#weekly round up: r1

Text

July 20th - July 29th, 2023

Thanks to @massivespacewren as always for the incredible fanart you see above.

Now let's get to some WinterIron goodies!

Dark Obsession by @scottxlogan

Rating: E

Tags: Alternate Universe - Canon Divergence, Canon-Typical Violence, Clubbing, Explicit Sexual Content, Dirty Talk, Light Choking, Rope Bondage, Light Dom/sub, BDSM, Wax Play, Sex Toys, Restraints, Swearing, Switching, Biting, Ice Play, Strangers to Lovers, Smut, Past Steve Rogers/Tony Stark, Past Bucky Barnes/Steve Rogers, Steve Rogers & Tony Stark Friendship

Summary: On the anniversary of his parents' deaths Tony finds himself looking for a distraction after Steve stands Tony up on their night clubbing. Undeterred in his quest to find a new distraction Tony works his way into a steamy new club in town where he finds himself drawn in by a sexy stranger who turns Tony's world around in unimaginable ways.

Falling in Love by @pandagirl45

Rating: T

Tags: James "Bucky" Barnes/Tony Stark, Tony Stark, James "Bucky" Barnes, Sam Wilson (Marvel), Alternate Universe - Modern Setting, Musicians, Inspired by Music, Shy Tony Stark, Singing, Bucky Barnes-centric, Meet-Cute, Awkward Flirting, Matchmaking, Sam Wilson is a Gift, Bucky Barnes & Sam Wilson Friendship, James "Rhodey" Rhodes & Tony Stark Friendship, Minor James "Rhodey" Rhodes/Sam Wilson, Implied Relationships

Summary: Sam takes Bucky to a music venue to get out for once, and Bucky ends up falling in love at first voice

A Sugar-Coated Pill - Chapter 3 by @polizwrites

Rating: T

Tags: No Powers AU, Omegaverse, Sugar Daddy AU, Political Campaigns, Amputee!Bucky, Alpha!Bucky, young!Tony, Omega!Tony, demisexual!Bucky,

Summary: Bucky hosts a donor party at his home and Tony once again proves himself invaluable. Afterwards, Tony asks for an advance and Bucky makes an alternate proposal.

The Silver Line by @endlesstwanted

Rating: T

Tags: Fandom Fusions, Co-workers, Post-Break Up, War Veteran Bucky

Summary: Training with Camille, Bucky and her notice that the new guy coming to work for the agency is the one who witnessed Sharon breaking up with him during their double date.

#scottxlogan#pandagirl45#polizwrites#endlesstwanted#weekly round up: r1#winteriron#starkbucks#ironwinter#tony stark#bucky barnes#iron man#winter soldier#marvel#bingowinteriron

23 notes

·

View notes

Text

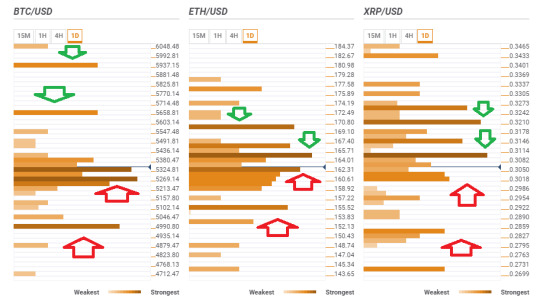

Cryptos look bullish after Binance’s Venus announcement

Cryptocurrencies have been rising as a new week kicks off.

Binance has revealed its project Venus rivaling Facebook’s Libra.

Here are the next levels to watch according to the Confluence Detector.

Cryptocurrencies have been advancing once again, with Bitcoin topping $10,500, Ethereum clawing its way back above $200, and Ripple extending its gains. Investors are jumping back into digital coins after a weak that saw struggles.

One of the upside drivers is Binance. The crypto exchange that also backs its own coin – BNB – has revealed a new project called Venus which aims to develop localized stablecoins all over the world.

Binance has said that it is well-positioned thanks to its public blockchain technology – Binance Chain – and its formidable status as one of the leading exchanges. Similar to Facebook, the crypto-exchange aims to work with corporations, tech companies, governments, and other players in the crypto-world. It aims to compete with the social media behemoth by launching a stable coin on a global scale.

The fresh news joins the announcement by Rakuten – a Japanese retail giant and the shirt-sponsor of FC Barcelona to compete with Binance and others by launching its crypto-exchange. Facilitating the entry of mainstream Japanese into the crypto-world is also bullish news for coins.

What levels should we watch?

This is what the Crypto Confluence Detector[1] shows in its latest update:

BTC/USD needs to break resistance at $10,800

Bitcoin[2] has one clear hurdle at $10,800, which is the convergence of the Fibonacci 61.8% one-week, the Simple Moving Average 50-one-day, the SMA 5-15m, the previous 4h-high, the Pivot Point one-day R2, and more.

If the granddaddy of cryptos breaks higher, the next cap is only at $11,640, which is the meeting point of last week’s high and the Fibonacci 61.8% one-month.

BTC/USD[3] has support at $10,528, where the previous daily high, the BB 15min-Middle, and the SMA 200-4h all converge.

The next cushion is at $10,306, where we note the confluence of the BB 4h-Middle, the SMA 200-15m, the SMA 50-1h, the SMA 10-4h, the Fibonacci 38.2% one-day, and the previous 4h-low.

ETH/USD break confirmation awaited

Ethereum[4] is trading above $200, which is not only a round number but also a dense cluster of lines including the BB 1h-Upper, the Fibonacci 61.8% one-week, the previous 1h-low, the PP 1d-R1, and the SMA 5-15m.

If Vitalik Buterin’s brainchild’s break is confirmed, the next noteworthy cap is $210, where we see the Pivot Point one-week R1 and the SMA 100-4h converge.

Further up, ETH/USD may find resistance at $217 where the previous weekly high meets the PP 1d-R3.

Strong support below $200 awaits at $192 where we see the confluence of the BB 1h-Lower, the Fibonacci 38.2% one-day, the SMA 10-4h, and other lines meet.

XRP/USD finally looking upbeat

Ripple[5], which was the laggard for many months, is finally looking bullish. XRP/USD has surpassed $0.2846, which is the convergence of the SMA 10-1d, the previous monthly low, the SMA 100-15m, and the previous monthly low. The line now serves as support.

It is backed up $0.2816, where we find the confluence of the BB 1h-Lower, the Fibonacci 61.8% one-week, the SMA 200-1h, the SMA 50-4h, and the Fibonacci 38.2% one-day.

Looking up, XRP faces some resistance at $0.3000. The round number is the meeting point of the PP 1w-R1 and the BB 1d-Middle.

