Don't wanna be here? Send us removal request.

Text

How to Spot a Financial Scam Before It’s Too Late

Smart Tips to Protect Your Money in Florida—Especially if You’re Involved in Cryptocurrency

These days, scammers are getting more creative—and if you live in Florida, you're especially at risk. Our state ranks among the highest in the U.S. for financial fraud and cybercrime. From fake investment pitches to shady cryptocurrency deals, fraud is everywhere.

But the good news is: you can spot a financial scam before it’s too late—if you know what to look for.

As a financial advisor, I’ve helped many clients in Florida avoid costly mistakes. Let’s break down how scams work, what red flags to watch for, and how you can keep your money safe.

Why Florida Residents Need to Be Extra Cautious

Florida is home to a large retiree population and a growing number of cryptocurrency investors. That makes it a prime target for scammers who prey on:

Retirees with retirement savings

Busy professionals looking for quick investment wins

New crypto investors who aren’t familiar with how it all works

So whether you’re investing in stocks, starting with crypto, or getting financial advice online—you’ve got to stay sharp.

5 Red Flags That Scream “SCAM”

1. “Too Good to Be True” Returns If someone promises you a guaranteed return—especially something like “you’ll make 10% per week”—run the other way. 👉 Real investing comes with risk. No one can guarantee high returns.

2. High Pressure to Act Fast Scammers will often say:

“This deal won’t last!” or “You must send money today to lock it in.” They want you to act without thinking. Always take your time and talk to a trusted advisor first.

3. Crypto Confusion Many fraudsters are now using cryptocurrency as a cover—creating fake wallets, bogus crypto platforms, or offering “mining opportunities.” They might even impersonate real financial companies.

Want to get smart about crypto? 👉 Check out our Cryptocurrency Advisory Services

4. Asking for Gift Cards, Crypto, or Wire Transfers If someone asks you to pay or invest using a gift card, Bitcoin wallet address, or a wire transfer to a random bank account—big red flag. That money is almost impossible to get back.

5. No Paper Trail Scammers hate contracts and written details. They’ll avoid giving you documents, or send shady-looking PDFs with fake signatures.

3 Common Scams Happening Right Now in Florida

🔒 The Fake Crypto Platform You sign up, invest money, and watch your “returns” grow. But when you try to withdraw your money? Nothing. These websites are often total fakes—set up just to steal from people.

📞 The “IRS” or “Social Security” Call You get a call claiming your benefits will be suspended unless you send money or verify sensitive info. It’s not real. The government will never call and ask for money or your SSN.

📧 The Email from a Fake Financial Advisor These emails might look like they’re from a real firm—but they’re not. Always double-check the sender’s email address and never click suspicious links.

How to Stay Safe

✅ Do Your Research – Look up the company or advisor’s name. Search “[Company Name] + Scam” online.

✅ Work with a Trusted Advisor – If you’re unsure about anything financial, talk to a real person you trust.

✅ Be Careful with Crypto – Never invest in cryptocurrency without understanding the risks or using a secure platform.

✅ Don’t Share Personal Info – Be cautious about sharing your Social Security number, bank info, or passwords.

Final Thoughts: Better Safe Than Sorry

Financial scams are constantly evolving—and no one is immune. But with a little awareness and the right support, you can keep your money safe and your future secure.

Whether you're just getting started with investing, or you've already dabbled in cryptocurrency, the best move you can make is working with a trusted professional.

Need personalized advice or want to review your current investments for any red flags? 👉 Schedule a consultation with Manna Wealth Management

We’re here to help Florida families, professionals, retirees, and crypto investors make smart, secure financial moves.

0 notes

Text

How Financial Advisors Could Help Real Estate Investors Succeed in Today’s Market

Real estate investing is often hailed as one of the most reliable paths to building wealth. From rental income to long-term property appreciation, the opportunities are vast. However, even seasoned real estate investors can face complex financial hurdles without the right guidance. That’s where the role of a financial advisor becomes not just helpful—but essential.

Whether you're purchasing your first rental property or managing a growing real estate portfolio, working with a financial advisor could mean the difference between strategic growth and missed opportunities. At Manna Wealth Management, investors gain more than just guidance—they gain a financial partner who understands how to tailor wealth strategies specifically for real estate.

1. Comprehensive Financial Planning Beyond the Property

Many real estate investors focus heavily on location, rental yields, and market trends—which are undeniably important. But what about cash flow forecasting, tax implications, or estate planning?

A skilled financial advisor helps real estate investors:

Build a balanced investment strategy that includes both real estate and other asset classes.

Plan for long-term goals like retirement, children's education, or legacy creation.

Create contingency plans in case of market shifts, vacancies, or interest rate hikes.

This holistic approach ensures you're not just investing in properties, but also building generational wealth.

2. Mitigating Risk and Managing Debt

Real estate often involves significant leverage through mortgages or loans. While this can amplify returns, it also increases financial risk. A financial advisor can:

Analyze debt levels to ensure you’re not over-leveraging.

Suggest strategies to refinance or consolidate property debt.

Help manage liquidity risks—ensuring you have enough cash reserves when unexpected costs arise.

At Manna Wealth Management, the focus is on minimizing downside exposure while maximizing the upside potential. Their advisors specialize in creating risk-managed portfolios that support your real estate investments without compromising your financial security.

3. Tax Efficiency & Smart Structuring

Taxes can eat into your profits if you’re not careful. From capital gains to depreciation recapture, the tax code surrounding real estate is full of pitfalls—and opportunities.

A financial advisor can:

Work with your CPA to maximize deductions such as depreciation and mortgage interest.

Advise on entity structure (LLC vs. S-Corp vs. Sole Proprietor) for optimal tax benefits and liability protection.

Strategize 1031 exchanges to defer taxes when upgrading properties.

Manna Wealth Management’s team stays ahead of tax law changes so their clients don’t have to. They ensure that your investments are not only profitable—but also tax-efficient.

4. Helping You Diversify Strategically

It’s tempting for real estate investors to go all-in on property. But putting all your eggs in one basket—even a lucrative one—can be risky.

A financial advisor helps you:

Diversify into stocks, bonds, ETFs, REITs, and other vehicles that complement your real estate holdings.

Prepare for market corrections by spreading risk across asset types.

Invest excess cash flow from your properties into higher-return opportunities.

This well-rounded strategy ensures you're not just surviving market cycles, but thriving in them.

5. Estate & Succession Planning

If your real estate portfolio is a big part of your legacy, have you thought about what happens to it after you're gone?

Financial advisors can:

Help you create wills, trusts, and succession plans to transfer wealth smoothly.

Work with attorneys and tax professionals to minimize estate taxes.

Ensure your loved ones are prepared and protected.

Manna Wealth Management focuses on multi-generational wealth strategies, ensuring your hard-earned assets continue to grow for your family’s future.

Real Estate Investing Isn’t Just About Buying Property—It’s About Building Wealth Wisely

Partnering with a trusted financial advisor can elevate your real estate investment strategy from good to great. From risk management and tax planning to diversification and succession strategies, financial advisors provide the framework that allows real estate investors to move with confidence.

If you’re ready to take your real estate investments to the next level, now is the time to partner with professionals who understand your goals. Visit Manna Wealth Management to explore how their personalized financial advisory services are helping real estate investors like you thrive in today’s complex market.

0 notes

Text

What Is a 529 College Savings Plan? A Smart Way to Save for Education

When it comes to saving for your child’s college education, there are tons of options out there—but a 529 college savings plan is one of the smartest and most flexible tools available. Whether you’re a parent, grandparent, or even a student planning ahead, understanding how a 529 plan works can save you money and stress in the long run.

In this article, we’ll break it all down in simple language: ���� What a 529 plan is, 👉 How it works, 👉 Why it's worth considering, 👉 And how experts like Manna Wealth Management can help guide you in the right direction.

So, What Is a 529 College Savings Plan?

A 529 plan is a tax-advantaged savings account designed to help families save money for future education costs. It’s named after Section 529 of the Internal Revenue Code, which created these plans back in 1996.

Here’s the short version: You put money into a 529 plan → it grows over time → you take the money out tax-free if you use it for qualified education expenses.

Who Can Use a 529 Plan?

Pretty much anyone!

Parents saving for their kids

Grandparents helping out

Students saving for themselves

Even family friends or generous relatives

You don’t have to be rich to start one either. Many plans let you begin with as little as $25–$50.

