REDVision Global is India's best Mutual Fund Software for Distributors and IFA, offers Robo Advisor and Advisor X along with Video KYC & Online ATM.

Don't wanna be here? Send us removal request.

Text

Why is Mutual Fund Software So Expensive for Mutual Fund Distributors?

Wealth management software is a crucial tool that helps mutual fund distributors manage client accounts, track performance, and comply with regulations. However, it might have a high cost. Here's why:

First, developing and maintaining mutual fund software for distributors is a complex and costly process. Especially for smaller distributors, this can be a significant expense.

Second, the software requires robust servers to handle large amounts of data and transactions. Regular updates and reliable uptime are necessary for accurate investor and distributor information, further adding to the cost.

Third, mutual fund software must adhere to various regulations, such as those related to securities, privacy, and anti-money laundering. Ensuring compliance increases the software's overall cost.

Additionally, supporting the software requires a team of experts who can assist distributors in effectively utilizing it. This support adds to the overall expense.

Apart from these factors, the cost of financial management software can also vary depending on the included features and functionality. For instance, software with portfolio management tools or customer relationship management (CRM) systems tends to be pricier than software without these features.

Despite the high cost, it offers valuable benefits to distributors. It provides access to data, tools, and support, which can enhance distributors' efficiency and effectiveness. Consequently, the software's cost can be justified by the benefits it brings.

Check out these advantages of using portfolio management software:

Greater efficiency: The software can automate many tasks involved in managing mutual fund investments, freeing up distributors' time to focus on other important responsibilities, such as providing financial advice and business development to clients.

Improved accuracy: It reduces errors in transaction processing and report generation, protecting distributors from regulatory fines and penalties.

Enhanced customer service: The software enables distributors to offer better customer service by granting clients access to account information and tools like online trading and account transfers.

Increased compliance: Software helps distributors comply with regulations governing securities, privacy, and anti-money laundering, shielding them from legal liabilities.

Overall, fund management software is a valuable asset for distributors, enhancing efficiency, accuracy, customer service, and compliance. Before buying software it’s important for the distributors to check the cost and the benefits it provides.

To choose the right wealth management software, consider the following tips:

Assess your needs: Before starting your search, think about your specific requirements. What features are you looking for? How many clients do you have? What is your budget?

Compare prices: Once you know what you need, compare prices from different vendors. Remember to include support and maintenance costs in your decision-making process.

Read reviews: Take the time to read reviews of various financial software options. By reading the reviews you can know what others think about the software and its offerings.

Get a demo: If possible, request a demo of the software before making a purchase. You can check out the demo if it meets your needs or not.

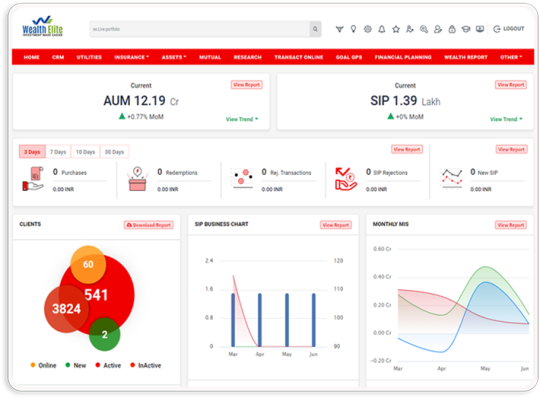

By following these tips, you can select the appropriate investment software that suits your requirements and budget. Wealth Elite is a top software for distributors that can fulfill all the needs of the MFDs including mutual fund transactions, reporting, planning, and performance.

#Mutual Fund Software#Mutual Fund Software for Distributors#Mutual Fund Software for Ifa#Mutual Fund Software in India#Top Mutual Fund Software in India#Best Mutual Fund Software in India#Best Mutual Fund Software for Distributors#Best Mutual Fund Software for Distributors in India#Top Mutual Fund Software for Distributors in India#Best Mutual Fund Software#Mutual Fund Software for Distributors in India#Financial Planning Software#Wealth Management Software#Financial Planning Software in India#Wealth Management Software in India#Best Wealth Management Platform#CRM Software for Mutual Fund Distributor#Financial Advisor Software#Best Mutual Fund Software for Ifa in India#Best online platform for mutual fund distributor

0 notes

Text

How can I use mutual fund software for IFA to manage my clients’ portfolios?

