Don't wanna be here? Send us removal request.

Text

Cointelegraph Unveils Russian Edition With Support From CryptoRobotics CEO Ivan Shcherbakov

The international crypto media outlet Cointelegraph has launched its Russian-language editorial division. The new information platform will provide professional translations of key global materials as well as original publications tailored to the CIS market. The Russian version of Cointelegraph was launched with the participation of Ivan Scherbakov, CEO of CryptoRobotics, who joined the project as a co-owner.

Founded in 2013, Cointelegraph is one of the most cited crypto media outlets in the world. The platform attracts over 12 million unique visitors per month and publishes an average of 35 articles daily. Its content is produced by an international team of more than 300 editors, analysts, and journalists.

Now, a significant portion of this content will be available in Russian, adhering to Cointelegraph’s editorial standards and enriched with original content on regional topics.

“This is more than just an investment for me. It’s an opportunity to contribute to the development of a high-quality information space for the Russian-speaking crypto community,” said Ivan Scherbakov.

Local content development is also overseen by Svyatoslav Konenkov, a DeFi expert and media consultant for the project.

The Russian editorial team will focus on:

Translating analysis and articles from Cointelegraph’s English-language edition

Covering projects, events, and trends within the CIS crypto market

Conducting interviews with leaders from crypto businesses and tech companies

Publishing original content on blockchain infrastructure, DeFi, Web3, and related fields

Key editorial topics include:

News on blockchain technology developments

Reviews and analytics on the cryptocurrency market

Materials on decentralized finance (DeFi) and NFTs

Commentary on regulation and policy issues

Interviews with project founders and developers

Information on exchanges, protocols, and investment solutions

The Russian-language version of Cointelegraph is available at:https://ru.cointelegraph.com

Follow the latest updates on Telegram:https://t.me/RUCointelegraph

Project partner:https://cryptorobotics.ai

0 notes

Text

Trade on MEXC via CryptoRobotics and automate crypto trading

The cryptocurrency exchange MEXC is now integrated with the CryptoRobotics trading platform. This integration enables users to automate spot crypto trading on MEXC using a variety of tools, including crypto signals, AI-powered bots, and analytics modules — all accessible through a single interface.

These tools are designed specifically to work with MEXC, allowing users to automate strategy execution without manually placing trades.

What is MEXC crypto trading?

MEXC is a global cryptocurrency exchange offering a wide range of digital assets for spot and futures trading. It is known for its liquidity, broad coin selection, and user-friendly interface. Now, MEXC users can connect their accounts to CryptoRobotics and use automated trading tools optimized for the MEXC spot market.

What is CryptoRobotics?

CryptoRobotics is a cloud-based crypto trading platform that supports multi-exchange trading and automation. It offers tools for:

Semi-automated crypto signals

Fully automated AI signal bots

Manual trading with smart interface

Risk management and analytics

With support for MEXC, CryptoRobotics expands its automation capabilities to a wider user base.

Key CryptoRobotics Trading Tools for MEXC

All tools listed below are fully compatible with MEXC spot trading.

Crypto Signals (Semi-Automated)

These signals are generated by professional analysts. Each one includes pre-configured parameters (entry, stop-loss, take-profit). The user decides whether to follow the signal. Once accepted, the trade is executed on MEXC automatically.

Examples:

CRYPTOSEGNALI — A strategy combining short- and mid-term trades, with average monthly profit of 25.81%.

KURESOFA — High-frequency signals with a strong track record and 12 active trades at a time.

Signal Bots (Fully Automated)

These bots receive signals from analysts but then analyze the market themselves before making any trade. The decision to enter a position is based on additional algorithmic filters and risk parameters.

Example:

FLASH SIGNALS Bot — Uses an AI-based breakout strategy and trades only if conditions are met. Supports MEXC and charges 18% from profit, with no fixed monthly fee.

Automated Bots on MEXC via CryptoRobotics

CryptoRobotics features several bots that work with MEXC spot trading, including the Fast&Furious series and TrendPal. These tools are built on indicator-based strategies and offer automation with flexible pricing models.

Advantages of crypto trading on MEXC via CryptoRobotics

Tailored for MEXC spot trading

Automation through bots and signals

No manual trading required

Flexible pricing (monthly or profit-share)

All trade settings are pre-configured by professionals

FAQs

Does CryptoRobotics support MEXC futures?No, currently only spot trading on MEXC is supported.

Are the tools beginner-friendly?Yes. Users only need to connect their MEXC account via API and choose tools to automate trades.

What fees are involved?Some bots charge a monthly fee, others take a percentage from profit. For example, FLASH SIGNALS takes 18% from successful trades.

Do the bots and signals work with MEXC only?All mentioned tools are fully operational on MEXC, though some may also support other exchanges.

How to start trading on MEXC via CryptoRobotics

Sign up at Сryptorobotics

Create and connect your MEXC API keys

Browse available bots and signal providers

Subscribe or connect to the selected tool

Let trades run automatically or monitor them through the dashboard

This setup allows traders to fully automate crypto trading on MEXC using reliable, pre-tested strategies without manually managing every order.

0 notes

Text

Optimus Crypto Bot Overview on the CryptoRobotics Platform

Optimus Crypto Bot is an automated trading system designed to operate on the cryptocurrency market. Its trading algorithm is based on analyzing the changes in the values of the RSI (Relative Strength Index) oscillator and crossing predefined threshold levels. Optimus enables users to automatically open and close trades, minimizing human influence and ensuring stable trading results based on mathematical calculations.

The key feature of the bot is its ability to use strategies based on various RSI levels for precise entry and exit points. This helps reduce risks and increase the likelihood of successful trades.

How the Optimus Crypto Bot Works

1. Entry into a Trade:

Optimus Crypto Bot determines market entry points by analyzing the RSI oscillator. Depending on the current RSI value, the bot selects the optimal point to start trading.

Entry Point 1: When the RSI value is between 30 and 37. In this case, when RSI crosses the level of 30 from below, the bot receives a buy signal.

Entry Point 2: When the RSI value is between 50 and 55. In this case, when RSI crosses the level of 50 from below, the bot also receives a buy signal.

2. Exit from a Trade:

Algorithmic Exit:

Exit Point 1: If Entry Point 1 was selected and the profit exceeds the minimum threshold, the exit signal is given when RSI reaches 50.

Exit Point 2: If Entry Point 2 was selected and the profit exceeds the minimum threshold, the exit signal is given when RSI reaches 60.

Exit Point 3: When RSI exceeds 70, and it crosses the 70 level from above, this signals the exit from the trade.

Stop Loss and Take Profit:

Exit Point 4: When Take Profit (the set profit level) is reached, this signals the exit.

Exit Point 5: When Stop Loss (the loss limit) is reached, the trade is automatically closed.

Timeframe Recommendations: To achieve the best results, it is recommended to use timeframes of 1H, 2H, and 4H. This will allow for accurate signals and minimize the impact of short-term market fluctuations.

Advantages of the Optimus Crypto Bot

Trade Automation: Optimus fully automates the trading process, eliminating human factors and emotions, making trading more efficient and stable.

Signal Accuracy: The use of the RSI oscillator and predefined levels for entry and exit allows for more precise identification of optimal trading moments.

Versatility: The bot offers various exit strategies (algorithmic, using Take Profit and Stop Loss), allowing users to customize it according to their preferences.

Support for Different Timeframes: Optimus supports trading on timeframes from 1 hour to 4 hours, making it suitable for various trading styles, from short-term to medium-term.