What Can You Use the Money For?

The biggest perk? Tax-free withdrawals when you use the money for approved education expenses. These include:

✅ Tuition for college, university, or vocational school ✅ Room and board (if you're enrolled at least half-time) ✅ Books and supplies ✅ Computers and internet access (if used for school) ✅ Even K-12 tuition (up to $10,000 per year) ✅ And now—student loan repayment (up to $10,000 lifetime limit)

How Does a 529 Plan Save You Money?

Let’s break it down:

Tax-Free Growth: Your money grows without being taxed—no capital gains taxes, no federal income tax on the earnings if used properly.

State Tax Benefits: Some states give you tax deductions or credits just for contributing.

Estate Planning Benefits: Want to reduce the size of your taxable estate? You can front-load five years' worth of contributions (up to $90,000 per child as of 2024) without gift tax.

Control Stays with You: Unlike custodial accounts, you remain in control of the funds, even after the child turns 18.

Are There Any Downsides?

Like anything, it’s not perfect. Here's what to consider:

⚠️ If you don’t use the funds for education, you’ll pay a 10% penalty on the earnings—plus income taxes. ⚠️ Investment options are limited to what the state’s plan offers. ⚠️ Your plan might affect financial aid eligibility, but usually not by much.

What Happens If Your Child Doesn’t Go to College?

No worries! You’ve got options:

🔁 Change the beneficiary to another family member (siblings, cousins, even yourself!) 💰 Use the funds to pay off up to $10,000 in student loans 📚 Use it for trade schools, grad school, or some international programs 🔥 Starting in 2024, you can roll over unused 529 funds (up to $35,000 lifetime) into a Roth IRA for the beneficiary (some rules apply)

How to Start a 529 Plan

Starting a 529 plan is easier than you might think:

Pick a plan – You don’t have to pick your own state’s plan; compare others too

Choose your investments – Most plans offer age-based options (they get more conservative as the child nears college)

Set up automatic contributions – Even $25 a month can add up big over time

Track and adjust as needed – Life changes, and so can your plan

Why It’s Smart to Work with a Financial Advisor

Sure, you can set up a 529 on your own, but getting advice from a professional can help you:

✅ Maximize tax savings ✅ Choose the best plan and investments ✅ Coordinate with your overall financial goals ✅ Avoid common mistakes that could cost you later

Manna Wealth Management is one such expert you can turn to. With years of experience in helping families plan for the future, they can walk you through every step of the 529 process—plus much more when it comes to long-term financial planning, retirement, and wealth building.

🔗 Check them out here: https://mannawealthmanagement.com/

Final Thoughts

A 529 college savings plan isn’t just a smart way to save for school—it’s a powerful financial tool that gives your family options and peace of mind. The earlier you start, the more you benefit from compound growth and tax savings. Whether you’re saving for a newborn’s future or catching up for a teen, it’s never too late to begin.

And if you’re feeling overwhelmed or unsure where to start? Reach out to trusted advisors like Manna Wealth Management. They’ll help you make sure your money is working for your future.

0 notes

Text

Liquid Net Worth: What It Means, How to Calculate It & Why It Really Matters

When people talk about wealth, they often throw around terms like net worth — but there's one version that matters even more in real life, especially when things get tight: liquid net worth.

You might be asking: “What exactly is liquid net worth? Why does it matter more than regular net worth?”

Let’s break it down in simple, clear language — no finance degree needed.

💡 What Is Liquid Net Worth?

Liquid net worth is how much money you’d actually have access to right now if you needed it fast — like in an emergency, big purchase, or sudden layoff.

It’s your total net worth, minus anything that isn’t easy to sell or convert to cash.

Here’s an easy way to think about it:

🔒 Net Worth = All your assets – all your debts 💧 Liquid Net Worth = Assets you can quickly turn into cash – debts

So, while your home, car, and retirement accounts might boost your net worth on paper… they may not help you much if your rent is due tomorrow and you’re out of work.

🏦 What Counts as a Liquid Asset?

Liquid assets are things you can quickly and easily convert to cash without losing much value. Examples include:

Cash (in your checking or savings account)

Money market accounts

Stocks, bonds, and mutual funds (that you can sell right away)

Cryptocurrency (depending on how easily you can sell it)

PayPal, Venmo, or cash app balances

Certificates of Deposit (CDs) — sometimes, but only if you can withdraw without a big penalty

🪙 What Doesn’t Count as Liquid?

These may be valuable, but they’re not liquid because they take time to sell or have early withdrawal penalties:

🏡 Your house

🚗 Your car

🏦 Retirement accounts (like 401(k)s or IRAs — especially before age 59½)

💎 Jewelry, art, collectibles

🏢 Business ownership or private equity

You might eventually get money from them — but not instantly, and sometimes not without a loss.

📲 How to Quickly Calculate Liquid Net Worth

Here's a simple 3-step formula:

List all your liquid assets

Checking: $5,000

Savings: $10,000

Stocks: $8,000

Total = $23,000

Subtract all your liabilities (what you owe)

Credit card debt: $3,000

Student loans: $12,000

Car loan: $10,000

Total = $25,000

Do the math: 💧 Liquid Net Worth = $23,000 – $25,000 = –$2,000

Even if your regular net worth is positive, your liquid net worth could be negative if most of your wealth is tied up in long-term or non-cashable assets.

🤔 Why Liquid Net Worth Matters More Than You Think

Knowing your liquid net worth helps you understand how financially prepared you really are.

Here’s why it’s important:

1. Emergencies Happen

Unexpected things like job loss, medical bills, or car repairs don’t wait for you to sell your house or cash out a retirement plan. Liquid net worth shows what you could actually use right now.

2. Helps You Plan Smarter

It’s a better measure of your financial flexibility. Are you ready to move across the country? Invest in a new opportunity? Your liquid net worth tells you how feasible that is.

3. Reduces Financial Stress

When you know you have a cushion of accessible funds, you feel more confident and less anxious about the “what ifs.”

4. Important for Lenders & Loans

Banks and lenders often care more about your liquidity than your overall net worth, especially for things like business loans or lines of credit.

💸 Tips to Increase Your Liquid Net Worth

Want to boost your liquid safety net? Try these steps:

Build your emergency fund (aim for 3–6 months of expenses)

Pay off high-interest debt to reduce liabilities

Invest in liquid assets like index funds or high-yield savings

Avoid locking too much money into illiquid investments

Review your spending to free up more cash each month

🧠 Quick Example to Wrap It All Up

Let’s compare two people:

👩 Sarah:

Owns a home worth $400K

Has $30K in her 401(k)

Only $2K in savings

Owes $10K in credit card debt

👨 Mike:

Rents an apartment

Has $15K in savings and $10K in stocks

No debt

Sarah's net worth may be higher, but Mike's liquid net worth is stronger, which means he’s in a better spot if something unexpected happens.

✅ Final Thoughts: Know What You Really Have

Your net worth might look impressive on paper, but if most of it isn’t easily accessible, it doesn’t help you in the moment.

Your liquid net worth is the real test of financial strength in everyday life.

Track it. Understand it. Grow it.

0 notes

Text

Cryptocurrency Explained: A Comprehensive Guide With Pros and Cons for Investment

What Is Cryptocurrency?

Cryptocurrency is a digital or virtual form of currency secured by cryptography and operates on decentralized blockchain technology. Unlike traditional currencies issued by governments, such as the U.S. dollar or the euro, cryptocurrencies are not controlled by central banks or financial institutions. Instead, transactions are verified and recorded on a public ledger known as a blockchain, which is maintained by a distributed network of computers.

The appeal of cryptocurrencies lies in their decentralized nature, security, and ability to facilitate peer-to-peer transactions without intermediaries. Popular examples of cryptocurrencies include Bitcoin (BTC), Ethereum (ETH), Solana (SOL), and many others.

A Brief History of Cryptocurrency

The concept of cryptocurrency dates back to the late 20th century, but it was not until the release of Bitcoin that the idea truly gained traction.

2008: Bitcoin’s whitepaper, authored by the pseudonymous Satoshi Nakamoto, introduced the concept of a peer-to-peer electronic cash system.

2009: Bitcoin’s blockchain officially went live, marking the birth of cryptocurrency and the first-ever decentralized digital currency.

