Future Market Insights (ESOMAR certified market research organization and a member of the Greater New York Chamber of Commerce) provides in-depth insights into governing factors elevating the demand in the market. It discloses opportunities that will favour the market growth in various segments based on Source, Application, Sales Channel and End-Use over the next 10 years.

Don't wanna be here? Send us removal request.

Text

Cocoa Beans Market to Reach USD 17.3 Billion by 2030, Driven by Premium Chocolate Demand and Functional Beverage Applications

The global cocoa beans market is valued at USD 14.4 billion in 2025 and is forecasted to grow to USD 17.3 billion by 2030, recording a CAGR of 3.74% during the forecast period. This steady expansion in market size is supported by Europe's processing dominance, rising premium chocolate consumption in North America, and production challenges in West Africa. Additionally, the growing ready-to-drink (RTD) functional beverage segment is driving demand for cocoa-derived polyphenol ingredients, expanding the market beyond traditional confectionery applications.

Get More Insights: https://www.mordorintelligence.com/industry-reports/cocoa-beans-market

Cocoa Beans Market Key Trends

Sustained Demand from Chocolate Manufacturers

Cocoa beans remain critical for the global chocolate industry, with demand strengthening as consumers seek premium, clean-label, and traceable products. The introduction of new chocolate variants, such as Hershey’s Choco Delights milk chocolate bar with crunchy inclusions in 2024, underscores manufacturers’ focus on product innovation to maintain brand relevance. This trend is expanding the market share of cocoa beans within premium and specialty chocolate categories.

Advanced Farming Technologies Enhance Production

Technological advancements in farming are improving cocoa yields and sustainability. For example, Kerala Agricultural University in India developed a cocoa bean extractor in 2023 to automate pod processing, reducing manual labour and injury risks while maintaining bean quality. Similarly, Lutheran World Relief launched Cacao Movil in 2024, a mobile app offering South American farmers interactive training on modern farming practices. Adoption of drones, sensors, and satellite imaging continues to improve productivity and climate resilience across major producing regions.

Government Initiatives Support Growers

Supportive government programs are helping stabilise cocoa bean supply chains. Côte d'Ivoire committed USD 16.75 million annually from 2024 to assist small exporters in securing bank financing, potentially doubling their annual purchasing capacity. Malaysia allocated USD 2.13 million in 2024 to revitalise cocoa projects, aiming to boost local production and strengthen its position within the global market.

Functional RTD Cocoa Beverages Create New Demand Streams

The popularity of cocoa-derived polyphenols for their antioxidant and cardiovascular benefits is fuelling demand in the functional beverage segment, particularly in North America. RTD products are incorporating cocoa ingredients as natural caffeine alternatives to synthetic sources, supporting market expansion into energy and wellness drinks. This shift enhances market value by diversifying applications beyond chocolate manufacturing.

Cocoa Beans Market Segmentation

By Geography

Europe maintained its leadership in 2024 with a 45% share of the cocoa bean market value, driven by extensive processing capacities, ethical sourcing initiatives, and advanced blockchain traceability systems. However, rising energy costs and reduced stockpiles are pressuring processor margins despite sustained demand for premium certified products.

North America is projected to grow at a CAGR of 7.2% through 2030. The region's market size is bolstered by the increasing launch of functional beverages using cocoa extracts, alongside expansion in craft chocolate manufacturing that values flavour-specific small-batch liquors.

Asia-Pacific is expanding its market share as Indonesia attracts processors with favourable geographical proximity and government incentives. Brazil in South America aims to double production by 2030 through mechanisation and disease-resistant varieties, reducing reliance on West African supplies.

Cocoa Beans Market Drivers Impacting Growth

Chocolate industry demand remains the largest growth driver, particularly in Europe and North America, supporting stable increases in the size of the cocoa beans market.

Advanced farming technologies are raising yields and improving sustainability across West Africa, South America, and Asia-Pacific.

Government initiatives in producing countries are strengthening supply chains and grower incomes.

Functional RTD cocoa beverages are creating new market opportunities for polyphenol-rich cocoa ingredients beyond traditional confectionery.

Cocoa Beans Market Restraints Impacting Growth

Disease outbreaks such as swollen shoot and black pod disease in Ghana and Côte d'Ivoire continue to threaten supply reliability, with swollen shoot affecting over 80% of cocoa-planted areas in Ghana’s Western North region in 2023.

Emergence of substitutes such as cocoa-free chocolate alternatives may impact traditional cocoa demand, particularly in mass-market products. For example, Voyage Foods launched a cocoa-free chocolate bar in 2024 using grape seeds and sunflower protein flour, offering a comparable flavour and texture profile.

Cocoa Beans Market Key Players and Recent Developments

Recent developments highlight strategic investments and sustainability commitments across the cocoa beans market:

February 2025: Guan Chong Berhad (GCB) acquired a 25% stake in Transcao Côte d'Ivoire, expanding its processing footprint at the world's largest cocoa origin.

January 2025: Mars, Incorporated committed to supporting 14,000 cocoa farmers in Côte d'Ivoire and Indonesia towards achieving a sustainable living income by 2030 under its Cocoa for Generations strategy.

January 2025: Olam Food Ingredients (ofi) set new targets to enhance regenerative agriculture practices in cocoa, aiming to cover over one million hectares by 2030, with plans to plant 15 million trees and establish seven landscape partnerships.

Get More Insights on This Industry: https://www.mordorintelligence.com/ja/industry-reports/cocoa-beans-market

Conclusion

The global cocoa beans market is set to reach USD 17.3 billion by 2030, with stable growth supported by premium chocolate demand, government-led farmer support, and expanding functional beverage applications. While Europe maintains the largest market share through processing strength and ethical sourcing programs, North America’s market size is increasing rapidly with innovations in RTD beverages and craft chocolate manufacturing. Technological advancements in farming, disease management efforts, and sustainability investments are key to ensuring consistent supply and market resilience amid challenges such as disease outbreaks and emerging cocoa substitutes. Companies and producing countries that integrate traceability, climate-smart farming, and product diversification will remain well-positioned to capitalise on the evolving global cocoa beans market landscape.

0 notes

Text

Cotton Market Size to Reach USD 51.60 Billion by 2030, Driven by Sustainable Farming and Traceability Demands

The global cotton market size is valued at USD 44.30 billion in 2025 and is projected to reach USD 51.60 billion by 2030, growing at a CAGR of 3.1% during the forecast period. This growth is underpinned by sustainability mandates, precision farming adoption, and increasing traceability regulations reshaping global supply chains. While the size of the cotton market continues to expand steadily, rising demand from major textile hubs such as Bangladesh and Vietnam, alongside Better Cotton Initiative (BCI) sourcing requirements, is changing the competitive landscape for growers and merchants worldwide.

