#$ashr

Explore tagged Tumblr posts

Text

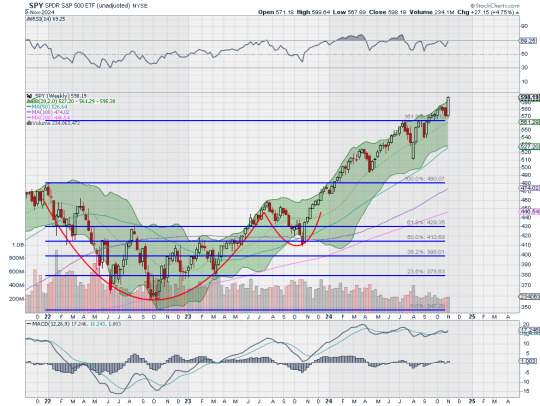

What to expect from the stock market this week

Last week, the review of the macro market indicators saw with October in the books and heading into the election and FOMC meeting, equity markets experienced a Halloween spooking. Elsewhere looked for Gold ($GLD) to continue its uptrend while Crude Oil ($USO) consolidated at the bottom of a broad range. The US Dollar Index ($DXY) looked to consolidate in its uptrend while US Treasuries ($TLT) pulled back in their consolidation. The Shanghai Composite ($ASHR) looked to continue the short term move higher while Emerging Markets ($EEM) pulled back in their uptrend.

The Volatility Index ($VXX) looked to remain at a neutral level, above the base established this year, and was likely to stay there at least until after the election. This might make for choppy light trading for equity markets to start next week. Their charts looked strong on the longer timeframe though. On the shorter timeframe both the $QQQ and $SPY had reset momentum measures lower and could reverse or turn bearish, likely a couple of days’ time would tell. The $IWM did not seem concerned about an election or Fed policy, churning sideways.

The week saw major movements happen following the election. It played out with Gold pulling back from its high Wednesday before a partial recovery while Crude Oil found some strength and moved higher in a choppy range. The US Dollar jumped to a 4 month high while Treasuries fell back to a 5½ month low Wednesday before a recovery. The Shanghai Composite continued the move to the upside while Emerging Markets chopped in a wide range.

Volatility crashed down to the low end of the range since August. This put a stiff breeze at the backs of equities and they started to move up Tuesday and then accelerated Wednesday through the end of the week. This resulted in the SPY and QQQ printing a new all-time highs Wednesday, Thursday and Friday and the IWM gapping up to a 1 year high. What does this mean for the coming week? Let’s look at some charts.

The SPY came into the week at the 50 day SMA on the daily chart in a pullback from the top. It had a gap left open from the end of the week. It held there on Monday and then started higher Tuesday, into the gap. It gapped up Wednesday to finish at a new all-time high and leaving an island below. It followed that up with new all-time highs Thursday and Friday. The Bollinger Bands® are open to the upside. The RSI is rising deep in the bullish zone with the MACD positive and rising.

The weekly chart shows a strong, long bullish candle rising from the 161.8% extension of the retracement of the 2022 drop. The 200% extension is now within view at 614 above. The RSI is rising near overbought territory in the bullish zone with the MACD drifting up and positive. There is no resistance above 599.60. Support lower sits at 585 and 580 then 574.50 and 571.50 before 565.50 and 556.50. Uptrend.

With the Presidential Election and November FOMC meeting in the rearview mirror, equity markets showed jubilation as they vaulted higher. Elsewhere look for Gold to in its uptrend while Crude Oil consolidates in a broad range. The US Dollar Index continues to move to the upside while US Treasuries consolidate in their pullback. The Shanghai Composite looks to continue the move higher while Emerging Markets chop in their short term uptrend.

The Volatility Index looks to remain low and drifting lower following the election making it easier for equity markets to continue higher. Their charts look strong on both timeframes, especially the SPY and QQQ. The IWM has now joined the party, a stone’s throw away from making its first new all-time high in 2 years. Use this information as you prepare for the coming week and trad’em well.

