Don't wanna be here? Send us removal request.

Text

Understanding Unlist Share Price: A Comprehensive Guide

Introduction to Unlist Shares

Unlisted shares, often termed as unlisted equities, are shares of companies that are not traded on formal stock exchanges like the NSE or the BSE. These companies may be start-ups, pre-IPO ventures, or privately held firms with robust business models and substantial growth trajectories. Unlike listed securities, unlisted shares are transacted in over-the-counter (OTC) markets or through private placements, offering a distinct avenue for discerning investors seeking exclusive opportunities.

What Determines Unlisted Share Price?

Unlike listed shares, whose prices fluctuate dynamically on live trading floors, the valuation of unlisted shares is far more nuanced. Several intrinsic and extrinsic factors interplay to determine the price of these shares:

Company Financials: Profitability, revenue growth, debt-to-equity ratios, and cash flow health are pivotal metrics.

Market Demand & Supply: Scarcity of available shares combined with investor demand often leads to price premiums.

Peer Comparisons: Benchmarking against listed counterparts in the same sector helps in approximating fair value.

Future Prospects: Anticipation of a forthcoming IPO or strategic acquisition can sharply elevate the perceived value.

The absence of real-time market quotations means the price discovery process leans heavily on negotiations and private assessments.

Methods to Track Unlisted Share Price

For investors keen on monitoring unlisted share prices, several pathways exist beyond conventional stock tickers:

Specialised Broking Platforms: Niche investment firms and brokers maintain curated lists of active unlisted share offerings along with indicative pricing.

OTC Marketplaces: Over-the-counter dealers often publish weekly price sheets reflecting recent trades.

Investor Communities & Forums: High-net-worth circles, investment groups, and digital forums provide anecdotal price updates and sentiment analysis.

Research Reports & Valuation Audits: Some financial advisory firms issue detailed reports estimating the fair value of high-interest unlisted shares.

These resources, albeit less structured than stock exchange feeds, are indispensable for informed decision-making in the unlisted space.

Price Volatility in Unlisted Shares

Unlisted share prices exhibit a unique volatility pattern, starkly different from their listed counterparts. The illiquid nature of these shares means that a single large transaction can significantly sway the price trajectory. Additionally, corporate developments like funding rounds, boardroom restructures, or regulatory changes can precipitate abrupt price recalibrations. This sporadic volatility, while intimidating for some, presents high-reward scenarios for astute investors who thrive on information asymmetry.

Key Risks and Rewards of Unlist Share Pricing

Investing in unlist shares is not for the faint-hearted. The opaque pricing mechanism and lack of public disclosures amplify the investment risk. There's always the peril of illiquidity, where selling off holdings might not be feasible at the desired price. Yet, this very opacity cultivates an arena where informed investors can secure stakes in burgeoning enterprises at valuations far below their eventual public market debut prices.

On the flip side, the potential rewards are monumental. Historical precedents abound where early investors in unlisted shares of marquee companies like Paytm, Nykaa, or Zomato witnessed exponential wealth creation post-IPO.

How to Evaluate a Fair Price for Unlist Shares

Valuing unlisted shares demands a blend of financial scrutiny and strategic foresight. Here’s a pragmatic approach:

Deep-Dive into Financial Statements: Analyse profit margins, revenue growth trends, and balance sheet strength.

Assess Business Model Viability: Is the company solving a scalable problem? What’s the competitive moat?

Understand Exit Opportunities: Potential IPO timelines, acquisition prospects, or secondary market avenues.

Seek Expert Valuations: Engage with financial advisors or valuation experts who specialise in private equity landscapes.

Negotiate Wisely: Pricing in the unlisted segment is negotiable; leverage market intelligence to strike favourable deals.

Conclusion

The world of unlisted share pricing is a confluence of opportunity and complexity. For those willing to navigate its opaque corridors, it offers a pathway to access high-growth companies long before they capture public market limelight. Mastering the dynamics of unlisted share prices is not just about numbers—it's about foresight, negotiation acumen, and a pulse on emerging business narratives.

