#trading nyse market

Text

the way that i am now downloading stock market news apps......... and squinting at these crazy ass news articles and learning finance terms n shit.... trying to read these number and graphs........

i am morphing into a middle aged dad of 3 kids. 🧍♂️

#mine#its so joever for me guys.#it started with the boomer ellipses and now here we are#save yourselves gang.... SAVE YOURSELVES#to be clear yes i am still Anarchist and anticapitalist#but man. sometimes you get sick and tired of being sick and tired and if pretending to day trade along with finance bros#and laughing at their misfortunes when stock values plummet helps out my mental health? then babey. lemme get my trading apps open#to be clear also: i'm not trading stocks either. well not actively anyways#ive just become irrationally obsessed with this shit out of nowhere. but rn my broke ass cannot afford to gamble money#on the current volatile ass market#so i'm safely sticking to my bonds and my etfs for now#and watching the circus that the NYSE turns into every 3rd quarter or so#oh ye btw finance news: warren buffet sold half of his tech shares recently including apple stocks#so its looking like it is So Joever for ai and tech which is absolutely hilarious considering all these phone companies#are pushing ai SO HARD rn. but even investors arent buying it anymore#news articles are saying lots of investors are pulling out of risky investments rn. selling stocks. piling their money into bonds for now#but last 2 quarters of every finance year are like that so i'm not too concerned#the October Scare is real with these guys lol#more reasons why october is my absolute fave month LMAO

3 notes

·

View notes

Text

The Why Files on the NWO plans ...

#the why files#nwo#fuck the wef#wef#uniparty#united nations#nato#banks#bankers#money management#old money#money#stock market#stock trading#nyse#nasdaq#real estate

5 notes

·

View notes

Text

NASDAQ: The electronic stock market - 1972.

#vintage advertising#vintage illustration#nasdaq#nyse#new york stock exchange#stocks#securities#electronic stock market#stock market#stock trading#bunker-ramo corporation

6 notes

·

View notes

Text

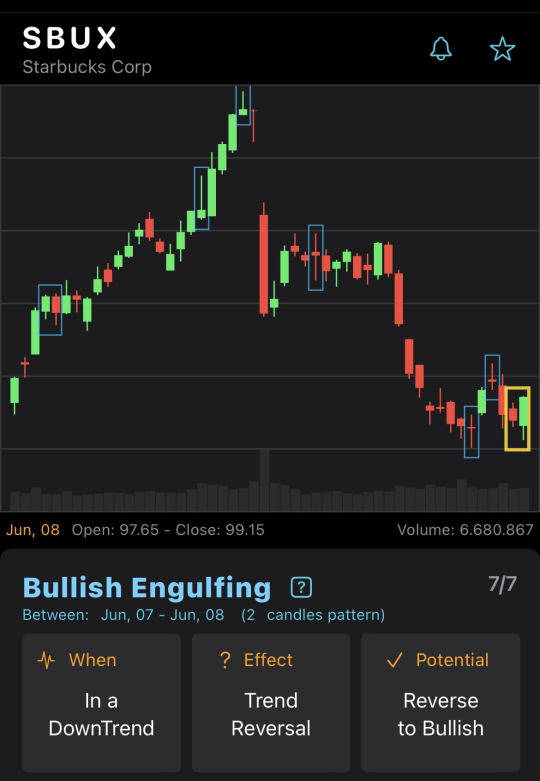

Bullish Engulfing on SBUX chart

BullishEngulfing CandleStickPattern on SBUX end-of-day chart on Jun, 08. Potential reverse to bullish.

7 notes

·

View notes

Text

Navigating the world of mergers and acquisitions (M&A) can be a daunting task, filled with intricate processes that require meticulous due diligence and feasibility studies. Alongside these technical assessments, subjective factors like cultural differences can complicate integration efforts, potentially undermining the economic rationale behind the deal. However, despite these challenges and the often hefty price tag associated with M&A, these transactions frequently present enticing growth opportunities for businesses. While organic growth—derived from a company’s current operations—offers steady improvements in market presence and financial performance, inorganic growth can yield significant advancements when approached with a clear understanding of strategic benefits and synergies....... Read More

#nyse#stock market#us stocks#stock trading#stocks#m&a advisory services#m&a#merger and acquisition#dividend#investing#finance

0 notes

Text

THIS IS A CALLOUT POST AGAINST THE NEW YORK STOCK EXCHANGE!!!1!!111!!

YOU THINK THIS IS A FUCKING JOKE?!

AFTER ALL WE’VE DONE FOR YOU FUCKERS YOU HAVE THE NERVE TO DELIST US?!

FUCKING BIG LOTS

YEAH WE’RE IN CHAPTER 11 BANKRUPTCY, YOU KNOW WHO ELSE FILED FOR THAT?

MARVEL ENTERTAINMENT

YOU KNOW WHAT? GOOD! WE DON’T NEED YOU OR YOUR STUPID INVESTMENTS

WE’LL BE BACK MOTHERFUCKERS JUST YOU WAIT

WE’LL BE ROLLING IN DOUGH WHILE YOU INVEST IN AMAZON FOR THE MILLIONTH TIME LIKE COWARDS

WE’RE NOT GOING “TO THE MOON” LIKE ALL OF THOSE BRAIN DEAD ELON SIMPS

WE’RE GOING BIG

SAYONARA YOU WEEABOO SHITS!!!!!111!!!111!!!!!!!1!