REDVision Global is the best client portfolio management mutual fund software for IFA, there are several factors to consider such as features, Functionality, User Interface, Ease of Use, Customization, Scalability, Security, Customer Support, Data Management, and Cost. Now request a demo or trial to assess on https://www.redvisionglobal.com/

#Mutual Fund Software#Mutual Fund Software for Distributors#Mutual Fund Software for Ifa#Mutual Fund Software in India#Top Mutual Fund Software in India#Best Mutual Fund Software in India#Best Mutual Fund Software for Distributors#Best Mutual Fund Software for Distributors in India#Top Mutual Fund Software for Distributors in India#Best Mutual Fund Software#Mutual Fund Software for Distributors in India#Financial Planning Software#Wealth Management Software#Financial Planning Software in India#Wealth Management Software in India#Best Wealth Management Platform#CRM Software for Mutual Fund Distributor#Financial Advisor Software#Best Mutual Fund Software for Ifa in India#Best online platform for mutual fund distributor

0 notes

Text

Which is the best Mutual Fund Software for Distributors that shows various features.

Redvision Global is a cutting-edge mutual fund software designed to help distributors streamline their operations and provide better service to their clients. Here are some of the key features that make Redvision Global stand out:

Portfolio Tracking: With online mutual fund platform, distributors can easily track the performance of their client's investments in mutual funds. The software provides real-time updates and alerts to ensure that the portfolio is on track.

Investment Recommendations: Redvision Global uses advanced algorithms to analyze market trends and provide personalized investment recommendations based on the risk profile of each client. This helps distributors make informed decisions and maximize returns.

Real-time Market Data: Wealth management software provides real-time updates on stock prices, NAVs, and other market data, allowing distributors to make informed investment decisions. This feature ensures that distributors are always up-to-date with the latest market trends.

Analytics: The software provides in-depth analytics on portfolio performance, asset allocation, and fund selection. This helps distributors identify areas of improvement and make informed decisions. With MF software, distributors can easily analyze their clients' portfolios and make data-driven decisions.

Customizable Reports: Financial Planning Software provides customizable reports that can be tailored to meet the specific needs of each client. Reports can be generated in multiple formats, including PDF, Excel, and HTML. This feature ensures that distributors can provide their clients with personalized reports that are easy to understand.

Risk Management: The software provides risk management tools that help distributors identify and mitigate potential risks in the portfolio. This feature ensures that distributors can manage risk effectively and protect their client's investments.

Mobile App: Wealth Elite mutual fund app has a mobile app that allows distributors to access their clients' portfolios on the go. The app provides real-time updates and alerts, making it easier to stay on top of portfolio performance. This feature ensures that distributors can provide their clients with timely updates and excellent service.

In conclusion, Redvision Global is a powerful mutual fund software that offers a range of features to help distributors manage their clients' portfolios effectively. To learn more https://www.redvisionglobal.com/

#Mutual Fund Software#Mutual Fund Software for Distributors#Mutual Fund Software for Ifa#Mutual Fund Software in India#Top Mutual Fund Software in India#Best Mutual Fund Software in India#Best Mutual Fund Software for Distributors#Best Mutual Fund Software for Distributors in India#Top Mutual Fund Software for Distributors in India#Best Mutual Fund Software#Mutual Fund Software for Distributors in India#Financial Planning Software#Wealth Management Software#Financial Planning Software in India#Wealth Management Software in India#Best Wealth Management Platform#CRM Software for Mutual Fund Distributor#Financial Advisor Software#Best Mutual Fund Software for Ifa in India#Best online platform for mutual fund distributor

0 notes

Text

How can mutual fund software for IFA help me grow my business?

Mutual fund software for IFA can aid in generating leads, building and managing portfolios, and providing personalized investment recommendations. It also offers analysis and reporting tools for business growth. For more information, visit https://www.redvisionglobal.com/

#Mutual Fund Software#Mutual Fund Software for Distributors#Mutual Fund Software for Ifa#Mutual Fund Software in India#Top Mutual Fund Software in India#Best Mutual Fund Software in India#Best Mutual Fund Software for Distributors#Best Mutual Fund Software for Distributors in India#Top Mutual Fund Software for Distributors in India#Best Mutual Fund Software#Mutual Fund Software for Distributors in India#Financial Planning Software#Wealth Management Software#Financial Planning Software in India#Wealth Management Software in India#Best Wealth Management Platform#CRM Software for Mutual Fund Distributor#Financial Advisor Software#Best Mutual Fund Software for Ifa in India#Best online platform for mutual fund distributor

0 notes

Text

Building Strong Client Relationships: The Role of Mutual Fund Software in Client Management

Mutual fund software has revolutionized the way financial advisors and distributors manage their clients' portfolios. The benefits of using investment software such as REDVision Global are well-known, such as ease of portfolio tracking, performance analysis, and reporting. However, one aspect that is often overlooked is how wealth management software can help in client management and relationship building.