Further resistance awaits at $0.3156, where the Fibonacci 23.6% one-month awaits the price.

Get the 5 most predictable currency pairs[6]

References

^ Crypto Confluence Detector (www.fxstreet.com)

^ Bitcoin (www.fxstreet.com)

^ BTC/USD (www.fxstreet.com)

^ Ethereum (www.fxstreet.com)

^ Ripple (www.fxstreet.com)

^ Get the 5 most predictable currency pairs (www.forexcrunch.com)

from Forex Crunch http://feedproxy.google.com/~r/ForexCrunch/~3/kkXBYwjF0_Q/

0 notes

Text

التحليل التقني لزوج يورو / دولار EUR / USD: تنتظر الدببة كسرًا مقنعًا أسفل قناة الاتجاه الصعودية

• استمر الزوج في صراعه للحفاظ على / البناء على محاولة الارتفاع اللحظي لما بعد المتوسط المتحرك لـ 50 ساعة ويبقى ضمن مسافة مدهشة لأدنى سعر في أسبوعين يوم الجمعة.

• تستمر المؤشرات الفنية على الرسوم البيانية للساعة / اليومية في البقاء في المنطقة الهبوطية وتدعم التوقعات لتمديد المسار الهبوطي المستمر على المدى القريب.

زوج يورو / دولار أمريكي على الرسم البياني للساعة الواحدة

على أية حال ، من المرجح أن ينتظر التجار الهبوطيًا اختراقًا مقنعاً أدنى تشكيل قناة الاتجاه الصعودي قصير الأمد على الرسم البياني اليومي قبل وضع أي رهانات عدوانية.

• أسفل الدعم المذكور ، من المرجح للزوج أن يخترق مستوى 1.1300 المستدير ويهدف إلى دعم مستويات منخفضة من عدة أشهر بالقرب من منطقة 1.1215.

الرسم البياني اليومي

EUR / USD

نظرة عامة:

اليوم آخر سعر للسنة: 1.1362

اليوم التغيير اليومي: -3 نقطة

اليوم التغيير اليومي٪: -0.03٪

Today Daily Open: 1.1365

Trends:

Daily SMA20:

1.143 Daily SMA50: 1.1386

Daily SMA100: 1.1463

Daily SMA200: 1.1604

Levels:

Previous Daily High : 1.1412

السابق انخفاض يومية: 1.1353

السابق ارتفاع

أسبوعي: 1.1491 أدنى سعر للأسبوع

السابق : 1.1353 سعر الشهرية السابقة مرتفع: 1.1486

السابقة أدنى سعر مستهدف: 1.1269

يومية فيبوناتشي 38.2٪: 1.1375

يومية فيبوناتشي 61.8٪: 1.1389

نقطة البيفوت

اليومية S1: 1.1341 المحورية اليومية S2: 1.1318

Pivot Point S3: 1.1283

Daily Pivot Point R1: 1.14

Daily Pivot Point R2: 1.1435

Daily Pivot Point R3: 1.1458

• The pair continued with its struggle to sustain/build on the attempted intraday up-move beyond 50-hour EMA and remains within striking distance of two-week lows set on Friday.

• Technical indicators on hourly/daily charts continue to hold in the bearish territory and support prospects for an extension of the ongoing bearish trajectory in the near-term.

EUR/USD 1-hourly chart

• Bearish traders, however, are likely to wait for a convincing break below a short-term ascending trend-channel formation on the daily chart before placing any aggressive bets.

• Below the mentioned support, the pair is likely to break through the 1.1300 round figure mark and aim towards challenging multi-month lows support near the 1.1215 region.

Daily chart

EUR/USD

Overview:

Today Last Price: 1.1362

Today Daily change: -3 pips

Today Daily change %: -0.03%

Today Daily Open: 1.1365

Trends:

Daily SMA20: 1.143

Daily SMA50: 1.1386

Daily SMA100: 1.1463

Daily SMA200: 1.1604

Levels:

Previous Daily High: 1.1412

Previous Daily Low: 1.1353

Previous Weekly High: 1.1491

Previous Weekly Low: 1.1353

Previous Monthly High: 1.1486

Previous Monthly Low: 1.1269

Daily Fibonacci 38.2%: 1.1375

Daily Fibonacci 61.8%: 1.1389

Daily Pivot Point S1: 1.1341

Daily Pivot Point S2: 1.1318

Daily Pivot Point S3: 1.1283

Daily Pivot Point R1: 1.14

Daily Pivot Point R2: 1.1435

Daily Pivot Point R3: 1.1458

Read the full article

0 notes

Text

New Post has been published on Forex Blog | Free Forex Tips | Forex News

!!! CLICK HERE TO READ MORE !!! http://www.forextutor.net/usdcad-trades-lower-on-employment-data/

USD/CAD Trades Lower on Employment Data

Talking Points:

USD/CAD Trades Lower on Employment Data

US NFP (March) Misses Expectations at 98k

Looking for additional trade ideas for Forex markets? Read our 2017 Market Forecast

The USD/CAD has dropped from weekly highs as US Non-farm Payrolls data for the month of March was released under expectations this morning. Expectations for the event were set at 180k, and released at an actual 98k. This news was coupled with a positive Net Change in Canadian Employment for March. Expectations for this event were set at 5.7k, and released at an actual 19.4k.

Technically the USD/CAD is again trending lower in the short term, after the pair was rejected at a line of resistance found at a 61.8% Fibonacci retracement value. This line is found at 1.3431 and will remain a point of resistance on the daily chart. With the USD/CAD trading lower today, the pair is now challenging its 10 day EMA (exponential moving average) at 1.3378. A daily close below this point should be seen as significant. If prices continue to decline below this value, traders may begin looking for longer term breakouts next week under the March 21st low of 1.3263.

USD/CAD, Daily Chart with 10 period EMA

(Created Using IG Charts)

Intraday analytics now has the USD/CAD trading below both its S1 and S2 pivots found at 1.3394 and 1.3370 respectively. With both of these lines convincingly broken during today’s news, the next value of support may be found at the S3 pivot at 1.3342. Prices have tested this value once so far today, but have failed to convincingly breakout below this point. In the event of a bearish breakdown in price below this point, traders may next begin to target the round 1.3300 figure, followed by the March 21st low of 1.3263.

In the event that the USD/CAD remains supported above 1.3342, traders may look for a rebound in price back towards today’s central pivot. For Friday’s trading this line is found at 1.3422. A move above the central pivot should be seen as significant, as the USD/CAD would have retraced all of this morning’s losses at that point. In this bullish scenario traders may find the next point of resistance at the R1 pivot located at 1.3444.

