Don't wanna be here? Send us removal request.

Text

Daiwa grants Goldman Sachs an outperform rating in light of the anticipated resurgence in the investment banking sector.

Goldman Sachs Steps into the Limelight: Daiwa's Delightful Upgrade

In a move that echoes the symphony of Wall Street, Goldman Sachs Group Inc. finds itself ascending to new heights as Daiwa Capital Markets bestows upon it the coveted outperform rating. Amidst the ebb and flow of financial tides, Analyst Kazuya Nishimura emerges as the maestro, orchestrating a crescendo of bullish sentiment towards the investment banking juggernaut.

With a flick of the wrist and a dash of optimism, Nishimura opines on the prospects of major U.S. banks, reserving his highest praise for none other than Goldman Sachs. Like a phoenix rising from the ashes, Goldman stands poised to lead the pack with its Wall Street deal-making prowess. Nishimura, in his symphonic proclamation, raises the stock's price target by a harmonious $20 to a resonating $430 per share.

"It's akin to predicting the weather in a financial storm, but Goldman Sachs shines as the brightest star among the galaxy of major banks," Nishimura quips in his research opus. With the tempest of negative catalysts subsiding, Goldman's ship sails smoothly into the hopeful horizon of investment banking resurgence.

As the melody of recovery wafts through the halls of finance, Nishimura envisions Goldman Sachs outpacing market expectations, its sails billowing with the winds of tightened cost controls. The stage set by Daiwa Capital Markets brims with optimism, heralding a bullish overture for big-bank performance in 2024.

In this financial sonnet, Goldman Sachs takes its place on the podium, ranking third in Nishimura's orchestration of major banks. Citigroup and JPMorgan Chase find themselves in the limelight, each bearing their own mantle of promise, while Wells Fargo awaits the lifting of its regulatory shackles.

As the curtain falls on this act of financial theater, Daiwa's ratings stand as the applause, with JPMorgan Chase and Citigroup basking in the glow of a buy recommendation. Meanwhile, Bank of America, Wells Fargo, and the newly anointed Goldman Sachs revel in the warmth of an outperform rating, leaving Morgan Stanley to await its cue in the neutral zone.

In this grand spectacle of finance, where numbers dance and charts sing, Goldman Sachs emerges as the lead performer, ready to take center stage in the epic saga of investment banking resurgence.

0 notes

Text

UBS's Goal: Setting Sights on the No. 6 Spot Among U.S. Investment Banks (Yep, Sixth Place)

Ah, strap yourselves in, folks, for UBS is pulling off a comeback story that would make even the most seasoned Wall Street cynic raise an eyebrow. After a hiatus that felt like an eternity in finance years, the Swiss juggernaut is strutting back onto the U.S. investment-banking dance floor, but this time, they're doing it with a touch of Swiss precision and a sprinkle of newfound humility.

Gone are the days of swinging for the fences like an overeager rookie. Nope, this time around, UBS is playing it cool, taking measured steps to reclaim its slice of the pie amidst the wreckage left by its peers' misfortunes and a takeover frenzy in the financial realm.

Picture this: while others are gunning for the gold, UBS executives are calmly sipping their espresso, outlining plans to snag the title of "Numero Sei" in the U.S. market. Sure, it's not exactly aiming for the stars, but hey, in an industry fueled by hubris and ambition, a little modesty can be refreshing.

Let's face it, the U.S. investment-banking scene is like a high-stakes poker game, and UBS is determined not to bluff its way to the top. While others have tried and failed spectacularly, UBS is playing the long game, focusing on being the best of the rest and a global force to be reckoned with.

But hey, even the best-laid plans can hit a few speed bumps. UBS might be a lean, mean banking machine, but it's still got limits. Chief Executive Officer Sergio Ermotti has made it clear: they're not abandoning their bread and butter, wealth management, for a wild investment-banking fling. So, while the dreams of a UBS investment-banking empire might be alive and kicking, they're still keeping one foot firmly planted in the world of wealth.

And let's not forget the skeptics, the naysayers who whisper tales of past failures and missed opportunities. But hey, who doesn't love an underdog story? With a little Swiss ingenuity and a lot of strategic maneuvering, UBS is poised to shake up the status quo once again.