Get More Insights: https://www.mordorintelligence.com/industry-reports/cotton-market

Cotton Market Key Trends

Persistent Demand from Textile-Importing Hubs

Major textile-importing countries such as Bangladesh and Vietnam continue to drive robust demand for high-grade cotton lint. Bangladesh is poised to become the world’s largest lint importer by 2025, reaching an estimated 8 million bales as mills seek uniform fiber characteristics for premium yarn production. Meanwhile, West African lint is gaining market share in Bangladesh, accounting for 39% of imports in fiscal 2022–23 due to its high micronaire values and assured pesticide-residue compliance.

Shift Toward Better Cotton Initiative Sourcing

BCI-certified cotton is becoming a procurement requirement rather than a preference, with over 2.13 million farmers across 22 countries adopting its protocols. Global retailers increased BCI lint purchases by 40% in the latest reporting cycle, driven by sustainability commitments from brands such as H&M and Target to source 100% verified cotton by 2030. This shift enhances the market position of compliant growers and merchants who can provide certified fiber under mass-balance chain-of-custody models.

Growth in Recycled Cotton Blends

While recycled cotton accounts for just 1% of total supply, demand is outstripping available feedstock due to sustainability targets set by global apparel majors. For example, Patagonia integrates 28% recycled cotton by weight in its fabrics. Mechanical recycling remains dominant, though new investments in chemical recycling, like Circ’s USD 500 million French plant, are expected to improve fiber yield and strength. Despite recycling growth, virgin cotton remains essential to maintain yarn performance, supporting a balanced market outlook.

Climate-Smart Irrigation and AI Forecasting Adoption

Climate-smart irrigation is increasingly adopted in North America and Australia, as sensor-based systems and AI yield-forecasting tools improve water-use efficiency and crop profitability. For instance, Arizona growers using deficit irrigation strategies achieved 10% yield gains while saving significant water resources, enhancing net margins despite rising input costs.

Cotton Market Segmentation

By Geography

North America holds the largest share of the cotton market, accounting for 38.9% of global value in 2024. Advanced precision farming tools, digitised classing, and robust traceability programs ensure consistent quality and compliance, strengthening North American lint’s position as a low-risk sourcing option for global brands.

Africa is projected to grow at a CAGR of 5.60% through 2030, driven by government subsidy programs supporting seed, fertilizer, and pest-control inputs. West African lint is expanding its presence in Asian markets, while initiatives such as Benin’s Special Economic Zone are boosting local yarn-spinning capacity.

Asia-Pacific remains a significant contributor to cotton output, with India focusing on stacked-trait seed development to combat pest resistance and Pakistan adopting climate-smart irrigation. Australia continues to maintain stable exports through IoT-enabled deficit-irrigation technologies. China primarily consumes its domestic cotton while managing import quotas to stabilize prices for its textile sector.

By Application

The cotton market remains dominated by textile manufacturing, accounting for the largest share of cotton utilization globally. However, segments such as recycled cotton blends are rising in importance as sustainability pressures increase across the apparel industry.

Cotton Market Drivers Impacting Growth

Persistent demand for high-grade lint in textile hubs such as Bangladesh and Vietnam is supporting market stability.

Better Cotton Initiative adoption is increasing, shifting sourcing preferences towards certified sustainable producers.

Growing use of recycled cotton blends is enhancing premium pricing opportunities while retaining virgin cotton’s essential role.

Climate-smart irrigation investments are improving yield resilience amid tightening water constraints in developed markets.

AI-enabled yield forecasting tools are reducing merchant risks and improving grower profitability.

Cotton Market Restraints Impacting Growth

Pink-bollworm resistance to GM traits is rising in countries like India and China, prompting reliance on integrated pest management.

Traceability and forced-labor regulations, such as the US Uyghur Forced Labor Prevention Act, are increasing compliance costs and slowing trade flows.

Competition from cellulosic fibers remains a structural headwind, particularly in fast-fashion segments prioritising cost and sustainability.

Volatile ocean-freight rates continue to impact merchant margins across global trade routes.

Cotton Market Key Players and Recent Developments

Recent industry updates highlight strategic shifts in major producing countries:

In June 2025, the Cotton Corporation of India procured 100 lakh bales at Minimum Support Prices, supporting farmers amid weak domestic demand.

In April 2025, India and Australia signed an MoU to boost bilateral cotton trade, enabling duty-free import of 51,000 metric tons annually into India.

In January 2025, Brazil exported 3.7 million metric tons of cotton for the 2024 season, a 16.64% increase year-on-year, cementing its role as the world’s leading exporter.

Major market players and institutions continue to focus on sustainability, digital traceability, and irrigation efficiency to maintain competitive advantage amid shifting regulatory landscapes and consumer expectations.

Get More Insights on this report: https://www.mordorintelligence.com/ja/industry-reports/cotton-market

Conclusion

The global cotton market is set to grow steadily to USD 51.60 billion by 2030, supported by robust demand from textile-importing nations, adoption of sustainability standards, and integration of climate-smart farming practices. While market size expansion is moderate, higher-value segments such as BCI-certified and recycled cotton blends are capturing a larger share within the market. Key producing regions are adapting to challenges such as pest resistance and water scarcity through technology investments and diversified sourcing strategies. As traceability regulations tighten globally, growers and merchants with transparent, compliant supply chains will be best positioned to capture future market growth and ensure long-term resilience.

0 notes

Text

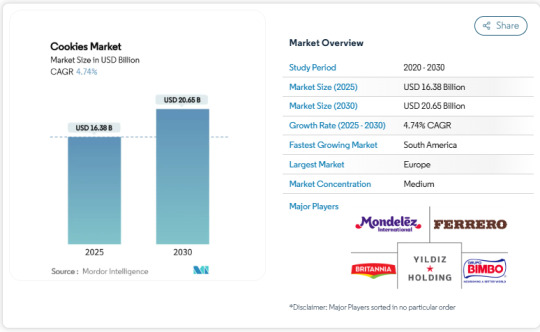

Global Cookies Market to Hit USD 20.65 Billion by 2030 Amid Demand for Portion-Controlled and Fortified Treats

The global cookies market size is valued at USD 16.38 billion in 2025 and is forecasted to reach USD 20.65 billion by 2030, advancing at a CAGR of 4.74% over the forecast period. Growth is supported by stable snacking demand worldwide, coupled with health-focused reformulations and premium positioning that align with evolving consumer preferences. Although conventional formats continue to dominate the size of the market, portion-controlled, fortified, and plant-based cookies are capturing incremental value, countering input cost volatility and broadening the overall market base.

Get More Insights: https://www.mordorintelligence.com/industry-reports/cookies-market

Cookies Market Key Trends

Rising Demand for Portion-Controlled Indulgence

The cookies industry is witnessing a notable shift towards portion-controlled indulgence snacks. Health-conscious consumers are opting for mini-cookies and single-serve packs to enjoy treats without overconsumption. This trend has driven major brands to reformulate recipes to meet the FDA’s upcoming 2028 “healthy” labeling rules, requiring tighter thresholds on saturated fat, sodium, and added sugars. Market leaders report premium pricing on portion-controlled lines, translating to favourable margins despite raw-material inflation.