Financial software can help financial advisors and distributors manage their clients' investments more efficiently, which ultimately leads to better client relationships. The software provides a comprehensive view of the client's investments, which makes it easier for the advisor to tailor their services to meet their client's needs. For example, if the software indicates that a client has a high-risk tolerance, the advisor can suggest investment options that align with this risk profile. Similarly, if the software indicates that the client has a low-risk tolerance, the advisor can suggest more conservative investment options.

Investment software can also help in client onboarding. The software can be used to collect client information, such as investment goals, risk tolerance, and financial history. This information can then be used to create a personalized investment plan for the client. This personalized plan is an excellent way to build trust with clients as it demonstrates that the advisor is taking the time to understand their needs.

Another way software can help in client management is by providing clients with real-time access to their investment portfolios. Clients can log in to the software and view their portfolio performance, which helps to keep them engaged and informed about their investments. This feature can also help build trust and strengthen the client-advisor relationship, as clients can see that their advisor is transparent about their investments.

Financial software can also help with client communication. The software can be used to send clients personalized reports and updates about their investments. For example, if there is a change in the market that affects the client's investments, the software can be used to send a notification to the client. This type of communication helps to keep clients informed and builds trust with the advisor.

One of the most significant benefits of using investment software for client management is the time-saving aspect. The software automates many of the processes involved in client management, such as portfolio tracking and reporting. This automation frees up time for the advisor to focus on more critical tasks, such as building relationships with clients.

In conclusion, these software’s can help in client management and relationship building in several ways. It provides a comprehensive view of the client's investments, which allows the advisor to tailor their services to meet their needs. It also helps in client onboarding, provides clients with real-time access to their portfolios, and enables personalized communication. The time-saving aspect of the software is also a significant benefit, as it frees up time for advisors to focus on building relationships with clients. Overall, it is an essential tool for financial advisors and distributors who want to improve client management and relationship building. For more information, visit https://www.redvisionglobal.com/

#Mutual Fund Software#Mutual Fund Software for Distributors#Mutual Fund Software for Ifa#Mutual Fund Software in India#Top Mutual Fund Software in India#Best Mutual Fund Software in India#Best Mutual Fund Software for Distributors#Best Mutual Fund Software for Distributors in India#Top Mutual Fund Software for Distributors in India#Best Mutual Fund Software#Mutual Fund Software for Distributors in India#Financial Planning Software#Wealth Management Software#Financial Planning Software in India#Wealth Management Software in India#Best Wealth Management Platform#CRM Software for Mutual Fund Distributor#Financial Advisor Software#Best Mutual Fund Software for Ifa in India#Best online platform for mutual fund distributor

0 notes

Text

"Safeguarding Investments: The Importance of Security in Mutual Fund Software for Distributors"

Mutual fund distributors handle a vast amount of sensitive data related to their clients, investments, and transactions. Hence, it is essential for them to ensure the security of their data. With the increasing reliance on technology and digitization, mutual fund software for distributors has become an essential tool in managing their businesses. However, it is equally important to ensure that this software is secure.

The consequences of a security breach can be severe, ranging from financial loss to reputational damage. Mutual fund distributors deal with a lot of financial information and if it falls into the wrong hands, it can lead to fraud or identity theft. Additionally, a security breach can result in legal action being taken against the distributor.

To prevent such situations, mutual fund software for distributors needs to have robust security features. The software must have a strong encryption system to protect sensitive information. It should also have secure login credentials to ensure that only authorized personnel can access the software.

Moreover, the software must be updated regularly to ensure that it is equipped with the latest security measures. This is crucial as new vulnerabilities are constantly being discovered, and outdated software can leave the distributor's data exposed to cyber-attacks.

In addition to protecting the data of the distributor and their clients, secure mutual fund software can also lead to increased efficiency. By automating routine tasks such as data entry and transaction processing, the software can help reduce errors and save time. This, in turn, can result in better client relationships and increased profitability.

Furthermore, secure mutual fund software can help distributors comply with regulatory requirements. Regulators such as SEBI (Securities and Exchange Board of India) have strict guidelines for data protection and privacy. By using secure mutual fund software, distributors can ensure that they are compliant with these regulations, avoiding legal issues and penalties.