0 notes

Text

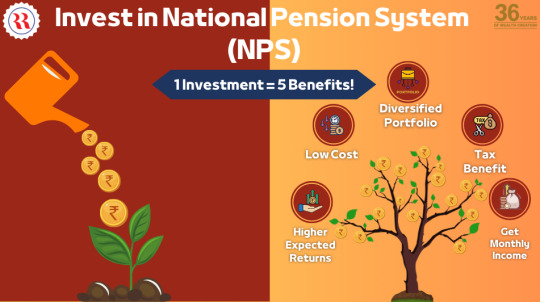

Invest in the National Pension System (NPS)

Unlocking Future Financial Security: The Importance of Early National Pension System Investment

The National Pension System(NPS)stands as a beacon of financial security, offering Indian citizens a voluntary and contributory pension scheme to ensure a comfortable retirement. Launched by the Government of India, NPS aims to provide retirement income by allowing individuals to contribute regularly during their working years. Upon retirement, subscribers receive either a lump sum or periodic payments, known as a pension, based on their contributions and investment returns. Regulated by the Pension Fund Regulatory and Development Authority (PFRDA), NPS offers a range of investment options, providing flexibility to contributors to choose between various asset classes such as equities, government bonds, and corporate debt. Available to citizens across all sectors, including public, private, and unorganized, as well as self-employed individuals, National Pension System offers tax benefits under Section 80CCD of the Income Tax Act, making it an attractive long-term savings avenue for retirement planning. The National Pension System details are given below.

Selecting the Right Mix : Asset Allocation in National Pension System

When it comes to planning for retirement through NPS, selecting the appropriate mix of asset classes and Pension Fund Manager (PFM) is crucial. NPS offers four primary asset classes under a single PFM, each with its unique characteristics and risk-return profiles:

Asset Class E – Equity and Related Instruments : Subscribers have the flexibility to allocate up to 75% of their Tier-I investment and 100% of their Tier-II investment to Equity, providing potential for higher returns over the long term.

Asset Class C – Corporate Debt and Related Instruments : This option allows subscribers to allocate a portion of their portfolio to corporate debt, enhancing stability and generating income.

Asset Class G – Government Bonds and Related Instruments : Subscribers can allocate a portion of their portfolio to government bonds, ensuring capital preservation while providing safety and stability.

Asset Class A - Alternative Investment Funds : Including instruments like CMBS, MBS, REITs, and AIFs, Alternative Investment Funds offer diversification and potential for higher returns. However, the allocation to Alternative Investment Funds cannot exceed 5% of the total portfolio value.

Exclusive Tax Benefits for NPS Subscribers -

NPS offers exclusive tax benefits to all subscribers under subsection 80CCD (1B) of the Income Tax Act, 1961. Subscribers can avail an additional deduction for investment up to Rs. 50,000 in NPS (Tier I account), over and above the deduction of Rs. 1.5 lakh available under section 80C. This makes NPS a tax-efficient investment avenue, providing an opportunity to save on taxes while building wealth for retirement.

The following are the benefits of NPS:

Investing in NPS at an early stage of life offers a multitude of benefits that can significantly impact one's financial future :

Harnessing the Power of Compounding : Early investment allows for maximum benefit from compounding, leading to substantial wealth accumulation over the long term.

Building a Sizeable Retirement Corpus : Starting NPS investments at a young age enables subscribers to build a sizeable retirement corpus through regular contributions and long-term investment growth, ensuring financial security during retirement

Availing Tax Benefits : NPS offers attractive tax benefits, including deductions under Section 80C, making it a tax-efficient investment avenue.

Flexibility and Portability : NPS offers flexibility and portability, allowing subscribers to choose their investment options and adapt their strategy as their financial circumstances evolve over time.

Long-Term Investment Horizon : NPS is designed for the long term, allowing subscribers to take advantage of the long investment horizon and potential market upswings over time.

In conclusion, the national pension system benefits the investor by providing a secure and tax-efficient avenue for retirement planning, with early investment providing numerous benefits, including harnessing the power of compounding, building a sizeable retirement corpus, and availing tax benefits. Therefore, starting National Pension System investments early is essential for securing a financially stable retirement future. For additional investment opportunities, kindly explore: https://www.rrfinance.com/

0 notes

Text

Invest Now in NPS: https://www.rrfinance.com/OurProducts/National-Pension-System-Landing-Page.aspx

0 notes

Text

Nifty Lot Size Slashed by NSE: How Will This Impact Traders? Summary

The National Stock Exchange has halved the market lot size for derivative contracts on several indices, including the Nifty 50. Effective April 26, the lot size for Nifty 50 will decrease from 50 to 25, while Nifty Financial Services will reduce from 40 to 25, and Nifty Midcap Select from 75 to 50. Nifty Bank's lot size remains unchanged at 15. These adjustments are part of the exchange's routine review of lot sizes in derivatives contracts.

