Motivating and talented professor driven to inspire students to pursue academic and personal excellence,

Don't wanna be here? Send us removal request.

Text

Hotel Guest Supplies Tutorial

Guest supplies refer those items which are provided by the hotel as an advantage to enhance the guest’s comfort and convenience. Though the types of guest supplies could be vary according to the nature and size of the hotel but the following areas are generally involved:

Guest Amenity

Guest essentials

Guest expendables

Guest loan items

In most cases the guest supplies affect in determining the room rate according to its quantity and quality due to huge collective cost. However the high price of luxurious items does not lead the large hotels to reduce the amount of supplies as they are a vital factor for attracting potential guests.

Guest supplies greatly require proper storage and effective security. Some guest supplies need large amount of area to store, for example items like guest pen or envelopes are stored in high volume and look very ordinary that may inspire low trained employees to use or steal. So tight security & locked storage should be made to prevent unexpected use and loss of guest supplies otherwise it may turn to be a big loss for hotel.

A. Guest Amenities

Amenity can play a vital role in gaining guest’s satisfaction. Amenity packages comprises of such lavish items which are provided for the guests arranged by the hotel at free of cost to qualify the service. To make best possible use of amenity service, the items should be provided based on the guest preferences. Read Typical Guest Room Amenities in Hotels & Resorts for clear understanding about general standard amenity package.

However in most cases the expenses of these items are remunerated with the guest’s room rate. Guest amenities are not only limited to the room, but also extended to the other service like free breakfasts, entertainment etc. Most important thing is that, the waste that is produced from amenities should be handled carefully in order to avoid any pollution. Many chains hotels also work as bulk dispensers for removing waste which can keep the hotel atmosphere pollution free.

Amenity packages generally comprises of bath amenities and guest room amenities which are as follows:

1. Bath Amenities:

To provide the bath amenities is the most prime and common practice for hotels. Even a hotel can achieve reputation only by providing better bath amenities, for example: Bellagio. A standard list of bathroom amenities which are available in most hotels are as follows:

Bathroom Amenity Items

Soap

Hand lotion

Aftershave

Mouthwash

Face soap

Shoe mitt

Shampoo

Body oils

Bath gel

Face lotions

Razors

Shaving cream

Hair conditioner

Tanning lotion

Bath salts

Deodorants

Deodorant soap

Body powder

Cosmetics

Glycerin soap

Sewing kit

Scissors

Facial mud packs

Bubble bath

Perfumes

Nail clippers

Loofah sponges

Emery boards

Shoehorn

Colognes

Fabric wash

Shower cap

2. Guestroom Amenities:

The amenities which are provided and arranged in the guest’s bedroom are as follows:

Guest amenities

Free in-room beverages

Luxury stationery

Clothes sachets

Free snacks

Coffeemaker

Bathrobes

Chocolate

Flowers

Corkscrews

Expensive pens

In-room movies

Quality pens

B. Guest Essentials

Guest essentials are regarded as those items which are certainly essential for meeting the guest requirements and to improve the service. These guest essentials are proposed and arranged for continuous use even after the guest’s departure. Like guest amenities, guest essentials are not used up by the guest and remain in the hotel for serving another expecting guest.

Guest essentials are generally marked with hotel logo in order to avoid any sort of unusual incidents like missing or stealing. The cost for providing these essentials basically shared with the marketing department if hotel logos are used as advertising purposes.

Here is a list of several guest essentials that are available in every standard hotel:

Guest Essentials

Clothes hangers

Ice buckets

Ashtrays

Glass (or plastic) drinking cups

Plastic trays

Waste baskets

Do-not-disturb signs

Water pitchers

Shower mats (rubber)

Fly swatters

Bibles

Suit bag

C. Guest Expendables

Unlike guest essentials, guest expendables are planned to be used up by the guests. Hotels do not have to invest a lot for providing these guest supplies as limited budget is required.

However, some guest expendables are not completely consumed by the guest and remain after guest’s departure, such as soaps, shampoos. While preparing the room for new guest, these supplies are replenished with new one.

Though the housekeeping department is generally responsible for arranging, inventorying and storing guest supplies, but guest expendables are also provided by other department which is beneficial for smoothen the hotel operation. Some of the common guest expendables are given below:

Guest Expendables

Dry bags

Plastic utility bags

Sani bags

Stationary

Matches

Disposal slipper

Facial tissue

Laundry tickets

Magazines Notepads

Postcards Pens

Toilet tissue

Emery boards

Bath soaps (bar)

Table tents (in-house advertising)

Individual packs of coffee

Toilet seat bands

Facial soaps (bar)

Candy mints

D. Guest Loan Items

Usually hotels do not provide guest loan items in the guest room. These supplies are only delivered when a guest request for any item on a receipted loan basis. The loan receipts signify the status (time of deliver, cost of the item) of the guest loan items.

Guest loan items are not frequently visible in the guest room as these supplies are not required by the all guests. Housekeeper stores certain necessary supplies in the linen room that can be requested by the guests which are as follows:

Guest Loan Items

Alarm clocks

Hot water bottles

Irons

Ice packs

Heating pads

Razors

Hair dryers

Electric shavers

Ironing boards

Bed boards

0 notes

Text

“Cleaning” in Housekeeping Department of Hotel

THE HOUSEKEEPING DAY

The “housekeeping day” refers to that part of the 24 hours in a day when housekeeping operations are in full swing. The daily routine may differ slightly from one hotel to other, and the shift timings may wary considerably, depending on their location and target clientele.

For systematic management of the daily routine of the housekeeping department, the housekeeping day is divided into different activities which are carried out by the employee in their respective shifts.

Following are the activities:

1. Briefing: The executive housekeeper, being the managerial staff, will hold the briefing session for all employees at the beginning of a work shift. This process facilitates a two-way communication between the management and the staff. Usually this is the time at which grooming standards are checked, before allocating jobs to the staff. The following may be communicated in the course of a briefing session of 10 minutes:

a) Any VIP in the house.

b) Policies and new procedures to be followed by the staff or the hotel in the general.

c) Job allocations

d) Immediate reporting relationships for the shift.

e) Checking of grooming standards and personal hygiene.

f) Appreciation for work well done on the earlier shifts.

g) Rectification required

h) Banquets or other events to be held in the hotel.

2. Room assignments: After briefing, the floor supervisors hand over the room assignment sheet to the GRAs. These GRAs are the ones who will be servicing these rooms in that particular shift.

3. Handover of keys: Once the GRAs have received their room assignment sheets, they are handed the floor master keys for their particular floors by the deputy housekeeper.

4. Readying the cart: The GRAs, armed with the master keys, and then proceed to the floor pantries on their individual floors, where they make additions and alterations to the room attendants cart according to the room occupancy.

5. Room status check: At this stage, one of the most important morning shift activities to be undertaken by the housekeeping staff is the physical checking of the room status.

6. Clean-up, reporting, and handover: The GRAs now send all the soiled linen to the laundry in a linen trolley. The floor supervisor collect and file away all forms and reports the GRAs submit at the control desk. After completing the document submission the GRAs hand over the keys to the control desk, sign the key control and assemble for their debriefing.

7. Debriefing: This session, similar and complementary to the briefing at the start of a shift, may include the following:

a) Discussing problems faced by any staff member.

b) Sharing experiences and inviting ideas or practical solutions to tackle any particular common problem.

c) Handover of any incomplete work to the staff on the next shift.

d) Checking the next day’s duty roster.

Methods of Cleaning/Types of Cleaning procedures in Hotel Housekeeping

The Executive Housekeeper is responsible for seeing that the housekeeping staff follow the standard cleaning procedures and methods. He/She should also oversee that proper tools (mechanized or non-mechanized) are used to carry out their assigned tasks.

Floors and carpets in the hotel require regular cleaning and finishing to retain their appearance and durability. Deciding when and how carpets and floors should be cleaning is an important task and this important task is further complicated by the different available cleaning procedures, machines and solutions.