In conclusion, security is a critical aspect of mutual fund software for distributors. With the increasing reliance on technology, it is essential for mutual fund distributors to ensure that their software is secure. A security breach can result in financial loss, reputational damage, and legal action. Secure mutual fund software like REDVision Global can lead to increased efficiency, better client relationships, and compliance with regulatory requirements. As such, mutual fund distributors must prioritize security in their software to protect themselves, their clients, and their businesses. For more information, visit https://www.redvisionglobal.com/

#Mutual Fund Software#Mutual Fund Software for Distributors#Mutual Fund Software for Ifa#Mutual Fund Software in India#Top Mutual Fund Software in India#Best Mutual Fund Software in India#Best Mutual Fund Software for Distributors#Best Mutual Fund Software for Distributors in India#Top Mutual Fund Software for Distributors in India#Best Mutual Fund Software#Mutual Fund Software for Distributors in India#Financial Planning Software#Wealth Management Software#Financial Planning Software in India#Wealth Management Software in India#Best Wealth Management Platform#CRM Software for Mutual Fund Distributor#Financial Advisor Software#Best Mutual Fund Software for Ifa in India#Best online platform for mutual fund distributor

0 notes

Text

Is it possible to offer multiple mutual fund schemes through Mutual Fund Software for Distributors?

Yes, it is possible to offer multiple mutual fund schemes through Mutual Fund Software for Distributors in India. The software provides access to various mutual fund schemes across different fund houses. For more information, visit https://www.redvisionglobal.com/

#Mutual Fund Software#Mutual Fund Software for Distributors#Mutual Fund Software for Ifa#Mutual Fund Software in India#Top Mutual Fund Software in India#Best Mutual Fund Software in India#Best Mutual Fund Software for Distributors#Best Mutual Fund Software for Distributors in India#Top Mutual Fund Software for Distributors in India#Best Mutual Fund Software#Mutual Fund Software for Distributors in India#Financial Planning Software#Wealth Management Software#Financial Planning Software in India#Wealth Management Software in India#Best Wealth Management Platform#CRM Software for Mutual Fund Distributor#Financial Advisor Software#Best Mutual Fund Software for Ifa in India#Best online platform for mutual fund distributor

0 notes

Text

What is the role of Mutual Fund Software in India?

Plays a vital role in Mutual Fund Software in India, mutual fund industry as it provides an easy way for investors to invest in mutual funds. It helps investors to manage their investments, monitor portfolios, and make informed investment decisions. For more information, visit https://www.redvisionglobal.com/

#Mutual Fund Software#Mutual Fund Software for Distributors#Mutual Fund Software for Ifa#Mutual Fund Software in India#Top Mutual Fund Software in India#Best Mutual Fund Software in India#Best Mutual Fund Software for Distributors#Best Mutual Fund Software for Distributors in India#Top Mutual Fund Software for Distributors in India#Best Mutual Fund Software#Mutual Fund Software for Distributors in India#Financial Planning Software#Wealth Management Software#Financial Planning Software in India#Wealth Management Software in India#Best Wealth Management Platform#CRM Software for Mutual Fund Distributor#Financial Advisor Software#Best Mutual Fund Software for Ifa in India#Best online platform for mutual fund distributor

0 notes

Text

How AI is revolutionizing mutual fund software for IFAs?

Mutual funds have been around for decades, and they remain a popular investment option for individuals seeking to grow their wealth. However, managing mutual funds can be a time-consuming and complex task, especially for independent financial advisors (IFAs) who often have to manage multiple clients at once. Fortunately, the rise of artificial intelligence (AI) is revolutionizing mutual fund software for IFAs, making it easier and more efficient to manage portfolios and provide tailored advice to clients.

Analyze data and insights: One of the most significant advantages of AI-powered mutual fund software is its ability to analyze large volumes of data quickly and accurately. This includes data on market trends, economic indicators, company performance, and more. With AI, IFAs can access real-time information on their clients' portfolios and make informed investment decisions based on the latest market insights. This can help IFAs optimize returns for their clients and reduce the risk of losses.

Personalized recommendations and advice: Another key benefit of AI-powered mutual fund software is its ability to provide personalized recommendations and advice to clients. By analyzing clients' investment histories, risk profiles, and financial goals, AI algorithms can suggest tailored investment strategies that align with their unique needs and preferences. This can help IFAs build stronger relationships with their clients and increase customer satisfaction.

Streamline operations and reduce logistics: AI-powered mutual fund software can also help IFAs streamline their operations and reduce administrative overhead. For example, by automating routine tasks such as portfolio rebalancing and performance tracking, IFAs can save time and focus on more valuable activities such as client engagement and business development. Additionally, AI algorithms can help IFAs identify and mitigate potential risks, such as exposure to a particular sector or asset class, before they become significant issues.