The National Stock Exchange (NSE), India's leading stock exchange, has halved the lot size of its Nifty futures and options contracts to 25 shares effective from April 26, in response to increasing competition from the BSE. This move aims to make NSE contracts more affordable compared to Sensex options contracts. The decision comes after considering the average closing prices of the underlying indices, with the Nifty contract value at ₹5.5 lakh and the Sensex contract value at ₹7.3 lakh. Additionally, NSE has adjusted the lot sizes for Nifty Financial Services (Finnifty) and Nifty Midcap Select contracts across various maturities to enhance market competitiveness. Web Link: https://www.rrfinance.com/

Source:https://www.livemint.com/market/stock-market-news/fo-update-nse-halves-lot-size-for-nifty-50-derivatives-contract-trading-from-april-26-11712063949659.html

0 notes

Text

Why It's the Perfect Time to Invest in Fixed Deposits

In the world of personal finance, timing is everything. And right now, the timing couldn't be better to consider investing in Fixed Deposits (FDs). Here's why:

Interest Rates Worldwide Are Peaking : Across the globe, interest rates have hit their highest point in recent times. Central banks are maintaining interest rates at higher levels to stabilize economies. This translates to a higher fixed deposit interest rate.

RBI Signals Potential Rate Cuts : Reserve Bank of India (RBI) has also signaled at future rate cuts. With India's GDP showing strong growth, the RBI aims to sustain this momentum. Rate cuts could be on the horizon, meaning the current high-interest-rate environment may not last long.

When the RBI cuts rates, banks and NBFCs usually follow suit by lowering the fixed deposit interest rate. This means the attractive rates we're seeing now might not stick around for long.

By investing in Fixed Deposits(FDs) now, you can lock in the higher interest rates before they potentially drop. It's a simple move that could pay off big in the long run.

In summary, the timing couldn't be better for Fixed Deposit investors. With interest rates reaching their peak globally and the possibility of rate cuts on the horizon, now is the perfect moment to consider investing.

Additionally, it's worth noting that Fixed Deposits offered by Housing Finance companies& NBFCs provide higherinterest rates than traditional banks, adding another layer of appeal to this investment avenue.

Don't hesitate – take advantage of this opportune time in the financial market and make the most of potential higher return.

The following are the Interest Rates for Fixed Deposits offered -: Rate HDFC fixed deposit interest rate:-7% - 7.75% PNB fixed deposit interest rate:- 6.79% - 7.40% Mahindra Finance fixed deposit rates:-7.05% - 8.05% Bajaj Finserv fixed deposit rates :-7.11% - 8.35% Shriram Finance fixed deposit rates:- 7.34% - 8.50%

0 notes

Text

Invest In 54EC Capital Gain Bonds

0 notes

Text

54EC Capital Gain Bonds

0 notes

Text

Discover Financial Excellence with RR Finance: Your Trusted Partner in Prosperity

Welcome to RR Finance, your trusted partner in financial growth and prosperity. At RR Finance, we understand the importance of sound financial planning and investment in achieving your life goals. With a commitment to excellence and a focus on your financial well-being, we offer a diverse range of investment products and services tailored to meet your unique needs. Our Products: Public Issues IPO/NCD: Participate in initial public offerings (IPOs) and non-convertible debentures (NCDs) to invest in promising companies and secure fixed-income avenues.

Fixed Deposits: Benefit from the stability and reliability of fixed deposits, providing you with a secure way to grow your wealth over time.

Mutual Funds SIP: Invest systematically in mutual funds through systematic investment plans (SIPs) to enjoy the power of compounding and create wealth over the long term.

Capital Gain Bonds: Optimize your capital gains with our specially curated capital gain bonds, providing tax benefits and stable returns.

Floating Rate Bonds: Explore the flexibility of floating rate bonds, offering a potential hedge against interest rate fluctuations and the opportunity for higher yields.

Gold Bonds: Diversify your portfolio with gold bonds, combining the allure of the precious metal with the benefits of a fixed-income investment.

Tax Saving Funds: Save on taxes while growing your wealth with our tax-saving funds, designed to provide you with both financial security and tax efficiency.

Stocks: Engage in the dynamic world of equities with our expert guidance, helping you make informed decisions in the stock market.

Insurance: Protect what matters most with our comprehensive insurance offerings, providing coverage for health, property, and more.

Life Insurance: Safeguard your loved ones' future with our life insurance solutions, ensuring financial security in times of need. Why Choose RR Finance:

Expert Guidance: Our team of seasoned financial experts is dedicated to providing you with personalized advice and strategies to maximize your returns.

