Don't wanna be here? Send us removal request.

Text

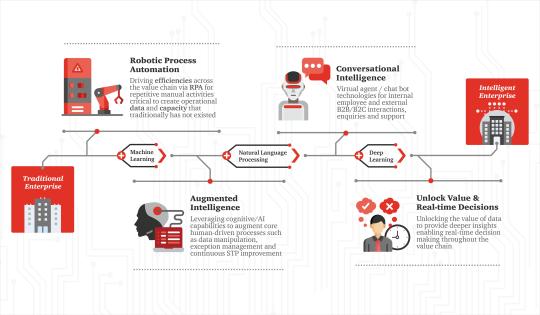

Robotic Process and Intelligent Automation for Finance

Robotic process and intelligent automation for finance can help organisations streamline their operations. With its ability to automate recurring, time-consuming tasks, it frees up staff to spend more time on strategic projects. And with the financial services industry under pressure to reduce costs, robotics can also be a useful tool.

The finance sector is under intense pressure to meet customer needs and improve service levels. To be able to do so, the finance team needs access to detailed, accurate information. Creating and maintaining reports is a time-consuming task. By implementing intelligent automation solutions, organisations can ensure that their financial forecasting is accurate.

Invoice processing is a recurring, repetitive task that requires attention to detail. Using software robots to perform common tasks like comparing invoices with purchase orders can help organisations save on labor costs. They can also set up reminders and alert teams to reconciliations.

Avinor, a Norwegian airport operator, uses an intelligent automation solution for billing reconciliation. This helps the organisation avoid payment delays and inaccuracies.

Avinor processes 100,000 invoices per year. Their previous approach involved a lot of errors and was labor-intensive. Avinor decided to use intelligent automation solutions to make their processes more effective.

Accounts payables and receivables are also two areas that can benefit from automation. By freeing up personnel to focus on more strategic projects, finance departments can save money.

The financial services industry generates large amounts of data, which can be very complex. Without the right automation tools, these processes can be difficult to manage. To help organisations achieve their goals, SolveXia provides a low-code solution to automate these processes. It can also help with reporting and advanced analytics.

youtube

Also Read : financial services

SITES WE SUPPORT

finance processes flow - blogger

SOCIAL LINKS

Facebook Twitter LinkedIn Instagram YouTube

0 notes

Text

Business Process Management and Accounting Workflow Automation

Accounting workflow automation tools can help your team be more efficient, streamline client communication and maximize staff productivity. It can also free up accountants and other staff members from routine data entry tasks.

In the modern finance department, automation has taken over from manual processes. For example, it is now common to send automated invoices to clients and receive vendor payments without human intervention. It is possible to automate recurring meetings, too.

Using an account management platform can also increase customer satisfaction. Automated address update processes can save time for both parties.

The first step in any client onboarding process is gathering information. This includes establishing key information such as addresses, phone numbers and other contact details. This information can be gathered automatically or manually.

One of the most time-consuming tasks is financial data preparation. With automated data entry, you can focus on high-value activities and minimize manual steps.

The FloQast Close software extension helps you get the most out of your financial operations. It's a central hub that allows you to track your workflow in real-time. In addition, it provides a centralized dashboard, task management and collaboration features that improve efficiency and make life easier for you.

FloQast also includes FloQast ReMind, an innovative request management workflow add-on. This feature makes it easy to get your money's worth from your accounting staff. The ReMind technology helps you manage exceptions and automates workflows. It also has a real-time notification system to help you keep on top of things.

youtube

Also Read : FloQast Close software

SITES WE SUPPORT

finance processes flow - blogger

SOCIAL LINKS

Facebook Twitter LinkedIn Instagram YouTube

0 notes

Text

Microsoft Financial Management Software

Microsoft Financial Management Software offers easy-to-use financial tools that help people make data-driven decisions. It delivers information in an analytical way that makes sense to non-financial experts. It also allows users to connect with others.

Microsoft Financial Management Software is designed to improve the efficiency of organizations. It enables financial managers to easily manage financial data across the enterprise. It offers a comprehensive set of modules that allow you to define, create, and maintain your financials. It provides extensive financial forecasting and revenue recognition capabilities. It can also help reduce risks and minimize auditing costs.