Urban On-the-Go Breakfast Culture Accelerates Demand

Rapid urbanisation in Asia-Pacific and Latin America has driven a transformation in breakfast habits, with consumers opting for convenient cookie-based breakfast alternatives. Brands such as Olyra Foods are addressing this trend with fortified breakfast biscuits that offer high fibre and low sugar in portable formats. This pivot towards breakfast-positioned cookies is expanding the market share of cookies among time-constrained professionals in metropolitan hubs.

Fortification and Nutrient Enhancement Fuel Market Growth

Fortified cookies are growing as consumers seek functional foods that deliver health benefits beyond basic indulgence. Companies are incorporating proteins, vitamins, minerals, and plant-based nutrients into cookies, transforming them into purposeful snacks that appeal to children, seniors, and athletes. This fortification trend is strengthening the position of cookies as versatile products aligned with both indulgence and health-conscious consumption patterns.

Gifting and Premiumisation Strengthen Emotional Positioning

Cookies have become popular gifting items beyond traditional holidays, extending into corporate gifts and personal celebrations. Brands like La Monarca Bakery launched new premium assortments, such as Mexican cookies featuring wedding cookies, cinnamon cookies, and Polvorones, emphasising artisanal craftsmanship and heritage appeal. This strategy is enhancing the value share of premium cookie lines in gifting markets.

Cookies Market Segmentation

By Product Type

Butter/Shortbread and Plain Cookies remain the leading segment with a market share of 33.85% in 2024, driven by their familiarity and classic appeal.

Bar Cookies are the fastest-growing, projected to advance at a CAGR of 6.05% through 2030. Their portion-control format resonates with health-conscious consumers seeking convenient, nutrient-rich options.

Molded/Drop Cookies continue to grow steadily due to manufacturing versatility, while Sandwich and Cream-filled Cookies maintain a niche in indulgent snacking.

By Category

Conventional Cookies accounted for 92.11% of the cookies market size in 2024, underlining mainstream consumer preferences.

Free-from Cookies are gaining momentum with a forecast CAGR of 6.77%, reflecting rising demand for allergen-free and vegan formulations that cater to specific dietary needs and command premium pricing.

By Distribution Channel

Hypermarkets and Supermarkets lead cookie distribution with a market share of 39.55% in 2024, leveraging broad consumer access and promotional reach.

Online Retail is the fastest-growing channel, advancing at a CAGR of 6.68% through 2030. Direct-to-consumer subscription services and e-commerce platforms provide brands with deeper consumer insights and higher margins.

By Packaging Format

Pouches and Sachets dominate packaging, accounting for 63.43% of market share in 2024, offering convenience and freshness.

Cartons are projected to grow at 5.88% CAGR, driven by premium gifting and sustainable packaging demands that elevate brand differentiation.

By Geography

Europe retained leadership with a cookies market share of 30.12% in 2024, benefiting from heritage brands, premium offerings, and robust regulatory standards.

South America is projected to record the fastest growth at a CAGR of 6.89%, driven by rising health-conscious snacking trends and investments like Nestlé’s USD 550.8 million expansion in Brazil.

Asia-Pacific continues to provide growth opportunities through rising middle-class consumption in countries like China and India, while North America remains a mature market focusing on premium, fortified, and direct-to-consumer innovations.

Cookies Market Key Players

The cookies sector maintains moderate market concentration with global conglomerates competing alongside regional specialists.

Mondelēz International, Inc. continues to strengthen its portfolio through partnerships like its June 2024 deal with Lotus Bakeries to expand the Biscoff brand in India.

Ferrero International S.A. leverages premiumisation with indulgent offerings under multiple brands.

Britannia Industries Ltd. dominates the Indian market with a broad product range catering to both mass and premium segments.

Grupo Bimbo SAB de CV enhances distribution scale across the Americas, integrating cookies into its extensive bakery network.

Yildiz Holding A.S. maintains strong positions in Europe and the Middle East with diversified biscuit and cookie offerings.

New entrants are disrupting traditional sales channels via direct-to-consumer models, while leading firms invest in digital marketing, e-commerce, and data analytics to remain competitive. Strategic acquisitions and joint ventures continue as companies seek to consolidate market share and expand product portfolios.

To Know More about this market, Visit: https://www.mordorintelligence.com/ja/industry-reports/cookies-market

Conclusion

The global cookies market is set for steady growth to USD 20.65 billion by 2030, underpinned by rising portion-controlled snack demand, fortified functional products, and premium gifting trends. While conventional formats continue to dominate the overall market size, segments such as bar cookies, free-from formulations, and online retail are growing rapidly, expanding the market share of cookies within broader snacking categories. Key players are focusing on reformulation to meet new health regulations, investing in sustainability-led packaging, and leveraging direct-to-consumer channels to enhance margins and consumer loyalty. As consumer expectations shift towards healthier yet indulgent treats, the cookies market remains well-positioned to balance traditional appeal with modern nutritional and convenience demands.

0 notes

Text

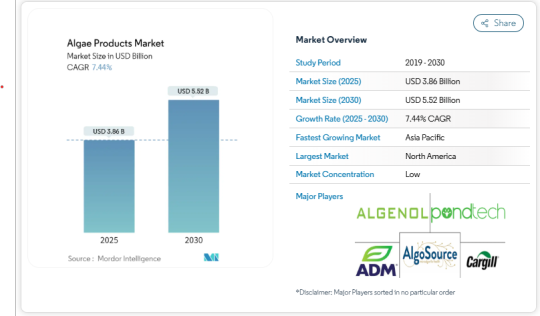

Algae Products Market Size to Reach USD 5.52 Billion by 2030 at 7.44% CAGR

The Algae Products Market is poised for strong growth, with its size estimated at USD 3.86 billion in 2025 and projected to reach USD 5.52 billion by 2030, reflecting a CAGR of 7.44% during the forecast period (2025-2030). This expansion is driven by rising demand for natural, sustainable, and functional ingredients across multiple sectors.

Get More Insights: https://www.mordorintelligence.com/industry-reports/algae-products-market

Rising Demand for Sustainable Products

One of the key drivers for the growth in the size of the Algae Products market is shifting consumer preference towards environmentally friendly and sustainable products. A recent survey highlighted that 71% of North American consumers seek sustainable options, a trend echoed globally. This is particularly evident in the personal care and cosmetics segment, where 72.33% of millennials in Europe use natural and organic products, fueling demand for algae-based formulations.

Production capabilities have also expanded, with China achieving a cultured algae production volume of 2.72 million metric tons in 2022, showcasing the robust manufacturing infrastructure supporting the share of the Algae Products market.

Integration into Food and Beverage Applications

Functional foods and beverages are becoming mainstream, driving algae’s use as a nutrient-rich ingredient. According to the Hartman Group, 46% of US adults consume functional foods for health benefits like digestion, energy, and bone strength. This trend has attracted investments, such as Thai Union Group’s EUR 13 million funding into algae startup Algama in January 2023, underlining strategic investor interest in the Algae Products Market.