2010–2023: The cryptocurrency market experienced explosive growth, giving rise to alternative cryptocurrencies (altcoins), decentralized finance (DeFi), and non-fungible tokens (NFTs). Major companies and financial institutions began adopting blockchain technology.

2021–2022: Bitcoin reached an all-time high of approximately $69,000 in 2021, followed by a sharp market-wide decline due to macroeconomic factors, increased regulation, and industry scandals such as the FTX collapse.

Despite the volatility, cryptocurrency continues to evolve, with institutional investors and retail traders alike exploring the opportunities it presents.

How Cryptocurrency Works

Cryptocurrency operates through blockchain technology, a decentralized and tamper-proof ledger that records all transactions across a distributed network of computers. Here are the key components of how it works:

Blockchain Technology

Blockchain is the foundation of cryptocurrencies. It is a decentralized ledger where transactions are grouped into blocks. These blocks are validated by either miners (Proof-of-Work) or validators (Proof-of-Stake) and then added to the chain, ensuring security and transparency.

Key Concepts

Decentralization: No single entity controls the network, reducing the risk of manipulation or censorship.

Mining/Staking: These are processes through which transactions are validated and the network is secured. Miners (Proof-of-Work) or validators (Proof-of-Stake) receive rewards in cryptocurrency for their efforts.

Wallets: Digital wallets store public and private keys, allowing users to securely access and manage their cryptocurrency holdings. Wallets can be hardware-based (cold storage) or software-based (hot wallets).

Cryptocurrency as an Investment: Pros and Cons

While cryptocurrency offers exciting investment opportunities, it also comes with risks. Let’s explore the advantages and disadvantages.

Pros of Investing in Cryptocurrency

1. High Return Potential

Bitcoin’s price surged from $0.09 in 2010 to an all-time high of $69,000 in 2021.

Many altcoins, such as Ethereum and Solana, have delivered multi-thousand percent returns for early investors.

2. Portfolio Diversification

Cryptocurrency has a low correlation with traditional assets like stocks and bonds, making it a potential hedge against market fluctuations.

3. Accessibility

Unlike traditional financial markets, cryptocurrency can be traded 24/7 across global exchanges such as Coinbase and Binance.

Fractional investing allows individuals to buy small portions of Bitcoin or other cryptocurrencies.

4. Inflation Hedge

Certain cryptocurrencies, like Bitcoin, have a fixed supply (21 million coins), which some believe makes them a hedge against inflation and fiat currency devaluation.

5. Innovation Opportunities

Blockchain technology powers innovations in decentralized finance (DeFi), gaming, supply chain management, and more.

Cons of Investing in Cryptocurrency

1. Extreme Volatility

Prices can fluctuate dramatically—Bitcoin dropped 65% in 2022 alone, showcasing the market’s unpredictability.

2. Regulatory Risks

Governments worldwide have introduced varying levels of regulation, with some countries imposing outright bans (e.g., China in 2021).

3. Security Vulnerabilities

Hacking incidents, scams, and exchange collapses (e.g., FTX in 2022) have resulted in significant financial losses for investors.

4. No Intrinsic Value

Unlike stocks or bonds, cryptocurrencies do not generate cash flow or represent ownership in a company, making their valuation largely speculative.

5. Environmental Concerns

Bitcoin mining consumes a massive amount of energy, estimated at 127 terawatt-hours annually, raising concerns about sustainability.

Tips for Investing in Cryptocurrency

To navigate the risks and maximize potential returns, consider the following investment strategies:

1. Research Thoroughly

Understand the use case, development team, and community behind a cryptocurrency before investing.

Avoid making decisions based on hype or FOMO (fear of missing out).

2. Diversify Strategically

Only allocate 1–5% of your total investment portfolio to cryptocurrency to manage risk.

Consider investing in blue-chip cryptocurrencies like Bitcoin and Ethereum while allocating smaller portions to promising altcoins.

3. Use Secure Storage

Store most of your crypto assets in cold wallets (e.g., Ledger, Trezor) to protect against hacking.

Keep minimal funds on exchanges to facilitate trading but avoid exposure to potential exchange failures.

4. Stay Updated on Regulations

Cryptocurrency regulations are constantly evolving, affecting taxation and compliance requirements.

The IRS treats cryptocurrency as property, meaning capital gains taxes apply to trades and sales.

5. Consider Professional Guidance

Working with financial advisors, such as Manna Wealth Management, can help create a tailored investment strategy while mitigating risks.

Cryptocurrency Advisory Services

Given the complexities of cryptocurrency investment, professional guidance can be invaluable. Firms like Manna Wealth Management offer specialized advisory services, including:

Portfolio allocation strategies

Risk assessment and mitigation

Tax optimization and regulatory compliance

Education on blockchain trends and emerging investment opportunities

Conclusion

Cryptocurrency presents exciting opportunities for investors seeking high returns, portfolio diversification, and exposure to blockchain innovation. However, the market is highly volatile, subject to regulatory uncertainties, and poses security risks. To navigate this dynamic asset class, investors should conduct thorough research, practice strategic diversification, utilize secure storage, and stay informed about regulations.

For those seeking expert guidance, professional firms like Manna Wealth Management can provide tailored strategies to help investors maximize gains while minimizing risks. As the cryptocurrency landscape continues to evolve, an informed and cautious approach will be key to long-term success in digital asset investing.

0 notes

Text

The Responsibilities of a Financial Advisor: A Guide to Financial Success

In today's complex financial landscape, managing wealth effectively requires expert guidance. A financial advisor plays a crucial role in helping individuals, families, and businesses achieve their financial goals. From investment management to retirement planning, tax strategies, and estate planning, financial advisors provide personalized solutions to ensure financial stability and growth.

What Does a Financial Advisor Do?

A financial advisor is a professional who provides expert financial guidance based on an individual's or business's unique financial situation. Their responsibilities go beyond just managing investments; they help clients navigate various aspects of financial planning, risk management, and wealth preservation.

1. Assessing Financial Needs and Goals

The first step in financial planning is understanding a client's financial situation, including income, expenses, assets, and liabilities. Financial advisors conduct a thorough financial assessment to determine the best strategy for achieving long-term financial success.

2. Investment Planning and Portfolio Management

Investment management is a key responsibility of a financial advisor. They help clients build a diversified portfolio based on their risk tolerance, time horizon, and financial goals. This includes selecting suitable assets such as stocks, bonds, mutual funds, real estate, and alternative investments.

3. Retirement Planning

Ensuring financial security during retirement is one of the most critical aspects of financial planning. Advisors assist clients in selecting appropriate retirement plans, such as 401(k)s, IRAs, annuities, and other long-term investment options. They also project future retirement income needs and devise strategies to sustain a comfortable lifestyle.

4. Tax Optimization Strategies

Tax planning is essential for wealth preservation. Financial advisors provide strategies to minimize tax liabilities through tax-efficient investments, deductions, and credits. They also help with estate and gift tax planning to ensure wealth is transferred efficiently to heirs.

5. Risk Management and Insurance Planning

Protecting wealth from unforeseen risks is another critical responsibility of a financial advisor. They recommend insurance policies such as life insurance, health insurance, long-term care insurance, and disability insurance to safeguard clients' financial future.

6. Estate Planning and Wealth Transfer

Proper estate planning ensures that assets are distributed according to a client's wishes. Financial advisors collaborate with estate attorneys to create wills, trusts, and power of attorney documents to facilitate smooth wealth transfer and minimize estate taxes.

7. Financial Education and Guidance

Many clients lack financial literacy, and a key responsibility of financial advisors is to educate them about budgeting, investing, debt management, and financial discipline. They empower clients with the knowledge to make informed financial decisions.

8. Adapting to Market and Economic Changes

Financial markets and economic conditions are constantly evolving. A skilled financial advisor monitors market trends, regulatory changes, and global economic factors to adjust strategies accordingly, ensuring clients’ portfolios remain resilient.

9. Providing Ongoing Financial Support

A financial advisor’s role doesn’t end with the initial financial plan. They provide continuous support and periodic reviews to ensure clients stay on track. Regular meetings help reassess financial goals, modify investment strategies, and make necessary adjustments.