Reduced Risk: Algorithmic trading helps minimize risk by automatically reacting to market changes and avoiding emotional decisions.

How to Start Using the Optimus Crypto Bot on the CryptoRobotics Platform

Register on the CryptoRobotics Platform: To start using the Optimus Crypto Bot, you need to register on the CryptoRobotics platform. Visit the platform’s website and create an account by providing your details.

API Keys Integration: The first thing you need to do is to integrate your exchange account to the platform via API in the Exchange Accounts section.

Select and Set Up the Bot: On the platform’s homepage, select the Optimus Crypto Bot from the list of available bots. Purchase a subscription or connect the robot via Profit Sharing. Then, configure the trading robot’s parameters, such as Take Profit, Stop Loss levels, and the selected timeframes for trading.

Launch the Bot: After setting up the bot, you can launch it on your account. Optimus will automatically start analyzing the market, opening, and closing trades according to the selected strategy.

Monitoring and Optimization: During trading, you can track the bot’s performance through your personal dashboard on the CryptoRobotics platform. If necessary, you can make adjustments to the bot’s settings or change the strategy.

Conclusion

The Optimus Crypto Bot on the CryptoRobotics platform is a powerful tool for automated trading in the cryptocurrency markets. It combines ease of use with high precision, making it an ideal choice for traders looking for stable profits and risk minimization. Thanks to its flexibility and support for various timeframes, Optimus is suitable for both beginners and experienced traders who want to automate their trading process and increase their profitability.

1 note

·

View note

Text

To moja 1 rocznica na Tumblrze 🥳

0 notes

Text

Win $50,000 and 100+ PRO Packages with OKX & Cryptorobotics

From November 18, 2024, 10:00 UTC to December 2, 2024, 10:00 UTC, Cryptorobotics, in collaboration with OKX, is hosting an exciting promotion with a total prize pool of $50,000 and over 100 PRO packages up for grabs. This is your opportunity to trade using Cryptorobotics bots on the OKX platform and earn valuable rewards.

How to Participate

Trade with Cryptorobotics bots connected to the OKX platform via API and gain access to trading bonuses and exclusive PRO packages based on your trading volume. Here’s how the tiers are structured:

$5,000 Trading Volume → $10 Trading Bonus + 1 Month of EXPERT PRO Package

$10,000 Trading Volume → $15 Trading Bonus + 1 Month of EXPERT PRO + 1 Month of Signals PRO

$30,000 Trading Volume → $30 Trading Bonus + 3 Months of EXPERT PRO

$50,000 Trading Volume → $50 Trading Bonus + 6 Months of EXPERT PRO

$100,000 Trading Volume → $100 Trading Bonus + 12 Months of EXPERT PRO

Compete on the Leaderboard for Additional Rewards

In addition to trading bonuses, the promotion offers rewards for top-performing participants. Trade your way to the top of the leaderboard and claim the following prizes:

1st Place: $1,500

2nd Place: $1,000

3rd Place: $500

4th-10th Place: $200

11th-20th Place: $150

21st-40th Place: $100

41st-100th Place: $50

Terms and Conditions

Promotion Period: November 18, 2024, 10:00 UTC - December 2, 2024, 10:00 UTC.

This campaign is open to Cryptorobotics users who connect their OKX account via API and activate a trading bot within the promotion period.

To participate, users must add their bot to the contest by clicking the “Join” button on the contest page and selecting “Add to OKX TOP” in the bot settings.

Each bot session counts towards the leaderboard. If the bot is stopped or settings are modified, the session will no longer count.

Both marketplace bots from Cryptorobotics and custom bots added by users are eligible.

The prize pool is limited and will be awarded on a first-come, first-served basis.

Start trading now and maximize your chance to win significant bonuses and PRO packages by reaching the top of the leaderboard!

0 notes

Text

The Evolution of Crypto Bots: How AI is Enhancing Trading Algorithms

In the early days of cryptocurrency, traders used simple trading strategies such as buy-and-hold, manual trading, and rudimentary automated systems. As the market grew more complex, the demand for sophisticated tools to manage trades increased. Enter crypto bots — automated software programs designed to execute trades based on pre-set conditions and market indicators.

The first generation of crypto bots was relatively simple, relying on basic technical indicators like moving averages (MAs) and Relative Strength Index (RSI) to make decisions. However, as the competition grew, so did the complexity and capabilities of these bots. Today’s bots, enhanced by artificial intelligence and machine learning, are more advanced than ever.

How AI is Revolutionizing Crypto Trading Bots

1. Adaptive Algorithms

AI allows crypto bots to learn from past market data, adapt to current trends, and improve their strategies over time. This capability gives AI-enhanced bots a significant edge in volatile markets, where traditional bots may struggle to keep up with rapid fluctuations.

For example, Optimus, a popular bot on the CryptoRobotics platform, leverages the RSI indicator to enter trades when the RSI falls within a specific range (30-37 or 50-55). What sets Optimus apart is its ability to execute different exit strategies based on real-time data, ensuring traders can capitalize on profitable trades. As AI continues to advance, bots like Optimus will be able to refine their strategies even further, optimizing entry and exit points based on evolving market conditions.

2. Predictive Analytics

One of the key benefits of AI is its ability to process vast amounts of data and make predictions based on historical patterns. By analyzing data from a variety of sources, including market trends, news, and social media sentiment, AI-powered bots can make more informed predictions about future price movements.

While Cyberbot primarily relies on Moving Average (MA) indicators to identify entry and exit points in the market, AI could soon enhance its decision-making capabilities by incorporating more complex data sets. For example, Cyberbot might one day use AI-driven predictive analytics to forecast when MA crossovers are likely to happen, allowing traders to stay ahead of the curve.

3. Automated Learning and Strategy Optimization

Unlike traditional bots that require manual input and constant monitoring, AI bots can analyze their own performance and make adjustments in real-time. This self-optimization capability allows AI bots to refine their strategies without human intervention.

Optimus, for example, already offers a flexible range of exit strategies based on RSI values. With AI-driven optimization, Optimus could continuously refine its parameters — such as adjusting Stop Loss and Take Profit levels — to improve performance and reduce risks in volatile markets.

4. Improved Risk Management

AI-enhanced bots are better equipped to handle the complexities of volatile markets, where risks are heightened. AI can analyze historical data to identify patterns of market crashes, bull runs, and stagnation periods. This allows bots to adjust their risk management strategies accordingly, safeguarding traders from significant losses during downturns.

Both Optimus and Cyberbot offer customizable Stop Loss and Take Profit settings, but with AI-driven enhancements, these bots could become even more adept at managing risk. By continuously learning from market conditions, AI bots can adjust their strategies to limit losses and maximize profits during volatile periods.

Key Features of AI-Enhanced Bots on the CryptoRobotics Platform

1. Optimus Crypto Trading Bot

Optimus uses the Relative Strength Index (RSI) as its primary indicator for initiating trades. Here’s how it works:

Entry Points: Optimus enters a trade when the RSI value falls within the 30-37 or 50-55 range.

Exit Strategies: The bot offers three algorithmic exit points:

When RSI equals 50 and a profit level is reached.

When RSI reaches 60, considering a minimum profit.

When RSI hits 70, the profit aligns with the preset threshold.

Customization: Traders can configure Stop Loss and Take Profit settings, allowing for more precise risk management.

Optimus is particularly effective in 1H, 2H, and 4H chart intervals, making it suitable for a range of trading scenarios. As AI continues to enhance its capabilities, Optimus will likely become even more adaptable, fine-tuning its strategies based on market trends.

