracts.

The potential impact of blockchain on the real estate finance industry is significant. By reducing costs and increasing efficiency for buyers and sellers, it can make the process of buying, selling, and investing in property more accessible and affordable. This can have a positive impact on the overall economy. Banks, other financial institutions, and regulators can also benefit from the enhanced security and transparency provided by blockchain technology, which can lead to a more stable and secure market.

Blockchain technology has the potential to revolutionize the real estate finance industry and bring significant benefits to all stakeholders. As technology continues to evolve, it will be interesting to see how it is adopted and integrated into the industry in the future. We encourage readers to continue learning about blockchain technology and its potential applications in real estate finance and other industries.

Join my Web 3 Community:

#blockchain#realestate#crypto#web3#property#smartcontract#decentralization#digitalassets#landregistry#transparency#efficiency#innovation#technology

0 notes

Text

Can you receive CASH for your home?

Yes, it is possible to receive cash for your home.Selling your home to a cash buyer: One of the most common ways to receive cash for your home is by selling it to a cash buyer. Cash buyers are individuals or companies who have the cash on hand to purchase your home outright. Selling your home to a wholesaler: Wholesalers are individuals or companies that purchase homes at a discounted price, usually for the purpose of flipping or renting them. They often pay cash and can close the sale quickly. Selling your home to a real estate investor: Real estate investors are individuals or companies that purchase homes as an investment. They may pay cash and can close the sale quickly. Selling your home through a short sale: A short sale is a way to sell your home for less than what is owed on the mortgage. It is typically used as a last resort when the homeowner is unable to make the mortgage payments and is facing foreclosure. In this case, the lender may agree to accept less than the full amount of the mortgage, and the homeowner can receive cash from the sale of the home. Rent to own: Rent to own is a type of arrangement where the homeowner rents out their property to a tenant, who has the option to purchase the property at a later date. The tenant typically pays a higher rent than market value and a portion of the rent goes towards the down payment for the property. This allows the homeowner to receive cash upfront and provides a potential buyer a chance to purchase the home.

Frequently Asked Questions:How do I know if a buyer is a cash buyer? One way to tell if a buyer is a cash buyer is to ask them if they have pre-approval for a loan. Cash buyers do not need to obtain financing and will not have pre-approval. Additionally, you can ask for proof of funds, such as a bank statement, to verify that they have the cash to purchase your home. How long does it take to close a cash sale? The length of time it takes to close a cash sale can vary, but it is generally faster than a traditional sale as cash buyers do not need to go through the process of obtaining financing. Typically, a cash sale can close within a few weeks. How can I protect myself when selling my home for cash? It is important to work with a reputable cash buyer and to have a written contract in place that includes all the terms of the sale. Additionally, it is a good idea to conduct a title search and to have a title insurance policy in place to protect yourself from any potential title issues.

Conclusion:

Receiving cash for your home can be done by selling it to a cash buyer, a wholesaler, a real estate investor, through a short sale or rent to own. it is important to verify that the buyer is a cash buyer by asking for proof of funds, such as a bank statement. sell your house fast in Virginia Additionally, it is important to protect yourself by working with a reputable cash buyer, having a written contract in place, and conducting a title search. It is recommended to consult with a local real estate agent for their expert opinion. Keep in mind that each situation is unique, and it is important to consider all options and make the best decision for your specific circumstances.

0 notes

Text

Title Loans in Virginia

No Credit Check Title Loan in Virginia Fast VA & Nationwide USA. Get Qualified for Title Loans Near Me Today. Fair Cash Offers. Any Location: Online Title Loans Virginia, Get a Loan With Car Title in Virginia Nationwide USA! 1 (833) 461-0143

Virginia Title Loans

Finding the best direct quick approval instant loan lender for bad credit is vital so that you get the loan at the best possible rates and no hidden fees. There are many online payday loan providers offering cash loans instantly at lower than the prevailing average rates in order to get more clients.

Title Loan Virginia is here to help you find the right instant cash lender, so that you would get the immediate cash online easily and also quickly. Hence, it is important to take your time when choosing the right online payday loan with same or next day approval in Virginia!

