#1099 C Generator

Explore tagged Tumblr posts

Text

The Easiest Way to Make W2 Forms Without Hiring a Pro

The stress-free way to make W2 forms is finally here. With PaystubUSA, you can create accurate, IRS-compliant forms without needing to hire a tax expert. Perfect for small business owners, freelancers, or anyone managing payroll on their own.

#W 2 Creator#1099 Form Creator#W4 Maker#Generate W9 Form#Online W7 Form#1099 C Generator#Make 8809 Online#Free SS 4 Creator#8995 Tax Form#Online 941 X Form#940 Form Creator#941 Form Creator#1040 Schedule 1 Online#1040 Schedule F Form#Form 1040 Schedule E

0 notes

Text

Favorite History Books || Godfrey of Bouillon: Duke of Lower Lotharingia, Ruler of Latin Jerusalem, c. 1060-1100 by Simon John ★★★★☆

The warrior whose statue dominates the Place Royale, then, is Godfrey of Bouillon. By any estimation, Godfrey was a significant historical figure. He was born around 1060, and was the second son of the count of Boulogne, an important figure in northern France and the surrounding regions. Through his maternal ancestry, Godfrey was a member of a prominent dynasty in Lotharingia, the westernmost region of the Western Empire. During his career, he attained the office of duke of Lower Lotharingia, in which capacity he was active in regional politics. In 1096, he set out at the head of a large army on the First Crusade, and, after its forces captured Jerusalem in July 1099, he was selected as the ruler of the incipient Latin polity centred upon the Holy City. Godfrey ruled in Jerusalem for a year, before dying after a brief illness on 18 July 1100. Godfrey came to enjoy rich fame after his death. In the Middle Ages, he was enshrined as the hero of the First Crusade, and his name became shorthand for the entire crusading ‘movement’. He also came to be regarded as an icon of chivalry, and was often held up as an epitome of aristocratic values and martial virtues. His reputation continued to develop in the early modern and modern periods. Crucially, however, the various portrayals of Godfrey produced between his death and the present day are generally more revealing of the social, cultural, and political contexts in which those portrayals were created than they are of Godfrey’s own career and epoch. The aforementioned statue of Godfrey in Brussels, for example, sheds more light on the preoccupations of mid–nineteenth-century Belgium than it does on the life of the historical figure whom the statue purports to depict. The ‘historical’ Godfrey and the later traditions which surround him are enmeshed so tightly that it is not a straightforward task to unravel them. Even the most rigorous and influential modern historians have sometimes discussed Godfrey’s life in the light of his later status as a hero of the First Crusade and paragon of chivalry. As a result, many aspects of Godfrey’s life have been misconstrued in the past few generations of scholarship.

#historyedit#litedit#godfrey of bouillon#belgian history#french history#european history#asian history#medieval#house of flanders#history#history books#nanshe's graphics

15 notes

·

View notes

Text

5 Critical Reasons to Consolidate Accounting and Payroll Under One Expert Team

For many businesses, accounting and payroll often run on parallel tracks—managed by different teams, systems, or providers. While this setup might suffice in the beginning, it tends to create inefficiencies, miscommunication, and increased administrative burden over time.

Bringing bookkeeping and payroll under one roof isn't just about simplifying operations—it’s a strategic move that strengthens compliance, improves cash flow visibility, and supports long-term growth.

5 Reasons to Combine Your Bookkeeping and Payroll Services

1. Reduce Errors and Close Books Faster

When payroll and bookkeeping are disconnected, data has to be manually moved between systems—raising the risk of mistakes like duplicated entries or misclassified expenses.

For instance, if payroll taxes are recorded inaccurately, your financial reports may show incorrect liabilities, leading to audit risks or misleading insights.

By unifying both services, you gain:

Automatic payroll entries into your general ledger

Real-time tracking of wages, benefits, and tax obligations

Faster, smoother month-end and year-end closes

Fewer manual steps mean greater data accuracy—and better decisions at the leadership level.

2. Clearer Insight into Labor Costs and Cash Flow

Payroll is one of the largest recurring expenses for most companies. Without an integrated view, it’s difficult to understand how labor costs affect financial health.

When payroll data flows directly into your accounting system, you can:

Analyze labor costs by team, project, or location

Spot overtime patterns early

Anticipate payroll-related cash flow needs

This level of visibility is especially valuable for businesses with tight margins or fluctuating staffing needs.

At C Numberz, we believe your financial data should work in your favor. Our integrated approach provides a real-time, accurate view of payroll and cash flow—so you can plan with confidence.

3. Easier Compliance and Tax Accuracy

Navigating employment tax laws and filing requirements across different jurisdictions can be overwhelming—especially when payroll is managed separately.

A combined setup helps ensure:

Timely and accurate payroll tax filings

Proper alignment of deductions, contributions, and expenses

Seamless generation of W-2s, 1099s, and year-end documents

Companies with diverse workforces—contractors, part-timers, and salaried staff—benefit significantly from centralized compliance support.

4. Cost-Efficient Operations

Running separate systems for payroll and accounting usually means extra software costs, duplicate support fees, and more time spent on reconciliation.

With a unified service, you can:

Lower software licensing and support costs

Reduce manual entries and error corrections

Cut internal payroll processing time

Your internal team also gains more capacity for higher-level financial work like forecasting and budgeting.

5. A Scalable System Built for Growth

As your business expands���whether adding staff, new locations, or service lines—your financial processes must keep up.

An integrated solution gives you flexibility to:

Automate payroll setup for new hires

Customize financial reporting by department or region

Adjust your systems as your operations evolve

This creates a strong foundation that scales smoothly with your growth.

Additional Benefits of Integration

Audit-ready reports

One trusted point of contact

Enhanced data security and access control

Smoother employee onboarding and offboarding

Why More Businesses Trust C Numberz

At C Numberz, we help businesses simplify their financial operations by unifying payroll and bookkeeping under one secure, intuitive platform. Our experienced team delivers reliable reporting, real-time insights, and ongoing support tailored to your business goals.

From day-to-day processing to compliance and advisory, we don’t just get it done—we get it right.

0 notes

Text

Employers Tax Calendar 2025—Stay Ahead with Key IRS Deadlines

Managing tax deadlines effectively is critical for every employer. Late filings and missed payments can result in penalties, interest charges, and compliance risks. For North America-based CPAs, EAs, and accounting firms, helping clients stay ahead of their 2025 tax obligations is essential.

The IRS Employer’s Tax Calendar (Publication 509) outlines key deadlines for payroll taxes, estimated tax payments, reporting obligations, and business tax filings. Let’s break down the most important dates and compliance strategies for the upcoming year.

Key Employer Tax Deadlines for 2025

1. Payroll Tax Deposits: Monthly & Semiweekly Schedules

Employers must withhold and deposit federal income tax, Social Security, and Medicare taxes according to their IRS-assigned schedule:

Monthly Depositors: Taxes are due on the 15th of the following month.

Semiweekly Depositors: Taxes are due three banking days after payday.