Diverse Product Range: From traditional investments like fixed deposits to cutting-edge financial instruments, we offer a comprehensive suite of products to suit every investor's preferences.

Transparency and Trust: At RR Finance, transparency is our hallmark. We believe in fostering trust by keeping you informed about your investments and the market trends.

Customer-Centric Approach: Your financial goals are at the center of everything we do. We work closely with you to understand your aspirations and tailor our services accordingly. Choose RR Finance for a journey towards financial success and security. Let us be your partner in building a prosperous future. Invest with confidence, invest with RR Finance.

0 notes

Text

Discover Financial Excellence with RR Finance: Your Trusted Partner in Prosperity

Welcome to RR Finance, your trusted partner in financial growth and prosperity. At RR Finance, we understand the importance of sound financial planning and investment in achieving your life goals. With a commitment to excellence and a focus on your financial well-being, we offer a diverse range of investment products and services tailored to meet your unique needs. Our Products: Public Issues IPO/NCD: Participate in initial public offerings (IPOs) and non-convertible debentures (NCDs) to invest in promising companies and secure fixed-income avenues.

Fixed Deposits: Benefit from the stability and reliability of fixed deposits, providing you with a secure way to grow your wealth over time.

Mutual Funds SIP: Invest systematically in mutual funds through systematic investment plans (SIPs) to enjoy the power of compounding and create wealth over the long term.

Capital Gain Bonds: Optimize your capital gains with our specially curated capital gain bonds, providing tax benefits and stable returns.

Floating Rate Bonds: Explore the flexibility of floating rate bonds, offering a potential hedge against interest rate fluctuations and the opportunity for higher yields.

Gold Bonds: Diversify your portfolio with gold bonds, combining the allure of the precious metal with the benefits of a fixed-income investment.

Tax Saving Funds: Save on taxes while growing your wealth with our tax-saving funds, designed to provide you with both financial security and tax efficiency.

Stocks: Engage in the dynamic world of equities with our expert guidance, helping you make informed decisions in the stock market.

Insurance: Protect what matters most with our comprehensive insurance offerings, providing coverage for health, property, and more.

Life Insurance: Safeguard your loved ones' future with our life insurance solutions, ensuring financial security in times of need. Why Choose RR Finance:

Expert Guidance: Our team of seasoned financial experts is dedicated to providing you with personalized advice and strategies to maximize your returns.

Diverse Product Range: From traditional investments like fixed deposits to cutting-edge financial instruments, we offer a comprehensive suite of products to suit every investor's preferences.

Transparency and Trust: At RR Finance, transparency is our hallmark. We believe in fostering trust by keeping you informed about your investments and the market trends.

Customer-Centric Approach: Your financial goals are at the center of everything we do. We work closely with you to understand your aspirations and tailor our services accordingly. Choose RR Finance for a journey towards financial success and security. Let us be your partner in building a prosperous future. Invest with confidence, invest with RR Finance.

0 notes

Text

Bonds for Capital Gains under Section 54EC

Investors have the opportunity to avail tax exemption on capital gains as per Section 54EC of the Income Tax Act, 1961, by opting for 54EC capital gain bonds. These bonds provide a means to save on long-term capital gains arising from the sale of property, provided the investment is made within six months of the property sale. The maximum allowable investment in these bonds is Rs. 50,00,000 per financial year. As of April 1st, 2023, the interest rate on these bonds has increased to 5.25% per annum. It's crucial to note that the interest earned on these bonds is liable to income tax.

Rural Electrification Corporation (REC):

Minimum Investment: Rs. 20,000

Return on Investment (ROI) per annum: 5.25%

Rating: AAA

Interest Credit Date: 30th June

Indian Railway Finance Corporation (IRFC):

Minimum Investment: Rs. 20,000

Return on Investment (ROI) per annum: 5.25%

Rating: AAA

Interest Credit Date: 15th October

Power Finance Corporation (PFC):

Minimum Investment: Rs. 20,000

Return on Investment (ROI) per annum: 5.25%

Rating: AAA

Interest Credit Date: 31st July

Click here for more details - https://www.rrfinance.com/OurProducts/Invest_in_Capital_Gain_Bonds_Online.aspx

0 notes

Text

Invest in Capital Gain Bonds

Invest in Capital Gain Bonds for saving your tax

0 notes

Text

Invest Securely with Muthoot Finance Limited NCD

In today's ever-changing financial landscape, securing your investments while aiming for lucrative returns is a top priority for many. If you're in search of a reliable avenue to grow your savings, Muthoot Finance Limited's Non-Convertible Debenture (NCD) could be the ideal choice. In this blog post, we'll delve into the intricacies of Muthoot Finance NCDs and explore why they are capturing the attention of savvy investors.