Virginia

Virginia Beach | Chesapeake | Arlington | Norfolk | Richmond | Newport News | Alexandria | Hampton | Roanoke | Portsmouth | Suffolk | Lynchburg | Centreville | Dale City | Reston | Harrisonburg | McLean | Leesburg | Tuckahoe | Charlottesville | Ashburn | Lake Ridge | Blacksburg | Woodbridge | Annandale | Manassas | Danville | Burke | Linton Hall | Mechanicsville | Marumsco | Oakton | Fair Oaks | South Riding | Petersburg | Springfield | Short Pump | Sterling | West Falls Church | Winchester | Fredericksburg | Cave Spring | Tysons | Staunton | Salem | Bailey's Crossroads | Herndon | Chantilly | Fairfax | Cherry Hill | Brambleton | Chester | West Springfield | Christiansburg | Hopewell | Lincolnia | Montclair | Waynesboro | McNair | Rose Hill | Meadowbrook | Woodlawn CDP | Merrifield | Buckhall | Neabsco | Lorton | Culpeper | Franklin Farm | Sudley | Franconia | Colonial Heights | Gainesville | Bon Air | Idylwood | Laurel | Burke Centre | Fort Hunt | Manassas Park | Bristol | Kingstowne | Bull Run | Highland Springs | Wolf Trap | Vienna | Hybla Valley | Glen Allen | Radford | Great Falls | Groveton | Hollins | Williamsburg | East Highland Park | Stone Ridge | Front Royal | Falls Church | Broadlands | Huntington | Brandermill | Martinsville | Kings Park West | Timberlake | Newington | Newington Forest | Mount Vernon | Poquoson | Lansdowne | Fairfax Station | Cascades | Sugarland Run | Lakeside | Stuarts Draft | Manchester | Wakefield | Dranesville | Forest | Loudoun Valley Estates | New Baltimore | George Mason | Wyndham | Lowes Island | Yorkshire | Madison Heights | Gloucester Point | Countryside | Belmont | Independent Hill | Lake Monticello | Warrenton | Fort Lee | Lake Barcroft | Fishersville | Triangle | Dunn Loring | Crozet | Seven Corners | Innsbrook | Pulaski | Purcellville | Woodburn | Rockwood | Hollymead | Smithfield | Dumbarton | Greenbriar | Fair Lakes | Abingdon | Floris | Laurel Hill | Wytheville | Franklin | Lake of the Woods | Vinton | South Boston | Montrose | University of Virginia | Long Branch | Sandston | Bellwood | Fort Belvoir | Ashland | Mantua | Carrollton | Woodlake | Farmville | North Springfield | Collinsville | Lexington | Ettrick | Strasburg | Belle Haven CDP | Aquia Harbour | Galax | Bedford | Buena Vista | Bridgewater | Pimmit Hills | South Run | Massanetta Springs | Potomac Mills | Bensley | Dulles Town Center | Bealeton | Woodstock | Emporia | Marion | Covington | Crosspointe | Dumfries

Nationwide USA

Alabama | Alaska | Arizona | Arkansas | California| Colorado | Connecticut | Delaware | Florida | Georgia | Hawaii | Idaho | Illinois | Indiana | Iowa | Kansas | Kentucky | Louisiana | Maine | Maryland | Massachusetts | Michigan | Minnesota | Mississippi | Missouri | Montana | Nebraska | Nevada | New Hampshire | New Jersey | New Mexico | New York | North Carolina | North Dakota | Ohio | Oklahoma | Oregon | Pennsylvania | Rhode Island | South Carolina | South Dakota | Tennessee | Texas | Utah | Vermont | Virginia | Washington | West Virginia | Wisconsin | Wyoming | Washington DC (District of Columbia)

Car Title Loans in Virginia

There are many offers like title loans online with instant decision on loan approval or same day cash advance loans for bad credit that you will find. You need to dig deep and choose wisely considering both cons and pros of such advances. The reality is that no one can guarantee you 100% approval and they will definitely carry out some sort of background check before lending you the quick loan online, even if you need emergency cash now.

Title Loans in Virginia

We can help you get the title loans you need–especially if you are dealing with an emergency situation. Best of all, unlike the bank, you won’t need to wait for too long to get approved for your loan. Unlike other lenders, Virginia Title Loan will give you a loan based on the value and equity of your car. Our title loans are accessible to everyone, even if you’ve been turned down by other lenders because of bad credit. Since our application process is super easy, the entire process can be as short as 15 minutes to get your loan approved! Even if you have a low credit score or a poor payment history, you can still get a loan and drive off in your own car!