Innovative launches support this integration. In July 2023, SimpliGood by AlgaeCore Technologies introduced a plant-based chicken schnitzel with 80% pure spirulina, and in May 2023, Corbion launched its AlgaVia line featuring omega-3 and omega-9 rich ingredients produced through algae fermentation.

Health Benefits Drive Market Share

The share of the Algae Products market is expanding due to algae’s numerous health benefits. Algae supplements provide essential nutrients such as proteins, vitamins, antioxidants, and omega-3 fatty acids, supporting immune health, heart health, and cognitive functions. The rise in plant-based protein demand is boosting algae-derived omega-3 products as sustainable alternatives to fish oil supplements.

Spirulina, in particular, dominates the market with approximately 53% share in 2024 due to its chlorophyll content, antimicrobial, and antioxidant properties. Its versatility spans food and beverages, cosmetics, and animal feed, strengthening its position within the Algae Products Market.

Focus on Natural and Sustainable Ingredients

Consumers’ aversion to synthetic chemicals has increased demand for plant-based options like algae. For example, in November 2022, GNT launched EXBERRY Shade Bright Green, a spirulina-turmeric blend for vibrant food color applications. Sustainability is integral to algae cultivation, requiring minimal land and water compared to traditional crops, resonating with the 71% of global consumers shifting to sustainable purchases.

Microalgae in Cosmetics and Blue Beauty

Microalgae have emerged as powerful ingredients in the cosmetics industry due to their antioxidant and anti-inflammatory properties. In 2022, Merck launched RonaCare JouvaMer, an algae extract targeting anti-aging through collagen stimulation. Such innovations cater to the rising number of consumers with sensitive skin seeking natural skincare solutions, further increasing the size of the Algae Products market in personal care applications.

Segment and Regional Analysis

By application, food and beverages lead with around 35% market share in 2024. Algae is widely used in dairy, yogurt, baby formulas, bakery items, and beverages, driven by its nutritional value and clean-label benefits.

The personal care and cosmetics segment is set to grow at approximately 12% CAGR from 2024 to 2029 due to algae’s unique properties that enhance skincare and beauty formulations. The dietary supplements and animal feed segments also play critical roles, with algae being integrated into health supplements, pet food, and livestock feed to enhance nutritional profiles.

Regionally, North America dominates the Algae Products Market due to consumer preference for sustainable and plant-based alternatives, with the United States holding about 77% of the regional share. Europe also shows strong growth, supported by stringent quality standards and consumer interest in natural products, with France commanding approximately 19% of Europe’s market.

Asia-Pacific is emerging rapidly due to expanding production capacity and rising consumer awareness, while South America and the Middle East & Africa show promising growth driven by favorable cultivation conditions and sustainability initiatives.

Competitive Landscape

Key players shaping the market include:

Archer Daniels Midland Company

Cargill, Incorporated

AlgoSource

Algenol Biotech

Pond Technologies Holdings Inc.

These companies focus on innovation, strategic investments, and partnerships to strengthen their market positions. For example, Brevel secured USD 18.5 million in seed funding in July 2023 to expand its algae-based ingredient production, reflecting investor confidence in algae’s potential.

Outlook

The Algae Products Market is set for robust growth driven by sustainability trends, health benefits, and technological advancements in cultivation and processing. As companies continue to innovate with algae-based food products, cosmetics, supplements, and bio-based industrial applications, the market’s expansion is expected to remain strong through 2030.

0 notes

Text

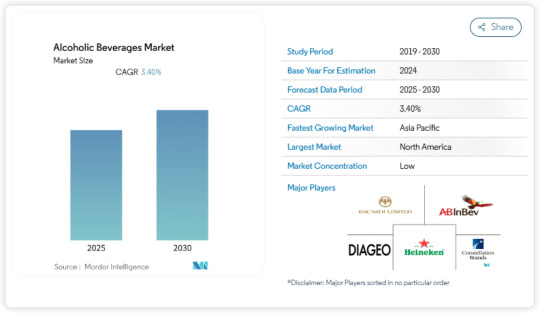

Alcoholic Beverages Market Size to Grow at 3.40% CAGR from 2025 to 2030

The global alcoholic beverages market size is poised for steady growth, registering a CAGR of 3.40% during the forecast period (2025-2030). This rise is fueled by an increasing young population, higher disposable incomes, and evolving consumer preferences towards premium offerings.

Get More Insights: https://www.mordorintelligence.com/industry-reports/alcoholic-beverages-market

Craft Beer and Product Innovation Fuel Growth

One key driver of market expansion is the growing demand for new variants, particularly in craft beer. Breweries worldwide are developing mild-lager and specialty beers tailored to shifting consumer tastes. In the United States, regional breweries accounted for 65.7% of craft beer production in 2021, while local microbreweries contributed 18.4%. This surge reflects consumers’ interest in diverse flavors and locally brewed options.

Premiumization Shapes Market Trends

Consumers today seek high-quality, distinctive alcoholic beverages, driving the premium and super-premium segments. According to the Distilled Spirits Council of the United States, 21.7 million 9-liter cases of premium whiskey and 21.1 million 9-liter cases of premium vodka were consumed in 2021. Moreover, super-premium whiskey and vodka posted impressive year-on-year growth rates of 14.1% and 13.9%, respectively.

Health-conscious consumers also prefer premium alcoholic beverages, often perceived as cleaner and safer options. Manufacturers are responding by introducing functional alcoholic drinks with exotic natural ingredients. For instance, in March 2022, Whitley Neill launched Oriental Spiced Gin in the United Kingdom, featuring botanicals such as coriander, ginger, chili, cumin, saffron, and star anise to attract health-focused drinkers.

Online Retail Expands Market Reach

The market has observed a notable rise in online retailing. Platforms like Drizly have recorded strong revenue growth in alcohol delivery, driven by consumer convenience and digital ordering trends. During the COVID-19 pandemic, companies witnessed increased off-premise sales as consumers stocked up for in-home consumption. For example, Constellation Brands reported a 30% surge in beer volume through US off-premise channels in February 2020.

Impact of COVID-19 on Market Dynamics

While the pandemic temporarily closed specialty shops, bars, and restaurants, off-premise sales growth and in-house consumption cushioned the overall market. Companies like Pernod Ricard revised financial outlooks due to restrictions, yet rising prices and stocking behaviors helped stabilize revenues. The demand for spirits such as whiskey and gin also increased during this period.

North America Maintains Market Leadership

North America remains a dominant region in the alcoholic beverages market share due to its substantial young adult demographic and growing preference for premium drinks. Higher disposable incomes and the popularity of craft beer and craft spirits are supporting regional growth. In the United States, over 10,000 wineries cater to diverse consumer preferences, with California holding over 85% of the market share. Wines with labels such as gluten-free, low carb, vegan-friendly, and organic are gaining traction as health-focused consumption grows.

Competitive Landscape Highlights

The alcoholic beverages market is highly competitive, with major global players accounting for significant shares. Key companies include:

Anheuser-Busch InBev

Heineken Holding NV

Diageo

Bacardi Limited

Constellation Brands Inc.