Understanding Muthoot Finance Limited NCD

Muthoot Finance NCDs represent a golden opportunity in the realm of investments. These Non-Convertible Debentures stand as a testament to financial security and promising returns. With a history built on trust and a commitment to financial excellence, Muthoot Finance Limited has meticulously crafted these NCDs to cater to discerning investors. Immerse yourself in the world of Muthoot Finance NCDs and embark on a journey toward financial growth and stability.

What are NCDs?

Non-Convertible Debentures (NCDs) are fixed-income instruments that offer investors a stable and predictable source of income. Corporations issue these debentures to raise capital for various purposes, including business expansion and debt repayment. Muthoot Finance Limited, a trusted name in the financial industry, is now offering NCDs with an enticing set of features.

Key Features of Muthoot Finance Limited NCD

Let's explore some of the key features of Muthoot Finance Limited NCDs by delving into the following highlights:

Issue Size (Net): Muthoot Finance Limited is offering NCDs with an issue size of up to Rs. 700 crores, making them accessible to a wide range of investors.

Credit Ratings: These NCDs have been rated AA+/Stable by ICRA Limited, indicating a high level of creditworthiness and stability.

Issue Dates: The issue opens on September 21, 2023, and closes on October 6, 2023, providing a limited window of opportunity to invest.

Series and Terms: Muthoot Finance Limited is offering seven series of NCDs with varying tenors and coupon rates. Investors can choose the series that best aligns with their financial goals.

Interest Payment Frequency: Depending on the series, you can receive interest payments monthly or annually, ensuring a regular income stream.

Coupon Rates: The coupon rates for Category I investors range from 7.75% to 8.00% per annum, while Category II, III, and IV investors can enjoy rates between 8.75% and 9.00% per annum.

Maturity Amount: The maturity amount per NCD varies based on the category and series, ensuring flexibility for investors.

Why Invest in Muthoot Finance Limited NCD?

Muthoot Finance is a trusted name in financial services. Established in 1997, it is a distinguished gold loan Non-Banking Financial Company (NBFC) hailing from Kerala, India. This financial institution boasts a remarkable heritage spanning 800 years within the family business. Over the years, Muthoot Finance has evolved and diversified its offerings to cater to a wide range of financial needs.

As of September 30, 2022, Muthoot Finance had an extensive gold loan portfolio with around 8.16 million loan accounts across 22 states, the national capital territory of Delhi, and six union territories in India. This vast network of services is supported by 4,641 branches, and the company employs 27,204 individuals in its operations.

In terms of financial stability, as of March 31, 2022, Muthoot Finance had borrowings of Rs. 276,630.69 million from various banks and financial institutions.

Investing in Muthoot NCDs can offer a range of benefits, making them an attractive option for investors looking to grow their wealth. Here are some key reasons why you should consider investing in Muthoot NCDs:

Stable Returns: With attractive coupon rates, these NCDs offer stable and competitive returns, making them a viable choice for income-oriented investors.

Creditworthiness: The AA+ rating by ICRA Limited signifies Muthoot Finance Limited's strong financial position and commitment to meeting its financial obligations.

Flexibility: With multiple series and tenor options, investors can tailor their investments to match their financial goals and risk appetite.

Regular Income: Monthly and annual interest payments provide investors with a steady income source, enhancing financial security.

Trusted Name: Muthoot Finance Limited has a longstanding reputation for integrity and excellence in the financial industry, instilling confidence in investors.

Conclusion

Muthoot NCDs present a compelling opportunity for investors looking to strike a balance between security and returns. With a strong credit rating, flexible investment options, and competitive coupon rates, these NCDs offer a path to financial growth and stability.

Before you invest your money, be sure to research and seek advice from a financial advisor. However, Muthoot NCDs are certainly worth considering if you're seeking a secure and profitable investment avenue. Don't miss out on the chance to invest in these NCDs during the specified window, and take a step towards securing your financial future.

Source :- https://www.evernote.com/shard/s349/sh/b60e1b0f-51ac-1317-3f7a-92f8c4c17686/ihWTqosybB9L-R7ueUy_vhDCdwjFWZYIxGA5ARz9QHcUurxfzHiWkH8AGQ

1 note

·

View note

Text

"Unlocking Financial Potential: A Comprehensive Guide to Indiabulls NCDs"

In today's dynamic world of investments, securing a stable financial future is a priority for many. One intriguing avenue that has garnered considerable attention is the Non-Convertible Debentures (NCDs) offered by Indiabulls Housing Finance Limited. In this article, we'll take a deep dive into this investment option, which could be a valuable addition to your portfolio.