Pro Tip for CPAs: Automate payroll tax deposits using the Electronic Federal Tax Payment System (EFTPS) to prevent delays and avoid penalties.

2. Quarterly Payroll Tax Filings (Form 941 & Excise Tax Filings - Form 720)

Q1 Deadline: April 30, 2025

Q2 Deadline: July 31, 2025

Q3 Deadline: October 31, 2025

Q4 Deadline: January 31, 2026

Employers must file Form 941 quarterly to report withheld taxes. Businesses subject to excise taxes must file Form 720 by these deadlines.

Compliance Tip: Help your clients review payroll records each quarter to avoid discrepancies that may trigger an IRS audit.

3. W-2 and 1099 Reporting Deadlines

January 31, 2025 – Employers must file W-2s (for employees) and 1099-NEC (for independent contractors) with the IRS and Social Security Administration.

March 31, 2025 – Electronic filing deadline for 1099-MISC and 1099-NEC.

Actionable Advice: Implement automated payroll and contractor payment systems to generate these forms accurately and on time.

4. Business Income Tax Filing Deadlines

Different business entities have varying tax filing deadlines:

March 17, 2025 – S Corporations (Form 1120-S) and Partnerships (Form 1065).

April 15, 2025 – C Corporations (Form 1120) and Sole Proprietors (Schedule C).

October 15, 2025 – Extended deadline for C Corporations and Sole Proprietors that filed for an extension.

Key Insight: Filing an extension doesn’t extend the payment deadline. Employers must estimate and pay taxes by April 15 to avoid penalties.

5. Federal Estimated Tax Payment Deadlines

For businesses and self-employed individuals, quarterly estimated tax payments are due:

April 15, 2025 – Q1

June 16, 2025 – Q2

September 15, 2025 – Q3

January 15, 2026 – Q4

Strategic Advice: Encourage clients to set up automated estimated tax payments to prevent cash flow disruptions and compliance issues.

How CPAs & Accounting Firms Can Help Employers Stay Compliant

Provide Proactive Tax Planning Regularly review employer tax obligations, ensuring compliance with changing IRS regulations.

Automate Payroll Tax Deposits & Reporting Encourage businesses to use EFTPS for payroll taxes and cloud-based accounting systems for real-time tax tracking.

Educate Clients on Filing Extensions & Penalties Make sure employers understand that filing an extension doesn’t extend their payment deadline, preventing costly surprises.

Offer Year-Round Compliance Support Tax planning shouldn’t be seasonal—help clients establish a rolling tax compliance strategy to avoid last-minute stress.

Final Thoughts

A well-structured employer tax calendar is more than just a compliance tool—it’s a roadmap for business stability. CPAs, EAs, and accounting firms play a crucial role in ensuring that businesses meet their tax obligations efficiently and accurately in 2025.

Need expert tax support?

Unison Globus offers tailored tax solutions for businesses, helping them navigate compliance with ease. Connect with us todayto streamline your 2025 tax obligations!

Key Tax Deadlines & Tips for Employers in 2025

Staying ahead of tax deadlines is crucial for compliance and avoiding penalties. Here are the important IRS deadlines for 2025, based on Publication 509:

General Tax Deadlines

📌 Jan 15, 2025 – Q4 2024 Estimated Tax Payment Due 📌 April 15, 2025 – Tax Day & Q1 Estimated Tax Payment Due 📌 June 16, 2025 – Q2 Estimated Tax Payment Due 📌 Sept 15, 2025 – Q3 Estimated Tax Payment Due 📌 Oct 15, 2025 – Extended Individual Tax Return Deadline

Employer Tax Deadlines

📌 Jan 31, 2025 – W-2 & 1099-NEC Submission Deadline 📌 Feb 28, 2025 – Paper Filing Deadline for 1099-MISC 📌 March 31, 2025 – E-filing Deadline for 1099-MISC 📌 April 30, 2025 – Q1 Payroll Tax Return (Form 941) Due 📌 July 31, 2025 – Q2 Payroll Tax Return (Form 941) Due 📌 Oct 31, 2025 – Q3 Payroll Tax Return (Form 941) Due

Excise & FUTA Tax Deadlines

📌 April 30, July 31, Oct 31, 2025 & Jan 31, 2026 – Quarterly Excise Tax (Form 720) & FUTA Tax (if liability exceeds $500)

Pro Tips for CPAs & Accounting Firms

Automate Payroll Deposits using EFTPS to prevent late fees.

Remind Clients about filing extensions NOT delaying tax payments.

Set Up Quarterly Compliance Checks to avoid last-minute issues.

Staying compliant is key to financial stability—plan ahead and stay on track!

Originally published on the Unison Globus LinkedIn page: https://www.linkedin.com/pulse/employers-tax-calendar-what-you-need-know-2025-unison-globus-kqwxf/

Disclaimer:

This article is for informational purposes only and should not be considered as tax, legal, or financial advice. Tax laws and deadlines may change, and employers should consult with a qualified tax professional or refer to official IRS guidelines for the most up-to-date information. Unison Globus is not responsible for any actions taken based on this content. For personalized tax compliance solutions, please contact our team.

#tax return preparation#tax returns#taxation#tax deductions#tax consultant#Employers Tax Calendar 2025#payroll tax filing#Form 941 due dates#W-2 filing schedule#tax compliance for CPAs#Unison Globus

0 notes

Text

Bookkeeping for Real Estate Agents: Why Winging It Just Won’t Cut It

Let’s be real—being a real estate agent isn’t exactly a slow-paced job. You're juggling open houses, client calls, back-to-back showings, late-night offers, and the occasional 7 AM coffee with a nervous first-time buyer. Amid all this chaos, who’s got the time (or mental bandwidth) to track mileage, categorize receipts, and reconcile bank statements?

But here’s the kicker: ignoring your bookkeeping—or worse, doing it half-heartedly—can quietly eat into your profits, stress you out come tax season, and hold your business back. It’s like driving a luxury car with a cracked dashboard. Looks good from the outside, but the internal systems? A mess.

So let’s talk about what smart agents are doing instead. Spoiler: they’re not staying up till midnight sorting through shoeboxes full of receipts.

Ever Feel Like Your Ledger’s a Maze?

If you’re a real estate agent, you probably didn’t get into the game because you love spreadsheets. You’re in it for the deals, the hustle, the stories behind the properties—not for reconciling bank statements or decoding tax codes. Yet somehow, bookkeeping creeps in, and suddenly, you’re spending your Saturday night color-coding expense categories.

Let’s not sugarcoat it: financial tracking in real estate can be a mess. Commissions come in lump sums, expenses are scattered across miles and meetings, and every transaction feels like a puzzle. And if you’re not on top of it? Tax season hits like a wrecking ball.

That’s where specialized bookkeeping services come into play—specifically tailored to agents like you. And no, this isn’t some one-size-fits-all accounting fluff. We’re talking about precision support designed for the unpredictability of real estate life. One standout in this space? Rapid Business Solutions—but more on them in a minute.

Why Real Estate Bookkeeping Isn’t Your Average Ledger Game

Let’s paint a picture.