Despite these advantages, some IFAs may be hesitant to adopt AI-powered mutual fund software due to concerns about cost and complexity. However, many software providers like REDVision Global offer affordable and user-friendly solutions that can be customized to meet the specific needs of individual IFAs and their clients. Additionally, many providers offer comprehensive training and support to help IFAs get up and running quickly and effectively.

In conclusion, AI-powered mutual fund software represents a significant opportunity for IFAs to improve their investment management capabilities and provide better outcomes for their clients. By leveraging AI algorithms to analyze data, provide personalized advice, and streamline operations, IFAs can stay ahead of the curve in a rapidly evolving market. As AI continues to advance, we can expect to see even more exciting developments in mutual fund software and other financial services that will benefit both IFAs and their clients. For more information, visit https://www.redvisionglobal.com/

#Mutual Fund Software#Mutual Fund Software for Distributors#Mutual Fund Software for Ifa#Mutual Fund Software in India#Top Mutual Fund Software in India#Best Mutual Fund Software in India#Best Mutual Fund Software for Distributors#Best Mutual Fund Software for Distributors in India#Top Mutual Fund Software for Distributors in India#Best Mutual Fund Software#Mutual Fund Software for Distributors in India#Financial Planning Software#Wealth Management Software#Financial Planning Software in India#Wealth Management Software in India#Best Wealth Management Platform#CRM Software for Mutual Fund Distributor#Financial Advisor Software#Best Mutual Fund Software for Ifa in India#Best online platform for mutual fund distributor

0 notes

Text

Grow your AUM with a mutual fund software. Check these 5 advantages

In recent years, the mutual fund industry has witnessed a significant transformation in terms of technology adoption. Mutual Fund Distributors (MFDs) are at the forefront of this transformation and are adopting technology-driven solutions to cater to the changing needs of their clients. One such solution is the Mutual Fund Software, which can help MFDs create a future-ready distribution model. In this blog, we will discuss how MFDs can leverage Mutual Fund Software to achieve this.

Streamlined Operations:

Mutual Fund Software for distributors can help streamline their operations and simplify their day-to-day tasks.

It can automate several processes such as client onboarding, investment management, and reporting,

It allows MFDs to focus on delivering value to their clients and develop their business.

This not only saves time but also minimizes the chances of errors.

Improved Client Experience:

MFDs can provide a better client experience by offering customized investment recommendations and a user-friendly interface.

The software can capture the investment preferences of each client and provide personalized investment recommendations based on their risk profile, investment goals, and past performance.

Its intuitive interface can enable clients to easily monitor their investments and track their returns, leading to a more satisfying experience.

Better Compliance:

Mutual Fund Software can help MFDs stay compliant with regulatory requirements.

The software can generate accurate reports on investments, commissions, and other transactions, enabling MFDs to adhere to regulatory guidelines.

The software can also alert MFDs about any compliance issues and help them take corrective action before any damage is done.

Enhanced Sales and Marketing:

The software can generate reports on the performance of various mutual funds, enabling MFDs to identify top-performing funds and offer them to clients.

It can provide insights into client behavior, enabling MFDs to customize their sales and marketing efforts.

Increased efficiency and productivity

The software can automate tasks, such as portfolio rebalancing, tax optimization, and investment tracking, which allows better portfolio management.

It provides real-time updates on portfolio performance, enabling MFDs to take quick and informed investment decisions during the times of market correctness.

In conclusion, Mutual Fund Software like Wealth Elite can help MFDs create a future-ready distribution model by streamlining their operations, improving client experience, ensuring compliance, enhancing sales and marketing, and increasing efficiency. The software can help MFDs deliver better value to their clients and stay ahead of the competition. Therefore, MFDs should consider investing in Mutual Fund Software to take advantage of these benefits and create a more robust and scalable distribution model. For more information, visit https://www.redvisionglobal.com/

#Mutual Fund Software#Mutual Fund Software for Distributors#Mutual Fund Software for Ifa#Mutual Fund Software in India#Top Mutual Fund Software in India#Best Mutual Fund Software in India#Best Mutual Fund Software for Distributors#Best Mutual Fund Software for Distributors in India#Top Mutual Fund Software for Distributors in India#Best Mutual Fund Software#Mutual Fund Software for Distributors in India#Financial Planning Software#Wealth Management Software#Financial Planning Software in India#Wealth Management Software in India#Best Wealth Management Platform#CRM Software for Mutual Fund Distributor#Financial Advisor Software#Best Mutual Fund Software for Ifa in India#Best online platform for mutual fund distributor

0 notes

Text

Which Mutual fund software represents the client portfolio status?