Join the Premium Users and you can view the Full Version with 20 detailed charts and analysis: Macro Week in Review/Preview November 8, 2024

44 notes

·

View notes

Text

Reasons Why I Disliked/ Hated Certain Characters in Onyx Storm:

1. Brennan (hate):

He existed.

Jokes aside, (that wasn't a joke) Brennan has been playing so conveniently. He always sides with the majority or whoever he thinks will be a safer choice.

Eg: Him not at all being concerned that his sister is dating a venin.

Also, he so conveniently takes the surname of his mother, who he criticizes in every chance he gets. He does nothing to fix the rift between his sisters. Cares about burnout wile his sister is dying. Yes. I'm mad about that because Mira wouldn't do the same. She wouldn't hesitate to save him.

2. Violet (dislike):

Violet head over heels for Xaden wasn't the problem. The problem was that she practically ignored the existence of everyone else that she loves and those who love her. Also, the whole ordeal with Mira and how she wasn't significant enough until she needed something from her.

On top of that, her not defending Dain from Xaden.

3. Tairn (dislike):

Dude gave Violet so much shit for trying to cure Xaden.

Tairn in IF and FW >>>>>>> Tairn in OS

4. Xaden (dislike):

Him giving shit to Dain. Other than that he was good.

5. Halden (hate):

I have straight up HATED him.

6. Talia (hate ultra pro max):

It's Talia.

7. Fen Riorson (hate):

He could've done a LOT more better as a father.

8. Asher Daxton (hater for life):

Dude sacrificed his daughter. Instant hate.

Dude neglected his first daughter in a series of post death notes. Instant hate AGAIN.

9. Aetos Sr. (Mega ultra I-phone 1029383838838 level hate)

10. The person who shot Trager. (Hate to the point where I will shove the same bow and arrow up his ass and rip him to shreds)

11. Garrick Tavis (based on assumption):

I have a strong feeling that he knows Imogen likes him. And if that is true, then he is simply playing with her feelings.

#fourth wing#iron flame#the empyrean#violet sorrengail#xaden riorson#rebecca yarros#onyx storm#ashr daxton#fen riorson#aetos senior#trager#brennan sorrengail#tairn#garrick tavis

24 notes

·

View notes

Text

I am tbh really stumped on what breed Rui should be. My brain tells me something weird, but idk what

#maybe he'll just be a streetrat with some funky genes that don't fully apply to any breed#at ik that Kasa is a dilute ashred Highflyer and Emu is ash red Roller of sorts#for Nene her being a pigeon closer to wildtype would work aswell but maybe there's a fancy breed that just fits her#zondesrambles#prsk pigeons

4 notes

·

View notes

Text

a*dy being a menace

#phc cast#a*dy ashr*f#abs*lut bazaar#i muted half the clips bc i was fighting off demons in the bg (cuteness aggression)

2 notes

·

View notes

Note

bad pic but I saw a stylish pigeon with a purple neck and brown wings and thought ud like it

Oh what a lad :D

That's a ash-red pigeon with t-check pattern. Ash-red colored pigeons are quite rare despite the color being a dominant trait, mostly because blues (especially t-check blues) are more camouflaged in the city. That guy seems to do well despite that, so I hope they'll have a nice long life

#I haven't seen a ash-red pigeon in a long while. The city in my area mostly houses blues#there seems to be some lahore pigeons being kept next to the railway so I sometimes spot a ashred one there#anyways yay thanks for the picture :D!#ask#pigeon

3 notes

·

View notes

Note

Dakota just feels ice cold sensation on his shoulders and already knows it's william but confuses him cause why is william grabbing onto his shoulders

HDHSH dakota voice will what the hell. what's up dude. vycnent did you do something william desperately moving fridge magnets HEAR ME ?

2 notes

·

View notes

Text

som times when i close my eyes, Im in garamsythe waterways

2 notes

·

View notes

Text

testing, testing.