USD/CAD, 30 Minute Chart with Pivots

(Created Using IG Charts)

— Written by Walker, Analyst for DailyFX.com

To Receive Walkers’ analysis directly via email, please SIGN UP HERE

See Walker’s most recent articles at his Bio Page.

Contact and Follow Walker on Twitter @WEnglandFX.

USD/CAD Trades Lower on Employment Data

USD/CAD Trades Lower on Employment Data

https://rss.dailyfx.com/feeds/technical_analysis

$inline_image

0 notes

Text

5 Ways to Find Support and Resistance Levels

Support and resistance levels are basically historical prices where a large number of orders accumulate to prevent a prevailing trend from continuing. Think for a second, if the EUR/USD has risen to 1.1100 and there is a huge volume of sell orders placed at 1.1100, and if the volume of sell orders equals the volume of buy orders, then the price will find an equilibrium. If there are more sellers than buyers, the price will not only stop going up, soon the market price might turn and start a bearish retracement, right? This is what happened in the scenario below.

If there are any time-tested method of trading Forex is finding pivot zones in a price chart and planning your trades around these levels. When a pivot level restricts bulls (buyers) from pushing the price further up, it is known as resistance and if the price is having difficulty crossing below a pivot level, it is called a support. What you need to note down is that a pivot level can act as both support and resistance. In fact, often supports turn into resistances, and vice versa.

Now, why Forex traders tend to concentrate a large number of orders around key historical price levels is up for debate. However, the most reasonable answer that can explain this phenomenon would be the concept of self-fulfilling prophecy. That’s why key Fibonacci retracement levels, Big Round Numbers (BRN) or even a dynamic price level based on Moving Averages (MAs) often end up acting as pivot levels and provide support and resistance to Forex prices.

Using Support and Resistance Levels Can Improve Your Trading Performance

If you knew there is a high probability that the bullish trend of a Forex pair will stop at a certain point ahead of time, how can you benefit from that information? The answer to that question and the possibilities of exploiting such valued information are endless.

You can reduce your exposure or simply close your trade and exit the market with some profit. If you are not in the market, you can look for opportunities to short the pair or wait for the price to break the resistance and ride the bullish momentum again. Hence, knowing how to identify support and resistance can add an immensely useful tool in your trading arsenal.

Moreover, as you already know precisely at what price level the market would likely to stop momentarily, you can get away with setting some tight stop losses, while giving enough breathing room to your trades to become profitable and doing so can immensely improve the reward to risk ratios of your trades.

Knowing how to identify potential support and resistance can revolutionize how you interpret the market and formulate strategies to improve your trading performance. Let’s take a look at some of the most common and effective strategies to find support and resistance in the global currency market.

Finding Support and Resistance by Looking at Historical Pivot Levels

Figure 1: The EURUSD Finds Major Resistance Near the 1.1500 Level

In figure 1, we can see that after November 2018, the EURUSD found a strong resistance near the 1.1500 level three times in the daily time frame. On the first occasion, it formed a large bearish shadow after reaching the 1.1500 level and ended up forming a bearish pin bar that signaled additional bearish momentum in the next few days. On the second occasion, it formed a large Bearish Outside Bar (BEOB). On the third occasion, it formed a small bearish pin bar. While the EURUSD managed to break above the 1.1500 level once since November 2018, the bullish momentum faded quickly and within two days, the pair resumed bearishness.

If you simply drew a horizontal line at the round number 1.1500 on November 7, 2018, and placed three short orders near it, over the last year, two out of your three trades may have been winners.

Historical support and resistance zones work because traders psychologically anchor their decision based on past experiences, and while enough orders accumulate around these levels, it ends up becoming a self-fulfilling prophecy.

Finding Support and Resistance by Daily Calculating Pivot Points

Pivot points are mathematical computation levels based on the previous day’s high, low, and closing prices. Pivot points are very popular with floor traders, and since a lot of large professional and institutional traders use these arbitrary levels in their trading, these levels often act as major support and resistance levels. These levels are important, especially, if you are a day trader and trade using time frames lower than 24-hour periods, such as 60-minute or even 5-minute charts.

Figure 2: EURUSD Finds Support and Resistance Near Pivot Points

In figure 2, we have used a built-in pivot point indicator to draw the S1-S3, R1-R3, and Pivot Point on a EURUSD chart. While these pivot points are based on the previous day’s high, low, and closing prices, these are only relevant for today’s market. Zooming into the 60-minute chart, we can see the EURUSD turned bearish early in the day but soon found support. When it turned bullish in the evening, the R1 and R2 levels provided momentary resistance to the bullish momentum.

You would often find that S1-S3 levels are providing support and causing the market to turn bullish. On the other hand, R1-R3 levels may cause the bullish trend to end and start a bearish reversal. Hence, knowing daily pivot points as a day trader can help you plan your trades as well as set entry and exit points more efficiently.

Anticipate Support and Resistance Around Big Round Numbers

Even wondered why that shirt you bought had a price tag of $39.99 instead of $40.00? Marketing professionals have long exploited how we humans perceive prices and how charging a cent less can have an impact on your purchasing behavior. While marketers exploit human psychology by not offering round figure prices on products, in the Forex market, the traders do flock around big round numbers and place their orders.

If you are a large bank or hedge fund and want to buy the EURUSD if it falls to 1.1000, would you place an order randomly at 1.0087 or would you place the order at 1.1000? Typically, the answer would be the big round number.

Figure 3: Big Round Numbers Provide Major Support and Resistance to GBPUSD on the Weekly Chart

In figure 3, we can see a weekly chart of the GBPUSD. Based on the historical price action, we have drawn four major support and resistance levels on the chart. As you can see, the Big Round Numbers like 1.2000, 1.2400, 1.3400, 1.4400 all acted as major pivot zones, providing support and resistance to falling and rising prices, respectively.

If you are new to trading and do not know how to correctly draw horizontal support and resistance levels, always round up to the next Big Round Number.

Find Support and Resistance with Fibonacci Retracement and Extension Levels

Fibonacci numbers are found in nature and Forex traders have come up with clever ways to implement these ratios to find support and resistance levels in the market. As you can draw the Fibonacci levels based on the high and low of a major price swing, these often act as major pivot zones that can predict the end of the retracement and where the market might resume the prevailing trend.

While retracement levels can help you enter the market, Fibonacci extension levels can help you identify potential profit targets. During a bullish market, Fibonacci retracement levels act as support, where you should enter the market and extension levels act as potential resistance above the high of the Fibonacci swing, where you should exit the market by taking some profits off the table. During a downtrend, you guessed it right, the Fibonacci retracement levels act as resistance and the extension levels act as support.

