Don't wanna be here? Send us removal request.

Text

New Stock-to-Flow Forecast Puts Average Bitcoin Price at $288K by 2024

The newest model of a preferred and to date correct Bitcoin (BTC) value mannequin predicts a mean value of $288,000 — and it may occur this 12 months.In a weblog submit introducing the third incarnation of the stock-to-flow (S2F) mannequin on April 27, analyst PlanB revealed contemporary calculations which can be taking his forecast ever larger.

BTC S2FX calls for $288Ok per coin

This time, gold and silver joined in, combining with BTC to create the brand new BTC S2F cross-asset mannequin or S2FX.Inventory-to-flow calculates a price based mostly on the availability of latest Bitcoins getting into circulation by mining versus the prevailing provide, or “inventory.”The retroactive software confirms that the mannequin is extraordinarily competent at charting Bitcoin’s development, with even final month’s 60% drop nonetheless falling inside its predicted vary.Previous to S2FX, an “up to date” stock-to-flow chart put BTC/USD at a mean of round $100,000 between 2020 and 2024. With the discharge of the brand new model, nevertheless, the prediction has virtually tripled in a single day.“The S2FX mannequin components can be utilized to estimate the market worth of the following BTC part/cluster (BTC S2F will probably be 56 in 2020–2024),” PlanB summarized....This interprets right into a BTC value (given 19M BTC in 2020–2024) of $288Ok.

Bitcoin S2FX chart. Supply: Medium

Unconvinced whale: Add Bitcoin SV

S2FX introduces the concept of “clusters” for Bitcoin because it strikes between varied use circumstances. In accordance with PlanB, the cryptocurrency has already been thought of as a “proof of idea,” for “funds,” as “E-gold” and at the moment as a “monetary asset.” Every tag accompanies a “cluster” of value factors on the S2F chart, and every cluster offers a markedly totally different value forecast.“Every of the 4 recognized BTC clusters has a really totally different S2F-market worth mixture that appears to be in step with halvings and altering BTC narratives,” he continued.To this point, it's the “monetary asset” cluster which has produced the biggest S2F worth and market worth — 25.1 and $114 billion respectively.Underneath S2FX and an S2F worth of 56, Bitcoin’s market worth ought to balloon to $5.5 trillion, comparable to a value per coin of $288,000.The replace was not with out its detractors. Having beforehand criticized earlier work, the high-volume Bitcoin dealer generally known as J0E007 took a contemporary swipe at stock-to-flow, arguing that PlanB ought to embrace extra “belongings” resembling controversial altcoin, Bitcoin SV (BSV).“I believe PlanB made a step in the precise course by together with extra belongings in his mannequin. Stable work,” he tweeted on Tuesday. As quickly as S2FX is confirmed for a variety of belongings like Pt, W, $BSV and $BCC, it'll have my enthusiastic help. Extremely scientific!In additional feedback, J0E007 claimed that Bitcoin’s upcoming halving is already “priced in” to BTC/USD, and that subsequent month’s occasion will precede a value crash.Ethereum co-founder Vitalik Buterin in the meantime can be amongst these with reservations about stock-to-flow. Credit score: Source link Read the full article

0 notes

Text

Hive Sees Massive Pump and Smaller Dump On Listing News

Supply: Adobe/sushaaaBlockchain platform Hive (HIVE), which forked from the Steem (STEEM) blockchain after an issue involving a hostile takeover by Tron’s Justin Solar, has seen each huge good points and losses in its value over the previous few days, following listings on a number of main crypto exchanges. As of press time on Tuesday (10:03 UTC), HIVE was down by 36% over the previous 24 hours, buying and selling at USD 0.525. The sharp loss at this time comes after HIVE gained almost 40% on Sunday and is up greater than 300% in every week. Following the most recent good points, HIVE is ranked because the 42nd most beneficial cryptoasset when it comes to market capitalization, in accordance with CoinMarketCap. Hive, which was listed on numerous the largest crypto exchanges – together with Binance, Huobi, and Hotbit – simply this previous week, has already been out there for buying and selling towards bitcoin (BTC) on Bittrex because it first went into circulation in mid-March. The longest buying and selling historical past for the asset is thus out there towards BTC, with all present US greenback markets having been added previously couple of days. Following at this time’s losses, HIVE is now buying and selling beneath its itemizing value in BTC phrases on Bittrex, after what has been a unstable experience for buyers.