Choosing the Right Financial Advisor

Selecting a financial advisor is a crucial decision. Clients should look for advisors with:

Proper certifications (e.g., CFP, CFA, CPA)

A solid track record and positive client testimonials

A fiduciary duty, ensuring they act in clients’ best interests

Transparent fee structures (fee-only vs. commission-based)

Comprehensive financial planning services

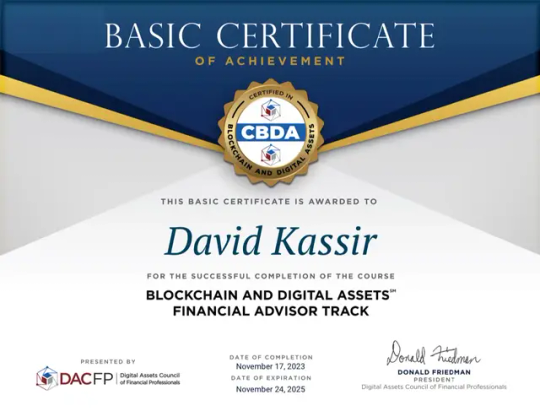

Work with an Expert: David Kassir

For individuals seeking an experienced and trusted financial advisor, David Kassir of Manna Wealth Management offers top-tier financial planning services. With years of expertise in wealth management, retirement planning, and investment advisory, David Kassir is dedicated to helping clients achieve financial freedom and success.

Conclusion

A financial advisor is a valuable partner in achieving financial stability and long-term prosperity. From investment management to tax planning, risk mitigation, and estate planning, they provide the expertise and personalized strategies needed to navigate the complexities of personal and business finances. If you're looking for professional financial guidance, consider working with an experienced advisor like David Kassir to secure your financial future.

0 notes

Text

How to Use a Mega Backdoor Roth for the Max Tax-Free Retirement Income

Planning for retirement is one of the most important financial steps you can take, and a Mega Backdoor Roth is one of the most powerful strategies to maximize your tax-free retirement income. If you're a high-income earner looking to supercharge your savings, this strategy might be perfect for you.

What is a Mega Backdoor Roth?

A Mega Backdoor Roth is an advanced retirement savings strategy that allows individuals to contribute after-tax dollars into a 401(k) plan and then convert those funds into a Roth IRA or Roth 401(k). This method enables tax-free growth and withdrawals in retirement, making it a game-changer for those who qualify.

How It Works

Here’s a step-by-step breakdown of how a Mega Backdoor Roth works:

Max Out Your Regular 401(k) Contributions

Make After-Tax Contributions to Your 401(k)

Convert After-Tax Funds to a Roth Account

Key Benefits of a Mega Backdoor Roth

✅ Tax-Free Growth – Once inside a Roth IRA or Roth 401(k), your investments grow completely tax-free.

✅ No RMDs (Required Minimum Distributions) – Roth IRAs are not subject to RMDs, meaning you can let your money grow as long as you like.

✅ Higher Contribution Limits – A standard Roth IRA only allows $7,000 ($8,000 if 50+) in 2024, but a Mega Backdoor Roth allows up to $46,000 more in after-tax contributions.

✅ Ideal for High-Income Earners – Since traditional Roth IRA contributions are income-limited, this is a great way for high earners to still benefit from a Roth strategy.

Is a Mega Backdoor Roth Right for You?

A Mega Backdoor Roth is not available in all 401(k) plans, so you need to check if your employer offers:

✔️ After-tax 401(k) contributions ✔️ In-plan Roth conversions or in-service withdrawals

Additionally, if you’re in a high tax bracket now but expect to be in a lower one in retirement, you might want to consider other strategies before doing a conversion.

Get Expert Guidance from a Financial Advisor

Navigating the complexities of a Mega Backdoor Roth requires expert advice. David Kassir, Managing Director and Sr. Financial Advisor at Manna Wealth Management, has helped countless clients maximize their retirement savings with strategic tax planning.

🔗 Learn more about David Kassir and Manna Wealth Management here

Final Thoughts

The Mega Backdoor Roth is a powerful tool that allows high earners to build substantial tax-free retirement income. However, proper planning and execution are crucial to ensure you maximize benefits while avoiding tax pitfalls.

If you're serious about securing your financial future, consulting with a professional like David Kassir can help you take full advantage of this incredible strategy. Reach out today and start planning for a tax-free retirement!

FAQs

1. What is a Mega Backdoor Roth?

A Mega Backdoor Roth is a strategy that allows high-income earners to contribute extra after-tax money to their 401(k) and then roll it into a Roth IRA or Roth 401(k) for tax-free growth and withdrawals in retirement.

2. Who can use the Mega Backdoor Roth strategy?

You can use this strategy if your employer’s 401(k) plan allows after-tax contributions and in-service withdrawals to a Roth IRA or in-plan Roth conversions.

3. How much can I contribute to a Mega Backdoor Roth in 2025?

The total 401(k) contribution limit (including employer and employee contributions) is $69,000 ($76,500 if 50 or older). After maxing out traditional and Roth 401(k) contributions ($23,000 or $30,500 if 50+), the remaining amount can be contributed as after-tax dollars for the Mega Backdoor Roth.

4. What’s the difference between a Backdoor Roth and a Mega Backdoor Roth?

A Backdoor Roth IRA is for individuals who exceed the income limit for direct Roth IRA contributions. A Mega Backdoor Roth allows much larger after-tax contributions through a 401(k), often tens of thousands more than a standard Backdoor Roth.

5. What are the benefits of a Mega Backdoor Roth?

Tax-free growth and withdrawals in retirement.

Larger contribution limits than a traditional Roth IRA.

No Required Minimum Distributions (RMDs) if rolled into a Roth IRA.

Allows high earners to bypass Roth IRA income limits.

6. Can I do a Mega Backdoor Roth if I already contribute to a Roth 401(k)?

Yes. You can max out both your Roth 401(k) employee contribution ($23,000 for 2025) and still use the Mega Backdoor Roth for additional after-tax contributions.

7. How do I execute a Mega Backdoor Roth conversion?

Contribute after-tax dollars to your 401(k) (beyond your regular pre-tax or Roth contributions).

Move the after-tax contributions into a Roth IRA (via in-service distribution) or convert them within your plan to a Roth 401(k).

Repeat annually for maximum benefits.

8. Does my employer need to offer specific plan features for this strategy?

Yes. Your employer’s 401(k) plan must allow:

After-tax contributions beyond the $23,000 employee deferral limit.

In-service distributions or in-plan Roth conversions to move after-tax funds.

9. What happens if my employer’s 401(k) doesn’t allow after-tax contributions?

You won’t be able to use the Mega Backdoor Roth. Instead, you can consider a Backdoor Roth IRA or standard Roth 401(k) contributions.

10. How often should I convert after-tax contributions to a Roth?

Ideally, immediately after contributing to minimize tax on any gains. Some employers allow automatic conversions to a Roth 401(k), which is even better.

11. Will I owe taxes when I convert after-tax 401(k) contributions to a Roth?

No, the principal (after-tax contributions) is not taxed when converted. However, any earnings before the rollover are taxable. That’s why frequent or immediate conversions help reduce taxes.

12. Does a Mega Backdoor Roth affect my regular IRA contributions?

No. You can still contribute to a Traditional IRA or Roth IRA (via the Backdoor method) even if you use the Mega Backdoor Roth.

13. Can I do a Mega Backdoor Roth if I already max out my 401(k) pre-tax contributions?

Yes! The $23,000 pre-tax or Roth 401(k) limit is separate. You can contribute after-tax funds beyond this limit up to $69,000 total (including employer contributions).

14. Are there income limits for the Mega Backdoor Roth?

No. Unlike direct Roth IRA contributions, there are no income limits for Mega Backdoor Roth contributions.

15. What’s the difference between rolling into a Roth 401(k) vs. Roth IRA?

Roth IRA: No Required Minimum Distributions (RMDs). More investment options.

Roth 401(k): Subject to RMDs (unless rolled over later). Limited investment choices but easier conversion.

16. What happens if I leave my job?

If you switch jobs, you can roll over your after-tax 401(k) contributions into a Roth IRA tax-free, but any earnings will be taxed at the time of rollover.

17. Are there any penalties for withdrawing Mega Backdoor Roth funds early?

If converted into a Roth IRA, withdrawals of contributions are penalty-free anytime. Earnings must follow the 5-year rule and be withdrawn after age 59½ to avoid taxes and penalties.

18. Can I do a Mega Backdoor Roth if I am self-employed?

It depends. If you have a solo 401(k) that allows after-tax contributions, you might be able to implement a Mega Backdoor Roth. However, most solo 401(k) plans do not allow this.