Cleaning processes in housekeeping can be either manual or mechanical. They may involve different methods like washing (using water as a cleaning and rinsing agent), friction (as in using an abrasive), static electricity (by using a static mop), suction (by using a vacuum cleaner), or by force (by using pressurized water). The various types of cleaning processes are summarized in this section.

A. Manual Cleaning Methods - Which do not require mechanized or electronic equipment:-

1) Sweeping:

What is the process involved in sweeping?

Sweeping is done to collect dust when the floor surface is too rough for a dust mop.

What is the Equipment required for sweeping?

A broom, a dustpan, a trash bag and a stocked pubic-space cleaning cart.

2) Dusting:

What is the process involved in dusting?

· This task requires a systematic and orderly approach for efficiency & ease.

· Room attendants should start dusting articles at the door & work clockwise around the room.

What are the Equipment & agents required for dusting?

Cloth duster, Micro Fiber Cloths, Feather duster & dusting solution if necessary.

3) Damp dusting:

What is the process of damp dusting?

· This is the most preferred way of cleaning in hotels as surfaces can be wiped as well as dusted, removing any sticky or dirty marks at the same time.

· A suitable lint-free cloth at the correct level of dampness should be used so as to avoid leaving any smears.

What are the Equipment & agents required for damp dusting?

Cloth duster, water, plastic bowl, & a neutral detergent if necessary.

4) Dust Mopping / Dry Mopping/ Mop Sweeping:

What is the process of Floor Dust Mopping?

· This is the preferred way to remove dust, sand or grit from the floor.

· If the dust and other substances are not removed from the floor on a daily basis, they will continually scratch the surface finish, diminishing its lustre, & will eventually penetrate down to the floor itself.

What are the Equipment & agents required for Dry Mopping the Floor?

Dust control mop, dust pan, dust- collecting bag, & dustbin.

5) Spot Mopping:

What is the process of Spot Mopping?

· Spot mopping is essential to the preservation of floor surface.

· Liquids & solids that are spilt on the floor, if left for any length of time, may penetrate the finish & stain the floor.

What are the Equipment & agents required for Spot Mopping the Floor?

Mop & bucket or a mop- wringer trolley, cold water, & a very dilute solution of neutral detergent if necessary.

6) Wet mopping / Damp mopping:

What is the process of Wet Mopping?

· A damp mop is used to remove spills & adhered soil that was not removed during the dry removal process.

What are the Equipment & agents required for Damp Mopping?

Caution signs, floor cleaner, wet mop & bucket or mop- wringer trolley, squeegee, & detergent solution.

7) Manual Scrubbing:

What is the process of Manual Scrubbing?

· For modern surfaces, very little hand -scrubbing is required.

· Scrub gently in straight lines away from yourself, working backwards.

What are the Equipment & agents required for Manual Scrubbing?

Long-handled scrubbing brush, mild detergent, bucket, squeegee, water, & mop.

8) Manual polishing:

What is the process of Manual Polishing?

· Apply the polish sparingly.

· Use cotton rags to apply polish & a cloth for buffing.

What are the Equipment & agents required for Manual Polishing?

Use proprietary polish for each type of floor or surface, clean cotton rags.

9) Spot Cleaning:

What is the process of Spot Cleaning?

· This refers to the removal of stains from different kinds of hard & soft surfaces.

· To remove a localized stain, the whole surface need not be treated with stain-removal reagents.

What are the Equipment & agents required for Spot Cleaning?

Cleaning Cloths, solvents, cleaning agents, brushes etc.

B. Mechanised Cleaning Methods - These utilize equipment powered by electricity as well as mechanical equipment:-

1) Suction Cleaning:

What is the process of Suction Cleaning or Vaccum cleaning?

· This is the basic & preparatory step to all other mechanized procedures & should be performed regularly.

· The goal is to remove as much dry soil as possible so that it does not spread, scratch the finish, or damage the surface.

What are the Equipment & agents required for Cleaning or Vaccum cleaning?

Caution signs, a stiff broom, wet/dry vacuum cleaner with attachments & a mild detergent for wet cleaning if necessary.

2) Spray buffing:

What is the process of Spray Buffing?

· This process uses a 175- or 300-rpm (revolutions per minute) floor machine & a soft pad or brush.

· As the machine goes over the area, soil, scuffs, light scratches, & marks are removed & the shine is restored to the surface.

What are the Equipment & agents required for Spray Buffing?

The equipment & agents required are a 175 –or 300-rpm buffing machine with beige pad, spray bottle, detergent, & finishing solution.

3) Polishing:

What is the process of:

· This process uses a 175- 1500-rpm floor machine & a soft pad or brush to remove some soil & brush to remove some soil & put the shine back in the finish.

· Vacuuming or dust- mopping should be carried out as a follow- up step to remove loosened dirt.

What are the Equipment & agents required for Spot Cleaning?

A 1500 – 2500 rpm floor machine.

4) Scrubbing:

What is the process of Scrubbing?

· This process removes embedded dirt, marks, deeper scuffs, & scratches from the floor along with some of the finish.

· The pad or brush, the type of detergent, the water temperature, & the weight & speed of the machine all determine whether the process is considered light or heavy scrubbing.

What are the Equipment & agents required for Scrubbing?

Floor- maintenance machines with a green pad.

5) Stripping:

What is the process of Stripping?

· This is a very aggressive process that requires removing all of the floor finish & sealer, leaving a bare floor ready for refinishing.

What are the Equipment & agents required for Stripping?

A floor-maintenance machine with a black pad.

6) Laundering:

What is the process of Laundry?

· This is the cleaning method used for washable fabrics.

· It is a process in which soil & stains are removed from textiles in an aqueous medium.

What are the Equipment & agents required for Laundering?

Washing Machines, Drying Machines, Steam Cabinets and Tunnels, Flatwork Irons, Folding Machine, Washing Chemicals and Detergents.

7) Dry Cleaning:

What is the process of Dry Cleaning?

This is the method in which soil & stains are removed from textiles in a non-aqueous medium.

Dry cleaning is any cleaning process for clothing and textiles using a chemical solvent other than water.

What are the Equipment & agents required for Dry Cleaning?

Chemical Solvents, Dry Cleaning Machine

Methods of Organizing Cleaning

1. Orthodox/ Traditional cleaning: In this method, the Guest Room attendant completes all the cleaning tasks in one room before proceeding to another room. On average, a GRA may be required to clean about 12-20 room in 8 hours duty.

ADVANTAGES:

Ø Improved security.

Ø More job satisfaction.

Ø Standard of work is higher if the individual is efficient.

Ø Training is simplified.

DISADVANTAGES:

Ø Each area takes longer to get cleaned.

Ø Maybe more expensive.

Ø Each staff will have to be given equipment, hence more equipment required.

Ø May be too rigid.

2. Block cleaning: In this method, GRA moves from one dirty room to another and completes the same task in every room before returning for starting the next task on the list. This involves blocking several rooms at a time and usually, more than 1 GRA are involved in cleaning at a time. Different GRA’s pick up different tasks. (Bed making, Toilet Cleaning, Room cleaning, replenishing supplies).

ADVANTAGES:

Ø Less equipment is required.

Ø Is cheaper to operate.

DISADVANTAGES:

Ø Security is weakened as lots of people enter the room.

Ø More disturbances to the guest if he’s in the room during room cleaning.

Ø May-be monotonous for staff.

3. Team cleaning: This is a combination of the two methods mentioned above. In this method two or more GRA’s work in the same room taking up different tasks so that room is cleaned quickly before moving on to the same room. A team of 3 GRA’s may be assigned 30-35 rooms in a day.

ADVANTAGES:

Ø Equipments can be shared.

Ø Heavy work can be carried with ease.

Ø New staff can be trained easily.

Ø Increased productivity.

DISADVANTAGES:

Ø In case of any damage to the equipment, no one can be held responsible.

Ø Standards can get lowered if proper supervision is missing.