Company Overview

Indiabulls Housing Finance Limited, established in 2005, stands tall as one of India's largest housing finance companies. It proudly serves as the flagship entity of the Indiabulls Group, providing a wide array of services ranging from Home Loans and Home Renovation Loans to Rural Home Loans and Home Extension Loans.

As of September 30, 2022, the company boasts an extensive network of 164 branches across India, ensuring a nationwide presence for customer interaction and service. Moreover, the company employs a dedicated sales team of 2,200 professionals spread throughout its network.

Indiabulls Housing Finance Limited holds a robust long-term credit rating of "AA; Outlook Stable" from CRISIL and ICRA, along with a "AA; Outlook Negative" rating from CARE Ratings. Its non-convertible debentures and subordinated debt program have earned a "AA+; Outlook Stable" rating from Brickwork Ratings.

Indiabulls NCD Issue Details

Here's a quick overview of the essential details about the Indiabulls Housing Finance Limited NCD:

Issuer: Indiabulls Housing Finance Limited Tranche II Issue

Instrument: Secured Redeemable Non-Convertible Debentures (NCDs)

Issue Opens: Wednesday, September 6, 2023

Issue Closes: Wednesday, September 20, 2023

Issue Size: Rs. 100 Crore with an option to retain oversubscription up to Rs. 100 Crore, aggregating up to Rs. 200 Crore

Issue Price / Face Value: Rs. 1,000/- per NCD

Minimum Application: Rs. 10,000/- (10 NCD) and in multiples of Rs. 1,000/- (1 NCD) thereafter

Credit Rating: "CRISIL AA/Stable" by CRISIL Ratings Limited and "[ICRA] AA (Stable)" by ICRA Limited

Registrar: KFIN Technologies Limited

Listing: The NCDs are proposed to be listed on BSE

Category Allocation

The NCDs are distributed across four segments with specific allocations:

Category I - Institutional: 30%

Category II - Non-Institutional: 10%

Category III - HNI: 30%

Category IV - Retail: 30%

Conclusion

Indiabulls NCDs offer an enticing investment opportunity for both individuals and institutions alike. With a solid credit rating and a range of series to choose from, investors can tailor their investments to align with their financial objectives and risk tolerance. However, it's advisable to conduct thorough research and consult financial experts before making any investment decisions to ensure that these NCDs fit seamlessly into your overall investment strategy.

In an ever-evolving financial landscape, Indiabulls NCDs present a promising path towards financial security and growth. Consider exploring this opportunity to bolster your investment portfolio and work toward achieving your financial goals.

Source :- https://www.minds.com/newsfeed/1546089403120619539?referrer=rrfinance93

0 notes

Text

Secure Your Investments with NIDO HOME FINANCE LIMITED NCDs

Investing in NIDO HOME FINANCE LIMITED, formerly known as Edelweiss Housing Finance Limited, is a priority for many individuals and investors seeking both security and attractive returns. This company offers an opportunity to achieve precisely that through its Secured Redeemable Non-Convertible Debentures (NCDs). In this article, we will delve into the specifics of NIDO HOME FINANCE LIMITED's NCDs and explain why they could be an excellent addition to your investment portfolio.

Company Overview

NIDO HOME FINANCE LIMITED, originally incorporated as Edelweiss Housing Finance Limited in 2008, is a non-deposit taking Housing Finance Company headquartered in Mumbai, India. It is a part of the renowned Edelweiss group, known for its diversified financial services in India. The company specializes in providing secured loan products tailored to meet the needs of individuals, particularly in the affordable housing category.

Credit Rating

Before exploring the details of NIDO HOME FINANCE LIMITED's NCDs, it's crucial to assess their creditworthiness. These NCDs have received a credit rating of "CRISIL AA-/Negative" from CRISIL and "[ICRA] A+ (Stable)" from ICRA Limited. These high ratings signify a robust level of safety and stability associated with these NCDs, rendering them an appealing choice for investors seeking secure investment avenues.