19. What’s the best way to ensure I maximize my tax-free retirement income?

Max out pre-tax or Roth 401(k) contributions first.

Max out employer match.

Use after-tax 401(k) contributions and convert them promptly.

Roll over into a Roth IRA for tax-free withdrawals.

20. Is the Mega Backdoor Roth at risk of being eliminated?

There have been proposals to eliminate it, but as of 2025, it remains a legal and powerful strategy. Always stay updated on tax laws to ensure compliance.

0 notes

Text

How Does the Florida Retirement System Work? A Complete Guide

Florida’s public employees—including teachers, state workers, first responders, and local government staff—rely on the Florida Retirement System (FRS) to secure their financial futures. Established in 1970, the FRS is one of the largest public pension systems in the U.S., serving over 1 million active and retired members. But how exactly does it work? This article explains the FRS structure, plan options, benefits, and key considerations to help you maximize your retirement readiness.

What is the Florida Retirement System (FRS)?

The FRS is a state-administered retirement program providing pension and investment benefits to eligible public employees. It offers two primary retirement plans:

FRS Pension Plan (a traditional defined benefit plan).

FRS Investment Plan (a defined contribution plan, similar to a 401(k)).

Employees must choose between these plans upon hiring, though limited opportunities to switch exist later. Both plans are funded by employee and employer contributions, with distinct rules for vesting, payouts, and risk.

Who is Eligible for the FRS?

Most full-time employees of Florida’s public sector are automatically enrolled in the FRS, including:

State government workers.

Public school and university staff.

County and municipal employees.

Firefighters, law enforcement, and emergency responders.

Part-time employees may qualify if they work at least 30 hours per week. Participants cannot opt out of the FRS unless they qualify for an alternative plan (e.g., a 401(k)-style plan for certain university roles).

How the FRS Pension Plan Works

The FRS Pension Plan guarantees a fixed monthly income for life, calculated using a formula based on years of service and salary.

Key Features

Benefit Calculation:

Monthly Pension = Years of Service × Average Final Compensation (AFC) × 1.6%

AFC: Average of your highest 8 years of salary.

Example: 25 years of service × 50,000AFC×1.650,000AFC×1.620,000/year ($1,667/month).

Contributions:

Employees contribute 3% of their salary pretax.

Employers cover the remaining cost (approximately 6-10% of salary, depending on job class).

Vesting:

Requires 8 years of service to qualify for lifetime benefits. Leaving before vesting forfeits employer-funded benefits.

Cost-of-Living Adjustments (COLAs):

Optional COLAs may be granted by the legislature, though not guaranteed.

Death Benefits:

Survivors (e.g., spouses) may receive 50-100% of the pension, depending on elected options.

Pros: Predictable income, inflation hedging (if COLAs apply), no investment risk. Cons: Lack of control, portability issues, dependency on legislative decisions.

How the FRS Investment Plan Works

The FRS Investment Plan operates like a 401(k), where retirement income depends on contributions and market performance.

Key Features

Contributions:

Employees contribute 3% of salary pretax.

Employers contribute a variable rate (e.g., ~3.3% for regular employees, higher for law enforcement).

Investments:

Funds are invested in options like target-date funds, stocks, bonds, and money markets.

Members choose their risk level and allocations.

Vesting:

Employee contributions are immediately vested.

Employer contributions vest after 1 year of service.

Withdrawals:

At retirement, funds can be withdrawn as a lump sum, annuity, or periodic payments.

Death Benefits:

The full account balance passes to designated beneficiaries.

Pros: Portability, investment control, potential for higher returns. Cons: Market risk, no guaranteed income, requires active management.

Additional FRS Benefits

Beyond retirement plans, the FRS offers:

Health Insurance Subsidy:

Retirees may qualify for a monthly stipend (up to $150) to offset health insurance costs.

Disability Benefits:

Total or partial disability coverage for members unable to work due to injury/illness.

Deferred Retirement Option Program (DROP):

Allows employees to “retire in place” for up to 5 years while accumulating pension payments in an interest-bearing account.

Choosing the Right Plan for You

Consider these factors when selecting between the Pension and Investment Plans:

Career Longevity: If you’ll stay in Florida public service for 8+ years, the Pension Plan’s guarantees may appeal to you.

Risk Tolerance: Prefer stability? Choose the Pension Plan. Comfortable with markets? Opt for the Investment Plan.

Portability Needs: The Investment Plan is ideal if you might switch sectors or move out of state.

Estate Goals: The Investment Plan allows heirs to inherit your full account balance.

Why Professional Advice is Critical

Navigating FRS rules, tax implications, and long-term planning can be overwhelming. A financial advisor, like those at Manna Wealth Management, can help you:

Model projected income under both plans.

Align your choice with life goals (e.g., retirement age, travel plans).

Optimize investments in the FRS Investment Plan.

Integrate FRS benefits with Social Security, IRAs, or other savings.

Final Thoughts

The Florida Retirement System provides a robust safety net for public employees, but its complexity demands careful planning. Whether you prioritize the Pension Plan’s security or the Investment Plan’s flexibility, understanding the mechanics of the FRS ensures you make informed decisions. For personalized guidance, consult a Florida-based financial advisor, such as the team at Manna Wealth Management, to tailor your retirement strategy and secure the future you deserve.

0 notes

Text

FRS Investment Plan vs. Pension Plan: A Comprehensive Comparison

Navigating retirement planning can be complex, especially when weighing options like the Florida Retirement System (FRS) Investment Plan and Pension Plan. Both offer distinct benefits and trade-offs, tailored to different financial goals and lifestyles. This article breaks down their structures, pros, cons, and key factors to consider—plus why consulting a Florida financial advisor, such as those at Manna Wealth Management, can help you make an informed decision.

Overview of the Florida Retirement System (FRS)

The FRS provides retirement benefits to public employees in Florida, including teachers, first responders, and state workers. It offers two primary plans:

FRS Pension Plan (Defined Benefit)

FRS Investment Plan (Defined Contribution)

Employees must choose between these plans upon eligibility, with limited opportunities to switch later. Understanding their differences is critical to aligning with your retirement vision.

FRS Pension Plan: Defined Benefit

How It Works

Structure: Guarantees a fixed monthly income for life, calculated using a formula: Benefit = Years of Service × Average Compensation (highest 8 years) × 1.6% Example: 30 years of service × 50,000averagesalary×1.650,000averagesalary×1.624,000/year.

Contributions: Employees contribute 3% of salary; employers fund the remainder.

Vesting: Requires 8 years of service to qualify for lifetime benefits.

Death Benefits: Provides survivor options (e.g., 50% continuation to a spouse).

Pros

Predictable, lifelong income unaffected by market fluctuations.

Potential cost-of-living adjustments (COLAs) to combat inflation.

No investment management required.

Cons

Lack of control over investments.

Limited portability if leaving Florida public employment before vesting.

Benefits depend on legislative decisions, which could alter terms.

FRS Investment Plan: Defined Contribution

How It Works

Structure: Functions like a 401(k). Contributions are invested in options (e.g., mutual funds), with retirement income dependent on market performance.

Contributions: Employees contribute 3% of salary; employers contribute a variable rate (set annually by the legislature).

Vesting: Immediate vesting for employee contributions; employer contributions vest after 1 year.

Death Benefits: Full account balance passes to beneficiaries.

Pros

Control over investment choices and risk level.

Portable—funds can roll into an IRA or new employer’s plan if you leave public service.

Potential for higher returns through strategic investing.

Cons

Market risk could lead to losses.

No guaranteed income; retirees must manage withdrawals.

Requires active investment decisions.

Key Differences at a Glance

FactorPension PlanInvestment PlanIncome TypeGuaranteed for lifeMarket-dependentContributionsEmployer-funded after employee 3%Employee + employer contributionsVesting Period8 years1 year (employer contributions)PortabilityLimitedHighInvestment ControlNoneFull controlDeath BenefitsSurvivor annuity optionsFull account inheritance

Factors to Consider When Choosing

Risk Tolerance: Prefer stability? The Pension Plan removes market worries. Comfortable with risk? The Investment Plan offers growth potential.

Career Plans: If you might leave Florida public service, the Investment Plan’s portability is advantageous.

Longevity Concerns: The Pension Plan ensures income for life, ideal for those worried about outliving savings.