#the powers of kyle and kylered and ashred compel me#still working on icons OTL#how do i look doc#how does tumblr rp even work these days. it's been years

4 notes

·

View notes

Text

What to expect from the stock market this week

Last week, the review of the macro market indicators saw with the inflation reports behind us, equity markets showed strength with the SPY ending at an all-time high. Elsewhere looked for Gold ($GLD) to continue its uptrend while Crude Oil ($USO) consolidated in a broad range. The US Dollar Index ($DXY) continued to move to the upside while US Treasuries ($TLT) consolidated in their downtrend. The Shanghai Composite ($ASHR) looked to reverse lower while Emerging Markets ($EEM) consolidate the start of an uptrend.

The Volatility Index ($VXX) looked to remain low making the path easier for equity markets to the upside. Their charts looked strong, especially the $SPY and $QQQ on the longer timeframe. On the shorter timeframe both the QQQ and SPY were now ready to resume the move higher. The $IWM looked a bit less powerful but was holding near resistance, a good show of relative strength for the small caps.

The week played out with Gold chugging higher and ending at a new all-time high while Crude Oil fell back in the broad consolidation. The US Dollar met resistance at a lower high at the end of the week while Treasuries printed a Dead Cat Bounce after finding support Monday. The Shanghai Composite continued lower toward the September month end gap while Emerging Markets turned consolidation into a falling wedge.

Volatility drifted down to the lowest close of the month. This gave equities some breathing room and they rose to to start the week with the SPY printing a new all-time high Monday. All gave back some gains midweek before recovering to finish the week strong. This left the SPY back at the high, the QQQ near the October high and the IWM holding at nearly 3 year highs. What does this mean for the coming week? Let’s look at some charts.

SPY Daily, $SPY

The SPY came into the week at a new all-time high. It started off on the right foot making another one on Monday but ended out of the Bollinger Bands® on the daily chart. That led to a pullback on Tuesday and small reversal higher on Wednesday. Thursday broke higher as well with a gap up at the open, but it did not hold and then another gap up Friday held with the SPY ending at a new all-time high. The RSI is rising in the bullish zone with the MACD positive and climbing as those Bollinger Bands point higher.

The weekly chart shows a 6th consecutive move higher as it makes some separation from the 161.8% extension of the retracement of the 2022 drop. The RSI is making a higher high, negating a possible momentum divergence with the MACD crossed up and rising. There is resistance at 585 above. Support comes at 580 and 574.50 then 571.50 and 565.50 before 561.50 and 556.50. Uptrend.

SPY Weekly, $SPY

With the October Options Expiration in the books, equity markets showed some strength battling against a narrative of slower Fed cuts. Elsewhere look for Gold to continue its uptrend while Crude Oil drops in consolidation. The US Dollar Index may reverse the short term uptrend while US Treasuries pullback in consolidation. The Shanghai Composite looks to drop back from its spike while Emerging Markets stall in their move higher.

The Volatility Index looks to remain low making the path easier for equity markets to the upside. Their charts look strong, especially on the longer timeframe. On the shorter timeframe the SPY is leading the way higher with the QQQ slowly battling back to its high and the IWM poking its head up perhaps to make another attempt at a run higher. Use this information as you prepare for the coming week and trad’em well.

Join the Premium Users and you can view the Full Version with 20 detailed charts and analysis: Macro Week in Review/Preview October 18, 2024

48 notes

·

View notes

Text

youtube

0 notes

Text

0 notes

Link

https://www.sugarberrymemorials.com/product/aurelia-ring/ ✨ Aurelia ✨ Cremation Ring with lab light pink sapphire 🩷🌸

#cremationjewelry#cremationring#memorialjewelry#mementomori#ashesintojewelry#ashjewelry#ashring#bespoke#bespokejewelry#inlovingmemory#handmadejewelry#handmadewithlove#pinksapphire

0 notes

Text

The answer for me was 5 out of 100. Because I have a playlist for Arknights, but I also have "Operation Ashring" (aka "Guardian Angel") in a few of the more generic playlists so that made it into the Top 10 at Number 5 whilst the others were scattered further down in the Top 100.

