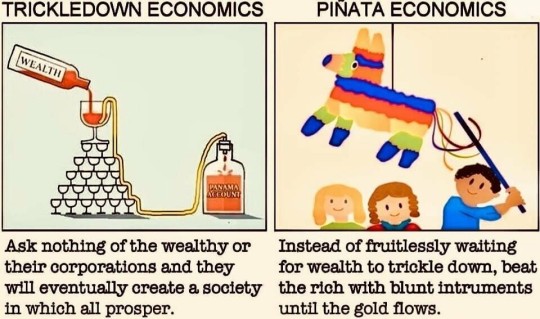

#trickle down economics

Text

Own a liberal by ruining the economy.

2K notes

·

View notes

Text

Jon Stewart, hitting the nail on the head once again.

#gacked from Jessica Chastain's tweet#jon stewart#on the ridiculous lies regarding#trickle down economics#and billionaires hoarding wealth to play with#abolish billionaires#us politics#but also kind of#uk politics#hell it's#world politics#billionaires and privatisation are a global threat

963 notes

·

View notes

Text

Hoover was a Republican.

810 notes

·

View notes

Text

#trickle down economics#piñata economics#fyi#psa#class war#classwar#capitalism#anti capitalist#capitalist hell#capitalist dystopia#capitalist bullshit#eat the rich#eat the fucking rich#fuck the gop#fuck the police#fuck the supreme court#fuck the patriarchy#ausgov#politas#auspol#tasgov#taspol#australia#neoliberal capitalism#fuck neoliberals#anthony albanese#albanese government#antiauthoritarian#antinazi#anti capitalism

494 notes

·

View notes

Text

Everything wrong with America for the past 40 years can be traced directly back to Ronald Reagan. And I dO mean everything

Everything

Everything

#politics#ronald reagan#reaganism#republicans#conservatism#reaganomics#trickle down economics#living wages#inequality

122 notes

·

View notes

Text

Reaganomics was fiction sold as fact. It has failed for over forty years. It's objective failure is proof for Republicans that we need more of it.

Trickle down economics is GOP malware.

2K notes

·

View notes

Text

If tax cuts give you $100 back in your wallet yet it gives the rich, $10,000 back in theirs, you are not $100 richer. Money is relative to wealth. When we give handouts or tax breaks and most of it goes to the rich YOU. GET. POORER. Tax the rich, don't just cut carbon taxes.

707 notes

·

View notes

Text

230 notes

·

View notes

Text

standing ovation..

246 notes

·

View notes

Text

Ko-Fi prompt from @kayasurin:

Economy topic - Trickle Down Economics, why they work/don't work

HI it's been two months since I got this prompt, so. Sorry about that. been a lot going on in my personal life, so let's hope this makes up for the wait.

(To anyone who was considering doing a ko-fi prompt... I promise to get to them, but I cannot promise a reasonable time frame, sorry.)

So, Trickle-down economics, and if they work.

Short answer: They absolutely don't.

Longer answer that you actually paid for:

Trickle-down is basically a propaganda-driven hustle that rich people run against the working class. It's an economic theory that is known to not function, but since it serves the people up top to keep pushing it, we still have to deal with people pretending it's a real thing.

The basic concept of it is that if the capitalists at the top are allowed to retain more money (less taxes), then that money will naturally find its way lower down the pyramid through natural market forces. If a wealthy individual is allowed to keep an extra 50% of their marginal income, then the bulk of that 50% will go into their businesses, reinvested to generate more wealth by purchasing new equipment, running R&D, and paying more money to more workers. By not paying the taxes, they wealthiest classes can direct their money as they see fit, so really they don't end up with any more money than they would have if they paid their taxes!

As you can guess, this is not what actually happens in almost every possible application of the theory.

First, let's address the concept of marginal tax rates. They get a lot of hate, but I find this infographic explains the reality best:

(source: This post, but originally from Kasia Babis on The Nib/@thenib)

To summarize for those using a screen reader:

Let's say you earn 50k every year, and we're not going to bother with currency, because this is a simplified explanation. In this scenario, there is a national/federal income tax of approximately 20%. With that, you give 10k to the government, and retain 40k for your own purposes.

You have a neighbor who makes 500k every year. In this hypothetical, a marginal tax rate applies to earnings over 100k. The marginal tax rate is 70%. What does that mean for your neighbor?

They pay 20% on the 100k, which is 20k. Then they pay 70% on the remaining 400k, which is 280k. Combining the base tax and marginal, they are taxed 300k.

At the end of the day, they are left with 200k. The total tax on their income is 60%. If you're following along, you can tell that regardless of the final percentage, anyone that the marginal tax applies to is always going to get to keep at least 80k, the amount left of the pay that is taxed at the base rate.

The more you earn, the more you are taxed. Again, this is super simplified, but this is the most basic way marginal taxation works. (Tax brackets are related but not entirely the same thing.)

With a marginal tax, exorbitant wealth is curtailed by forcing that wealth back into the system. The understanding is that nobody can actually perform hundreds of times more labor than their lowest-paid worker, and so all that surplus income was in some way not distributed properly. They get to keep enough to live on, quite comfortably, but not all of it.