#big lots#corpo blog#gimmick blog#parody#corpoverse#corporate blog#nyse#investing stocks#stock market#stock trading#ooc cmon don’t kick them while they’re down :(

1 note

·

View note

Text

Penny Stocks Trading in a Nutshell

Penny stocks are a unique segment of the stock market, characterized by their low price and high volatility. Trading in penny stocks can be both exciting and risky, offering the potential for significant gains but also the possibility of substantial losses. This article provides a comprehensive guide to penny stocks trading, exploring what they are, how they work, the benefits and risks involved,…

#Diversification#Entry and Exit Points#Investing#Limit Orders#Liquidity#NASDAQ#NYSE#Overtrading#Penny Stocks#Review#Stock Market#Stop-Loss#Technical Analysis#Trading Plan#Trading Strategies#Trading Volume#Volatility

0 notes

Text

FCC strikes a blow against prison profiteering

TOMORROW NIGHT (July 20), I'm appearing in CHICAGO at Exile in Bookville.

Here's a tip for policymakers hoping to improve the lives of the most Americans with the least effort: help prisoners.

After all, America is the most prolific imprisoner of its own people of any country in world history. We lock up more people than Stalin, than Mao, more than Botha, de Klerk or any other Apartheid-era South African president. And it's not just America's vast army of the incarcerated who are afflicted by our passion for imprisonment: their families and friends suffer, too.

That familial suffering isn't merely the constant pain of life without a loved one, either. America's prison profiteers treat prisoners' families as ATMs who can be made to pay and pay and pay.

This may seem like a losing strategy. After all, prison sentences are strongly correlated with poverty, and even if your family wasn't desperate before the state kidnapped one of its number and locked them behind bars, that loved one's legal defense and the loss of their income is a reliable predictor of downward social mobility.

Decent people don't view poor people as a source of riches. But for a certain kind of depraved sadist, the poor are an irresistible target. Sure, poor people don't have much money, but what they lack even more is protection under the law ("conservativism consists of the principle that there is an in-group whom the law protects but does not bind, and an out-group whom the law binds but does not protect" -Wilhoit). You can enjoy total impunity as you torment poor people, make them so miserable and afraid for their lives and safety that they will find some money, somewhere, and give it to you.

Mexican cartels understand this. They do a brisk trade in kidnapping asylum seekers whom the US has illegally forced to wait in Mexico to have their claims processed. The families of refugees – either in their home countries or in the USA – are typically badly off but they understand that Mexico will not lift a finger to protect a kidnapped refugee, and so when the kidnappers threaten the most grisly tortures as a means of extracting ransom, those desperate family members do whatever it takes to scrape up the blood-money.

What's more, the families of asylum seekers are not much better off than their kidnapped loved ones when it comes to seeking official protection. Family members who stayed behind in human rights hellholes like Bukele's El Salvador can't get their government to lodge official complaints with the Mexican ambassador, and family members who made it to the USA are in no position to get their Congressjerk to intercede with ICE or the Mexican consulate. This gives Mexico's crime syndicates total latitude to kidnap, torture, and grow rich by targeting the poorest, most desperate people in the world.

The private contractors that supply services to America's prisons are basically Mexican refugee-kidnappers with pretensions and shares listed on the NYSE. After decades of consolidation, the prison contracting sector has shrunk to two gigantic companies: Securus and Viapath (formerly Global Tellink). These private-equity backed behemoths dominate their sector, and have diversified, providing all kinds of services, from prison cafeteria meals to commissary, the prison stores where prisoners can buy food and other items.

If you're following closely, this is one of those places where the hair on the back of your neck starts to rise. These companies make money when prisoners buy food from the commissary, and they're also in charge of the quality of the food in the mess hall. If the food in the mess hall is adequate and nutritious, there's no reason to buy food from the commissary.

This is what economists call a "moral hazard." You can think of it as the reason that prison ramen costs 300% more than ramen in the free world:

https://pluralistic.net/2024/04/20/captive-market/#locked-in

(Not just ramen: in America's sweltering prisons, an 8" fan costs $40, and the price of water went up in Texas prisons by 50% during last summer's heatwave.)

It's actually worse than that: if you get sick from eating bad prison food, the same company that poisoned you gets paid to operate the infirmary where you're treated:

https://theappeal.org/massachusetts-prisons-wellpath-dentures-teeth/

Now, the scam of abusing prisoners to extract desperate pennies from their families is hardly new. There's written records of this stretching back to the middle ages. Nor is this pattern a unique one: making an unavoidable situation as miserable as possible and then upcharging people who have the ability to pay to get free of the torture is basically how the airlines work. Making coach as miserable as possible isn't merely about shaving pennies by shaving inches off your legroom: it's a way to "incentivize" anyone who can afford it to pay for an upgrade to business-class. The worse coach is, the more people you can convince to dip into their savings or fight with their boss to move classes. The torments visited upon everyone else in coach are economically valuable to the airlines: their groans and miseries translate directly into windfall profits, by convincing better-off passengers to pay not to have the same thing done to them.

Of course, with rare exceptions (flying to get an organ transplant, say) plane tickets are typically discretionary. Housing, on the other hand, is a human right and a prerequisite for human thriving. The worse things are for tenants, the more debt and privation people will endure to become home-owners, so it follows that making renters worse off makes homeowners richer:

https://pluralistic.net/2021/06/06/the-rents-too-damned-high/

For Securus and Viapath, the path to profitability is to lobby for mandatory, long prison sentences and then make things inside the prison as miserable as possible. Any prisoner whose family can find the funds can escape the worst of it, and all the prisoners who can't afford it serve the economically important function of showing the prisoners whose families can afford it how bad things will be if they don't pay.

If you're thinking that prisoners might pay Securus, Viapath and their competitors out of their own prison earnings, forget it. These companies have decided that the can make more by pocketing the difference between the vast sums paid by third parties for prisoners' labor and the pennies the prisoners get from their work. Remember, the 13th Amendment specifically allows for the enslavement of incarcerated people! Six states ban paying prisoners at all. North Carolina caps prisoners' wages at one dollar per day. The national average prison wage is $0.52/hour. Prisoners' labor produces $11b/year in goods and services:

https://www.dollarsandsense.org/archives/2024/0324bowman.html

Forced labor and extortion are a long and dishonorable tradition in incarceration, but this century saw the introduction of a novel, exciting way of extracting wealth from prisoners and their families. It started when private telcos took over prison telephones and raised the price of a prison phone call. These phone companies found willing collaborators in local jail and prison systems: all they had to do was offer to split the take with the jailers.