Ø While training, new staff can pick up bad habits.

Ø Due to mis-understanding some work can get left out.

Ø If there are any clashes between staff, working together can be a disadvantage.

FREQUENCY OF CLEANING

Cleaning tasks may be divided according to the frequency of their scheduling, which depends upon the level of soiling, the type of surface, the amount of traffic, the type of hotel and the cleaning standards. Employees should be given the procedures and frequencies for carrying out various tasks outlined in the book or manual. This information may also be displayed in the floor pantries.

1. DAILY CLEANING:

These are routing operations carried out on a day-to-day basis by the staff of the housekeeping department. These include the regular servicing of guestrooms, cleaning of bathrooms and toilets, suction cleaning of floors and the floor coverings and so on.

2. PERIODIC CLEANING:

A. WEEKLY CLEANING:

These, as term implies, are routine tasks carried out on a weekly basis. Mostly the time consuming tasks are placed under this category which, must be done at least once in a week and cannot be undertaken on a daily basis. Some of the weekly jobs are as follows:

a) Polishing of brass ware, metal work, fitting and fixtures.

b) Scrubbing of bathroom tiles.

c) pest control of the rooms and floors

d) laundering of the shower curtains

B. SPRING CLEANING:

This is a term used for annual cleaning of guestrooms and public areas in offseason periods and low occupancy periods. This involves a complete overhaul of the rooms by undertaking a few steps as:

a) Removal of carpets from the room for shampooing

b) Polishing wooden furniture, shampooing upholstery (sofas)

c) Painting on walls

d) Cleaning air conditioning vents

e) Airing the room Redecoration

C. Deep cleaning:

It refers to the intensive cleaning schedule in which periodic cleaning tasks are scheduled for monthly, quarterly, half-yearly or annual frequency. This is done for areas and surfaces which cannot be cleaned on a daily basis. This kind of cleaning is conducted in close coordination with the maintenance department. Some of the deep cleaning jobs are as follows:

a) carpet shampooing

b) Rotating and cleaning mattresses

c) Cleaning of Ceilings, light fittings, fans, signage boards

d) Laundering of soft furnishings.

Apart from the above cleaning there can be:

1. Evening service (Or Turn- Down Service): This is the service given to room in the evening to prepare the room for the night. This service should be done prior to the guest retiring for the night.

2. Second Service: this is service given to the VIP guest staying in the hotel or on the guest request. This normally happens when a guest has/ had a party or meeting in his room & would like his room to be put in order as a consequence. This may be charged by the hotel.

Hotel Guest Room Cleaning

A.ENTERING THE GUEST ROOM:

Procedure followed in entering the guest room

1. During Hotel Guest Room Cleaning always knock the door announcing Housekeeping.

2. If there is no answer, after 15 seconds knock the door again the second time announcing Housekeeping.

3. If there is still no answer, use the master key to open the door announcing Housekeeping and enter the room while knocking.

B.PREPARE GUEST ROOM FOR CLEANING:

1. Remove room service equipment's from room:

1. Pickup all room service equipment and move it to the floor pantry.

2. Move the room service cart / trolley to the floor pantry.

3. Inform the room service / IRD department to clear the trays / trolley from guest room / floor pantry.

4. Never place the room service trays or trolleys on the guest corridor or the service elevator.

2. Removing rubbish:

1. Collect recyclable items such as (Newspapers / Aluminum cans, glass bottles, News paper bags etc.) and place them either in the bag or on the floor pantry.

2. Empty the waste paper basket and ashtray on to the garbage bag.

3. Pick up all the rubbish and put it in the rubbish bag.

4. All rubbish removed from room upon entering that room, and placed in rubbish bag on trolley.

5. Extra care should be taken with broken glass, razor etc.

6. Remove all disposal items like ash, cigarette buds etc. into the dustbin.

7. Keep ashtrays and glassware under washbasin tap to wash.

8. With lukewarm water and teepol, clean the ashtrays and glassware with the help of sponge.

9. Wash liberally with water.

10. Wipe with a lint free cloth.

11. After drying, place back the items in the appropriate place.

12. Ashtrays and glassware are spotless and clean.

13. Use a dry tissue to collect hair from the vanity, toilet, bath tub and floor.

14. Do not throw away any guest property that may be wrapped in a tissue.

15. Cleaning of ashtrays and glassware.

16. Collect all ashtrays and glassware.

3. Emptying dirty linen:

1. Remove any guest clothing from the bed and neatly lay it across the back of the chair.

2. If there is any personal items on the bed then remove them and place it neatly on the table.

3. If it’s a departure dirty room then if you find any guest items and record the same as lost and found item.

4. Remove all dirty linen from the room and put everything in the space provided for storing soiled linen in the R/A trolley.

5. When the dirty linen is at level with the top of the trolley, empty the linen and collect in the pantry.

6. All the dirty linen removed from room and put in linen bag in the trolley.

7. Do not use guest linen and towels for cleaning the guest rooms.

C.

v SERVICING OF OCCUPIED ROOMS:

1. All occupied rooms are serviced twice daily and as and when requested by the guest.

2. Enter the room according to the procedure of entry to guestrooms.

3. Clear the garbage according to the procedure of removal of garbage from dustbins.

4. Collect the soiled linen and throw in the linen bag.

5. Make the bed, follow the bed making procedure.

6. Perform dusting of the room.

7. Vacuuming of carpet and the upholstery maintenance.

8. Clean Bathroom.

9. All amenities are replenished in bathroom. (Maintain photograph for standard amenity placement)

10. After servicing the room following facilities function to be checked.

11. Television

12. All Telephones

13. All Bulbs.

14. Any in room Entertainment system.

v SERVICING OF VACANT ROOM:

1. Room has to be spic and span at every given time.

2. Knock the door.

3. Switch on all lights.

4. Open heavy and sheer curtains.

5. Remove turn down service.

6. Put bed cover.

7. Do the dusting.

8. Replenish water and ice.

9. Mop bathroom flooring with disinfectant.

10. Vacuum the carpet if necessary.

11. Close sheer curtain.

12. Heavy curtain should be half closed.

13. Put of all the lights.

14. Give final looks and shut the door.

v SERVICING OF VACANT DIRTY ROOM:

1. Vacant dirty rooms cleaned thoroughly and all used items/ amenities are changed with fresh ones. Left guest items to be deposited at Housekeeping control Desk.

2. Knock and enter the room.

3. All drawers and cupboards are checked for any lost and found of guest.

4. All dustbins are cleared of garbage.

5. Soiled linen to be removed.

6. Bed is made according to procedure for bed making.

7. Dusting of room is done.

8. Vacuum upholstery and carpet.

9. All glassware and Ashtrays have to be cleaned.

10. All guest amenities in room have to be replenished.

11. Bathroom is cleaned according to procedure.

12. Replenished amenities in the bathroom.

13. All items used by the previous guest are changed with fresh ones.

14. All maintenance work are noted and given to the Engineering department.

15. Inform room status to the Housekeeping control desk.

v SERVICING OF DEPARTURE ROOM:

When a guest releases a room and leaves the hotel that particular room is known as ‘departure room or check-out room.’ The housekeeping department has to clean the room, get the room ready so that the hotel can sell that particular room to some other guest also.

The following are the steps how to clean a departure room for guest room cleaning;

1. Switch off the room air- conditioner or heating. Remove all the curtains and open the windows for airing the room

2. Remove soiled linens from bed and bath. Shake out the linen to ensure that guest articles are lost in the folds of the linens.

3. Check for maintenance requirements and report the same to the control desk and enter in the room checklist.

4. Contact room service to remove extra trays and glasses.

5. Turn the mattress side –to side on succeeding days followed by end –to end turning. Smooth out the mattress and air it.