Auto Title Loan VA

Virginia Title Loans is happy to help those who have fallen into a rough patch as we know these things are temporary. Aside from credit score, another large determining factor when trying to get a loan is your employment and income status, meaning when you’re out of a job or are self-employed the process gets exceedingly difficult.

At Virginia Title Loans, we’re happy to work around these kinds of situations and still provide cash to our customers with an auto title loan. These are the times that you’re going to need cash the most, and Title Loans Virginia is here to help the communities that have allowed us to remain in business for so long. No matter how unique your situation might be, we’re happy to help you evaluate your options at no cost to you and find a way to get you your cash.

1 note

·

View note

Note

I would like to piggy back off the previous anon's comment and please request the classic's within the fandom 🙏

Sorry, I have no clue what previous anon ask you’re referring to. We have answered this, and other asks along the same lines, several times before. The fandom classics don’t really change, so please check out our previous responses here, here, here, here, and here!

A few, more recent, popular fics (that have been mentioned on this blog before!) that may become staple fandom classics are...

The False and the Fair by Princip1914 (E)

Growing up in the shadow of West Virginia’s Eden Mountain, Aziraphale Wright always expected to work for the family coal mining company. Anthony Crowley, the son of a down-and-out miner, was going to become a pilot and leave town forever. Now, thirty years later, neither of their lives have gone as planned, and an unexpected inheritance brings them back into one another’s orbit. Aziraphale hopes that they can move beyond their shared past, and a high school arrangement that ended in disaster, but he has secrets of his own that threaten their fragile reconnection…

Finished, July 2021.

This fic will occasionally be archive locked (I put all my E rated work behind a lock at various times due to personal reasons) but please don’t let that put you off reading it!

Old Vines by sevdrag (E)

A.Z. Fell, one of the most respected names in wine and food blogging, has been sent on assignment with his assistant Warlock Dowling to spend six months in California Wine Country. Under direction (by his boss, Gabriel) to use this experience to double his blog followers and write a novel, Aziraphale is both excited and anxious about the opportunity.

Anthony J. Crowley is the owner and viticulturalist of Ecdyses, a winery that unexpectedly fell into his lap eleven years ago when he hit rock bottom. He may be in debt, yeah, but he’s paying off his loans — and despite pressure from his lenders and their team of inspectors, Crowley has found a kind of contentment tending his little corner of terroir and producing extraordinary wine. Crowley’s old vines are the heart of his vineyard, and he’s never let anyone in.

Crowley finds Aziraphale intriguing; Aziraphale finds Crowley enthralling. Turns out a famous wine expert and an experienced viticulturalist can still learn things from each other. The summer of 2019 unfolds.

What We Make of It (Shotgun Wedding) by charlottemadison (E)

The important thing, Crowley tells himself -- the most important thing -- is Adam, his brilliant, creative, empathetic nephew. Being fourteen's hard enough; the kid didn't ask to deal with the weight of the world on top of it.

And if taking care of Adam means Crowley has to tough it out at a job he can’t stand, so be it.

And if Crowley's job means that Adam’s charming English teacher is NOT a romantic possibility, well, that's just how things go.

But the occasional drink with Aziraphale proves hard to resist. They frequent the same pub, so who can object to them saying hello? Briefly sharing a table? Perhaps a little conversation? The painful knowledge that it can’t be anything more -- not without somebody getting fired or sued or both -- well, that can't be helped.

Until Crowley stumbles onto a terribly reckless idea...

(This story was formerly titled 'Shotgun Wedding: sometimes a first date requires paperwork.' Some edits and updates to the text have been made as of Dec. 2021.)

- Mod D

157 notes

·

View notes

Photo

Memoirs written by Asian Authors

Selected titles celebrating Asian American/Pacific Islander Heritage Month

Eat a Peach by David Chang

In 2004, David Chang opened a noodle restaurant named Momofuku in Manhattan's East Village, not expecting the business to survive its first year. In 2018, he was the owner and chef of his own restaurant empire, with 15 locations from New York to Australia, the star of his own hit Netflix show and podcast, was named one of the most influential people of the 21st century and had a following of over 1.2 million. In this inspiring, honest and heartfelt memoir, Chang shares the extraordinary story of his culinary coming-of-age.