You close a deal—big one. Commission rolls in. You cover marketing costs out-of-pocket, pay your assistant, fuel up for all those showings, grab client gifts, maybe even cover staging fees. Then, tax time arrives and your CPA asks, “Where’s the breakdown?”

And you pause... because, well, there isn’t one. Not yet.

Real estate bookkeeping is a high-wire act. Why?

Irregular income: Some months are goldmines. Others? Crickets.

1099 contractor status: You're essentially a business of one—tax-wise, that gets messy.

Mileage, meals, and marketing: Deductible, yes. Easy to track? Not so much.

Team dynamics: If you lead a team, it’s not just your books anymore—it’s payroll, splits, and bonuses.

And while QuickBooks might be great in theory, let’s be honest: most agents don’t have the time (or the patience) to categorize every dollar with precision.

Here’s the Thing—The Cost of “Winging It”

You might think, "I’ll just figure it out during tax season."

Spoiler: That strategy costs more than it saves.

Missed deductions: Forget to log mileage for a month? That’s hundreds gone.

Overpaying taxes: Without clean books, your CPA’s guessing—and probably erring on the safe (read: expensive) side.

IRS red flags: A sloppy Schedule C screams “audit me!” even if you're squeaky clean.

Plus, there’s the hidden toll: stress. Ever tried calculating quarterly taxes on the fly, with ten listings and three escrows in play? It’s like juggling while skydiving.

Enter Rapid Business Solutions—Not Just Another Bookkeeping Firm

So, let’s talk about Rapid Business Solutions. These folks aren’t just number crunchers. They’re real estate-savvy bookkeeping pros who get the quirks of your industry.

Here’s what makes them stand out:

Specialized expertise: They know real estate bookkeeping. Not general accounting. Not random business categories. Real estate. That means they’ll know the difference between your listing photos and your car wrap expense—and how both affect your bottom line.

Real-time visibility: Using cloud-based tools, Rapid Business solution lets you see where your money’s going without waiting for a month-end email. It's bookkeeping you can actually understand—no accounting degree required.

Tax-prep synergy: They don’t just organize your books; they make life easier for your tax pro too. That means fewer surprises, cleaner filings, and often, lower bills.

Human-first service: You’re not just another client ID in a system. They treat you like a partner—because they get that you’re running a business, even if it’s just you and your car full of open house signs.

“But I’ve Got a System…”

Sure. Maybe it’s an Excel sheet. Or a shoebox. Or an app you downloaded three months ago and forgot about.

Systems are great... until they fail under pressure.

Rapid Business solution doesn’t just replace your current system. They improve it. They tailor a bookkeeping setup that fits your workflow, not the other way around. That’s a game-changer. Especially if you’re scaling your business or dreaming of finally hiring that first assistant.

Why It’s Not Just About the Books

Let’s zoom out.

Good bookkeeping isn’t just about taxes. It’s about clarity. It’s about knowing:

How much you actually made this month.

Whether your marketing spend is paying off.

If that flashy lead gen service is worth renewing.

When to hire, when to hold, and when to push harder.

With clean books, you move with confidence. You plan smarter. You sleep better.

It’s not just numbers. It’s peace of mind. And let’s face it—peace of mind is in short supply when you’re running from a closing to a showing to a school play all in the same day.

Let’s Be Real: Time Is the Real Currency

Here’s the real kicker. The time you spend trying to be your own bookkeeper? That’s time you could spend closing deals. Building relationships. Growing your brand.

Imagine what even 5 extra hours a week could mean. More calls. More listings. More chances to actually take a day off.

Rapid Business solutions gets that. They’re not just saving you time—they’re handing you back your focus.

So, Is It Worth It?

If you’re serious about real estate—and honestly, if you’ve read this far, you probably are—then yes. Outsourcing your bookkeeping is absolutely worth it.

Because it’s not just a service. It’s a strategy.

It’s one less thing pulling your attention. One more thing done right. And in this business, where details matter and time moves fast, that kind of support is priceless.

Final Thoughts: Don’t Wait for Chaos

You know how buyers always wait too long to get pre-approved? That’s how most agents treat their finances. They wait until it’s a mess—then panic.

Don’t do that.

Whether you’re a solo agent just starting out or running a multi-agent team, Rapid Business Solutions can help you build a financial foundation that actually supports your growth.

0 notes

Text

Board Meeting Minutes 1/20/09

Board Meeting Minutes 1/20/09 Potsdam Humane Society Board Meeting Minutes 1/20/09 Attendees: Scott Soules, Gymo Tom Compo, Gymo Pat Tubbs, Fund Raising Consultant Tracy Adle Jane Amelotte Bonnie Boyd Linda Caamano Cindy Dusharm (excused) Rob Jewett Irene Hargrave Helen Hollinger Adam Huckle (excused) Ruth Huckle (excused) Amber Lindsey Jackie Pinover Carrie Tuttle Lucille Waterson Location: SUNY Potsdam 1. Informational session on Capital Plan began at 4:58 p.m. - Rug in Training Room; up for discussion. - Color for vinyl siding; requested color scheme from architect for approval by Board President. - Outside kennels; chain link proposed in between kennels; Board requested that architect consider solid panels between as alternative in bid. - Schedule: meeting with Village of Potsdam Planning Board on 2/5 at 7 p.m. Tom, Carrie and Bonnie will attend; planning for 3/5 approval by Village. - Some ways to save costs are to select vinyl siding over a composite board; gravel parking lot versus paved; 23 spaces versus 40 spaces. - Budget: $900k is current estimate; market is quite volatile and estimate will change. 2. Pat Tubbs Fund Raising Report - Handed out and asked Board to review 1/6 fund raising discussion - Reviewed immediate items from first planning session. Planning fund raising event on 2/2, at Potsdam Presbyterian Church at 7 p.m.; on 2/4 for General Community Presentation at 7 p.m. at Potsdam Middle School; on 2/14 possibly at Walmart; Hills Event; Thermometer update; Website update; progress report distribution; Bon Ton promo; Tastefully Simple Home party; Rooftop fundraiser; Makeover video; Grants; Clarkson class project; Empire Zone tax credit request; Elevator speech. 3. Anne’s Report - Some personnel issues are being addressed. - Ag & Mrkts provided Anne with a list of things that ACOs need and she is working on it. - Discussed issues with ACOs and Amish animal licensing issues. 4. Meeting Rules - Consider not giving committees 10 minutes; 2-5 minutes instead. - Following Robert’s Rules for meetings; Lucille will email these to Board members so they can review. 5. Jackie moved to approve meetings from last meeting; Helen seconded. Unanimously approved. 6. Reviewed action items from previous meeting - Letter has not been drafted regarding dental equipment; tabled as a lower priority may want to revisit at another date. - Advertising in Freetrader is occurring. - School education program is underway. - Compilation of PR packet for PHS is ongoing. - Linda and Bonnie were to meet to review volunteer list; will report on next meeting. - Motion made by Carrie to keep the liability insurance; Jane seconded motion. Unanimously approved. At least two members require the insurance for them to able to remain active Board members. 7. Committee Reports a. Board Development - Bonnie and Jane are working on recruiting members from Canton. - Jackie made a motion to approve edited PHS Vacation and Leave Time for Full Time Employees; Rob seconded the motion. Helen requested that Personnel committee develop a policy for part-time employees. b. Operations - Ron Kilgore has repaired all the damaged kennel doors; and began to address electrical issues; removing forced air unit, etc. - Floor drain issue is continuing to be an issue; Bronson plans to come back this week or when weather permits. - In reception area broken keyboard return has been replaced and made improvements to cord mess. - Received new mop bucket and food canister with rollers from anonymous donor. - Hacketts donated new 15 gallon wet/dry shop vac. - Still working on back kennel door, broken window in surgery room, weather tightening, some broken lighting, non-combustible dryer vent, leaking sink w/ pinholes c. Finance - $27,061.21, collected since Progress Reports went out. - W2s and 1099 will be in the mail to employees this week. - Quickbooks program is now up and running. - Irene sent out balance sheets and other cash flow reports; month of December was positive in terms of cash flow ($1171.72 to the positive). - Shelter personnel are being tra