Control vs. Simplicity: The Investment Plan demands active management; the Pension Plan requires none.

Why Professional Guidance Matters

Choosing between these plans impacts your financial security for decades. A financial advisor can help you:

Analyze personal goals, risk appetite, and career trajectory.

Model scenarios (e.g., Pension Plan COLAs vs. Investment Plan growth).

Optimize tax strategies and estate planning.

For Floridians, Manna Wealth Management offers specialized expertise in FRS plans, ensuring your retirement strategy aligns with your unique needs.

Conclusion

The FRS Pension Plan suits those prioritizing guaranteed income and simplicity, while the Investment Plan appeals to individuals seeking flexibility and growth potential. Carefully evaluate your priorities, and consider consulting a financial advisor to navigate this critical decision. With tools and insights from experts like Manna Wealth Management, you can confidently secure your financial future.

1 note

·

View note

Text

Is $2 Million Enough to Retire at 60 in Florida? [4 Case Studies]

Retirement is a major milestone, and Florida remains one of the top destinations for retirees. With its no state income tax, warm climate, and retirement-friendly lifestyle, the Sunshine State is an attractive option. But is $2 million enough to retire at 60 in Florida? The answer depends on multiple factors, including lifestyle choices, healthcare costs, and financial planning.

This guide provides a detailed breakdown of whether $2 million is sufficient, along with four case studies to illustrate different scenarios.

Factors to Consider When Retiring in Florida With $2 Million

1. Cost of Living in Florida

The cost of living in Florida varies depending on the city. Major metropolitan areas like Miami and Naples have a higher cost of living compared to smaller towns like Ocala or Lakeland.

Housing: A home in Miami may cost $600,000+, whereas in Tampa, a similar home may cost around $400,000.

Utilities & Maintenance: Expect to spend $200–$300 per month.

Groceries & Dining: Roughly $500–$1,000 per month depending on lifestyle.

Transportation: Car payments, insurance, and gas could add up to $500–$800 per month.

Entertainment & Travel: Florida offers an abundance of activities that can cost between $200–$1,000 monthly.

2. Healthcare Costs

Healthcare is a significant expense in retirement. A couple in their 60s may need $300,000+ for healthcare expenses over their lifetime. Consider Medicare premiums, out-of-pocket expenses, and supplemental insurance plans.

3. Taxes

Florida has no state income tax, which is beneficial for retirees. However, sales tax (6%–7.5%) and property taxes still apply. Depending on location and exemptions, annual property taxes can range from $2,000 to $10,000.

4. Investment & Income Strategy

With a $2 million portfolio, managing withdrawals efficiently is crucial. Following the 4% withdrawal rule, a retiree can withdraw $80,000 annually. However, market fluctuations and longevity risk should be considered.

A well-structured portfolio managed by professionals like Manna Wealth Management can help optimize investments, minimize risks, and ensure long-term financial security.

Case Study 1: The Modest Retiree (Living on $60,000 Per Year)

Profile:

Retired at 60, living in a mid-sized town like Sarasota.

Owns a mortgage-free home valued at $400,000.

Annual expenses: $60,000.

Financial Plan:

Social Security starts at 67 (~$30,000 per year).

Withdraws $30,000 annually from a $2 million portfolio.

Keeps a conservative portfolio (50% stocks, 50% bonds).

Outcome:

This retiree can comfortably sustain their lifestyle, accounting for inflation and healthcare costs.

Case Study 2: The Luxury Lifestyle Retiree (Living on $120,000 Per Year)

Profile:

Retired at 60 in Miami.

Owns a waterfront condo worth $800,000.

Annual expenses: $120,000.

Financial Plan:

Social Security starts at 67 (~$35,000 per year).

Withdraws $85,000 per year from investments.

Maintains a balanced portfolio (60% stocks, 40% bonds).

Outcome:

A more luxurious lifestyle is possible, but market downturns could impact sustainability. Working with financial advisors like Manna Wealth Management can help ensure long-term stability.

Case Study 3: The Traveler (Living on $90,000 Per Year With Frequent Travel)

Profile:

Retired at 60, lives in Naples.

Enjoys international travel, cruises, and seasonal home rentals.

Annual expenses: $90,000.

Financial Plan:

Delays Social Security to 70 for maximum benefits (~$40,000 per year).

Withdraws $50,000–$60,000 from portfolio annually.

Invests in rental property generating $15,000 per year.

Outcome:

This retiree can sustain their lifestyle if investments perform well. However, market downturns could impact travel plans, making a flexible financial plan essential.

Case Study 4: The Family-Oriented Retiree (Spends Generously on Grandkids & Charity – $75,000 Per Year)

Profile:

Retired at 60 in Orlando.

Prioritizes family vacations, grandkids' education, and charitable donations.

Annual expenses: $75,000.

Financial Plan:

Social Security starts at 67 (~$28,000 per year).

Withdraws $47,000 from portfolio annually.

Uses part-time work or side income for flexibility.

Outcome:

This retiree maintains a fulfilling lifestyle while preserving wealth for future generations.

Key Takeaways: Is $2 Million Enough?

✅ Yes, If You:

Manage withdrawals wisely (4% rule or less).

Keep a diversified investment portfolio.

Choose an affordable Florida location.

Plan for healthcare costs.

❌ Potential Risks:

Market downturns affecting investments.

Increased healthcare costs.

Higher-than-expected inflation.

Get Expert Financial Guidance

Proper planning is key to ensuring $2 million lasts through retirement. Consulting with financial professionals like Manna Wealth Management can help optimize your investment strategies, minimize risks, and build a secure financial future.

Final Thoughts

For many retirees, $2 million is enough to retire comfortably at 60 in Florida. However, lifestyle choices, spending habits, and investment strategies play a crucial role in long-term financial security.

If you're planning retirement and need a personalized strategy, consult Manna Wealth Management to ensure your financial future is on track!

FAQs

1. Can I Retire Comfortably at 60 in Florida with $2 Million?

Yes, $2 million can provide a comfortable retirement in Florida, but it depends on your expenses, investment strategy, and expected lifespan. If you maintain a moderate lifestyle and withdraw around 4% annually ($80,000 per year), you should have sufficient funds for 30 years. However, factors like healthcare costs and market downturns must be considered.

2. How Long Will $2 Million Last in Retirement?

The longevity of your savings depends on your withdrawal rate, investment returns, and inflation. A 4% withdrawal rate suggests your money could last 25-30 years. If investments grow at an average of 6-7% annually and inflation remains moderate, your nest egg could last even longer.

3. What Is the Cost of Living in Florida for Retirees?

Florida’s cost of living varies by city. Generally, it is more affordable than states like New York or California but can be expensive in areas like Miami, Naples, and Sarasota. Housing, healthcare, and property taxes play a significant role in determining costs.

4. What Are the Best Places to Retire in Florida?

Popular retirement destinations include:

The Villages – A retirement-friendly community with golf courses and social activities.

Sarasota – Offers a mix of culture, beaches, and affordable living.

Naples – Higher-end but excellent for retirees who love luxury.

Tampa Bay – A mix of affordability and entertainment.

5. What Are the Tax Benefits of Retiring in Florida?

Florida is tax-friendly for retirees. There’s no state income tax, which means your Social Security benefits, pensions, and withdrawals from retirement accounts (like IRAs and 401(k)s) are not taxed at the state level. However, property taxes vary by county, and sales taxes are around 6-7%.

6. How Much Should I Budget for Healthcare Costs?

Healthcare expenses increase with age. A couple retiring at 60 may spend $300,000 to $400,000 on healthcare over retirement. Florida has excellent healthcare facilities, but out-of-pocket costs can be high if you retire before qualifying for Medicare at 65. Private health insurance or a high-deductible plan may be necessary.

7. How Can I Minimize My Healthcare Expenses Before Medicare?

To cover healthcare costs before Medicare (age 65), you can:

Use a Health Savings Account (HSA) if you have one.

Purchase a private health plan through the ACA marketplace.

Consider part-time work with employer-sponsored health insurance.

Enroll in a high-deductible health plan with lower premiums.

8. Will Social Security Help If I Retire at 60?

If you retire at 60, you won’t be able to claim Social Security until at least 62, with full benefits kicking in at 67. If you delay benefits until 70, you receive higher monthly payments. You may need to rely on savings and investments for the first few years of retirement.