Growing up in Virginia, the son of Korean immigrant parents, Chang struggled with feelings of abandonment, isolation and loneliness throughout his childhood. After failing to find a job after graduating, he convinced his father to loan him money to open a restaurant. Momofuku's unpretentious air and great-tasting simple staples - ramen bowls and pork buns - earned it rave reviews, culinary awards and before long, Chang had a cult following.

Momofuku's popularity continued to grow with Chang opening new locations across the U.S. and beyond. In 2009, his Ko restaurant received two Michelin stars and Chang went on to open Milk Bar, Momofuku's bakery. By 2012, he had become a restaurant mogul with the opening of the Momofuku building in Toronto, encompassing three restaurants and a bar.

Chang's love of food and cooking remained a constant in his life, despite the adversities he had to overcome. Over the course of his career, the chef struggled with suicidal thoughts, depression and anxiety. He shied away from praise and begged not to be given awards. In Eat a Peach, Chang opens up about his feelings of paranoia, self-confidence and pulls back the curtain on his struggles, failures and learned lessons. Deeply personal, honest and humble, Chang's story is one of passion and tenacity, against the odds.

All You Can Ever Know by Nicole Chung

What does it mean to lose your roots—within your culture, within your family—and what happens when you find them?

Nicole Chung was born severely premature, placed for adoption by her Korean parents, and raised by a white family in a sheltered Oregon town. From early childhood, she heard the story of her adoption as a comforting, prepackaged myth. She believed that her biological parents had made the ultimate sacrifice in the hopes of giving her a better life; that forever feeling slightly out of place was simply her fate as a transracial adoptee. But as she grew up—facing prejudice her adoptive family couldn’t see, finding her identity as an Asian American and a writer, becoming ever more curious about where she came from—she wondered if the story she’d been told was the whole truth.

With warmth, candor, and startling insight, Chung tells of her search for the people who gave her up, which coincided with the birth of her own child. All You Can Ever Know is a profound, moving chronicle of surprising connections and the repercussions of unearthing painful family secrets—vital reading for anyone who has ever struggled to figure out where they belong.

Dear Girls: Intimate Tales, Untold Secrets, & Advice for Living Your Best Life by Ali Wong

Ali Wong's heartfelt and hilarious letters to her daughters (the two she put to work while they were still in utero), covering everything they need to know in life, like the unpleasant details of dating, how to be a working mom in a male-dominated profession, and how she trapped their dad.

In her hit Netflix comedy special Baby Cobra, an eight-month pregnant Ali Wong resonated so heavily that she became a popular Halloween costume. Wong told the world her remarkably unfiltered thoughts on marriage, sex, Asian culture, working women, and why you never see new mom comics on stage but you sure see plenty of new dads.

The sharp insights and humor are even more personal in this completely original collection. She shares the wisdom she's learned from a life in comedy and reveals stories from her life off stage, including the brutal singles life in New York (i.e. the inevitable confrontation with erectile dysfunction), reconnecting with her roots (and drinking snake blood) in Vietnam, tales of being a wild child growing up in San Francisco, and parenting war stories. Though addressed to her daughters, Ali Wong's letters are absurdly funny, surprisingly moving, and enlightening (and disgusting) for all.

The Woman Warrior by Maxine Hong Kingston

The Woman Warrior: Memoirs of a Girlhood Among Ghosts is Kingston's disturbing and fiercely beautiful account of growing up Chinese-American in California. The young Kingston lives in two worlds: the America to which her parents have immigrated and the China of her mother's "talk stories." Her mother tells her traditional tales of strong, wily women warriors - tales that clash puzzlingly with the real oppression of women. Kingston learns to fill in the mystifying spaces in her mother's stories with stories of her own, engaging her family's past and her own present with anger, imagination, and dazzling passion.