1-day chart of HIVE/BTC. Supply: www.tradingview.comAs beforehand reported, the creation of Hive is the results of an effort by the Steem group to evade a takeover of the platform by Justin Solar. Given the launch of the brand new blockchain community, which went reside as just lately as March 20 this 12 months, and the numerous itemizing bulletins seen in latest days, it seems as if the transfer to date has been profitable for the previous Steem group members. In accordance with an earlier announcement from Hive, the brand new platform is a fork of Steem, “created by a big group of Steem group members,” together with over thirty builders, in addition to enterprise house owners and customers. The platform additional claims to be “the blockchain for Internet 3.0,” with the core being decentralization, pace and scalability. Since coming into circulation in March, HIVE is now nearing a return of 100% for the earliest patrons, information from CoinMarketCap revealed on Tuesday. !function(f,b,e,v,n,t,s) {if(f.fbq)return;n=f.fbq=function(){n.callMethod? n.callMethod.apply(n,arguments):n.queue.push(arguments)}; if(!f._fbq)f._fbq=n;n.push=n;n.loaded=!0;n.version='2.0'; n.queue=;t=b.createElement(e);t.async=!0; t.src=v;s=b.getElementsByTagName(e); s.parentNode.insertBefore(t,s)}(window, document,'script', 'https://connect.facebook.net/en_US/fbevents.js'); fbq('init', '892641644236996'); fbq('track', 'PageView'); Credit score: Source link Read the full article

0 notes

Text

Kik and SEC Oppose Each Other’s Motions for Summary Judgment

The U.S. Securities and Change Fee, or SEC, and Kik Interactive have each filed oppositions to one another's motions for abstract judgment on April 24.Whereas Kik claims its choices have been exempt from registration necessities, the SEC asserts Kik’s 2017 preliminary coin providing (ICO) comprised a transparent violation of securities legal guidelines.

Kik and SEC battle it out over Howey Check

Kik maintains that the SEC has failed to offer enough proof that it cultivated the expectation of earnings amongst its clients, or that Kik’s buyers entered into a standard enterprise with the corporate — two of the Howey Check’s three components.The corporate notes that its advertising supplies explicitly said that Kik “could be simply certainly one of many builders and members contributing to the success of the Kin financial system.” Against this, the SEC argues that Kik’s ICO absolutely satisfies the Howey take a look at, asserting that every one Kin tokensale members “made an funding of cash” into “a standard enterprise” with “an affordable expectation of earnings to be derived from the entrepreneurial or managerial efforts of others.”Refuting assertions from Kik founder, Ted Livingston, that Kin has been used as a forex since its launch, the SEC additionally argues that “at no level throughout its advertising marketing campaign did Kik determine any particular good or service that may very well be bought with kin.”

SEC depends on ‘poorly reasoned’ Telegram case

Kik’s normal counsel, Eileen Lyon, advised Cointelegraph that the SEC’s case depends excessively on rulings made within the Telegram case, asserting that there are vital variations between the 2 choices:"Our tackle the SEC's Opposition is that it depends closely on the latest Telegram case which we predict was poorly reasoned and wrongly determined. As you understand, the Telegram case isn't binding precedent, so will probably be fascinating to see what influence it may need, in gentle of the numerous different authorities now we have cited and the numerous factual variations within the two token choices.” “Moreover, we felt their arguments relating to the "integration" concern have been conclusory and round," she added.

Kik claims exemption from SEC registration

Kik additionally argues that the SEC’s movement for abstract must be denied on the idea of failing to proof that both of its token points required SEC registration.The Kik ICO comprised a personal pre-sale to accredited buyers and public token distribution occasion. The corporate claims that the 2 gross sales “didn't contain the “issuance of the identical class of securities” and must be assessed independently.As such, Kik argues that the non-public sale comprised the non-public sale of funding contracts to accredited buyers, whereas denying that its token distribution occasion comprised the issuance of funding contracts. “The second transaction, having been performed after the infrastructure for Kin already existed, and provided that it was merely a sale of products to the general public, was not an providing of securities. Thus, the sale didn't require registration with the SEC.”Additional, Kik argues that the SEC failed to offer it with enough warning that it might be working in violation of securities legal guidelines:“The SEC’s Movement fails to ascertain that Kik was offered sufficient discover to Kik that the actual info and circumstances of its sale of Kin would represent an ‘funding contract.’” Credit score: Source link Read the full article

0 notes

Text

Users’ Funds Are Safe Following Reported Etana Custody Breach

Etana Custody, a custody agency that gives fiat funding companies to the key cryptocurrency change Kraken, was reportedly breached on April 18. Regardless of an unauthorized social gathering infiltrating Etana’s system, a spokesperson from the corporate indicated to reporters that no shopper funds had been impacted. Credit score: Source link Read the full article

0 notes

Text

5 Things to Know for Crypto Markets This Week (4/27)

Bitcoin (BTC) has consolidated good points nearer $8,000 — however does the approaching week have in retailer for the asset leaving shares within the mud?After leaping 10% in a day final week, BTC/USD has managed to maintain maintain of its good points over the weekend. Cointelegraph considers the foremost elements which merchants ought to control to keep away from a nasty shock.