6. Clean the carpet with the help of vacuum cleaner or carpet brush.

7. Empty all the ashtrays and waste paper baskets.

8. Clean the bathroom and replenish all the required supplies is also a part of guest room cleaning.

9. Collect all the old news paper and magazines which the guest has left over and keep in chamber maid’s trolley.

10. Use stiff upholstery brush or vacuum cleaner on upholstered furniture arms backs and seats.

11. Replace all the stationery as prescribed by the management. The number of items must exactly be as per standard.

12. Dust and replace each item on the dresser and desk. Special attention must be given to the display of publicity materials as prescribed by the management.

13. Clean lamp shades with a clean duster. Lift lamp and clean under the base.. Replace lamp if damaged and adjust the shade.

14. Disinfect the telephone in the room and bathroom with the Dettol Wipe balance of the telephone with a damp cloth. Then check for dial tone.

15. Clean mirrors with a dry cloth first then with a damp news paper, to make it sparkling.

16. Dust all the closet, shelves hangers and rods. Brush the closet floor. Supply new laundry bags and replace the missing hangers

17. Dust both sides of the room doors, head boards, window sills inside and outside the window rails air conditioning unit.

18. Close all the windows.

19. Change the bed linens and bath linens.

20. Arrange the furniture if necessary.

21. Have a final look at the room.

22. Inform the desk control the room is ready and guest room cleaning is done.

Hotel Public area cleaning

Public areas are the common places and facilitates accessible to in house guest and non-resident guest. Guest requires common areas to meet, sit and carry other activities. The place comes under the are lobby, restaurants, bars, banquets, and other Food and Beverage Outlets. Public area cleaning is the most important and challenging task for hotel / hospitality housekeeping. Since most of the public areas are highly traffic area, housekeeping maintains a deep cleaning schedule for those areas at night and regular cleaning and maintenance during the day time.

Public area cleaning:

1. Entrance:

Guest get their 1st impression of hotel from the entrance lobby. Entrances which arecnot cleaned and maintained daily, it will become unpleasant for the guest due to heavy traffic and exposure. The maintenance and cleaning of the entrance and the door is important . So proper and daily cleaning is required in this areas. Normally cleaning is done at night.

2. Lobbies:

These are the common meeting points of the guest near the reception. Many lobbies are carpeted while others are hard flooring. Floors in the lobbies are need to be cleaned frequently., since these are spaces where guest interact., relax etc. Lobbies may have high ceilings elaborate chandelier which are difficult to clean so it is cleaned at night. The daily cleaning tasks involves

Public area cleaning of waste paper bins and ashtrays at

Flower arrangement should be done daily as a part of Public area cleaning.

Glass surface and windows to be cleaned daily.

Doors and door knobs to be dusters and cleaned daily.

Any stain on the carpets and upholstery should be cleaned immediately.

Hard floor should be mopped regularly.

3. Front office:

Housekeeping department is responsible for this Public area cleaning and maintaining of front office because front office is the face of the hotel. So daily cleaning of the department is required. Mopping of the floor, dusting of the furniture and fixture and vacuuming of carpets are essentials.

4. Elevators:

Elevators must be cleaned at the time of day when it is least used. The necessary boards indicating the cleaning is carried out must be displayed promptly. Elevators doors are made of steel. In steel door shows lots of grease marks from finger easily. Elevators should be cleaned daily and more through cleaning may be done on periodic basic.

5. Stair case:

Stair case should be cleaned when there is less traffic. While cleaning of staircase care should be taken that dart and dust do not fall down words.

6. Guest corridors:

While cleaning of the corridors necessary boards indicating the public area cleaning is carried on must be displayed prominently. Carpets in the corridors should be vacuumed daily. The cleaning tasks of the guest corridors are as follows

Carpets should be vacuumed regularly.

The wall skirting should be cleaned regularly.

Any finger marks on the walls should be cleaned immediately.

All the wall painting should be dusted every day.

7. Banquet hall:

Banquet hall mainly used for conferences, weddings exhibition etc. So proper public area cleaning is required for this department. The cleaning includes mopping of floor, vacuuming of the floor carpets regular dusting of fixture and furniture are required.

8. Health club:

Health club is another hotel facility provided to the guest to exercise and work out. So proper cleaning of machine is required daily because it is the busiest ares. The cleaning tasks of the health club are as follows

Proper dusting of equipments.

Damp dusting of furniture

Cleaning of glass and window panel.

Cleaning of carpet floor

Removing of soil linens and replacing with the fresh linen for future use.

9. Swimming Pool:

Regular Public area cleaning and disinfecting of swimming pool is important for the point of hygiene. If is not regularly cleaned swimming pool may becomes carries of water borne disease.

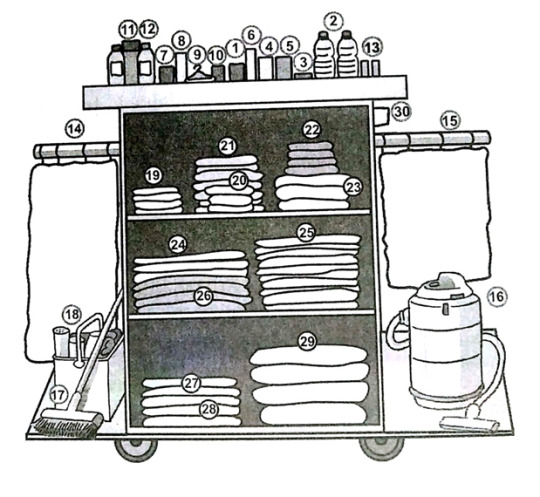

Maid’s Cart/ Room Attendants’ Trolley

Also called a room attendants’ trolley, maid’s cart, or chambermaids’ trolley, this is perhaps the most significant piece of equipment in the housekeeping department. It is like a giant toolbox, stocked with everything necessary to service a guestroom effectively. Most such carts available now are made of metal, but sometimes wooden cart may be used. The cart should be spacious enough to carry all supplies needed for a GRA to complete half a day’s room assignments. Since the cart is large and may be heavily loaded, it must be easily movable as well. The cart should be well organized so that the GRAs do not have to waste time in searching for supplies or make frequent trips back to the supply room. Also, if the cart is not stacked neatly, it will look very unsightly when in guests view. There is usually one such cart for each room section and it is stored in the floor pantry along with other housekeeping supplies.

Most of these carts have 3 deep shelves-the lower two for linen and the top, portioned shelf for small supplies. The carts also have a sack for soiled linen, detachable trash bags, and storage space for vacuum cleaner and a hand caddy. While arranging the linen on the cart, it should be kept in mind that the heavier linen must be placed on the lowermost shelf and the smaller, lighter ones on the top shelf.

Following is an organized room attendants’ cart:

1. Water tumblers and trays

2. Water bottles/jugs

3. Ashtrays and matchboxes

4. Shoe mitts, Sewing kits, Bible/Gita

5. Service directories, telephone books, business kits

6. Guest stationery, ball point pens and pencils, scribbling pads

7. DND cards, guest house rules, breakfast knob cards, “polish my shoe” cards, room service menu, tent cards, “clean my room” cards, telegraph forms

8. Laundry forms, Laundry bags

9. Cloth hangers

10. Light bulbs

11. Toilet roils, toilet tissues, blade dispensers, shower caps

12. Shampoo Bottles, soap bars, soap buds, foam bath, loofah pads, cotton wool, dental kit, cologne, after shave

13. Toilet strips, sanitary pads

14. Soiled linen bag

15. Trash bag

16. Vacuum cleaner

17. Broom

18. Hand caddy: all purpose cleaner, window cleaner, bowl brush, cloths and sponges, rubber gloves, disinfectants, naphthalene balls, room fresheners, deodoriser, basso, wax polish, scrubber

Linen

19. Face towels-2/room

20. Hand towels-2/room

21. King pillowcases-2/bed(fold in pairs)

22. Standards pillowcases-2/bed(fold in pairs)

23. Bath towels-2/bathroom

24. Standard sheet-2/twin bed(fold in pairs)

25. Double sheets-2/double bed(fold in pairs)

26. King shets-2/king bed(fold in pairs)

27. Mattress protectors

28. Bath mats

29. Bed spreads (a few to replace if necessary)

30. Guest key box

Housekeeping supplies found in a room attendants’ cart:

0 notes

Text

Emergency Situations in Hotel

Emergency Situations

Safety and security are the most important aspects that the guest considers while choosing a hotel to stay. Hence hotels now days have raised the security level of the hotels, this in turn builds confidence among the guests and also the employees feel safe to work. The chapter discusses some of the important precautionary measures adapted by the hotels in order to carry on safe business.