With the advent of the internet, things got far worse. Digitalization meant that prisons could replace the library, adult educations, commissary accounts, letter-mail, parcels, in-person visits and phone calls with a single tablet. These cheaply made tablets were offered for free to prisoners, who lost access to everything from their kids' handmade birthday cards to in-person visits with those kids.

In their place, prisoners' families had to pay huge premiums to have their letters scanned so that prisoners could pay (again) to view those scans on their tablets. Instead of in-person visits, prisoners families had to pay $3-10/minute for a janky, postage-stamp sized video. Perversely, jails and prisons replaced their in-person visitation rooms with rooms filled with shitty tablets where family members could sit and videoconference with their incarcerated loved ones who were just a few feet away:

https://pluralistic.net/2024/02/14/minnesota-nice/#shitty-technology-adoption-curve

Capitalists hate capitalism. The capital classes are on a relentless search for markets with captive customers and no competitors. The prison-tech industry was catnip for private equity funds, who bought and "rolled" up prison contractors, concentrating the sector into a duopoly of debt-laden companies whose ability to pay off their leveraged buyouts was contingent on their ability to terrorize prisoners' families into paying for their overpriced, low-quality products and services.

One particularly awful consequence of these rollups was the way that prisoners could lose access to their data when their prison's service-provider was merged with a rival. When that happened, the IT systems would be consolidated, with the frequent outcome that all prisoners' data was lost. Imagine working for two weeks to pay for a song or a book, or a scan of your child's handmade Father's Day card, only to have the file deleted in an IT merger. Now imagine that you're stuck inside for another 20 years.

This is a subject I've followed off and on for years. It's such a perfect bit of end-stage capitalist cruelty, combining mass incarceration with monopolies. Even if you're not imprisoned, this story is haunting, because on the one hand, America keeps thinking of new reasons to put more people behind bars, and on the other hand, every technological nightmare we dream up for prisoners eventually works its way out to the rest of us in a process I call the "shitty technology adoption curve." As William Gibson says, "The future is here, it's just not evenly distributed" – but the future sure pools up thick and dystopian around America's prisoners:

https://pluralistic.net/2021/02/24/gwb-rumsfeld-monsters/#bossware

My background interest in the subject got sharper a few years ago when I started working on The Bezzle, my 2023 high-tech crime thriller about prison-tech grifters:

https://us.macmillan.com/books/9781250865878/thebezzle

One of the things that was on my mind when I got to work on that book was the 2017 court-case that killed the FCC's rules limit interstate prison-call gouging. The FCC could have won that case, but Trump's FCC chairman, Ajit Pai, dropped it:

https://arstechnica.com/tech-policy/2017/06/prisoners-lose-again-as-court-wipes-out-inmate-calling-price-caps/

With that bad precedent on the books, the only hope prisoners had for relief from the FCC was for Congress to enact legislation specifically granting the agency the power to regulate prison telephony. Incredibly, Congress did just that, with Biden signing the "Martha Wright-Reed Just and Reasonable Communications Act" in early 2023:

https://www.congress.gov/bill/117th-congress/senate-bill/1541/text

With the new law in place, it fell to the FCC use those newfound powers. Compared to agencies like the FTC and the NLRB, Biden's FCC has been relatively weak, thanks in large part to the Biden administration's refusal to defend its FCC nomination for Gigi Sohn, a brilliant and accomplished telecoms expert. You can tell that Sohn would have been a brilliant FCC commissioner because of the way that America's telco monopolists and their allies in the senate (mostly Republicans, but some Democrats, too) went on an all-out offensive against her, using the fact that she is gay to smear her and ultimately defeat her nomination:

https://pluralistic.net/2023/03/19/culture-war-bullshit-stole-your-broadband/

But even without Sohn, the FCC has managed to do something genuinely great for America's army of the imprisoned. This week, the FCC voted in price-caps on prison calls, so that call rates will drop from $11.35 for 15 minutes to just $0.90. Both interstate and intrastate calls will be capped at $0.06-0.12/minute, with a phased rollout starting in January:

https://arstechnica.com/tech-policy/2024/07/fcc-closes-final-loopholes-that-keep-prison-phone-prices-exorbitantly-high/

It's hard to imagine a policy that will get more bang for a regulator's buck than this one. Not only does this represent a huge savings for prisoners and their families, those savings are even larger in proportion to their desperate, meager finances.

It shows you how important a competent, qualified regulator is. When it comes to political differences between Republicans and Democrats, regulatory competence is a grossly underrated trait. Trump's FCC Chair Ajit Pai handed out tens of billions of dollars in public money to monopoly carriers to improve telephone networks in underserved areas, but did so without first making accurate maps to tell him where the carriers should invest. As a result, that money was devoured by executive bonuses and publicly financed dividends and millions of Americans entered the pandemic lockdowns with broadband that couldn't support work-from-home or Zoom school. When Biden's FCC chair Jessica Rosenworcel took over, one of her first official acts was to commission a national study and survey of broadband quality. Republicans howled in outrage:

https://pluralistic.net/2023/11/10/digital-redlining/#stop-confusing-the-issue-with-relevant-facts

The telecoms sector has been a rent-seeking, monopolizing monster since the days of Samuel Morse:

https://pluralistic.net/2024/07/18/the-bell-system/#were-the-phone-company-we-dont-have-to-care

Combine telecoms and prisons, and you get a kind of supermonster, the meth-gator of American neofeudalism:

https://www.nbcnews.com/news/us-news/tennessee-police-warn-locals-not-flush-drugs-fear-meth-gators-n1030291

The sector is dirty beyond words, and it corrupts everything it touches – bribing prison officials to throw out all the books in the prison library and replace them with DRM-locked, high-priced ebooks that prisoners must toil for weeks to afford, and that vanish from their devices whenever a prison-tech company merges with a rival:

https://pluralistic.net/2024/04/02/captive-customers/#guillotine-watch

The Biden presidency has been fatally marred by the president's avid support of genocide, and nothing will change that. But for millions of Americans, the Biden administration's policies on telecoms, monopoly, and corporate crime have been a source of profound, lasting improvements.