Advanced financial management software can enable you to streamline your financials, improve productivity, and drive business growth. It can also simplify regulatory reporting, tax calculations, and accounting. It can also unify global financials.

Microsoft Dynamics 365 Finance and Operations is a powerful financial management tool that automates your financial processes. It is built on the foundation of Dynamics AX, and it helps you drive strategic financial decisions. It can improve your cashflows, optimize costs, and deliver flexibility for your global business. It can even help you avoid potential disruptions.

With this financial management software, you can customize your own chart of accounts and add custom categories. It also has a no-code configuration service that simplifies tax reporting. It also has security features.

It has a simple user interface that lets you focus on your business. It also has an extensive network of ISVs and third-party integrations.

youtube

Also Read : minimize auditing costs

SITES WE SUPPORT

finance processes flow - blogger

SOCIAL LINKS

Facebook Twitter LinkedIn Instagram YouTube

0 notes

Text

The Use of Robotic Process Automation in Accounting and Finance

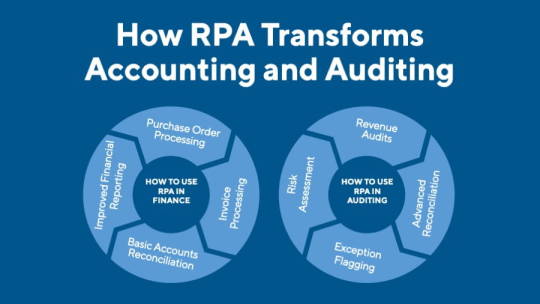

The use of robotic process automation in finance and accounting is rapidly transforming the world of work for accountants and finance professionals. By automating simple tasks and reducing waste, robotics can help businesses reach new markets and increase productivity.

For instance, a software robot can input purchase orders into a system or scan for critical data. It can also set up approval requests and flag invoices for manual review. It can even perform audits.

Automated processes can reduce operating costs, improve competitiveness, and free up finance staff to do more meaningful work. They can also improve financial reporting, which is important for making important business decisions.

When implemented correctly, RPA can reduce data entry errors and the number of invoice touches. It can also improve accuracy and operational efficiency.

In addition, it can save up to 40 percent of labor costs. It can eliminate the need for data copying. It can also identify data issues and programmatically correct them.

In addition to basic operations, RPA can also help with more complex financial tasks, such as account reconciliation. This can include debt collection, variance analysis, and financial forecasting. It can also automate tax calculations and compliance.

Robotic process automation can help finance and accounting teams retain talent. For example, an automated accounts payable process can allow staff members to focus on more important tasks.

Another type of automation can eliminate late payments. By incorporating RPA, a company can save up to 25k hours of work per month. This time can be used for revenue-generating activities.

youtube

Also Read : critical data

SITES WE SUPPORT

finance processes flow - blogger

SOCIAL LINKS

Facebook Twitter LinkedIn Instagram YouTube

0 notes

Text

Finance Workflow Systems

Finance workflow software streamlines the finance process and automates the manual tasks of financial administration. This means that your staff can focus on other aspects of the job. It also ensures that the process is carried out correctly.

The finance workflow software can be installed on-site or on the Cloud. It can be used to monitor the progress of a task, identify task stalls, and flag discrepancies. It can also be used to manage approvals.

The workflow can be filtered to only send workorders to the relevant parties. It can also provide reports to keep track of expenditure. It can even automatically allocate requests based on spending limits.

It can automate contract creation, eSignature reminders, and price quotes. It can also be used to create online loan applications.

Workflows can help improve cash flow, onboard new suppliers, and enforce petty cash policies. They can also reduce errors and increase productivity. They can also enable companies to close books on autopilot.

The Zoho Creator is a platform that allows users to create and manage financial processes. It also offers a low-code platform. Those who do not have coding expertise can use ready-made native mobile apps and color-coded dashboards.

Another finance workflow software solution is Cflow Workflow. It has helped organizations organize payment systems in Vietnam. It reduces error rates, increases efficiency, and boosts sales. It also allows for integration with 1000s of other apps via Zapier.

Investing in finance workflow software can help you reach your digital transformation goals. It can save you money and free up your team to do more value-adding activities.

youtube

Also Read : flag discrepancies

SITES WE SUPPORT

finance processes flow - blogger

SOCIAL LINKS

Facebook Twitter LinkedIn Instagram YouTube

1 note

·

View note