New alarm bells for shares

Shares proceed to maneuver larger, and Bitcoin continues to maneuver in step with inventory market sentiment.Whereas decreasing its correlation in latest weeks, Bitcoin nonetheless stays delicate to main strikes on Wall Avenue. This week, costs there proceed to development upwards, however all is just not what it appears, analysts warn. “Sharp declines in market breadth previously have typically signaled massive market drawdowns,” Bloomberg quoted strategists at Goldman Sachs as saying on April 27. Slim breadth can final for prolonged durations, however previous episodes have signaled below-average market returns and eventual momentum reversals.

Bitcoin versus S&P 500 3-month chart. Supply: SkewThe warning that present swift good points might flip to losses capitalizes on present issues in regards to the paradoxical established order on markets. Regardless of hundreds of thousands of newly unemployed, small enterprise implosions and trillions of {dollars} of cash printing, shares hold enhancing.

Oil costs lose large as buying and selling begins

Oil is steaming forward with its protracted sell-off. In Asian morning buying and selling on Monday, WTI plunged by virtually 10%, whereas Brent slumped 3.2% to close $20 a barrel.No respite appears in sight for a market hammered by unprecedented unfavourable costs final week — demand is unlikely to select up for a number of months, whereas storage services have all however run out.A earlier effort by OPEC+ international locations to chop manufacturing was not sufficient, commentators have mentioned. Bitcoin is total impacted much less by oil’s points than these of different markets.

The cash printing machine retains turning

Central banks proceed to pump extra nugatory money into the stricken and more and more “neo-feudal” financial system.On Monday, it was the Financial institution of Japan’s flip to announce a flood of paper, signaling it will purchase limitless bonds as a way to incentivize borrowing. Questions stay over whether or not the US Federal Reserve and European Central Financial institution will comply with swimsuit, the previous having already inflated its stability sheet to a report $6.6 trillion.

Bitcoin fundamentals steadily enhance

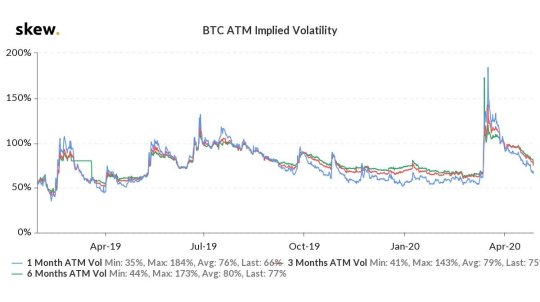

For Bitcoin community members, in the meantime, the image is more and more — and verifiably — constructive.Hash fee has recovered nicely because it dipped following the March value crash, consolidating at round 115 quintillion hashes per second (h/s). In accordance with estimates from Blockchain, that is simply 7 quintillion h/s beneath all-time highs seen earlier final month.Mining problem can also be set for a wholesome uptick of three.2% on the subsequent adjustment in round eight days’ time. This follows a bigger 8.5% enhance that Cointelegraph reported on beforehand.General implied volatility, monitoring useful resource Skew notes, is now additionally virtually again at early March ranges.

Analyst dispels myths over Might halving downturn

It's now simply over two weeks till the third Bitcoin block reward halving. At that time, Bitcoin’s block subsidy will drop from 12.5 BTC to six.25 BTC per block.This reduces miner earnings considerably, whereas additionally drives up Bitcoin’s stock-to-flow ratio, as there might be fewer “new” Bitcoins created relative to the prevailing provide. Some analysts have turn out to be anxious that the drop in income will spark issues for miners, however the creator of the seminal stock-to-flow value mannequin for Bitcoin now believes in any other case.“2012&2016 halving information exhibits that problem will NOT regulate downward, however will hold rising submit halving,” a tweet from PlanB on Friday reads.Miners have ALREADY invested in new hw and are ready for -50% income. Credit score: Source link Read the full article

1 note

·

View note