0 notes

Text

Short Sale Tax Implications in the US: What You Need to Know

When one intends to engage in a short sale in his/her home in the USA, knowing the tax consequences is fundamental. While a short sale can act as a means through which one is able to avoid an arduous financial situation, it always presents with definite tax repercussions, and ignoring these risks could prove unfortunate. Therefore, here's what one should know regarding tax implications with respect to short sale in the United States of America.

What is Short Sale?

A short sale is a transaction where the owner sells his property for an amount lower than the remaining mortgage amount. This usually involves seeking the lender's consent, as he has to accept less than the total debt owed. Although a short sale will save a homeowner from foreclosure, there could be tax implications affecting their future financial life.

Tax Consequences of a Short Sale in the USA

1. CODI:

In a short sale, when a lender forgives a portion of your mortgage debt, the forgiven amount is generally considered taxable income by the IRS. This is known as "Cancellation of Debt Income" (CODI). For instance, if you owe $200,000 on your mortgage but sell your home for $150,000, the $50,000 difference may be treated as taxable income.

2. The Mortgage Forgiveness Debt Relief Act:

The Mortgage Forgiveness Debt Relief Act (MFDRA) was established to help ease the plight of home owners. This act can exclude the canceled debt from your income, if it relates to your first-time home and qualifies under certain conditions. The MFDRA has had several periods of extensions and expirations, so check the status for now.

3. State Tax Implications:

Federal taxes are not the only source of tax implications; some states consider forgiven debt as taxable income. State rules vary, so a local tax professional is advised to determine how your state handles short sale tax implications.

4. Capital Gains Tax:

While CODI is the primary concern in a short sale, you also have the possibility of capital gains tax if the sale generates a profit. However, for most homeowners, this is unlikely in a short sale scenario since the property is sold for less than the mortgage balance.

How to Minimize Tax Consequences of a Short Sale

1. Work with a Tax Professional:

Navigating the tax implications of a short sale can be complex. A qualified tax professional can help you understand your obligations, identify potential exclusions, and prepare the necessary forms.

2. Check for Exemptions:

If your short sale qualifies under the Mortgage Forgiveness Debt Relief Act, ensure you claim the exemption properly on your tax return. This can significantly reduce or eliminate your CODI.

3. Understand Insolvency Rules:

If you were insolvent at the time of the short sale, you could be eligible to exclude some or all of the forgiven debt from taxable income. Being insolvent means that your total debts exceeded your total assets immediately before the debt was forgiven.

Key Forms to File

- Form 982: Reduction of Tax Attributes Due to Discharge of Indebtedness

Use this form to take exemptions, such as the Mortgage Forgiveness Debt Relief Act or bankruptcy.

- Form 1099-C: Cancellation of Debt

The lender will usually mail this form to you if the lender forgives any amount of your debt. Always review it carefully to be sure that the information on the form is correct.

Final Thoughts

A short sale can be a lifeline for homeowners in financial distress, but tax consequences of a short sale in the USA are something to consider to avoid any surprise tax bills. Work with a tax professional, explore available exemptions, and stay informed about the current laws to make this process less daunting.

If you’re considering a short sale or have questions about its tax implications, don’t hesitate to seek expert advice. Proper planning and knowledge can make a significant difference in managing your financial future.

0 notes

Text

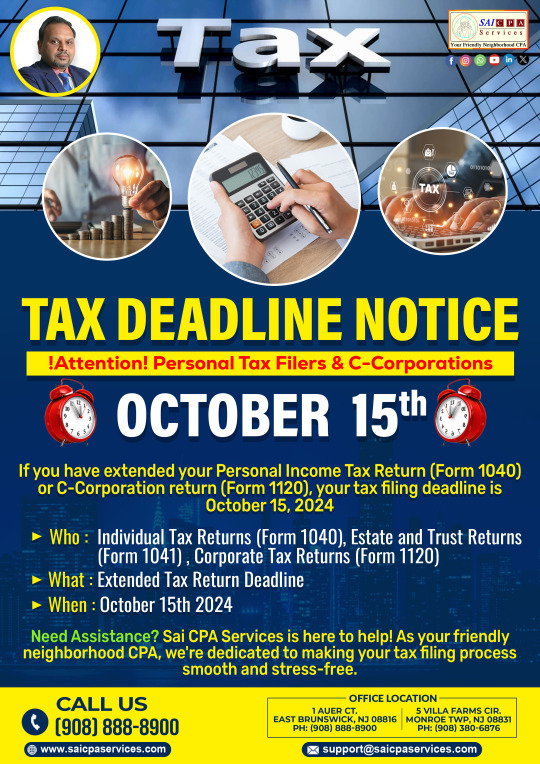

Tax Deadline Alert: October 15th Final Extension Deadline Approaching

As we near the extended tax filing deadline, Sai CPA Services wants to ensure all taxpayers are well-prepared and informed. The October 15th, 2024 deadline is quickly approaching for all extended tax returns, and it's crucial to act now to avoid potential penalties.

Who Needs to File by October 15th?

Individual taxpayers who filed for an extension on their Form 1040

Estates and trusts with extended Form 1041 returns

C-Corporations with pending Form 1120 submissions

Important Considerations:

Final Deadline: Unlike the initial April deadline, October 15th is the final extension deadline. No additional extensions are available for personal returns.

Payment Status: Remember that while you received an extension to file, any taxes owed were still due by the original deadline. Additional interest and penalties may have accrued if payment wasn't made by then.

Documentation Required: Ensure you have all necessary documents:

W-2 forms

1099 statements

Business income records

Deductible expense receipts

Investment statements

Why Choose Sai CPA Services?

As your trusted neighborhood CPA, we offer:

Expert tax preparation

Last-minute filing assistance

Professional review of your tax documents

Strategic tax planning for future years

Year-round financial advisory services

Don't Risk Late Filing Penalties!