It's not just presidents who can make this difference. Millions of America's prisoners are rotting in state and county jails, and as California has shown, state governments have broad latitude to kick out prison profiteers:

https://pluralistic.net/2023/05/08/captive-audience/#good-at-their-jobs

Support me this summer on the Clarion Write-A-Thon and help raise money for the Clarion Science Fiction and Fantasy Writers' Workshop!

If you'd like an essay-formatted version of this post to read or share, here's a link to it on pluralistic.net, my surveillance-free, ad-free, tracker-free blog:

https://pluralistic.net/2024/07/19/martha-wright-reed/#capitalists-hate-capitalism

Image:

Cryteria (modified)

https://commons.wikimedia.org/wiki/File:HAL9000.svg

CC BY 3.0

https://creativecommons.org/licenses/by/3.0/deed.en

--

Flying Logos (modified)

https://commons.wikimedia.org/wiki/File:Over_$1,000,000_dollars_in_USD_$100_bill_stacks.png

CC BY-SA 4.0

https://creativecommons.org/licenses/by-sa/4.0/deed.en

--

kgbo (modified)

https://commons.wikimedia.org/wiki/File:Suncorp_Bank_ATM.jpg

CC BY-SA 3.0

https://creativecommons.org/licenses/by-sa/3.0/deed.en

#pluralistic#prison tech#fcc#martin hench#marty hench#the bezzle#captive audiences#carceral state#worth rises#bezzles#Martha Wright-Reed Just and Reasonable Communications Act#capitalists hate capitalism#shitty technology adoption curve

347 notes

·

View notes

Text

Summer Doldrums Have Arrived - Market Volume Likely to Continue Fading

In a typical year, barring any external event triggers, trading activity typically begins to decline around the July 4th holiday towards a summer low usually in late August. We refer to this summertime slowdown in trading as the doldrums due to the anemic volume and uninspired trading on Wall Street. Fading summer volume is also why many summer rallies tend to be short lived and can be quickly followed by a pullback or correction.

Click here to view chart full size…

Click here to view chart full size…

Above are plotted the one-year seasonal volume patterns for the NYSE since 1965 and since 1978 for NASDAQ against the annual average daily volume moving average for 2024 as of the close on July 5, 2024. The typical summer lull is highlighted in yellow. After spiking around quarterly options expiration and the end of the first half of the year, trading volume has been retreating in typical seasonal fashion. A prolonged surge in volume during the typically quiet summer months, especially when accompanied by market gains, can be an encouraging sign that the bull market will continue. However, should traders lose their conviction and participate in the annual summer exodus from The Street, a market pullback or correction could quickly unfold.

16 notes

·

View notes

Text

Always a bull market for the Miracle Romance

Shout-out to the amazing contributors and moderators of @usamamoweek ! It's been a sleep deprived week of Schrodinger poor-not-poor life decisions and I wouldn't trade it or any of you for the world. 😘👏♥️ Pun intended.

Meanwhile, overheard on the floor of the NYSE:

Trader 1: Hmm, middling performance this week. I wonder what's going on.

Trader 2: Oh, it's UsaMamo Week.

Trader 1: Usa what?

Trader 2: UsaMamo Week.

Trader 1: Is that NASCAR?

Trader 2: No, it's some kind of fanclub about a couple of idiots, I dunno. But people stay up real late all week doing God knows what. Fan things, I guess. Anyway, things'll be back to normal next week.

Trader 1: Cool.

6 notes

·

View notes

Text

Nasdaq: A Complete Guide for Stock Trading

If you’re tuned into financial news or planning for retirement, you’ve likely heard of Nasdaq. It’s the world’s second-largest stock market, just behind the NYSE.

What Is Nasdaq?

Although the New York Stock Exchange (NYSE) is the top global stock market, Nasdaq is a close second. This stock market is popular for tech-related businesses like Apple, Amazon, and Microsoft. It is unique for its online trading, facilitated through an efficient computer system, fulfilling its digital-first vision from inception.

Nasdaq performance is outstanding and is also a host for big companies like Starbucks and Tesla. Since it targets high-growth companies, stocks here tend to be more volatile. The market trades both listed and OTC stocks, identifiable by 4-5 letter codes. It has pioneered several firsts, like online trading and cloud-based data storage.

In 2008, Nasdaq merged with OMX ABO in Stockholm and formed Nasdaq Inc. This company allows trades in various financial products, including ETFs and debt.

How the Nasdaq Works

The Nasdaq started as a way to get instant stock quotes and focused on over-the-counter (OTC) trading from the beginning. It added automated trading systems that give real-time info on how many shares are being traded. This exchange was one of the first to offer online trading.

If you want to buy or sell on this stock market, you have to go through dealers, who are sometimes called “market makers.” to complete the trades.

There are three different factors that should be considered during trading with this stock market.

Nasdaq Trading Hours

The Nasdaq operates from 9:30 a.m. to 4:00 p.m. However, it also offers extended trading hours, with “pre-market” sessions from 4 a.m. to 9:30 a.m. and “post-market” sessions from 4 p.m. to 8 p.m.