So, will UBS succeed in its quest to reclaim its spot among the investment-banking elite? Well, grab your popcorn and stay tuned, because this is one financial rollercoaster you won't want to miss.

0 notes

Text

KKR's Latest Move: Decoding Japan's Real Estate Investment Revolution

Henry Kravis, the maestro behind KKR's financial symphony, isn't shying away from Japan's real estate realm, even with whispers of interest rates picking up for the first time since '07.

Ralph Rosenberg, the mastermind steering KKR's real estate ship globally, isn't just dipping toes but diving headfirst into Japan's property pool. Bloomberg's got the scoop on KKR's readiness to splash out anywhere from $20 million to a cool billion in Japanese real estate.

What's the allure? Well, Japan's been playing the low-interest-rate game for ages, courtesy of the Bank of Japan's playbook. It's been a gravy train for investors, with returns comfortably riding shotgun over borrowing costs.

But wait, there's more! Despite the looming interest rate shuffle, Rosenberg's sanguine about Japan's investment allure. He's pointing to the stable yet enticing gap between returns and costs, crediting Japan's prudent approach to speculation and property price hikes.

While other economies are battening down the hatches against inflation storms, Japan's been riding the deflation-defying wave with negative interest rates. But hey, winds of change are blowing, and wages are rising. Yet, Rosenberg's not losing sleep over it. KKR's still getting sweet borrowing deals at around the mid-1%.

So, where's KKR placing its bets? Think top-notch assets in multifamily digs, logistics hubs, and hospitality havens, eyeing returns of 4-5% before the debt dragon's accounted for.

And what's up with those exiting investors? Rosenberg's brushing off their farewell waves as more about liquidity cravings than doubts in Japan's real estate mojo.

He's seeing Japan's economic pulse in sync with its property prospects, signaling green lights for investments. Plus, KKR's got its sights set on swooping in on property partings with Japanese firms, a nifty side dish to its private equity antics in the Land of the Rising Sun.

Recent buys like the Hyatt Regency Tokyo tag team and snagging a real estate asset manager previously in UBS Group AG and Mitsubishi Corp.'s stable? Just more proof that KKR's got a one-way ticket to Japan's real estate rollercoaster.

With a cool $69 billion in global property power, including a $16 billion slice in Asia Pacific, KKR's real estate empire is only getting bigger. And this journey? Well, it's been a ride since 2011.

0 notes

Text

Mitsubishi Electric invests 100M into Nozomi Networks

Well, well, well, Nozomi Networks just hit the jackpot with a hefty $100 million Series E funding round. And guess who's popping the champagne? None other than industry big shots Mitsubishi Electric and Schneider Electric. Talk about putting your money where the cyber threats are!

CEO Edgard Capdevielle isn't beating around the bush—he knows we need security solutions that can shape-shift across all kinds of environments. With cyber threats knocking on everyone's door, this investment is like a shot of adrenaline for their product development and global expansion plans.

Barbara Frei-Spreiter from Schneider Electric is singing the same tune, emphasizing the importance of cybersecurity that can flex its muscles in any industrial setting. And let's not forget Satoshi Takeda from Mitsubishi Electric, giving Nozomi Networks a pat on the back for their game-changing role in keeping critical infrastructure safe and sound.

Nozomi Networks isn't just talking the talk—they've got the numbers to back it up. Over a decade of leading the charge in OT and IoT cybersecurity, protecting a whopping 105 million devices worldwide. And get this, their ARR has skyrocketed fivefold since they dropped their Vantage product like it's hot in 2021.

With Mitsubishi Electric and Schneider Electric hopping on board alongside other heavy hitters like Activate Capital and Honeywell Ventures, Nozomi Networks is all set to be the superhero of the cyber world, defending critical infrastructure from every cyber villain out there.

0 notes

Text

Sources suggest that the Bank of Japan is inclined to proceed cautiously with rate hikes, even in the event of terminating its negative-rate policy.

Ah, picture this: the Bank of Japan's dance with interest rates is like watching a turtle run a marathon. Sources whisper that even if they bid adieu to negative rates, they'll tiptoe like ballerinas before considering positive territory. Why rush when the nation's inflation game is still playing hide and seek after decades of tag with deflation?