2. Cyberbot

Cyberbot operates based on Moving Average (MA) indicators and RSI levels. It identifies entry points through MA crossovers and adjusts its strategy based on RSI readings. Key features include:

Entry Points: Cyberbot uses three entry points:

MA4 crosses MA9 and MA20 from below.

MA4 crosses MA20, or RSI shows positive momentum.

MA4 crosses MA9 from below, and RSI is at 50, with both MA4 and MA9 above MA20.

Exit Strategies: Similar to Optimus, Cyberbot offers flexible exit strategies, including the option to set Stop Loss and Take Profit levels.

With AI enhancements, Cyberbot could analyze more complex data sets and improve its trade execution timing, making it an even more effective tool for traders.

The Future of AI in Crypto Trading Bots

As AI technology continues to advance, the potential for innovation in crypto trading bots is vast. Here are a few trends to watch:

1. AI-Driven Market Sentiment Analysis

AI can analyze social media sentiment, news, and other external factors that influence cryptocurrency prices. In the future, bots like Optimus and Cyberbot could integrate these data sources to predict market shifts more accurately and adjust their trading strategies accordingly.

2. Decentralized AI Bots

Decentralized trading bots using AI could run on blockchain technology, providing even greater transparency, security, and efficiency. Traders will be able to trust that their bots are operating in a fully decentralized, tamper-proof environment.

3. Enhanced Personalization

AI will continue to enhance the ability of bots to tailor strategies to individual traders’ risk profiles, goals, and market preferences. This could lead to fully personalized trading bots that adjust their strategies to suit each user’s unique needs.

Conclusion

The evolution of crypto bots from simple trading programs to AI-enhanced tools has revolutionized the way traders interact with volatile markets. With the integration of AI, bots like Optimus and Cyberbot on the CryptoRobotics platform are becoming more intelligent, adaptable, and efficient at navigating the complexities of cryptocurrency trading.

As AI technology continues to improve, we can expect crypto trading bots to become even more powerful, offering traders enhanced predictive capabilities, risk management tools, and fully automated trading solutions. Whether you’re a seasoned trader or a beginner, AI-powered crypto bots are shaping the future of trading, providing an exciting glimpse into the possibilities that lie ahead.

0 notes

Text

What is an AI Crypto Trading Bot?

An AI crypto trading bot is an automated tool powered by artificial intelligence that enables traders to execute trades in the cryptocurrency market without constant monitoring. These bots are designed to analyze market conditions, predict price movements, and make decisions on when to buy or sell digital assets. The AI Columbus Futures trading bot, available on the Cryptorobotics platform, is a prime example of how AI is revolutionizing cryptocurrency trading by leveraging machine learning algorithms for enhanced market insights.

How Does AI Columbus Futures Work?

AI Columbus Futures uses advanced machine-learning techniques to forecast cryptocurrency price movements. Every hour, it predicts the value of a digital asset and determines whether it's the right time to enter a trade. The bot continuously retrains itself based on recent market data, updating its trading strategies every six hours to adapt to evolving market conditions. This ability to operate in both rising and falling markets ensures that traders can benefit from any market trend, enhancing profitability.

Why Use an AI Crypto Trading Bot?

There are several key reasons to consider using an AI-powered trading bot like AI Columbus Futures:

24/7 Trading: The bot can trade around the clock, capitalizing on opportunities at any time, even when the trader is not actively monitoring the market.

No Need for Constant Monitoring: With AI handling decision-making, traders don’t need to spend hours analyzing market trends or tracking asset prices.

Ability to Trade in All Market Conditions: Whether the market is going up or down, the bot can generate profits by making the right moves based on its predictive models.

Risk Management: AI bots can help manage risk by setting stop losses, adjusting strategies, and avoiding emotional trading mistakes.

Transparency: AI Columbus Futures offers open statistics for each trade, allowing users to track the performance of their investments over time.

Affordability: The cost of using the bot is reasonable, making it accessible to both novice and experienced traders.

How to Start Using AI Columbus Futures on Cryptorobotics

Getting started with AI Columbus Futures is simple:

Register on the Cryptorobotics platform.

Navigate to the Algotrading section and select Autofollowing.

Choose AI Columbus Futures and subscribe to the bot’s channel.

Set the necessary parameters for your trading preferences.

Launch the AI bot and start trading.

With this setup, traders can take advantage of cutting-edge AI technology to automate and optimize their crypto trading strategies.

0 notes

Text

Bitcoin: Advantages and Disadvantages

The cryptocurrency market is evolving rapidly and is increasingly trusted by people engaging in various transactions. While numerous cryptocurrencies exist, Bitcoin remains the most prominent and demanded.

What is Bitcoin?

Bitcoin is a virtual currency not controlled by any central bank. Instead, its financial system is managed by a network of computers worldwide. Bitcoin's appeal lies in its censorship resistance, single-use transaction capability, and 24/7 transaction availability.

A History of Bitcoin

Bitcoin, introduced in 2008 and launched in 2009, was the first digital coin. It was created by the pseudonymous Satoshi Nakamoto. The exact identity of Nakamoto remains unknown, though speculation suggests an English-speaking origin due to their proficiency in English.

What Can You Buy with Bitcoin?

Bitcoin can be used to purchase various items, although physical stores accepting BTC are rare. Online, Bitcoin can be used for:

Clothes

Airplane tickets

Real estate

Food and drink

Gift cards

Hotel rooms

Online subscriptions

How Can You Get Bitcoin?

Bitcoin can be obtained through:

Purchasing or exchanging for other cryptocurrencies

Earning rewards for completing tasks

Mining

Advantages and Disadvantages of Bitcoin

Advantages:

Low or no fees for BTC transfers

Anonymity

Deflationary nature

Global transaction capability

Ease of creating a wallet without personal data

No taxation

Disadvantages:

High volatility leading to potential losses

Black market use

Cybersecurity risks

Possible increased regulation

No refunds

How to Invest in Bitcoin through Cryptorobotics

Trading Bitcoin is a popular investment method due to its price volatility. The Cryptorobotics trading platform facilitates both manual and algorithmic trading. It provides tools such as:

Autofollowing

Copytrading

Crypto trading bots

Signal Trading

Cryptorobotics also offers risk management features:

OCOs (smart orders)

Stop limit orders

Limit orders

Alerts

Steps to Start Trading Bitcoin on Cryptorobotics:

Register on the Cryptorobotics platform.

Set up an account with a cryptocurrency exchange.

Link your exchange account to the terminal.

Choose between manual or algorithmic trading.

Conclusion

Bitcoin is not without flaws but has gained global recognition. As more countries develop regulations and tax laws for cryptocurrencies, Bitcoin's popularity continues to grow. According to Cambridge University, the number of cryptocurrency users has surged from 25 million to 100 million in the past four years, signaling a positive outlook for Bitcoin and cryptocurrencies overall.

0 notes

Text

Unlocking Success with Bitcoin Trading Bots: A Comprehensive Review

In the ever-evolving landscape of cryptocurrency trading, Bitcoin trading bots have emerged as game-changers for both novice and seasoned traders. These automated tools promise to streamline trading processes, enhance decision-making, and optimize returns. In this review, we delve into the features, advantages, and practical aspects of using the Cryptorobotics Bitcoin trading bot.

What is a Bitcoin Trading Bot?

A Bitcoin trading bot is a software application designed to automate cryptocurrency trading. By analyzing market data, executing trades, and managing portfolios without human intervention, these bots aim to maximize efficiency and profitability.