These players adopt strategies like mergers, acquisitions, partnerships, and product innovations to strengthen their market positions. For instance, in June 2021, Diageo India launched United’s Epitome Reserve, an artisanal craft whisky made from 100% rice, released in a limited batch of 2,000 numbered bottles to tap into the premium craft segment.

Looking Forward

The alcoholic beverages market is expected to remain robust, driven by a rising global young adult population, premiumization trends, and innovative product launches. As breweries and distilleries focus on meeting health-conscious demands with functional and exotic variants, the market will continue evolving to match changing consumer lifestyles and preferences.

0 notes

Text

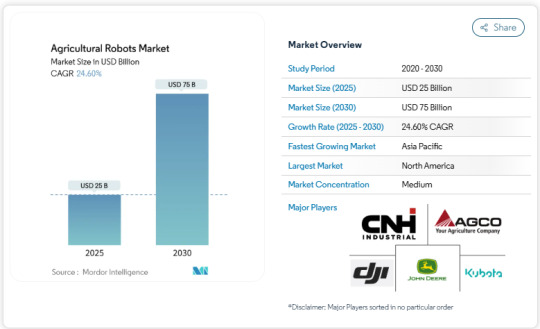

Agricultural Robots Market Set to Triple by 2030 Amid Labor Shortages and Tech Advancements

The global agricultural robots market size is experiencing rapid growth, with its value projected to rise from USD 25 billion in 2025 to USD 75 billion by 2030, reflecting a robust CAGR of 24.6%. This expansion is driven by the need to offset labor shortages, boost productivity, and manage input costs through advanced automation technologies.

Get More Insights: https://www.mordorintelligence.com/industry-reports/agricultural-robots-market

Why Farmers are Turning to Robots

Farm labor shortages have become a structural issue, particularly in North America and Europe, where an aging farmer population and shrinking rural workforce threaten production continuity. For instance, 60% of U.S. agribusinesses delayed projects in 2024 due to difficulties in securing seasonal labor. Autonomous robots offer a reliable solution, operating 24/7 without overtime and reducing wage-related pressures. Companies now focus on deploying user-friendly systems that integrate easily into existing farm operations, lowering adoption barriers for growers.

Strong Investment Backing Fuels Innovation

Investment trends continue to favor agricultural robotics, despite broader AgTech funding volatility. In 2024, capital directed to farm robotics rose 9%, highlighting investor confidence in scalable automation. Notable collaborations include New Holland’s partnership with Bluewhite to retrofit specialty tractors, a move expected to cut orchard and vineyard operating costs by up to 85%. Start-ups such as Verdant Robotics and Fieldwork Robotics have also secured significant funding to accelerate product development and global market entry.

Government Incentives Accelerate Adoption

Public initiatives tying sustainability goals to technology adoption are shaping the market. For example, the UK’s Improving Farm Productivity grant subsidizes autonomous systems, while Australia’s National Robotics Strategy targets AUD 600 billion (USD 420 billion) in economic gains through robotics, with agriculture as a priority sector. These incentives shorten payback periods for farmers and encourage investments in advanced automation.

Rapid Technological Advances

Technological progress in AI, computer vision, and LIDAR is enhancing agricultural robots’ capabilities. Companies like John Deere are integrating multi-camera systems and machine learning to achieve centimeter-level precision under challenging field conditions. Such advances enable robots to detect obstacles, classify plants, and adapt their operations in real time, supporting new use cases in greenhouse and broad-acre farming.

Market Segmentation Insights

By Technology: UAVs and drones held a 35% market share in 2024, with automated harvesting systems posting the fastest 26% CAGR. Drones remain essential for aerial imagery and spraying, while harvesting robots address labor shortages in fruit and vegetable production.

By Application: Broad-acre farming tasks, such as fertilizing and weeding, accounted for 24% of market revenue in 2024. Greenhouse automation is growing at a 24% CAGR, with robots performing tasks like spraying, pollination, and selective harvesting in controlled environments.

By Offering: Hardware dominated with 60% of revenue in 2024, driven by robust robotic chassis, arms, and navigation modules. However, software is expanding at a 21% CAGR, as farmers demand integrated platforms for fleet management, predictive maintenance, and prescription mapping.

Regional Analysis

North America leads the market share with a 37% revenue share, backed by large farm sizes, regulatory support, and strong venture capital flows. Companies like Carbon Robotics continue to attract major investments for chemical-free weeding solutions.

Asia-Pacific is the fastest-growing region at a 25.5% CAGR, driven by China’s funding of domestic robotics firms and Japan’s subsidies for orchard automation. Australia’s National Robotics Strategy further fuels regional growth, while India explores affordable weeding and spraying robots suited to smallholders.

Europe’s growth is supported by labor shortages, strict crop protection regulations, and sustainability goals. The EU’s updated Machinery Regulation provides clearer compliance pathways for autonomous machines, while countries like Germany and the UK pilot electric and multi-robot solutions in various crop sectors.

Challenges Facing the Market

Despite its growth, the agricultural robots market faces barriers, particularly in developing economies. High upfront costs and uncertain returns deter smallholders, while fragmented certification standards for autonomous machines increase compliance complexity for manufacturers. Gaps in rural connectivity also limit real-time control capabilities in parts of Africa and Asia.

Competitive Landscape

The market is moderately concentrated, with the top five companies commanding 56% of global revenue. Key players include:

Deere & Company: Leading innovations in battery-powered electric powertrains and autonomous navigation.

CNH Industrial N.V.: Partnering with start-ups to retrofit tractors with autonomy kits.

AGCO Corporation: Offering OutRun retrofit kits that enhance fuel efficiency and cross-fleet compatibility.

Kubota Corporation: Advancing specialized autonomous machinery for orchard and horticulture use.

SZ DJI Technology Co., Ltd.: Dominating UAV segments with robust drone solutions.

The competitive edge now hinges on AI model robustness, precision perception systems, and integrated software ecosystems. Companies that bundle hardware with subscription-based software and service packages are better positioned to capture long-term customer value, especially as hardware becomes increasingly commoditized.

Looking Ahead

As agricultural robots continue to prove their value in boosting productivity, reducing labor dependence, and supporting sustainable farming, their adoption is set to accelerate across regions and crop segments. Falling component prices, supportive policies, and rapid technological innovation suggest a market poised for robust expansion through the next decade.

0 notes

Text

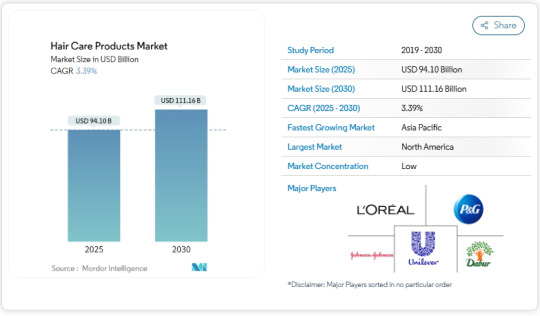

Hair Care Products Market to Reach USD 111.16 Billion by 2030, Driven by Organic Ingredients, Scalp Health Awareness, and Asia-Pacific Growth

The global hair care products market is forecast to grow from USD 94.10 billion in 2025 to USD 111.16 billion by 2030, registering a compound annual growth rate (CAGR) of 3.39%. Rising demand for specialized hair treatments, natural and organic ingredients, and evolving consumer lifestyles—particularly in Asia-Pacific—are driving this steady growth. Leading companies such as Procter & Gamble, L'Oréal, Unilever, Johnson & Johnson, and Dabur are expanding their portfolios to meet these shifting preferences.