Sure, inflation's been poking its head above the 2% target for a while now, but BOJ bigwigs aren't exactly doing cartwheels about it. They're wary of pulling a 'Fed move' and kicking off a rate hike spree like it's going out of style. One insider even quipped, "Speeding up the rate hike train might just derail the economy!"

And let's not forget the market rollercoaster! The Nikkei took a dive like it was auditioning for the Olympics of plunges just on the rumors of BOJ antics. Talk about being sensitive!

Now, BOJ Governor Kazuo Ueda and the gang have been singing the '2% inflation' anthem, but investors seem to be humming a different tune, barely nudging inflation expectations past the 1% mark. It's like they're saying, "We'll believe it when we see it, fellas!"

Meanwhile, Finance Minister Shunichi Suzuki crashed the party, reminding everyone that Japan's still got some deflation hangover to shake off. Talk about throwing shade on the inflation parade!

0 notes

Text

Becoming an investment banker Progress report November 2023 - March 2024

Written by Michael, on Mar. 12 , 2024

Image stolen from the Dolphine Project progress report - Short link

As I transition out of the military, Its time to apply more pressure to the areas of my life that will move me into investment banking. I want to document as much as possible so that I can both keep track of my changes and others can follow in my footsteps. Big updates are I'm not out of the military, I've completed a pseudo internship at Goldman Sachs, and have a new job at Accenture Federal Services paying about the same as my previous job - not accounting for taxes.

In some more important news, I am testing a new 'operating system' for myself that has more checks for productivity and progress making. It's been a challenge to get into a good rhythm that works with my wife and my own needs at the same time, but it is getting easier as time goes on.

Add to all of that a marathon of my first ever internship applications and my internship prep, and another course I signed up for and you've got yourself a BAIB Progress Report.

Enjoy.

Notable Changes

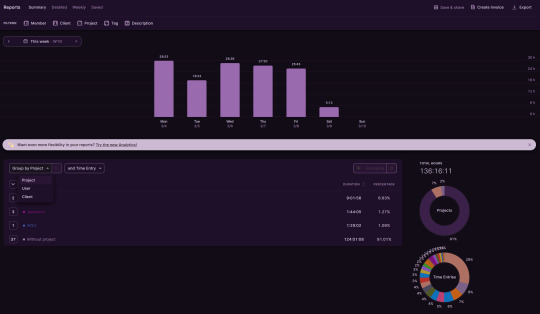

Started using Toggl again from a reminder on a Rian Doris video. I've been following Rian Doris for a while and his videos are just unreal as far as the quality and actionability of them goes.

The 10-Minute Rule That Makes Hard Work Feel Like TikTok

When I first implemented watching these videos regularly, I ended up tracking them in outlook as "Flow" R&D. I make it a point to watch a video per week and implement the lessons in my schedule.

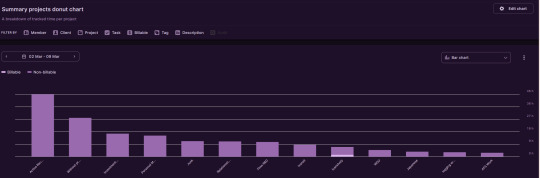

Unable to track things properly without assigning them 'Projects"

I can use something like this but it doesn't really offer any insigts unless EVERYTHING is in a categroie. So I took about 45 minutes and put everything in a category.

I did more time driving than I can study prep

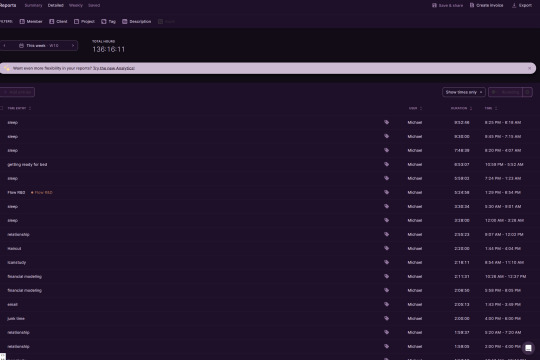

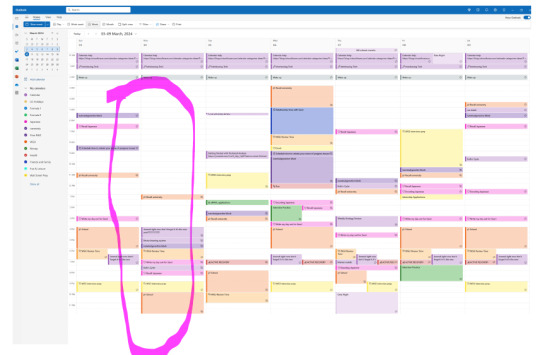

This is what typical calendar looks like when I plan it. You can see here where I tried moving things around if I didn't get a chance to get to the, I don't always do it and find it easier to just track what I'm doing in toggl and get back to work