Redvision Global is a mutual fund software in India, that can help represent the client's portfolio status. It is a comprehensive software that offers features like portfolio tracking, investment recommendations, real-time market data, and analytics. Redvision Global also provides customizable reports and dashboards, making it easier for distributors to represent their clients' portfolio status in a visually appealing way. However, it's essential to evaluate different options and choose the software that best suits your needs and your client's requirements. For more information, visit https://www.redvisionglobal.com/

#Mutual Fund Software#Mutual Fund Software for Distributors#Mutual Fund Software for Ifa#Mutual Fund Software in India#Top Mutual Fund Software in India#Best Mutual Fund Software in India#Best Mutual Fund Software for Distributors#Best Mutual Fund Software for Distributors in India#Top Mutual Fund Software for Distributors in India#Best Mutual Fund Software#Mutual Fund Software for Distributors in India#Financial Planning Software#Wealth Management Software#Financial Planning Software in India#Wealth Management Software in India#Best Wealth Management Platform#CRM Software for Mutual Fund Distributor#Financial Advisor Software#Best Mutual Fund Software for Ifa in India#Best online platform for mutual fund distributor

0 notes

Text

How to improve performance on Mutual Fund Software for MFDs?

Improving performance on REDVision Global for Mutual Fund Distributors (MFDs) involves several key areas that can be addressed to enhance the efficiency and effectiveness of the software. Here are some potential strategies:

Optimize Database: The database is a crucial component of mutual fund software, as it stores and manages large amounts of data. Optimizing the database by implementing efficient data indexing, partitioning, and caching mechanisms can significantly improve the software's performance.

Streamline User Interface: An intuitive and user-friendly interface can greatly enhance the performance of Wealth Elite software. Simplify the user interface by removing unnecessary clutter, reducing the number of clicks required to perform tasks, and providing easy navigation.

Enhance Data Integration: Mutual fund software for Distributors often integrates with various external data sources, such as market data feeds, portfolio management systems, and custodian banks. Ensuring smooth and efficient data integration can improve the software's performance by reducing delays and errors in data retrieval and processing.

Optimize Algorithmic Processing: Wealth management software often performs complex calculations and algorithms, such as NAV (Net Asset Value) calculations, portfolio rebalancing, and performance analytics. Optimizing these algorithms for performance, such as using efficient data structures and algorithms, can significantly speed up processing times and improve overall software performance.

Implement Caching: Caching involves storing frequently accessed data in memory to reduce the need for a repeated database or external data source queries. Implementing caching mechanisms, such as in-memory caching or distributed caching, can greatly improve the performance of Financial Advisor Software by reducing data retrieval times.

Conduct Regular Performance Testing: Regularly testing the MF platform for performance issues and addressing them promptly can help identify and fix performance bottlenecks. Conducting load testing, stress testing, and performance profiling can provide insights into areas that need improvement and help optimize the software for better performance.

Update Software and Hardware: Keeping the CRM MF software up-to-date with the latest software patches, upgrades, and hardware requirements can improve its performance. Ensure that the software is running on a compatible and optimized hardware infrastructure, including servers, storage, and network components.

Provide Training and Support: Training and supporting Mutual Fund Distributors (MFDs) on how to effectively use the software can improve their efficiency and productivity. Providing regular training sessions, documentation, and support can help MFDs utilize the software's features effectively and make the most out of its capabilities.

By optimizing the database, streamlining the user interface, enhancing data integration, optimizing algorithmic processing, implementing caching, conducting regular performance testing, updating software and hardware, and providing training and support, Mutual Fund Distributors (MFDs) can improve the performance of RED Vision software and enhance their overall productivity and effectiveness. For more information, visit https://www.redvisionglobal.com/

#Mutual Fund Software#Mutual Fund Software for Distributors#Mutual Fund Software for Ifa#Mutual Fund Software in India#Top Mutual Fund Software in India#Best Mutual Fund Software in India#Best Mutual Fund Software for Distributors#Best Mutual Fund Software for Distributors in India#Top Mutual Fund Software for Distributors in India#Best Mutual Fund Software#Mutual Fund Software for Distributors in India#Financial Planning Software#Wealth Management Software#Financial Planning Software in India#Wealth Management Software in India#Best Wealth Management Platform#CRM Software for Mutual Fund Distributor#Financial Advisor Software#Best Mutual Fund Software for Ifa in India#Best online platform for mutual fund distributor

0 notes

Text

How does online mutual fund software deliver reliable results?