Nasdaq Listing Requirements

To get listed on the Nasdaq, a company must:

Show strong financials, liquidity, and governance

Hold a valid SEC registration

Have at least three market makers

Meet size and trading volume criteria

Learn more details: https://finxpdx.com/what-is-nasdaq-a-complete-guide-for-stock-trading/

2 notes

·

View notes

Text

Premarket U.S. Stock Movers: Tesla, Macy’s, Coinbase, Nio, Shell, Amazon

In today's early trading, the U.S. stock market is already buzzing with notable movements among key players. Investors and analysts are closely monitoring the premarket activity of several prominent stocks, each showing distinctive performance dynamics.

Tesla (NASDAQ) has started the day on a positive note, with its stock rising by 1.8%. This upward movement follows recent market optimism surrounding Tesla's innovative developments in electric vehicles and sustainable energy solutions. As a pioneering force in the automotive industry, Tesla continues to capture investor interest with its innovative technological advancements and ambitious growth strategies.

Macy’s (NYSE) is another standout performer in the premarket, showcasing a robust 6.8% increase. This surge reflects renewed investor confidence in the retail giant's ability to navigate challenges and capitalize on evolving consumer trends. Macy's ongoing efforts to enhance its digital capabilities and strategic initiatives in omnichannel retailing are positioning the company for sustained growth in a competitive market landscape.

Coinbase (NASDAQ), however, faces a 4.6% decline in its premarket trading. The cryptocurrency exchange platform is experiencing volatility amidst regulatory scrutiny and market fluctuations in digital assets. Despite its leadership in the digital currency space, Coinbase's stock performance underscores the inherent volatility and regulatory uncertainties impacting the crypto industry.

Nio (NYSE), known for its electric vehicle offerings, is witnessing a 2.3% decrease in its American Depositary Receipts (ADRs) during premarket trading. This decline comes amid broader sectoral challenges and market sentiment towards growth stocks in the EV sector. Nio continues to navigate through supply chain disruptions and competitive pressures as it strives to expand its market presence globally.

Shell (LON) ADRs, representing Royal Dutch Shell, have shown a modest 1.1% rise in premarket trading. As a global energy leader, Shell's stock performance reflects investor sentiment toward energy markets and macroeconomic factors influencing oil and gas prices. The company's strategic focus on sustainable energy transitions and operational resilience in a dynamic energy landscape remains pivotal amid evolving market conditions.

Amazon (NASDAQ), a cornerstone of e-commerce and cloud computing services, is demonstrating a minor 0.3% change in its premarket activity. Amazon's stock movement reflects ongoing investor sentiment towards tech giants amid regulatory scrutiny and competitive pressures in digital retail and cloud computing markets. The company continues to innovate across its business segments, driving growth and adaptation to evolving consumer behaviors.

Today's premarket movements highlight the diverse dynamics shaping the U.S. stock market. Investors are navigating through a mix of sector-specific trends, regulatory developments, and macroeconomic factors influencing stock performance. As market participants analyze these early signals, the day's trading session promises to offer further insights into the evolving landscape of global financial markets.

2 notes

·

View notes

Text

New York Stock Exchange

The New York Stock Exchange (NYSE, nicknamed "The Big Board")is an American stock exchange in the Financial District of Lower Manhattan in New York City.

Who owns the NY stock exchange?

Owner - Intercontinental Exchange

What is the difference between the NYSE and the Nasdaq?

The NYSE is an auction market that uses specialists (designated market makers), while the Nasdaq is a dealer market with many market makers in competition with one another. Today, the NYSE is part of Intercontinental Exchange (ICE), and the Nasdaq is part of the publicly traded Nasdaq, Inc.

What is the purpose of the New York Stock Exchange?

The New York Stock Exchange has two primary functions: It provides a central marketplace for investors to buy and sell stock. It enables companies to list their shares and raise capital from interested investors.

Read also - why are there steam vents in new york

#new york stock exchange#nyse#New York City#new york#newyork#New-York#nyc#ny#manhattan#urban#city#usa#visit-new-york.tumblr.com

83 notes

·

View notes

Text

The Republic of the Marshall Islands (RMI) Companies

The Republic of the Marshall Islands (RMI), located in the Pacific Ocean, is known for its unique business and maritime environment. Although it might be a relatively small island nation, there are several companies incorporated in the RMI that are publicly traded on major exchanges like the New York Stock Exchange (NYSE) and NASDAQ. These firms have chosen the Marshall Islands for its well-established corporate laws, favorable taxation rules, and strategic geographic location.

One example of such a company is International Seaways Inc. (INSW), a major global tanker company. INSW is incorporated in the Marshall Islands and listed on the NYSE. The company operates a diversified fleet of crude and product tankers that deliver energy globally. International Seaways Inc. was founded with a commitment to safety, transparency, and reliable service, which remains at its core today.

Similarly, Navios Maritime Holdings Inc. (NM), a global, vertically integrated seaborne shipping and logistics company, is incorporated in the Marshall Islands and is listed on the NYSE. They specialize in the transportation and transshipment of dry bulk commodities, including iron ore, coal, and grain.

On NASDAQ, we have Costamare Inc. (CMRE), a leading international owner of containerships. Like the previous two, Costamare is incorporated in the Marshall Islands. The company provides marine transportation services worldwide by chartering its container vessels to liner operators under long, medium, and short-term time charters.

However, it’s important to note that while these companies are incorporated in the RMI, their physical operations are often based elsewhere, usually in global shipping hubs such as Singapore, Greece, or the United States. This setup is primarily due to the favorable corporate and tax structure offered by the Marshall Islands. Their listings on the NYSE and NASDAQ enable these companies to access the larger US and international markets for their financial operations.