Consumer interest in hair care has expanded well beyond basic grooming. Concerns about hair thinning, dandruff, sensitivity, and hair loss are pushing demand for products formulated to treat specific scalp and hair conditions. Alongside this, the popularity of fashion-forward hairstyling trends is increasing the use of salon-quality styling products.

Across developed and emerging markets alike, consumers are looking for products that combine convenience, performance, and clean formulations. The increasing presence of working women, urban migration, and greater exposure to heat-styling tools are key lifestyle factors that have elevated the importance of targeted and restorative hair care.

Get More Insights: https://www.mordorintelligence.com/industry-reports/hair-care-products-market

Key Trends: What’s Shaping the Hair Care Market

1. Increased Spending on Specialist and Organic Hair Care

Global consumers are spending more on products tailored to their hair types and concerns. In the U.S., for example, average annual household spending on hair care products rose to USD 85.53 in 2022, up from USD 77.17 in 2021 (U.S. Bureau of Labor Statistics).

There is also a marked shift toward natural formulations. Consumers are reading labels more carefully and avoiding harsh chemicals like sulfates and parabens. Organic oils, herbal shampoos, and clean-label serums are in high demand—especially in markets where hair care is deeply linked to traditional remedies.

Product launches such as Dabur India’s Ayurvedic Vatika Neelibhringa21 and Conagra’s Evol carbon-neutral frozen meals (a sustainability case parallel) highlight growing consumer expectations around both natural ingredients and environmental responsibility.

2. Fashion and Lifestyle Influence Hair Styling Trends

Hair styling products are benefiting from the rising popularity of fashion and celebrity culture. Demand is especially high for damage-repair serums, heat protectants, and color-protecting shampoos as consumers replicate salon styles at home. In the UK alone, households spent nearly GBP 1.74 billion on personal care salon services in Q2 2022, a reflection of growing salon visits and premium hair product purchases.

This trend is further boosted by the social media influence of beauty bloggers and celebrities, who drive interest in styling tools and the latest hair care routines.

Market Segmentation: What Consumers Are Buying

The hair care products market includes a range of categories such as shampoos, conditioners, oils, serums, styling products, and colorants. Key drivers by category include:

Shampoos and Conditioners

Largest share of the organic segment due to daily usage

Popular formats include anti-dandruff, sulfate-free, and volumizing formulas

Hair Oils

High demand for Ayurvedic and herbal oils in Asia

Moroccan oil continues to trend globally for its restorative benefits

Styling Products

Fast-growing segment fueled by home styling needs

Includes heat-protectant sprays, gels, mousses, and hair waxes

Hair Serums and Treatments

Focused on specific issues like hair fall, frizz control, and scalp sensitivity

Increasingly formulated with plant-derived actives and vitamins

Regional Insights: Asia-Pacific Leading Global Growth

Asia-Pacific: Fastest-Growing Market

Asia-Pacific is emerging as the fastest-growing region in the hair care sector. Countries like China, India, and Japan are showing strong demand due to changing consumer dynamics, urban lifestyles, and rising female workforce participation. In China, the female labor force participation rate stood at 61.07% in 2022, creating demand for time-efficient, multi-functional hair products.

India’s growing organic beauty segment and strong Ayurvedic heritage further support product innovation. In February 2022, Arata launched an advanced curl care range in India to meet demand from the curly-haired community, showing how niche products are entering mainstream retail.

Europe: Strong Market for Natural and Clean Beauty

Europe remains a key market, with a mature consumer base that demands ingredient transparency and efficacy. Shoppers in Germany, France, and the UK continue to prefer eco-conscious brands and sulfate-free, paraben-free formulations.

North America: Premiumization and Hair Wellness

In North America, the market is shaped by consumer willingness to spend on premium hair health solutions. Products focused on scalp health, hair loss prevention, and color preservation are performing well. U.S. consumers are also fueling growth in salon-quality at-home treatments.

Key Players: Innovation, Ingredients, and Sustainability Drive Strategy

The hair care products industry is competitive and innovation-driven. Major players are focusing on organic product development, brand repositioning, and sustainable packaging to stay ahead in a dynamic market.

Leading Companies Include:

Procter & Gamble: Offers a wide range of hair care products under brands like Pantene and Head & Shoulders. Strong focus on scalp health and digital marketing.

L'Oréal SA: Market leader with brands like L’Oréal Paris and Garnier. Focused on sustainable sourcing and inclusive product ranges for diverse hair types.

Unilever PLC:Owns brands such as Dove and TRESemmé. Active in both premium and mass-market segments.

Johnson & Johnson: Known for dermatology-backed hair care, with a focus on scalp conditions and sensitive skin.

Dabur India Ltd: A key player in the Ayurvedic and natural segment, with a strong foothold in India and growing global presence.

In addition to product development, these companies are investing in digital campaigns, influencer collaborations, and localized offerings to deepen market reach.

Conclusion: Hair Care Moves Toward Wellness, Sustainability, and Personalization

The global hair care products market is evolving into a more personalized, health-focused, and environmentally conscious space. Consumers are no longer looking for just clean hair—they want products that treat specific concerns, fit their lifestyle, and reflect their values.

With strong regional growth in Asia-Pacific and steady demand in Europe and North America, the market is set for healthy expansion through 2030. Brands that can balance performance, clean formulations, and targeted solutions will be best positioned to lead this evolving market. The future of hair care is holistic, inclusive, and increasingly ingredient-conscious.

About Mordor Intelligence: Mordor Intelligence is a trusted partner for businesses seeking comprehensive and actionable market intelligence. Our global reach, expert team, and tailored solutions empower organizations and individuals to make informed decisions, navigate complex markets, and achieve their strategic goals. With a team of over 550 domain experts and on-ground specialists spanning 150+ countries, Mordor Intelligence possesses a unique understanding of the global business landscape. This expertise translates into comprehensive syndicated and custom research reports covering a wide spectrum of industries, including aerospace & defense, agriculture, animal nutrition and wellness, automation, automotive, chemicals & materials, consumer goods & services, electronics, energy & power, financial services, food & beverages, healthcare, hospitality & tourism, information & communications technology, investment opportunities, and logistics.