The IRS imposes significant penalties for late filing:

Up to 5% of unpaid taxes for each month your return is late

Maximum penalty of 25% of your unpaid taxes

Additional interest charges on unpaid tax amounts

Take Action Now

Don't let the October 15th deadline catch you unprepared. Sai CPA Services is ready to assist with your:

Personal tax returns

Estate and trust filings

Corporate tax submissions

Remember, proper tax compliance is not just about meeting deadlines—it's about ensuring your financial well-being. Let Sai CPA Services be your partner in achieving your financial goals through expert tax management and planning.

Act Today for Peace of Mind Tomorrow!

Disclaimer: This notice serves as a general reminder and may not apply to all tax situations. Please consult with our tax professionals for advice specific to your circumstances.

Contact us to transform your financial future:

Facebook: AjayKCPA Instagram: sai_cpa_services Twitter: SaiCPA LinkedIn: Sai CPA Services WhatsApp: Sai CPA Channel Phone: (908) 380-6876

(908) 888-8900

📍 1 Auer Ct, East Brunswick, NJ 08816

0 notes

Text

Direct Deposit Check Stub: Everything You Need To Know

A Direct Deposit Check Stub is called a pay stub or earning statement. It is a document that summarizes an employee’s pay for a specific period. Yup, your funds are deposited directly into a bank account, but using this stub provides a breakdown.

#Direct Deposit Check Stub#Salaried Pay Stub#Online Payslip Generator#Salary Slip Generator#Free Payslip Generator Online#Payroll Generator#Real Paycheck Stubs#Paycheck Now#Check Stub Maker#How To Make Check Stubs#Check Stubs#Make Check Stubs#Pay Stubs Generator#Pay Check Maker#Online Paystub Maker#W2 Generator#Free Online W2 Generator#Generate 1099 Misc Online#Free W4 Generator#Free W9 Creator#Online W7 Form#1099 C Generator#Free 8809 Creator#SS 4 Form Creator#8995 Form Generator#941B Form Creator#1099-Div Form Generator#1099 OID Form Online#1099 INT Form Generator#Create 1099 G Form Online

0 notes

Text

Understanding Debt Relief Tax: What You Need to Know

Debt can be a heavy burden, affecting not just financial stability but also mental and emotional well-being. For those who find themselves in overwhelming debt situations, debt relief options can provide a path toward recovery. However, it’s important to understand the potential tax implications of debt relief, particularly regarding what’s known as the Debt Relief Tax. IRS Audit

What is Debt Relief?

Debt relief refers to various strategies individuals or businesses can use to reduce or eliminate their debt. This can include debt consolidation, debt settlement, bankruptcy, or negotiating lower payments with creditors. While these methods can provide immediate financial relief, they often come with significant consequences, one of which is the Debt Relief Tax.

What is Debt Relief Tax?

The Debt Relief Tax refers to the Internal Revenue Service (IRS) rule that treats forgiven debt as taxable income. According to the IRS, if a creditor forgives or cancels a debt, the amount forgiven may be considered income, which means you could owe taxes on that amount.

Key Points About Debt Relief Tax

Taxable Income: If a creditor cancels a debt of $600 or more, you may receive a Form 1099-C, Cancellation of Debt. The amount listed on this form is generally considered taxable income.

Exemptions and Exceptions: Not all forgiven debt is taxable. Certain situations allow for exceptions, including:

Bankruptcy: Debt discharged in bankruptcy is not taxable.

Insolvency: If you were insolvent at the time the debt was canceled, you may not have to report the forgiven amount as income. Insolvency means that your total liabilities exceed your total assets.

Qualified Principal Residence Indebtedness: For a limited time, certain types of forgiven mortgage debt on a primary residence may not be taxable.

Impact on Tax Returns: If you have canceled debt, you must report it on your tax return. This could increase your tax liability, impacting any refunds you may expect or resulting in a balance due.

Potential Penalties: Failure to report forgiven debt can lead to penalties and interest on unpaid taxes. It’s crucial to understand your obligations and file correctly.

Steps to Take if You Receive Debt Relief

Consult a Tax Professional: If you’ve received debt relief, consulting a tax professional can help you understand your specific situation. They can assist with determining if your forgiven debt is taxable and guide you through the filing process.

Document Your Situation: Keep all records related to your debts, including any agreements with creditors, cancellation notices, and Form 1099-C. Documentation is crucial for justifying your tax status.

Assess Your Financial Situation: Understanding your overall financial health, including assets and liabilities, can help you determine whether you qualify for exemptions based on insolvency.

Plan Ahead: If you expect a significant tax liability due to debt forgiveness, it may be wise to plan for it. Setting aside funds or adjusting your withholdings could help mitigate the impact when tax season arrives. IRS Audit

Conclusion

Debt relief can provide a much-needed lifeline for those drowning in financial obligations, but it's essential to be aware of the tax implications that come with it. The Debt Relief Tax can surprise many, leading to unexpected tax liabilities. By staying informed and seeking professional guidance, individuals can navigate these challenges effectively, paving the way toward a healthier financial future.

0 notes

Text

iPhone 17 Series With A17 Chip, Camera Upgrades, And USB-C

iPhone 17 rumors

Apple’s iPhone 17 series will maintain its innovation and performance. Rumors and industry speculation hint at the next-generation iPhones’ features. A detailed look at the iPhone 17 series’ predicted features, design, and technology.

Expected iPhone 17 series Models

Apple will likely produce many iPhone 17 versions, including:

iPhone 17

iPhone 17 Plus/Max

iPhone 17 Pro

iPhone 17 Pro Max/Ultra

This series will have ordinary and “Pro” models with pro features including superior cameras and performance.

Style and Display

The iPhone 17 series is expected to follow Apple’s streamlined, basic design. Due to better Face ID integration under the display, the iPhone 17 series may continue the flat-edge design of the iPhone 12 series but with thinner bezels and possibly no notches.

Display Dimensions

We may see iPhone 17 series displays comparable to those of its predecessors:

6.1-inch for the iPhone 17 and 17 Pro

6.7-inch for the iPhone 17 Plus and 17 Pro Max/Ultra

The Pro variants may have OLED screens with ProMotion 120Hz refresh rates and always-on displays for a more responsive user experience.

Improvements to cameras

Every iPhone announcement highlights the camera system, and the iPhone 17 series should improve it. Regular iPhone 17 models will likely have dual cameras, while Pro models may have triple or quad cameras.

Possible Camera Enhancements:

48MP primary Camera: The iPhone 17 Pro may have a higher-resolution primary camera for clearer shots and good low-light performance.

Periscope Zoom: The Pro Max/Ultra model may have 10x optical zoom with a periscope zoom lens, one of the most anticipated features.

Night Mode, Deep Fusion, and Smart HDR will improve thanks to AI processing.

Video recording will advance with ProRes support on Pro models, 8K video recording, and better cinematic mode for professional content creation.