Investors considering these stocks should always conduct thorough due diligence and consider the unique risks and benefits associated with companies incorporated in jurisdictions like the RMI. The listings provide an opportunity to invest in the maritime industry, often an indicator of global economic health, through companies tied to the Republic of the Marshall Islands.

More public companies registered in the Marshall Islands

3 notes

·

View notes

Text

indian stock market

Title: Navigating the Stock Market: A Beginner's Guide

Introduction

The stock market is a dynamic and complex financial ecosystem where investors buy and sell shares of publicly-traded companies. It's a place where fortunes can be made and lost, but understanding the fundamentals can significantly reduce the risk associated with investing. In this beginner's guide to the stock market, we'll explore the basics, terminology, and strategies to help you embark on your investment journey with confidence.

Chapter 1: What is the Stock Market?

Definition: The stock market is a marketplace where buyers and sellers trade ownership in companies through stocks (equity).

Historical Perspective: Learn about the origins and evolution of stock markets.

Types of Stock Markets: Understand the differences between major stock exchanges (e.g., NYSE, NASDAQ).

Chapter 2: Stock Market Participants

Investors: Discover the various types of investors, from individual traders to institutional investors.

Public Companies: Explore why companies go public and what it means for investors.

Regulators: Learn about the regulatory bodies that oversee stock markets.

Chapter 3: Stock Market Basics

Stocks and Shares: Differentiate between stocks and shares and understand their value.

Market Indices: Discover how indices like the S&P 500 and Dow Jones work.

Market Orders: Learn about market orders, limit orders, and stop orders.

Trading Hours: Know the opening and closing times of stock markets.

Chapter 4: Investment Strategies

Long-Term Investing: Explore the benefits of buy-and-hold strategies.

Day Trading: Understand the fast-paced world of day trading.

Value Investing: Learn about the principles made famous by Warren Buffett.

Risk Management: Discover strategies to mitigate risk and protect your investments.

Chapter 5: Analyzing Stocks

Fundamental Analysis: Evaluate a company's financial health and performance.

Technical Analysis: Study price charts and indicators to make short-term predictions.

Sentiment Analysis: Understand how market sentiment can affect stock prices.

Chapter 6: Diversification and Portfolio Management

Diversification: Learn how to spread risk by investing in various asset classes.

Building a Portfolio: Explore the process of constructing a well-balanced investment portfolio.

Rebalancing: Understand the importance of periodically adjusting your portfolio.

Chapter 7: Tax Implications and Regulations

Capital Gains Tax: Discover how profits from stock trading are taxed.

IRA and 401(k): Learn about tax-advantaged retirement accounts for long-term savings.

Chapter 8: Common Pitfalls and Mistakes

Overtrading: Avoid the urge to make excessive, impulsive trades.

Ignoring Research: Stress the importance of thorough research before investing.

Emotional Decision-Making: Learn to manage emotions when making investment decisions.

Chapter 9: Staying Informed

Financial News: Keep abreast of financial news and its impact on the market.

Investment Resources: Explore useful websites, books, and forums for learning and advice.

Conclusion

The stock market can be an exciting and rewarding place for investors, but it's crucial to approach it with knowledge and a well-thought-out strategy. With a solid understanding of the basics, a clear investment plan, and the discipline to stick to it, you can navigate the stock market and work towards achieving your financial goals. Remember that, like any other endeavor, successful stock market investing takes time, patience, and continuous learning.

2 notes

·

View notes

Text

Investing in Stocks 101: A Beginner's Guide to Building Wealth with Confidence

I. Introduction to Investing in Stock

Investing in stocks can be a powerful tool for building long-term wealth. By acquiring ownership in companies through stock ownership, individuals can participate in the profits and growth of these businesses. This comprehensive guide aims to provide beginners with a solid foundation to navigate the complex world of stock investing, enabling them to make informed decisions with confidence.

Understanding the Basics of Investing in Stocks

Before diving into the intricacies of stock investing, it is crucial to grasp the basic concept of stocks. Stocks, also known as shares or equities, represent a portion of ownership in a company. When individuals purchase stocks, they become shareholders in that company, which entitles them to a share of its profits and assets.

Why Investing in Stocks is Essential for Wealth Building

Investing in stocks offers numerous advantages for wealth building. Unlike traditional savings accounts, stocks have the potential to generate substantial returns over the long term. Additionally, investing in stocks allows individuals to diversify their portfolios and participate in the growth of different industries and sectors. By harnessing the power of compounding returns, investors can exponentially increase their wealth over time.

II. Getting Started in Stock Investing

Embarking on a journey of stock investing requires careful planning and consideration. Before delving into the world of stocks, beginners should lay a strong foundation by following these steps:

Setting Financial Goals and Time Horizon

Determining financial goals is paramount in creating a roadmap for successful investing. Whether the objective is saving for retirement, buying a home, or funding education, setting clear goals helps investors tailor their investment strategies accordingly. Additionally, identifying the time horizon, or the length of time an investor plans to stay invested, plays a crucial role in selecting suitable investment options.

Assessing Risk Tolerance and Investment Options

Understanding personal risk tolerance is vital when considering investment options. Risk tolerance refers to an individual's willingness and ability to withstand fluctuations in investment values. It is essential to strike a balance between risk and potential returns to align investment choices with personal comfort levels. Furthermore, investors should explore different investment vehicles such as stocks, bonds, and mutual funds to diversify their portfolios and manage risk effectively.

Building a Solid Foundation: Budgeting and Emergency Funds

Before entering the world of stock investing, it is imperative to establish a solid financial foundation. Implementing a budgeting system enables individuals to monitor their income, expenses, and savings. By creating a clear picture of their financial health, investors can allocate funds for stock investments without compromising their overall financial stability. Additionally, building emergency funds safeguards against unforeseen circumstances, ensuring the availability of funds for emergencies rather than withdrawing invested capital prematurely.