For any inquiries or to access the full report, please contact: [email protected] https://www.mordorintelligence.com/

0 notes

Text

Global Ready Meals Market Set to Grow at 4.62% CAGR, Driven by Demand for Convenience, Organic Options, and Ethnic Varieties

The global ready meals market is projected to expand at a compound annual growth rate (CAGR) of 4.62% from 2025 to 2030. This growth is supported by increased consumer preference for convenient, time-saving food solutions, a rising number of working professionals and students, and the growing popularity of organic and ethnic ready meals. Market leaders such as Nestlé SA, Conagra Brands, Nomad Foods, McCain Foods, and J.M. Smucker Co. are responding with innovative offerings and expanding product portfolios.

The demand for ready meals continues to rise as modern consumers seek food options that are fast, easy to prepare, and require minimal effort. In an increasingly urban and fast-paced world, these products meet the needs of busy professionals, students, and families who value convenience without compromising on taste or variety.

Chilled and frozen ready meals are leading the segment, offering long shelf lives and broad variety. Ethnic food options—such as Indian curries, Thai noodles, and Italian pizzas—are gaining popularity globally. Frozen pizza, in particular, stands out as the most consumed ethnic ready meal, contributing significantly to global revenue.

Urbanization, rising disposable incomes, and lifestyle shifts are key drivers of this trend. With more working women and time-constrained students, the demand for grab-and-go meals and products that require minimal preparation continues to accelerate.

Get More Insights: https://www.mordorintelligence.com/industry-reports/ready-meals-market

Key Trends: What’s Driving the Market

1. Surge in Organic and Health-Conscious Ready Meals

Health awareness is playing a more prominent role in shaping the ready meals segment. More consumers are scrutinizing food labels and seeking out healthier options—especially organic and minimally processed meals. This shift is driven by concerns over food safety, artificial additives, and long-term health impacts.

As a result, brands are responding with clean-label and organic product lines. Evol, a brand by Conagra, became the first frozen food brand to offer certified carbon-neutral meals in 2022, reflecting both environmental and health-conscious commitments. Portion-controlled packaging and balanced nutrition further add to the appeal of organic ready meals.

2. Cultural Curiosity Fuels Ethnic Ready Meal Demand

Global consumers are more adventurous with their food choices, embracing dishes from various cultures. Ethnic ready meals such as frozen Indian curries, Chinese stir-fries, and Mexican burritos are gaining ground. The popularity of frozen pizza alone highlights the appeal of globally inspired comfort foods.

Manufacturers are introducing new products to meet this demand. J.M. Smucker Co., for instance, launched Uncrustables pepperoni roll-ups and bites that cater to Western tastes with an Italian twist. This rising interest in international cuisines presents a strong opportunity for brands to diversify their portfolios and capture new market segments.

Market Segmentation: Product Categories and Consumer Segments

Ready meals are segmented by type (chilled, frozen, canned, shelf-stable), ingredient focus (meat-based, vegetarian, organic), and consumer application (individual, family, on-the-go). Key drivers for each segment include:

Chilled and Frozen Meals

High demand due to long shelf life and wide variety

Easy to store and reheat; ideal for busy households and singles

Organic and Clean-Label Meals

Growing appeal among health-conscious consumers

Includes gluten-free, plant-based, and preservative-free options

Ethnic and International Dishes

Increasingly popular in Western and Asian markets

Wide range includes Italian, Indian, Thai, and Mediterranean cuisines

Ready-to-Heat Snacks and Mini-Meals

Especially appealing to college students and office workers

Often microwavable and portion-controlled

Geographic Insights: Europe Leads, Asia and North America Rising

Europe: Core Market for Natural and Convenient Meals

Europe continues to dominate the ready meals market, with Germany, the UK, and France showing robust growth. European consumers are particularly drawn to products with natural ingredients, minimal additives, and quick prep times. As consumption rises, major players like Nestlé and Nomad Foods are launching new offerings to match evolving regional tastes.

For example, Nestlé’s Garden Gourmet line introduced plant-based shrimp (Vrimp) and egg alternatives in 2021, reinforcing the continent’s growing interest in both convenience and sustainability.

Asia-Pacific: Urban Growth and Western Influence Fuel Adoption

Urbanization and changing work patterns in countries like India and China are boosting demand for fast and convenient meals. Western QSR trends and busy lifestyles are leading to greater consumption of frozen meals and pre-packaged snacks, especially among younger populations and dual-income households.

North America: Convenience and Clean-Label Dominate

In the United States, demand for ready meals continues to grow, supported by interest in clean-label, organic, and functional meals. The popularity of frozen options remains strong, and brands are actively investing in innovation to meet these needs. College students and working adults represent a particularly active consumer base.

Key Players: Expansion, Innovation, and Market Penetration

The ready meals market is dominated by a few key players with wide geographic reach and diversified product offerings. These companies are actively investing in product development, sustainability, and strategic acquisitions to maintain market leadership.

Major Companies Include:

Nestlé SA: A global food leader, Nestlé continues to invest in plant-based and clean-label ready meals to meet evolving health trends.

Conagra Brands, Inc.: Known for product innovation and sustainability, Conagra’s Evol brand is leading in organic and carbon-neutral ready meal options.

Nomad Foods Group: Strong in the European market, Nomad focuses on frozen meals and natural ingredient formulations.

McCain Foods Limited: A major name in frozen foods, McCain offers diverse ready meal products that align with comfort food trends.

J.M. Smucker Co.: Expanding into the lunch and snack segments with inventive ready-to-eat solutions tailored for younger demographics.

These companies maintain a competitive edge through strong supply chains, ongoing R&D investments, and close attention to consumer preferences, especially in the areas of health and sustainability.

Conclusion: The Future of Ready Meals Is Global, Convenient, and Health-Conscious

The ready meals market is set for consistent growth through 2030, supported by global shifts toward urban living, health awareness, and convenience. Consumers increasingly favor meals that are quick to prepare, nutritionally balanced, and aligned with their lifestyle and dietary values.

With innovation in organic offerings, ethnic meals, and sustainable packaging, the ready meals sector is no longer just about convenience—it’s about choice, quality, and trust. Companies that continue to invest in healthier ingredients, global flavors, and environmentally friendly practices are well positioned to lead this market into the next decade.

About Mordor Intelligence: Mordor Intelligence is a trusted partner for businesses seeking comprehensive and actionable market intelligence. Our global reach, expert team, and tailored solutions empower organizations and individuals to make informed decisions, navigate complex markets, and achieve their strategic goals. With a team of over 550 domain experts and on-ground specialists spanning 150+ countries, Mordor Intelligence possesses a unique understanding of the global business landscape. This expertise translates into comprehensive syndicated and custom research reports covering a wide spectrum of industries, including aerospace & defense, agriculture, animal nutrition and wellness, automation, automotive, chemicals & materials, consumer goods & services, electronics, energy & power, financial services, food & beverages, healthcare, hospitality & tourism, information & communications technology, investment opportunities, and logistics.