A17 Bionic Chip performs

Next-generation A17 Bionic chips on the 3nm technology will likely power the iPhone 17 series. Expect this new chip to offer:

Better battery life through efficiency

Game and hard task performance faster

Improved camera, AR, and machine learning AI processing

The iPhone 17 series will have unmatched speed and performance for multitasking, gaming, and more with the A17 CPU.

Battery Life/Charging

Apple may improve iPhone 17 battery life with the A17 chip’s efficiency. Larger batteries in Pro models may provide all-day battery life under heavy use.

Charging:

MagSafe will likely remain, potentially with faster charging.

There are speculations about reverse wireless charging, which would let you charge AirPods on the iPhone’s back.

USB-C port: New European regulations require a universal charger, therefore the iPhone 17 series may convert to USB-C for speedier data transfer and charging.

Internet and 5G

iPhone 17 series should enable 5G with enhanced performance and efficiency. Pro models may include Wi-Fi 7, which improves speeds and connectivity in busy networks.

Software: iOS18

New features, additions, and optimizations will likely come with iOS 18 on the iPhone 17 series. Expect deeper AI system integration, new privacy features, and more device customization.

Important iOS 18 Features:

Multitasking and widget improvements

AI-powered personal assistant functionality

Optimizing apps for better performance

Storage and Cost

Storage will likely start at 128GB and increase to 1TB or more in Pro variants. Due to the upgraded camera technology and features, the Pro Max/Ultra variants may cost more than earlier models.

Pricing (based on speculation):

iPhone 17: $799 iPhone 17 Plus costs $899 iPhone 17 Pro: $1099 iPhone 17 Pro Max/Ultra costs $1199

Release Date

Expect the iPhone 17 series in September 2025, as Apple usually releases new iPhones in September. A week following the announcement, pre-orders may begin, followed by general release.

Conclusion

The A17 CPU, improved cameras, and maybe a USB-C port are making the iPhone 17 series a powerhouse. Whether you’re interested in the Pro models’ sophisticated capabilities or the iPhone 17’s elegant, efficient design, this series will maintain Apple’s smartphone technology tradition. As the release approaches, check official announcements for features and details.

Read more on Govindhtech.com

#iPhone#iPhone17#iphone17pro#A17chip#iphone17max#iphone17plus#news#Technology#technews#technologytrends#govindhtech#technologynews

0 notes

Text

Hong Kong tax filing

Tax submitting is usually a critical when-a-12 months job for people and firms alike. Irrespective For anyone who is a seasoned taxpayer or perhaps a Major-timer, staying accustomed to the nuances of tax publishing may possibly報稅 make it easier to steer clear of frequent pitfalls and optimize your return. This info provides an in-depth think of the essentials of tax filing, showcasing techniques and insights for creating the method smoother plus much more affordable.

Awareness Tax Submitting:

Tax distributing consists of distributing tax returns to The federal government to report profits, expenses, together with other pertinent financial details. This process ensures that people nowadays and enterprises fork out their honest share of taxes and alter to your regulation. Within the usa, The inner Earnings Aid (IRS) oversees tax assortment and enforcement.

Assemble Necessary Paperwork:

Get rolling by amassing all desired paperwork, like W-2s, 1099s, receipts, and information of deductible fees. Ensure that you have info on any investments, belongings gross sales, and other earnings sources.

Pick the Correct Submitting Standing:

Your distributing standing (a person, married submitting jointly, married publishing individually, head of domestic, or qualifying widow(er)) influences your tax level and eligibility of course deductions and credits. Pick the place that best suits your scenario.

Recognize Deductions and Credits:

Deductions decrease your taxable earnings, nevertheless credits lower your tax authorized duty. Familiarize your self with well-known deductions (e.g., mortgage loan drive, well being care service fees) and credits (e.g., Attained Revenue Tax Credit rating, Youngster Tax Credit score score) To optimize your tax Advantages.

Make your brain up Involving Regular and Itemized Deductions:

The regular deduction is a fixed full that lessens your taxable profits. Itemized deductions, Alternatively, include listing special deductible prices. Decide on the selection which presents the best tax attain.

Use Tax Software bundle or Employ the assistance of a qualified:

Tax program system can simplify the submitting system by guiding you thru Each transfer and mechanically calculating your return. Alternatively, choosing a tax professional can supply individualized info and make sure your taxes are submitted correctly.

Publishing Your Tax Return: Complete the necessary tax forms (e.g., Type 1040 for people). Warranty all info is exact and full to stop delays or audits.

Double-Have a look at Your Return: Overview your return for challenges or omissions. Even more compact faults could cause delays or penalties. Double-Consider calculations and assure all anticipated documentation is hooked up.

Post Your Return: It can be done to file your return electronically (e-file) or by mail. E-publishing is quicker and safer, and you’ll get affirmation the IRS has acquired your return. In the function you owe taxes, You may as well make payments electronically or by Check out.

Watch Your Refund: In case you’re anticipating a refund, make use of the IRS’s “Wherever’s My Refund?” Instrument to trace its posture. Refunds are generally issued within three weeks of submitting, but processing situations may vary.

Typical Tax Submitting Faults to stay clear of:

Lacking Deadlines: The IRS tax publishing deadline is 香港報稅 regularly April 15th. Missing this deadline may perhaps turn out in penalties and interest on any unpaid taxes. If you want far more time, file for an extension using Sort 4868.

Incorrect Social Defense Figures: Make selected that each one Social Protection portions in your tax return are exact. Problems may result in processing delays and difficulties Together with the IRS.

Failing to Report All Gains: Report all funds, which incorporates facet Perform prospects, freelance perform, and investments. The IRS receives copies of your entire income paperwork and can detect discrepancies.

Overlooking Deductions and Credits:

Hong Kong is renowned for its minimal and straightforward tax routine, that makes it a beautiful place for businesses and expatriates alike. However, navigating the nuances of tax filing in Hong Kong can having said that be Superior, especially for These unfamiliar When utilizing the Local community limits.

Comprehending Hong Kong's Tax Procedure:

Hong Kong's tax procedure is territorial, that means that only earnings derived from or sourced in Hong Kong is taxable. Critical taxes contain Salaries Tax, Earnings Tax, and Home Tax. The tax twelve months operates from April one to March 31, and Adult men and women and corporations ought to file their tax returns Using the Inland Income Segment (IRD) appropriately.

Wonderful things about Employing a Hong Kong Tax Publishing Help:

Tax business experts in Hong Kong are well-versed in spot tax laws and rules. Their knowledge will make guaranteed that each one facets of the tax submitting are taken care of specifically, aiding to maintain from blunders and penalties.

Time-Conserving: Creating Prepared and distributing taxes can be time-consuming, especially for firms with complex financial constructions. A tax submitting provider handles each on the list of paperwork and procedures, releasing up your time and effort and endeavours to Middle on other vital duties.

Compliance: Making certain compliance Combined with the IRD’s necessities is very important so as to steer clear of fines and approved challenges. Tax publishing methods stay awake-to-date with alterations in tax legislation and limitations, generating selected your tax returns are compliant.