III. Demystifying the Stock Market

The stock market can be an intimidating concept for beginners. However, gaining a fundamental understanding of its key aspects can help demystify the process of stock investing.

Exploring the Stock Market: Definitions, Exchanges, and Indexes

The stock market refers to the platform where investors can buy and sell stocks. It is an organized marketplace where buyers and sellers meet to trade shares of publicly listed companies. Stock exchanges, such as the New York Stock Exchange (NYSE) and NASDAQ, facilitate these transactions. Indexes, such as the S&P 500 and Dow Jones Industrial Average, track the performance of specific groups of stocks, enabling investors to gauge overall market trends.

How Stock Prices are Determined

Stock prices are determined by supply and demand dynamics in the stock market. When there is high demand for a particular stock, its price tends to rise, while low demand leads to price declines. Various factors, such as company performance, economic conditions, and investor sentiment, contribute to the fluctuations in stock prices.

Key Players in the Stock Market: Brokers, Investors, and Analysts

Several key players participate in the stock market, each with distinct roles and responsibilities. Brokers act as intermediaries between investors and the stock exchange, facilitating the buying and selling of stocks. Investors, who can be individuals or institutions, purchase and own stocks based on their investment objectives. Analysts play a pivotal role by analysing companies, industries, and economic factors to provide insights and recommendations to investors.

IV. Different Types of Stocks

Understanding the different types of stocks available in the market is essential for investors seeking to diversify their portfolios effectively.

Common Stocks vs. Preferred Stocks: Understanding the Differences

Common stocks and preferred stocks are the two primary types of stocks available to investors. Common stocks represent ownership in a company and provide individuals with voting rights in corporate matters. Preferred stocks, on the other hand, typically do not carry voting rights but offer higher priority for dividends and liquidation proceeds.

Growth Stocks, Value Stocks, and Dividend Stocks: Choosing Investments

Within the stock market, investors can select from various categories of stocks based on their investment objectives and strategies. Growth stocks are shares of companies with high growth potential but may not necessarily pay dividends. Value stocks, on the other hand, are stocks that are considered undervalued compared to their intrinsic worth. Dividend stocks are shares of companies that regularly distribute a portion of their profits to shareholders in the form of dividends.

V. Fundamental Analysis: Evaluating Stocks

Fundamental analysis plays a crucial role in evaluating the financial health and performance of companies, enabling investors to make informed decisions about their investments.

Introduction to Fundamental Analysis

Fundamental analysis focuses on assessing the underlying factors that drive a company's financial performance and stock value. By analyzing financial statements, economic factors, and industry trends, investors can gauge the intrinsic value of a stock.

Examining Financial Statements: Balance Sheets, Income Statements, and Cash Flow

Financial statements provide a comprehensive view of a company's financial health. The balance sheet showcases a company's assets, liabilities, and shareholders' equity. The income statement presents the company's revenues, expenses, and profits or losses. The cash flow statement illustrates the movement of cash into and out of the company, providing insights into its liquidity.

Key Financial Ratios for Stock Analysis

Financial ratios offer valuable insights into a company's financial health and performance. Ratios, such as price-to-earnings (P/E), return on equity (ROE), and debt-to-equity (D/E), can help investors assess a company's profitability, efficiency, and financial leverage.

VI. Technical Analysis: Analysing Stock Price Patterns

Technical analysis complements fundamental analysis by examining stock price patterns, trends, and indicators to predict future price movements.

Introduction to Technical Analysis

Technical analysis revolves around the belief that historical price and volume data can provide insights into future price movements. It involves studying stock charts, trend lines, and technical indicators to identify patterns that can guide investment decisions.

Understanding Stock Charts, Trends, and Patterns

Stock charts display the historical price movements of stocks over different time frames. Trend lines help identify the direction and strength of a stock's price movement. Various chart patterns, such as head and shoulders, double bottoms, and triangles, indicate potential reversals or continuations in stock prices.

Utilising Technical Indicators for Decision Making

Technical indicators, such as moving averages, relative strength index (RSI), and MACD (moving average convergence divergence), provide additional insights into stock price movements. These indicators help investors identify overbought or oversold conditions, as well as potential trend reversals, aiding in strategic decision-making.

VII. Building a Diversified Stock Portfolio

Diversification is a principle that mitigates risk by spreading investments across various stocks, sectors, and industries.

The Importance of Diversification

Diversifying a stock portfolio protects investors against the risk of holding a concentrated position. By investing in stocks across different industries and sectors, individuals can reduce the impact of negative events affecting a specific company or sector.

Choosing Stocks across Different Industries and Sectors

When building a diversified stock portfolio, it is crucial to allocate investments across various industries and sectors. This strategy ensures exposure to different economic cycles, reducing the potential vulnerability of the portfolio to specific events or industry downturns.

Allocating Portfolio Weightings and Risk Management

Determining the allocation of investments within a portfolio requires careful consideration. By diversifying holdings based on risk tolerance, investment goals, and time horizon, investors can achieve an optimal balance between risk and return.

VIII. Investing Strategies for Long-term Growth

Investing in stocks for long-term growth involves adopting specific strategies that capitalize on compounding returns and market cycles.

Buy and Hold Strategy: Investing for the Long Run

The buy and hold strategy entails purchasing stocks with the intention of holding them for an extended period, often years or even decades. This approach relies on the long-term growth potential of well-established companies and minimises the impacts of short-term market fluctuations.

Dollar-Cost Averaging: Regular Investing Regardless of Market Conditions

Dollar-cost averaging involves investing a fixed amount of money regularly, regardless of market conditions. This strategy allows investors to buy more shares when prices are low and fewer shares when prices are high, potentially reducing the overall average cost of investments.