Figure 4: USDJPY Finds Support and Resistance Near Fibonacci Retracement and Extension Levels

In figure 4, we can see the USDJPY had a bullish swing. Based on the high and low of this bullish swing, we have drawn the Fibonacci retracement levels. As you can see, the USDJPY bearish retracement stopped near the 50% Fibonacci level. Consequently, it resumed the trend and reversed near the 261.8% Fibonacci extension point, which is based on the High, Low and Retracement levels of the initial bullish swing.

One of the problems of using Fibonacci retracement levels for finding support and resistance is not knowing beforehand that at which level the retracement will end, or will the retracement turn into a reversal itself! Hence, using a confluence of technical indicators to confirm the end of the retracement is vital when you are using these levels to anticipate support and resistance levels.

Similarly, there is no way to know if the trend will extend to 161.8% Fibonacci extension to run up to 261.8% or higher. Hence, you should not exit a profitable trade just because the market has reached a certain arbitrary Fibonacci extension level. Instead, try to look for overbought or oversold market conditions or divergence using Oscillators near these Fibonacci extension levels before taking profit and exiting the market.

Look for Dynamic Support and Resistance with Moving Averages

Moving averages are some of the most popular technical indicators used by Forex traders. The sheer popularity of some long-term moving averages makes them ideal candidates for dynamic support and resistance levels in the market.

Among day traders, short-term period moving averages like the EMA 5 and 13 are very popular as both of these are from the Fibonacci sequence of numbers. If you are a swing trader, sticking to EMA 50, 100, and 200 would likely be more appropriate as traders use these longer-term moving averages to identify momentum over days and weeks.

Figure 5: Exponential Moving Averages Acting as Support and Resistance to USDCHF

In figure 5, we can see a weekly chart of USDCHF with three different exponential moving averages plotted on the chart – the EMA 13, 50, and 100. As you can see, the EMA 13 provided short-term resistance during a sustained downtrend. However, even though the EMA 50 and 100 were trailing the price way above the downtrend, once the price retraced up, the EMA 100 acted as a resistance. Soon, the downturn found support near the EMA 50, creating a momentary price channel.

When there are no obvious historical support and resistance on a chart, using popular moving averages like the 50 and 100 periods EMAs can provide Forex traders with some very useful dynamic support and resistance levels.

The Bottom Line

While you should definitely not blindly trade such major support and resistance zones and should have a combined strategy that uses secondary confirmations, like a signal from a technical indicator or a candlestick pattern, simply knowing where to look for trend continuation or reversal can improve your win rate.

Keep in mind that incorporating different types of support and resistance also comes with some drawbacks. One of the major problems of having too many pivot zones on a chart would mean that you would be always uncertain about how far a trend will run as a cluttered chart will make it difficult to let your profits run. Hence, it is always best to use one or two ways of identifying support and resistance levels and using different strategies to plan your trades around these levels.

Also, the whole point of using support and resistance levels is to improve your money management by efficiently entering and exiting the market more effectively. Support and resistance levels should be taken into consideration in a way that helps you identify trades that require small stop loss and large profit targets. So, if you want to enter a long trade, make sure the entry has a short distance from a support level. By contrast, the next resistance level should be much higher to allow your trade a free run.

If you can learn to successfully identify major support and resistance levels and plan your trades around these levels, it will help you dramatically improve your reward to risk ratio, as well as win rate.

The post 5 Ways to Find Support and Resistance Levels appeared first on Tradeciety Online Trading.

5 Ways to Find Support and Resistance Levels published first on your-t1-blog-url

0 notes

Text

Top 3 Price Prediction Bitcoin, Ripple, Ethereum: As Novogratz sees the bottom coming, cryptos eye further healthy gains

New Post has been published on https://cryptnus.com/2018/12/top-3-price-prediction-bitcoin-ripple-ethereum-as-novogratz-sees-the-bottom-coming-cryptos-eye-further-healthy-gains/

Top 3 Price Prediction Bitcoin, Ripple, Ethereum: As Novogratz sees the bottom coming, cryptos eye further healthy gains

Cryptocurrencies made another move higher with another consolidation as Blockstream sends another satellite to space.

The moves are the opposite of a “dead cat bounce” and represent a healthy recovery.

Here are the levels to watch according to the Confluence Detector, our proprietary tool

The crypto comeback continues. Among the recent news items, we learned that Blockstream expanded its presence above the blue planet by sending its fifth satellite to space. Another piece of positive news came from Mike Novogratz that sees a bottom coming to Bitcoin prices.

The recent moves in cryptos are two steps up, one step down. Every move is followed by consolidation without a significant retreat in the prices of digital coins. We are witnessing the exact opposite of the infamous “dead cat bounces” that we have seen until last week.

BTC/USD already braces for levels above $4,000

Bitcoin, the granddaddy of cryptocurrencies faces a medium-sized hurdle at $3,770 where we see the convergence of the Pivot Point one-day Resistance 1, the Bollinger Band 15-minute Upper, the previous 4h-high, the BB 4h-Upper, and the PP one-week R2.

However, the more significant resistance line awaits at $4,199 where the all-important Fibonacci 23.6% one-month awaits BTC/USD.

Looking down, significant support awaits at $3,655 which is the confluence of the previous weekly high, the BB 1d-middle, the BB 1h-middle, the Fibonacci 23.6% 1d, and the Simple Moving Average 5-4h.

The most substantial support is at $3,500. Apart from being a round number, it is the PP 1w-R1, the SMA 100-4h and it is followed by the previous month’s low, and the Fibonacci 61.8% 1w.

ETH/USD can rest above $101, looking at $113.80

Vitalik Buterin’s coin finally recaptured the $100 level and now battles $103 where we see a dense cluster including the SMA 5-1h, the SMA 5-15m, the BB 15m-Middle, the previous day’s high, and the SMA 10-1h.

Ethereum faces a few resistance levels on the way up, but the most significant cap and upside target is at $113.80 where we see the meeting point of the PP 1w-R3 and the SMA 200-4h.

Support for ETH/USD awaits at $101 which is a fierce floor level including the previous monthly low, the Fibonacci 23.6% one-day, the SMA 5-4h, last week’s high, the Fibonacci 38.2% one-day and the BB 1d-Middle.

XRP/USD may need to wait before taking $0.40

Ripple has run fast and hard and now eyes a tough cap at $0.3825 which is the convergence of the Fibonacci 23.6% one-month and the previous 4h high.

If it manages to overcome that level, the next cap is at $0.4170 where we see the Fibonacci 38.2% one-month.

Support awaits XRP/USD at $0.3670 which is the confluence of the PP one-day R1 and the SMA 200-4h. The next level to watch is close: $0.3555 where the PP one-week R3 meets the SMA 5-4h and the previous daily high.