Cryptorobotics Bitcoin Trading Bot is a notable player in this arena, offering a range of features tailored to different trading needs.

Key Features of the Cryptorobotics Bitcoin Trading Bot

Automation at its Core: The bot automates key trading functions, from market analysis to executing buy and sell orders. This reduces the need for constant manual input and allows for continuous trading.

Advanced Algorithms: Utilizes sophisticated algorithms to analyze market conditions, interpret technical indicators, and forecast price movements. This ensures precise and timely trading decisions.

Customizable Strategies: Provides a variety of trading strategies that can be tailored to individual preferences and risk tolerance. Traders can adjust parameters to fit their specific needs.

24/7 Operation: Operates around the clock, capturing trading opportunities regardless of time or market fluctuations.

How It Works: A Closer Look

Algorithmic Analysis: The bot uses advanced algorithms to process market data, including indicators such as moving averages, RSI, and MACD. This analysis helps identify trading opportunities and execute trades efficiently.

Automated Execution: Once a trading opportunity is identified, the bot automatically places buy or sell orders on the connected exchange. This ensures that trades are executed swiftly and accurately.

Risk Management: Includes tools for setting stop-loss and take-profit levels, which help manage risk and protect investments from significant losses.

Strategy Customization: Allows users to select and fine-tune trading strategies based on their goals and market conditions. This customization enhances the bot’s effectiveness.

4. Benefits of Using Cryptorobotics Bitcoin Trading Bot

Increased Efficiency: Automates routine trading tasks, enabling traders to focus on strategic aspects rather than manual execution.

Enhanced Accuracy: Advanced algorithms minimize human error and improve the precision of trades.

Effective Risk Management: Integrated risk management tools help safeguard investments and control overall risk exposure.

Flexibility and Adaptability: Offers customizable strategies and settings, making it suitable for various trading styles and market conditions.

User-Friendly Interface: Designed to be accessible to both beginners and experienced traders, with an intuitive interface for easy setup and management.

5. Popular Trading Strategies Supported

Optimus: Ideal for low volatility markets, focusing on positive price movements with specific technical indicators. Compatible with major exchanges like Binance and Bittrex.

CyberBot: Suitable for bearish markets, avoiding trades against prevailing trends to reduce risk.

Crypto Future: Versatile for both rising and falling markets, with customizable settings for risk management. Supports Binance Futures trading pairs.

Trade Holder: Employs a long-term investment strategy by building and managing a portfolio of promising cryptocurrencies.

Noah: Specializes in high liquidity trading pairs, using AI to adapt to various market conditions.

AI Alpha and AI Alpha Futures: Utilize machine learning to analyze real-time data and optimize trading decisions in both spot and futures markets.

Terminator Volatility and ALT+ Volatility Bot: Use volatility signals to trade short and long positions, effective for futures trading on Binance Futures.

Supported Exchanges

The Cryptorobotics Bitcoin trading bot supports a wide range of exchanges, including:

Binance and Binance Futures

Bybit

Bitfinex, Bittrex, and HTX

OKX and Gate.io

KuCoin and Kraken

This compatibility provides flexibility in choosing the right platform for your trading needs.

Getting Started

To begin using the Cryptorobotics Bitcoin trading bot:

Register: Create an account on the Cryptorobotics platform.

Choose: Select the trading bot that aligns with your trading objectives.

Configure: Adjust the bot’s settings to match your trading strategy and risk tolerance.

Connect: Link your account to a supported cryptocurrency exchange.

Activate: Start the bot to begin automated trading.

Demo Mode: Cryptorobotics offers a demo mode to test the bot’s functionality without financial risk, allowing you to experiment with different strategies and settings.

Common Questions

What should I look for in a trading bot?

Consider factors like algorithm complexity, user interface, risk management features, and exchange compatibility.

Are trading bots expensive?

Many platforms, including Cryptorobotics, offer flexible pricing models like profit-sharing, making bots more accessible.

Is using a trading bot legal?

Generally, using trading bots is legal, but ensure compliance with your trading platform’s regulations and local laws.

Can a trading bot replace human traders?

While trading bots automate many tasks, human oversight is crucial for strategic decision-making and managing overall trading strategies.

By leveraging the advanced features of the Cryptorobotics Bitcoin trading bot, traders can enhance their trading strategies, manage risks more effectively, and potentially achieve greater success in the competitive cryptocurrency market.

0 notes

Text

What is a Market Order?

A market order is a type of trading order that instructs to buy or sell stocks, bonds, or cryptocurrency at the current market price. The primary goal of a market order is to ensure quick execution of the trade rather than achieving a specific price. Features of a market order:

Immediate execution: A market order is executed almost instantly at the best available price at the time of its receipt.

No price guarantees: The price at which a market order is executed may differ from the current quoted price due to market fluctuations.

High liquidity: Market orders are most often used in liquid markets, where the difference between buyers and sellers is minimal. This type of order is suitable for traders and investors who want to immediately enter or exit a position and are willing to accept the current market price, without waiting for more favorable conditions.

How Does a Market Order Work

A market order on the cryptocurrency market operates as follows:

Sending an order: A trader or investor submits a market order through a trading platform or cryptocurrency exchange. The order specifies the purchase or sale of a certain quantity of coins at the current market price.

Order processing: The platform automatically receives the order and passes it to the market (exchange), where trading of that coin occurs.

Searching for the best available price: The exchange automatically searches for the best available price at the time the order is received. If it is a purchase, the order is executed at the lowest available offer price (ask price). If it is a sale, the order is executed at the highest available demand price (bid price).

Order execution: The market order is executed immediately at the best price. If the volume of the order exceeds the available amount at the current best price, the order may be executed partially at this price, and the remaining part at the next best available price.

Confirmation of the transaction: After the order is executed, the trader receives confirmation of the completed transaction, including information about the number of coins bought or sold and the prices at which they were executed.

Example of a Market Order on the Crypto Market

Consider an example of a market order on the crypto market:

Background:

A trader wants to buy 2 bitcoins (BTC) at the market price.

The current offer price (ask) on the exchange is $30,000 for 1 BTC.

Trader's action:

The trader accesses their cryptocurrency exchange (e.g., Binance, Coinbase, Kraken).

In the trading interface, the trader selects BTC/USD and specifies that they want to buy 2 BTC.

Instead of setting a limit order with a specific price, the trader chooses a market order.

Sending and executing the order:

The trader sends the market order.

The exchange receives the order and begins to execute it immediately at the current best available offer price.

Result:

At the moment the order is executed, the offer price on the exchange remains $30,000 per 1 BTC.

The exchange executes the order, purchasing 2 BTC at $30,000 each.

The trader receives confirmation of purchasing 2 BTC at an average price of $30,000 per 1 BTC.

Market Orders vs. Limit Orders

Market orders and limit orders are the two main types of trading orders used by traders and investors to buy and sell assets on financial markets, including cryptocurrency markets. Let's consider their differences, advantages, and disadvantages.

When to Use a Market Order?

A market order makes sense in the following situations:

The need for quick entry or exit from a position: If it is important to immediately enter or exit the market, a market order provides instant execution at the current available price.

High liquidity of the market: In highly liquid markets (e.g., major cryptocurrencies like bitcoin or Ethereum, or shares of large companies), the spread between the buying and selling price is minimal, and the risk of significant price slippage is low.

News events and high volatility: During moments of important news releases or sharp market movements, market orders allow quick responses to changes and secure positions.

Small trading volumes: If you trade small volumes, the impact of slippage on the overall cost of the transaction will be minimal.