9. How Much Can I Safely Withdraw from My $2 Million Nest Egg?

The 4% rule suggests withdrawing $80,000 annually to make your money last 30 years. If you want to be more conservative, withdrawing 3-3.5% ($60,000-$70,000) could extend your savings further.

10. What Types of Investments Should I Have in Retirement?

A diversified portfolio should include:

Stocks (for growth)

Bonds (for stability)

Dividend-paying investments (for passive income)

Cash reserves (for emergencies)

A financial advisor can help balance your risk tolerance with your income needs.

11. What Are the Housing Costs in Florida for Retirees?

Housing costs vary widely:

A condo in Miami may cost $400,000+.

A single-family home in Sarasota could range from $350,000-$600,000.

In more affordable areas like Ocala, homes may cost around $250,000. Renting is also an option, but costs are rising in many Florida cities.

12. Should I Buy or Rent a Home in Retirement?

Buying makes sense if you plan to stay in one place long-term. Renting may be better if you want flexibility or plan to travel frequently. Homeownership costs include maintenance, property taxes, and HOA fees, which should be factored into your budget.

13. How Can I Plan for Inflation in Retirement?

Inflation reduces purchasing power over time. You can combat it by:

Investing in stocks for long-term growth.

Holding real estate as a hedge.

Delaying Social Security to increase future payments.

A 3% annual inflation rate means your expenses could double in 25 years, so your financial plan should account for this.

14. What Are the Risks of Running Out of Money?

Main risks include:

Market downturns reducing investment value.

Inflation eroding purchasing power.

Longer lifespan leading to higher expenses.

Unexpected medical costs depleting savings.

Regularly reviewing your plan can help manage these risks.

15. Can I Travel in Retirement with $2 Million?

Yes, but travel costs must be included in your budget. If you spend $10,000-$20,000 per year on travel, ensure your other expenses allow for this. A mix of domestic and international travel can help control costs.

16. Should I Consider Downsizing in Retirement?

Downsizing can free up home equity and reduce maintenance and property taxes. Moving to a smaller home or condo can lower expenses and provide extra funds for travel and leisure.

17. Will I Need Long-Term Care Insurance?

Long-term care is costly. A private room in a Florida nursing home can cost $100,000+ per year. Long-term care insurance can help cover these costs but can be expensive. Some retirees opt for hybrid policies that include life insurance benefits.

18. Can I Still Work Part-Time in Retirement?

Yes, part-time work can supplement your income, delay withdrawals, and provide social engagement. Many retirees work as consultants, freelancers, or in hospitality and retail.

19. How Can I Reduce Taxes on My Retirement Income?

Florida’s tax-friendly policies help, but consider tax-efficient withdrawal strategies:

Withdraw from taxable accounts first.

Delay Social Security to increase benefits.

Convert traditional IRAs to Roth IRAs gradually to reduce future RMDs (required minimum distributions).

20. How Can I Make Sure My Retirement Plan Is Secure?

Review your financial plan annually.

Keep a diverse portfolio.

Plan for healthcare and long-term care costs.

Adjust spending based on market performance.

Work with a financial planner for tailored advice.

1 note

·

View note

Text

Top 3 Reasons to Consider Crypto for Retirement Savings

As the financial landscape continues to evolve, retirement planning is no longer just about traditional assets like stocks, bonds, and real estate. Cryptocurrency is emerging as a viable option for long-term savings, offering potential benefits that can enhance retirement portfolios. While crypto is still considered a volatile asset, its unique advantages make it an attractive investment for forward-thinking retirees. Below, we explore the top three reasons to consider cryptocurrency for your retirement savings.

1. Potential for High Returns

One of the primary reasons investors consider cryptocurrency for retirement savings is its potential for high returns. Over the past decade, Bitcoin and other cryptocurrencies have significantly outperformed many traditional investment assets. While volatility is a concern, long-term holders (often referred to as "HODLers") have seen exponential gains.

Historical Growth Trends

Bitcoin has seen an average annual return of over 200% in its best years.

Ethereum, another major cryptocurrency, has provided significant returns due to its role in decentralized finance (DeFi) and smart contract applications.

Comparing Crypto with Traditional Investments

The stock market averages about a 10% annual return over time.

Real estate offers steady but lower gains, typically in the 5-10% range.

Bonds and savings accounts yield significantly lower returns.

While past performance does not guarantee future results, the historical data suggests that crypto assets have the potential to provide high-yield returns over a long-term horizon, making them an attractive option for retirement portfolios.

2. Hedge Against Inflation and Economic Instability

Inflation can erode the value of traditional retirement savings over time. Cryptocurrencies, particularly Bitcoin, are often considered a hedge against inflation and economic instability due to their decentralized nature and limited supply.

Why Crypto Acts as a Hedge

Bitcoin’s Fixed Supply: Unlike fiat currencies, which central banks can print indefinitely, Bitcoin has a fixed supply of 21 million coins, making it resistant to inflation.

Decentralization: Unlike traditional assets, cryptocurrencies operate on decentralized networks, meaning they are less susceptible to government control, banking failures, and geopolitical crises.

Global Demand: Cryptocurrencies are accessible worldwide, making them a valuable asset in times of financial instability, especially in countries experiencing economic turmoil.

With rising concerns about government debt and economic downturns, many investors view crypto as a safeguard to protect their retirement savings from the devaluation of traditional currencies.

3. Diversification and Portfolio Growth

A well-diversified investment portfolio helps mitigate risk while optimizing growth opportunities. Adding cryptocurrency to a retirement portfolio can enhance diversification and improve overall performance.

How Crypto Complements Traditional Investments

Crypto often moves independently of stock markets, providing an alternative asset that may perform well even during stock market downturns.

The increasing adoption of digital assets by institutional investors suggests long-term sustainability.

Blockchain technology continues to grow, with new applications emerging in finance, healthcare, real estate, and beyond, further strengthening the crypto market.

Including Crypto in Retirement Accounts

Bitcoin IRAs: Many financial institutions now offer Bitcoin and cryptocurrency IRAs, allowing investors to include digital assets in tax-advantaged retirement accounts.

Self-Directed IRAs: These allow investors to hold a variety of assets, including crypto, offering greater control and flexibility.

By incorporating a carefully selected amount of cryptocurrency into a retirement portfolio, investors can take advantage of growth potential while reducing overall risk through diversification.

How to Get Started with Crypto for Retirement

If you are considering adding cryptocurrency to your retirement savings, it's important to work with financial professionals who understand the market and can guide you through the process. At Manna Wealth Management, we offer expert cryptocurrency advisory services to help clients make informed investment decisions.

Steps to Consider:

Assess Your Risk Tolerance – Crypto is a high-risk asset; ensure it aligns with your financial goals.

Choose a Secure Wallet – Store your digital assets safely using hardware or multi-signature wallets.

Consider a Crypto IRA – Use tax-advantaged accounts to hold crypto for long-term growth.

Stay Informed – Follow market trends, regulatory developments, and institutional adoption.

Consult Experts – Seek professional advice from cryptocurrency advisors like those at Manna Wealth Management’s Cryptocurrency Advisory Services.

Final Thoughts

Cryptocurrency offers a compelling opportunity for retirement savings, with the potential for high returns, protection against inflation, and enhanced portfolio diversification. However, as with any investment, due diligence and professional guidance are key. By working with trusted advisors and using secure investment strategies, you can take advantage of this evolving asset class while managing risks effectively.

If you're interested in exploring cryptocurrency as part of your retirement strategy, reach out to Manna Wealth Management for expert guidance and tailored financial planning services.

0 notes

Text

How to Save More Money for Retirement Outside of Pension and 457(b) Plans

Planning for a secure retirement requires a multifaceted approach, especially when looking beyond traditional pension plans and 457(b) accounts. As a financial advisor with over 28 years of experience, I've guided many individuals in Florida toward achieving their retirement goals through diversified strategies. In this guide, we'll explore various methods to enhance your retirement savings, providing practical examples to illustrate each approach.

1. Maximize Contributions to Tax-Advantaged Accounts

Options to Consider:

Traditional IRAs: Tax-deferred growth with taxes paid upon withdrawal.

Roth IRAs: Tax-free growth since contributions are made after-tax.

Contribution Limits (2025):

Under 50: $6,500 annually

50 and older: $7,500 annually

Example:

Sarah, a 45-year-old Florida teacher, contributes $6,500 yearly to a Roth IRA.