0 notes

Text

June 10th - July 20th, 2023

It's been a minute!

Look under the cut for the amazing works made in the past month and a half-ish.

We will be returning to our normal Saturday schedule next week.

Thanks to @massivespacewren as always for the incredible fanart you see here.

Now let's get to some WinterIron goodies!

The Theory of Love, Electric by Halfpennybuddha

Rated: M

Tags: No archive warnings apply, Princess Diaries AU, Royal AU, High School AU, Gay Bucky Barnes, Bisexual Tony Stark, implied/referenced drug use, implied/referenced self-harm, Bucky Barnes Needs a Hug, Bullying, non-consentual kiss, no sex, but minor over clothes frottage and kissing, Tony & Bucky are both 18, dancer Bucky Barnes, Steve Rogers is a Good Bro, endless shopping, implied/referenced alcohol abuse, underage drinking (not main characters), mentions of cancer, mentions of serious illness (past), supportive family, family feels, Jewish Bucky Barnes, unplanned pregnancy, light angst

Summary: "“Even after his tragic death, it should not have changed much regarding succession. I…well, I was still in good health, though in mourning. But now…your grandfather’s death last year, and my testicular cancer, you see. The treatment…well, I am sterile, Iacob.”

Bucky dropped his sandwich.

AKA The Winteriron Princess Diaries AU that nobody asked for."

Takin’ What They’re Givin’ (‘Cause I’m Workin’ for a Livin’) - Chapter 8: Mission Six: Breaking All the Rules by @polizwrites

Rated: E

Tags: Identity Porn, camboy!Bucky, Iron Man Tony Stark/Modern Bucky Barnes, Cap!Steve/Modern Bucky Barnes, oral sex, anal sex, Sugar Daddy, Revelations, Happy Endings

Summary: Bucky's little camboy sidegig - where he plays 'Special Agent Jay' -- gets him attention from an unexpected quarter.

Chapter 8 Bucky finally makes it to Seoul, and so do two people very important to him.

My Love is Vengeance - Chapter 4 by @polizwrites

Rated: T

Tags: Canon Divergence, young!Tony, bodyguard!Winter Soldier, recovering!Bucky, POV Bucky, Hydra, double agent

Summary: "[Part of Behind Blue Eyes Series]

Still disguised as Jacob, the Soldier goes to a club with Tony. Tony runs into trouble and they both reveal their feelings just before the Soldier’s hand is forced.

Chapter 4: The next day, Tony and Bucky are separated and learn more about what Hydra expects of them before reuniting again. "

Surprise Afternoon Shopping by @endlesstwanted

Rated: E

Tags: Sugar Daddy AU, Lingerie, Semi-Public Sex

Summary: With Bucky’s promotion’s party this weekend, Tony’s taken on a surprise afternoon shopping session in search of clothes for the occasion. They just may or may not have spent all of it at Bucky’s regular sex shop.

Home Again (Chapter 31) by @scottxlogan

Rated: E

Tags: Post-Avengers: Endgame (Movie), Canon Divergence - Avengers: Endgame (Movie), Supernatural Elements, Canon-Typical Violence, Alternate Universe - Canon Divergence, References to Depression, Bucky Barnes Has PTSD, Bucky Barnes & Sam Wilson Friendship, Pre-Relationship, Angst with a Happy Ending, Angst and Hurt/Comfort, Angst and Tragedy, Angst and Romance, Blood Loss, Adult Content, Explicit Language, Enemies to Friends to Lovers, Blood and Injury, Dreams and Nightmares, Slow Burn, Sexual Content

Summary: After a few surprising truths are revealed Bucky and Tony are reunited at the reservoir in Wakanda. Will it spell disaster or prove to be the happy ending they've both been searching for?

WinterIron Bingo - July 2023 Round Robin by AoifeLaufeyson, endlesstwanted, HadrianPeverellBlack, Politzania, scottxlogan, Sivan325

Rated: G

Tags: Alternate Universe - Modern: No Powers, Fake/Pretend Relationship, Love Confessions, Crushes, Mutual Pining

Summary: When Natasha talks Bucky into pretending to be her boyfriend so her nosy (but well-meaning) family will leave her alone -- the last thing Bucky expects is to run into his crush: Tony Stark.

Late-Night Requirements by @every-marveler-ever

Rated: G

Tags: Tony Stark is scared (but won’t admit it), Hydra

Summary: Hydra had always been a pain for them, but since dating Sam and Bucky, Hydra became a whole new level of scary to Tony. They said it would be easy, and simple, but Tony just couldn’t believe that.

Love You Doll by Aralia Tutela

Rated: T

Tags: Living Doll

Summary: Put me away like a doll when they didn't need me.' Tony's mind caught on that phrase, and suddenly he knew what he could do to help his lover relax.

And So It Goes by @purpleicedteas

Rated: M

Tags: Single Dad Tony, Recluse Bucky, Brief mention of Pepper's breast cancer and death; Silver Fox Bucky, Silver Fox Tony, Single Dad Tony, Engineer Tony, Former FBI Agent Bucky, Recluse Bucky, Alpine the Cat

Summary: Bucky Barnes was a retired FBI agent living as a recluse. Content with a solitary lifestyle, he lived for years with only the company of Alpine, his feline companion. When the empty home next to theirs is filled with new neighbors, Alpine and Bucky find their lives weaving with the handsome engineer and his daughter.

Never Have I Ever by @scottxlogan

Rated: E

Tags: Sexual Content, Jealousy, Implied/Referenced Cheating, Alternate Universe - Canon Divergence, Not Steve Rogers Friendly, Past Steve Rogers/Tony Stark, Past Bucky Barnes/Steve Rogers, Minor Sharon Carter/Steve Rogers, Light Bondage, Angst with a Happy Ending, Light Angst, Blindfolds, Restraints, Declarations Of Love, Established Relationship, Angst, Alcoholic Tony Stark, Past Alcohol Abuse/Alcoholism

Summary: When the team gets together to spend a night under the stars playing a game of Never Have I Ever, it opens the door to a tense situation where Bucky and Tony are left facing an uncomfortable truth about the history they have with Steve. Will it prove to be the think that pulls their blossoming relationship apart or will it bring them closer together when everything is said and done?

Its Vital Heat by @halfpennybuddha

Rating: G

Tags: James "Bucky" Barnes/Tony Stark, Winifred Barnes/George Barnes, Meeting the Parents, Modern Art

Summary:

“You don’t recognize me, do you?” He couldn’t tell if her voice was teasing or reproachful, and it made him a bit nervous.

“Uh, no, ma’am. I’m sorry.” She laughed, then, the sound a bit like the tinkling of bells.