There may be some companies that are willing to cap their highest wages in relation to their lowest, but those are far and few between. There's a reason the average ratio of CEO to entry level worker in the US is nearly 400:1... up from 1965's 20:1. (source)

Trickle-down theorizes that, if allowed to keep that exorbitant wealth, the Capitalists will distribute that wealth back to their workers or reinvest it into productive enterprise, and do so in response to market forces or out of fear of a return of the marginal tax.

This is not what happens, basically ever. People do not earn that much money if they are already paying a living wage and distributing wealth properly. You cannot get exorbitantly wealthy through anything other than wage theft, system abuse, or capital-based market manipulation (see: hedge funds, housing market).

I suppose you could inherit the money, or win the lottery, but the latter is actually taxed higher than the former, believe it or not. The United States federal government doesn't have an inheritance tax, and most states also don't. There might be various legal fees and such, but not any actual taxes.

Where we end up is that those taxes the rich don't have to pay go instead towards 'passive income' schemes and market manipulation like the housing market.

(That is an entire separate rant, but yeah, most of the housing market at that income bracket is, to some degree, deliberately manipulated by those involved in it. We are all 100% watching for that bubble burst that is inevitably heading our way.)

The wealth does not trickle down to the workers. It is guided by those who have it, and they are significantly more likely to put it in foreign bank accounts, liquid assets, and real estate that they hope will gain value for a capital gain at sale.

Trickle-down economics relies on the goodwill of the wealthy, but almost nobody gets that wealthy by having goodwill to spare.

(Prompt me on ko-fi!)

259 notes

·

View notes

Text

#trickle down economics#anti capitalism#current events#lgbtqia#working class#fuck capitalism#eat the rich#wealth inequality#communism#anarchism#revolution#marxism#socialism#leftism#left wing#leftist#liberalism#late stage capitalism#capitalism#social issues#corporations

100 notes

·

View notes

Link

Tax cuts for the wealthy have long drawn support from conservative lawmakers and economists who argue that such measures will "trickle down" and eventually boost jobs and incomes for everyone else. But a new study from the London School of Economics says 50 years of such tax cuts have only helped one group — the rich.

The new paper, by David Hope of the London School of Economics and Julian Limberg of King's College London, examines 18 developed countries — from Australia to the United States — over a 50-year period from 1965 to 2015. The study compared countries that passed tax cuts in a specific year, such as the U.S. in 1982 when President Ronald Reagan slashed taxes on the wealthy, with those that didn't, and then examined their economic outcomes.

Per capita gross domestic product and unemployment rates were nearly identical after five years in countries that slashed taxes on the rich and in those that didn't, the study found.

But the analysis discovered one major change: The incomes of the rich grew much faster in countries where tax rates were lowered. Instead of trickling down to the middle class, tax cuts for the rich may not accomplish much more than help the rich keep more of their riches and exacerbate income inequality, the research indicates.

"Based on our research, we would argue that the economic rationale for keeping taxes on the rich low is weak," Julian Limberg, a co-author of the study and a lecturer in public policy at King's College London, said in an email to CBS MoneyWatch. "In fact, if we look back into history, the period with the highest taxes on the rich — the postwar period — was also a period with high economic growth and low unemployment."

File this one under “No shit, Sherlock.” But it needed to be done. And it needs to be reported far and wide.

25 notes

·

View notes

Text

"Trust me!" said Satan.

"Just as grace showers down from God above, money trickles down from the wealthy, and it is in your own financial interest to earn less so they may prosper. And remember, any money the wealthy pay in taxes is money they are taking out of your pocket!"

And the peasant replied, "Do I look like a freakin' idiot?"

And upon hearing those words, Satan vanished in a puff of smoke.

25 notes

·

View notes

Text

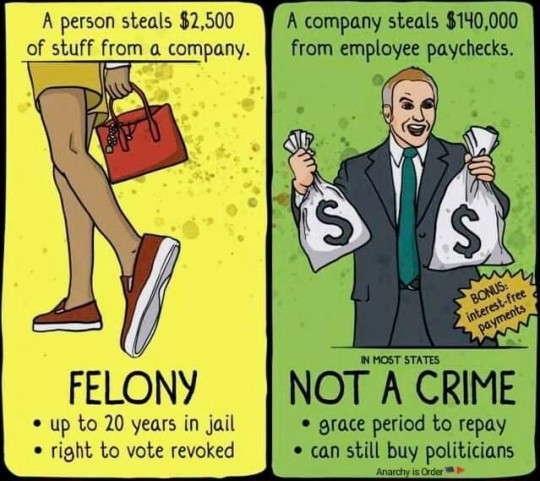

When criminals run society

#society#trickle down economics#economics#gst#tax#capitalism#poverty#greedy bastards#greedy#greedisthecreed#morals#ethics#ausgov#politas#auspol#tasgov#taspol#australia#neoliberal capitalism#fuck neoliberals#anthony albanese#albanese government#anti capitalist#capitalist hell#capitalist dystopia#capitalist bullshit#class war#classwar#eat the rich#eat the fucking rich

187 notes

·

View notes