Stop-loss and take-profit: Market orders are often used to execute stop-loss and take-profit orders when the price reaches a set level, to quickly limit losses or secure profits.

How to Start Using a Market Order on the Cryptoroborics Platform?

To use a market order on the Cryptoroborics platform, follow these steps:

Log in to your account: Log into your account on the Cryptoroborics platform.

Select a trading pair: In the upper left corner, select the required trading pair, for example, BTC/USD.

Open the orders section: At the bottom of the screen, find the tab with orders, where tabs such as "LIMIT", "MARKET", "STOP LIMIT", "ALERT" are available.

Choose "MARKET" order: Go to the "MARKET" tab, which is designed for creating market orders.

Specify the number of coins: Enter the amount of cryptocurrency you want to buy or sell in the appropriate field. For example, if you want to buy Bitcoin, enter the amount of BTC you want to purchase.

Use all available funds: If you want to use all available funds, press the "ALL" button next to the "Available" field.

Confirm the transaction: Check the entered data and press the "Buy BTC" button to buy or "Sell BTC" to sell. The market order will be executed immediately at the current market price.

Example:

If you want to buy 0.1 BTC at the market price:

Go to the "MARKET" tab.

Enter 0.1 in the "Amount of BTC" field.

Press the "Buy BTC" button.

Your order will be executed immediately at the current market price, and you will receive confirmation of the transaction.

These steps will help you quickly and efficiently use market orders on the Cryptoroborics platform.

Conclusion

Choosing between a market order and a limit order depends on the trader's goals, strategy, and current market conditions. Market orders are better suited for quick execution, while limit orders allow better control over the price at which the transaction takes place.

0 notes

Text

Overview of CryptoRobotics Crypto Signals

CryptoRobotics is a platform designed for the automation of cryptocurrency trading. A distinctive feature of the platform is the use of crypto signals, which are formed by professional analysts. These signals are automatically integrated into the trading system, allowing users to trade effectively without the need for manual trade settings.

How Do Crypto Signals Work on CryptoRobotics?

Signal Formation

On the CryptoRobotics platform, the best crypto signals are developed by qualified analysts who conduct a deep analysis of market trends and changes. Each signal includes recommendations about the best entry and exit points for trades, target profit levels, and stop-losses.

Trading Automation

After the signals are formed, the platform automatically inputs the trade settings, including all parameters recommended by the analyst. This means that users do not need to manually set up each trade — all trading is executed automatically, minimizing manual labor and reducing the likelihood of errors.

Benefits of Using Automated Crypto Signals

Maximizing Efficiency

Automatic execution of signals helps traders maximize their efficiency, as it allows for quick responses to market changes without the delays associated with manual data entry.

Reducing Risks

Automation of trading reduces the risks associated with human factors, such as emotional decisions or calculation errors. Strict adherence to analytical recommendations contributes to more stable and predictable trading.

Saving Time

Using automated signals frees up users' time, allowing them to focus on strategic planning rather than the technical aspects of trading operations.

Conclusion

The CryptoRobotics platform provides a powerful tool for automating cryptocurrency trading. Thanks to professionally developed crypto signals and their automatic execution, users can improve their trading results, reduce risks, and optimize their time. This makes CryptoRobotics an ideal choice for traders of all levels who are aiming for effective and successful trading in the cryptocurrency market.

0 notes

Text

Creating and Using an API Key for HTX on the Cryptorobotics Platform

youtube

In the modern world of cryptocurrency trading, efficiency and security are key factors for success. One of the important tools ensuring these aspects is using API keys. API keys allow traders to securely connect to cryptocurrency exchanges and integrate various trading platforms for automating their operations. In this article, we will look at how to create and use an API key for one of the leading cryptocurrency exchanges — HTX, and how to integrate it with the popular platform for automated trading - Cryptorobotics.

We will provide you with a step-by-step guide, starting from the process of registering on HTX, and creating an API key, to its addition and use in Cryptorobotics. This guide will be useful for both novice traders and experienced users who wish to expand their capabilities in the world of cryptocurrency trading. Follow our advice to ensure the security of your account and maximize the efficiency of your trading strategies.

Registering on HTX

Registration on HTX is the first step to start trading cryptocurrencies and using the various tools offered by the platform. Here is a step-by-step instruction on how to register on HTX:

Step 1: Go to the HTX Website

Visit the official HTX website.

Step 2: Start the Registration Process

On the main page of the site, click the "Registration" button. This button is located at the top of the screen.

Step 3: Enter Data

During registration, you will be prompted to enter a series of personal data. This includes your email address, phone number, and other necessary information. Also, create a strong password that meets the security requirements of the site.

Step 4: Email Confirmation

After entering all the data, check your email box. The HTX team will send a letter with a link to confirm your email address. Then follow the link in the letter to complete registration.

Step 5: Account Verification

There is an extended verification procedure on the HTX exchange, which includes "Identity Verification" and "Face Recognition". This process is required to perform certain operations on the exchange and ensure transaction security.

Step 6: Completing Registration

Once your account is confirmed and verified, you can fully use all the features of the HTX platform.

Important to Remember

Ensure that you use a secure and reliable connection when registering.

Keep your login and password secure and do not share them with third parties.

Monitor the security of your email box, as it is linked to your account on HTX.

Following these steps and recommendations will help you safely register on HTX and start using all the benefits of cryptocurrency trading on this platform.

Creating an API Key on HTX

After completing registration and identity verification, you need to create an API key.

The API key on HTX is an important tool for secure and efficient management of your trading operations on the platform. Here is a detailed instruction on creating an API key on HTX.

Step 1: Log into Your HTX Account

Log into your account on the official HTX website.

Step 2: Access API Management

After logging in, find the account management section. This can usually be done by clicking on your avatar or username at the top right of the screen. Select the option "API Management" or similar in meaning.

Step 3: Create a New API Key

On the API management page, select the option to create a new API key.

Enter a name for your API key in the "Note" field. This will help you identify the key in the future.

Set the necessary permissions for the key. Frequently, this includes permission for Trading, but not for withdrawal.

Click the "Create" button to generate a new key.

Important Points

Never set permission for fund withdrawal for an API key unless it is necessary for your trading strategy.

Note that the validity of the key without binding to an IP address is 90 days. After that, it will need to be updated or a new one created.

Saving the Secret Key

After creating the key, the secret key will be shown only once. Copy it and save it in a secure place. Losing the secret key may necessitate creating a new API key.

Step 4: Email Verification

To complete the creation of the key, go through email verification. Click on the "Get Code" button, enter the code received by email, and confirm its entry.

After successful verification, your API key will be created. Now you can use it for trading through third-party services or for integration with trading bots.

Adding the Key to Cryptorobotics

After creating an API key on HTX, the next step is its integration with the Cryptorobotics platform for automated trading. Here is a detailed instruction on adding your API key to Cryptorobotics.

Step 1: Log into Your Cryptorobotics Account

Log into your account on the Cryptorobotics platform. If you do not have an account yet, you will need to register.

Step 2: Access the Exchange Accounts Section

In the Cryptorobotics user interface, find and go to the "Account" section and then to the "Exchange Accounts" subsection.

Step 3: Add a New Exchange

In this section, you should choose to add a new exchange. Click the "ADD NEW EXCHANGE" button or similar.

Step 4: Select the Exchange and Enter the Data

From the list provided, select the HTX exchange.

You will be prompted to enter the public key from your account on HTX. This is the key that you created in the previous steps on the HTX platform.