A. Theft:-

Theft of articles is a huge threat to the hotel. It may be guest belongings or hotel belongings. The people involved in theft may be the hotel staff, guest staying in the hotel or outside people entering into the hotel.

1. Theft by employee of the hotel:

Great amount of care is taken to see that the staff do not steal anything from the hotel, but it is human tendency to take chance. For the same reason hotels have stepped up security to safeguard the hotel property. Some of the measures taken by the hotels to prevent theft are:

a) Check the credentials of the staff during recruitment.

b) Train the staff towards being loyal and honest.

c) Awarding and rewarding honest employees.

d) Maintain registers and surveillance cameras to record movement of staff in the hotel.

e) Provide safe deposit locker for all the guests in their rooms to secure their valuables.

f) Preventing hotel staff from carrying large amount of cash on them while on duty.

g) Restricting the issue of room key cards to the employees.

h) Check and frisk the hotel staff while they leave the hotel after the duty.

2. Theft by the guests:

It may be the guest staying in a hotel who indulges in theft, a great care and observation on the part of the hotel security is required to prevent such acts by the guest.

Some of the precautions taken by hotel to prevent theft by guests are

a) All the guests staying in the hotel are requested for their personal identity.

b) Any suspicious movements of the house guest are observed and immediate action taken.

c) Any unauthorized movement is severely condemned and auctioned upon.

B. Fire:-

It is very uncertain that high rise buildings and complexes have a threat of fire accidents. Several precautionary measures will be taken to see that fire does not happen, but due to obvious reasons sometimes hotels experience fire accidents. Fire accidents prove fatal if not attended immediately, not only property but also life of guests and staff can be at stake. Ever staff working in the hotel is trained in fire fighting.

The following is the procedure followed during fire accident in a hotel:

a) A soon as a fire is noticed the staff should not panic, he/she should inform the immediate senior.

b) The telephone operator is informed about the fire, so that the operator will inform the required managers and further action on their guidance.

c) The general manager should be in the lobby and very much reachable for all the people required for any guidance.

d) Strictly, elevators should not be used during the fire, as it can be more disastrous if the lift gets stuck with the people inside.

e) If evacuation is ordered, the same should be informed to the guest promptly.

f) The staff should reach the guest and help them in guiding the way during evacuation.

The priority should be in the following manner while saving:

a) The guest in the hotel

b) Staff of the hotel

c) The hotel property.

C. Bomb Threat:-

When faced with a bomb threat, the primary concern must always be the safety of personnel. A comprehensive threat response policy is required to ensure the maximum margin of safety of all persons. This section has been prepared with this most essential criterion in mind.

In the event of a bomb threat, if evacuation is initiated, the exit routes and assembly areas should be searched prior to vacating the premises. Personnel cannot safely re-occupy the building and resume normal activities until a search has been conducted. These processes require a procedure with logical, chronological steps.

Bomb Threat Check List to be followed after receiving a bomb threat call:

Bomb threats are often transmitted by phone. Be courteous, listen, and do not interrupt the caller’s message. Do not hang up. Signal to someone (by a prearranged signal) to call 100 and after caller hangs up, do not put handset back on the receiver. Gather as much information as possible then bring this form with you when you evacuate the building.

The person receiving the call should be prepared to obtain precise information, including.

a) The time the call was received and on which telephone number or extension.

b) The exact words of the person making the threat

c) Indicate whether it was a male or female voice and an approximate age.

d) Note any accent or speech impediment or slurring of speech which could indicate intoxication or an unbalanced condition.

e) Listen for the presence of any background noises such as traffic, music, or other voices indicate if the voice is familiar.

f) The person receiving the threatening call should be prepared to ask the caller certain questions if the information has not been volunteered.

· Where is the bomb?

· When is it going to explode?

· What does it look like?

· What kind of bomb is it?

· Why did you place the bomb?

· What is your name?

The caller may provide specific information by answering these questions.

Often the type of person making a threat of this nature becomes so involved that they will answer questions impulsively. Any additional information obtained will be helpful to police and explosive technicians. The Bomb Threat Checklist Report should be kept near your phone to assist you in recording this information.

Ø Try to Determine the Following

Caller Is: Male Female Adult Juvenile Child (age/years): .................

a) Voice: Loud Soft Low High Raspy Pleasant Intoxicated.

b) Familiar Voice:

c) Accent: Local Regional (describe) :

d) Foreign (country/region):

e) Speech: Fast Slow Distinct Distorted Stutter Nasal Excellent Good Fair Poor Foul

f) Manner :Calm Angry Rational Irrational Coherent Incoherent Deliberate Emotional Righteous Laughing

Other (describe): g) Background Noises: Traffic Trains Planes Street Voices Music Party Animals Office Machines Factory Machines Quiet II. Action to be Taken

The employee receiving the call will notify his/her manager/supervisor immediately and provide a completed Bomb Threat Checklist Report to him/ her, if their manager/supervisor is not available, contact the first available manager.

Senior Management will

a) Proceed to emergency Response Room, or other Designated Area, to co-ordinate emergency efforts

b) Notify the police - Call 102

c) Uniform Police Officer(s) will be dispatched to the scene

d) Initiate the search procedure on direction of police

e) Initiate evacuation on direction of police (evacuation will be in accordance with the Fire Plan)

Notification to police should be prompt, and include as much detail as possible. The person who received the threatening call should be available immediately for police interviewing.

f) Search Procedure

Police cannot conduct a proper search of your premises. Co-ordination of employee’s response is essential. Management staff and volunteer personnel will be designated responsibility for searching a specific area including washrooms and meeting rooms, etc. The Emergency Response Room (General Managers Office) will be specified as the control centre. A printed floor plan should be available to assist the search coordinator. As each area is searched, it must be reported to the designated Emergency Response Room and crossed off the floor plan. Senior Management in the designated Emergency Response Room will then determine if the search has been completed.

Areas that are accessible to the public require special attention during a search, and may be vitally important if an evacuation is to be conducted.

During the search procedure the question often arises, “What am I looking for?” The basic rule is look for something that does not belong, or is out of the ordinary, or out of place. Conduct the search quickly, yet thoroughly, keeping the search time to a maximum of 15 to 20 minutes. Both the interior and exterior of the building should be searched. If an unidentified or suspicious object is found, Do Not Touch it.

D. Accidents:

1. Breathing difficulties -

Breathing difficulties can range from being short of breath, unable to take a deep breath, gasping for air, or feel like you are not getting enough air.

Considerations

Breathing difficulty is almost always a medical emergency (other than feeling slightly winded from normal activity such as exercise).

Causes:

There are many different causes for breathing problems. Common causes include

· Asthma

· Being at a high altitude

· Blood clot in the lung

· Chronic obstructive pulmonary disease (COPD)

· Collapsed lung

· Heart attack

· Heart disease or heart failure

· Injury to the neck, chest wall, or lungs

· Life-threatening allergic reaction

· Respiratory infections, including pneumonia, acute bronchitis, whooping cough, croup, and others

2. First aid for burns-

First aid advice for burns and scalds caused by heat, such as flames, is outlined below.

· Stop the burning process as soon as possible. This may mean removing the person from the area, dousing flames with water or smothering flames with a blanket. Do not put yourself at risk of getting burnt as well.

· Remove any clothing or jewellery near the burnt area of skin, but do not attempt to remove anything that is stuck to the burnt skin because this could cause more damage.