Key Features of NIDO HOME FINANCE LIMITED's NCDs

Issue Structure

Issuer: NIDO HOME FINANCE LIMITED (Formerly Known as Edelweiss Housing Finance Limited)

Instrument: Secured Redeemable Non-Convertible Debentures (NCDs)

Issue Period: Opens on Wednesday, August 30, 2023, and closes on Tuesday, September 12, 2023

Issue Size: The offering comprises an initial size of Rs. 75 Crore, with the possibility to exercise an oversubscription option of up to Rs. 75 Crore, aggregating up to Rs. 150 Crore

Issue Price / Face Value: Rs. 1,000/- per NCD

Minimum Application: Rs. 10,000/- (10 NCD) and in multiples of Rs. 1,000/- (1 NCD) thereafter.

Listing: The NCDs are proposed to be listed on BSE

Category Allocation

Category I - Institutional: 10%

Category II - Non-Institutional: 10%

Category III - HNI (High Net Worth Individuals): 40%

Category IV - Retail: 40%

Investing in NIDO HOME FINANCE LIMITED's NCDs presents an opportunity for a secure and potentially rewarding addition to your investment portfolio. If read more then Click here

1 note

·

View note

Text

Before investing in capital gain bonds, there are a few things you should know.

Capital gain bonds are an attractive investment option for those looking to save on taxes. These bonds are issued by specific institutions and are designed to help investors save capital gains tax by investing their profits from the sale of an asset in these bonds. However, before investing in capital gain bonds, there are several things that investors should consider.

Eligibility Criteria

Not everyone can invest in capital gain bonds. Only individuals or Hindu Undivided Families (HUFs) who have made a long-term capital gain on the sale of any asset and want to save tax on it are eligible to invest in these bonds. Therefore, investors should first determine whether they meet the eligibility criteria before investing.

Tax Benefits

One of the primary reasons investors invest in capital gain bonds is to save on tax. The interest earned on these bonds is tax-free, and investors can claim a tax exemption for the amount invested in the bonds. However, it is important to note that this tax benefit is limited to a maximum investment of Rs. 50 lakh per financial year.

Interest Rate

The interest rate on capital gain bonds is typically lower than that of other fixed income investments like fixed deposits or mutual funds. However, the tax benefits make them an attractive investment option for those looking to save on taxes. Investors should also keep in mind that the interest rate on these bonds is fixed for the entire tenure of the investment.

Lock-in Period

Capital gain bonds have a lock-in period of five years, which means investors cannot sell or transfer them for five years after the date of purchase. Therefore, investors should carefully consider their financial goals and liquidity needs before investing in these bonds.

Redemption

After the lock-in period of five years, investors can redeem the bonds, and the principal amount will be returned to them along with the interest earned during the lock-in period. Investors should also note that premature withdrawal of these bonds is not allowed.

Availability

Capital gain bonds are issued by specific institutions like Rural Electrification Corporation Limited (REC), National Highways Authority of India (NHAI), and Power Finance Corporation (PFC). Therefore, investors should check their availability and interest rates before investing.

Alternatives

While capital gain bonds can be a good investment option for those looking to save on taxes, investors should also consider other investment options like equity-linked savings schemes (ELSS), mutual funds, or National Pension System (NPS). These investments also offer tax benefits and higher returns.

Risk Factors

Investors should also consider the risk factors associated with investing in capital gain bonds. While these bonds are considered safe investments, there is still a risk of default by the issuing institution. Therefore, investors should research the creditworthiness of the issuing institution before investing in these bonds.

Conclusion

Investing in capital gain bonds can be a good way for individuals or HUFs to save on taxes. However, investors should carefully consider their financial goals, eligibility criteria, interest rates, lock-in periods, and liquidity needs before investing in these bonds. They should also explore alternative investment options and research the creditworthiness of the issuing institution. By taking these factors into consideration, investors can make informed decisions about whether or not to invest in capital gain bonds.

0 notes

Text

Before investing in capital gain bonds, there are a few things you should know.

Capital gain bonds are an attractive investment option for those looking to save on taxes. These bonds are issued by specific institutions and are designed to help investors save capital gains tax by investing their profits from the sale of an asset in these bonds. However, before investing in capital gain bonds, there are several things that investors should consider.

Eligibility Criteria

Not everyone can invest in capital gain bonds. Only individuals or Hindu Undivided Families (HUFs) who have made a long-term capital gain on the sale of any asset and want to save tax on it are eligible to invest in these bonds. Therefore, investors should first determine whether they meet the eligibility criteria before investing.

Tax Benefits

One of the primary reasons investors invest in capital gain bonds is to save on tax. The interest earned on these bonds is tax-free, and investors can claim a tax exemption for the amount invested in the bonds. However, it is important to note that this tax benefit is limited to a maximum investment of Rs. 50 lakh per financial year.