REDVision Global Technologies delivers reliable results through a combination of several factors, including robust data management, sophisticated algorithms, and industry best practices. Here are some key ways for online deliver reliable results with Best Mutual Fund Software in India:

Data accuracy and integrity: Reliable online mutual fund software ensures that data used for calculations, analysis, and reporting is accurate and up-to-date. This includes accurate NAV (Net Asset Value) data, historical performance data, and other fund-related information. The software should have data validation checks in place to identify and correct any inconsistencies or errors in the data.

Advanced analytics: REDVision often incorporates advanced analytics techniques, such as statistical models and machine learning algorithms, to analyze historical data, identify trends, and make predictions about future performance. This advanced analytics help in generating reliable insights that can aid in decision-making and portfolio management.

Risk management: MF software includes robust risk management tools that help in assessing and managing various types of risks, such as market risk, credit risk, and liquidity risk. These tools provide insights into the risk profile of mutual funds and help investors make informed decisions.

Compliance and regulatory adherence: MF Distributors software must adhere to industry regulations and compliance requirements, such as Anti-Money Laundering (AML) regulations, Know Your Customer (KYC) requirements, and other applicable regulations. Reliable software ensures that these compliance requirements are met, providing a secure and reliable environment for managing mutual fund investments.

User-friendly interface: Wealth Management Software should have a user-friendly interface that allows investors to easily navigate and use the platform. A well-designed interface ensures that users can access relevant information, perform transactions, and monitor their investments accurately and efficiently, contributing to reliable results.

Regular updates and maintenance: Financial Advisor Software requires regular updates and maintenance to ensure that it remains current with industry best practices, regulatory changes, and technological advancements. This helps in delivering accurate and reliable results over time.

In conclusion, online mutual fund software delivers reliable results through a combination of accurate data management, advanced analytics, risk management, compliance adherence, a user-friendly interface, and regular updates and maintenance. These factors work together to provide investors with a reliable platform for managing their mutual fund investments effectively. For more information, visit https://www.redvisionglobal.com/

#Mutual Fund Software#Mutual Fund Software for Distributors#Mutual Fund Software for Ifa#Mutual Fund Software in India#Top Mutual Fund Software in India#Best Mutual Fund Software in India#Best Mutual Fund Software for Distributors#Best Mutual Fund Software for Distributors in India#Top Mutual Fund Software for Distributors in India#Best Mutual Fund Software#Mutual Fund Software for Distributors in India#Financial Planning Software#Wealth Management Software#Financial Planning Software in India#Wealth Management Software in India#Best Wealth Management Platform#CRM Software for Mutual Fund Distributor#Financial Advisor Software#Best Mutual Fund Software for Ifa in India#Best online platform for mutual fund distributor

0 notes

Text

Why Mutual fund software for IFA rebalances investment?

The portfolio of the investors is rebalanced to decrease the chance of loss without missing the great outcomes which is possible through the mutual fund software for IFA that supports distributors in handling funds. For more information, visit https://www.redvisionglobal.com/

#Mutual Fund Software#Mutual Fund Software for Distributors#Mutual Fund Software for Ifa#Mutual Fund Software in India#Top Mutual Fund Software in India#Best Mutual Fund Software in India#Best Mutual Fund Software for Distributors#Best Mutual Fund Software for Distributors in India#Top Mutual Fund Software for Distributors in India#Best Mutual Fund Software#Mutual Fund Software for Distributors in India#Financial Planning Software#Wealth Management Software#Financial Planning Software in India#Wealth Management Software in India#Best Wealth Management Platform#CRM Software for Mutual Fund Distributor#Financial Advisor Software#Best Mutual Fund Software for Ifa in India#Best online platform for mutual fund distributor

0 notes

Text

How Mutual fund software for distributors provides safety to distributors?

Redvison's Mutual fund software for distributors provides safety to distributors in several ways:

Automated Transactions: Mutual fund software for distributors allows for automated transactions and eliminates the need for manual record-keeping. This reduces the chances of errors and ensures that all transactions are accurately recorded.

Portfolio Management: The software helps distributors manage their clients' portfolios efficiently by providing a comprehensive view of their investments. This ensures that the portfolio is diversified, which minimizes the risk of losses.

Risk Management: The best Mutual fund software provides tools for risk management, such as alerts for unusual market movements and the ability to set up stop-loss orders. This helps distributors take timely action to mitigate risk and prevent losses.

Compliance: The software ensures compliance with regulatory requirements by providing timely updates on changes in regulations and automatically generating reports that are required by regulators.