Maximizing Deductions and Reliefs:

Tax specialists can create all competent deductions and tax reliefs, optimizing your tax posture. This will likely result in substantial tax Expense savings, notably for enterprises and men and ladies with intricate tax cases.

Satisfaction: Employing knowledgeable supplier provides pleasure that the taxes are submitted effectively and punctually. This minimizes the pressure connected to tax time and permits you to definitely center on other priorities.

The entire process of Using a Hong Kong Tax Submitting Guidance:

The treatment starts obtaining an First session where because of the tax assistance support service provider assesses your tax dilemma. This characteristics realizing your earnings methods, fiscal pursuits, and any distinct scenario which could influence your tax submitting.

Doc Selection: You must supply the required documentation, As an example earnings statements, expenditure documents, economic establishment statements, and former tax returns. The tax guidance provider will guideline you on what precise files are necessary.

Tax Calculation and Arranging: The tax authorities will work out your tax legal responsibility, taking into account all applicable deductions, allowances, and tax reliefs. They put jointly your tax return, guaranteeing all facts is correct and detailed.

Evaluation and Acceptance: When the tax return is prepared, it will be reviewed in conjunction with you for acceptance. This can be an opportunity to focus on any concerns or concerns and assure all aspects is appropriate beforehand of submission.

Filing and Submission: The tax services provider will file your tax return electronically With the many IRD. They may also deal with any correspondence or abide by-up queries from the IRD by yourself behalf.

Place up-Submitting Assistance: Right after filing, the business services service provider will source ongoing aid, such as support with tax payments, handling any audits, and giving aid for probable tax arranging.

Selecting the Ideal Tax Submitting Assistance:

Array of Alternatives: Make sure the assistance service provider provides in depth providers that fulfill your Choices, whether or not you demand unique tax distributing, corporate tax methods, or specialised assistance for expatriates.

Personalised Provider: Choose an organization which gives personalized services tailor-produced to The actual tax circumstance. This assures you get The best strategies and assist to your Outstanding wishes.

Summary:

Tax submitting in Hong Kong, even though supplemental uncomplicated than in a myriad of other jurisdictions, however necessitates quite cautious interest to factor and compliance with community legislation. Employing a Hong Kong tax filing aid can simplify the process, guaranteeing precision, compliance, and future tax economical discounts. By leveraging the knowledge of tax gurus, you'll be able to navigate the complexities of tax submitting with self-self confidence and satisfaction. Irrespective When you are anyone, a company operator, or an expatriate, a highly regarded tax submitting company may be an priceless affiliate in taking care of your tax obligations effectively and proficiently.

0 notes

Text

Top 5 Questions to Ask Before Hiring a Bookkeeping Service Provider

For business owners, selecting the right bookkeeping services for small businesses is an investment in operational stability and future growth. An experienced bookkeeper not only maintains accurate financial records but also supports critical decision-making and tax compliance efforts. Before entering into an agreement, it is essential to ask strategic questions that clarify the provider’s expertise, capabilities, and alignment with your organizational needs.

Business owners in the Twin Cities of MN should carefully evaluate prospective providers using these five key questions—with extra pointers to guide your discussion:

1. What Is a Bookkeeper’s Role Within a Business?

A professional bookkeeper performs far more than data entry. Their role encompasses:

Accounts payable & receivable management: tracking vendor invoices and customer billing schedules

Bank reconciliations: matching ledger balances to bank statements to detect errors or fraud

Preparation of financial statements: compiling balance sheets, income statements, and cash flow statements

Cash flow monitoring: analyzing inflows and outflows to forecast liquidity needs

Additional pointers:

Ask how they handle variance analysis when actual results deviate from budgets.

Clarify if they can prepare departmental P&Ls or project-level profitability reports.

2. How Will Your Services Be Structured to Meet the Specific Needs of My Business?

Each business requires a financial management approach suited to its model. Consider:

Industry software expertise: QuickBooks Online, Xero, Sage, or custom ERP integrations

Reporting frequency: monthly close schedules, quarter-end deep dives, or ad-hoc analyses

Accounting method: cash basis vs. accrual basis and handling of deferred revenue

Additional pointers:

Inquire about their process for job costing or inventory valuation if you carry stock.

Discuss how they manage multi-entity consolidations if your operations span several legal entities.

3. What Types of Financial Reporting Will You Provide?

Robust reporting is the cornerstone of informed strategy:

Cash flow projections: three- to twelve-month forecasts to guide working capital decisions

Budget vs. actual reports: highlighting cost overruns or revenue shortfalls

Key financial ratios: gross margin percentage, current ratio, debt ratio

Additional pointers:

Request samples of dashboard summaries showing KPIs at a glance.

Ask if they can generate custom ad hoc reports for board meetings or investor updates.

4. What Is Your Approach to Tax Preparedness and Regulatory Compliance?

Efficient bookkeeping lays the groundwork for accurate tax filings:

Tracking deductible expenses and capital expenditures for depreciation schedules

Maintaining sales tax logs and filing calendars for multiple jurisdictions

Collaboration protocols with your CPA during year-end tax preparations

Additional pointers:

Verify how they stay informed of changes in payroll tax rates or state filing thresholds.

Ask if they can support 1099 and W-2 processing, and manage year-end reconciliations.

5. How Will You Protect My Financial Data?

With cloud-based platforms, data security is a non-negotiable requirement:

Encryption: at-rest and in-transit safeguards for sensitive files

Access controls: user permissions, two-factor authentication, and audit trails

Disaster recovery: routine backups and off-site storage

Additional pointers:

Confirm their compliance with industry standards such as SOC 1/SOC 2 reports.

Ask about their protocol for data breach notifications and incident response drills.

Bonus Pointer: What Is Your Pricing Model?

Before signing, clarify:

Fee structure: fixed monthly retainer vs. hourly rates vs. per-transaction fees

Scope creep handling: how additional tasks or special projects are billed

Onboarding charges: setup fees for migrating data or configuring software

Conclusion

Hiring a bookkeeping partner that truly understands your business can transform raw numbers into strategic guidance. By probing these questions—and the extra pointers—you will gain confidence in your provider’s ability to support your financial health.

For business owners in the Twin Cities of MN seeking professional bookkeeping services for small businesses, visit CNumberz to explore our comprehensive solutions. Let our experienced team maintain your financial clarity so you can concentrate on driving growth.

0 notes

Text

Key Differences Between Business and Personal Tax Returns

When it comes to tax season, both individuals and businesses are required to file returns, each adhering to a distinct set of rules and regulations. Understanding the key differences between business and personal tax returns is crucial for entrepreneurs and business owners to ensure compliance and optimize their financial strategies.

Structural Variances:

The most apparent difference lies in the structure of the tax returns. Personal tax returns, known as Form 1040 in the United States, focus on the individual taxpayer’s income, deductions, and credits. On the other hand, businesses file their taxes using various forms, such as the Form 1120 for C Corporations, Form 1120-S for S Corporations, or Form 1065 for Partnerships.