This is what calendar integration looks like. I struggle with doing things 'on schedule' because I don't have as much control of my day as I would like to. This is actually alarming as I'm on vacation until the 25th. I should have total control of my calendar life but I use small things like my wife needing a ride to work both as a crutch not to get things done when I say I will, and as a crutch to not try to plan my day at all.

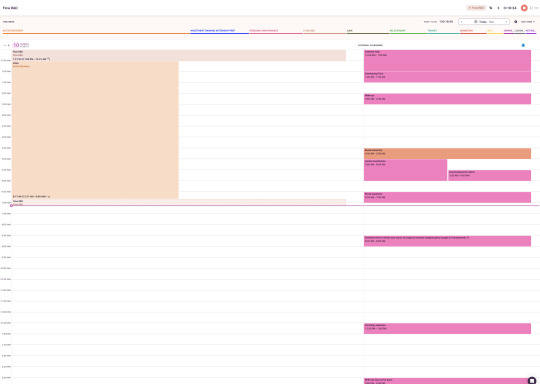

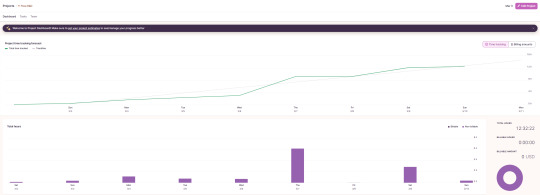

I think its shocking that as someone who prioritizes personal performance, I never bothered to track my time.

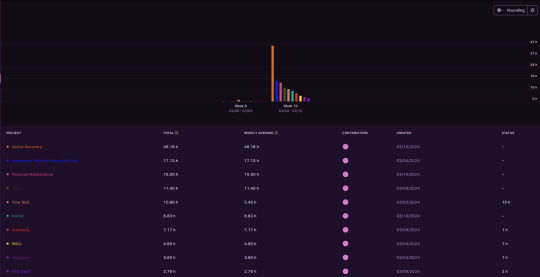

Its interesting to see this particular line graph for each project, but as far as I can tell there isn't a way to view these overlayed on each other or even on the same screen without screenshotting them manually.

The other course I signed up for is icanstudy. Its got a bunch of study methods for you to try out.

Knowledge mastery (order of learning)

Techniques

Lower-order

(Best for direct fact recall and detail memorization)

3Cs

Flashcards (simple)

Brain dump (linear)

Generated questions (isolated)

Teaching (isolated)

Feynman method*

Method of loci or our Modified Method of Loci

Story/link method

Ben system

Mid-order

(Best for knowledge application, basic problem solving, and obvious relationships)

Flashcards (simple relational)

Brain dump (mindmap)*

Generated questions (simple relational or multi-relational)

Teaching (simple relational)

Practice questions (direct method and advanced group method*)

Feynman method*

Higher-order

(Best for discussions and complex problem-solving where multiple concepts affect each other)

Chunkmaps

Flashcards (evaluative)

Brain dump (mindmap)*

Generated questions (evaluative)

Teaching (Modified WPW)

Peer/Group discussion (evaluative)

Practice questions (extended method and advanced group method*)

Feynman method*

The course is a little expensive but it comes with access to the instructors and a discord community, so I'm finding value from it

Answering the questions

Evaluating our confidence

Creating perfect answers

Checking our answers against official answers to find even more gaps

Choose a Topic: Select the topic or concept you want to learn or understand.

Teach it to a Child: Explain the topic as if you were teaching it to a child or someone with no prior knowledge of the subject. Use simple language and avoid jargon.