· Cool the burn with cool or lukewarm water for 10-30 minutes, ideally within 20 minutes of the injury occurring. Never use ice, iced water or any creams or greasy substances, such as butter.

· Make sure that the person keeps warm, using a blanket or layers of clothing (avoiding the injured area). This is to prevent hypothermia occurring, when a person’s body temperature drops below 35°C (95°F). This is a risk if you are cooling a large burnt area, particularly in children and the elderly.

· Cover the burn with cling film in a layer over the burn, rather than by wrapping it around a limb. A clean, clear plastic bag can be used for burns on your hand.

· The pain from a burn can be treated with paracetamol or ibuprofen. Always check the manufacturer’s instructions when using over-the- counter (OTC) medication. Children under 16 years of age should not be given aspirin.

· Once you have taken these steps, you will need to decide whether further medical treatment is necessary (see box, right).

· See Recovery for advice about what to do next.

3. Electrical burns-

Electrical burns may not look serious, but they can be very damaging. Someone who has an electrical burn should seek immediate medical attention at an accident and emergency department.

If the person has been injured by a low-voltage source, up to 220-240 volts (such as a domestic electricity supply), safely switch off the power supply or remove the person from the electrical source using a non-conductive material. This is a material that does not conduct electricity, such as a wooden stick or a wooden chair.

Do not approach a person who is connected to a high-voltage source (1,000 volts or more).

4. Chemical burns-

As with electrical burns, chemical burns can be very damaging and immediate medical attention should be sought at a medial department. If possible, find out what chemical caused the burn so that you can inform the healthcare professionals when receiving medical assistance.

If you are assisting someone else, wear appropriate protective clothing, then.

· Remove any affected clothing from the person who has been burnt

· If the chemical is in a dry form, brush it off the skin

· Use running water to remove any traces of the chemical from the burnt area

5. Sunburn-

In cases of sunburn, follow the advice below.

· If you notice any signs of sunburn, such as hot, red and painful skin, move into the shade or preferably inside.

· Take a cool bath or shower to cool down the burnt area of skin.

· Apply after-sun lotion to the affected area to moisturise, cool and soothe it. Do not use greasy or oily products.

· If you experience any pain, paracetamol or ibuprofen should help to relieve it. Always read the manufacturer’s instructions and do not give aspirin to children under 16 years of age.

· Stay hydrated by drinking plenty of water.

· Watch out for signs of heat exhaustion or heatstroke, when the temperature inside your body rises to 37-40°C (98.6-104°F) or above. These include dizziness, a rapid pulse or vomiting.

· Seek medical advice if you experience any of the symptoms of heat exhaustion or heatstroke. See Complications for more information.

6. Scald-

A scald is a burn that is caused by hot liquid or steam. Scalds are managed in the same way as burns.

7. Fainting-

Fainting is a medical emergency, till proven otherwise When a person feels faint- Make them sit down or lie down If sitting, position head between knees When a person faints, position him on his back Check to see if airways are clear Restore blood flow by loosening clothing/belts/collars Elevate feet above head level Patient should become normal within a minute If not, seek medical help Check if breathing/pulse is normal If not, perform Cardio- pulmonary resuscitation (CPR).

0 notes

Text

Key and Key Control

Key and Key Control

A key is a specially shaped piece of instrument that you place in a lock in order to open or lock a door etc. In a hotel Individual heads of departments are responsible for all the keys in their areas. The housekeeper is usually responsible for more keys than any other departmental head.

Types of Keys

The housekeeping department is primarily concerned with the following categories of keys:

1. Emergency Keys/ Grandmaster Key -

An emergency key or grand master key opens all guestrooms even when they are double-locked. These keys should be highly protected and their use should be strictly controlled and recorded. Such a key should never be removed from the premises.

2. Master Keys-

Master key opens all guestrooms that are not double locked. It should be secured in a designated place for safekeeping and should be issued to authorized personnel only and that after a written record is maintained of identity of individual and time taken and returned.

a) Section Master Keys:

These keys open all rooms in one work section of the hotel. A supervisor may be issued more than one key of this type as he or she may be required to inspect the work of more than one GRA.

b) Floor Master Key:

A GRA is given this key to open the rooms he or she is assigned to clean on a floor. The floor key opens all rooms on a particular floor that are not double-locked. If the employee has rooms to clean on more than one floor or area, he or she may need more than one floor key. Floor keys typically open the storeroom for that floor too.

1. Guestroom Keys-

A guestroom key opens a single guestroom if the door is not double locked. This key should be given to a guest after proper identification of the registered guest. Front desk agents should remind guests to return the key at check out. Well- secured key boxes in the lobby and entrance can serve as additional reminders.

2. Supply Keys-

These keys are used within the servicing sector of the hotel by the supervisory-level staff to ensure that stocks and equipment are safety stored away when not in use. Store keys, office keys, and linen room keys and are examples of such keys.

Key Control

Key control is the process of reducing guest and hotel property theft and other security related incidents by careful monitoring and tracking the use of keys in the hospitality operation.

The control of guestroom keys is one of the cornerstones of the hotel security that guests have a right to except under common law. Key control is the process of reducing guest property theft and other security-related incidents by carefully monitoring and tracking the use of keys in hospitality operation.

Key control policies:

Following policies should be considered for key control:

1. Coding-

A few precautions to take while coding are as follows:

i. Room keys must not have any form of tag that identifies the hotel.

ii. Keys must not have the room number on them. Keys must be identified by a numeric or alphanumeric code. That code should not, in any way, directly correspond to the building or room numbers.

2. Issuing Keys-

Apart from the basic precautions for all the keys, there is more stringent security for keys with higher access.

a) Guestroom Keys: These are the keys with minimum access, unlocking just the one room. When keys are given to guests upon registration, the guest’s room no. must not be spoken aloud if there are others within hearing range. Room nos. should be shown to the guests in writing with a reminder that they should note it down if a guest check-in packet is not used. Explain to the guest that the coding system is their protection. GRA’s and others who find keys in unoccupied guestrooms or elsewhere should place them in their pockets or in the locked key boxes provided, not on their carts (where they are accessible to others), and turn them in to their supervisor to be returned to the front desk.

b) Master and Sub-master Keys: All section master keys, room master keys, grand master keys, and emergency master keys (normally kept in a safety box) should be signed out each time they are taken and their return noted in a key control sheet. All the keys should be stamped ‘do not duplicate’.

3. Custody of Keys-

These are the precautions to be taken while the key is with a guest or employee after being issued as per the correct procedure.

a) Employees should not be allowed to loan the keys assigned to them to one another.

b) Employee should hand over keys whenever they leave the property, even the meal breaks.

c) Individual who have been issued master or sub-master keys should be spot-checked from time to time to ensure that they have them on their person.

4. Changing locks and keys-

Whenever a new key is made or a new lock is fitted, certain precautions are necessary.

a) A record must be kept of how many keys are made for each room and when they are made.

The general manager must review this record on weekly basis, installing and dating the key-making log each time she or he reviews it.

b) If required as a result of this review, the general manager must instruct the maintenance staff either to re-key a lock or to exchange room locks around within a housekeeping section.

c) If new room codes are to be used or locks are being switched, the code on the keys must be adjusted accordingly and over stamped until the old code is illegible and the new code should be stamped nearby if locks are swapped within a section. As a standard practice, it is recommended that some locks in a section be moved quarterly.

d) A log must be kept of all lock swaps and re-keying.

5. Loss of Keys:

This is a time when particular vigilance must be exercised.

a) If a section master key is lost under circumstances that may result in a guest being at risk, the entire section should be re-keyed. If a section is being re-keyed, also consider re-keying a new grandmaster and emergency key so that, in effect, a phased re-keying of the entire hotel is accomplished if it has been some time since this was last done.

b) If a master key or emergency key is lost under any circumstances, it must be reported to the owner or the corporate office immediately by the general manager. After the circumstances are discussed, they can decide whether the entire hotel should be re-keyed.

c) As an additional step, the general manager or somebody he or she delegates the responsibility to must cross- index all incidents of theft, missing property, damage, and so on as follows:

i. Room no. or location. Watch out for locks that have been moved.

ii. Names of potentially implicated employees.