For any inquiries or to access the full report, please contact: [email protected] https://www.mordorintelligence.com/

0 notes

Text

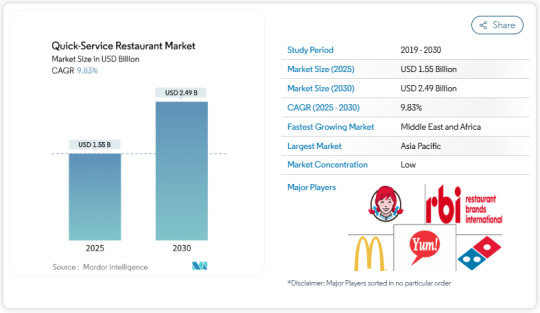

Global Quick Service Restaurant (QSR) Market to Reach USD 2.49 Billion by 2030, Fueled by Urbanization, Menu Customization, and Delivery Innovation

The global quick service restaurant (QSR) market is projected to expand from USD 1.55 billion in 2025 to USD 2.49 billion by 2030, growing at a CAGR of 9.83%. Key factors contributing to this growth include increased urbanization, time-constrained lifestyles, expanding food delivery services, and rising demand for customizable, globally inspired menu options. Leading brands such as McDonald's, Yum! Brands, Domino’s Pizza, and Restaurant Brands International are capitalizing on evolving consumer behavior with targeted expansions and technology-driven services.

Quick service restaurants have become a staple of modern urban life. As more people gravitate toward cities and adopt busy, on-the-go lifestyles, demand for affordable, efficient, and accessible food options continues to rise. QSRs fill this need by offering standardized menus, speedy service, and increasingly, mobile-friendly ordering and delivery systems.

Global chains are investing heavily in expansion and digital infrastructure to strengthen their market presence. McDonald’s, for instance, aims to operate 50,000 outlets worldwide by 2027, reflecting the sector’s confidence in its long-term growth. Additionally, delivery services such as Uber Eats, DoorDash, and WAAYU are reshaping the way consumers interact with restaurants, making off-premise dining more convenient than ever.

Get More Insights: https://www.mordorintelligence.com/industry-reports/quick-service-restaurants-market

Quick Service Restaurant (QSR) Market Key Trends:

1. Growing Demand for International and Customizable Meat-Based Menus

As global consumers explore more diverse cuisines, QSRs are responding with expanded meat-based offerings. Poultry, which remains the most consumed meat globally (140 million tons in 2023), features heavily in updated menus that include grilled chicken, gourmet burgers, and regional dishes like peri-peri chicken.

Customization is a major appeal for modern consumers. Chains such as Chipotle are creating new brands like Farmesa, offering options such as grilled tri-tip steak and salmon bowls that cater to health-conscious and flavor-focused diners. Local adaptations, like Jollibee’s customized offerings in Vietnam, help QSRs resonate with regional tastes while maintaining global appeal.

2. Delivery and Digital Ordering Fuel Market Reach

The surge in app-based food delivery has redefined convenience in the QSR space. From DoorDash in the U.S. to Swiggy in India, consumers can now access a wide range of food options with just a few taps on their phone. Innovations such as WAAYU’s zero-commission delivery app in Hyderabad reflect the growing diversity of solutions in this area.

Digital platforms don’t just support delivery—they help build loyalty and boost efficiency. Personalized promotions, loyalty rewards, and real-time updates are making digital platforms central to the customer experience.

Quick Service Restaurant (QSR) Market Segmentation: Who’s Driving the Demand and Where

Asia-Pacific Leads Global QSR Growth

Asia-Pacific holds a commanding position in the QSR market due to a large population, growing urban centers, and increasing disposable incomes. Countries like China, India, and Japan show strong adoption of QSR formats:

China: With 60.9% of the population aged 16–59, QSRs meet the needs of a busy working demographic. Chains maintain customer loyalty through efficiency and affordability.

India: Urban consumers are increasingly drawn to fast, affordable meals. Brands like McDonald’s are rapidly expanding, with Westlife Foodworld opening 15 new outlets in one quarter alone.

Japan: Menu localization is key. QSRs in Japan successfully balance traditional cuisine with modern offerings, maintaining broad appeal.

Australia: Dining out is on the rise, with a 72% increase in restaurant spending between 2021 and 2025, creating more opportunities for QSRs.

Other Key Regions

North America: A mature yet growing market, driven by delivery innovation, loyalty programs, and product diversification.

Europe: Consumers continue to seek fast dining options with an emphasis on sustainability and locally sourced ingredients.

Middle East & Africa: Growing middle-class populations and an increase in international tourism are accelerating QSR development.

South America: A rising interest in Western food formats and mobile ordering supports steady growth in urban centers.

Quick Service Restaurant (QSR) Market Key Players: Strategies and Competitive Landscape

The QSR market is highly competitive, with global brands competing alongside strong regional and local players. Market leaders focus on expansion, menu innovation, partnerships, and customer engagement to maintain and grow their positions.

Leading Companies Include:

McDonald’s Corporation: A global icon, McDonald’s continues to expand aggressively and lead in digital integration, with innovations in self-service kiosks and delivery partnerships.

Yum! Brands, Inc.: Parent of KFC, Taco Bell, and Pizza Hut, Yum! Brands focuses on emerging markets and localized product development.

Domino’s Pizza, Inc.: Known for delivery efficiency, Domino’s remains a key player by investing in technology and operational scalability.

The Wendy’s Company: Wendy’s continues to explore international growth and offers differentiated products like premium burgers and breakfast menus.

Restaurant Brands International Inc.: Owner of Burger King and Popeyes, RBI’s acquisition of Burger King China for USD 158 million in 2025 highlights its push into Asia.

Each of these companies is leveraging digital platforms, delivery services, and global-local menu strategies to remain competitive in a fast-changing market.

Conclusion: Quick Service Restaurants Set for a Dynamic Decade

The QSR market is entering a new era marked by digital transformation, culinary exploration, and rapid global expansion. As consumer lifestyles continue to evolve, quick-service models are proving resilient and adaptable. Brands that focus on local relevance, customer customization, and technology integration are well positioned to thrive.

Between now and 2030, the industry is expected to benefit from rising urbanization, growing demand for convenience, and shifting dietary habits. The integration of regional flavors, sustainable practices, and personalized experiences will be essential in defining the next wave of QSR success.

The future of the QSR industry isn’t just fast—it’s smart, global, and increasingly personalized.

About Mordor Intelligence: Mordor Intelligence is a trusted partner for businesses seeking comprehensive and actionable market intelligence. Our global reach, expert team, and tailored solutions empower organizations and individuals to make informed decisions, navigate complex markets, and achieve their strategic goals. With a team of over 550 domain experts and on-ground specialists spanning 150+ countries, Mordor Intelligence possesses a unique understanding of the global business landscape. This expertise translates into comprehensive syndicated and custom research reports covering a wide spectrum of industries, including aerospace & defense, agriculture, animal nutrition and wellness, automation, automotive, chemicals & materials, consumer goods & services, electronics, energy & power, financial services, food & beverages, healthcare, hospitality & tourism, information & communications technology, investment opportunities, and logistics.

For any inquiries or to access the full report, please contact: [email protected] https://www.mordorintelligence.com/

0 notes