Understanding Market Cycles and the Role of Patience

Markets experience cycles of expansion, consolidation, and contraction. Recognizing these cycles and maintaining patience are integral to long-term investment success. By avoiding knee-jerk reactions to short-term market movements, investors can harness the power of compounding returns over time.

IX. Performing Due Diligence: Researching and Selecting Stocks

Researching and selecting stocks requires thorough due diligence to make informed investment decisions.

Identifying Sources of Investment Information

Accurate and reliable information is crucial when researching stocks. Investors can access various sources of information, such as financial news websites, company annual reports, SEC filings, and industry reports, to gather insights and make informed decisions.

Evaluating Company Fundamentals and Industry Performance

Analysing a company's fundamentals, including revenue growth, profitability, competitive advantages, and management, helps assess its potential for long-term success. Additionally, understanding industry trends, competition, and market dynamics provides a broader context for evaluating a company's performance.

Selecting Stocks for Your Portfolio

The process of stock selection involves filtering potential investments based on established criteria, such as financial strength, growth prospects, and valuation. By carefully evaluating stocks, investors can assemble a portfolio that aligns with their investment goals and risk tolerance.

X. The Art of Buying and Selling Stocks

Executing buy and sell orders requires understanding various types of stock orders and maintaining a disciplined approach.

Placing Stock Orders: Market Orders, Limit Orders, and Stop Orders

Investors can place different types of orders to buy or sell stocks. Market orders execute immediately at the prevailing market price, while limit orders allow investors to specify the desired price at which to buy or sell. Stop orders are triggered when the stock reaches a specific price, aiming to limit losses or secure gains.

Timing the Market vs. Time in the Market

Timing the market, or attempting to buy stocks at the lowest price and sell at the highest, is extremely challenging and often unsuccessful. Instead, the time spent in the market is a more reliable strategy, allowing investors to benefit from the long-term upward trend of the stock market.

Emotional Pitfalls to Avoid

Emotions can significantly impact investment decisions. Fear and greed often lead to irrational behaviour, such as panic selling during market downturns or chasing speculative investments during market euphoria. Avoiding emotional pitfalls and maintaining a disciplined approach based on the investment plan is key to long-term success.

XI. Managing and Monitoring Your Stock Portfolio

Regularly managing and monitoring a stock portfolio ensures it remains aligned with evolving financial goals and market conditions.

Regular Portfolio Review and Rebalancing

Periodic portfolio reviews are essential to evaluate the performance of individual stocks and the overall portfolio. Rebalancing involves adjusting the portfolio's weightings to maintain the desired allocation and risk level.

Tracking Performance and Monitoring News

Monitoring the performance of individual stocks and the broader market is crucial for making informed decisions. Additionally, staying abreast of relevant news, such as company announcements, industry developments, and economic indicators, allows investors to react to potential opportunities or threats in a timely manner.

Tax Considerations and Investment Record-Keeping

Investors should be mindful of tax implications related to their stock investments. It is important to keep accurate records of transactions and consult with a tax professional to maximize tax efficiency. Maintaining proper documentation also facilitates overall investment record-keeping and simplifies the tax filing process.

XII. Potential Risks and Mitigation Strategies

Investing in stocks involves inherent risks. By understanding them and implementing appropriate mitigation strategies, investors can safeguard their portfolios.

Understanding Volatility and Market Fluctuations

Volatility refers to the degree of variation in stock prices over time. Market fluctuations can be driven by a wide range of factors, including economic events, geopolitical risks, and investor sentiment. Investors should be prepared for the occasional turbulence and remain focused on long-term objectives.

Assessing Systematic and Unsystematic Risks

Systematic risks, also known as market risks, affect the overall stock market and cannot be diversified away. Unsystematic risks, on the other hand, impact specific companies or sectors and can be mitigated through diversification. By diversifying across industries and sectors, investors can mitigate unsystematic risks while accepting the broader market risks.

Hedging and Protective Measures

Hedging involves employing strategies to offset potential losses in a portfolio. Options, futures, and exchange-traded funds (ETFs) are common hedging instruments. Protective measures, such as utilising stop-loss orders or setting trailing stops, enable investors to limit potential downside risks.

XIII. Investing in Stocks for Retirement

Stocks play a crucial role in retirement planning, providing long-term growth potential and income generation.

The Role of Stocks in Retirement Planning

Incorporating stocks in retirement investment portfolios can help counteract the effects of inflation and generate long-term growth. As stocks historically outperform other investment options over extended periods, they play a vital role in ensuring adequate retirement savings.

Considerations for Different Retirement Ages

The appropriate allocation to stocks within a retirement portfolio varies depending on an individual's age and risk tolerance. Younger individuals may have a higher allocation to equities due to their longer time horizon, while older individuals may opt for a more conservative allocation.

Balancing Risk and Income in Retirement Investment Portfolios

Retirees often seek a balance between risk and income in their investment portfolios. This involves diversifying holdings to mitigate potential volatility while considering income-generating assets, such as dividend-paying stocks, to meet ongoing financial needs.

XIV. Investing in Stocks for Specific Goals

Beyond retirement planning, stocks can be utilised to achieve various financial objectives.

Investing for Education: College Funds and 529 Plans

Investors can leverage stocks through college funds, such as 529 plans, to save for their children's education. By starting investments early and adopting a long-term perspective, individuals can potentially accumulate substantial funds for educational expenses.

Investing for a Home Purchase or Down Payment

Stock investments can serve as a means to save for a home purchase or down payment. Aligning investment strategies with the desired time frame and risk tolerance allows individuals to accumulate funds for this significant financial milestone.

Stocks as Passive Income: Dividend Investing

Dividend investing involves selecting stocks that regularly distribute a portion of their profits as dividends. By building a portfolio centred around dividend-paying stocks, investors can generate passive income and

3 notes

·

View notes