It may be discovered that room thefts never occur when so- and-so is odd, or that they occurred, regardless of the room no., when so-and-so was working in maintenance or housekeeping.

6. Electronic Locks:

These are a precaution in themselves. Since the introduction of the recordable electronic door locks in the late 1970’s, the hotel security has been virtually transformed. The focus at the time of its invention was increased guest security. Now there are countries where hotels that do not feature electronic locking mechanisms in guestrooms will be unable to obtain insurance. Even the simplest of key card locks have been found to reduce break-ins by upto 80 per cent. Employee key-cards can even be coded to allow access only to their assigned units of responsibility and only during the hours of their shift.

7. Smart Cards:

The future of security, however, lies in smart cards. ‘Smart card’ is a generic term for a card the size and thickness of a credit or debit card that is embedded with a microprocessor chip. The chip itself has ‘intelligence’ by way of computational power similar to that of early personal computers. These powerful computing capabilities make smart cards much more secure than the other types of cards presently in use. Electronic locks require some form of physical interaction with or proximity to the lock to function. Smart locks integrate with wireless, Bluetooth or similar technologies to enable remote access control, typically through a mobile device.

0 notes

Text

Property Management System (PMS)

Property Management System (PMS):

A PMS is a computer based management system. In the hospitality industry, it is a computerised system used to manage guest bookings, online reservations, points of sale, telephone, and other amenities.

In recent times, hotels have started using PMS in order to manage and respond to guest needs efficiently and effectively. A PMS is a single site version and is need-specific to an individual property.

A PMS is a generic term used to describe the computer applications (computer hardware and software) in managing the interface of various departments in a hotel in order to manage the property effectively.

Property management systems (PMS) interface with stand-alone systems:

A PMS is important and essential to front office operations in modern hotels. It includes the process of reservations, registration, guest accounts, guest check in and checkout, handling discounts and allowances and the night audit. Interfacing, electronic sharing of data of departments such as Front Office, F&B through points of sale, Maintenance through monitoring of energy and heating and cooling systems and Security through control of guest keys are a few of its applications in a hotel, mentioned below:

· Energy Management System (EMS)

· Material Management System (MMS)

· Point of Sale (MICROS)

· Human Resource Information System (HRIS)

· Accounting System

· Call Accounting System (CAS)

· Management Information System (MIS)

Importance/Benefits of a Property Management System (PMS) in the Hotel

The right property management system (PMS) is a key factor in hotel success. Having a system that makes front desk workflows easy, will create a seamless guest experience.

Following are few advantages of PMS in a hotel:

1. Guest’s first impression

Upon arrival, a guest’s first impression is created as they walk through the doors and interact with the first point of contact, your front desk. A property management system should easily display arrivals for the day and have any important information about stay preferences attached to a guest’s booking. This will ensure you make a good and memorable first impression.

2. Easy check-in and check-out

There is nothing more frustrating than waiting a long time to be checked in or out, these processes should be fast and easy to provide a seamless guest experience. Having streamlined and easy check in and checkout processes is important for both the guest experience and hotel efficiency. A property management system will help you perform these tasks with ease, increasing productivity and delivering that exceptional guest experience.

3. Clear communication

Having clear lines of communication between all departments of your property and with the guest is integral to a successful accommodation. With a property management system you can facilitate easy communication, and ensure that all departments are operating effectively and efficiently.

4. No double bookings

A PMS that connects to a channel manager means all your availability is constantly being updated. This means no double bookings, saving you and your team time by eliminating double bookings. When the guest arrives there won’t be any complications with their room or booking, making for a pleasant guest experience.

5. More focus on the guests

The guest experience is such an important aspect of your accommodation, and is the key to returning guests. Using a streamlined and intuitive PMS will save you time on your day-to-day processes. So you’ll have more time and opportunities to interact with your guest and offer them a truly personalized experience.

PMS application for front office department Or “Modules of PMS” in Front Office

There are different modules of PMS to mange individual departments of a hotel, such as front office module, housekeeping module, restaurant management system, and back office module. These PMS solutions can be modified to meet the requirements of the hotel.

The PMS application for the front office has different modules for the efficient functioning of the entire department. Following are the different modules of PMS in front office department of a hotel:

I. Reservation Module:

The reservation module is used to create and manage guest reservation, both for individual as well as groups. The reservation module includes the following features:

1. It can provide status records when the date of arrival, date of departure and the type of guest room are entered in the system.

2. It can colour code the room status by using different colours.

3. It can check the reservation status of a guest quickly as it can search by guest name, company name, or arrival and departure dates.

4. It can display room availability status by simply selecting a date.

5. It can post an advance deposit on a room.

6. It can enter remarks, which are visible upon reservation retrieval.

7. It can attach guest’s messages to relevant reservations, to be delivered to the guest upon arrival.

8. It can create special group rates.

9. It can reserve and track the availability of service items such as rollway beds, cribs, and refrigerators.

II. Registration module:

This is linked by information transferred from the reservations module. Pre-registration, quick guest room assignments and online verification of room status increase the efficiency during the check in process. The information gets updated automatically which further speeds up the process of handling guest check in, issuing of key cards and card keys as well as handling group arrivals.

III. Rooms management (housekeeping):

This module allows for constant updating of room status and maintenance status of all room types in the hotel. This information can also be communicated and made accessible for confirmation to the Front Office. It can display work area allocations of different staff on the floors and can create room occupancy reports and other reports required by housekeeping. It can store statistics related to occupancy with room history records that can help in future planning and in providing better maintenance services to keep rooms in shipshape condition.

IV. Night auditing:

The most important function of daily operations of a hotel is the night audit. This process posts room tariff and taxes automatically on the guest’s folio and helps confirm and reconcile the final balance of the entire day’s transactions. During the night audit procedural rights of front office staff are limited and therefore the PMS needs to have features that can allow other non-accounting tasks to be carried out during the night audit process.

V. Sales & catering ( banquets):

This function of the PMS deals with banquet activities and reservations regarding the booking status for any function space, specific occasions as well as days and time of the booking. More advanced systems also record the number of pax and employee assignment. The most important function is billing or posting of transactions to the Sales ledger which can be handled efficiently by the F&B staff.

VI. Guest accounting & check out:

This provides accurate online posting of guest charges when interfaced with the POS. Split charges and multiple folios with specific billing instructions that have been set for each guest speeds up the accounting process. Master and Incidental folios can be monitored easily and effectively. Foreign exchange vouchers control flow of foreign currency and helps in handling settlement of guest folios with different payment methods. Guest check outs can be handled more efficiently and smoothly.

SELECTION OF A PMS

Hotels often make the mistake of choosing a lower end PMS solution that doesn’t fulfil their basic requirements or else, they opt for a high end solution that comes with a lot of features which may not be of much use to the hotel.

Since the PMS is a capital investment, great thought goes into the decision for the shift of a manual working system to a fully automated one. Following are some factors to be kept in mind while selecting a PMS for a hotel.

I. NEEDS ANALYSIS

Needs analysis enables to know what is needed and what is not needed and will help choose from the many PMS available in the market. It includes such issues as analysing the ease with which the telephone system can be used; the availability of room status; the length of time taken to complete a reservation request; analysis of needs includes such issues as how do the F&B report guest charges? How does Engineering monitor and control energy usage in guestrooms?

II. SOFTWARE SELECTION

Today, software is available in modules to cater for different areas in a hotel.