#nonfiction#non-fiction#nonfiction books#memoir#AAPI#asian american heritage month#asian american pacific islander heritage month#tbr#to read#currently reading#book recs#reading recommendations#recommended reading#library#public library#important topics

108 notes

·

View notes

Text

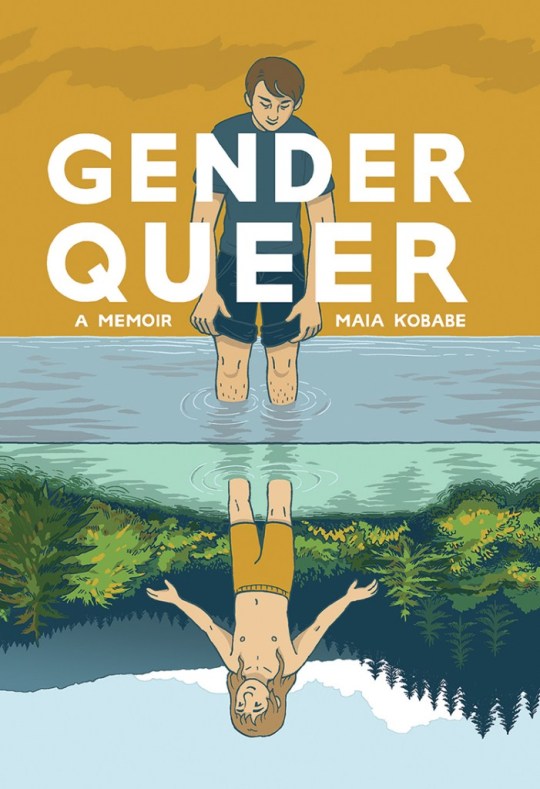

Virginia politicians seek restraining order to prevent Barnes & Noble from selling ‘Gender Queer’ to minors

Virginia State Delegate and lawyer is seeking a restraining order against Barnes and Noble and Virginia Beach Schools “to enjoin them from selling or loaning” the graphic novel Gender Queer and the novel A Court of Mist and Fury to minors without parent consent, according to Book Riot.

On his Facebook page, Tim Anderson, a member of the Virginia House of Delegates, says he is seeking the restraining order on behalf of his client, Tommy Altman, who is currently running for U.S. Congress in Virginia.

“Today, the Virginia Beach Circuit Court has found probable cause that the books Gender Queer and a Court of Mist and Fury are obscene to unrestricted viewing by minors,” Anderson posted. “My client, Tommy Altman, has now directed my office to seek a restraining order against Barnes and Noble and Virginia Beach Schools to enjoin them from selling or loaning these books to minors without parent consent.”

The move follows a decision from last week by the Virginia Beach school board to remove Gender Queer from shelves in the school district’s libraries.

ICv2 received a statement from Barnes & Noble about the situation:

Asked for comment, a Barnes & Noble spokesperson said, “As booksellers, we carry thousands of books whose subject matter some may find offensive. We live in a diverse society, and that diversity of opinion is reflected in the books we carry on our shelves that cater to the wide range of interests of our customers. We ask that our customers respect our responsibility to offer this breadth of reading materials, and respect also that, while they chose not to purchase many of these themselves, they may be of interest to others.”

IcV2 also points out that Anderson was ordered by a judge in 2016 to do pro-bono work for impersonating a federal bankruptcy court judge.

Gender Queer by Maia Kobabe has made headlines over the last few years — first, for winning several awards like the Stonewall Honor Award and an Alex Award, and second, for attempts at banning by libraries across the country. It was the No. 1 most challenged book of 2021, according to the the American Library Association. Its LGBTQIA+-positive content has made it a favored target of conservative politicians who seek to rile up their base prior to the election.

“What I’m learning is that a book challenge is like a community attacking itself,” Kobabe said. “The people who are hurt in a challenge are the marginalized readers in the community where the challenge takes place. That is readers who are younger, readers who do not have the financial means to buy books if they’re not available for free in the library. That is queer teens who might not feel comfortable bringing a book with such an obvious title into their home, if they have more conservative parents who would only feel safe reading the book secretly in the library without even checking it out. So yes, it upsets me because what I’m seeing is resources being taken away from queer marginalized youth, which does hurt. That does hurt me.”