Then enter the secret key, which was also generated on HTX and saved by you.

Give a descriptive name to the key in the "Description" field. This will help you identify the key in the future.

Step 5: Add the Key

After entering all the data, click the button to add the key. This could be an "Add", "Save", or similar button.

Checking and Starting Trading

After successful addition, the key will appear in the list of your trading accounts on Cryptorobotics. Now you can use this key for trading in the "Trading" and "Algorithmic Trading" sections of the platform.

Important Notes

Ensure that your spot account on HTX has the necessary balance for trading.

If your package in Cryptorobotics includes the Multi-Accounts feature, you can add multiple keys from different HTX accounts.

Adding your HTX API key to Cryptorobotics allows you to automate trading operations and use advanced platform features to improve your trading experience.

0 notes

Text

Optimus Crypto Bot Review

Cryptocurrencies have become a crucial component of the financial market in today's digital age. As various crypto platforms continue to emerge, the demand for automated tools to manage assets effectively has increased. To meet this demand, the Cryptorobotics platform has introduced the Optimus crypto bot, a highly efficient tool for asset management.

Cryptorobotics provides an interface that is easy to use and a range of tools for trading cryptocurrencies. Meanwhile, the Optimus crypto bot is a sophisticated tool that automates trading operations. It is created to increase profits and decrease risks, which makes it a popular choice for traders of different levels of experience.

Optimus is a highly promising solution in the field of crypto trading due to its ability to adapt to changing market conditions, ease of setup, and a high degree of automation. The purpose of this review is to evaluate the functional capabilities and effectiveness of the Optimus crypto bot, as well as to examine its advantages and disadvantages in the context of the Cryptorobotics platform.

What sets apart the Optimus cryptocurrency bot?

The Optimus cryptocurrency bot is a standout feature of the Cryptorobotics platform. It is specifically designed to navigate flat markets, using technical analysis indicators to identify such market conditions. The bot then executes trades through pre-established algorithms and oscillators, making it an expert in this field.

Operating 24/7, Cryptorobotics offers fully automated trading robots, including the Optimus bot. These robots engage in trading all currency pairs on the selected exchange. The platform itself is designed to streamline the buying and selling of cryptocurrencies across various exchanges, using predefined algorithms and strategies to execute transactions seamlessly on behalf of users.

The Optimus bot, like other bots on the Cryptorobotics platform, offers users the ability to automate their trading strategies. This means that users can capitalize on market opportunities and optimize their profits through the swift and efficient execution of automated trading.

How Does Optimus Crypto Trading Bot Function on the Cryptorobotics Platform

The Optimus crypto trading bot is a powerful tool available on the Cryptorobotics platform for automated cryptocurrency trading. Its functionality primarily depends on the Relative Strength Index (RSI) indicator, which acts as the main trigger for initiating trades. The bot receives a signal to start trading when the RSI value falls within the parameters of 30 to 37 or 50 to 55.

Optimus utilizes various strategies to exit trades during its operation. When the algorithmic approach is chosen, three exit scenarios are implemented.

The first scenario triggers when RSI equals 50 and a specific profit level is achieved. The second scenario activates when RSI hits 60, considering a minimum profit. The third scenario kicks in when the RSI reaches 70, and the profit aligns with the preset threshold.

Besides the algorithmic method, users can configure Stop Loss and Take Profit parameters to introduce two additional exit points from the trade. Take Profit triggers when a profit level is reached, while Stop Loss activates at a specified loss level. With these features, the Optimus crypto bot provides users with flexibility and convenience in executing trades with ease and efficiency.

To ensure the bot performs at its best, it's recommended to set up trading charts with intervals of 1H, 2H, and 4H. One of the impressive capabilities of Optimus is its independence - after a quick setup, the bot autonomously manages the trading process on the chosen exchange.

Advantages of Optimus trading bot

Several benefits arise from using the Optimus trading bot on the Cryptorobotics platform, which stems from the information presented earlier as well as the wider advantages of automated cryptocurrency trading.

Optimus simplifies the trading process, allowing users to save time and reduce the need for continuous market monitoring.

To identify optimal entry and exit points for trades, the bot uses technical analysis, specifically the RSI indicator.

Optimus offers a range of exit strategies, including algorithmic scenarios and customizable Stop Loss and Take Profit parameters.

Optimus can be customized to fit specific trading strategies and adapt to prevailing market conditions.

Once set up, Optimus autonomously oversees the trading process on the selected exchange, making it advantageous for traders with busy schedules.

Optimus helps maximize profits and minimize losses by automatically executing trading strategies across varied market conditions.

While specializing in flat market trading, Optimus can be configured for operation in different market conditions through parameter adjustments.

Optimus is user-friendly, even for less experienced traders, as it allows for easy configuration of trading parameters and charts with intervals of 1H, 2H, and 4H.

Optimus Bot Pricing

The Optimus bot can be purchased for $11, or users can choose to use a profit-sharing model to make it more accessible to a wider range of users. This profit-sharing system is ideal for those who prefer to share some of their profits in exchange for the use of a high-level trading bot, rather than paying a fixed upfront fee. This method caters to a larger user base and also lowers the initial entry barrier for new users who are interested in automated cryptocurrency trading on the Cryptorobotics platform.

In addition, the Optimus trading bot is seamlessly integrated into all PRO packages on the Cryptorobotics platform. By choosing either the Basic PRO or Expert PRO package, users have access to a variety of trading tools, including the Optimus bot, as part of these comprehensive packages.

How to start using Optimus trading bot Crytptorobotics

To start using the Optimus trading bot on Cryptorobotics, you first need to create an account on this platform. Once you have created an account, you can then connect your exchange account and set up the bot according to your preferences. Cryptorobotics offers a user-friendly interface that makes it easy to navigate and set up the bot. You can also find tutorials and guides to help you get started. Once your bot is set up, it will automatically execute trades for you based on the parameters you have set.

0 notes

Text

Take profit and stop-loss: what are they, why are they needed, and how to set them

Investing is a strategic allocation of funds to preserve and increase them. Among various investment methods, investing in cryptocurrencies remains one of the most sought-after.

However, earning profits on a cryptocurrency exchange is associated with financial risk. To effectively manage risk, investors use special types of orders known as stop-loss and take-profit. These smart orders are considered a key tool for controlling a trader's position in the market, providing the ability to reduce financial risks during trading systematically.

Setting up these smart orders is relatively simple and quick. To set stop-loss and take-profit on a cryptocurrency exchange or trading platform, log into your account, choose the desired asset, and open a trade. Then, determine the stop-loss levels (to minimize losses) and take-profit levels (to lock in profits) before confirming the order. Let's look at what smart orders are and how they work.

What is a stop-loss?

A stop-loss is a strategic order set by a trader for the automatic closure of a trade when the price of an asset reaches a certain level. The primary goal of a stop-loss is to minimize losses in the event of unfavorable market movements, protecting the investor from significant downturns. This order helps the trader monitor risks and manage investments, freeing them from the need for constant market monitoring.

These tools have two key characteristics:

Automatic opening or closing of a position, eliminating the need for manual intervention.

The actual execution of the trade is not instantaneous but occurs after a certain period.

Thus, operations can be carried out without the trader's involvement, allowing them to be away from the market at that moment.

How Stop-Loss Works:

When you buy Bitcoin for $50,000, there is a risk that its value may decline. To safeguard your funds, you set a stop-loss at a level, let's say, $48,000.

Setting the level: You set the stop-loss at $48,000, determining the maximum loss level you are willing to allow.