Identify Gaps and Simplify: As you explain the topic, pay attention to areas where your explanation is unclear or where you struggle to simplify. This helps you identify gaps in your understanding.

Review and Refine: Go back to your primary sources and learning materials to fill in the gaps and improve your understanding. Simplify your explanation further if necessary.

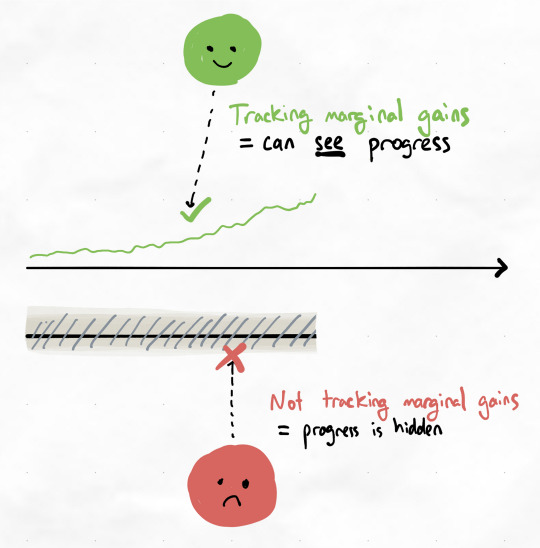

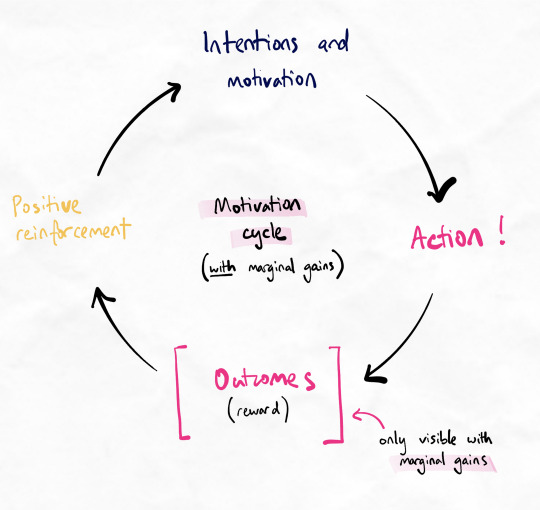

right now I'm focusing on marginal gains

Think about marginal gains consistently. Train yourself to view progress through this lens by default.

Whenever you make mistakes, feed them back in as reflections for your next cycle of experiments.

Avoid randomly experimenting on different changes every time.

Get feedback on your work and progress regularly.

Ensure you are getting advice from reliable, qualified sources of expertise.

Non-linear note-taking

Delayed note-taking

Grouping and categorising

So Anyway, this is the report. I'll check in next month with an improved reporting methods. See ya!

0 notes

Text

Moving from youtube

Deciding to move from youtube as keeping up posting consistently stresses me out and the fomo of not being a top-10 creator stresses me out too. I start thinking about how to monetize and how to get more subscribers and I loose the internal drive to just get better at investment banking. I'll hopefully find it easier here.

0 notes

Text

Setting priorities

First post.

Train on Flow

Ryan Doris

Free videos on YouTube - the key is to take notes and implement the lessons properly.

Train on Studying

I canStudy.com

Train on Math

Khan Academy

This is actually to fill in the gaps with my math knowledge and what is required to finish undergrad.

Train on Modeling

Aswath Damodaran

I want to pay for the wall st prep ones but I want to commit to and complete a free one before I do.

Finish School

Sophia/ WGU

Already submitted my transcripts to WGU so while I'm waiting to start in FEB i can do khan academy for the courses I know I need to take

Apply for MBA programs

Want to be located in a school close to new york or one of these List of Investment Banks | Boutique and Middle-Market (2023) (wallstreetprep.com)

Have each school's timeline for applications

looks something like below - not in order

University of Pennsylvania

New York University

University of Michigan

The University of Texas at Austin

Georgetown

Harvard

Columbia

Cornell

Yale

Brown

Where I go to school is NETWORKING BASED, so pretty much in New york or somewhere near a bunch of regional boutiques. I can also DCF and model on my own and post it here. Most important thing is finishing undergrad, then getting experience. I can get the experience modeling online and sending in reports for review.

0 notes