Based on requirements based on the conclusion of the need analysis in step 1, a hotel may go in for the entire PMS or parts of it, i.e. certain modules. Many hotels combine modules for different departments from various PMS available. A hotel may have the rooms’ module of Fidelio, the payroll and accounting module of Shawman, and so on.

a. Proper software selection is important as it involves heavy investment.

b. It should be configured or customised as per the need of the hotel.

c. Other features of a software that should be considered are:

i. Growth and flexibility:

It should be able to handle present needs and grow with the hotel; i.e. can be added on with increased number of services.

ii. User friendliness:

Should be well designed with clear menu prompts, self-explanatory input screens, simple error correction, should require minimum training, etc.

iii. Operating system:

Should be carefully selected and compatible with the hardware.

iv. Multi-user capability:

Several users can have access to and enter data at the same time.

v. Report generator:

To meet special requirements of the hotel those are meaningful to management.

vi. Stability:

PMS should be able to operate without crashing and causing loss of information.

vii. Secure:

The PMS should be able to incorporate security needs of the property- establishing user rights, tracking changes with user ID, etc. in order to establish accountability of actions of the users.

III. HARDWARE SELECTION:

Hardware selected should be appropriate to run the selected software with the basic concept to:

a) Processor speed:

How fast a CPU makes calculations per second

b) Disk drive:

In megabytes is the access time- the time taken by the processor to retrieve information from the hard drive in milli- seconds.

c) I-O ports (Input and out put devices):

Keyboards, printers, monitors, mouse, modem, CD drives, etc.

d) Other supplies:

Paper, ink, toner, CDs, DVDs, etc.

IV. OTHER CONSIDERATIONS:

a) Vendor claims:

(Claims made by the supplier) One may inquire about the product from current users whether they are satisfied using their system.

b) Installation plans:

Proper planning of installation is essential for maintaining guest satisfaction and employee morale. One must have a complete plan laid out for hardware and questions such as who would be installing the hardware and cables, etc. should be clearly identified.

c) Training:

Is classroom and on-the-job training provided by the vendor or not? If yes, is it charged for separately or is inclusive in the price quoted? Whether a training module is included or not?

d) Documentation of procedures:

Clear-cut procedures and instructions, guides and manuals provided- yes/no?

e) Back-up power supply:

Provision of UPS sources- yes/no?

f) Maintenance agreement:

The cost of repair and replacement of hardware and software; provision of emergency services should be considered. Annual Maintenance Contracts- AMC- may be a good idea to keep the system functioning smoothly.

V. FINANCIAL CONSIDERATIONS

The following should be considered:

a. The decision regarding option of purchase or rental of a PMS since it is a heavy investment it can tie up cash flow of an organisation.

b. If cost benefits are not realistically projected, profit may be difficult to come by.

c. Analyse the savings in terms of overtime paid to employees, losses due to late charges, cost of marketing, database collection, etc.

BACK OFFICE SYSTEMS OF THE PMS

Other modules used by the hotel management for operating efficient hotel operations usually include:

I. MATERIAL MANAGEMENT SYSTEM-MMS- (Stores & Purchase):

This covers the entire material management operations such as requirement planning, purchase, receiving of stock, costing, etc. The system also provides information for effective decision making and budgeting.

a) Purchase requirement is effectively managed helping in better management.

b) It stores the history of purchase vendors in order to efficiently study cost analysis for lower purchase costs.

c) It gives automatic reminders on pending purchases which is helpful during high occupancy this ensures orders for timely supplies.

d) Easy monitoring of stock.

e) Assists management in making effective purchase in relation to proper storage area.

f) Provide for automatic stock accounting details.

g) Facilitates on the spot checking of stock.

h) Facilitates comparison of market trends for analysis and decision making.

II. MANAGEMENT INFORMATION SYSTEM (MIS):

The MIS should provide statistical information to the management to assist in decision making and revenue control.

a) MIS provides the database regarding forecasts and budgets which helps management in establishing room rates.

b) Comparison of budgeted figures along with actual figures established by sales & marketing department in relation with front office helps the management to address the problem in case of losses.

c) An MIS should provide data which is comprehensive, accurate and detailed with business and sales analysis to ensure increased revenue and higher occupancy.

III. FINANCIAL ACCOUNTING SYSTEM:

This module provides information required for basic accounting as well as financial management of the hotel. Its main features are:

a) Integration of account receivable, account payable, material management, ledgers, and payroll in the financial accounting system.

b) An accounting system facilitates the administration in audit reconciliation on a daily basis, comparing of cash with raised vouchers, etc.

c) Monthly information regarding balances, profit and loss statements is also prepared.

d) Provides timely updated and accurate financial information to accounts receivable for future financial control.

e) Forecasts daily cash flow for better cash management.

f) Comparison of budgeted to actual revenue and related expenditure is efficiently managed.

g) Timely financial statement of account is made available.

IV. F&B CONTROL SYSTEM

This is the most important area of concern as a major POS which can raise revenue and create a lot of savings through control of F&B by minimising wastage of material.

a) An efficient control system should establish standards of raw material usage in order to minimise wastage.

b) This should highlight raw material consumption reports in case consumption is exceptionally high.

c) It should automatically pick up sales details for the POS system.

d) This should also control and check beverage consumption through the POS.

V. HUMAN RESOURCE INFORMATION SYSTEM (HRIS):

The human resource of the hotel is the most important and the most expensive asset. A good HRIS should integrate the requirement for effective career planning, personnel administration, and payroll information.

a) The system should include comprehensive data regarding personnel career development as well as future manpower requirements.

b) Should facilitate extensive reporting on appraisals.

c) Should facilitate a complete database on leave and attendance.

d) Should facilitate comprehensive and detailed payroll system with automatic salary calculation and printing of payslips.

MISCELLANEOUS FUNCTIONS OF A PMS

I. HOTEL SECURITY:

This includes electronic locks and computerised card systems.

a) Other locking systems such as recording signatures, fingerprints (for biometric scanners and access), and attendance of employees are all a result of technology.

b) This also facilitates guest room video check in and checks out in some hotel properties.

II. ENERGY MANAGEMENT SYSTEM- EMS- (Engineering &Maintenance):

An EMS is used to keep track of energy consumption as this provides a more effective control by highlighting excessive consumption an important application of this is in monitoring and adjusting lighting and temperature requirements in guestrooms and public areas of the hotel.

III. TV INTERACTIVITY

Through this interactive system guests can view and have access to their favourite programmes at their convenience. The tv can also be interfaced with the telephone and front office for viewing their folios and even settlement. The TV can also be used for accessing local or city information in many hotels.

IV. E-CONCIERGE (Electronic Concierge):

This facility helps the guest to make a multimedia graphic and sound assisted virtual tour of the hotel. This also provides and facilitates a virtual tour of the city, local areas and attractions, restaurants and shopping centres in addition to guest rooms. This may even assist a guest in making reservations at local restaurants and theatres, etc.

V. POINT- OF- SALE (POS) SYSTEM:

A POS system is made up of a number of terminals located at various outlets or points of sale in the hotel. Each POS terminal contains its own input and output components which are interfaced with a remote central processing unit. The interface allows the electronic data to be processed, and transferred to guest folios when required, thus reducing the time required to post a charge in the appropriate guest folio and recording of the F&B sale at the same time.

VI. CENTRALISED RESERVATION SYSTEM (CRS):

A CRS is used for a chain or group of hotels to enable the sale of their rooms more effectively.

a) The CROs (Central Reservation Offices) are linked for an effective and real time management

b) It primarily works on WAN- Wide Area Network

Examples are:

i. MARSHA, TAJ, Leading Hotels of the World,

ii. WELCOMNET, Holiday Inn World Wide,

iii. OCC (Oberoi Call Centre), and more

a) The CRS can operate in two ways. One, it can be a CRS for one group of hotels in different locations (affiliate members). Second, it can sell rooms belonging to different hotels which are not connected or linked to each other but use the services of the CRS to sell their rooms on a wider scale thus reducing their investment and reaching a greater market which may not have been possible on their own.

b) Repeat guest history data for each hotel can be stored in the CRS. The past stay information on each guest history is updated at the time of the last departure. When the guest wants to return to the same hotel, this data can guide the reservationist to offer appropriate rooms.

Amadeus