Automatic operation: When the price of Bitcoin reaches or falls below the $48,000 level, the stop-loss is automatically activated.

Trade closure: The stop-loss automatically sends a sell order for Bitcoin at the current market price.

Minimizing losses: The sale occurs instantly, minimizing your losses to the $48,000 level.

Thus, the stop-loss serves as a protective mechanism that allows you to automatically exit a position at a pre-determined loss level, preventing further financial losses.

What is Take Profit?

Take Profit (TP) is a strategic order in trading aimed at the automatic closure of a trade when a certain profit level is reached. When a trader sets a take profit, they determine a target price at which the trade automatically closes, locking in the expected profit. Thus, take profit helps traders protect their earnings, preventing the missed opportunity of closing a position profitably in volatile market conditions.

How does Take Profit work?

Take Profit is not just a technical term in the world of cryptocurrency trading; it is a strategic tool that allows traders to automatically lock in profits when a target level is reached. Let's break down how it works in practice, using Bitcoin and a specific scenario.

Imagine you enter a position in the Bitcoin market, buying it at the current price of $50,000. You anticipate that the asset's price will rise and need a mechanism to protect and capture future profits.

It is crucial to determine the desired profit. You decide to set the take profit at $55,000 – the price at which you are willing to automatically close your position, securing the profit.

In the following days, the price of Bitcoin rises and eventually reaches $55,000.

When the market price reaches or exceeds the $55,000 level, your take profit is automatically activated.

Now, according to your strategy, you automatically closes your position at the current market price. The difference between the opening price and the take profit is your fixed profit.

Thus, take profit acts as an automated mechanism that helps you lock in profits in volatile market conditions, guarding against potential trend changes and providing more effective management of your investment portfolio.

Similarities and Differences between Stop Loss and Take Profit

These tools, although performing different functions, both aim at risk management and can be key elements in a trading strategy.

The ratio of Stop Loss and Take Profit

The ratio of stop loss to take profit in trading is determined by a crucial aspect – risk and reward management. These two parameters are often considered together and form the basis for effective investment management. The recommended ratio between stop loss and take profit is often expressed as the Risk-Reward Ratio.

Risk-Reward Ratio:

Stop Loss: This parameter determines the level of maximum losses a trader is willing to allow in the event of an unfavorable market movement. For example, if a trader sets a stop loss at 2% of their capital, it means that the maximum losses in the trade will not exceed 2%.

Take Profit: This parameter defines the profit level that a trader aims to achieve. For instance, if a trader sets a take profit at 4%, it means that they expect to gain a profit of 4% of their capital.

Examples of Risk-Reward Ratios:

Risk-Reward Ratio: 1:3

The trader is willing to risk losing 1% of their capital (stop loss) to gain 3% in profit (take profit).

Risk-Reward Ratio: 1:2

The trader sets a stop loss at 1% and a take profit at 2%. Thus, they are prepared to lose 1% of their capital but expect to gain a 2% profit.

Risk-Reward Ratio: 1:1

The trader is willing to risk 1% of their capital (stop loss) to achieve an equal profit of 1% (take profit).

Risk-Reward Ratio: 2:1

The trader sets a stop loss at 2% and a take profit at 1%. Consequently, they risk a loss of 2% but anticipate a profit of 1%.

Why Ratios are Important:

Most traders aim for a ratio where potential profit exceeds potential losses, as this can ensure effective risk management in trading. The choice of a specific ratio depends on the trader's strategy, their comfort level with risk, and market conditions.

How to Set Stop Loss and Take Profit on the Cryptorobotics Platform

Cryptorobotics provides a convenient and powerful trading functionality, including the ability to place stop-limit, limit, and market orders along with Stop Loss and Take Profit. This tool will not only help you increase the profitability of your trades but also reduce losses in market downturns.

Steps to Set Smart Orders for Buy/Sell:

Log in to your account on the Cryptorobotics platform.

Go to the "Trading" section.

On the tab with the selected cryptocurrency pair, click the "Smart Order" or "Buy" button.

When creating a new order, open its advanced settings.

Specify the price at which you want to purchase the coin.

Determine the quantity of the coin you want to buy.

Choose a percentage of the free deposit or specify the balance in the base currency.

In the advanced settings section, you have the option to activate Stop Loss and Take Profit, specifying the corresponding prices.

Confirm and complete the creation of the smart order, ensuring the accuracy of the entered data.

Conclusion:

Applying Stop Loss and Take Profit in the cryptocurrency market is a key factor in a trading strategy, providing the ability for effective risk management and profit fixation. These essential tools not only help minimize losses but also ensure traders adhere precisely to their strategy, especially when using pending orders. This approach allows for a reduction in psychological stress and more confident decision-making in the dynamic environment of cryptocurrency trading. In light of this, every market participant can familiarize themselves with the advantages of these tools and actively incorporate them into their trading strategy for more successful portfolio management.

0 notes

Text

Crypto Signals by Cryptorobotics: An Innovative Path to Success

Cryptocurrencies have become an integral part of the modern financial world, and many investors seek to use them for profit. However, the cryptocurrency market is also known for its high volatility and complexity. In this article, we will explore this platform that offers crypto signals as an innovative way to succeed in cryptocurrency investment.

What Is Cryptorobotics?

Cryptorobotics is a platform designed to provide crypto signals and automate cryptocurrency trading. It is an innovative solution that helps investors make informed decisions in the cryptocurrency market.

Crypto signals are indicators provided by analysts and trading robots to help traders identify optimal entry and exit points in the market.

Advantages of the Cryptorobotics crypto signals

The advantages of Cryptorobotics crypto signals can provide significant benefits to cryptocurrency traders. Here are some of the key advantages:

Informed Decision-Making: Cryptorobotics crypto signals provide traders with valuable insights and information about the cryptocurrency market. These signals are based on market analysis and expert predictions, helping traders make informed decisions about when to enter or exit a trade.

Reduced Emotionality: Emotions can often cloud a trader's judgment and lead to impulsive decisions. Cryptorobotics crypto signals are generated by algorithms and data-driven analysis, which eliminates the emotional aspect of trading. This can lead to more rational and disciplined trading decisions.

Time Efficiency: Analyzing the cryptocurrency market and identifying trading opportunities can be time-consuming. Cryptorobotics automates this process by providing signals, saving traders time and effort in conducting market research.

Access to Expertise: Cryptorobotics employs experienced analysts and trading algorithms to generate crypto signals. This means that even novice traders can benefit from the expertise of professionals in the field, potentially improving their trading performance.

Risk Management: Crypto signals often come with risk management strategies. These strategies can help traders set stop-loss orders, take-profit levels, and manage their risk effectively. This can be crucial in preserving capital and reducing losses.

Diversification: Cryptorobotics offers a variety of crypto signals for different cryptocurrencies, allowing traders to diversify their portfolios. Diversification can help spread risk and potentially enhance profitability.

User-Friendly Interface: Cryptorobotics typically provides a user-friendly interface that is easy to understand and navigate, making it accessible to traders of varying experience levels.

Real-Time Updates: The platform usually provides real-time updates on cryptocurrency market conditions and signal performance, enabling traders to stay up-to-date and adjust their strategies accordingly.

Backtesting and Historical Data: Some crypto signal providers offer historical data and backtesting capabilities. Traders can use this information to assess the performance of past signals and improve their trading strategies.

Cost-Efficiency: In comparison to the time and effort required for independent market analysis, using crypto signals can be a cost-effective solution. Traders can benefit from professional insights without the expense of hiring a personal analyst.