In contrast, 17 of my Top 100 were from the 2nd Artist on the list of Top 5, Within Temptation, including the No.1 "Stand My Ground".

2K notes

·

View notes

Text

What to expect from the stock market this week

Last week, the review of the macro market indicators saw heading into the March options expiration and FOMC meeting, equity markets showed possible exhaustion in the pullbacks of the past 4 weeks. Elsewhere looked for Gold ($GLD) to continue its bull run higher while Crude Oil ($USO) consolidated at the bottom of a broad range. The US Dollar Index ($DXY) continued to pullback in the consolidation zone while US Treasuries ($TLT) consolidated in their downtrend. The Shanghai Composite ($ASHR) looked to continue in consolidation in the uptrend while Emerging Markets ($EEM) chopped sideways in consolidation.

The Volatility Index ($VXX) looked to remain elevated but moving lower making the path easier for equity markets to the upside. Their charts had experienced some damage on the longer timeframe but remained long term bullish. On the shorter timeframe both the $QQQ and $SPY had found support at key levels that could lead to a reversal. Caution was to wait for proof before acting. The $IWM was broken on the shorter timeframe and at risk on in the longer timeframe.

The week played out with Gold continuing to new highs before profiting taking to end the week while Crude Oil continued to hold at the bottom of the consolidation range. The US Dollar found support and consolidated while Treasuries moved higher in consolidation. The Shanghai Composite built a narrow flag in consolidation while Emerging Markets continued to chop.

Volatility ticked down but stalled when it broke 20. This allowed equities to start the week moving higher but news and the FOMC meeting stalled that quickly. This resulted in the SPY, the QQQ and the IWM holding just off the bottom from Friday last week. What does this mean for the coming week? Let’s look at some charts.

The SPY came into the week bouncing off the 61.8% retracement of the leg higher since August 2023 and reclaiming the 161.8% extension of the retracement of the 2022 drop. It moved up slightly Monday but failed to put any daylight between price and the 161.8% level for the rest of the week. It finished the week still below the 20 and 200 day SMA’s. It has a RSI stalling short of the midline on the bounce with the MACD about to cross up and negative.

The weekly chart shows a second narrow body week holding just under the 50 week SMA. The RSI has gone level at the bottom of the bullish zone with the MACD dropping but positive. There is resistance above at 565.50 and 569 then 571 and 574.50 before 581 and 585. Support lower is at 556.50 and 549.50 then 545.75 and 542.50 before 540 and 537. Pullback in Uptrend.

With the March FOMC meeting and options expiration in the books, equity markets shifted to stability after 3 weeks of downward price action. Elsewhere look for Gold to continue its ascent into space while Crude Oil consolidates at the bottom of a broad range. The US Dollar Index looks to have found support in its drift lower while US Treasuries look weaker in their consolidation. The Shanghai Composite looks to digest the recent move higher while Emerging Markets consolidate in a narrow range.

The Volatility Index looks to remain slightly elevated, putting some pressure on equity markets. Their charts remain at risk of more downside, especially on the longer timeframe. On the shorter timeframe both the QQQ and SPY may be stabilizing as they hold the bounce this week. The IWM is a bit weaker. Use this information as you prepare for the coming week and trad’em well.

Join the Premium Users and you can view the Full Version with 20 detailed charts and analysis: Macro Week in Review/Preview March 21, 2025

16 notes

·

View notes

Text

Beleth Ashre Sinvyre

Demon Hunter

Coloured sketch

1 note

·

View note

Text

14.02.2025 a bittersweet day

HAPPY 19TH BIRTHDAY BABY BOOOOY WOOOOOO🎉🎉🎉🎉

authors of the pics in the screens:

うれえる

グライダー

ashr

uroe

川崎 貴司

篁惺

#crying screaming throwing up#as we speak#NINETEEN WHOLE YEARS!!!!?? TF!!!!!#vocaloid#kaito#kaito vocaloid#vocaloid kaito#kaito fanart#KAITO誕生祭 2025#KAITO誕生祭

91 notes

·

View notes