“Don’t fret so, child. My name is Maria Stark. My son has spoken of you often the past few weeks.” She informed him, taking a delicate sip of her drink.

Oh, God. Tony’s mother.

A Sugar-Coated Pill - Chapter 2 by @polizwrites

Rated: T

Tags: No Powers AU, A/B/O AU, Sugar Daddy AU, Political Campaigns, Amputee!Bucky, Alpha!Bucky, young!Tony, Omega!Tony, Slow Dancing

Summary: Now that they have a few events under their belts, Bucky and Tony start to get more comfortable around one another during a Fourth of July party.

Looking At You by @scottxlogan

Rated: M

Tags: 5+1 Things, Romance, Implied Sexual Content, Implied/Referenced Sex, Falling In Love, Jealousy, Yoga, Light Angst, Happy Ending, Digital Art, Prompt Fic

Summary: Bucky reflects on those five times he's seen Tony in his yoga pants and the way they made an impact on him. Later Tony reflects on the one time he saw Bucky in his.

The Upside by @otpcutie

Rated: E

Tags: body swap AU, found family, transguy Tony, flirting, teasing, mutual pining, boys in love, fluff, jerking off, smut

Summary: Tony and Bucky give each other permission to get off while body swapped.

#halfpennybuddha#polizwrites#endlesstwanted#scottxlogan#aoifelaufeyson#hadrianpeverellblack#sivan325#every-marveler-ever#aralia tutela#purpleicedteas#otpcutie#weekly round up: r1#winteriron#starkbucks#ironwinter#tony stark#bucky barnes#iron man#winter soldier#marvel

23 notes

·

View notes

Text

After a late begin to 2017, Orena’s large announcement was their R1

After a late begin to 2017, Orena’s large announcement was their R1. 7 mil Orena Championship Series. The series invites 16 teams to the week long LAN Final after a 14-week Online Double Round Robin to decided seedings. 16 Teams will receive direct invites (8 Dota 2, 8 CS: GO), but the others have a chance of grabbing the final two places through the online Premier Division which commences on June 5th.

The registrations for your online qualifier leg are open to all teams, and you’re not only competing for a spot at the LAN final, but also the R50, 000 prize pool for the online season, as described in their initial statement.

The OCS may have a strict broadcast schedule bringing you bi-weekly broadcasts of the top matches both in CS: GO and Dota 2 . Registrations are open and, and leave an area for up and coming groups to compete and grow as they look to contend at the LAN Finals which will be happening in September. The Dota 2 competitors will run from the 21st to the 24th, with the CS: PROCEED one taking place the week after from the 28th to the first of October. This particular new LAN file format ensures ample area and time for both tournaments to be broadcast, along with a venue offering space for spectators who wish to attend the LAN Finals.

0 notes

Text

US Data – CPI lighter, Weekly Claims better

USDJPY, H1

US September CPI was flat, and the core was up 0.1%, both a little shy of estimates, following unrevised gains of 0.1% and 0.3%, respectively. The 12-month headline and core rates were steady at 1.7% y/y and 2.4% y/y, with the latter holding above the Fed’s 2% target (though the PCE is the favoured indicator). Energy costs were down -1.4% following the 1.9% prior slide, with gasoline off -2.4%. Used car prices dropped 1.6%. Food prices dipped 0.1% and apparel fell -0.4%. Pressure on prices remains elusive.

Meanwhile, US initial jobless claims dropped 10k to 210k in the week ended October 5, surprising forecasts for a rise, after increasing 5k to 220k previously (revised from 219k). That’s stronger than expected despite the UAW strike in its 4th week. The 4-week moving average edged up to 213.75k from 212.75k (revised from 212.5k). Continuing claims climbed 29k to 1,684k in the September 28 week after slipping 1k to 1,655k (revised from 1,651k).

Initial reaction from the Dollar was a dip after the cooler CPI outcome, seeing USDJPY slip briefly to 107.37 from near 107.50, and EURUSD trade over 1.1030 from under 1.1025. USDJPY has since recovered to test 107.60 but is capped at R1 and 107.75 with support at S1 and 107.00 ahead of Day One of the latest round of high level US-China trade talks, which has all eyes on Washington DC.

Click here to access the Economic Calendar

Stuart Cowell

Head Market Analyst

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.

US Data – CPI lighter, Weekly Claims better published first on https://alphaex-capital.blogspot.com/

0 notes

Text

Weekend Round Up from Coach Lyall!

Well well well, what a conclusion that was to our 2016/17 Octopus Olympics P2P Series!!! After 8 events beginning with the Phelps P2P on September 10th and concluding with the Owens P2P on May 6th, we had 9 months of mayhem as 125 total Scozzie participants battled one another for precious ranking points to conclude our season in spectacular style! We had a total of 62 players complete the minimum 4 events (of the 8 total) to be eligible for final ranking positions and the annual awards ceremony.

Several awards were presented before play started; Male MVP – Austin Zheung, who completed all 8 events and showed incredible improvement throughout. His series was capped with an excellent R1 qualifying victory over Alex on Saturday.

Female MVP – Avika Pande, who amazingly has never missed a P2P in 2 years (the only Scozzie!). She’s even been known to persuade her dad to change vacation dates to accommodate P2P dates… big things ahead!!

Rookie of the Year – Abby Ward, played 7 of 8 events and displayed amazing improvement and development in the 9 month period. Has gone from beginner level to competitive on US Squash Tour.

Most Improved – Ethan Benstock, produced some incredible numbers over the course of the season. Improved from achieving 475 points in P2P #1 to 900 in P2P #7 (when he defeated several high schoolers rated significantly higher), unquestionably, the largest improvement across all Scozzie’s.

Junior of the Year – Peter Miller, who achieved a very impressive average of 950.25 and finished 3rd overall in P2P end of season standings. Added to his achievement of aging out at #5 Nationally.

Octopus Olympic Champion 2017 – After Sean won the Spider Series in 2016 with the loss of only 1 match all season (1 more than his freshman year at Harvard), Coach Sam amazingly went on a historic undefeated run from September until the last event in May and had an unrivaled perfect 1000 average. Could he achieve P2P history and go unbeaten all season, or could someone prove the big upset of the season?!

The presentation was followed by a brief joke telling contest with Scozzie chief jokester – Betsy, unusually quiet refusing to give up any of her trademarked jokes! The winners came from Coach Lyall and you can judge if they really deserved the title… yes, he was also the judge!

Q – what do you two Octopus who look alike? A – I-tentacle!!!

Q – how do you make an Octopus laugh? A – ten-tickles!!!