Interest Rate

The interest rate on capital gain bonds is typically lower than that of other fixed income investments like fixed deposits or mutual funds. However, the tax benefits make them an attractive investment option for those looking to save on taxes. Investors should also keep in mind that the interest rate on these bonds is fixed for the entire tenure of the investment.

Lock-in Period

Capital gain bonds have a lock-in period of five years, which means investors cannot sell or transfer them for five years after the date of purchase. Therefore, investors should carefully consider their financial goals and liquidity needs before investing in these bonds.

Redemption

After the lock-in period of five years, investors can redeem the bonds, and the principal amount will be returned to them along with the interest earned during the lock-in period. Investors should also note that premature withdrawal of these bonds is not allowed.

Availability

Capital gain bonds are issued by specific institutions like Rural Electrification Corporation Limited (REC), National Highways Authority of India (NHAI), and Power Finance Corporation (PFC). Therefore, investors should check their availability and interest rates before investing.

Alternatives

While capital gain bonds can be a good investment option for those looking to save on taxes, investors should also consider other investment options like equity-linked savings schemes (ELSS), mutual funds, or National Pension System (NPS). These investments also offer tax benefits and higher returns.

Risk Factors

Investors should also consider the risk factors associated with investing in capital gain bonds. While these bonds are considered safe investments, there is still a risk of default by the issuing institution. Therefore, investors should research the creditworthiness of the issuing institution before investing in these bonds.

Conclusion

Investing in capital gain bonds can be a good way for individuals or HUFs to save on taxes. However, investors should carefully consider their financial goals, eligibility criteria, interest rates, lock-in periods, and liquidity needs before investing in these bonds. They should also explore alternative investment options and research the creditworthiness of the issuing institution. By taking these factors into consideration, investors can make informed decisions about whether or not to invest in capital gain bonds.

Source :- https://sites.google.com/view/rrfinance-cgb/home

0 notes

Text

Maximize Your Savings with LIC Housing Finance Ltd.'s Fixed Deposits

A well-known financial company in India, LIC Housing Finance Ltd., provides a variety of financial products and services, including fixed deposits (FDs). The FDs offered by LIC Housing Finance Ltd. are a terrific way to increase your savings because they provide a variety of tenures and high interest rates.

Here are some reasons why purchasing fixed deposits from LICHFL may be a wise move:

Exorbitant Interest Rates

Compared to savings accounts and other conventional investing choices, LIC Housing Finance Ltd.’s FDs provide greater interest rates. According to the tenure and kind of FD, the interest rates for LIC Housing Finance Ltd.’s FDs range from 7.25% to 7.75% annually as of April 2023.

Versatile Tenures

The adjustable terms of the FDs offered by LIC Housing Finance Ltd. range from one year to five years. This enables you to select a term that fits your financial objectives and time horizon for investments.

Set Returns

The set returns offered by LIC Housing Finance Ltd.’s FDs ensure that you know exactly how much money you will earn at the end of the term. It is now simpler for you to arrange your budget and reach your financial objectives.

Secure and Safe

The financial company LIC Housing Finance Ltd. has a solid reputation for providing consumers with excellent service for more than 30 years. Due to their AAA rating from the top credit rating agencies, investments in the FDs of LIC Housing Finance Ltd. are risk-free and secure.

Simple to invest

The FDs offered by LIC Housing Finance Ltd. are simple and hassle-free to invest in. By going to a branch of LIC Housing Finance Ltd., you can make an offline or online investment. To determine the interest generated and the maturity amount, you can use use the online FD calculator.

Let’s look at some suggestions to make the most of your money with these FDs.

Pick the Correct Tenure

When investing in FDs from LIC Housing Finance Ltd., picking the appropriate tenure is essential. Choose a short-term FD with a tenure of 1–3 years if you have short-term financial objectives. Choose a long-term FD with a tenure of 5–10 years if you have long-term financial objectives. By doing this, you can be confident that you’ll get the best return on your investment.

Put money into accumulative FDs.

The two forms of FDs offered by LIC Housing Finance Ltd. are cumulative and non-cumulative. In cumulative FDs, interest is compounded annually and reinvested, meaning that interest is earned on interest. Long-term, this results i higher returns. Choose a cumulative FD if you don’t require regular income from your investments.

Diversify Your Investments

Every investing portfolio should be diversified. Diversify your portfolio by making investments in corporate fixed deposits like those offered by LIC Housing Finance Ltd. rather than putting all of your savings into bank FDs. You can spread out the risk and increase returns by doing this.

Source - https://sites.google.com/view/lic-housing-fd/home

0 notes