With a 6% annual return over 20 years, her account could grow to $238,000, tax-free.

2. Utilize a Health Savings Account (HSA)

Key Benefits:

Triple Tax Advantage:

Contributions are tax-deductible.

Growth is tax-free.

Withdrawals for qualified medical expenses are tax-free.

Example:

John, 50, contributes the family maximum of $8,300 annually.

After 15 years at a 5% annual return, his HSA could grow to $165,000, which can cover medical costs in retirement.

3. Invest in Taxable Brokerage Accounts

Why Choose Brokerage Accounts?

Unlimited Contributions: No caps like retirement accounts.

Diverse Investment Options: Includes stocks, bonds, mutual funds, and ETFs.

Example:

Emily invests $10,000 yearly in a diversified portfolio.

Over 20 years, assuming a 7% annual return, her account could reach $424,000.

4. Explore Real Estate Investments

Benefits of Real Estate:

Steady Income: Passive rental income.

Appreciation Potential: Real estate values often rise over time.

Example:

Mike buys a $300,000 rental property in Miami, paying 20% down.

He nets $1,200 monthly in rental income. After 15 years, the mortgage is paid off, and the property appreciates to $450,000.

5. Leverage Employer-Sponsored Plans Beyond 457(b)

Consider These Options:

401(k) and 403(b) Plans: Take advantage of employer matching.

Example:

Lisa’s employer offers a 5% 401(k) match.

She contributes $20,000 annually, and her employer adds $1,000.

Over 25 years, with a 6% annual return, her savings grow to $1.2 million.

6. Delay Social Security Benefits

Key Advantage:

Increased Benefits: Delaying Social Security until age 70 increases monthly payments by about 8% per year.

Example:

Tom’s full retirement benefit is $2,000 monthly at 67.

By waiting until 70, his monthly benefit increases to $2,480, providing an extra $5,760 annually.

7. Start a Side Hustle or Part-Time Work

Benefits:

Additional Income: Keep earning while pursuing a passion.

Extra Investment Opportunities: Use the income to grow your retirement funds.

Example:

Maria, a retired teacher, earns $10,000 annually tutoring students part-time. She invests this extra income to boost her savings.

8. Follow a Tax-Efficient Withdrawal Strategy

Plan Your Withdrawals:

Withdraw from taxable accounts first, then tax-deferred, and finally tax-free accounts to minimize taxes.

Example:

David starts withdrawals from his taxable brokerage account, allowing his Roth IRA to grow tax-free and reducing his taxable income.

9. Review and Adjust Your Plan Regularly

Stay on Track:

Annual Check-Ins: Meet with a financial advisor to review your portfolio and adapt to changes.

Example:

Karen reviews her investment portfolio every year with her advisor, making adjustments based on market conditions and her goals.

Final Thoughts

By diversifying your retirement savings strategy, you can build a secure financial future. Whether through maximizing tax-advantaged accounts, investing in real estate, or leveraging a side hustle, every step brings you closer to a comfortable retirement.

For personalized guidance, contact David Kassir at Manna Wealth Management. With over 28 years of experience, we can help you tailor a plan that aligns with your goals and financial situation.

Secure your future today!

0 notes

Text

Donald Trump's $TRUMP Meme Coin: Crypto Gold or Campaign Gimmick?

In a move emblematic of the peculiar intersection of politics and cryptocurrency, Donald Trump has unveiled his own digital asset: a meme coin called $TRUMP. The launch took place on January 17th, 2025, just days before his presidential inauguration, and has since created shockwaves in both the political and crypto spheres. Within 24 hours, the coin's market capitalization reached an astonishing $4.8 billion, with a fully diluted valuation of $24.3 billion. Could this signal the next big thing in meme coins, or is it simply a shrewd campaign strategy?

A Presidential Coin for the Meme Economy

Announced via Trump’s official X (formerly Twitter) and Truth Social accounts, $TRUMP is a Solana-based meme coin designed to make a splash in the crypto ecosystem. The announcement redirected users to a dedicated website, sparking excitement across the crypto community. As the news broke, interest surged, with many speculating on whether the token could compete with meme coin giants like Dogecoin.

According to BeInCrypto, the coin's market capitalization shot to $8 billion within three hours, with trading volumes nearing $1 billion. The price of $TRUMP skyrocketed by over 300%, climbing from an initial value of $0.18 to $7.10 within hours.

Legitimacy or Gimmick?

While the announcement came from official channels, skepticism loomed over its authenticity. Was it a legitimate launch, or had Trump's accounts been hacked? Later, The Verge reported that sources close to Trump’s family confirmed the coin’s legitimacy, dispelling rumors of a cyber-attack.

Nevertheless, questions about the coin’s purpose remain. Is this simply a meme coin leveraging Trump’s personal brand, or is there a broader financial or political agenda at play?

Tokenomics: Concentrated Wealth and Centralized Control

The $TRUMP token comes with a total supply of 1 billion tokens, which will be unlocked over three years. Currently, 200 million tokens are available for trading, while the remaining 80% of the supply is locked in a multi-signature wallet. According to BeInCrypto, the bulk of the tokens are allocated to six entities, including CIC Digital Groups, a company tied to Trump’s trust. This same company was responsible for managing Trump’s previous NFT ventures.

This allocation strategy has raised concerns within the crypto community. Experts are wary of the potential for price manipulation, as 90% of the circulating supply is controlled by the top five wallets. Such concentrated ownership could make the coin vulnerable to sharp price fluctuations.

The Potential for $TRUMP: Can It Dethrone Dogecoin?

Currently trading at $25, $TRUMP’s potential for further growth is a hot topic among crypto enthusiasts. With Dogecoin maintaining a market capitalization of approximately $60 billion, some speculate that Trump Coin could reach $100-$300 per token if it surpasses Dogecoin as the leading meme coin.

However, such predictions are purely speculative. Meme coins are inherently volatile, with their value often hinging more on community enthusiasm than underlying fundamentals. The success of $TRUMP could depend heavily on sustaining its hype and preventing sell-offs by large holders.

Meme Coins and Regulatory Impact

Beyond its market performance, $TRUMP raises larger questions about the state of cryptocurrency regulation and innovation. Its launch coincides with the departure of Gary Gensler, the former chair of the SEC, whose tenure was marked by aggressive crypto enforcement. Ironically, Gensler’s strict regulatory approach may have stifled utility-focused tokens, inadvertently encouraging the rise of meme coins like $TRUMP.

Unlike utility tokens, meme coins operate in a legal gray area by explicitly positioning themselves as speculative assets. Without promising profit-sharing or utility, they evade the SEC’s classification as securities. This dynamic has allowed meme coins such as Dogecoin, Shiba Inu, and now Trump Coin to flourish, while more ambitious projects like Libra (later Diem) and LBRY faced insurmountable regulatory challenges.

The Broader Implications for Crypto

Whether $TRUMP succeeds or fails as an investment, its existence marks a pivotal moment in the intersection of cryptocurrency and politics. For Trump, the coin represents yet another extension of his brand into the digital realm. For the crypto industry, it underscores the growing significance of meme coins as cultural and financial phenomena.

As the coin gains traction, it could set a precedent for future political campaigns or celebrity endorsements in the crypto space. At the same time, its rise may spark debates about the need for clearer regulatory frameworks to address issues like centralized control and market manipulation.

A Word of Caution

For those considering an investment in $TRUMP, the risks are as apparent as the opportunities. Meme coins are notoriously volatile, and the concentrated ownership structure of $TRUMP raises red flags for potential price manipulation. Investors should approach this asset with careful research and a clear understanding of the risks involved.

For guidance on navigating the complexities of cryptocurrency investments, Manna Wealth Management offers professional cryptocurrency advisory services. Whether you’re a seasoned investor or new to the space, working with experts can help you make informed decisions and mitigate risks in this unpredictable market.

Conclusion

The launch of $TRUMP is a fascinating experiment at the crossroads of politics, cryptocurrency, and branding. Whether it ultimately thrives as a meme coin or fades into obscurity, it’s a bold statement about the current state of digital finance and political innovation. As $TRUMP vies for meme coin supremacy, it also raises pressing questions about the evolving role of cryptocurrencies in shaping economic and regulatory landscapes.

0 notes

Text

How Spot Bitcoin ETFs Changed Crypto Investing in the Year Since Launch