Yeah we guessed your response… terrible jokes!! Luckily the squash was significantly better and spectators were in for a treat as soon as qualifying matches began at 9:30am. 9 total matches went to a deciding game and left parents on the edge of their seats! Without question, many Scozzie’s were producing their best squash of the season and provides a great platform to build from through summer to create the foundation they want before the 2017/18 season. Six divisions were packed and the divisional titles were sought before they were fought for!

The Premier Division had all eyes as Sam attempted unthinkable, going a full P2P season unbeaten. Max managed to scrape a game in the semi’s, but like many of the kids, his squash was as good as it’s been all year. Coach Lyall couldn’t capitalize on the confidence gained from a mid week victory and was outclassed in the final. 5 P2P titles, a perfect 1000 average and a new highest world ranking in the month of May! The sky is the limit for the young Welshman and Scozzie can’t wait to see what our fav coach can produce next season. Top 100?! Zach and Charlie played one of the matches of the year in the unofficial 3/4 play off (max was the official 3rd place winner). The layout of the match was extremely unique – two tap rules, with referee and spectators must be positioned inside the court on the back wall! The crowd were on stitches whilst spectating and Zach eventually prevailed 11/9 in the 5th!!

Division 2’s hero was John Sutherby, who bounced back from a tough learning experience at Bronze Nationals to have match ball against Alden in qualifying, before defeating Winston, Chase and Catie on route to winning D2, his highest finishing position this year.

Sean showed remarkable improvement in D3 and after winning his qualifying match 2/0, didn’t drop a set through the whole day! His improvement in 2017 has seen his ability level jump several grades and one of US Squash hottest and most improvement players is full of confidence entering the summer schedule of events. Jacqui had a great 3/2 victory over Corey to finish 2nd and John Z came in 4th.

Chase L lost to Sean P in qualifying, as the luck of the draw went against him. Not one to feel bad for himself, he bounced back in style to win D4 defeating Anushka in the final. Braiden and Alex made up the 3/4 positions. Daniel was the D5 Champ ahead of Will and Omar, who completed the podium and Charly had her 3rd successive top 4 finish in P2P events.

The day was brought to an end with some great squash in D6 with our New Jersey contingent Shrey and Ben taking home 1st and 2nd! Betsy took home the Bronze medal to round a memorable day and a hugely fun and eventful 8 legged series – 2016/17 Octopus Olympics. Votes are being cast for the 2017/18 title – currently in first place is the Tarantula Tour, but entries are open until the beginning of summer, so let us here your thoughts! Thanks to everyone who participated and brought so much excitement and anticipation to our Saturday mornings.

Well done finally to all Scozzie’s who travelled out west for the Seattle Gold. A special congratulations to Caroline Glaser in making her first Gold quarter final at U17 and the Herbert brothers on good runs in the BU15 Consolation.

Our weekly Scozzie Awards were as follows; Tournament Player of the Week – Coach Sam for his incredible unseated P2P season.

Scozzie of the Week – Zoe, check the report on the website detailing Zoe’s huge progress since a Silver Nationals.

Lesson of the Week – MJ, for finally discovering his drop shot and now can master his varied game plan of power and touch!

Our season concluding event – The Club Championships 2017 will be held on May 20th! Enter now with your desired age category – U11, U13, U15, U17 or U19 for what should be a cracking end to 2016/17 season! Now everyone turn on your TV’s and watch all the Scozzie’s attempt the Broad Street 10 mile on ABC… who will win in the showcased showdown – Coach Lyall or Teddy?!?! 100 push ups are on the line! Stay tuned!

from WordPress http://ift.tt/2pW8lr2

via IFTTT

0 notes

Text

Bitcion rises, can it carry the rest?

Cryptocurrencies are rising in a calmer mood than previous days.

The technical levels look favorable to Bitcoin but not to the others.

Here are the levels to watch according to the Confluence Detector.

Cryptocurrency markets are calm as European traders return from their May Day holidays. The calm proves positive for all top three digital coins that enjoy some positive news.

Washington State decided to recognize Blockchain records as not only legally valid but also as enforceable, opening the door to broader adoption. The Chair of the US CFT said that interest in crypto could bring about more Clearing Houses. Broader institutional involvement for cryptos is good news.

And the crypto-sphere also needs to clean up its act. CoinMarketCap, one of the top sites, decided to remove certain exchanges from its listings if they do not provide certain figures. There had been reports that some crypto-exchanges bloat the trading volume in order to stand out.

This is what the Crypto Confluence Detector[1] shows in its latest update:

BTC/USD is sitting on firm ground

Bitcoin[2], the King of Cryptocurrencies, enjoys the best technical outlook. It enjoys a dense cluster of support lines at $5,324 which is the confluence of the Fibonacci 61.8% one-day, the Simple Moving Average 10-4h, the Bollinger Band 15min-Lower, the previous low 4h, the SMA 100-15m, the Bollinger Band 1h-Middle, the Simple Moving Average 5-4h, the SMA 50-15m, the SMA 10-1h, the Fibonacci 38.2% one-day.

Another considerable cushion awaits at $5,269where we see the convergence of the SMA 50-4h, the Fibonacci 23.6% one-month, the SMA 200-1h, the previous daily low.

BTC/USD[3] faces some resistance at $5,658 which is the meeting point of the previous monthly high and the weekly high as well.

The upside target is $5,937 where the PP 1m-R1 and the PP 1w-R2 converge.

ETH/USD is stuck in a narrow range

Ethereum[4] also enjoys substantial support, like Bitcoin. The $162 level is the confluence of the previous 4h-low, the SMA 10-1d, the SMA 50-15m, the SMA 10-1h, the BB 1h-Middle, the Fibonacci 23.6% on, and the SMA 200-15m.

However, it also faces resistance quite close, at $164.50 where the SMA 200-4h and the Fibonacci 61.8% one-day meet.

If ETH/USD[5] drops, it has support at $155.50 where we see the convergence of the SMA 50-1d, the Fibonacci 23.6% one-week, and the BB 4h-Lower.

And if Vitalik Buterin’s brainchild breaks higher, it will find resistance at the round number of $170 which is a juncture including the Fibonacci 38.2% one-month and the PP 1d-R2.

XRP/USD faces fierce resistance

Ripple[6] is in a worse situation. It is capped by $0.3100 which is a dense cluster including the SMA 200-15m, the Fibonacci 38.2% one-day, the previous 1h-high, the previous 4h-high, and the SMA 10-4h.

Another considerable cap awaits at $0.3210 which is a convergence of the Fibonacci 61.8% one-month, the PP 1d-R2.

Some support awaits at $0.3018 where the SMA 50-5h, the SMA 200-1h, and the PP 1d-S1 converge.

The downside target is $0.2840 where the previous monthly low and the previous weekly low meet up.

