Corey Rockafeler-Fintech executive is an asset-based lending & crypto currency expert helping businesses grow with custom financing solutions. As a passionate client-first advocate and small business champion, I preach the gospel of long-term, well-priced capiatl with complete transparency.

Don't wanna be here? Send us removal request.

Link

Corey Rockafeler Blog Post

0 notes

Video

tumblr

American Credit, is a fintech lender changing the industry . Here is the new AMC Streamline Program; A fast, simple, fully digital way to buy equipment.

0 notes

Text

Corey Rockafeler

Corey Rockafeler is a fintech executive & asset-based financing expert helping businesses grow and expand with one-of-a-kind ABL loans

0 notes

Text

Corey Rockafeler Developing Successful Business

Corey Rockafeler Managing Director - Bell Funding Solutions. Bell Funding Solutions is a global leader in small and medium sized business financing. Corey Rockafeler Developing successful business strategies for C-level executives, entrepreneurs, top attorneys, and small business owners has been Corey Rockafeler’s DNA for over 25 years.

0 notes

Text

Corey Rockafeler Business Financing Expert

Corey Rockafeler is the President of Vaalk Media Group and Managing Director and small business financing expert at Bell Funding Solutions in New York City.

0 notes

Text

Top Mistakes In Commercial Realestate Investing By Corey Rockafeler

Top Mistakes in Commercial Real Estate Investing by Corey Rockafeler 1. Failing to Understand the Terms of Balloon Financing. 2. Incorrectly Assessing the Value of a Property. 3. Focusing Too Much on Gross Income. 4. Forgetting About Occupancy Licenses. 5. Not Knowing Your LTV & DSCR. 6. Not Having a Cost Segregation Study. 7. Failing to Structure a Holding Entity Correctly. 8. Miscalculating Cash Flow. 9. Underestimating Vacancy & Tenant Improvement Cost. 10.Not Checking Local Zoning Ordinances

0 notes

Text

Corey Rockafeler | Director Bell Funding Solutions

Corey Rockafeler is the President of Vaalk Media Group and Managing Director and small business financing expert at Bell Funding Solutions in New York City.

0 notes

Text

Corey Rockafeler CEO Achievement Awards Winner

Corey Rockafeler multiple-CEO Achievement Awards Winner with consistent over quota Top 5% performance in closed business, superior account management, and strategic partnerships. Proven track record managing complex sales cycles with multiple touch points and driving revenue & profit growth.

0 notes

Text

Corey Rockafeler - Insurance Specialist

Corey Rockafeler highly developed negotiation skills with elite oral & written communication abilities. Multiple-CEO Achievement Awards Winner with consistent over quota Top 5% performance in closed business, superior account management, and strategic partnerships.

0 notes

Text

Corey Rockafeler Fintech Executive-Asset-Based Lending & Cryptocurrency Expert

Corey Rockafeler, Highly accomplished multi-million dollar producing B2B Sales/Business Development/Strategic Partnership Executive ,and member of Microsoft All -Access team with 15+ years’ experience producing over $40 million in revenue within highly competitive, milestone & quota-driven high-growth start-ups, established businesses, and nonprofits. Recognized track record closing high-value strategic partnerships such as $1.5 million financing partnership with the largest small business consulting company in America. Highly developed negotiation skills with elite oral & written communication abilities.

0 notes

Text

Corey Rockafeler Information

Corey Rockafeler is the President of Vaalk Media Group and Managing Director and small business financing expert at Bell Funding Solutions in New York City.He work as Managing Director. Complete financing solutions for small and medium sized businesses.

0 notes

Text

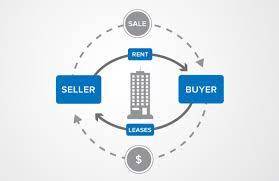

What is a Sale Leaseback?

Corey Rockafeler | In a sale and leaseback, an equipment owner sells their existing equipment to a leasing company (such as AmCredit ) and then leases the same equipment back. As a business owner who sells your equipment, you become a lessee, and the purchaser (AmCredit), becomes the lessor.Usually, sale and leasebacks are considered to be true or tax leases and the lessee makes monthly rental payments to the Lessor.At the end of the term of the lease, the lessee can return the equipment, release the equipment, or purchase the equipment from the lessor.

0 notes

Text

What is a Sale Leaseback By Corey Rockafeler

Corey Rockafeler "In a sale and leaseback, an equipmentowner sells their existing equipment to aleasing company (such as AmCredit ) andthen leases the same equipment back. Asa business owner who sells yourequipment, you become a lessee, and thepurchaser (AmCredit), becomes the lessor.Usually, sale and leasebacks areconsidered to be true or tax leases and thelessee makes monthly rental payments tothe Lessor. At the end of the term of the lease, thelessee can return the equipment, releasethe equipment, or purchase theequipment from the lessor".

0 notes

Text

Corey Rockafeler | Equipment Financing Or Leasing

4 Key Tips to help you make the right decision. Part I by Corey Rockafeler Tip #1 – Be ready to clearly describe how the business equipment will benefit your business. Tip #2 – Review your credit report/scores and organize your financial information before contacting an equipment financing provider. Tip #3 – Review your business credit report and update any information that is outdated or incorrect prior to contacting an equipment financing provider. Tip #4 – Know the difference between a fair market value lease and a $1 purchase option lease.

0 notes

Text

About Corey Rockafeler

Corey Rockafeler President of Vaalk Media Group. Corey Rockafeler Managing Director at Bell Funding Solutions in New York City help small business to grow.

1 note

·

View note