Data Security: Mutual fund software provides data security by using encryption and secure login protocols. This ensures that confidential information about clients and their investments is protected from unauthorized access.

Top Mutual fund software provides safety by automating transactions, managing portfolios, mitigating risk, ensuring compliance, and maintaining data security. This enables distributors to focus on providing high-quality service to their clients while minimizing risks to themselves and their clients. For more information, visit https://www.redvisionglobal.com/

#Mutual Fund Software#Mutual Fund Software for Distributors#Mutual Fund Software for Ifa#Mutual Fund Software in India#Top Mutual Fund Software in India#Best Mutual Fund Software in India#Best Mutual Fund Software for Distributors#Best Mutual Fund Software for Distributors in India#Top Mutual Fund Software for Distributors in India#Best Mutual Fund Software#Mutual Fund Software for Distributors in India#Financial Planning Software#Wealth Management Software#Financial Planning Software in India#Wealth Management Software in India#Best Wealth Management Platform#CRM Software for Mutual Fund Distributor#Financial Advisor Software#Best Mutual Fund Software for Ifa in India#Best online platform for mutual fund distributor

0 notes

Text

Mutual fund software needs to create ordered statements?

At REDVision Global Technologies, Mutual fund software can be used to create ordered statements that provide investors with detailed information about their investments. These statements typically include information about the investor's account balance, the current value of their holdings, any fees or expenses associated with their account, and any recent transactions or changes to their portfolio.

To create ordered statements using mutual fund software, you will need to follow a few basic steps:

Gather the necessary data: Collect all the relevant information about the investor's account, including their account balance, holdings, transactions, fees, and expenses.

Organize the data: Arrange the data in a logical and easy-to-follow format. This may involve grouping transactions by type, organizing holdings by asset class or sector, and breaking out fees and expenses by category.

Format the statement: Use the mutual fund software to format the statement in a clear and visually appealing way. This may involve using charts, tables, and graphs to help illustrate key points.

Review and edit: Before sending the statement to the investor, review it carefully to ensure that all the information is accurate and up-to-date. Make any necessary edits or revisions to improve clarity or readability.

By following these steps, you can use mutual fund software to create ordered statements that provide investors with the information they need to make informed decisions about their investments. For more information, visit https://www.redvisionglobal.com/

#Mutual Fund Software#Mutual Fund Software for Distributors#Mutual Fund Software for Ifa#Mutual Fund Software in India#Top Mutual Fund Software in India#Best Mutual Fund Software in India#Best Mutual Fund Software for Distributors#Best Mutual Fund Software for Distributors in India#Top Mutual Fund Software for Distributors in India#Best Mutual Fund Software#Mutual Fund Software for Distributors in India#Financial Planning Software#Wealth Management Software#Financial Planning Software in India#Wealth Management Software in India#Best Wealth Management Platform#CRM Software for Mutual Fund Distributor#Financial Advisor Software#Best Mutual Fund Software for Ifa in India#Best online platform for mutual fund distributor

0 notes

Text

Why Mutual fund software for distributors supports fund as per goals?

Mutual fund software for distributors supports fund as per goals because it is important for investors to have a clear understanding of their investment goals and objectives before investing in mutual funds.

Investment goals can vary from short-term goals like saving for a vacation or a down payment on a house, to long-term goals like saving for retirement. Based on the investor's goals and risk tolerance, the mutual fund software recommends suitable funds that align with the investor's objectives.

This approach helps investors to achieve their financial goals and objectives by investing in the appropriate mutual funds. It also helps distributors to provide customized solutions to their clients, which can increase customer satisfaction and loyalty.

By supporting fund as per goals, mutual fund software for distributors can streamline the investment process, reduce the potential for errors, and provide better insights into the performance of the investments over time. This can ultimately help investors to make more informed investment decisions and achieve their financial goals. For more information, visit https://www.redvisionglobal.com/

#Mutual Fund Software#Mutual Fund Software for Distributors#Mutual Fund Software for Ifa#Mutual Fund Software in India#Top Mutual Fund Software in India#Best Mutual Fund Software in India#Best Mutual Fund Software for Distributors#Best Mutual Fund Software for Distributors in India#Top Mutual Fund Software for Distributors in India#Best Mutual Fund Software#Mutual Fund Software for Distributors in India#Financial Planning Software#Wealth Management Software#Financial Planning Software in India#Wealth Management Software in India#Best Wealth Management Platform#CRM Software for Mutual Fund Distributor#Financial Advisor Software#Best Mutual Fund Software for Ifa in India#Best online platform for mutual fund distributor

0 notes