References

^ Crypto Confluence Detector (www.fxstreet.com)

^ Bitcoin (www.fxstreet.com)

^ BTC/USD (www.fxstreet.com)

^ Ethereum (www.fxstreet.com)

^ ETH/USD (www.fxstreet.com)

^ Ripple (www.fxstreet.com)

from Forex Crunch http://feedproxy.google.com/~r/ForexCrunch/~3/C4KvHcxQq2c/

0 notes

Link

American Honda Goes Superbike Racing Again! No, it’s not quite a full factory effort again, but the fact the surprise announcement took place in the hallowed halls of American Honda’s old race shop behind Door #10 in Torrance shows Big Red is back and seriously behind the effort. Jake Gagne won the Red Bull Rookies Cup in 2010, the AMA Sportbike championship in 2014 on an R6, the first MotoAmerica Superstock Championship in `15 on an R1 – and finished 10th in Superbike last year on anther R1. For 2017, his main Broaster Chicken sponsor is back but this time so is American Honda after a 10-year hiatus, and their new bike is the CBR1000RR SP. Danny Walker of Roadracing Factory fame is still the team owner, and will continue to be based in Fort Collins, Colorado. Scott Jensen will continue to crew chief, Danny Anderson and Evan Steel will build chassis and engines. However, now they also have close ties to Ten Kate in Holland, who will help out with WSBK-spec equipment and expertise. (Also whatever HRC parts Honda’s Mike Snyder can smuggle out on his frequent trips to Japan.) MotoAmerica principal Wayne Rainey is genuinely excited to have Honda back on board in any capacity: “My first bike was a Mini Trail 50, and I still look back on that [1987] AMA Superbike championship on the Honda.” Rainey had been trying to woo Honda (and other factories) back into the paddock for years with weekly phone calls, trying to put something together. “What have you got? Anything, I’ll ride it myself!” Finally the timing was right with the introduction of the new CBR. Furthermore, a change in MotoAmerica Superbike rules, dealing mostly with electronics and suspension, puts them right in line with World Superbike spec machines and made possible the Ten Kate connection. What are the differences? Tires, says Rainey. Everything else is the same. Which only makes sense. “The rules package was really what was keeping them [Honda and other manufacturers] on the fence. They’d all say, `It doesn’t make sense for us to build two bikes’, in a sport that’s expensive enough already. The rules change is really what allowed this to happen.” Which leads to, when will Ducati and Kawasaki and the other OEMs return? “We keep them informed of what’s going on,” Rainey says with a smile. “The vast majority of national series enjoy much broader manufacturer support,” adds Honda’s Jon Seidel, “and that’s what MotoAmerica is of course aiming for. We’re thrilled to be back. I can’t wait for April.” One step at at time. “It’s quite incredible,” says Rainey. “That first year we just tried to stabilize and only had five races. The second year was when I was most worried, then we got the TV package last year. Now we’re up to 10 races and looking at ways to get the fans back at the races, including minimoto, stunt shows and combining local club races at some events. Having Honda back is another big step.” Racer Jake Gagne and former racer Danny Walker are all smiles about their new deal with Honda. Team owner Danny Walker couldn’t seem to be any happier, either: “It’s huge for me and the team to bring Honda back to roadracing. We’ve been trying to put this deal together for two years, and I’ve been looking to spend more time with Jake. He deserves it.” The deal with Honda and Broaster Chicken is a multi-year one: Walker says having Gagne consistently in the hunt for the podium by end of this season will seem like success to him, followed by a serious run at the championship in 2018. Gagne interjects his own timeframe: “COTA” (Circuit of the Americas, the first round coming up April 21). Gagne says he’s never ridden a CBR at all, and will be getting his first laps in next week at Chuckwalla in the California desert. Meanwhile, Honda also hooked up the San Diego native with a CRF450F, his favored training device. Eat plenty of Broaster Chicken while you wait for the season opener. Founded in 1954 in Wisconsin, there are over 4000 outlets nationwide. And work it off at an American Supercamp flat-track school; Walker says he’ll have enough time to keep putting them on. American Honda Goes Superbike Racing Again! appeared first on Motorcycle.com.

0 notes

Text

July 29th - August 19th

Thanks to @massivespacewren as always for the incredible fanart you see above.

Now let's get to some WinterIron goodies!

WinterIron Bingo Round One - August Round Robin by endlesstwanted, Faustess, Politzania, Sivan325

Rated: G

Tags: No Powers AU, Round Robin, Tattoo Parlor AU

Summary: When Tony learns that Bucky and Wanda are looking at expanding their tattoo studio to a second location, he offers to help. Bucky is afraid of mixing business and pleasure; turns out that might not be a problem.

Transcendental Phenomena by @pandagirl45

Rated: E

Tags: Tony Stark, Bucky Barnes, Winteriron, Tony is an eldritch horror, magic au, eldritch horror/human hybrid, Bucky crushing, Tony crushing, Angst, pre-relationship, strangers to friends, to lovers, hurt/comfort

Summary: Bucky never understood, how or why the fight in Siberia was so awkward, hazy, and most importantly, maddening. It doesn’t stop when he realizes the man of the hour is stranger than anything else in his life

For Tony, his life has always been a little maddening

Santa’s Little Minions by @endlesstwanted

Rated: G

Tags: Christmas, Pining, Avengers Family, Friends to Lovers, Father-Daughter Relationship

Summary: Tony writes Santa a letter to make Morgan happy, but he’d never believe that wishes come true just as easily as you make them.

Waking Up To Forever by @scottxlogan

Rated: E

Tags: Post-Avengers: Endgame (Movie), Canon Divergence - Post-Avengers: Endgame (Movie), Supernatural Elements, Multiverse, Established Relationship, Adult Content, Angst and Romance, Honeymoon, Dreams and Nightmares, Parent Tony Stark

Summary: Tony and Bucky's happily ever after begins in Wakanda on their honeymoon where Tony's return to the world around him has opened the door to new possibilities for his life moving forward. Finally home again Tony had everything he ever could've asked for with his husband and his family, yet in his newfound joy Tony finds himself returning to a dark place in the world where another version of himself had been caught up in a dark war under the thumb of a tyrannical ruler. When Tony's dark dreams of another man's life threaten to steal his joy from him, Tony and Bucky realize the only way to save their future for those they love is in understanding the past through another's eyes in a world that was never meant to be theirs to begin with.

#weekly round up: r1#winteriron#starkbucks#ironwinter#tony stark#bucky barnes#iron man#winter soldier#marvel#bingowinteriron#endlesstwanted#polizwrites#faustess#sivan325#pandagirl45#scottxlogan

12 notes

·

View notes