It's important to note that while crypto signals can provide significant advantages, they are not foolproof and should be used in conjunction with a trader's own research and risk management. Additionally, the cryptocurrency market is inherently volatile, and there are risks associated with trading, so caution and diligence are always recommended.

How to Use the Cryptorobotics Crypto Signals

To use Cryptorobotics, a trader needs to:

Start by visiting the official Cryptorobotics website.

Click on the "Sign Up" button on the homepage.

Fill in the required information, which typically includes your full name, email address, and a secure password.

Review and accept the platform's terms and conditions and privacy policies, if presented.

Click the "Register" button to create your account.

Pass the email verification. Check your email for a confirmation link and follow the instructions to verify your email address.

Link your Cryptorobotics account to a compatible cryptocurrency exchange using their API (Application Programming Interface). This connection allows you to trade and access exchange data directly through the platform.

Follow the specific instructions provided by Cryptorobotics for integrating with the chosen exchange.

Select the Cryptorobotics crypto signals.

Customize your account settings, trading preferences, risk management strategies, and notification settings according to your trading style and objectives.

Start crypto trading.

Conclusion

Cryptorobotics offers investors the opportunity to trade cryptocurrencies successfully, minimizing risks and increasing profits. Innovative features such as crypto signals and trading automation make this platform a valuable tool for anyone looking to delve into the world of cryptocurrency investments. However, like any form of investment, investors should be prepared for risks, conduct market research, and make informed decisions. Cryptorobotics can be a useful tool in this process, but it is essential to remember that success always comes with risks."

0 notes

Text

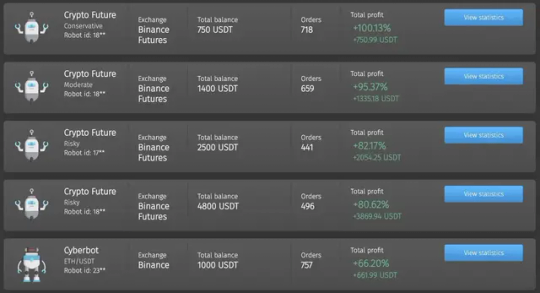

Detailed Overview of the Functionality of Crypto Future Bot on the Cryptorobotics Platform

The Cryptorobotics platform features a unique Crypto Future. This futures crypto trading bot is capable of trading in both bullish and bearish markets. It ensures profitability under various market conditions, offering users the flexibility to choose leverage for effective trading. Let's take a closer look at what they entail and how they operate in the cryptocurrency market.

Definition of Crypto Future Bots

Crypto Future is an innovative futures robot for automated cryptocurrency trading. These are programs that execute trading operations automatically based on predefined algorithms. The Crypto Future robots on the Cryptorobotics platform provide a unique solution, trading in diverse market conditions and offering users a flexible choice of strategy.

How Crypto Future Works

The platform introduces three future robots with different risk levels: conservative, moderate, and high. These robots differ in take-profit levels, stop-loss settings, and the number of crypto pairs for trading. Users can choose a subscription or Profit Sharing for 15% of the profit.

Advantages of Using Crypto Future Robots on the Cryptorobotics Platform

Automated Trading: Crypto Future futures robots offer a fully automated solution for cryptocurrency trading. This frees users from the need to constantly monitor the market and allows robots to react efficiently to real-time changes.

Flexibility in Trading Bull and Bear Markets: The unique ability of robots to trade in both bullish and bearish market conditions ensures stable profitability in various market scenarios. Users can effectively utilize robots in diverse trending conditions.

Variety of Risk Levels: Users can choose between conservative, moderate, and high-risk levels based on their preferences and strategies. This provides a personalized approach to trading, aligning with individual financial goals and comfort levels.

Testing and Demonstration of Operation: The ability to launch a robot in test mode, without affecting the real balance, allows users to assess its effectiveness before engaging in real trades. This contributes to confidence in the chosen strategy and robot settings.

Transparent Statistics and Analytics: Users have access to detailed statistics for each robot, including the percentage of successful and unsuccessful trades, average profit, and loss. This transparency enhances understanding of the robot's operation and helps make informed decisions.

Effective Risk Management: Crypto Future robots offer opportunities for effective risk management, including choosing leverage for trading and setting stop-loss to limit potential losses. This promotes a safer and more sustainable trading strategy.

Technical and Mathematical Analysis: Based on technical and mathematical analysis, Crypto Future robots employ channel trading principles. This allows them to analyze historical data, identify entry points, and automatically set targets for take-profit and stop-loss.

The choice between Subscription or Profit Sharing: Users can choose between a fixed subscription or the Profit Sharing system, providing flexibility in selecting the payment model for using the robot.

Launching the Crypto Future Robot in Test Mode

Users can launch the robot in test mode, where it engages in real trades without affecting the balance. Testing is available on any package, including the free one, for a period of up to 14 days.

Setting Up and Robot Statistics for Crypto Future

The process of setting up the robot includes selecting the exchange, currency, and balance for trading. It is recommended to use reasonable leverage for risk management. The robot automatically sets targets for take-profit and stop-loss, ensuring effective loss management.

Technical Analysis and Robot Strategy

The Crypto Future robot executes trades based on technical and mathematical analysis, using channel trading principles. Analyzing historical data, establishing price levels, and utilizing technical indicators enable the robot to identify entry points and automatically manage trades.

Conclusion

The Crypto Future robot on the Cryptorobotics platform provides signals for market reversals, offering users a reliable means for effective and secure cryptocurrency trading.

0 notes

Text

CryptoRobotics Teams Up with Cointelegraph Accelerator to Foster Cryptocurrency Trading Innovation

(Tallinn, Estonia - November 5, 2023) – A strategic partnership has been unveiled between CryptoRobotics and Cointelegraph Accelerator, to catalyze innovation in cryptocurrency trading. This alliance amalgamates the technological finesse of CryptoRobotics with the abundant resources and industry savvy of Cointelegraph Accelerator, heralding an optimistic future for cryptocurrency trading.

The partnership envisages an expansion of CryptoRobotics' media outreach, solidification of community relations, and bolstering brand recognition, all under the proficient guidance of Cointelegraph Accelerator. This collaborative venture is committed to availing state-of-the-art tools and resources to the cryptocurrency trading and investment community, thereby paving a path for successful trading and investment pursuits in the cryptocurrency domain.

Cointelegraph Accelerator is a notable program designed to propel startups in the Web3 sector, aiding in their media presence, community growth, and brand visibility. The program extends a variety of support including media products, marketing strategy assistance, and introductions to potential investors and partners, focusing predominantly on decentralized finance, NFT, GameFi, and other Web3 segments.

CryptoRobotics is a distinguished cryptocurrency trading platform offering a comprehensive suite of tools and resources for efficacious trading across cryptocurrency markets. The platform includes automated trading bots, manual trading tools, risk management through smart orders, and functionalities for copy trading and automated farming. By integrating with major cryptocurrency exchanges and supporting diverse devices, CryptoRobotics aspires to make cryptocurrency trading more accessible, convenient, and profitable for traders of varying expertise levels.

This collaborative initiative is anticipated to usher in a new epoch of cryptocurrency trading by availing sophisticated tools and resources, thereby nurturing a more accessible and effective trading ecosystem.

For further details regarding this partnership and the offerings of CryptoRobotics, interested parties can reach out to the media contacts provided below.

Media Contact:

Company: Cryptorobotics

Email: [email protected]

Website

Instagram

Facebook

Twitter

1 note

·

View note