6 notes

·

View notes

Text

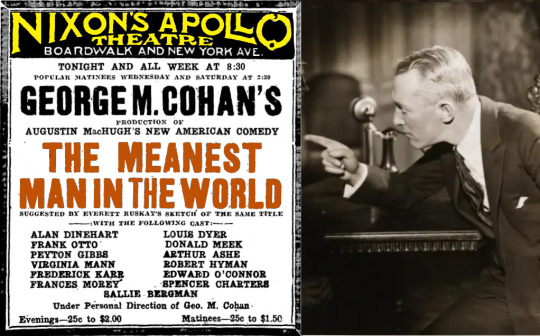

THE MEANEST MAN IN THE WORLD

1920

The Meanest Man in the World is a three-act play by Augustin MacHugh based on a one-act play by Everett Ruskay. Staged by John Meehan, it was originally produced and starring George M. Cohan.

Despite the title, the play is not another version of Charles Dickens’ A Christmas Carol.

Richard Clarke is a good-natured lawyer who lacks the hard-boiled legal instincts to be financially successful. When the object of his affections, Janie Brown, decides to marry a wealthy suitor, Richard resolves, with the help of cutthroat colleague Frederick Leggitt, to win Janie's heart by making the transformation from nice-guy attorney to ruthless legal shark.

The play premiered at Nixon’s Apollo Theatre on the Boardwalk in Atlantic City NJ on July 26, 1920. From AC to AP (Asbury Park), the play did three nights at the Asbury Park Savoy. Three weeks later, when nothing had been heard from the Man...

The ways of the theatre sometimes baffle even those Identified with it and to an outsider the theatre as an institution is about as mystifying as a heathen Chinee.

Take, for Instance, the case of "The Meanest Man In the World," the George M. Cohan production which had Its premier here this summer, Asbury Park folk flocked to see "The Meanest Man" and liked it, and everybody predicted that It was headed for a sure fire Broadway success. There was surprise, therefore, when Alan Dlnehart, who was the man who converted "The Meanest Man" and made a whole community millionaires, bobbed up Monday night In support of Miss Florence Reed In "The Mirage," the new Selwyn play at the Savoy. So we hunted up the smiling' southern gentleman under whose tutelage we have been all season, and asked him about it.

"No, there's nothing the matter with “The Meanest Man In the World," he said. Mr. Cohan Just hadn't room for it In New York, so it has been taken off and is being recast. Meantime, Mr. Dinehart's salary had to be paid, so he was loaned to the Selwyn for "The Mirage." The southern gentleman also whispered that another star, recently appearing in a premiere at the Savoy, has been withdrawn from that cast and Is being rehearsed for still another play which was presented here this summer before being submitted to Broadway. ~ ASBURY PARK PRESS, SEPTEMBER 15, 1920

Simultaneously, in other publications, Cohan was assuring reporters that the Man was booked for Broadway and in rehearsal. Before the Rialto, Cohan took the play to Hartford.

The play opened on Broadway at the Hudson Theatre (formerly the Savoy Nightclub) on October 12, 1920 and ran 202 performances. Dinehart never returned to the role of Leggitt, which was assumed by Elwood F. Bostick. Coincidentally, Cohan’s leading lady had the same surname as his theatre - Hudson.

Meanwhile, two blocks away, the Broadway theatre named for Cohan hosted three different plays since the Meanest Man began.

On December 22, 1923, a silent film version of the play premiered in Atlantic City at the Virginia Theatre on the Boardwalk starring Burt Lytell and Blanche Sweet.

Two decades later, a remake film starred Jack Benny and Priscilla Lane. The script was extensively re-written to trade on Benny’s radio personae, including creating a role for his sidekick, Rochester and using Benny’s theme tune “Love in Bloom”. The film started screening in Atlantic City at the Strand at the end of February 1943. It was eventually also seen at the Capitol and Rialto Theatres on Atlantic Avenue. Historically speaking, it was the shortest (57 minutes) A film released, which caused scheduling problems with theatres nationwide. Today it is problematic because Benny appears in blackface. Sadly, George M. Cohan died while the film was in production.

#George M. Cohan#The Meanest Man in the World#Broadway#Broadway Play#Theatre#Stage#Atlantic City#Nixon's Apollo Theatre#Jack Benny#Hudson Theatre#Augustin MacHugh#1920

3 notes

·

View notes