Income Reporting:

For personal tax returns, income is generally reported on a W-2 for employed individuals or a 1099 form for those with additional income sources. In contrast, businesses must report their revenue, deductions, and profits or losses through their specific tax forms, reflecting the unique financial structure of the business entity.

Deduction Opportunities:

While individuals can claim various deductions, such as mortgage interest, student loan interest, and medical expenses, businesses have a broader spectrum of deductible expenses. Business owners can deduct operating expenses, depreciation on assets, employee wages, and other costs associated with running the business.

Tax Rates:

Another significant difference is the tax rates applied to personal and business income. Personal income tax rates are progressive, meaning they increase as an individual’s income rises. In contrast, business taxes can be subject to different rates based on the entity type. C Corporations, for example, face corporate income tax rates, while pass-through entities like S Corporations and Partnerships pass their income through to individual owners, who report it on their personal returns.

Quarterly Payments:

Individuals typically pay their taxes annually, with the option to make quarterly estimated tax payments if their income isn’t subject to withholding. Businesses, especially sole proprietors and those with significant income, are often required to make quarterly estimated tax payments to ensure a steady inflow of revenue for government operations.

Record-Keeping Requirements:

The documentation and record-keeping obligations for businesses far exceed those for individuals. Businesses need to maintain detailed records of income, expenses, assets, and liabilities, as these play a crucial role in substantiating their tax returns. Personal tax returns generally require less documentation, focusing on individual income sources and deductions.

Filing Deadlines:

While personal tax returns are typically due on April 15th, the deadlines for business tax returns vary. C Corporations, for instance, often have a deadline of April 15th, while S Corporations and Partnerships usually have a deadline of March 15th. Sole proprietors who file a Schedule C with their personal tax returns adhere to the individual deadline of April 15th.

In conclusion, understanding the distinctions between personal and business tax returns is essential for anyone involved in entrepreneurial endeavors. From the structure of the forms to the nuances of deductions and tax rates, a comprehensive grasp of these differences ensures that individuals and businesses alike can navigate tax season with confidence and compliance.Seek expert advice from the best tax preparation company in Mayfield Heights, OH.

0 notes

Text

Setting up business in UK

One-stop solutions for company incorporation in the USA and UK, Setting up a limited company in the UK, company registration, and company formation services.

Mercurius & Associates LLP - Chartered accountant firms in India | Setting up business in UK

Organization Consolidation in the USA We offer problem-free administrations of organization fuse in the USA. The cycle starts with an exhaustive meeting and master evaluation of the organization's development, guaranteeing that it follows the necessities of setting up an organization in the ideal country. Post which, our specialists gather and set up the important records and present the application for organization enlistment. Toward the finish of the enlistment methodology, a testament of enrollment will be conveyed to you through messenger administration. Setting up business in UK

We will help you with the accompanying exercises:

Joining of an organization Endorsement of Development/Joining Working Arrangement year enrolled specialist administration Help with setting up a virtual ledger Acquiring EIN number

Boss Recognizable Proof Number, generally known as EIN is an obligatory expense ID number that permits you to direct business in the USA. It behaves like an identifier involved by the IRS for organizations and different substances. One requirement is the EIN number for charge documentation, deals charge enlistment, opening a financial balance, and so on. Getting ITIN number

A Singular Citizen ID Number is an expense handling number in the US given by the Inner Income Administration (IRS). It is given to the people who are expected to have a duty distinguishing proof number yet are not qualified to have an SSN. In this manner, ITIN is simply given to alien outsiders and not to the residents (except if they are ineligible for SSN). US Duties Our group remains consistently side by side with changes in charge approaches, organization and guidelines, and homegrown and global law. We help organizations to amplify esteem by recognizing and carrying out broad strategies for corporate, global, and nearby charges to guarantee that the flowing impact of all duties together is insignificant on our clients. We have broad involvement with documenting of assessment forms and are fair on the state and government charge recording ideas. We help our clients with the following:

Month-to-month/quarterly/bi-yearly/yearly deals expense form with the division of income. Individual, LLC, S-corp, C-corp returns in the USA utilizing approved outsider programming projects, for example, Super expense or Assessment Act Structure 1099, 1040, 1040A, 1120, W2, K1,etc Organization Fuse in the UK Organization fuse for non-UK residents would never be more straightforward than this. Our group of experts can assist you with deciding the most appropriate corporate design for your business in the UK and consolidate the elements in like manner. Our administrations incorporate"

Development of the organization Enrolling of Organizations House Documenting Computerized as well as Printed Declaration of Fuse, Offer Authentications, Notice, and Articles Tank Enrollment (whenever required) An enrolled office address in London for a long time (with free output and email administration) Limited .com or .co.uk space name Help with setting up a virtual financial balance UK Tank number

One should enlist their business for Tank with HMRC on the off chance that its Tank available turnover is more than £85,000. It is pertinent for organizations that supply labor and products in the UK apathetic regarding where they reside or where their business is laid out. UK Expenses

We help our clients in recording Tank get back with HMRC in the UK, Set of records, CT600 with Organizations House and HMRC, and individual charges. We likewise help with finance charge handling for RTI entries, FPS/EPS returns, P45, P60, and P11D documenting. Setting up business in UK

#audit#accounting & bookkeeping services in india#ajsh#income tax#auditor#businessregistration#chartered accountant#foreign companies registration in india#taxation

0 notes

Text

It is expected that the technology giant Apple will unveil the new generation of iPhone phones next September. Although it has not been officially announced, the information leaked so far provides perceptions about iPhone 15 in the future. Expectations of iPhone 15 Some expectations indicate that the company may follow a similar pattern to last year's lineup, especially as Apple approaches the launch of the 15th series of the iPhone. Price of iPhone 15 It is expected that the price of the phone, the cheapest of the new models, will reach $1099, as it is said that this year’s series consists of 4 models, while it is expected that Apple will maintain its designs for this year; Some leaks suggest that it will come thinner than its predecessors. Frame of iPhone 15 It will also use a frame made of matte titanium instead of “stainless steel” to protect the structure while reducing the weight of the device, in addition to two new colors for the structure, which are blue and red. It is expected that the iPhone 15 will give up the upper notch in favor of a larger coverage of the screen in which it uses what is called “composite formation with low injection pressure”, which is supposed to reduce the size of the borders and appendages. It also dispensed with the previously known mute button; With a general button that can be customized according to the user's desire to perform various functions. In compliance with a previous agreement between Apple and the European Union concluded two years ago; The company will switch to relying on a USB-C charger instead of the usual Apple Lightning charger. Camera of iPhone 15 As for the cameras, while the iPhone will inherit from its predecessor a 48-megapixel rear camera, the “Pro Max” model will come with a Bielsco telephoto lens that supports optical zoom up to 6 times, and we may find larger lenses that double the value of this model. Processor of iPhone 15 What distinguishes the two high-end phones in the series is their reliance on the latest Apple processor, which is expected to include the first chip manufactured according to the architecture used in a smartphone, and it is the largest leap in performance and efficiency for Apple chips since 2020, because it allows to perform more tasks simultaneously at a faster rate and card. 35% less.

0 notes